UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 14, 2024

SHUTTLE PHARMACEUTICALS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41488 | 82-5089826 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

401 Professional Drive, Suite 260

Gaithersburg, MD 20879

(Address of principal executive offices) (Zip Code)

(240) 430-4212

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock $0.00001 per share | SHPH | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On October 14, 2024, Shuttle Pharmaceuticals Holdings, Inc., a Delaware corporation (the “Company”), closed on $600,000 of an up to $1.3 million 5% original issue discount senior secured convertible note and warrant offering (the “Offering”), entering into securities purchase agreements (“Purchase Agreement”) with a small group of accredited investors (the “Investors”).The Company’s Chief Executive Officer, Anatoly Dritschilo, invested $237,500 in the Offering.

Under the terms of the Purchase Agreement, the Investors agreed to purchase and the Company agreed to issue and sell (i) senior secured Convertible promissory notes, carrying a 5% original issue discount (each, a “Note” and, collectively, the “Notes”) and (ii) Warrants equal to 45% of the shares of common stock each investor Note is convertible into, with each warrant having an exercise price equal to 125% of the closing price of the Company’s shares of common stock, as reported by the Nasdaq Stock Market LLC on the day prior to the closing. The Purchase Agreement contains customary representations, warranties, covenants and agreements by the Company and customary conditions to closing. To date, the Company has received investments of $570,000, and issued a total of $600,000 in Notes and Warrants to purchase 286,169 shares of common stock, exercisable at $1.53 per share.

The Notes mature one year from the date of issuance (the “Term”), accrue interest at the rate of 14.5% per annum, and are convertible at a 110% premium at any time beginning three months after the date of issuance. The Company has the option to prepay the Convertible Notes at any time, upon 10 days written notice, for 107% of total outstanding balance (the “Optional Prepayment Right”). Any outstanding principal will be paid in conversion of shares of common stock at the end of the Term, subject to the Company’s exercise of the Optional Prepayment Right; any accrued interest will be repaid quarterly in cash. The conversion price of the Convertible Notes will be the lower of a 15% discount to (i) the 5-day VWAP immediately prior to Closing or (ii) the price of any offering entered into by the Company during the Term of the Convertible Notes, including the Company’s planned follow-on offering. The Convertible Notes may not be converted into shares of common stock if such conversion would result in the holder and its affiliates beneficially owning an aggregate of in excess of 4.99% of the then-outstanding shares of common stock.

The Warrants are immediately exercisable after issuance and will remain exercisable for a period of five years from the date of issuance. The Exercise Price is subject to adjustment for any stock split, stock dividend, stock combination, recapitalization or similar event. In the event the Warrant Shares have not been registered within six months of the Initial Exercise Date, and only if the Warrant Shares are not otherwise eligible to use Rule 144 under the Securities Act, the Warrants may be exercised on a cashless basis pursuant to their terms.

The Company is obligated to file a resale registration statement registering the shares of common stock issuable upon conversion of the Notes and exercise of the Warrants within three months following the issuance date.

The foregoing summary of the Purchase Agreement, the Notes and Warrants does not purport to be complete and is qualified in its entirety by reference to the full text of such documents, which are filed herewith as Exhibits 10.1, 10.2 and 10.3 and are incorporated herein by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information disclosed in Item 1.01 of this Current Report on Form 8-K regarding the Purchase Agreement, the Notes and Warrants is incorporated herein by reference. The Notes and underlying shares of common stock, and the Warrants and underlying shares of common stock, have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. The Company is relying on the private placement exemption from registration provided by Section 4(a)(2) of the Securities Act and by Rule 506 of Regulation D, and similar exemptions under applicable state laws.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| Exhibit 10.1 | Form of Securities Purchase Agreement | |

| Exhibit 10.2 | Form of Senior Secured Convertible Notes | |

| Exhibit 10.3 | Form of Common Warrants | |

| Exhibit 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| SHUTTLE PHARMACEUTICALS HOLDINGS, INC. | ||

| Dated: October 17, 2024 | ||

| By: | /s/ Timothy Lorber | |

| Name: | Timothy Lorber | |

| Title: | Chief Financial Officer | |

Exhibit 10.1

FORM OF SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement, dated as of October [*], 2024 (this “Agreement”), is entered into by and among Shuttle Pharmaceuticals Holdings Inc., a Delaware corporation (the “Company”), and the persons and entities listed on the signature page hereto (each an “Investor” and, collectively, the “Investors”).

RECITALS

A. On the terms and subject to the conditions set forth herein, each Investor is willing to purchase from the Company, and the Company is willing to sell to such Investor, (i) a 5% Original Issue Discount convertible promissory note in the principal amount set forth opposite such Investor’s name on the signature page hereto and (ii) warrants equal to 45% of the shares of common stock the Investor’s note is convertible into, with each warrant having an exercise price equal to 125% of the closing price of SHPH shares of common stock, as reported by the Nasdaq Stock Market LLC, on the day prior to Closing.

B. Capitalized terms not otherwise defined herein shall have the meaning set forth in the form of Note (as defined below) and Warrant attached hereto as Exhibit A and Exhibit B, respectively.

AGREEMENT

NOW THEREFORE, in consideration of the foregoing, and the representations, warranties, and conditions set forth below, the parties hereto, intending to be legally bound, hereby agree as follows:

| 1. | The Notes and Warrants. |

| (a) | Issuance of Securities. Subject to all of the terms and conditions hereof, the Company agrees to issue and sell to each of the Investors, and each of the Investors severally agrees to purchase the following: |

| (i) | A convertible promissory note, carrying a 5% original issue discount, in the form of Exhibit A hereto (each, a “Note” and, collectively, the “Notes”), in the principal amount set forth opposite the respective Investor’s name on the signature page hereto. The obligations of the Investors to purchase Notes are several and not joint. The aggregate principal amount for all Notes issued hereunder shall not exceed $1,300,000. The Notes shall be convertible, from time to time, at the discretion of each Investor upon the terms and conditions set forth in the Notes. Such shares issuable thereunder shall be subject to a blocker such that no more than 19.99% of the Company’s shares issued and outstanding at the time issuance of the Notes shall be eligible for conversion prior to obtaining shareholder approval in accordance with Nasdaq Listing Rule 5635. | |

| (ii) | A warrant, in the form of Exhibit B hereto (each, a “Warrant” and, collectively, the “Warrants”), equal to 45% of the shares of common stock into which the Investor’s Note is convertible into, with such Warrant being exercisable at 125% of the closing price of SHPH common shares on the trading day immediately preceding Closing. |

| (b) | Delivery. The sale and purchase of the Notes and Warrants shall take place at a closing (the “Closing”) to be held at such place and time as the Company and the Investors may determine (the “Closing Date”). At the Closing, the Company will deliver to each of the Investors the Note and Warrant to be purchased by such Investor, against receipt by the Company of the note amount, taking into account a 5% original issue discount, set forth on the signature page hereto (such amount, the “Purchase Price”). (For illustration purposes, an investor would be obligated to pay $237,500 for the purchase of a $250,000 Note.) The Company may conduct one or more additional closings, or conduct closings on a rolling basis, prior to October 31, 2024 (each, an “Additional Closing”) to be held at such place and time as the Company and the Investors participating in such Additional Closing may determine (each, an “Additional Closing Date”). At each Additional Closing, the Company will deliver to each of the Investors participating in such Additional Closing the Note to be purchased by such Investor, against receipt by the Company of the corresponding Purchase Price. Each of the Notes will be registered in such Investor’s name in the Company’s records. | |

| (c) | Use of Proceeds. The proceeds of the sale and issuance of the Notes and Warrants shall be used for general corporate purposes. |

