UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number 001-42183

QMMM Holdings Ltd.

(Translation of registrant’s name into English)

Unit 1301, Block C, Sea View Estate, 8 Watson Road Tin Hau, Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Financial Statements and Exhibits.

The following exhibits are being filed herewith:

| Exhibit No. | Description | |

| 99.1 | QMMM Holdings Ltd. Announces First Half 2024 Unaudited Financial Results |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: August 26, 2024

| QMMM HOLDINGS LTD. | ||

| By: | /s/ Bun Kwai | |

| Name: | Bun Kwai | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

QMMM HOLDINGS LIMITED

INDEX TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

TABLE OF CONTENTS

| F- |

QMMM HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Stated in US Dollars, except for number of shares)

| March 31, 2024 |

September 30, 2023 |

|||||||

| (Audited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 218,893 | $ | 130,201 | ||||

| Accounts receivable, net | 611,748 | 519,367 | ||||||

| Deposits and other current assets, net | 53,589 | 53,556 | ||||||

| Total current assets | 884,230 | 703,124 | ||||||

| Non-current assets: | ||||||||

| Property and equipment, net | 34,263 | 45,975 | ||||||

| Intangible assets, net | 19,326 | 24,534 | ||||||

| Deferred initial public offering (“IPO”) costs | 87,750 | 87,750 | ||||||

| Operating lease right-of-use assets, net | 240,757 | 325,153 | ||||||

| Total non-current assets | 382,096 | 483,412 | ||||||

| TOTAL ASSETS | $ | 1,266,326 | $ | 1,186,536 | ||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 7,073 | $ | 6,941 | ||||

| Contract liabilities | 34,540 | 7,943 | ||||||

| Due to shareholders | 1,630,169 | 1,240,238 | ||||||

| Operating lease liabilities, current | 178,410 | 172,066 | ||||||

| Income tax payable | 163,264 | 187,453 | ||||||

| Accrued liabilities and other payables | 233,979 | 316,624 | ||||||

| Accrued liabilities and other payables – related parties | 18,122 | 17,814 | ||||||

| Total current liabilities | 2,265,557 | 1,949,079 | ||||||

| Non-current liabilities: | ||||||||

| Operating lease liabilities, non-current | 62,347 | 153,043 | ||||||

| Total non-current liabilities | 62,347 | 153,043 | ||||||

| TOTAL LIABILITIES | $ | 2,327,904 | $ | 2,102,122 | ||||

| Commitments and contingencies | - | - | ||||||

| SHAREHOLDERS’ (DEFICIT) EQUITY | ||||||||

| Ordinary share, $0.0001 par value; 500,000,000 shares authorized, 15,000,000 shares issued and outstanding as of March 31, 2024 and September 30, 2023, respectively* | $ | 1,500 | $ | 1,500 | ||||

| Additional paid in capital | 13,500 | 13,500 | ||||||

| Accumulated deficits | (1,079,621 | ) | (933,549 | ) | ||||

| Accumulated other comprehensive income | 3,043 | 2,963 | ||||||

| Total Shareholders’ Deficit | (1,061,578 | ) | (915,586 | ) | ||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 1,266,326 | $ | 1,186,536 | ||||

| * | Retrospectively restated for effect of share reorganization (see Note 12) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| F- |

QMMM HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Stated in US Dollars, except for number of shares)

| Six Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenues | $ | 2,047,889 | $ | 1,345,145 | ||||

| Cost of revenues | (1,493,014 | ) | (1,020,594 | ) | ||||

| Gross profit | 554,875 | 324,551 | ||||||

| Operating expenses | ||||||||

| Selling and marketing expenses | - | (2,965 | ) | |||||

| General and administrative expenses | (688,032 | ) | (942,729 | ) | ||||

| Total operating expenses | (688,032 | ) | (945,694 | ) | ||||

| Operating loss | (133,157 | ) | (621,143 | ) | ||||

| Other (expenses) income, net | ||||||||

| Government grants | - | 23,339 | ||||||

| Interest income | 1,316 | 666 | ||||||

| Interest expense | (10,372 | ) | (5,729 | ) | ||||

| Total other (expenses) income, net | (9,056 | ) | 18,276 | |||||

| Loss before taxes | (142,213 | ) | (602,867 | ) | ||||

| Provision for income taxes | (3,859 | ) | (9,105 | ) | ||||

| Net loss | $ | (146,072 | ) | $ | (611,972 | ) | ||

| Other comprehensive income | ||||||||

| Foreign currency translation adjustment | 80 | 119 | ||||||

| Total comprehensive loss | $ | (145,992 | ) | $ | (611,853 | ) | ||

| Loss per share – basic and diluted | $ | (0.01 | ) | $ | (0.04 | ) | ||

| Basic and diluted weighted average shares outstanding* | 15,000,000 | 15,000,000 | ||||||

| * | Retrospectively restated for effect of share reorganization (see Note 12) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| F- |

QMMM HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ (DEFICIT) EQUITY

(Stated in US Dollars, except for number of shares)

| Six Months Ended March 31, 2023 | ||||||||||||||||||||||||

| (Accumulated | Accumulated | |||||||||||||||||||||||

| Number | Additional | deficit) / | other | |||||||||||||||||||||

| of | Ordinary | paid in | Retained | comprehensive | ||||||||||||||||||||

| Shares | Shares | capital | Earnings | income | Total | |||||||||||||||||||

| Balance, October 1, 2022 | 15,000,000 | $ | 1,500 | $ | 13,500 | $ | 357,680 | $ | 2,102 | $ | 374,782 | |||||||||||||

| Net loss | - | - | - | (611,972 | ) | - | (611,972 | ) | ||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 119 | 119 | ||||||||||||||||||

| Balance, March 31, 2023 | 15,000,000 | $ | 1,500 | $ | 13,500 | $ | (254,292 | ) | $ | 2,221 | $ | (237,071 | ) | |||||||||||

| Six Months Ended March 31, 2024 | ||||||||||||||||||||||||

| Accumulated | ||||||||||||||||||||||||

| Number | Additional | other | ||||||||||||||||||||||

| of | Ordinary | paid in | Accumulated | comprehensive | ||||||||||||||||||||

| Shares | Shares | capital | deficit | income | Total | |||||||||||||||||||

| Balance, October 1, 2023 | 15,000,000 | $ | 1,500 | $ | 13,500 | $ | (933,549 | ) | $ | 2,963 | $ | (915,586 | ) | |||||||||||

| Net loss | - | - | - | (146,072 | ) | - | (146,072 | ) | ||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | 80 | 80 | ||||||||||||||||||

| Balance, March 31, 2024 | 15,000,000 | $ | 1,500 | $ | 13,500 | $ | (1,079,621 | ) | $ | 3,043 | $ | (1,061,578 | ) | |||||||||||

