UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from [ ] to [ ]

Commission file number 001-41600

BULLFROG AI HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 84-4786155 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

325 Ellington Blvd., Unit 317

Gaithersburg, MD 20878

(Address of principal executive offices)

Registrant’s telephone number: (240) 658-6710

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.00001 per share | BFRG | The Nasdaq Stock Market LLC (The Nasdaq Capital Market) | ||

| Tradable Warrants | BFRGW | The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if registrant is a well-known seasoned issuer, as defined under Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2024, the aggregate market value of the common stock of the registrant held by non-affiliates was approximately $9.0 million. Shares of common stock held by each officer and director of the registrant on June 30, 2024 have been excluded in that such persons may be deemed to be affiliates.

The number of shares of the registrant’s common stock outstanding as of March 11, 2025 was 9,415,525.

Documents incorporated by reference

None.

TABLE OF CONTENTS

|

|

In this report, unless the context indicates otherwise, the terms “Company,” “we,” “us,” “our” and similar words refer to Bullfrog AI Holdings, Inc. (“Bullfrog”), a Nevada corporation.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, or the “Securities Act,” and Section 21E of the Securities Exchange Act of 1934 or the “Exchange Act.” These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or anticipated results.

In some cases, you can identify forward-looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “anticipate,” “estimate,” “predict,” “potential,” or the negative of these terms. These terms and similar expressions are intended to identify forward-looking statements. The forward-looking statements in this report are based upon management’s current expectations and beliefs, which management believes are reasonable. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor or combination of factors, or factors we are aware of, may cause actual results to differ materially from those contained in any forward-looking statements. You are cautioned not to place undue reliance on any forward-looking statements. These statements represent our estimates and assumptions only as of the date of this report. Except to the extent required by federal securities laws, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

You should be aware that our actual results could differ materially from those contained in the forward-looking statements due to a number of factors, including:

| ● | our future financial performance, including our revenue, costs of revenue, operating expenses and profitability; |

| ● | the sufficiency of our cash and cash equivalents to meet our liquidity needs; |

| ● | our predictions about, and the development of, digital transformation technology and bio health businesses and their respective market trends; |

| ● | our ability to attract and retain customers for our products and services in each of our business segments; |

| ● | the availability of financing for smaller publicly traded companies like us; |

| ● | our current and future capital requirements to support the continued development and commercialization of our products and services; |

| ● | our ability to successfully expand in our three principal business markets and into new markets and industry verticals; and |

| ● | our ability to effectively manage our growth and future expenses. |

Other risks and uncertainties include such factors, among others, as market acceptance and market demand for our products and services, pricing, the changing regulatory environment, the effect of our accounting policies, industry trends, adequacy of our financial resources to execute our business plan, our ability to attract, retain and motivate key personnel, and other risks described from time to time in periodic and current reports we file with the United States Securities and Exchange Commission, or the “SEC.” You should consider carefully the statements under this report, which address additional factors that could cause our actual results to differ from those set forth in the forward-looking statements and could materially and adversely affect our business, operating results and financial condition. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the applicable cautionary statements.

|

|

PART I

ITEM 1. BUSINESS

Our Corporate History and Background

Bullfrog AI Holdings, Inc. was incorporated in the State of Nevada on February 6, 2020. Bullfrog AI Holdings, Inc. is the parent company of Bullfrog AI, Inc. and Bullfrog AI Management, LLC, which were incorporated in Delaware and Maryland, in 2017 and 2021, respectively. All our operations are currently conducted through Bullfrog AI Holdings, Inc. The Company’s principal business address is 325 Ellington Blvd, Unit 317, Gaithersburg, MD 20878. Our website address is www.bullfrogai.com. The references to our website in this Annual Report on Form 10-K (the “Form 10-K”) are inactive textual references only. The information on our website is not incorporated into this Form 10-K.

Acquisition of Bullfrog AI, Inc.

In June 2020, Bullfrog AI Holdings, Inc. acquired Bullfrog AI, Inc. pursuant to an exchange agreement under which each share of Bullfrog AI, Inc. common stock was exchanged for a share of common stock of the Company. Immediately prior to the share exchange, each outstanding common share of Bullfrog AI, Inc. was split into 25 shares of common stock. Pursuant to the share exchange agreement, 24,223,975 shares of the Company’s common stock were issued to the shareholders of Bullfrog AI, Inc. in exchange for 100% of the outstanding stock of Bullfrog AI, Inc. Upon completion of the exchange, Bullfrog AI, Inc. became the Company’s wholly-owned subsidiary and the shareholders of Bullfrog AI, Inc. held 100% of the common stock of the Company. As a result, the Company assumed a total of $330,442 in net liabilities of Bullfrog AI, Inc. Both of the entities were controlled before and after the transactions by the same controlling shareholder.

Bullfrog AI Corporate History

Bullfrog AI, Inc. was incorporated in the State of Delaware on August 25, 2017. Vininder Singh, the Chief Executive Officer, was the founder, CEO and chairman of Bullfrog AI, Inc.

Business Overview

Most new therapeutics will fail at some point in preclinical or clinical development. This is the primary driver of the high cost of developing new therapeutics. A major part of the difficulty in developing new therapeutics is efficient integration of complex and highly dimensional data generated at each stage of development to de-risk subsequent stages of the development process. Artificial Intelligence and Machine Learning (“AI/ML”) has emerged as a digital solution to help address this problem.

We use artificial intelligence and machine learning to advance medicines for both internal and external projects. We are committed to increasing the probability of success and decreasing the time and cost involved in developing therapeutics. Most current AI/ML platforms still fall short in their ability to synthesize disparate, high-dimensional data for actionable insight. Our platform technology, named, bfLEAP™, is an analytical AI/ML platform derived from technology developed at The Johns Hopkins University Applied Physics Laboratory (“JHU-APL”), which is able to surmount the challenges of scalability and flexibility currently hindering researchers and clinicians by providing a more precise1, multi-dimensional understanding of their data. We are deploying bfLEAP™ for use at several critical stages of development for internal programs and through strategic partnerships and collaborations with the intention of streamlining data analytics in therapeutics development, decreasing the overall development costs by decreasing failure rates for new therapeutics, and impacting the lives of countless patients that may otherwise not receive the therapies they need.

1 In an August 2021 publication in DeepAI.org (https://deepai.org/publication/random-subspace-mixture-models-for-interpretable-anomaly-detection), the algorithms used in bfLEAP were compared to 10 of the most popular clustering algorithms in the world using 12 data sets. The end result showed that the algorithms used in bfLEAP had the highest average score when measuring speed and accuracy of prediction. The bfLEAP platform currently has more advanced versions of these algorithms and is applying them in multiple data analytics projects.

|

|

Recent Developments

In February 2025, we announced our entry into a collaboration agreement with Eleison Pharmaceuticals Inc. (“Eleison”), a Phase III oncology company focused on novel chemotherapeutic treatments for rare cancers. Through this collaboration, we will apply our proprietary Bullfrog Data Networks™ solution, powered by the bfLEAP® platform, to analyze clinical data from Eleison’s ongoing Phase III trial and previous clinical studies of glufosfamide, an investigational treatment for pancreatic cancer. The platform will evaluate the current trajectory of the trial with respect to safety signals, extract predictive biomarkers for efficacy and safety performance from prior studies to support future trial design, and provide data-driven insights to optimize Eleison’s planned clinical trials for inhaled lipid-complexed cisplatin (ILC) and dibromodulcitol (DBD). These insights are expected to streamline trial efficiency and improve decision-making for Eleison’s broader oncology pipeline.

