UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended February 29, 2024 |

or

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ______ to ______ |

Commission file number: 001-38015

NEXTTRIP, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 27-1865814 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

3900 Paseo del Sol

Santa Fe, New Mexico 87507

(Address of principal executive offices)

(954) 526-9688

(Registrant’s telephone number, including area code):

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | NTRP | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐. No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒. No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐. No ☒.

Based on the closing price of the registrant’s common stock as reported on The NASDAQ Capital Market, the aggregate market value of the Registrant’s common stock held by non-affiliates on June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter) was approximately $3,725,594. Shares of common stock held by directors and executive officers and any ten percent or greater stockholders and their respective affiliates have been excluded from this calculation, because such stockholders may be deemed to be “affiliates” of the registrant. This is not necessarily determinative of affiliate status for other purposes.

The number of outstanding shares of the registrant’s common stock as of August 31, 2024 was 1,388,641.

Documents incorporated by reference: None

NEXTTRIP, INC.

FORM 10-K — FISCAL YEAR ENDED FEBRUARY 29, 2024

TABLE OF CONTENTS

|

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This Report, including any documents which may be incorporated by reference into this Report, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements for purposes of these provisions, including, but not limited to, statements regarding our expectations about development and commercialization of our technology, any projections of revenues or statements regarding our anticipated revenues or other financial items, any statements of the plans and objectives of management for future operations, any statements concerning proposed new products or services, any statements regarding future economic conditions or performance, and any statements of assumptions underlying any of the foregoing. All forward-looking statements included in this document are made as of the date hereof and are based on information available to us as of such date. We assume no obligation to update any forward-looking statement. In some cases, forward-looking statements can be identified by the use of terminology such as “may,” “will,” “expects,” “plans,” “anticipates,” “intends,” “believes,” “estimates,” “potential,” or “continue,” or the negative thereof or other comparable terminology. Although we believe that the expectations reflected in the forward-looking statements contained herein are reasonable, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct, and actual results could differ materially from those projected or assumed in the forward-looking statements. Future financial condition and results of operations, as well as any forward-looking statements are subject to inherent risks and uncertainties, including any other factors referred to in our press releases and reports filed with the Securities and Exchange Commission (“SEC”). All subsequent forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Certain factors that may have a direct bearing on our operating results are described under “Risk Factors” and elsewhere in this Report.

PART I

ITEM 1. BUSINESS.

The Company:

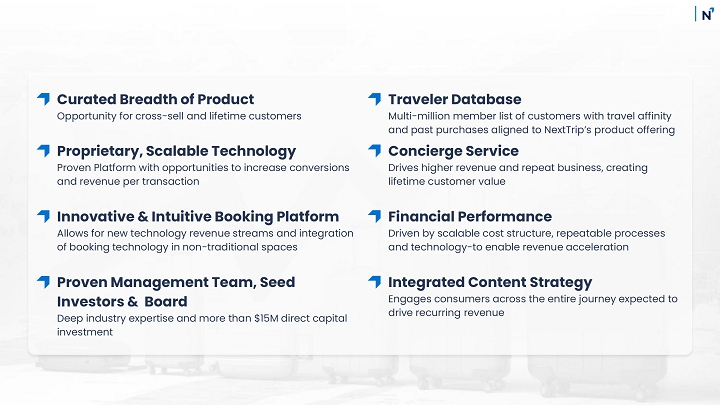

NextTrip, Inc. (the “Company,” “NextTrip,” “we,” “us” and “our”) is an innovative technology company that is building next generation solutions to power the travel industry. NextTrip, through its subsidiaries, provides travel technology solutions with sales originating in the United States, leisure travel, business travel, groups travel, media and tech. We connect people to new places and discoveries by utilizing digital media engagement, seasoned planning expertise, and unique inventory to curate custom vacations and business travel across the globe. Our proprietary booking engine, branded as NXT2.0, provides travel distributors and consumers access to a sizeable inventory.

Our vision is to drive the evolution of the travel industry by merging advanced digital solutions with personalized travel services. Our core technology – a fully integrated travel booking platform – focuses on untapped and underserved sectors of the travel industry, intending to capture new markets. We expect that our future growth will be accelerated by interactive technology, immersive media and unparalleled travel industry expertise.

We believe NextTrip will revolutionize the travel industry by combining advanced digital technologies with personalized travel services. Our mission is to become the premier travel, media, and lifestyle brand, inspiring and empowering individuals to explore the world. Through our brands, including NextTrip Vacations, Travel Magazine, and Compass.TV, we aim to create a unique ecosystem that reduces dependency on traditional marketing methods, where major travel companies spend billions to attract customers.

Our strategy focuses on both the Media and Travel divisions working together to draw users into our ecosystem by offering the following benefits:

| ● | Access to a wealth of highly relevant travel videos and articles for research. | |

| ● | The ability to plan and save future travel destinations and activities on personalized profiles. | |

| ● | Options to share travel ideas and communicate with others. | |

| ● | Assistance from our concierge help desk and AI-powered solutions. | |

| ● | The convenience of booking travel online or through a call center. | |

| ● | Access to customer support before, during, and after travel. | |

| ● | The opportunity to earn rewards that encourage repeat bookings. |

Our ecosystem is built on four key pillars:

| 1. | NextTrip: A comprehensive travel booking platform that offers curated, personalized, and seamless travel experiences for every budget and interest. Powered by the NXT2.0 booking platform, NextTrip serves as our direct-to-consumer hub, providing users with detailed scheduling, pricing, and availability information for airlines, hotels, rental cars, and other travel products. We also offer dynamically assembled travel packages and provide valuable content, including destination information, maps, and travel details, all supported by our customer call center . | |

| 2. | Travel Magazine: A trusted source of captivating travel inspiration, offering authentic stories, practical advice, and diverse perspectives to fuel wanderlust and create lasting vacation memories. Travel Magazine will soon launch MyBucketList, a platform designed for travelers to build and share their travel bucket lists with personalized suggestions, booking support, and local insights. | |

| 3. | Compass.TV: Our Free Ad-supported Streaming TV (FAST) channel, slated for launch in fall 2024. Compass.TV will offer over 1,000 hours of travel shows and long-form travel content at launch. To draw users into the NextTrip ecosystem, the launch will be supported by travel influencers, promoted to our 6 million-strong email list, and marketed to major streaming platforms like Roku and YouTube. Compass.TV plans to use artificial intelligence to personalize content, convert blogs and articles to video, and enable users to create custom videos. This platform will allow users to create fully customized FAST channels featuring vacation opportunities that can be explored and booked directly through the NextTrip booking engine. | |

| 4. | PrometheanTV: A unique influencer-led platform that drives advertising revenue and content-to-commerce. We recently secured a perpetual license with Promethean TV, Inc., the developer of the Ignite TV interactive video platform. This technology will power Compass.TV and video content on Travel Magazine/MyBucketList, allowing for targeted advertising via video overlays, enabling viewers to purchase travel directly from their screens. This integration is designed to enhance customer engagement, drive ad-supported revenue, and increase travel transactions. |

