UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 30, 2023

or

| ☐ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

COMMISSION FILE NUMBER: 001-37575

STAFFING 360 SOLUTIONS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 68-0680859 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

757 3rd Avenue

27th Floor

New York, New York 10017

(Address of principal executive offices) (Zip code)

(646) 507-5710

(Registrant’s telephone number)

Securities registered under Section 12(b) of the Exchange Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.00001 per share | STAF | NASDAQ |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of the chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files.) Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal controls over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act): Yes ☐ No ☒

As of July 1, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common stock held by non-affiliates of the registrant was approximately $2,902(000s) based on the closing price (last sale of the day) for the registrant’s common stock on the Nasdaq Capital Market on June 30, 2023, of $0.65 per share.

As of June 7, 2024, 6,391,388 shares of common stock, $0.00001 par value, were outstanding.

Staffing 360 Solutions, Inc.

TABLE OF CONTENTS

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report, including Management’s Discussion and Analysis of Financial Condition and Results of Operations, on Form 10-K (“Annual Report”) contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements that address expectations or projections about the future, including, but not limited to, statements about our plans, strategies, adequacy of resources and future financial results (such as revenue, gross profit, operating profit, cash flow), are forward-looking statements. Some of the forward-looking statements can be identified by words like “anticipates,” “believes,” “expects,” “may,” “will,” “could,” “should,” “intends,” “plans,” “estimates,” “goal,” “target,” “possible,” “potential” and similar references to future periods. These statements are not guarantees of future performance and involve a number of risks, uncertainties and assumptions that are difficult to predict. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control or are subject to change, actual outcomes and results may differ materially from what is expressed or forecasted in these forward-looking statements. Important factors that could cause actual results to differ materially from these forward-looking statements include, but are not limited to: our ability to regain and maintain compliance with the Nasdaq Capital Market’s (“Nasdaq”) listing standards, our ability to continue as a going concern, weakness in general economic conditions and levels of capital spending by customers in the industries we serve; weakness or volatility in the financial and capital markets, which may result in the postponement or cancellation of our customers’ capital projects or the inability of our customers to pay our fees; the termination of a major customer contract or project; delays or reductions in U.S. government spending; credit risks associated with our customers; competitive market pressures; the availability and cost of qualified labor; our level of success in attracting, training and retaining qualified management personnel and other staff employees; changes in tax laws and other government regulations, including the impact of health care reform laws and regulations; the possibility of incurring liability for our business activities, including, but not limited to, the activities of our temporary employees; our performance on customer contracts; negative outcome of pending and future claims and litigation; government policies, legislation or judicial decisions adverse to our businesses; potential cost overruns and possible rejection of our business model and/or sales methods; our ability to access the capital markets by pursuing additional debt and equity financing to fund our business plan and expenses on terms acceptable to us or at all; and our ability to comply with our contractual covenants, including in respect of our debt. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We assume no obligation to update such statements, whether as a result of new information, future events or otherwise, except as required by law. We recommend readers to carefully review the entirety of this Annual Report, including the “Risk Factors” in Item 1A of this Annual Report and the other reports and documents we file from time to time with the Securities and Exchange Commission (“SEC”), particularly our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

As used in this Annual Report, the terms “we,” “us,” “our,” “Staffing 360” and the “Company” mean Staffing 360 Solutions, Inc. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in thousands except for share and per share values, unless otherwise indicated.

The disclosures set forth in this report should be read in conjunction with our financial statements and notes thereto for the period ended December 30, 2023.

|

|

PART I

ITEM 1. BUSINESS

General

Staffing 360 Solutions, Inc. (“we,” “us,” “our,” “Staffing 360,” or the “Company”) was incorporated in the State of Nevada on December 22, 2009, as Golden Fork Corporation, which changed its name to Staffing 360 Solutions, Inc., ticker symbol “STAF”, on March 16, 2012. On June 15, 2017, we changed our domicile to the State of Delaware. As a rapidly growing public company in the domestic staffing sector, our high-growth business model is based on finding and acquiring, suitable, mature, profitable, operating, domestic staffing companies. Our targeted consolidation model is focused specifically on the accounting and finance, information technology (“IT”), engineering, administration and light industrial disciplines.

All amounts in this Annual Report are expressed in thousands, except share and per share amounts, or unless otherwise indicated.

Business Model and Acquisitions

We are a high-growth domestic staffing company engaged in the acquisition of United States (“U.S.”) based staffing companies. As part of our consolidation model, we pursue a broad spectrum of staffing companies supporting primarily accounting and finance, IT, engineering, administration (collectively, the “Professional Business Stream”) and commercial (“Commercial Business Stream”) disciplines. Our typical acquisition model is based on paying consideration in the form of cash, stock, earn-outs and/or promissory notes. In furthering our business model, we are regularly in discussions and negotiations with various suitable, mature acquisition targets. To date, we have completed 10 acquisitions since November 2013.