* Retrospectively restated for effect of share reorganization (see Note 12)

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| F- |

QMMM HOLDINGS LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Stated in US Dollars)

| Six Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (146,072 | ) | $ | (611,972 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation of property and equipment | 11,753 | 10,616 | ||||||

| Amortization of intangible assets | 5,229 | 5,178 | ||||||

| Amortization of operating lease right-of-use assets | 84,693 | 84,409 | ||||||

| Expected credit loss allowance | 8,147 | (6,415 | ) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (100,304 | ) | 139,451 | |||||

| Contract costs | - | (30,091 | ) | |||||

| Deposits and other current assets | - | (7,644 | ) | |||||

| Accounts payable | 128 | (28,671 | ) | |||||

| Contract liabilities | 26,622 | 214,416 | ||||||

| Accrued liabilities and other payables | (82,415 | ) | 136,962 | |||||

| Operating lease liabilities | (84,650 | ) | (86,659 | ) | ||||

| Income tax payable | (24,334 | ) | (4,200 | ) | ||||

| Net cash used in operating activities | (301,203 | ) | (184,620 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchase of property and equipment | - | (974 | ) | |||||

| Purchase of intangible assets | - | (20,000 | ) | |||||

| Net cash used in investing activities | - | (20,974 | ) | |||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

| Repayment of short-term bank loans | - | (155,224 | ) | |||||

| Proceeds from shareholders | 389,912 | 638,853 | ||||||

| Net cash provided by financing activities | 389,912 | 483,629 | ||||||

| Net increase in cash and cash equivalents | 88,709 | 278,035 | ||||||

| Effect of foreign currency translation on cash and cash equivalents | (17 | ) | 677 | |||||

| Cash and cash equivalents, beginning of period | 130,201 | 364,449 | ||||||

| Cash and cash equivalents, end of period | $ | 218,893 | $ | 643,161 | ||||

| Supplementary cash flow information: | ||||||||

| Taxes (refunded) paid | $ | (28,193 | ) | $ | 13,941 | |||

| Interest paid | $ | - | $ | 2,208 | ||||

| Listing fees | $ | 387,574 | $ | 635,243 | ||||

* Retrospectively restated for effect of share reorganization (see Note 12)

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES

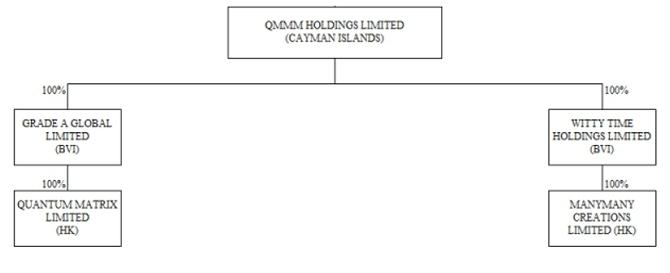

QMMM Holdings Limited (The “Group” or the “Company”) was incorporated in the Cayman Island on July 29, 2022 as an investment holding company. The Company conducts its primary operations through two of its indirectly wholly owned subsidiaries ManyMany Creations Limited (“MM”) and Quantum Matrix Limited (“QM”) which are both incorporated and domiciled in the Hong Kong Special Administrative Region (“HK SAR”). The Company is primarily engaged in providing digital media advertising and marketing production services and it is headquartered in Hong Kong.

The following is an organization chart of the Company and its subsidiaries:

As of March 31, 2024, the Company’s subsidiaries are detailed in the table as follows:

SCHEDULE OF SUBSIDIARIES

| Name | Background | Ownership % | Principal activity | |||||

| Grade A Global Limited | ● A BVI company ● Incorporated on July 5, 2022 |

100 | % | Holding Company | ||||

| Witty Time Holdings Limited | ● A BVI company ● Incorporated on July 5, 2022 |

100 | % | Holding Company | ||||

| ManyMany Creations Limited (“MM”) |

● A Hong Kong company ● Incorporated on June 15, 2005 |

100 | % | Digital media advertising and marketing production services | ||||

| Quantum Matrix Limited (“QM”) |

● A Hong Kong company ● Incorporated on March 20, 2014 |

100 | % | Digital media advertising and marketing production services | ||||

The registration statement for the Company’s Initial Public Offering (the “Offering”) was declared effective by the SEC on July 1, 2024. On July 22, 2024, the Company consummated the Offering of 2,150,000 ordinary shares at a price to the public of $4.00 per share. On August 8, 2024, the Company further issued 56,342 ordinary shares at a price of $4.00 per share with underwriter partially exercised the over-allotment option. The aggregate gross proceeds from the Offering amounted to $8,825,368, prior to deducting underwriting discounts, commissions and offering-related expenses.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 1 – ORGANIZATION AND PRINCIPAL ACTIVITIES (CONTINUED)

Group reorganization

Pursuant to a group reorganization (the “group reorganization”) to rationalize the structure of the Company and its subsidiary companies (herein collectively referred to as the “Group”) in preparation for the listing of our shares, the Company becomes the holding company of the Group on November 14, 2022. As the Group were under same control of the shareholders and their entire equity interests were also ultimately held by the shareholders immediately prior to the group reorganization, the unaudited condensed consolidated statements of operations and comprehensive loss, unaudited condensed consolidated statements of changes in shareholders’ (deficit) equity and unaudited condensed consolidated statements of cash flows are prepared as if the current group structure had been in existence throughout the beginning of the period, or since the respective dates of incorporation/establishment of the relevant entity, where this is a shorter period.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of consolidation and basis of preparation

The accompanying unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries (collectively the “Company”). The Company eliminates all significant intercompany balances and transactions in its unaudited condensed consolidated financial statements.

Management has prepared the accompanying unaudited condensed consolidated financial statements and these notes in accordance to generally accepted accounting principles in the United States (“US GAAP”). The Company maintains its general ledger and journals with the accrual method accounting.

Use of estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”), requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the unaudited condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Management makes these estimates using the best information available when the calculations are made; however, actual results could differ materially from those estimates.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Foreign currency translation

The accompanying unaudited condensed consolidated financial statements are presented in the United States Dollars (“USD” or “$”), which is the reporting currency of the Company. The functional currency of the Company’s subsidiaries in the Hong Kong is Hong Kong Dollars (“HKD” or “HK$”), its other subsidiaries which are incorporated in British Virgin Islands is United States Dollars, respectively, which are their respective local currencies based on the criteria of ASC 830, “Foreign Currency Matters”.

The Company’s assets and liabilities are translated into $ from HK$ at year-end exchange rates. Its revenues and expenses are translated at the average exchange rate during the period. Capital accounts are translated at their historical exchange rates when the capital transactions occurred.

