UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 17, 2024 (April 16, 2024)

BLUE STAR FOODS CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-40991 | 82-4270040 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

3000 NW 109th Avenue

Miami, Florida 33172

(Address of principal executive offices)

Registrant’s telephone number, including area code: (305) 836-6858

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbols | Name of each exchange on which registered | ||

| Common Stock, $0.0001 | BSFC |

The Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1.01 Entry Into A Material Definitive Agreement.

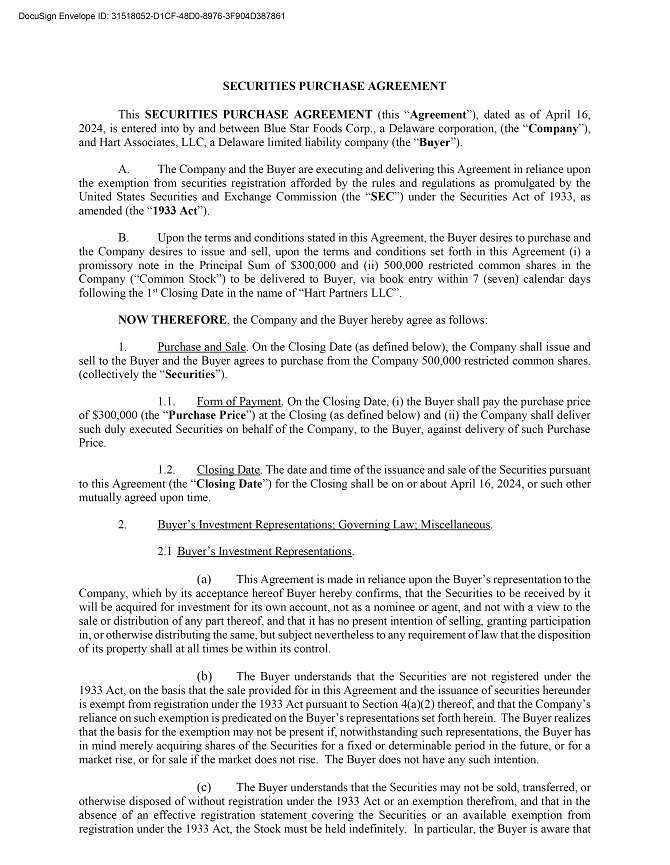

The Hart Note

On April 16, 2024 Blue Star Foods Corp. (the “Company”) entered into a securities purchase agreement (the “Purchase Agreement”) with Hart Associates, LLC, a Delaware limited liability company (the “Hart”), pursuant to which the Company issued to Hart a promissory note in the principal amount of $300,000 (the “Hart Note”). In connection with the issuance of the Hart Note the Company issued 500,000 shares of its restricted common stock to Hart. The Hart Note will have a one-time interest payment of $50,000 payable on the maturity date of May 15, 2024, which can be extended up to 90 days (the “Maturity Date”). The proceeds from the sale of the Hart Note are for general working capital.

The Company may prepay the Hart Note at any time without penalty. Any failure on the Company’s part to comply with the material terms of the Hart Note will be considered an event of default and the principal sum of the Hart Note will increase by 20% of the outstanding owed balance for each subsequent 30 days it remains in default.