|

|

| (d) | Payments. The Company will make all cash payments due under the Notes in immediately available funds by 5:00 p.m. ET on the date such payment is due, as set forth in the Note, at the address for such purpose specified below each Investor’s name on the signature page hereto, or at such other address, or in such other manner, as an Investor or other registered holder of a Note may from time to time direct in writing. |

| 2. | Registration Rights. The Company agrees to register for resale the shares of common stock issuable upon conversion of the Notes and exercise of the Warrants pursuant to a registration statement on Form S-1 or Form S-3 (the “Resale Registration Statement”), with such Resale Registration Statement to be filed with the Securities and Exchange Commission within three months following Closing. |

| 3. | Representations and Warranties of the Company. The Company represents and warrants to each Investor that: |

| (a) | Due Incorporation, Qualification, etc. The Company (i) is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware; (ii) has the power and authority to own, lease and operate its properties and carry on its business as now conducted; and (iii) is duly qualified, licensed to do business and in good standing as a foreign corporation in each jurisdiction where the failure to be so qualified or licensed could reasonably be expected to have a material adverse effect on the Company. | |

| (b) | Authority. The execution, delivery and performance by the Company of each Transaction Document (as defined below) to be executed by the Company and the consummation of the transactions contemplated thereby (i) are within the power of the Company and (ii) have been duly authorized by all necessary actions on the part of the Company. | |

| (c) | Enforceability. Each Transaction Document executed, or to be executed, by the Company has been, or will be, duly executed and delivered by the Company and constitutes, or will constitute, a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity. | |

| (d) | Non-Contravention. The execution and delivery by the Company of this Agreement and the Notes and Warrants (collectively, the “Transaction Documents”) and the performance and consummation of the transactions contemplated thereby do not and will not (i) violate the Company’s Certificate of Incorporation, as amended to date, or Bylaws, as amended to date (the “Charter Documents”) or any material judgment, order, writ, decree, statute, rule or regulation applicable to the Company; (ii) violate any provision of, or result in the breach or the acceleration of, or entitle any other Person to accelerate (whether after the giving of notice or lapse of time or both), any material mortgage, indenture, agreement, instrument or contract to which the Company is a party or by which it is bound; or (iii) result in the creation or imposition of any Lien upon any property, asset or revenue of the Company or the suspension, revocation, impairment, forfeiture, or nonrenewal of any material permit, license, authorization or approval applicable to the Company, its business or operations, or any of its assets or properties. | |

| (e) | No “Bad Actor” Disqualification. The Company has exercised reasonable care, in accordance with Securities and Exchange Commission rules and guidance, to determine whether any Covered Person (as defined below) is subject to any of the “bad actor” disqualifications described in Rule 506(d)(1)(i) through (viii) (“Disqualification Events”) under the Securities Act of 1933, as amended (the “Securities Act”). To the Company’s knowledge, no Covered Person is subject to a Disqualification Event, except for a Disqualification Event covered by Rule 506(d)(2) or (d)(3) under the Securities Act. The Company has complied, to the extent applicable, with any disclosure obligations under Rule 506(e) under the Securities Act. “Covered Persons” are those persons specified in Rule 506(d)(1) under the Securities Act, including the Company; any predecessor or affiliate of the Company; any director, executive officer, other officer participating in the offering, general partner or managing member of the Company; any beneficial owner of 20% or more of the Company’s outstanding voting equity securities, calculated on the basis of voting power; any promoter (as defined in Rule 405 under the Securities Act) connected with the Company in any capacity at the time of the sale of the Notes; and any person that has been or will be paid (directly or indirectly) remuneration for solicitation of purchasers in connection with the sale of the Notes (a “Solicitor”), any general partner or managing member of any Solicitor, and any director, executive officer or other officer participating in the offering of any Solicitor or general partner or managing member of any Solicitor. |

|

|

| 4. | Representations and Warranties of Investors. Each Investor, for that Investor alone, represents and warrants to the Company upon the acquisition of a Note as follows: |

| (a) | Binding Obligation. Such Investor has full legal capacity, power and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement and the Transaction Documents constitute valid and binding obligations of such Investor, enforceable in accordance with their terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity. | |

| (b) | Securities Law Compliance. Such Investor has been advised that the Notes and Warrants and the underlying securities have not been registered under the Securities Act, or any state securities laws and, therefore, cannot be resold unless they are registered under the Securities Act and applicable state securities laws or unless an exemption from such registration requirements is available. Such Investor is aware that the Company is under no obligation to effect any such registration with respect to the Notes and Warrants or the underlying securities or to file for or comply with any exemption from registration, other than as set forth herein. Such Investor has not been formed solely for the purpose of making this investment and is purchasing the Notes and Warrants to be acquired by such Investor hereunder for its own account for investment, not as a nominee or agent, and not with a view to, or for resale in connection with, the distribution thereof, and Investor has no present intention of selling, granting any participation in, or otherwise distributing the same. Such Investor has such knowledge and experience in financial and business matters that such Investor is capable of evaluating the merits and risks of such investment, is able to incur a complete loss of such investment without impairing such Investor’s financial condition and is able to bear the economic risk of such investment for an indefinite period of time. Such Investor is an accredited investor as such term is defined in Rule 501 of Regulation D under the Securities Act and shall submit to the Company a completed accredited investor questionnaire as set forth in Annex A hereto. | |

| (c) | Access to Information. Such Investor acknowledges that the Company has given such Investor access to the corporate records and accounts of the Company and to all information in its possession relating to the Company, has made its officers and representatives available for interview by such Investor, and has furnished such Investor with all documents and other information required for such Investor to make an informed decision with respect to the purchase of the Notes and Warrants. | |

| (d) | Tax Advisors. Such Investor has reviewed with its own tax advisors the U.S. federal, state and local and non-U.S. tax consequences of this investment and the transactions contemplated by this Agreement. With respect to such matters, such Investor relies solely on any such advisors and not on any statements or representations of the Company or any of its agents, written or oral. Such Investor understands that it (and not the Company) shall be responsible for its own tax liability that may arise as a result of this investment and the transactions contemplated by this Agreement. | |

| (e) | No “Bad Actor” Disqualification Events. Neither (i) such Investor, (ii) any of its directors, executive officers, general partners or managing members, nor (iii) any beneficial owner of any of the Company’s voting equity securities (in accordance with Rule 506(d) of the Securities Act) held by such Investor if such beneficial owner is deemed to own 20% or more of the Company’s outstanding voting securities (calculated on the basis of voting power) is subject to any Disqualification Event (as defined in Section 2(e)), except for Disqualification Events covered by Rule 506(d)(2)(ii) or (iii) or (d)(3) under the Securities Act and disclosed reasonably in advance of the Closing in writing in reasonable detail to the Company. |

|

|

| 5. | Conditions to Closing of the Investors. Each Investor’s obligations at the Closing are subject to the fulfillment, on or prior to the Closing Date, of all of the following conditions, any of which may be waived in whole or in part by all of the Investors: |

| (a) | Representations and Warranties. The representations and warranties made by the Company in Section 2 hereof shall have been true and correct when made, and shall be true and correct on the Closing Date. | |

| (b) | Legal Requirements. At the Closing, the sale and issuance by the Company, and the purchase by the Investors, of the Notes and Warrants shall be legally permitted by all laws and regulations to which the Investors or the Company are subject. | |

| (c) | Transaction Documents. The Company shall have duly executed and delivered to the Investors the following documents: |

| (i) | This Agreement; and | |

| (ii) | Each Note and Warrant issued hereunder. |

| 6. | Conditions to Additional Closings of the Investors. The obligations of any Investor participating in an Additional Closing are subject to the fulfillment, on or prior to the applicable Additional Closing Date, of all of the following conditions, any of which may be waived in whole or in part by all of the Investors participating in such Additional Closing: |