Our Strategy

We plan to achieve our business objectives by enabling the successful development of drugs and biologics using a precision medicine approach via our proprietary artificial intelligence platform bfLEAP. The bfLEAP™ platform utilizes both supervised and unsupervised machine learning; as such, it is able to reveal meaningful connections in the data without the need for a prior hypothesis. Supervised machine learning uses labeled input and output data, while an unsupervised learning algorithm does not. In supervised learning, the algorithm “learns” from the training dataset by iteratively making predictions on the data and adjusting for the correct answer. Unsupervised learning, also known as unsupervised machine learning, uses machine learning algorithms to analyze and cluster unlabeled datasets. These algorithms discover hidden patterns or data groupings without the need for human intervention. Algorithms used in the bfLEAP™ platform are designed to handle highly imbalanced data sets to successfully identify combinations of factors that are associated with outcomes of interest.

Together with our strategic partners and collaborators, our primary goal is to improve the odds of success at any stage of pre-clinical and clinical therapeutics development. Our primary business model is improving the success and efficiency of drug development which is accomplished either through acquisition of drugs or partnerships and collaborations with companies that are developing drugs. We hope to accomplish this through strategic acquisitions of current clinical stage and failed drugs for in-house development, or through strategic partnerships with biopharmaceutical industry companies. We are able to pursue our drug asset enhancement business by leveraging a powerful and proven AI/ML platform (trade name: bfLEAP™) initially derived from technology developed at JHU-APL. We believe the bfLEAP™ analytics platform is a potentially disruptive tool for analysis of pre-clinical and clinical data sets, such as the robust pre-clinical and clinical trial data sets being generated in translational R&D and clinical trial settings. In November 2021, we amended our license agreement with JHU-APL to include additional advanced AI technology. On July 8, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from JHU-APL for the additional technology developed to enhance the bfLEAP™ platform. The July 8, 2022 JHU-APL license provides the Company with new intellectual property and also encompasses most of the intellectual property from our original February 2018 license agreement with JHU-APL.

We believe bfLEAP™ will inform and enable decision making throughout the development cycle:

| ● | Discovery Phase - Analyze and categorize discovery phase data to better define highest-value leads from groups of candidates, for advancement to preclinical phase of development. Integrate data from high-throughput screening, pharmacodynamics assays, pharmacokinetics assays, and other key data sets to create the most accurate profile of a pool of therapeutic candidates. There is often a high degree of similarity among closely related therapeutics in a candidate pool - bfLEAP™ is able to harmonize disparate data streams for a more nuanced understanding of each candidate’s characteristics/potency. |

| ● | Pre-Clinical Data - Large-scale, multivariate analysis of pre-clinical and early-stage clinical data sets. In these settings, bfLEAP could be used to find novel drug targets, elucidate mechanism of action, predict potential off-target effects/side effects, uncover specific genetic/phenotypic background(s) with highest correlation to therapeutic response, etc. These insights from bfLEAP™ analysis can be used to inform decision making and study design at the subsequent step(s) of therapeutic and diagnostic development, including first-inhuman/Phase I randomized controlled trials. |

|

|

| ● | Clinical Development – Advanced, multivariate analysis of Phase I and Phase II clinical trials data, to find niche populations of highly responsive patients and/or inform patient selection for later-stage clinical trials. This can be used to decrease overall study risk for larger clinical trials - including Phase II trials, and any Phase III Registration Clinical Trials. The bfLEAP™ platform analysis can also be used to more precisely understand complex correlations between therapeutic treatment and adverse events, side effects, and other undesirable responses which could jeopardize clinical trial success. |

Our platform is agnostic to the disease indication or treatment modality and therefore we believe that it is of value in the development of biologics or small molecules.

The process for our drug asset enhancement program is to:

| ● | acquire the rights to a drug from a biopharmaceutical industry company or academia; |

| ● | use the proprietary bfLEAP™ AI/ML platform to determine a multi-factorial profile for a patient that would best respond to the drug; |

| ● | rapidly conduct a clinical trial to validate the drug’s use for the defined “high-responder” population; and |

| ● | divest and sell the rescued drug asset with the new information back to a large player in the pharma industry, following positive results of the clinical trial. |

As part of our strategy, we will continue evolving our intellectual property, analytical platform and technologies, build a large portfolio of drug candidates, and implement a model that reduces risk and increases the frequency of cash flow from rescued drugs. This strategy will include strategic partnerships, collaborations, and relationships along the entire drug development value chain, as well as acquisitions of the rights to developing failed drugs and possibly the underlying companies.

To date, we have not conducted clinical trials on any pharmaceutical drugs and our platform has not been used to identify a drug candidate that has received regulatory approval for commercialization. However, we currently have a strategic relationship with a leading rare disease non-profit organization for AI/ML analysis of late-stage clinical data. We have acquired the rights to a series of preclinical and early clinical drug assets from universities and entered into a strategic collaboration with a world-renowned research institution to create a HSV1 viral therapeutic platform to engineer immunotherapies for colorectal cancer. We have signed exclusive worldwide license agreements with Johns Hopkins University for a cancer drug that targets glioblastoma (brain cancer), pancreatic cancer, and other cancers. We have also signed an exclusive worldwide license with George Washington University for another cancer drug that targets hepatocellular carcinoma (liver cancer), and other liver diseases.

Our platform was originally developed by JHU-APL. JHU-APL uses the same technology for applications related to national defense. Over several years, the software and algorithms have been used to identify relationships, patterns, and anomalies, and make predictions that otherwise may not be found. These discoveries and insights provide an advantage when predicting a target of interest, regardless of industry or sector. We have applied the technology to various clinical data sets and have identified novel relationships that may provide new intellectual property, new drug targets, and other valuable information that may help with patient stratification for a clinical trial thereby improving the odds for success. The platform has not yet aided in the development of a drug that has reached commercialization. However, we have licensed one drug candidate that has completed a Phase I trial and a second candidate that is in the preclinical stages. Our aim is to use our technology on current and future available data to help us better determine the optimal path for development.

While we have not generated significant revenues from our AI/ML operations, we anticipate generating revenue in the future from the following three sources:

Contract Services

Our fee for service partnership offering model is designed for biopharmaceutical companies, as well as other organizations, of all sizes that have challenges analyzing data throughout the drug development process. We provide the customer with an analysis of large complex data sets using our proprietary AI/ML platform called bfLEAP™. This platform is designed to predict targets of interest, patterns, relationships, and anomalies. Our service model involves fees in cash, equity or other consideration and, in some instances, the potential for rights to new intellectual property generated from the analysis, which can be performed at the discovery, preclinical, or clinical stages of drug development.

|

|

Collaborative Arrangements

We plan to enter into collaborative arrangements with biotechnology and pharmaceutical companies who have drugs that are in development or have failed late Phase II or Phase III trials. The collaborations may also be at the discovery or preclinical stages of drug development. Our revenue will be a combination of fee for service payments and success fees based on achieving certain milestones as determined by each specific arrangement. There may also be fees or legal rights associated with the development of new intellectual property.

Acquisition of Rights to Certain Drugs

We may acquire the rights to drugs that have failed late Phase II or Phase III trials and generate revenues by using our platform to accurately determine the profile of patients that would respond to the drugs, conduct a clinical trial to test our findings either independently or with a clinical partner, and finally sell the drug back to pharmaceutical companies. We have and may continue acquiring the rights to drugs that have not yet failed any trials. We will use our technology to improve the chances for success, conduct a trial, and divest the asset. When divesting assets, the transaction may involve a combination of upfront payments, milestone payments based on clinical success, and royalties on sales of the product.

