UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): April 19, 2024

MANGOCEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Texas | 001-41615 | 87-3841292 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

15110 N. Dallas Parkway, Suite 600 Dallas, Texas |

75248 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (214) 242-9619

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, $0.0001 Par Value Per Share | MGRX |

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

Patent Purchase Agreement

Effective on April 24, 2024, Mangoceuticals, Inc., a Texas corporation (the “Company”, “we” and “us”), entered into a Patent Purchase Agreement (the “IP Purchase Agreement”), with Intramont Technologies, Inc. (“Intramont”). Pursuant to the IP Purchase Agreement, we purchased certain patents and patent applications owned by Intramont, related to prevention of infections, including the common cold, respiratory diseases, and orally transmitted diseases such as human papillomavirus (HPV) (the “Patents”), in consideration for $20,000,000, which is payable to Intramont by (a) the issuance of 980,000 shares of the Company’s newly designated 6% Series C Convertible Preferred Stock (the “Series C Preferred Stock”), with a face value of $20.00 per share, for a total value of $19,600,000 (the “Series C Shares”); and (b) $400,000 in cash, (i) with $200,000 payable on or before June 30, 2024, (ii) $100,000 payable on or before August 31, 2024, and (iii) $100,000 payable on or before November 30, 2024 (collectively, the “Cash Payments”).

In the event any of the Cash Payments have not been made on or before the due date thereof as provided above, we have 30 days to cure such non-payment, and if not paid by the end of such 30 day period, we have the option of paying Intramont $15,000 for a thirty day extension period for each Cash Payment.

The IP Purchase Agreement, and the purchase of the Patents, closed on April 24, 2024, upon the parties entry into the IP Purchase Agreement, and the Series C Shares were also issued on April 24, 2024.

The rights and preferences of the Series C Preferred Stock are discussed in greater detail below under “Item 5.03 Amendments to Designation of Incorporation or Bylaws; Change in Fiscal Year”.

The IP Purchase Agreement included standard representations and warranties and confidentiality and indemnification obligations of the parties, for a transaction of that type and size.

The Company purchased the Patents through its newly formed wholly-owned subsidiary, MangoRx IP Holdings, LLC, a Texas limited liability company.

The IP Purchase Agreement also included a grant back license, whereby the Company provided Intramont, an irrevocable, co-exclusive, non-transferable and non-assignable (except in the event of a change of control), non-sublicensable, worldwide, license to use the Patents for the lives thereof (the “Grant Back-License”). The Grant Back-License is subject to Intramont paying the Company a royalty of ten percent (10%) of gross worldwide sales of products sold by Intramont which utilize the Patents, beginning on April 24, 2025, and continuing until the end of the life of the last Patent (the “Royalty Payments”). The Royalty Payments are to be paid to the Company on an annual basis, within 30 days after the end of the calendar year.

Finally, the IP Purchase Agreement granted Intramont a right of first refusal, which provides that, if at any time prior to April 24, 2027, if we receive an offer to purchase the Patents and determine to accept such offer, or we determine to sell the Patents to a third party, we are required to provide Intramont the right of first refusal to either match such offer, or negotiate different purchase terms for the Patents.

The Company intends to utilize the Patents by commencing research, development, clinical trial studies and efficacy testing on a variety of oral applications including, but not limited to, an oral dissolvable tablet (ODT), lozenge, toothpaste and/or mouthwash.

The foregoing description of the IP Purchase Agreement is only a summary of the material terms of such agreement and does not purport to be complete and is qualified in its entirety by reference to the full text of such agreement, which is filed as Exhibit 10.1, to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The information set forth in Item 1.01 above is incorporated into this Item 2.01 by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 above and Item 5.03 below, is incorporated herein by reference.

The issuance of the Series C Shares was exempt from registration pursuant to an exemption from registration provided by Section 4(a)(2) and/or Rule 506 of Regulation D of the Securities Act of 1933, as amended (the “Securities Act”), since the foregoing issuance did not involve a public offering, the recipient took the securities for investment and not resale, we took appropriate measures to restrict transfer, and the recipient is an “accredited investor”. The securities are subject to transfer restrictions, and the certificates evidencing the securities contain an appropriate legend stating that such securities have not been registered under the Securities Act and may not be offered or sold absent registration or pursuant to an exemption therefrom. The securities were not registered under the Securities Act and such securities may not be offered or sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable state securities laws.

If the Series C Shares were converted in full, without factoring in any dividends which can be paid in-kind and/or shares of common stock, a maximum of 1,960,000 shares of common stock would be due to the holder thereof.

Item 3.03 Material Modification to Rights of Security Holders.

The information contained in Item 5.03 relating to the Series C Designation (as discussed in Item 5.03), below, is incorporated in this Item 3.03 by reference.

Item 5.03 Amendments to Designation of Incorporation or Bylaws; Change in Fiscal Year.

On April 19, 2024, the Company submitted for filing to the Secretary of State of Texas, a Certificate of Designations of Mangoceuticals, Inc. Establishing the Designations, Preferences, Limitations and Relative Rights of Its 6% Series C Convertible Cumulative Preferred Stock (the “Series C Designation”), which was filed with the Secretary of State of Texas on April 23, 2024, effective as of April 19, 2024. The Series C Designation designated 6,250,000 shares of Series C Preferred Stock.

The Series C Designation provides for the Series C Preferred Stock to have the following terms:

6% Series C Convertible Cumulative Preferred Stock

Dividend Rights. From and after the issuance date of the Series C Preferred Stock, each share of Series C Preferred Stock is entitled to receive, when, as and if authorized and declared by the Board of Directors of the Company, out of any funds legally available therefor, cumulative dividends in an amount equal to (i) the 6% per annum on the stated value (initially $20 per share)(the “Stated Value”) as of the record date for such dividend (as described in the Series C Designation), and (ii) on an as-converted basis, any dividend or other distribution, whether paid in cash, in-kind or in other property, authorized and declared by the Board of Directors on the issued and outstanding shares of common stock in an amount determined by assuming that the number of shares of common stock into which such shares of Series C Preferred Stock could be converted on the applicable record date for such dividend or distribution.

Dividends payable pursuant to (i) above are payable quarterly in arrears, if, as and when authorized and declared by the Board of Directors, or any duly authorized committee thereof, to the extent not prohibited by law, on March 31, June 30, September 30 and December 31 of each year (unless any such day is not a business day, in which event such dividends are payable on the next succeeding business day, without accrual of interest thereon to the actual payment date), commencing on June 30, 2024.

Accrued dividends may be settled in cash, subject to applicable law, shares of common stock (valued at the closing price on the date the dividend is due) or in-kind, by increasing the Stated Value by the amount of the quarterly dividend.

Liquidation Preference. Upon any liquidation, dissolution or winding-up of the Company, whether voluntary or involuntary (a “Liquidation”), the holders of the Series C Preferred Stock are entitled to receive out of the assets, whether capital or surplus, of the Company an amount equal to the Stated Value (the “Liquidation Preference”), for each share of Series C Preferred Stock, before any distribution or payment is made to the holders of any junior securities, but after the payment of any liquidation preference of any holder of senior securities, including the Series B Convertible Preferred Stock, which has a preferential right to payments in liquidation, and if the assets of the Company are insufficient to pay in full such amounts, then the entire assets to be distributed to the holders of the Series C Preferred Stock are to be ratably distributed among the holders of the Series C Preferred Stock in accordance with the respective amounts that would be payable on such shares if all amounts payable thereon were paid in full.

