UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2025

AGRIFORCE GROWING SYSTEMS, LTD.

(Exact Name of Registrant as Specified in Charter)

| British Columbia | 001-40578 | 00-0000000 NA | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

A1

|

800-525 West 8th Avenue Vancouver, BC, Canada |

V5Z1C6 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (604) 757-0952

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares | AGRI | The Nasdaq Capital Market |

Item 1.01 Entry into a Material Definitive Agreement.

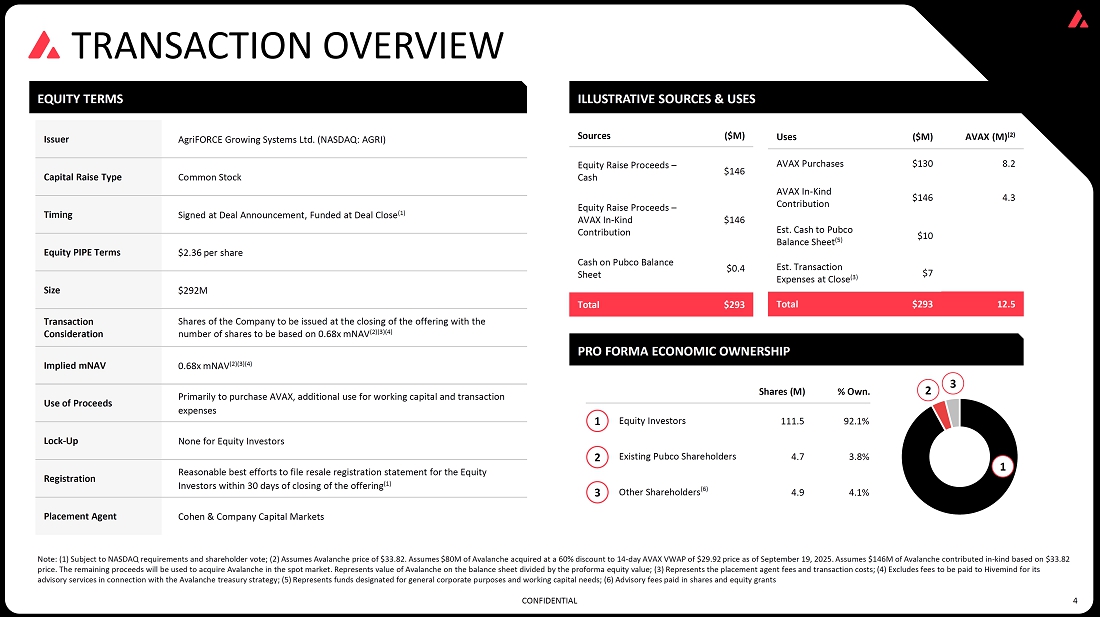

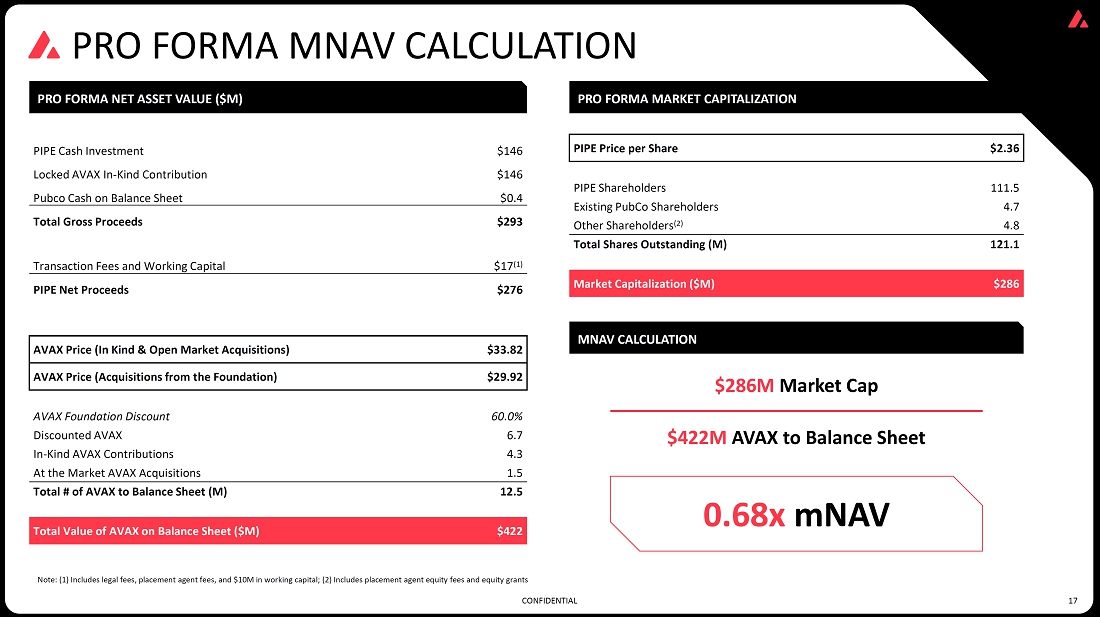

On September 22, 2025, AgriFORCE Growing Systems Ltd. (the “Company”) entered into subscription agreements (each, a “Subscription Agreement” and collectively, the “Subscription Agreements”) with certain institutional and accredited investors (each, an “Investor” and collectively, the “Investors”), pursuant to which the Company, subject to the restrictions and upon satisfaction of the conditions in the Subscription Agreements, agreed to sell in one or more private placement transactions exempt from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Offering”), to the Investors Company common shares, no par value per share (in generality, the “Common Shares”, and the aggregate number thereof referenced in this sentence, the “Shares”), in an aggregate amount of $292.4 million. The per Share purchase price is $2.36 (the “Share Price”).

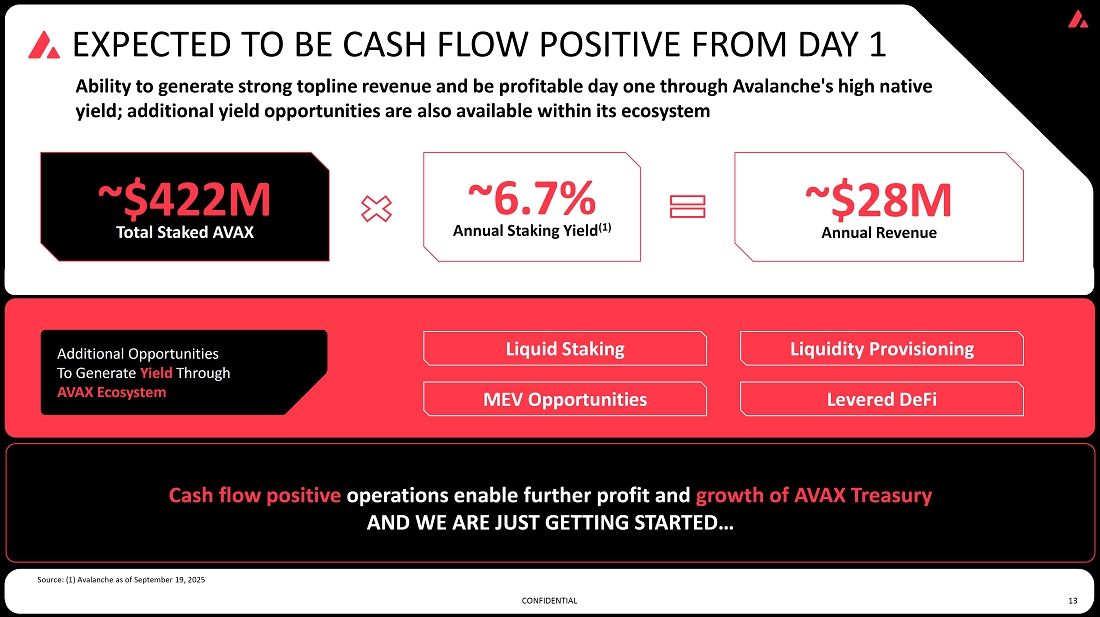

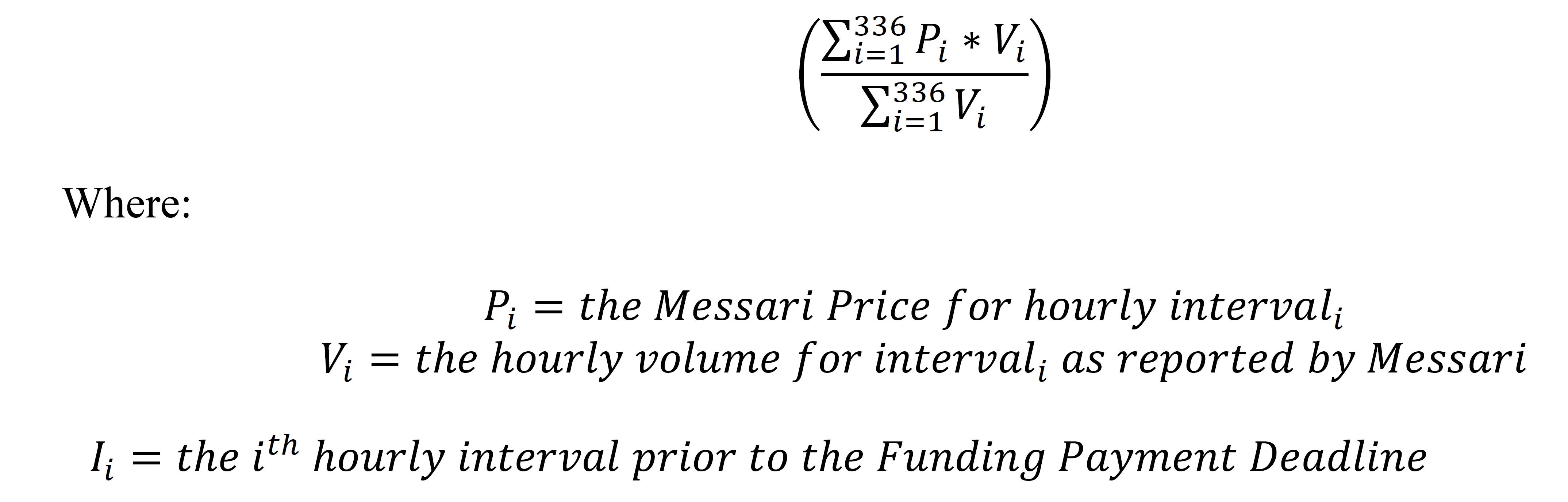

Of the aggregate $292.4 million purchase price for the Shares, an aggregate of (i) $146.4 million is expected to be paid in cash, the cryptocurrency stablecoin commonly referred to as USDC (“USDC”) based on a purchase price of $1.00 per USDC, and the cryptocurrency stablecoin commonly referred to as USDT (“USDT” and together with USDC, “Stablecoins”) based on a purchase price of $1.00 per USDT, and (ii) $146.0 million is expected to be paid in the native cryptocurrency of the Avalanche Network, referred to as AVAX Tokens (“AVAX Tokens”), which will be valued for purposes of the Subscription Agreements at the volume-weighted average price of an AVAX Token (rounded to two decimal places) during the 14 consecutive calendar days ending on the Funding Payment Deadline (as defined in the Subscription Agreements) based on midnight UTC, calculated by using the hourly volume and the Messari Price as reported on messari.io (the “Specified AVAX Token Value”). Because the Specified AVAX Token Value will not be set until the Funding Payment Deadline, the aggregate amount of Shares to be issued in the Offering is not currently known. Based on an indicative value of $33.82 per AVAX Token, which was the Messari Price of AVAX Tokens at 4:00 pm on September 19, 2025, as reported on messari.io (the “Illustrative AVAX Token Price”), the aggregate number of Shares that are expected to be issued is 112 million. Such amount is preliminary and subject to change based on changes in AVAX Token prices.