Our Products

| Product/Platform | Description | Target Market/Indications | ||

| bfLEAP™ – AI/ML platform for analysis of preclinical and clinical data | AI/ML analytics platform derived from technology developed at JHU-APL and licensed by the Company. | Biotechnology and pharmaceutical companies and other organizations. | ||

| siRNA | Small interfering RNA targeting Beta2-spectrin in the treatment of human diseases developed at George Washington University and licensed by the Company. Product has not yet initiated clinical testing. | Hepatocellular carcinoma, treatment of obesity, non-alcoholic fatty liver disease, and non-alcoholic steatohepatitis. | ||

| Mebendazole | Improved formulation of Mebendazole developed at Johns Hopkins University and licensed by the Company. Product has begun the process of clinical testing but has not received regulatory approval for commercialization. | Glioblastoma. |

On January 14, 2022, the Company entered into an exclusive, worldwide, royalty-bearing license from George Washington University (“GWU”) for rights to use siRNA targeting Beta2-spectrin in the treatment of human diseases, including hepatocellular carcinoma (“HCC”). The license covers methods claimed in three U.S. and worldwide patent applications, and also includes use of this approach for treatment of obesity, non-alcoholic fatty liver disease, and non-alcoholic steatohepatitis. This program is currently in the preclinical stage of development. The Company initiated proof-of-concept studies on this asset and will use the outcome of these studies to inform a clinical development plan that would include initiation of IND-enabling studies.

|

|

Metabolic dysfunction-associated steatotic liver disease (known as MASLD, which until recently was called non-alcoholic fatty liver disease, or NAFLD) is a condition in which excess lipids, or fat, build up in the liver. This condition, which is more common in people who have obesity and related metabolic diseases including type 2 diabetes, affects as many as 24% of adults in the United States and is associated with risk of progression to more serious conditions, including metabolic dysfunction-associated steatohepatitis (“MASH”), with associated liver inflammation and fibrosis, and HCC. Evidence in animal models of obesity suggest that a protein called β2-spectrin may play a key role in lipid accumulation, tissue fibrosis, and liver damage, and targeting expression or activity of this protein may be a useful approach in treating MASH and liver cancer (Rao et al., 2021).

In February 2022, the Company entered into an exclusive, worldwide, royalty-bearing license with Johns Hopkins University (“JHU”) for the use of an improved formulation of Mebendazole for the treatment of any human cancer or neoplastic disease. This formulation shows potent activity in animal models with different types of cancer and has been evaluated in a Phase I clinical trial in patients with high-grade glioma (NCT01729260). The trial, an open-label dose-escalation study, assessed the safety of the improved formulation with adjuvant temozolomide in 24 patients with newly diagnosed gliomas. Investigators observed no dose-limiting toxicity in patients receiving all but the highest tested dose (200mg/kg/day). Four of the 15 patients receiving the maximum tested dose of 200mg/kg/day experienced dose-limiting toxicity, all of which were reversed by decreasing or eliminating the dose given. There were no serious adverse events attributed to mebendazole at any dose during the trial. The Company is currently formulating a strategy to find a partner to conduct additional clinical trials with this asset to enable evaluation of safety in humans.

In October 2022, the Company entered into an exclusive, world-wide, royalty-bearing license with JHU and the Institute of Organic Chemistry and Biochemistry (“IOCB”) of the Czech Academy of Sciences for rights to commercialize N-substituted prodrugs of mebendazole that demonstrate improved solubility and bioavailability. The license covers prodrug compositions and use for treating disease as claimed in multiple United States and worldwide patent applications. Patents have since been issued in the United States and Australia and are still in the prosecution phase in other territories. In September 2023, the Company announced results from a preclinical study demonstrating the effectiveness of BF-223, a compound chosen from this class, in an animal model for glioblastoma. The Company is currently formulating a strategy for initiating IND-enabling studies on BF-223 and is conducting outreach to identify partners that may want to license or partner in the development of BF-223.

Our bfLEAP™ Analytics Platform

We are able to pursue our drug rescue business by leveraging a powerful and proven AI/ML platform (trade name: bfLEAP™) derived from technology developed at JHU-APL. The bfLEAP™ platform is based on an exclusive, world-wide license granted by JHU-APL. The license covers three (3) issued patents, as well as a new provisional patent application, non-patent rights to proprietary libraries of algorithms and other trade secrets, which also includes modifications and improvements. On July 8, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from JHU-APL for the additional technology developed to enhance the bfLEAP™ platform. The new license provides additional intellectual property rights including patents, copyrights and knowhow to be utilized under the Company’s bfLEAP™ analytical AI/ML platform. Under the terms of the new license agreement, JHU-APL will be entitled to eight percent (8%) of net sales for the services provided by the Company to other parties and three percent (3%) for internally developed drug projects in which the JHU-APL license was utilized. The new license also contains tiered sub licensing fees that start at 50% and reduce to 25% based on revenues.

We believe the bfLEAP™ analytics platform is a potentially disruptive tool for analysis of pre-clinical and clinical data sets, such as the robust pre-clinical and clinical trial data sets being generated in translational R&D and clinical trial settings. The input data for bfLEAP™ can include raw data (preclinical and/or clinical readouts), categorical data, sociodemographic data of patients, and various other inputs. Thus, the bfLEAP™ platform is capable of capturing the particular genetic and physical characteristics of patients in an unbiased manner, and contextualizing it against other disparate data sources from patients (e.g. molecular data, physiological data, etc.) for less biased and more meaningful conclusions. It is also uniquely scalable - the bfLEAP™ platform is able to perform analysis on large, high-volume data sets (i.e. ‘big data’) and also able to analyze highly disparate “short and wide” data as well. In terms of visualization, bfLEAP™ is able to integrate with most commonly used visualization tools for graph analytics.

We believe that the combination of (a) scalable analytics (i.e., large data or short/wide data), (b) state-of-the-art proprietary algorithms, (c) unsupervised machine learning, and (d) streamlined data ingestion and visualization makes bfLEAP™ one of the most flexible and powerful new platforms available on the market.

The Company will continue to evolve and improve bfLEAP™.

Bullfrog Data Networks™

The Company’s Bullfrog Data Networks™ solution incorporates publicly available, proprietary, and custom data sources to generate novel insights toward target identification and validation, understanding mechanism of action, clinical trial optimization, drug repurposing, and more. Bullfrog Data Networks™ can be created for any therapeutic area, and we use this technology in our own research and development pipeline including in oncology and central nervous system indications. Our approach finds patient subgroups with similar molecular signatures and identifies the most relevant genes driving disease biology. Data networks created from this process generate insights that allow researchers to accelerate drug discovery and development and increase the odds of technical and regulatory success. In February 2025, we entered into a collaboration agreement with Eleison Pharmaceuticals Inc. (“Eleison”), a Phase III oncology company focused on novel chemotherapeutic treatments for rare cancers, where we will apply our proprietary Bullfrog Data Networks™ solution, powered by the bfLEAP® platform, and we plan to offer this solution to other biotechnology and pharmaceutical companies going forward.

|

|

Lieber Institute for Brain Development

On September 8, 2023, the Company entered a data use and technology partnership agreement (the “Partnership Agreement”) with the Lieber Institute for Brain Development (“LIBD”). The Partnership Agreement covers the right of the Company to leverage its bfLEAP™ platform to mine LIBD’s comprehensive brain data, including transcriptomic, genomic, DNA methylation, cell-line, clinical, and imaging data to identify previously unrecognized relationships. The goal of the partnership is to identify previously unrecognized relationships between genes and pathways in the brain and the development of neurologic and psychiatric disorders, thereby facilitating the development of more effective treatments for diseases of the human brain. The collaboration will proceed in two stages, with the first involving unsupervised construction of graphical models to reveal relationships between brain diseases and genomic/biologic attributes, with the goal of identifying new biomarkers and drug targets across disorders. The second stage will involve creating disease-specific models that will enable identification of genes and pathways within these respective disorders. The Partnership Agreement had a one-year term of data exclusivity to complete the first stages of analyses, with a two-year extension option as performance milestones are met.