Operating History

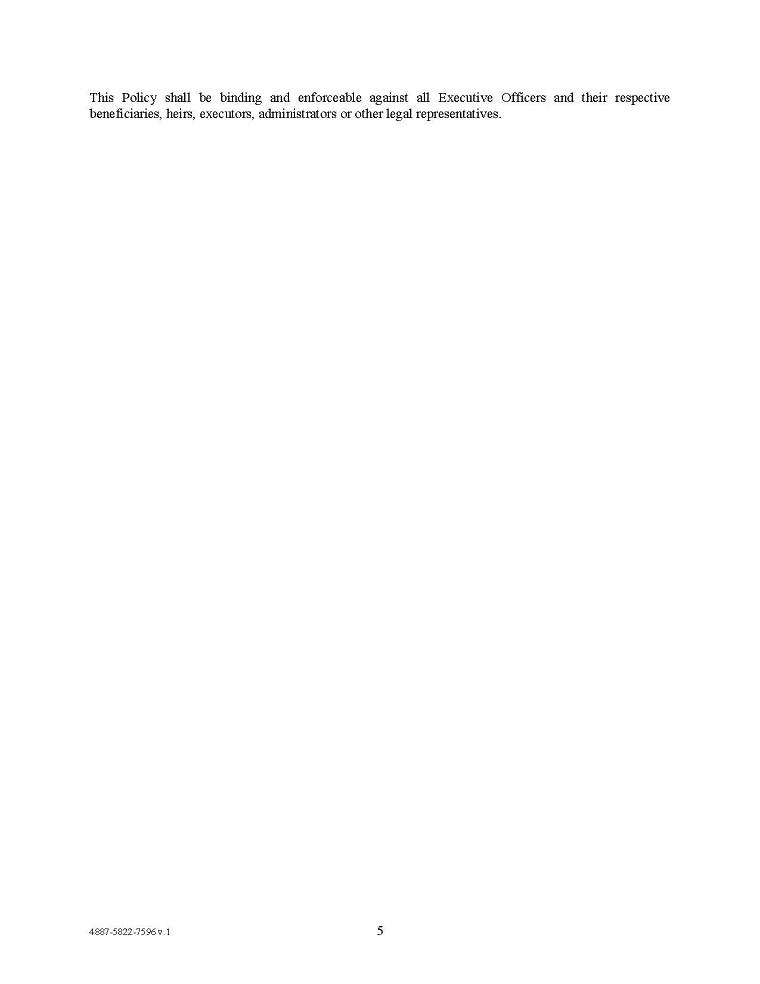

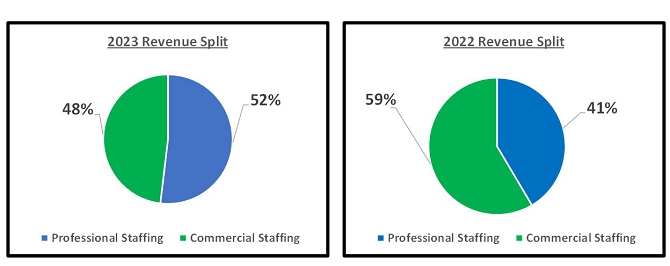

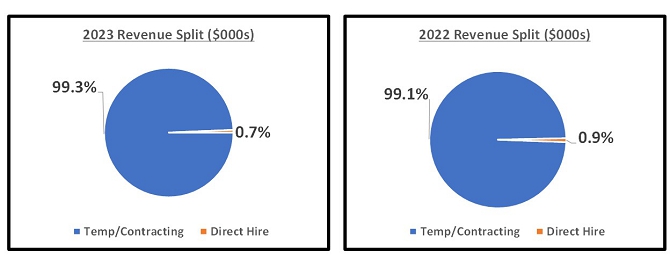

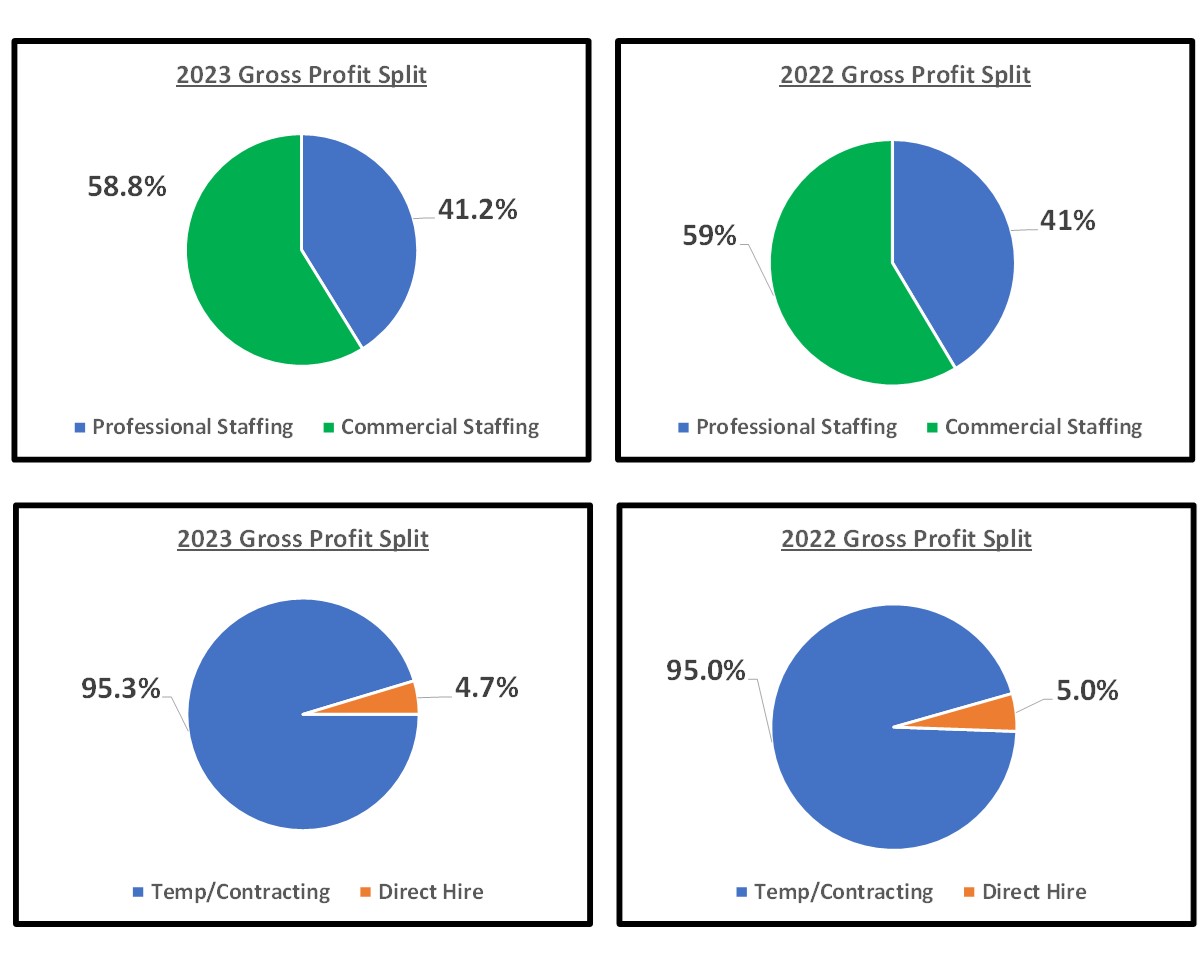

We generated revenue of $190,876 and $184,884 for the years ended December 30, 2023 (“Fiscal 2023”) and December 31, 2022 (“Fiscal 2022”), respectively. This increase was primarily caused by the acquisition of Headway Workforce Solutions (“Headway”), partly offset due to the decline in commercial staffing revenue.

Headway Acquisition and Series H Convertible Preferred Stock

On April 18, 2022, we entered into a stock purchase agreement (the “Stock Purchase Agreement”) with Headway and Chapel Hill Partners, LP, as the representatives of all the stockholders of Headway (“Chapel Hill”), pursuant to which, among other things, we agreed to purchase all of the issued and outstanding securities of Headway in exchange for (i) a cash payment of $14, and (ii) 9,000,000 shares of our Series H Convertible Preferred Stock (the “Series H Preferred Stock”), with a value equal to the Closing Payment, as defined in the Stock Purchase Agreement (the “Headway Acquisition”). On May 18, 2022, the Headway Acquisition closed. The purchase price in connection with the Headway Acquisition was approximately $9,000. Pursuant to certain covenants in the Stock Purchase Agreement, the Company may be subject to a Contingent Payment of up to $4,450 based on the Adjusted EBITDA (such term as defined in the Stock Purchase Agreement) of Headway during the Contingent Period (such term as defined in the Stock Purchase Agreement), subject to additional potential adjustments tied to customary purchase price adjustments described in the Stock Purchase Agreement.

2023 Letter Agreement

On July 31, 2023, we, Chapel Hill and Jean-Pierre Sakey (“Sakey”) entered into a letter agreement (the “Letter Agreement”) in connection with the Stock Purchase Agreement. Pursuant to the Letter Agreement, if on or prior to September 30, 2023, we pay an aggregate of $11,340 (the “Agreed Amount”) to the holders of the Series H Preferred Stock and Chapel Hill for the redemption of the 9,000,000 shares of Series H Preferred Stock issued and outstanding with the remaining amount to be paid to Chapel Hill, less $525 to be paid to third-parties to satisfy existing incentives and fees due, with such fees and incentive payments to be allocated at the discretion of Chapel Hill and Sakey, then our obligation to redeem the Series H Preferred Stock pursuant to the Purchase Agreement and Certificate of Designation of Preferences, Rights and Limitations of Series H Convertible Preferred Stock, as amended (the “Series H COD”), shall be deemed satisfied, and our contingent liabilities, covenants and indemnification obligations pursuant to the Stock Purchase Agreement shall be extinguished and of no further force and effect.

