UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(B) OR 12(G) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number: 001-41647

Ohmyhome Limited

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

11 Lorong 3 Toa Payoh

Block B, #04-16/21, Jackson Square

Singapore 319579

(Address of principal executive offices)

Rhonda Wong

ir@ohmyhome.com

+65 6886 9009

11 Lorong 3 Toa Payoh

Block B, #04-16/21, Jackson Square

Singapore 319579

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Ordinary shares, par value $0.001 per share |

OMH | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 22,785,110 ordinary shares issued and outstanding as of December 31, 2023.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | ||

| Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued | Other ☐ | ||

| by the International Accounting Standards Board ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

☐ Yes ☐ No

Table of Contents

INTRODUCTION

Except where the context otherwise requires and for purposes of this annual report only the term:

| ● |

“AI” refers to artificial intelligence.

|

|

| ● | “Amended and Restated Memorandum and Articles of Association” refers to the amended and restated memorandum and articles of association of our Company adopted on November 28, 2022, and as amended from time to time. | |

| ● | “Anthill” refers to Anthill Corporation Pte. Ltd., a company incorporated in Singapore and owned as to 50% each by Ms. Rhonda Wong and Ms. Race Wong and which own 8,415,406 Ordinary Shares representing approximately 36.93% of the entire issued share capital of our Company. | |

| ● | “BVI” refers to the British Virgin Islands. | |

| ● | “CEA” refers to Council for Estate Agencies of Singapore. | |

| ● | “Company” or “our Company” refers to Ohmyhome Limited, an exempted company incorporated in the Cayman Islands with limited liability under the Companies Act on July 19, 2022. | |

| ● | “Companies Act” refers to the Companies Act (2021 Revision) of the Cayman Islands, as amended, supplemented or modified from time to time. | |

| ● | “Cora.Pro” refers to Cora.Pro Pte. Ltd., a company incorporated in Singapore on May 21, 2020, and an indirect wholly-owned subsidiary of our Company. | |

| ● | “COVID-19” refers to the Coronavirus Disease 2019. | |

| ● |

“COVID-19 Act” refers to the COVID-19 (Temporary Measures) Act 2020 of Singapore, as amended, supplemented or modified from time to time.

|

|

| ● | “COVID-19 Regulations” refers to the COVID-19 (Temporary Measures) (Control Order) Regulations 2020 of Singapore, as amended, supplemented or modified from time to time. | |

| ● | “Directors” refers to the directors of our Company as at the date of this annual report, unless otherwise stated. | |

| ● | “DIY” refers to do-it-yourself. | |

| ● | “DreamR” refers to The DreamR Project Pte. Ltd., a company incorporated in Singapore on December 7, 2021, and an indirect wholly-owned subsidiary of our Company. |

|

|

| ● | “Estate Agents Act” refers to the Estate Agents Act 2010 of Singapore, as amended, supplemented or modified from time to time. | |

| ● | “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended. | |

| ● | “Executive Directors” refers to the executive directors of our Company as at the date of this annual report, unless otherwise stated. | |

| ● | “Executive Officers” refers to the executive officers of our Company as at the date of this annual report, unless otherwise stated. | |

| ● | “Group,” “our Group,” “we,” “us,” or “our” refers to our Company and its subsidiaries or any of them, or where the context so requires, in respect of the period before our Company becoming the holding company of its present subsidiaries, such subsidiaries as if they were subsidiaries of our Company at the relevant time or the businesses which have since been acquired or carried on by them or as the case may be their predecessors. | |

| ● | “GST” refers to the Goods and Services Tax chargeable pursuant to the Goods and Services Tax Act 1993 of Singapore. | |

| ● | “HDB” refers to the Housing & Development Board of Singapore. | |

| ● | “Independent Directors” refers to the independent non-executive Directors of our Company as at the date of this annual report, unless otherwise stated. | |

| ● | “MATCH” refers to the property matching technology and algorithm developed by our Group. | |

| ● | “MOM” refers to the Ministry of Manpower of Singapore. | |

| ● | “Ms. Race Wong” refers to Ms. Wong Wan Pei, our Director and Chief Operating Officer. | |

| ● | “Ms. Rhonda Wong” refers to Ms. Wong Wan Chew, our Director, Chief Executive Officer, and Chief Financial Officer. | |

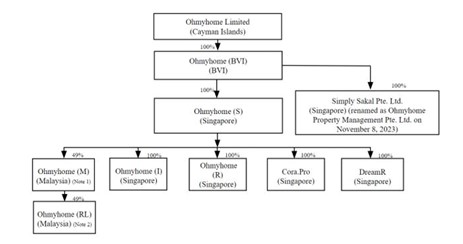

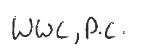

| ● | “Ohmyhome (BVI)” refers to Ohmyhome (BVI) Limited, a company incorporated in the BVI on July 27, 2022, and a wholly-owned subsidiary of our Company. | |

| ● | “Ohmyhome (I)” refers to Ohmyhome Insurance Pte. Ltd., a company incorporated in Singapore on March 5, 2020, and an indirect wholly-owned subsidiary of our Company. | |

| ● | “Ohmyhome (M)” refers to Ohmyhome Sdn. Bhd., a company incorporated in Malaysia on January 17, 2019, and an indirect subsidiary of our Company. | |

| ● | “Ohmyhome (R)” refers to Ohmyhome Renovation Pte. Ltd., a company incorporated in Singapore on March 5, 2020, and an indirect wholly-owned subsidiary of our Company. | |

| ● | “Ohmyhome (RL)” refers to Ohmyhome Realtors Sdn. Bhd., a company incorporated in Malaysia on January 17, 2019, and an indirect subsidiary of our Company. | |

| ● | “Ohmyhome (S)” refers to Ohmyhome Pte. Ltd., a company incorporated in Singapore on June 12, 2015, and an indirect wholly-owned subsidiary of our Company. |

|

|

| ● | “Ordinary Shares” refers to the ordinary shares in the capital of our Company. | |

| ● | “Operating Subsidiaries” refers to Ohmyhome (S), Ohmyhome (I), Ohmyhome (R), Cora.Pro, DreamR, Ohmyhome (M) and Ohmyhome (RL). | |

| ● | “Other Existing Shareholders” refers to the existing shareholders of our Company immediately prior to the initial public offering (excluding Anthill), namely Ang Yen Ney, Anthony Craig Bolger, Ong Eng Yaw, Primefounders Pte. Ltd., Teo Khiam Chong, Vienna Management Ltd., Wang Yu Huei, K3 Ventures Pte. Ltd., Lee Kwi Thai, GEC Tech Ltd., Chew Kwee San, Fong Cheng Kee, Swettenham Blue Pte. Ltd. and Tsai Chun-Chia (all of whom are Independent Third Parties except Anthony Craig Bolger, Lee Kwi Thai and Vienna Management Ltd.) holding 284,806; 58,693; 344,593; 591,395; 230,215; 1,785,941; 460,429; 118,662; 122,307; 1,227,446; 292,280; 301,120; 625,024 and 416,683 Ordinary Shares, respectively. | |

