UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

| Date of Report (Date of earliest event reported): | August 7, 2025 |

| Verb Technology Company, Inc. |

| (Exact Name of Registrant as Specified in Charter) |

| Nevada | 001-38834 | 90-1118043 | ||

| (State or Other Jurisdiction | (Commission | (IRS Employer | ||

| of Incorporation) | File Number) | Identification No.) |

| 3024 Sierra Juniper Ct | ||

| Las Vegas, Nevada | 89138 | |

| (Address of Principal Executive Offices) | (Zip Code) |

| Registrant’s Telephone Number, Including Area Code: | (855) 250-2300 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.0001 | VERB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

PIPE Financing

On August 7, 2025, Verb Technology Company, Inc. (the “Company”) completed its previously announced transactions involving the entry into a subscription agreement (the “Subscription Agreement”) with certain institutional investors (the “PIPE Subscribers”) for the issuance of 57,425,254 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at a price per share of $9.51, and 1,276,863 pre-funded warrants to purchase shares of Common Stock at a purchase price per warrant of $9.5099 (“Pre-Funded Warrants”, together with the Common Stock, the “Acquired Securities”), and gross proceeds of approximately $558 million (the “PIPE Financing”). The Acquired Securities were issued in a private placement in reliance upon the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (“Securities Act”), and/or Regulation D promulgated thereunder and in reliance on similar exemptions under applicable state laws.

The net proceeds from the PIPE Financing are intended to be used by the Company to purchase Toncoin (“Toncoin”), the native cryptocurrency of The Open Network (“TON”) blockchain, and for working capital and general corporate purposes.

Approximately one-third of the PIPE Subscribers have agreed to lock-up restrictions with the Company (the “Lock-Up Investors”) whereby they will not sell or transfer the Acquired Securities for six months, with respect to all of the Acquired Securities held by such PIPE Subscribers, or for 12 months, with respect to 50% of the Acquired Securities held by each such PIPE Subscriber, in each case measured from the date of execution of the Subscription Agreement, subject to customary exceptions (the “Lock-Up Restrictions”). Pursuant to the previously disclosed purchase agreement, the Lock-Up Investors that contributed Toncoin not eligible for trading or transfer (the “Locked Toncoin”) are also subject to Lock-Up Restrictions with respect to the Acquired Securities issued as consideration for the Locked Toncoin for the same duration as the Locked Toncoin are not eligible for trading or transfer, which may exceed 12 months.

Advisory Services Agreement

On August 7, 2025, the Company entered into an advisory services agreement (the “Advisory Services Agreement”) with Kingsway Capital Partners Limited (“Kingsway”), which is controlled by Manuel Stotz, the Company’s newly appointed Executive Chairman of the Board of Directors (the “Board”) (as disclosed below in Item 5.02 of this Current Report on Form 8-K (the “Current Report”)). Pursuant to the Advisory Services Agreement, Kingsway will provide advisory and consulting services to the Company with respect to the expansion and diversification of the Company’s business through the Company’s new TON treasury strategy. In consideration for these services, the Company will pay to Kingsway, payable in Toncoin or cash (upon mutual agreement of Kingsway and the Company), (i) a one-time set-up fee having a notional value of $3.0 million within five business days of the date of execution of the Advisory Services Agreement and (ii) an annual advisory fee equal to 2.0% of the Company’s market capitalization (calculated based upon the Company’s equity ownership on a fully diluted, as converted basis), payable in arrears, in 12 monthly installments with such market capitalization calculated as of the last day of each calendar month; however, if the advisory fee is paid in Toncoin, the amount of Toncoin due will be determined using the weighted-average TON execution price as of the last day of each calendar month. The Company will also reimburse Kingsway for such reasonable fees and expenses incurred in connection with the services rendered under the Advisory Services Agreement. The Advisory Services Agreement has a 20-year term and successive one-year renewal periods upon the mutual agreement of Kingsway and the Company, unless earlier terminated.

The foregoing description of the Advisory Services Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Advisory Services Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information contained in response to Item 1.01 above is incorporated herein by reference.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers; Compensatory Arrangements of Certain Officers

Director Resignations

Effective as of August 7, 2025 (the “Effective Date”), Messrs. Kenneth S. Cragun, James P. Geiskopf, and Edmund C. Moy resigned from the Board and, to the extent applicable, all committees thereof (collectively, the “Resignations”). The Resignations were not related to any disagreement with the Company. At the time of the Resignations: Mr. Cragun served on the Audit Committee (“Audit Committee”) of the Board (Chair), the Risk and Disclosure Committee (the “Risk Committee”) of the Board (Chair), the Governance and Nominating Committee (the “Governance and Nominating Committee”) of the Board and the Compensation Committee (the “Compensation Committee”) of the Board; Mr. Geiskopf served on the Compensation Committee (Chair), the Audit Committee, the Governance and Nominating Committee and the Risk Committee; and Mr. Moy served on the Governance and Nominating Committee (Chair), the Audit Committee, the Compensation Committee and the Risk Committee.

Director Appointments

Immediately following the Resignations, also on August 7, 2025, the then-current Board elected each of Nicolas Cary (independent), Evan Sohn (independent) and Manuel Stotz (Executive Chairman) as directors of the Company (the “New Directors”, together with the Board, the “Post-Resignations Board”) to fill the newly created vacancies on the Board. Immediately upon filling the vacancies, the Post-Resignations Board determined it to be in the best interests of the Company to (i) increase the size of the Post-Resignations Board from four members to five members and (ii) to appoint Tucker Highfield (independent) as a director (the Post-Resignations Board, following Mr. Highfield’s appointment, the “New Board”). Messrs. Highfield and Cary were each appointed to serve on the Governance and Nominating Committee of the New Board, Messrs. Cary, Sohn and Highfield were each appointed to serve on the Audit Committee of the New Board and Messrs. Sohn and Cary were each appointed to serve on the Compensation Committee of the New Board (the “New Board Compensation Committee”). In recognition of their service on the New Board, the New Board Compensation Committee approved the following compensation arrangements: Messrs. Cary, Sohn, and Highfield will receive a $187,500 cash retainer and received a $292,500 annual equity award in the form of restricted stock units (“RSUs”); a $150,000 cash retainer and $240,000 annual equity award in the form of RSUs; and a $150,000 cash retainer and $240,000 annual equity award in the form of RSUs, respectively.

Mr. Stotz is currently the Chief Executive Officer of Kingsway. In addition to the Advisory Services Agreement disclosed in Item 1.01 of this Current Report, Kingsway participated in the PIPE Financing, pursuant to which it purchased approximately $118 million in Common Stock. The information contained in response to Item 1.01 above is incorporated herein by reference.

Resignation of Mr. Cutaia and Mr. Rivard as Chief Executive Officer and Chief Financial Officer

In connection with the Officer Appointments (as defined below), Rory Cutaia and Bill Rivard stepped down as the President, Chief Executive Officer and Interim Chief Financial Officer of the Company, respectively. Each of Mr. Cutaia’s and Mr. Rivard’s decision to resign is not due to any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Mr. Cutaia will remain a director and an employee of the Company serving as the head of the Company’s existing social commerce technology and video marketing operations. Mr. Rivard will remain an employee of the Company.

Appointment of Chief Executive Officer

Veronika Kapustina was appointed by the New Board as the Chief Executive Officer of the Company on August 7, 2025 (the “CEO Appointment”). Ms. Kapustina, age 39, is the Founder and Advisor of Houghton Street Ventures LLP, an early-stage investment firm launched in partnership with the London School of Economics & Political Science, where she led the firm’s creation, team recruitment, and initial fund launch. She has also served as an Advisor to the TON Foundation, from January to July 2025, providing strategic guidance on organizational restructuring, operational efficiency, and ecosystem stakeholder management. Previously, Ms. Kapustina was a Technology Investment Banker at Morgan Stanley from 2010 to 2017, in both the UK and U.S., where she executed over 40 transactions totaling $37 billion in value, including high-profile equity and debt raises and M&A transactions for leading technology companies. She has held directorships at several private companies, including VK Strategies Ltd and Reframe Venture Ltd (VentureESG), and served as a board member of ClearAccessIP LLC. Ms. Kapustina holds a BSc in Economics from the London School of Economics & Political Science. She is licensed with the UK Financial Conduct Authority (CF4 and CF30).