Pursuant to the Letter Agreement, if on or prior to September 30, 2023, we do not redeem the Series H Preferred Stock and remit the Contingent Payment (as defined in the Purchase Agreement), then we shall make the Contingent Payment in the amount of $5,000, as set forth in the Stock Purchase Agreement, in five equal installments of $1,000 each, less $134 per installment to be paid to third-parties to satisfy existing incentives and fees due, with such fees and incentive payments to be allocated at the discretion of Chapel Hill and Sakey (the “Contingent Payment Installments”), with such Contingent Payment Installments to be made on or before December 31, 2023, March 31, 2024, June 30, 2024, September 30, 2024 and December 31, 2024 (each such date, a “Contingent Installment Payment Date”). On each Contingent Installment Payment Date, we shall additionally redeem 100,000 shares of Series H Preferred Stock at a price per share equal to $0.0000001 per share. As of the date of this Annual Report, the Contingent Payment Installments due on December 31, 2023 and March 31, 2024, have not been paid.

Pursuant to the Letter Agreement, we shall also have no obligation to pay the Preferred Dividend (as defined in the Series H COD) on June 30, 2023, September 30, 2023 and December 31, 2023.

On February 22, 2024, Company, Chapel Hill Partners and JP Sakey entered into a Forbearance Agreement (the “Forbearance Agreement”) pursuant to which the holders of the Series H Preferred Stock and Chapel Hill agreed to forebear from exercising their right with respect to the failure to repay the payment due on December 31, 2023 and March 31, 2024 until April 30, 2024, in consideration for a fee of $50 for each installation payment and a reduction on the recovery of Series H Preferred Stock of $100 for each installation payment. The contingent payments due on December 31, 2023 and March 31, 2023 were not paid.

Industry Background

The staffing industry is divided into three major segments: temporary staffing services, professional employer organizations (“PEOs”) and placement agencies. Temporary staffing services provide workers for limited periods, often to substitute for absent permanent workers or to help during periods of peak demand. These workers, who are often employees of the temporary staffing agency, will generally fill clerical, technical, or industrial positions. PEOs, sometimes referred to as employee leasing agencies, contract to provide workers to customers for specific functions, often related to human resource management. In many cases, a customer’s employees are hired by a PEO and then contracted back to the customer. Placement agencies, sometimes referred to as executive recruiters or headhunters, find workers to fill permanent positions at customer companies. These agencies may specialize in placing senior managers, mid-level managers, technical workers, or clerical and other support workers.

We consider ourselves a temporary staffing company within the broader staffing industry. However, we provide permanent placements at the request of existing clients and some consulting services clients.

Staffing companies identify potential candidates through online advertising and referrals, and interview, test and counsel workers before sending them to the customer for approval. Pre-employment screening can include skills assessment, drug tests and criminal background checks. The personnel staffing industry has been radically changed by the internet. Many employers list available positions with one or several internet personnel sites like www.monster.com or www.careerbuilder.com, and on their own sites. Personnel agencies operate their own sites and often still work as intermediaries by helping employers accurately describe job openings and by screening candidates who submit applications.

Major end-use customers include businesses from a wide range of industries such as manufacturing, construction, wholesale and retail. Marketing involves direct sales presentations, referrals from existing clients and advertising. Agencies compete both for customers and workers. Depending on market supply and demand at any given time, agencies may allocate more resources either to finding potential employers or potential workers. Permanent placement agencies work either on a retained or on a contingency basis. Clients may retain an agency for a specific job search or on contract for a specific period. Temporary staffing services charge customers a fixed price per hour/day or a standard markup on prevailing hourly/daily rates.

For many staffing companies, demand is lower late in the fourth calendar quarter and early in the first calendar quarter, partly because of holidays, and higher during the rest of the year. Staffing companies may have high receivables from customers. Temporary staffing agencies and PEOs must manage a high cash flow because they funnel payroll payments from employers. Cash flow imbalances also occur because agencies must pay workers even though they haven’t been paid by clients.

|

|

The revenue of staffing companies depends on the number of jobs they fill, which in turn can depend upon the economic environment. During economic slowdowns, many client companies stop hiring altogether. Internet employment sites expand a company’s ability to find workers without the help of traditional agencies. Staffing companies often work as intermediaries, helping employers accurately describe job openings and screen candidates. Increasing the use of sophisticated, automated job description and candidate screening tools could make many traditional functions of personnel agencies obsolete. Free social networking sites such as LinkedIn and Facebook are also becoming a common way for recruiters and employees to connect without the assistance of a staffing agency.

To avoid large placement agency fees, big companies may use in-house personnel staff, current employee referrals, or human resources consulting companies to find and hire new personnel. Because placement agencies typically charge a fee based on a percentage of the first year’s salary of a new worker, companies with many jobs to fill have a financial incentive to avoid agencies.

Many staffing companies are small and may depend heavily on a few big customers for a large portion of revenue. Large customers may lead to increased revenue, but also expose agencies to higher risks. When major accounts experience financial hardships, and have less need for temporary employment services, agencies stand to lose large portions of revenue.

The loss of a staff member who handles a large volume of business may result in a large loss of revenue for a staffing company. Individual staff members, rather than the staffing company itself, often develop strong relationships with customers. Staff members who move to another staffing company are often able to move customers with them.

Some of the best opportunities for temporary employment are in industries traditionally active in seasonal cycles, such as manufacturing, construction, wholesale and retail. However, seasonal demand for workers creates cash flow fluctuations throughout the year.

Staffing companies are regulated by the U.S. Department of Labor and the Equal Employment Opportunity Commission, and often by state authorities. Many federal anti-discrimination rules regulate the type of information that employment firms can request from candidates or provide to customers about candidates. In addition, the relationship between the agency and the temporary employees, or employee candidates may not always be clear, resulting in legal and regulatory uncertainty. PEOs are often considered co-employers along with the client, but the PEO is responsible for employee wages, taxes and benefits. State regulation aims to ensure that PEOs provide the benefits they promise to workers.

Trends in the Staffing Business

Start-up costs for a staffing company are very low. Individual offices can be profitable, but consolidation is driven mainly by the opportunity for large agencies to develop national relationships with big customers. Some agencies expand by starting new offices in promising markets, but most prefer to buy existing independent offices with proven staff and an existing customer roster.

At some companies, temporary workers have become such a large part of the workforce that staffing company employees sometimes work at the customer’s site to recruit, train, and manage temporary employees. The Company has a number of onsite relationships with its customers. Staffing companies try to match the best qualified employees for the customer’s needs, but often provide additional training specific to that company, such as instruction in the use of proprietary software.

Some personnel consulting firms and human resource departments are increasingly using psychological tests to evaluate potential job candidates. Psychological or liability testing has gained popularity, in part, due to recent fraud scandals. In addition to stiffer background checks, headhunters often check the credit history of prospective employees.

We believe the trends of outsourcing entire departments and dependence on temporary and leased workers will expand opportunities for staffing companies. Taking advantage of their expertise in assessing worker capabilities, some staffing companies manage their clients’ entire human resource functions. Human resources outsourcing (“HRO”) may include management of payroll, tax filings, and benefit administration services. HRO may also include recruitment process outsourcing (“RPO”), whereby an agency manages all recruitment activities for a client.

New online technology is improving staffing efficiency. For example, some online applications coordinate workflow for staffing agencies, their clients and temporary workers, and allow agencies and customers to share work order requests, submit and track candidates, approve timesheets and expenses, and run reports. Interaction between candidates and potential employers is increasingly being handled online.

|

|

Initially viewed as rivals, some Internet job-search companies and traditional employment agencies are now collaborating. While some Internet sites do not allow agencies to use their services to post jobs or look through resumes, others find that agencies are their biggest customers, earning the sites a large percentage of their revenue. Some staffing companies contract to help client employers find workers online.

