UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 18, 2024

MGO Global Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41592 | 83-1833607 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

1515 SE 17th Street, Suite 121/#460236 Fort Lauderdale, Florida |

33346 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (347) 913-3316

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.00001 par value | MGOL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

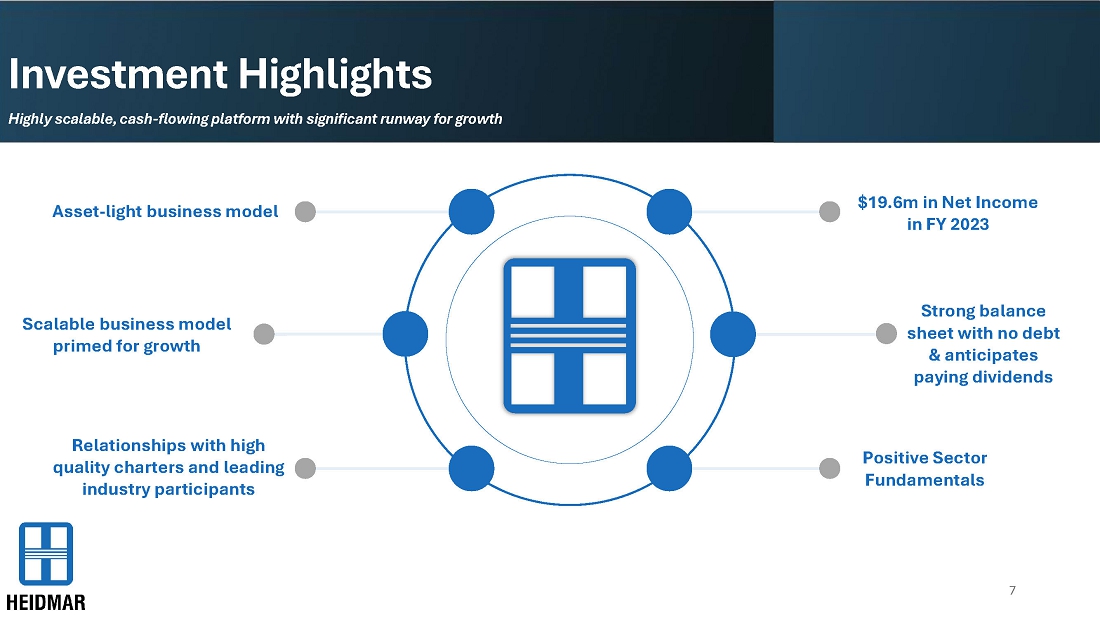

Exhibit 99.1 to this Current Report on Form 8-K contains additional information relating to the Business Combination, Holdings and HMI, including risk factors relating to the Business Combination, Holdings and HMI, HMI’s management’s discussion and analysis of financial condition and results of operations, a description of HMI’s business, and the consolidated financial statements of HMI. Stockholders of the Company and other interested parties are encouraged to carefully read this report, including the information attached hereto and all of the exhibits hereto, because they contain important information about the Business Combination, Holdings and HMI. Capitalized but undefined terms used above are as defined below in Item 1.01.

Item 1.01. Entry into a Material Definitive Agreement.

Business Combination Agreement

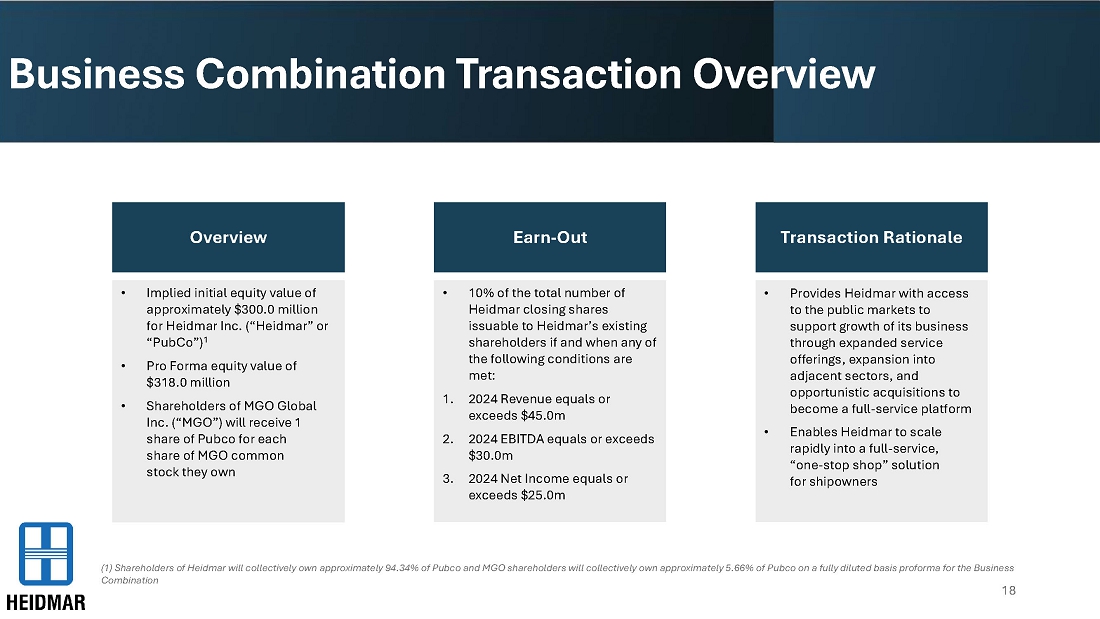

On June 18, MGO Global, Inc., a Delaware corporation (the “Company” or “MGO”) entered into a definitive Business Combination Agreement and Plan of Merger (the “Business Combination Agreement”) with Heidmar, Inc., (“HMI”), a company organized under the laws of the Republic of the Marshall Islands, Heidmar Maritime Holdings Corp., a company organized under the laws of the Republic of the Marshall Islands (“Holdings”), and HMR Merger Sub Inc., a Delaware corporation and wholly-owned subsidiary of Holdings (“Merger Sub”), and Rhea Marine Ltd. and Maistros Shipinvest Corp (the “HMI Shareholders”). The Company, Merger Sub, Holdings, HMI and HMI Shareholders are sometimes referred to herein individually as a “Party” and, collectively, as the “Parties.”

Business Combination

Pursuant to the Business Combination Agreement, the Parties will effect a business combination involving the following transactions (collectively, the “Business Combination”):

| (a) | Merger Sub will merge (the “Merger”) with and into the MGO, with MGO continuing as the surviving entity and a wholly owned subsidiary of Holdings; | |

| (b) | all of the issued and outstanding shares of common stock of MGO (the “MGO Common Stock”) prior to the effective time of the Merger will be converted into the right to receive common shares of Holdings (the “Holdings Common Shares”) on a one-for-one basis; | |

| (c) | immediately after the effective time of the Merger, the HMI Shareholders will transfer all the outstanding shares of common stock of HMI (the “HMI Shares”) to Holdings (the “HMI Share Acquisition”), with HMI becoming a wholly owned subsidiary of Holdings; and | |

| (d) | Holdings shall issue to the HMI Shareholders (i) at the closing of the Business Combination (the “Closing”), a number of Holdings Common Shares equal to (x) the number of the Company’s outstanding shares of common stock on a fully diluted and as-converted basis immediately prior to the effective time of the Merger, times (y) 16.6667, divided by (z) the number of outstanding HMI Shares immediately prior to the HMI Share Acquisition and (ii) after the Closing and upon the satisfaction of certain earnout conditions set forth in the Business Combination Agreement, additional Holdings Common Shares equal to 10% of the shares issued to the Heidmar Shareholders on the Closing. |

MGO expects that the holders of MGO Common Stock and the Heidmar Shareholders will hold 5.66% and 94.34% (inclusive of shares to be distributed to advisors), respectively, of the Holdings Common Shares after the Closing.

|

|

Representations and Warranties; Covenants

Pursuant to the Business Combination Agreement, the Parties (other than Merger Sub) made customary representations and warranties for transactions of this type. All of the representations and warranties of the Company, Holdings and HMI will survive Closing for a period of two years after Closing. The covenants and agreements of the Company, Holdings and HMI that by their terms are to be performed prior to the Closing or otherwise relate solely to the period prior to the Closing shall, in each case, terminate at the Closing. The covenants and agreements of the Company, Holdings and HMI that by their terms are to be performed at or after the Closing shall, in each case, survive until fully performed. In addition, the parties to the Business Combination Agreement agreed to be bound by certain covenants that are customary for transactions of this type, including obligations of the parties during the period (the “Interim Period”) between the date of the execution of the Business Combination Agreement and the Closing to use commercially reasonable efforts to operate their respective businesses in the ordinary course, and to refrain from taking certain specified actions without the prior written consent of the other party, in each case, subject to certain exceptions and qualifications.

