UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) May 14, 2024

HYCROFT MINING HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 001-38387 | 82-2657796 | ||

| (State or other jurisdiction | (Commission | (IRS Employer | ||

| of incorporation) | File Number) | Identification No.) |

|

P.O. Box 3030 Winnemucca, Nevada |

89446 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (775) 333-0545

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A common stock, par value $0.0001 per share | HYMC | The Nasdaq Stock Market LLC | ||

| Warrants to purchase Common Stock | HYMCW | The Nasdaq Stock Market LLC | ||

| Warrants to purchase Common Stock | HYMCL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On October 3, 2024, Hycroft Mining Holding Corporation (the “Company”) issued a press release announcing additional drill results from the 2024 exploration drill program (the “Drill Program”) at the Hycroft Mine, located in Nevada, a Tier-1 mining jurisdiction. According to the release, the drilling was designed to test the mineralization controls of the west dipping low angle structures. The drill program is designed to improve continuity within the recently discovered high-grade silver trends (Vortex – Camel and Camel – Brimstone), extend mineralization along strike and at depth, and test new exhibiting potential for high-grade within and outside the currently known resource.

A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

The information included in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit | ||

| Number | Description | |

| 99.1 | Press release issued by the registrant on October 3, 2024. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Date: October 3, 2024 | Hycroft Mining Holding Corporation | |

| By: | /s/ Rebecca A. Jennings | |

| Rebecca A. Jennings | ||

| Senior Vice President and General Counsel | ||

|

|

Exhibit 99.1

Hycroft Expands Vortex - Encounters Significant Silver and Gold

Drilling extends Vortex west ~100 meters

Multiple intervals exceeding 1000 g/t silver

Significant gold intercepts being encountered

WINNEMUCCA, NV, October 3, 2024 – Hycroft Mining Holding Corporation (Nasdaq: HYMC) (“Hycroft” or “the Company”) announces additional drill results from the 2024 exploration drill program (the “Drill Program”) at the Hycroft Mine, located in Nevada, a Tier-1 mining jurisdiction.

Webinar

For additional context on this news release, join President and CEO Diane R. Garrett and Alex Davidson, V.P. Exploration for a live webinar today, October 3rd at 5pm ET/2pm PT. Click here to register.

Highlights from the drilling include:

| ● | Drill results extend Vortex mineralization approximately 100 meters to the west and to the south | |

| ● | Encountering elevated gold (“Au”) intercepts (including 1.5 meters of 4.78 g/t) in the silver (“Ag”) dominant Vortex trend | |

| ● | Potential feeder zone at Vortex identified | |

| ● | Results demonstrating continuity of both high-grade silver and gold | |

| ● | Vortex remains open in all directions and at depth |

Vortex drill highlights:

| ● | H24D-6001: | 124.4 meters of 102.59 g/t Ag and 0.95 g/t Au (2.28 AuEq) |

Including:

| ● | 2.8 meters of 40.85 g/t Ag and 7.38 g/t Au. (7.90 g/t AuEq) | |

| ● | 14.2 meters of 77.34 g/t Ag and 2.13 g/t Au (3.13 g/t AuEq) | |

| ● | 38.6 meters of 134.25 g/t Ag and 0.71 g/t Au (2.44 g/t Au Eq) | |

| ● | 0.3 meters of 4,170.00 g/t Ag and 0.03 g/t Au (53.80 g/t AuEq) | |

| ● | 8.9 meters of 475.56 g/t Ag and 0.31 g/t Au (6.44 g/t AuEq) | |

| ● | 0.7 meters of 1,700.00 g/t Ag and 0.42 g/t Au (22.34 g/t AuEq) | |

| ● | 1.4 meters of 1,538.78 g/t Ag and 0.34 g/t Au (20.19 g/t AuEq) |

| ● | H24D-6002: | 100.92 meters of 100.65 g/t Ag and 0.38 g/t Au (1.68 g/t AuEq) |

Including:

| ● | 20.4 meters of 357.01 g/t Ag and 0.83 g/t Au (5.43 g/t AuEq) | |

| ● | 4.6 meters of 1,066.47 g/t Ag and 1.59 g/t Au (15.34 g/t AuEq) | |

| ● | 0.5 meters of 3,310.00 g/t Ag and 5.90 g/t Au (48.58 g/t AuEq) |

| ● | H24D-6005: | 222.4 meters of 32.38 g/t Ag and 0.45 g/t Au (0.86 g/t AuEq) |

Including:

| ● | 10 meters of 328.25 g/t Ag and 0.34 g/t Au (4.57 g/t AuEq) | |

| ● | 1.7 meters of 1,155.27 g/t Ag and 0.94 g/t Au (15.84 g/t AuEq) |

19 meters of 142.14 g/t Ag and 0.37 g/t Au (2.21 g/t AuEq)