As contemplated in the Partnership Agreement, on October 16, 2023, the Company and LIBD entered into a commercial agreement (the “Commercial Agreement”) that sets forth the key terms for commercialization of products and services developed under the Partnership Agreement. Pursuant to the Commercial Agreement, LIBD granted the Company a worldwide, royalty-bearing exclusive license so long as the Company receives net sales or income from the licensing of “Licensed Products” (as defined in the Commercial Agreement) in the application of machine learning and artificial intelligence for research and development in drug development, and specifically includes therapeutic products, patient selection strategies, and target identification, but excludes diagnostics and incidental uses of machine learning and/or artificial intelligence on data derived from research. Generally, “Licensed Products” are any product or service which incorporates, results from, or is derived from LIBD’s Data (meaning finished brain-related data, including but not limited to DNA methylation, RNAseq, genomic, DNA methylation, cell-line, clinical, and imaging data, and the specified data set forth in the Partnership Agreement) and that the Company or its affiliate develops during the term of the Partnership Agreement, and any improvements thereof after the term of the Partnership Agreement, and all Licensed Products or services derived therefrom by the Company or its affiliates. Licensed Products may include, but are not limited to, biomarker and target identification, target validation, mapping unmet needs, identifying genetic risk factors and predictive modeling.

The Company was also granted the right to sublicense, to use the deliverables under the Partnership Agreement, and LIBD’s intellectual property rights in the data, to (i) use, sell, distribute for sale, have distributed for sale, offer for sale, have sold, import and have imported Licensed Products and (ii) to develop, have developed, make, have made Licensed Products that are derived from Licensed Products developed during the term of the Partnership Agreement, and any improvements made following the term. The Company is prohibited from sublicensing LIBD Data. The Company shall pay LIBD a royalty based on net sales of all Licensed Products sold by the Company and its affiliates.

The Commercial Agreement, generally, may be terminated at any time by either the Company or LIBD if either party defaults or breaches any material term of the agreement or files for protection under bankruptcy laws, makes an assignment for the benefit of creditors, appoints or suffers appointment of a receiver, trustee, or similar agent over its property.

Summary for CATIE Schizophrenia Case Study

As part of the Partnership Agreement, the Company worked with LIBD to analyze data from the landmark Clinical Antipsychotic Trials of Intervention Effectiveness (“CATIE”) trials. The CATIE trials were the largest trials ever conducted for anti-psychotic medications. The Company analyzed CATIE data from ~200 schizophrenia patients, with a library of almost 1 million genetic data points for each patient, more than 200 non-genetic attributes per patient, and 4 different medications used in the trial. For each of the four medications used, bfLEAP™ analysis revealed new, previously unknown relationships between individual genetic variants and negative patient symptoms. The genetic loci identified represent potential druggable targets, as well as potential stratifying criteria for future clinical trials in schizophrenia.

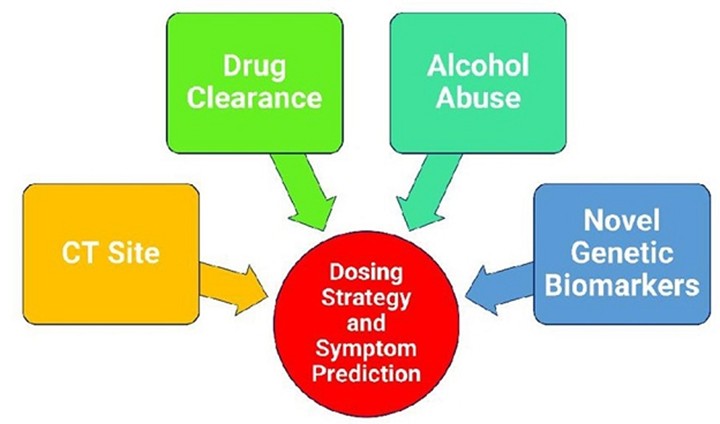

We performed another analysis on the data using our new advanced clustering algorithms bfLEAP 2.0 but focused on one particular drug named Olanzapine. Our bfLEAP™ 2.0 analytical results identified previously unknown, multi-dimensional associations among newly identified genetic variants, drug clearance, clinical trial sites, and clinical outcome variables in schizophrenia patients.

|

|

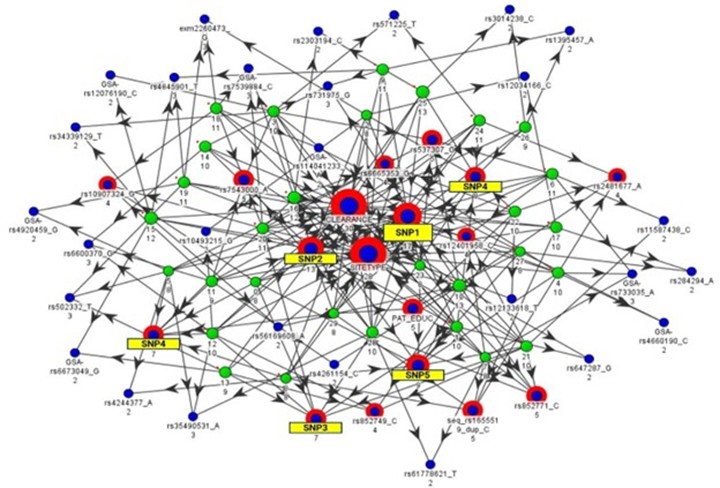

FIGURE 1 – bfLEAP™ Analytical Map

Each green node represents a different sampling of the data, and arrows point to attributes (blue nodes) which were found to be key indicators according to that sampling. Attribute importance is determined by how many samplings identify that attribute as an indicator (i.e., number of incoming arrows to each blue node).

Identification of clustered multi-variate associations (e.g., novel genetic variants, drug clearance, substance abuse) could help us (1) identify novel drug targets, (2) predict which patients are most likely to respond, and (3) identify modifiable factors that could contribute to better outcomes.

|

|

Summary for Cardiovascular Case Study

The Company worked with an international collaborator in cardiovascular devices to analyze data from an ongoing clinical trial for a new device. Bullfrog analyzed data from ~55 patients, with a library of almost 15,000 unique attributes of data for each patient. The data also included adverse events, and key demographic information. For this collaborator, bfLEAP™ analysis was able to provide ground truth for the Company, confirming multiple correlations and non-correlations within the data. In terms of actionable output, the analytical results confirmed at least two demographic co-variates for the ongoing trial, and also provided a starting point for deeper physiological and molecular studies.

Our Supply Chain and Customer Base

We have launched our businesses using funds from our initial public offering and through our partnerships and relationships. We have a strategic relationship with FSHD Society, a leading non-governmental organization, for AI/ML analysis of clinical trial data for patients with a rare neuromuscular disorder. We also have several other developing strategic relationships in the project design phase. The Company has executed a joint development deal for a biologics discovery phase opportunity that is directed toward targeted cancer therapeutics. The Company has also obtained exclusive worldwide rights to a Phase II ready glioblastoma drug and a discovery phase hepatocellular carcinoma drug from universities. Since we intend to conduct late-stage clinical trials with partners on rescued therapeutic assets, there will be a requirement of drug product or other significant services to plan and execute our clinical development programs. The success of our partnered clinical development programs will require adequate availability of raw materials and drug product for our R&D and clinical trials, and, in some cases, may also require establishment of third-party arrangements to obtain finished drug product that is manufactured appropriately under industry-standard guidelines, and packaged for clinical use or sale. Since we are a digital biopharmaceutical company, our clinical development programs will also require, in some cases, the establishment of third-party relationships for execution and completion of clinical trials.