Closing Conditions

Pursuant to the Business Combination Agreement, the obligations of the parties to consummate the Business Combination are subject to the satisfaction or waiver of certain customary closing conditions of the respective parties, including, without limitation: (i) the representations and warranties of the Company, HMI and the HMI Shareholders being true and correct subject to the materiality standards contained in the Business Combination Agreement; (ii) material compliance by the Parties of their respective pre-closing covenants and agreements, subject to the standards contained in the Business Combination Agreement; (iii) the approval by the Company’s stockholders of the Business Combination; (iv) the absence of any Material Adverse Effect (as defined in the Business Combination Agreement) with respect to HMI since the effective date of the Business Combination Agreement that is continuing and uncured; (v) the expiration or termination, as applicable, of any waiting period (and any extension thereof) applicable to the consummation of the Business Combination Agreement under any antitrust laws; (vi) no governmental authority of competent jurisdiction shall have enacted any law or order in effect at the time of Closing which has the effect of making the Business Combination or other ancillary transactions illegal or otherwise prohibiting consummation of the Business Combination or ancillary transactions (a “Legal Restraint”); (vii) the Registration Statement (as defined below) being declared effective by the U.S. Securities and Exchange Commission (the “SEC”); (viii) the articles of incorporation and bylaws of Holdings have been amended and restated as set forth in an exhibit to the Business Combination Agreement; (ix) the entry into certain ancillary agreements as of the Closing; (x) the approval of the listing of the Holdings Common Shares on Nasdaq (or such other national securities exchange), and (xi) the receipt of certain closing deliverables.

The Company’s Conduct of Business During the Interim Period

During the Interim Period, the conduct of the Company’s business will be subject to the restrictions contained in the Business Combination Agreement, which include restrictions on: (i) amending, waiving or otherwise changing its certificate of incorporation or bylaws of other than with respect to administrative or de minimis changes; (ii) issuing, granting selling, pledging or disposing its equity securities; (iii) except as necessary to maintain the Company’s listing on Nasdaq, taking corporate actions such as stock splits, combinations, recapitalizations, subdivisions or pay any dividends or make any other distributions on its equity or redeem, purchase or otherwise acquire any of its securities; (iv) incurring or guaranteeing any indebtedness not made in the ordinary course of business; (v) terminating, waiving or assigning any material right under any material agreement to which the Company is a party or entering into any material contract; (vi) establishing a new subsidiary or new line of business; (vii) failing to keep in force insurance policies or coverage; (viii) waiving, releasing, assigning, settling or compromising litigation in excess of $25,000; (ix) mergers and acquisitions activity; (x) adopting a plan of liquidation, dissolution, merger, consolidation, restructuring, recapitalization or other reorganization; (xi) entering into any agreement, understanding or arrangement with respect to the voting or transfer of its equity securities (other than the voting agreements that are contemplated by the Business Combination Agreement); (xii) taking certain actions described in the Business Combination Agreement related to taxes; (xiii) hiring employees and adopting benefit plans; entering into, amending waiving or terminating (other than terminations in accordance with their terms) any transaction with any related party to the Company (other than compensation and benefits and advancement of expenses, in each case, provided in the ordinary course of business; and (xiv) authorizing or agreeing to taking any of the foregoing actions.

Notwithstanding the foregoing restrictions on the Company’s activities, pursuant to the Business Combination Agreement, during the Interim Period and prior to the Closing, the Company will be permitted to to raise up to $6,000,000 in capital through the offer and sale of shares of MGO Common Stock to pay all of the costs associated with the transactions contemplated by the Business Combination Agreement, provide its operating subsidiary with working capital and make up to $1,500,000 in severance payments to directors and officers of the Company. The amount of capital raised by the Company will have no impact on the aggregate ownership percentage of Holdings by the holders of MGO Common Stock or the Heidmar Shareholders immediately following the Business Combination.

|

|

Indemnification by the Company and the MGO Principals

Subject to certain limitations contained in the Business Combination Agreement, the Company will indemnify Holdings, HMI, the HMI Shareholders and each of their affiliates (i) during the Interim Period for up to $4,000,000 for any claims made during the Interim Period arising out of the Company’s capital raises made during the Interim Period and for up to $300,000 for certain threatened litigation claims made during the Interim Period and (ii) after the Closing for damages incurred by the HMI Shareholders as a result of breaches by the Company of representations warranties and covenants under the Business Combination Agreement. The sole source of the payment of post-Closing indemnity claims will be an additional 20,408,163 Holdings Common Shares that are held in reserve for making indemnity payments by issuing such shares to HMI Shareholders as set forth in the Business Combination Agreement. To the extent these shares are not issued to cover post-Closing indemnity claims within the second anniversary of the Closing, these shares will be cancelled.

Indemnification by Holdings

Subject to certain limitations contained in the Business Combination Agreement, after the Closing and until the second anniversary thereof, Holdings will indemnify the MGO Principals (as defined below) for damages incurred by the Company as a result of breaches by the Holdings or HMI of representations warranties and any breaches by Holdings, HMI or Merger Sub of any covenants or agreements under the Business Combination Agreement up to the VWAP determined value of 50% of the Holdings Shares they receive at the Closing as set forth in the Business Combination Agreement.

Post-Closing Board of Directors and Officers of Holdings

The board of directors and officers of Holdings after the Closing shall be comprised of individuals determined by HMI prior to the Closing. None of the current officers or directors of the Company will be officers or directors of MGO after the Closing.

Termination

The Business Combination Agreement may be terminated time prior to the Closing, including, among others, (i) by the mutual written consent of the Company and HMI, (ii) by written notice by the Company or HMI if any of the conditions to the Closing have not been satisfied or waived by December 31, 2024; (iii) by written notice by either the Company or HMI to the other if a Legal Restraint has become final and non-appealable; (iv) by written notice by HMI to the Company if there has been certain specified breaches by the Company of any of its representations, warranties, covenants or agreements contained in the Business Combination Agreement, or if any representation or warranty of the Company shall have become untrue or inaccurate; (v) by written notice by HMI to the Company if during the Interim Period (a) Company receives a notice of delisting from Nasdaq and Company is not reasonably able to cure the deficiency that is the subject of the notice of delisting within three months of the date of the notice of delisting, or (b) the Company files a Form 25, or is formally delisted from Nasdaq and the Company shares cease trading on Nasdaq; (vi) by written notice by the Company to HMI if (a) there has been certain specified breaches by HMI, the HMI Shareholders or Holdings of any of their respective representations, warranties, covenants or agreements contained in the Business Combination Agreement, or if any representation or warranty of such Parties shall have become untrue or inaccurate; or (viii) by written notice by either the Company or HMI to the other if a special stockholder meeting is held for the purpose of approving the Business Combination Agreement and such approval is not obtained at such meeting.

The foregoing description of the Business Combination Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Business Combination Agreement filed as Exhibit 2.1 to this Current Report on Form 8-K and incorporated herein by reference. The Business Combination Agreement provides investors with information regarding its terms and is not intended to provide any other factual information about the parties. In particular, the assertions embodied in the representations and warranties contained in the Business Combination Agreement were made as of the execution date of the Business Combination Agreement only and are qualified by information in confidential disclosure schedules provided by the parties in connection with the signing of the Business Combination Agreement. These disclosure schedules contain information that modifies, qualifies, and creates exceptions to the representations and warranties set forth in the Business Combination Agreement. Moreover, certain representations and warranties in the Business Combination Agreement may have been used for the purpose of allocating risk between the parties rather than establishing matters of fact. Accordingly, you should not rely on the representations and warranties in the Business Combination Agreement as characterizations of the actual statements of fact about the parties. Any terms not defined herein shall have the same meaning attributed to them in the Business Combination Agreement.

|

|

Fairness Opinion

The Company has obtained an independent fairness opinion from Newbridge Securities Corporation dated June 18, 2024, which states that in the opinion of Newbridge Securities Corporation, based on Holdings having a value of $300 million, the number of Holdings Common Shares issued to the Company’s stockholders in exchange for their shares of MGO Common Stock is fair, from a financial point of view, to the Company’s stockholders.

Voting and Support Agreement

In connection with entry into the Business Combination Agreement, the Company and Holdings will enter into voting and support agreements with certain shareholders of MGO (the “MGO Principals”) currently representing in aggregate approximately 61.28% of the issued and outstanding shares of the Company. Pursuant to the Voting and Support Agreements, each MGO Principals will agree, among other things, to vote its shares in favor of approval of the Business Combination Agreement, the Business Combination and the other transactions contemplated thereby.