In connection with the CEO Appointment, the Company entered into an employment agreement with Ms. Kapustina effective as of the Effective Date (the “CEO Employment Agreement”). Ms. Kapustina’s minimum annual base salary will be $850,000. Within 90 days from the Effective Date, Ms. Kapustina will receive two grants, an Initial Equity Award and a Secondary Equity Award (each, as defined in the CEO Employment Agreement). Each of the Initial Equity Award and the Secondary Equity Award will be comprised of time-based restricted stock units under the Company’s 2019 Stock and Incentive Compensation Plan, as amended (the “Plan”), in an amount equal to 1% of Common Stock on a fully diluted basis as of the Effective Date, subject to approval by the New Board (or the New Board Compensation Committee), with (i) 25% of the Initial Equity Award vesting on the one-year anniversary of the Effective Date and one thirty-sixth of the remaining Initial Equity Award vesting on each monthly anniversary thereafter and (ii) the Secondary Equity Award vesting on a quarterly basis over forty-eight (48) months beginning on the Effective Date, with a quarterly tranche performance-vest as to one-sixteenth (1/16) of the overall Secondary Equity Award, with threshold performance measured at 1.4x a multiple of market capitalization of the Company over net asset value and maximum performance at 1.8x a multiple of market capitalization of the Company over net asset value, with straight-line interpolation between threshold and maximum performance levels (0%-100% of the applicable quarterly tranche), in each case subject to Ms. Kapustina’s continued employment with the Company through each such date. In addition, Ms. Kapustina will also be eligible to receive an annual performance award (the “CEO Annual Bonus”) pursuant to the Plan with an annual target of 100% of her annual base salary, with achievement to be based on specific performance objectives determined by the New Board, in the form of a cash payment no later than March 15th of the calendar year that immediately follows the calendar year to which the CEO Annual Bonus relates.

There are no arrangements or understandings between Ms. Kapustina and any other person pursuant to which she was appointed to serve as Chief Executive Officer of the Company. There are no family relationships between Ms. Kapustina and any director or executive officer of the Company, and Ms. Kapustina does not have a direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Appointment of Chief Financial Officer and Chief Operating Officer

Sarah Olsen was appointed by the New Board as the Chief Financial Officer and Chief Operating Officer of the Company on August 7, 2025 (the “CFO and COO Appointment”, together with the CEO Appointment, the “Officer Appointments”). Ms. Olsen, age 39, most recently served as Co-founder and Managing Partner of Europa Digital Assets Limited, where she led the firm’s alternative investment strategies focused on market-neutral, relative value, and derivative strategies across global cryptocurrency markets from 2022 to 2025. Prior to this, Ms. Olsen was the Global Head of Corporate Development for Onyx by J.P. Morgan, J.P. Morgan’s digital asset group, from 2020 to 2022, where she was responsible for strategic investments, partnerships, and product development in the blockchain and Web3 sectors. Ms. Olsen holds a Bachelor of Arts degree in Philosophy from Georgetown University. She has served as a director for several entities, including Europa Digital Assets Limited, Europa Opportunistic Master Fund, and Europa Opportunistic Offshore Fund.

In connection with the CFO and COO Appointment, the Company entered into an employment agreement with Ms. Olsen effective as of the Effective Date (the “CFO and COO Employment Agreement”). Ms. Olsen’s minimum annual base salary will be $850,000. Within 90 days from the Effective Date, Ms. Olsen will receive two grants, an Initial Equity Award and a Secondary Equity Award (each, as defined in the CFO and COO Employment Agreement). Each of the Initial Equity Award and the Secondary Equity Award will be comprised of time-based restricted stock units under the Plan in an amount equal to 1% of Common Stock on a fully diluted basis as of the Effective Date, subject to approval by the New Board (or the New Board Compensation Committee), with (i) 25% of the Initial Equity Award vesting on the one-year anniversary of the Effective Date and one thirty-sixth of the remaining Initial Equity Award vesting on each monthly anniversary thereafter, and (ii) the Secondary Equity Award vesting on a quarterly basis over forty-eight (48) months beginning on the Effective Date, with a quarterly tranche performance-vest as to one-sixteenth (1/16) of the overall Secondary Equity Award, with threshold performance measured at 1.4x a multiple of market capitalization of the Company over net asset value and maximum performance at 1.8x a multiple of market capitalization of the Company over net asset value, with straight-line interpolation between threshold and maximum performance levels (0%-100% of the applicable quarterly tranche), in each case subject to Ms. Olsen’s continued employment with the Company through each such date. In addition, Ms. Olsen will be eligible to receive an annual performance award (the “CFO and COO Annual Bonus”) pursuant to the Plan with an annual target of 100% of her annual base salary, with achievement to be based on specific performance objectives determined by the New Board, in the form of a cash payment no later than March 15th of the calendar year that immediately follows the calendar year to which the CFO and COO Annual Bonus relates. Lastly, Ms. Olsen will be eligible to receive a one-time bonus with a total value of $1,500,000. This bonus was granted 50% in RSUs (i.e., $750,000 worth of RSUs) of the Company under the Plan and the remaining 50% (less certain amounts) will be delivered as cash. The cash portion of the bonus will be paid to Ms. Olsen within 30 days of the Effective Date, subject to her continued employment with the Company through the date of payment. The equity portion of the bonus will vest on the six month anniversary of the Effective Date following the successful and timely filing of the Company’s first quarterly report on Form 10-Q following the Effective Date.

There are no arrangements or understandings between Ms. Olsen and any other person pursuant to which she was appointed to serve as Chief Financial Officer and Chief Operating Officer of the Company. There are no family relationships between Ms. Olsen and any director or executive officer of the Company, and Ms. Olsen does not have a direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

In connection with the appointment, each newly appointed director of the New Board and executive officer will enter into an indemnification agreement with the Company in a similar form as the Company has entered into with its other directors and executive officers (the “Indemnification Agreements”).

Each of the foregoing descriptions of the CEO Employment Agreement, the CFO and COO Employment Agreement and the Indemnification Agreements does not purport to be complete and is qualified in its entirety by the respective terms and conditions of each agreement, which are attached hereto as Exhibits 10.2, 10.3 and 10.4, respectively, and are incorporated herein by reference.

