UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from January 1, 2025 to June 30, 2025

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report __________

Commission file number 001-42604

TMD ENERGY LIMITED

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

B-10-06, Block B, Plaza Mont Kiara

No. 2, Jalan Kiara, Mont Kiara

50480 Kuala Lumpur

Wilayah Persekutuan, West Malaysia

(Address of principal executive office)

Dato’ Sri Kam Choy Ho, Chief Executive Officer

Telephone: +603 6419 1266

Email: corporate@tmdel.com

At the address of the Company set forth above

(Name, Telephone, E-mail and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary Shares, par value $0.0001 per share | TMDE | NYSE American LLC |

Securities registered or to be registered pursuant to Section 12(g): None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Transition Report.

23,565,000 ordinary shares were outstanding as of June 30, 2025

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☒

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registration has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which consolidated financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). ☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

Table of Contents

| Page | ||||

| PART I. | ||||

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 1 | ||

| ITEM 8. | FINANCIAL INFORMATION | 20 | ||

| PART II. | ||||

| ITEM 13. | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 20 | ||

| ITEM 14. | MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 20 | ||

| PART III. | ||||

| ITEM 17. | FINANCIAL STATEMENTS | 21 | ||

| ITEM 18. | FINANCIAL STATEMENTS | 21 | ||

| ITEM 19. | EXHIBITS | 21 |

|

|

CONVENTIONS THAT APPLY TO THIS TRANSITION REPORT

Unless we indicate otherwise, references in this Transition Report to:

| ● | “6M2024” are to six months ended June 30, 2024; | |

| ● | “6M2025” are to six months ended June 30, 2025; | |

| ● | “Exchange Act” are to the U.S. Securities Exchange Act of 1934, as amended from time to time; | |

| ● | “FY2022” are to the financial year ended December 31, 2022; | |

| ● | “FY2023” are to the financial year ended December 31, 2023; | |

| ● | “FY2024” are to the financial year ended December 31, 2024; | |

| ● | “IPO” are to the Company’s initial public offering which was consummated on April 22, 2025; | |

| ● | “Labuan” are to Labuan, an island federal territory of Malaysia; | |

| ● | “Labuan Companies Act” are to Labuan Companies Act 1990 (Act 441) of Labuan, as amended and restated from time to time; | |

| ● | “Malaysia” are to the sovereign state of Malaysia; | |

| ● | “mt” are to the metric ton; | |

| ● | “M.T.” are to the motor tanker; | |

| ● | “Ordinary Shares” are the ordinary shares of our Company, par value of $0.0001 per share; | |

| ● | “our Board” are to the board of directors of our Company; | |

| ● | “our Company” are to TMD Energy Limited, a company incorporated in the Cayman Islands with limited liability on October 17, 2023; | |

| ● | “our Group”, “we”, “us” and “our” are to our Company and its subsidiaries, as the context requires; | |

| ● | “our Director(s)” are to the director(s) of our Company; | |

| ● | “RM” are to the legal currency of Malaysia; | |

| ● | “SEC” are to U.S. Securities and Exchange Commission; | |

| ● | “SGD” are to the legal currency of Singapore; | |

| ● | “Singapore” are to Republic of Singapore; | |

| ● | “STS” are to ship-to-ship; and | |

| ● | “$”, “USD”, “US$” or “U.S. dollars” are to the legal currency of the United States. |

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Transition Report contains forward-looking statements that involve risks and uncertainties, including statements based on our current expectations, assumptions, estimates and projections about us and our industry. These forward-looking statements are made under the “safe harbor” provision under Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and as defined in the Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. In some cases, these forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “anticipate”, “aim”, “estimate”, “intend”, “plan”, “believe”, “potential”, “continue”, “is/are likely to” or other similar expressions. The forward-looking statements included in this Transition Report relate to, among others:

| ● | timing of the development of future business; | |

| ● | capabilities of our business operations; | |

| ● | expected future economic performance; | |

| ● | competition in our market; | |

| ● | continued market acceptance of our services and products; | |

| ● | protection of our intellectual property rights; | |

| ● | changes in the laws that affect our operations; | |

| ● | inflation and fluctuations in foreign currency exchange rates; | |

| ● | our ability to obtain and maintain all necessary government certifications, approvals, and/or licenses to conduct our business; | |

| ● | continued development of a public trading market for our securities; | |

| ● | the cost of complying with current and future governmental regulations and the impact of any changes in the regulations on our operations; | |

| ● | managing our growth effectively; | |

| ● | projections of revenue, earnings, capital structure and other financial items; | |

| ● | fluctuations in operating results; and | |

| ● | health crisis, including due to pandemics such as the COVID-19 pandemic and government measures taken in response thereto. |

You should read these statements in conjunction with the risks disclosed in “Item 3. Key Information—3.D. Risk Factors” of our annual report on Form 20-F filed with the SEC on May 14, 2025 and other risks outlined in our other filings with the Securities and Exchange Commission, or the SEC. Moreover, we operate in an evolving environment. New risks may emerge from time to time, and it is not possible for our management to predict all risks, nor can we assess the impact of such risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ materially from those contained in any forward-looking statements. The forward-looking statements made in this Transition Report relate only to events or information as of the date on which the statements are made in this Transition Report. Except as required by law, we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this Transition Report and the documents that we have referred to in this Transition Report, completely and with the understanding that our actual future results may be materially different from what we expect.

|

|

PART I.

| ITEM 5. | OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

You should read the following discussion and analysis of the Group’s financial condition and results of operations in conjunction with the Group’s unaudited consolidated financial statements and the related notes included elsewhere in this transition report on Form 20-F. This discussion may contain forward-looking statements based upon current expectations that involve risks and uncertainties. The Group’s actual results may differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth under “Item 3. Key Information — 3.D. Risk Factors” of our annual report on Form 20-F for the year ended December 31, 2024. We caution you that our businesses and financial performance are subject to substantial risks and uncertainties.