The foregoing description is only a summary of the voting and support agreements and is qualified in its entirety by reference to the full text of the form of voting and support agreement, which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Lock-Up/Leak-Out Agreement

All Company directors, officers and affiliates and the HMI Shareholders shall, prior to the Closing. enter into lock-up/leak-out agreements with Holdings, pursuant to which they will agree not to sell or otherwise transfer their Holdings Common Shares for four months after the Closing and to limit the aggregate of their the aggregate of transfers of shares on any trading day in the subsequent two months to 10% of the trading volume of Holdings Common Shares on the prior trading day as reported by Bloomberg; provided, that beginning on the day the closing price of Holdings Common Shares is at least $2.29 per share for 10 out of 30 trading days following the Closing, each such person shall be permitted to sell or otherwise transfer 25% of the Holdings Common Shares such person holds.

The foregoing description is only a summary of the lock-up/leak out agreements and is qualified in its entirety by reference to the full text of the form of lock-up/leak out agreement, which is filed as Exhibit 10.2 hereto and incorporated by reference herein.

Prospectus and Proxy Statement

As promptly as practicable after the effective date of the Business Combination Agreement, Holdings will file with the SEC a Registration Statement on Form F-4 registering the Holdings Common Shares (the “Registration Statement”) and containing a prospectus and proxy statement (as amended or supplemented, the “Prospectus and Proxy Statement”) to be delivered to the Company’s stockholders in connection with a special meeting of the Company’s stockholders to consider approval and adoption of (i) the Business Combination Agreement and the Business Combination; and (ii) such other matters as the parties mutually determine to be necessary or appropriate in order to effect the Business Combination (the approvals described in foregoing clauses (i) through (iii), collectively, the “Stockholder Approval Matters”); and (iv) the adjournment of the special meeting of the Company’s stockholders, if necessary, to permit further solicitation and vote of proxies in the reasonable determination of the Company.

Additional Information and Where to Find It

As discussed above, Holdings intends to file the Prospectus and Proxy Statement with the SEC, which Prospectus and Proxy Statement will be delivered to the Company’s stockholders once definitive. This document does not contain all the information that should be considered concerning the Business Combination and the other Stockholder Approval Matters and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination and the other Stockholder Approval Matters. THE COMPANY’S STOCKHOLDERS AND OTHER INTERESTED PERSONS ARE ADVISED TO READ, WHEN AVAILABLE, THE PROSPECTUS AND PROXY STATEMENT AND THE AMENDMENTS THERETO AND OTHER DOCUMENTS FILED IN CONNECTION WITH THE BUSINESS COMBINATION AND OTHER STOCKHOLDER APPROVAL MATTERS, AS THESE MATERIALS WILL CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY, HOLDINGS, HMI, THE MERGER SUB, THE BUSINESS COMBINATION AND THE OTHER STOCKHOLDER APPROVAL MATTERS. When available, the Prospectus and Proxy Statement and other relevant materials for the Business Combination and other Stockholder Approval Matters will be mailed to stockholders of the Company as of a record date to be established for voting on the Business Combination and the other Stockholder Approval Matters. Stockholders will also be able to obtain copies of the Prospectus and Proxy Statement and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov.

|

|

No Offer or Solicitation

This Current Report on Form 8-K is for informational purposes only and is not intended to and shall not constitute a proxy statement or the solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Business Combination and is not intended to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

The Business Combination May Not Occur

The consummation of the Business Combination is subject to numerous closing conditions described above and could be delayed or may never occur. Accordingly, any shares of common stock of the Company offered and purchased (including newly issued shares of MGO Common Stock sold under MGO’s at-the-market program or through other capital raising activities) following the announcement of the Business Combination but prior to the Closing is an investment in the Company. The Business Combination is subject to the approval of the Company’s stockholders, and while stockholders holding a majority of the issued and outstanding shares of common stock of the Company have agreed to vote to approve the Business Combination, it is possible that events could occur that would prevent this approval from being obtained. The closing conditions set forth in the Business Combination Agreement, which must be satisfied or waived before the closing of the Business Combination can occur are summarized in this Form 8-K under the heading “Business Combination Agreement—Closing Conditions.”. The Company and Heidmar may not satisfy all of these closing conditions and if these closing conditions are not satisfied or waived, the Business Combination will not occur, or will be delayed pending later satisfaction or waiver, which could have a material adverse effect on the Company’s business, results of operations, cash flows and financial position.

Further, the aggregate percentages of Holdings Common Shares to be issued to the holders of MGO Common Stock on one hand and the HMI Shareholders on the other immediately after the consummation of the Business Combination is fixed pursuant to the Business Combination Agreement. Accordingly, the issuance of new shares of MGO Common Stock following announcement of the Business Combination Agreement, including through the Company’s at-the-market sales program or other capital raises, will not increase the aggregate ownership percentage of Holdings Common Shares to be issued to holders of MGO Common Stock following consummation of the Business Combination, but will dilute the Holdings ownership percentage that each individual holder of MGO Common Stock would receive.

Cautionary Statement Regarding Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future operations, products and services; and other statements identified by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,” “plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include, but are not limited to, statements regarding the Target’s industry and market sizes, future opportunities for the Company, the Company’s estimated future results and the transactions contemplated by the Business Combination Agreement, including the implied enterprise value, the expected transaction and ownership structure and the likelihood and ability of the parties to successfully consummate the transactions contemplated by the Business Combination Agreement. Such forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may differ materially from the results anticipated in these forward-looking statements.

|

|

In addition to factors previously disclosed in the Company’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (i) the risk that the transactions contemplated by the Business Combination Agreement may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s securities; (ii) the risk that the transactions contemplated by the Business Combination Agreement may not be completed by the Company’s Business Combination deadline and the potential failure to obtain an extension of the Business Combination deadline if sought by the Company; (iii) the failure to satisfy the conditions to the consummation of the transactions contemplated by the Business Combination Agreement, including the adoption of the Business Combination Agreement by the stockholders of the Company and the receipt of certain governmental and regulatory approvals; (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the Business Combination Agreement; (v) the outcome of any legal proceedings that may be instituted against the Company related to the Business Combination Agreement or the transactions contemplated thereby; (vi) the ability to maintain the listing of the Holdings’ securities on the Nasdaq; (vii) the ability to implement business plans, forecasts, and other expectations after the completion of the transactions contemplated by the Business Combination Agreement, and identify and realize additional opportunities; (viii) the risk of downturns and the possibility of rapid change in the highly competitive industry in which Holdings operates, and the risk of changes in applicable law, rules, regulations and regulatory guidance that could adversely impact Holdings’ operations. For more risk factors on the Business Combination, Holdings and HMI see Exhibit 99.1 to this Current Report on Form 8-K.

Actual results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on the fact that the Business Combination will be completed or upon forward-looking statements as a predictor of future performance as projected financial information and other information are based on estimates and assumptions that are inherently subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein speaks only as of the date hereof in the case of information about the Company and HMI or the date of such information in the case of information from persons other than the Company or HMI, and we disclaim any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this communication. Forecasts and estimates regarding HMI’s and Holdings’ industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts and estimates will prove accurate in whole or in part. Annualized, pro forma, projected, and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

Item 7.01 Regulation FD Disclosure

Attached as Exhibit 99.3 hereto is a press release issued by the Company announcing the execution of the Business Combination Agreement.