By integrating the NextTrip booking platform across all our media platforms, we will enable users to research and book travel seamlessly from any of our offerings. Our ecosystem will encompass leisure travel, wellness travel, business travel, alternative lodging, and innovative technology and media solutions. We will engage with consumers throughout the entire travel planning journey, from initial research to post-travel, offering robust product options and preferred rates in top global destinations. We believe that NextTrip stands apart from other travel companies, providing users with the tools to create personalized vacation packages and travel solutions, resulting in a more rewarding experience than traditional pre-packaged offerings. This ensures a thriving and growing ecosystem that drives both travel transactions and targeted advertising revenue while supporting consumers on their travel journeys—truly a next-generation travel company.

|

|

Organizational History

Historical Monaker Group Business

NextTrip’s travel business was the principal business of NextPlay NextPlay Technologies, Inc. (“NextPlay”) (then, Monaker Group, Inc. (“Monaker”)) until June 30, 2020, when Monaker entered into a share exchange transaction with HotPlay Enterprise Limited (“HotPlay”), resulting in HotPlay becoming a wholly owned subsidiary of Monaker and HotPlay’s business becoming the principal business of Monaker. Prior to this share exchange, the primary focus of Monaker had been its travel business, which included the sale of vacation rentals, and in particular, ALRs, to consumers through its proprietary booking engine. To support its travel offerings, Monaker introduced travelmagazine.com, featuring travel and lifestyle content to appeal to travelers researching destinations and planning future vacations. In January 2023, NextPlay spun the NextTrip business out to its founders to separate it from NextPlay’s primary business.

COVID-era Transition and Technology Development

The spread of the COVID-19 virus globally beginning in January 2020 severely impacted our business. Beginning in March 2020, many U.S. states and foreign countries began issuing “stay-at-home” orders and closed their borders to interstate and international travel. Such restrictions on travel, together with other measures implemented by governments around the world, severely restricted the level of economic activity around the world and had an unprecedented effect on the global travel industry. The public’s ability to travel was severely curtailed through border closures, mandated travel restrictions and limited operations of hotels, airlines, and additional voluntary or mandated closures of travel-related businesses from December 2019 through the beginning of 2022 (and beyond in some jurisdictions). Measures implemented during the COVID-19 pandemic led to unprecedented levels of temporary and permanent business closures, cancellations and limited new travel bookings, having a severe negative impact on our business, financial condition and results of operations.

Due to the significant decrease in demand for the travel related services provided by us during the peak of the COVID-19 pandemic, we shifted our focus to developing and enhancing our program offerings. For example, we began to develop our online media platform -TravelMagazine.com allowing consumers to research future travel options as well as enhancing the functionality of our booking engines, including developing a booking engine platform that allows customers to book packaged vacations and wellness programs along with the development of a platform to arrange and manage business travel.

Acquisition of Bookit.com Asset

Following NextTrip’s separation from NextPlay, our team focused on the continued technological development of its booking platform. As part of this development, we acquired a travel platform in June 2022 to help power our proprietary NXT2.0 booking technology. Previously, this technology powered the Bookit.com business, a well-established online leisure tour operator generating over $400 million in annual sales as recently as 2019 (pre-pandemic). As part of the acquisition of the assets of Bookit.com, we were not only able to acquire a proven technology platform that could be integrated with our core travel sectors, but we were also able to secure the database with millions of past travelers and opt-in consumers.

Since 2022, and the acquisition of the Bookit.com business, we have been focused on the holistic development and integration of the NXT2.0 technology platform, which serves as a base for current and future technology projects as well as proprietary system enhancements. This integration includes re-engaging with and re-negotiating more than 250 contracts with hotel, airline, and cruise suppliers, and securing unique product inventory of more than 3 million lodging, air and tour product suppliers at exceptional rates to over 2,100 destinations in 200+ countries worldwide.

Through this strategic offering, we will focus on key areas of opportunity in the travel sector and drive enhanced booking conversion rates. Our proprietary technology, when combined with media, product offerings and customer service, provides a unique lane to serve mid-to luxury travelers.

Recent Developments

Acquisition by Sigma Additive Solutions, Inc.; Name Change

In December 2023, Sigma Additive Solutions, Inc. (“Sigma”) acquired 100% of the outstanding equity interests in NextTrip, which resulted in NextTrip becoming a wholly-owned subsidiary of a public company and the principal business of the Company moving forward. To align the new business with NextTrip’s travel-focused business model, the Company recently changed its name to “NextTrip, Inc.”

Acquisition of Promethean FAST TV Exclusive License

We recently entered into a perpetual license agreement with Promethean TV, Inc. (“Promethean”), the owner and developer of the Ignite TV interactive video platform used for driving engagement and commerce. This license will form the basis for our Free Ad-supported streaming TV (FAST) channel – Compasss.TV allowing for targeted advertising via video overlays, allowing the viewer to purchase travel from their screen. This integrated technology is intended to boost engagement with customers driving ad-supported revenue and travel transactions.

|

|

Our Fully Integrated Travel Booking Platform

We have established a direct-to-consumer presence though a number of websites, powered by the NXT2.0 booking platform. Today, the primary leisure platform is hosted on nexttrip.com and the media platform is hosted on travelmagazine.com.

NextTrip sells travel services to leisure and corporate customers across these websites. Our primary focus is our current offerings of scheduling, pricing and availability information for booking reservations for airlines, hotels, rental cars, as well as other travel products such as transfers, sightseeing tours, shows and event tickets. NextTrip sells these travel services both individually and as components of dynamically assembled packaged travel vacations and trips. In addition, we provide content that presents travelers with information about travel destinations, maps and other travel details.

Our online travel publication, travelmagazine.com, provides travelers around the world with inspiration for future vacation destinations and trips. The publication offers written articles, videos, and podcasts. The website is expected to be supported by advertising and allow for research and booking of vacation products.

|

|

Travel Products and Services

We are building an ecosystem with technology and product offerings that will include leisure travel, wellness travel, business travel, alternative lodging, technology and media solutions. We engage with consumers and distributors throughout the travel planning journey from initial research through post-travel. Through direct relationships, we have established robust product offerings and preferred rates across the top destinations world-wide. Our primary product offerings are as follows:

| ● | NextTrip Travel brings travel solutions and a proprietary booking engine that allows customers to book customized travel, including vacation packages, airline tickets, hotel reservations, tours and activities, curated journeys, wellness, business and group travel. Additionally, we are developing a travel agent portal to drive bookings and travel agent brand loyalty across the leisure space. | |

| ● | NextTrip Solutions offers technology solutions for product and inventory management as well as white label offerings including NextTrip products under their brand, and technology solutions. | |

| ● | NextTrip Media includes Travel Magazine and the Compass.TV experience, which is currently in development. These digital solutions engage consumers at the initial phases of travel planning, offering relevant content, destination information and immersive online experiences as well as solutions for travel suppliers. This ecosystem, once fully developed, is expected to allow users to create their own fully customized FAST channel featuring vacation journey opportunities that customers can explore prior to booking the actual vacation. |

Products and Services for Travelers

Search Tools and Ability to Compare. Our online marketplace nexttrip.com provides travelers with the tools to search for and filter several travel products including air, accommodations, activities, and transportation based on various criteria, such as destination, travel dates, type of property, number of travelers, amenities, price, or keywords.