5.A. Operating Results

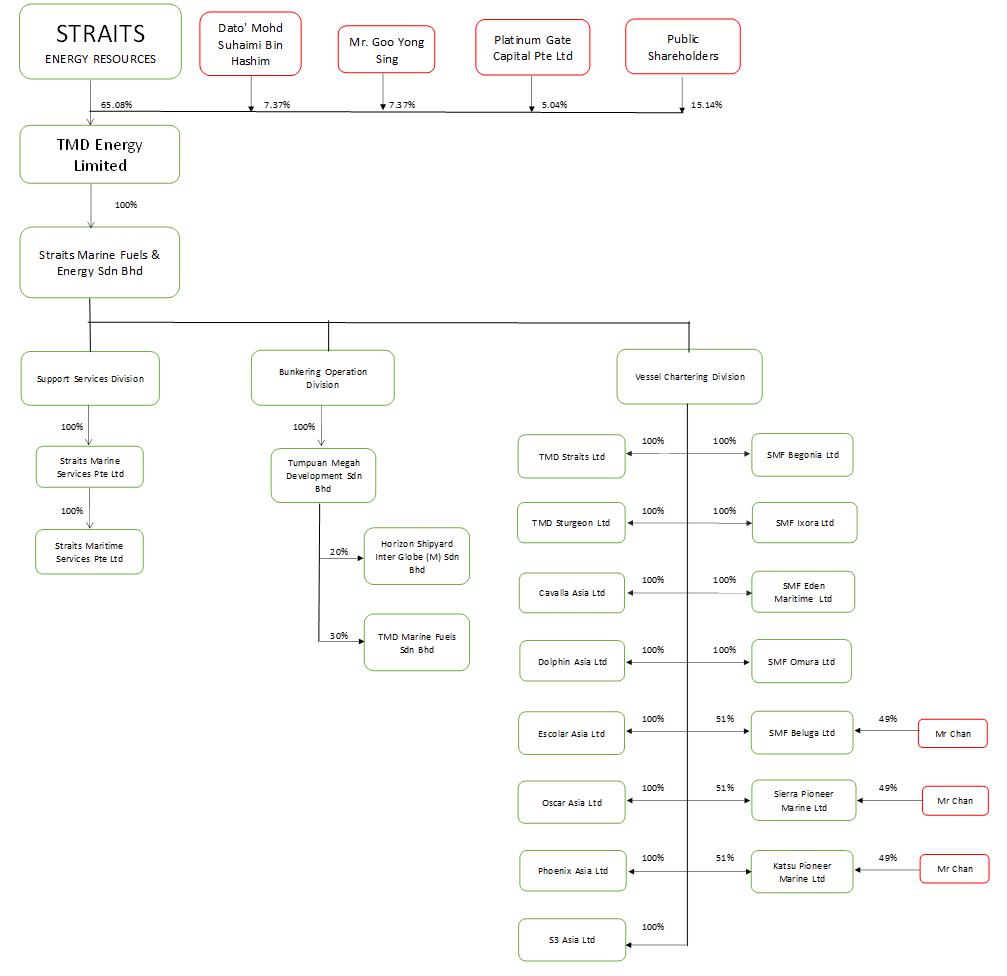

Holding Company Structure

Our Company is a holding company with no material operations of its own other than investment holding. We conduct our operations primarily through our indirect operating subsidiaries which are owned by Straits Marine Fuels & Energy Sdn. Bhd. (“SMF”), the sole direct subsidiary of our Company. Similarly, SMF is a holding company with no material operations of its own other than holding investment in all the indirect subsidiaries of our Company. As a result, both our Company and SMF’s ability to pay dividends depends upon dividends paid by our subsidiaries. Some of our subsidiaries have debt on their own with instruments governing their debt that may restrict their ability to pay dividend to us, unless those debts are repaid. The same restrictions may apply if they incur any new debt on their own in the future.

Straits Energy Resources Berhad (“Straits”), the holding company of our Company through its wholly-owned subsidiary, Straits Management Services Sdn. Bhd. will continue to provide overall group management and coordination services encompassing but not restricted to listing compliance and requirement, group consolidation and reporting, corporate governance, corporate secretarial, corporate finance, corporate banking, accounting, market and public relations at a management fee that will be reviewed annually for our group of companies.

Our Company, through our various subsidiaries, are involved in oil trading and bunkering with its own vessel management team overseeing its fleet of bunkering vessels servicing and providing quality bunker to both domestic and international liners and vessels of all nature, that ply through Malaysian waters. Being a Malaysian company operating in Malaysian waters, it is natural that this oil trading and bunkering unit maintain its financial records and statements in its domestic currency, RM. Our Company will be looking into possibilities of expanding its operation regionally out of Malaysian waters.

Recent Developments

We consummated our initial public offering on the NYSE American on April 22, 2025, issuing 3,100,000 ordinary shares at a price of $3.25 per share. In addition, we entered into an underwriting agreement with the underwriter on April 21, 2025, which granted the underwriter a 45-day option to purchase up to an additional 465,000 ordinary shares at the public offering price of $3.25 per share to cover any over-allotment. Subsequently, on April 22, 2025, the underwriter exercised the over-allotment option in full, purchasing an additional 465,000 ordinary shares at the public offering price of $3.25 per share. The initial public offering closed on April 22, 2025 and the exercise of the over-allotment option closed on April 24, 2025, with gross proceeds totaling $11.59 million, before deducting underwriting discounts and offering expenses. The ordinary shares began trading on April 21, 2025 on NYSE American and commenced trading under the ticker symbol “TMDE”.

On May 16, 2025, we had changed our fiscal year end from December 31 to June 30, to align with the fiscal year end of our holding company, Straits.

Factors Affecting Our Results of Operations

We rely on sales to key customers and purchases from a limited number of suppliers, where reduction or loss of key customers or supply chain disruptions and price volatility from supplier could diminish our operating results.

We have not derived a significant amount of revenue from volume commitments or any other understandings with our key customers related to future purchases. Orders from our key customers could be reduced or ceased at any time without obligation. Our Group also does not enter into long-term agreements with our customers. If any of our major customers terminate their business relationship with us, and we fail to secure new customers or new orders from other existing customers in a timely manner, a substantial reduction or termination of purchases by our key customer could significantly affect our operations.

In addition, we currently purchase refined marine fuel products from a limited number of suppliers. If our relationship with any of our key suppliers is terminated or if our key suppliers experience production disruptions, we may not be able to obtain a sufficient quantity of refined marine fuel on acceptable terms and without interruptions to our business. We may encounter difficulties and delays in obtaining marine fuel from alternative sources. Any interruption or delay in the supply of marine fuel, or the inability to obtain fuel from alternate sources at acceptable prices and within a reasonable timeframe, would impair our ability to meet scheduled deliveries to our customers and could lead to order cancellations or penalties.

|

|

We rely on the expertise of our senior management, and our inability to retain key personnel could disrupt our business and limit our growth.

Our business success and growth prospects depend significantly on the continued service of our senior management team and our ability to hire and retain key members of our management team. The unexpected loss of any of these key individuals could disrupt our operations, damage important business relationships, and delay strategic initiatives, potentially harming our competitive position. We face inherent challenges in attracting and retaining qualified personnel due to intense industry competition for executive talent. While we implement retention measures, there is no assurance that we will successfully maintain our current management team. Any disruption in leadership could materially adversely affect our operations.

Material disruptions in the availability or supply of oil may reduce the supply of our products and have a material impact on our operations.

Our operations face substantial risks from marine fuel supply disruptions that could impair our ability to fulfill customer demand. Global oil markets remain exposed to geopolitical conflicts, trade restrictions, and natural disasters that may reduce refinery output or disrupt logistics. Political instability in producing regions, terrorist activity, or military actions could abruptly constrain supply availability, while extreme weather or accidents might damage critical infrastructure. Such events typically trigger sudden price spikes and inventory shortages across the bunker fuel market.

These constraints would directly limit our sales volumes and erode our competitive pricing position. Although we maintain alternative supply arrangements, the integrated nature of oil markets means local disruptions often escalate into prolonged shortages. Our commodity-based business model leaves us particularly vulnerable to these shocks, as securing substitute fuel during crises becomes costly and time-consuming. Persistent supply issues could damage customer relationships and significantly pressure margins, leading to lasting effects on financial performance.

Adverse conditions in the shipping industry may reduce the demand for our products and services and negatively affect our results of operations and financial condition.

Our marine fuel supply business remains highly dependent on the cyclical performance of the shipping industry. Fluctuations in vessel charter rates, fuel costs, and operational expenses directly impact our customers’ purchasing capacity. During market downturns, when freight rates decline or operating costs rise, shipping companies typically reduce bunkering consumption, creating immediate pressure on our sales volumes and margins. The industry’s vulnerability to risks, including geopolitical conflicts, piracy incidents, trade disputes, and port security threats, can disrupt shipping routes and vessel operations, leading to sudden drops in regional fuel demand. Prolonged market weakness often forces shipowners to idle vessels or slow steam, further depressing bunker demand.

While we actively monitor industry trends and adjust our commercial strategies accordingly, these macroeconomic and geopolitical factors remain beyond our control. Our financial performance will continue to reflect shipping market volatility, with potential impacts on revenue stability, profitability, and cash flow generation. This inherent sector exposure represents a persistent challenge to our business model’s resilience.

Impact of Russia’s Invasion of Ukraine, Conflicts in Middle East and Related Supply Chain Issues

In February 2022, Russia launched a military attack on Ukraine, leading to further regional and international conflicts or armed action. As Russia is one of the largest exporters of crude oil in the world, this crisis had disrupted the oil supply and caused a spike in oil prices for the year ended December 31, 2022 (“FY2022”), which subsequently declined for the year ended December 31, 2023 (“FY2023”). Since late 2023, conflicts in the Middle East, including the Israel–Gaza war and related regional escalations, have contributed to heightened geopolitical instability. These developments, combined with increased security risks in major shipping lanes, disrupted global maritime trade by lengthening voyage times and raising operational costs across the industry.

The Russia-Ukraine conflict caused a spike in oil prices that was offset by a continuing growth in demand volume in our oil cargo bunkered in FY2023, resulting in our revenue dropping to $633.1 million in FY2023 from approximately $702.1 million in FY2022.

As the financial impact of this crisis had already been reflected in FY2022 and FY2023, there was no material impact on our revenue for the year ended December 31, 2024 (“FY2024”). In fact, after considering the increase in the volume of oil cargo bunkered, our revenue rose from $633.1 million in FY2023 to $688.6 million in FY2024, driven by the expansion of our marketplace.

Since then, the direct effect of the Russia-Ukraine conflict on our operations has moderated, and subsequent movements in oil prices have been influenced more by global economic conditions and trade policy developments and regional conflicts in the Middle East.