The information set forth below under this Item 7.01, including the exhibits attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| (d) | Exhibits. |

| Exhibit No. | Description | |

| 2.1* | Business Combination Agreement dated June 18, 2024 | |

| 10.1 | Form of Voting and Support Agreement dated June 18, 2024 | |

| 10.2 | Form of Lock-up/Leak out Agreement | |

| 99.1 | Information About the Business Combination and HMI | |

| 99.2 | Presentation | |

| 99.3 | Press Release | |

| 104 | Cover Page Interactive Data File (Embedded within the Inline XBRL document and included in Exhibit) | |

| * | Certain of the exhibits and schedules to this exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2). The Company agrees to furnish supplementally a copy of all omitted exhibits and schedules to the SEC upon its request. |

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 20, 2024 | MGO Global Inc. | |

| By: | /s/ Maximiliano Ojeda | |

| Name: | Maximiliano Ojeda | |

| Title: | Chief Executive Officer | |

|

|

Exhibit 2.1

BUSINESS COMBINATION AGREEMENT

by and among

MGO GLOBAL INC.,

HEIDMAR INC.,

HEIDMAR MARITIME HOLDINGS CORP.,

HMR MERGER SUB INC.

and

THE HMI SHAREHOLDERS

Dated as of June 18, 2024

TABLE OF CONTENTS

| ARTICLE I MERGER | 2 | |

| 1.1 | Merger | 2 |

| 1.2 | Merger Effective Time | 3 |

| 1.3 | Effect of the Merger | 3 |

| 1.4 | Organizational Documents | 3 |

| 1.5 | Directors and Officers of Surviving Company | 3 |

| 1.6 | Effect of Merger on MGO Securities and Merger Sub Shares | 3 |

| 1.7 | Satisfaction of Rights | 4 |

| 1.8 | Lost, Stolen or Destroyed MGO Certificates | 4 |

| 1.9 | Stock Transfer Books | 4 |

| 1.10 | Appointment of Transfer Agent | 4 |

| 1.11 | Exchange of Book-Entry Shares | 4 |

| 1.12 | Taking of Necessary Action; Further Action | 5 |

| 1.13 | Tax Consequences | 5 |

| ARTICLE II SHARE ACQUISITION | 5 | |

| 2.1 | Exchange of HMI Shares | 5 |

| 2.2 | Consideration | 6 |

| 2.3 | Transfer of HMI Shares and Other Undertakings | 6 |

| 2.4 | Earnout Shares | 7 |

| 2.5 | Fractional Shares | 7 |

| 2.6 | HMI Shareholder Consent | 8 |

| 2.7 | Termination of Certain Agreements | 8 |

| 2.8 | Withholding | 8 |

| ARTICLE III MERGER CLOSING; SHARE ACQUISITION CLOSING | 8 | |

| 3.1 | Closing | 8 |

| ARTICLE IV REPRESENTATIONS AND WARRANTIES OF MGO | 9 | |

| 4.1 | Organization and Standing | 9 |

| 4.2 | Authorization; Binding Agreement | 9 |

| 4.3 | Governmental Approvals | 10 |

| 4.4 | Non-Contravention | 10 |

| 4.5 | Capitalization | 11 |

| 4.6 | SEC Filings; MGO Financials; Internal Controls | 11 |

| 4.7 | Compliance with Laws | 13 |

| 4.8 | Actions; Orders; Permits | 13 |

| 4.9 | Taxes and Returns | 13 |

| 4.10 | Employees and Employee Benefit Plans | 15 |

| 4.11 | Labor Matters | 17 |

| 4.12 | Litigation | 18 |

| 4.13 | Intellectual Properties | 18 |

| 4.14 | Real Property; Assets | 19 |

| 4.15 | Data Protection and Cybersecurity | 20 |

| 4.16 | Material Contracts | 20 |

| 4.17 | Transactions with Affiliates | 21 |

| 4.18 | Investment Company Act; JOBS Act | 21 |

| 4.19 | Finders and Brokers | 21 |

| 4.20 | Certain Business Practices | 21 |

| 4.21 | Insurance | 22 |

| 4.22 | Information Supplied | 22 |

| 4.23 | No Undisclosed Liabilities | 22 |

| 4.24 | MGO Acknowledgment | 22 |

| ARTICLE V REPRESENTATIONS AND WARRANTIES OF HOLDINGS | 23 | |

| 5.1 | Organization and Standing | 23 |

| 5.2 | Authorization; Binding Agreement | 23 |

| 5.3 | Governmental Approvals | 23 |

| 5.4 | Non-Contravention | 24 |

| 5.5 | Capitalization | 24 |

| 5.6 | Holdings Activities | 25 |

| 5.7 | Finders and Brokers | 25 |

| 5.8 | Investment Company Act | 25 |

| 5.9 | Taxes | 25 |

| 5.10 | Information Supplied | 25 |

| ARTICLE VI REPRESENTATIONS AND WARRANTIES OF HMI | 25 | |

| 6.1 | Organization and Standing | 25 |

| 6.2 | Authorization; Binding Agreement | 26 |

| 6.3 | Capitalization | 26 |

| 6.4 | HMI Subsidiaries | 27 |

| 6.5 | Governmental Approvals | 27 |

| 6.6 | Non-Contravention | 27 |

| 6.7 | Financial Statements | 28 |

| 6.8 | Absence of Certain Changes | 29 |

| 6.9 | Compliance with Laws | 29 |

| 6.10 | Company Permits | 30 |

| 6.11 | Litigation | 30 |

| 6.12 | Material Contracts | 30 |

| 6.13 | Intellectual Property | 33 |

| 6.14 | Taxes and Returns | 34 |

| 6.15 | Real Property | 36 |

| 6.16 | Personal Property | 36 |

| 6.17 | Employee Matters | 36 |

| 6.18 | Benefit Plans | 37 |

| 6.19 | Environmental Matters | 38 |

| 6.20 | Transactions with Related Persons | 39 |

| 6.21 | Insurance | 39 |

| 6.22 | Merchants and Suppliers. | 40 |

| 6.23 | Data Protection and Cybersecurity | 40 |

| 6.24 | Certain Business Practices | 41 |

| 6.25 | Investment Company Act | 42 |

| 6.26 | Finders and Brokers | 42 |

| 6.27 | Information Supplied | 42 |

| 6.28 | HMI Acknowledgment | 42 |

| ARTICLE VII REPRESENTATIONS AND WARRANTIES OF THE HMI SHAREHOLDERS | 43 | |

| 7.1 | Organization and Standing | 43 |

| 7.2 | Authorization; Binding Agreement | 43 |

| 7.3 | Ownership | 43 |

| 7.4 | Governmental Approvals | 43 |

| 7.5 | Non-Contravention | 44 |

| 7.6 | Litigation | 44 |

| 7.7 | Finders and Brokers | 44 |

| 7.8 | Information Supplied | 44 |

| ARTICLE VIII COVENANTS | 45 | |

| 8.1 | Access and Information | 45 |

| 8.2 | Conduct of Business of HMI during the Interim Period | 46 |

| 8.3 | Conduct of Business of MGO during the Interim Period | 48 |

| 8.4 | Conduct of Business of Holdings during the Interim Period | 51 |

| 8.5 | Interim Period Control | 52 |

| 8.6 | Preparation and Delivery of Additional HMI Financial Statements | 52 |

| 8.7 | MGO Financal Statements; Registration Statement | 52 |

| 8.8 | MGO Public Filings | 52 |

| 8.9 | Cash Upon Closing | 53 |

| 8.10 | Stock Exchange Listings | 53 |

| 8.11 | Exclusivity | 54 |

| 8.12 | No Trading | 55 |

| 8.13 | Notification of Certain Matters | 55 |

| 8.14 | Regulatory Approvals | 55 |

| 8.15 | Further Assurances | 57 |

| 8.16 | Tax Matters | 57 |

| 8.17 | The Registration Statement; Special Shareholder Meeting | 58 |

| 8.18 | Public Announcements | 61 |

| 8.19 | Confidential Information | 62 |

| 8.20 | Post-Closing Board of Directors and Officers of Holdings | 63 |

| 8.21 | Indemnification of Directors and Officers; Tail Insurance | 63 |

| 8.22 | Voting and Support Agreements | 64 |

| 8.23 | Lock-Up/Leak-Out Agreements | 64 |

| 8.24 | Holdings Equity Incentive Plan | 64 |

| 8.25 | Litigation | 64 |

| 8.26 | Advisory Agreements | 64 |

| ARTICLE IX SURVIVAL | 65 | |

| 9.1 | Survival | 65 |

| 9.2 | Indemnification | 65 |

| 9.3 | Limitations | 67 |

| 9.4 | Indemnification Procedures | 67 |

| 9.5 | Sole Remedy | 68 |

| 9.6 | Tax Treatment | 68 |

| ARTICLE X CONDITIONS TO OBLIGATIONS OF THE PARTIES | 68 | |

| 10.1 | Conditions to Each Party’s Obligations | 68 |

| 10.2 | Conditions to Obligations of HMI, the HMI Shareholders, Holdings and Merger Sub | 69 |