Item. 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

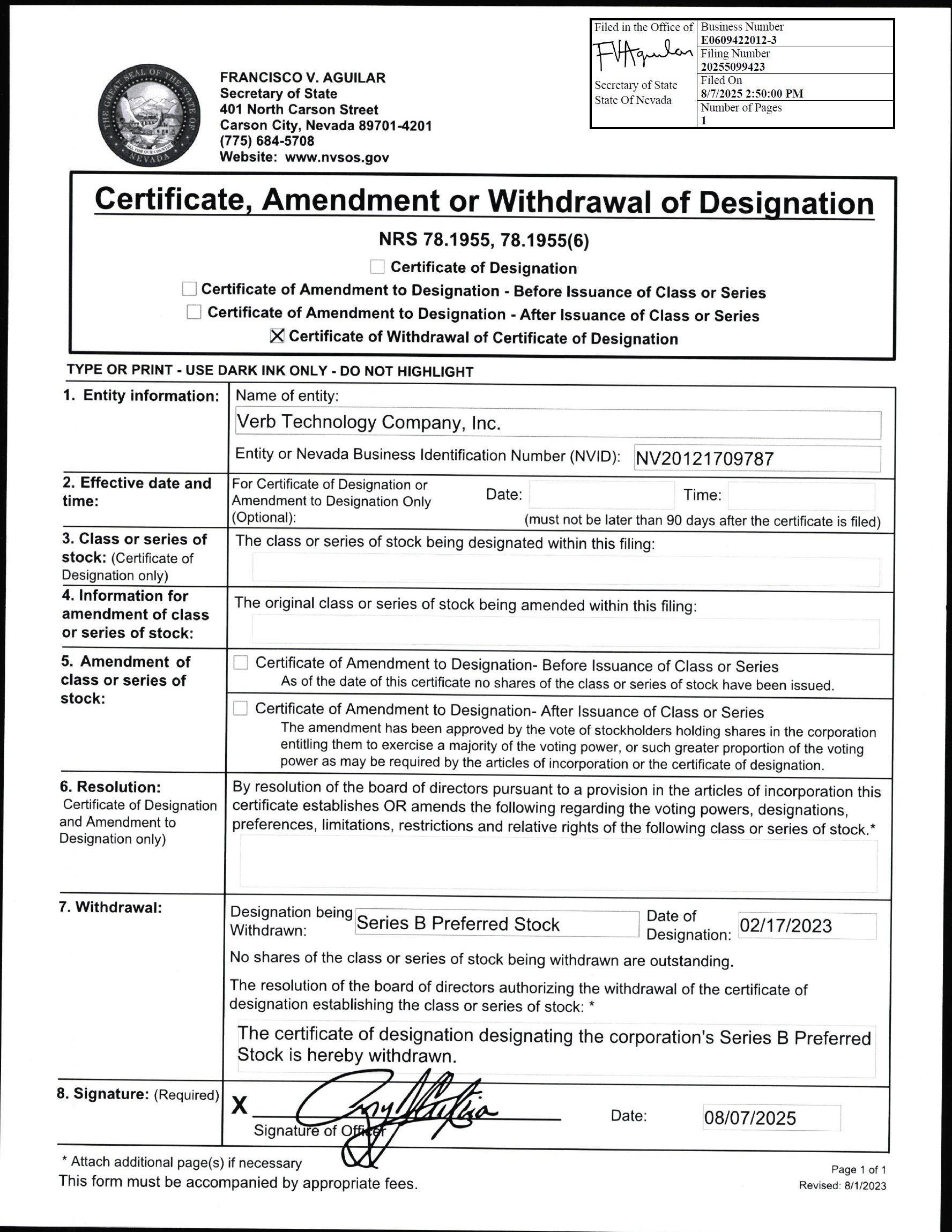

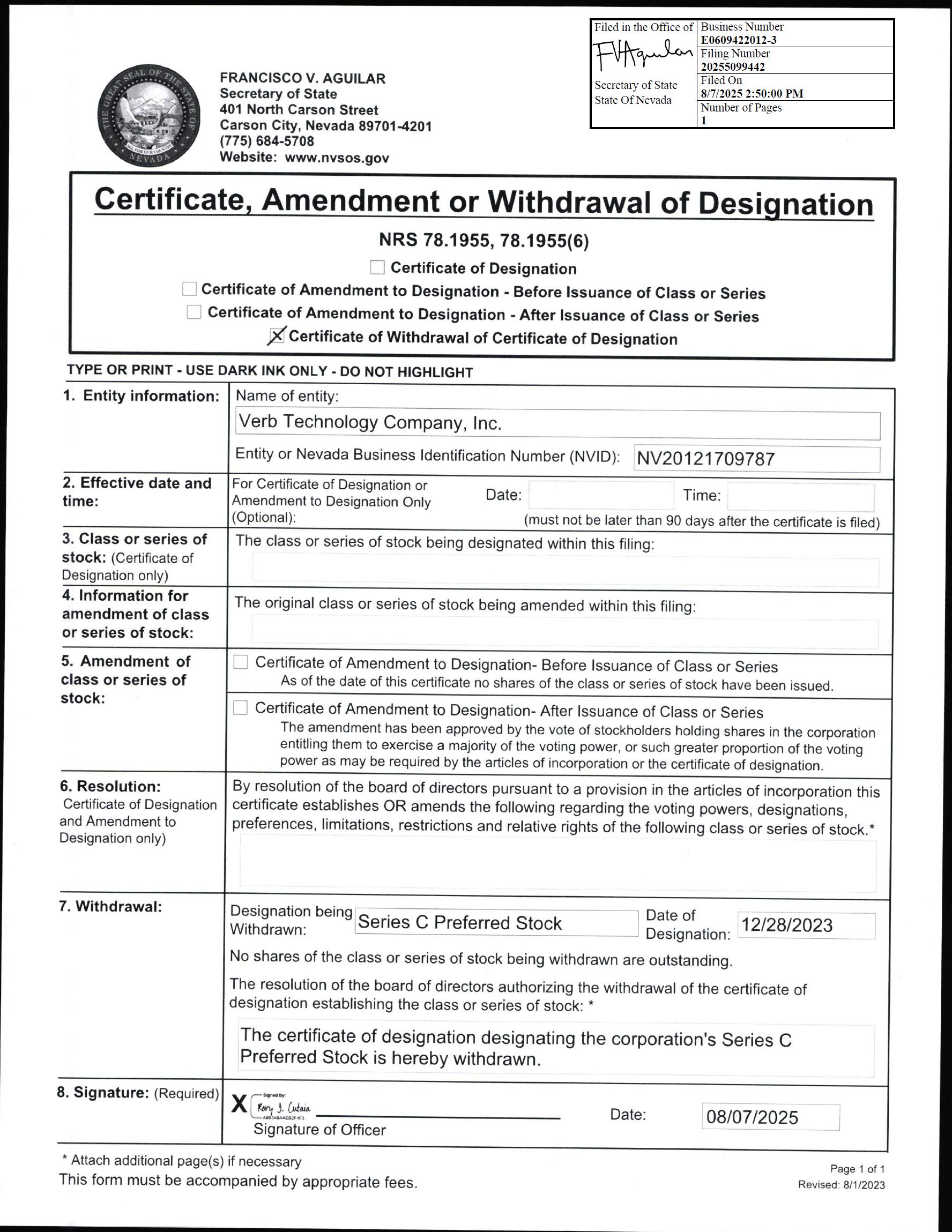

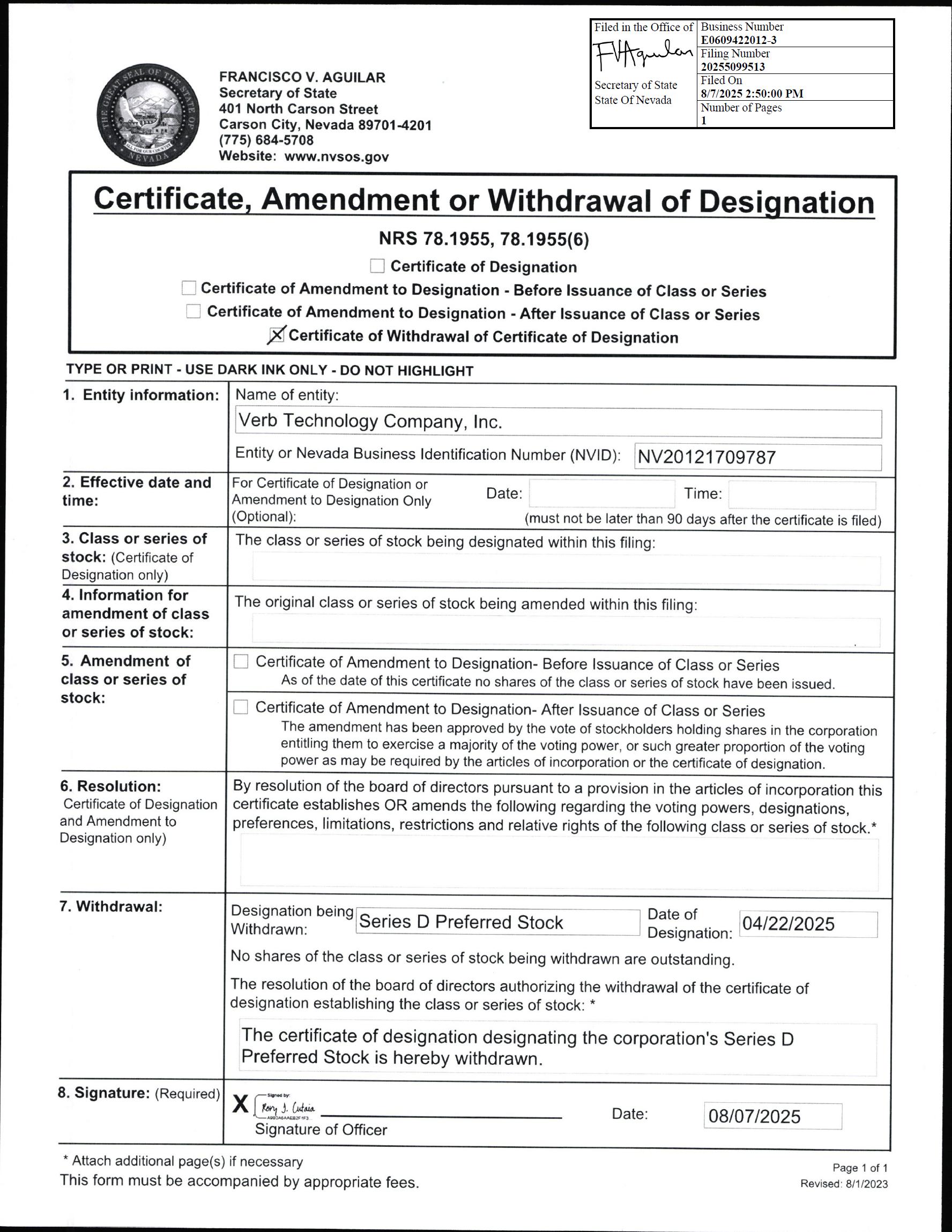

On August 7, 2025, the Company filed certificates of withdrawal relating to the Company’s Series A Convertible Preferred Stock, Series B Preferred Stock, Series C Preferred Stock and Series D Preferred Stock with the Nevada Secretary of State withdrawing from its Articles of Incorporation all matters set forth in the Certificate of Designation of Series A Convertible Preferred Stock, the Certificate of Designation of Series B Preferred Stock, the Certificate of Designation of Series C Preferred Stock and Certificate of Designation of Series D Preferred Stock, respectively (the “Certificates of Withdrawal”). Copies of the Certificates of Withdrawal are listed as Exhibits 3.1, 3.2, 3.3 and 3.4 to this Current Report on Form 8-K and are incorporated herein by reference.

Item 7.01. Regulation FD.