Our Market Opportunity

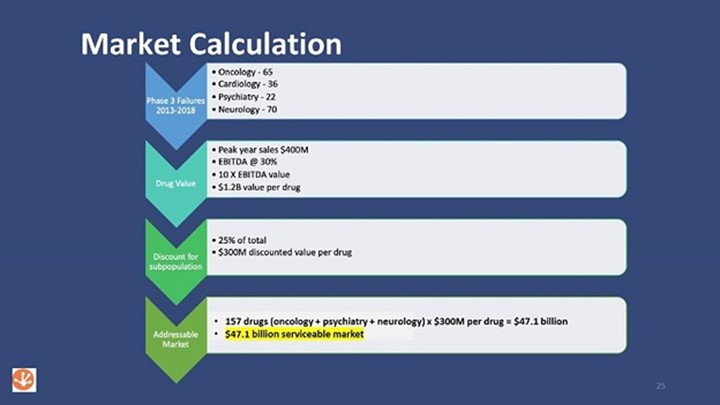

One aim of our business is to “rescue” drugs that have failed in Phase III clinical trials by using our technology to analyze all available data with the goal of designing a precision medicine clinical trial that will have a better chance of being successful. The graphic below illustrates the estimated market opportunity for these failed drugs. The top arrow shows the number of failed Phase III trials for several disease categories over a 5-year period. The arrows below provide our assumptions for narrowing or discounting certain parameters associated with the market size calculation. The final arrow shows the math behind the $47.1 billion market opportunity. To date, we have not penetrated the failed drug market, however; we are actively searching for failed drug opportunities.

|

|

Identification of candidates with potential for rescue may be challenging and require significant resources, and once these assets are identified the Company may find it challenging to license them under favorable terms in order to create value for shareholders. Subsequent development of these assets for clinical testing may require significant effort and resources. Ultimately, these assets must undergo rigorous clinical testing and approval by FDA or comparable regulatory authorities in other countries in order to be marketed. A key part of our strategy is to partner our R&D programs. In addition, we do not intend on commercializing drugs and instead will seek to divest each drug asset to a company that will commercialize the drug. The Company may receive future royalties in some transactions.

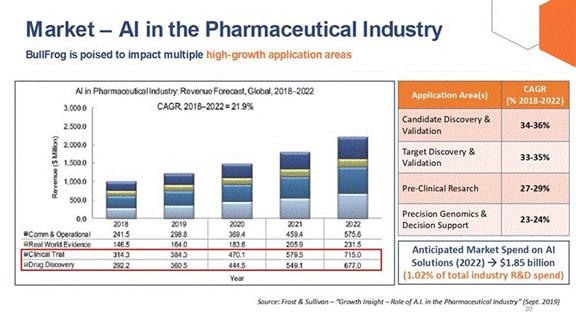

The following graphic illustrates the global revenue forecast for applying AI in the pharmaceutical industry, as well as the increase in anticipated market spend and annual growth rate for AI solutions per certain application areas.

|

|

Intellectual Property

Patents

We have exclusive worldwide rights to the following patents related to our intellectual property:

Mebendazole Polymorph For Treatment And Prevention Of Tumors

| Serial Number | Country | Status | Issue Date | Expiration Date | ||||

| 62/112,706 | United States | Converted | N/A | N/A | ||||

| PCT/US2016/016968 | PCT | Nationalized | N/A | N/A | ||||

| 11,110,079 | United States | Granted | 9/7/2021 | 2/8/2036 | ||||

| 17/402,131 | United States | Abandoned | N/A | N/A | ||||

| 18/525,209 | United States | Pending | N/A | N/A | ||||

| 16747414.7 | Europe | Granted | 12/15/2021 | 2/8/2036 | ||||

| 16747414.7 | Czech Republic | Granted | 12/15/2021 | 2/8/2036 | ||||

| 16747414.7 | France | Granted | 12/15/2021 | 2/8/2036 | ||||

| 60 2016 067 384.3 | Germany | Granted | 12/15/2021 | 2/8/2036 | ||||

| 16747414.7 | Ireland | Granted | 12/15/2021 | 2/8/2036 | ||||

| 502022000018341 | Italy | Granted | 12/15/2021 | 2/8/2036 | ||||

| 16747414.7 | Spain | Granted | 12/15/2021 | 2/8/2036 | ||||

| 16747414.7 | Switzerland | Granted | 12/15/2021 | 2/8/2036 | ||||

| 16747414.7 | United Kingdom | Granted | 12/15/2021 | 2/8/2036 | ||||

| 253854 | Israel | Granted | 6/26/2021 | 2/8/2036 | ||||

| 2016800144274 | China | Granted | 6/25/2021 | 2/8/2036 | ||||

| 201717028684 | India | Granted | 12/1/2020 | 2/8/2036 | ||||

| 2017-541687 | Japan | Granted | 11/18/2020 | 2/8/2036 |

Mebendazole Prodrugs with Enhanced Solubility and Oral Bioavailability

| Serial Number | Country | Status | Issue Date | Expiration Date | ||||

| 62/627,810 | United States | Converted | N/A | N/A | ||||

| PCT/US2019/017291 | PCT | Nationalized | N/A | N/A | ||||

| 11,712,435 | United States | Granted | 8/1/2023 | 2/8/2039 | ||||

| 2019216757 | Australia | Granted | 1/4/2024 | 2/8/2039 | ||||

| 19751700.6 | Europe | Pending | N/A | N/A | ||||

| 3,090,691 | Canada | Pending | N/A | N/A |

Inhibition of SPTBN1 to treat Obesity/NASH and Obesity/NASH-driven cancer

| Serial Number | Country | Status | Filing Date | Expiration Date | ||||

| 63/113,745 | United States | Converted | 11/13/2020 | N/A | ||||

| 63/147,141 | United States | Converted | 2/8/2021 | N/A | ||||

| PCT/US2021/059245 | United States | Nationalized | 11/12/2021 | N/A | ||||

| 2023-528428 | Japan | Filed | 11/12/2021 | N/A | ||||

| 18/252,771 | United States | Filed | 5/12/2023 | N/A | ||||

| 21892928.9 | Europe | Filed | 6/13/2023 | N/A | ||||

| 2021800763877 | Canada | Filed | 11/12/2021 | N/A |

|

|

John Hopkins University Applied Physics Lab Licensed Intellectual Property:

| Title | Serial Number | File Date | Country | Status | Expiration Date | Assignee | ||||||

| Apparatus and Method for Distributed Graph Processing | U.S. Patent 10,146,801 | 7/13/2015 | US | Granted | 3/2/2037 | The Johns Hopkins University | ||||||

| Method and Apparatus for Analysis and Classification of High Dimensional Data Sets | U.S. Patent 10,936,965 | 10/5/2017 | US | Granted | 9/25/2038 | The Johns Hopkins University | ||||||

| Generalized Low Entropy Mixture Model | U.S. Patent 10,839,256 | 4/2/2018 | US | Granted | 12/15/2038 | The Johns Hopkins University |

Licenses

We hold the following licenses related to our intellectual property:

| Licensor | Licensee | Description of Rights Granted | ||

| Johns Hopkins University Applied Physics Lab | Bullfrog AI, Inc. | Worldwide, exclusive rights for therapeutics development and analytical services | ||

| George Washington University | Bullfrog AI Holdings | Worldwide, exclusive rights for therapeutics development | ||

| Johns Hopkins University | Bullfrog AI Holdings | Worldwide, exclusive rights for therapeutics development |