For the six months ended June 30, 2025, our performance was affected by a combination of factors. Middle East tensions contributed to additional volatility in oil prices and operational costs, serving as another headwind that, together with trade and tariff issues, led to a decline in our revenue.

In response to these market challenges, we have been strengthening collaboration with our key service providers and exploring alternative sourcing and supply chain options to enhance resilience and operational continuity. While these measures aim to mitigate potential impacts, there can be no assurance that they will fully shield us from ongoing geopolitical and trade policy volatility.

|

|

Escalating Trade Tensions and Impacts of Tariff Policy Volatility

Recent global trade developments have introduced heightened uncertainty into international commerce. In early 2025, the implementation of broad new tariffs on a wide range of imported goods significantly disrupted global trade dynamics, raising concerns across multiple sectors. Frequent changes in tariff rates and enforcement timelines further disrupted global shipping schedules, causing vessel delays, delivery rescheduling, and a slowdown in trade flows across major routes.

The prolonged tariff crisis reduced shipping activity and cargo movement, which in turn lowered demand for marine fuel. Coupled with softer global consumption, weaker economic growth, and a continuing shift toward alternative energy, these headwinds exerted downward pressure on oil demand and contributed to a significant decline in international oil prices, with the global average oil price declined.

For the six months ended June 30, 2025, revenue decreased to $276.3 million from $357.5 million for the six months ended June 30, 2024. This decline was primarily attributable to lower sales volume, despite our enlarged customer base compared to the six months ended June 30, 2024. In addition, weaker shipping activity and softer global consumption further depressed oil prices, which deteriorated our performance for the six months ended June 30, 2025.

In response, we are strengthening collaboration with our key service providers and exploring alternative sourcing and supply chain options to enhance resilience and operational continuity. While these strategic measures aim to mitigate potential impacts, there can be no assurance that they will fully shield us from the broader effects of ongoing trade policy shifts. We will continue to monitor developments closely and adapt our business strategy as needed to maintain operational stability and financial performance.

Nevertheless, any negative impact arising from an escalation of geopolitical tensions, including the Russia-Ukraine conflict, conflicts in the Middle East, a slowdown in global economy, or continued trade tension and tariff crisis could adversely affect our business conditions. The volatility of crude oil price and inflationary pressures can increase our operating cost and a prolonged crisis may adversely impact the supply and demand of oil cargo, which may result in a lower volume of oil cargo bunkered. In addition, any significant increase in marine fuel price might tighten the operating cash flows of our Group, which may, in turn, adversely affect our working capital requirements, financial conditions and prospects. These disruptions may also heighten many other risks disclosed in the “Risk Factors” section in our annual report on Form 20-F for the year ended December 31, 2024, including our ability to market our securities, raise equity or debt financing.

The ultimate impact of the conflict on our operations remains unknown and will depend on future developments. The Group will continuously monitor the situation closely and initiate any necessary mitigating actions when required.

Six Months Ended June 30, 2025 Compared to Six Months Ended June 30, 2024

Results of Operations

The following table summarizes the results of our operations during the six months ended June 30, 2025 and 2024, respectively, and provides information regarding the dollar and percentage increase or (decrease) during such years.

|

For the Six Months Ended June 30, |

||||||||||||||||

| 2025 | 2024 | Variance – | ||||||||||||||

| $’000 | $’000 | Increase (Decrease) | ||||||||||||||

| (Unaudited) | (Unaudited) | $’000 | % | |||||||||||||

| Revenues, net | 276,185 | 357,486 | (81,301 | ) | (22.7 | ) | ||||||||||

| Revenues – related party, net | 155 | 39 | 116 | 297.4 | ||||||||||||

| Total revenues | 276,340 | 357,525 | (81,185 | ) | (22.7 | ) | ||||||||||

| Cost of revenues | (272,275 | ) | (351,629 | ) | (79,354 | ) | (22.6 | ) | ||||||||

| Cost of revenues – related party | (82 | ) | (350 | ) | (268 | ) | (76.6 | ) | ||||||||

| Total cost of revenues | (272,357 | ) | (351,979 | ) | (79,622 | ) | (22.6 | ) | ||||||||

| Gross profit | 3,983 | 5,546 | (1,563 | ) | (28.2 | ) | ||||||||||

| Operating expenses | ||||||||||||||||

| Selling and marketing expenses | (38 | ) | (47 | ) | (9 | ) | (19.1 | ) | ||||||||

| General and administrative expenses | (3,330 | ) | (3,061 | ) | 269 | 8.8 | ||||||||||

| Depreciation expenses | (2,559 | ) | (2,305 | ) | 254 | 11.0 | ||||||||||

| Total operating expenses | (5,927 | ) | (5,413 | ) | 514 | 9.5 | ||||||||||

| (Loss) Income from operations | (1,944 | ) | 133 | (2,077 | ) | (1,561.7 | ) | |||||||||

| Other (expenses) income, net | ||||||||||||||||

| Interest income | 16 | 29 | (13 | ) | (44.8 | ) | ||||||||||

| Sundry (expense) income | (775 | ) | 3,229 | (4,004 | ) | (124.0 | ) | |||||||||

| Interest expenses | (2,803 | ) | (1,987 | ) | 816 | 41.1 | ||||||||||

| Share of losses of associate | (4 | ) | - | (4 | ) | (100.0 | ) | |||||||||

| Total other (expenses) income, net | (3,566 | ) | 1,271 | (4,837 | ) | (380.6 | ) | |||||||||

| (Loss) Income before income taxes | (5,510 | ) | 1,404 | (6,914 | ) | (492.5 | ) | |||||||||

| Income tax benefits (expenses) | 988 | (277 | ) | 1,265 | 456.7 | |||||||||||

| Net (loss) income | (4,522 | ) | 1,127 | (5,649 | ) | (501.2 | ) | |||||||||

| Less: loss (income) attributable to non-controlling interest | 212 | (287 | ) | 499 | 173.9 | |||||||||||

| Net (loss) income attributable to controlling interest | (4,310 | ) | 840 | (5,150 | ) | (613.1 | ) | |||||||||

| Other comprehensive (loss) income: | ||||||||||||||||

| Net (loss) income | (4,522 | ) | 1,127 | (5,649 | ) | (501.2 | ) | |||||||||

| Foreign currency translation adjustments | (96 | ) | (248 | ) | 152 | 61.3 | ||||||||||

| Total comprehensive (loss) income | (4,618 | ) | 879 | (5,497 | ) | (625.4 | ) | |||||||||

|

|

Key Components of Results of Operations

Revenues

Our Group’s revenue comprises of bunkering services, vessel chartering services and ship management services as tabulated below:

| Total Revenue | Inter-Segment | Revenue from Customers | ||||||||||||||||||||||||||||||

|

For the Six Months Ended June 30, |

For the Six Months Ended June 30, |

For the Six Months Ended June 30, |

Variance – | |||||||||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | 2025 | 2024 | Increase | ||||||||||||||||||||||||||

| $’000 | $’000 | $’000 | $’000 | $’000 | $’000 | (Decrease) | ||||||||||||||||||||||||||

| (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | (Unaudited) | $’000 | % | |||||||||||||||||||||||||

| Analysis By Segment: | ||||||||||||||||||||||||||||||||

| Bunkering services | 275,440 | 357,350 | - | - | 275,440 | 357,350 | (81,910 | ) | (22.9 | ) | ||||||||||||||||||||||

| Vessel chartering services | 3,548 | 3,486 | 3,548 | 3,486 | - | - | - | - | ||||||||||||||||||||||||

| Ship management services | 5,074 | 965 | 4,174 | 790 | 900 | 175 | 725 | 414.3 | ||||||||||||||||||||||||

| Total Revenue | 284,062 | 361,801 | 7,722 | 4,276 | 276,340 | 357,525 | (81,185 | ) | (22.7 | ) | ||||||||||||||||||||||

Overall

Our Group’s overall revenue for the six months ended June 30, 2025 had decreased by 22.7%, or equivalent to $81.2 million, to $276.3 million from $357.5 million achieved for the six months ended June 30, 2024 due to decrease in contribution from the bunkering services segment, as it contributed more than 99% of our Group’s revenue for the six months ended June 30, 2025, offset by a slight increase in ship management services. The decrease in revenue for the six months ended June 30, 2025 was primarily attributable to a decrease in the volume of oil cargo bunkered of approximately 11.2%, from 578,614 metric ton for the six months ended June 30, 2024 to 514,025 metric ton for the six months ended June 30, 2025.

