UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C., 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 8, 2025

BONK, INC.

(Exact name of registrant as specified in charter)

| Delaware | 001-39569 | 83-2455880 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

18801 N Thompson Peak Pkwy Ste 380, Scottsdale, AZ 85255

(Address of principal executive offices) (Zip Code)

(561) 244-7100

(Registrant’s telephone number, including area code)

Safety Shot, Inc.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | BNKK |

The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

||

| Warrants, each exercisable for one share of Common Stock at $8.50 per share | BNKKW |

The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mart if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Effective as of October 10, 2025, the Board of Directors (the “Board”) of Bonk, Inc. (the “Company”) appointed Connor Klein as an independent member of the Board and of the Company’s audit committee to serve until the Company’s 2026 Annual Meeting of Stockholders. Mr. Klein will receive compensation consistent with the Company’s non-executive directors.

Mr. Klein does not have any family relationships with any of the Company’s directors or executive officers.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Name and Symbol Change

On September 16, 2025, the Board approved the change in the name of the Company to “Bonk, Inc.” (the “Name Change”) and the change in the trading symbol of the Company to “BNKK” on the Nasdaq Capital Market (the “Symbol Change”) to align with its major transformation into a BONK strategy company.

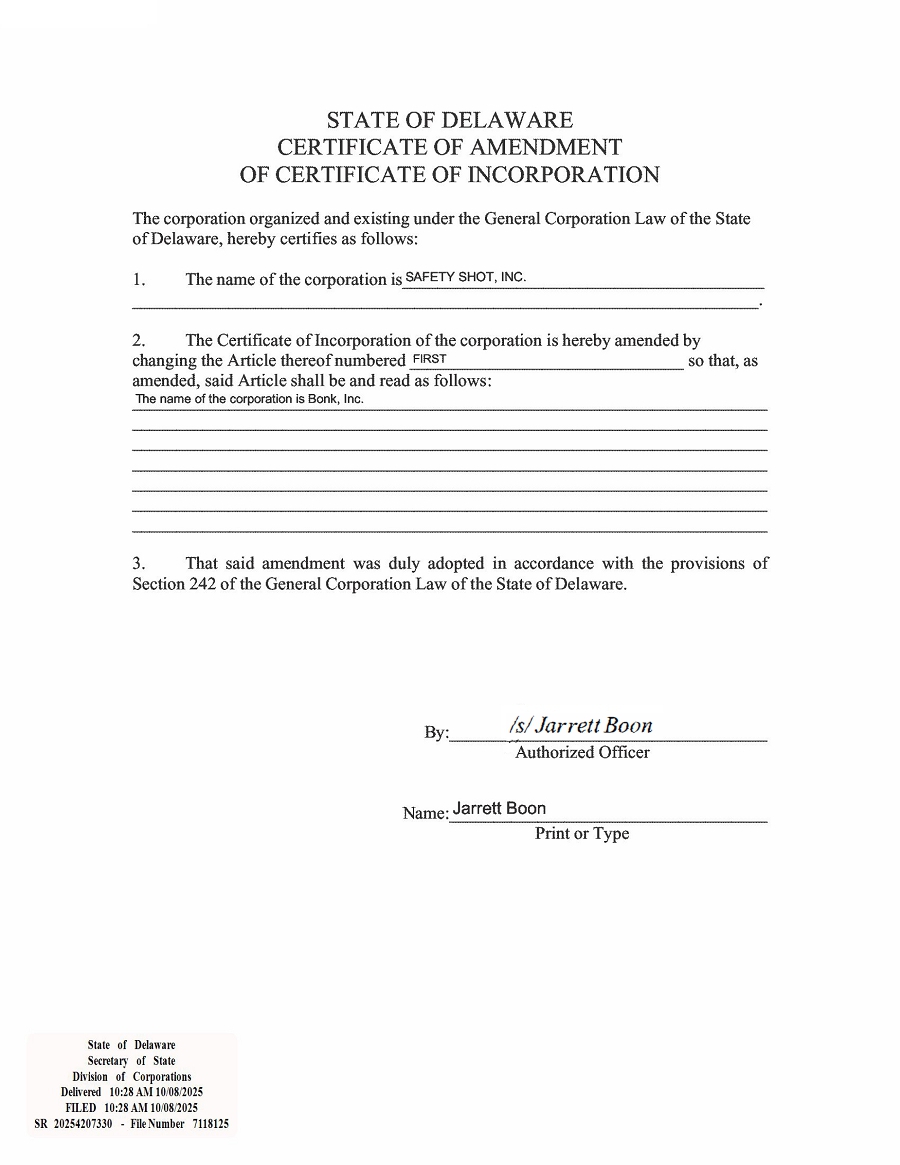

On October 8, 2025, to effectuate the Name Change, the Company filed a Certificate of Amendment of the Certificate of Incorporation of the Company, as amended and restated (the “Charter Amendment”), with the Secretary of State of the State of Delaware.