Traveler Login. Travelers are able to create accounts on our website(s) that give them access to their booking activity through the website. Members will also have access to special rates and discounts on the NextTrip product.

Travel Blog. Travel guides, videos and pictures as well as travel articles can be accessed through travelmagazine.com.

Security. We use a combination of technology and human review to evaluate the content of listings and to screen for inaccuracies or fraud with the goal of providing only accurate and trustworthy information to travelers. NextTrip is Payment Card Industry compliant to ensure the safety and security of its customer credit card data.

Communication. Travelers who create an account on our websites will receive regular communications, including notices about places of interest, special offers, new listings, and an email newsletter. The newsletter will be available to any traveler who agrees to receive it and offers introductions to new destinations and properties, as well as tips and useful information when traveling.

Since the COVID-19 pandemic arose, we have primarily focused on developing our booking engine and establishing relationships with suppliers to increase the size of our instantly bookable inventory. The booking engine has produced little revenue to date because of, among other reasons, the efforts that have been taken to integrate the NextTrip travel platforms with the Bookit.com technology since its acquisition in the summer of 2022. The new platform was launched in beta in May 2023 with a limited number of hotel properties in Mexico and the Caribbean. We have expanded our distribution since launch to include over one million hotel properties worldwide and have completed a full launch of the leisure travel website in May 2024.

|

|

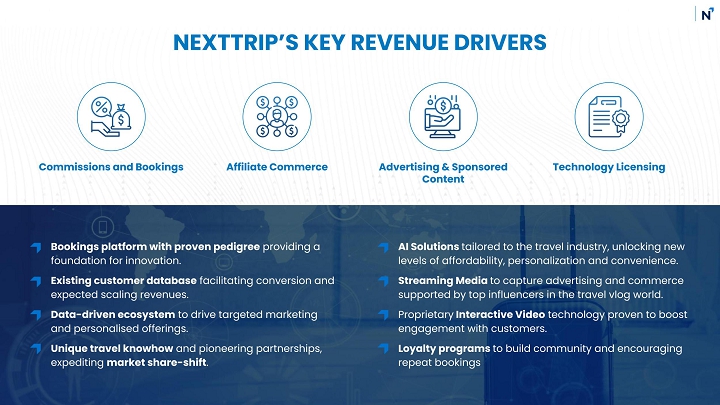

Key Revenue Drivers

NextTrip’s fully integrated travel booking platform serves as the foundation of our revenue-generating business. The platform contains a robust booking engine with merchandising capabilities that drive increased conversions and higher per revenue transactions. We plan to leverage the bookit.com foundational travel database consisting of 6 million customers to further drive revenues. Those revenues consist primarily of commissions and bookings but are expanding to include affiliate commerce, advertising and sponsored content (via Compass.TV and Travel Magazine).

In addition, as the booking platform expands, it establishes an opportunity for product expansion and revenue from technology licensing, including white-labeling key technology. A monthly software-as-a-service (SaaS) model is being established around key technology developments and innovative platforms, including turn-key booking solutions, product management and targeted audience offerings.

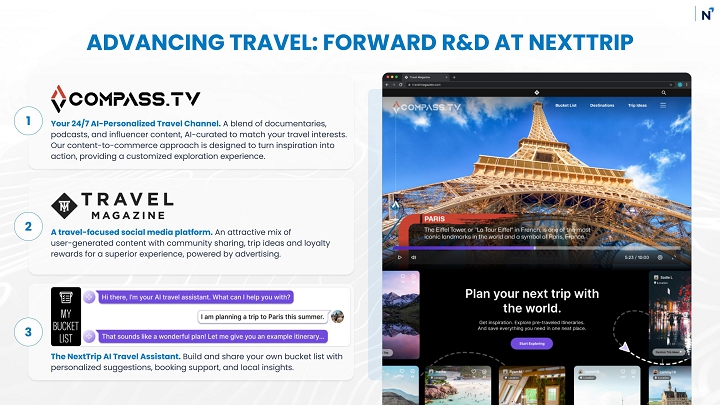

Advancing Travel: Future Research & Development Driving Growth

As we expand the reach of our booking platforms, including to different underserved areas of the travel industry, we plan to focus on future technologies to drive growth by investing in research and development.

|

|

Compass.TV

As Free Ad-Supported Streaming TV (FAST) gains momentum globally, we are in the process of developing Compass.TV, with a targeted launch in the fall of 2024. Our innovative travel channel is being developed in conjunction with our perpetual license with Promethean discussed above. With over 200 hours of relevant travel content secured, Compass.TV intends to utilize artificial intelligence (AI) to personalize content, convert blogs and articles to video, and empower users to create custom travel channels. Integration with the NextTrip Concierge desk will enable seamless booking and assistance.

NextTrip recognizes the pivotal role of video in promoting travel sales and engagement, hence our focus on incorporating video across platforms. To maximize effectiveness, NextTrip has entered into the license with Promethean enabling targeted advertising and transactional capabilities without interrupting content. The Company has also established strategic partnerships for content, distribution and technology with key players in the FAST space. This will enhance and accelerate the growth of our user base and enhance the opportunity for revenue generation from the platform.

Travel Magazine

We are transforming our Travel Magazine website into a social media platform catering to all things travel. The site was re-launched mid-2024, and features enhanced media capabilities and targeted advertising using the Promethean solution. A private consumer section called “MyBucketList,” is targeted for release in the fall of 2024 and will feature connectivity to booking engines, AI travel planner assist and AI-driven content creation.

My Bucket List

With My Bucket List, NextTrip is building a technology solution catered to travelers to build and share their own travel bucket list with personalized suggestions, booking support and local insights.

Technology and Infrastructure

Our websites are hosted using cloud services distributed globally across multiple regions. Our systems architecture has been designed to manage increases in traffic through additional computing power without making software changes. Our cloud services provide our online marketplace with scalable and redundant Internet connectivity and redundant power and cooling to our hosting environments. We use security methods to ensure the integrity of our networks and protection of confidential data collected and stored on our servers, and we have developed and use internal policies and procedures to protect the personal information of travel suppliers and customers using our websites that we collect and use as part of our normal operations. Access to our networks, and the servers and databases, on which confidential data is stored, is protected by industry standard firewall and encryption technology. Physical access to our servers and related equipment is secured by limiting access to the data center to operations personnel only.

|

|

Competition

The U.S. travel market is highly competitive and rapidly evolving. The markets are dominated by a few key distributors, which has caused suppliers to look for viable alternatives that would diversify their business mix.