Bunkering Services

The decrease in the bunkering services revenue by $81.9 million to $275.4 million for the six months ended June 30, 2025 from $357.3 million for the six months ended June 30, 2024 was substantially attributable to the decrease of approximately 11.2% in volume of oil cargo bunkered, from 578,614 metric ton for the six months ended June 30, 2024 to 514,025 metric ton for the six months ended June 30, 2025. In addition, because the selling price of bunker fuel is generally benchmarked to the prevailing market oil price, the 17.9% decrease in the average oil price for the six months ended June 30, 2025 compared to the six months ended June 30, 2024 further reduced the revenue recognized from bunkering services.

We expanded our customer base in bunkering services from 53 customers for the six months ended June 30, 2024 to 77 for the six months ended June 30, 2025. Despite this expansion, bunkered volume declined due to a slowdown in global trade and shipping activity. The tariff crisis in early 2025, marked by broad new tariffs and frequent changes in implementation timelines, significantly disrupted shipping schedules and cargo flows. These disruptions, together with softer global consumption and weaker economic growth, reduced overall demand for marine fuel and directly contributed to the decline in oil cargo bunkered.

The combined impact of reduced bunkered volume and declining global marine fuel prices offset the benefits of customer base expansion, thereby constraining overall revenue growth in our bunkering services.

Vessel Chartering Services

Our vessel chartering services segment previously generated revenue by chartering vessels to third parties. There was no revenue from third parties related to vessel chartering services for the six months ended June 30, 2025 and 2024, as our Group temporarily discontinued the segment after the chartering contract expired in July 2023. The vessel was subsequently redeployed to our bunkering fleet to support the growth of our oil bunkering operations.

Ship Management Services

Our ship management services, supported by a competent team of qualified professional mariners, also managed third-party vessels, including tugboats used in the port and STS operations that are owned by other subsidiaries within the Straits Group, which are outside our Group.

The ship management services generated approximately $0.9 million and $0.2 million for the six months ended June 30, 2025 and 2024, respectively, due to the addition of new customers for the six months ended June 30, 2025.

Cost of revenues

Our cost of revenues represent direct expenses incurred to generate revenue. These costs are recorded and accrued as incurred. The cost of revenues primarily comprise oil cargo cost, along with other bunkering operation costs such as bunker own used, port charges, crew wages and consumables, transport costs and agency fees. It also includes vessel operation-related costs, such as vessel consumables, insurance, general upkeep and repair costs.

|

|

Its major cost components are as follow:

|

For the Six Months Ended June 30, |

||||||||||||||||

| 2025 | 2024 | Variance – | ||||||||||||||

| (Unaudited) | (Unaudited) | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Oil cargo sold | 264,009 | 343,994 | (79,985 | ) | (23.3 | ) | ||||||||||

| Bunker own used | 1,818 | 2,136 | (318 | ) | (14.9 | ) | ||||||||||

| Crew wages | 1,815 | 1,767 | 48 | 2.7 | ||||||||||||

| Other operating cost | 4,715 | 4,082 | 633 | 15.5 | ||||||||||||

| Total cost of revenues | 272,357 | 351,979 | (79,622 | ) | (22.6 | ) | ||||||||||

Our overall cost of revenues decreased by 22.6%, or equivalent to $79.6 million, to $272.4 million for the six months ended June 30, 2025 from $352.0 million for the six months ended June 30, 2024, representing 98.6% and 98.4% of our total revenue respectively. This decrease was in line with the decline in the volume of cargo bunkered, with oil cargo costs dropped to $264.0 million for the six months ended June 30, 2025 from $344.0 million for the six months ended June 30, 2024. In addition, other operating costs increased to $4.7 million for the six months ended June 30, 2025 from $4.1 million for the six months ended June 30, 2024. The increase was primarily attributable to higher port-related operation costs, partially offset by a reduction in equipment upkeep expenses.

Gross Profit and Gross Profit Margin

Overall

|

For the Six Months Ended June 30, |

||||||||||||||||

| 2025 | 2024 | Variance – | ||||||||||||||

| (Unaudited) | (Unaudited) | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Revenue | 276,340 | 357,525 | (81,185 | ) | (22.7 | ) | ||||||||||

| Cost of revenues | (272,357 | ) | (351,979 | ) | (79,622 | ) | (22.6 | ) | ||||||||

| Gross profit | 3,983 | 5,546 | (1,563 | ) | (28.2 | ) | ||||||||||

| Gross profit margin | 1.44 | % | 1.55 | % | (0.11 | )% | (7.1 | ) | ||||||||

As a result of the foregoing, we recorded an overall decrease of 28.2% in gross profit, or equivalent to $1.6 million, to $4.0 million for the six months ended June 30, 2025 from $5.6 million for the six months ended June 30, 2024.

Nevertheless, our gross profit margin decreased marginally by 0.11%, to 1.44% for the six months ended June 30, 2025 from 1.55% for the six months ended June 30, 2024 primarily reflecting increased operational expenses from our oil bunkering services, resulting in a marginal compression of our gross profit margin.

Bunkering Services

|

For the Six Months Ended June 30, |

||||||||||||||||

| 2025 | 2024 | Variance – | ||||||||||||||

| (Unaudited) | (Unaudited) | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Revenue | 275,440 | 357,350 | (81,910 | ) | (22.9 | ) | ||||||||||

| Cost of revenues | (271,627 | ) | (351,979 | ) | (80,352 | ) | (22.8 | ) | ||||||||

| Gross profit | 3,813 | 5,371 | (1,558 | ) | (29.0 | ) | ||||||||||

| Gross profit margin | 1.38 | % | 1.50 | % | (0.12 | )% | (7.9 | ) | ||||||||

| Total metric ton sold (mt) | 514,025 | 578,614 | (64,589 | ) | (11.2 | ) | ||||||||||

| Average gross profit per metric ton | $ | 7.42 | $ | 9.28 | $ | (1.86 | ) | (20.0 | ) | |||||||

We recorded a decrease of 29.0% in gross profit of bunkering services, or equivalent to $1.6 million, to $3.8 million for the six months ended June 30, 2025 from $5.4 million for the six months ended June 30, 2024. Our gross profit margin decreased marginally by 0.12%, to 1.38% for the six months ended June 30, 2025 from 1.50% for the six months ended June 30, 2024.

The average gross profit per mt of oil cargo sold had decreased by approximately 20.0%, or equivalent to $1.86 per mt, to $7.42 per mt for the six months ended June 30, 2025 from $9.28 per mt for the six months ended June 30, 2024. This margin compression was largely due to elevated operating costs and sharp decline in demand for bunkering. Tariff-related delays and logistical disruptions increased transportation and handling expenses, while deferred tariff adjustments limited cost pass-through capabilities. Additionally, global oil demand softness and broader inflationary pressures narrowed the spread between selling prices and procurement costs, further eroding profitability.

|

|

Ship Management Services

Gross profit of ship management services was relatively stable, representing $169,761 for the six months ended June 30, 2025, up from $175,465 for the six months ended June 30, 2024.

The slight decrease in gross profit margin primarily reflects the recognition of certain direct costs associated with technical management and agency services for the six months ended June 30, 2025.

Selling and Marketing Expenses

The selling and marketing expenses comprise marketing, advertising and business development expenses incurred by the sales and marketing team.

Our selling and marketing expenses decreased by 19.1% or approximately $0.01 million, to $0.04 million for the six months ended June 30, 2025, down from $0.05 million for the six months ended June 30, 2024. The decrease was primarily attributable to a reversal of approximately $0.03 million in previously over provisioned marketing expenses, partially offset by an increase in spending of $0.04 million for business development for the six months ended June 30, 2025.

General and Administrative Expenses

The general and administrative expenses which increased by 8.8% or $0.2 million, to $3.3 million for the six months ended June 30, 2025 from $3.1 million for the six months ended June 30, 2024 comprise the following:

|

For the Six Months Ended June 30, |

||||||||||||||||

| 2025 | 2024 | Variance – | ||||||||||||||

| (Unaudited) | (Unaudited) | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Staff cost | 1,505 | 1,174 | 331 | 28.2 | ||||||||||||

| Management fees | 373 | 91 | 282 | 309.9 | ||||||||||||

| Professional fees | 410 | 353 | 57 | 16.1 | ||||||||||||

| Leasing license | 170 | 160 | 10 | 6.3 | ||||||||||||

| Others | 872 | 1,283 | (411 | ) | (32.0 | ) | ||||||||||

| Total general and administrative expenses | 3,330 | 3,061 | 269 | 8.8 | ||||||||||||

Staff cost increased by $0.3 million, to $1.5 million for the six months ended June 30, 2025, up from $1.2 million for the six months ended June 30, 2024. Without significant change in the number of overall headcounts, the increase was primarily due to annual salary adjustments and bonus payments during the six months ended June 30, 2025. In addition, approximately $0.07 million of directors’ remuneration was incurred following our listing.