Translation of amounts from HKD into USD has been made at the following exchange rates:

SCHEDULE OF FOREIGN CURRENCY EXCHANGE RATES

| March 31, 2024 |

September 30, 2023 |

March 31, 2023 |

||||||||||

| Period-end $: HK$ exchange rate | 7.8259 | 7.8308 | 7.8496 | |||||||||

| Period average $: HK$ exchange rate | 7.8172 | 7.8317 | 7.8930 | |||||||||

Cash and cash equivalents

Cash and cash equivalents represent cash on hand and time deposits, which are unrestricted as to withdrawal or use, and which have original maturities less than three months.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Deposits and other current assets, net

Deposits are mainly for rent, utilities and money deposited with certain vendors. These amounts are refundable and bear no interest. The short-term deposits usually have a one-year term and are refundable upon contract termination. The long-term deposits are refunded from suppliers when terms and conditions set forth in the agreements have been satisfied.

Other current assets, net, primarily consists of other receivables from third parties. These amounts are non-refundable, unsecured and bear no interest. Management reviews periodically to determine if the allowance is adequate and adjusts the allowance when necessary.

As of March 31, 2024 and September 30, 2023, the Company made $56 and $56 allowance for expected credit losses for deposit and other current assets, respectively.

Property and equipment, net

Property and equipment are carried at cost less accumulated depreciation and any impairment losses. Depreciation is provided over their estimated useful lives, using the straight-line method. The Company typically applies a salvage value of 0%. The estimated useful lives of the plan and equipment are as follows:

SCHEDULE OF ESTIMATED USEFUL LIVES OF PROPERTY AND EQUIPMENT

| Furniture and fixtures | 4 years | |

| Office equipment | 4 years | |

| Motor vehicle | 5 years |

The cost and related accumulated depreciation of assets sold or otherwise retired are eliminated from the accounts, and any gain or loss are included in the Company’s unaudited condensed consolidated statements of operations and comprehensive income. The costs of maintenance and repairs are recognized as incurred; significant renewals and betterments are capitalized.

Intangible assets, net

Intangible assets purchased from third parties are initially recorded at cost and amortized on a straight-line basis over the estimated economic useful lives. The acquired intangible assets are recognized and measured at fair value and are expensed or amortized using the straight-line approach over the estimated economic useful lives of the assets. The Company typically applies a salvage value of 0%.

The estimated useful lives of major intangible assets are as follows:

SCHEDULE OF ESTIMATED USEFUL LIVES OF MAJOR INTANGIBLE ASSETS

| Website | 4 years | |

| Patent | 4 years |

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Impairment of long-lived assets

Long-lived assets, representing property and equipment and intangible assets with finite lives are reviewed for impairment whenever events or changes in circumstances (such as a significant adverse change to market conditions that will impact the future use of the assets) indicate that the carrying value of an asset may not be recoverable. We assess the recoverability of the assets based on the undiscounted future cash flows the assets are expected to generate and recognize an impairment loss when estimated undiscounted future cash flows expected to result from the use of the asset plus net proceeds expected from disposition of the asset, if any, are less than the carrying value of the asset. If an impairment is identified, we would reduce the carrying amount of the asset to its estimated fair value based on a discounted cash flows approach or, when available and appropriate, to comparable market values. As of March 31, 2024 and September 30, 2023, no impairment of long-lived assets was recognized.

Deferred IPO costs

Pursuant to ASC 340-10-S99-1, IPO costs directly attributable to an offering of equity securities are deferred and would be charged against the gross proceeds of the offering as a reduction of additional paid-in capital. These costs include underwriting fees related to the registration preparation, FINRA filing fees and Nasdaq filing fees.

Lease

Effective October 1, 2020, the Company adopted ASU 2016-02, “Leases” (Topic 842), and elected the practical expedients that do not require us to reassess: (1) whether any expired or existing contracts are, or contain, leases, (2) lease classification for any expired or existing leases and (3) initial direct costs for any expired or existing leases. For lease terms of twelve months or fewer, a lessee is permitted to make an accounting policy election not to recognize lease assets and liabilities. The Company also adopted the practical expedient that allows lessees to treat the lease and non-lease components of a lease as a single lease component.

Lease terms used to calculate the present value of lease payments generally do not include any options to extend, renew, or terminate the lease, as the Company does not have reasonable certainty at lease inception that these options will be exercised. The Company generally considers the economic life of its operating lease ROU assets to be comparable to the useful life of similar owned assets. The Company has elected the short-term lease exception, therefore operating lease ROU assets and liabilities do not include leases with a lease term of twelve months or less. Its leases generally do not provide a residual guarantee. The operating lease ROU asset also excludes lease incentives. Lease expense is recognized on a straight-line basis over the lease term.

As of March 31, 2024 and September 30, 2023, there were approximately $240,757 and $325,153 right of use (“ROU”) assets and approximately $240,757 and $325,109 lease liabilities based on the present value of the future minimum rental payments of leases, respectively. The Company’s management believes that using an incremental borrowing rate of the Hong Kong Dollar Best Lending Rate (“BLR”) 5.875% (2023: 5.875%) plus Margin 1.500% p.a. was the most indicative rate of the Company’s borrowing cost for the calculation of the present value of the lease payments; the rate used by the Company was 7.375% (2023: 7.375%).

Bank loans

Bank loans are initially recognized at fair value, net of upfront fees incurred. Bank loans are subsequently measured at amortized cost. Any difference between the proceeds (net of transaction costs) and the redemption amount is recognized in profit or loss over the period of the loan using the effective interest method.

Accounts payable

Accounts payable represents trade payables to vendors.

Accrued liabilities and other payables

Accrued liabilities and other payables primarily include salaries payable, accrual and other payable.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Related parties

The Company adopted ASC 850, Related Party Disclosures, for the identification of related parties and disclosure of related party transactions.

Recent accounting pronouncements

In October 2021, the FASB issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, which requires entities to recognize and measure contract assets and contract liabilities acquired in a business combination in accordance with ASU 2014-09, Revenue from Contracts with Customers (Topic 606). The update will generally result in an entity recognizing contract assets and contract liabilities at amounts consistent with those recorded by the acquiree immediately before the acquisition date rather than at fair value. The new standard is effective on a prospective basis for fiscal years beginning after December 15, 2022, with early adoption permitted. This standard is effective for the Company on October 1, 2023 and the Company does not expect a significant impact to the consolidated financial statements upon adoption. However, the ultimate impact is dependent upon the size and frequency of future acquisitions.

The Company does not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on the Company’s unaudited condensed consolidated balance sheets, statement of operations and comprehensive income and statement of cash flows.