| 10.3 | Conditions to Obligations of MGO | 70 |

| 10.4 | Frustration of Conditions | 71 |

| ARTICLE XI TERMINATION AND EXPENSES | 71 | |

| 11.1 | Termination | 71 |

| 11.2 | Effect of Termination | 72 |

| 11.3 | Fees and Expenses | 72 |

| ARTICLE XII WAIVERS AND RELEASES | 73 | |

| 12.1 | Mutual Releases | 73 |

| ARTICLE XIII MISCELLANEOUS | 74 | |

| 13.1 | Notices | 74 |

| 13.2 | Binding Effect; Assignment | 75 |

| 13.3 | Third Parties | 75 |

| 13.4 | Governing Law; Jurisdiction | 75 |

| 13.5 | Waiver of Jury Trial | 75 |

| 13.6 | Specific Performance | 76 |

| 13.7 | Severability | 76 |

| 13.8 | Amendment | 76 |

| 13.9 | Waiver | 76 |

| 13.10 | Entire Agreement | 76 |

| 13.11 | Interpretation | 76 |

| 13.12 | Counterparts | 78 |

| 13.13 | No Recourse | 79 |

| 13.14 | Scope of the HMI Shareholders’ Obligations | 79 |

| ARTICLE XIV DEFINITIONS | 79 | |

| 14.1 | Certain Definitions | 79 |

| 14.2 | Section References | 92 |

SCHEDULE

Schedule 1 – HMI Shareholders

Schedule 2 – MGO Principals

EXHIBITS

Exhibit A – Form of Voting and Support Agreement

BUSINESS COMBINATION AGREEMENT

Exhibit B – Form of Lock-Up/Leak-Out Agreement This Business Combination Agreement (this “Agreement”) is made and entered into as of June 18, 2024, by and among MGO Global, Inc. (“MGO”), Heidmar Maritime Holdings Corp. (“Holdings”), Heidmar Inc. (“HMI”), HMR Merger Sub Inc. (“Merger Sub”), and the HMI Shareholders (as defined below). MGO, Holdings, HMI and the HMI Shareholders are sometimes referred to herein individually as a “Party” and, collectively, as the “Parties”.

RECITALS

WHEREAS, Holdings is a newly incorporated company organized and existing under the laws of Marshall Islands, formed for the purpose of participating in the Transactions (as defined below);

WHEREAS, Merger Sub is a newly incorporated Delaware corporation, formed by Holdings for the purpose of participating in the Transactions (as defined below), that is a wholly owned direct Subsidiary of Holdings;

WHEREAS, MGO is a Delaware corporation, and HMI is a company incorporated in the Republic of the Marshall Islands;

WHEREAS, as of the date of this Agreement, Rhea Marine Ltd. and Maistros Shipinvest Corp. (together, the “HMI Shareholders”), which are set forth on Schedule 1, are the shareholders of HMI collectively owning 100% of the outstanding shares of common stock, no par value, of HMI (the “HMI Shares”);

WHEREAS, the Parties desire and intend to effect a business combination transaction whereby (a) Merger Sub will merge with and into MGO (the “Merger”), as a result of which (i) the separate corporate existence of Merger Sub shall cease and MGO shall continue as the surviving entity and a wholly owned direct subsidiary of Holdings and (ii) each issued and outstanding MGO Share immediately prior to the Merger Effective Time shall no longer be outstanding and shall automatically be cancelled, in exchange for the right of the holder thereof to receive the MGO Merger Consideration, (b) immediately after the Merger Effective Time, the HMI Shareholders will transfer all of the outstanding HMI Shares to Holdings (the “Share Acquisition”, and, together with the Merger and the other transactions contemplated by this Agreement and the Ancillary Documents, the “Transactions”) the consideration for which will be (x) the issuance by Holdings to the HMI Shareholders at Closing of new Holdings Common Shares in accordance with the terms hereof, and (y) the issuance by Holdings to the HMI Shareholders at some time after Closing, and contingent on the achievement of certain conditions set forth in Section 2.4 of additional Holdings Common Shares, all upon the terms and subject to the conditions set forth in this Agreement and in accordance with the provisions of applicable Law;

WHEREAS, the Board of Directors of MGO (the “MGO Board”) has unanimously (a) determined that this Agreement, the Ancillary Documents to which it is or will be a party, the Merger, the Share Acquisition and the other Transactions are in the best interests of MGO and its shareholders (the “MGO Shareholders), (b) approved and declared the advisability of this Agreement, the Ancillary Documents to which MGO is or will be a party, the Merger, the Share Acquisition and the other Transactions, and (c) recommended the approval and adoption by the MGO Shareholders of this Agreement, the Ancillary Documents to which MGO is or will be a party, the Merger, and the Share Acquisition;

WHEREAS, concurrently with the execution and delivery of this Agreement, MGO and the MGO Shareholders set forth in Schedule 2 attached hereto (collectively, the “MGO Principals”), representing approximately 61.28% of the issued and outstanding MGO Shares, shall each enter into a voting and support agreements with Holdings in substantially the form attached as Exhibit A hereto (each, a “Voting and Support Agreement”).

WHEREAS, the Board of Directors of HMI (the “HMI Board”) has unanimously (a) determined that this Agreement, the Ancillary Documents to which it is or will be a party and the Transactions are in the best interests of HMI, (b) approved this Agreement, the Ancillary Documents to which HMI is or will be a party, and the Transactions and (c) recommended the approval and adoption of this Agreement, the Ancillary Documents to which HMI is or will be a party and the Transactions by the HMI Shareholders;

WHEREAS, the HMI Shareholders have approved this Agreement, the Ancillary Documents to which HMI is or will be a party and the Transactions;

WHEREAS, the Board of Directors of Holdings (the “Holdings Board”) has (a) determined that this Agreement, the Ancillary Documents to which it is or will be a party and the Transactions are in the best interests of Holdings, (b) approved this Agreement, the Ancillary Documents to which it is or will be a party and the Transactions, and (c) resolved to recommend that the shareholder of Holdings approves this Agreement, the Ancillary Documents to which Holdings is or will be a party and the Transactions;

WHEREAS, the shareholder of Holdings has approved this Agreement, the Ancillary Documents to which Holdings is or will be a party and the Transactions;

WHEREAS, the Board of Directors of Merger Sub has (a) determined that this Agreement, the Ancillary Documents to which it is or will be a party and the Transactions are in the best interests of Merger Sub, (b) approved this Agreement, the Ancillary Documents to which it is or will be a party and the Transactions, and (c) resolved to recommend that the shareholder of Merger Sub approves this Agreement, the Ancillary Documents to which Holdings is or will be a party and the Transactions;

WHEREAS, the shareholder of Merger Sub has approved this Agreement and the Ancillary Documents to which Merger Sub is or will be a party and the Transactions;

WHEREAS, certain capitalized terms used herein are defined in Article XIV hereof.

NOW, THEREFORE, in consideration of the premises set forth above, and the representations, warranties, covenants and agreements contained in this Agreement, and intending to be legally bound hereby, the Parties agree as follows.

ARTICLE I

MERGER

1.1 Merger. At the Merger Effective Time, subject to and upon the terms and conditions of this Agreement and the certificate of merger to be filed relating to the Merger, in a form consistent with the provisions of this Agreement and agreed to by the Parties in good faith (the “Certificate of Merger”), and in accordance with the applicable provisions of the Delaware General Corporation Law, MGO and Merger Sub shall consummate the Merger, pursuant to which Merger Sub shall be merged with and into MGO with MGO being the surviving entity, following which the separate corporate existence of Merger Sub shall cease and MGO shall continue as the surviving company and a wholly owned direct Subsidiary of Holdings. MGO, as the surviving company after the Merger, is hereinafter referred to for the periods at and after the Merger Effective Time as the “Surviving Company”.

|

|

1.2 Merger Effective Time. MGO, Merger Sub and Holdings shall cause the Merger to be consummated by filing the executed Certificate of Merger with the Secretary of State of the State of Delaware in accordance with Section 251 of the Delaware General Corporation Law. The Merger shall become effective at the time when the Certificate of Merger has been duly filed with the Secretary of State of the State of Delaware or at such later time as may be agreed by MGO and Merger Sub (with the prior written consent of HMI) in writing and specified in the Certificate of Merger (the “Merger Effective Time”).

1.3 Effect of the Merger. At the Merger Effective Time, the effect of the Merger shall be as provided in this Agreement, the Certificate of Merger and the applicable provisions of the Delaware General Corporation Law. Without limiting the generality of the foregoing, and subject thereto, at the Merger Effective Time, all the property, rights, privileges, agreements, powers and franchises, debts, Liabilities, duties and obligations of MGO and Merger Sub shall become the property, rights, privileges, agreements, powers and franchises, debts, Liabilities, duties and obligations of the Surviving Company, which shall include the assumption by the Surviving Company of any and all agreements, covenants, duties and obligations of MGO and Merger Sub set forth in this Agreement to be performed after the Merger Effective Time.

