UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission file number 001-40730

DRAGONFLY ENERGY HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 85-1873463 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

1190

Trademark Drive, #108 |

89521 | |

| (Address of Principal Executive Offices) | (Zip Code) |

(775) 622-3448

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common stock, par value $0.0001 per share | DFLI | The Nasdaq Global Market | ||

| Redeemable Warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment | DFLIW | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued statements. ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to Section 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of voting stock held by non-affiliates of the Registrant on June 30, 2023, based on the closing price of $1.48 for shares of the registrant’s common stock as reported by the Nasdaq Global Market, was approximately $45.2 million.

As of April 12, 2024, there were 60,260,282 shares of the registrant’s common stock, par value $0.0001 per share, issued and outstanding.

Documents incorporated by reference:

Portions of the registrant’s Proxy Statement relating to the 2024 Annual Meeting of Stockholders, scheduled to be filed with the Securities and Exchange Commission within 120 days after the end of the registrant’s fiscal year ended December 31, 2023, are incorporated by reference into Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “can,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,” “plan,” “point to,” “project,” “predict,” “could,” “intend,” “target,” “potential” and other similar words and expressions of the future.

There are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking statement made by us. These factors include, but are not limited to:

| ● | our ability to successfully increase market penetration into target markets; | |

| ● | the addressable markets that we intend to target do not grow as expected; | |

| ● | the potential for events or circumstances that result in our failure to timely achieve the anticipated benefits of our customer arrangements with THOR Industries and its affiliate brands (including Keystone RV Company (“Keystone”)), including Keystone’s decision in July 2023, that, due to weaker demand for its products and its subsequent focus on reducing costs, it would no longer install our storage solutions as standard equipment, but rather return to offering those solutions as an option to dealers and consumers; | |

| ● | our ability to generate revenue from future product sales and our ability to achieve and maintain profitability; | |

| ● | the loss of any members of our senior management team or other key personnel; | |

| ● | the loss of any relationships with key suppliers, including suppliers in China; | |

| ● | the loss of any relationships with key customers; | |

| ● | our ability to protect our patents and other intellectual property; | |

| ● | the failure to successfully optimize solid-state cells or to produce commercially viable solid-state cells in a timely manner or at all, or to scale to mass production; | |

| ● | changes in applicable laws or regulations, including changes in the rates of tariffs or any adjustments to the amounts payable by us to customs as a result of improperly identifying the applicable tariff rate payable on our products; | |

| ● | our ability to maintain the listing of our common stock on the Nasdaq Global Market and Public Warrants (as defined herein) on the Nasdaq Capital Market; | |

| ● | the possibility that we may be adversely affected by other economic, business and/or competitive factors (including an economic slowdown or inflationary pressures); | |

| ● | our ability to sell the desired amounts of shares of common stock at desired prices under our equity facility; | |

| ● | our ability to raise additional capital to fund our operations; | |

| ● | the accuracy of our projections and estimates regarding our expenses, capital requirements, cash utilization, and need for additional financing; | |

| ● | developments relating to our competitors and our industry; | |

| ● | our ability to engage target customers and successfully retain these customers for future orders; | |

| ● | the reliance on two suppliers for our lithium iron phosphate cells and a single supplier for the manufacture of our battery management system; | |

| ● | the potential impact of geopolitical events, including the Russia-Ukraine conflict and Hamas’ attack on Israel, and their effects on our operations; and | |

| ● | our current dependence on a single manufacturing facility. |

The foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or risk factors that we are faced with that may cause our actual results to differ from those anticipated in such forward-looking statements. Please see “Part I—Item 1A—Risk Factors” for additional risks which could adversely impact our business and financial performance.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this report or the date of the document incorporated by reference into this report. We have no obligation, and expressly disclaims any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections in good faith and believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will result or be achieved or accomplished.

|

|

Part I

Item 1. Business

All references in this report to “Dragonfly,” the “Company,” “we,” “us,” or “our” mean Dragonfly Energy Holdings Corp. and its subsidiaries unless stated otherwise or the context otherwise indicates.

Overview

We are a manufacturer of non-toxic deep cycle lithium-ion batteries that caters to customers in the consumer industry (including the recreational vehicle (“RV”), marine vessel, solar and off-grid residence industries), and industrial and energy storage markets, with proprietary, patented and disruptive battery cell manufacturing and non-flammable solid-state cell technology currently under development. Our goal is to develop technology to deliver environmentally impactful solutions for energy storage to everyone globally. We believe that the innovative design of our lithium-ion batteries is ideally suited for the demands of modern customers who rely on consumer electronics, connected devices and smart appliances that require continuous, reliable electricity, regardless of location.

Our deep cycle lithium iron phosphate (“LFP”) batteries provide numerous advantages compared to incumbent products, such as lead-acid batteries. LFP batteries are non-toxic and environmentally friendly, do not rely on scarce or controversial metals and are a highly cost-effective storage solution. LFP batteries use lithium iron phosphate (“LiFePO4”) as the cathode material for lithium-ion cells rather than nickel or cobalt. Although the energy density of LFP batteries is lower, they have a longer cycle life and experience a slower rate of capacity loss. LFP is also intrinsically safer than sulfide gases due to its thermal and chemical stability, meaning our LFP batteries are less flammable than alternative products. As we develop our proprietary solid-state cell technology, we believe our use of LFP will continue to provide significant advantages over the lithium-ion technology in development by most other companies that still incorporate less stable components in their chemistries (such as sulfide gases, which are chemically unstable and form hydrogen sulfide when exposed to air).

We have a dual-brand strategy for battery products, Dragonfly Energy (“Dragonfly Energy”) and Battle Born Batteries (“Battle Born”). Battle Born branded products are primarily sold direct-to-consumers (“DTC”), while the Dragonfly Energy brand is primarily sold to original equipment manufacturers (“OEMs”). However, with the growing popularity and brand recognition of Battle Born, these batteries have become increasingly popular with our OEM customers. Based on the extensive research and optimization undertaken by our team, we have developed a line of products with features including a proprietary battery management system and an internal battery heating feature for cold temperatures, and we have recently launched our unique battery communication system. We currently source the LFP cells incorporated into our batteries from a limited number of carefully selected suppliers that can meet our demanding quality standards and with whom we have developed long-term relationships.

We began as an aftermarket-focused business initially targeting DTC sales in the RV market. Since 2020, we have sold over 290,000 batteries. For the years ended December 31, 2023 and 2022, we sold 64,906 and 96,034 batteries, respectively, and had $64.5 million and $86.3 million in sales, respectively. Historically, we have increased total sales through a combination of: increasing DTC sales of batteries for RV applications; expanding into the marine vessels and off-grid storage markets with related DTC sales; selling batteries to RV OEMs; increasing sales to distributors; and reselling accessories for battery systems. Our RV OEM customers currently include Keystone RV Company (“Keystone”), who fulfills certain of its LFP battery requirements exclusively through our Supply Agreement (as defined herein), THOR Industries (“THOR”), who has made a strategic investment in our business and with whom we intend to enter into a future, mutually agreed exclusive North American distribution agreement with an initial term of two years (with potential annual renewals), Airstream, and REV, and we are in ongoing discussions with a number of additional RV OEMS to further increase adoption of our products. For the year ended December 31, 2023, we faced a number of demand headwinds associated with increased inflation and rising interest rates, which caused a significant year-over-year decline in units produced for North American RV OEMs. The impact of these unit declines combined with the associated lower demand in the direct-to-consumer business caused total revenue to decline for the year ended December 31, 2023 compared to the same period last year. Based on our discussions with customers and current unit forecast projections, we expect our revenue in the RV market to increase in 2024.