The Subscription Agreements contain representations and warranties of the Company and the Investors which are typical for transactions of this type. In the Subscription Agreements, the Company has granted to the Investors, and the Investors have granted to the Company, customary indemnification rights. The Subscription Agreements also contain conditions precedent to closing, including but not limited to, shareholder approval pursuant to Nasdaq Listing Rules 5635(b)-(d).

Cohen & Company Securities, LLC (“Cohen”) acted as the sole placement agent in connection with the Offering.

The Offering is expected to close promptly after the satisfaction of customary closing conditions, including approval of the Offering by the Company’s stockholders.

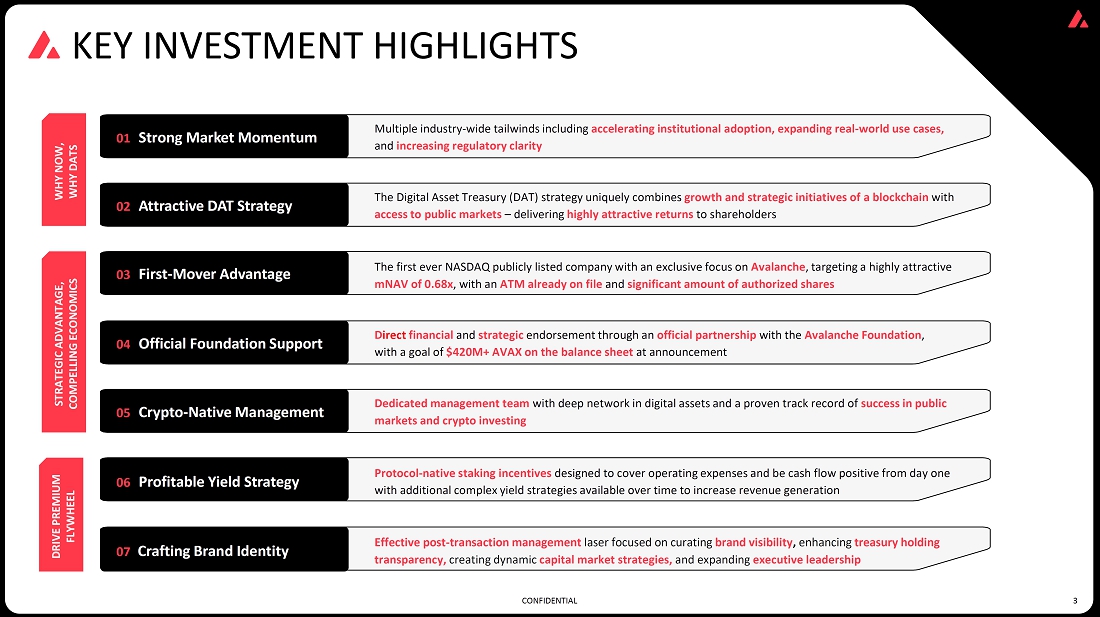

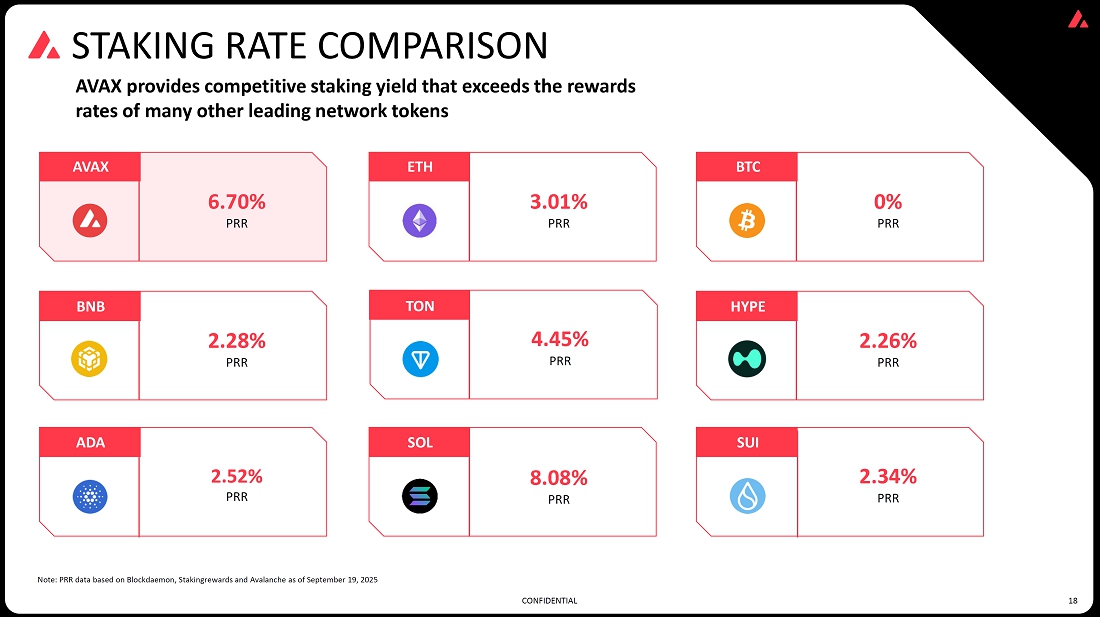

The Company intends to use up to $10 million of the cash net proceeds from the Offering for general corporate purposes initiated after the closing and for pre-existing working capital commitments or obligations, and the remaining cash net proceeds for the acquisition of AVAX Tokens. The AVAX Tokens so acquired, together with the remaining net proceeds, will be used for the establishment of the Company’s cryptocurrency treasury operations to the extent consistent with the Company’s investment policy as amended or otherwise modified from time to time. In connection with the announcement of the Offering, the Company announced the launch of its digital asset treasury reserve strategy, to be effective upon the closing of the Offering, pursuant to which the Company plans to use AVAX Tokens as its primary treasury reserve asset on an ongoing basis.

The Company also intends to continue substantive operation of its Bitcoin mining business. The Company’s current management team, consisting of Jolie Kahn, as Chief Executive Officer, and Chris Polimeni, as Chief Financial Officer, will continue in their respective roles with the Company after the closing of the Offering. However, with the exception of Amy Griffith who will continue as a director of the Company after closing, all current directors of the Company have agreed to resign upon closing of the Offering and will be replaced at the time of the closing of the Offering. Please refer to the Company’s Preliminary Proxy Statement on Schedule 14A, filed on the date hereof, for more information regarding the Company’s anticipated post-closing board of directors.

Registration Rights

In the Subscription Agreements, the Company agreed to, among other things, use reasonable best efforts to submit or file with the Securities and Exchange Commission (the “SEC”), within 30 calendar days after the closing of the Offering, a registration statement on Form S-3 (or Form S-1 if Form S-3 is not available) (the “Registration Statement”), registering the resale of the Registrable Securities (as defined below), and the Company agreed to use its commercially reasonable efforts to have the Registration Statement declared effective as soon as practicable after filing and upon the earlier of (i) the twenty-fifth (25th) business day (or sixtieth (60th) business day if the SEC notifies the Company that it will “review” the Registration Statement) following the filing date and (ii) the 5th business day after the date the Company is notified (orally or in writing, whichever is earlier) by the SEC that the Registration Statement will not be “reviewed” or will not be subject to further review. The Company agreed to use commercially reasonable efforts to maintain the effectiveness of the Registration Statement until the earlier of (a) the Investors cease to hold any Registrable Securities, (b) the date all Registrable Securities held by the Investors may be sold without restriction under Rule 144 of the Securities Act, including without any volume and manner of sale restrictions which may be applicable to affiliates under Rule 144 and without the requirement for the Issuer to be in compliance with the current public information required under Rule 144, and (c) three years from the effective date of the Registration Statement. “Registrable Securities” means the Shares and any Common Shares issued or issuable with respect to the Shares as a result of any stock split or subdivision, stock dividend, recapitalization, exchange or similar event.

Asset Management Agreement

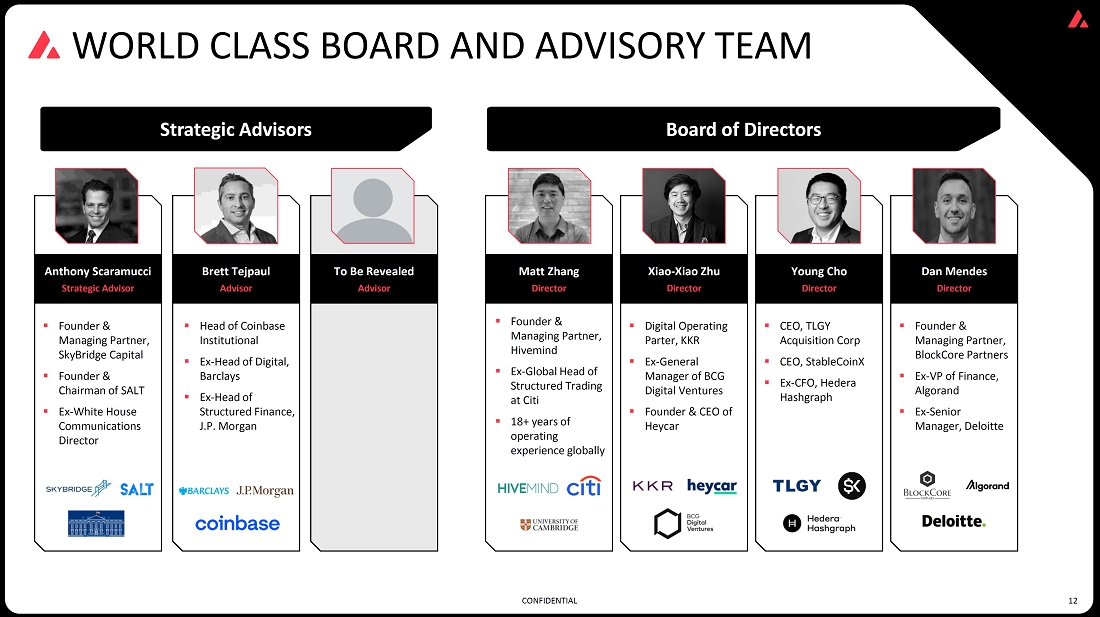

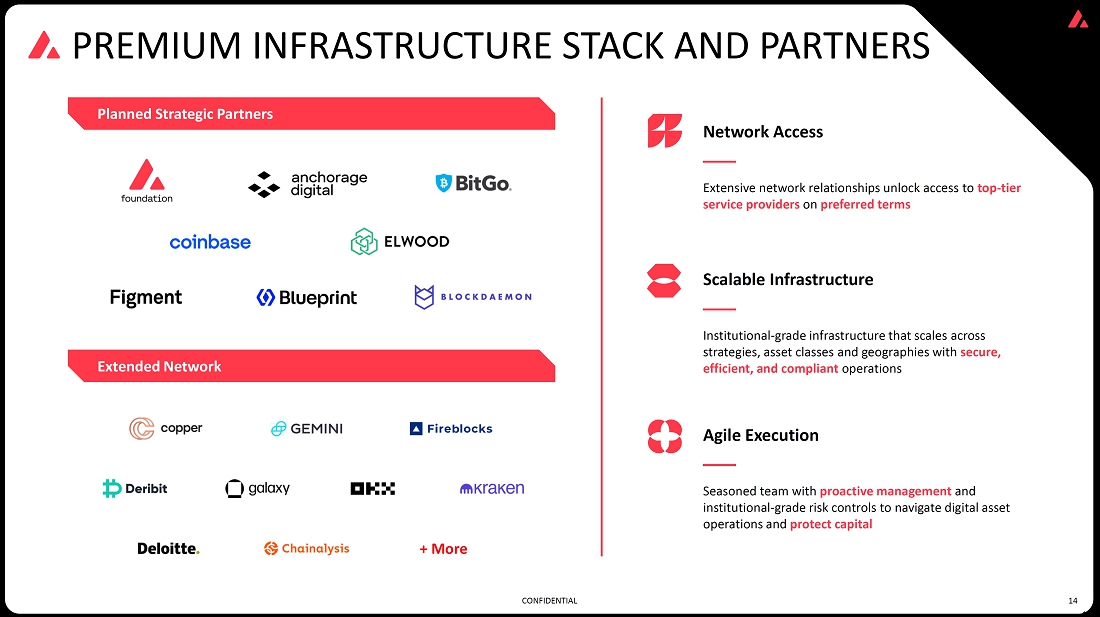

On September 18, 2025, the Company entered into an Asset Management Agreement (the “Asset Management Agreement”) with Hivemind Capital Partners, LLC (the “Asset Manager”). The Asset Manager shall provide discretionary asset management services with respect to, among other assets (including without limitation certain subsequently raised, received or allocated funds or assets), the Company’s proceeds from the Offering (the “Account Assets”) in connection with any of the Company’s digital asset strategies, in accordance with the terms of the Asset Management Agreement. The custodians under the Asset Management Agreement will consist of cryptocurrency wallet providers agreed to by the Company and the Asset Manager. The Asset Management Agreement will become effective upon closing of the Offering.