| ● | “Representative” refers to Prime Number Capital LLC, acting as the lead managing underwriter and book-runner with respect to the Ordinary Shares subject to the initial public offering. | |

| ● | “RM” refers to Malaysian ringgit, the lawful currency of Malaysia. | |

| ● | “S$” or “SGD” or “Singapore Dollars” refers to Singapore dollar(s), the lawful currency of Singapore. | |

| ● | “SCAL” refers to Singapore Contractors’ Association Limited. | |

| ● | “SEC” refers to the United States Securities and Exchange Commission; | |

| ● | “Securities Act” refers to the U.S. Securities Act of 1933, as amended, supplemented or modified from time to time. | |

| ● | “Shareholders” refers to the holders of Ordinary Shares. | |

| ● | “Singapore Companies Act” refers to the Companies Act 1967 of Singapore, as amended, supplemented or modified from time to time. | |

| ● | “Simply” or “Simply (Singapore)” refers to Simply Sakal Pte. Ltd., a company incorporated in Singapore and a wholly-owned subsidiary of our Company. With effect from November 8, 2023, the name of the Company was changed from Simply Sakal Pte. Ltd. to Ohmyhome Property Management Pte. Ltd. | |

| ● | “Super Agents” refers to licensed real estate agents and salespersons employed by our Group on a full-time basis and not associated with any other agencies in the jurisdictions where we operate. | |

| ● | “TDSR” refers to the Total Debt Servicing Ratio. | |

| ● | “US$” or “U.S. dollars” refers to the lawful currency of the United States; | |

| ● | “U.S.” or “United States” refers to the United States of America. | |

| ● | “VR” refers to virtual reality. |

Ohmyhome Limited is a holding company with operations conducted in Singapore and Malaysia through its operating subsidiaries in Singapore and Malaysia, using Singapore dollars and Malaysian Ringgit. Our reporting currency is in Singapore dollars. This annual report also contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Singapore dollars into U.S. dollars were made at S$1.3193 to US$1.00 for the financial year ended December 31, 2023 amounts, S$1.3404 to US$1.00 for the financial year ended December 31, 2022 amounts, S$1.352 to US$1.00 for the financial year ended December 31, 2021 amounts, S$1.3800 to US$1.00 for the financial year ended December 31, 2020 amounts, in accordance with our internal exchange rate. We make no representation that the Singapore dollar or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Singapore dollars, as the case may be, at any particular rate or at all.

We obtained the industry and market data used in this annual report or any document incorporated by reference from industry publications, research, surveys and studies conducted by third parties and our own internal estimates based on our management’s knowledge and experience in the markets in which we operate. We did not, directly or indirectly, sponsor or participate in the publication of such materials, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report. We have sought to provide current information in this annual report and believe that the statistics provided in this annual report remain up-to-date and reliable, and these materials are not incorporated in this annual report other than to the extent specifically cited in this annual report.

|

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. You can find many (but not all) of these statements by the use of words such as “approximates,” “believes,” “hopes,” “expects,” “anticipates,” “estimates,” “projects,” “intends,” “plans,” “will,” “would,” “should,” “could,” “may” or other similar expressions in this annual report. These statements are likely to address our growth strategy, financial results and product and development programs. You must carefully consider any such statements and should understand that many factors could cause actual results to differ from our forward-looking statements. These factors may include inaccurate assumptions and a broad variety of other risks and uncertainties, including some that are known and some that are not. No forward-looking statement can be guaranteed and actual future results may vary materially. Factors that could cause actual results to differ from those discussed in the forward-looking statements include, but are not limited to:

| ● | our goals and strategies; | |

| ● | our future business development, financial condition and results of operations; | |

| ● | introduction of new product and service offerings; | |

| ● | expected changes in our revenues, costs or expenditures; | |

| ● | our expectations regarding the demand for and market acceptance of our products and services; | |

| ● | expected growth of our customers, including consolidated account customers; | |

| ● | competition in our industry; | |

| ● | government policies and regulations relating to our industry; | |

| ● | the length and severity of the recent COVID-19 outbreak and its impact on our business and industry | |

| ● | any recurrence of the COVID-19 pandemic and scope of related government orders and restrictions and the extent of the impact of the COVID-19 pandemic on the global economy; | |

| ● | other factors that may affect our financial condition, liquidity and results of operations; and | |

| ● | other risk factors discussed under “Item 3. Key Information — 3.D. Risk Factors.” |

We base our forward-looking statements on our management’s beliefs and assumptions based on information available to our management at the time the statements are made. We caution you that actual outcomes and results may, and are likely to, differ materially from what is expressed, implied or forecast by our forward-looking statements. Accordingly, you should be careful about relying on any forward-looking statements. Except as required under the federal securities laws, we do not have any intention or obligation to update publicly any forward-looking statements after the distribution of this annual report, whether as a result of new information, future events, changes in assumptions, or otherwise.

|

|

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable for annual reports on Form 20-F.

Item 2. Offer Statistics and Expected Timetable

Not applicable for annual reports on Form 20-F.

Item 3. Key Information

3.A. Reserved

3.B. Capitalization and Indebtedness

Not applicable for annual reports on Form 20-F.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable for annual reports on Form 20-F.

3.D. Risk Factors

Risk Factor Summary

You should carefully consider all of the information in this annual report before making an investment in our Ordinary Shares. Below please find a summary of the principal risks and uncertainties we face, organized under relevant headings. Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, financial condition, results of operations, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks Relating to Our Business and Industry

| ● | We are dependent on our Super Agents, in-house employees and our third party business partners on our platform to provide quality services to customers (at page 7). | |

| ● | We may be unable to maintain our relationships with our existing third party business partners and/or develop relationships with new third party partners (at page 8). | |

| ● | We may be unable to generate profit in the future or at all (at page 9). | |

| ● | Our business model and growth strategy depend on our ability to attract home buyers and home sellers to our online platform in a cost-effective manner (at page 10). | |

| ● | We rely heavily on Internet search engines and mobile application stores to direct traffic to our website and our mobile application, respectively (at page 11). | |

| ● | The proper functioning and reliability of our online platform is essential to our business (at page 11). | |

| ● | We depend on the reliable performance of third party networks and mobile infrastructure (at page 12). | |

| ● | We incur costs and are subject to certain challenges which our competitors with different business models do not face (at page 12). | |