On August 8, 2025, the Company issued a press release announcing the closing of the PIPE Financing. A copy of the press release is attached as Exhibit 99.1 hereto.

Total Shares Outstanding

As of the date hereof, the Company has 60,538,922 total shares outstanding.

The information in this Item 7.01 to this Current Report on Form 8-K, and in Exhibits 99.1 and 99.2 furnished herewith, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

Disclosure Channels to Disseminate Information

Company investors and others should note that the Company announces material information to the public about the Company, its strategy and other items through a variety of means, including on the Company website (https://www.verb.tech.com/), its investor relations website (https//ir.verb.tech), its email alerts subscription website (https://ir.verb.tech/news-events/email-alerts), its filings with the SEC, press releases, public conference calls, webcasts, site tours and its various social media accounts in order to achieve broad, non-exclusionary distribution of information to the public. The Company encourages its investors and others to review the information it makes public in the locations below as such information could be deemed to be material information. PLEASE NOTE THAT, FOLLOWING THE CLOSING OF THE PIPE FINANCING, THE COMPANY HAS UPDATED ITS SOCIAL MEDIA ACCOUNTS.

Following the closing of the PIPE Financing, the Company intends to post information about the Company (which may or may not be material) via the following social media accounts: the Company’s new Telegram handle (@tonstrat) and its new X.com handle (@tonstrat). The Company also expects Mr. Stotz to post information about the Company (which may or may not be material) through his social media accounts, including his X.com handle (@ManuelStotz). The social media channels used by the Company and Mr. Stotz may be updated by the Company and Mr. Stotz, respectively, from time to time.

Although the Company does not intend for its social media accounts to be its primary method of disclosure for material information, it is possible that certain information the Company posts on its social media accounts may be deemed material to investors. Therefore, the Company is notifying investors, the media and other interested parties that it intends to use the aforementioned social media accounts, together with its investor relations website, traditional press releases, and filings with the Commission, to publish important information about the Company, including information that may be deemed material to investors. The Company encourages investors, the media and other interested parties to review the information it posts on its aforementioned investor relations website and social media channels, in addition to information announced by the Company through our filings with the SEC, press releases, webcasts and other presentations.

Forward-Looking Statements

This Current Report contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements relating to the Company’s Toncoin holdings, the implementation of its TON treasury strategy, the anticipated rebranding of the Company, the future of the Company’s ongoing business operations, and other initiatives. Forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially, and reported results should not be considered as an indication of future performance. Important factors that may affect actual results or outcomes include, but are not limited to: the potential impact of market and other general economic conditions; the ability of the Company to successfully execute its business plan, including the implementation of the TON treasury strategy and achieve the intended benefits thereof; the Company’s failure to manage growth effectively; the Company’s failure to fully realize the anticipated benefits of the PIPE Financing and use of proceeds therefrom; and other risks and uncertainties set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2025 filed with the Securities and Exchange Commission (the “SEC”), and in the Company’s subsequent filings with the SEC. These forward-looking statements speak only as of the date hereof, and the Company disclaims any obligation to update these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

No Offer or Solicitation. None of this Current Report nor the exhibits attached hereto constitutes an offer to sell, or a solicitation of an offer to buy, Common Stock or any other securities, nor shall there be any sale of Common Stock or any other securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Item 9.01 Financial Statements and Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: August 8, 2025 | Verb Technology Company, Inc. | |

| By: | /s/ Sarah Olsen | |

| Name: | Sarah Olsen | |

| Title: | Chief Financial Officer and Chief Operating Officer | |

Exhibit 3.1

Exhibit 3.2

Exhibit 3.3

Exhibit 3.4

Exhibit 10.1

Execution Version

ADVISORY SERVICES AGREEMENT

This ADVISORY SERVICES AGREEMENT (this “Agreement”), effective August 7, 2025 (the “Effective Date”), is entered into by and between Verb Technology Company, Inc. (the “Company”), and Kingsway Capital Partners Limited (the “Advisor” and, together with the Company, the “Parties” and each, a “Party”).

WHEREAS, the Company desires to expand and diversify its business through integration of cryptocurrency and digital asset strategies as part of its treasury management strategy; and

WHEREAS, the Company wishes to appoint the Advisor, and the Advisor wishes to be appointed by the Company, to provide certain advisory and consulting services to the Company for such purposes, subject to and in accordance with the terms and conditions contained herein.

NOW, THEREFORE, in consideration of the mutual promises contained herein, and for such other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree to be bound on the terms and conditions set forth below:

1. Engagement of the Advisor; Independent Contractor.

(a) The Company hereby engages the Advisor to provide certain advisory services with respect to the expansion and diversification of the Company’s business through the integration of cryptocurrency and digital asset strategies as part of the Company’s treasury management strategy, and the Advisor hereby accepts the engagement and agrees to provide advisory and consulting services to the Company as described in Schedule A attached hereto (the “Services”) upon the terms and conditions set forth herein. The Company and the Advisor understand and agree that changes to Schedule A may be made from time to time following the date of execution of this Agreement by mutual agreement of the Parties.

(b) It is understood and agreed that the Advisor shall be deemed to be an independent contractor of the Company and not as an employee, agent, or joint venturer of the Company and that the Advisor shall not have authority to act for or represent the Company in any way and shall not otherwise be deemed to be agent of the Company. Nothing contained herein shall create or constitute the Advisor and the Company as members of any partnership, joint venture, association, syndicate, unincorporated business, or other separate entity, nor shall be deemed to confer on any of them any express, implied, or apparent authority to incur any obligation or liability on behalf of any other such entity.

2. Term; Termination.

(a) This Agreement shall commence on the Effective Date and shall continue for a period of twenty (20) years and shall thereafter continue for successive one (1)-year renewal periods upon the mutual agreement of the Advisor and the Company (each, a “Renewal Period”, and the period during which this Agreement is in effect, the “Term”) unless terminated in accordance with this Section 2.

(b) This Agreement may be terminated immediately upon written notice if the other Party materially breaches this Agreement and fails to cure such breach within sixty (60) days after receiving written notice of the breach, or in the case of willful misconduct, gross negligence or fraud of the other Party.

(c) Termination shall not affect liabilities or obligations incurred or arising from transactions initiated under this Agreement prior to such termination, including the provisions regarding arbitration, which shall survive any expiration or termination of this Agreement.

3. Advisory Fees.

(a) As compensation for the Services rendered hereunder, the Company shall pay: (i) a one-time set-up fee, payable in Toncoin or cash, upon mutual agreement of the Company and the Advisor, and having a notional value of Three Million Dollars ($3,000,000) (the “Set-Up Fee”) and (ii) an annual advisory fee equal to two percent (2%) of the Company’s market capitalization (calculated based upon the Company’s equity ownership on a fully diluted, as converted basis) (the “Advisory Fee”).

(b) The Set-Up Fee shall be earned upon the execution of this Agreement and will be payable within 5 business days. The Advisory Fee shall be paid in twelve (12) monthly installments, with each installment equal to one-twelfth (1/12) of two percent (2%) of the Company’s market capitalization (calculated based upon the Company’s equity ownership on a fully diluted, as converted basis) as of the last day of each calendar month. The Company’s market capitalization for each month shall be determined by the Advisor in a commercially reasonable manner and in good faith. Each monthly installment of the Advisory Fee shall be payable in arrears, and, following the determination of the Company’s market capitalization for the relevant month, the Advisor and the Company upon mutual agreement shall elect, that the Advisor receive payment of such installment either in Toncoin or in cash. If the Advisory Fee is elected to be paid in Toncoin, the amount of Toncoin due will be determined using the weighted-average TON execution price as of the last day of each calendar month. The Advisor will furnish invoices monthly, including all reasonable fees and expenses incurred by Advisor, and the Company shall pay such invoice no later than ten (10) business days following the Company’s receipt of any such invoice. Advisor acknowledges and agrees to cooperate fully with the Company and to provide, upon reasonable request, all information and documentation necessary to enable the Company to maintain compliance with generally accepted accounting principles (GAAP), its internal financial controls, and applicable requirements under the Sarbanes-Oxley Act of 2002. The Company hereby acknowledges that it is the Company’s responsibility to verify the accuracy of the calculation of the Advisor’s fees.

(c) Notwithstanding any early termination of this Agreement pursuant to Section 2 hereof, (i) the Set-Up Fee and (ii) the Advisory Fee shall be deemed earned upon the execution of this Agreement by the Parties. If Advisor and the Company are required to report the issuance of the Advisor’s fees to any third party governmental or regulatory authority, the parties shall consult and mutually agree upon a consistent reporting position.

(d) Each Party will be responsible for all of their respective overhead costs.