We currently offer several lines of batteries across our two brands, each differentiated by size, power and capacity, consisting of seven different models, four of which come with a heated option. To supplement our battery offerings, we are also a reseller of accessories for battery systems. These include chargers, inverters, monitors, controllers and other system accessories from brands such as Victron Energy, Progressive Dynamics, Magnum Energy and Sterling Power. Pursuant to the Asset Purchase Agreement dated April 22, 2022 by and among us and Thomason Jones Company, LLC (“Thomason Jones”) and the other parties thereto, we also acquired the assets, including the Wakespeed Offshore brand (“Wakespeed”) of Thomason Jones, allowing us to include our own alternator regulator in systems that we sell.

|

|

Our battery packs are designed and assembled in-house in the United States. In April 2021, we opened our current 99,000 square foot facility in Reno, Nevada, which has allowed us to increase our production capacity and gave us the ability to increase sales to existing customers and penetrate new markets. Our 99,000 square foot facility provides a streamlined, partially autonomous production process for our current batteries, which comprises module assembly and battery assembly, with the availability to expand the number of lines to handle increased volumes and the additional battery modules we intend to introduce in the near future. We also entered into a lease for use of an approximately 64,000 square foot facility to further increase our capacity to produce our patented dry electrode process (the “Fernley Lease Agreement”). We plan to continue to expand our production capacity as needed and have entered into a lease for a 390,240 square foot facility in Reno, Nevada that is currently under construction which is expected to be completed in the second half of 2024. The commencement date for the lease for this facility was March 25, 2024, based on the construction project being identified as “substantially complete”. This facility will enable us to consolidate various operations in Reno, NV and will allow for expected expansion for new markets.

Through our Battle Born Batteries and Wakespeed brands, we operate in three primary consumer end markets: RVs, marine vessels, and off-grid storage systems. We are strategically expanding into additional markets, with a focus on heavy-duty trucks, work trucks, and industrial solar integration. Within our core markets, we focus on displacing lead-acid batteries with our technologically advanced and greener lithium-ion solutions. Our Battle Born Batteries portfolio is designed to provide customers with a reliable, long-lasting, and highly efficient off-grid power source for powering appliances, air conditioning, lighting, and other devices commonly found in these applications.

We continue to leverage our proven sales and marketing strategy to efficiently penetrate our target end markets. We prioritize customer education through various channels, highlighting the distinct advantages of lithium-ion batteries over traditional lead-acid alternatives. Tradeshows, rallies, and industry events serve as key platforms for direct customer engagement, featuring product demonstrations, educational seminars, and opportunities for interaction with knowledgeable sales and technical experts. We further amplify our reach through a robust social media program, strategically partnering with content creators and industry influencers to disseminate product benefits to targeted audiences. Additionally, we cultivate relationships with industry publications to secure editorial coverage that informs and educates potential customers. We also employ a targeted pay-per-click (“PPC”) advertising campaigns across various platforms, including search engines, social media, and connected TV to efficiently convert high-intent customers at the bottom of the purchase funnel.

Drawing upon our success in collaborating with RV and marine OEMs, we have begun expanding into the heavy-duty trucking market. We are leveraging our expertise in designing and supporting lithium-ion storage systems to tailor solutions meeting specific OEM requirements. These solutions have been adopted as factory-installed features, demonstrating their value proposition for truck fleets seeking to:

| ● | Reduce diesel fuel costs: our technology delivers significant fuel savings, offering a rapid return on investment. | |

| ● | Comply with anti-idling regulations: Lithium-ion batteries enable efficient power management eliminating the need for long haul truck drivers to idle, thus aligning with increasingly stringent regulations. | |

| ● | Enhance sustainability efforts: Transitioning to long lasting and greener lithium-ion solutions contributes to improved environmental impact. |

This strategic approach has resulted in successful pilot programs with fleets representing over 15% of the North American heavy-duty trucking market.

To augment our core lithium-ion battery pack business, we rely on our research and development department. The team has successfully developed innovative manufacturing processes for dry-electrode manufacturing of lithium-ion cells, and continues development efforts relating to next-generation solid-state technology. Since our inception, we have built a comprehensive patent portfolio around our proprietary dry-electrode battery manufacturing process, which eliminates the use of harmful solvents and energy-intensive drying ovens compared to traditional methods. This translates to significant environmental and cost benefits, including reduced energy consumption, smaller space requirements, and a lower carbon footprint.

Moreover, our solid-state technology in development removes the need for a liquid electrolyte, thereby addressing safety concerns related to flammability. Our unique competitive edge lies in the combination of solid-state technology with its scalable dry-electrode manufacturing process. This enables the rapid production of cells having an intercalation anode (like graphite or silicon), unlike many competitors reliant on less stable lithium metal anodes. We believe this design offers superior cyclability and safety, serving as a key differentiator in the energy storage market. Furthermore, internal production of both conventional and solid-state cells streamlines our supply chain and enables vertical integration, ultimately driving down production costs.

|

|

Industry Background

For decades, lead-acid batteries have been the dominant player in power and energy markets worldwide. Since the introduction of the absorbed glass mat (“AGM”) lead-acid battery in the mid-1970s, the technological advancements in lead-acid battery technology have been limited. LFP batteries have numerous advantages over the incumbent lead-acid batteries used in today’s markets:

| ● | Environmentally Friendly, Socially Responsible and Safer. Lead-acid batteries that are not recycled or disposed of properly are extremely toxic and can cause areas of poisonous groundwater and lead buildups, impacting both humans and the environment. Research by EcoMENA shows that a single lead-acid battery disposed of incorrectly into a municipal solid waste collection system could contaminate 25 tonnes of municipal solid waste and prevent recovery of organic resources due to high lead levels. Lithium-ion batteries, specifically LFP batteries, have no toxic elements, offering a much safer environmental alternative to lead-acid batteries. LFP batteries also do not rely on controversial elements such as cobalt as part of their chemistry. Compared to lead-acid batteries, there is no concern of “off-gassing,” or the emission of noxious gases, for lithium-ion batteries, and therefore no need to take into consideration required ventilation or off-gas related fire risk when installing or recharging our LFP batteries. | |

| ● | Longer Lifespan. Lithium-ion batteries have longer lifecycles compared to lead-acid batteries. LFP batteries are able to cycle (i.e., discharge and charge) 3,000 to 5,000 times before hitting the 80% capacity mark. Comparatively, lead-acid batteries degrade quickly, only cycling 300-500 times before hitting 50% of their original capacity. Our third-party validated internal research suggests that if a typical AGM lead-acid battery and our LFP battery were cycled once every day, the AGM battery and our LFP battery would have a respective lifespan of 1.98 years and 19.18 years before reaching 80% depth of discharge (i.e., 80% of our battery would have been discharged relative to the overall capacity of the battery in that lifespan). In many storage applications, lithium-ion batteries have a lifespan exceeding the lifetime of the project with very limited maintenance requirements, compared to lead-acid batteries, which have a one- to two-year useful life in most applications. | |