| ● | We may be unable to successfully renew our estate agent license (at page 13). | |

| ● | Our business is dependent on the availability of mortgage financing (at page 14). | |

| ● | Our business generates and processes a large amount of consumer data, and the improper use, collection or disclosure of such data could subject us to significant reputational, financial, legal and operational consequences (at page 14). | |

| ● | We may be unable to adequately protect our intellectual property and proprietary rights (at page 15). | |

| ● | We rely on certain technology and software licensed from third parties (at page 17). | |

| ● | Our technology, software and systems are highly complex and may contain undetected errors or vulnerabilities. (at page 17). | |

| ● | We are dependent on key management personnel for our future success and growth (at page 18). | |

| ● | We may be unable to attract, retain, effectively train, motivate, and utilize Super Agents (at page 19). | |

| ● | We rely on certain key operating metrics to evaluate the performance of our business, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business (at page 21). | |

| ● | Acquisitions by our Company has potential benefits such as expanding product and service offerings, entering new markets, and acquiring new technologies, but also carries risks such as integration, cultural, financial, regulatory, and legal risks (at page 22). |

|

|

Risks related to our Ordinary Shares

| ● | We may not maintain the listing of our Ordinary Shares on the Nasdaq Capital Market which could limit investors’ ability to make transactions in our Ordinary Shares and subject us to additional trading restrictions (page 23). | |

| ● | The trading price of our Ordinary Shares may be volatile and there may not be an active, liquid trading market for our Ordinary Shares, which could result in substantial losses to you (page 24). | |

| ● | We may experience extreme stock price volatility, including any stock-run up, unrelated to our actual or expected operating performance, financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our Ordinary Shares (page 24). | |

| ● | Because we do not expect to pay dividends in the foreseeable future, you must rely on price appreciation of our Ordinary Shares for a return on your investment. You may not realize a return on your investment in our shares and you may even lose your entire investment (page 25). | |

| ● | Short selling may drive down the market price of our Ordinary Shares (page 26). | |

| ● | If securities or industry analysts do not publish or publish inaccurate or unfavorable research about our business, or if they adversely change their recommendations regarding our Ordinary Shares, the market price for our Ordinary Shares and trading volume could decline (page 26). | |

| ● | As a company incorporated in the Cayman Islands, we are permitted to follow certain home country practices in relation to corporate governance matters in lieu of certain requirements under the Nasdaq Capital Market Listing Rules. These practices may afford less protection to shareholders than they would enjoy if we complied fully with the Nasdaq Capital Market Listing Rules (page 26). | |

| ● | You may face difficulties in protecting your interests, and your ability to protect your rights through U.S. courts may be limited, because we are incorporated under Cayman Islands law (page 26). | |

| ● | Certain judgments obtained against us by our shareholders may not be enforceable (on page 27). | |

| ● | We are a foreign private issuer within the meaning of the Exchange Act, and as such we are exempt from certain provisions applicable to United States domestic public companies (on page 27). | |

| ● | We may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses to us (on page 28). | |

| ● | If we are classified as a passive foreign investment company, United States taxpayers who own our securities may have adverse United States federal income tax consequences (page 28). | |

| ● | We may need additional capital, and we may be unable to obtain such capital in a timely manner or on acceptable terms, or at all (page 29). | |

| ● | We are exposed to risks in respect of acts of war, terrorist attacks, epidemics, political unrest, natural disasters, adverse weather and other uncontrollable events (page 29). | |

| ● | We will incur increased costs as a result of being a public company after we cease to qualify as an emerging growth company (page 29). | |

| ● | We are an “emerging growth company” and the reduced disclosure requirements applicable to emerging growth companies may make our Ordinary Shares less attractive to investors (page 30). |

|

|

Risks Relating to the Jurisdictions where we operate

| ● | Any adverse changes in the political, economic, legal, regulatory taxation or social conditions in the jurisdictions that we operate in or intend to expand our business may have a material adverse effect on our operations, financial performance and future growth (at page 30). |

Risks Related to our Business and Industry

We are dependent on our Super Agents, in-house employees and our third party business partners on our platform to provide quality services to customers.

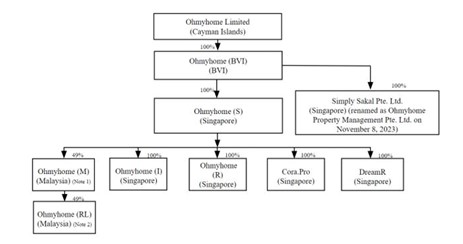

The success of our business depends substantially on our ability to provide quality and satisfactory customer experience in the property transaction services offered on our platform, which, in turn, depends on a variety of factors, including our ability to offer high standards of service from our in-house Super Agents and relationship managers, as well as external business partners such as financial advisers, legal service providers, contractors and professional house movers who offer their services through our platform.

In terms of our in-house staff, although we have implemented various service protocols and conduct regular trainings to ensure the service quality of our Super Agents and relationship managers, we cannot guarantee that we will effectively manage all of our employees to ensure consistent and satisfactory customer experience in all service settings. Our brokerage services is our core business, which generated a revenue of S$3,731,586, S$3,072,060, S$2,817,930, representing 85.2%, 43.7%, and 56.3% of our total revenue for the years ended December 31, 2021, 2022, and 2023 respectively. As such, we are heavily reliant on our Super Agents to provide high standards of service to our customers looking to engage professional property agents for their property transactions. Our Super Agents may, from time to time, fail to fully comply with our protocols and relevant laws or regulations and/or may engage in misconduct or illegal actions, which may result in negative publicity and adversely impact our reputation and brand image. While we have, in the past, received customer complaints in respect of the service standards of some of our Super Agents, such complaints are relatively minor in nature and are resolved expeditiously, such as by changing the Super Agent serving the customer in question, at no additional cost to the customer. If we are unable to continue to provide satisfactory customer experience, our customers may choose other service providers over our platform for their intended property transactions, which could adversely and materially impact our business, prospects, financial condition and results of operations.

In addition to the services provided by our in-house Super Agents and employees, we also rely on a large number of third party service providers to provide various service offerings available on our platform, such as contractors to subcontract certain renovation works, partner banks to provide mortgage solutions, partner law firms to provide legal advice and conveyancing services, and professional movers and other home service providers to provide moving and other housing-related services. In this regard, customers who wish to obtain such services from our platform will typically primarily liaise and engage with us. Accordingly, any lapses in service standards by our third party service providers will, in turn, negatively affect our relationship and reputation with the customer. While we have implemented various safeguards to ensure high-quality service standards from such third parties, such as conducting extensive checks before selecting any third party service providers, and conducting regular evaluations to ensure adherence to high levels of service, we cannot ensure that the third party service providers will always comply with such standards. To the extent they are unable to provide satisfactory services to our users and/or they engage in any inappropriate or illegal actions, which may be due to factors that are beyond our control, we may suffer actual or reputational damage as a result and our business, prospects, financial condition and results of operations could be adversely affected as a result.

|

|

We are affected by regional and worldwide political, regulatory, social and economic conditions in the jurisdictions in which we and our customers and suppliers operate and in the jurisdictions which we intend to expand our business in.