Conversion Rights. Each holder of Series C Preferred Stock may, at its option, convert its shares of Series C Preferred Stock into that number of shares of common stock equal to the Stated Value of such share of Series C Preferred Stock, divided by the conversion price of $10.00 per share (i.e., initially a 2-for-1 conversion ratio) (the “Conversion Price”), subject to adjustment for stock splits and stock dividends, with any fractional shares rounded up to the nearest whole share.

The Series C Designation includes a conversion limitation prohibiting any holder and their affiliates from converting the Series C Preferred Stock into common stock in the event that upon such conversion their beneficial ownership of the Company’s common stock would exceed 4.999% (which can be increased as to any holder, to up to 9.999%, with 61 days prior written notice by such holder). The Series C Designation also includes a general restriction prohibiting the issuance of more than 19.99% of the Company’s outstanding shares as of the date of entry into the IP Purchase Agreement, without the Company’s stockholders approving such issuance(s) under the rules of the Nasdaq Capital Market.

Voting Rights. The Series C Preferred Stock have no voting rights, except in connection with the protective provisions discussed below.

Protective Provisions. So long as any shares of Series C Preferred Stock are outstanding, the Company cannot without first obtaining the approval of the holders of a majority of the then outstanding shares of Series C Preferred Stock, voting together as a class:

(a) Amend any provision of the Series C Designation;

(b) Increase or decrease (other than by redemption or conversion) the total number of authorized shares of Series C Convertible Preferred Stock;

(c) Amend the Certificate of Formation of the Company (including by designating additional series of Preferred Stock) in a manner which adversely affects the rights, preferences and privileges of the Series C Preferred Stock;

(d) Effect an exchange, or create a right of exchange, cancel, or create a right to cancel, of all or any part of the shares of another class of shares into shares of Series C Preferred Stock; or

(e) Alter or change the rights, preferences or privileges of the shares of Series C Preferred Stock so as to affect adversely the shares of such series.

Redemption Rights. The Company may redeem the outstanding Series C Preferred Stock shares, from time to time, in whole or in part, at any time after April 24, 2025, and continuing indefinitely thereafter, at the option of the Company, for cash, at the aggregate Liquidation Preference of the shares redeemed.

* * * * * The foregoing description of the Series C Preferred Stock and Series C Designation is only a summary of the material terms of such Series C Preferred Stock and Series C Designation and does not purport to be complete and is qualified in its entirety by reference to the full text of the Series C Designation, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 8.01. Other Events.

Press Release

On April 25, 2024, the Company issued a press release announcing the closing of the IP Purchase Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Nasdaq Minimum Stockholders’ Equity Compliance

As previously disclosed in the Current Report on Form 8-K, filed by the Company with the Securities and Exchange Commission (the “Commission” or the “SEC”) on November 7, 2023, on November 3, 2023, the Company received a letter from The Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it was not in compliance with the minimum stockholders’ equity requirement for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5550(b)(1) (the “Rule”) requires companies listed on the Nasdaq Capital Market to maintain stockholders’ equity of at least $2,500,000. In the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, the Company reported stockholders’ equity of $1,354,821, which is below the minimum stockholders’ equity required for continued listing pursuant to the Rule. Additionally, the Company did not meet the alternative Nasdaq continued listing standards under Nasdaq Listing Rules.

Nasdaq provided the Company until December 18, 2023 to submit to Nasdaq a plan to regain compliance. We submitted the plan to regain compliance in a timely manner, and on January 24, 2024, as reported in the Current Report on Form 8-K filed by the Company with the Commission on January 25, 2024, Nasdaq advised the Company that it determined to grant the Company an extension to regain compliance with the Rule until April 29, 2024.

As a result of the purchase of the Patents as described in the IP Purchase Agreement in Item 1.01 above, and the funds raised pursuant to the initial closing of the April 4, 2024, Securities Purchase Agreement, entered into with an institutional accredited investor , as described in greater detail in the Company’s Current Report on Form 8-K filed with the Commission on April 11, 2024, as of the date of this Current Report on Form 8-K, the Company believes it has regained compliance with the Rule because it believes that its stockholders’ equity exceeds $2.5 million and that it also satisfies the minimum $5 million equity requirement for initial listing on The Nasdaq Capital Market. In that regard, the Company believes that as of the date of this Form 8-K filing, stockholders’ equity exceeds $5 million. The Company anticipates evidencing compliance with the Rule as of the date of its next periodic report.

Notwithstanding such expected compliance, Nasdaq will continue to monitor the Company’s ongoing compliance with the stockholders’ equity requirement and, if at the time of its next periodic report the Company does not evidence compliance, the Company may be subject to delisting.

Notwithstanding the above, the Company remains out of compliance with Nasdaq’s minimum bid price requirement as of the date of this Current Report on Form 8-K and intends to request a further 180 day extension from Nasdaq to obtain compliance with such requirement. If granted by Nasdaq, the Company plans to a reverse stock split during the extension period, if necessary, to cure such deficiency.

Item 9.01 Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 3.1* | Certificate of Designations, Preferences and Rights of 6% Series C Convertible Preferred Stock of Mangoceuticals, Inc., filed with the Secretary of State of Texas on April 19, 2024 | |

| 10.1*# | Patent Purchase Agreement dated April 24, 2024, by and between Mangoceuticals, Inc., as purchaser and Intramont Technologies, Inc., as seller | |

| 99.1* | Mangoceuticals, Inc. Press Release dated April 25, 2024 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document and included in Exhibit 101). |

* Filed herewith.

# Certain schedules and exhibits have been omitted pursuant to Item 601(b)(2)(ii) of Regulation S-K. A copy of any omitted schedule or Exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however that Mangoceuticals, Inc. may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedule or Exhibit so furnished.

Forward-Looking Statements

This Current Report on Form 8-K, including the press release furnished as Exhibit 99.1, to this Current Report on Form 8-K, contains forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995, and, as such, may involve known and unknown risks, uncertainties and assumptions. You can identify these forward-looking statements by words such as “may,” “should,” “expect,” “anticipate,” “believe,” “estimate,” “intend,” “plan” and other similar expressions. These forward-looking statements relate to the Company’s current expectations and are subject to the limitations and qualifications set forth in the press release as well as in the Company’s other filings with the Securities and Exchange Commission, including, without limitation, that actual events and/or results may differ materially from those projected in such forward-looking statements. These statements also involve known and unknown risks, which may cause the results of the Company, its divisions and concepts to be materially different than those expressed or implied in such statements, including those referenced in the press release. Accordingly, readers should not place undue reliance on any forward-looking statements. Forward-looking statements may include comments as to the Company’s beliefs and expectations as to future financial performance, events and trends affecting its business and are necessarily subject to uncertainties, many of which are outside the Company’s control. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Cautionary Statement Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s most recently filed periodic reports on Form 10-K and Form 10-Q and subsequent filings with the SEC and available at www.sec.gov and in the “Investors–SEC Filings” section of the Company’s website at www.mangorx.com. Forward-looking statements speak only as of the date they are made. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as otherwise provided by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MANGOCEUTICALS, INC. | ||

| Date: April 25, 2024 | By: | /s/ Jacob D. Cohen |

| Jacob D. Cohen | ||

| Chief Executive Officer | ||

Exhibit 3.1

CERTIFICATE OF DESIGNATIONS

OF

MANGOCEUTICALS, INC.