4. Confidentiality.

(a) “Confidential Information” means any non-public information regarding the disclosing Party’s business affairs, products, services, confidential intellectual property, trade secrets, third-party confidential information and other sensitive or proprietary information, whether orally or in visual, written, electronic, or other form or media, and whether or not marked, designated, or otherwise identified as “confidential.” Confidential Information does not include information that: (i) is or becomes publicly available without breach of this Agreement; (ii) was known to the receiving Party prior to disclosure; (iii) is independently developed by the receiving Party without use of or reference to the disclosing Party’s Confidential Information; or (iv) is disclosed pursuant to legal or regulatory requirements, provided, however, that in the case of clause (iii), the disclosing Party shall disclose no more than that portion of the Confidential Information which, on the advice of the receiving Party’s legal counsel, such legal or regulatory requirement specifically requires the receiving Party to disclose.

(b) Each Party shall: (i) protect and safeguard the confidentiality of the disclosing Party’s Confidential Information with at least the same degree of care as the receiving Party would protect its own Confidential Information, but in no event with less than a commercially reasonable degree of care; (ii) not use the disclosing Party’s Confidential Information, or permit it to be accessed or used, for any purpose other than to perform its obligations under this Agreement; and (iii) not disclose any such Confidential Information to any person or entity, except to the receiving Party’s representatives who need to know the Confidential Information to assist the receiving Party, or act on such receiving Party’s behalf, to exercise such receiving Party’s rights or perform such receiving Party’s obligations under this Agreement. The receiving Party shall be responsible for any breach of this Section 4 caused by any of its representatives. On the expiration or termination of the Agreement, the receiving Party and its representatives shall promptly return to the disclosing Party all copies, whether in written, electronic or other form or media, of the disclosing Party’s Confidential Information, or destroy all such copies and certify in writing to the disclosing Party that such Confidential Information has been destroyed.

(c) The obligations under this Section 4 shall survive the termination or expiration of this Agreement for a period of two (2) years.

5. Representations of the Advisor. The Advisor represents to the Company as follows:

(a) the Advisor has been duly organized and is validly existing and in good standing under the laws of its jurisdiction of organization, with power and authority to own its own properties and conduct its business as currently conducted;

(b) the Advisor has or will obtain all other governmental authorizations, approvals, consents or filings required in connection with the execution, delivery or performance of this Agreement, including compliance with applicable U.S. federal and state laws, rules, and regulations, and any requirements imposed by relevant regulatory authorities;

(c) this Agreement constitutes a binding obligation of the Advisor, enforceable against the Advisor in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar laws relating to or affecting creditors’ rights or by general equity principles, regardless of whether such enforceability is considered in a proceeding in equity or at law; and (d) the execution, delivery and performance of this Agreement do not conflict with any obligation by which the Advisor is bound, whether arising by contract, operation of law or otherwise, or any applicable law, in each case in a manner that would result in a material adverse effect on the Advisor or the Company or that would materially impede the Advisor’s ability to perform its obligations hereunder.

6. Representations of the Company. The Company represents and warrants to the Advisor as follows:

(a) the Company has been duly organized and is validly existing and in good standing under the laws of its jurisdiction of organization, with power and authority to own its own properties and conduct its business as currently conducted;

(b) the Company has the authority to engage the Advisor to provide the Services and has, by appropriate action, duly authorized the execution and implementation of this Agreement;

(c) this Agreement constitutes a binding obligation of the Company, enforceable against the Company in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and other similar laws relating to or affecting creditors’ rights or by general equity principles, regardless of whether such enforceability is considered in a proceeding in equity or at law; and

(d) the execution, delivery and performance of this Agreement do not conflict with any obligation by which the Company is bound, whether arising by contract, operation of law or otherwise, or any applicable law, in each case in a manner that would result in a material adverse effect on the Advisor or the Company or that would materially impede the Company’s ability to perform its obligations hereunder.

7. Liability.

(a) Except in the cases of willful misconduct, gross negligence or fraud (each, a “Disqualifying Action”), none of the Advisor, its affiliates or their respective officers, directors and employees (collectively, the “Covered Persons”) shall have any liability (whether direct or indirect, in contract or tort or otherwise) for any claims, liabilities, losses, damages, penalties, obligations or expenses of any kind whatsoever, including reasonable and documented attorneys’ fees and court costs (“Losses”), suffered by the Company as the result of any act or omission by the Advisor in connection with, arising out of or relating to the performance of the Services hereunder. The Company further agrees that no Covered Person shall be liable for any Losses caused, directly or indirectly, by any act or omission of the Company or any act or omission by any third party, unless such acts, omissions or other conduct is at the direction of the Advisor and the Advisor’s direction constitutes a Disqualifying Action.

(b) The Advisor and any person acting on its behalf shall be entitled to rely in good faith upon information, opinions, reports or statements of legal counsel (as to matters of law) and accountants (as to matters of accounting or tax) and, accordingly, such good faith reliance by a person shall not constitute a Disqualifying Action so long as such counsel or accountant is qualified and was selected and consulted with due care. Under no circumstances shall the Advisor or any Covered Person be liable for any special, incidental, exemplary, consequential, punitive, lost profits or indirect damages.

(c) The Company agrees to indemnify and hold harmless each of the Covered Persons, against any Losses suffered or incurred by reason of, relating to, based upon, arising from or in connection with (directly or indirectly) (i) the Services rendered by or on behalf of the Advisor, (ii) a Disqualifying Action by the Company, or (iii) the Company’s breach of this Agreement, in each case except to the extent that such Losses are determined by a court of competent jurisdiction, upon entry of a final judgment, to be attributable to a Disqualifying Action of such Covered Person.

(d) To the fullest extent permitted by law, the Company shall, upon the request of any Covered Person, advance or promptly reimburse such Covered Person’s out-of-pocket costs of investigation (whether internal or external), litigation or appeal, including attorneys’ reasonable and documented fees and disbursements, reasonably incurred in responding to, litigating or endeavoring to settle any claim, action, suit, investigation or proceeding, whether or not pending or threatened, and whether or not any Covered Person is a party, arising out of or in connection with or relating to the Services (a “Claim”); provided, that the affected Covered Person shall, as a condition of such Covered Person’s right to receive such advances and reimbursements, undertake in writing to promptly repay the applicable funds for all such advancements or reimbursements if a final judgment of a court of competent jurisdiction has determined that such Covered Person is not then entitled to indemnification under this Section 7. If any Covered Person recovers any amounts in respect of any Claims from insurance coverage or any third party source, then such Covered Person shall, to the extent that such recovery is duplicative, reimburse the Company for any amounts previously paid to it by the Company in respect of such Claims.

(e) Promptly after receipt by a Covered Person of notice of any Claim or of the commencement of any action or proceeding involving a Claim, such Covered Person shall, if a claim for indemnification in respect thereof is to be made against the Company, give written notice to the Company of the receipt of such Claim or the commencement of such action or proceeding; provided, that the failure of any Covered Person to give notice as provided herein shall not relieve the Company of its obligations hereunder, except to the extent that the Company is actually prejudiced by such failure to give notice.

(f) Each Covered Person shall cooperate with the Company and its counsel in responding to, defending and endeavoring to settle any proceedings or Losses that may be subject to indemnification by the Company pursuant to this Section 7. Without limiting the generality of the immediately preceding sentence, if any proceeding is commenced against a Covered Person, the Company shall be entitled to participate in and to assume the defense thereof to the extent that the Company may wish, with counsel reasonably satisfactory to such Covered Person. After notice from the Company to such Covered Person of the Company’s election to assume the defense thereof, the Company shall not be liable for expenses subsequently incurred by such Covered Person without the consent of the Company (which shall not be unreasonably withheld) in connection with the defense thereof. Without the Covered Person’s consent, the Company will not consent to entry of any judgment in or enter into any settlement of any such action or proceeding which does not include as an unconditional term thereof the giving by every claimant or plaintiff to such Covered Person of a release from all liability in respect of such claim or litigation.

(g) The right of any Covered Person to indemnification as provided herein shall be cumulative of, and in addition to, any and all rights to which such Covered Person may otherwise be entitled by contract or as a matter of law or equity and shall extend to such Covered Person’s successors, assigns and legal representatives.

(h) The federal laws may impose liabilities under certain circumstances on persons who act in good faith; therefore, nothing herein shall in any way constitute a waiver or limitation of any rights which the undersigned may have under any applicable federal law.