The Company shall pay the Asset Manager an annual management fee (the “Management Fee”) equal to one and one-quarter percent (1.25%) of the Account Size (as defined in the Asset Management Agreement). The Management Fee will be calculated and payable quarterly in advance, as of the first business day of each calendar quarter. In addition to the Management Fee, the Company will reimburse the Asset Manager for all documented out-of-pocket expenses incurred by the Asset Manager in connection with the performance of the Asset Manager’s duties under the Asset Management Agreement.

The Asset Management Agreement will, unless early terminated, continue in effect until the tenth anniversary of the Effective Date (as defined in the Asset Management Agreement) and, unless a party to the agreement elects to not continue the effectiveness of the Asset Management Agreement, will continue for successive five-year renewal periods upon the mutual agreement of the Asset Manager and the Company. The Asset Management Agreement may be terminated at any time for cause (i) by the Company upon at least 30 days prior written notice to the Asset Manager and (ii) by the Asset Manager upon at least 60 days prior written notice to the Company. The Asset Manager may immediately terminate the Asset Management Agreement upon written notice to the Company if the Asset Manager reasonably determines that the continuation of its services or the Asset Management Agreement would result in a violation of any applicable law, regulation, or regulatory guidance.

The foregoing summaries of the the Securities Purchase Agreements (for both cash/Stablecoin and AVAX Token subscriptions), and the Asset Management Agreement do not purport to be complete and are qualified in their entirety by reference to the complete text of those agreements, which are attached hereto as Exhibits 10.1, 10.2, and 10.3, respectively, to this Current Report on Form 8-K and are hereby incorporated by reference into this Item 1.01. The representations, warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

The Shares will be issued and sold by the Company in reliance upon an exemption from registration pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and/or Rule 506 of Regulation D of the Securities Act. The Company relied on this exemption from registration based in part on representations made by the Investors and the Advisor. Neither this Current Report on Form 8-K, nor any exhibit attached hereto, is an offer to sell or the solicitation of an offer to buy the securities described herein.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The applicable information regarding the resignation of the Company’s directors upon the closing of the Offering included in Item 1.01 above, is incorporated herein by reference. None of the resigning directors resigned as the result of any disagreement with the Company on any matter relating to the Company’s operations, policies, or practices.

Item 7.01 Regulation FD Disclosure.

On September 22, 2025, the Company issued a press release announcing the Offering and related transactions, including the launch of its digital asset treasury strategy. The Company intends to continue to pursue its current lines of business in addition to the pursuit of its digital asset treasury strategy.