| ● | Power and Performance. As new technologies evolve and people consume more electricity, the importance of battery power and performance increases. Compared to lead-acid batteries, lithium-ion batteries can discharge power at a higher voltage and more consistently through the discharge cycle (i.e., until they are 100% discharged) while utilizing a smaller physical space and weighing less. In addition, unlike lead-acid batteries, lithium-ion batteries can be discharged below 50% capacity without causing irreparable harm to the battery. Lithium-ion batteries also provide the same energy capacity with one-fifth the weight of a standard lead-acid battery. Lithium-ion batteries are also significantly more reliable and efficient, especially in cold temperatures, allowing for year-round all-climate usage. | |

| ● | Charging. Lead-acid batteries were the first rechargeable batteries on the market. However, due to new advancements in energy density (i.e., the amount of energy stored by mass volume) and charge/discharge rates, lithium-ion batteries now significantly outperform traditional lead-acid batteries. LFP batteries currently charge five times faster than their lead-acid counterparts, with even faster charging rates expected for the next generation of lithium-ion cells. With the appropriate battery management system, lithium-ion batteries can be charged in cold temperatures, something lead-acid batteries are unable to do, resulting in two to three times more power delivered. | |

| ● | Maintenance-Free. LFP batteries provide the benefit of being a maintenance-free option compared to lead-acid batteries. Unlike lead-acid batteries which have no battery management system to regulate current flow and charging rates, all our LFP battery packs include a proprietary battery management system that regulates current and provides temperature, short circuit and cold charging protection. Our LFP batteries also do not require cleaning or water, eliminating the need for periodic maintenance found in today’s lead-acid batteries. While our LFP batteries are generally designed to replace and physically fit into racks made for existing lead-acid batteries, our batteries can be installed in any position and without the need for venting. |

End Markets

Current Markets

According to a Frost and Sullivan report commissioned by us in 2021 (“Frost & Sullivan”), the total addressable market (“TAM”) of our three current end markets is estimated to be approximately $12 billion by 2025.

| ● | Recreational Vehicles. The growth of the RV market is expected to continue to drive demand for LFP storage batteries. According to the 2022 RV Industry Association (“RVIA”) Annual Report, 22% of RV buyers are between the ages of 18 and 34. In addition, nearly a third of the respondents in the study (31%) are first-time owners, underscoring the growth of the industry in the past decade. RV interiors are becoming more modern as customers adopt the full-time RV lifestyle, with additional appliances and electronics being installed, increasing the need for reliable power. According to the RVIA and THOR Industries, North American RV shipments have had an estimated 10-year compound annual growth rate (“CAGR”) of 5.6% from 2012 to 2022. The need for greater power and power storage capabilities to power interiors is driving a shift towards the use of LFP batteries. Incumbent lead-acid batteries are heavy, take up a lot of space, have inefficient power discharge and require ventilation. Our product addresses all of these problems by allowing for shorter charge times, weighing one-fifth of a standard lead-acid battery, providing a reliable and consistent source of power and being maintenance-free. Our market focus has traditionally been on motorized RVs (i.e., drivable RVs), however, OEMs have begun to introduce batteries into towable units (i.e., RVs that require another vehicle to drive them), which has created a growing subsector in the RV market for LFP batteries. According to the RVIA’s 2021 RV Market Report, approximately 91% of wholesale RV units shipped in 2021 were towable units, representing a significant growth opportunity for LFP batteries. |

|

|

| ● | Marine Vessels. As boating becomes more popular in North America, the need for a reliable, non-flammable energy storage system is becoming increasingly apparent. According to the 2020 Recreational Boating Statistics and the 2020 National Recreational Boating Safety Survey, in 2018 over 84 million Americans participated in some form of boating activity, with a total of over 11.8 million boats on the water as of 2020, of which 93% are power boats. We believe that the marine vessel market will grow to approximately $8 billion by 2025. Similar to the RV market, customers are becoming more technologically advanced and are adding more electronics to their vessels, in turn driving demand for larger and more reliable energy storage, such as LFP batteries. Tightening marina regulations are also driving the need for electric docking motors on more vessels and increasing the focus on safety, which LFP batteries are well-suited to address. | |

| ● | Off-Grid Residences. Many people are turning to off-grid housing and, as individuals and governments become more conscious of their carbon footprint, a shift towards renewable energy sources for off-grid housing will be increasingly popular. Solar installations continue to see an increase globally, with global PV installations projected to rise from 144 GW (DC) in 2020 to 334 GW (DC) in 2030 according to Bloomberg. According to the Solar Energy Industries Association (“SEIA”), approximately 11% of solar installations in 2021 were supplemented with a battery system for efficient storing of excess energy generated during daylight hours. However, the number of new behind-the-meter solar systems with supporting battery systems is projected to rise to over 29% by 2025. LFP batteries are able to solve the weakest part of renewable energy adoption, which is the lack of consistent, reliable and efficient energy storage that is safer than alternative energy storage options currently on the market. As this shift towards clean energy becomes more prominent and cost-effective, the LFP battery market will be able to penetrate the largely untapped off-grid markets. |

Addressable Adjacent Markets

Our addressable markets are areas with significant growth potential that we will be positioned to penetrate as customers turn towards LFP and other lithium-ion batteries as replacements for traditional lead-acid batteries. As these medium- and long-term markets mature, we intend to deploy our solid-state technology, once developed, while concurrently continuing to further displace the incumbent lead-acid technology. According to Frost & Sullivan, our TAM is estimated to be $85 billion by 2025.

| ● | Heavy Duty Truck. The heavy-duty truck market encompasses a broad range of vehicles designed for extensive commercial and industrial use, such as long-haul transport, construction, and logistics. With more than 300,000 Class 8 units sold in 2022, the market demonstrates a robust demand for vehicles that are integral to the backbone of global commerce and infrastructure projects. As the demand for more efficient, sustainable, and reliable transportation solutions grows, the use of Auxiliary Power Units (“APUs”) in heavy duty trucks is becoming increasingly significant. APUs provide an alternative energy source for powering onboard systems and maintaining cabin comfort during rest periods, without the need for the main engine to run—thereby reducing fuel consumption and emissions. Additionally, the market opportunity extends to the electrification of Transport Refrigeration Units (“TRUs”) on trailers and smaller class refrigerated vehicles, which are crucial for the cold chain logistics sector. This shift towards electrification is driven by the need for more sustainable and efficient cooling solutions, reducing the carbon footprint of refrigerated transport. The expansion of global trade and the continuous push for lower emissions standards are driving the demand for heavy duty trucks equipped with APUs, as well as for the electrification of TRUs, highlighting a considerable market opportunity. This trend emphasizes the potential for advanced battery technologies not only as an environmental solution but also as a competitive advantage in the heavy-duty truck and refrigerated transport markets, offering a substantial retrofitting and market penetration opportunity for battery manufacturers and suppliers with the requisite expertise and product offerings. | |

| ● | Industrial / Material Handlings / Work Truck. The industrial vehicle market includes work trucks, material handling and warehousing equipment and compact construction equipment. As industrial vehicles increase in terms of automation and incorporate more onboard tools, the need for a long-lasting, reliable and environmentally friendly energy source grows. The continuous growth of e-commerce is increasing the demand for warehousing and automated equipment. According to material handling equipment manufacturer Hyster-Yale Materials Handling, in 2021 the global market volume in units for lift trucks was approximately 2.3 million, most of which were powered by traditional lead-acid batteries, presenting a large retrofitting opportunity for LFP batteries. | |