8. General Provisions.

(a) Assignment. This Agreement shall be binding upon and inure to the benefit of the Company, the Advisor and their respective successors and permitted assigns. The Company may not assign all or any portion of its rights, obligations or liabilities under this Agreement without the consent of the Advisor to this Agreement. The Advisor may assign all or any portion of its rights, obligations or liabilities under this Agreement to an affiliate of the Advisor, in its sole discretion (an “Affiliate Assignee”). The Advisor may not assign all or any portion of its rights, obligations or liabilities under this Agreement to any non-affiliate of the Advisor without the consent of the Company. For the avoidance of doubt, this Section 8 shall not prohibit or require Company consent for any change of control of such Affiliate Assignee following the assignment of this Agreement. For purposes of this Section 8(a), such assignee shall not include (a) any director, officer, agent, employee, affiliate or representative (“Person”) listed in any sanctions-related list of designated Persons maintained by the U.S. Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), the United States Department of State, the United Nations Security Council, the European Union (or any participating member state thereof), His Majesty’s Treasury, or other relevant sanctions authority (collectively, “Sanctions”), (b) any Person operating, organized or resident in a country, region or territory which is itself the subject or target of any Sanctions (“Sanctioned Person”), (c) any Person owned or controlled by any such Person or Persons described in clauses (a) and (b) above, including a Person that is deemed by OFAC to be a Sanctions target based on the ownership of such legal entity by Sanctioned Person(s) or (d) any Person otherwise a target of Sanctions, including vessels, planes and ships, that are designated under any Sanctions program.

(b) Third Party Beneficiaries. This Agreement is not intended to and does not convey any rights to persons not a Party to this Agreement, except that a Covered Person may in its own right enforce Section 7 of this Agreement.

(c) Other Relationships. The Company acknowledges that the Advisor, its affiliates and their respective members, partners, officers, employees and other personnel may provide business and advisory services and advice of the type contemplated by this Agreement to others, and that, subject to the provisions of Section 4 of this Agreement, nothing contained herein shall be construed to limit or restrict the Advisor in providing such services or advice to others.

(d) Entire Agreement. This Agreement, including the Schedules attached hereto, constitutes the entire agreement between the Parties concerning the subject matter hereof and supersedes all prior agreements and understandings, oral or written, between them regarding such subject matter.

(e) Amendments. Except to the extent otherwise expressly provided herein, this Agreement may not be amended except in a writing signed by the Parties hereto.

(f) Waivers. Each Party may by written consent waive, either prospectively or retrospectively and either for a specified period of time or indefinitely, the operation or effect of any provision of this Agreement. No failure or delay by a Party in exercising any right hereunder shall operate as a waiver thereof, nor shall any waiver of any such right constitute any further waiver of such or any other right hereunder. No waiver of any right by any Party hereto shall be construed as a waiver of the same or any other right at any other time.

(g) Notices. Except as otherwise expressly provided in this Agreement, whenever any notice is required or permitted to be given under any provision of this Agreement, such notice shall be in writing, shall be signed by or on behalf of the Party giving the notice and shall be mailed by first class mail or sent by courier or by email (including email with an attached PDF) or other electronic transmission with confirmation of transmission to the other Party at the address set forth below or to such other address as a Party may from time to time specify to the other Party by such notice hereunder.

If to the Advisor:

Kingsway Capital

9th Floor, Smithson Tower

25 St James’s Street

London SW1A 1HA, United Kingdom

Attn:

Email:

If to the Company:

Verb Technology Company, Inc.

3024 Sierra Juniper Court

Las Vegas, Nevada, 89138

Attn: Sarah Olsen

Email:

Any such communications, notices, instructions or disclosures shall be deemed duly given when deposited by first class mail address as provided above, when delivered to such address by courier or when sent by email (including email with an attached PDF) or other electronic transmission (with the receipt confirmed).

(h) Governing Law. This Agreement shall be governed by, and construed and enforced in accordance with, the laws of the State of New York, without giving effect to its principles of conflicts of law.

(i) Arbitration. Notwithstanding anything herein to the contrary, including the Parties’ submission to jurisdiction of the courts of the State of New York pursuant to Section 8(j) below, any dispute, claim or controversy arising out of or relating to this Agreement or the breach, termination, enforcement, interpretation or validity thereof, including the determination of the scope or applicability of this agreement to arbitrate, shall be determined by arbitration in the New York offices of the Judicial Arbitration and Mediation Service Inc. or its successor (“JAMS”) before three (3) qualified arbitrators, one (1) selected by each Party and one (1) selected by both Parties. The arbitration shall be administered by JAMS under its Comprehensive Arbitration Rules and Procedures (the “Rules”) in accordance with the expedited procedures in those Rules. Judgment on the arbitration award may be entered in any state or federal court sitting in New York, New York or in any other applicable court. This Section 8(i) shall not preclude the Parties from seeking provisional remedies in aid of arbitration from a court of appropriate jurisdiction. In the event that this Agreement is terminated pursuant to this Section 8(i), the Advisor shall be entitled to any and all damages and legal remedies arising from or in connection with such default but limited to direct damages and lost profits and business in the future. Any arbitration arising out of or related to this Agreement shall be conducted in accordance with the expedited procedures set forth in the Rules as those Rules exist on the effective date of this Agreement. The Parties agree that they will give conclusive effect to the arbitrators’ determination and award and that judgment thereon may be entered in any court having jurisdiction. The arbitrators may issue awards for all damages and legal remedies arising from or in connection with such default including, but not limited to, direct, indirect, special, consequential, speculative and punitive damages, as well as lost profits and business in the future. Any Party may, without inconsistency with this arbitration provision, apply to any state or federal court sitting in New York, New York and seek interim provisional, injunctive or other equitable relief until the arbitration award is rendered or the controversy is otherwise resolved. The arbitration will be conducted in the English language. The arbitrators shall decide the dispute in accordance with the law of the State of New York. The arbitration provisions contained herein are self-executing and will remain in full force and effect after expiration or termination of this Agreement. The costs and expenses of the arbitration shall be funded fifty percent (50%) by the claimant and the remaining fifty percent (50%) shall be split equally among the respondent(s). All Parties shall bear their own attorneys’ fees during the arbitration. The prevailing Party on substantially all its claims shall be repaid all of such costs and expenses by the non-prevailing Party within ten (10) days after receiving notice of the arbitrator’s decision.

(j) Submission to Jurisdiction; Consent to Service of Process. Subject to Section 8(i) above, the Parties hereto hereby irrevocably submit to the exclusive jurisdiction of and consent to service of process and venue in the state and federal courts in the County of New York, State of New York in any dispute, claim, controversy, action, suit or proceeding between the Parties arising out of this Agreement which are permitted to be filed or determined in such court. Subject to Section 8(i) above, the Parties hereby irrevocably waive, to the fullest extent permitted by applicable law, any objection which they may now or hereafter have to the laying of venue of any such dispute brought in such court or any defense of inconvenient forum for the maintenance of such dispute. The Parties agree that process may be served in any action, suit or proceeding by mailing copies thereof by registered or certified mail (or its equivalent) postage prepaid, to the Party’s address set forth in Section 8(g) of this Agreement or to such other address to which the Party shall have given written notice to the other Party. The Parties agree that such service shall be deemed in every respect effective service of process upon such Party in any such action, suit or proceeding and shall, to the fullest extent permitted by law, be taken and held to be valid personal service upon and personal delivery to such Party. Nothing in this Section 8(j) shall affect the right of the Parties to serve process in any manner permitted by law.

(k) Force Majeure. No Party to this Agreement shall be liable for damages resulting from delayed or defective performance when such delays or defects arise out of causes beyond the control and without the fault or negligence of the offending Party. Such causes may include, but are not restricted to, acts of God or of the public enemy, terrorism, acts of the state in its sovereign capacity, fires, floods, earthquakes, power failure, tariffs, government regulations or executive orders, disabling strikes, epidemics, pandemics, quarantine restrictions and freight embargoes.

(l) Headings. The headings contained in this Agreement are intended solely for convenience and shall not affect the rights of the Parties to this Agreement.

(m) Severability. In the event any provision of this Agreement shall be held invalid or unenforceable, by any court of competent jurisdiction, such holding shall not invalidate or render unenforceable any other provisions hereof.

(n) Counterparts; Electronic Signature and Delivery. This Agreement may be executed in counterparts, including counterparts sent via PDF other electronic transmission, each of which, when taken together shall constitute one and the same instrument. This Agreement may also be executed and delivered by electronic mail (including pdf or any electronic signature complying with the U.S. federal ESIGN Act of 2000) or other transmission method, and any counterpart so delivered shall be deemed to have been duly and validly delivered and be valid and effective for all purposes.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, each of the Parties has caused this Agreement to be duly executed as of the Effective Date.

| KINGSWAY CAPITAL ADVISORS LIMITED | ||

| By: | /s/ Conor McNaughton | |

| Name: | Conor McNaughton | |

| Title: | Chief Operating Officer | |

| VERB TECHNOLOGY COMPANY, INC. | ||

| By: | /s/ Veronika Kapustina | |

| Name: | Veronika Kapustina | |

| Title: | Chief Executive Officer | |

[Signature Page to Advisory Services Agreement]

Schedule A

Services

| 1. | Analyze and evaluate the implementation of the Company’s Toncoin treasury strategy. |

| 2. | Advise the Company on the creation and ongoing review of its Treasury Reserve Policy. |

| 3. | Advise the management team regarding the Company’s Toncoin treasury strategy. |

| 4. | Advise and assist with investor relations with regards to the Company. |

| 5. | Review presentations and related materials regarding the Toncoin treasury strategy. |

| 6. | Provide assistance to the Company’s board of directors in the recruitment of executives to the Company. |

Exhibit 10.2

EMPLOYMENT AGREEMENT

This Employment Agreement (this “Agreement”) is effective immediately on August 7, 2025 (the “Closing”, or the “Effective Date”), and is entered into by and between Verb Technology Company, Inc. or its successor (the “Company”), and Veronika Kapustina (“Employee”) (collectively with the Company, the “Parties”; each of the Parties referred to individually as a “Party”). “PIPE Financing” means the offer, sale and issuance of the Company’s common stock in a private placement offering pursuant to a certain Subscription Agreement between and among the Company, certain of its subsidiaries, and investors.