We and our customers and suppliers are governed by the laws, regulations and government policies in each of the various jurisdictions in which we and our customers and suppliers operate or into which we intend to expand our business and operations. Our business and future growth are dependent on the political, regulatory, social and economic conditions in these jurisdictions, which are beyond our control. Any economic downturn, changes in policies, currency and interest rate fluctuations, capital controls or capital restrictions, labor laws, changes in environmental protection laws and regulations, duties and taxation and limitations on imports and exports in these countries may materially and adversely affect our business, financial condition, results of operations and prospects.

Generally, we fund our purchases of heavy construction equipment via our internal resources and short and long-term financing from banks and other financial institutions. Any disruption, uncertainty and volatility in the global credit markets may limit our ability to obtain the required working capital and financing for our business at reasonable terms and finance costs. If all or a substantial portion of our credit facilities are withdrawn and we are unable to secure alternative funding on acceptable commercial terms, our operations and financial position will be adversely affected. The interest rates for most of our credit facilities are subject to review from time to time by the relevant financial institutions. Given that we rely on these credit facilities to finance our purchase of heavy construction equipment and that interest expenses represent a significant percentage of our expenses, any increase in the interest rates of the credit facilities extended to us may have a material adverse impact on our profitability.

In addition, such fluctuations and volatility in the global credit markets could limit credit lines of our current and potential customers from banks or financial institutions. Accordingly, such customers may not commence or continue their construction projects, or may not be able to obtain sufficient financing to purchase or rent our heavy construction equipment, or we may be required to lower our rates in order to cater to our customers’ current situation. This may have an adverse impact on our revenue and financial performance.

We may be unable to maintain our relationships with our existing third party business partners and/or develop relationships with new third party partners.

We operate a one-stop-shop property platform which seeks to provide comprehensive, end-to-end property solutions for our customers through a single integrated platform. In order to do so, we partner with various third party service providers to provide certain property-related services, including but not limited to mortgage, legal, moving, relocation and other property-related services. To this end, we have forged partnerships with several key players in each of the service industries across Singapore and Malaysia.

We believe our large and active network of business partners contributes significantly to the success of our platform. However, we cannot guarantee that we will be able to maintain our relationships with our existing business partners on commercially acceptable terms, or at all, after the terms of the current cooperation agreements expire, or if we are able to develop relationships with new business partners for our current or new services, or in new jurisdictions in the future. In the event that we are unable to maintain existing relationships or develop new relationships with such service providers, our ability to provide a one-stop-shop platform to serve all of our customers’ property-related needs may be hindered, which may, in turn, materially and adversely affect our business, prospects, financial condition and results of operations.

|

|

We may be unable to generate profit in the future or at all.

We recorded a negative cash flow from operating activities of S$1,812,064 as at December 31, 2021, and a negative cash flow from operating activities of S$3,106,317 as at December 31, 2022, and a negative cash flow from operating activities of S$4,854,939 (US$3,679,937) as at December 31, 2023. We may continue to record net current liabilities, a total deficit and/or negative cash flow from operating activities in the foreseeable future, which can expose us to liquidity risks. A net current liabilities position can expose us to the risk of shortfalls in liquidity, in which case our ability to raise funds, obtain bank loans and declare and pay dividends will be materially and adversely affected.

We cannot assure you that we will be able to continue to generate net income in the future. We anticipate that our operating cost and expenses will increase in the foreseeable future as we continue to grow our business. Our efforts to grow our business may prove more costly than we currently anticipate, and we may not succeed in increasing our revenue sufficiently to offset these higher expenses.

Our profitability and liquidity position are dependent on, among other factors, our ability to grow our business and extend our product offering to existing customers and expand our customer base. Any material decrease in our service fees would have a substantial impact on our margin. As a result of the foregoing and other factors, our net income may decline, or we may incur net losses in the future and be unable to achieve or maintain profitability and improve our liquidity position.

We operate in a highly competitive industry and we face competition from other industry players.

The property transactions and services industry is rapidly evolving and increasingly competitive, with numerous service providers competing for customers for their property-related service offerings. Although we believe no other industry player in Southeast Asia operates under the integrated platform business model similar to ours, we face competition from players in different segments of the property transactions and services industry. We also compete with traditional real estate brokerage firms for real estate agents and property customers locally, as well as a growing number of Internet-based residential brokerages and others who operate with non-traditional real estate business models. Certain of our service offerings such as our brokerage services are also dependent on attracting a substantial pool of property listings on our platforms from homeowners. In this regard, we face competition from other online real estate listing platforms.

Some of our competitors may have longer operating histories and stronger brand recognition in certain markets, and may possess greater operational, financial, research and development, and marketing capabilities than us. Some of our competitors may also be more aggressive in their pricing policies in order to capture or retain market share, or may have lower operating costs, overhead expenditure or procurement costs due to their larger scale of operations and product development. In addition, the entry of new players will increase the competitive pressure faced by us. Furthermore, as the industry is constantly evolving, our current or future competitors may be better able to position themselves to compete more effectively as the industry develops.

|

|

Increasing competition may lead to declining market share and commission rate, make it more difficult for us to retain and attract business partners and users, or force us to increase sales and marketing expenses, any of which could harm our financial condition and results of operations. We cannot assure you that we will be able to compete successfully against current or future competitors. In the event that we are unable to maintain our competitiveness, our business, prospects, financial condition and results of operations may be adversely affected.

Our business may be affected by technological changes and developments.

As a data and technology-driven property technology company, we may be affected by rapid changes in technology, changing market trends and evolving industry standards across all areas of our business. The risks we may face include but are not limited to:

| (a) | not being able to anticipate and adapt to new technology and developing technology trends in the property technology sector; |

| (b) | our competitors developing more innovative and efficient solutions as compared to us; and |

| (c) | not being able to expand our suite of property-related solutions and resources quickly enough to keep up with demand. |

Accordingly, our success depends on our ability to innovate and adapt our technology-backed property solutions to meet evolving industry standards and our customers’ and business partners’ expectations. We have invested, and expect to continue to invest, substantial time, capital, and other resources in understanding the needs of our customers and developing technologies, tools, features and service offerings to meet those needs. We cannot assure you that our current and future offerings will be satisfactory to or broadly accepted by customers, or competitive with the offerings of our competitors. If our current or future offerings are unable to meet industry and customer expectations in a timely and cost-effective manner, our business, prospects, financial condition and results of operations may be adversely affected.