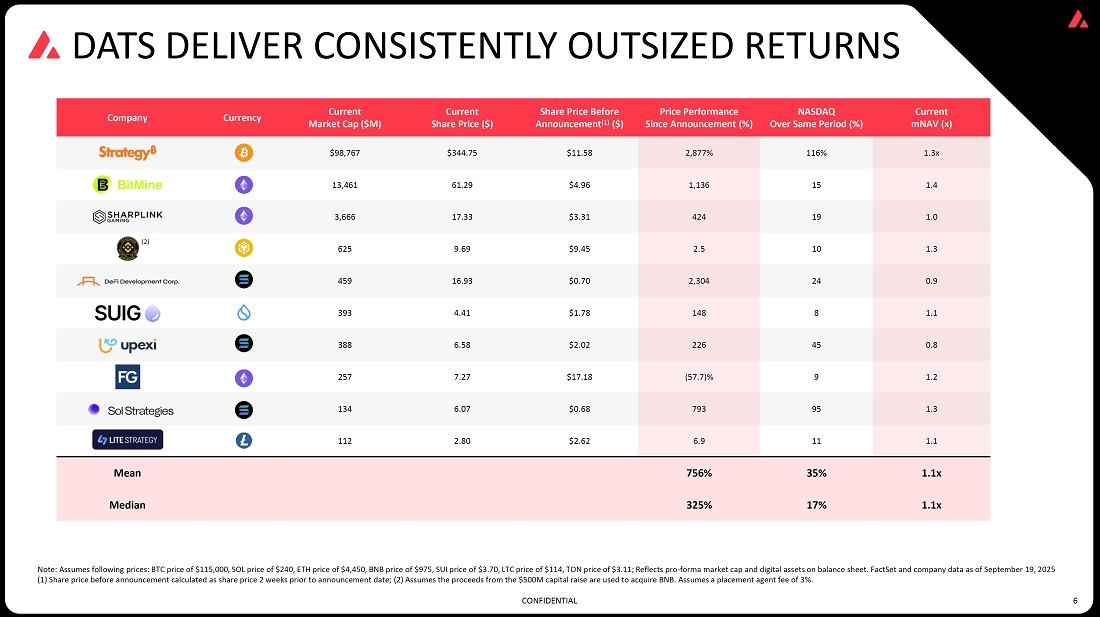

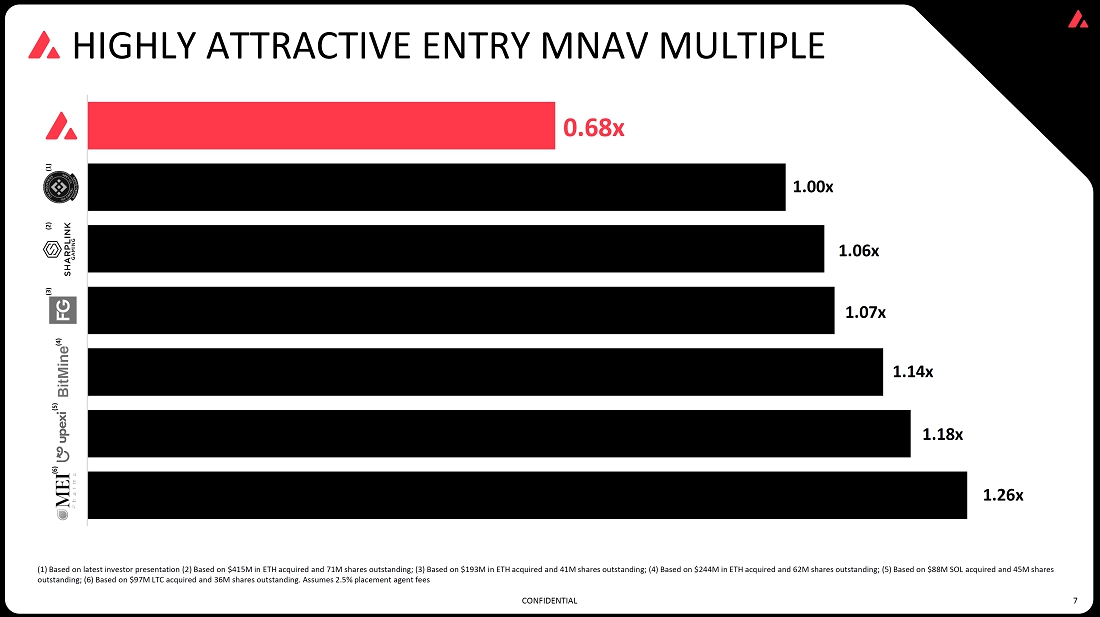

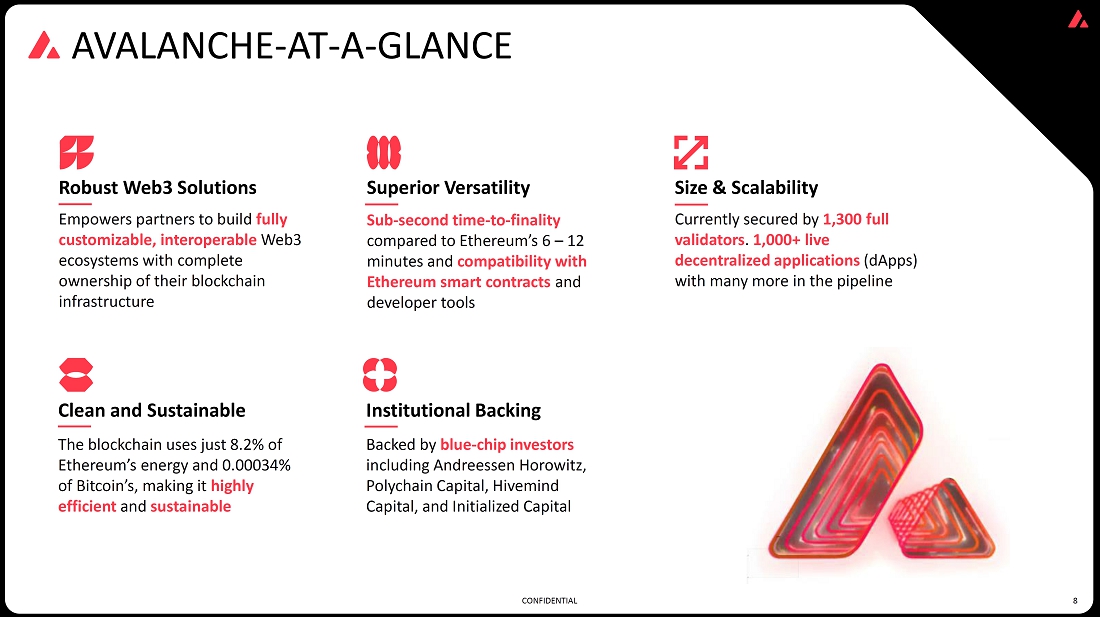

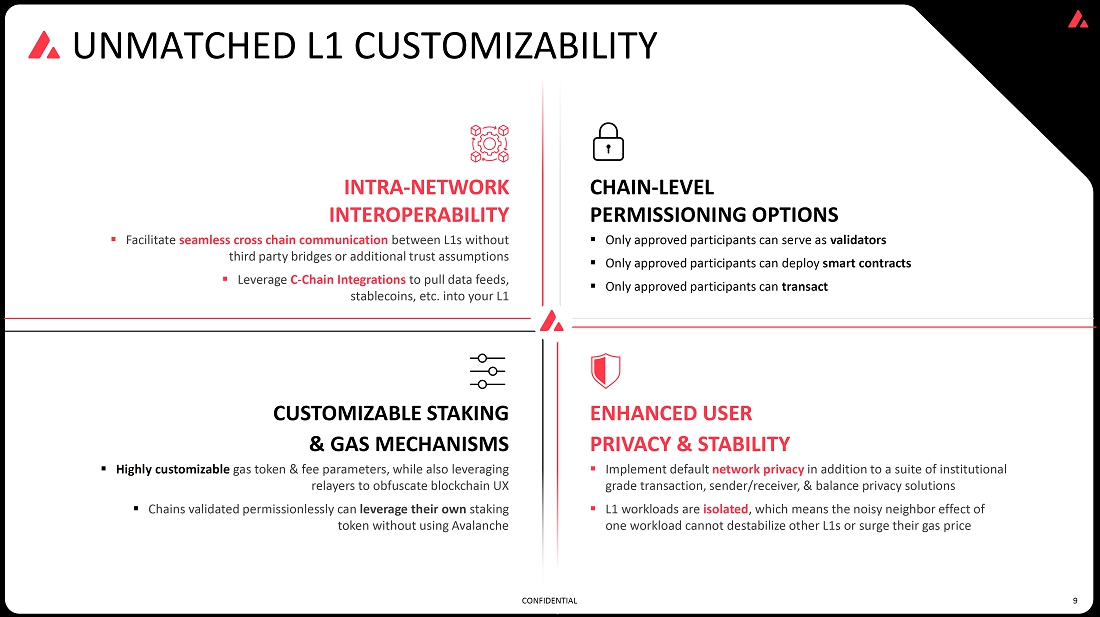

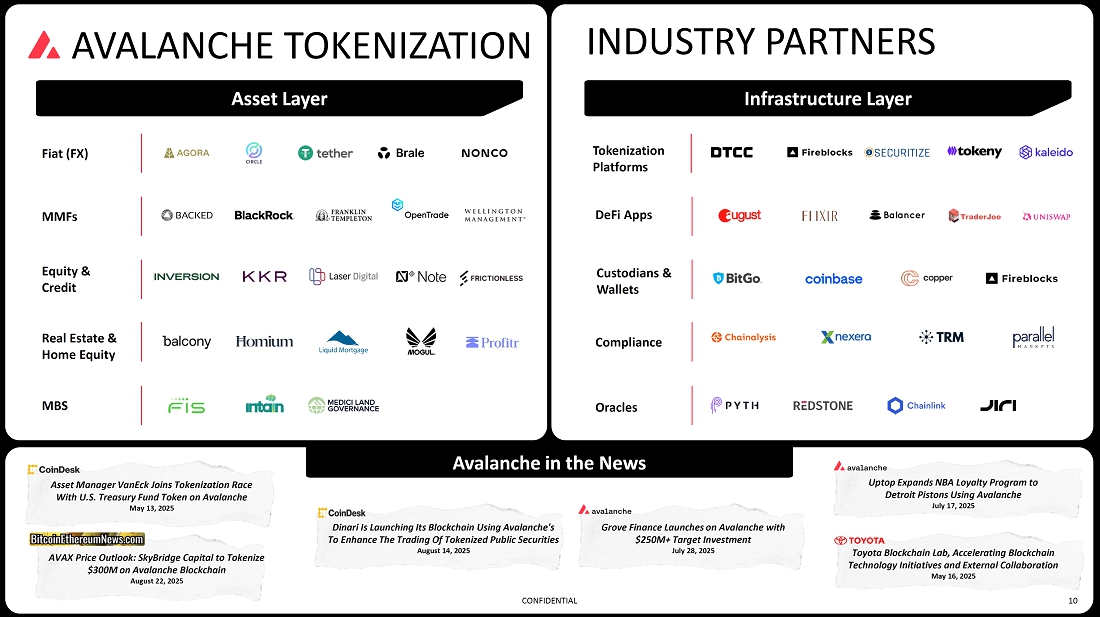

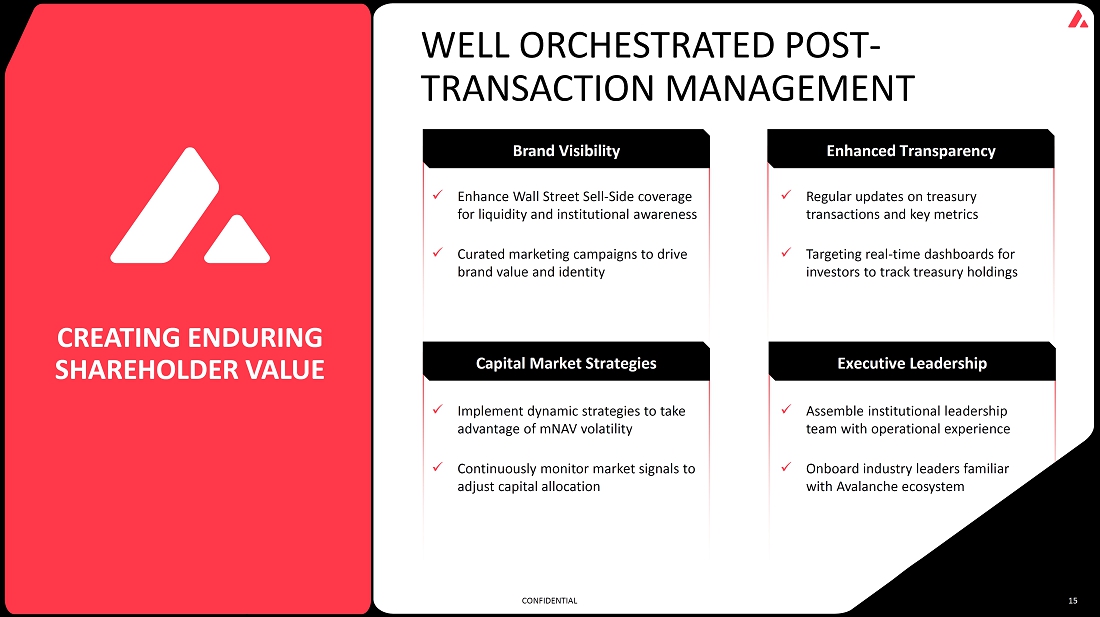

In connection with the Offering and related transactions described herein, the Company delivered an investor presentation (the “Investor Presentation”) to potential investors on a confidential basis.

The press release and investor presentation are attached as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated into this Item 7.01 by reference. The information in this Item 7.01, including Exhibits 99.1 and 99.2 attached hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Information.

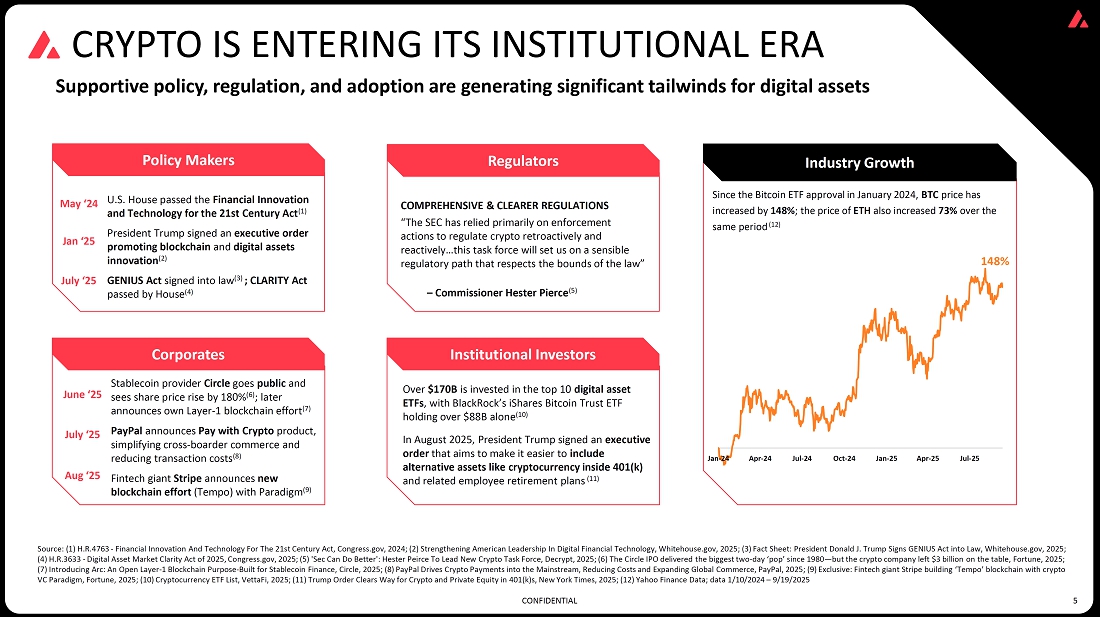

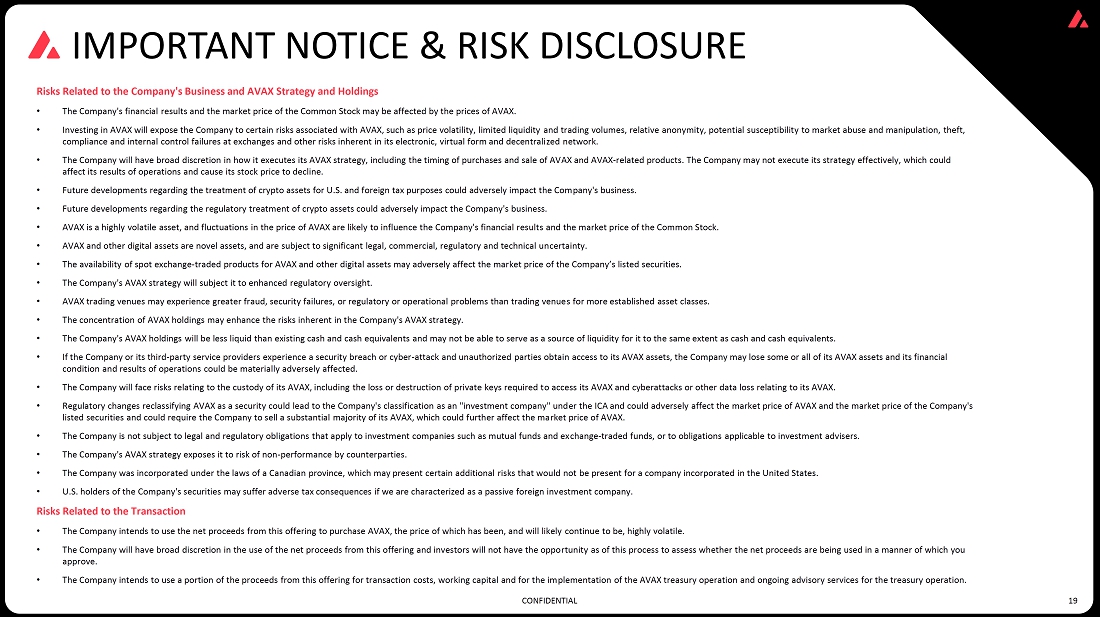

The following risk factors are being provided herein in light of the Offering and the launch of the Company’s digital asset treasury reserve strategy and for the purpose of supplementing and updating disclosures contained in the Company’s prior public filings, including those discussed under the heading “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on April 7, 2025 (as amended):