Competition

Our staffing divisions face competition in attracting clients as well as temporary candidates. The staffing industry is highly competitive, with a number of firms offering services similar to those provided by us on a national, regional or local basis. In many areas, the local staffing companies are our strongest competitors. The most significant competitive factors in the staffing business are price and reliability of service. We believe its competitive advantage stems from its experience in niche markets, and commitment to the specialized employment market, along with its growing global presence.

The staffing industry is characterized by a large number of competing companies in a fragmented sector. Major competitors also exist across the sector, but as the industry affords low barriers to entry, new entrants are constantly introduced to the marketplace.

The top layer of competitors includes large corporate staffing and employment companies which have yearly revenue of $75 million or more. The next (middle) layer of the competition consists of medium-sized entities with yearly revenue of $10 million or more. The largest portion of the marketplace is the bottom layer of this competitive landscape consisting of small, individual-sized or family-run operations. As barriers to entry are low, sole proprietors, partnerships and small entities routinely enter the industry.

Employees

We employ approximately 150 full-time employees as part of our internal operations. Additionally, we employ more than 4,500 individuals that are placed directly with our clients through our various operating subsidiaries.

Available Information

We are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended, and, in accordance therewith, we file periodic reports, proxy statements and other information with the SEC. We make available, free of charge, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports on our website at www.staffing360solutions.com as soon as reasonably practicable after those reports and other information is electronically filed with, or furnished to, the SEC.

ITEM 1A. RISK FACTORS.

There are numerous and varied risks that may prevent us from achieving our goals, including those described below. You should carefully consider the risks described below and the other information included in this Annual Report, including our consolidated financial statements and related notes. Our business, financial condition, and results of operations could be harmed by any of the following risks. If any of the events or circumstances described below were to occur, our business, the financial condition and the results of operations could be materially adversely affected. As a result, the trading price of our common stock could decline, and investors could lose part or all of their investment. The risks below are not the only risks we face. Additional risks not currently known to us or that we currently deem to be immaterial may also adversely affect our business, financial condition or results of operations.

Risk Factor Summary

Below is a summary of the principal factors that make an investment in our common stock speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below under the heading “Risk Factors” and should be carefully considered, together with other information in this Annual Report and our other filings with the SEC, before making an investment decision regarding our common stock.

|

|

| ● | We have incurred significant losses since our inception and may continue to incur losses and thus may never achieve or maintain profitability; | |

| ● | Our debt level could negatively impact our financial condition, results of operations and business prospects; | |

| ● | Our debt instruments contain covenants that could limit our financing options and liquidity position, which would limit our ability to grow our business; | |

| ● | The Jackson Notes are secured by substantially all of our assets that are not secured by our revolving loans facility with Midcap., and the terms of the Jackson Notes may restrict our current and future operations. Additionally, Jackson may be able to exert significant influence over us as our senior secured lender (each as defined herein); | |

| ● | We will need to raise additional capital to meet our business requirements in the future, which is likely to be challenging, could be highly dilutive and may cause the market price of our common stock to decline; | |

| ● | We have significant working capital needs and if we are unable to satisfy those needs from cash generated from our operations or borrowings under our debt instruments, we may not be able to continue our operations; | |

| ● | Our revenue can vary because our customers can terminate their relationship with us at any time with limited or no penalty; | |

| ● | We operate in an intensely competitive and rapidly changing business environment, and there is a substantial risk that our services could become obsolete or uncompetitive; | |

| ● | We have been and may be exposed to employment-related claims and losses, including class action lawsuits, which could have a material adverse effect on our business; | |

| ● | Our growth of operations could strain our resources and cause our business to suffer; | |

| ● | Our strategy of growing through acquisitions may impact our business in unexpected ways; | |

| ● | A more active, liquid trading market for our common stock may not develop, and the price of our common stock may fluctuate significantly; | |

| ● | We depend on attracting, integrating, managing, and retaining qualified personnel; | |

| ● | If we are unable to retain existing customers or attract new customers, our business and results of operations could suffer; | |

| ● | We are dependent upon technology services, and if we experience damage, service interruptions or failures in our computer and telecommunications systems, our customer relationships and our ability to attract new customers may be adversely affected; | |

| ● | Our management has identified a material weakness in our internal control over financial reporting relating to the lack of a sufficient complement of competent finance personnel to appropriately account for, review and disclose the completeness and accuracy of transactions entered into by the Company. This material weakness, if not remediated, could result in material misstatements in our consolidated financial statements. We may be unable to develop, implement and maintain appropriate internal controls over financial reporting. If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results and current and potential stockholders may lose confidence in our financial reporting. |

Risks Relating to Our Organization and Our Financial Condition

We have incurred significant losses since our inception and may continue to incur losses and thus may never achieve or maintain profitability.

We have incurred substantial losses since our inception, anticipate that we will continue to incur losses for the foreseeable future and may not achieve or sustain profitability. Because of the numerous risks and uncertainties associated with the staffing industry, we are unable to predict the extent of any future losses or when we will become profitable, if at all. Expected future operating losses will have an adverse effect on our cash resources, stockholders’ equity and working capital. Our negative working capital and liquidity position raise substantial doubt about our ability to continue as a going concern.

|

|

Our failure to become and remain profitable could depress the value of our common stock and impair our ability to raise capital, expand our business, maintain our development efforts, diversify our portfolio of staffing companies, or continue our operations. A decline in the value of our common stock could also cause you to lose all or part of your investment.

Our independent registered public accounting firms have included an explanatory paragraph in its report as of and for the year ended December 30, 2023 expressing substantial doubt in our ability to continue as a going concern based on our negative working capital and liquidity position and other macro-economic indicators. Our consolidated financial statements do not include any adjustments that might result from the outcome of this going concern uncertainty and have been prepared under the assumption that we will continue to operate as a going concern, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. If we are unable to continue as a going concern, we may be forced to liquidate our assets which would have an adverse impact on our business and developmental activities. In such a scenario, the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. The reaction of investors to the inclusion of a going concern statement by our independent registered public accounting firm and our potential inability to continue as a going concern may materially adversely affect our stock price and our ability to raise new capital or to enter into strategic alliances.

Our debt level could negatively impact our financial condition, results of operations and business prospects.

As of December 30, 2023, our total gross debt was approximately $19,116. Our level of debt could have significant consequences to our stockholders, including the following:

| ● | requiring the dedication of a substantial portion of cash flow from operations to make payments on debt, thereby reducing the availability of cash flow for working capital, capital expenditures and other general business activities; | |

| ● | requiring a substantial portion of our corporate cash reserves to be held as a reserve for debt service, limiting our ability to invest in new growth opportunities; | |

| ● | limiting the ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions and general corporate and other activities; | |

| ● | limiting the flexibility in planning for, or reacting to, changes in the business and industry in which we operate; | |

| ● | increasing our vulnerability to both general and industry-specific adverse economic conditions | |

| ● | putting us at a competitive disadvantage versus less leveraged competitors; and | |

| ● | increasing vulnerability to changes in the prevailing interest rates. |

Our ability to make payments of principal and interest, or to refinance our indebtedness, depends on our future performance, which is subject to economic, financial, competitive and other factors. We had negative cash flows from operations for the fiscal year ended December 30, 2023, and we may not generate cash flow in the future sufficient to service our debt because of factors beyond our control, including but not limited to our ability to expand our operations. If we are unable to generate sufficient cash flows, we may be required to adopt one or more alternatives, such as restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive. Our ability to refinance our indebtedness will depend on the capital markets and our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable terms, which could result in a default on our debt obligations. A default on our debt obligations could have a material adverse effect on our business, financial condition and results of operations and may cause you to lose all or part of your investment.