| (a) | Representations and Warranties. Subject to the Disclosure Schedule, including any update thereto delivered to the Investor prior to or at the time the Investor executes this Agreement, the representations and warranties made by the Company in Section 2 hereof shall be true and correct in all material respects on the applicable Additional Closing Date. | |

| (b) | Governmental Approvals and Filings. Except for any notices required or permitted to be filed after the Additional Closing Date with certain federal and state securities commissions, the Company shall have obtained all governmental approvals required in connection with the lawful sale and issuance of the Notes at such Additional Closing. | |

| (c) | Legal Requirements. At the Additional Closing, the sale and issuance by the Company, and the purchase by the Investors participating in such Additional Closing, of the Notes shall be legally permitted by all laws and regulations to which such Investors or the Company are subject. | |

| (d) | Transaction Documents. The Company shall have duly executed and delivered to the Investors participating in such Additional Closing each Note and Warrant to be issued at such Additional Closing. |

| 7. | Conditions to Obligations of the Company. The Company’s obligation to issue and sell the Notes and Warrants at the Closing and at each Additional Closing is subject to the fulfillment, on or prior to the Closing Date or the applicable Additional Closing Date, of the following conditions, any of which may be waived in whole or in part by the Company: |

| (a) | Representations and Warranties. The representations and warranties made by the applicable Investors in Section 3 hereof shall be true and correct when made, and shall be true and correct on the Closing Date and the applicable Additional Closing Date. | |

| (b) | Governmental Approvals and Filings. Except for any notices required or permitted to be filed after the Closing Date or the applicable Additional Closing Date with certain federal and state securities commissions, the Company shall have obtained all governmental approvals required in connection with the lawful sale and issuance of the Notes. | |

| (c) | Legal Requirements. At the Closing and at each Additional Closing, the sale and issuance by the Company, and the purchase by the applicable Investors, of the Notes shall be legally permitted by all laws and regulations to which such Investors or the Company are subject. | |

| (d) | Purchase Price. Each Investor shall have wired to the Company, in accordance with the wiring instructions set forth below, the Purchase Price in respect of the Note and Warrant being purchased by such Investor referenced in Section 1(b) hereof. |

|

|

Beneficiary Name: Shuttle Pharmaceuticals Inc.

Beneficiary Address: 401 Professional Drive

Suite 260

Gaithersburg, MD 20879

Routing No.: 043000096

PNC Bank Account No.: 5386875995

| 8. | Miscellaneous. |

| (a) | Waivers and Amendments. Any provision of this Agreement and the Notes and Warrants may be amended, waived or modified only upon the written consent of the Company and of the Required Investors; provided however, that no such amendment, waiver or consent shall: (i) reduce the principal amount of any Note without the affected Investor’s written consent, or (ii) reduce the rate of interest of any Note without the affected Investor’s written consent. Any amendment or waiver effected in accordance with this paragraph shall be binding upon all of the parties hereto. Notwithstanding the foregoing, this Agreement may be amended to add a party as an Investor hereunder in connection with Additional Closings without the consent of any other Investor, by delivery to the Company of a counterparty signature page to this Agreement and a completed Accredited Investor Questionnaire in the form of Annex A hereto. Such amendment shall take effect at the Additional Closing and such party shall thereafter be deemed an “Investor” for all purposes hereunder. | |

| (b) | Governing Law. This Agreement and all actions arising out of or in connection with this Agreement shall be governed by and construed in accordance with the laws of the State of New York, without regard to the conflicts of law provisions of the State of New York or of any other state. | |

| (c) | Survival. The representations, warranties, covenants and agreements made herein shall survive the execution and delivery of this Agreement. | |

| (d) | Successors and Assigns. Subject to the restrictions on transfer described in Sections 8(e) and 8(f) below, the rights and obligations of the Company and the Investors shall be binding upon and benefit the successors, assigns, heirs, administrators and transferees of the parties. | |

| (e) | Registration, Transfer and Replacement of the Notes. The Company will keep, at its principal executive office, books for the registration of the Investors and registration of transfer of the Notes. Prior to presentation of any Note for registration of transfer, the Company shall treat the Person in whose name such Note is registered as the owner and holder of such Note for all purposes whatsoever, whether or not such Note shall be overdue, and the Company shall not be affected by notice to the contrary. Subject to any restrictions on or conditions to transfer set forth in any Note, the holder of any Note, at its option, may in person or by duly authorized attorney surrender the same for exchange at the Company’s chief executive office, and promptly thereafter and at the Company’s expense, except as provided below, receive in exchange therefor one or more new Note(s), each in the principal requested by such holder, dated the date to which interest shall have been paid on the Note so surrendered or, if no interest shall have yet been so paid, dated the date of the Note so surrendered and registered in the name of such Person or Persons as shall have been designated in writing by such holder or its attorney for the same principal amount as the then unpaid principal amount of the Note so surrendered. Upon receipt by the Company of evidence reasonably satisfactory to it of the ownership of and the loss, theft, destruction or mutilation of any Note and (a) in the case of loss, theft or destruction, of indemnity reasonably satisfactory to it; or (b) in the case of mutilation, upon surrender thereof, the Company, at its expense, will execute and deliver in lieu thereof a new Note executed in the same manner as the Note being replaced, in the same principal amount as the unpaid principal amount of such Note and dated the date to which interest shall have been paid on such Note or, if no interest shall have yet been so paid, dated the date of such Note. | |

| (f) | Assignment by the Company. The rights, interests or obligations hereunder may not be assigned, by operation of law or otherwise, in whole or in part, by the Company without the prior written consent of the Required Investors. | |

| (g) | Entire Agreement. This Agreement together with the other Transaction Documents constitute and contain the entire agreement among the Company and Investors and supersede any and all prior agreements, negotiations, correspondence, understandings and communications among the parties, whether written or oral, respecting the subject matter hereof. |

|

|

| (h) | Notices. All notices, requests, demands, consents, instructions or other communications required or permitted hereunder shall in writing and faxed, mailed, emailed or delivered to each party as follows: (i) if to an Investor, at such Investor’s address, facsimile number or electronic mail address set forth on the signature page hereto, or at such other address, facsimile number or electronic mail address as such Investor shall have furnished the Company in writing, or (ii) if to the Company, at 401 Professional Drive, Suite 260, Gaithersburg, MD 20879, or at such other address, facsimile number or electronic mail address as the Company shall have furnished to the Investors in writing. All such notices and communications will be deemed effective on the earlier of (i) when received, (ii) when delivered personally, (iii) one business day after being deposited with an overnight courier service of recognized standing, (iv) four days after being deposited in the U.S. mail, first class with postage prepaid, (v) if sent via facsimile, upon confirmation of facsimile transfer or (vi) if sent via electronic mail, when directed to the relevant electronic mail address, if sent during normal business hours of the recipient, or if not sent during normal business hours of the recipient, then on the recipient’s next business day. | |

| (i) | Expenses. The Company and the Investors shall each pay their own expenses in connection with the preparation, execution and delivery of this Agreement and the Notes and Warrants. | |

| (j) | Separability of Agreements; Severability of this Agreement. The Company’s agreement with each of the Investors is a separate agreement and the sale of the Notes to each of the Investors is a separate sale. Unless otherwise expressly provided herein, the rights of each Investor hereunder are several rights, not rights jointly held with any of the other Investors. Any invalidity, illegality or limitation on the enforceability of the Agreement or any part thereof, by any Investor whether arising by reason of the law of the respective Investor’s domicile or otherwise, shall in no way affect or impair the validity, legality or enforceability of this Agreement with respect to other Investors. If any provision of this Agreement shall be judicially determined to be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby. | |

| (k) | Counterparts. This Agreement may be executed in one or more counterparts, each of which will be deemed an original, but all of which together will constitute one and the same agreement. Facsimile copies of signed signature pages will be deemed binding originals. |