1.4 Organizational Documents. The certificate of incorporation and bylaws of Merger Sub as in effect immediately prior to the Merger Effective Time shall be the certificate of incorporation and bylaws of the Surviving Company (except that references to the name “HMR Merger Sub Inc.” shall be changed to “MGO Global Inc.”) following the Merger Effective Time, with such changes as Holdings, in its sole discretion, may believe appropriate, until thereafter amended in accordance with such articles of incorporation and bylaws and applicable Law.

1.5 Directors and Officers of Surviving Company. At the Merger Effective Time, the directors and officers of the Surviving Company shall be the persons designated by HMI, which designation shall be delivered to MGO in writing at least three Business Days before the Closing Date, each to hold office in accordance with the Organizational Documents of the Surviving Company until their resignation or removal in accordance with the Organizational Documents of the Surviving Company or until their respective successors are duly elected or appointed and qualified. At the Merger Effective Time, the board of directors and officers of MGO shall resign and automatically cease to hold office.

1.6 Effect of Merger on MGO Shares and Merger Sub Shares.

(a) MGO Shares. At the Merger Effective Time, by virtue of the Merger and without any action on the part of any Party or the holders of securities of MGO or Holdings, each MGO Share that is issued and outstanding immediately prior to the Merger Effective Time shall thereupon be converted into, and the holder of such MGO Share shall be entitled to receive, the MGO Merger Consideration. All of the MGO Shares converted into the right to receive the MGO Merger Consideration pursuant to this Section 1.6(a) shall no longer be outstanding and shall automatically be cancelled and shall cease to exist at the Merger Effective Time, and each holder of any such MGO Shares shall thereafter cease to have any rights with respect to such securities, except the right to receive the MGO Merger Consideration into which such MGO Shares shall have been converted in the Merger.

(b) Merger Sub Shares. At the Merger Effective Time, by virtue of the Merger and without any action on the part of any Party, the MGO Shareholders or Holdings, each Merger Sub Share that is issued and outstanding immediately prior to the Merger Effective Time shall be converted into and become one validly issued, fully paid and non-assessable share of common stock of the Surviving Company.

|

|

(c) No Liability. Notwithstanding anything to the contrary in this Section 1.6, none of the Surviving Company, Holdings, HMI or any other Party shall be liable to any Person for any amount properly paid to a public official pursuant to any applicable abandoned property, escheat or similar Law.

1.7 Satisfaction of Rights. All securities issued upon the surrender of MGO Securities in accordance with the terms hereof shall be deemed to have been issued in full satisfaction of all rights pertaining to such securities; provided, that any restrictions on the sale and transfer of MGO Securities shall also apply to the Holdings Common Shares so issued in exchange.

1.8 Lost, Stolen or Destroyed MGO Certificates. In the event any certificates representing MGO Securities shall have been lost, stolen or destroyed, upon the making of an affidavit of such fact and indemnity by the Person claiming such certificate to be lost, stolen or destroyed, Holdings shall issue, in exchange for such lost, stolen or destroyed certificates, as the case may be, such securities, as may be required pursuant to Section 1.6.

1.9 Stock Transfer Books. At the Merger Effective Time, the register of security holders of MGO shall be closed, and there shall be no further registration of transfers of MGO Securities thereafter on the records of MGO.

1.10 Appointment of Transfer Agent. Prior to the Closing, Holdings shall appoint a transfer agent acceptable to HMI (the “Transfer Agent”) as its agent, for the purpose of (a) exchanging MGO Securities for Holdings Common Shares and (b) issuing the Exchange Shares. The Transfer Agent shall (i) exchange each MGO Share for the MGO Merger Consideration, (ii) issue the Exchange Shares, and (iii) take or cause to be taken such actions as are necessary to update Holdings’ register of security holders to reflect the actions contemplated by clauses (i) and (ii) of this sentence, in each case in accordance with the terms of this Agreement and, to the extent applicable, the Certificate of Merger, the Delaware General Corporation Law and customary transfer agent procedures and the rules and regulations of the Depository Trust Company (“DTC”), in each case in a form approved by HMI.

1.11 Exchange of Book-Entry Shares.

(a) Exchange Procedures. As soon as practicable after the Merger Effective Time (and in no event later than five Business Days after the Merger Effective Time), Holdings shall cause the Transfer Agent to mail to each holder of record of MGO Shares that were converted pursuant to Section 1.6(a) into the MGO Merger Consideration instructions for use in effecting the surrender of the MGO Shares in exchange for MGO Merger Consideration in a form acceptable to HMI and MGO. Upon receipt of an “agent’s message” by the Transfer Agent (or such other evidence, if any, of transfer as the Transfer Agent may reasonably request), the holder of a MGO Share that was converted pursuant to Section 1.6(a) into MGO Merger Consideration shall be entitled to receive in exchange therefor, subject to any required withholding Taxes, the MGO Merger Consideration applicable to the surrendered shares in book-entry form, without interest (subject to any applicable withholding Tax). The Holdings Common Shares to be delivered as MGO Merger Consideration shall be settled through DTC and issued in uncertificated book-entry form through the customary procedures of DTC, unless a physical Holdings Common Share is required by applicable Law, in which case Holdings and HMI shall jointly cause the Transfer Agent to promptly send certificates representing such Holdings Common Shares to such holder. If payment of MGO Merger Consideration is to be made to a Person other than the Person in whose name the surrendered MGO Share in exchange therefor is registered, it shall be a condition of payment that (i) the Person requesting such exchange present proper evidence of transfer or shall otherwise be in proper form for transfer and (ii) the Person requesting such payment shall have paid any transfer and other Taxes required by reason of the payment of MGO Merger Consideration to a Person other than the registered holder of MGO Share surrendered or shall have established to the reasonable satisfaction of Holdings and HMI that such Tax either has been paid or is not applicable.

|

|

(b) Distributions with Respect to Exchanged Common Shares. All Holdings Common Shares to be issued as MGO Merger Consideration shall be deemed issued and outstanding as of the Merger Effective Time. Subject to the effect of escheat, Tax or other applicable Laws, the holder of whole Holdings Common Shares issued in exchange for MGO Shares pursuant to Section 1.6(a) will be promptly paid, without interest (subject to any applicable withholding Tax), the amount of dividends or other distributions with a record date after the Merger Effective Time and theretofore paid with respect to such whole Holdings Common Shares.

(c) Adjustments to MGO Merger Consideration. The MGO Merger Consideration shall be adjusted to reflect appropriately the effect of any stock split, reverse stock split, stock dividend, reorganization, recapitalization, reclassification, combination, exchange of shares or other like change with respect to MGO Shares or HMI Shares occurring on or after the date of this Agreement and prior to the Merger Effective Time.

1.12 Taking of Necessary Action; Further Action. If, at any time after the Merger Effective Time, any further action is necessary or desirable to carry out the purposes of this Agreement and to vest the Surviving Company with full right, title and possession to all assets, property, rights, privileges, powers and franchises of MGO and Merger Sub, the officers and directors of MGO and Holdings are fully authorized in the name of their respective entities to take, and will take, all such lawful and necessary action, so long as such action is not inconsistent with this Agreement.

1.13 Tax Consequences. The Parties hereby agree and acknowledge that for U.S. federal income tax purposes, it is intended that (a) taken together, the Share Acquisition and the Merger will qualify as an exchange under Section 351 of the Code and (b) the Merger will not result in gain being recognized under Section 367(a)(1) of the Code by any stockholder of MGO (other than for any stockholder that would be a “five-percent transferee shareholder” (within the meaning of United States Treasury Regulations Section 1.367(a)-3(c)(5)(ii)) of Holdings following the transaction that does not enter into a five-year gain recognition agreement (“GRA”) pursuant to United States Treasury Regulations Section 1.367(a)-8(c)) ((a) and (b), together, the “Intended Tax Treatment”). To the extent permitted under applicable Law, (i) the Parties intend that the Merger also qualify as a “reorganization” under Section 368(a) of the Code and (ii) this Agreement is intended to constitute and hereby is adopted as a “plan of reorganization” with respect to the Merger within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a) for purposes of Sections 354, 361 and 368 of the Code and the Treasury Regulations thereunder.