| ● | Specialty Vehicles. According to Mordor Intelligence, as of 2019, approximately 40% of the specialty vehicle market in the United States consists of medical and healthcare vehicles and approximately 30% consists of law enforcement and public safety vehicles. The market for emergency vehicles has grown as the baby boomer generation continues to age, and there has been increased demand for electrified devices and equipment on board these emergency vehicles. Our LFP batteries are well-suited to capture this market as they offer a more reliable power source with longer lifecycles compared to lead-acid batteries. In addition, LFP batteries are safer, lighter and modular, allowing for more tools to be stored on-board emergency vehicles without sacrificing the performance of the battery system. |

|

|

| ● | Emergency and Standby Power. Demand for reliable emergency and standby power sources is expected to continue to drive demand for effective power storage for residential, commercial and industrial uses. Power outages in the United States cost an estimated $150 billion per year, according to the Department of Energy, increasing the demand for uninterrupted power sources. The need for reliable emergency and standby power exists in both hazardous and non-hazardous environments and is particularly acute in areas where the existing grid service is subject to intermittencies or is otherwise inefficient (including as a result high peak electricity usage, grid and related equipment age or severe weather and other environmental factors). LFP batteries are able to offset grid-related intermittencies and inefficiencies and assist in providing grid stabilization. Importantly, LFP batteries achieve these benefits in a clean, reliable and safe manner by supplanting or reducing the use of fossil fuel backup generators. | |

| ● | Telecom. Demand for mobile data continues to increase and network providers are investing heavily in 5G networks, particularly in unserved and underserved regions, to support this demand. According to the CTIA’s 2021 annual survey, there were 417,215 cell sites in the United States in 2020. Batteries provide backup power to these sites when external power is interrupted. While lead-acid batteries are commonly used as backup batteries today, the compact nature of lithium-ion batteries, together with the fact that they are safer and more environmentally friendly, make them ideal alternatives as new wireless sites are built and the older wireless sites require upgrades. LFP batteries are maintenance free and have a longer lifespan, allowing for a more efficient and reliable power source for large wireless sites. The ability to monitor the battery systems remotely enables telecom operators to reduce onsite maintenance checks, thereby reducing overall operational costs while ensuring network uptime. | |

| ● | Rail. Rail transportation is a large potential market, with an estimated U.S. market size of $110.1 billion in 2023, according to IBISWorld. Many railroad operators have invested in infrastructure and equipment upgrades in recent years, in an attempt to boost capacity and productivity. As noted in a study conducted by the International Energy Analysis Department and the Lawrence Berkeley National Laboratory, a shift from fossil fuel-based rail cars to emission-free power sources will greatly affect the economic and environmental impact from the rail industry. Two suggested pathways from this study were (1) electrifying railway tracks and using emission-free electricity which requires significant storage combined with renewable electricity on the grid, and (2) adding battery storage cars to diesel-electric trains. A battery-electric rail sector would provide more than 200GWh of modular and mobile storage, which could in turn provide grid services and improve the resilience of the power system. |

| ● | Data Centers. Data centers have seen strong growth in recent years, with over 5,000 data centers in the United States as of September 2023 according to Statista. Constant technological advancements and larger amounts of data generated and stored by companies for increasingly longer periods of time are driving growth in the importance, and the amount, of physical space dedicated to data centers. As software companies, such as Google and Oracle, continue to develop new technologies, such as artificial intelligence, data centers where the computer and storage functions are co-located also continue to grow. As the industry seeks to cut operating costs, become more efficient and minimize dedicated physical space, we expect there to be a shift towards light, compact lithium-ion batteries that can reduce overall costs and provide a reliable power supply without sacrificing performance. Lithium-ion batteries are designed to operate in environments with higher ambient temperatures than incumbent energy storage methods (such as lead-acid batteries). This ability for lithium-ion batteries to withstand and operate at higher temperatures can also reduce cooling costs. | |

| ● | On-grid Storage. On-grid energy storage is used on a large-scale platform within an electrical power grid in conjunction with variable renewable energy sources such as solar and wind projects. These storage units (including large-scale stationary batteries) store energy when electricity is plentiful, and discharge energy at peak times when electricity is scarce. Because of the low cost of fossil fuels, the adoption of large-scale batteries has been slow. However, according to the U.S. Energy Information Administration 2021 report on battery storage in the United States, lithium-ion battery installations in large-scale storage grew from less than 50 MWh of energy capacity annual additions in 2010 to approximately 400 MWh in 2019. As lithium-ion battery production scales, the related cost of storage for all lithium-ion batteries will decline and the cost of renewable energy (including associated storage costs) is expected to approach $0.05 per kWh, which is the amount required to be cost competitive with the price of power from the electrical grid. We believe our ability to cost-effectively develop and manufacture LFP solid-state batteries will position renewable energy projects deploying these batteries to reach “grid parity” sooner. |

|

|

Our Competitive Strengths

We believe that we possess the largest share in the markets we operate in due to our following business strengths, which distinguish us in this competitive landscape and position us to capitalize on the anticipated continued growth in the energy storage market:

| ● | Premier Lithium-Ion Battery Technology. Each of our innovative batteries features custom designed components to enhance power and performance in any application or setting. Our batteries feature LFP chemistry that is environmentally friendly, does not heat up or swell when charging or discharging, and generates more power in less physical space than competing lead-acid batteries. Unlike our competitors, our internal heating technology keeps our batteries within optimal internal conditions without drawing unnecessary energy and sustaining minimal energy drain. To protect our products, our batteries possess a proprietary battery management system that shuts off the ability to charge at 24 degrees Fahrenheit. This technology increases performance in cold weather conditions while possessing a unique heating solution that does not require an external energy source. | |

| ● | Extensive, Growing Patent Portfolio. We have developed and filed patent applications on commercially relevant aspects of our business including chemical compositions systems and production processes. To date, we have owned 44 issued patents, with an additional 48 patent applications pending, in the United States, Canada, Australia, Korea, Japan, India, China, and Europe (with individual patents in Germany, France and the United Kingdom). | |

| ● | Proven Go-To-Market Strategy. We have successfully established a DTC platform and have developed strong working relationships with major OEMs and fleets in the RV, marine and heavy trucking markets. We custom design and engineer storage systems for new and existing applications. We see opportunities to continue to leverage our success in the aftermarket to expand our relationships to other leading OEMs, fleets, and distributors while further enhancing our DTC offerings. Extensive informational videos and exceptional customer service provide sales, technical and hands-on service support to facilitate consumer transition from traditional lead-acid or incumbent lithium-ion batteries to our products. | |

| ● | Established Customer Base with Brand Recognition. We have a growing customer base of more than 23,000 customers featuring OEMs, distributors, upfitters and end consumers across diverse end markets and applications including RV, marine vessels and off-grid residences. Customer demand and brand recognition of Battle Born batteries from an aftermarket sales perspective have helped drive significant adoption from OEMs and fleets with visibility for future growth through further expansion of our existing relationships. | |

| ● | High Quality Manufacturing Process. Unlike competitors that outsource their manufacturing processes, our batteries are designed, assembled and tested in the United States, ensuring that our manufacturing process is thoroughly tested and our batteries are of the highest quality as a result of governmental regulations for performance and safety. | |

| ● | Drop-in Replacement. Our battery modules are largely designed to be “drop-in replacements” for traditional lead-acid batteries, which means that they are designed to fit standard RV or marine vessel configurations without any adjustments. Our target applications are powering devices and appliances in larger vehicles and low speed industrial vehicles. We offer a full line of compatible components and accessories to simplify the replacement process and provide consumers with customer service to ensure a seamless transition to our significantly safer and environmentally friendly battery. Over their lifetime, our batteries are significantly cheaper from both an absolute cost and a cost per energy perspective. These lifetime costs, at current costs and capacity, will naturally drop as we continue to take advantage of economies of scale. |