The Name Change and the Symbol Change took effect on the Nasdaq Capital Market on October 10, 2025.

Pursuant to Section 242(d)(1) of the Delaware General Corporation Law, no shareholder approval was required for the Charter Amendment because it only related to a name change. A copy of the Charter Amendment is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Neither the Name Change nor the Symbol Change affects the rights of the Company’s stockholders, and stockholders do not need to take any action in connection with the Name Change or the Symbol Change. The CUSIP number for the Company’s common stock and warrants remain 48208F105 and 48208F113, respectively.

Series C Certificate of Designation Amendment

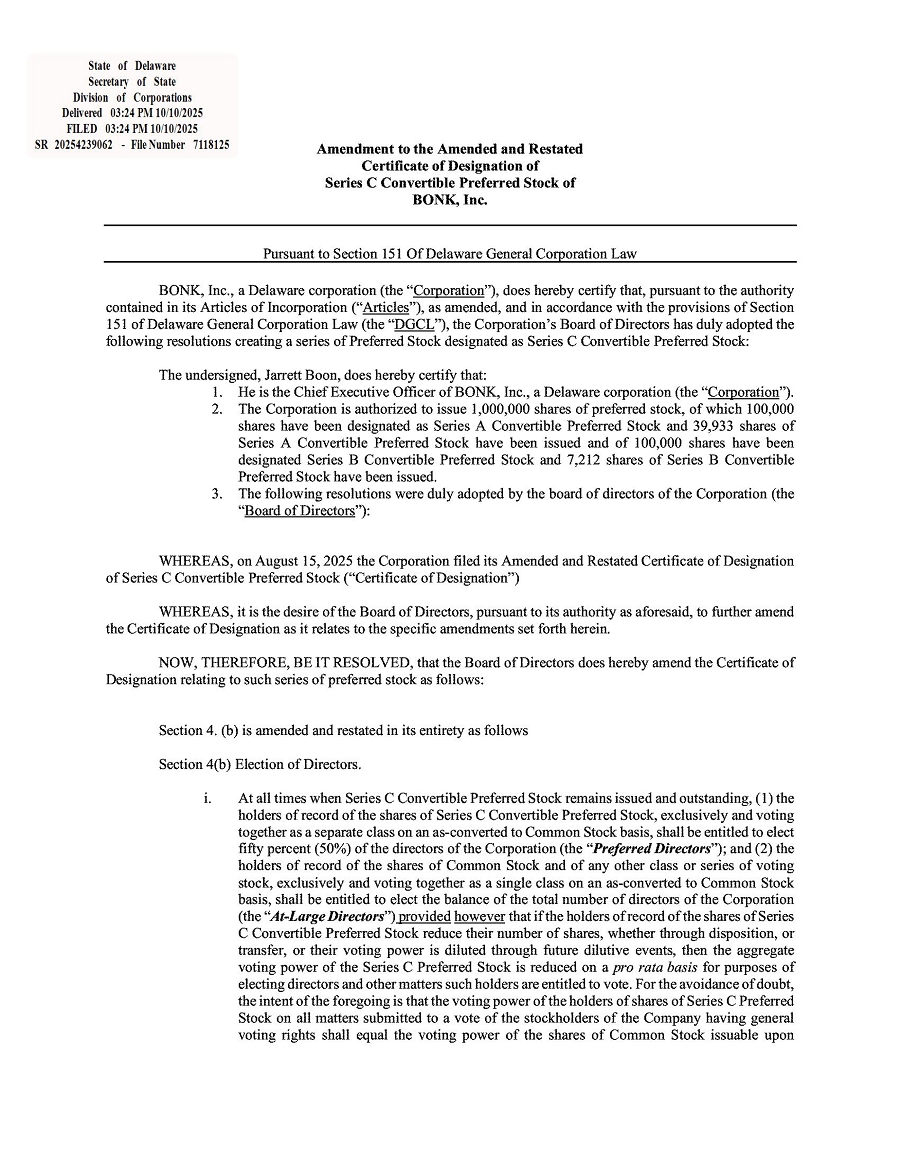

On October 10, 2025, the Company, upon approval of the Company’s Board of Directors and the sole holder of the Company’s Series C Convertible Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”), filed an Amendment to the Amended and Restated Certificate of Designation of Series C Preferred Stock with the Secretary of State of the State of Delaware (the “Series C Certificate of Designation Amendment”). The Series C Certificate of Designation Amendment adds a “step-down provision” in respect of the rights granted to the holders of Series C Preferred Stock to elect members of the Board.