Revenue Recognition

Effective October 1, 2020, the Company adopted ASC 606 “Revenue from Contracts with Customers”, which replaced ASC Topic 605, using the modified retrospective method of adoption. Results for reporting periods beginning after October 1, 2020 are presented under ASC Topic 606 while prior period amounts are not adjusted and continue to be presented under the Company’s historic accounting under ASC Topic 605. The Company’s accounting for revenue remains substantially unchanged. There were no cumulative effect adjustments for service contracts in place prior to October 1, 2020. The effect from the adoption of ASC Topic 606 was not material to the Company’s unaudited condensed consolidated financial statements.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition (continued)

The five-step model defined by ASC Topic 606 requires the Company to:

| 1. | identify its contracts with customers; | |

| 2. | identify its performance obligations under those contracts; | |

| 3. | determine the transaction prices of those contracts; | |

| 4. | allocate the transaction prices to its performance obligations in those contracts; and | |

| 5. | recognize revenue when each performance obligation under those contracts is satisfied. Revenue is recognized when promised services are transferred to the client in an amount that reflects the consideration expected in exchange for those services. |

The Company enters into service agreements with its customers that outline the rights, responsibilities, and obligations of each party. The agreements also identify the scope of services, service fees, and payment terms. Agreements are acknowledged and signed by both parties. All the contracts have commercial substance, and it is probable that the Company will collect considerations from its customers for service component.

The Company currently generates its revenue from the following:

Revenue from provision of digital media advertising and marketing production services

The Company provides digital media advertising and marketing production services to its customers by designing animations, creating virtual reality contents, tailoring virtual avatar characters, providing virtual apparel technology services and arranging physical and online display. The Company typically enter into service contracts with its customers which will set forth the terms and conditions including the transaction price, services to be delivered, terms of delivery, and terms of payment. Service contracts are fixed priced with no variable consideration and are typically satisfied in one year or less. The terms serve as the basis of the performance obligations that the Company must fulfill in order to recognize revenue. The key performance obligation is identified as a single performance obligation where display of finished contents to the public or targeted audiences at the physical location or online platform specified by the customer indicates that the Company has completed all the services agreed upon in the service contract. The Company assesses that content production and content display services is considered as one performance obligation as the clients do not obtain benefit for each separate service. The Company therefore recognizes revenue at a point in time when finished contents are accepted by customers and published. Typically, the Company collects approximately 40% of contract sum upfront, with the remaining balance collected in two to three installments based on milestones and project completion.

Significant accounts related to the revenue cycle are as follows:

Cost of revenues

Cost of revenue consists primarily of personnel costs (including base pay and benefits) and subcontracting cost for consultancy and production services which are directly related to revenue generating transactions.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition (continued)

Accounts receivable, net

Accounts receivable represents trade accounts due from customers. The trade receivables are all without customer collateral and interest is not accrued on past due accounts. Management reviews its receivables on a regular basis to determine if the allowance for expected credit losses is adequate and provides allowance when necessary. The allowance is based on management’s best estimates of specific losses on individual customer exposures, as well as the historical trends of collections. Account balances are charged off against the allowance after all means of collection have been exhausted and the likelihood of collection is not probable. As of March 31, 2024 and September 30, 2023, the Company made $8,167 and $21,191 allowance for expected credit losses for accounts receivable, respectively.

Contract Costs

Contract costs incurred during the production phases of the Company’s service contracts, are capitalized when the costs relate directly to the contract, are expected to be recovered, and generate or enhance resources to be used in satisfying the performance obligation and such deferred costs will be recognized upon the recognition of the related revenue. These costs primarily consist of procurement and material costs directly related to the contract. Contract costs are recognized as cost of revenue when performance obligation(s) is fulfilled and revenue is recognized concurrently.

The Company performs periodic reviews to assess the recoverability of the contract costs. The carrying amount of the asset is compared to the remaining amount of consideration. The Company expects to receive for the services to which the asset relates, less the costs that relate directly to providing those services that have not yet been recognized. If the carrying amount is not recoverable, an impairment loss is recognized. For the six months ended March 31, 2024 and for the year ended September 30, 2023, no impairment loss was recognized.

Contract liabilities

Contract liabilities represents payment advanced from customers. It is recognized when a payment is received from a customer before the Company transfers the related goods or services.

Contract liabilities are recognized as revenue when the Company performed its performance obligation(s) under the contract (i.e., transfers control of the related goods or services to the customer).

Expected credit loss

ASU No. 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments requires entities to use a current lifetime expected credit loss methodology to measure impairments of certain financial assets. Using this methodology will result in earlier recognition of losses than under the current incurred loss approach, which requires waiting to recognize a loss until it is probable of having been incurred. There are other provisions within the standard that affect how impairments of other financial assets may be recorded and presented, and that expand disclosures. The Company adopted the new standard effective October 1, 2020, the first day of the Company’s fiscal year and applied to accounts receivable and other financial instruments. The adoption of this guidance did not materially impact the net earning and financial position and has no impact on the cash flows.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Revenue Recognition (continued)

The details of revenue and cost of revenue of the Company is as follows:

SCHEDULE OF DETAILS OF REVENUE AND COST OF REVENUE

| Six Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenue | 2,047,889 | 1,345,145 | ||||||

| Cost of Revenue | (1,493,014 | ) | (1,020,594 | ) | ||||

| Gross Profit | $ | 554,875 | $ | 324,551 | ||||

| Gross Profit Margin | 27.1 | % | 24.1 | % | ||||

Government Grant

Government grants as the compensation for expenses already incurred or for the purpose of giving immediate financial support to the Company during the COVID-19 pandemic. Government grants are recognized when received and all the conditions for their receipt have been met. The grants received were $nil and $23,339 for the six months ended March 31, 2024 and 2023, respectively from the Hong Kong SAR Government.

General and administrative expenses

General and administrative expenses consist primarily of personnel-related compensation expenses, including salaries and related Mandatory Provident Fund (“MPF”) costs for our operations and support personnel, carpark rental and property management fees, professional services fees, depreciation, travelling expenses, office supplies, utilities, communication and expenses related to general operations.

Selling and marketing expenses

Selling and marketing expenses consist primarily of promotion expenses and media expense.

Retirement benefits

Retirement benefits in the form of mandatory defined contribution plans are charged to either expense as incurred or allocated to wages as part of cost of revenues.