Our Growth Strategy

We intend to leverage our competitive strengths, technology leadership and market share position to pursue our growth strategy through the following:

| ● | Expand Product Offerings. In the short-term, our aim is to further diversify our product offerings to give consumers, as well as OEMs and distributors, more options for additional applications. We intend to launch and scale production of additional 12 voltage and 24 voltage batteries and we have recently introduced 48 voltage battery systems, which we believe will extend our market reach in each of our targeted end markets. Additionally, in January 2023, we launched Dragonfly IntelLigence, a proprietary monitoring and communication system that allows us to monitor, optimize, and in some cases compile data on battery banks. We believe the natural evolution of our product offering is to become a system integrator for solar and other energy storage solutions. | |

| ● | Expand End Markets. We have identified additional end markets that we believe in the medium- to longer-term will increasingly look to alternative energy solutions, such as LFP batteries. Markets, such as long-haul trucking, standby power, industrial vehicles, specialty vehicles and utility-grade storage, are in the early stages of adoption of lithium-ion batteries (including LFP batteries), and we aim to be at the forefront of this movement by continuing to develop and produce products with these end users in mind. | |

| ● | Commercialize our Dry Electrode Cell Manufacturing Technology. In July 2023, we completed the construction of our proprietary and patented cell manufacturing pilot line. Our patented dry deposition process is chemistry agnostic – meaning it can produce battery cells across a variety of chemistries – and is less capital intensive, uses less energy, and can produce cells in a smaller manufacturing footprint, leading to a lower total cost of manufacturing. In August 2023, we successfully demonstrated the ability to produce anode material at scale using this manufacturing process and did the same with cathode material in October 2023. We are currently producing sample cells for prospective customers across a variety of chemistries and end-markets and expect to begin scaling production in the second half of 2024. |

|

|

| ● | Develop and Commercialize Solid-State Technology. We believe solid-state technology presents a significant advantage to all products currently on the market, with the potential to be lighter, smaller, safer and cheaper. Once we have optimized the chemistry of our LFP solid-state batteries to enhance conductivity and power, we intend to scale up for mass production of separate solid-state batteries for various applications and use cases. |

Our Products and Technology

Chemistry Comparison

Lead-acid batteries were the first form of rechargeable battery to be developed and modified across different platforms for a variety of uses, from powering small electronics to use for energy storage in back-up power supplies in cell phone towers. Since the development in the 1970s of AGM lead-acid batteries, a form of sealed lead-acid battery that enables operation in any position, there has been limited innovation in lead-acid battery technology. The push to develop longer-lasting, lower-cost, more environmentally-friendly and faster-charging batteries has led to the development of lithium-ion batteries and, within the lithium-ion battery market, different chemistries.

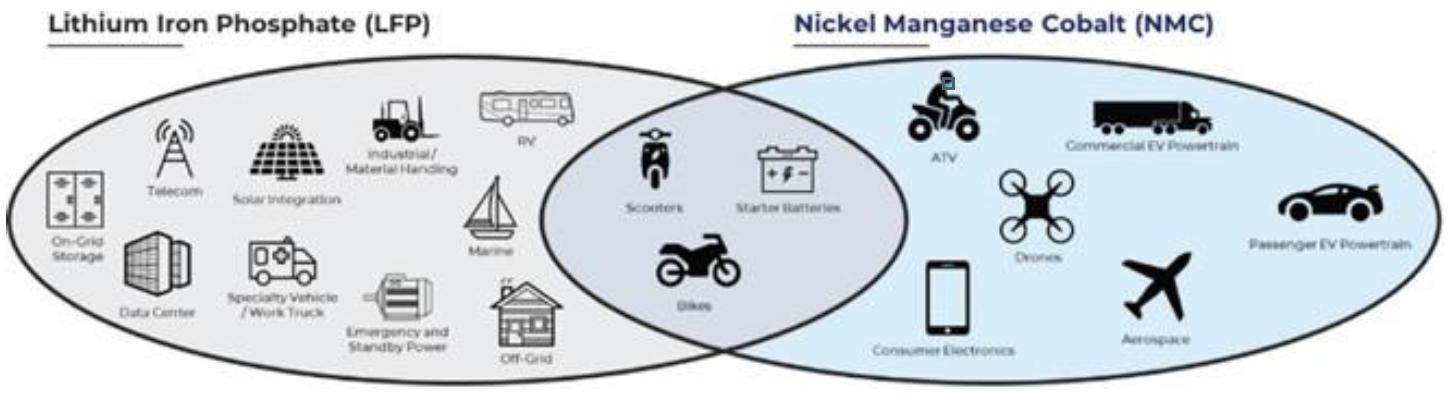

There are several dominant battery chemistries in the lithium-ion market that can be used for different purposes. Two widely adopted chemistries found in the market today are nickel manganese cobalt (“NMC”), and nickel cobalt aluminum (“NCA”). The higher energy density and shorter cycle life found in NMC and NCA batteries are suitable for markets where fast charging and high energy density are required, such as electric vehicle (“EV”) powertrains and consumer electronics. LFP batteries are best suited for energy storage markets where long life and affordability are paramount, such as RV, marine vessel, off-grid storage, onboard tools, material handling, utility-grade storage, telecom, rail and data center markets.

NMC batteries are highly dependent on two metals that present significant constraints — nickel, which is facing an industry-wide shortage, and cobalt, a large percentage of which comes from conflict-ridden countries. According to an article by McKinsey & Company titled “Lithium and Cobalt: A tale of two commodities”, global forecasts for cobalt show supply shortages arising as early as 2022, slowing down NMC battery growth. Both of these elements are also subject to commodity price fluctuations, making NMC and NCA batteries less cost-effective than LFP batteries. LFP batteries do not contain these elements and materials can be sourced domestically, and are therefore not subject to these shortages, geopolitical concerns or commodity price fluctuations. In fact, LFP batteries have no toxic elements, offering a much safer environmental alternative. The temperature threshold for thermal runaway (i.e., lithium-ion battery overheating that can result in an internal chemical reaction) is higher for LFP batteries as compared to NMC and NCA batteries, making LFP batteries less flammable and safer.

LFP batteries have a useful life of approximately 10 to 15 years compared to one to two years for lead-acid batteries, and typically charge up to five times faster. LFP batteries are also not constrained by weight (having the same energy capacity at one-fifth of the weight) or temperature (having the ability to generate power even in low temperatures and to not swell or heat up when charging or discharging) and are generally maintenance free.