Our competition, which is strong and increasing, includes online and offline travel companies that target leisure and corporate travelers, including travel agencies, tour operators, travel supplier direct websites and their call centers, consolidators and wholesalers of travel products and services, large online portals and search websites, certain travel metasearch websites, mobile travel applications, social media websites, as well as traditional consumer eCommerce and group buying websites. These companies include Expedia, Booking.com, TripAdvisor, Sabre Corp., and TravelZoo. In some cases, competitors are offering more favorable terms and improved interfaces to suppliers and travelers, which make competition increasingly difficult. We also face competition for customer traffic on internet search engines and metasearch websites, which impacts our customer acquisition and marketing costs.

Seasonality

We experience seasonal fluctuations in the demand for our travel products and services. For example, traditional leisure travel bookings are generally the highest in the first three quarters as travelers plan and book their spring, summer and winter holiday travel. The number of bookings typically decreases in the fourth quarter. Because revenue for most of our travel products is recognized when the travel takes place rather than when it is booked, revenue typically lags bookings by several weeks to several months. As a result, although travel bookings through NextTrip’s platforms tend to be highest from the period from January to June, moderate from July through September and low from October through December, the majority of revenue is recognized in the summer months (June, July, and August), and during the winter holidays (November and December).

Intellectual Property

Our intellectual property includes the content of our websites, registered domain names, registered and unregistered trademarks, business plan, business strategies and trade secrets, proprietary and acquired software platforms and related assets, licensed software platforms, and customer and third-party supplier lists. We believe that our intellectual property is an essential asset of our business and that our registered domain names and our technology infrastructure will give us a competitive advantage in the online market and arrangements with attractions and tour operators. We rely on a combination of trademark, copyright and trade secret laws in the United States, as well as contractual provisions, to protect our proprietary technology and our brands. We also rely on copyright laws to protect the appearance and design of our sites and applications. We have registered numerous Internet domain names related to our business in order to protect our proprietary interests.

Regulation

Our ability to provide our services and any future services is affected by legal regulations of governments and regulatory authorities around the world, many of which are evolving and subject to revised interpretations. Violations of any laws or regulations could result in fines, penalties, and criminal sanctions against us, our officers or employees, and prohibitions on how or where we conduct our business, which could damage our reputation, brands, global expansion efforts, ability to attract and retain employees and business partners, business, and operating results. Even if we comply with these laws and regulations, doing business in certain jurisdictions or violations of these laws and regulations by the parties with which we conduct business runs the risk of harming our reputation and our brands. Regulations that impact our business or our industry include:

● Data Protection and Privacy: We have policies and a global governance framework to comply with privacy laws that apply to our business, meet evolving stakeholder expectations, and support business innovation and growth. In the European Union, the General Data Protection Regulation (the “GDPR”) imposes significant compliance obligations and costs. In the United States, the California Consumer Privacy Act (the “CCPA”) and the California Privacy Rights Act (“CPRA”) impose privacy requirements and rights for consumers in California that will result in additional compliance complexity, risks, and costs. Other U.S. states and jurisdictions globally have adopted or may adopt similar data protection regulations. Some data protection and privacy laws afford consumers a private right of action against companies like ours for certain statutory violations.

|

|

● Regulation of the Travel Industry: Our business is impacted by travel-related regulations such as local regulation of the use of alternative accommodations. Local jurisdictions around the world have instituted a variety of measures to address the issues of “overtourism” and the impact of tourism on the climate. As our business evolves, we expect to become subject to existing and new regulations. For example, some parts of our business are already subject to certain requirements of the US Department of Transportation (DOT), and as our offerings continue to diversify and expand, we may become subject to additional requirements of regulatory agencies across the world.

● Payments: As we expand our payments services to consumers and business partners, we are subject to additional regulations, such as financial services regulations and license requirements, which has resulted in increased compliance costs and complexities, including those associated with the implementation of new or advanced internal controls. We are also subject to payment card association rules and obligations under our contracts with payment card processors, including the Payment Card Industry Data Security Standard, compliance with which is complex and costly.

Facilities

Our principal executive offices are located at 3900 Paseo del Sol, Santa Fe, New Mexico 87507. The lease has a 6-month term which ends on December 31, 2024. The landlord can terminate the lease upon 30 days written notice and NextTrip can terminate the lease upon 45 days written notice.

Human Capital Resources

As of August 31, 2024, we had 14 full-time employees and 13 independent contractors, We use independent contractors and temporary personnel to supplement our workforce, particularly in the software development and technology tasks. Our employees are not represented by a labor union, and we consider our employee relations to be very good. Competition for qualified personnel in its industry has historically been intense, particularly for software engineers, developers, and other technical staff. Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and additional employees. We strive to provide competitive compensation and benefits to our employees. Our benefit programs include bonuses, stock-based compensation awards, a 401(k) plan with employer matching, healthcare and insurance benefits, flexible paid time off and other employee assistance programs.

The principal purposes of our equity incentive plans are to attract, retain and motivate selected employees, consultants and directors through the granting of stock-based compensation awards and cash-based performance bonus awards.

All employees are responsible for upholding the NextTrip Code of Ethics and Business Conduct, which is important in delivering on our strategy. We maintain a compliance hotline for the confidential reporting of any suspected policy violations or unethical business conduct on the part of our businesses, employees, officers, directors, suppliers, or customers.

Global Conflicts

Current conflicts throughout the world, including the Russia-Ukraine war and the Israel-Hamas war, could further impact the global economy, financial markets, and inflation. Due to the uncertainty around the duration or outcome of the conflicts, we cannot predict the effect on our business.

We have no sales to Russia, Ukraine, or Israel, nor do we have any assets, employees or third-party contractors in those countries.

Corporate Information

Sigma was initially incorporated as Messidor Limited in Nevada on December 23, 1985, and changed its name to Framewaves Inc. in 2001. On September 27, 2010, the name was changed to Sigma Labs, Inc. On May 17, 2022, Sigma Labs, Inc. began doing business as Sigma Additive Solutions, and on August 9, 2022, changed its name to Sigma Additive Solutions, Inc. On March 13, 2024, we changed our name to NextTrip, Inc.

Our principal executive offices are located at 3900 Paseo del Sol, Santa Fe, New Mexico 87507, and our current telephone number at that address is (954) 526-9688. Our website address is www.nexttrip.com. The Company’s annual reports, quarterly reports, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and other information related to the Company, are available, free of charge, on that website as soon as we electronically file those documents with, or otherwise furnish them to, the SEC. The Company’s website and the information contained therein, or connected thereto, are not and are not intended to be incorporated into this Report.

|

|

ITEM 1A. RISK FACTORS.

Our business is subject to numerous risks. We caution you that the following important factors, among others, could cause our actual results to differ materially from those expressed in statements made by us or on our behalf in filings with the SEC, press releases or communications with investors and others. Any or all of our statements in this Report and in any other public statements we make may turn out to be wrong. They can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. The factors mentioned in the discussion below will be important in determining future results. Consequently, actual future results may vary materially from those anticipated in this Report or our other public statements. The occurrence of any of the events or developments described below could harm our financial condition, results of operations, business and prospects. In such an event, the market price of our securities could decline. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may have similar adverse effects on us.

Risks Related to Our Business

Our revenue is derived from the global travel industry, and a prolonged or substantial decrease in global travel, particularly air travel, could adversely affect our operating results.