Management fees paid to Straits Management Services Sdn. Bhd., a related company within the Straits Group, increased to $0.4 million for the six months ended June 30, 2025 from $0.1 million for the six months ended June 30, 2024. These fees cover overall group management and coordination services, encompassing but not limited to listing compliance and requirement, group consolidation and reporting, corporate governance, corporate secretarial, corporate finance, corporate banking, accounting, market and public relations to the subsidiaries of our Company. The increase was mainly due to a higher fee being charged for the six months ended June 30, 2025.

Professional fees include statutory audit fees, tax fees, corporate secretarial fees, and legal fees. The professional fees remained relatively stable for the six months ended June 30, 2025, which mainly represented fee incurred in connection with our expenses related to investor relationship and a provision of audit fee for the consolidated financial statement.

Corporations incorporated under Labuan Companies Act 1990 are required to pay an annual leasing license fee of $20,000 to Labuan Financial Services Authority (“LFSA”). As such, there was leasing license fee of $0.01 million each for the six months ended June 30, 2025 and 2024. In addition, $0.02 million and $0.01 million represents other license fees charged for the six months ended June 30, 2025 and 2024, respectively.

The decrease in other general and administrative expenses for the six months ended June 30, 2025 primarily reflected the reduced in late charge in payment to suppliers driven by greater access to funding and implementation of our cost savings initiatives aimed at optimizing operational efficiency and reducing discretionary spending.

Depreciation

Depreciation represents the annual depreciation on the cost of Group’s fleet of 15 vessels, dry-dock cost, tools, office equipment, computer hardware and software, motor vehicles, real property and furniture and fittings.

|

|

The increase in depreciation by $0.3 million to $2.6 million for the six months ended June 30, 2025, up from $2.3 million for the six months ended June 30, 2024, was due to the addition of dry-dock cost which resulted in higher depreciation charges.

Other (Expense) Income, net

Interest Income

Interest income decreased to $16,072 for the six months ended June 30, 2025 from $28,903 for the six months ended June 30, 2024. The decrease was primarily attributable to an adjustment recorded in respect of interest income relating to earlier periods during the six months ended June 30, 2024, with no corresponding adjustment in the six months ended June 30, 2025. Interest income was derived from principal sums approximating $0.1 million and $2.4 million placed with lender bank of Tumpuan Megah Development Sdn. Bhd. (“Tumpuan Megah”) as a term deposit and in a designated current account respectively.

Sundry (Expense) Income

|

For the Six Months Ended June 30, |

||||||||||||||||

| 2025 | 2024 | Variance – | ||||||||||||||

| (Unaudited) | (Unaudited) | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| (Loss) Gain on foreign exchange | (1,496 | ) | 3,210 | (4,706 | ) | (146.6 | ) | |||||||||

| Miscellaneous income | 721 | 19 | 702 | 3,694.7 | ||||||||||||

| Total sundry (expense) income | (775 | ) | 3,229 | (4,004 | ) | (124.0 | ) | |||||||||

Although the majority of our business activities are denominated in USD, the functional currencies of our five subsidiaries remain RM and SGD. As a result, foreign currency gains and losses arise when USD-denominated balances of these subsidiaries are remeasured into their respective functional currencies. We currently do not have a foreign currency hedging policy, as the USD generated from our revenue is sufficient to cover our USD purchases. However, we continue to monitor our foreign exchange exposure and will consider hedging significant foreign currency exposure should the need arise. In the current state of RM and SGD strengthening against the USD, the weakening of the USD reduced the RM-equivalent and SGD-equivalent values of our USD-denominated cash balances, receivables and payables, resulting in a net foreign currency loss. We recorded a net foreign currency loss of $1.5 million for the six months ended June 30, 2025 as compared to net foreign currency gain of $3.2 million for the six months ended June 30, 2024.

Miscellaneous income primarily comprises late payment interest income of $0.6 million from a related party, Straits, arising from late payment at an interest rate of 8.25%.

Interest Expense

Interest expense included interest on trade financing facilities granted to Tumpuan Megah, term loan interest and vessel vendor financing interest.

The increase in interest expense by $0.8 million, to $2.8 million for the six months ended June 30, 2025, up from $2.0 million for the six months ended June 30, 2024, was due to a higher volume of trade financing facilities granted to Tumpuan Megah, which bear interest rates ranging from 5.75% to 7.75%.

Provision For Income Taxes

Cayman Islands

Our Company was incorporated in Cayman Islands. Under the current tax laws of Cayman Islands, we are not subject to income, corporation or capital gains tax, and no withholding tax is imposed upon the payment of dividends.

Malaysia

Profits of Malaysian corporations incorporated under the Companies Act 2016 are subject to the prevailing corporate income tax rate at 24%, and this is applicable to SMF, TMD Marine Fuels Sdn. Bhd. and Tumpuan Megah.

For corporations incorporated under the Labuan Companies Act 1990, that individually own each of our 15 vessels, their audited net profits are subject to the prevailing corporate income tax rate at 3%.

Singapore

For Singapore incorporated corporations, their prevailing corporate income tax rate is at 17% with the following partial tax exemption on its chargeable income:

| 1. | 75% of its first chargeable income of SGD10,000; and | |

| 2. | 50% of its next chargeable income of SGD190,000. |

|

|

With the aforementioned, our Group’s effective tax rate was 19.7% for the six months ended June 30, 2024. For the six months ended June 30, 2025, the Group recorded an income tax benefit of $1.0 million, representing (i) current tax expenses of $0.08 million for the ended June 30, 2025; (ii) deferred tax income arising from temporary differences amounted to $0.07 million; and (iii) over-provision of income tax expenses of $1.0 million in FY2024 due to the change in our fiscal year end.

| For the Six Months Ended June 30, |

||||||||||||||||

| 2025 | 2024 | Variance – | ||||||||||||||

| (Unaudited) | (Unaudited) | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Current Income Tax | ||||||||||||||||

| Based on result for the period | 78 | 277 | (199 | ) | (71.8 | ) | ||||||||||

| Over provision in prior periods | (1,001 | ) | - | (1,001 | ) | (100.0 | ) | |||||||||

| (923 | ) | 277 | (1,200 | ) | (433.2 | ) | ||||||||||

| Deferred Tax | ||||||||||||||||

| Reversal of temporary differences | (65 | ) | - | (65 | ) | 100.0 | ||||||||||

| Under provision in prior periods | - | - | - | - | ||||||||||||

| (65 | ) | - | (65 | ) | 100.0 | |||||||||||

| Total income tax (benefit) expense | (988 | ) | 277 | (1,265 | ) | (456.7 | ) | |||||||||

With the change of fiscal year end from December 31 to June 30, the tax reporting period of Tumpuan Megah covered 18 months from January 1, 2024 to June 30, 2025. Given Tumpuan Megah recorded a net loss for the six months ended June 30, 2025, the tax loss position reduced the overall assessable profits for the full 18-month reporting period. As a result, the provision for income tax previously recognized for the year ended December 31, 2024 was overstated by $1.0 million.

Year Ended December 31, 2024 Compared to Year Ended December 31, 2023

Results of Operations

The following table summarizes the results of our operations during the fiscal years ended December 31, 2024 and 2023, respectively, and provides information regarding the dollar and percentage increase or (decrease) during such years.