In the electric vehicle market, the race to provide the highest energy density facilitating frequent, rapid acceleration, greatest range and fastest charging battery — all while competing on cost — is where many new battery companies are prioritizing their efforts. Success in the electric vehicle market requires use of chemistries capable of optimization to these requirements. In our targeted stationary storage markets, the ideal solution requires a safe, long-lasting battery in terms of discharge/charge cycles with a focus on providing a steady power stream. LFP batteries are better suited for the stationary storage market compared to NMC and NCA batteries, as LFP batteries are safer and have a significantly longer life cycle making them more cost-effective. The market for utility grade storage, particularly for clean energy projects, and the related adoption of lithium-ion batteries (including LFP batteries) is expected to increase as the fully-loaded cost of energy (production and storage) approaches cost parity with inexpensive fossil fuel energy provided through the electric grid. Compared to NMC and NCA batteries, LFP batteries are at or much closer to grid parity.

|

|

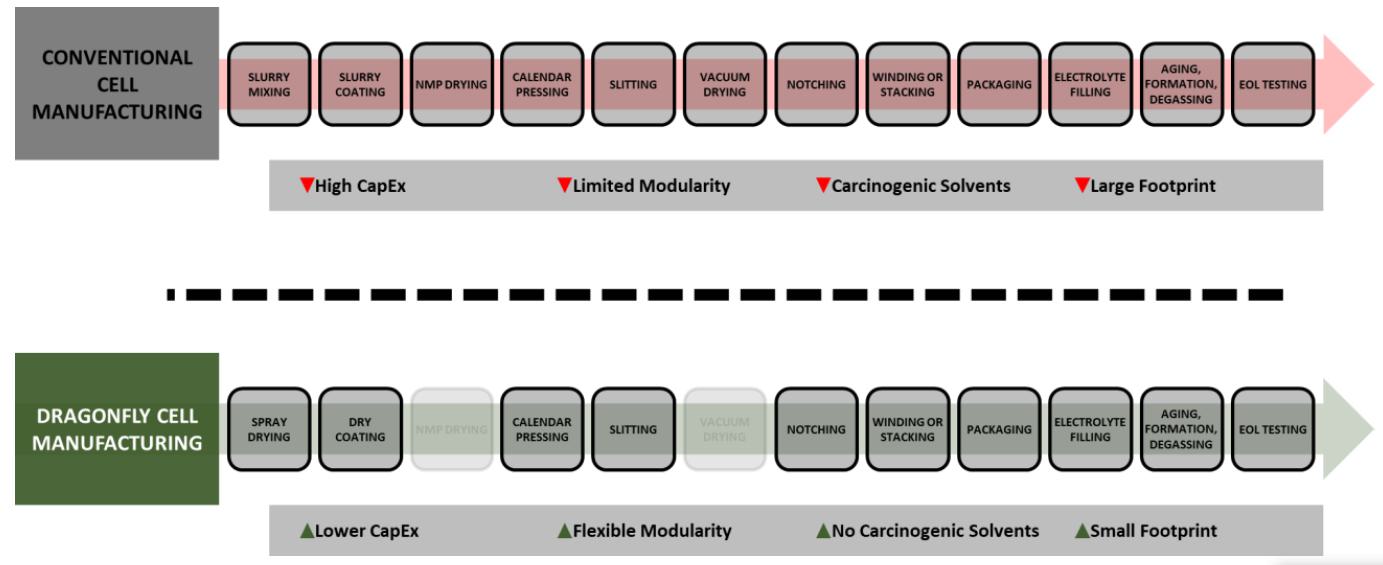

Dry Electrode Cell Manufacturing Technology

Since our inception, we have been developing proprietary dry-electrode manufacturing processes for which we have issued patents and pending patent applications, where appropriate. Dry-electrode manufacturing eliminates the use of toxic and expensive solvents and energy-intensive drying ovens in the cell manufacturing process. This in turn reduces the energy usage, space requirements, carbon footprint, and overall cost as compared to conventional slurry-based methods. Furthermore, the manufacturing technology is chemistry agnostic – meaning it can produce battery cells across a variety of different chemistries and application use cases. In July 2023, we completed the construction of our dry-electrode manufacturing pilot line. In August 2023, we successfully demonstrated the ability to produce Anode material at scale using this manufacturing process and did the same with Cathode material in October 2023. We are currently producing sample cells for prospective customers across a variety of chemistries and end-markets and expect to begin scaling production in the second half of 2024.

Solid-State Cells

LFP batteries are not without their disadvantages. While less flammable than other chemistries, the existence of a flammable liquid electrolyte still poses safety risks. Like all liquid-based lithium-ion batteries, LFP batteries have a potential to produce solid lithium dendrites, icicle-like formations which can pierce the physical separators in LFP batteries, which are necessary in LFP batteries to separate the positively charged liquid electrolyte from the negatively charged liquid electrolyte, and which, over time, will degrade the performance of LFP batteries and potentially result in fire-related risks. The next phase in the development of lithium-ion batteries is solid-state cell development, which contains a solid, rather than a liquid, electrolyte, eliminating many of the current disadvantages to LFP batteries while increasing the safety of the battery cells. We believe that the development of our solid-state technology will provide us with a unique competitive advantage.

Compared to current lithium-ion technology, where lithium-ions cross a liquid electrolyte barrier between a battery’s anode (negative electrode) and cathode (positive electrode), solid-state batteries aim to use a solid electrolyte to regulate the lithium-ions. As a battery charges and discharges, an electrochemical reaction occurs creating a flow of electrical energy between the cathode, electrolyte and anode as the electrodes lose and reacquire electrons. In addition to the use of non-toxic electrode components, the removal of a liquid electrolyte will eliminate the risk of fire, making solid-state cells inherently safe. The move to a non-liquid electrolyte also means that solid-state batteries will be, on average, smaller and lighter than existing lithium-ion batteries. The process for manufacturing our solid-state cells is described below under “— Research and Development”.

Our Products

We provide various industries with clean, reliable, and efficient power solutions through our comprehensive product portfolio. These products and solutions are sold to both OEMs and retail customers.

Our lead product line is Battle Born Batteries product line, respected for its exceptional performance and durability. When compared to traditional lead-acid options, Battle Born Batteries deliver two to three times the power in the same physical space, one-fifth the weight for equal usable power, and up to five times faster charging. Additionally, these batteries have extended lifespans of 3,000-5,000 cycles, translating to ten to fifteen years of reliable use under typical conditions. This longevity is backed by our 10-year warranty, showcasing our commitment to quality. The Battle Born Batteries product line currently features various sizes and configurations including models with proprietary built-in heating for cold weather charging and Dragonfly IntelLigence™, a communication technology that unlocks real-time monitoring, instant notifications, various protocol integration and superior battery protection. A focus on safety is central to our products, and all Battle Born Battery products utilize LiFePO4 chemistry, the safest lithium-ion chemistry available on the market. Additionally, our battery products undergo rigorous testing under stringent industry standards like UL Standard 2054, IEC 62133, UN 38.3 and IP65 to ensure safety and reliability.