(Signature Page Follows)

|

|

[Company Signature Page]

The parties have caused this Agreement to be duly executed and delivered by their proper and duly authorized officers as of the date and year first written above.

| COMPANY: | ||

| Shuttle Pharmaceuticals Holdings, Inc. | ||

| By: | ||

| Name: | Anatoly Dritschilo, M.D. | |

| Title: | Chief Executive Officer | |

|

|

[Investor Signature Page]

The parties have caused this Agreement to be duly executed and delivered by their proper and duly authorized officers as of the date and year first written above.

| INVESTOR: | ||

| [INVESTOR’S NAME] | ||

| By: | ||

| Name: | ||

| Title: | ||

| Address: | ||

| Tax ID: | ||

Investment Amount: $_______________________________ (with 5% OID)

Note Amount $ ____________________________________

|

|

Annex A – Accredited Investor Questionnaire

(ALL INFORMATION WILL BE TREATED CONFIDENTIALLY).

This Investor Questionnaire (“Questionnaire”) must be completed by each potential investor in connection with the offer and sale of the senior secured convertible notes and warrants (collectively, the “Securities”) of Shuttle Pharmaceuticals Holdings, Inc., a Delaware corporation (the “Corporation”). The Securities are being offered and sold by the Corporation without registration under the Securities Act of 1933, as amended (the “Act”), and the securities laws of certain states, in reliance on the exemptions contained in Section 4(2) of the Act and on Regulation D promulgated thereunder and in reliance on similar exemptions under applicable state laws. The Corporation must determine that a potential investor meets certain suitability requirements before offering or selling Securities to such investor. The purpose of this Questionnaire is to assure the Corporation that each investor will meet the applicable suitability requirements. The information supplied by you will be used in determining whether you meet such criteria, and reliance upon the private offering exemptions from registration is based in part on the information herein supplied.

This Questionnaire does not constitute an offer to sell or a solicitation of an offer to buy any security. Your answers will be kept strictly confidential. However, by signing this Questionnaire, you will be authorizing the Corporation to provide a completed copy of this Questionnaire to such parties as the Corporation deems appropriate in order to ensure that the offer and sale of the Securities will not result in a violation of the Act or the securities laws of any state and that you otherwise satisfy the suitability standards applicable to purchasers of the Securities. All potential investors must answer all applicable questions and complete, date and sign this Questionnaire. Please print or type your responses and attach additional sheets of paper if necessary to complete your answers to any item.

PART A. BACKGROUND INFORMATION

Name of Beneficial Owner of the Securities: ____________________

Business Address: ____________________

____________________

Telephone Number: (___) ____________________

If a corporation, partnership, limited liability company, trust, or other entity:

Type of entity: ____________________

State of formation: ____________________

Approximate date of formation: ____________________

Were you formed for the purpose of investing in the securities being offered?

Yes ___ No ___

If an individual: Residence Address: ____________________

____________________

Telephone Number: (___) __________

Age ______ Citizenship ____________________ Where registered to vote: ____________________

Set forth in the space provided below the state(s), if any, in the United States in which you maintained your residence during the past two years and the dates during which you resided in each state:

____________________

____________________

____________________

____________________

|

|

Are you a director or executive officer of the Corporation?

Yes ___ No ___

Social Security or Taxpayer Identification No. ____________________

PART B. ACCREDITED INVESTOR QUESTIONNAIRE

In order for the Company to offer and sell the Securities in conformance with state and federal securities laws, the following information must be obtained regarding your investor status. Please initial each category applicable to you as a Purchaser of Securities of the Company.

______ (1) A bank as defined in Section 3(a)(2) of the Securities Act, or any savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act whether acting in its individual or fiduciary capacity;

______ (2) A broker or dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

______ (3) An investment adviser registered pursuant to Section 203 of the Investment Advisers Act of 1940, as amended (the “Investment Advisers Act” or registered pursuant to the laws of a state; or an investment adviser relying on the exemption from registering with the Securities and Exchange Commission (the “SEC”) under Section 203(l) or (m) of the Investment Advisers Act.

______ (4) An insurance company as defined in Section 2(a)(13) of the Securities Act.

______ (5) An investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company Act”), or a business development company as defined in Section 2(a)(48) of the Investment Company Act.

______ (6) A Small Business Investment Company licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958.

______ (7) A Rural Business Investment Company as defined in Section 384A of the Consolidated Farm and Rural Development Act.

______ (8) A plan established and maintained by a state, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5,000,000.

______ (9) An employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974, if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such act, which is either a bank, savings and loan association, insurance company, or registered investment adviser, or if the employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made solely by persons that are accredited investors.

______ (10) A private business development company as defined in Section 202(a)(22) of the Investment Advisers Act.

______ (11) An organization described in Section 501(c)(3) of the Internal Revenue Code, a corporation, Massachusetts or similar business trust, partnership, or limited liability company not formed for the specific purpose of acquiring the Securities, with total assets in excess of $5,000,000.

______ (12) An executive officer or director of the Company.

______ (13) A natural person whose individual net worth, or joint net worth with that person’s spouse or spousal equivalent, at the time of his or her purchase exceeds $1,000,000.

______ (14) An entity in which all of the equity owners qualify under any of the above subparagraphs. If the undersigned belongs to this investor category only, list the equity owners of the undersigned, and the investor category which each such equity owner satisfies.

|

|

______ (15) A trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the Securities, whose purchase is directed by a sophisticated person who has such knowledge and experience in financial and business matters that such person is capable of evaluating the merits and risks of investing in the Company;

______ (16) An entity in which all of the equity owners qualify under any of the above subparagraphs. If the undersigned belongs to this investor category only, list the equity owners of the undersigned, and the investor category which each such equity owner satisfies.

______ (17) An entity, of a type not listed above, not formed for the specific purpose of acquiring the securities offered, owning investments in excess of $5,000,000.

______ (18) A natural person holding in good standing one or more professional certifications or designations or credentials from an accredited educational institution that the SEC has designated as qualifying an individual for accredited investor status.

______ (19) A family office (as defined in the Investment Advisers Act): (i) with assets under management over $5,000,000, (ii) that is not formed specifically to acquire the securities offered, and (iii) whose prospective investment is directed by a person with such knowledge and experience in financial and business matters that such family office can evaluate the merits and risks of the prospective investment.

______ (20) A family client (as defined in the Investment Advisers Act) of a qualifying family office whose prospective investment in the issuer is directed by a person with such knowledge and experience in financial and business matters that such family office can evaluate the merits and risks of the prospective investment.

A. FOR EXECUTION BY AN INDIVIDUAL:

| Date: | ||

| By: | ||

| Print Name: |

B. FOR EXECUTION BY AN ENTITY:

| Entity Name: | ||

| Date: | ||

| By: | ||

| Print Name: | ||

| Title: |

C. ADDITIONAL SIGNATURES (if required by partnership, corporation or trust document):

| Entity Name: | ||

| Date: | ||

| By: | ||

| Print Name: | ||

| Title: | ||

| Entity Name: | ||

| Date: | ||

| By: | ||

| Print Name: | ||

| Title: |

|

|

Exhibit A

Form of Note

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS NOTE NOR THE SECURITIES INTO WHICH THIS NOTE IS CONVERTIBLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL TO THE HOLDER (IF REQUESTED BY THE COMPANY), IN A FORM REASONABLY ACCEPTABLE TO THE COMPANY, THAT REGISTRATION IS NOT REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD OR ELIGIBLE TO BE SOLD PURSUANT TO RULE 144 UNDER SAID ACT.