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Revenues, net | 688,430 | 632,790 | 55,640 | 8.8 | ||||||||||||

| Revenues – related party, net | 178 | 290 | (112 | ) | (38.6 | ) | ||||||||||

| Total revenues | 688,608 | 633,080 | 55,528 | 8.8 | ||||||||||||

| Cost of revenues | (671,616 | ) | (619,867 | ) | 51,749 | 8.3 | ||||||||||

| Cost of revenues – related party | (947 | ) | (1,123 | ) | (176 | ) | (15.7 | ) | ||||||||

| Total cost of revenues | (672,563 | ) | (620,990 | ) | 51,573 | 8.3 | ||||||||||

| Gross profit | 16,045 | 12,090 | 3,955 | 32.7 | ||||||||||||

| Operating expenses | ||||||||||||||||

| Selling and marketing expenses | (40 | ) | (101 | ) | (61 | ) | (60.4 | ) | ||||||||

| General and administrative expenses | (5,249 | ) | (5,127 | ) | 122 | 2.4 | ||||||||||

| Depreciation expenses | (4,758 | ) | (4,257 | ) | 501 | 11.8 | ||||||||||

| Total operating expenses | (10,047 | ) | (9,485 | ) | 562 | 5.9 | ||||||||||

| Income from operations | 5,998 | 2,605 | 3,393 | 130.2 | ||||||||||||

| Other (expenses) income | ||||||||||||||||

| Interest income | 52 | 10 | 42 | 420.0 | ||||||||||||

| Sundry income, net | 2,022 | 3,321 | (1,299 | ) | (39.1 | ) | ||||||||||

| Interest expenses | (4,598 | ) | (2,203 | ) | (2,395 | ) | (108.7 | ) | ||||||||

| Share of losses of associate | (1 | ) | - | (1 | ) | (100.0 | ) | |||||||||

| Total other (expenses) income, net | (2,525 | ) | 1,128 | (3,653 | ) | 323.8 | ||||||||||

| Income before income taxes | 3,473 | 3,733 | (260 | ) | (7.0 | ) | ||||||||||

| Income tax expenses | (1,428 | ) | (774 | ) | 654 | 84.5 | ||||||||||

| Net income | 2,045 | 2,959 | (914 | ) | (30.9 | ) | ||||||||||

| Less: income attributable to non-controlling interest | (168 | ) | (963 | ) | (795 | ) | (82.6 | ) | ||||||||

| Net income attributable to controlling interest | 1,877 | 1,996 | (119 | ) | (6.0 | ) | ||||||||||

| Other comprehensive income: | ||||||||||||||||

| Net income | 2,045 | 2,959 | (914 | ) | (30.9 | ) | ||||||||||

| Foreign currency translation adjustments | 276 | 1,888 | (1,612 | ) | (85.4 | ) | ||||||||||

| Total comprehensive income | 2,321 | 4,847 | (2,526 | ) | (52.1 | ) | ||||||||||

|

|

Key Components of Results of Operations

Revenues

Our Group’s revenue comprises of bunkering services, vessel chartering services and ship management services as tabulated below:

| Total Revenue | Inter-Segment | Revenue from Customers | ||||||||||||||||||||||||||||||

| For the Years Ended December 31, |

For the Years Ended December 31, |

For the Years Ended December 31, |

Variance – Increase |

|||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023 | (Decrease) | ||||||||||||||||||||||||||

| $’000 | $’000 | $’000 | $’000 | $’000 | $’000 | $’000 | % | |||||||||||||||||||||||||

| Analysis By Segment: | ||||||||||||||||||||||||||||||||

| Bunkering services | 688,210 | 631,608 | - | - | 688,210 | 631,608 | 56,602 | 9.0 | ||||||||||||||||||||||||

| Vessel chartering services | 7,097 | 8,041 | 7,097 | 6,847 | - | 1,194 | (1,194 | ) | (100.0 | ) | ||||||||||||||||||||||

| Ship management services | 1,917 | 1,911 | 1,519 | 1,633 | 398 | 278 | 120 | 43.2 | ||||||||||||||||||||||||

| Total Revenue | 697,224 | 641,560 | 8,616 | 8,480 | 688,608 | 633,080 | 55,528 | 8.8 | ||||||||||||||||||||||||

Overall

Our Group’s overall revenue for FY2024 had increased by 8.8%, or equivalent to $55.5 million, to $688.6 million from $633.1 million achieved in FY2023 due to rise in contribution from the bunkering services segment, as it contributed more than 99% of our Group’s revenue. The increase in revenue in FY2024 was primarily attributable to an increase in the volume of oil cargo bunkered of approximately 6.0%, from 933,418 metric ton in FY2023 to 989,512 metric ton in FY2024.

Bunkering Services

The increase in the bunkering services revenue by $56.6 million to $688.2 million in FY2024 from $631.6 million in FY2023 was substantially attributable to the increase of approximately 6.0% in volume of oil cargo bunkered, from 933,418 metric ton in FY2023 to 989,512 metric ton in FY2024.

The increase in bunkered volume was driven by both our Group’s ongoing efforts to meet customer demand through enhanced operational efficiency. In addition, we expanded our customer base in bunkering services from 90 customers in FY2023 to 101 in FY2024, which further contributed to the increase in bunkered volume and revenue.

We also benefited from higher vessel capacity, as one of our vessels, previously chartered to a third party in FY2023, was redeployed to our bunkering fleet in July 2023 following the expiration of the charter contract to support the expansion of our oil bunkering operations.

Vessel Chartering Services

Our vessel chartering services segment previously generated revenue by chartering vessels to third parties. There was no revenue from third parties related to vessel chartering services in FY2024, compared to $1.2 million in FY2023, as our Group temporarily discontinued the segment after the chartering contract expired in July 2023. The vessel was subsequently redeployed to our bunkering fleet to support the growth of our oil bunkering operations.

Ship Management Services

Our ship management services, supported by a competent team of qualified professional mariners, also managed third-party vessels, including tugboats used in the port and STS operations that are owned by other subsidiaries within the Straits Group, which are outside our Group.

The ship management services remained steady, generating approximately $0.4 million and $0.3 million in FY2024 and FY2023, respectively.

Cost of revenues

Our cost of revenues represent direct expenses incurred to generate revenue. These costs are recorded and accrued as incurred. The cost of revenues primarily comprise oil cargo cost, along with other bunkering operation costs such as bunker own used, port charges, crew wages and consumables, transport costs and agency fees. It also includes vessel operation-related costs, such as vessel consumables, insurance, general upkeep and repair costs.

|

|

Its major cost components are as follow:

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Oil cargo sold | 656,864 | 606,451 | 50,413 | 8.3 | ||||||||||||

| Bunker own used | 4,011 | 4,439 | (428 | ) | (9.6 | ) | ||||||||||

| Crew wages | 3,550 | 3,481 | 69 | 2.0 | ||||||||||||

| Other operating cost | 8,138 | 6,619 | 1,519 | 22.9 | ||||||||||||

| Total cost of revenues | 672,563 | 620,990 | 51,573 | 8.3 | ||||||||||||

Our overall cost of revenues increased by 8.3%, or equivalent to $51.6 million, to $672.6 million for FY2024 from $621.0 million for FY2023, representing 97.7% and 98.1% of our total revenue respectively. This increase was in line with the growth in the volume of cargo bunkered, with oil cargo costs rising to $656.9 million in FY2024 from $606.4 million in FY2023. In addition, other operating costs increased to $8.1 million in FY2024 from $6.6 million in FY2023, primarily due to higher vessel maintenance and bunkering loading costs.

Gross Profit and Gross Profit Margin

Overall

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Revenue | 688,608 | 633,080 | 55,528 | 8.8 | ||||||||||||

| Cost of revenues | (672,563 | ) | (620,990 | ) | (51,573 | ) | (8.3 | ) | ||||||||

| Gross profit | 16,045 | 12,090 | 3,955 | 32.7 | ||||||||||||

| Gross profit margin | 2.33 | % | 1.91 | % | 0.42 | % | 22.0 | |||||||||

As a result of the foregoing, we recorded an overall increase of 32.7% in gross profit, or equivalent to $3.9 million, to $16.0 million for FY2024 from $12.1 million in FY2023.

Nevertheless, our gross profit margin increased marginally by 0.42% to 2.33% in FY2024 from 1.91% in FY2023 due to improved margins in our oil bunkering services.

Bunkering Services

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Revenue | 688,210 | 631,608 | 56,602 | 9.0 | ||||||||||||

| Cost of revenues | (672,563 | ) | (620,610 | ) | 51,953 | 8.4 | ||||||||||

| Gross profit | 15,647 | 10,998 | 4,649 | 42.3 | ||||||||||||

| Gross profit margin | 2.27 | % | 1.74 | % | 0.53 | % | 30.5 | |||||||||

| Total metric ton sold (mt) | 989,512 | 933,418 | 56,094 | 6.0 | ||||||||||||

| Average gross profit per metric ton | $ | 15.81 | $ | 11.78 | $ | 4.03 | 34.2 | |||||||||

We recorded an increase of 42.3% in gross profit of bunkering services, or equivalent to $4.6 million, to $15.6 million in FY2024 from $11.0 million in FY2023. Our gross profit margin increased marginally by 0.53% to 2.27% in FY2024 from 1.74% in FY2023.