JHU-APL Technology License

On February 7, 2018, the Company entered into an exclusive, world-wide, royalty-bearing license with JHU-APL (the “2018 License Agreement”). The license covers three (3) issued patents, one (1) new provisional patent application, non-patent rights to proprietary libraries of algorithms and other trade secrets, as well as modifications and improvements. In October 2021, the Company executed an amendment to the original license for improvements and new advanced analytics capabilities. In consideration of the rights granted to the Company under the 2018 License Agreement, JHU-APL received a warrant equal to five percent (5%) of the then fully diluted equity base of the Company, which was diluted following the closing of our initial public offering. Under the terms of the 2018 License Agreement, JHU-APL will be entitled to an eight percent (8%) royalty on net sales for the services provided by the Company as well as fifty percent (50%) of all sublicense revenues received by the Company on services and sublicenses in which the JHU-APL licensed technology was utilized. In addition, the Company is required to pay JHU-APL an annual maintenance fee of $1,500. Minimum annual royalty payments are $20,000 for 2022, $80,000 for 2023, and $300,000 per year for 2024 and beyond. If cumulative annual royalty payments do not reach these levels, the amount due to JHU-APL to reach the annual minimum is due by January 1st of the following year. Failure to make annual royalty payments is considered a material breach under the agreement and, upon notice from JHU-APL of a material breach, the Company will have 60 days to cure the material breach.

On July 8, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from JHU-APL for the additional technology developed to enhance the bfLEAP™ platform (the “2022 License Agreement”). The new license provides additional intellectual property rights including patents, copyrights, and knowhow to be utilized under the Company’s bfLEAP™ analytical AI/ML platform. This 2022 License Agreement supersedes the previous 2018 License Agreement. In consideration of the new license, the Company issued 39,879 shares of common stock to JHU-APL. Under the terms of the 2022 License Agreement, JHU-APL will be entitled to eight percent (8%) of net sales for the services provided by the Company to other parties and three percent (3%) for internally developed drug projects in which the JHU-APL license is utilized. The new license also contains tiered sub licensing fees that start at 50% and reduce to 25% based on revenues. In addition, under the new license agreement, the minimum annual royalty payments are $30,000 for 2022, $80,000 for 2023, and $300,000 per year for 2024 and beyond, all of which are creditable by royalties. The financial terms of the new license agreement replace the original terms from the 2018 License Agreement and are not duplicative.

On May 31, 2023, the Company and JHU-APL entered into Amendment Number 1 of the July 8, 2022 License Agreement whereby the Company gained access to certain improvements including additional patents and knowhow in exchange for a series of payments totaling $275,000. The first of these payments for $75,000 was paid in July 2023 and the remaining payments of $75,000, $75,000, and $50,000 are due in years 2025, 2026 and 2027, respectively. The amendment also reduced the 2023 minimum annual royalty payment to $60,000, all other financial terms remain the same. As of December 31, 2024, we have accrued $300,000 of the 2024 minimum annual royalty payments, and the entire accrued balance was paid in January 2025.

|

|

George Washington University - Beta2-spectrin siRNA License

On January 14, 2022, the Company entered into an exclusive, world-wide, royalty-bearing license from GWU for rights to use siRNA targeting Beta2-spectrin in the treatment of human diseases, including HCC. The license covers methods claimed in three U.S. and worldwide patent applications, and also includes use of this approach for treatment of obesity, non-alcoholic fatty liver disease, and non-alcoholic steatohepatitis. This program is currently in the preclinical stage of development. The Company has not yet initiated development activities or IND-enabling studies on this asset; however, the plan is to conduct this work over the next 24 months. All R&D on this candidate to date has been conducted by the licensor of the technology, GWU. The term of the agreement began on January 14, 2022 and ends on the expiration date of the last patent to expire or 10 years after the first sale of a licensed product if no patents have been issued. The license can be terminated by the licensee upon 60 days’ written notice, or by the licensor if the Company is more than 30 days late in paying amounts owed to the licensor and does not make payment upon demand, or in the event of any material breach of the license that is not cured within 45 days.

Non-alcoholic fatty liver disease (“NAFLD”) is a condition in which excess lipids, or fat, build up in the liver. This condition, which is more common in people who have obesity and related metabolic diseases including type 2 diabetes, affects as many as 24% of adults in the United States and is associated with risk of progression to more serious conditions, including non-alcoholic steatohepatitis (“NASH”), with associated liver inflammation and fibrosis, and hepatocellular carcinoma (“HCC”). Evidence in animal models of obesity suggest that a protein called β2-spectrin may play a key role in lipid accumulation, tissue fibrosis, and liver damage, and targeting expression or activity of this protein may be a useful approach in treating NASH and liver cancer (Rao et al., 2021).

In consideration of the rights granted to the Company under the license agreement, GWU received a $20,000 license initiation fee. Under the terms of the license agreement, GWU will be entitled to a three percent (3%) royalty on net sales subject to quarterly minimums once the first sale has occurred subsequent to regulatory approval, as well sublicense or assignment fees in the event the Company sublicenses or assigns their rights to use the technology. The Company will also reimburse GWU for previously incurred and ongoing patent costs. The sublicense and assignment fee amounts decline as the Company advances the clinical development of the licensed technology. The license agreement also contains milestone payments for clinical development through the approval of a New Drug Application (“NDA”) and commercialization.

Aggregate future milestone costs could reach $860,000 if the drug successfully completes clinical trials and is the subject of an NDA to the U.S. FDA. Future milestones on sales revenue are limited to $1 million on the first $20 million in net sales.

As of December 31, 2024 and 2023, there has been no accrual for royalties since we have not begun to generate applicable revenue. The Company assessed whether the license should be capitalized and determined that the licensed program is in the early stage and therefore may not be recoverable; the Company expensed the license fee and will expense development costs until commercial viability is likely.

Johns Hopkins University – Mebendazole License

On February 22, 2022, the Company entered into an exclusive, worldwide, royalty-bearing license with JHU for the use of an improved formulation of Mebendazole for the treatment of any human cancer or neoplastic disease. This formulation shows potent activity in animal models with different types of cancer, and has been evaluated in a Phase I clinical trial in patients with high-grade glioma (NCT01729260). The trial, an open-label dose-escalation study, assessed the safety of the improved formulation with adjuvant temozolomide in 24 patients with newly diagnosed gliomas. Investigators observed no dose-limiting toxicity in patients receiving all but the highest tested dose (200mg/kg/day). Four of the 15 patients receiving the maximum tested dose of 200mg/kg/day experienced dose-limiting toxicity, all of which were reversed by decreasing or eliminating the dose given. There were no serious adverse events attributed to mebendazole at any dose during the trial. The Company is currently formulating a strategy to conduct additional clinical trials with this asset to enable evaluation of safety in humans.

|

|

The license covers six (6) issued patents and one (1) pending application, with the term of the agreement beginning on February 22, 2022 and ending on the date of expiration of the last to expire patent. The license can be terminated by the licensee upon 90 days’ written notice, or by the licensor in the event of any material breach of the license that is not cured within 30 days. In consideration of the rights granted to the Company under the license agreement, JHU received a staggered upfront license fee of $250,000, with the first $50,000 paid in 2022 and the remaining balance of $200,000 paid in 2023. The Company also reimbursed JHU for previously incurred and ongoing patent costs. Under the terms of the license agreement, JHU will be entitled to three- and one-half percent (3.5%) royalty on net sales by the Company in which the JHU license was utilized. In addition, the Company is required to pay JHU minimum annual royalty payments of $5,000 for 2022, $10,000 for 2023, $20,000 for 2024, $30,000 for 2025 and $50,000 for 2026 and each year after until the first commercial sale, after which the annual minimum royalty shall be $250,000. The license agreement also contains milestone payments for clinical development steps through the approval of an NDA and commercialization. Aggregate future milestone costs could reach $1,500,000 if the drug successfully completes Phase II and III clinical trials and is approved for sale and marketing by the United States FDA. Future milestones on sales revenue are $1 million on the first $20 million in sales revenue, $2 million in the first-year cumulative sales revenue exceeds $100 million, $10 million in the first-year cumulative sales revenue exceeds $500 million, and $20 million in the first-year cumulative sales revenue exceeds $1 billion. As of December 31, 2024 and 2023, the balance of accrued expense related to this license agreement was $20,000 and $10,000, respectively. The Company assessed whether the license should be capitalized and determined that the licensed program is in the early stage and therefore may not be recoverable; the Company expensed the license fee and will expense development costs until commercial viability is likely.