ESTABLISHING THE DESIGNATIONS, PREFERENCES,

LIMITATIONS AND RELATIVE RIGHTS OF ITS

6% SERIES C CONVERTIBLE CUMULATIVE PREFERRED STOCK

Pursuant to Section 21.155 of the Texas Business Organizations Code (the “TBOC”), Mangoceuticals, Inc., a corporation organized and existing under the TBOC (the “Company”),

DOES HEREBY CERTIFY that pursuant to the authority conferred upon the Board of Directors by the Certificate of Formation of the Company, as amended (the “Certificate of Formation”), and pursuant to Section 21.155 of the TBOC, the Board of Directors, pursuant to Section 6.201 of the TBOC, by unanimous consent of all members of the Board of Directors on April 18, 2024, duly adopted a resolution providing for the designation of a series of Six Million Two Hundred and Fifty Thousand (6,250,000) shares of Series C Convertible Preferred Stock, which resolution is and reads as follows:

RESOLVED, that pursuant to the authority expressly granted to and invested in the Board of Directors by the provisions of the Certificate of Formation of the Company and Section 21.155 of the TBOC, the Company hereby establishes a new series of Preferred Stock, par value $0.0001 per share, of the Company and fixes the number of shares of such series and the powers, designations, preferences and relative rights of such series, and the qualifications, limitations or restrictions thereof as follows:

The new series of Preferred Stock, par value $0.0001 per share, of the Company shall be, and hereby is, designated “6% Series C Convertible Cumulative Preferred Stock” (the “Series C Preferred Stock” or the “Preferred Stock”), and the initial number of designated shares constituting such series shall be Six Million Two Hundred and Fifty Thousand (6,250,000) (the “Shares”). The powers and preferences, and the relative, participating, optional and other rights, and the qualifications, limitations, and restrictions thereon of the Series C Preferred Stock shall be set forth in this Certificate of Designations (the “Designation” or the “Certificate of Designation”) below:

1. Definitions. For purposes of the Shares and as used in this Designation, in addition to other terms defined throughout this Designation, the following terms have the following meanings when used herein:

“Board” shall mean the board of directors of the Company or any committee of members of the board of directors authorized by such board to perform any of its responsibilities with respect to the Shares.

“Business Day” shall mean any day other than a Saturday, Sunday or a day on which state or federally chartered banking institutions in New York, New York are not required to be open.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

“Call Date” shall mean the date fixed for redemption of the Shares and specified in the notice to Holders required under paragraph (b) of Section 4 hereof as the Call Date.

“Closing Sales Price” means the last sales price of the Company’s Common Stock on the Principal Market as reported by NASDAQ.com (or a comparable reporting service of national reputation)(collectively, “NASDAQ.com”), or if the foregoing does not apply, the last reported sales price of such security on a national exchange or in the over-the-counter market on the electronic bulletin board for such security as reported by NASDAQ.com, or, if no such price is reported for such security by NASDAQ.com, the average of the bid prices of all market makers for such security as reported in the “pink sheets” by OTC Markets, in each case for such date or, if such date was not a Trading Day for such security, on the next preceding date that was a Trading Day. If the Closing Sales Price cannot be calculated for such security as of either of such dates on any of the foregoing bases, the Closing Sales Price of such security on such date shall be the fair market value as reasonably determined by the Company.

“Common Shares” or “Common Stock” shall mean the shares of common stock, $0.0001 par value, of the Company.

“Company” shall mean Mangoceuticals, Inc., a Texas corporation.

“Conversion Price” means $10.00, subject to adjustment in connection with any Recapitalization.

“Conversion Rights” shall have the meaning set forth in Section 5 hereof.

“Designation” shall mean this Certificate of Designations of Mangoceuticals, Inc. Establishing the Designations, Preferences, Limitations and Relative Rights of Its 6% Series C Convertible Preferred Stock.

“Dividend Payment Date” shall have the meaning set forth in subparagraph (a) of Section 2 hereof.

“Dividend Periods” shall mean quarterly dividend periods commencing on the first day of each of January, April, July and October and ending on and including the day preceding the first day of the next succeeding Dividend Period.

“Dividend Rate” is 6% per annum.

“Dividend Record Date” shall have the meaning set forth in subparagraph (a) of Section 2 hereof.

“Exchange Act” shall mean the U.S. Securities Exchange Act of 1934, as amended and the rules and regulations promulgated thereunder.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

“Issue Date” shall mean the date that any Shares are first issued by the Company.

“Holder” shall mean the person or entity in which the Shares are registered on the books of the Company, which shall initially be the person or entity which such Shares are issued to, and shall thereafter be permitted and legal assigns which the Company is notified of by the Holder and which the Holder has provided a valid legal opinion in connection therewith to the Company and to whom such Shares are legally transferred.

“Junior Shares” shall have the meaning set forth in paragraph (a)(iii) of Section 7 hereof.

“Liquidation Preference” means the Stated Value.

“Parity Shares” shall have the meaning set forth in paragraph (a)(ii) of Section 7 hereof.

“Person” shall mean any individual, firm, partnership, limited liability company, corporation or other entity, and shall include any successor (by merger or otherwise) of such entity.

“Preferred Stock Certificates” means the stock certificate(s) issued by the Company representing the applicable Series C Preferred Stock shares.

“Principal Market” means initially the Nasdaq Capital Market and shall also include the New York Stock Exchange, NYSE American, the Nasdaq Global Market, the OTCQB, the OTCQX or the OTC Pink Market, whichever is at the time the principal trading exchange or market for the Common Shares, based upon share volume.

“Recapitalization” shall mean any stock dividend, stock split, combination of shares, reorganization, recapitalization, reclassification or other similar event described in Sections 10(b) through (c).

“Restricted Shares” means shares of the Company’s Common Stock which are restricted from being transferred by the Holder thereof unless the transfer is effected in compliance with the Securities Act and applicable state securities laws (including investment suitability standards, which shares shall bear the following restrictive legend (or one substantially similar)):

The securities represented by this certificate have not been registered under the Securities Act of 1933 or any state securities act. The securities have been acquired for investment and may not be sold, transferred, pledged or hypothecated unless (i) they shall have been registered under the Securities Act of 1933 and any applicable state securities act, or (ii) the corporation shall have been furnished with an opinion of counsel, satisfactory to counsel for the corporation, that registration is not required under any such acts.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

“Securities Act” means the Securities Act of 1933, as amended (and any successor thereto) and the rules and regulations promulgated thereunder.

“Senior Shares” shall have the meaning set forth in paragraph (a)(i) of Section 7 hereof.

“set apart for payment” shall be deemed to include, without any further action, the following: the recording by the Company in its accounting ledgers of any accounting or bookkeeping entry that indicates, pursuant to an authorization by the Board and a declaration of dividends or other distribution by the Company, the initial and continued allocation of funds to be so paid on any series or class of shares of stock of the Company; provided, however, that if any funds for any class or series of Junior Shares or any class or series of Parity Shares are placed in a separate account of the Company or delivered to a disbursing, paying or other similar agent, then “set apart for payment” with respect to the Shares shall mean irrevocably placing such funds in a separate account or irrevocably delivering such funds to a disbursing, paying or other similar agent.

“Shares” has the meaning set forth in the introductory paragraphs hereof.

“Simple Majority” means the holders of at least a majority of the then issued and outstanding Shares.

“Stated Value” means $20.00 per Share, as adjusted pursuant to Sections 2.5 and 2.6 hereof, as applicable.

“Trading Day” means any day on which the Common Shares are traded on the Principal Market, or, if the Principal Market is not the principal trading market for the Common Shares, then on the principal securities exchange or securities market on which the Common Shares is then traded; provided that “Trading Day” shall not include any day on which the Common Shares is scheduled to trade on such exchange or market for less than 4.5 hours or any day that the Common Shares is suspended from trading during the final hour of trading on such exchange or market (or if such exchange or market does not designate in advance the closing time of trading on such exchange or market, then during the hour ending at 4:00:00 p.m., New York Time).