Further, the outstanding Amended and Restated Senior Secured 12% Promissory Note (the “2022 Jackson Note”) and the 12% Senior Secured Promissory Note (the “2023 Jackson Note” and together with the 2022 Jackson Note, the “Jackson Notes”) each issued to Jackson Investment Group LLC (“Jackson”) and due October 14, 2024 contain certain customary financial covenants, and we have had instances of non-compliance. Management has historically been able to obtain, from Jackson, waivers of any non-compliance and management expects to continue to be able to obtain necessary waivers in the event of future non-compliance; however, there can be no assurance that we will be able to obtain such waivers, and should Jackson refuse to provide a waiver in the future, the outstanding debt under the agreement could become due immediately. Our financing with MidCap Funding X Trust (“MidCap”) includes customary financial covenants and we have had instances of non-compliance. We have been able to obtain forbearance of any non-compliance from MidCap, and management expects to continue to be able to obtain necessary forbearance in the event of future non-compliance; however, there can be no assurance that we will be able to obtain such forbearance, and should MidCap refuse to provide a forbearance in the future, the outstanding debt under the agreement could become due immediately, which exceeds our current cash balance.

|

|

Our debt instruments contain covenants that could limit our financing options and liquidity position, which would limit our ability to grow our business.

Covenants in our debt instruments impose operating and financial restrictions on us. These restrictions prohibit or limit our ability to, among other things:

| ● | pay cash dividends to our stockholders, subject to certain limited exceptions; | |

| ● | redeem or repurchase our common stock or other equity; | |

| ● | incur additional indebtedness; | |

| ● | permit liens on assets; | |

| ● | make certain investments (including through the acquisition of stock, shares, partnership or limited liability company interests, any loan, advance or capital contribution); | |

| ● | sell, lease, license, lend or otherwise convey an interest in a material portion of our assets; | |

| ● | cease making public filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and | |

| ● | sell or otherwise issue shares of our common stock or other capital stock subject to certain limited exceptions. |

Our failure to comply with the restrictions in our debt instruments could result in events of default, which, if not cured or waived, could result in us being required to repay these borrowings before their due date. The holders of our debt may require fees and expenses to be paid or other changes to terms in connection with waivers or amendments. If we are forced to refinance these borrowings on less favorable terms, our results of operations and financial condition could be adversely affected by increased costs and rates. In addition, these restrictions may limit our ability to obtain additional financing, withstand downturns in our business or take advantage of business opportunities.

The Jackson Notes are secured by substantially all of our assets that are not secured by our revolving loan facility with Midcap and the terms of the Jackson Notes may restrict our current and future operations. Additionally, Jackson may be able to exert significant influence over us as our senior secured lender.

The Jackson Notes contain a number of restrictive covenants that impose significant operating and financial restrictions on us and may limit our ability to engage in acts that we believe may be in our long-term best interests. The Jackson Notes include covenants limiting or restricting, among other things, our ability to:

| ● | incur or guarantee additional indebtedness; | |

| ● | pay distributions on, redeem or repurchase shares of our capital stock or redeem or repurchase any of our subordinated debt; | |

| ● | make certain investments; | |

| ● | sell assets; | |

| ● | enter into agreements that restrict distributions or other payments from our restricted subsidiaries; | |

| ● | incur or allow the existence of liens; | |

| ● | consolidate, merge or transfer all or substantially all of our assets; and | |

| ● | engage in transactions with affiliates. |

In addition, the Jackson Notes contain financial covenants including, among other things, a fixed charge coverage ratio, minimum liquidity requirements and total leverage ratio. A breach of any of these financial covenants could result in a default under the Jackson Notes. If any such default occurs, Jackson may elect to declare all outstanding borrowings, together with accrued interest and other amounts payable thereunder, to be immediately due and payable, which would adversely impact our financial condition and operations. In addition, following an event of default under the Jackson Notes, Jackson will have the right to proceed against the collateral granted to it to secure the debt, which includes our available cash. If the debt under the Jackson Notes were to be accelerated, we cannot assure you that our assets would be sufficient to repay in full our debt.

|

|

We review the recoverability of goodwill and other indefinite lived intangible assets annually as of the first day of our fiscal fourth quarter, and whenever events or circumstances indicate that the carrying value of a reporting unit, including goodwill, or an indefinite lived intangible asset may not be recoverable.

To evaluate goodwill and other indefinite lived intangible assets for impairment, we may use qualitative assessments to determine whether it is more likely than not that the fair value of a reporting unit, including goodwill, or an indefinite lived intangible asset is less than its carrying amount. The qualitative assessments require assumptions to be made regarding multiple factors, including the current operating environment, historical and future financial performance and industry and market conditions. If an initial qualitative assessment identifies that it is more likely than not that the carrying value of a reporting unit exceeds its estimated fair value, additional quantitative testing is performed. Alternatively, we may elect to bypass the qualitative assessment and instead perform a quantitative impairment test to calculate the fair value of the reporting unit in comparison to its associated carrying value.

The quantitative impairment tests require us to make an estimate of the fair value of our reporting units. An impairment could be recorded as a result of changes in assumptions, estimates or circumstances, some of which are beyond our control. Because a number of factors may influence determinations of fair value of goodwill, we are unable to predict whether impairments of goodwill will occur in the future, and there can be no assurance that continued conditions will not result in future impairments of goodwill. The future occurrence of a potential indicator of impairment could include matters such as (i) a decrease in expected net earnings; (ii) adverse equity market conditions; (iii) a decline in current market multiples; (iv) a decline in our common stock price; (v) a significant adverse change in legal factors or the general business climate; and (vi) a significant downturn in employment markets in the United States. Any such impairment would result in us recognizing a non-cash charge in our consolidated statement of operations, which could adversely affect our business, results of operations and financial condition.

We cannot accurately predict the effect of the weakness in the national economy on our future operating results or the market price of our voting common stock.

The national economy in general is currently facing challenges of a scope unprecedented in recent history. We cannot accurately predict the severity or duration of the current economic downturn, which has adversely impacted the markets we serve. Any further deterioration in national or local economic conditions would have an adverse effect, which could be material, on our business, financial condition, results of operations and prospects, and could also cause the market price of our voting common stock to decline. While it is impossible to predict how long these conditions may exist, the current economic downturn could present substantial risks for some time for the banking industry and for us. The Company currently does not have any exposure to Silicon Valley Bank (now owned by First Citizens Bank), Signature Bank (now owned by New York Community Bancorp), Republic Bank (now owned by JPMorgan Chase & Co.) or Pacific Western Bank (now owned by Bank of California) during the regional banking of crisis of 2023, nor does the Company believe that any of the banks with which it does business currently face a material risk of collapse.

We will need to raise additional capital to meet our business requirements in the future, which is likely to be challenging, could be highly dilutive and may cause the market price of our common stock to decline.