Income Taxes

The Company accounts for income taxes pursuant to ASC Topic 740, Income Taxes. Income taxes are provided on an asset and liability approach for financial accounting and reporting of income taxes. Any tax paid by subsidiaries during the period is recorded. Current tax is based on the profit or loss from ordinary activities adjusted for items that are non-assessable or disallowable for income tax purpose and is calculated using tax rates that have been enacted or substantively enacted at the balance sheet date. ASC Topic 740 also requires the recognition of deferred tax assets and liabilities for both the expected impact of differences between the financial statements and the tax basis of assets and liabilities, and for the expected future tax benefit to be derived from tax losses and tax credit carry-forwards. ASC Topic 740 additionally requires the establishment of a valuation allowance to reflect the likelihood of realization of deferred tax assets. Realization of deferred tax assets are dependent upon future earnings, if any, of which the timing and amount are uncertain.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Income Taxes (continued)

The Company adopted ASC Topic 740-10-05, “Income Taxes: Overview and Background”, which provides guidance for recognizing and measuring uncertain tax positions, it prescribes a threshold condition that a tax position must meet for any of the benefits of the uncertain tax position to be recognized in the financial statements. It also provides accounting guidance on derecognizing, classification and disclosure of these uncertain tax positions.

Comprehensive Income

The Company presents comprehensive income in accordance with ASC Topic 220, Comprehensive Income. ASC Topic 220 states that all items that are required to be recognized under accounting standards as components of comprehensive income be reported in the unaudited condensed consolidated financial statements. The components of comprehensive income were the net income for the periods and the foreign currency translation adjustments.

The Company computes earnings per share (“EPS”) following ASC Topic 260, “Earnings per share.” Basic EPS is measured as the income or loss available to common shareholders divided by the weighted average common shares outstanding for the period. Diluted EPS presents the dilutive effect on a per-share basis from the potential conversion of convertible securities or the exercise of options and or warrants; the dilutive impacts of potentially convertible securities are calculated using the as-if method; the potentially dilutive effect of options or warranties are computed using the treasury stock method. Potentially anti-dilutive securities (i.e., those that increase income per share or decrease loss per share) are excluded from diluted EPS calculation. There were no potentially dilutive securities that were in-the-money that were outstanding during the six months ended March 31, 2024 and 2023.

Segment Reporting

ASC 280, “Segment Reporting”, establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organizational structure as well as information about geographical areas, business segments and major customers in financial statements for detailing the Company’s business segments.

The Company’s chief operating decision maker is the Chief Executive Officer, who reviews the financial information of each separate operating segment when making decisions about allocating resources and assessing the performance of the segment. The Company has determined that it has a single operating segment for purposes of allocating resources and evaluating financial performance; accordingly, the Company does not provide additional segment reporting in these accompanying notes.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Financial instruments

The Company’s financial instruments, including cash and cash equivalents, accounts and other receivables, accounts and other payables, accrued liabilities, amounts due from (to) related parties and lease liabilities, have carrying amounts that approximate their fair values due to their short maturities. ASC Topic 820, “Fair Value Measurements and Disclosures” requires disclosing the fair value of financial instruments held by the Company. ASC Topic 825, “Financial Instruments” defines fair value and establishes a three-level valuation hierarchy for disclosures of fair value measurement that enhances disclosure requirements for fair value measures. The carrying amounts reported in the unaudited condensed consolidated balance sheets for cash and cash equivalents, accounts and other receivables, accounts and other payables, accrued liabilities and amounts due from (to) related parties, each qualify as financial instruments and are a reasonable estimate of their fair values because of the short period between the origination of such instruments and their expected realization and their current market rate of interest. The three levels of valuation hierarchy are defined as follows:

| ● | Level 1 - inputs to the valuation methodology used quoted prices for identical assets or liabilities in active markets. |

| ● | Level 2 - inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets and information that are observable for the asset or liability, either directly or indirectly, for substantially the financial instrument’s full term. |

| ● | Level 3 - inputs to the valuation methodology are unobservable and significant to the fair value measurement. |

The Company analyzes all financial instruments with features of both liabilities and equity under ASC 480, “Distinguishing Liabilities from Equity” and ASC 815, “Derivatives and Hedging”.

NOTE 3 – ACCOUNTS RECEIVABLE, NET

Accounts receivable, net consists of the following:

SCHEDULE OF ACCOUNTS RECEIVABLE, NET

| March 31, 2024 |

September 30, 2023 |

|||||||

| Accounts receivable | $ | 669,488 | $ | 568,940 | ||||

| Less: allowance for expected credit loss | (57,740 | ) | (49,573 | ) | ||||

| Accounts receivable, net | $ | 611,748 | $ | 519,367 | ||||

The movement of allowances for expected credit loss is as follow:

SCHEDULE OF ALLOWANCES OF EXPECTED CREDIT LOSS

| March 31, 2024 |

September 30, 2023 |

|||||||

| Balance at beginning of the period | $ | 49,573 | $ | 28,382 | ||||

| Provision | 8,167 | 21,191 | ||||||

| Ending balance | $ | 57,740 | $ | 49,573 | ||||

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 4 – CONTRACT COSTS

Contract costs consist of the following:

SCHEDULE OF CONTRACT COSTS

| March 31, 2024 |

September 30, 2023 |

|||||||

| Balance at the beginning of period | $ | - | $ | 171,261 | ||||

| Additions | - | 212,499 | ||||||

| Recognized to cost of revenue during the period | - | (383,760 | ) | |||||

| Balance at the end of period | $ | - | $ | - | ||||

NOTE 5 – DEPOSITS AND OTHER CURRENT ASSETS, NET

Deposits and other current assets, net consist of the following:

SCHEDULE OF DEPOSITS AND OTHER CURRENT ASSETS NET

| March 31, 2024 |

September 30, 2023 |

|||||||

| Deposits | $ | 51,224 | $ | 51,193 | ||||

| Other current assets, net | 2,421 | 2,419 | ||||||

| Less: allowance for expected credit loss | (56 | ) | (56 | ) | ||||

| Deposits and other current assets | $ | 53,589 | $ | 53,556 | ||||

The movement of allowances for expected credit loss is as follow:

SCHEDULE OF MOVEMENT OF ALLOWANCES FOR EXPECTED CREDIT LOSS

| March 31, 2024 |

September 30, 2023 |

|||||||

| Balance at beginning of the period | $ | 56 | $ | 47 | ||||

| Provision | - | 9 | ||||||

| Ending balance | $ | 56 | $ | 56 | ||||

NOTE 6 – PROPERTY AND EQUIPMENT, NET

Property and equipment, net consist of the following:

SCHEDULE OF PROPERTY AND EQUIPMENT NET

| March 31, 2024 |

September 30, 2023 |

|||||||

| At cost: | ||||||||

| Office equipment | $ | 161,937 | $ | 161,581 | ||||

| Fixture and fittings | 100,085 | 99,848 | ||||||

| Motor vehicle | 52,294 | 52,170 | ||||||

| Exchange adjustment | 196 | 717 | ||||||

| Property and equipment, gross | 314,512 | 314,316 | ||||||

| Less: accumulated depreciation | (280,249 | ) | (268,341 | ) | ||||

| Total | $ | 34,263 | $ | 45,975 | ||||

Depreciation expense for the six months ended March 31, 2024 and 2023 was $11,753 and $10,616, respectively.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 7 – INTANGIBLE ASSETS, NET

Intangible assets, net consist of the following:

SCHEDULE OF INTANGIBLE ASSETS NET

| March 31, 2024 |

September 30, 2023 |

|||||||

| At cost: | ||||||||

| Website | $ | 21,709 | $ | 21,658 | ||||

| Patent | 20,048 | $ | 20,046 | |||||

| Exchange adjustment | 26 | $ | 53 | |||||

| Less: accumulated amortization | (22,457 | ) | $ | (17,223 | ) | |||

| Total | $ | 19,326 | $ | 24,534 | ||||

Amortization expense for the six months ended March 31, 2024 and 2023 was $5,229 and $5,178, respectively.