Looking beyond batteries, we also offer a diverse range of power products.

| ● | Our Wakespeed Advanced Alternator Regulator, WS500, utilizes current, voltage, and temperature to deliver precise and effective charging of battery banks via an alternator. Its intelligent control leverages advanced multi-PID engine technology to ensure the most accurate charging available, simplifying installation, configuration, and operation. The WS500 offers superior protection for both lead-acid and lithium battery chemistries, making it a valuable investment for optimizing power management and extending battery life. | |

| ● | The Battle Born Batteries Lithium Power Pack Series features all-in-one power solutions for RVs, vans, and other mobile, off-grid, and industrial applications. These pre-wired, ready-to-go systems make the upgrade to lithium simple with easy installation into RVs or other applications. Designed with the dimensions and mounting points of traditional generators in mind, Lithium Power Packs are made to be quiet, sustainable, and simple drop-in replacements, allowing customers to eliminate generator fuel and noise. Custom configurations of Lithium Power Pack products are available for dealers and OEMs to size these all-in-one solutions to their specific needs. |

|

|

| ● | Designed for the demanding world of heavy-duty trucking, our Battle Born All-Electric APU leverages a lithium battery system to empower drivers with long lasting power for their hotel loads. This upgrade eliminates the need for idling and its associated fuel costs and emissions—this APU provides power to run a truck’s HVAC, appliances, and electronics during mandatory rest periods. The Battle Born All Electric APU is pre-assembled and pre-wired, seamlessly integrating into a truck’s frame rails. |

Additionally, as a distributor of leading brands like Victron, Schneider, and REDARC, we act as a one-stop shop for full system integration, catering to both OEMs and retail customers. Our complete offering allows customers to benefit from clean and sustainable power, extended lifespans, reduced costs, increased efficiency, and seamless integration - all backed by expert service and support.

Battery Management System

Our proprietary battery management system is developed and tested in-house. It offers a complete solution for monitoring and controlling our complex battery systems and is designed to protect battery cells from damage in various scenarios. We believe our battery management system is industry-leading for a number of reasons:

| ● | it enables batteries to draw power under 135 degrees Fahrenheit, and is designed to cut off charging at 24 degrees Fahrenheit to protect cells; | |

| ● | it actively monitors the rate of change of currents to detect and prevent short circuiting, and also protects against potential ground faults; | |

| ● | it allows for up to an average of 300 amps continuously, 500 amp surges for 30 seconds, and momentary, half second maximum capacity surges; | |

| ● | it enables batteries to recharge even if completely drained; | |

| ● | it utilizes larger resistors to ensure balanced loads to improve performance and extend useful life; and | |

| ● | it facilitates scalability by enabling batteries to be combined in parallel and in series. |

Battery Communication System

We have developed a complete communication system branded Dragonfly IntelLigence, for which a U.S. non-provisional patent application and an international PCT patent application have been filed, to be used with Dragonfly Energy OEM systems and Battle Born batteries and bundles. This communication system will enable end customers to monitor each battery in real time, providing information on energy input and output and current or voltage imbalances. The communication system will be able to communicate with up to 24 batteries in a bank at one time and aggregate the data received from these batteries into a central system such as a phone or tablet. We expect to begin offering the Dragonfly IntelLigence product line to OEMs in the second quarter of 2024 as an adjacent component and in our product bundles.

Alternator Regulation

Charging batteries in a vehicle, such as a boat or RV, often requires pulling electrical current off of the vehicle’s alternator. Alternator regulation is important to ensure that the alternator does not get unduly stressed during the current delivery to the batteries, and that the current delivery remains within the operating limits of the onboard battery bank. The acquisition of the assets of Wakespeed has allowed us to deliver our own proprietary solution to alternator regulation while also leveraging an established brand name. Wakespeed is especially popular in the marine industry, and our ability to offer this complete solution sets the stage for further penetration into marine markets.

Product Pipeline

Beyond our current battery modules, we have several LFP products in development that will enable us to access additional end markets.

| ● | New Products. Our current offerings feature battery products that serve the RV, marine vessel and off-grid markets. Although manufacturing operations were previously capacity constrained the expansion into our new manufacturing facility will allow us to add production capacity and increase product offerings and scale based on demand. |

|

|

| ● | The majority of our current batteries are 12 volt batteries, which provide 100 amp hours of energy and are an affordable solution to customers utilizing smaller or lower power applications. The smaller stature and drop-in replacement nature of these batteries have made these popular within the RV and marine vessel markets. Through the expansion of our 12 voltage battery product offerings, we will be able to penetrate further into additional applications including towable RVs, truck campers and trolling motors for small boats. | |

| ● | We also offer 24 voltage batteries, which currently deliver 50 amp hours, and plan to further expand our 24 voltage battery offerings to provide additional drop-in replacements for AGM batteries. A single 24 voltage battery is more efficient than two 12 voltage batteries due to the ability to power directly from the source without sacrificing power through cables and connectors. This attractive power source is ideal for off-grid housing, telecommunication, solar, marine and motorized home markets, providing enhanced power to larger scale applications. A vast majority of telecommunication cell sites utilize 24 voltage batteries, greatly expanding our addressable market. | |

| ● | We intend to offer 48 voltage batteries at 100 amp hours that utilize the Dragonfly IntelLigence system to maintain balance and full visibility into the status of all cells. The 48 voltage batteries provide further efficiency gains with higher voltage. These higher voltage batteries are currently more suitable for luxury mobile homes, larger off-grid uses, and high-end marine applications. We aim to further expand our 48 voltage batteries’ end market exposure into other highly attractive industries including standby power for data center and utility grade energy storage. |

| ● | System Integrator. A natural evolution of our business is to offer customers a system integration solution providing more efficient power solutions at a cost-effective price point. We currently offer components and accessories necessary to build out complete lithium power systems, including solar panels, chargers and inverters, system monitoring, Wakespeed’s alternator regulators, accessories, and more. We have an in-house expert customer service team that assists customers in fully integrating their applications to our technologies for a seamless transition to lithium-based energy storage systems. Through our evolving technology and the customized architecture and application of our products, we are able to offer customers a seamless transition to creating a centralized coordinated system. |

Research and Development

Our research and development team has built up its efforts to support two main initiatives – (1) scale up of our patented dry electrode process for cell manufacturing and (2) the advanced manufacturing of solid-state lithium-ion batteries. We believe the dry electrode process can be leveraged to help us vertically integrate from a pack supplier to a cell supplier – positioning ourselves for long-term competitiveness in the given geopolitical, economic, and technological landscapes. Our innovations in dry electrode processing result in reduced manufacturing costs, CO2 equivalents, and factory footprint while eliminating the need for solvents like N-Methyl-2-pyrrolidone (“NMP”). A third-party assessment conducted by Sphere Energy confirming these benefits has been completed in the first quarter of 2024 relating to cost effectiveness and sustainability of our dry electrode battery manufacturing process (the “Sphere Energy Assessment”).

The Sphere Energy Assessment concluded that our dry electrode battery manufacturing process resulted in a 9% reduced carbon footprint of cell manufacturing with no toxic NMP solvent required, resulting in a significantly more sustainable process. This sustainability advantage is further augmented by a 71% reduction in energy usage during electrode manufacturing using our process (spray drying, coating, calendaring) compared to standard cell manufacturing operations (slurry casting, drying, calendaring). By removing the need for large and expensive drying ovens, our manufacturing process requires 22% less square footage. The culmination of these advantages results in a 25% reduction in emissions from energy use, making our manufacturing process more sustainable and much more environmentally friendly as compared to conventional manufacturing methods.

In addition to the energy savings, the cost assessment found our process to be highly cost-effective with an estimated 5% savings (depending on cell chemistry) on process-related costs compared to conventional methods. Importantly, these savings were calculated without the additional cost benefits provided by domestically manufacturing battery cells such as Inflation Reduction Act tax credits (issued by the IRS), tariffs, and shipping.