Furthermore, technological development is inherently challenging, time-consuming and expensive, and the nature of development cycles may result in delays between the time we incur expenses and the time we make available new offerings and generate revenue, if any, from those investments. Anticipated customer demand for an offering we are developing could also decrease after the development cycle has commenced, and we would not be able to recoup substantial costs we incurred. In addition, we cannot assure you that we will be able to identify, design, develop, implement, and utilize, in a timely and cost-effective manner, technology necessary for us to compete effectively, that such technology will be commercially successful, or that products and services developed by others will not render our offerings non-competitive or obsolete. If we do not achieve the desired outcome from our technological investments, our business, prospects, financial condition and results of operations may be adversely affected.

Our business model and growth strategy depend on our ability to attract home buyers and home sellers to our online platform in a cost-effective manner.

Our success depends, in part, on our ability to attract home buyers and home sellers to our online platform in a cost-effective manner. Our website and mobile application are our primary channels for meeting customers. We rely heavily on traffic generated from search engines and other sources to acquire customers. We use a variety of methods in our marketing efforts to drive traffic, including online marketing such as social media marketing, paid search advertising, and targeted email communications, and offline marketing through promotional events, out-of-home advertising, and radio commercials. We intend to continue to invest resources in our marketing efforts.

These marketing efforts may not succeed for a variety of reasons, including changes to search engine algorithms, ineffective campaigns across marketing channels, and limited experience in certain marketing channels like television. External factors beyond our control may also affect the success of our marketing initiatives, such as filtering of our targeted communications by email servers, home buyers and home sellers failing to respond to our marketing initiatives, and competition from third parties. Any of these factors could reduce the number of home buyers and home sellers on our online platform. We also anticipate that our marketing efforts will become increasingly expensive as competition increases and we seek to expand our business in existing markets. Generating a meaningful return on our marketing initiatives may be difficult. If our strategies do not attract home buyers and home sellers efficiently, our business, prospects, financial condition and results of operations may be adversely affected.

|

|

We rely heavily on Internet search engines and mobile application stores to direct traffic to our website and our mobile application, respectively.

We rely heavily on Internet search engines, such as Google, Bing, and Yahoo!, to drive traffic to our website and on mobile application stores, such as the Apple iTunes Store and the Android Play Store, to promote downloads of our mobile application. The number of visitors to our website and mobile application downloads depends in large part on how and where our website and mobile application rank in Internet search results and mobile application stores, respectively. While we use search engine optimization to help our web pages rank highly in search results, maintaining our search result rankings is not within our control. Internet search engines frequently update and change their ranking algorithms, referral methodologies, or design layouts, which determine the placement and display of a user’s search results. In some instances, Internet search engines may change these rankings in order to promote their own competing services or the services of one or more of our competitors. Similarly, mobile application stores can change how they display searches and how mobile applications are featured. For instance, editors at the Apple iTunes Store can feature prominently editor-curated mobile applications and cause the mobile application to appear larger than other applications or more visibly on a featured list. Listings on our website and mobile application have experienced fluctuations in search result and mobile application rankings in the past, and we anticipate fluctuations in the future. If our website or listings on our website fail to rank prominently in Internet search results, our website traffic could decline. Likewise, a decline in our website and mobile application traffic could reduce the number of customers for our services, which may in turn adversely affect our business, prospects, financial condition and results of operations.

The proper functioning and reliability of our online platform is essential to our business.

As we operate an online-to-offline real estate platform, the success of our business and ability to attract and retain customers substantially depends on the satisfactory performance, reliability and availability of our online platform, which in turn depends on a variety of factors. Any system interruptions or failures in the proper functioning of our platform may result in the unavailability or slowdown of our services, reduction in transaction volume and/or hamper the delivery of satisfactory services to our customers. These interruptions may be due to unforeseen events that are beyond our control, such as telecommunications failures, security breaches, additional regulatory requirements which we cannot satisfy on a timely basis, or at all, or adverse development or negative publicity involving our platform participants. Our servers may also be vulnerable to computer viruses or similar disruptions from time to time, which could lead to system interruptions, website and mobile application slowdown or unavailability, delays or errors in transaction processing, loss of data and/or the inability to accept and fulfill customer requests. If we are unable to resolve such disruptions or platform failures in a timely and cost-efficient manner, our business, prospects, financial condition and results of operations may be adversely affected.

In addition, developing, supporting and maintaining our online platform across multiple operating systems and devices require substantial time and resources. As new mobile devices and mobile operating systems are released, we may encounter problems in developing or supporting our mobile application for them. The success of our online platform could also be harmed by factors outside our control, such as:

| (a) | increased costs to develop, distribute, or maintain our website or mobile application; |

| (b) | changes to the terms of service or requirements of a mobile application store that requires us to change our mobile application development or features in an adverse manner; and |

| (c) | changes in mobile operating systems, such as Apple’s iOS and Google’s Android, that disproportionately affect us, degrade the functionality of our mobile website or mobile application, require that we make costly upgrades to our offerings, or give preferential treatment to competitive websites or mobile applications. |

|

|

If any of the aforementioned situations arise and we are unable to ensure our platform adapts in a proper and timely manner, this may cause delays or disruptions to our operations and access to our platform, resulting in increased costs which would, in turn, adversely affect our business, prospects, financial condition and results of operations.

If we fail to adopt new technologies or adapt our platform and systems to changing user requirements or emerging industry standards, our business may be materially and adversely affected.

We seek to continually enhance and improve the functionality, effectiveness and features of our online website and mobile application. However, our existing technologies and systems could be rendered obsolete at any time due to rapid technological evolution, changes in customer requirements and preferences, frequent introductions of new products and services embodying new technologies and/or the emergence of new industry standards and practices. The success of our online platform will depend, in part, on our ability to identify, develop, acquire or license technologies useful in our business, and respond to technological advances and emerging industry standards and practices in a cost-effective and timely way. We must also continue to enhance and improve the ease of use, functionality and features of our website and mobile application.

The development of our website, mobile application and other technologies entails significant technical and business risks. Furthermore, such new features, functions and services may not achieve market acceptance or serve to enhance our brand loyalty. We cannot assure you that we will be able to successfully develop or effectively use new technologies, recoup the costs of developing new technologies or adapt our website, mobile application, proprietary technologies and systems to meet customer requirements or emerging industry standards. If we are unable to adapt in a cost-effective and timely manner in response to changing market conditions or user preferences, whether for technical, legal, financial or other reasons, our business, prospects, financial condition and results of operations may be materially and adversely affected.

We depend on the reliable performance of third party networks and mobile infrastructure.