As of December 30, 2023, we had a working capital deficiency of $45,419, an accumulated deficit of $125,056 and a net loss for the fiscal year ended December 30, 2023 of $26,041. We will need to raise additional capital to pursue growth opportunities, improve our infrastructure, finance our operations and otherwise make investments in assets and personnel that will allow us to remain competitive. Additional capital would be used to accomplish the following:

| ● | financing our current operating expenses; | |

| ● | pursuing growth opportunities; | |

| ● | making capital improvements to improve our infrastructure; | |

| ● | hiring and retaining qualified management and key employees; | |

| ● | responding to competitive pressures; | |

| ● | complying with regulatory requirements; and | |

| ● | maintaining compliance with applicable laws. |

To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of those securities could result in substantial dilution for our current stockholders. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then-outstanding. We may issue additional shares of our common stock or securities convertible into or exchangeable or exercisable for our common stock in connection with hiring or retaining personnel, option or warrant exercises, future acquisitions or future placements of our securities for capital-raising or other business purposes. The issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline further and existing stockholders may not agree with our financing plans or the terms of such financings. In connection with this offering, we may agree to amend the terms of certain of our outstanding warrants held by certain purchasers in this offering. Any such amendments may, among other things, decrease the exercise prices or increase the term of exercise of those warrants.

In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition.

|

|

Furthermore, any additional debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain such additional financing on a timely basis, we may have to curtail our development activities and growth plans and/or be forced to sell assets, perhaps on unfavorable terms, which would have a material adverse effect on our business, financial condition and results of operations, and we ultimately could be forced to discontinue our operations and liquidate, in which event it is unlikely that stockholders would receive any distribution on their shares. Further, we may not be able to continue operating if we do not generate sufficient revenues from operations needed to stay in business.

We review the recoverability of goodwill and other indefinite lived intangible assets annually as of the first day of our fiscal fourth quarter, and whenever events or circumstances indicate that the carrying value of a reporting unit, including goodwill, or an indefinite lived intangible asset may not be recoverable.

To evaluate goodwill and other indefinite lived intangible assets for impairment, we may use qualitative assessments to determine whether it is more likely than not that the fair value of a reporting unit, including goodwill, or an indefinite lived intangible asset is less than its carrying amount. The qualitative assessments require assumptions to be made regarding multiple factors, including the current operating environment, historical and future financial performance and industry and market conditions. If an initial qualitative assessment identifies that it is more likely than not that the carrying value of a reporting unit exceeds its estimated fair value, additional quantitative testing is performed. Alternatively, we may elect to bypass the qualitative assessment and instead perform a quantitative impairment test to calculate the fair value of the reporting unit in comparison to its associated carrying value.

The quantitative impairment tests require us to make an estimate of the fair value of our reporting units. An impairment could be recorded as a result of changes in assumptions, estimates or circumstances, some of which are beyond our control. Because a number of factors may influence determinations of fair value of goodwill, we are unable to predict whether impairments of goodwill will occur in the future, and there can be no assurance that continued conditions will not result in future impairments of goodwill. The future occurrence of a potential indicator of impairment could include matters such as (i) a decrease in expected net earnings; (ii) adverse equity market conditions; (iii) a decline in current market multiples; (iv) a decline in our common stock price; (v) a significant adverse change in legal factors or the general business climate; and (vi) a significant downturn in employment markets in the U.S. Any such impairment would result in us recognizing a non-cash charge in our consolidated statement of operations, which could adversely affect our business, results of operations and financial condition.

We have significant working capital needs and if we are unable to satisfy those needs from cash generated from our operations or borrowings under our debt instruments, we may not be able to continue our operations.

We require significant amounts of working capital to operate our business. We often have high receivables from our customers, and as a staffing company, we are prone to cash flow imbalances because we have to fund payroll payments to temporary workers before receiving payments from clients for our services. Cash flow imbalances also occur because we must pay temporary workers even when we have not been paid by our customers. If we experience a significant and sustained drop in operating profits, or if there are unanticipated reductions in cash inflows or increases in cash outlays, we may be subject to cash shortfalls. If such a shortfall were to occur for even a brief period of time, it may have a significant adverse effect on our business. In particular, we use working capital to pay expenses relating to our temporary workers and to satisfy our workers’ compensation liabilities. As a result, we must maintain sufficient cash availability to pay temporary workers and fund related tax liabilities prior to receiving payment from customers.

In addition, our operating results tend to be unpredictable from quarter to quarter. Demand for our services is typically lower during traditional national vacation periods when customers and candidates are on vacation. No single quarter is predictive of results of future periods. Any extended period of time with low operating results or cash flow imbalances could have a material adverse effect on our business, financial condition and results of operations.

We derive working capital for our operations through cash generated by our operating activities, equity raises, and borrowings under our debt instruments. If our working capital needs increase in the future, we may be forced to seek additional sources of capital, which may not be available on commercially reasonable terms. The amount we are entitled to borrow under our debt instruments is calculated monthly based on the aggregate value of certain eligible trade accounts receivable generated from our operations, which are affected by financial, business, economic and other factors, as well as by the daily timing of cash collections and cash outflows. The aggregate value of our eligible accounts receivable may not be adequate to allow for borrowings for other corporate purposes, such as capital expenditures or growth opportunities, which could reduce our ability to react to changes in the market or industry conditions.

We face risks associated with litigation and claims.

We are a party to certain legal proceedings as further described under “Legal Proceedings”. In addition, from time to time, we may become involved in various claims, disputes and legal or regulatory proceedings that arise in the ordinary course of business and relate to contractual and other obligations. Due to the uncertainties of litigation, we can give no assurance that we will prevail on any claims made against us in any such lawsuit. Also, we can give no assurance that any other lawsuits or claims brought in the future will not have an adverse effect on our financial condition, liquidity or operating results. Adverse outcomes in some or all of these claims may result in significant monetary damages that could adversely affect our ability to conduct our business.

|

|

Our revenue can vary because our customers can terminate their relationship with us at any time with limited or no penalty.

We focus on providing mid-level professional and light industrial personnel on a temporary assignment-by-assignment basis, which customers can generally terminate at any time or reduce their level of use when compared with prior periods. To avoid large placement agency fees, large companies may use in-house personnel staff, current employee referrals, or human resources consulting companies to find and hire new personnel. Because placement agencies typically charge a fee based on a percentage of the first year’s salary of a new worker, companies with many jobs to fill have a large financial incentive to avoid agencies.

Our business is also significantly affected by our customers’ hiring needs and their views of their future prospects. Our customers may, on very short notice, terminate, reduce or postpone their recruiting assignments with us and, therefore, affect demand for our services. As a result, a significant number of our customers can terminate their agreements with us at any time, making us particularly vulnerable to a significant decrease in revenue within a short period of time that could be difficult to quickly replace. This could have a material adverse effect on our business, financial condition and results of operations.

Most of our contracts do not obligate our customers to utilize a significant amount of our staffing services and may be cancelled on limited notice, so our revenue is not guaranteed.

Substantially all of our revenue is derived from multi-year contracts that are terminable for convenience. Under our multi-year agreements, we contract to provide customers with staffing services through work or service orders at the customers’ request. Under these agreements, our customers often have little or no obligation to request our staffing services. In addition, most of our contracts are cancellable on limited notice, even if we are not in default under the contract. We may hire employees permanently to meet anticipated demand for services under these agreements that may ultimately be delayed or cancelled. We could face a significant decline in revenues and our business, financial condition or results of operations could be materially adversely affected if:

| ● | we see a significant decline in the staffing services requested from us under our service agreements; or | |

| ● | our customers cancel or defer a significant number of staffing requests; or our existing customer agreements expire or lapse and we cannot replace them with similar agreements. |

|

|

We could be adversely affected by risks associated with acquisitions and joint ventures.