Johns Hopkins University – Mebendazole Prodrug License

On October 13, 2022, the Company entered into an exclusive, worldwide, royalty-bearing license with JHU and the Institute of Organic Chemistry and Biochemistry (“IOCB”) of the Czech Academy of Sciences for rights to commercialize N-substituted prodrugs of mebendazole that demonstrate improved solubility and bioavailability. The license covers prodrug compositions and use for treating disease as claimed in multiple U.S. and worldwide patent applications. The term of the agreement began on October 13, 2022 and continues until the date of expiration of the last to expire patent, or for 20 years from the effective date of the agreement if no patents are issued. The license can be terminated by the Company upon 90 days’ written notice, or by the licensor in the event of any material breach of the license that is not cured by the Company within 30 days.

In consideration for the rights granted to the Company under the license agreement, JHU and IOCB will receive a staggered upfront license fee of $100,000. The Company also reimbursed JHU and IOCB for previously incurred patent costs totaling $33,265 and will be responsible for reimbursing licensors for future patent costs. Under the terms of the license agreement, the licensors will be entitled to a four percent (4%) royalty on net sales subject to annual minimums upon first commercial sale of a licensed product, as well as sublicense or assignment fees in the event the Company sublicenses or assigns their rights to use the technology. The sublicense fee amount declines as the Company advances the clinical development of licensed technology. The Company is required to pay minimum annual royalties beginning in year 4 of the agreement. The minimum annual royalty for year 4 will be $5,000 (2026), increasing to $10,000 in year 5 (2027), $20,000 in year 6 (2028), $30,000 in year 7 (2029), and $50,000 in year 8 and subsequent years (2030 and beyond). The Company will be responsible for milestone payments for patent issuance of up to $50,000 and clinical development milestones up to and including approval of an NDA totaling up to $2.3 million. The Company will be required to pay a commercial milestone of $1 million once sales reach $20 million in the United States, $2 million when sales in the United States reach $100 million, $10 million when United States sales reach $500 million, and $20 million when United States sales exceed $1 billion.

As of December 31, 2024 and 2023, the balance of accrued expense related to this license agreement was $0. The Company assessed whether the license should be capitalized and determined that the licensed program is in the early stage and therefore may not be recoverable; the Company expensed the license fee and will expense development costs until commercial viability is likely.

On September 26, 2023, the Company announced positive data in a preclinical study investigating the anti-cancer activity of a novel prodrug of mebendazole for the treatment of glioblastoma. The study assessed the relative efficacy of BF-222, a novel formulation of mebendazole that has been evaluated in clinical trials, and BF-223, a novel prodrug of mebendazole with improved solubility and bioavailability relative to BF-222, compared with placebo in mice that had been implanted with tumor cells as a model for human glioblastoma. Animals treated with BF-223 had an average survival time of 27.9 days compared with 27.3 days for mice treated with BF-222 and 23.4 days for mice given placebo. Mice treated with BF-223 were administered 80% of the dose that mice treated with BF-222 received, and improved outcomes for both treatment groups were statistically significant compared to placebo. In addition, animals treated with equivalent doses of BF-222 and BF-223 showed comparable and significant reduction in tumor growth compared to control animals during the study.

|

|

Competition

The pharmaceutical and biotechnology industries are characterized by rapidly advancing technologies, intense competition, and a strong emphasis on proprietary products. The immuno-oncology, neuroscience, and rare disease segments of the industry in particular are highly competitive. While we believe that our technology, development experience and scientific knowledge provide competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical, and biotechnology companies, academic institutions and governmental agencies, and public and private research institutions.

Many of our competitors may have significantly greater financial resources, and expertise in research and development, manufacturing, preclinical studies, conducting clinical trials, obtaining regulatory approvals, and marketing approved medicines than we do. Mergers and acquisitions in the pharmaceutical, biotechnology, and diagnostic industries may result in even more resources being concentrated among a smaller number of our competitors. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and in establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to or necessary for our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies.

The key competitive factors affecting the success of all of our product candidates, if approved, are likely to be their efficacy, safety, convenience, price, the effectiveness of companion diagnostics in guiding the use of related therapeutics, if any, the level of generic competition and the availability of reimbursement from government and other third-party payors.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize medicines that are safer, are more effective, have fewer or less severe side effects, are more convenient or are less expensive than any medicines we may develop. Our competitors also may obtain FDA or other regulatory approval for their medicines more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market. In addition, our ability to compete may be affected in many cases by insurers or other third-party payors seeking to encourage the use of generic medicines. There are many generic medicines currently on the market for certain of the indications that we are pursuing, and additional generics are expected to become available over the coming years. If our therapeutic product candidates are approved, we expect that they will be priced at a significant premium over competitive generic medicines.

Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future. If the product candidates of our priority programs are approved for the indications for which we are currently planning clinical trials, they will compete with the drugs discussed below and will likely compete with other drugs currently in development.

bfLEAP

The analytics industry and application of AI/ML in healthcare is growing rapidly. Competition exists along the entire continuum of the drug development process from discovery to commercialization and beyond. We believe the weakness of the industry is the quality of the data and we believe bfLEAP provides several competitive advantages, that will position the Company for success, First, bfLEAP is highly scalable and can process data from small to extremely large complex data sets without the need for additional code being developed. Second, it is adept at processing and analyzing incomplete data and making predictions that we do not believe other technologies are capable of doing. Third, bfLEAP has the ability to extract the most important features for analysis out of extremely large complex data sets using unsupervised machine learning algorithms, thereby greatly simplifying complex problems. Since data quality is a problem that exists in the healthcare industry, we see these as major differentiators. The ability to make predictions, find relationships and patterns and anomalies in extremely large complex data sets has been demonstrated by the JHU-APL in other applications and sectors. Finally, the algorithms used by bfLEAP are proprietary and protected, having been developed at JHU-APL. We believe most of the competitors rely on open-source algorithms and we also believe that we have already demonstrated our superiority via the August 2021 publication in DeepAI.org.

|

|

Government Regulation

The FDA does not currently require approval of AI/ML technologies used to aid in therapeutics, but that could change in the future. The FDA will regulate any clinical trials conducted by the Company.

Our clinical development programs will, in some cases, require regulatory review of preclinical and/or clinical data by the FDA or other governing agencies, and subsequent compliance with applicable federal, state, local, and foreign statutes and regulations. The results of the clinical trials that we conduct will be evaluated by the FDA and other regulatory bodies. The comments and approvals that are obtained are expected to lead to milestone payments under the collaborative agreement. Accordingly, our ability to navigate the regulatory process is extremely important to the success of the Company. We believe that we have a competitive advantage in this process due to primarily focusing on drug candidates that already have some level of success in clinical trials. Previous success of a particular candidate in trials combined with our precision medicine approach to clinical trial design using our bfLEAP platform, will de-risk the development process and improve the chances for success.