NOTE 8 – DEFERRED INITIAL PUBLIC OFFERING (“IPO”) COSTS

Deferred initial public offering (“IPO”) costs consist of the following:

SCHEDULE OF DEFERRED INITIAL PUBLIC OFFERING IPO COSTS

| March 31, 2024 |

September 30, 2023 |

|||||||

| Underwriting fee | $ | 80,000 | $ | 80,000 | ||||

| Nasdaq filing fee | 5,000 | 5,000 | ||||||

| FINRA filing fee | 2,750 | 2,750 | ||||||

| Total | $ | 87,750 | $ | 87,750 | ||||

NOTE 9 – CONTRACT LIABILITIES

Contract liabilities consists of the following:

SCHEDULE OF CONTRACT LIABILITIES

| March 31, 2024 |

September 30, 2023 |

|||||||

| Balance at beginning of period | $ | 7,943 | $ | 254,163 | ||||

| Additions | 965,310 | 586,860 | ||||||

| Recognized to revenue during the period | (938,713 | ) | (833,080 | ) | ||||

| Balance at the end of period | $ | 34,540 | $ | 7,943 | ||||

Contract liabilities represent the payment advanced from customers.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 10 – LEASES

The Company has an operating lease for office space. During the period, the Company recognized a right-of-use asset of $240,757, and a lease liability of $240,757 in accordance with ASC842, Leases. The lease agreement does not specify an explicit interest rate. The Company’s management believes that using an incremental borrowing rate of the Hong Kong Dollar Best Lending Rate (“BLR”) 5.875% plus Margin 1.500% p.a. was the most indicative rate of the Company’s borrowing cost for the calculation of the present value of the lease payments; the rate used by the Company was 7.375%.

As of March 31, 2024 and September 30, 2023, the right-of-use assets totalled $240,757, and $325,153, respectively.

As of March 31, 2024 and September 30, 2023, lease liabilities consist of the following:

SCHEDULE OF OPERATING LEASE LIABILITIES

| March 31, 2024 |

September 30, 2023 |

|||||||

| Operating lease liabilities – current portion | $ | 178,410 | $ | 172,066 | ||||

| Operating lease liabilities – non-current portion | 62,347 | 153,043 | ||||||

| Total | $ | 240,757 | $ | 325,109 | ||||

During the six months ended March 31, 2024 and 2023, the Company incurred total operating lease expenses of $84,693 and $84,409, respectively.

Other lease information is as follows:

SCHEDULE OF LEASE INFORMATION

| March 31, 2024 |

September 30, 2023 |

|||||||

| Weighted-average remaining lease term – operating leases | 16 months | 22 months | ||||||

| Weighted-average discount rate – operating leases | 7.375 | % | 7.375 | % | ||||

The following is a schedule of future minimum payments under operating leases as of March 31, 2024 and September 30, 2023:

SCHEDULE OF LEASE FUTURE MINIMUM PAYMENTS

|

March 31, 2024 |

September 30, 2023 |

|||||||

| Year ending September 30, 2024 | $ | 94,916 | $ | 189,712 | ||||

| Year ending September 30, 2025 | 158,192 | 158,094 | ||||||

| Total undiscounted lease obligations | 253,108 | 347,806 | ||||||

| Less: imputed interest | (12,351 | ) | (22,697 | ) | ||||

| Lease liabilities recognized in the unaudited condensed consolidated balance sheet | $ | 240,757 | $ | 325,109 | ||||

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 11 – ACCRUED LIABILITIES AND OTHER PAYABLES

Accrued liabilities and other payables consist of the following:

SCHEDULE OF ACCRUED LIABILITIES AND OTHER PAYABLES

| March 31, 2024 |

September 30, 2023 |

|||||||

| Accrued salary | $ | 105,569 | $ | 120,925 | ||||

| Amount due to third parties | 128,410 | 195,699 | ||||||

| Total | $ | 233,979 | $ | 316,624 | ||||

NOTE 12 – EQUITY

Ordinary shares

The Company was incorporated in the Cayman Islands as an exempted company with limited liability on July 29, 2022, with an authorized share capital of US$50,000 divided into 50,000,000 shares of US$0.001 each.

On February 22, 2023, 14,990,000 additional Shares of US$0.001 were issued and fully paid. The Company allotted 10,493,000 shares to Mr. Bun Kwai and 4,497,000 share to Lasting Success Holdings Limited. Immediately after the share allotment, the Company had 50,000,000 authorized shares, par value of US$0.001, of which 15,000,000 were issued and outstanding.

On May 17, 2023, the Company’s shareholders and Board of Directors approved to amend the authorized share capital from US$50,000, divided into 50,000,000 Ordinary Shares of a par value of US$0.001 per share, to US$50,000, divided into 500,000,000 Ordinary Shares of a par value of US$0.0001 per share. At the same day, the shareholders of the Company surrendered 135,000,000 Ordinary Shares of US$0.0001 par value each to the Company for no consideration. As a result, the Company has 500,000,000 authorized shares, par value of US$0.0001, of which 15,000,000 were issued and outstanding as of March 31, 2024 and September 30, 2023.

The Company only has one single class of Ordinary Shares that are accounted for as permanent equity.

On July 22, 2024, the Company consummated the Offering of 2,150,000 ordinary shares at a price to the public of $4.00 per share. On August 8, 2024, the Company further issued 56,342 ordinary shares at a price of $4.00 per share with underwriter partially exercised the over-allotment option. The aggregate gross proceeds from the Offering amounted to $8,825,368, prior to deducting underwriting discounts, commissions and offering-related expenses.

Upon the completion of the Offering, 17,206,342 Ordinary Shares are issued and outstanding.

NOTE 13 – EMPLOYEE BENEFIT PLANS

HK SAR

The Company has a defined contribution pension scheme for its qualifying employees. The scheme assets are held under a provident fund managed by an independent fund manager. The Company and its employees are each required to make contributions to the scheme calculated at 5% of the employees’ basic salaries on monthly basis.