We are engaged in the acquisition of staffing companies, and our typical acquisition model is based on paying consideration in the form of cash, stock, earn-outs and/or promissory notes. To date, we have completed 10 acquisitions. We intend to expand our business through acquisitions of complementary businesses, services or products, subject to our business plans and management’s ability to identify, acquire and develop suitable investments or acquisition targets in both new and existing service categories. In certain circumstances, acceptable investments or acquisition targets might not be available. Acquisitions involve a number of risks, including:

| ● | difficulty in integrating the operations, technologies, products and personnel of an acquired business, including consolidating redundant facilities and infrastructure; | |

| ● | potential disruption of our ongoing business and the distraction of management from our day-to-day operations; | |

| ● | difficulty entering markets in which we have limited or no prior experience and in which competitors have a stronger market position; | |

| ● | difficulty maintaining the quality of services that such acquired companies have historically provided; potential legal and financial responsibility for liabilities of acquired businesses; | |

| ● | overpayment for the acquired company or assets or failure to achieve anticipated benefits, such as cost savings and revenue enhancements; | |

| ● | increased expenses associated with completing an acquisition and amortizing any acquired intangible assets; | |

| ● | challenges in implementing uniform standards, accounting policies, customs, controls, procedures and policies throughout an acquired business; | |

| ● | failure to retain, motivate and integrate key management and other employees of the acquired business; and | |

| ● | loss of customers and a failure to integrate customer bases. |

Our business plan for continued growth through acquisitions is subject to certain inherent risks, including accessing capital resources, potential cost overruns and possible rejection of our business model and/or sales methods. Therefore, we provide no assurance that we will be successful in carrying out our business plan. We continue to pursue additional debt and equity financing to fund our business plan. We have no assurance that future financing will be available to us on acceptable terms or at all.

In addition, if we incur indebtedness to finance an acquisition, it may reduce our capacity to borrow additional amounts and require us to dedicate a greater percentage of our cash flow from operations to payments on our debt, thereby reducing the cash resources available to us to fund capital expenditures, pursue other acquisitions or investments in new business initiatives and meet general corporate and working capital needs. This increased indebtedness may also limit our flexibility in planning for, and reacting to, changes in or challenges relating to our business and industry. The use of our common stock or other securities (including those convertible into or exchangeable or exercisable for our common stock) to finance any such acquisition may also result in dilution of our existing shareholders.

The potential risks associated with future acquisitions could disrupt our ongoing business, result in the loss of key customers or personnel, increase expenses and otherwise have a material adverse effect on our business, results of operations and financial condition.

Our business is subject to cybersecurity risks and we could be harmed by improper disclosure or loss of sensitive or confidential company, employee, associate or customer data, including personal data.

Our operations are increasingly dependent on information technologies and services and in connection with the operation of our business, we store, process and transmit a large amount of data, including personnel and payment information, about our employees, customers, associates and candidates, a portion of which is confidential and/or personally sensitive. We rely on our own technology and systems, and those of third-party vendors we use for a variety of processes. We and our third-party vendors have established policies and procedures to help protect the security and privacy of this information. Threats to information technology systems associated with cybersecurity risks and cyber incidents or attacks continue to grow, and include, among other things, storms and natural disasters, terrorist attacks, utility outages, theft, viruses, phishing, malware, design defects, human error, and complications encountered as existing systems are maintained, repaired, replaced, or upgraded. Risks associated with these threats include, among other things:

| ● | theft or misappropriation of funds; |

| ● | loss, corruption, or misappropriation of proprietary, confidential or personally identifiable information (including employee data); |

| ● | disruption or impairment of our and our business operations and safety procedures; |

| ● | damage to our reputation with our potential partners, clients, and the market; |

| ● | exposure to litigation; |

| ● | increased costs to prevent, respond to or mitigate cybersecurity events. |

Additionally, unauthorized disclosure or loss of sensitive or confidential data may occur through a variety of methods. These include, but are not limited to, systems failure, employee negligence, fraud or misappropriation, or unauthorized access to or through our information systems, whether by our employees or third parties, including a cyberattack by computer programmers, hackers, members of organized crime and/or state-sponsored organizations, who may develop and deploy viruses, worms or other malicious software programs.

|

|

Such disclosure, loss or breach could harm our reputation and subject us to government sanctions and liability under our contracts and laws that protect sensitive or personal data and confidential information, resulting in increased costs or loss of revenues. Moreover, we have no control over the information technology systems of third-party vendors and others with which our systems may connect and communicate. It is possible that security controls over sensitive or confidential data and other practices we and our third-party vendors follow may not prevent the improper access to, disclosure of, or loss of such information. Further, data privacy is subject to frequently changing rules and regulations, which sometimes conflict among the various jurisdictions in which we provide services. Any failure or perceived failure to successfully manage the collection, use, disclosure, or security of personal information or other privacy related matters, or any failure to comply with changing regulatory requirements in this area, could result in legal liability or impairment to our reputation in the marketplace.

We have cybersecurity insurance coverage in the event we become subject to various cybersecurity attacks, however, we cannot ensure that it will be sufficient to cover any particular losses we may experience as a result of such cyberattacks. Any cyber incident could have a material adverse effect on our business, financial condition and results of operations.

We have been and may be exposed to employment-related claims and losses, including class action lawsuits, which could have a material adverse effect on our business.

We employ people internally and in the workplaces of other businesses. Many of these individuals have access to customer information systems and confidential information. The risks of these activities include possible claims relating to:

| ● | discrimination and harassment; | |

| ● | wrongful termination or denial of employment; | |

| ● | violations of employment rights related to employment screening or privacy issues; | |

| ● | classification of temporary workers; | |

| ● | assignment of illegal aliens; | |

| ● | violations of wage and hour requirements; | |

| ● | retroactive entitlement to temporary worker benefits; | |

| ● | errors and omissions by our temporary workers; | |

| ● | misuse of customer proprietary information; | |

| ● | misappropriation of funds; | |

| ● | damage to customer facilities due to negligence of temporary workers; and | |

| ● | criminal activity. |

We may incur fines and other losses or negative publicity with respect to these problems. In addition, these claims may give rise to litigation, which could be time-consuming and expensive. New employment and labor laws and regulations may be proposed or adopted that may increase the potential exposure of employers to employment-related claims and litigation. There can be no assurance that the corporate policies we have in place to help reduce our exposure to these risks will be effective or that we will not experience losses as a result of these risks. There can also be no assurance that the insurance policies we have purchased to insure against certain risks will be adequate or that insurance coverage will remain available on reasonable terms or be sufficient in amount or scope of coverage.

Provisions in our corporate charter documents and under Delaware law could make an acquisition of us more difficult and may prevent attempts by our stockholders to replace or remove our current management.