“Transfer Agent” means ClearTrust, LLC, or such other agent or agents of the Company as may be designated by the Board or its duly authorized designee as the transfer agent, registrar and dividend disbursing agent for the Shares, including, at the option of the Board, the Company itself.

2. 2.1 Dividends in General. From and after the Issue Date of each Share, each Share shall be entitled to receive, when, as and if authorized and declared by the Board of Directors, out of any funds legally available therefor, cumulative dividends in an amount equal to (i) the Dividend Rate on the Stated Value of such Share as of the Record Date for such dividend (each such dividend on the Shares, a “Regular Dividend” and, collectively, the “Regular Dividends”), and (ii) on an as-converted basis, any dividend or other distribution, whether paid in cash, in-kind or in other property (including, for the avoidance of doubt, any securities other than Common Shares, but not in connection with any stock dividend paid solely in Common Shares), authorized and declared by the Board of Directors on the issued and outstanding Common Shares in an amount determined by assuming that the number of Common Shares into which such Share could be converted pursuant to Section 5 hereof, on the applicable Record Date for such dividend or distribution on the Common Shares were issued to, and held by, the Holder of such Share on such Record Date (each such dividend on the Shares pursuant to this clause (ii), a “Participating Dividend” and, collectively, the “Participating Dividends” and, together with the Regular Dividends, the “Dividends”).

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

2.2 “Record Date” shall mean, with respect to any dividend, distribution or other transaction or event in which the holders of Common Shares or shares of Shares, as applicable, have the right to receive any cash, securities or other property or in which the Common Shares or shares of Shares (or other applicable security), as applicable, are exchanged for or converted into any combination of cash, securities or other property, the date fixed for determination of shareholders entitled to receive such cash, securities or other property (whether such date is fixed by the Board of Directors or a committee thereof, or by statute, contract, this Certificate of Designations or otherwise). With respect to any Regular Dividend payable on any Regular Dividend Payment Date, the Record Date therefor will be the immediately preceding March 15, June 15, September 15 or December 15, as applicable.

2.3 Payment of Regular Dividends. Regular Dividends shall be payable quarterly in arrears, if, as and when authorized and declared by the Board of Directors, or any duly authorized committee thereof, to the extent not prohibited by law, on March 31, June 30, September 30 and December 31 of each year (unless any such day is not a Business Day, in which event such Regular Dividends shall be payable on the next succeeding Business Day, without accrual of interest thereon to the actual payment date), commencing on June 30, 2024 (each such payment date, a “Regular Dividend Payment Date,” and the period from, and including, the Issue Date to, and including, the first Regular Dividend Payment Date and each such quarterly period thereafter from, but excluding, the immediately preceding Regular Dividend Payment Date to, and including, the next occurring Regular Dividend Payment Date, a “Regular Dividend Period”). The amount of Regular Dividends payable in respect of each Share for any period shall be computed on the basis of a 360-day year consisting of twelve thirty-day months. Regular Dividends shall begin to accrue from the Issue Date whether or not declared and whether or not the Company has assets legally available to make payment thereof, at a rate equal to the Dividend Rate and, if not declared and paid, shall be cumulative, regardless of whether or not in any Regular Dividend Period there are funds of the Company legally available for the payment of such Regular Dividend. In the event that the Board of Directors has authorized the payment of any Regular Dividend, the Company may, in its sole discretion and notwithstanding anything to the contrary in this Certificate of Designations, settle such Regular Dividend in cash out of funds legally available therefor, in Common Shares pursuant to the terms and conditions of Section 2.4, in-kind pursuant to the terms and conditions of Section 2.4, or a combination of cash and in-kind settlement pursuant to the terms and conditions of Section 2.6, and the Company shall set aside sufficient funds for the portion of any Regular Dividend to be paid in whole or in part in cash before the Board of Directors or any other authorized Person may declare, set apart funds for or pay any dividend on the Junior Shares; provided, however, that, to the extent any such payment in cash is prohibited by applicable law, such payment will be made in Common Shares in accordance with the terms and conditions of Section 2.4 or in-kind in accordance with the terms and conditions of Section 2.4. Participating Dividends shall be payable as and when paid to the holders of Common Shares (each such date, a “Participating Dividend Payment Date” and, together with a Regular Dividend Payment Date, a “Dividend Payment Date”). Participating Dividends are payable on a cumulative basis once declared, regardless of whether or not there are then funds of the Company available for the payment of such Participating Dividend pursuant to law.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

2.4 Dividends Paid in Common Shares. With respect to each Share, any Regular Dividend or portion thereof in respect of such Share that has accrued during any applicable Regular Dividend Period but is not paid (in whole or in part) in cash or by a PIK Dividend (pursuant to Section 2.45 hereof) on the applicable Regular Dividend Payment Date may be paid at the option of the Company in Common Shares, by issuing each Holder a number of Common Shares equal to (x) the total amount of the Regular Dividend due to such Holder, divided by (y) the Closing Sales Price, rounded up to the nearest whole Common Share (“Dividend Shares”). Dividend Shares shall be issued to each Holder within five (5) Trading Days of the applicable Divided Payment Date.

2.5 Accrued or PIK Dividends. With respect to each Share, any Regular Dividend or portion thereof in respect of such Share that has accrued during any applicable Regular Dividend Period but is not paid (in whole or in part) in cash or Common Shares (pursuant to Section 2.4 hereof) on the applicable Regular Dividend Payment Date (the amount of any accrued and unpaid Regular Dividend with respect to any Share for any Regular Dividend Period, regardless of whether such Regular Dividend is paid in cash or kind, the “Accrued Dividend Amount” with respect to such Share for such Regular Dividend Period) shall, regardless of whether or not such Regular Dividend is authorized and declared by the Board of Directors, or whether the Company has assets legally available to make payment thereof, be added to the Stated Value of such Share immediately following the close of business on such Regular Dividend Payment Date. Any such addition of the Accrued Dividend Amount in respect of a Share to the Stated Value of such Share pursuant to this Section 2.4 is referred to herein as a “PIK Dividend.” The Accrued Dividend Amount in respect of any Regular Dividend Period that is not paid (in whole or in part) in cash or in Common Shares pursuant to Section 2.4, shall, without duplication of any prior PIK Dividends (if any) only be added to the Stated Value of such Share once. Regular Dividends with respect to each Share shall continue, from and after the date of each PIK Dividend, if any, to accrue in an amount per annum equal to the Dividend Rate of the Stated Value of such Share as of the relevant Record Date. Notwithstanding anything to the contrary in this Certificate of Designations, the Company will not be permitted to make any PIK Dividend election to the extent such election would violate the listing standards of the Principal Market; provided, however, that nothing herein will affect the compounding of any Regular Dividend that the Company does not pay in cash (which compounding will apply even if the Company is otherwise prohibited from electing to make any PIK Dividend pursuant to this sentence).

2.6 Cash and PIK Dividends. In the event that the Board of Directors has authorized and declared the payment of a Regular Dividend and the settlement of such Regular Dividend payment in part by payment of cash to each Holder of Shares and in part pursuant to a PIK Dividend (any such Regular Dividend, a “Cash and PIK Dividend”), the Company shall, on the applicable Regular Dividend Payment Date and in respect of each Share, (i) pay to the Holder thereof an amount of cash equal to the Cash and PIK Dividend Cash Settlement Amount in respect of such Share, and (ii) add to the Stated Value of such Share an amount equal to (A) the Accrued Dividend Amount with respect to such Share for the Regular Dividend Period ending on, and including, such Regular Dividend Payment Date, minus (B) the Cash and PIK Dividend Cash Settlement Amount in respect of such Share. If the Board of Directors declares a Cash and PIK Dividend, and any portion of the cash payment of such Cash and PIK Dividend per Share is not paid pursuant to the terms of this Section 3, then such portion shall be added to the Stated Value of such Share in accordance with the terms of this Section 2.6.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

2.7 In the event that the Board of Directors has authorized and declared the payment of a Participating Dividend, such Participating Dividend shall be paid in a manner consistent with the payments of dividends on the Common Shares. The Company will not declare any dividend or distribution on the Common Shares unless, concurrently therewith, the Company declares a corresponding Participating Dividend, except for dividends paid on Common Shares solely in Common Shares, which shall not be deemed Participating Dividends.