WHEREAS, the Company desires to employ Employee in accordance with the terms and conditions set forth below; and

WHEREAS, Employee desires to be employed by the Company in accordance with the terms and conditions set forth below.

NOW, THEREFORE, immediately following the Closing, Employee will become an employee of the Company.

1. EMPLOYMENT.

| a. | Title. The Company hereby agrees to employ Employee, and Employee hereby accepts such employment, as Chief Executive Officer (CEO) of the Company, reporting to the Executive Chairman of the Board of Directors of the Company (the “Board”) and the Board. |

| b. | Employment Period. Employee’s employment with the Company shall commence on the Effective Date. This Agreement shall be effective as of the Effective Date and shall continue until terminated in accordance with the terms of this Agreement. |

| c. | Principal Place of Employment. It is anticipated that Employee will move to Dubai during Employee’s employment with the Company and upon such relocation, Employee shall be permitted to work remotely in Dubai. |

| d. | At Will Relationship. Employee’s employment with the Company shall commence as of the Effective Date. Employee’s employment shall be considered “at will” in nature and, accordingly, either the Company or Employee may terminate this Agreement and Employee’s employment at any time and for any reason, with or without Cause or prior notice, subject to Section 3. Nothing in this Agreement, except as Section 3 hereof, shall be construed as, or shall interfere with, abridge, limit, modify, or amend the “at will” nature of Employee’s employment with Company. Except as set forth in this Agreement, upon Employee’s separation from employment with the Company (for any reason), all compensation and benefits payable or provided to Employee shall, except as required by applicable law or the terms of such applicable plan, policy or arrangement, terminate as of the effective date of Employee’s termination (the “Termination Date”). |

| e. | Duties and Responsibilities. During Employee’s employment with the Company, Employee shall at all times: (i) comply with the terms and conditions set forth in this Agreement; (ii) perform and carry out such responsibilities, duties, and authorities as the Company may direct, designate, request of, or assign to Employee from time to time, which shall include, but not necessarily be limited to, such duties, responsibilities and authorities that are typically performed by and assigned to employees in similar positions within similar companies; (iii) perform the duties and carry out the responsibilities assigned to her by the Company to the best of her ability, in a trustworthy, business-like, and efficient manner for the purpose of advancing the business and interests of the Company; (iv) devote sufficient time, attention, effort, and skill to her position with and the business of the Company; (v) comply with and abide by the Company’s policies, practices, and procedures (as may be amended or otherwise modified from time to time by the Company); and (vi) comply with all laws, rules, regulations, and licensing requirements of, or that may be applicable to, her employment with the Company. |

In the event that any term(s) of this Agreement conflicts with a term(s) of any employee handbook, policy, practice, or procedure adopted or maintained, at any time, by the Company, the term(s) of this Agreement shall control and supersede such conflicting term(s).

| f. | No Conflicts. Employee represents and warrants that she is not bound by or subject to any written or oral agreement, pact, covenant, or understanding with any previous or concurrent employer, or any other party, that would limit, abridge, restrict, or interfere with, in any way, her ability to perform her duties and obligations hereunder. Employee further represents and warrants that the performance of her duties and obligations hereunder shall not violate any written or oral agreement, pact, covenant, or understanding by and between her and any previous or concurrent employer, or any other party. Employee further represents and warrants that she will not use any trade secret, or confidential or proprietary information, of any of her previous or concurrent employers, or that was obtained, learned, or procured during any period of employment prior to or concurrent with her employment with the Company, in connection with her employment with the Company or in the performance of her duties and obligations hereunder. |

2. COMPENSATION AND BENEFITS. Subject to the terms and conditions of Sections 1 and 3 of this Agreement and, except as otherwise provided herein, Employee’s continued employment with the Company, and in consideration for the services to be provided hereunder by Employee, the Company hereby agrees to pay or otherwise provide Employee with the following compensation and benefits during her employment with the Company:

| a. | Annual Salary. The Company shall pay Employee a base salary equal to $850,000 per year (as it may be adjusted from time to time, the “Annual Salary”), less applicable taxes, withholdings, and deductions, and any other deductions that may be authorized by Employee, from time to time, in accordance with applicable federal, state, and/or local law. The Annual Salary shall be payable in accordance with the Company’s standard payroll practices and procedures, as in effect from time to time. Employee acknowledges and understands that her position of employment with the Company is considered “exempt,” as that term is defined under the Fair Labor Standards Act and applicable state or local law. As an exempt employee, Employee is not eligible to receive overtime pay. |

Notwithstanding the foregoing, the Annual Salary may be reviewed by the Company from time to time and may be subject to upward or downward adjustment, in the Company’s sole discretion, based upon a review and consideration of various factors, including but not limited to Employee’s performance and/or the Company’s overall financial performance.

| b. | Initial Equity Award. Following completion of the Closing and at a time determined by the Board, such time not to exceed 90 days from the Effective Date, Employee shall receive a grant of time-based restricted stock units under the 2019 Stock and Incentive Compensation Plan (the “Plan”) in an amount equal to one-percent (1%) of the shares of common stock of the Company on a fully diluted basis as of the Effective Date, subject to approval by the Board (or its compensation committee) (the “Initial Equity Award”), such approval not to be unreasonably withheld, with the actual number of shares of common stock of the Company underlying the Initial Equity Award to be calculated in good faith by the Board. One fourth (25%) of the Initial Equity Award shall vest on the one-year anniversary of the Effective Date and one thirty-sixth of the remaining Initial Equity Award shall vest on each monthly anniversary thereafter, subject to Employee continuing to be employed by the Company through each such date. The Equity Awards shall be subject to other customary terms to be set forth in the corresponding award agreement and the Plan. For the avoidance of doubt, the Initial Equity Award shall not be granted to Employee unless and until the Closing is consummated. While the parties acknowledge that the Initial Equity Award must be approved by the Board (or its compensation committee) in accordance with the Plan, the Company’s obligation to cause such approval and issue the award on the terms described herein is nevertheless a binding contractual commitment on the Company. |

| c. | Secondary Equity Award. Following the completion of the Closing and at a time determined by the Board, such time not to exceed 90 days from the Effective Date, Employee shall receive a grant of performance-based restricted stock units under the Plan in an amount equal to one-percent (1%) of the shares of common stock of the Company on a fully diluted basis as of the Effective Date, subject to approval by the Board (or its compensation committee) (the “Secondary Equity Award”), such approval not to be unreasonably withheld, with the actual number of shares of common stock of the Company underlying the Secondary Equity Award to be calculated in good faith by the Board. The Secondary Equity Award shall vest on a quarterly basis over forty-eight (48) months beginning on the Effective Date, each quarterly tranche (i) performance-vest as to one-sixteenth (1/16) of the overall Secondary Equity Award, with threshold performance measured at 1.4x a multiple of market capitalization of the Company over NAV and maximum performance at 1.8x a multiple of market capitalization of the Company over NAV, with straight-line interpolation between threshold and maximum performance levels (0%-100% of the applicable quarterly tranche), all as calculated by the Board (or its compensation committee) in good faith, and (ii) time-vest subject to Employee’s continued employment through the end of the applicable quarter. For the avoidance of doubt, in order for the Secondary Equity Award to vest, both the time and performance-based vesting conditions must be satisfied as to each quarterly tranche. Notwithstanding the foregoing, upon a termination without Cause or resignation by Employee for Good Reason, Employee shall be permitted to continue to vest in the Secondary Equity Award with respect to the quarter in which the Termination Date occurs, as if Employee had remained employed through the end of such quarter, subject to achievement of the applicable performance metrics. The Secondary Equity Awards shall be subject to other customary terms to be set forth in the corresponding award agreement and the Plan. For the avoidance of doubt, the Secondary Equity Award shall not be granted to Employee unless and until the Closing is consummated. For purposes herein, “NAV” shall mean the net asset value of the Company, and shall be calculated by the Board; provided however that the NAV shall be consistent with the Company’s public filings. While the parties acknowledge that the Secondary Equity Award must be approved by the Board (or its compensation committee) in accordance with the Plan, the Company’s obligation to cause such approval and issue the award on the terms described herein is nevertheless a binding contractual commitment on the Company. |