Government Regulation and Product Approval

Government authorities in the United States, at the federal, state and local level, and in other countries and jurisdictions extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, marketing, post-approval monitoring and reporting, and import and export of pharmaceutical products. The processes for obtaining regulatory approvals in the United States and in foreign countries and jurisdictions, along with subsequent compliance with applicable statutes and regulations and other regulatory authorities, require the expenditure of substantial time and financial resources.

FDA Approval Process

In the United States, pharmaceutical products are subject to extensive regulation by the FDA. The Federal Food, Drug, and Cosmetic Act (“FD&C Act”) and other federal and state statutes and regulations govern, among other things, the research, development, testing, manufacture, storage, recordkeeping, approval, labeling, promotion and marketing, distribution, post-approval monitoring and reporting, sampling and import and export of pharmaceutical products. Failure to comply with applicable U.S. requirements may subject a company to a variety of administrative or judicial sanctions, such as FDA refusal to approve pending new drug applications (“NDAs”), warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties and criminal prosecution.

Pharmaceutical product development for a new product or certain changes to an approved product in the U.S. typically involves preclinical laboratory and animal tests, the submission to the FDA of an investigational new drug application (“IND”) which must become effective before clinical testing may commence, and adequate and well-controlled clinical trials to establish the safety and effectiveness of the drug for each indication for which FDA approval is sought. Satisfaction of FDA pre-market approval requirements typically takes many years and the actual time required may vary substantially based upon the type, complexity and novelty of the product or disease.

Preclinical tests include laboratory evaluation of product chemistry, formulation and toxicity, as well as animal trials to assess the characteristics and potential safety and efficacy of the product. The conduct of the preclinical tests must comply with federal regulations and requirements, including good laboratory practices. The results of preclinical testing are submitted to the FDA as part of an IND along with other information, including information about product chemistry, manufacturing and controls, and a proposed clinical trial protocol. Long-term preclinical tests, such as animal tests of reproductive toxicity and carcinogenicity, may continue after the IND is submitted. A 30-day waiting period after the submission of each IND is required prior to the commencement of clinical testing in humans. If the FDA has neither commented on nor questioned the IND within this 30-day period, the clinical trial proposed in the IND may begin. Clinical trials involve the administration of the investigational new drug to healthy volunteers or patients under the supervision of a qualified investigator. Clinical trials must be conducted: (i) in compliance with federal regulations; (ii) in compliance with good clinical practice, or GCP, an international standard meant to protect the rights and health of patients and to define the roles of clinical trial sponsors, administrators, and monitors; as well as (iii) under protocols detailing the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. Each protocol involving testing on U.S. patients and subsequent protocol amendments must be submitted to the FDA as part of the IND.

|

|

Clinical trials to support NDAs for marketing approval are typically conducted in three sequential phases, but the phases may overlap. In Phase I, the initial introduction of the drug into healthy human subjects or patients, the drug is tested to assess metabolism, pharmacokinetics, pharmacological actions, side effects associated with increasing doses, and, if possible, early evidence of effectiveness. Phase II usually involves trials in a limited patient population to determine the effectiveness of the drug for a particular indication, dosage tolerance and optimum dosage, and to identify common adverse effects and safety risks. If a drug demonstrates evidence of effectiveness and an acceptable safety profile in Phase II evaluations, Phase III trials are undertaken to obtain the additional information about clinical efficacy and safety in a larger number of patients, typically at geographically dispersed clinical trial sites, to permit the FDA to evaluate the overall benefit-risk relationship of the drug and to provide adequate information for the labeling of the drug. In most cases, the FDA requires two adequate and well-controlled Phase III clinical trials to demonstrate the efficacy of the drug. A single Phase III trial with other confirmatory evidence may be sufficient in rare instances, such as where the study is a large multicenter trial demonstrating internal consistency and a statistically very persuasive finding of a clinically meaningful effect on mortality, irreversible morbidity, or prevention of a disease with a potentially serious outcome and confirmation of the result in a second trial would be practically or ethically impossible.

After completion of the required clinical testing, an NDA is prepared and submitted to the FDA. FDA approval of the NDA is required before marketing of the product may begin in the U.S. The NDA must include the results of all preclinical, clinical and other testing and a compilation of data relating to the product’s pharmacology, chemistry, manufacture and controls. The cost of preparing and submitting an NDA is substantial. The submission of most NDAs is additionally subject to a substantial application user fee, and the applicant under an approved NDA is also subject to an annual program fee for each prescription product. These fees are typically increased annually. Sponsors of applications for drugs granted Orphan Drug Designation are exempt from these user fees.

The FDA may also refer applications for novel drug products, or drug products that present difficult questions of safety or efficacy, to an outside advisory committee – typically a panel that includes clinicians and other experts – for review, evaluation, and a recommendation as to whether the application should be approved. The FDA is not bound by the recommendation of an advisory committee, but it generally follows such recommendations.

Before approving an NDA, the FDA will typically inspect one or more clinical sites to assure compliance with GCP. Additionally, the FDA will inspect the facility or the facilities at which the drug is manufactured. The FDA will not approve the product unless compliance with current good manufacturing practices (cGMPs) is satisfactory and the NDA contains data that provide substantial evidence that the drug is safe and effective in the indication studied.

Fast Track Designation

The FDA is required to facilitate the development, and expedite the review, of drugs that are intended for the treatment of a serious or life-threatening disease or condition for which there is no effective treatment and which demonstrate the potential to address unmet medical needs for the condition. Under the Fast Track program, the sponsor of a new drug candidate may request that the FDA designate the drug candidate for a specific indication as a Fast Track drug concurrent with, or after, the filing of the IND for the drug candidate. FDA must determine if the drug candidate qualifies for Fast Track Designation within 60 days of receipt of the sponsor’s request.

If a submission is granted Fast Track Designation, the sponsor may engage in more frequent interactions with the FDA, and the FDA may review sections of the NDA before the application is complete. This rolling review is available if the applicant provides, and the FDA approves, a schedule for the submission of the remaining information and the applicant pays applicable user fees. However, the FDA’s time period goal for reviewing an application does not begin until the last section of the NDA is submitted. While we may seek Fast Track Designation, there is no guarantee that we will be successful in obtaining any such designation. Even if we do obtain such designation, we may not experience a faster development process, review or approval compared to conventional FDA procedures. A Fast Track Designation does not ensure that the product candidate will receive marketing approval or that approval will be granted within any particular timeframe. Additionally, Fast Track Designation may be withdrawn by the FDA if the FDA believes that the designation is no longer supported by data emerging in the clinical trial process.

Post-Approval Requirements

Once an NDA is approved, a product will be subject to certain post-approval requirements. For instance, the FDA closely regulates the post-approval marketing and promotion of drugs, including standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the internet. Drugs may be marketed only for the approved indications and in accordance with the provisions of the approved labeling.

|

|

Adverse event reporting and submission of periodic reports are required following FDA approval of an NDA. The FDA also may require post-marketing testing, known as Phase IV testing, REMS and surveillance to monitor the effects of an approved product, or the FDA may place conditions on an approval that could restrict the distribution or use of the product. In addition, quality control, drug manufacture, packaging and labeling procedures must continue to conform to cGMPs after approval. Drug manufacturers and certain of their subcontractors are required to register their establishments with FDA and certain state agencies. Registration with the FDA subjects entities to periodic unannounced inspections by the FDA, during which the Agency inspects manufacturing facilities to assess compliance with cGMPs. Accordingly, manufacturers must continue to expend time, money, and effort in the areas of production and quality-control to maintain compliance with cGMPs. Regulatory authorities may withdraw product approvals or request product recalls if a company fails to comply with regulatory standards, if it encounters problems following initial marketing, or if previously unrecognized problems are subsequently discovered.

Generic Competition