Our brand, reputation, and ability to attract customers to our platform depend on the reliable performance of third-party network and mobile infrastructure. As our range of services, the number of platform users and the number of property listings shared on our online platform increase, our need for additional network capacity and computing power will also grow. Operating our underlying technology systems is expensive and complex, and we could experience operational failures from time to time. If we experience interruptions or failures in these systems, whether due to system failures, computer viruses, physical or electronic break-ins, attacks on domain name servers or other third parties on which we rely, or any other reason, the security and availability of our services and technologies could be affected. Any such event could cause us to incur additional costs, result in delays in our service offerings, cause detrimental harm to our brand and reputation, and/or create a loss in confidence of our customers who use our platform or the third-party service providers whom we work with, resulting in a material adverse effect on our business, prospects, financial condition and results of operations.

We incur costs and are subject to certain challenges which our competitors with different business models do not face.

Our Super Agents are employed by our Group, unlike traditional brokerage firms where real estate agents are mostly hired as independent contractors. As a result, we incur related costs and expenses that are not typically incurred by our brokerage competitors, such as base pay, employee benefits, expense reimbursement, training, and the hiring of employee transactional support staff. As a data and technology-driven property technology company, we also invest heavily in advancing, developing and improving our technology, as well as regularly conducting research and development for new service offerings. As a result, we have significant costs, some of which would not be otherwise incurred by competitor brokerage firms operating under traditional or different business models.

|

|

In the event of fluctuations in demand in the services offered on our platform, or a reduction in property sale prices, whether due to seasonality, cyclicality, changes in interest rates, fiscal policy, or other events beyond our control, we will be unable to adjust our expenses as rapidly as many of our competitors, and as a result, there would be material adverse effects on our business, prospects, financial condition and results of operations. Additionally, due to these costs, our property agent turnover may be more costly to us than to traditional brokerages, and if we are unable to achieve optimal levels of productivity and revenue returns from such agents to offset their related costs, our business, prospects, financial condition and results of operations may be adversely affected.

We are required to comply with requirements governing the licensing and conduct of real estate brokerages and brokerage-related businesses in the jurisdictions in which we operate.

As a brokerage, we and our Super Agents are required to comply with the laws, regulations, government policies, codes of conduct and other requirements governing the licensing and conduct of real estate brokerages and brokerage-related businesses in the markets where we operate, including the Estate Agents Act and its applicable subsidiary legislation, and any other requirements imposed by the CEA. These laws and regulations contain general standards for and limitations on the conduct of real estate brokerages and agents, including but not limited to licensing requirements, fiduciary and agency duties, administration of trust funds, collection of commissions, advertising, and consumer disclosures. Under such applicable laws and regulations, we and our Super Agents are also required to adhere to certain duties and standards of conduct. If we or our Super Agents fail to obtain or maintain the required licenses for conducting our brokerage business, or fail to conduct ourselves in accordance with the standards stipulated by such regulations, we may be subject to regulatory action from the relevant government authorities, including the disciplinary action, suspension or revocation of our license, suspension of our brokerage business or the imposition of fines or other penalties. Any of these outcomes could result in a material adverse effect on our business, prospects, financial condition and results of operations.

Regulators such as the CEA may also conduct industry-wide investigations into certain products, selling practices or other aspects of the business within the regulator’s purview. Such investigations can arise due to events beyond our control, such as acts or omissions of another industry participant. A regulator may determine that we have failed to comply with the applicable laws, regulations or rules or that we have not undertaken corrective action required by the regulator. The impact of us being found to be non-compliant in any such inquiry and/or investigation is difficult to assess or quantify and would depend on which regulatory regime was involved and the disciplinary and/or enforcement powers of the relevant regulator. Such inquiries or investigations could result in adverse publicity for, or negative perceptions of us and affect our relationships with regulators as well as current and potential customers. This may also cause our management’s attention to be diverted and additional expenses to be incurred.

In addition, any changes in laws, regulations, government policies, codes of conduct and other applicable requirements, such as adverse tax (including stamp duty land tax) policies, changes in the regulation of the property technology and/or real estate agency industry or changes in regulations relating to the granting of mortgages to potential buyers (such as the TDSR framework - see “Item 3. Key Information-3.D. Risk Factors-Risks Related to - Risks Related to Our Business and Industry - Our business is dependent on the availability of mortgage financing”), may depress the property market and the volume of property transactions in the jurisdictions we operate in, or may increase the cost or reduce the profitability of providing services related to such transactions. Changes may also limit our ability to offer certain property-related services, or subject it to more stringent requirements. While some of these policies and changes may have a positive impact on the property market in the long-run, such changes may create uncertainty and decrease residential property transaction volumes in the short-term, which could have a material adverse effect on our business, prospects, financial condition and results of operations.

We may be unable to successfully renew our estate agent license.

Under the Estate Agents Act, we are required to apply for and renew our estate agent license with the CEA once every year. While we have not had any issues in renewing our estate agent license in the past and to the best of our knowledge and belief, we are not aware of any facts or circumstances which would cause such license to be suspended, revoked or canceled, as the case may be, or for any applications for, or renewal of such license to be rejected by the CEA, there is no assurance that we will be able to renew our estate agent license in the future in a timely manner, or at all. In the event that we are unable to renew our estate agent license, it would affect our ability to continue to carry on the real estate agency business, and our business, prospects, financial condition and results of operations will be adversely affected.

|

|

We are dependent on the property market and the volume and value of property transactions in the jurisdictions we operate in.

We are adversely affected by factors that reduce transaction volumes, sales prices and/or rental rates in the property markets of jurisdictions we operate in, particularly the Singapore residential property market, which accounted for a significant proportion of our Group’s total income in 2021, 2022 and 2023.

The volume of property transactions may decrease depending on several factors which are beyond our control, including (a) the level of household income and disposable income; (b) prevailing sales prices and rental rates and the future outlook of sales prices and rental rates; (c) vacancy rates; (d) the availability and affordability of mortgage financing to purchase homes and the willingness of borrowers to incur mortgage loans to finance property purchases; (e) the number of foreigners or expatriates in the markets we operate in who require rental accommodation; and (f) any change in cultural predispositions towards property ownership or rentals. Where the volume of property transactions brokered by our Super Agents decreases without a corresponding increase in the level of commissions and/or property prices, the revenue we earn from our brokerage services will also decrease. Further, our renovation and home services and other property-related services gain traction and rely to a certain extent on the customer traffic brought in by our brokerage services to our one-stop platform. Accordingly, a decrease in the number of brokerage transactions will result in a corresponding decrease in the revenue derived from our other service offerings. Accordingly, any decline in the volume or value of property transactions may result in a material adverse impact on our business, prospects, financial condition and results of operations.

Our business is dependent on the availability of mortgage financing.