Our revenue is derived from the global travel industry and would be significantly impacted by declines in, or disruptions to, travel activity, particularly air travel. Global factors over which we have no control, but which could impact our clients’ willingness to travel and, depending on the scope and duration, cause a significant decline in travel volumes include, among other things:

● widespread health concerns, epidemics or pandemics, such as the COVID-19 pandemic, the Zika virus, H1N1 influenza, the Ebola virus, avian flu, SARS or any other serious contagious diseases;

● global security concerns caused by terrorist attacks, the threat of terrorist attacks, or the precautions taken in anticipation of such attacks, including elevated threat warnings or selective cancellation or redirection of travel;

● cyber-terrorism, political unrest, the outbreak of hostilities or escalation or worsening of existing hostilities or war, such as Russia’s invasion of Ukraine and the military conflict in Israel, resulting sanctions imposed by the U.S. and other countries and retaliatory actions taken by sanctioned countries in response to such sanctions;

● natural disasters or severe weather conditions, such as hurricanes, flooding and earthquakes;

● climate change-related impact to travel destinations, such as extreme weather, natural disasters and disruptions, and actions taken by governments, businesses and supplier partners to combat climate change;

● the occurrence of travel-related accidents or the grounding of aircraft due to safety concerns;

● the impact of macroeconomic conditions (including inflation) and labor shortages on the cost and availability of airline travel; and

● adverse changes in visa and immigration policies or the imposition of travel restrictions or more restrictive security procedures.

Any decrease in demand for consumer or business travel could materially and adversely affect our business, financial condition and results of operations.

|

|

We need additional capital, which may not be available on commercially acceptable terms, if at all, which raises questions about our ability to continue as a going concern.

As of February 29, 2024, we had $5,088,842 in total assets, $1,960,813 in total liabilities, negative working capital of $245,005 and a total accumulated deficit of $24,151,139. We had a net loss of $7,339,276 for the fiscal year ended February 29, 2024 and $5,033,496 for the fiscal year ended February 28, 2023.

We are subject to all the substantial risks inherent in the development of a new business enterprise within an extremely competitive industry. Due to the absence of a long-standing operating history and the emerging nature of the markets in which it competes, we anticipate operating losses until we can successfully implement our business strategy, which includes all associated revenue streams. Our revenue model is new and evolving, and we cannot be certain that it will be successful. The potential profitability of this business model is unproven. We may never achieve profitable operations or generate significant revenues. Our future operating results depend on many factors, including demand for our products, the level of competition, and the ability of our officers to manage our business and growth. Additional development expenses may delay or negatively impact our ability to generate profits. Accordingly, we cannot assure you that our business model will be successful or that we can sustain revenue growth, achieve or sustain profitability, or continue as a going concern.

The Company believes that, in the aggregate, it could require several millions of dollars to support and expand the marketing and development of its products, repay debt obligations, provide capital expenditures for additional equipment and development costs, payment obligations, office space and systems for managing the business, and cover other operating costs until its planned revenue streams from all products are fully implemented and begin to offset its operating costs. We estimate that we will need to raise a minimum of $5.5 million in net proceeds to continue operations for the next twelve months.

In the event the Company is unable to raise adequate funding in the future for its operations and to pay its outstanding debt obligations, the Company may be forced to scale back its business plan and/or liquidate some or all of its assets or may be forced to seek bankruptcy protection

In light of the foregoing, there is substantial doubt our ability to continue as a going concern, and the report of our registered independent public accounting firm on our financial statements as of and for the year ended February 29, 2024 contains a going concern qualification.

We are not profitable and may never become profitable.

We have incurred losses in every reporting period since we commenced business operations in 2010 and expect to continue to incur significant losses for the foreseeable future. Our net loss applicable to common stockholders for the years ended February 29, 2024 and February 28, 2023 was $7,339,276 and $5,033,496, respectively. As of February 29, 2024, our accumulated deficit was $24,151,139. There is no assurance that any revenues we generate will be sufficient for us to become profitable or to maintain profitability. Our revenues for the years ended February 29, 2024 and February 28, 2023 were $458,752 and $382,832, respectively, and our operating expenses for those periods were $5,740,577 and $4,979,766, respectively. Our current revenues are not sufficient to fund our operations. We cannot predict when, if ever, we might achieve profitability and we are not certain that we will be able to sustain profitability, if achieved. If we fail to achieve or maintain profitability, the market price of our securities is likely to be adversely affected.

We have outstanding indebtedness, which could adversely affect our business and financial condition.

Risks relating to its indebtedness include:

| ● | increasing our vulnerability to general adverse economic and industry conditions; | |

| ● | requiring us to dedicate a portion of our cash flow from operations to principal and interest payments on our indebtedness, thereby reducing the availability of cash flow to fund working capital, capital expenditures, acquisitions and investments and other general corporate purposes; | |

| ● | making it more difficult for us to optimally capitalize and manage the cash flow for our businesses; | |

| ● | limiting our flexibility in planning for, or reacting to, changes in our businesses and the markets in which we operate; | |

| ● | possibly placing us at a competitive disadvantage compared to our competitors that have less debt; and | |

| ● | limiting our ability to borrow additional funds or to borrow funds at rates or on other terms that we find acceptable. |

|

|

If distributors are unable to drive customers to our websites and/or we are unable to drive visitors to our websites, from search engines or otherwise, this could negatively impact transactions on the websites of our distributors as well as our own websites and consequently cause our travel revenue to decrease.

Many visitors find the distributors and NextTrip’s websites by searching for vacation information through Internet search engines. A critical factor in attracting visitors to NextTrip’s websites, and those of our distributors, is how prominently our distributors and NextTrip are displayed in response to search queries. Accordingly, we utilize search engine marketing, or SEM, as a means to provide a significant portion of our visitor acquisition. SEM includes both paid visitor acquisition (on a cost-per-click basis) and unpaid visitor acquisition, which is often referred to as organic search.

We plan to employ search engine optimization, or SEO, to acquire visitors. SEO involves developing NextTrip’s websites in order to rank highly in relevant search queries. In addition to SEM and SEO, we may also utilize other forms of marketing to drive visitors to our websites, including branded search, display advertising and email marketing.

The various search engine providers, such as Google and Bing, employ proprietary algorithms and other methods for determining which websites are displayed for a given search query and how highly websites rank. Search engine providers may change these methods in a way that may negatively affect the number of visitors to our distributors’ websites as well as our own websites and may do so without public announcement or detailed explanation. Therefore, the success of our SEO and SEM strategy depends, in part, on our ability to anticipate and respond to such changes in a timely and effective manner.

In addition, websites must comply with search engine guidelines and policies. These guidelines and policies are complex and may change at any time. If we or our distributors fail to follow such guidelines and policies properly, the search engine may cause our content to rank lower in search results or could remove the content altogether. If we or our distributors fail to understand and comply with these guidelines and policies and ensure their websites’ compliance, our SEO and SEM strategy may not be successful.