Risks Related to the Company’s Business and AVAX Strategy and Holdings

| ● | The Company’s financial results and the market price of the Common Shares may be affected by the prices of AVAX. | |

| ● | Investing in AVAX will expose the Company to certain risks associated with AVAX, such as price volatility, limited liquidity and trading volumes, relative anonymity, potential susceptibility to market abuse and manipulation, theft, compliance and internal control failures at exchanges and other risks inherent in its electronic, virtual form and decentralized network. | |

| ● | The Company will have broad discretion in how it executes its AVAX strategy, including the timing of purchases and sale of AVAX and AVAX-related products. The Company may not execute its strategy effectively, which could affect its results of operations and cause its stock price to decline. | |

| ● | A significant decrease in the market value of the Company’s AVAX holdings could adversely affect its ability to satisfy its financial obligations under debt financings. | |

| ● | Future developments regarding the treatment of crypto assets for U.S. and foreign tax purposes could adversely impact the Company’s business. AVAX and other digital assets are novel assets, and are subject to significant legal, commercial, regulatory and technical uncertainty. | |

| ● | AVAX is a highly volatile asset, and fluctuations in the price of AVAX are likely to influence the Company’s financial results and the market price of the Common Shares. | |

| ● | AVAX and other digital assets are novel assets, and are subject to significant legal, commercial, regulatory and technical uncertainty. | |

| ● | The availability of spot exchange-traded products for other digital assets may adversely affect the market price of its listed securities. | |

| ● | The Company’s AVAX strategy will subject it to enhanced regulatory oversight. | |

| ● | AVAX trading venues may experience greater fraud, security failures, or regulatory or operational problems than trading venues for more established asset classes. | |

| ● | The concentration of AVAX holdings may enhance the risks inherent in the Company’s AVAX strategy. | |

| ● | The Company’s AVAX holdings will be less liquid than existing cash and cash equivalents and may not be able to serve as a source of liquidity for it to the same extent as cash and cash equivalents. | |

| ● | If the Company or its third-party service providers experience a security breach or cyber-attack and unauthorized parties obtain access to its AVAX assets, the Company may lose some or all of its AVAX assets and its financial condition and results of operations could be materially adversely affected. | |

| ● | The Company will face risks relating to the custody of its AVAX, including the loss or destruction of private keys required to access its AVAX and cyberattacks or other data loss relating to its AVAX. If the Company loses or otherwise cannot access the Company Wallet, the AVAX Tokens held in the Company Wallet may be irretrievable. Additionally, because blockchain records and wallets are publicly available to view, the Company Wallet may become a target for bad actors to hack or otherwise gain unauthorized access to the Company Wallet and the Company’s AVAX Tokens. |

| ● | Regulatory changes reclassifying AVAX as a security could lead to the Company’s classification as an “investment company” under the Investment Company Act of 1940, as amended, and could adversely affect the market price of AVAX and the market price of the Company’s listed securities and could require the Company to sell a substantial majority of its AVAX, which could further affect the market price of AVAX. | |

| ● | The Company is not subject to legal and regulatory obligations that apply to investment companies such as mutual funds and exchange-traded funds, or to obligations applicable to investment advisers. | |

| ● | The Company’s AVAX strategy exposes it to risk of non-performance by counterparties. | |

| ● | U.S. holders of the Company’s securities may suffer adverse tax consequences if the Company is characterized as a passive foreign investment company. |

Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “expect,” “plan,” “could,” “may,” “will,” “believe,” “estimate,” “forecast,” “goal,” “project,” and other words of similar meaning. These forward-looking statements address various matters including statements relating to the anticipated benefits and timing of the completion of the Offering and related transactions, the intended use of proceeds from the Offering, the Company’s proposed digital asset treasury strategy, the digital assets to be held by the Company and the expected benefits from the transactions described herein. Each forward-looking statement contained in this Current Report on Form 8-K is subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statement. Applicable risks and uncertainties include, among others, the risk that the proposed transactions described herein may not be completed in a timely manner or at all; the Company’s shareholder meeting may not provide the necessary approval for the Company to close the Offering; failure to realize the anticipated benefits of the Offering and related transactions, including the proposed digital asset treasury strategy; changes in business, market, financial, political and regulatory conditions; risks relating to the Company’s operations and business, including the highly volatile nature of the price of AVAX Tokens and other cryptocurrencies; the risk that the Company’s stock price may be highly correlated to the price of the digital assets that it holds; risks related to increased competition in the industries in which the Company does and will operate; risks relating to significant legal, commercial, regulatory and technical uncertainty regarding digital assets generally; risks relating to the treatment of crypto assets for U.S. and foreign tax purpose, as well as those risks and uncertainties identified in this Current Report on Form 8-K, as well as in the investor presentation filed as Exhibit 99.1 to this Current Report on Form 8-K, and those identified under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and other information the Company has or may file with the SEC.

The Company cautions investors not to place considerable reliance on the forward-looking statements contained in this Current Report on Form 8-K. You are encouraged to read the Company’s filings with the SEC, available at www.sec.gov, for a discussion of these and other risks and uncertainties. The forward-looking statements in this Current Report on Form 8-K speak only as of the date of this report, and we undertake no obligation to update or revise any of these statements. The Company’s business is subject to substantial risks and uncertainties, including those referenced above. Investors, potential investors, and others should give careful consideration to these risks and uncertainties.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 10.1* | Form of Subscription Agreement (cash/Stablecoin subscription), dated as of September 22, 2025, between the Company and each Subscriber (as defined therein). | |

| 10.2* | Form of Subscription Agreement (AVAX subscription), dated as of September 22, 2025, between the Company and each Subscriber (as defined therein). | |

| 10.3 | Asset Management Agreement, dated as of September 22, 2025, between the Company and Hivemind Capital Partners, LLC. | |

| 99.1 | Press Release, dated September 22, 2025. | |

| 99.2 | Investor presentation. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

* Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted schedule and/or exhibit will be furnished to the SEC upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: September 22, 2025

| AGRIFORCE GROWING SYSTEMS, LTD. | ||

| By: | /s/ Jolie Kahn | |

| Name: |

Jolie Kahn Chief Executive Officer |

|

Exhibit 10.1

SUBSCRIPTION AGREEMENT

This SUBSCRIPTION AGREEMENT (this “Subscription Agreement”) is entered into on September 22, 2025, by and among Agriforce Growing Systems, Ltd., a corporation incorporated and organized under the laws of the Province of British Columbia (the “Issuer”), and the undersigned investors (collectively, the “Subscribers” and each a “Subscriber”).

This Subscription Agreement may be executed by an investment manager on behalf of one or more managed funds or accounts set forth on a schedule hereto, each of which severally and not jointly shall be a Subscriber hereunder.

WHEREAS, in connection with the Transaction (as defined below), on the terms and subject to the conditions set forth in this Subscription Agreement, Subscriber desires to subscribe for and purchase in cash or USD Coin (“USDC”), a stablecoin pegged to the value of the U.S. dollar, or Tether (“USDT”), a stablecoin pegged to the value of the U.S. dollar, from the Issuer (i) the number of shares of the Issuer’s common stock, at no par value per share (the “Common Stock”), set forth on the Subscriber’s signature page hereto (the “Acquired Shares”) for a purchase price of $2.36 per share (the “Share Purchase Price”) and/or (ii) the number of pre-funded warrants to purchase Common Stock (the “Warrant Shares”) substantially in the form attached hereto as Exhibit B (the “Pre-Funded Warrants” and, together with the Acquired Shares, the “Acquired Securities”) set forth on the signature page hereto, if any, at a purchase price equal to the Share Purchase Price less $0.0001 per Pre-Funded Warrant, with an exercise price equal to $0.0001 per Warrant Share (the “Warrant Purchase Price” and, the aggregate purchase price set forth on the Subscriber’s signature page hereto for the Acquired Securities, the “Purchase Price”), and the Issuer desires to issue and sell to Subscriber the Acquired Securities in consideration of the payment of the Purchase Price by or on behalf of Subscriber to the Issuer at or prior to the Closing Date (as defined herein);

WHEREAS, the Issuer intends to use the net proceeds of the sale of Acquired Securities to purchase Avalanche ‘AVAX’ Tokens (“AVAX” or “AVAX Tokens”) and for general corporate purposes; and

WHEREAS, in connection with the Transaction, Cohen & Company Capital Markets, a division of Cohen & Company Securities, LLC, in its capacity as placement agent (the “Placement Agent”) for the offer and sale of the Acquired Securities (the “Transaction”) may identify and solicit certain other “qualified institutional buyers” (as defined in Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”)) or “accredited investors” (as such term is defined in Rule 501 under the Securities Act, and each such “qualified institutional buyer” or “accredited investor,” an “Other Subscriber”), each of which shall have entered into subscription agreements with the Issuer substantially similar to this Subscription Agreement (provided that certain subscription agreements contemplate a purchase of Acquired Securities for AVAX Tokens) contemporaneously herewith (the “Other Subscription Agreements”), pursuant to which such Other Subscribers have agreed to subscribe for and purchase, and the Issuer has agreed to issue and sell to such Other Subscribers, on the Closing Date, shares of Common Stock and/or Pre-Funded Warrants at the Share Purchase Price and/or the Warrant Purchase Price (the “Other Subscriptions”).

NOW, THEREFORE, in consideration of the foregoing and the mutual representations, warranties and covenants, and subject to the conditions, herein contained, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

1. Subscription. Subject to the terms and conditions hereof, Subscriber hereby agrees to subscribe for and purchase, and the Issuer hereby agree to sell to Subscriber, upon the payment of the Purchase Price, the Acquired Securities (such subscription and issuance, the “Subscription”).

2. Closing.

a. Subject to the satisfaction or waiver of the conditions set forth in Sections 2.d and 2.e (other than those conditions that by their nature are to be satisfied at Closing, but without affecting the requirement that such conditions be satisfied or waived at Closing), the closing of the Subscription contemplated hereby (the “Closing”) shall occur substantially concurrently with the closing of the Other Subscriptions (such date, the “Closing Date”).

| - |

b. On or prior to the Funding Payment Deadline (as defined below), each Subscriber (i) if paying for the Acquired Securities in cash, will pay its total Purchase Price by wire transfer of immediately available funds in accordance with wire instructions provided by the Issuer to the Subscribers or (ii) if paying for the Acquired Securities with USDC or USDT, will deliver the Purchase Price to the Issuer’s digital asset wallet account (the “Issuer Wallet”). At the Closing, the Issuer shall deliver or cause to be delivered to the Subscriber a number of Acquired Securities, registered in the name of the Subscriber (or its nominee in accordance with such Subscriber’s delivery instructions), equal to the number of Acquired Securities indicated on the Subscriber’s signature page to this Subscription Agreement. The Issuer will deliver or cause to be delivered to Subscriber as promptly as practicable after the Closing, evidence from the Issuer’s transfer agent of the issuance to Subscriber of Subscriber’s Acquired Securities on and as of the Closing Date.

c. Subject to the satisfaction or waiver of the conditions set forth in Sections 2.d and 2.e (other than those conditions that by their nature are to be satisfied at Closing, but without affecting the requirement that such conditions be satisfied or waived at Closing):

(i) Subscriber shall deliver to the Issuer (A) no later than the Funding Payment Deadline, the Purchase Price for the Acquired Securities by (i) wire transfer of U.S. dollars in immediately available funds or (ii) to the Issuer Wallet, to the account specified by the Issuer and (B) no later than two (2) business days in advance of the Closing, any other information that is reasonably requested in the notice provided by Issuer (the “Closing Notice”) that is required in order to enable the Issuer to issue, deliver and sell the Acquired Securities, including, without limitation, the legal name of the person (or nominee) in whose name such Acquired Securities are to be delivered and a duly executed Internal Revenue Service Form W-9 or W-8, as applicable; and