Provisions in our amended and restated certificate of incorporation, as amended (the “Certificate of Incorporation”) and our amended and restated bylaws (the “Bylaws”) may discourage, delay or prevent a merger, acquisition or other change in control of us that stockholders may consider favorable, including transactions in which stockholders might otherwise receive a premium for their shares. These provisions could also limit the price that investors might be willing to pay in the future for shares of our common stock, thereby depressing the market price of our common stock. In addition, these provisions may frustrate or prevent any attempts by our stockholders to replace or remove our current management by making it more difficult for stockholders to replace members of our Board of Directors (the “Board”). Because our Board is responsible for appointing the members of our management team, these provisions could in turn affect any attempt by our stockholders to replace current members of our management team. Among others, these provisions include that:

| ● | our Board has the exclusive right to expand the size of our Board and to elect directors to fill a vacancy created by the expansion of the Board or the resignation, death or removal of a director, which prevents stockholders from being able to fill vacancies on our Board; |

|

|

| ● | a special meeting of stockholders may be called only by a majority of the Board, the executive chairman or the president, which may delay the ability of our stockholders to force consideration of a proposal or to take action, including the removal of directors; | |

| ● | our stockholders do not have the right to cumulate votes in the election of directors, which limits the ability of minority stockholders to elect director candidates; | |

| ● | our Board may alter our Bylaws without obtaining stockholder approval; | |

| ● | stockholders must provide advance notice and additional disclosures in order to nominate individuals for election to the Board or to propose matters that can be acted upon at a stockholders’ meeting, which may discourage or deter a potential acquiror from conducting a solicitation of proxies to elect the acquiror’s own slate of directors or otherwise attempting to obtain control of our company; and | |

| ● | our Board is authorized to issue shares of preferred stock and to determine the terms of those shares, including preferences and voting rights, without stockholder approval, which could be used to significantly dilute the ownership of a hostile acquiror. |

In addition, the terms of the Jackson Notes limit our ability to consolidate, merge, or transfer all or substantially all of our assets or to effect a change in control of ownership of our company. A breach of such restrictions could result in a default under the Jackson Notes, under which Jackson may elect to declare all outstanding borrowings under the Jackson Notes, together with accrued interest and other amounts payable thereunder, to be immediately due and payable.

Moreover, because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which prohibits a person who owns in excess of 15% of our outstanding voting stock from merging or combining with us for a period of three years after the date of the transaction in which the person acquired in excess of 15% of our outstanding voting stock, unless the merger or combination is approved in a prescribed manner.

Furthermore, our Certificate of Incorporation specifies that, unless we consent in writing to the selection of an alternative forum, a state court located within the State of Delaware will be the sole and exclusive forum for most legal actions involving actions brought against us by stockholders, which may include federal claims and derivative actions, except that if no state court located within the State of Delaware has jurisdiction over such claims (including subject matter jurisdiction), the sole and exclusive forum for such claim shall be the federal district court for the District of Delaware. We believe these provisions may benefit us by providing increased consistency in the application of Delaware law and federal securities laws by chancellors and judges, as applicable, particularly experienced in resolving corporate disputes, efficient administration of cases on a more expedited schedule relative to other forums and protection against the burdens of multi-forum litigation. However, these provisions may have the effect of discouraging lawsuits against our directors and officers. The enforceability of similar choice of forum provisions in other companies’ certificates of incorporation has been challenged in legal proceedings, and it is possible that, in connection with any applicable action brought against us, a court could find the choice of forum provisions contained in the Certificate of Incorporation to be inapplicable or unenforceable in such action. Specifically, the choice of forum provision in requiring that the state courts of the State of Delaware be the exclusive forum for certain suits would (i) not be enforceable with respect to any suits brought to enforce any liability or duty created by the Exchange Act and (ii) have uncertain enforceability with respect to claims under the Securities Act of 1933, as amended (the “Securities Act”). The choice of forum provision in the Certificate of Incorporation does not have the effect of causing our stockholders to have waived our obligation to comply with the federal securities laws and the rules and regulations thereunder.

Certain of our warrants contain provisions that may prevent us from effectuating a change in control transaction, or obligate us to make cash payments to the holders of such warrants upon a change of control transaction, which may affect our liquidity, financial condition, and results of operations.

The warrants issued on February 20, 2023, to a certain investor (the “February 2023 Investor Warrants”) in the public offering consummated in February 2023 (“February 2023 Offering”), and the warrants issued to H.C. Wainwright & Co., LLC and its designees as placement agent compensation in connection with the February 2023 Offering (the “February 2023 Wainwright Warrants,” collectively with February 2023 Investor Warrants, the “February 2023 Warrants”), contain certain provisions that may make it difficult for us to effectuate a change in control transaction, or obligate us to make cash payments to such holders upon a change in control transaction.

Pursuant to the terms of the February 2023 Warrant, in the event of a fundamental transaction (as defined in the February 2023 Warrants, and includes, among other events, any merger any reorganization, recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock, or any person or group becoming the beneficial owner of 50% or more of the voting power represented by our outstanding common stock), the holders of the February 2023 Warrants will be entitled to receive upon exercise of the February 2023 Warrants the kind and amount of securities, cash or other property that the holders would have received had they exercised the February 2023 Warrants immediately prior to such fundamental transaction. In addition, upon a fundamental transaction, the holder of a February 2023 Warrant will have the right to require us to repurchase such holder’s February 2023 Warrants at the Black-Scholes value; provided, however, that, if the fundamental transaction is not within our control, including not approved by our Board, then the holder will only be entitled to receive the same type or form of consideration (and in the same proportion), at the Black-Scholes value of the unexercised portion of the February 2023 Warrant that is being offered and paid to the holders of our common stock in connection with the fundamental transaction. Such amount calculated at the Black-Scholes value could be significantly more than the holders would otherwise receive if they were to exercise their warrants and receive the same consideration as the other holders of common stock, which in turn could reduce the consideration that holders of common stock would be concurrently entitled to receive in such fundamental transaction. The foregoing obligation to repurchase the February 2023 Warrants in cash equal to the Black-Scholes value may impair our cash position, as well as delay, hinder or prevent us from completing such fundamental transaction or prevent a third party from acquiring us, which may in turn affect our liquidity and financial condition and results of operations.

Risks Relating to Our Business and Industry

Our growth of operations could strain our resources and cause our business to suffer.

While we plan to continue growing our business organically through expansion, sales efforts, and strategic acquisitions, while maintaining tight controls on our expenses and overhead, lean overhead functions combined with focused growth may place a strain on our management systems, infrastructure and resources, resulting in internal control failures, missed opportunities, and staff attrition which could impact our business and results of operations.

|

|

Our strategy of growing through acquisitions may impact our business in unexpected ways.

Our growth strategy involves acquisitions that help us expand our service offerings and diversify our geographic footprint. We continuously evaluate acquisition opportunities, but there are no assurances that we will be able to identify acquisition targets that complement our strategy and are available at valuation levels accretive to our business.

Even if we are successful in acquiring, our acquisitions may subject our business to risks that may impact our results of operations, including:

| ● | inability to integrate acquired companies effectively and realize anticipated synergies and benefits from the acquisitions; | |

| ● | diversion of management’s attention to the integration of the acquired businesses at the expense of delivering results for the legacy business; | |

| ● | inability to appropriately scale critical resources to support the business of the expanded enterprise and other unforeseen challenges of operating the acquired business as part of our operations; | |

| ● | inability to retain key employees of the acquired businesses and/or inability of such key employees to be effective as part of our operations; | |

| ● | impact of liabilities of the acquired businesses undiscovered or underestimated as part of the acquisition due diligence; | |

| ● | failure to realize anticipated growth opportunities from a combined business, because existing and potential clients may be unwilling to consolidate business with a single supplier or to stay with the acquirer post-acquisition; | |

| ● | impacts of cash on hand and debt incurred to finance acquisitions, thus reducing liquidity for other significant strategic or operational objectives; and | |

| ● | internal controls, disclosure controls, corruption prevention policies, human resources and other key policies and practices of the acquired companies may be inadequate or ineffective. |

We operate in an intensely competitive and rapidly changing business environment, and there is a substantial risk that our services could become obsolete or uncompetitive.