| d. | Annual Performance Award. Following completion of the Closing, Employee shall be eligible for a performance-based cash bonus, in an amount determined by the Board, subject to approval by the Board in its sole and absolute discretion (the “Annual Bonus”), based upon achievement of performance criteria established by the Company, which generally shall include Company performance, Employee’s individual performance and such other general or specific criteria determined by the Board in its discretion. The target level of such Annual Bonus is one hundred percent (100%) of Annual Salary. Such Annual Bonus will be payable in the form of a lump sum cash payment no later than March 15th of the calendar year that immediately follows the calendar year to which the Annual Bonus relates. In order for Employee to be eligible to receive the Annual Bonus pursuant to this Section 2(d), Employee must remain continuously employed by the Company through the payment date to which such Annual Bonus relates. |

| e. | Benefit Plans. Employee shall be entitled to participate in any and all medical insurance, group health, disability insurance, life insurance, incentive, savings, retirement, and other benefit plans, if any, which are made generally available to similarly-situated employees of the Company (and subject to eligibility requirements, enrollment criteria, and other terms and conditions of such plans), and which the Company (or any affiliate maintaining any such arrangement), in its sole discretion, may at any time amend, modify, or terminate, subject to the terms and conditions of such plans and applicable federal, state, or local law. |

| f. | Vacation and Sick Leave. Employee shall be entitled to vacation and sick leave in accordance with the Company’s respective vacation and sick leave policies, as in effect from time to time. |

| g. | Expenses. Employee shall be entitled to reimbursement for all reasonable expenses that she incurs in connection with the performance of her duties and obligations hereunder. Upon presentment by Employee of appropriate and sufficient documentation, as determined in the Company’s sole discretion, the Company shall reimburse Employee for all such expenses in accordance with the Company’s expense reimbursement policy, as in effect from time to time. |

3. EFFECT OF TERMINATION. Employee’s employment may be terminated by the Company for Cause (as defined below) or without Cause or by resignation for any reason. In the event of any such termination, Employee shall only be entitled to the following:

| a. | Termination of Employment for Any Reason, Resignation by the Employee other than for Good Reason, or Termination by the Company for Cause. If Employee’s employment is terminated for any reason, is terminated by the Company for Cause or Employee resigns from her employment for any reason other than Good Reason (defined below), then in full satisfaction of the Company’s obligations under this Agreement, Employee shall be entitled to receive (i) any vacation accrued but unused as of the Termination Date, subject to the Company’s policies regarding vacation pay, and (ii) any Annual Salary earned but unpaid as of the Termination Date (the “Accrued Obligations”). |

| b. | Termination by the Company without Cause or Resignation by Employee for Good Reason within 18 months following the Effective Date. If Employee’s employment is terminated by the Company without Cause or the Employee resigns for Good Reason within eighteen (18) months following the Effective Date, subject to the Employee timely executing and not revoking a general release of all claims against the Company, its subsidiaries, and any of their respective affiliates in a reasonable form to be provided to Employee from the Company (a “Release”) and the expiration of any applicable revocation period with respect to the Release within forty-five (45) days after the Employee’s Termination Date (the last day of the maximum period of time that the Release can be executed and no longer revocable, the “Release Consideration Expiration Date”, and the actual date in which the Release is fully effective and no longer revocable, the “Release Effective Date”), then in full satisfaction of the Company’s obligations under this Agreement, Employee shall be entitled to receive: |

| (i) | An amount equal to twelve (12) months of then-current Annual Salary, as of the Termination Date, which shall be paid, in equal monthly installments in accordance with the Company’s general payroll practices, with the first installment to be paid on the first payroll date following the effective date of the Release (the “Severance Payment Commencement Date”), with any such payments that would have otherwise been made to Employee following their Termination Date but prior to the Release Effective Date to be paid on the Severance Payment Commencement Date; and |

| (ii) | If Employee properly elects COBRA coverage, then the Company will reimburse or directly pay Employee for Employee and Employee’s eligible dependents for the twelve (12) month period following the Termination Date, or until such earlier date that Employee is eligible for health coverage with a subsequent employer. Notwithstanding the foregoing, if Employee is not eligible for COBRA coverage or the Company cannot provide COBRA coverage, the Company shall in lieu thereof provide to Employee a taxable monthly payment in an amount equal to the monthly COBRA premium that Employee would be required to pay to continue group health coverage in effect on the Termination Date, which payments shall be made in accordance with the Company’s standard payroll practices and procedures, as in effect from time to time. |

For purposes herein, “Cause” shall mean the occurrence of any one or more of the following events, as determined in the sole discretion of the Company:

| a. | Willful Misconduct or Gross Negligence: Employee’s willful misconduct, gross negligence, or material failure to perform the duties and responsibilities of their position (other than as a result of physical or mental incapacity), after written notice from the Company and a 30-day opportunity to cure, if curable. |

| b. | Violation of Policies: Employee’s material violation of any written policy, code of conduct, or procedure of the Company, its subsidiaries, or any of their respective affiliates, including but not limited to those relating to harassment, discrimination, workplace safety, or substance abuse. |

| c. | Dishonesty or Fraud: Employee’s commission of, or participation in, any act of fraud, dishonesty, embezzlement, misappropriation, or other act of material misconduct with respect to the Company, its subsidiaries, or any of their respective affiliates. |

| d. | Criminal Conduct: Employee’s indictment for, conviction of, or plea of guilty or nolo contendere to, a felony or any crime involving moral turpitude, dishonesty, or theft. |

| e. | Breach of Agreement or Fiduciary Duty: Employee’s material breach of this Agreement or any other written agreement with the Company, its subsidiaries, or any of their respective affiliates, or Employee’s breach of any fiduciary duty owed to the Company, its subsidiaries, or any of their respective affiliates. |

| f. | Unauthorized Disclosure: Employee’s unauthorized use or disclosure of any confidential or proprietary information of the Company, its subsidiaries, or any of their respective affiliates. |

For purposes herein, “Good Reason” means there has been, without the consent of Employee, the occurrence of any of the following grounds that has not been cured by the Company within thirty (30) days after written notice to the Company of such purported grounds (which notice must be provided within thirty (30) days following the actual knowledge by Employee of such purported grounds): (i) a material diminution in Employee’s Annual Salary; provided, however that a material reduction in the Employee’s Annual Salary pursuant to a salary reduction program affecting all or substantially all of the employees of the Company and that does not adversely affect the Employee to a greater extent than other similarly situated employees shall not constitute Good Reason; (ii) a material diminution of Employee’s authority, duties, or responsibilities (other than during a suspension or investigation of grounds that may constitute Cause); or (iii) Employee being required to relocate the Employee’s primary work location to a facility or location that would increase the Employee’s one way commute distance by more than twenty-five miles from the Employee’s primary work location as of immediately prior to such change or a change in the Employee’s ability to work remotely.

If the Company timely cures the condition giving rise to Good Reason for Employee’s resignation, the notice of termination shall become null and void.

4. RESTRICTIVE COVENANTS. The Parties agree that the Company, its subsidiaries and their respective affiliates are engaged in a highly competitive industry and would suffer irreparable harm and incur substantial damage if Employee were to enter into competition with the Company and its subsidiaries and affiliates. Therefore, in order for the Company to protect its legitimate business interests, Employee covenants and agrees as follows:

| a. | Employee shall not, at any time during her employment with the Company and for a period of twenty four (24) months thereafter, anywhere in the United States or any jurisdiction in which the Company and its subsidiaries and affiliates conduct material business operations (the “Restricted Territory), either directly or indirectly: (i) accept employment with or render services to (whether as an agent, servant, owner, partner, consultant, employee, independent contractor, representative, director, officer, or stockholder) any person or entity that is a business competitor of the Company and its subsidiaries and affiliates or entity that competes with the Company and its subsidiaries and affiliates in the field of digital asset treasury public companies, or has at any time during Employee’s employment with the Company engaged or attempted to engage in business competition with the Company and its subsidiaries and affiliates, in a position, capacity, or function that is similar, in title or substance, whether in whole or in part, to any position, capacity, or function that Employee held with or in which Employee served the Company; or (ii) invest in any person or entity that is a business competitor of the Company and its subsidiaries and affiliates, or has at any time during Employee’s employment with the Company engaged or attempted to engage in business competition with the Company and its subsidiaries and affiliates, except that Employee may own up to one percent (1%) of any outstanding class of securities of any company registered under Section 12 of the Securities Exchange Act of 1934, as amended; |