2.8 Partial Dividend Payments. Except as otherwise provided herein, if at any time the Company pays, in cash, less than the total amount of Dividends then accrued, but unpaid, with respect to the Shares, such cash payment shall be distributed pro rata among the Holders thereof based upon the Stated Value of all Shares held by each such Holder as of the Record Date for such payment. When Dividends are not paid in full upon the Shares, all dividends declared on Shares and any other class or series of stock which has parity rights with the Shares (“Parity Stock”) shall be paid pro rata so that the amount of dividends so declared on the Shares and each such other class or series of Parity Stock shall in all cases bear to each other the same ratio as accrued, but unpaid, Dividends (for the full amount of dividends that would be payable for the most recently completed Regular Dividend Period if dividends were declared in full on non-cumulative Parity Stock) on the Shares and such other class or series of Parity Stock bear to each other.

2.9 No dividend on the Shares will be declared by the Company or paid or set apart for payment by the Company in cash at such time as the terms and provisions of Senior Shares or any agreement of the Company, including any agreement relating to its indebtedness, prohibit such declaration, payment or setting apart for payment or provide that such declaration, payment or setting apart for payment would constitute a breach thereof or a default thereunder, or if such declaration, payment or setting aside of funds is restricted or prohibited under Texas law or other applicable law; provided, however, notwithstanding anything to the contrary contained herein, dividends on the Shares shall continue to accrue without interest and accumulate regardless of whether: (i) any or all of the foregoing restrictions exist; (ii) the Company has earnings or profits; (iii) there are funds legally available for the payment of such dividends; or (iv) such dividends are authorized by the Board. Accrued and unpaid dividends on the Shares will accumulate as of the Dividend Payment Date on which they first become payable or on the date of redemption of the Shares, as the case may be. Notwithstanding anything in this Section 2, no Dividends shall be paid on the Shares prior to the payment in full of all dividends due on Senior Shares.

2.10 Within one Business Day of the Record Date for any Regular Dividend, the Company will send written notice to each Holder of shares of Shares stating (i) whether such Regular Dividend will be paid in cash, in Common Shares pursuant to Section 2.4 hereof, by increasing the Stated Value of each Share pursuant to Section 2.4, or pursuant to a Cash and PIK Dividend pursuant to Section 2.6, and (ii) if such Regular Dividend will be paid, at least in part, by increasing the Stated Value of a Share pursuant to Section 2.4 or pursuant to a Cash and PIK Dividend pursuant to Section 2.6, the Stated Value of each Share immediately before and immediately after the applicable increase. If the Company fails to send such written notice at or before the Close of Business on the Business Day immediately following the Record Date for any Regular Dividend, then the Company will be deemed to have irrevocably elected to pay such Regular Dividend by increasing the Stated Value of each Share pursuant to Section 2.4.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

2.11 Non-Cash Distributions. Whenever a Participating Dividend shall be payable in property other than cash, the value of such Participating Dividend shall be deemed to be the fair market value of such property as determined in good faith by the Board of Directors.

2.12 Restricted Securities. Unless the Dividend Shares are covered by a valid and effective registration under the Securities Act or the Holder provides the Company a valid opinion from an attorney stating that such Dividend Shares can be issued free of restrictive legend, which shall be determined by the Company (or the Transfer Agent) in its sole discretion, such shares shall be issued as Restricted Shares.

2. Liquidation Preference.

(a) Subject to the priority rights of the holders of Senior Shares and the rights of the Parity Shares, in the event of any liquidation, dissolution or winding up of the Company, whether voluntary or involuntary, after the payment in full of all amounts due to the holders of Senior Shares, but before any payment or distribution of the assets of the Company (whether capital or surplus) shall be made to or set apart for the holders of Junior Shares as to the distribution of assets on any liquidation, dissolution or winding up of the Company, each Holder of the Shares shall be entitled to receive an amount of cash equal to the Liquidation Preference. If, upon any liquidation, dissolution or winding up of the Company, after the payment in full to all holders of the Senior Shares, the assets of the Company, or proceeds thereof, distributable among the Holders of the Shares shall be insufficient to pay in full the preferential amount aforesaid and liquidating payments on any other shares of any class or series of Parity Shares as to the distribution of assets on any liquidation, dissolution or winding up of the Company, then such assets, or the proceeds thereof, shall be distributed among the Holders of Shares and any such other Parity Shares ratably in accordance with the respective amounts that would be payable on such Shares and any such other Parity Shares if all amounts payable thereon were paid in full.

(b) Written notice of any such liquidation, dissolution or winding up of the Company, stating the payment date or dates when, and the place or places where, the amounts distributable in such circumstances shall be payable, shall be given by first class mail, postage pre-paid, not less than twenty (20) nor more than sixty (60) days prior to the payment date stated therein, to each record Holder of Shares at the respective address of such Holders as the same shall appear on the stock transfer records of the Company.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

(c) Subject to the rights of the holders of Senior Shares and Parity Shares upon liquidation, dissolution or winding up, upon any liquidation, dissolution or winding up of the Company, after payment shall have been made in full to the Holders of the Shares, as provided in this Section 3, any other series or class or classes of Junior Shares shall, subject to the respective terms and provisions (if any) applying thereto, be entitled to receive any and all assets remaining to be paid or distributed, and the Holders of the Shares shall not be entitled to share therein.

(d) If any assets of the Company distributed to stockholders in connection with any liquidation, dissolution, or winding up of the Company are other than cash, then the value of such assets shall be their fair market value as determined in good faith by the Board of Directors.

3. Company Call Option.

(a) Optional Redemption at Election of Company. The Company may redeem the Shares, from time to time, in whole or in part, at any time after the first anniversary of the Issue Date and continuing indefinitely thereafter, at the option of the Company, for cash, at the aggregate Liquidation Preference of the Shares redeemed (the “Redemption Amount”). If fewer than all of the outstanding Shares are to be redeemed pursuant to the Company’s exercise of its redemption right under this Section 4(a), the Shares to be redeemed shall be selected pro rata (as nearly as practicable without creating fractional shares) or by lot or in such other equitable method prescribed by the Company.

(b) Redemption Procedures. Notice of the redemption of any Shares under paragraph (a) of this Section 4 shall be mailed by first class mail or via electronic mail to each Holder of record of Shares to be redeemed at the address of each such Holder as shown on the Company’s records, not less than twenty (20) nor more than sixty (60) days prior to the Call Date. Neither the failure to deliver any notice required by this paragraph (b), nor any defect therein or in the delivery thereof, to any particular Holder, shall affect the sufficiency of the notice or the validity of the proceedings for redemption with respect to the other Holders. Any notice delivered in the manner herein provided shall be conclusively presumed to have been duly given on the date mailed whether or not the Holder receives the notice. Each such mailed notice shall state, as appropriate: (1) the Call Date; (2) the number of Shares to be redeemed and, if fewer than all the Shares held by such Holder are to be redeemed, the number of such Shares to be redeemed from such Holder; (3) the redemption price per Share (determined as set forth in paragraph (a) of this Section 4); (4) if any Shares are represented by certificates, the place or places at which certificates for such Shares are to be surrendered; and (5) any other information required by law or by the applicable rules of any exchange or national securities market upon which the Shares may be listed or admitted for trading. Notice having been delivered as aforesaid, from and after the Call Date (unless the Company shall fail to make available an amount of cash necessary to effect such redemption), (i) said Shares shall no longer be deemed to be outstanding, and (ii) all rights of the Holders thereof as Holders of Shares shall cease (except the right to receive cash payable upon such redemption, without interest thereon, upon surrender and endorsement of their certificates if so required).