The average gross profit per metric ton of oil cargo sold had increased by approximately 34.2%, or equivalent to $4.03 per mt, to $15.81 in FY2024 from $11.78 in FY2023. This improvement was attributable to our strategic focus on penetrating new markets and expanding our customer base contributed to higher sales volumes. We successfully attracted new customers while maintaining strong relationships with existing buyers. Through maintaining a steady demand, we optimized resource usage and lowered the overall cost of providing services for FY2024. In addition, the increase in bunkering activities, which led to higher operational efficiencies, enabling us to leverage economies of scale and optimize our cost structure.

Vessel Chartering Services

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Revenue | - | 1,194 | (1,194 | ) | (100.0 | ) | ||||||||||

| Cost of revenues | - | (380 | ) | 380 | 100.0 | |||||||||||

| Gross profit | - | 814 | 814 | 100.0 | ||||||||||||

| Gross profit margin | - | 68.2 | % | (68.2 | )% | (100.0 | ) | |||||||||

|

|

We recorded a decrease in gross profit of vessel chartering services to nil in FY2024, down from $0.8 million in FY2023. Our gross profit margin decreased to nil in FY2024 from 68.2% in FY2023.

The drop in gross profit of vessel chartering services was due to our Group redeployed the chartered vessel to our bunkering fleet of vessels to meet the growing demand for our bunkering services following the expiration of the charter contract in July 2023.

Ship Management Services

Gross profit of ship management services increased to $ 0.4 million in FY2024, from $0.3 million in FY2023, remaining relatively stable.

Selling and Marketing Expenses

The selling and marketing expenses comprise marketing travelling and advertising expenses incurred by the sales and marketing team.

Our selling and marketing expenses decreased by 60.4% or approximately $0.06 million, to $0.04 million in FY2024, down from $0.1 million in FY2023, due to cost-saving plan on marketing expenses in FY2024.

General and Administrative Expenses

The general and administrative expenses which increased by 2.4% or $0.1 million, to $5.2 million in FY2024 from $5.1 million in FY2023 comprise the following:

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Staff cost | 2,300 | 2,266 | 34 | 1.5 | ||||||||||||

| Management fees | 499 | 487 | 12 | 2.5 | ||||||||||||

| Professional fees | 424 | 415 | 9 | 2.2 | ||||||||||||

| Leasing license | 300 | 300 | - | - | ||||||||||||

| Vessel deposit written off | - | 273 | (273 | ) | (100.0 | ) | ||||||||||

| Impairment/ assets written off | 71 | (5 | ) | 76 | 1,520.0 | |||||||||||

| Others | 1,655 | 1,391 | 264 | 19.0 | ||||||||||||

| Total general and administrative expenses | 5,249 | 5,127 | 122 | 2.4 | ||||||||||||

Staff cost increased by $0.03 million to $2.30 million in FY2024, up from $2.27 million in FY2023. This was mainly due to higher staff-related costs and the recruitment of a senior management member for a subsidiary, Straits Marine Services Pte. Ltd. in FY2024. This increase was partially offset by the adjustment for the over-provision of staff and director bonuses for FY2023 in Tumpuan Megah.

Management fees are paid to Straits Management Services Sdn. Bhd., a related company within the Straits Group, remained stable at $0.5 million in both FY2024 and FY2023. These fees cover overall group management and coordination services, encompassing but not limited to listing compliance and requirement, group consolidation and reporting, corporate governance, corporate secretarial, corporate finance, corporate banking, accounting, market and public relations to the subsidiaries of our Company.

Professional fees include statutory audit fees, tax fees, corporate secretarial fees, and legal fees. The increase in professional fees for FY2024 was due to legal expenses incurred in connection with securing additional trade facilities from local financial institutions.

Corporations incorporated under Labuan Companies Act 1990 are required to pay an annual leasing license fee of $20,000 to Labuan Financial Services Authority (“LFSA”). As such, there was leasing license fee of $0.3 million each in FY2024 and FY2023.

We paid a deposit of approximately $0.3 million in FY2020 for the purchase of a vessel. However, the deposit was written off during FY2023 as the vendor became uncontactable after the COVID-19 Pandemic, and the vessel was not maintained and was in a deplorable condition. We have taken the necessary action in our attempts to recover the deposit paid.

The significant change under impairment was mainly due to an allowance for expected credit loss of our accounts receivable amounted to $0.07 million in FY2024.

The increase in other general and administrative expenses mainly represented (i) an increase in environmental, social, and governance activities payable to a related party, Benua Hijau Sdn. Bhd., an entity owned by a controlling shareholder, amounting to $0.1 million; (ii) an increase of $0.1 million in bank charges for issuing $6.5 million in bank guarantees to suppliers; and (iii) an increase in operating costs, such as insurance and travelling expenses, amounting to $0.05 million due to the expansion of business.

Depreciation

Depreciation represents the annual depreciation on the cost of Group’s fleet of 15 vessels, dry-dock cost, tools, office equipment, computer hardware and software, motor vehicles, real property and furniture and fittings.

The increase in depreciation by $0.5 million to $4.8 million in FY2024, up from $4.3 million in FY2023, was due to the addition of dry-dock cost incurred during the year.

|

|

Other Income, net

Interest Income

Interest income increased to $0.05 million in FY 2024 from $0.01 million in FY2023. The increase arises from approximately $0.04 million which consists of principal sums approximating $0.1 million and $2.0 million placed with lender bank of Tumpuan Megah as a term deposit and in a designated current account respectively.

Sundry Income

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Gain on foreign exchange | 1,415 | 2,982 | (1,567 | ) | (52.5 | ) | ||||||||||

| Cancellation fees | - | 230 | (230 | ) | (100.0 | ) | ||||||||||

| Fair value adjustments | - | 46 | (46 | ) | (100.0 | ) | ||||||||||

| Miscellaneous income | 607 | 63 | 544 | 863.5 | ||||||||||||

| Total sundry income | 2,022 | 3,321 | (1,299 | ) | (39.1 | ) | ||||||||||

Our business activities are substantially denominated in USD, while our assets and liabilities are denominated in our functional currency. We currently do not have a foreign currency hedging policy, as the USD generated from our revenue is sufficient to cover our USD purchases. However, we continue to monitor our foreign exchange exposure and will consider hedging significant foreign currency exposure should the need arise. In the current state of RM strengthening against the USD, we recorded a lower net foreign currency gain of $1.4 million for FY2024 as compared to $3.0 million for FY2023.

Cancellation fees are received from customers who cancelled their purchase of oil cargo. There was no cancellation fee recorded in FY2024.

A fair value adjustment of approximately $0.1 million was made in FY2022 on a debt due from the vendor of Tumpuan Megah. Approximately $0.05 million of this impairment was written back in FY2023 following subsequent payment from the vendor. The debt was related to legal fees for a legal case involving Tumpuan Megah prior to the acquisition of Tumpuan Megah by Straits in 2018. The debt currently stood at approximately $1.8 million of which $0.8 million was being repaid through a repayment plan spanning a period beyond 12 months commencing from April 2023 till March 2027. No adjustment was made in FY2024.

Miscellaneous income includes interest income of $0.4 million from related party, Straits on late payment with interest rate at 8.25%. In addition, there was a $0.2 million adjustment related to the previously recognized value of the acquisition of SMF.

Interest Expense

Interest expense included interest on trade financing facilities granted to Tumpuan Megah, term loan interest and vessel vendor financing interest.

The increase in interest expense by $2.4 million to $4.6 million in FY2024, up from $2.2 million in FY2023, was due to a higher volume of trade financing facilities granted to Tumpuan Megah, which bear interest rates ranging from 5.82% to 8.25%.

Provision For Income Taxes

Cayman Islands

Our Company was incorporated in Cayman Islands. Under the current tax laws of Cayman Islands, we are not subject to income, corporation or capital gains tax, and no withholding tax is imposed upon the payment of dividends.

Malaysia

Profits of Malaysian corporations incorporated under the Companies Act 2016 are subject to the prevailing corporate income tax rate of 24%, and this is applicable to SMF, TMD Marine Fuels Sdn. Bhd. and Tumpuan Megah.