Our real estate brokerage business is particularly exposed to the level of mortgage approvals in the markets which we operate in. For instance, in the Singapore property market, the TDSR framework was introduced by the Monetary Authority of Singapore in 2013, which imposed maximum thresholds on the amount that financial institutions could lend to prospective property buyers, based on the prospective buyer’s gross monthly income. Since then, the number of mortgage approvals in Singapore for property transactions has decreased considerably. Mortgage approval levels may also be affected by (a) macroeconomic factors, such as the factors leading to the Global Financial Crisis in 2008, constrained wholesale funding markets, availability of credit and higher interest rates; (b) new regulations, especially those increasing the capital requirements of certain banks or decreasing buyers’ ability to borrow; and (c) changes in lenders’ approval policies and processes. Any reduction (or perceived reduction) in mortgage loan availability or in the affordability of mortgage products for prospective property buyers could result in a decrease in volumes of residential property transactions, which could materially and adversely affect our business, prospects, financial condition and results of operations.

Our business generates and processes a large amount of consumer data, and the improper use, collection or disclosure of such data could subject us to significant reputational, financial, legal and operational consequences.

We regularly collect, store and use customer information and personal data in the course of our business and marketing activities. The collection and use of personal data is governed by the various data privacy and protections laws and regulations in Singapore and Malaysia, and we are required to comply with applicable laws, rules and regulations relating to the collection, use, storage, transfer, disclosure and security of personal data. We face risks inherent in handling and protecting a large amount of data that our business generates and processes from the significant number of property transactions our platform facilitates, such as protecting the data hosted on our system against attacks on our system or fraudulent behavior or improper use by our employees. Although we employ comprehensive security measures to prevent, detect, address, and mitigate these risks (including access controls, data encryption, vulnerability assessments, and maintenance of backup and protective systems), these threats may still materialize. We also cannot guarantee the effectiveness of the policies and measures undertaken by the business partners on our platform. If any of our or our business partner’s security measures are compromised, information of our customers or other data belonging to our customers may be misappropriated or publicly disseminated, which may result in enforcement action being taken against our Group by the relevant data protection regulatory bodies, such as fines, revocation of licenses, suspension of relevant operations or other legal or administrative penalties. Furthermore, any failure or perceived failure by us or our business partners to comply with all applicable data privacy and protection laws and regulations may result in negative publicity, which may, in turn, damage our reputation, cause customers to lose trust and confidence in us, and stop using our platform altogether. We may also incur significant costs to remedy such security breaches, such as repairing any system damage and compensation to customers and business partners. If any of these risks were to materialize, it could have a material adverse effect on our business and results of operations.

|

|

Additionally, privacy regulations continue to evolve and, occasionally, may be inconsistent from one jurisdiction to another. Compliance with applicable privacy regulations may increase our operating costs. If we fail to comply with any of the applicable laws and regulations, depending on the type and severity of any such violation, we may be subject to, amongst others, warnings from relevant authorities, imposition of fines and/or criminal liability, being ordered to close down our business operations and/or suspension of relevant licenses and permits. As a result, our reputation may be harmed and our business, prospects, financial condition and results of operations could be materially and adversely affected.

Any failure to maintain, protect, and enhance our brand could impede our ability to grow our business, particularly in markets where we have limited brand recognition.

All of our service offerings are marketed under the Ohmyhome brand. As a result, maintaining, protecting, and enhancing our brand is crucial in growing our business, especially in jurisdictions where our reputation and brand recognition is limited and/or we are required to compete with well-established market players, such as traditional brokerages with longer operating histories, greater brand recognition and an established customer base. In addition, as part of our business strategy, we may license our Ohmyhome brand to third parties to utilize our Ohmyhome platform in markets which our Group does not currently operate in. In such instances, we are dependent on the ability of our licensees to uphold the reputation and goodwill of our Ohmyhome brand in such markets.

Our success in building and promoting our brand image depends on a number of factors, including:

| (a) | the success of our and our licensees’ advertising and other marketing activities; |

| (b) | our ability to ensure the quality and reliability of our services and to provide effective, differentiated services to our customers; and |

| (c) | our ability to protect our brand from infringement of our intellectual property rights. |

We may be required to make substantial investments, such as in marketing and advertising, technology, and agent training, in order to enhance and protect our brand value. In addition, despite these investments, our brand could be damaged from other events beyond our control, such as litigation claims or customer complaints, whether unfounded or not, or failure by our licensees to provide high quality services in the markets in which they operate. If our efforts to build and promote our brand image are not effective for any reason or if any of such events occur, our reputation and the market recognition of our platform and services may deteriorate and as a result, we may not be able to compete effectively and expand our business. This would adversely impact our business, prospects, financial condition and results of operations.

We may be unable to adequately protect our intellectual property and proprietary rights.

Our success and ability to compete depends in part on our intellectual property. As of December 31, 2023, we have one (1) registered trademark in Singapore and one (1) registered trademark in the Philippines. We have filed applications for the registration of one (1) trademark in Malaysia.

|

|

While the applications and documents submitted by us have not been withdrawn, rejected or adversely affected by any notice and/or objection by any relevant authority or third parties, there is no assurance that these trademarks will be successfully registered. In addition, until such trademarks have been registered, there remains the risk that third parties may use similar or identical trademarks but we will not be able to bring any lawsuits or take any action against such third parties. Any use of trademarks by third parties which are similar or identical to ours may also result in imitation of our platform, which may adversely affect our business, prospects, financial condition and results of operation.

We seek to protect our proprietary technology and intellectual property primarily through a combination of intellectual property laws as well as confidentiality procedures and contractual restrictions. Our employees are subject to confidentiality obligations under the terms of their respective employment contracts and we also require external consultants with access to our proprietary information to enter into non-disclosure agreements. However, there can be no assurance that these measures are effective, or that infringement of our intellectual property rights by other parties does not exist now or will not occur in the future. In addition, our intellectual property rights may not be adequately protected because:

| (a) | other parties may still misappropriate, copy or reverse engineer our technology despite our internal governance processes or the existence of laws or contracts prohibiting it; and |

| (b) | policing unauthorized use of our intellectual property may be difficult, expensive and time consuming, and we may be unable to determine the extent of any unauthorized use. |

To protect our intellectual property rights and maintain our competitiveness, we may file lawsuits against parties who we believe are infringing upon our intellectual property rights. Such proceedings may be costly and may divert management attention and other resources away from our business. In certain situations, we may have to bring lawsuits in foreign jurisdictions, in which case we are subject to additional risks as to the result of the proceedings and the amount of damages that we can recover. Any of our intellectual property rights may also be challenged by others or invalidated through administrative processes or litigations. We can provide no assurance that we will prevail in such litigations, and, even if we do prevail, we may not obtain a meaningful relief. Any inability to adequately protect our proprietary rights may have a material negative impact on our ability to compete, to generate revenue and to grow our business. Under such circumstances, our business, prospects, financial condition and results of operations would be materially and adversely affected.