Unfavorable changes in, or interpretations of, government regulations or taxation of the evolving product offerings, Internet and e-commerce industries could harm our travel division operating results.

We have contracted for products in markets throughout the world, in jurisdictions which have various regulatory and taxation requirements that can affect our travel division operations or regulate the activity of travel suppliers.

Compliance with laws and regulations of different jurisdictions imposing different standards and requirements is very burdensome because each region has different regulations with respect to licensing and other requirements. Our online marketplaces are accessible by travelers in many states and foreign jurisdictions. Compliance requirements that vary significantly from jurisdiction to jurisdiction impose added costs and increased liabilities for compliance deficiencies. In addition, laws or regulations that may harm our business could be adopted, or interpreted in a manner that affects our activities, including but not limited to the regulation of personal and consumer information and real estate licensing requirements. Violations or new interpretations of these laws or regulations may result in penalties, negatively impact our operations and damage our reputation and business.

In addition, many of the fundamental statutes and regulations that impose taxes or other obligations on travel and lodging companies were established before the growth of the Internet and e-commerce, which creates a risk of these laws being used, in ways not originally intended, that could burden travel suppliers or otherwise harm our business. These and other similar new and newly interpreted regulations could increase costs for, or otherwise discourage, suppliers from partnering with NextTrip, which could harm its business and operating results.

Furthermore, as we expand or change the products and services that we offer or the methods by which we offer them, we may become subject to additional legal regulations, tax requirements or other risks. Regulators may seek to impose regulations and requirements on us even if we utilize third parties to offer the products or services. These regulations and requirements may apply to payment processing, insurance products or the various other products and services we may now or in the future offer or facilitate through our marketplace. Whether we comply with or challenge these additional regulations, our costs may increase, and our business may otherwise be harmed.

|

|

If we are not able to maintain and enhance our NextTrip brand and the brands associated with each of our websites, our reputation and business may suffer.

It is important for NextTrip to maintain and enhance its brand identity in order to attract and retain travel suppliers and customers. The successful promotion of our brands will depend largely on our marketing and public relations efforts. We expect that the promotion of our brands will require us to make substantial investments, and, as its market becomes more competitive, these branding initiatives may become increasingly difficult and expensive. In addition, we may not be able to successfully build our NextTrip brand identity without losing value associated with, or decreasing the effectiveness of, our other brand identities. If we do not successfully maintain and enhance our brands, we could lose traveler traffic, which could, in turn, cause suppliers to discontinue their distribution with us. In addition, our brand promotion activities may not be successful or may not yield revenue sufficient to offset their cost, which could adversely affect our reputation and business.

Our long-term success depends, in part, on our ability to expand traveler bases outside of the United States and, as a result, our business is susceptible to risks associated with international operations.

We have limited operating and e-commerce experience in many foreign jurisdictions and are making significant investments to build our international operations. We plan to continue our efforts to expand globally, including potentially acquiring international businesses and conducting business in jurisdictions where we do not currently operate. Managing a global organization is difficult, time-consuming and expensive and any international expansion efforts that we undertake may not be profitable in the near or long term or otherwise be successful. In addition, conducting international operations subjects the Company to risks that include:

| ● | the cost and resources required to localize its services, which requires the translation of our websites and their adaptation for local practices and legal and regulatory requirements; | |

| ● | adjusting the products and services we provide in foreign jurisdictions, as needed, to better address the needs of local owners, managers, distributors and travelers, and the threats of local competitors; | |

| ● |

being subject to foreign laws and regulations, including those laws governing Internet activities, email messaging, collection and use of personal information, ownership of intellectual property, taxation and other activities important to our online business practices, which may be less developed, less predictable, more restrictive, and less familiar, and which may adversely affect financial results in certain regions;

|

|

| ● | competition with companies that understand the local market better than we do or who have pre-existing relationships with suppliers, distributors and travelers in those markets; | |

| ● | legal uncertainty regarding our liability for the transactions and content on our websites, including online bookings, property listings and other content provided by suppliers, including uncertainty resulting from unique local laws or a lack of clear precedent of applicable law; | |

| ● | lack of familiarity with and the burden of complying with a wide variety of other foreign laws, legal standards and foreign regulatory requirements, including invoicing, data collection and storage, financial reporting and tax compliance requirements, which are subject to unexpected changes; | |

| ● | laws and business practices that favor local competitors or prohibit or limit foreign ownership of certain businesses; | |

| ● | challenges associated with joint venture relationships and minority investments; | |

| ● | adapting to variations in foreign payment forms; | |

| ● | difficulties in managing and staffing international operations and establishing or maintaining operational efficiencies; | |

| ● | difficulties in establishing and maintaining adequate internal controls and security over our data and systems; | |

| ● | currency exchange restrictions and fluctuations in currency exchange rates; | |

| ● | potentially adverse tax consequences, which may be difficult to predict, including the complexities of foreign value added tax systems and restrictions on the repatriation of earnings; | |

| ● | political, social and economic instability abroad, war, terrorist attacks and security concerns in general; | |

| ● | the potential failure of financial institutions internationally; | |

| ● | reduced or varied protection for intellectual property rights in some countries; and | |

| ● | higher telecommunications and Internet service provider costs. |

Operating in international markets also requires significant management attention and financial resources. We cannot guarantee that our international expansion efforts in any or multiple territories will be successful. The investment and additional resources required to establish operations and manage growth in other countries may not produce desired levels of revenue or profitability and could instead result in increased costs.

|

|

The market in which we participate is highly competitive, and we may be unable to compete successfully with our current or future competitors.

The market to provide listing, search and marketing services for the travel industry is very competitive and dominated by key players, such as Expedia and Booking.com. In addition, the barriers to entry are low and new competitors may enter. All of the services that we plan to provide to travelers are provided separately or in combination by current or potential competitors. Our competitors may adopt aspects of our business model, which could reduce our ability to differentiate our services. Additionally, current or new competitors may introduce new business models or services that we may need to adopt or otherwise adapt to in order to compete, which could reduce our ability to differentiate our business or services from those of our competitors.

In addition, most of our current or potential competitors are larger and have more resources than we do. Many of our current and potential competitors enjoy substantial competitive advantages, such as greater name recognition in their markets, longer operating histories and larger marketing budgets, as well as substantially greater financial, technical and other resources. In addition, our current or potential competitors may have access to larger traveler bases. As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standards or distribution or traveler requirements. For all of these reasons, the Company may not be able to compete successfully against its current and future competitors.

If we are unable to introduce new or upgraded products, services or features that distributors, travelers or agents recognize as valuable, we may fail to: (i) drive additional travelers to our websites, (ii) retain existing distributors, and/or (iii) attract new distributors. Our efforts to develop new and upgraded services and products could require us to incur significant costs.

In order to attract travelers to our distributors, as well as our own online marketplace while retaining, and attracting new suppliers, we will need to continue to invest in the development of new products, services and features that both add value for travelers and suppliers and differentiate us from our competitors. The success of new products, services and features depends on several factors, including the timely completion, introduction and market acceptance of the product, service or feature. If travelers, or suppliers do not recognize the value of our new services or features, they may choose not to utilize our products or make their inventory available through our channels.