Including:

| ● | 0.3 meters of 6,260.00 g/t Ag and 0.06 g/t Au (80.78 g/t AuEq) |

4.9 meters of 170.25 g/t Ag and 0.31 g/t Au (2.50 g/t AuEq)

| ● | H24D-6006: | Assays pending | |

| ● | H24D-6007: | 69 meters of 108.38 g/t Ag and 0.57 g/t Au (1.97 g/t AuEq) |

Including:

| ● | 40.7 meters of 144.20 g/t Ag and 0.70 g/t Au (2.6 g/t AuEq) | |

| ● | 2.5 meters of 645.30 g/t Ag and 0.70 g/t Au (9.0 g/t AuEq) | |

| ● | 0.5 meters of 1,430.00 g/t Ag and 1.20 g/t Au (19.6 g/t AuEq) | |

| ● | 1.5 meters of 960.00 g/t Ag and 4.80 g/t Au (17.2 g/t AuEq)– top of target zone |

| ○ | Hole was lost at the top of the target zone, follow-up drilling planned |

Alex Davidson, Vice President, Exploration commented: “We are very pleased with the assay results from the Vortex - Camel high-grade silver dominant trend. The drilling was designed to test the west dipping low angle structures responsible for brecciation that is allowing for the significant mineralization at Vortex. This new drilling not only adds significantly to the known high-grade silver mineralization by extending Vortex to the west and south, but also vertically ties together what were previously considered to be discrete zones of high-grade. Furthermore, the drilling contributes significantly to our understanding of how these low angle structures open exploration potential to the east of the current resource.”

Holes 6001 and 6002 were designed to test continuity of more than 150 meters of spacing between holes drilled in 2023 and to test downdip extensions of Vortex. Both objectives were achieved in growing Vortex vertically as well as extending laterally, confirming the system continues to remain open in all directions and at depth.

Hole 6007 targeted the farthest western extension of the Vortex trend. The intercept from this hole extends mineralization past the current resource to the west by approximately 100 meters. Additionally, 6007 targeted a potential feeder zone for Vortex mineralization, based on a large area of native sulfur mapped near the surface above the target an indicator of a zone of high fluid flow. Unfortunately, the hole was lost in the top of the target zone where it intersected 1.5 meters of 950 g/t silver and 4.78 g/t gold. Follow up drilling is planned for 2024.

Hole 6000 was lost in a fault zone but not before encountering mineralization from 71 meters to over 300 meters at depth. The hole will be re-entered at a future date.

Assays are pending for the Brimstone high-grade trend (Holes 6003, 6004, 6009 – 6012).

|

Page |

Table 1.

Significant intercepts from 2024 Drill Program, Vortex

Gold Equivalent (“AuEq”) is calculated at a gold-to-silver ratio of 77.55:1 (based on $1900 gold and $24.50 silver)

| FROM | TO | INTERVAL | GRADE | |||||||||||||||||||||

| Hole ID | (meters) | (meters) | (meters) | Ag (g/t) | Au (g/t) | AuEQ (g/t) | ||||||||||||||||||

| Vortex | ||||||||||||||||||||||||

| H24D-6000 | 71.75 | 102.26 | 30.51 | 13.80 | 0.64 | 0.82 | ||||||||||||||||||

| 272.00 | 318.82 | 46.82 | 18.12 | 0.69 | 0.92 | |||||||||||||||||||

| H24D-6001 | 189.31 | 224.58 | 35.27 | 6.32 | 0.66 | 0.74 | ||||||||||||||||||

| Including | 220.0 | 223.5 | 3.5 | 16.76 | 1.07 | 1.29 | ||||||||||||||||||

| 383.2 | 507.5 | 124.4 | 102.59 | 0.95 | 2.28 | |||||||||||||||||||

| Including | 385.4 | 388.2 | 2.8 | 40.85 | 7.38 | 7.90 | ||||||||||||||||||

| Including | 385.4 | 386.3 | 0.9 | 80.60 | 19.65 | 20.69 | ||||||||||||||||||

| 410.7 | 424.8 | 14.2 | 77.34 | 2.13 | 3.13 | |||||||||||||||||||

| 449.4 | 488.0 | 38.6 | 134.25 | 0.71 | 2.44 | |||||||||||||||||||

| Including | 451.7 | 452.0 | 0.3 | 4170.00 | 0.03 | 53.80 | ||||||||||||||||||

| Including | 458.5 | 462.1 | 3.6 | 40.94 | 2.99 | 3.52 | ||||||||||||||||||

| Including | 470.2 | 478.9 | 8.7 | 207.33 | 0.32 | 2.99 | ||||||||||||||||||

| 498.2 | 507.0 | 8.9 | 475.56 | 0.31 | 6.44 | |||||||||||||||||||

| Including | 498.2 | 498.8 | 0.7 | 1700.00 | 0.42 | 22.34 | ||||||||||||||||||

| Including | 504.6 | 506.0 | 1.4 | 1538.78 | 0.34 | 20.19 | ||||||||||||||||||

| H24D-6002 | 357.26 | 458.18 | 100.92 | 100.65 | 0.38 | 1.68 | ||||||||||||||||||

| Including | 357.3 | 359.3 | 2.1 | 4.53 | 2.86 | 2.91 | ||||||||||||||||||

| 428.4 | 448.8 | 20.4 | 357.01 | 0.83 | 5.43 | |||||||||||||||||||

| Including | 428.4 | 429.4 | 1.0 | 300.12 | 1.38 | 5.25 | ||||||||||||||||||

| Including | 435.9 | 439.5 | 3.6 | 397.04 | 0.66 | 5.78 | ||||||||||||||||||

| Including | 440.4 | 445.0 | 4.6 | 1066.47 | 1.59 | 15.34 | ||||||||||||||||||

| Including | 441.9 | 442.4 | 0.5 | 3310.00 | 5.90 | 48.58 | ||||||||||||||||||

| 452.2 | 454.2 | 2.0 | 225.49 | 0.32 | 3.22 | |||||||||||||||||||

| H24D-6005 | 111.2 | 119.1 | 8.0 | 176.54 | 0.79 | 3.06 | ||||||||||||||||||

| 207.4 | 234.5 | 27.1 | 6.33 | 0.40 | 0.48 | |||||||||||||||||||

| 254.4 | 476.9 | 222.4 | 32.38 | 0.45 | 0.86 | |||||||||||||||||||

| Including | 385.2 | 395.2 | 10.0 | 328.25 | 0.34 | 4.57 | ||||||||||||||||||

| Including | 385.2 | 386.9 | 1.7 | 1155.27 | 0.94 | 15.84 | ||||||||||||||||||

| Including | 408.2 | 419.0 | 10.8 | 107.02 | 0.24 | 1.62 | ||||||||||||||||||

| 537.1 | 556.1 | 19.0 | 142.14 | 0.37 | 2.21 | |||||||||||||||||||

| Including | 537.4 | 537.6 | 0.3 | 6260.00 | 0.06 | 80.78 | ||||||||||||||||||

| 594.2 | 599.1 | 4.9 | 170.25 | 0.31 | 2.50 | |||||||||||||||||||

| H24D-6007 | 46.15 | 93.57 | 47.43 | 22.51 | 0.35 | 0.64 | ||||||||||||||||||

| Including | 47.7 | 50.2 | 2.6 | 307.40 | 0.12 | 4.08 | ||||||||||||||||||

| Including | 64.0 | 64.6 | 0.5 | 54.40 | 3.10 | 3.80 | ||||||||||||||||||

| 113.4 | 125.0 | 11.6 | 16.56 | 0.98 | 1.19 | |||||||||||||||||||

| 371.3 | 399.5 | 28.2 | 11.98 | 0.44 | 0.59 | |||||||||||||||||||

| 468.4 | 537.8 | 69.4 | 108.38 | 0.57 | 1.97 | |||||||||||||||||||

| Including | 468.4 | 474.7 | 6.4 | 213.71 | 0.63 | 3.38 | ||||||||||||||||||

| Including | 497.1 | 537.8 | 40.7 | 144.2 | 0.7 | 2.6 | ||||||||||||||||||

| Including | 497.1 | 500.9 | 3.8 | 193.6 | 0.2 | 2.7 | ||||||||||||||||||

| Including | 512.4 | 514.9 | 2.5 | 645.3 | 0.7 | 9.0 | ||||||||||||||||||

| Including | 513.2 | 513.7 | 0.5 | 1430.0 | 1.2 | 19.6 | ||||||||||||||||||

| Including | 536.3 | 537.8 | 1.5 | 960.0 | 4.8 | 17.2 | ||||||||||||||||||

|

Page |

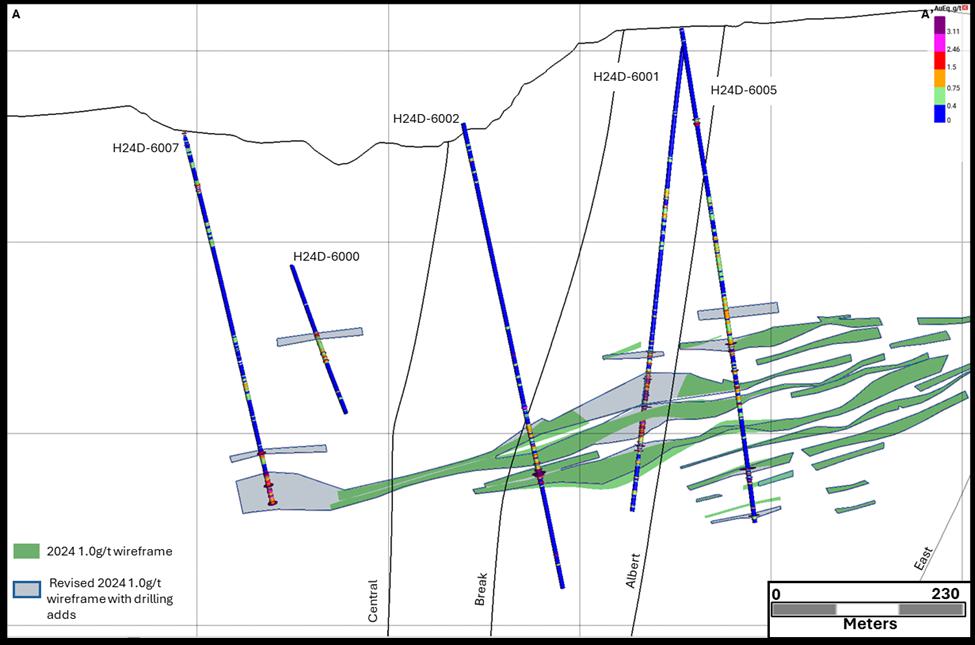

Figure 1.

2024 Wireframe (green) denoting increased mineralization (gray) from these results

Corporate Update

The Company’s unrestricted cash balance was $56 million at September 30, 2024 and is in compliance with its debt covenants.

Ms. Garrett continued: “Our primary objective is to deliver exceptional value to our shareholders. From the start, we set out to do so by building a solid foundation for the next phase of operations and maintaining a strong balance sheet. The team’s exceptional efforts are yielding strong results not only in exploration but also with the technical studies that are of critical importance. We have a lot in store for the remainder of 2024 and 2025 and look forward to providing more updates in the near future.”

About the 2024 Exploration Drill Program

The drill program is designed to improve continuity within the recently discovered high-grade silver trends (Vortex – Camel and Camel – Brimstone), extend mineralization along strike and at depth, and test new exhibiting potential for high-grade within and outside the currently known resource. Through this work the Company hopes to develop opportunities to mine higher-grade ore early in the mine plan, thereby enhancing the project’s economics. The 2024 Drill Program, consists of a total of 8,500 meters of core drilling. The drilling is being conducted by Timberline Drilling Incorporated of Elko, NV. Assays are being completed by ALS Geochemistry of Reno, NV. The Company’s Qualified Person is Alex Davidson, Vice President, Exploration.

|

Page |

About Hycroft Mining Holding Corporation

Hycroft Mining Holding Corporation is a US-based gold and silver company developing the Hycroft Mine, among the world’s largest precious metals deposits located in northern Nevada, a Tier-One mining jurisdiction. After a long history of oxide heap leaching operations, the Company is focused on completing the technical studies to transition the Hycroft Mine into the next phase of commercial operations for processing the sulfide ore. In addition, the Company is engaged in a robust exploration drill program to further expand the newly discovered high-grade dominant silver systems and unlock the full potential of this worldclass asset.

For further information, please contact:

info@hycroftmining.com

www.hycroftmining.com

Cautionary Note Regarding Forward-Looking Statements

This news release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other applicable laws. Such forward-looking statements may include, without limitation, estimates and expectations of future production, reserve estimates, exploration outlook and expected expenditure, and operational and financial performance. The exploration target does not represent, and should not be construed to be, an estimate of a mineral resource or mineral reserve, as ranges of potential tonnage and grade (or quality) of the exploration target are conceptual in nature; there has been insufficient exploration of the relevant property or properties to estimate a mineral resource; and it is uncertain if further exploration will result in the estimation of a mineral resource. Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, such statements are subject to risks, uncertainties, assumptions and other factors, which could cause actual results to differ materially from future results expressed or implied by the “forward-looking statements”. Such assumptions, include, but are not limited to the key assumptions set forth on page 4 hereof. Investors are also encouraged to refer to the Company’s Form 10-K for its fiscal year 2023, filed with the SEC on March 14, 2024, as updated by Form 10-Q for the quarterly periods ended March 31, 2024 and June 30, 2024, filed with the SEC on May 7, 2024 and August 6, 2024, respectively, as well as Hycroft’s other SEC filings for additional information. The Company does not undertake any obligation to release publicly revisions to any “forward-looking statement,” including, without limitation, outlook, to reflect events or circumstances after the date of this news release, or to reflect the occurrence of unanticipated events, except as may be required under applicable securities laws. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement. Continued reliance on “forward-looking statements” is at investors’ own risk.

|

Page |