ARTICLE II

SHARE ACQUISITION

2.1 Exchange of HMI Shares. At the Share Acquisition Closing and subject to and upon the terms and conditions of this Agreement and the Organizational Documents of HMI, HMI Shareholders shall sell, assign and transfer to Holdings, and Holdings shall purchase, acquire, assume and accept from the HMI Shareholders, all of the legal and beneficial title to the HMI Shares with full title guarantee, free from all Liens (other than Liens arising as a result of transfer restrictions under applicable securities Laws and the relevant Organizational Documents) and together with all rights attaching to the HMI Shares at the Share Acquisition Closing (including the right to receive all distributions, returns of capital and dividends declared, paid or made in respect of the HMI Shares after the Share Acquisition Closing). Following the Share Acquisition Closing, HMI will be a wholly owned Subsidiary of Holdings.

|

|

2.2 Consideration.

(a) Subject to and upon the terms and conditions of this Agreement, the aggregate consideration owed to each HMI Shareholder in exchange for such HMI Shareholder’s HMI Shares shall consist of (i) the issuance in respect of each HMI Share owned by that HMI Shareholder of a number of Holdings Common Shares equal to the HMI Share Consideration (collectively, the “HMI Closing Shares”), and (ii) the issuance of the proportion of the total Earnout Shares, if any, set forth next to the name of the relevant HMI Shareholder in Schedule 1 to this Agreement, in each case subject to, and in an amount determined in accordance with, Section 2.4 (collectively, in respect of each HMI Shareholder, its “HMI Shareholder Consideration”).

(b) Holdings shall issue to each HMI Shareholder (i) the HMI Closing Shares at the Share Acquisition Closing and (ii) the Earnout Shares, if any, on the date determined in accordance with Section 2.4.

(c) In addition, Holdings shall issue to Maxim Partners LLC (or its designees) (i) at the Closing a number of Holdings Common Shares equal to 2.64 % of the total HMI Closing Shares and (ii) at such time the Earnout Shares, if any, are issued pursuant to Section 2.4(c), a number of Holdings Common Shares equal to 2.64% of the Earnout Shares issued at such time, such issuances to be in full satisfaction of all obligations of MGO under the Advisory Agreement.

2.3 Transfer of HMI Shares and Other Undertakings.

(a) At or prior to the Closing, each HMI Shareholder shall deliver or procure the delivery to Holdings of:

(i) a duly executed stock transfer form in respect of its HMI Shares to effect the transfer of its HMI Shares (the “STFs”);

(ii) share certificates representing its HMI Shares (“HMI Certificate”), if its HMI Shares are certificated (in the event that any HMI Certificate shall have been lost, stolen or destroyed, in lieu of delivery of a HMI Certificate to Holdings, the relevant HMI Shareholder may instead deliver to Holdings an indemnity for lost certificate in form and substance reasonably acceptable to Holdings);

(iii) a copy of any power of attorney in form and substance reasonably acceptable to Holdings under which any document to be executed by any HMI Shareholder under this Agreement has been executed;

(iv) a duly executed counterpart to the Lock-Up/Leak Out Agreement; and

(v) a duly executed certificate in accordance with Section 10.3(c).

(b) At the Share Acquisition Closing, HMI shall deliver or procure the delivery to Holdings of a copy of the executed and undated resolution of the board of directors of HMI, or similar authorization, (i) approving the form of the STFs and the transfer of the HMI Shares from the HMI Shareholders to Holdings and (ii) instructing the Transfer Agent to update HMI’s register of security holders such that Holdings is entered in the register of members as the sole holder of all of the HMI Shares.

|

|

2.4 Earnout Shares.

(a) In consideration for the HMI Shareholders’ sale, assignment and transfer of the HMI Shares pursuant to the Share Acquisition (and in addition to the issuance of the HMI Closing Shares pursuant to Section 2.2), Holdings shall issue Holdings Common Shares equal to 10% of the total number of HMI Closing Shares issued pursuant to Section 2.2, as adjusted to take into account any share consolidation, stock split, stock dividend, or similar event effected with respect to Holdings Common Shares (the “Earnout Shares”) to the HMI Shareholders who were securityholders of HMI immediately prior to the Closing, if any of the following conditions are met:

(i) the 2024 Revenue equals or exceeds US$45.0 million,

(ii) the 2024 EBITDA equals or exceeds US$30.0 million, or

(iii) the 2024 Net Income equals or exceeds US$25.0 million.

(b) For purposes of this Section 2.4:

(i) “2024 Revenue” shall mean the amount of revenue (or its equivalent metric under U.S. GAAP) reported in the consolidated audited statement of income/operations of Holdings for the year ended December 31, 2024 included in the annual report of Holdings filed with the SEC for that year (the “2024 Annual Report”);

(ii) “2024 Net Income” shall mean the amount of net income (or its equivalent metric under U.S. GAAP) reported in the consolidated audited statement of income/operations of Holdings for the year ended December 31, 2024 included in the 2024 Annual Report; and

(iii) “2024 EBITDA” shall mean 2024 Net Income, plus the amount of interest, taxes, depreciation and amortization (or their equivalent metrics under U.S. GAAP) reported in the consolidated audited statement of income/operations of Holdings for the year ended December 31, 2024 included in the 2024 Annual Report;

in each case, adjusted to eliminate (without duplication) (x) the effects of the Transactions, including fees and expenses, taxes incurred, paid or recognized, any gain or loss on disposition, and any one-time accounting charges, adjustments or write-downs, in each case directly attributable to the Transactions, and (y) any revenue, net income, or component of EBITDA of MGO consolidated into the financial statements of Holdings.

(c) If any condition in Section 2.4(a) is satisfied, the Earnout Shares shall be issued within ten calendar days following the date on which Holdings files its 2024 Annual Report with the SEC.

2.5 Fractional Shares. Notwithstanding anything to the contrary contained herein, no fraction of a Holdings Common Share will be issued, in any form, by virtue of this Agreement, the Merger or the other Transactions, and each Person who would otherwise be entitled to a fraction of a Holdings Common Share (after aggregating all fractional Holdings Common Shares that would otherwise be received by such Person) shall instead have the number of Holdings Common Shares issued to such Person rounded up or down to the nearest whole Holdings Common Share. No cash settlements shall be made with respect to fractional shares eliminated by rounding. Calculations in respect of fractional shares will be made separately in respect of Holdings Common Shares issued at Closing and Holdings Common Shares issued as Earnout Shares.

|

|

2.6 HMI Shareholder Consent. Each HMI Shareholder hereby approves, authorizes and consents to HMI’s execution and delivery of this Agreement and the Ancillary Documents to which HMI is or is required to be a party or otherwise bound, the performance by HMI of its obligations hereunder and thereunder and the consummation by HMI of the Transactions. Each HMI Shareholder acknowledges and agrees that the consent set forth herein is intended and shall constitute such consent of such HMI Shareholder as may be required (and shall, if applicable, operate as a written shareholder resolution of HMI) pursuant to HMI’s Organizational Documents, the Shareholders’ Agreement, any other agreement in respect of HMI to which such HMI Shareholder is a party or bound and all applicable Laws. Each of HMI Shareholders hereby waives and disapplies any and all pre-emption rights, rights of first refusal, tag along, drag along and other rights (each, howsoever described) which may have been conferred on it under HMI’s Organizational Documents, the Shareholders’ Agreement or otherwise as may affect the Transactions (other than its rights pursuant to this Agreement). Further, subject to applicable Law, HMI and the HMI Shareholders hereby waive any obligations of any other Person pursuant to HMI’s Organizational Documents to the extent they relate to the Transactions.

2.7 Termination of Certain Agreements. Without limiting the provisions of Section 2.6, HMI and the HMI Shareholders hereby agree that, effective at the Closing, any shareholders, voting or similar agreement among HMI and any of the HMI Shareholders or among the HMI Shareholders with respect to HMI or its shares (including the Shareholders’ Agreement) that is effective immediately prior to the Closing shall automatically, and without any further action by any of the Parties, terminate in full and become null and void and of no further force and effect with no Liability whatsoever for HMI; provided, that this provision shall not apply to any agreement between Holdings and the HMI Shareholders with respect to Holdings or the Holdings Common Shares. Further, HMI and the HMI Shareholders hereby waive any obligations of the parties under any agreement described in the preceding sentence with respect to the Transactions, and any failure of such parties to comply with the terms thereof in connection with the Transactions.

2.8 Withholding. MGO, Holdings, HMI, the Transfer Agent and any other applicable withholding agent shall be entitled to deduct and withhold (or cause to be deducted and withheld) from any consideration payable pursuant to this Agreement such amounts as are required to be deducted and withheld under applicable Tax Law. To the extent that amounts are so withheld, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of which such deduction and withholding was made.