Attempting to develop and deliver these new or upgraded products, services or features involves inherent hazards and difficulties, and is costly. Efforts to enhance and improve the ease of use, responsiveness, functionality and features of our existing websites have inherent risks, and we may not be able to manage these product developments and enhancements successfully. We may not succeed in developing new or upgraded products, services or features or new or upgraded products, services or features may not work as intended or provide value. In addition, some new or upgraded products, services or features may be difficult for us to market and may also involve unfavorable pricing. Even if we succeed, we cannot guarantee that our suppliers will respond favorably.

In addition to developing our own improvements, we may choose to license or otherwise integrate applications, content and data from third parties. The introduction of these improvements imposes costs on the Company and creates a risk that it may be unable to continue to access these technologies and content on commercially reasonable terms, or at all. In the event we fail to develop new or upgraded products, services or features, the demand for our services and ultimately our results of operations may be adversely affected.

|

|

We are exposed to fluctuations in currency exchange rates.

Because we plan to conduct a significant portion of our business outside the United States, but report our results in U.S. dollars, we face exposure to adverse movements in currency exchange rates, which may cause our revenue and operating results to differ materially from expectations. In addition, fluctuation in our mix of U.S. and foreign currency denominated transactions may contribute to this effect as exchange rates vary. Moreover, as a result of these exchange rate fluctuations, revenue, cost of revenue, operating expenses and other operating results may differ materially from expectations when translated from the local currency into U.S. dollars upon consolidation. For example, if the U.S. dollar strengthens relative to foreign currencies our non-U.S. revenue would be adversely affected when translated into U.S. dollars. Conversely, a decline in the U.S. dollar relative to foreign currencies would increase our non-U.S. revenue when translated into U.S. dollars. We may enter into hedging arrangements in order to manage foreign currency exposure, but such activity may not completely eliminate fluctuations in our operating results, and there are costs associated with such hedging activities.

If we fail to protect confidential information against security breaches, or if distributors or travelers are reluctant to use our online marketplace because of privacy or security concerns, we might face additional costs, and activity on our websites could decline.

We collect and use personally identifiable information of distributors and travelers in the operation of our business. Our systems may be vulnerable to computer viruses or physical or electronic break-ins that our security measures may not detect. Anyone that is able to circumvent our security measures could misappropriate confidential or proprietary information, cause an interruption in our operations, damage our computers or those of our users, or otherwise damage our reputation and business. We may need to expend significant resources to protect against security breaches or to address problems caused by breaches. Security breaches of our systems, or the systems of third parties we rely upon, such as credit card processors, could damage our reputation and expose us to litigation and possible liability under various laws and regulations. Concern among distributors and travelers regarding our use of personal information collected on our websites could keep them from using, or continuing to use, our online marketplace.

There are risks of security breaches both on our systems and on third party systems which store our information as we increase the types of technology that we use to operate our marketplace, such as mobile applications. New and evolving technology systems and platforms may involve security risks that are difficult to predict and adequately guard against. In addition, third parties that process credit card transactions between NextTrip and travelers maintain personal information collected from them. Such information could be stolen or misappropriated, and we could be subject to liability as a result. Our distributors and travelers may be harmed by such breaches, and we may in turn be subject to costly litigation or regulatory compliance costs, and harm to our reputation and brand. Moreover, some distributors and travelers may cease using our marketplace altogether.

The laws of some states and countries require businesses that maintain personal information about their residents in electronic databases to implement reasonable measures to keep that information secure. Our practice is to encrypt all sensitive information, but we do not know whether our current practice will be challenged under these laws. In addition, under certain of these laws, if there is a breach of our computer systems and we know or suspect that unencrypted personal data has been stolen, we are required to inform any user whose data was stolen, which could harm our reputation and business. Complying with the applicable notice requirements in the event of a security breach could result in significant costs. We may also be subject to contractual claims, investigation and penalties by regulatory authorities, and claims by persons whose information was disclosed.

Compounding these legal risks, many states and countries have enacted different and often contradictory requirements for protecting personal information collected and maintained electronically. Compliance with these numerous and contradictory requirements is particularly difficult for us because we collect personal information from users in multiple jurisdictions. While we intend to comply fully with these laws, failure to comply could result in legal liability, cause the Company to suffer adverse publicity and lose business, traffic and revenue. If we were required to pay any significant amount of money in satisfaction of claims under these or similar laws, or if we were forced to cease our business operations for any length of time as a result of our inability to comply fully, our business, operating results and financial condition could be adversely affected.

|

|

Cyber-attacks and system vulnerabilities could lead to sustained service outages, data loss, reduced revenue, increased costs, liability claims, or harm to our competitive position.

We may experience targeted and organized malware, phishing, and account takeover attacks and other forms of attack such as ransomware, SQL injection (where a third-party attempts to insert malicious code into its software through data entry fields in its websites in order to gain control of the system) and attempts to use our websites as a platform to launch a denial-of-service attack on another party. Our existing security measures may not be successful in preventing attacks on our systems. Our existing IT business continuity and disaster recovery practices are less effective against certain types of attacks such as ransomware, which could result in our services being unavailable for an extended period of time, nullify our data, expose our payment card and personal data, or expose the Company to an extortion attempt.

Reductions in the availability and response time of our online services could cause loss of substantial business volumes during the occurrence of a cyber-attack on our systems and measures we may take to divert suspect traffic in the event of such an attack could result in the diversion of bona fide customers. These issues are more difficult to manage during any expansion of the number of places where we operate and the variety of services we offer, and as the tools and techniques used in such attacks become more advanced. We use sophisticated technology to identify cybersecurity threats; however, a cyberattack may go undetected for a period of time resulting in harm to our computer systems and the loss of data. This could result in financial penalties being imposed by the regulators and reputational harm. Our insurance policies have coverage limits and may not be adequate to reimburse us for all losses caused by security breaches. Successful attacks could result in significant interruptions in our operations, severe damage to our information technology infrastructure, negative publicity, damage our reputation, and prevent consumers from using our services during the attack, any of which could cause consumers to use the services of our competitors, which would have a negative effect on the value of our brands, market share, business, and results of operations.

If our systems cannot cope with the level of demand required to service our consumers and accommodations, we could experience unanticipated disruptions in service, slower response times, decreased customer service and customer satisfaction, and delays in the introduction of new services.

As an online business, we are dependent on the Internet and maintaining connectivity between itself and consumers, sources of Internet traffic, such as Google, and our travel service providers and restaurants. As consumers increasingly turn to mobile and other smart devices, we also depend on consumers’ access to the Internet through mobile carriers and their systems. Disruptions in internet access, especially if widespread or prolonged, could materially adversely affect our business and results of operations. While we maintain redundant systems and hosting services, it is possible that we could experience an interruption in our business, and we do not carry business interruption insurance sufficient to compensate us for all losses that may occur. We have computer hardware for operating our services located in hosting facilities around the world. We do not have a comprehensive disaster recovery plan in every geographic region in which we conduct business, and these systems and operations are vulnerable to damage or interruption from human error, misconduct, or catastrophic events. In the event of any disruption of service at such facilities or the failure by such facilities to provide our required data communications capacity, we may not be able to switch to back-up systems immediately and it could result in lengthy interruptions or delays in our services. We have taken and continue to take steps to increase the reliability and redundancy of our systems. These steps are expensive, may reduce our margins, and may not be successful in reducing the frequency or duration of unscheduled downtime.