(ii) On the Closing Date, the Issuer shall deliver or cause to be delivered to Subscriber the Acquired Securities against payment by Subscriber in book-entry form, free and clear of any Liens (as defined below) or other restrictions whatsoever (other than those arising under state or federal securities laws), in the name of Subscriber (or its nominee in accordance with its delivery instructions) or to a custodian designated by Subscriber, as applicable. Each book entry for the Acquired Securities shall contain a legend in substantially the following form:

[NEITHER] THIS SECURITY [NOR THE SECURITIES INTO WHICH THIS SECURITY IS EXERCISABLE] HAS [NOT] BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. THIS SECURITY [AND THE SECURITIES ISSUABLE UPON EXERCISE OF THIS SECURITY] MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN SECURED BY SUCH SECURITIES.

d. The Issuer’s obligation to effect the Closing shall be subject to the satisfaction on the Closing Date, or, to the extent permitted by applicable law, the waiver by the Issuer, of each of the following conditions:

(i) the Placement Agent and the Issuer, shall each have received a completed copy of the “Eligibility Representations of Subscriber” questionnaire in substantially the form attached as Schedule A hereto no later than the Closing Date and if the Subscriber is a resident of Canada, a questionnaire and acknowledgement with respect to appliable Canadian securities laws;

(ii) all representations and warranties of Subscriber contained in this Subscription Agreement shall be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or Subscriber Material Adverse Effect (as defined herein), which representations and warranties shall be true and correct in all respects) at and as of the Closing Date;

| - |

(iii) Subscriber shall have performed, satisfied and complied in all material respects with all covenants, agreements and conditions required by this Subscription Agreement to be performed, satisfied or complied with by it at or prior to the Closing, except where the failure of such performance, satisfaction or compliance would not or would not be reasonably expected to prevent, materially delay or materially impair the ability of Subscriber to consummate the Closing; and

(iv) no applicable governmental authority shall have enacted, issued, promulgated, enforced or entered any judgment, order, law, rule or regulation (whether temporary, preliminary or permanent) that is then in effect and has the effect of making consummation of the Subscription illegal or otherwise preventing or prohibiting consummation of the Subscription, and no governmental authority shall have instituted or threatened in writing a proceeding seeking to impose any such prevention or prohibition.

e. Subscriber’s obligation to effect the Closing shall be subject to the satisfaction on the Closing Date, or, to the extent permitted by applicable law, the written waiver by Subscriber, of each of the following conditions:

(i) no suspension of the listing on The Nasdaq Capital Market or another national securities exchange (collectively, the “Exchange”), of the Common Stock shall have occurred, and the Issuer shall have filed with The Nasdaq Stock Market LLC (“Nasdaq”) a Notification Form: Listing of Additional Shares for the listing of the Acquired Shares, and Nasdaq shall not have raised any objection to such notice or the transactions contemplated hereby;

(ii) all representations and warranties of the Issuer contained in this Subscription Agreement shall be true and correct in all material respects (other than representations and warranties that are qualified as to materiality or Material Adverse Effect (as defined herein), which representations and warranties shall be true and correct in all respects) at and as of the Closing Date (except for representations and warranties made as of a specific date, which shall be true and correct in all material respects or in all respects, as applicable as of such date);

(iii) the Issuer, as applicable, shall have performed, satisfied and complied (unless waived) in all material respects with all covenants, agreements and conditions required by this Subscription Agreement to be performed, satisfied or complied with by it at or prior to the Closing;

(iv) no applicable governmental authority shall have enacted, issued, promulgated, enforced or entered any judgment, order, law, rule or regulation (whether temporary, preliminary or permanent) that is then in effect and has the effect of making consummation of the Subscription illegal or otherwise preventing or prohibiting consummation of the Subscription and no governmental authority shall have instituted or threatened in writing a proceeding seeking to impose any such prevention or prohibition;

(v) the Issuer shall have provided each Subscriber with the Issuer’s wire instructions or Issuer Wallet instructions, on Issuer letterhead and executed by the Chief Executive Officer or Chief Financial Officer of the Issuer;

(vi) if required, the Issuer shall have delivered a Pre-Funded Warrant registered in the name of such Subscriber to purchase up to a number of Warrant Shares included on the signature page hereto;

(vii) the Issuer shall have delivered to such Subscriber a certificate, in the form acceptable to such Subscriber, executed by an officer of the Issuer and dated as of the Closing Date, as to (i) the resolutions consistent with Section 3.a as adopted by the Issuer’s board of directors (the “Board of Directors”) in a form reasonably acceptable to such Subscriber and (ii) the Charter Documents (as defined below), each as in effect at the Closing;

| - |

(viii) the Issuer shall have furnished to the Placement Agent a certificate, dated the Closing Date, of its Chief Executive Officer and its Chief Financial Officer stating in their respective capacities as officers of the Issuer on behalf of the Issuer and not in their individual capacities that (x) for the period from and including the date of this Subscription Agreement through and including the Closing Date, there has not occurred any Material Adverse Effect, (y) to their knowledge, after reasonable investigation, as of the Closing Date, the representations and warranties of the Issuer in this Subscription Agreement are true and correct and the Issuer has complied with all agreements and satisfied all conditions on its part to be performed or satisfied hereunder at or prior to the Closing Date, and (z) there has not been, subsequent to the date of the most recent audited financial statements included or incorporated by reference in SEC Documents (as defined below), any Material Adverse Effect in the financial position or results of operations of the Issuer, or any change or development that, singularly or in the aggregate, would reasonably be expected to involve a Material Adverse Effect, except as set forth in the SEC Documents. “knowledge” means the actual knowledge of the officers of the Issuer; and

(ix) no event or series of events that, individually or in the aggregate, has had or would reasonably be expected to have a Material Adverse Effect shall have occurred and be continuing on the Closing Date; and

f. Promptly following the date of this Subscription Agreement or, if the Issuer is required to hold a stockholder vote in connection with the approval of the Transaction and/or related matters, within one (1) business day of the receipt of stockholder approval of the Transactions and/or related matters, the Issuer shall deliver the Closing Notice to the Subscribers, setting out the expected Closing Date and specifying the date and time for the funding of the Purchase Price (the “Funding Payment Deadline”), with such Funding Payment Deadline to be at least two (2) business days following delivery of the Closing Notice and at least one (1) business day prior to the expected Closing Date.

g. Prior to or at the Closing, the parties hereto shall execute and deliver such additional documents and take such additional actions as the parties reasonably may deem to be practical and necessary in order to consummate the Subscription as contemplated by this Subscription Agreement.

3. Issuer Representations and Warranties. The Issuer represents and warrants as of the date hereof and the Closing Date, that:

a. Each of the Issuer and the Subsidiaries has been duly incorporated and is validly existing as a corporation in good standing under the laws of its jurisdiction of incorporation, with corporate power and authority to own, lease and operate its respective properties and conduct its business as presently conducted and to enter into, deliver and perform its obligations under this Subscription Agreement. Neither the Issuer nor any subsidiary of the Issuer as set forth in the SEC Documents and shall, where applicable, also include any direct or indirect subsidiary of the Issuer formed or acquired after the date hereof ( a “Subsidiary”) is in violation nor default of any of the provisions of its respective certificate or articles of incorporation, memorandum and articles of association, notice of articles, bylaws or other organizational or charter documents (the “Charter Documents”). Each of the Issuer and the Subsidiaries is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, would not have or reasonably be expected to result in: (i) a material adverse effect on the legality, validity or enforceability of any Transaction Document (as defined below), (ii) a material adverse effect on the results of operations, assets, business, prospects or condition (financial or otherwise) of the Issuer and the Subsidiaries, taken as a whole, or (iii) a material adverse effect on the Issuer’s ability to perform in any material respect on a timely basis its obligations under any Transaction Document (any of (i), (ii) or (iii), a “Material Adverse Effect”) and no Proceeding has been instituted in any such jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification. “Proceeding” means an action, claim, suit, investigation or proceeding (including, without limitation, an informal investigation or partial proceeding, such as a deposition), whether commenced or threatened.

b. As of the Closing Date, the Acquired Shares will have been duly authorized and, when issued and sold and delivered to Subscriber against full payment for the Acquired Shares in accordance with the terms of this Subscription Agreement, the Acquired Shares will be validly issued, fully paid and non-assessable and will not have been issued in violation of or subject to any preemptive or similar rights whether created by contract, under the Issuer’s Charter Documents (as in effect at such time of issuance) or under the laws of the Province of British Columbia.

| - |

c. The Warrant Shares have been duly authorized and reserved for issuance and, upon issuance pursuant to the terms of the Pre-Funded Warrants against full payment therefor in accordance with the terms of the Pre-Funded Warrants, will be duly and validly issued, fully paid and non-assessable and will be issued free and clear of any Liens or other restrictions (other than those as provided in the Transaction Documents (as defined below) or restrictions on transfer under applicable state and federal securities laws), and the holder of the Warrant Shares shall be entitled to all rights accorded to a holder of Common Stock. If the Subscriber is a resident of Canada it acknowledges and agrees that the transfer of the Acquired Shares and the Warrant Shares shall be subject to the requirements of applicable Canadian securities laws, including without limitation National Instrument 45-106.

d. This Subscription Agreement, the Other Subscription Agreements and the Pre-Funded Warrants (collectively, the “Transaction Documents”) have been duly authorized, executed and delivered by the Issuer and the Subsidiaries party thereto and the Transaction Documents constitute the valid and legally binding obligation of the Issuer and such Subsidiaries, enforceable against the Issuer and such Subsidiaries in accordance with their respective terms, except as may be limited or otherwise affected by (i) bankruptcy, insolvency, fraudulent conveyance, reorganization, moratorium or other laws relating to or affecting the rights of creditors generally and (ii) principles of equity, whether considered at law or equity.

e. Assuming the accuracy of Subscriber’s representations and warranties in Section 4, the execution and delivery of the Transaction Documents by the Issuer and the Subsidiaries party thereto, and the performance by the Issuer and such Subsidiaries of their respective obligations under the Transaction Documents, including the issuance and sale of the Acquired Securities, do not and will not conflict with or result in a breach or violation of any of the terms or provisions of, or constitute a default under, or result in the creation or imposition of any lien, charge or encumbrance upon any of the property or assets of the Issuer or such Subsidiaries pursuant to the terms of (i) any indenture, mortgage, deed of trust, loan agreement, lease, license or other agreement or instrument to which the Issuer or any such Subsidiary is a party or by which the Issuer or any such Subsidiary is bound or to which any of the property or assets of the Issuer or any such Subsidiary is subject, which would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect or materially affect the validity of the Acquired Securities or the legal authority of the Issuer or any such Subsidiary to comply in all material respects with the terms of this Subscription Agreement or any other Transaction Document; (ii) the Charter Documents; or (iii) any statute or any judgment, order, rule or regulation of any court or governmental agency or body, domestic or foreign, having jurisdiction over the Issuer or any such Subsidiary or any of its respective properties that would reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect or materially affect the validity of the Acquired Securities or the legal authority of the Issuer or any such Subsidiary to comply in all material respects with the terms of this Subscription Agreement or any other Transaction Document.

f. There are no securities or instruments issued by or to which the Issuer is a party containing anti-dilution, price reset or similar provisions that will be triggered by the issuance of (i) the Acquired Securities, or (ii) the Common Stock to be issued pursuant to any Other Subscription Agreement or Pre-Funded Warrants, in each case, that have not been or will not be validly and irrevocably waived on or prior to the Closing Date.