ARTICLE III

MERGER CLOSING; SHARE ACQUISITION CLOSING

3.1 Closing. The closing of the Merger (the “Merger Closing”) shall occur on the third Business Day following the satisfaction or, to the extent legally permissible, waiver of the conditions set forth in Article X (other than those conditions that by their nature are to be fulfilled at the Closing, but subject to the satisfaction of or, to the extent legally permissible, waiver by the Party benefitting from, such conditions), or at such other date as MGO, Holdings and HMI may agree in writing. The closing of the Share Acquisition (the “Share Acquisition Closing”) shall occur immediately following the Merger Closing. The closing of the Transactions (including the Merger Closing and the Share Acquisition Closing) shall be referred to herein as the “Closing”. The date of the Closing shall be referred to herein as the “Closing Date”. The Closing shall take place virtually or at such place as MGO, Holdings and HMI may agree in writing, and at such times on the Closing Date as MGO, Holdings and HMI agree in writing.

|

|

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF MGO

Except as set forth in (a) the disclosure schedules delivered by MGO to HMI on the date hereof (the “MGO Disclosure Schedules”), or (b) the 2024 SEC Reports that are available on the SEC’s website through EDGAR, but excluding disclosures referred to in “Forward-Looking Statements”, “Risk Factors” and any other disclosures therein to the extent they are of a predictive or cautionary nature or related to forward-looking statements (provided, that nothing disclosed in such SEC Reports will be deemed to modify or qualify the representations and warranties set forth in Section 4.1, Section 4.2 or Section 4.5), MGO represents and warrants to HMI, Holdings and the HMI Shareholders, as of the date hereof, and as of the Closing, as follows.

4.1 Organization and Standing. MGO is a corporation duly incorporated, validly existing and in good standing under the Laws of the State of Delaware and has all requisite corporate power and authority to own, lease and operate its properties and to carry on its business as now being conducted, except where the failure to be in good standing or to have such corporate power and authority, individually or in the aggregate, has not had and would not reasonably be expected to have a Material Adverse Effect on MGO. MGO is duly qualified or licensed and in good standing to do business in each jurisdiction in which the character of the property owned, leased or operated by it or the nature of the business conducted by it makes such qualification or licensing necessary, except in each case where the failure to be so qualified or licensed or in good standing, individually or in the aggregate, would not reasonably be expected to have a Material Adverse Effect on MGO. MGO has made available to HMI accurate and complete copies of its Organizational Documents, each as currently in effect. MGO is not in violation of any provision of its Organizational Documents in any material respect.

4.2 Authorization; Binding Agreement. MGO has all requisite corporate power and authority to execute and deliver this Agreement and each Ancillary Document to which it is a party, to perform its obligations hereunder and thereunder and to consummate the Transactions, subject to obtaining the Required Shareholder Approval. The execution and delivery of this Agreement and each Ancillary Document to which it is a party and the consummation of the Transactions (a) have been duly and validly authorized by the MGO Board and (b) other than the Required Shareholder Approval, no other corporate proceedings (including any vote of holders of any class or series of securities of MGO), other than as set forth elsewhere in this Agreement, on the part of MGO are necessary to authorize the execution and delivery of this Agreement and each Ancillary Document to which it is a party or to consummate the Transactions. The MGO Board obtained and reviewed a fairness opinion presentation, dated June 3, 2024 in connection with the Transactions from Newbridge Securities Corporation, which included a draft fairness opinion. The MGO Board, at a duly called and held meeting or in writing as permitted by MGO’s Charter, has unanimously (i) determined that this Agreement, the Ancillary Documents to which it is party and the Transactions, including the Share Acquisition and the Merger, are advisable, fair to and in the best interests of MGO Shareholders, (ii) approved and adopted this Agreement and the Ancillary Documents to which it is party, (iii) recommended that MGO Shareholders vote in favor of the approval of this Agreement, the Ancillary Documents to which it is party, the Share Acquisition, the Merger, and the other Shareholder Approval Matters (the “MGO Recommendation”) and (iv) directed that this Agreement, the Ancillary Documents to which it is party and the Shareholder Approval Matters be submitted to MGO Shareholders for their approval. This Agreement has been, and each Ancillary Document to which MGO is a party shall be when delivered, duly and validly executed and delivered by MGO and, assuming the due authorization, execution and delivery of this Agreement and such Ancillary Documents by the other parties hereto and thereto, constitutes, or when delivered shall constitute, the valid and binding obligation of MGO, enforceable against MGO in accordance with its terms, except to the extent that enforceability thereof may be limited by applicable bankruptcy, insolvency, reorganization and moratorium laws and other laws of general application affecting the enforcement of creditors’ rights generally and subject to general principles of equity (collectively, the “Enforceability Exceptions”).

|

|

4.3 Governmental Approvals. No Consent of or with any Governmental Authority, on the part of MGO is required to be obtained or made in connection with the execution, delivery or performance by MGO of this Agreement and each Ancillary Document to which it is a party or the consummation by MGO of the Transactions, other than (a) any filings required with Nasdaq or the SEC with respect to the Transactions, (b) applicable requirements, if any, of the Securities Act, the Exchange Act, and any state “blue sky” securities Laws, and the rules and regulations thereunder, (c) the applicable requirements of any Antitrust Laws and the expiration or termination of the required waiting periods, or the receipt of other Consents, thereunder and (d) where the failure to obtain such Consents, or to make such filings or notifications, individually or in the aggregate, has not had and would not reasonably be expected to have a Material Adverse Effect on MGO.

4.4 Non-Contravention. The execution and delivery by MGO of this Agreement and each Ancillary Document to which it is a party, the consummation by MGO of the Transactions, and compliance by MGO with any of the provisions hereof and thereof, will not:

(a) conflict with or violate any provision of MGO’s Organizational Documents,

(b) subject to obtaining the Consents from Governmental Authorities referred to in Section 4.3, and any condition precedent to such Consent having been satisfied, conflict with or violate any Law, Order or Consent applicable to MGO or any of its properties or assets, or

(c) (i) violate, conflict with or result in a breach of,

(ii) constitute a default (or an event which, with notice or lapse of time or both, would constitute a default) under,

(iii) result in the termination, withdrawal, suspension, cancellation or modification of,

(iv) accelerate the performance required by MGO under,

(v) result in a right of termination or acceleration under,

(vi) give rise to any obligation to make payments or provide compensation under,

(vii) result in the creation of any Lien (other than a Permitted Lien) upon any of the properties or assets of MGO under,

(viii) give rise to any obligation to obtain any Third Party Consent or provide any notice to any Person or

(ix) give any Person the right to declare a default, exercise any remedy, claim a rebate, chargeback, penalty or change in delivery schedule, accelerate the maturity or performance, cancel, terminate or modify any right, benefit, obligation or other term under, any of the terms, conditions or provisions of, any MGO Material Contract,

except for any deviations from any of the foregoing clauses (b) or (c) that, individually or in the aggregate, would not reasonably be expected to have a Material Adverse Effect on MGO.

|

|

4.5 Capitalization.

(a) As of the date of this Agreement, the issued and outstanding MGO Securities are set forth hereto in Section 4.5(a) of the MGO Disclosure Schedules. As of the date of this Agreement, there are no issued or outstanding shares of preferred stock of MGO. All outstanding MGO Securities are duly authorized, validly issued, fully paid and non-assessable and not subject to or issued in violation of any purchase option, right of first refusal, pre-emptive right, subscription right or any similar right under the Delaware General Corporation Law, the MGO’s Organizational Documents or any Contract to which MGO is a party. None of the outstanding MGO Securities has been issued in violation of any applicable securities Laws. Prior to giving effect to the Transactions, MGO does not have any Subsidiaries or own any equity interests in any other Person other than the MGO Subsidiaries.

(b) Section 4.5(b) of the MGO Disclosure Schedules sets forth a true and complete list, as of the date of this Agreement, of (i) each MGO Equity Award, (ii) the name of the MGO Equity Award holder, (iii) the number of shares of MGO Common Stock underlying each MGO Equity Award, (iv) with respect to unvested MGO Equity Awards, the date on which the MGO Equity Award was granted, (v) with respect to unvested MGO Equity Awards, the vesting schedule with respect to the MGO Equity Award, including any right of acceleration of such vesting schedule, (vi) the exercise price of each MGO Equity Award, if applicable, and (vii) the expiration date of each MGO Equity Award, if applicable. Except as would not, individually or in the aggregate, reasonably be expected to be material to MGO and the MGO Subsidiaries, taken as a whole, each MGO Equity Award has been granted in compliance with all applicable securities laws or exemptions therefrom and all requirements set forth in the MGO Equity Plan and applicable award agreements.

(c) All Indebtedness of MGO as of the date of this Agreement is disclosed in Section 4.5(c) of the MGO Disclosure Schedules.