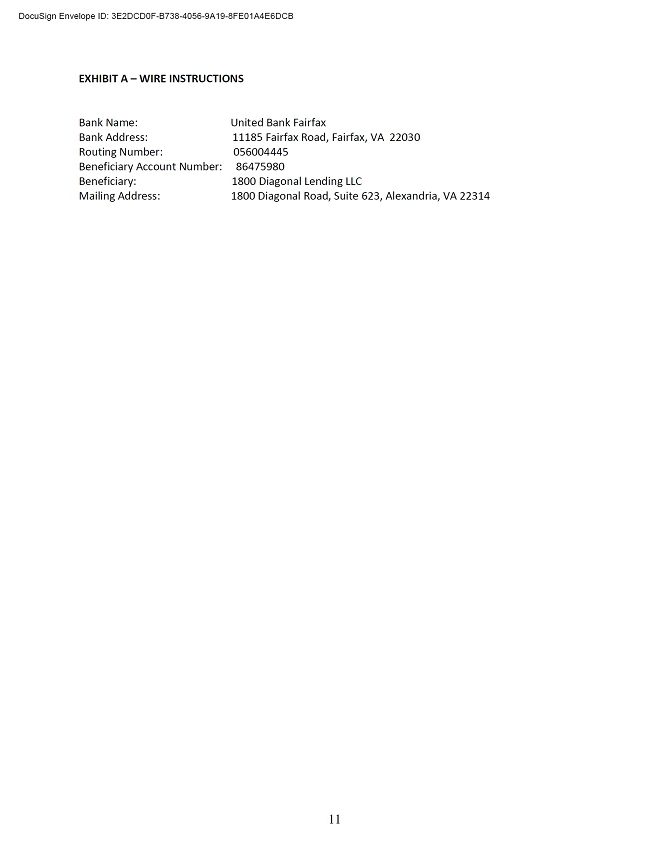

The Diagonal Note

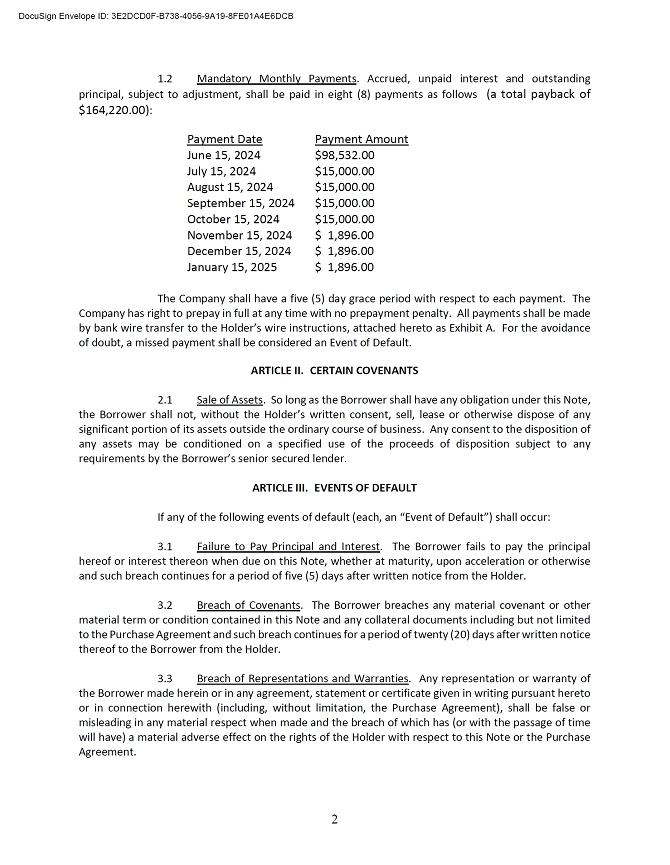

On April 16, 2024 the Company issued to 1800 Diagonal Lending LLC, a Virginia limited liability company, a convertible promissory note in the principal amount of $138,000 which had an original issue discount of $23,000 (the “Diagonal Note”). The Diagonal Note has a one-time interest payment of $26,220 paid upon issuance and a maturity date of January 15, 2025. The proceeds from the sale of the Diagonal Note are for general working capital.