g. Assuming the accuracy of each Subscriber’s representations and warranties in Section 4, neither the Issuer nor any Subsidiary party to the Transaction Documents is required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local, provincial or other governmental authority, self-regulatory organization (including the Exchange) or other person in connection with the execution, delivery and performance by the Issuer or any such Subsidiary of this Subscription Agreement (including, without limitation, the issuance of the Acquired Securities and Warrant Shares), other than (i) the filing with the Securities and Exchange Commission (the “Commission”) of the Registration Statement (as defined below), (ii) the filings required in accordance with Section 7.m, (iii) notifications required by each Exchange, and (iv) the failure of which to obtain would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect or have a material adverse effect on the Issuer’s or any such Subsidiary’s ability to consummate the transactions contemplated hereby or thereby, including the sale and issuance of the Acquired Securities.

| - |

h. As of the date hereof, the authorized capital stock of the Issuer consists of (i) unlimited shares of preferred stock, with no par value per share (“Preferred Stock”) and (ii) unlimited shares of Common Stock. As of the date hereof, there are no shares of Preferred Stock issued and outstanding, there are 2,522,438 shares of Common Stock issued and outstanding, and there are 355,062 total warrants outstanding, with a weighted average exercise price of $4.716 and a 5-year exercise term. The Issuer has not issued any shares of Common Stock since its most recently filed or furnished report under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), other than (i) any Acquired Shares issued pursuant to this Subscription Agreement, (ii) pursuant to the exercise of employee share options under the Issuer’s outstanding share option awards, (iii) the issuance of Common Stock or other equity securities to employees pursuant to the Issuer’s equity incentive plan, and (iv) pursuant to the conversion and/or exercise of Common Stock Equivalents outstanding as of the date of the most recent Quarterly Report on Form 10-Q filed with the Commission. No Person has any right of first refusal, preemptive right, right of participation, or any similar right to participate in the transactions contemplated by the Transaction Documents. Except as a result of the purchase and sale of the Acquired Securities and described in the SEC Documents, there are no outstanding options, warrants, scrip rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities, rights or obligations convertible into or exercisable or exchangeable for, or giving any Person any right to subscribe for or acquire, any Common Stock or the capital stock of any Subsidiary, or contracts, commitments, understandings or arrangements by which the Issuer or any Subsidiary is or may become bound to issue additional Common Stock or Common Stock Equivalents or capital stock of any Subsidiary. The issuance and sale of the Acquired Securities will not obligate the Issuer or any Subsidiary to issue Common Stock or other securities to any Person (other than the Subscribers). There are no outstanding securities or instruments of the Issuer or any Subsidiary with any provision that adjusts the exercise, conversion, exchange or reset price of such security or instrument upon an issuance of securities by the Issuer or any Subsidiary. There are no outstanding securities or instruments of the Issuer or any Subsidiary that contain any redemption or similar provisions, and there are no contracts, commitments, understandings or arrangements by which the Issuer or any Subsidiary is or may become bound to redeem a security of the Issuer or such Subsidiary. The Issuer does not have any outstanding share appreciation rights or “phantom stock” awards or agreements or any similar award or agreement. All of the outstanding shares of the Issuer are duly authorized, validly issued as fully paid and nonassessable, have been issued in compliance with all federal and state securities laws, and none of such outstanding shares was issued in violation of any preemptive rights or similar rights to subscribe for or purchase securities. No further approval or authorization of any shareholder, the Board of Directors or others is required for the issuance and sale of the Acquired Securities. There are no shareholders agreements, voting agreements or other similar agreements with respect to the Issuer’s shares of Common Stock to which the Issuer is a party or, to the knowledge of the Issuer, between or among any of the Issuer’s shareholders. “Common Stock Equivalents” means any securities of the Issuer or the Subsidiaries which would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, any debt, preference share, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

i. The financial statements of the Issuer included in the SEC Documents (as defined below) comply in all material respects with applicable accounting requirements and the rules and regulations of the Commission with respect thereto as in effect at the time of filing or as such financial statements have been amended or corrected in a subsequent filing. Such financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) applied on a consistent basis during the periods involved, except as may be otherwise specified in such financial statements or the notes thereto and except that unaudited financial statements may not contain all footnotes required by GAAP, and fairly present in all material respects the financial position of the Issuer and its consolidated Subsidiaries as of and for the dates thereof and the results of operations and cash flows for the periods then ended, subject, in the case of unaudited statements, to normal, immaterial, year-end audit adjustments. Since the date of the latest audited financial statements included within the SEC Documents or as otherwise disclosed in the SEC Documents, (i) there has been no event, occurrence or development that has had or that would reasonably be expected to result in a Material Adverse Effect, (ii) the Issuer has not incurred any liabilities (contingent or otherwise) other than (A) trade payables and accrued expenses incurred in the ordinary course of business consistent with past practice and (B) liabilities not required to be reflected in the Issuer’s financial statements pursuant to GAAP or disclosed in filings made with the Commission, (iii) the Issuer has not altered its method of accounting, (iv) the Issuer has not declared or made any dividend or distribution of cash or other property to its shareholders or purchased, redeemed or made any agreements to purchase or redeem any shares and (v) the Issuer has not issued any equity securities to any officer, director or affiliate, except pursuant to existing Issuer equity incentive plans. The Issuer does not have pending before the Commission any request for confidential treatment of information. Except for the issuance of the Acquired Securities contemplated by this Subscription Agreement, the other transactions contemplated by the Transaction Documents, no event, liability, fact, circumstance, occurrence or development has occurred or exists or is reasonably expected to occur or exist with respect to the Issuer or its Subsidiaries or their respective businesses, prospects, properties, operations, assets or financial condition that would be required to be disclosed by the Issuer under applicable securities laws at the time this representation is made or deemed made that has not been publicly disclosed at least one (1) trading day prior to the date that this representation is made.

| - |

j. The Issuer has not received any written communication from a governmental entity that alleges that the Issuer or any of its Subsidiaries is not in compliance with or is in default or violation of any applicable law, except where such non-compliance, default or violation would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

k. The issued and outstanding shares of Common Stock are, and as of the Closing will be, registered pursuant to Section 12(b) of the Exchange Act, and are listed for trading on the Exchange. The Issuer has taken no action that is designed to terminate the registration of the Common Stock under the Exchange Act or the listing of the Common Stock on the Exchange. Except as included in the SEC Documents, the Issuer has not received notice from any Exchange on which the Common Stock are or have been listed or quoted to the effect that the Issuer is not in compliance with the listing or maintenance requirements of such Exchange. There is no suit, action, proceeding or investigation pending or, to the knowledge of the Issuer, threatened against the Issuer by the Exchange or the Commission with respect to any intention by such entity to deregister the Common Stock or prohibit or terminate the listing of the Common Stock on the Exchange. The Issuer is, and has no reason to believe that it will not in the foreseeable future continue to be, in compliance with all such listing and maintenance requirements. The Common Stock are currently eligible for electronic transfer through the Depository Trust Company or another established clearing corporation and the Issuer is current in payment of the fees to the Depository Trust Company (or such other established clearing corporation) in connection with such electronic transfer.

l. Assuming the accuracy of Subscriber’s representations and warranties set forth in Section 4, no registration under the Securities Act is required for the offer and sale of the Acquired Securities by the Issuer to Subscriber or the Other Subscribers in the manner contemplated by this Subscription Agreement or the Other Subscription Agreements, as the case may be. The issuance, sale and delivery of the Acquired Securities hereunder does not contravene the rules and regulations of the Exchange.

m. Neither the Issuer nor any person acting on their respective behalf has engaged or will engage in any form of general solicitation or general advertising (within the meaning of Regulation D of the Securities Act) in connection with any offer or sale of the Acquired Securities.

n. The Issuer is not, and immediately after receipt of payment for the Acquired Securities and the use of proceeds as contemplated hereby will not be (i) an “investment company” within the meaning of the Investment Company Act of 1940, as amended (the “ICA”) and (ii) an “investment fund” within the meaning of the Securities Act (Ontario).

o. The Issuer has not entered into any subscription agreement, side letter or other agreement with any Other Subscriber or any other investor (except with respect to payment method and timing) in connection with such Other Subscriber’s or investor’s direct or indirect investment in the Issuer, other than (i) the Other Subscription Agreements, (ii) the Pre-Funded Warrants, and (iii) agreements or forms thereof that have been publicly filed as exhibits to the SEC Documents via the Commission’s EDGAR system, including filings made by the Issuer.

p. The Issuer acknowledges and agrees that each of the Subscribers is acting solely in the capacity of an arm’s length purchaser with respect to this Subscription Agreement and the transactions contemplated hereby. The Issuer further acknowledges that no Subscriber is acting as a financial advisor or fiduciary of the Issuer (or in any similar capacity) with respect to this Subscription Agreement and the transactions contemplated hereby and thereby and any advice given by any Subscriber or any of their respective representatives or agents in connection with this Subscription Agreement and the transactions contemplated hereby and thereby is merely incidental to the Subscriber’s purchase of the Acquired Securities. The Issuer further represents to each Subscriber that the Issuer’s decision to enter into this Subscription Agreement and the Other Subscription Agreements has been based solely on the independent evaluation of the transactions contemplated hereby by the Issuer and its respective representatives.

| - |

q. Anything in this Subscription Agreement or elsewhere herein to the contrary notwithstanding, it is understood and acknowledged by the Issuer that: (i) none of the Subscribers has been asked by the Issuer to agree, nor has any Subscriber agreed, to desist from purchasing or selling, long and/or short, securities of the Issuer, or “derivative” securities based on securities issued by the Issuer or to hold the Acquired Securities for any specified term; (ii) past or future open market or other transactions by any Subscriber, specifically including, without limitation, “short sales” (as defined in Rule 200 of Regulation SHO under the Exchange Act) or “derivative” transactions, before or after the closing of this or future private placement transactions, may negatively impact the market price of the Issuer’s publicly-traded securities; (iii) any Subscriber, and counter-parties in “derivative” transactions to which any such Subscriber is a party, directly or indirectly, presently may have a “short” position in the Common Stock, and (iv) each Subscriber shall not be deemed to have any affiliation with or control over any arm’s length counter-party in any “derivative” transaction. The Issuer further understands and acknowledges that (y) one or more Subscribers may engage in hedging activities at various times during the period that the Acquired Securities are outstanding, and (z) such hedging activities (if any) could reduce the value of the existing shareholders’ equity interests in the Issuer at and after the time that the hedging activities are being conducted. The Issuer acknowledges that such aforementioned hedging activities do not constitute a breach of this Subscription Agreement or any of the Transaction Documents.

r. The Issuer has made available to Subscriber (including via the Commission’s EDGAR system) a copy of each form, report, statement, schedule, prospectus, proxy, registration statement and other document, if any, filed by the Issuer with the Commission since its initial registration of the Common Stock (the foregoing materials filed or furnished by the Issuer under the Securities Act and the Exchange Act, including the exhibits thereto and documents incorporated by reference therein, being collectively referred to herein as the “SEC Documents”), which SEC Documents, as of their respective filing dates, complied in all material respects with the requirements of the Securities Act and Exchange Act applicable to the SEC Documents and the rules and regulations of the Commission promulgated thereunder applicable to the SEC Documents on a timely basis or has received a valid extension of such time of filing and has filed any such SEC Documents prior to the expiration of any such extension. None of the SEC Documents filed under the Exchange Act (except to the extent that information contained in any SEC Document has been superseded by a later timely filed SEC Document) contained, when filed, any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary to make the statements therein not misleading, in the case of any SEC Document that is a registration statement, or included, when filed, any untrue statement of a material fact or omitted to state a material fact necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading, in the case of all other SEC Documents.