We could be required to cease certain activities or incur substantial costs as a result of any claim of infringement of another party’s intellectual property rights.

Our success depends largely on our ability to use and develop our technology and know-how without infringing the intellectual property rights of third parties. There can be no assurance that we will not be subject to claims of infringement upon the intellectual property rights of third parties, including from our competitors. Defending such claims can be both costly and time consuming and may significantly divert the efforts and resources of our technical and management personnel.

The results of such disputes or litigation are also difficult to predict. An adverse determination in any such litigation or proceedings to which we are a party may subject us to significant liability to third parties, require us to seek licenses from third parties, pay ongoing royalties, cease offering or using technologies that incorporate the challenged intellectual property, redesign our solutions to avoid infringement or subject us to injunctions prohibiting the offering of such services.

If we are required to make substantial payments or undertake any of the other actions noted above as a result of any intellectual property infringement claims against us, such payments or costs could have an adverse effect on our business and financial results. Protracted litigation may also result in our customers or potential customers deferring or limiting their use of our platform and services until the resolution of such litigation. Even if we were to prevail, such claims and proceedings could harm our reputation and brand name. As a result, our business, prospects, financial condition and results of operations would be materially and adversely affected.

|

|

We rely on certain technology and software licensed from third parties.

As part of our business, we employ certain technology and software licensed from third parties, such as Amazon Web Services, HubSpot and Amplitude. We typically do not enter into long-term agreements for the licensing of such software and tools, and the license agreements are typically on an annual subscription basis. Accordingly, there is no assurance that such third parties will continue to extend such licenses to us after the expiry of the current license period, and if such licenses are renewed, whether such renewals will be on terms favorable to us. Although we believe that there are commercially reasonable alternatives to the third-party software we currently license, this may not always be the case, or it may be difficult or costly to replace. Any failure to maintain the existing licenses or to obtain new licenses on favorable terms or at all may cause a disruption to our platform and service offerings.

In addition, we may be susceptible to undetected errors or defects in the third-party software or technology, which would in turn impair the usage of our technology, disrupt our platform operations and delay or impede our service offerings to customers. This may cause customers to lose confidence in our platform and also cause damage to our reputation, which would in turn adversely affect our business, prospects, financial condition and results of operations.

We utilize open source software in certain aspects of our technologies.

Certain aspects of our technologies, software and systems utilize open source software. The licenses governing the open source software may require any source code that is developed using such open source software be made publicly available, and that any modifications or derivative works developed through such open source software to continue to be licensed under the relevant open source licenses. If we fail to comply with the terms and conditions of any applicable open source license, we may be subject to claims from third parties for infringement of their intellectual property rights and may be required to obtain licenses from such third parties for the continued application and use of such software, on terms which may not be favorable to us. If such licenses cannot be obtained, we may also be required to re-engineer our technology and systems to remove or replace the open source software, or to discontinue the relevant technology altogether. We may also be required to pay monetary damages or be required to release or license the source code for our proprietary technology which was developed in-house using such open source code.

In addition, our use of open source software can pose liability issues, as open source licensors do not typically provide warranties or indemnities in respect of their open source software. Further, as the source code for open source software is made publicly available, there may be additional security risks imposed on us, as hackers or other third parties may be able to easily breach our software and systems which rely on open source software.

Any of the foregoing risks, if materialized, could have a material adverse effect on our business, prospects, financial condition and results of operations.

Our technology, software and systems are highly complex and may contain undetected errors or vulnerabilities.

Our platform is based on underlying technology, software and systems, which are highly complex and may contain undetected errors or vulnerabilities, some of which may only be discovered after their implementation. Despite our development and testing processes in place, we may still encounter technical issues with such software and technology from time to time. Any technical errors, inefficiencies or vulnerabilities discovered in our software and systems after release could delay or reduce the quality of our services and/or disrupt our customers’ access to and use of our platform. This could result in damage to our reputation, result in unexpected costs incurred and result in an adverse effect on our business, prospects, financial condition and results of operations.

Errors or inaccuracies in our business data and algorithms may adversely affect our business decisions and the customer experience.

We regularly rely on and analyze our business data and algorithms to predict and evaluate growth trends, measure our performance and make strategic decisions. Much of this data is generated and calculated internally through our own processes, without independent verification by a third party source. While we believe our processes in place ensure that the calculations used are reasonable, interpretation of such data is inherently subjective and subject to human error. We cannot guarantee that the data, or the calculations of such data, are accurate. Errors or inaccuracies in the data could result in incurring unnecessary costs, improper allocation of resources or misinformed strategic initiatives. For instance, if we overestimate the number of active users on our platform, we may not allocate sufficient resources in our marketing strategies to attract new customers. In such situations, our business, prospects, financial condition and results of operations may be materially and adversely affected.

|

|

We also use our business data and algorithms to inform our property matching technology and machine learning technology, such as our Real Estate Valuation Tool. If there are any lapses in such business data or algorithms, such as failure of our property matching technology to accurately match home buyers with home sellers, or if customers do not agree with the property valuation generated by our Real Estate Valuation Tool, we may be unable to successfully complete property transactions or to attract customers to transact on our platform. As a result, there may be a loss in customer confidence and brand reputation, which will adversely impact our business, prospects, financial condition and results of operations.

Our historical growth and performance may not be indicative of our future growth and performance.

Although our Group has experienced growth in operating our platform, in terms of monthly active users, GTV as well as growth in revenue, we may fail to continue our growth or maintain our historical growth rates. You should not consider our historical growth and profitability as indicative of our future financial performance. You should consider our future operations in light of the challenges and uncertainties that we may encounter, which include our ability to, among other things:

| (a) | successfully increase our market share, brand recognition and reputation; |

| (b) | develop our infrastructure to enhance service efficiency and customer experience; |

| (c) | retain existing platform users and attract new users to our platform; |

| (d) | maintain an extensive and authentic property listing database on our platform; |

| (e) | continue to implement and optimize our procedures for ensuring authentic listings; |

| (f) | continue to develop our technology and enhance our data insights; |

| (g) | adapt our operations to new policies, regulations and measures that may come into effect from time to time; |

| (h) | deliver compelling value propositions to our customers on our platform and ecosystem; and |

| (i) | expand our service offerings and expand into new jurisdictions and/or businesses. |

We may not be successful in our efforts to do any of the foregoing, in which case, our business, prospects, financial condition and results of operations could be materially and adversely affected.

We are dependent on key management personnel for our future success and growth.