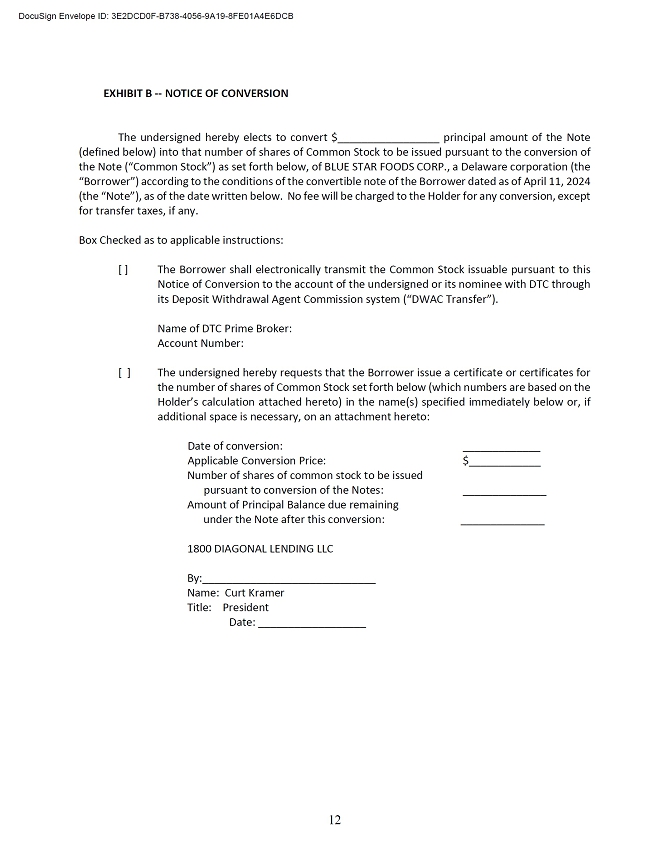

Upon the occurrence of an event of default as described in the Diagonal Note, the Diagonal Note will become immediately due and payable at a default interest rate of 150% of the then outstanding principal amount of the Diagonal Note. Additionally Diagonal will have the right to convert all or any part of the outstanding and unpaid amount of the Diagonal Note into fully paid and non-assessable shares of the Company’s common stock at a conversion price of 61% of the Market Price as described in the Diagonal Note.

So long as the Company has any obligation under the Diagonal Note, the Company shall not, without Diagonal’s written consent, sell, lease or otherwise dispose of any significant portion of its assets outside the ordinary course of business. The Company will reserve from its authorized and issued common stock a sufficient number of shares to provide for the issuance of shares upon the full conversion of the Diagonal Note.

The foregoing descriptions of the Purchase Agreement, Hart Note and Diagonal Note are not complete and are qualified in their entirety by reference to the full text of the forms of the Purchase Agreement, Hart Note and Diagonal Note, copies of which were attached as Exhibits 10.85, 4.10 and 4.11 respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The disclosure set forth above under Item 1.01 (Entry into a Material Definitive Agreement) above with respect to the Note is incorporated by reference into this Item 2.03.

|

|

Item 3.02 Unregistered Sale of Equity Securities.

Reference is made to the disclosure set forth under Item 1.01 above, which disclosure is incorporated herein by reference.

The issuance of 500,000 shares of common stock of the Company to Hart was exempt from registration under Section 4(a)(2) and/or Rule 506(b) of Regulation D as promulgated by the Securities and Exchange Commission under of the Securities Act of 1933, as amended (the “Act”), as transactions by an issuer not involving any public offering. At the time of their issuance, the shares of common stock were deemed to be restricted securities for purposes of the Act and will bear restrictive legends to that effect.

Item 8.01 Other Events.

On April 17, 2024, the Company issued a press release announcing the Purchase Agreement, Hart Note and Diagonal Note. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

Description | |

| 4.10 | Promissory Note dated April 16, 2024 in the principal amount of $300,000 issued by Blue Star Foods Corp. to Hart Associates, LLC | |

| 4.11 | Promissory Note dated April 16, 2024 in the principal amount of $138,000 issued by Blue Star Foods Corp. to 1800 Diagonal Lending LLC | |

| 10.87 | ||

| 99.1 | Blue Star Foods Secures Additional Growth Capital to Support Expansion of Business Under Existing Master Service Agreement & Soft Shell Crab Operations | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BLUE STAR FOODS CORP. | ||

| Date: April 17, 2024 | By: | /s/ John Keeler |

| John Keeler Executive Chairman and Chief Executive Officer | ||

|

|

Exhibit 4.10

Exhibit 4.11

Exhibit 10.87

Exhibit 99.1

Blue Star Foods Secures Additional Non-Dilutive Growth Capital to Support Expansion of Business Under Existing Master Service Agreement & Soft Shell Crab Operations