NOTE 14 – PROVISION FOR INCOME TAXES

British Virgin Islands

QMMM Holdings Limited is incorporated in Cayman Islands and Grade A Global Limited and Witty Time Holdings Limited are incorporated in the British Virgin Islands and are not subject to tax on income or capital gains under current Cayman Islands law and British Virgin Islands law, respectively. In addition, upon payments of dividends by these entities to their shareholders, no withholding tax will be imposed.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 14 – PROVISION FOR INCOME TAXES (Continued)

HK SAR

On March 21, 2018, the HK SAR Legislative Council passed The Inland Revenue (Amendment) (No. 7) Bill 2017 (the “Bill”) which introduces the two-tiered profits tax rates regime. The Bill was signed into law on March 21, 2018 and was gazetted on the following day. Under the two-tiered profits tax rates regime, the first HK$2 million of profits of the qualifying group entity will be taxed at 8.25%, and profits above HK$2 million will be taxed at 16.5%. The profits of group entities not qualifying for the two-tiered profits tax rates regime will continue to be taxed at a flat rate of 16.5%.

Accordingly, the HK SAR profits tax is calculated at 8.25% on the first HK$2 million of the estimated assessable profits and at 16.5% on the estimated assessable profits above HK$2 million. The following tables provide the reconciliation of the difference between the statutory and effective tax expenses for the six months ended March 31, 2024 and 2023.

SCHEDULE OF RECONCILIATION OF PROVISION FOR INCOME TAXES

| March 31, | ||||||||

| 2024 | 2023 | |||||||

| Loss before tax expenses | $ | (142,213 | ) | $ | (602,867 | ) | ||

| Income taxes computed at Hong Kong Profits Tax rate | (23,465 | ) | (99,473 | ) | ||||

| Tax allowance at the statutory tax rates | (530 | ) | (3,967 | ) | ||||

| Tax effect on non-assessable income* | - | (4,997 | ) | |||||

| Tax effect on non-deductible expenses | 49,946 | 107,421 | ||||||

| Tax effect on tax losses not recognized | - | 19,226 | ||||||

| Tax effect on utilization of tax losses | (18,233 | ) | - | |||||

| Tax effect of two-tier tax rate | (3,859 | ) | (9,105 | ) | ||||

| Income taxes | $ | 3,859 | $ | 9,105 | ||||

| * | Income that is not taxable mainly consisted of government grants which are non-taxable under Hong Kong profits tax law for the six months ended March 31, 2024 and 2023. |

Significant component of deferred tax assets as follows:

SCHEDULE OF DEFERRED TAX ASSETS

|

March 31, 2024 |

September 30, 2023 |

|||||||

| Net operating loss carry forward | $ | 22,070 | $ | 40,257 | ||||

| Valuation allowance | (22,070 | ) | (40,257 | ) | ||||

| Deferred tax assets | $ | - | $ | - | ||||

In assessing the realizability of deferred tax assets, management consider whether it is more likely than not that some portion or all of the deferred tax assets will be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the periods in which those temporary differences become deductible. Management considers the cumulative earnings and projected future taxable income in making the assessment. Recovery of substantially all of the Company’s deferred tax assets is dependent upon the generation of future income, exclusive of reversing taxable temporary differences. The Company concludes that it cannot reliably predict future profitability, and accordingly, unable to determine if it can derive future benefits from the deferred tax assets arising from the net operating loss carry forward.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 15 – CONCENTRATIONS OF RISK

Customers Concentrations

The following table sets forth information as to each customer that accounted for top 5 of the Company’s revenues for the six months ended March 31, 2024 and 2023.

SCHEDULES OF CONCENTRATION OF RISK

| For the six months ended | ||||||||||||||||

| Customers | March 31, 2024 | March 31, 2023 | ||||||||||||||

| Amount $ | % | Amount $ | % | |||||||||||||

| A | 674,204 | 32.9 | % | - | - | |||||||||||

| B | 441,274 | 21.5 | % | 24,832 | 1.9 | % | ||||||||||

| C | 177,671 | 8.7 | % | - | - | |||||||||||

| D | 138,797 | 6.8 | % | 137,400 | 10.2 | % | ||||||||||

| E | 127,923 | 6.2 | % | - | - | |||||||||||

| F | - | - | 457,632 | 34.0 | % | |||||||||||

| G | - | - | 152,033 | 11.3 | % | |||||||||||

| H | - | - | 88,686 | 6.6 | % | |||||||||||

| I | 10,234 | 0.5 | % | 78,297 | 5.8 | % | ||||||||||

The following table sets forth information as to each customer that accounted for top 5 of the Company’s accounts receivable as of March 31, 2024 and September 30, 2023.

| Customers | March 31, 2024 | September 30, 2023 | ||||||||||||||

| Amount $ | % | Amount $ | % | |||||||||||||

| B | 351,180 | 52.5 | % | 213,193 | 37.5 | % | ||||||||||

| J | 76,668 | 11.5 | % | 127,701 | 22.4 | % | ||||||||||

| K | 71,302 | 10.7 | % | - | - | |||||||||||

| D | 68,363 | 10.2 | % | 64,757 | 11.4 | % | ||||||||||

| A | 35,242 | 5.3 | % | - | - | |||||||||||

| L | 2,556 | 0.4 | % | 76,867 | 13.5 | % | ||||||||||

| F | - | - | 36,906 | 6.5 | % | |||||||||||

Suppliers Concentrations

The following table sets forth information as to each supplier that accounted for top 5 of the Company’s purchase for the six months ended March 31, 2024 and 2023.

| For the six months ended | ||||||||||||||||

| Suppliers | March 31, 2024 | March 31,2023 | ||||||||||||||

| Amount $ | % | Amount $ | % | |||||||||||||

| M | 332,600 | 44.3 | % | - | - | |||||||||||

| N | 239,626 | 31.9 | % | - | - | |||||||||||

| O | 94,998 | 12.7 | % | - | - | |||||||||||

| P | 35,428 | 4.7 | % | - | - | |||||||||||

| Q | 13,816 | 1.8 | % | - | - | |||||||||||

| R | - | - | 91,853 | 28.3 | % | |||||||||||

| S | - | - | 74,749 | 23.0 | % | |||||||||||

| T | - | - | 36,819 | 11.3 | % | |||||||||||

| U | - | - | 23,438 | 7.2 | % | |||||||||||

| V | - | - | 15,203 | 4.7 | % | |||||||||||

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 16 – RISKS

| A. | Credit risk |

Accounts receivable

In order to minimize the credit risk, the management of the Company has delegated a team responsible for determination of credit limits and credit approvals. Other monitoring procedures are in place to ensure that follow-up action is taken to recover overdue debts. Internal credit rating has been given to each category of debtors after considering aging, historical observed default rates, repayment history and past due status of respective accounts receivable. Estimated loss rates are based on probability of default and loss given default with reference to an external credit report and are adjusted for reasonable and supportable forward-looking information that is available without undue costs or effort while credit-impaired trade balances were assessed individually. In this regard, the directors consider that the Company’s credit risk is significantly reduced. The maximum potential loss of accounts receivable for the six months ended March 31, 2024 is $611,748.