THIS NOTE HAS BEEN ISSUED WITH A FIVE PERCENT (5%) ORIGINAL ISSUE DISCOUNT (“OID”). PURSUANT TO TREASURY REGULATION §1.1275-3(b)(1), THE CHIEF FINANCIAL OFFICER OF THE COMPANY, BEGINNING TEN DAYS AFTER THE ISSUANCE DATE OF THIS NOTE, WILL PROMPTLY MAKE AVAILABLE TO THE HOLDER UPON REQUEST THE INFORMATION DESCRIBED IN TREASURY REGULATION §1.1275-3(b)(1)(i). THE CHIEF FINANCIAL OFFICER OF THE COMPANY MAY BE REACHED AT TELEPHONE NUMBER (240) 403-4212.

SHUTTLE PHARMACEUTICALS HOLDINGS, INC.

CONVERTIBLE SECURED PROMISSORY NOTE

Original Principal Amount: $[ ]

Issuance Date: October [*], 2024

FOR VALUE RECEIVED, Shuttle Pharmaceuticals Holdings, Inc., a Delaware corporation (“Debtor” or “Company”), promises to pay to the order of [lender] (“Lender”), the principal sum of [ ] dollars ($[ ]) and to pay interest on the outstanding principal of this Note, in accordance with Section 2 of this Note. This Note is issued as part of a series of similar notes (collectively, the “Notes”) to be issued pursuant to the terms of that certain Purchase Agreement (the “Agreement”), dated as of October [*], 2024 (the “Agreement Date”), to the purchasers listed on the Schedule of Purchasers thereof (the “Holders”).

| 9. | Maturity. To the extent not previously converted in accordance with Section 4 of this Note, Debtor shall repay the unpaid principal of this Note in full, together with all accrued and unpaid interest thereon, on October [*], 2025 (the “Maturity”). All payments under this Note shall be made in lawful money of the United States to the Lender at the address set forth on the signature page hereto, or such other place as Lender may designate by written notice to Debtor. All payments on the Notes shall be made pro rata based on the principal amount thereof outstanding on the date of payment and shall be applied first against costs of collection (if any), then against accrued and unpaid interest, then against principal. |

|

|

| 10. | Interest. Interest shall accrue on the unpaid principal balance of this Note, commencing on the date hereof and continuing until repayment of this Note, in full, at the rate of 14.5% per annum, calculated on the basis of a 360-day year and actual days elapsed. Interest shall be repaid in cash quarterly in arrears. |

| 11. | Optional Prepayment. At anytime prior to the Maturity Date, upon 10 days’ notice to Lender, Debtor may prepay any unpaid principal balance due to Lender hereunder at a 107% premium. |

| 12. | Conversion. This Note shall be convertible on the following basis: |

| (a) | Mandatory Conversion. Upon Maturity, this Note shall either (i) be paid in cash by the Debtor or in the event there is an effective registration statement in place (ii) automatically convert, in whole, without any further action by Lender, into shares of common stock, par value $0.00001 per share, of the Company based on the outstanding principal amount hereof at a conversion price equal to the lower of a 15% discount to (i) $[***]1 per share or (ii) the price of any offering entered into by the Company during the term of the Note (the shares being converted hereunder referred to as the “Conversion Shares”). | |

| (b) | Optional Conversion. The Lender may convert at any point after [ ]2 (three months after the Issuance Date), or after such period as may be required of the placement agent participating in the Company’s registered follow-on offering, either all or a portion of the principal amount due under this Note at a conversion premium of 110%. | |

| (c) | Reservation of Securities. The Company shall reserve, for the life of this Note, such number of shares of common stock as is necessary to ensure that there is a sufficient quantity of shares of common stock into which the Note can be converted. | |

| (d) | Costs. Debtor shall pay all documentary, stamp, transfer and/or other transactional taxes attributable to the issuance or delivery of shares of stock upon conversion of all or any portion of this Note. | |

| (e) | Approvals. If any shares of stock to be reserved for the purpose of conversion of all or any portion of this Note require registration with or approval of any governmental authority under any law before such shares may be validly issued or delivered upon conversion, then Debtor will use its best efforts to secure such registration or approval, as the case may be. | |

| (f) | Valid Issuance. All shares of stock issued upon conversion of all or any portion of this Note will, upon such issuance, be duly and validly issued, fully paid and nonassessable and free from all taxes, liens and charges with respect to the issuance thereof, and Debtor shall take no action that will cause a contrary result. |

1 The 5-day VWAP immediately prior to Issuance.

2 The date that is three months after the date of issuance.

|

|

| (g) | Partial Conversion. In the case of any partial conversion of this Note, Debtor shall cancel the Note upon surrender hereof and shall execute and deliver a new Note in substantially the form hereof in the principal amount of the remaining unconverted principal amount. | |

| (h) | Ownership Blocker. At no point shall the Lender hold more than 4.99% of the outstanding common stock of the Company. | |

| (i) | 20% Blocker. The overall Conversion Shares issuable in the Note offering shall be subject to a blocker such that no more than 19.99% of the Company’s total shares issued and outstanding at the time of issuance of this Note shall be eligible for conversion prior to obtaining shareholder approval in accordance with Nasdaq Listing Rule 5635. |

| 13. | Anti-Dilution. The Conversion Price shall be subject to a one-time price match if the Borrower issues equity at a lower price in the future prior to the Maturity date. |

| 14. | Registration Rights. The Company shall file a resale registration statement with the Securities and Exchange Commission registering the Notes within three months following the Issuance Date. |

| 15. | Security Interest. |

| (a) | The Debtor pledges and grants to the Lender a security interest in the Collateral (as defined below) to secure payment and performance of all of the obligations and liabilities of the Debtor under this Note and the Agreement. At the request of the Lender, the Debtor shall use commercially reasonable efforts to procure, execute and deliver from time to time any consents, approvals, endorsements, assignments, financing statements and other writings deemed necessary or appropriate by the Lender to perfect, maintain and protect its security interest and the priority thereof. | |

| (b) | The “Collateral” shall consist of all personal property of the Debtors, whether presently owned or existing or hereafter acquired or coming into existence, wherever situated, and all additions and accessions thereto and all substitutions and replacements thereof, and all proceeds, products and accounts thereof, including, without limitation: |

(i) All goods, including, without limitation, (A) all machinery, equipment, computers, furniture, special and general tools, fixtures, test and quality control devices and other equipment of every kind and nature and wherever situated, together with all documents of title and documents representing the same, all additions and accessions thereto, replacements therefor, all parts therefor, and all substitutes for any of the foregoing and all other items used and useful in connection with any Debtor’s businesses and all improvements thereto; and (B) all inventory;