The foregoing description of the Series C Certificate of Designation Amendment does not purport to be a complete description of such document and is qualified in its entirety by reference to the full text of such document, a copy of which is filed herewith as Exhibit 3.2 and incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On October 9, 2025, the Company issued a press release announcing the Name Change and Symbol Change. A copy of the press release is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 8.01 Other Events.

On March 31, 2025, the Company filed a Current Report on Form 8-K attaching a press release dated March 31, 2025 stating that the Company would be executing a spin-off of its Caring Brands division, with 2 million shares being distributed to Safety Shot shareholders. The Company is no longer distributing the 2 million shares to Safety Shot shareholders.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit | Description | |

| 3.1 | Certificate of Amendment of Certificate of Incorporation | |

| 3.2 | Amendment to Amended and Restated Certificate of Designation of Series C Preferred Stock | |

| 99.1 | Press Release dated October 9, 2025 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 14, 2025

| BONK, INC. | ||

| By: | /s/ Jarrett Boon | |

| Jarrett Boon | ||

| Chief Executive Officer | ||

Exhibit 3.1

Exhibit 3.2

Exhibit 99.1

Safety Shot, Inc. to Become Bonk, Inc., to Trade on Nasdaq Under New Ticker Symbol “BNKK”

Rebranding Solidifies Company’s Full Strategic Transformation into the Premier Public Vehicle for the BONK Ecosystem

SCOTTSDALE, AZ – October 9, 2025 (GLOBE NEWSWIRE) – Safety Shot, Inc. (Nasdaq: SHOT) (the “Company”) today announced that it has changed its corporate name to Bonk, Inc. to reflect its new strategic direction as a leader at the intersection of public markets and the digital asset ecosystem.

The Company will begin trading on the Nasdaq Capital Market under its new name and the new ticker symbol “BNKK” at the open of trading on Friday, October 10, 2025.

This rebranding completes the Company’s strategic pivot to align fully with the multi-billion dollar BONK ecosystem. The transformation has been driven by the acquisition of a recurring revenue sharing interest in the highly profitable memecoin launchpad, letsBONK.fun, and the subsequent building of a formidable treasury of BONK tokens. The Company’s new name as Bonk, Inc., is a direct reflection of its core mission: to build shareholder value by leveraging its unique position as the public market proxy for the growth and success of the BONK community.

“This is a momentous occasion for our company and its shareholders,” said Jarrett Boon, CEO. “The name change to Bonk, Inc. and our new ticker symbol ‘BNKK’ is the final and most visible step in our transformation. Our new name is a clear declaration of our strategy: to build the world’s leading digital asset treasury by leveraging our revenue sharing interest and our deep integration with the BONK ecosystem. We believe this new, focused direction provides a direct and compelling path to unlocking significant long-term shareholder value.”

Mitchell Rudy (a.k.a. Nom), a BONK core contributor and board member, added, “Today, the BONK ecosystem officially has a home in the public markets. The Company’s transformation into Bonk, Inc. creates a first-of-its-kind vehicle that allows public investors to participate directly in the success of one of the most vibrant communities in DeFi. The revenue streams from letsBONK.fun and the active management of our growing BONK treasury are the engines that will drive value for Bonk, Inc. We are incredibly excited to build this new future with our shareholders.”

The Company’s CUSIP numbers for its common stock (48208F105) and warrants (48208F113) will remain unchanged. No action is required by the Company’s stockholders with respect to the name and ticker symbol change.

About Safety Shot, Inc. Safety Shot, Inc. (Nasdaq: SHOT), is a company evolving bridge the gap between traditional public markets and the digital asset ecosystem. Following its strategic integration with letsBONK.fun, the Company is executing a new strategy focused on acquiring revenue-generating assets within the DeFi space to build a robust treasury of digital assets. The Company’s beverage division holds the patented Sure Shot beverage, designed to rapidly reduce blood alcohol content as well as Yerbaé’s plant-based, energy beverage.

Investor Relations: Phone: 561-244-7100 Email: investors@drinksafetyshot.com

Forward-Looking Statements: This press release contains forward-looking statements. Such statements are subject to risks and uncertainties, many of which are outside of the Company’s control, and actual results could differ materially. Factors that could cause or contribute to such differences include, but are not limited to, the performance of BONK tokens, the successful integration and operational success with letsBONK.fun, the ability to execute on the Company’s treasury strategy, and other risks detailed in Safety Shot’s filings with the Securities and Exchange Commission.