s. Except as disclosed in the SEC Documents or for such matters as would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, there is no action, suit, inquiry, notice of violation, proceeding or investigation pending or, to the knowledge of the Issuer, threatened against or affecting the Issuer, any Subsidiary or any of their respective properties before or by any court, arbitrator, governmental or administrative agency or regulatory authority (federal, state, county, local or foreign) (collectively, an “Action”). Except as disclosed in the SEC Documents, none of the Actions, if any, (i) adversely affects or challenges the legality, validity or enforceability of any of the Transaction Documents or the Acquired Securities or (ii) would, if resolved adversely to the Issuer, have or reasonably be expected to result in a Material Adverse Effect. Neither the Issuer nor any Subsidiary, nor any director or officer thereof, is or has been the subject of any Action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty. There has not been, and to the knowledge of the Issuer, there is not pending or contemplated, any investigation by the Commission involving the Issuer or any current or former director or officer of the Issuer. The Commission has not issued any stop order or other order suspending the effectiveness of any registration statement filed by the Issuer or any Subsidiary under the Exchange Act or the Securities Act.

t. Except for any placement fees payable to the Placement Agents and as set forth on Schedule 3t., the Issuer has not paid, and is not obligated to pay, any brokerage, finder’s or other commission or similar fees in connection with the transactions contemplated by the Transaction Documents. The Subscribers shall have no obligation with respect to any fees or with respect to any claims made by or on behalf of other Persons for fees of a type contemplated in this Section that may be due in connection with the transactions contemplated by the Transaction Documents.

| - |

u. None of the Issuer, any predecessor or affiliated issuer of the Issuer, any director, executive officer or other officer of the Issuer or to the Issuer’s knowledge, any beneficial owner of twenty percent (20%) or more of the Issuer’s outstanding voting equity securities, calculated on the basis of voting power, or any promoter connected with the Issuer in any capacity (collectively, “Issuer Covered Persons”), is subject to any of the “bad actor” disqualifications within the meaning of Rule 506(d) under the Securities Act, except for a disqualification event covered by Rule 506(d)(2) or (d)(3).

v. The Issuer acknowledges that there have been no representations, warranties, covenants and agreements made to Issuer by or on behalf of the Subscriber, any of its respective affiliates or any of its or their control persons, officers, directors, employees, partners, agents or representatives, expressly or by implication, regarding the transactions contemplated by this Subscription Agreement other than those representations, warranties, covenants and agreements included in this Subscription Agreement (inclusive of the exhibits and schedules attached hereto).

w. The gross proceeds from the Acquired Securities contemplated by the Transaction will be utilized for purposes of acquiring AVAX Tokens (including costs associated with such acquisition), transaction costs, working capital and general corporate purposes.

x. No labor dispute exists or, to the knowledge of the Issuer, is threatened with respect to any of the employees of the Issuer, which would reasonably be expected to result in a Material Adverse Effect. None of the Issuer’s or its Subsidiaries’ employees is a member of a union that relates to such employee’s relationship with the Issuer or such Subsidiary, and neither the Issuer nor any of its Subsidiaries is a party to a collective bargaining agreement, and the Issuer and its Subsidiaries believe that their relationships with their employees are good. No executive officer of the Issuer or any Subsidiary, is, or is now expected to be, in violation of any material term of any employment contract, confidentiality, disclosure or proprietary information agreement or non-competition agreement, or any other contract or agreement or any restrictive covenant in favor of any third party, and the continued employment of each such executive officer does not subject the Issuer or any of its Subsidiaries to any liability with respect to any of the foregoing matters. The Issuer and its Subsidiaries are in compliance with all U.S. federal, state, local, Canadian provincial and federal and foreign laws and regulations relating to employment and employment practices, terms and conditions of employment and wages and hours, except where the failure to be in compliance would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. Except as described in the SEC Documents, neither the Issuer nor any Subsidiary is a party to any litigation, order or administrative proceeding, nor to the Issuer’s knowledge is any litigation, order or administrative proceeding threatened against the Issuer or any Subsidiary. The reserves disclosed in the SEC Documents in respect of any litigation, order or administrative proceeding that the Issuer or any Subsidiary are subject to are appropriate and reasonable.

y. The Issuer and the Subsidiaries possess all certificates, authorizations and permits issued by the appropriate federal, state, local or foreign regulatory authorities necessary to conduct their respective businesses as described in the SEC Documents, except where the failure to possess such permits would not reasonably be expected to result in a Material Adverse Effect (“Material Permits”), and neither the Issuer nor any Subsidiary has received any notice of proceedings relating to the revocation or modification of any Material Permit.

z. The Issuer and its Subsidiaries have good and marketable title to their respective owned properties and assets owned by them that are material to the business of the Issuer and the subsidiaries, in each case, free and clear of all Liens, except for Liens set forth on Schedule 3z. or as do not materially affect the value of such property, taken as a whole, and do not interfere in any material respect with the use made or proposed to be made of such properties by the Issuer and its Subsidiaries, taken as a whole. Any real property and facilities held under lease by the Issuer and the Subsidiaries are held by them under valid, subsisting and enforceable leases with which the Issuer and the Subsidiaries are in compliance, except where such non-compliance would not have or reasonably be expected to have a Material Adverse Effect. “Liens” means a lien, charge, pledge, security interest, encumbrance, right of first refusal, preemptive right or other restriction.

| - |

aa. The Issuer and the Subsidiaries have, or have rights to use, all patents, patent applications, trademarks, trademark applications, service marks, trade names, trade secrets, inventions, copyrights, licenses and other intellectual property rights and similar rights necessary or required for use in connection with their respective businesses as described in the SEC Documents and which the failure to so have would have a Material Adverse Effect (collectively, the “Intellectual Property Rights”). None of, and neither the Issuer nor any Subsidiary has received a notice (written or otherwise) that any of, the Intellectual Property Rights has expired, terminated or been abandoned, or is expected to expire or terminate or be abandoned, within two (2) years from the date of this Agreement, except where such expiration, termination or abandonment would not have or reasonably be expected to have a Material Adverse Effect. Neither the Issuer nor any Subsidiary has received, since the date of the latest audited financial statements included within the SEC Documents or as otherwise disclosed in the SEC Documents, a written notice of a claim or otherwise has any knowledge that the Intellectual Property Rights violate or infringe upon the rights of any Person, except as would not have or reasonably be expected to not have a Material Adverse Effect. All such Intellectual Property Rights are enforceable and there is no existing infringement by another Person of any of the Intellectual Property Rights. The Issuer and its Subsidiaries have taken reasonable security measures to protect the secrecy, confidentiality and value of all of their intellectual properties, except where failure to do so would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

bb. The Issuer and the Subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as are prudent and customary for companies of similar size as the Issuer in the businesses in which the Issuer and the Subsidiaries are engaged, including, but not limited to, directors and officers insurance coverage. Neither the Issuer nor any Subsidiary has any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business without a significant increase in cost.

cc. Except as disclosed in the SEC Documents, none of the officers or directors of the Issuer or any Subsidiary, and none of the employees of the Issuer or any Subsidiary is presently a party to any transaction with the Issuer or any Subsidiary (other than for services as employees, officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, providing for the borrowing of money from or lending of money to or otherwise requiring payments to or from any officer, director or such employee or any entity in which any officer, director, or any such employee has a substantial interest or is an officer, director, trustee, shareholder, member or partner, in each case in excess of $120,000 other than for (i) payment of salary or consulting fees for services rendered, (ii) reimbursement for expenses incurred on behalf of the Issuer and (iii) other employee benefits, including equity incentives granted under any equity incentive plan of the Issuer.

dd. Except as set forth in the SEC Documents, the Issuer and the Subsidiaries are in compliance in all material respects with any and all applicable requirements of the Sarbanes-Oxley Act of 2002, as amended, that are effective as of the date hereof, and any and all applicable rules and regulations promulgated by the Commission thereunder that are effective as of the date hereof and as of the Closing Date. Except as set forth in the SEC Documents, the Issuer and the Subsidiaries maintain a system of internal accounting controls sufficient to provide reasonable assurance that: (i) transactions are executed in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP and to maintain asset accountability, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. The Issuer and the Subsidiaries have established disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the Issuer and the Subsidiaries and designed such disclosure controls and procedures to ensure that information required to be disclosed by the Issuer in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms.

ee. Except as set forth in SEC Documents and in connection with this Transaction, no Person has any right to cause the Issuer or any Subsidiary to effect the registration under the Securities Act of any securities of the Issuer or any Subsidiary.

ff. The Issuer and the Board of Directors have taken all necessary action, if any, in order to render inapplicable any control share acquisition, business combination, poison pill (including any distribution under a rights agreement) or other similar anti-takeover provision under the Charter Documents or the laws of its jurisdiction of incorporation that is or could become applicable to the Subscribers as a result of the Subscribers and the Issuer fulfilling its obligations or exercising their rights under the Transaction Documents, including without limitation as a result of the Issuer’s sale and delivery of the Acquired Securities and the Subscribers’ ownership of the Acquired Securities.

| - |

gg. Assuming the accuracy of the Subscribers’ representations and warranties set forth in Section 4, neither the Issuer nor any of its respective affiliates, nor any Person acting on its behalf has, directly or indirectly, made any offers or sales of any security or solicited any offers to buy any security, under circumstances that would cause this offering of the Acquired Securities to be integrated with prior offerings by the Issuer for purposes of (i) the Securities Act which would require the registration of any such securities under the Securities Act, or (ii) any applicable shareholder approval provisions of any Exchange on which any of the securities of the Issuer are listed or designated.

hh. Except for matters that would not, individually or in the aggregate, have or reasonably be expected to result in a Material Adverse Effect, the Issuer and its Subsidiaries each (i) has made or filed all federal, state and local income and all foreign income and franchise tax returns, reports and declarations required by any jurisdiction to which it is subject, (ii) has paid all taxes and other governmental assessments and charges that are material in amount, shown or determined to be due on such returns, reports and declarations and (iii) has set aside on its books provisions reasonably adequate for the payment of all material taxes for periods subsequent to the periods to which such returns, reports or declarations apply. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction.

ii. None of the Issuer, any Subsidiary or any agent or other person acting on behalf of the Issuer or any Subsidiary has (i) directly or indirectly, used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses related to foreign or domestic political activity, (ii) made any unlawful payment to foreign or domestic government officials or employees or to any foreign or domestic political parties or campaigns from corporate funds, (iii) failed to disclose fully any contribution made by the Issuer or any Subsidiary (or made by any person acting on its behalf of which the Issuer is aware) which is in violation of law, or (iv) violated in any material respect any provision of Foreign Corrupt Practices Act of 1977, as amended.

jj. The Issuer’s accounting firm is CBiz, Inc. (fka Marcum, LLP) (the “Accountant”). The Accountant (i) is a registered public accounting firm as required by the Exchange Act, (ii) is independent public accountants within the meaning of the Securities Act and the Public Company Accounting Oversight Board (United States), and (iii) shall express its opinion with respect to the financial statements to be included in the Issuer’s Annual Report on Form 10-K for the fiscal year ending December 31, 2025. Marcum, LLP, whose report was included on the consolidated financial statements of the Issuer for the fiscal year ended December 31, 2024, during the periods covered of its report, was independent public accountants within the meaning of the Securities Act and the Public Company Accounting Oversight Board (United States). There are no disagreements of any kind presently existing, or reasonably anticipated by the Issuer to arise, between the Issuer and the accountants formerly or presently employed by the Issuer, and the Issuer is current with respect to any fees owed to its accountants which could affect the Issuer’s ability to perform any of its obligations under any of the Transaction Documents. Each of the accountants formerly or presently employed by the Issuer is not, or was not, in violation of the auditor independence requirements of the Sarbanes-Oxley Act of 2002, as amended, with respect to the Issuer.