|

|

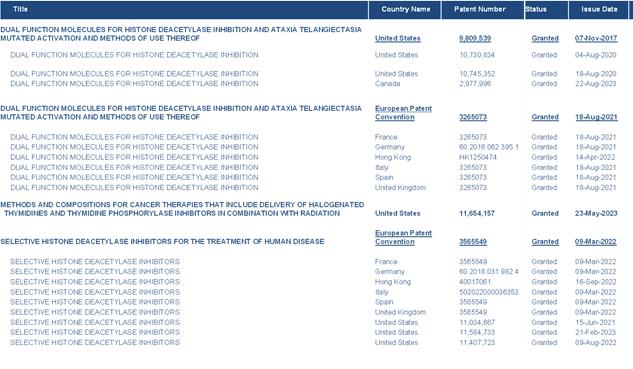

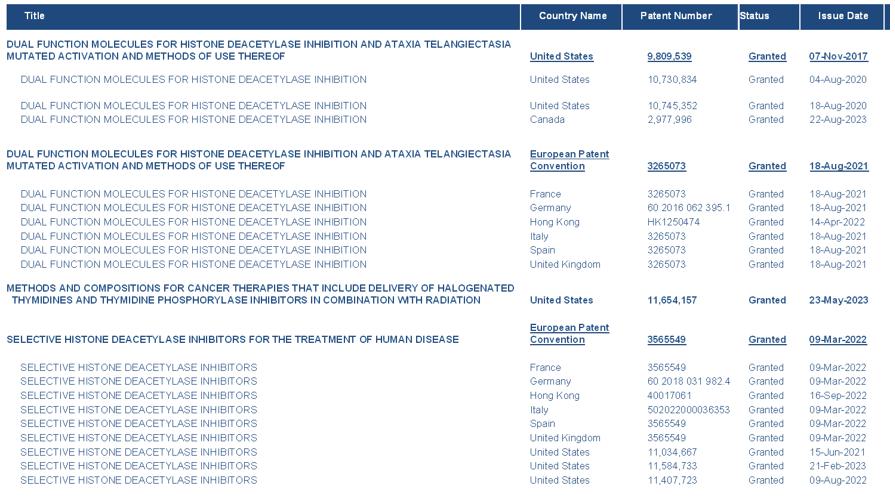

(ii) Intellectual Property, all awarded US, Canadian and European Union patents as listed below:

(iii) All accounts, together with all instruments, all documents of title representing any of the foregoing;

(iv) All deposit accounts and all cash (whether or not deposited in such deposit accounts);

(v) All investment property;

(vi) All supporting obligations;

(vii) All files, records, books of account, business papers, and computer programs; and

(viii) The products and proceeds of all of the foregoing Collateral set forth in clauses (i)-(vii) above, including all proceeds from the sale or transfer of the Collateral and of insurance covering the same and of any tort claims in connection therewith, and all dividends, interest, cash, notes, securities, equity interests or other property at any time and from time to time acquired, receivable or otherwise distributed in respect of, or in exchange for, any or all investment property.

Notwithstanding the foregoing, nothing herein shall be deemed to constitute an assignment of any asset which, in the event of an assignment, becomes void or voidable by operation of applicable law or the assignment of which is otherwise prohibited by applicable law (in each case to the extent that such applicable law is not overridden by Sections 9-406, 9-407 and/or 9-408 of the UCC or other similar applicable law); provided, however, that to the extent permitted by applicable law and solely to the extent doing so does not void or invalidate such asset, this Agreement shall create a valid security interest in such asset and, to the extent permitted by applicable law, this Agreement shall create a valid security interest in the proceeds of such asset.

|

|

| (c) | The Debtor hereby grants and transfers the right and power of attorney to Lender as the attorney in fact of the Debtor in the name and place of the Debtor to execute such documents and to take such other actions as the Lender may deems necessary, useful or appropriate to perfect, enforce, exercise, collect or otherwise effectuate Lender’s security interest, or otherwise place a lien on, in any or all of the Collateral or any of the Lender’s rights or remedies with respect to the Collateral, this Note or the Agreement. | |

| (d) | Upon either (i) the Debtor’s indefeasible repayment in cash in accordance with this Note of the outstanding principal balance of this Note, all interest accrued and unpaid thereon and all other amounts owing in connection with this Note and the Agreement or secured by any or all of the Collateral, or (ii) the conversion of this Note pursuant to Section 4, the Lender will execute and deliver any agreement, financing statement termination or other writings necessary to release the security interest granted pursuant to this Section 5. | |

| (e) | The Lender shall have all of the rights and remedies provided to secured parties by the Uniform Commercial Code (UCC) and other applicable law. In addition, whether or not any event of default exists at such time, the Lender shall be entitled to notify any account debtor of the Lender’s rights in the Collateral pursuant to UCC §§ 9318 and 9502 (to the extent applicable before its revised version takes effect) and revised UCC §§ 9607 and 9608 (when applicable) and to enforce direct collection of all liabilities of any account debtor to the Debtor in accordance with those applicable laws and to apply any obligations under this Note. | |

| (f) | If Lender seeks to foreclose on the Collateral under this Note, Lender will first provide written notice to the other Holders of its intention to do so, and all the Holders shall share in any assets of the Company available to them on a pro rata basis, notwithstanding the order of filing of the UCC-1 financing statements with respect to the security interests. |

| 16. | Default. For purposes of this Agreement and the Note, the term “default” shall include any of the following: |

| (a) | The failure by Debtor to pay any amounts due under this Note or the Agreement upon Maturity of this Note or failure to convert the Note within ten business days of the Lender’s delivery of its conversion notice to the Company; | |

| (b) | A material breach by Debtor of any other term or provision of the Agreement or of this Note which breach continues for 30 days after Debtor knows or should have known of such breach; |

|

|

| (c) | Debtor (i) makes an assignment for the benefit of creditors or petition or apply to any tribunal for the appointment of a custodian, receiver or trustee for it or a substantial part of its assets, (ii) commences any proceeding under any bankruptcy, reorganization, arrangement, readjustment of debt, dissolution or liquidation law or statute of any jurisdiction, whether now or hereafter in effect, (iii) has any such petition or application filed or any such proceeding commenced against it that is not dismissed within sixty (60) days following such initial application, (iv) indicates, by any act or intentional and purposeful omission, its consent to, approval of or acquiescence in any such petition, application, proceeding or order for relief or the appointment of a custodian, receiver or trustee for it or a substantial part of its assets, or (v) suffers any such custodianship, receivership or trusteeship to continue undischarged for a period of 60 days or more; | |

| (d) | Debtor adopts a plan of liquidation or dissolution, or the Company’s charter expires or is otherwise revoked; | |

| (e) | The sale or other transfer by Debtor of all or any material part of its property or assets except in the usual and ordinary course of the operation of its business; or a change in the general character, or suspension of any significant part, of Debtor’s business. |

Upon each such default, Lender may, at its option, accelerate repayment of this Note, in which case the principal amount outstanding under this Note, all interest accrued thereon and all other amounts owing hereunder shall be due and payable immediately; provided that if there shall occur an Event of Default described in subparagraph (d), the entire unpaid balance of principal with interest accrued thereon and all other sums due under this Note shall be immediately due and payable without any action by Lender.