For corporations incorporated under the Labuan Companies Act 1990, that individually own each of our 15 vessels, their audited net profits are subject to the prevailing corporate income tax rate of 3%.

Singapore

For Singapore incorporated corporations, their prevailing corporate income tax rate is at 17% with the following partial tax exemption on its chargeable income:

| 3. | 75% of its first chargeable income of SGD10,000; and | |

| 4. | 50% of its next chargeable income of SGD190,000. |

|

|

With the aforementioned, our Group’s effective tax rate was 41.1% for FY2024 and 20.7% for FY2023. The increase in income tax expenses in FY2024 was primarily due to higher gross profit from our bunkering services, which led to increased operating income. In addition, certain bank charges and professional fees incurred in relation to bank facilities were non-deductible for tax purposes. Furthermore, a non-taxable exchange gain of approximately $2.5 million reduced chargeable income in FY2023, whereas a non-deductible exchange loss of approximately $0.5 million increased chargeable income in FY2024. The reduction in non-taxable income further contributed to the increase in chargeable income for FY2024. Consequently, higher tax expenses and an increased effective tax rate were observed in FY2024. No deferred tax was recognized in FY2024 after the crystallization of deferred tax liabilities arising from assets controlled transfer to Labuan companies.

|

For the Years Ended December 31, |

Variance – |

|||||||||||||||

| 2024 | 2023 | Increase (Decrease) | ||||||||||||||

| $’000 | $’000 | $’000 | % | |||||||||||||

| Current Income Tax | ||||||||||||||||

| Based on result for the year | 1,458 | 698 | 760 | 108.9 | ||||||||||||

| (Over) Under provision in prior years | (30 | ) | 168 | (198 | ) | (117.9 | ) | |||||||||

| 1,428 | 866 | 562 | 64.9 | |||||||||||||

| Deferred Tax | ||||||||||||||||

| Reversal of temporary differences | - | (88 | ) | 88 | 100.0 | |||||||||||

| Over provision in prior years | - | (4 | ) | 4 | 100.0 | |||||||||||

| - | (92 | ) | 92 | 100.0 | ||||||||||||

| Total income tax expense | 1,428 | 774 | 654 | 84.5 | ||||||||||||

5.B. Liquidity and Capital Resources

We are exposed to liquidity risk, which is the risk that we may encounter difficulties in meeting our financial obligations as they become due. We manage this risk by maintaining adequate levels of cash and cash equivalents, monitoring cash flows, and maintaining access to financing sources.

As of June 30, 2025, we had net working capital deficit of $8.7 million and a net loss of $4.5 million. Despite this, we believe that we can meet all our financial obligations as they become due in the foreseeable future. This conclusion is based on a detailed assessment of our financial position, forecast, and plans up to the date of approval of these financial statements.

Key considerations in this assessment include:

| ● | We maintained cash and cash equivalents of $7.1 million as of June 30, 2025. |

| ● | Our strong payment track record and long-standing relationships suggest that trade facilities amounting to approximately $91.8 million and supplier purchasing limits of $11.2 million will be available for the next 12 months. |

| ● | As of June 30, 2025, we had balances of available trade facilities amounting to $7.6 million to support our operational needs. |

| ● | We entered into a repayment plan with major debtors covering approximately $15.0 million, with scheduled monthly repayments from June 2025 to May 2026, which are expected to provide additional liquidity. |

Prior to the consummation of our initial public offering on April 22, 2025, our principal sources of liquidity to finance our operating activities were from the working capital, trade financing from financial institutions, suppliers credit financing and cash generated from business operation.

On April 22, 2025, we consummated our initial public offering on the NYSE American. In this offering, 3,100,000 ordinary shares were issued at a price of $3.25 per share. In addition, we entered into an underwriting agreement with the underwriter on April 21, 2025, which granted the underwriter a 45-day option to purchase up to an additional 465,000 ordinary shares at the public offering price of $3.25 per share to cover any over-allotment. Subsequently, on April 22, 2025, the underwriter exercised the over-allotment option in full, purchasing an additional 465,000 ordinary shares at the public offering price of $3.25 per share. The initial public offering closed on April 22, 2025 and the exercise of the over-allotment option closed on April 24, 2025, with gross proceeds totaling $11.59 million, before deducting underwriting discounts and offering expenses.

We believe that our existing cash resources, anticipated cashflow from operations, anticipated cash raised from financing together with net proceeds from our public offering will be sufficient to meet and fund our anticipated operation working capital and capital expansion requirements for the next 12 months from the date of this transition report.

If we experience an adverse operating environment or incur unanticipated capital expenditure requirements, or if we determine to accelerate our growth, then additional financing may be required. No assurance can be given, however, that such financing would be available at all or on favorable terms. Additional financing may include the use of debt, credit facilities from financial institutions, or the sale of equity or instruments convertible into equity securities, whether by our Group or its holding company. Any issuance of additional equity could result in immediate and possibly significant dilution to our existing shareholders, while incurrence of debt would increase fixed obligations and bring along operating covenants that could restrict our operations.

As at June 30, 2025, our cash and cash equivalents were approximately $7.1 million, comprising primarily in cash and cash equivalent.

|

|

Cash Flows and Working Capital

The following table sets forth a summary of our cash flows for the six months ended June 30, 2025 and 2024 and the years ended December 31, 2024 and 2023 as indicated.

|

For the Six Months Ended June 30, |

For the Years Ended December 31, |

|||||||||||||||

| 2025 | 2024 | 2024 | 2023 | |||||||||||||

| (Unaudited) | (Unaudited) | (Audited) | (Audited) | |||||||||||||

| $’000 | $’000 | $’000 | $’000 | |||||||||||||

| Net cash (used in) provided by operating activities | (20,251 | ) | (42,896 | ) | (24,290 | ) | 654 | |||||||||

| Net cash used in investing activities | (2,096 | ) | (1,942 | ) | (3,761 | ) | (3,148 | ) | ||||||||

| Net cash provided by (used in) financing activities | 12,778 | 45,136 | 38,655 | (2,489 | ) | |||||||||||

| Net (decrease) increase in cash and restricted cash | (9,569 | ) | 298 | 10,604 | (4,983 | ) | ||||||||||

| Effect of exchange rates on cash and restricted cash | 559 | 860 | 636 | (1,456 | ) | |||||||||||

| Cash and restricted cash, beginning of period / year | 16,070 | 4,830 | 4,830 | 11,269 | ||||||||||||

| Cash and restricted cash, end of period / year | 7,060 | 5,988 | 16,070 | 4,830 | ||||||||||||

Operating Activities

Our cash inflow from operating activities was principally from collections of revenue. Our cash outflows used in operating activities was principally for payment of oil cargo purchased, operating expenses, staff cost and general administrative expenses.

The net cash used in operating activities for the six months ended June 30, 2025 was $20.3 million, after adjusting for non-cash item which includes:

| i. | $2.6 million in depreciation charges for the six months ended June 30, 2025. The increase in depreciation charges was due to additional capital expenditure incurred on docking expenditure for the six months ended June 30, 2025. |

Meanwhile, the changes for the six months ended June 30, 2025 working capital were mainly attributable by the following operating assets and liabilities:

| i. | Increase in accounts receivable by $6.6 million due to the implementation of our accounts receivable repayment plan, in which installment agreements were established with customers for repayment of outstanding balances. In addition, slower collections from customers were observed for the six months ended June 30, 2025, primarily due to delays in cargo movement and the ongoing tariff situation. These disruptions affected delivery schedules and invoicing cycles, which in turn strained customer cash flows and extended payment timelines; | |

| ii. | Lower inventory levels were maintained amid market instability for the six months ended June 30, 2025, resulting in a decrease of $2.5 million; | |

| iii. | Increase in other receivables and current assets by $11.9 million, mainly due to advance payments related to marketing and business development activities of and a vessel deposit paid for sourcing target vessel amounting to total of $6.1 million. In addition, advance payments were made to suppliers for purchase of cargo oil increased by $3.7 million; and | |

| iv. | Decrease in income tax payable of $1.8 million as the operating entity, Tumpuan Megah, incurred a net loss for the six months ended June 30, 2025 which reduced the current tax expense and related tax payable. |

The net cash used in operating activities for the six months ended June 30, 2024 was $42.9 million, after adjusting for non-cash item which includes: