UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________ to _________

Commission File Number: 001-37776

| SHINECO, INC. |

| (Exact name of issuer as specified in its charter) |

| Delaware | 52-2175898 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| incorporation or organization) | identification number) |

| Room 1707, Block D, Modern City SOHO, | ||

| No. 88, Jianguo Road, Chaoyang District, | ||

| Beijing, People’s Republic of China | 100022 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (+86) 10-68130220

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Ticker Symbol | Name of each exchange on which registered | ||

| Common stock, $0.001 par value | SISI | NASDAQ Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity stock held by non-affiliates of the registrant was approximately $46,782,541 as of December 30, 2022, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price of the registrant’s common stock on such date of $2.38 per share, as reported on the Nasdaq Capital Market.

As of September 30, 2024, the registrant had 33,817,606 shares of common stock issued and outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED JUNE 30, 2023

All references to “we,” “us,” “our,” “SISI,” “Company,” “registrant” or similar terms used in this report refer to Shineco, Inc., a Delaware corporation (“SISI”), including the variable interest entities (“VIEs”) and its consolidated subsidiaries, unless the context otherwise indicates. In the context of describing our business, “we,” “us,” “our,” “SISI,” “Company,” or “registrant” refers to the VIEs and their subsidiaries, unless the context otherwise indicates.

Our reporting currency is the US$. The functional currency of our entities located in China is the RMB. For the entities whose functional currency is the RMB, results of operations and cash flows are translated at average exchange rates during the period, assets and liabilities are translated at the unified exchange rate at the end of the period, and equity is translated at historical exchange rates. As a result, amounts relating to assets and liabilities reported on the statements of cash flows may not necessarily agree with the changes in the corresponding balances on the balance sheets. Translation adjustments resulting from the process of translating the local currency financial statements into US$ are included in determining comprehensive income/loss. Transactions denominated in foreign currencies are translated into the functional currency at the exchange rates prevailing on the transaction dates. Assets and liabilities denominated in foreign currencies are translated into the functional currencies at the exchange rates prevailing at the balance sheet date with any transaction gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred.

On February 1, 2024, the Company’s stockholders approved a 1-for-10 reverse stock split of the shares (the “Reverse Stock Split”) of the Company’s common stock, with a par value of $0.001 per share, which became effective on February 16, 2024. As a result of the Reverse Stock Split, each of the ten pre-split shares of common stock outstanding automatically combined and converted to one issued and outstanding share of common stock without any action on the part of the stockholders. Unless otherwise indicated, all share amounts and per share amounts in this annual report have been presented to give effect to the 1-for-10 reverse stock split of the shares of the Company’s common stock.

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (the “Report”) and other reports (collectively the “Filings”) filed by the registrant from time to time with the Securities and Exchange Commission (the “SEC”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, the registrant’s management as well as estimates and assumptions made by the registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to the registrant or the registrant’s management identify forward looking statements. Such statements reflect the current view of the registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this Report entitled “Risk Factors”) relating to the registrant’s industry, the registrant’s operations and results of operations and any businesses that may be acquired by the registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the registrant believes that the expectations reflected in the forward-looking statements are reasonable, the registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the registrant’s financial statements and the related notes thereto included in this Report.

|

|

Part I

| ITEM 1. | BUSINESS |

General Overview

Shineco, Inc. is a holding company incorporated in Delaware. As a holding company with no material operations of our own, we conduct our operations through our subsidiaries and in the two years ended June 30, 2023 and 2024, through the VIEs and subsidiaries. Our shares of common stock currently listed on the Nasdaq Capital Markets are shares of our Delaware holding company. The Chinese regulatory authorities could disallow our structure, which could result in a material change in our operations and the value of our securities could decline or become worthless.

Current Business

On December 30, 2022, Shineco Life Science Group Hong Kong Co., Limited (“Shineco Life”), a company established under the laws of Hong Kong and a wholly owned subsidiary of the Company, closed the acquisition of 51% of the issued equity interests of Changzhou Biowin Pharmaceutical Co., Ltd. (“Biowin”), a company established under the laws of China, pursuant to the previously announced stock purchase agreement, dated as of October 21, 2022, among Beijing Kanghuayuan Medicine Information Consulting Co., Ltd., a company established under the laws of China (“Seller”), Biowin, the Company and Shineco Life. As the consideration for the acquisition, the Company paid to Seller US$9,000,000 in cash and the Company issued 326,000 shares of the Company’s common stock, par value US$0.001 per share, to the equity holders of Biowin or any persons designated by Biowin. According to a supplementary agreement, dated as of December 30, 2022, by and among Shineco Life, the Seller and Biowin, the Seller owned 51% of the issued equity interests of Biowin before January 1, 2023, and transferred the 51% of the issued equity interests of Biowin together with its controlling rights of production and operation of Biowin to Shineco Life on January 1, 2023.

On May 29, 2023, Shineco Life entered into a stock purchase agreement with Dream Partner Limited, a BVI corporation (“Dream Partner”), Chongqing Wintus Group, a corporation incorporated under the laws of mainland China (“Wintus”), and certain shareholders of Dream Partner (the “Sellers”), pursuant to which Shineco Life shall acquire 71.42% equity interest in Wintus (the “Acquisition”). On September 19, 2023, the Company closed the Acquisition. As the consideration for the Acquisition, the Company (a) paid the Sellers an aggregate cash consideration of US$2,000,000; (b) issued certain shareholders, as listed in the agreement, an aggregate of 1,000,000 shares of the Company’s restricted Common Stock; and (c) transferred and sold to the Sellers 100% of the Company’s equity interest in Beijing Tenet-Jove Technological Development Co., Ltd. (“Tenet-Jove Shares”). Following the closing of the Acquisition and the sale of the Tenet-Jove Shares, the Company divested its equity interest in its operating subsidiary Tenet-Jove (“Tenet-Jove Disposal Group”) and thereby terminated its VIE Structure.

We used our subsidiaries’ vertically and horizontally integrated production, distribution, and sales channels to provide health and well-being focused plant-based products. Through our subsidiary, Biowin, which specializes in the development, production and distribution of innovative rapid diagnostic products and related medical devices for the most common diseases, we also stepped into the Point-of-Care Testing industry. Also, following the acquisition of Wintus, we entered into a new business segment of producing, processing and distributing agricultural products, such as silk, silk fabrics and fresh fruit. Meanwhile, our newly established subsidiary, Fuzhou Meida Health Management Co., Ltd. (“Fuzhou Meida”), recently opened its restaurant, which is a health-oriented chain restaurant that focuses on the concept of “improving metabolism through diet.” As of June 30, 2024, the Company, through its subsidiaries, operates the following main business segments:

Developing, producing and distributing innovative rapid diagnostic products and related medical devices for the most common diseases (“Rapid Diagnostic and Other Products”) - This segment is conducted through Biowin, which specializes in the development, production and distribution of innovative rapid diagnostic products and related medical devices for the most common diseases. The operations of this segment are located in Jiangsu Province. Its products are sold not only in China, but also overseas countries such as Germany, Spain, Italy, Thailand, Japan and other countries.

Producing, processing and distribution of agricultural products, such as silk and silk fabrics as well as fresh fruit (“Other agricultural products”): – This segment is conducted through Wintus, which specializes in producing, processing and distribution of agricultural products, such as silk and silk fabrics as well as trading of fresh fruit. The operations of this segment are located in Chongqing, China. Its products are sold not only in China, but also overseas countries such as United States, Europe (Germany, France, Italy, Poland), Japan, South Korea, and Southeast Asia (India, Thailand, Indonesia, Bangladesh, Cambodia), among other countries and regions. In addition to silk products, Wintus also engages in fruit trading business. It imports fruits from Southeast Asia and other regions, distributing them through dealers to supermarkets and stores nationwide in China.

|

|

Developing and selling healthy meals for people with slow metabolic health and those in recovery from metabolic disorders. (“Healthy meals products”): – This segment is conducted through Fuzhou Meida, which specializes in developing healthy meals for people with slow metabolic health and those in recovery from metabolic disorders. Fuzhou Meida recently opened its restaurant in Fuzhou city, Fujian Province. The restaurant features an open kitchen and adopts a modern Chinese style, offering a variety of modern Chinese healthy light meals and metabolism-boosting meal sets. The Company plans to gradually establish additional branches in key cities across China, including Beijing, Shanghai, Guangzhou, and other southeastern coastal regions.

Tenet-Jove Disposal Group conducts three other business segments. First, developing, manufacturing, and distributing specialized fabrics, textiles, and other by-products derived from an indigenous Chinese plant Apocynum Venetum, known in Chinese as “Luobuma” or “Bluish Dogbane,” as well as Luoboma raw materials processing; this segment is conducted through our wholly owned subsidiary, Tenet-Jove. Second, planting, processing and distributing green and organic agricultural produce, growing and cultivation of yew trees, as well as planting fast-growing bamboo willows and scenic greening trees; this segment is conducted through Qingdao Zhihesheng Agricultural Produce Services, Ltd (“Qingdao Zhihesheng”) and Yushe County Guangyuan Forest Development Co., Ltd. (“Guangyuan”). Third, providing domestic air and overland freight forwarding services by outsourcing these services to a third party; this segment is conducted through the Zhisheng VIE, Yantai Zhisheng International Freight Forwarding Co., Ltd (“Zhisheng Freight”). These three business segments were reclassified as discontinued operations. The assets and liabilities of the Tenet-Jove Disposal Group have been reclassified as “assets of discontinued operations” and “liabilities of discontinued operations” within current and non-current assets and liabilities, respectively, on the audited condensed consolidated balance sheets as of June 30, 2024 and June 30, 2023. The results of operations of Tenet-Jove Disposal Group have been reclassified to “net income (loss) from discontinued operations” in the audited condensed consolidated statements of income and comprehensive income for the fiscal years ended June 30, 2024 and 2023.

On July 9, 2024, the Company’s subsidiary, Fuzhou Meidashan Biotechnology Co., Ltd (“Fuzhou Meidashan”) entered into distribution agreements (the “Distribution Agreements”) with four distributors, Harbin Liaotongtang Chinese Medicine and Health Research Institute, Three Minutes (Zhejiang) Information Service Co., Hangzhou Misimao Science and Technology Co., Ltd., and Wu Qiang (each, the “Distributor” and collectively, the “Distributors”), respectively. Pursuant to the Distribution Agreements, Harbin Liaotongtang Chinese Medicine and Health Research Institute, Three Minutes (Zhejiang) Information Service Co., Hangzhou Misimao Science and Technology Co., Ltd., and Wu Qiang agreed to distribute Fuzhou Meidashan’s water-soluble phospholipid concentrate health food beverage (the “Food Beverage”) with an annual projected goal of approximately $1,374,420, $1,209,490, $7,256,934 and $2,418,980, respectively, in sales on a “best-effort” basis, for a term of three years. The price of the Food Beverage is set by the Company. Under the terms of the Distribution Agreements, the Distributors shall sell the Food Beverage in the directly-operated stores and franchises owned by such Distributors, and not through any other channels, including e-commerce platforms, without prior authorization from the Company.

Discontinued Business

Prior to the Acquisition, we conducted a majority of our operations through the operating entities established in the People’s Republic of China, or the PRC, through the VIEs, which were then terminated in September 2023, following the Acquisition. We did not have any equity ownership of the VIEs, instead we received the economic benefits of the VIEs’ business operations through certain contractual arrangements. We used our subsidiaries and the VIEs’ vertically and horizontally integrated production, distribution, and sales channels to provide plant-based health and well-being focused products. The health and well-being focused plant-based products previously sold by the Company are divided into the following three major segments:

Processing and distributing traditional Chinese herbal medicine products as well as other pharmaceutical products - This segment was conducted through Ankang Longevity Pharmaceutical (Group) Co., Ltd. (“Ankang Longevity Group”), a Chinese company formerly under contractual arrangement with the Company which operated 66 cooperative retail pharmacies throughout Ankang Longevity Group, a city in southern Shaanxi province, China, through which we sold directly to individual customers traditional Chinese medicinal products produced by us as well as by third parties. Ankang Longevity Group also owned a factory specializing in decoction, which was the process by which solid materials are heated or boiled in order to extract liquids, and distributed decoction products to wholesalers and pharmaceutical companies around China.

|

|

On June 8, 2021, Tenet-Jove entered into a Restructuring Agreement with various parties. Pursuant to the terms of the Restructuring Agreement, (i) the Company transferred all of its rights and interests in Ankang Longevity Group to Guangyuan’s Shareholders in exchange for Guangyuan Shareholders entering into VIE agreements with Tenet-Jove, which composed of one group of similar identifiable assets; (ii) Tenet-Jove entered a Termination Agreement with Ankang Longevity Group and the Ankang Longevity Group Shareholders; (iii) as a consideration to the Restructuring Agreement and based on a valuation report on the equity interests of Guangyuan issued by an independent third party, Tenet-Jove relinquished all of its rights and interests in Ankang Longevity Group and transferred those rights and interests to the Guangyuan Shareholders; and (iv) Guangyuan and the Guangyuan Shareholders entered into a series of variable interest entity agreements with Tenet-Jove. After signing the Restructuring Agreement, the Company and the shareholders of Ankang Longevity Group and Guangyuan actively carried out the transferring of rights and interests in Ankang Longevity Group and Guangyuan, and the transferring was completed subsequently on July 5, 2021. Afterwards, with the completion of all other follow-ups works, on August 16, 2021, the Company, through its subsidiary Tenet-Jove, completed the previously announced acquisition pursuant to the Restructuring Agreement dated June 8, 2021. The management determined that July 5, 2021 was the disposal date of Ankang Longevity Group.

Processing and distributing green and organic agricultural produce as well as growing and cultivating yew trees (taxus media) - We cultivated and sold yew mainly to group and corporate customers, but did not process yew into Chinese or Western medicines. This segment was conducted through the following VIEs: Qingdao Zhihesheng. Meanwhile, we planted fast-growing bamboo willows and scenic greening trees through Guangyuan. The operations of this segment were located in the North regions of Mainland China, mostly carried out in Shanxi Province.

Providing domestic air and overland freight forwarding services - We provided domestic air and overland freight forwarding services by outsourcing these services to a third party. This segment was conducted through the Zhisheng VIE, Zhisheng Freight.

Developing and distributing specialized fabrics, textiles, and other byproducts derived from an indigenous Chinese plant Apocynum Venetum, grown in the Xinjiang region of China, and known in Chinese as “Luobuma” or “bluish dogbane” - The Luobuma products are specialized textile and health supplement products designed to incorporate traditional Eastern medicines with modern scientific methods. These products are predicated on centuries-old traditions of Eastern herbal remedies derived from the Luobuma raw material. This segment is channeled through our directly-owned subsidiary, Beijing Tenet-Jove Technological Development Co., Ltd. (“Tenet-Jove”), and its 90% subsidiary Tianjin Tenet Huatai Technological Development Co., Ltd. (“Tenet Huatai”).

Contractual Arrangements with Each VIE

Shineco conducted its business through a combination of contractual arrangements with PRC operating companies and equity ownership of PRC subsidiaries. The contractual arrangements with respect to the VIEs were not equivalent to an equity ownership in the business of the VIEs but were used to replicate foreign investments in China-based companies where Chinese law prohibit or limit direct foreign investment in Chinese companies belonging to certain categories. Where Shineco operated its business through such contractual relationships, it was subject to risks related to such operation. As of June 30, 2024, any references to control or benefits that accrued to Shineco because of the VIEs are limited to, and subject to conditions we have satisfied for consolidation of the VIEs under U.S. GAAP. As of June 30, 2024, the VIEs are consolidated for accounting purposes but none of them is an entity in which Shineco owned equity. Shineco did not conduct any active operations and was the primary beneficiary of the VIEs for accounting purposes. Our shareholders did not own any equity in any of Shineco’s subsidiaries or the VIEs.

The principal regulation governing foreign ownership of businesses in the PRC is the Foreign Investment Industrial Guidance Catalogue, effective as of April 10, 2015 (the “Catalogue”). The Catalogue classifies various industries into three categories: encouraged, restricted and prohibited. Shineco was engaged in businesses and industries where direct foreign investment is expressly prohibited: the preparation of traditional Chinese medicines in small pieces ready for decoction.

Due, in part, to the regulations on foreign ownership of PRC businesses, neither Shineco neither our subsidiaries owned any equity interest in the Zhisheng Group, with which Beijing Tenet-Jove Technological Development Co., Ltd., a Chinese company and wholly-owned subsidiary of Shineco (“WFOE”) had entered into one set of VIE agreements respectively with each following Chinese operating companies: Zhisheng Biotech, Yantai Zhisheng and Zhihesheng. In addition, as a result of the Restructuring Agreement dated June 8, 2021, WFOE entered into the series of VIE agreements with Guangyuan Forest and its shareholders on the same date. Instead of direct ownership, Shineco received the economic benefits of each VIEs’ business operations through a series of contractual arrangements. WFOE, each of the four VIEs and their shareholders had entered into a series of contractual arrangements, also known as VIE Agreements.

|

|

Each set of the VIE Agreements is described below and consisted of, for each of the Zhisheng Group and Guangyuan, (a) exclusive business cooperation agreements, (b) equity interest pledge agreements, (c) exclusive option agreements, and (d) powers of attorney. As an overview, these agreements taken together were designed to allow Shineco to manage the operations of each of the VIEs and to receive all of the net income of such VIEs in return therefor. To secure WFOE’s interest in the VIEs, the equity interest pledges and option agreements and the powers of attorney were designed to allow WFOE to step in and convert its contractual interest into an equity interest in the event we determined that doing so is warranted.

The following is a summary of the common contractual arrangements that enabled us to receive substantially all of the economic benefits from the four VIEs’ operations for accounting purposes under U.S. GAAP in the years ended June 30, 2023 and 2024.

Exclusive Business Cooperation Agreements

WFOE entered into an Exclusive Business Cooperation Agreement with Zhisheng Biotech, Yantai Zhisheng, Zhihesheng, and Guangyuan Forest on February 24, 2014, June 16, 2011, May 24, 2012, and June 8, 2021, respectively. WFOE managed each VIE pursuant to the terms of each of the four Exclusive Business Cooperation Agreements.

Pursuant to substantially identical Exclusive Business Cooperation Agreements between each VIE and WFOE, WFOE provided each VIE with technical support, consulting services and other management services relating to its day-to-day business operations and management, on an exclusive basis, utilizing its advantages in technology, human resources, and information. Additionally, each VIE had granted an irrevocable and exclusive option to WFOE to purchase from such VIE, any or all of its assets, to the extent permitted under applicable PRC law. WFOE also could exercise, at its sole discretion, the option to purchase from each VIE any or all of such VIE’s assets at the lowest purchase price permitted by PRC law. If WFOE exercised such option, the parties had to enter into a separate asset transfer or similar agreement. WFOE owned all intellectual property rights that are developed during the course of each Exclusive Business Cooperation Agreement. For services rendered to each VIE by WFOE under the agreement to which such VIE is a party, WFOE was entitled to collect a service fee calculated based on the time of services rendered multiplied by the corresponding rate, which were approximately equal to the net income of such VIE.

Each Exclusive Business Cooperation Agreement remained in effect for ten years until it was extended or terminated by WFOE, which could have be done unilaterally, except in the case of gross negligence or fraud, in which case the VIE could terminate the agreements. Pursuant to each such agreement, WFOE had absolute authority relating to the management of each VIE, including but not limited to decisions with regard to expenses, salary raises and bonuses, hiring, firing and other operational functions. Although the Exclusive Business Cooperation Agreements did not prohibit related party transactions, the audit committee of Shineco was required to review and approve in advance any related party transactions, including transactions involving WFOE or any VIE. To continue the contractual relationship with Zhihesheng, WFOE entered into an amendment dated April 24, 2022 to the Exclusive Business Cooperation Agreement with Zhihesheng to extend the term of such Agreement for additional twenty (20) years from May 23, 2022. Similarly, to continue the contractual relationship with Yantai Zhisheng, WFOE entered into an amendment dated June 1, 2021 to the Exclusive Business Cooperation Agreement with Yantai Zhisheng to extend the term of such Agreement for additional twenty (20) years from June 15, 2021.

Equity Interest Pledge Agreements

Under the Equity Interest Pledge Agreements among the WFOE, each VIE and each group of shareholders of the VIE, the shareholders pledged all of their equity interests in each such VIE to WFOE to guarantee the performance of such VIE’s obligations under the respective Exclusive Business Cooperation Agreement. Under the terms of each agreement, in the event that the VIE or its shareholders breached their respective contractual obligations under the Exclusive Business Cooperation Agreement to which they are a party, WFOE, as pledgee, was entitled to certain rights, including, but not limited to, the right to collect dividends generated by the pledged equity interests. Each VIE’s shareholders also agreed that upon occurrence of any event of default, as set forth in the applicable Equity Interest Pledge Agreement, WFOE was entitled to dispose of the pledged equity interest in accordance with applicable PRC laws. Each VIE’s shareholders further agreed not to dispose of the pledged equity interests or take any actions that would prejudice WFOE’s interest in the applicable VIE.

Each Equity Interest Pledge Agreement was effective until all payments due under the related Exclusive Business Cooperation Agreement were paid by the VIE party thereto. WFOE could cancel or terminate an Equity Interest Pledge Agreement upon a VIE’s full payment of fees payable under its applicable Exclusive Business Cooperation Agreement.

Exclusive Option Agreements

Under the Exclusive Option Agreements, shareholders of each VIE irrevocably granted WFOE (or its designee) an exclusive option to purchase, to the extent permitted under PRC law, once or at multiple times, at any time, part or all of their equity interests in each VIE. The option price was equal to the capital paid in by the applicable VIE shareholders subject to any appraisal or restrictions required by applicable PRC laws and regulations. The option purchase price could be increased in case the applicable VIE shareholders make additional capital contributions to such VIE.

Each agreement remained effective for a term of ten years and could be unilaterally renewed at WFOE’s election. WFOE, Zhihesheng and all of the shareholders of Zhihesheng entered into an amendment dated April 25, 2022 to the Exclusive Option Agreement to extend the term of such Agreement for additional twenty (20) years from May 23, 2022. Yantai Zhisheng, WFOE and all of the shareholders of Yantai Zhisheng entered into an amendment dated June 1, 2021 to the Exclusive Option Agreement with Yantai Zhisheng to extend the term of such Agreement for additional twenty (20) years from June 15, 2021.

|

|

Powers of Attorney

Under the Powers of Attorney, the shareholders of each VIE authorized WFOE to act on their behalf as their exclusive agent and attorney with respect to all rights as shareholders of the respective VIEs, including but not limited to: (a) attending shareholders’ meetings; (b) exercising all the shareholder’s rights, including voting, that shareholders are entitled to under the laws of China and the Articles of Association, including but not limited to the sale or transfer or pledge or disposition of shares in part or in whole; and (c) designating and appointing on behalf of shareholders the legal representative, the executive director, supervisor, the chief executive officer and other senior management members of the respective VIEs.

Summary of challenges and risks involved in the VIE Arrangements and enforcing the VIE Agreements

Prior to the Acquisition and the termination of the VIE structure, Shineco was also subject to the legal and operational risks associated with being based in and having the majority of its operations in China and operating through VIEs. These risks could result in material changes in operations, or a complete hindrance of Shineco’s ability to offer or continue to offer its securities to investors, and could cause the value of Shineco’s securities to significantly decline or become worthless. Recently, the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas using the variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. On July 6, 2021, the General Office of the Communist Party of China Central Committee and the General Office of the State Council jointly issued an announcement to crack down on illegal activities in the securities market and promote the high-quality development of the capital market, which, among other things, requires the relevant governmental authorities to strengthen cross-border oversight of law-enforcement and judicial cooperation, to enhance supervision over China-based companies listed overseas, and to establish and improve the system of extraterritorial application of the PRC securities laws. On July 10, 2021, the PRC State Internet Information Office issued the Measures of Cybersecurity Review, which requires cyberspace companies with personal information of more than one (1) million users that want to list their securities on a non-Chinese stock exchange to file a cybersecurity review with the Office of Cybersecurity Review of China. On December 28, 2021, a total of thirteen governmental departments of the PRC, including the Cyberspace Administration of China (the “CAC”), issued the Measures of Cybersecurity Review, which became effective on February 15, 2022. The Cybersecurity Review Measures provide that an online platform operator, which possesses personal information of at least one million users, must apply for a cybersecurity review by the CAC if it intends to be listed in foreign countries. Because our previous operations doid not possess personal information from more than one million users at this moment, Shineco did not believe that it is subject to the cybersecurity review by the CAC.

As of June 30, 2024, neither the Measures of Cybersecurity Review nor the anti-monopoly regulatory actions had impacted Shineco’s ability to conduct its business, accept foreign investments, or continue its listing on Nasdaq or on another non-Chinese stock exchange; however, there are uncertainties in the interpretation and enforcement of these new laws and guidelines, which could materially and adversely impact the Company’s overall business and financial outlook. In summary, as of June 30, 2024, the recent statements and regulatory actions by China’s government related to the use of variable interest entities and data security or antimonopoly concerns had not affected the Company’s ability to conduct its business, accept foreign investments, or list on a U.S. or other foreign exchange. However, since these statements and regulatory actions by the PRC government are newly published and official guidance and related implementation rules have not been issued, it is highly uncertain what the potential impact such modified or new laws and regulations will have on Shineco’s daily business operation, the ability to accept foreign investments and list on a U.S. or non-Chinese exchange. The Standing Committee of the National People’s Congress (the “SCNPC”) or other PRC regulatory authorities may in the future promulgate laws, regulations or implementing rules that would require Shineco or any of its subsidiaries to obtain regulatory approval from Chinese authorities before listing in the U.S.

Prior to the Acquisition and the termination of the VIE structure, because Shineco did not hold equity interests in the VIEs, we were subject to risks due to the uncertainty of the interpretation and application of the PRC laws and regulations, including but not limited to regulatory review of oversea listing of PRC companies through a special purpose vehicle, and the validity and enforcement of the contractual arrangement with the VIEs. We were also subject to the risks of the uncertainty that the PRC government could disallow the VIE structure, which could have likely resulted in a material change in our operations, or a complete hindrance of our ability to offer or continue to offer our securities to investors, and the value of our shares of common stock may had depreciated significantly. The arrangements of VIE Agreements are less effective than direct ownership due to the inherent risks of the VIE structure and that Shineco could have had difficulty in enforcing any rights it had under the VIE agreements with the VIEs, its founders and shareholders in the PRC because all of the VIE agreements are governed by the PRC laws and provide for the resolution of disputes through arbitration in the PRC, where the legal environment is uncertain and not as developed as in the United States, and where the Chinese government has significant oversight and discretion over the conduct of Shineco’s business and may intervene or influence Shineco’s operations at any time with little advance notice, which could result in a material change in our operations and/or the value of your common stock. In addition, the contractual agreements with the VIEs have not been tested in court in China and this structure involves unique risks to investors. Furthermore, these VIE agreements may not be enforceable in China if the PRC authorities or courts take a view that such VIE agreements contravene with the PRC laws and regulations or are otherwise not enforceable for public policy reasons. In the event we were unable to enforce these VIE Agreements, Shineco would have not been able to derive economic benefits from the VIEs and Shineco’s ability to conduct its business could have been materially and adversely affected. As of June 30, 2024, any references to economic benefits that accrued to Shineco because of the VIEs are limited to, and subject to conditions we had satisfied for consolidation of the VIEs under U.S. GAAP. The VIEs are consolidated for accounting purposes but none of them is an entity in which Shinceco owned equity. Shineco did not conduct any active operations and was the primary beneficiary of the VIEs for accounting purposes. See “Risk Factors — Risks Associated With Doing Business in China” and “Risk Factors — Risks Relating to Investment in Our Common Stock” for more information.

|

|

Asset Transfer and Dividend Distribution Among Shineco, its Subsidiaries and the VIEs

As of the date of this report, Shineco, any of its subsidiaries or any of the VIEs have not distributed any earnings or settled any amounts owed under the VIE Agreements. We intend to keep any future earnings to finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future.

As of June 30, 2024, Shineco’s operating subsidiaries and the VIEs received substantially all of the Company’s revenue in RMB. Under our previous corporate structure of mixed ownership and VIE arrangement, the WFOE had paid some of Shineco’s expenses and Shineco had from time to time transferred cash to WFOE to fund WFOE and other subsidiaries’ or VIEs’ operations. For the year ended June 30, 2024, Shineco did not transfer any cash to WFOE and WFOE did not pay any expense on behalf of Shineco. For the year ended June 30, 2023, Shineco transferred cash in the total amount of $200,000 to WFOE and WFOE paid expense of approximately $23,746 on behalf of Shineco. The assets transfer was for business operation purposes. There was no distribution of earnings by the PRC operating subsidiaries to Shineco during the years ended June 30, 2024 and 2023, respectively.

Under the existing PRC foreign exchange regulations, payments of current account items, such as profit distributions and trade and service-related foreign exchange transactions, can be made in foreign currencies without prior approval from the State Administration of Foreign Exchange (the “SAFE”) by complying with certain procedural requirements. Approval from or registration with appropriate government authorities is, however, required where RMB is to be converted into a foreign currency and remitted out of China to pay capital expenses, such as the repayment of loans denominated in foreign currencies. The PRC government may also, at its discretion, restrict access in the future to foreign currencies for Shineco’s accounts with little advance notice.

Product Description

Yew Trees, fast-growing bamboo willows and scenic greening trees

Prior to the Acquisition and the termination of the VIE structure, through Zhisheng Group VIEs, we sold ornamental yew trees and yew cuttings to third parties. We also rented ornamental yew trees to companies who desired the environmental benefits of natural plants in their workplaces. Before engaging in the business of selling yew trees and yew cuttings, we were primarily engaged in the production, distribution and sale of agricultural products, including the planting and processing of organic fruits and vegetables, such as tomatoes, eggplants, string beans, peppers as well as certain popular fruits in China like blueberries and wine grapes, but those operations were temporarily scaled back due to stiff competition and a change of our internal policy in favor of the expansion of the yew tree business.

As our inventories of young yew trees matured, our long-term goals were particularly focused on the extraction of paclitaxel or taxol, which is derived from certain species of yew trees including those we grew. Taxol, a broad-spectrum mitotic inhibitor used in cancer chemotherapy, can be extracted from mature yew trees. As a mitotic inhibitor, taxol adheres to rapidly dividing cancerous cells during mitosis (cell division) and interferes with the division process. It may suppress tumor growth through regulating microtubule stabilization, inducing apoptosis and adjusting immunologic mechanism. Taxol is also used for the prevention of restenosis, which is the narrowing of blood vessels. In the treatment of certain soft tissue cancers, such as breast cancer, taxol is given for early stage and metastatic breast cancer after combination anthracycline and cytoxan therapy and is also given as treatment to shrink a tumor before surgery. It can also be used together with a drug called Cisplatin to treat advanced ovarian cancer and non-small cell lung cancer, or “NSCLC.” The U.S. Food and Drug Administration approved taxol as the primary and secondary treatment for NSCLC. There are other generally accepted protocols for the use of taxol as a cancer drug alone or in combination with other drugs depending upon the diagnosis, staging and type of cancer, as well as a patient’s medical history, tolerances and allergies, among other relevant factors. Taxol is usually sold to large pharmaceutical companies to be used in their products, which can be used to treat patients with lung, ovarian, breast, head and neck cancer, and advanced forms of Kaposi’s sarcoma.

Following the acquisition of Guangyuan, we entered the market of planting fast-growing bamboo willows and scenic greening trees. The operations of this segment were located in the North regions of Mainland China, mostly carried out in Shanxi Province.

|

|

Tenet-Jove Textiles

Various scientists and other Chinese researchers have brought modern scientific methods to the study of Luobuma, and have determined that Luobuma fibers have an increased tendency to radiate light at the “far infrared” end of the light spectrum, with wavelengths measuring between 8-15 microns (referred to as “FIR”). Based on Chinese scientific studies some believe that Luobuma’s FIR-radiating qualities exert a positive effect on various functions of the human body, including cellular metabolism. For this reason, we had marketed and sold these products utilizing such technology. These products are popular with Chinese customers seeking the perceived benefits of traditional Chinese medicine.

For example, according to a report by the College of Science of Tianjin University, tests conducted by the PRC’s National Institute of Metrology have reported that the radiance rate of far infrared light from Luobuma fiber is 84%, 2 to 4 times higher than that from cotton and other natural fibers. The same tests found that the FIR radiance rate from our proprietary bio-ceramic powder reaches 91%. Healthful benefits have been observed at radiance rate levels above 70%. Based on these observations about FIR radiance, we had developed textiles that our customers can wear and from which we believe they can receive those health benefits commonly associated with Chinese herbal remedies.

Tenet-Jove first commercially developed the natural FIR-radiant properties of the Luobuma plant in 1997. We referred to this natural Luobuma fiber as a “Second Generation” FIR textile. The “First Generation” of FIR-radiant textiles initially became popular in China around 1989, when manufacturers learned to add 3% of a FIR-radiant inorganic material to synthetic fibers comparable to nylon or polyester. This “First Generation” FIR material employs a relatively low level of technology and has relatively few perceived or measurable health benefits. The “Second Generation” FIR textiles we had developed are softer, smoother and more breathable natural fibers that are not as prone to static electricity as the low technology “First Generation” FIR-radiant textiles.

The Luobuma fabrics had been a success in the Chinese domestic market and had also received numerous awards. The technology applied to the Luobuma-based FIR Therapeutic Clothing and Textile Products had received a “Special Golden Award” from the China National Intellectual Property Bureau at China’s National Patent and Brand Expo. The products under the brand name of “Tenethealth” had also been honored with the title of “Consumer’s Favorite Products” by the Chinese Consumer Association.

The fibers of natural Luobuma FIR materials can contain up to 32 medicinal compounds, many of which are familiar to practitioners of traditional Chinese medicine. In addition, the processes for manufacturing Luobuma textiles produced a fabric that is smooth, air-permeable, and soft. By combining a product that is familiar to PRC consumers seeking the benefits of traditional Chinese medicine with quality and comfort, we believes we were innovative and had chosen a product that had great commercial potential in the Chinese textile market.

Tenet-Jove Product Development

We had developed what we term a “Third Generation” of FIR textiles under a contract with the Institute of Process Engineering at the Chinese Academy of Sciences, one of the leading scientific institutions in China. Our research and development had focused on adding nanotechnology enhancements to the Luobuma textile products, in which we used small-scale nanotechnology to be embed or impregnate our Luobuma-fiber textiles with other FIR-radiant materials, bio-ceramic materials, or other Chinese herbal remedies. Using these nanotechnology methods, we had developed and marketed health-promoting textile goods that are impregnated with FIR-radiant materials or other Chinese herbal remedies, which are then absorbed through the wearer’s skin. We believed that these “Third Generation” FIR textiles will better combine the health benefits of Luobuma with an even softer, more natural cotton-like fabric that will be popular with Chinese consumers.

Prior to the Acquisition and the termination of the VIE structure, the Company produced approximately 100 “Third Generation” FIR textile products. These textile products included:

| ● | Far Infrared bedding sets (including various pillows, comforters, and sheets); | |

| ● | Far Infrared underwear, T-shirts, and socks; | |

| ● | Far Infrared knee and shin pads, waist supports and other protective clothing; and | |

| ● | Far Infrared body wraps or protectors (for the ankle, elbow, wrist, and knee). |

All our textile products were made of Luobuma-based fibers and were impregnated with bio-ceramic powder, which contains various minerals such as halloysite. Both the fiber and the bio-ceramic powder were developed with the Company’s patented, proprietary techniques.

|

|

Manufacturing and Production Facilities

Prior to the Acquisition and the termination of the VIE structure, we had formed strategic alliances with several certified knitting and clothing manufacturers throughout China in order to produce the Luobuma products. We assigned them limited manufacturing jobs and require certain conditions, including protecting our proprietary techniques and meeting our rigid quality standards.

Strategy for Research and Development

| ● | To keep the products proprietary and patented; | |

| ● | To commit to further development of the Luobuma byproducts, houpu magnolia products, and selenium-enriched herbs and plants; and | |

| ● | To build strategic alliances with universities and scientific institutions, which allowed us exposure to advanced technologies, excellent researchers and scientists and we believed that it will lower the costs and timing of the development of new products. |

Tenet-Jove specialized in developing Luobuma products and combining FIR technology with natural herbal medicines. We estimated that there are large supplies of Luobuma in China, especially Xinjiang Province. In China, Luobuma can grow as high as 3.6 meters. In the first year after planting, Luobuma can be harvested once during that year; thereafter, it can be harvested twice per year before or at the beginning of the flowering period in June and a second time around September.

Intellectual Property

Trademarks

Tenet-Jove, Biowin and Wintus had obtained 18, 5 and 22 trademark registrations at the China Trademark Office, respectively. As of June 30, 2024, we are not aware of any valid claim or challenges to our right to use the registered trademarks or any counterfeit or other infringement to the registered trademarks.

Distribution Network

Prior to the Acquisition and the termination of the VIE structure, we sold the products through various distribution networks.

The Luobuma product distribution networks consisted of four distributors who distribute the products to approximately 21 outlets, including flagship stores, retail stores and sales counters. These distributors sold the products throughout mainland China, under the proprietary brand name and “Tenethealth®” trademark. We also sold the Luobuma textile products online through third party e-commerce websites, such as Taobao, Tmall and JD. The yew trees and agricultural products were primarily sold through our sales personnel and group and institutional sales.

Our sales and distribution strategy for the products focused on expanding our distribution network of retail stores and sales counters into all major provinces and cities of China. We also planned to use our then distribution network to introduce the newly developed products into target markets more efficiently and effectively.

Sales and Marketing

Prior to the Acquisition and the termination of the VIE structure, we marketed Luobuma to consumers primarily by highlighting its unique characteristics— the material is soft like cotton, breathable like hemp and is smooth to the touch like silk, and its FIR-radiating qualities are believed by some to exert a positive effect on various functions of the human body. Very few other companies in China were involved with Luobuma fiber production, so we were chiefly able to market the products against products of natural and man-made fibers that do not have the perceived advantages of Luobuma. The small number of companies that were involved in Luobuma fiber production were still using the traditional, outdated methods of producing Luobuma. We were the only company using advanced technologies. Tenet-Jove’s overall marketing strategy included:

| ● | Brand marketing strategy, primarily through media publicity, product- and market-oriented strategy; | |

| ● | Distinguishing Luobuma as a high-end, technologically advanced native Chinese product; and | |

| ● | Online advertising, which included online advertisements appearing on the sites where we sold our products, as well as social media advertising, including Wechat, and direct e-mail solicitations. |

|

|

The Zhisheng Group emphasized the following marketing strategies:

| ● | Focusing on the advanced growing conditions provided by the modern greenhouse operations and the potential pharmaceutical byproducts of yew, especially paclitaxel or taxol; and | |

| ● | Brand marketing to focus on the yew’s brand positioning. |

Prior to the discontinuation and the Acquisition, the Company’s sales were generated through the following five major channels:

| 1. | Retail stores and sales counters. We mainly sold the Luobuma related products through sales counters and medicine through the pharmacy chain stores. | |

| 2. | Sales to group or institutional customers. We mainly sold the organic agricultural products and yew trees to group or corporate customers. | |

| 3. | Seminars and conferences. Because a majority of new consumers need to learn about our new products before buying them, it was very important and effective for us to organize or sponsor seminars and events to present healthcare knowledge while introducing and selling the products to new users. | |

| 4. | E-commerce. We mainly sold the Luobuma related products through Tmall and Taobao to underdeveloped regions in China, Taiwan and Macau. We were one of only three certified online sellers of Luobuma textile products on China’s largest online sales platform, Tmall run by Alibaba. Selling through the Internet had become increasingly important to our sales in undeveloped regions and developed cities. |

The Market

Prior to the Acquisition and the termination of the VIE structure, we primarily marketed our health and wellbeing-focused products in China. We did not sell any of our products in the United States or Canada. On the demand side, we believed that the following four forces drove market growth in all three of the business segments:

| 1. | The rapid growth of China’s economy, which has produced one of the largest groups of middle-class families in the world, with the largest collective purchasing power in the world. The Brookings Institution estimates that by 2030, over 70 percent of China’s population could be middle class, consuming approximately $10 trillion in goods and services. | |

| 2. | The increase of China’s aging population. The China Census Bureau predicts that the majority of the China “baby boom” population (representing 40% of China’s total population) will be 66 or older by 2021, which represents over 500 million potential consumers of our pharmaceutical and healthcare products, the majority of which are sold to older customers. | |

| 3. | Chinese people’s increasing attention and awareness to healthy and active lifestyles, especially in urban areas. | |

| 4. | Chinese healthcare reforms. |

|

|

Competition

We competed with other top-tier healthcare companies in China. Many of them were more established than we were and had significantly greater financial, technical, marketing and other resources than we possessed. Some of our competitors had greater name recognition and a larger customer base. Those competitors could have responded more quickly to new or changing opportunities and customer requirements and could have undertaken more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. Some of our competitors had also developed similar products that compete with ours.

Our most prominent competitors in China’s textile products market were primarily large-scale textile companies, such as Luolai Home Textile Co., Fuanna Bedding and Furnishing Co., Ltd., Violet Home Textile Co., and Shuixing Home Textile Co., Ltd, as well as Bauerfeind Sports and Albert Medical, makers of protective clothing products similar to our protective clothing products. Our most prominent competitors in China’s agricultural market were Beijing Jinfu Yinong Agricultural Technology Group Co., Ltd. for vegetables and other produce and Shenyang Xincheng Garden Engineering Co., Ltd. for yew trees.

Zhisheng Group

There were dozens of companies planting and cultivating yew trees in China, some of which were large-scale companies. Shenyang Xincheng Garden Engineering Co., Ltd. was a large agricultural competitor whose main product is yew. Their nurseries had the most mature yew trees in northeast China, and the average age of their yew trees is more than eleven years old. Another competitor, Chongqing Jiangjin District Mansheng Agricultural Development Co., Ltd., had the biggest nursery for young plants in Southwest China. And Jingyin City Hengtu Town Green Industry Yew Base specializes in cultivating, planting, gardening, and technological development of yew trees. They were the first company to introduce taxus media yew trees in China.

Tenet-Jove

There were few viable competitors producing advanced technology textile products with health benefits like our Luobuma textile products. Principally, our competitors were those that market and sold traditional textile products, such as Luolai Home Textile Co., Fuanna Bedding and Furnishing Co., Ltd., Violet Home Textile Co., and Shuixing Home Textile Co., Ltd, as well as those companies that marketed and sold protective clothing, like Bauerfeind Sports and Albert Medical. Luobuma is native to China, thus our ability to source raw materials locally greatly enhanced our competitive position in the Chinese market for high quality textile products with perceived health benefits.

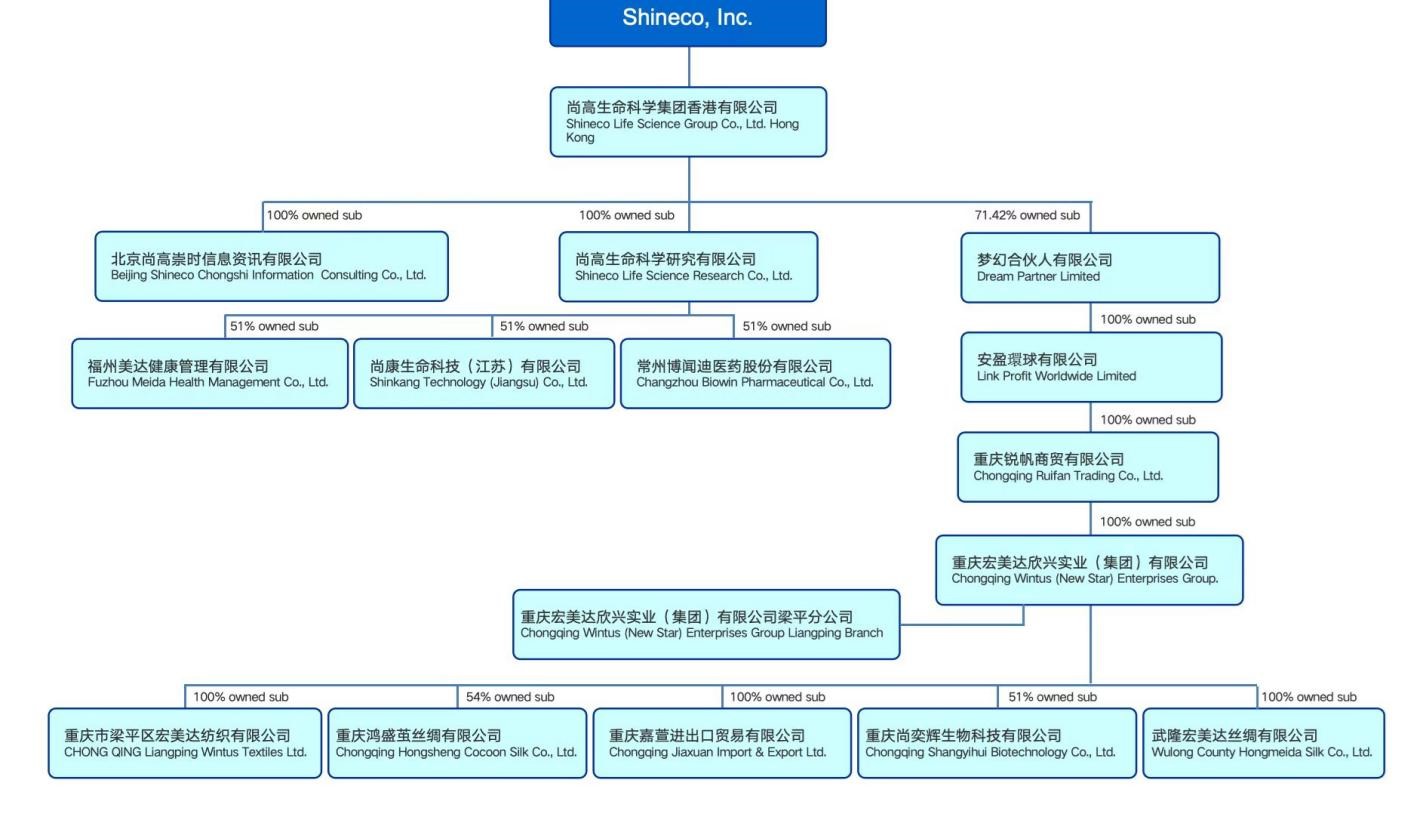

Corporate Structure

The chart below depicts the corporate structure of the Company as of the date of this report.

Employees

As of June 30, 2024, we employed a total of 119 full-time and no part-time employees.

Our employees are not represented by a labor organization or covered by a collective bargaining agreement. We have not experienced any work stoppages.

The Company plans to hire additional employees as required. Its management and employees enjoy both compensation and welfare benefits pursuant to Chinese laws. We are required under PRC law to make contributions to employee benefit plans at specified percentages of our after-tax profit. In addition, we are required by PRC law to cover employees in China with various types of social insurance. In fiscal years 2024 and 2023, we contributed approximately $229,355 and $200,875, respectively, to employee social insurance. The effect on our liquidity by the payments for these contributions is immaterial. We believe that we are in material compliance with the relevant PRC employment laws.

|

|

Relevant PRC Regulations

Permissions from the PRC Authorities to Issue Our Common Stock to Foreign Investors

As of June 30, 2024, Shineco and our subsidiaries, (1) were not required to obtain any permission from any PRC authorities to offer, sell or issue our common stock to non-Chinese investors, (2) were not covered by the permission requirements from the China Securities Regulatory Commission (the “CSRC”), Cyberspace Administration of China (the “CAC”), or any other regulatory agency that is required to approve of our subsidiaries’ operations, and (3) had not received nor been denied such permissions by any PRC authorities. Nevertheless, the General Office of the Central Committee of the Communist Party of China and the General Office of the State Council jointly issued the “Opinions on Severely Cracking Down on Illegal Securities Activities According to Law,” or the July 6, 2021 Opinions, which were made available to the public on July 6, 2021. The July 6, 2021 Opinions emphasized the need to strengthen the administration over illegal securities activities, and the need to strengthen the supervision over overseas listings by Chinese companies. Given the current PRC regulatory environment, it is uncertain whether and when we or any of our subsidiaries, will be required to obtain any permission from the PRC government to list or continue listing on a U.S. stock exchange in the future, and even when we obtain such permission, whether it will be denied or rescinded. We have been closely monitoring regulatory developments in China regarding any necessary approvals from the CSRC, CAC or other PRC governmental authorities required for overseas listings.

If (i) we, our subsidiaries inadvertently conclude that any of such permission was not required or (ii) it is determined in the future that the approval of the CSRC, CAC or any other regulatory authority is required for maintaining listing of our securities on Nasdaq, we will actively seek such permissions or approvals but may face sanctions by the CSRC, CAC or other PRC regulatory agencies. These regulatory agencies may impose fines and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or restrict the repatriation of the proceeds from offerings into China or take other actions that could have a material adverse effect on our business, financial condition, results of operations and prospects, as well as the trading price of our securities. The CSRC, CAC or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt offerings before settlement and delivery of our securities. Any uncertainties and/or negative publicity regarding such an approval requirement could have a material adverse effect on the trading price of our securities. In the event that we failed to obtain such required approvals or permissions, it would be likely that our securities would be delisted from the Nasdaq or any other foreign exchange our securities are listed then.

The Holding Foreign Companies Accountable Act

On May 20, 2020, the U.S. Senate passed the Holding Foreign Companies Accountable Act (“HFCAA”) requiring a foreign company to certify it is not owned or controlled by a foreign government if the PCAOB is unable to audit specified reports because the company uses a foreign auditor not subject to PCAOB inspection. On December 18, 2020, the Holding Foreign Companies Accountable Act or HFCAA was signed into law. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCAA, which prohibits foreign companies from listing their securities on U.S. exchanges if the company has been unavailable for PCAOB inspection or investigation for three consecutive years.

Our common stock may be prohibited from trading on a national exchange or “over-the-counter” markets under the HFCAA if the Public Company Accounting Oversight Board (“PCAOB”) determines that it is unable to inspect or fully investigate our auditor and as a result the exchange where our securities are traded may delist our securities. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (the “AHFCAA”), which was signed into law on December 29, 2022, amending the HFCAA and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchange if its auditor is not subject to PCAOB inspections for two consecutive years instead of three consecutive years. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the PCAOB was unable to inspect or investigate completely certain named registered public accounting firms headquartered in mainland China and Hong Kong. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered public accounting firms.

Our auditor, an independent registered public accounting firm, as an auditor of companies that are traded publicly in the United States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. Our auditor Assensture PAC is headquartered in Singapore, and is subject to inspection by the PCAOB on a regular basis. Notwithstanding the foregoing, in the future, if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, you may be deprived of the benefits of such inspection which could result in limitation on or restriction to our access to the U.S. capital markets and trading of our securities, including trading on the national exchange and trading on “over-the-counter” markets.

|

|

SUMMARY CONSOLIDATED FINANCIAL DATA

The following historical statements of operations and statements of cash flows for the fiscal years ended June 30, 2024 and June 30, 2023, and balance sheet data as of June 30, 2024 and June 30, 2023, which have been derived from our audited financial statements for those periods. Our historical results are not necessarily indicative of the results that may be expected in the future.

Selected Condensed Consolidated Statements of Loss and Comprehensive Loss

| For the Year Ended June 30, 2024 | ||||||||||||||||||||||||

| Shineco, Inc. (U.S.) | Subsidiaries (Hong Kong & PRC) |

WFOE and WFOE’s Subsidiaries (PRC) |

VIE and VIE’s Subsidiaries (PRC) |

Eliminations | Consolidated Total | |||||||||||||||||||

| Revenue | $ | - | $ | 9,801,856 | $ | - | $ | - | $ | - | $ | 9,801,856 | ||||||||||||

| Revenues from discontinued operations | $ | - | $ | - | $ | 4,439 | $ | - | $ | - | $ | 4,439 | ||||||||||||

| Cost of revenue | $ | - | $ | 8,919,688 | $ | - | $ | - | $ | - | $ | 8,919,688 | ||||||||||||

| Cost of revenue from discontinued operations | $ | - | $ | - | $ | 4,183 | $ | - | $ | - | $ | 4,183 | ||||||||||||

| Share of loss from subsidiaries | $ | (21,458,529 | ) | $ | - | $ | - | $ | - | $ | 21,458,529 | $ | - | |||||||||||

| Net income (loss) from discontinued operations | $ | 8,904,702 | $ | - | $ | (109,881 | ) | $ | 60,426 | $ | - | $ | 8,855,247 | |||||||||||

| Net income (loss) attributable to Shineco, Inc. | $ | (22,509,443 | ) | $ | (21,349,443 | ) | $ | (109,086 | ) | $ | 60,426 | $ | 21,458,529 | $ | (22,449,017 | ) | ||||||||

| Comprehensive income (loss) attributable to Shineco, Inc. | $ | (22,509,443 | ) | $ | (21,344,601 | ) | $ | (109,086 | ) | $ | 60,426 | $ | 21,458,529 | $ | (22,444,175 | ) | ||||||||

| For the Year Ended June 30, 2023 | ||||||||||||||||||||||||

| Shineco, Inc. (U.S.) | Subsidiaries (Hong Kong & PRC) | WFOE and WFOE’s Subsidiaries (PRC) | VIE and VIE’s Subsidiaries (PRC) | Eliminations | Consolidated Total | |||||||||||||||||||

| Revenue | $ | - | $ | 550,476 | $ | - | $ | - | $ | - | $ | 550,476 | ||||||||||||

| Revenues from discontinued operations | $ | - | $ | - | $ | 43,431 | $ | 2,448,508 | $ | - | $ | 2,491,939 | ||||||||||||

| Cost of revenue | $ | - | $ | 424,291 | $ | - | $ | - | $ | - | $ | 424,291 | ||||||||||||

| Cost of revenue from discontinued operations | $ | $ | - | $ | 2,638 | $ | 3,042,798 | $ | - | $ | 3,045,436 | |||||||||||||

| Share of loss from subsidiaries | $ | (5,590,602 | ) | $ | - | $ | - | $ | - | $ | 5,590,602 | $ | - | |||||||||||

| Net income (loss) from discontinued operations | $ | - | $ | - | $ | (3,760,652 | ) | $ | 515,789 | $ | - | $ | (3,244,863 | ) | ||||||||||

| Net income (loss) attributable to Shineco, Inc. | $ | (13,879,188 | ) | $ | (1,838,318 | ) | $ | (3,752,284 | ) | $ | 515,789 | $ | 5,590,602 | $ | (13,363,399 | ) | ||||||||

| Comprehensive income (loss) attributable to Shineco, Inc. | $ | (13,879,188 | ) | $ | 2,974,394 | $ | (9,249,594 | ) | $ | (1,691,238 | ) | $ | 5,590,602 | $ | (16,255,024 | ) | ||||||||

Selected Condensed Consolidated Balance Sheets

| As of June 30, 2024 | ||||||||||||||||||||||||

| Shineco, Inc. (U.S.) | Subsidiaries (Hong Kong & PRC) | WFOE and WFOE’s Subsidiaries (PRC) | VIE and VIE’s Subsidiaries (PRC) | Eliminations | Consolidated Total | |||||||||||||||||||

| Cash and cash equivalents | $ | 45,539 | $ | 320,601 | $ | - | $ | - | $ | - | $ | 366,140 | ||||||||||||

| Service fee receivable due from VIE and VIE’s subsidiaries | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

| Intercompany receivable | $ | 58,661,000 | $ | - | $ | - | $ | - | $ | (58,661,000 | ) | $ | - | |||||||||||

| Current assets held for discontinued operations | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

| Total current assets | $ | 58,706,539 | $ | 20,858,422 | $ | - | $ | - | $ | (58,661,000 | ) | $ | 20,903,961 | |||||||||||

| Investments in subsidiaries | $ | (4,233,354 | ) | $ | - | $ | - | $ | - | $ | 4,233,354 | $ | - | |||||||||||

| Non-current assets held for discontinued operations | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

| Total non-current assets | $ | (4,233,354 | ) | $ | 63,275,418 | $ | - | $ | - | $ | 4,233,354 | $ | 63,275,418 | |||||||||||

| Total Assets | $ | 54,473,185 | $ | 84,133,840 | $ | - | $ | - | $ | (54,427,646 | ) | $ | 84,179,379 | |||||||||||

| Service fee payable due to WFOE | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

| Intercompany payable | $ | - | $ | 58,661,000 | $ | - | $ | - | $ | (58,661,000 | ) | $ | - | |||||||||||

| Total liabilities held for discontinued operations | $ | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||

| Total Liabilities | $ | 16,454,489 | $ | 89,808,195 | $ | - | $ | - | $ | (58,661,000 | ) | $ | 47,601,684 | |||||||||||

| Total Shareholders’ Equity (Deficit) | $ | 38,018,696 | $ | (16,251,117 | ) | $ | - | $ | - | $ | 4,233,354 | $ | 26,000,933 | |||||||||||

| Non-controlling interest | $ | - | $ | 10,576,762 | $ | - | $ | - | $ | - | $ | 10,576,762 | ||||||||||||

| Total Equity (Deficit) | $ | 38,018,696 | $ | (5,674,355 | ) | $ | - | $ | - | $ | 4,233,354 | $ | 36,577,695 | |||||||||||

| Total Liabilities and Equity (Deficit) | $ | 54,473,185 | $ | 84,133,840 | $ | - | $ | - | $ | (54,427,646 | ) | $ | 84,179,379 | |||||||||||

| As of June 30, 2023 | ||||||||||||||||||||||||

| Shineco, Inc. (U.S.) | Subsidiaries (Hong Kong & PRC) | WFOE and WFOE’s Subsidiaries (PRC) | VIE and VIE’s Subsidiaries (PRC) | Eliminations | Consolidated Total | |||||||||||||||||||

| Cash and cash equivalents | $ | 45,539 | $ | 580,427 | $ | - | $ | - | $ | - | $ | 625,966 | ||||||||||||

| Service fee receivable due from VIE and VIE’s subsidiaries | $ | - | $ | - | $ | 37,085,179 | $ | - | $ | (37,085,179 | ) | $ | - | |||||||||||

| Intercompany receivable | $ | 44,177,210 | $ | - | $ | 1,368,690 | $ | - | $ | (45,545,900 | ) | $ | - | |||||||||||

| Current assets held for discontinued operations | $ | - | $ | - | $ | 43,030,297 | $ | 32,532,618 | $ | (38,453,869 | ) | $ | 37,109,046 | |||||||||||

| Total current assets | $ | 46,272,162 | $ | 1,719,745 | $ | 43,030,297 | $ | 32,532,618 | $ | (82,631,079 | ) | $ | 40,923,743 | |||||||||||

| Investments in subsidiaries | $ | 17,225,175 | $ | - | $ | - | $ | - | $ | (17,225,175 | ) | $ | - | |||||||||||

| Non-current assets held for discontinued operations | $ | - | $ | - | $ | 81,816 | $ | 2,493,882 | $ | - | $ | 2,575,698 | ||||||||||||

| Total non-current assets | $ | 17,225,175 | $ | 19,969,698 | $ | 81,816 | $ | 2,493,882 | $ | (17,225,175 | ) | $ | 22,545,396 | |||||||||||

| Total Assets | $ | 63,497,337 | $ | 21,689,443 | $ | 43,112,113 | $ | 35,026,500 | $ | (99,856,254 | ) | $ | 63,469,139 | |||||||||||

| Service fee payable due to WFOE | $ | - | $ | - | $ | - | $ | 37,085,179 | $ | (37,085,179 | ) | $ | - | |||||||||||

| Intercompany payable | $ | - | $ | 15,631,584 | $ | 24,916,426 | $ | 4,997,890 | $ | (45,545,900 | ) | $ | - | |||||||||||

| Total liabilities held for discontinued operations | $ | - | $ | - | $ | 25,762,654 | $ | 48,035,508 | $ | (66,999,495 | ) | $ | 6,798,667 | |||||||||||

| Total Liabilities | $ | 16,498,932 | $ | 18,950,078 | $ | 25,762,654 | $ | 48,035,508 | $ | (82,631,079 | ) | $ | 26,616,093 | |||||||||||

| Total Shareholders’ Equity (Deficit) | $ | 46,998,405 | $ | 2,739,365 | $ | 13,058,311 | $ | (13,009,008 | ) | $ | (17,225,175 | ) | $ | 32,561,898 | ||||||||||

| Non-controlling interest | $ | - | $ | - | $ | 4,291,148 | $ | - | $ | - | $ | 4,291,148 | ||||||||||||

| Total Equity (Deficit) | $ | 46,998,405 | $ | 2,739,365 | $ | 17,349,459 | $ | (13,009,008 | ) | $ | (17,225,175 | ) | $ | 36,853,046 | ||||||||||

| Total Liabilities and Equity (Deficit) | $ | 63,497,337 | $ | 21,689,443 | $ | 43,112,113 | $ | 35,026,500 | $ | (99,856,254 | ) | $ | 63,469,139 | |||||||||||

|

|

Selected Condensed Consolidated Statements of Cash Flows

| For the Year Ended June 30, 2024 | ||||||||||||||||||||||||

| Shineco, Inc. (U.S.) | Subsidiaries (Hong Kong & PRC) | WFOE and WFOE’s Subsidiaries (PRC) | VIE and VIE’s Subsidiaries (PRC) | Eliminations | Consolidated Total | |||||||||||||||||||

| Net cash used in operating activities from continuing operations | $ | (2,419,393 | ) | $ | (1,348,447 | ) | $ | - | $ | - | $ | - | $ | (3,767,840 | ) | |||||||||

| Net cash provided by (used in) operating activities from discontinued operations | $ | - | $ | - | $ | (275,535 | ) | $ | 113,124 | $ | - | $ | (162,411 | ) | ||||||||||

| Net cash used in investing activities from continuing operations | $ | (15,759,736 | ) | $ | (7,140,172 | ) | $ | - | $ | - | $ | 1,919,984 | $ | -20,979,924 | ||||||||||

| Net cash provided by financing activities from continuing operations | $ | 2,369,393 | $ | 10,260,545 | $ | - | $ | - | $ | (1,919,984 | ) | $ | 10,709,954 | |||||||||||

| Net cash provided by financing activities from discontinued operations | $ | - | $ | - | $ | 293,592 | $ | - | $ | - | $ | 293,592 | ||||||||||||

| For the Year Ended June 30, 2023 | ||||||||||||||||||||||||

| Shineco, Inc. (U.S.) | Subsidiaries (Hong Kong & PRC) | WFOE and WFOE’s Subsidiaries (PRC) | VIE and VIE’s Subsidiaries (PRC) | Eliminations | Consolidated Total | |||||||||||||||||||

| Net cash used in operating activities from continuing operations | $ | (2,390,511 | ) | $ | (2,488,339 | ) | $ | - | $ | - | $ | 357,506 | $ | (4,521,344 | ) | |||||||||

| Net cash provided by (used in) operating activities from discontinued operations | $ | - | $ | - | $ | (954,674 | ) | $ | 442,930 | $ | (357,506 | ) | $ | (869,250 | ) | |||||||||

| Net cash provided by (used in) investing activities from continuing operations | $ | (3,184,315 | ) | $ | 603,133 | $ | - | $ | - | $ | 3,099,444 | $ | 518,262 | |||||||||||

| Net cash provided by investing activities from discontinued operations | $ | - | $ | - | $ | 217,106 | $ | - | $ | 298,106 | $ | 515,212 | ||||||||||||

| Net cash provided by financing activities from continuing operations | $ | 4,769,777 | $ | 3,486,724 | $ | - | $ | - | $ | (3,782,769 | ) | $ | 4,473,732 | |||||||||||

| Net cash provided by (used in) financing activities from discontinued operations | $ | - | $ | - | $ | (429,291 | ) | $ | 51,708 | $ | 385,219 | $ | 7,636 | |||||||||||

Roll-Forward of Investment in Subsidiaries

| Balance, June 30, 2022 | $ | 22,815,777 | ||

| Share of loss from subsidiaries | (5,590,602 | ) | ||

| Balance, June 30, 2023 | $ | 17,225,175 | ||

| Share of loss from subsidiaries | (21,458,529 | ) | ||

| Balance, June 30, 2024 | $ | (4,233,354 | ) |

|

|

| ITEM 1A. | RISK FACTORS |

Risks Associated With Doing Business in China

In light of recent events indicating greater oversight by the CAC over data security, we may be subject to a variety of PRC laws and other obligations regarding cybersecurity and data protection, and any failure to comply with applicable laws and obligations could have a material adverse effect on our business, our listing on Nasdaq, financial condition, and results of operations.