Upon any such default, Lender will have full recourse against any tangible or intangible assets of Debtor and may pursue any legal or equitable remedies. Lender shall have a full right of offset for any amounts due upon such a default against any amounts payable by Lender to Debtor. Lender agrees that if it seeks to foreclose on the Collateral under the Note, Lender will first provide written notice to the other Holders of its intention to do so, and all the Holders shall share in any assets of Debtor available to them on a pro rata basis, notwithstanding the order of filing of the UCC-1 financing statements with respect to the security interests.

| 17. | Covenants. Until the principal amount of this Note and all accrued interest and other amounts due hereunder have been paid in full, |

| (a) | Debtor will not without the prior written consent of Lender, directly or indirectly, |

| (i) | pay any dividends or make any distributions on, or repurchase any shares of, its capital stock; | |

| (ii) | create, assume, incur or in any manner become liable for or suffer to exist any indebtedness for money borrowed to any person or entity senior to the debt of the Holders; or | |

| (iii) | create, assume or suffer to exist any security interest, lien, charge or other encumbrance in favor of any individual or entity senior to the Holders. |

|

|

| 18. | Miscellaneous. |

| (a) | All payments under this Note shall be made unconditionally, indefeasibly and in full without deduction, setoff, recoupment, counterclaim, or other defense, all of which are hereby waived to the maximum extent permitted by applicable law. If the Debtor or any of its affiliates have any claim, recoupment, setoff, defense or other right to the contrary, the Debtor shall notify the Lender in writing immediately, and the Debtor represents and warrants that it presently has no such claims, recoupments, setoffs, defenses or other such rights. Debtor hereby waives presentment, demand, protest, notice of dishonor, diligence and all other notices, any release or discharge arising from any extension of time, discharge of a prior party, release of any or all of any security given from time to time for this Note, or other cause of release or discharge other than actual payment in full hereof. | |

| (b) | Lender shall not be deemed, by any act or omission, to have waived any of its rights or remedies hereunder unless such waiver is in writing and signed by Lender and then only to the extent specifically set forth in such writing. A waiver with reference to one event shall not be construed as continuing or as a bar to or waiver of any right or remedy as to a subsequent event. No delay or omission of Lender to exercise any right, whether before or after a default hereunder, shall impair any such right or shall be construed to be a waiver of any right or default, and the acceptance at any time by Lender of any past-due amount shall not be deemed to be a waiver of the right to require prompt payment when due of any other amounts then or thereafter due and payable. | |

| (c) | Time is of the essence hereof. Upon any default hereunder, Lender may exercise all rights and remedies provided for herein and by law or equity, including, but not limited to, the right to immediate payment in full of this Note. | |

| (d) | The remedies of Lender as provided herein, or any one or more of them, or in law or in equity, shall be cumulative and concurrent, and may be pursued singularly, successively or together at Lender’s sole discretion and may be exercised as often as occasion therefor shall occur. | |

| (e) | This Note shall be governed by and construed in accordance with and under the laws of the State of Delaware applicable to contracts wholly made and performed in such state. The federal and state courts of the State of Delaware shall have sole and exclusive jurisdiction over any dispute arising from this Note. | |

| (f) | The Company shall pay all costs and expenses, including reasonable attorney’s fees and disbursements, incurred in the collection or enforcement hereof. | |

| (g) | This Note shall be binding upon Debtor and its successors and assigns, provided, however, that Debtor may not assign or transfer its obligation hereunder without the prior written consent of Lender. This note may only be assigned by Lender with the written consent of Debtor. | |

| (h) | If any provision of this Note is held to be invalid or unenforceable by a court of competent jurisdiction, the other provisions of this Note shall remain in full force and effect and shall be liberally construed in favor of Lender in order to effect the provisions of this Note. | |

| (i) | This Note may not be changed or amended orally, but only by an agreement in writing, signed by an authorized representative of the party against whom enforcement is sought. | |

| (j) | The headings/captions appearing in this Note have been inserted for the purposes of convenience and ready reference, and do not purport to and shall not be deemed to define, limit or extend the scope or intent of the provisions to which they pertain. |

[Signature page to Follow]

|

|

IN WITNESS WHEREOF, Debtor has executed this Note as of the date first above written.

| SHUTTLE PHARMACEUTICALS HOLDINGS, INC. | ||

| By: | ||

| Name: | Anatoly Dritschilo, M.D. | |

| Title: | Chief Executive Officer | |

|

|

Exhibit B

Form of Warrant

COMMON STOCK WARRANT

NEITHER THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT, OR (B) AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS OR BLUE SKY LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE COMPANY. NOTWITHSTANDING THE FOREGOING, THE SECURITIES MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.

SHUTTLE PHARMACEUTICALS HOLDINGS, INC.

WARRANT TO PURCHASE COMMON STOCK

Warrant No. ____________________

Original Issue Date: ____________________

Shuttle Pharmaceuticals Holdings, Inc., a Delaware corporation (the “Company”), hereby certifies that, for value received, _____________ or its or his/her permitted registered assigns (the “Holder”), is entitled to purchase from the Company up to a total of _____3 shares of common stock, $0.00001 par value per share (the “Common Stock”), of the Company (each such share, a “Warrant Share” and all such shares, the “Warrant Shares”) at an exercise price per share equal to $___4 per share (the “Exercise Price”), at any time and from time to time from [ ], 2024 (the “Initial Exercise Date”) and through and including 5:30 P.M., New York City time, on __________, 2029 (the “Expiration Date”), and subject to the following terms and conditions:

This Warrant (this “Warrant”) is one of a series of similar warrants issued pursuant to that certain Securities Purchase Agreement, dated ____________________, by and among the Company and the Purchasers identified therein (the “Purchase Agreement”). All such warrants are referred to herein, collectively, as the “Warrants.”

| 19. | Definitions. In addition to the terms defined elsewhere in this Warrant, capitalized terms that are not otherwise defined herein have the meanings given to such terms in the Purchase Agreement. |

| 20. | Registration of Warrants. The Company shall register this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant Register”), in the name of the record Holder (which shall include the initial Holder or, as the case may be, any registered assignee to which this Warrant is permissibly assigned hereunder) from time to time. The Company may deem and treat the registered Holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual notice to the contrary. |

| 21. | Registration of Transfers. The Company shall register the transfer of all or any portion of this Warrant in the Warrant Register, upon surrender of this Warrant, with the Form of Assignment attached as Schedule 2 hereto duly completed and signed, to the Company’s transfer agent or to the Company at its address set forth below and (x) delivery, at the request of the Company, of an opinion of counsel reasonably satisfactory to the Company to the effect that the transfer of such portion of this Warrant may be made pursuant to an available exemption from the registration requirements of the Securities Act and all applicable state securities or blue sky laws and (y) delivery by the transferee of a written statement to the Company certifying that the transferee is an “accredited investor” as defined in Rule 501(a) under the Securities Act and making the representations and certifications to that effect to the Company. Upon any such registration or transfer, a new warrant to purchase Common Stock in substantially the form of this Warrant (any such new warrant, a “New Warrant”) evidencing the portion of this Warrant so transferred shall be issued to the transferee, and a New Warrant evidencing the remaining portion of this Warrant not so transferred, if any, shall be issued to the transferring Holder. The acceptance of the New Warrant by the transferee thereof shall be deemed the acceptance by such transferee of all of the rights and obligations in respect of the New Warrant that the Holder has in respect of this Warrant. The Company shall prepare, issue and deliver at its own expense any New Warrant under this Section 3. |

3 Shall equal 45% of the number of shares the convertible note would convert into using a price equal to a 15% discount to the 5-day VWAP immediately proceeding closing on the offering.

4 125% of the per share closing price on the day prior to closing.

|

|

| 22. | Exercise and Duration of Warrants. |

| (a) | All or any part of this Warrant shall be exercisable by the registered Holder as set forth in Section 10 at any time and from time to time on or after the Initial Exercise Date and through and including 5:30 P.M. New York City time, on the Expiration Date. At 5:30 P.M., New York City time, on the Expiration Date, the portion of this Warrant not exercised prior thereto shall be and become void and of no value and this Warrant shall be terminated and no longer outstanding. | |

| (b) | The Holder may exercise this Warrant by delivering to the Company (i) an exercise notice, in the form attached as Schedule 1 hereto (the “Exercise Notice”), completed and duly signed, and (ii) payment of the Exercise Price for the number of Warrant Shares as to which this Warrant is being exercised and the date such items are delivered to the Company (as determined in accordance with the notice provisions hereof) is an “Exercise Date.” The Holder shall not be required to deliver the original Warrant in order to effect an exercise hereunder. Execution and delivery of the Exercise Notice shall have the same effect as cancellation of the original Warrant and issuance of a New Warrant evidencing the right to purchase the remaining number of Warrant Shares. | |

| (c) | In the event the Warrant Shares have not been registered within six months of the Initial Exercise Date, and only if the Warrant Shares are not otherwise eligible to use Rule 144 under the Securities Act, in lieu of exercising this Warrant by payment of cash or check payable to the order of the Company pursuant to Section 2.1 above, this Warrant may also be exercised, in whole or in part, at such time by means of a “cashless exercise” in which the Holder shall be entitled to receive a number of shares of Common Stock equal to the quotient obtained by dividing [(A-B) (X)] by (A) and multiplying the product by 0.8, where: |

(A) = the FMV of one share of Common Stock;

(B) = the Exercise Price of this \Warrant, as adjusted hereunder; and

(X) = the number of shares of Common Stock underlying the Warrant that would be issuable upon exercise of this Warrant in accordance with the terms of this Warrant if such exercise were by means of a cash exercise rather than a cashless exercise.