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

(c) Set Asides. The Company’s obligation to provide cash in accordance with the preceding subsection shall be deemed fulfilled if, on or before the Call Date, the Company shall irrevocably deposit funds necessary for such redemption, in trust, with a bank or trust company that has, or is an affiliate of a bank or trust company that has, capital and surplus of at least $50 million, with irrevocable instructions that such cash be applied to the redemption of the Shares so called for redemption, in which case the notice to Holders of the Shares will (i) state the date of such deposit, (ii) specify the office of such bank or trust company as the place of payment of the redemption price and (iii) require such Holders to surrender the certificates, if any, representing such Shares at such place on or about the date fixed in such redemption notice (which may not be later than the Call Date) against payment of the redemption price. No interest shall accrue for the benefit of the Holders of Shares to be redeemed on any cash so set aside by the Company. Subject to applicable escheat laws, any such cash unclaimed at the end of six months from the Call Date shall revert to the general funds of the Company after which reversion the Holders of such Shares so called for redemption shall look only to the general funds of the Company for the payment of such cash.

(d) Holder Obligations. Without limiting the obligation of each Holder set forth herein (including in the subsequent clause (e)), the Company and/or the Company’s Transfer Agent shall be authorized to take whatever action necessary, if any, following the issuance and delivery of the Redemption Amount to reflect the cancellation of the Series C Preferred Stock subject to the redemption, which shall not require the approval and/or consent of any Holder (a “Cancellation”).

(e) Further Assurances. Notwithstanding the above, each Holder, by accepting such Preferred Stock certificates (if any) hereby covenants that it will, whenever and as reasonably requested by the Company and the Transfer Agent, at the Company’s sole cost and expense, do, execute, acknowledge and deliver any and all such other and further acts, deeds, assignments, transfers, conveyances, confirmations, powers of attorney and any instruments of further assurance, approvals and consents as the Company or the Transfer Agent may reasonably require in order to complete, insure and perfect the Cancellation, if such may be reasonably required by the Company and/or the Company’s Transfer Agent.

4. Conversion. The Holders of the Shares shall have conversion rights as follows (the “Conversion Rights”):

(a) Right to Convert. Each Share shall be convertible (each a “Conversion”) into that number of fully-paid, nonassessable Common Shares determined by dividing (i) the Stated Value, by (ii) the Conversion Price (such total number of Common Shares due, the “Conversion Shares”), at the option of the Holder thereof, in whole or in part at any time after the second anniversary of the Issue Date and continuing indefinitely thereafter, at the option of the Holder, by providing a notice in the form attached hereto, to the Company, at the office of the Company or any transfer agent for such stock. If any conversion of Series C Preferred Stock would result in the issuance of a fractional number of Common Shares (aggregating all shares of Series C Preferred Stock being converted), then, the number of shares of Common Shares issuable upon conversion of the Series C Preferred Stock shall be the next higher whole number of shares.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

(b) Mechanics of Conversion. Before any Holder of Shares shall be entitled to convert the same into Common Shares, they shall surrender the certificate or certificates therefor, duly endorsed, at the office of this Company or of any transfer agent for the Shares, and shall give written notice to this Company at its principal corporate office, of the election to convert the same and shall state therein the name or names in which the certificate or certificates for Common Shares are to be issued. This Company shall, as soon as practicable thereafter, issue and deliver at such office to such Holder of Shares, or to the nominee or nominees of such Holder, a certificate or certificates for the number of Common Shares to which such Holder shall be entitled as aforesaid. Such conversion shall be deemed to have been made immediately prior to the close of business on the date of such surrender of the Shares to be converted, and the person or persons entitled to receive the Common Shares issuable upon such conversion shall be treated for all purposes as the record Holder or Holders of such Common Shares as of such date.

(c) No Impairment. The Company will not, by amendment of its Certificate of Formation or through any reorganization, recapitalization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by this Company, but will at all times in good faith assist in the carrying out of all the provisions of this Section and in the taking of all such action as may be necessary or appropriate in order to protect the Conversion Rights of the Holders of the Shares against impairment.

(d) Notice. Any notice required by the provisions of this Section to be given to the Holders of Shares shall be deemed given if deposited in the United States mail, postage prepaid, and addressed to each Holder of record at his address appearing on the books of the Company.

(e) Restricted Shares. Unless the Conversion Shares are covered by a valid and effective registration under the Securities Act or the Holder provides the Company a valid opinion from an attorney stating that such Conversion Shares can be issued free of restrictive legend, which shall be determined by the Company (or the Transfer Agent) in its sole discretion, such shares shall be issued as Restricted Shares.

(f) Beneficial Ownership Limitation for Conversion; Exchange Cap.

(i) No Holder Conversion shall result in the conversion of more than that number of shares of Series C Preferred Stock, if any, such that, upon such Conversion, the aggregate beneficial ownership of the Company’s Common Shares (calculated pursuant to Rule 13d-3 of the Exchange Act) of such Holder and all persons affiliated with such Holder as described in Rule 13d-3 is more than 4.999% of the Company’s Common Shares then outstanding (the “Maximum Percentage”). By written notice to the Company, a Holder may increase or decrease the Maximum Percentage to any percentage not in excess of 9.999% as specified in such written notice; provided that (A) any such increase will not be effective until the 61st day after such notice is received by the Company; and (B) any such increase or decrease will apply only to the requesting Holder and not to any other Holder. In the event any Conversion would result in the issuance of shares of Common Shares to any Holder in excess of the Maximum Percentage, only that number of shares of Series C Preferred Stock which when Converted would not result in such Holder exceeding the Maximum Percentage shall be subject to such applicable Conversion, if any, and Holder shall continue to hold any remaining shares of Series C Convertible Preferred Stock, the conversion of which would result in Holder exceeding the Maximum Percentage.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

(ii) The Company’s Transfer Agent shall be authorized to promptly disclose the total outstanding Common Shares to the Holder from time to time at the request of the Holder in order for the Holder to determine its compliance with the Maximum Percentage.

(iii) The Company shall not be required to verify or investigate or confirm whether any Conversion would exceed the Maximum Percentage, and instead the Company shall be able to rely on any notice of holder conversion as prima facie evidence of, and as a representation by, the applicable Holder, that such applicable conversion described in the notice of holder conversion would not result in a violation of the Maximum Percentage.

(iv) The Maximum Percentage shall not apply to any Common Shares issued by the Company in connection with a redemption as described in Section 4 hereof.

(v) Until the Company obtains approval to waive this Section 5(f)(v) by the requisite number of its stockholders at a duly called special or annual meeting of stockholders, the Company shall not deliver Common Shares, Dividend Shares, and/or upon Conversion Shares under Section 5 hereof, to the extent that (A) the aggregate Common Shares issued by the Company to all Holders pursuant to Section 2.4 as Dividend Shares, (B) the aggregate Common Shares issued by the Company to all Holders pursuant to Section 5, as Conversion Shares, plus (C) the aggregate Common Shares issued by the Company hereunder would exceed 19.99% of the Common Shares issued and outstanding on the date of this Designation, subject to adjustment in connection with any Recapitalization. No Holder shall vote any Common Shares in favor of any proposal to waive this Section 5(f)(v) at any meeting of Common Stockholders.