Loss or material modification of our credit card acceptance privileges could have a material adverse effect on our business and operating results.

The loss of our credit card acceptance privileges could significantly limit the availability and desirability of our products and services. Moreover, if we fail to fully perform our contractual obligations, we could be obligated to reimburse credit card companies for refunded payments that have been contested by the cardholders. In addition, even when we are in compliance with these obligations, we bear other expenses including those related to the acceptance of fraudulent credit cards. As a result of all of these risks, credit card companies may require us to set aside additional cash reserves, may increase the transaction fees they charge us, or may even refuse to renew our acceptance privileges.

In addition, credit card networks, such as Visa, MasterCard and American Express, have adopted rules and regulations that apply to all merchants who process and accept credit cards and include the Payment Card Industry Data Security Standards, or the PCI DSS. Under these rules, we are required to adopt and implement internal controls over the use, storage and security of card data. We assess our compliance with the PCI DSS rules on a periodic basis and makes necessary improvements to our internal controls. Failure to comply may subject us to fines, penalties, damages and civil liability and could prevent us from processing or accepting credit cards. However, we cannot guarantee that compliance with these rules will prevent illegal or improper use of our payment systems or the theft, loss or misuse of the credit card data.

The loss of, or the significant modification of, the terms under which we obtain credit card acceptance privileges could have a material adverse effect on our business, revenue and operating results.

|

|

We currently rely on a small number of third-party service providers to host and deliver a significant portion of our services, and any interruptions or delays in services from these third parties could impair the delivery of our services and harm our business.

We rely on third-party service providers for numerous products and services, including payment processing services, data center services, web hosting services, insurance products for customers and travelers and some customer service functions. We rely on these companies to provide uninterrupted services and to provide their services in accordance with all applicable laws, rules and regulations.

We use a combination of third-party data centers to host our websites and core services. We do not control the operation of any of the third-party data center facilities we use. These facilities may be subject to break-ins, computer viruses, denial-of-service attacks, sabotage, acts of vandalism and other misconduct. They are also vulnerable to damage or interruption from power loss, telecommunications failures, fires, floods, earthquakes, hurricanes, tornadoes and similar events. We currently do not have a comprehensive disaster recovery plan in place nor do our systems provide complete redundancy of data storage or processing. As a result, the occurrence of any of these events, a decision by our third-party service providers to close their data center facilities without adequate notice or other unanticipated problems could result in loss of data as well as a significant interruption in our services and harm to our reputation and brand.

If our third-party service providers experience difficulties and are not able to provide services in a reliable and secure manner, if they do not operate in compliance with applicable laws, rules and regulations and, with respect to payment and card processing companies, if they are unable to effectively combat the use of fraudulent payments on our websites, our results of operations and financial positions could be materially and adversely affected. In addition, if such third-party service providers were to cease operations or face other business disruption either temporarily or permanently, or otherwise face serious performance problems, we could suffer increased costs and delays until we find or develop an equivalent replacement, any of which could have an adverse impact on our business and financial performance.

If we do not adequately protect our intellectual property, our ability to compete could be impaired.

Our intellectual property includes the content of our websites, registered domain names, as well as registered and unregistered trademarks. we believe that our intellectual property is an essential asset of our business and that our domain names and our technology infrastructure currently give us a competitive advantage in the online market for travel. If we do not adequately protect our intellectual property, our brand, reputation and perceived content value could be harmed, resulting in an impaired ability to compete effectively.

To protect our intellectual property, we rely on a combination of copyright, trademark, patent and trade secret laws, contractual provisions and our user policy and restrictions on disclosure. Upon discovery of potential infringement of our intellectual property, we promptly take action we deem appropriate to protect our rights. We also enter into confidentiality agreements with our employees and consultants and seek to control access to and distribution of our proprietary information in a commercially prudent manner. The efforts we have taken to protect our intellectual property may not be sufficient or effective, and, despite these precautions, it may be possible for other parties to copy or otherwise obtain and use the content of our websites without authorization. We may be unable to prevent competitors from acquiring domain names or trademarks that are similar to, infringe upon or diminish the value of our domain names, service marks and our other proprietary rights. Even if we do detect violations and decide to enforce our intellectual property rights, litigation may be necessary to enforce our rights, and any enforcement efforts we undertake could be time-consuming, expensive, distracting and result in unfavorable outcomes. A failure to protect our intellectual property in a cost-effective and meaningful manner could have a material adverse effect on our ability to compete.

Effective trademark, copyright and trade secret protection may not be available in every country in which our offerings are available over the Internet. In addition, the legal standards relating to the validity, enforceability and scope of protection of intellectual property rights are uncertain and still evolving.

|

|

We may be subject to claims that we violated intellectual property rights of others, which are extremely costly to defend and could require us to pay significant damages and limit our ability to operate.

Companies in the Internet and technology industries, and other patent and trademark holders seeking to profit from royalties in connection with grants of licenses, own large numbers of patents, copyrights, trademarks and trade secrets and frequently enter into litigation based on allegations of infringement or other violations of intellectual property rights. There may be intellectual property rights held by others, including issued or pending patents and trademarks, that cover significant aspects of our technologies, content, branding or business methods. Any intellectual property claims against us, regardless of merit, could be time-consuming and expensive to settle or litigate and could divert management’s attention and other resources. These claims also could subject us to significant liability for damages and could result in the Company having to stop using technology, content, branding or business methods found to be in violation of another party’s rights. We might be required or may opt to seek a license for rights to intellectual property held by others, which may not be available on commercially reasonable terms, or at all. If we cannot license or develop technology, content, branding or business methods for any allegedly infringing aspect of our business, we may be unable to compete effectively. Even if a license is available, we could be required to pay significant royalties, which could increase our operating expenses. We may also be required to develop alternative non-infringing technology, content, branding or business methods, which could require significant effort and expense and be inferior. Any of these results could harm our operating results.

If the businesses and/or assets that we have acquired or invested in do not perform as expected or we are unable to effectively integrate acquired businesses, our operating results and prospects could be harmed.

Our future mergers and acquisitions, if any, will involve numerous risks, including the following:

| ● | difficulties in integrating and managing the combined operations, technologies, technology platforms and products of the acquired companies and realizing the anticipated economic, operational and other benefits in a timely manner, which could result in substantial costs and delays or other operational, technical or financial problems; | |

| ● | legal or regulatory challenges or post-acquisition litigation, which could result in significant costs or require changes to the businesses or unwinding of the transaction; | |

| ● | failure of the acquired company or assets to achieve anticipated revenue, earnings or cash flow; | |

| ● | diversion of management’s attention or other resources from our existing business; | |