If the Shares are issued in such a cashless exercise, the parties acknowledge and agree that in accordance with Section 3(a)(9) of the Securities Act of 1933, as amended (the “Act”), the Shares shall take on the registered characteristics of the Warrants being exercised. The Company agrees not to take any position contrary to this Section 4(c).

Notwithstanding anything herein to the contrary, on the Expiration Date, this Warrant shall be automatically exercised via cashless exercise pursuant to this Section 4(c).

|

|

“FMV” means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed or quoted on a Trading Market, the value shall be deemed to be the highest intra-day or closing price on any trading day on such Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg L.P. (based on a trading day from 9:30 a.m. (Eastern time) to 4:02 p.m. (Eastern time)) during the five trading days preceding the exercise, (b) if OTCQB or OTCQX is not a Trading Market, the value shall be deemed to be the highest intra-day or closing price on any trading day on the OTCQB or OTCQX on which the Common Stock is then quoted as reported by Bloomberg L.P. (based on a trading day from 9:30 a.m. (Eastern time) to 4:02 p.m. (Eastern time)) during the five trading days preceding the exercise, as applicable, (c) if the Common Stock is not then listed or quoted for trading on OTCQB or OTCQX and if prices for the Common Stock are then reported on the Pink Open Market operated by OTC Markets Group, Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the “OTC Markets Group,” the value shall be deemed to be the highest intra-day or closing price on any trading day on the Pink Sheets on which the Common Stock is then quoted as reported by OTC Markets Group (based on a trading day from 9:30 a.m. (Eastern time) to 4:02 p.m. (Eastern time)) during the five trading days preceding the exercise, or (d) in all other cases, the fair market value of a share of Common Stock as determined by an independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the fees and expenses of which shall be paid by the Company.

“Trading Market” means The Nasdaq Capital Market, or any of the following other markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the NYSE American, The Nasdaq Global Market, The Nasdaq Global Select Market or the New York Stock Exchange (or any successors to any of the foregoing).

| (d) | Unless duly registered, each certificate for the securities purchased under this Warrant shall bear a legend as follows unless such securities have been registered under the Act: |

“The securities represented by this certificate have not been registered under the Securities Act of 1933, as amended (the “Act”), or applicable state law. Neither the securities nor any interest therein may be offered for sale, sold or otherwise transferred except pursuant to an effective registration statement under the Act, or pursuant to an exemption from registration under the Act and applicable state law which, in the opinion of counsel to the Company, is available.”

| 23. | Delivery of Warrant Shares. |

| (a) | Upon exercise of this Warrant, the Company shall promptly (but in no event later than three (3) Trading Days after the Exercise Date) issue or cause to be issued and cause to be delivered to or upon the written order of the Holder and in such name or names as the Holder may designate (provided that if the Holder directs the Company to deliver a certificate for the Warrant Shares in a name other than that of the Holder or an Affiliate of the Holder, it shall deliver to the Company on the Exercise Date an opinion of counsel reasonably satisfactory to the Company to the effect that the issuance of such Warrant Shares in such other name may be made pursuant to an available exemption from the registration requirements of the Securities Act and all applicable state securities or blue sky laws), (i) a certificate for the Warrant Shares issuable upon such exercise, free of restrictive legends, or (ii) an electronic delivery of the Warrant Shares to the Holder’s account at the Depository Trust Company (“DTC”) or a similar organization, unless in the case of clause (i) and (ii) such shares are not Rule 144 eligible in which case such certificates shall be issued with the appropriate restrictive legend. The Holder, or any Person permissibly so designated by the Holder to receive Warrant Shares, shall be deemed to have become the holder of record of such Warrant Shares as of the Exercise Date. If the Warrant Shares are to be issued free of all restrictive legends, the Company shall, upon the written request of the Holder, use its reasonable best efforts to deliver, or cause to be delivered, Warrant Shares hereunder electronically through The Depository Trust Company or another established clearing corporation performing similar functions, if available. | |

| (b) | To the extent permitted by law, the Company’s obligations to issue and deliver Warrant Shares in accordance with the terms hereof are absolute and unconditional, irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by the Holder or any other Person of any obligation to the Company or any violation or alleged violation of law by the Holder or any other Person, and irrespective of any other circumstance that might otherwise limit such obligation of the Company to the Holder in connection with the issuance of Warrant Shares. Nothing herein shall limit the Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver certificates representing shares of Common Stock upon exercise of the Warrant as required pursuant to the terms hereof. |

|

|

| 24. | Charges, Taxes and Expenses. Issuance and delivery of certificates for shares of Common Stock upon exercise of this Warrant shall be made without charge to the Holder for any issue or transfer tax, transfer agent fee or other incidental tax or expense in respect of the issuance of such certificates, all of which taxes and expenses shall be paid by the Company; provided, however, that the Company shall not be required to pay any tax that may be payable in respect of any transfer involved in the registration of any certificates for Warrant Shares or the Warrants in a name other than that of the Holder or an Affiliate thereof. The Holder shall be responsible for all other tax liability that may arise as a result of holding or transferring this Warrant or receiving Warrant Shares upon exercise hereof. |

| 25. | Replacement of Warrant. If this Warrant is mutilated, lost, stolen or destroyed, the Company shall issue or cause to be issued in exchange and substitution for and upon cancellation hereof, or in lieu of and substitution for this Warrant, a New Warrant, but only upon receipt of evidence reasonably satisfactory to the Company of such loss, theft or destruction (in such case) and, in each case, a customary and reasonable indemnity and surety bond, if requested by the Company. Applicants for a New Warrant under such circumstances shall also comply with such other reasonable regulations and procedures and pay such other reasonable third-party costs as the Company may prescribe. If a New Warrant is requested as a result of a mutilation of this Warrant, then the Holder shall deliver such mutilated Warrant to the Company as a condition precedent to the Company’s obligation to issue the New Warrant. |

| 26. | Reservation of Warrant Shares. The Company covenants that it will at all times reserve and keep available out of the aggregate of its authorized but unissued and otherwise unreserved Common Stock, solely for the purpose of enabling it to issue Warrant Shares upon exercise of this Warrant as herein provided, the number of Warrant Shares that are initially issuable and deliverable upon the exercise of this entire Warrant, free from preemptive rights or any other contingent purchase rights of persons other than the Holder (taking into account the adjustments and restrictions of Section 9). The Company covenants that all Warrant Shares so issuable and deliverable shall, upon issuance and the payment of the applicable Exercise Price in accordance with the terms hereof, be duly and validly authorized, issued and fully paid and nonassessable. The Company will take all such action as may be reasonably necessary to assure that such shares of Common Stock may be issued as provided herein without violation of any applicable law or regulation, or of any requirements of any securities exchange or automated quotation system upon which the Common Stock may be listed. |