5. Status of Acquired Shares. All Shares issued, redeemed by the Company or converted by the Holder in accordance with Sections 4 or 5 hereof, or otherwise acquired by the Company, shall be cancelled by the Company.

6. Ranking.

(a) Any class or series of shares of stock of the Company that shall be deemed to rank:

(i) prior to the Shares, as to the payment of dividends and as to distribution of assets upon liquidation, dissolution or winding up, if the Holders of such class or series shall be entitled to the receipt of dividends or of amounts distributable upon liquidation, dissolution or winding up, as the case may be, in preference or priority to the Holders of Shares, and such shares shall be defined as “Senior Shares”. For the sake of clarity and in an abundance of caution, the Series B Convertible Preferred Stock of the Company shall be deemed Senior Shares;

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

(ii) on a parity with the Shares, as to the payment of dividends and as to distribution of assets upon liquidation, dissolution or winding up, whether or not the dividend rates, dividend payment dates or redemption or liquidation prices per share thereof be different from those of the Shares, if the Holders of such class or series and the Shares shall be entitled to the receipt of dividends and of amounts distributable upon liquidation, dissolution or winding up in proportion to their respective amounts of accrued and unpaid dividends per share or liquidation preferences, without preference or priority one over the other (“Parity Shares”); and

(iii) junior to the Shares, as to the payment of dividends and as to the distribution of assets upon liquidation, dissolution or winding up, if such class or series shall be the Common Shares or any other class or series of shares of stock of the Company now or hereafter issued and outstanding over which the Shares have preference or priority in the payment of dividends and in the distribution of assets upon any liquidation, dissolution or winding up of the Company (“Junior Shares”).

(b) The Company’s Common Shares shall be considered Junior Shares relative to the Shares.

7. Voting Rights. Except for the Protective Provisions described below, and as expressly required by the NRS, the Series C Preferred Stock shall not have any voting rights. For so long as any Shares are outstanding, the Company shall not, without first obtaining the approval (at a meeting duly called or by written consent, as provided by law) of a Simple Majority (collectively, the “Protective Provisions”):

(a) Amend any provision of this Designation;

(b) Increase or decrease (other than by redemption or conversion) the total number of authorized shares of Series C Preferred Stock of the Company;

(c) Amend the Certificate of Formation of the Company (including by designating additional series of Preferred Stock) in a manner which adversely affects the rights, preferences and privileges of the Series C Convertible Preferred Stock;

(d) Effect an exchange, or create a right of exchange, cancel, or create a right to cancel, of all or any part of the shares of another class of shares into shares of Series C Preferred Stock; or

(e) Alter or change the rights, preferences or privileges of the shares of Series C Preferred Stock so as to affect adversely the shares of such series.

Except as required by applicable provisions of Texas law, the Shares shall not have any relative, participating, optional or other special voting rights and powers other than as set forth herein, and the consent of the Holders thereof shall not be required for the taking of any corporate action. No amendment to these terms of the Shares shall require the vote of the holders of Common Shares (except as required by law).

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

8. Record Holders. The Company and the Transfer Agent shall deem and treat the record Holder of any Shares as the true and lawful owner thereof for all purposes, and neither the Company nor the Transfer Agent shall be affected by any notice to the contrary.

9. Adjustments for Recapitalizations.

(a) Equitable Adjustments for Recapitalizations. (i) The Liquidation Preference, the Stated Value, and the Conversion Price, and any provisions hereof which are expressly tied to the price or value of Shares (each, as and if applicable) (the “Preferred Stock Adjustable Provisions”), and; (ii) any and all other terms, conditions, amounts and provisions of this Designation which (x) pursuant to the terms of this Designation provide for equitable adjustment in the event of a Recapitalization (the “Other Equitable Adjustable Provisions”); or (y) the Board of Directors of the Company determines in their reasonable good faith judgment is required to be equitably adjusted in connection with any Recapitalizations, shall each be subject to equitable adjustment as provided in Sections 10(b) through (c), below, as determined by the Board of Directors in their sole and reasonable discretion.

(b) Adjustments for Subdivisions or Combinations of Common Shares. In the event the outstanding Common Shares shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of Common Shares, without a corresponding subdivision of the Series C Preferred Stock and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately and equitably adjusted. In the event the outstanding Common Shares shall be combined (by reclassification or otherwise) into a lesser number of shares of Common Stock, without a corresponding combination of the Series C Preferred Stock and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately and equitably adjusted.

(c) Adjustments for Subdivisions or Combinations of Series C Preferred Stock. In the event the outstanding shares of Series C Preferred Stock shall be subdivided (by stock split, by payment of a stock dividend or otherwise), into a greater number of shares of Series C Preferred Stock, the applicable Preferred Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such subdivision shall, concurrently with the effectiveness of such subdivision, be proportionately and equitably adjusted. In the event the outstanding shares of Series C Preferred Stock shall be combined (by reclassification or otherwise) into a lesser number of shares of Series C Preferred Stock, the applicable Preferred Stock Adjustable Provisions and the Other Equitable Adjustable Provisions (if any) in effect immediately prior to such combination shall, concurrently with the effectiveness of such combination, be proportionately and equitably adjusted. Provided however that the result of any concurrent adjustment in the Common Shares (as provided under Section (b)) and Series C Preferred Stock (as provided under Section (c)) shall only be to affect the equitable adjustable provisions hereof once.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

(d) Other Adjustments. The Board of Directors of the Company shall also adjust equitably, and shall have the right to adjust equitably, any or all of the Preferred Stock Adjustable Provisions or Other Equitable Adjustable Provisions from time to time, if the Board of Directors of the Company determines in their reasonable good faith judgment that such values and/or provisions are required to be equitably adjusted in connection with any Company action.

(f) Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment pursuant to this Section 10, the Company at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and furnish to each Holder a certificate setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Company shall, upon the reasonable written request at any time of any Holder, furnish or cause to be furnished to such Holder a like certificate setting forth (i) such adjustments and readjustments, (ii) the Conversion Price at the time in effect, and (iii) the number of Common Shares and the amount, if any, of other property which at the time would be received upon the conversion of the Series C Preferred Stock.

10. Sinking Fund. The Shares shall not be entitled to the benefits of any retirement or sinking fund.

11. Uncertificated Book-Entry Securities. At the option of the Company, the Shares may be issued as book-entry securities directly registered in the stockholder’s name on the Company’s or Transfer Agent’s books and records. If entered as book-entry, the Shares need not be represented by certificates, but instead would be uncertificated securities of the Company.

12. Other Rights. Except as otherwise stated herein, there are no other rights, privileges, or preferences attendant or relating to in any way to the Shares, including by way of illustration but not limitation, those concerning participation, or anti-dilution rights or preferences.

13. Reports. The Company shall mail to all Holders of Series C Preferred Stock those reports, proxy statements and other materials that it mails to all of its Holders of Common Shares.

14. Replacement Preferred Stock Certificates. In the event that any Holder notifies the Company that a Preferred Stock Certificate evidencing shares of Series C Preferred Stock has been lost, stolen, destroyed or mutilated, the Company shall issue a replacement stock certificate evidencing the Series C Preferred Stock identical in tenor and date (or if such certificate is being issued for shares not covered in a redemption or conversion, in the applicable tenor and date) to the original Preferred Stock Certificate evidencing the Series C Preferred Stock, provided that the Holder executes and delivers to the Company and/or its Transfer Agent, as applicable, an affidavit of lost stock certificate and an agreement reasonably satisfactory to the Company and its Transfer Agent to indemnify the Company from any loss incurred by it in connection with such Series C Preferred Stock certificate, and provides the Company and/or its Transfer Agent such other information, documents and if applicable, bonds and indemnities as the Company or its Transfer Agent customarily requires for reissuances of stock certificates (collectively the “Lost Certificate Materials”); provided, however, the Company shall not be obligated to re-issue replacement stock certificates if the Holder contemporaneously requests the Company to convert or redeem the full number of shares evidenced by such lost, stolen, destroyed or mutilated certificate.