Bank balances

The credit risk on liquid funds is limited because the counterparties are banks with high credit ratings assigned by international credit-rating agencies. The Company is exposed to concentration of credit risk on liquid funds which are deposited with several banks with high credit ratings.

Deposits and other current assets

The Company assessed the impairment for its other current assets individually based on internal credit rating and ageing of these debtors which, in the opinion of the directors, have no significant increase in credit risk since initial recognition. Based on the impairment assessment performed by the Company, the directors consider the loss allowance for deposits and other current assets as of March 31, 2024 and September 30, 2023 is $56 and $56, respectively.

| B. | Interest risk |

Cash flow interest rate risk

The Company is exposed to cash flow interest rate risk through the changes in interest rates related mainly to the Company’s variable-rates line of credit, short-term bank loans and bank balances.

The Company currently does not have any interest rate hedging policy in relation to fair value interest rate risk and cash flow interest rate risk. The directors monitor the Company’s exposures on an ongoing basis and will consider hedging the interest rate should the need arises.

Sensitivity analysis

The sensitivity analysis below has been determined assuming that a change in interest rates had occurred at the end of the reporting period and had been applied to the exposure to interest rates for financial instruments in existence at that date. 1% increase or decrease is used when reporting interest rate risk internally to key management personnel and represents management’s assessment of the reasonably possible change in interest rates.

If interest rates had been 1% higher or lower and all other variables were held constant, the Company’s post tax loss for the six months ended March 31, 2024 and 2023 would have increased or decreased by approximately $2,189 and $566, respectively.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 16 – RISKS (Continued)

Foreign currency risk

Foreign currency risk is the risk that the holding of foreign currency assets will affect the Company’s financial position as a result of a change in foreign currency exchange rates.

The Company’s monetary assets and liabilities are mainly denominated in HK$, which are the same as the functional currencies of the relevant group entities. Hence, in the opinion of the directors of the Company, the currency risk of $ is considered insignificant. The Company currently does not have a foreign currency hedging policy to eliminate the currency exposures. However, the directors monitor the related foreign currency exposure closely and will consider hedging significant foreign currency exposures should the need arise.

| C. | Economic and political risks |

The Company’s operations are mainly conducted in HK SAR. Accordingly, the Company’s business, financial condition, and results of operations may be influenced by changes in the political, economic, and legal environments in HK SAR.

The Company’s operations in HK SAR are subject to special considerations and significant risks not typically associated with companies in North America and Western Europe. These include risks associated with, among others, the political, economic and legal environment and foreign currency exchange. The Company’s results may be adversely affected by changes in the political and social conditions in HK SAR, and by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion, remittances abroad, and rates and methods of taxation, among other things.

| D. | Inflation Risk |

Management monitors changes in prices levels. Historically inflation has not materially impacted the Company’s unaudited condensed consolidated financial statements; however, significant increases in the price of labor that cannot be passed to the Company’s customers could adversely impact the Company’s results of operations.

NOTE 17 – RELATED PARTY TRANSACTIONS

The summary of amount due to related parties as the following:

SCHEDULE OF AMOUNT DUE TO RELATED PARTIES

| March 31, 2024 |

September 30, 2023 |

|||||||||

| Due to related parties consist of the following: | ||||||||||

| Mr. Bun Kwai | Due to shareholders | 23,147 | 20,791 | |||||||

| Mr. Bun Kwai | Accrued liabilities and other payables | 10,861 | 10,855 | |||||||

| Mr. Chun San Leung* | Accrued liabilities and other payables | 2,214 | 2,107 | |||||||

| Mr. Pak Lun Patrick Au* | Accrued liabilities and other payables | 5,047 | 4,852 | |||||||

| MSB Infinitus Limited *** | Due to shareholders | 1,607,022 | 1,219,447 | |||||||

| $ | 1,648,291 | $ | 1,258,052 | |||||||

The amounts due to related parties are unsecured, interest free with no specific repayment terms.

| F- |

QMMM HOLDINGS LIMITED

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(Stated in US Dollars)

NOTE 17 – RELATED PARTY TRANSACTIONS (Continued)

In addition to the transactions and balances detailed elsewhere in these unaudited condensed consolidated financial statements, the Company had the following transactions with related parties:

| For the six months ended | ||||||||

| March 31, | ||||||||

| 2024 | 2023 | |||||||

| Service fee to Cubic Creation Limited** | - | 48,218 | ||||||

| Salary to Mr. Bun Kwai | 66,210 | 55,492 | ||||||

| Salary to Mr. Chun San Leung* | 13,303 | - | ||||||

| Salary to Mr. Pak Lun Patrick Au* | 30,327 | 20,018 | ||||||

| * | Mr. Chun San Leung and Mr. Pak Lun Patrick Au are the directors of QMMM Holdings Limited |

| ** | Cubic Creations Limited is fully owned by Mr. Chun San Leung |

| *** | MSB Infinitus Limited is the sole shareholder of Lasting Success Holdings Limited which is a shareholder of the Company |

NOTE 18 – COMMITMENTS AND CONTINGENCIES

Contingencies

In the ordinary course of business, the Company may be subject to legal proceedings regarding contractual and employment relationships and a variety of other matters. The Company records contingent liabilities resulting from such claims, when a loss is assessed to be probable, and the amount of the loss is reasonably estimable. In the opinion of management, there were no pending or threatened claims and litigation as of March 31, 2024 and through the issuance date of these unaudited condensed consolidated financial statements.

NOTE 19 – SUBSEQUENT EVENTS

The Company has assessed all events from March 31, 2024, through August 26, 2024 which is the date that these unaudited condensed consolidated financial statements are available to be issued. Unless as disclosed below, there are not any material subsequent events that require disclosure in these unaudited condensed consolidated financial statements.

Completion of initial public offering

On July 22, 2024, the Company consummated the Offering of 2,150,000 ordinary shares at a price to the public of $4.00 per share. On August 8, 2024, the Company further issued 56,342 ordinary shares at a price of $4.00 per share with underwriter partially exercised the over-allotment option. The aggregate gross proceeds from the Offering amounted to $8,825,368, prior to deducting underwriting discounts, commissions and offering-related expenses.

Due to shareholders

Up to the date that these unaudited condensed consolidated financial statements are available to be issued, of the $1,630,169 due to shareholders balance as of March 31, 2024, $1,607,022 was repaid by the Company.

| F- |