Miami, FL – April 17, 2024 (GLOBE NEWSWIRE) – Blue Star Foods Corp., (“Blue Star,” the “Company,” “we,” “our” or “us”) (NASDAQ: BSFC), an integrated Environmental, Social, and Governance (ESG) sustainable seafood company with a focus on Recirculatory Aquaculture Systems (RAS), today announced it has secured additional funding to help meet increased demand under its previously announced Master Service Agreement as well as increase the volume in its soft shell crab operations.

On April 16, 2024 Blue Star entered into a securities purchase agreement with an accredited investor pursuant to which Blue Star issued a promissory note in the principal amount of $300,000 and 500,000 shares of its restricted common stock. The promissory note is due May 15, 2024 and can be extended up to 90 days.

On the same date, Blue Star also issued a convertible promissory note to an institutional investor, in the principal amount of $138,000. The note bears a one-time interest charge of 19% on the date of issuance and an annual rate of 22% thereafter and is due January 15, 2025. The note is convertible in the event of default and has a conversion price of 61% multiplied by the Market Price.

John Keeler, CEO of Blue Star Foods, commented, “We believe this quarter will finish strong with an increased volume in soft shelf crabs operations and an increased demand for gourmet value-added meals, through 2,776 retail outlets. We also intend to rollout of 4 new products at the club store segment, commencing in late June and throughout the summer. Our efforts call for increased working capital support, which we have initially secured through promissory notes. We will continue to explore ways to strengthen our balance sheet and raise additional working capital. I am fully committed to grow revenue and profitably and explore flexible and less dilutive financing opportunities. Lastly, we are confident in our efforts remain listed with NASDAQ.”

On April 10, 2024, the Company received a letter from the NASDAQ Hearings Panel indicating that our request for continued listing on Nasdaq was granted subject to the following: (i) on or before April 1, 2024, we file our Form 10-K for the period ended December 31, 2023 demonstrating compliance with Listing Rule 5550(b)(1), which was accomplished; (ii) on or before May 15, 2024, we file our Form 10-Q for the period ended March 31, 2024 demonstrating continued compliance with Listing Rule 5550(b)(1), and (iii) on or before May 30, 2024, we demonstrate compliance with Listing Rule 5550(a)(2) by evidencing a closing bid price of $1.00 or more per share for a minimum of ten (10) consecutive trading sessions.

About Blue Star Foods Corp. (NASDAQ: BSFC)

Blue Star Foods Corp. an integrated Environmental, Social, and Governance (ESG) sustainable seafood company with a focus on Recirculatory Aquaculture Systems (RAS) that processes, packages and sells high-value seafood products. The Company believes it utilizes best-in-class technology, in both resource sustainability management and traceability, and ecological packaging. The Company also owns and operates the oldest continuously operating Recirculating Aquaculture System (RAS) full grow-out salmon farm in North America. The company is based in Miami, Florida, and its corporate website is: https://bluestarfoods.com

Forward-Looking Statements:

The foregoing material may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without limitation statements regarding the Company’s product development and business prospects, and can be identified by the use of words such as “may,” “will,” “expect,” “project,” “estimate,” “anticipate,” “plan,” “believe,” “potential,” “should,” “continue” or the negative versions of those words or other comparable words. Forward-looking statements are not guarantees of future actions or performance. These forward-looking statements are based on information currently available to the Company and its current plans or expectations and are subject to a number of risks and uncertainties that could significantly affect current plans. Risks concerning the Company’s business are described in detail in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and other periodic and current reports filed with the Securities and Exchange Commission. The Company is under no obligation to, and expressly disclaims any such obligation to, update or alter its forward-looking statements, whether as a result of new information, future events or otherwise.

Investor Contacts:

investors@bluestarfoods.com