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

15. Construction. When used in this Designation, unless a contrary intention appears: (i) a term has the meaning assigned to it; (ii) “or” is not exclusive; (iii) “including” means including without limitation; (iv) words in the singular include the plural and words in the plural include the singular, and words importing the masculine gender include the feminine and neuter genders; (v) any agreement, instrument or statute defined or referred to herein or in any instrument or certificate delivered in connection herewith means such agreement, instrument or statute as from time to time amended, modified or supplemented and includes (in the case of agreements or instruments) references to all attachments thereto and instruments incorporated therein; (vi) the words “hereof”, “herein” and “hereunder” and words of similar import when used in this Designation shall refer to this Designation as a whole and not to any particular provision hereof; (vii) references contained herein to Article, Section, Schedule and Exhibit, as applicable, are references to Articles, Sections, Schedules and Exhibits in this Designation unless otherwise specified; (viii) references to “dollars”, “Dollars” or “$” in this Designation shall mean United States dollars; (ix) reference to a particular statute, regulation or law means such statute, regulation or law as amended or otherwise modified from time to time; (x) any definition of or reference to any agreement, instrument or other document herein shall be construed as referring to such agreement, instrument or other document as from time to time amended, supplemented or otherwise modified (subject to any restrictions on such amendments, supplements or modifications set forth herein); (xi) unless otherwise stated in this Designation, in the computation of a period of time from a specified date to a later specified date, the word “from” means “from and including” and the words “to” and “until” each mean “to but excluding”; (xii) references to “days” shall mean calendar days; and (xiii) the paragraph and Section headings contained in this Designation are for convenience only, and shall in no manner affect the interpretation of any of the provisions of this Designation.

——————————————————————————

NOW THEREFORE BE IT RESOLVED, that the Designation is hereby approved, affirmed, confirmed, and ratified; and it is further

RESOLVED, that each officer of the Company be and hereby is authorized, empowered and directed to execute and deliver, in the name of and on behalf of the Company, any and all documents, and to perform any and all acts necessary to reflect the Board of Directors approval and ratification of the resolutions set forth above; and it is further

RESOLVED, that in addition to and without limiting the foregoing, each officer of the Company and the Company’s attorney be and hereby is authorized to take, or cause to be taken, such further action, and to execute and deliver, or cause to be delivered, for and in the name and on behalf of the Company, all such instruments and documents as he may deem appropriate in order to effect the purpose or intent of the foregoing resolutions (as conclusively evidenced by the taking of such action or the execution and delivery of such instruments, as the case may be) and all action heretofore taken by such officer in connection with the subject of the foregoing recitals and resolutions be, and it hereby is approved, ratified and confirmed in all respects as the act and deed of the Company; and it is further

RESOLVED, that this Designation may be executed in several counterparts, each of which is an original; that it shall not be necessary in making proof of this Designation or any counterpart hereof to produce or account for any of the other.

[Remainder of page left intentionally blank. Signature page follows.]

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

IN WITNESS WHEREOF, Mangoceuticals, Inc. has approved and caused this “Certificate of Designation of Mangoceuticals, Inc. Establishing the Designations, Preferences, Limitations and Relative Rights of Its 6% Series C Convertible Preferred Stock” to be duly executed and approved this 18th day of April 2024.

| /s/ Jacob D. Cohen | |

| Jacob D. Cohen | |

| Chief Executive Officer |

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

NOTICE OF CONVERSION

(TO

BE EXECUTED BY THE REGISTERED HOLDER IN ORDER TO CONVERT

PREFERRED SHARES)

The undersigned hereby elects to convert the number of 6% Series C Convertible Preferred Shares indicated below into common shares, $0.0001 par value (the “Common Shares”), of Mangoceuticals Inc. (the “Company”), a corporation organized under the laws of the State of Texas, according to the conditions hereof, as of the date written below.

Conversion

calculations:

Date to Effect Conversion:

| Number of Preferred Shares owned prior to Conversion: | |

| Number of Preferred Shares to be Converted: | |

| Stated Value of the Preferred Shares to be Converted: | |

| Number of Common Shares to be Issued: | |

| Applicable Conversion Price: |

| Number of Preferred Shares subsequent to Conversion: |

_________________

| Address for Delivery: |

or

DWAC Instructions:

Broker no:__________

Account no:__________

| HOLDER | ||

| By: | ||

| Name: | ||

| Title: | ||

| Mangoceuticals, Inc.: Certificate of Designations of 6% Series C Convertible Preferred Stock | Page |

Exhibit 10.1

PATENT PURCHASE AGREEMENT

This PATENT PURCHASE AGREEMENT (“Agreement”) is entered into and made effective as of this 24th day of April 2024 (“Effective Date”) by and between Mangoceuticals, Inc., a Texas corporation with a place of business at 15110 Dallas Parkway, Suite 600, Dallas, TX 75248 (“Purchaser”), and Intramont Technologies, Inc., a New Jersey corporation, with a place of business at 185 Prospect Avenue, Unit 7i, Hackensack, NY 07601 (“Seller”) (each of Seller and Purchaser is defined herein as a “Party”, and collectively referred to as the “Parties”).

WITNESSETH:

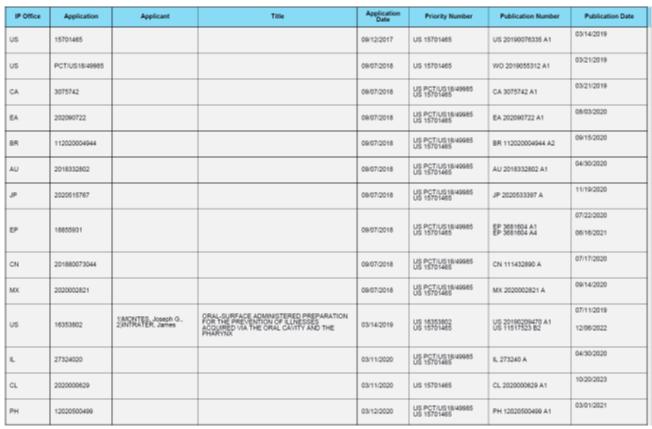

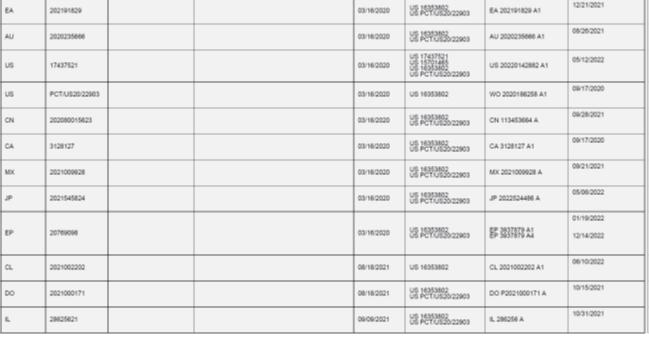

WHEREAS, Seller owns certain patents and patent applications set forth in Exhibit A hereto; and

WHEREAS, Purchaser desires to purchase from Seller, and Seller desires to sell and assign to Purchaser, such patents and patent applications set forth in Exhibit A hereto, on the terms and conditions set forth herein.