The dry electrode battery manufacturing process we employ uses a patented spray coating technology to adhere the anode and cathode electrodes, eliminating the need for large, energy-intensive equipment such as slurry coaters, conveyor dryers, and NMP processing equipment. This process is chemistry agnostic, allowing for the various applications, such as electric vehicles, consumer electronics, and energy storage, which is expected to enable us to expand into new markets and to achieve our goal of domestically producing nonflammable all-solid-state battery cells.

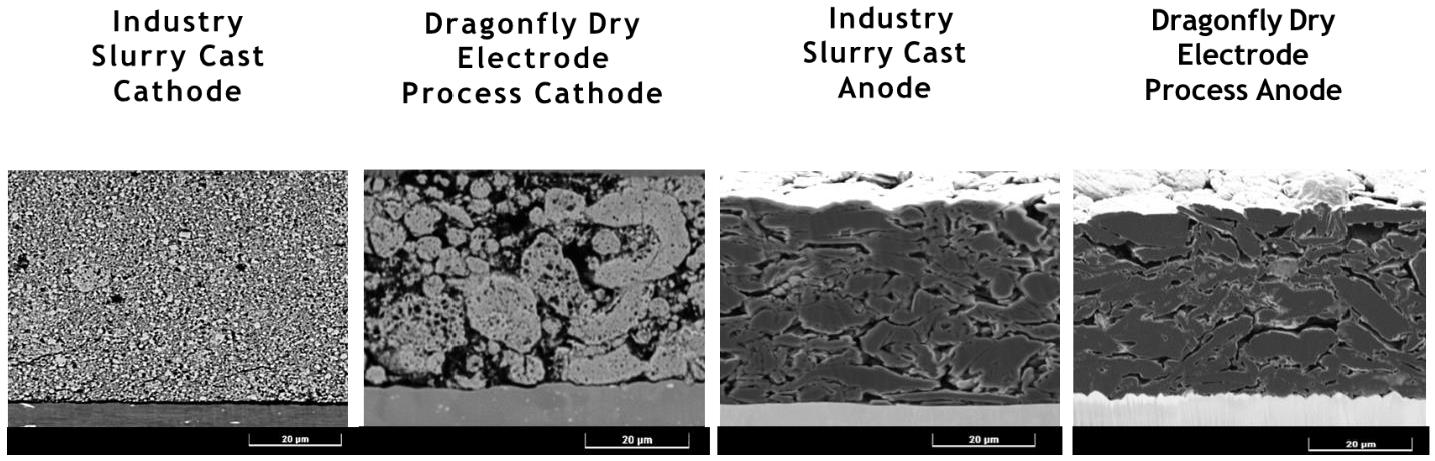

We have successfully produced anode and cathode electrode reels at scale using the dry electrode process and are now qualifying prototype cells for the core business and potential partners. When compared to slurry cast electrode tapes, which is the conventional manufacturing method, electrode tapes produced using the dry electrode process match or surpass mechanical integrity and electrochemical performance. We are considering joint development agreements, licensing agreements, and offtake agreements as instruments of partnership with interested parties.

|

|

In comparison with traditional manufacturing methods, our patented process leverages two off-the-shelf technologies to deliver the stated cell manufacturing benefits – spray drying and electrostatic powder coating. Technical risk is reduced by using off-the-shelf equipment and both unit operations are being optimized in 2024. A new set of spray dryers will arrive at our facility in the second quarter of 2024, enabling us to produce larger volumes of material for the electrode coating lines.

We have developed our patented to be chemistry agnostic and capable of producing current cell chemistries (graphite, LCO, LFP, LTO, NCA, NMC, LTO, silicon, etc.) and next generation cell chemistries (sodium-ion, solid-state, ionic liquid electrolytes, etc.). We believe this flexibility and our robust intellectual property protection internationally positions us well for potential partnerships with cell manufacturers, EV companies, and other pack suppliers in need of cell capacity. The next stage in technical development is to produce larger volumes of sample cells for qualification. These production runs will be completed with partners in the United States and at our own facilities once the new headquarters facility is completed, which is expected to occur in the second half of 2024. We have invested significant resources into developing an in-house comprehensive understanding of cell manufacturing – raw material qualification, quality control such as, cell failure diagnostics, aging, and formation processes. Our research and development Lab is equipped with over $20 million in research infrastructure to support the development of new cell chemistries, process quality control, failure diagnostics, and more. This equipment includes quality control instruments (ex. moisture analysis, particle size analysis, peel testing and titrations) and cutting-edge research instrumentation such as en operando nuclear magnetic resonance (“NMR”), electron microscopes with lithium-tracking capabilities, and en operando x-ray diffraction. This infrastructure has allowed us to optimize the dry-electrode process, allowing our team to match or surpass traditional electrode tape performance and mechanical integrity. Because our process is dry and the active material is coated directly onto the current collector, interfacial and composite resistivity of the electrode tapes often surpass the quality of slurry cast equivalents.

Our solid-state technology continues to progress as we qualify new chemistries and refine the dry electrode process for solid-state applications. Currently, we are cycling solid-state coin cells with the aim of producing prototype pouch cells by the end of 2024. These cell chemistries are nonflammable, solid-state, and an LFP/graphite cell chemistry. We believe these cells will be a pivotal technology in grid storage applications once fully deployed. We intend to integrate our conventional and solid-state cells produced using our dry-electrode process into the existing Dragonfly Energy and Battle Born Batteries product portfolios.

|

|

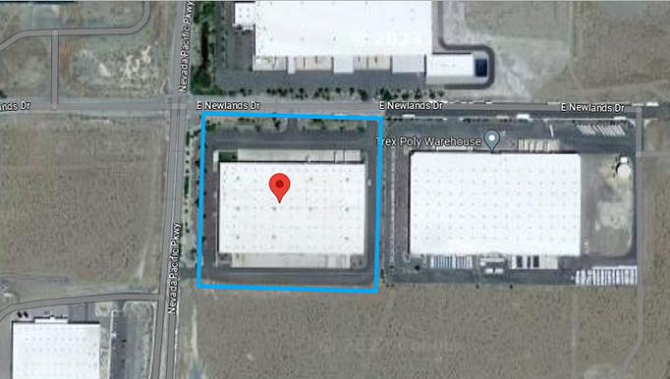

Headquarters, Manufacturing, and Production

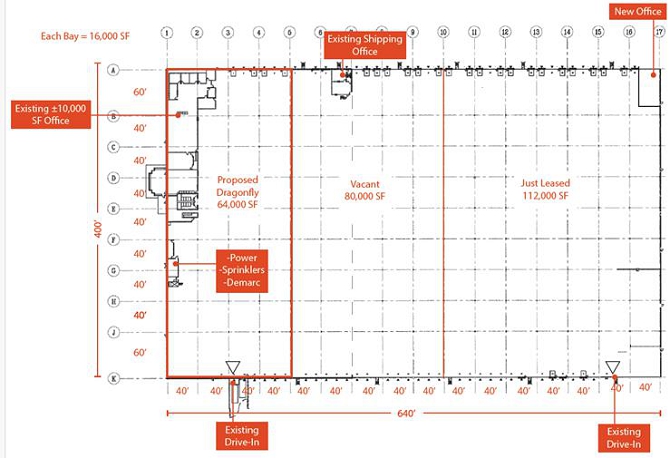

Our headquarters is located in our 99,000 square foot manufacturing facility in Reno, Nevada. The lease for this building was entered into on March 1, 2021, and expires on April 30, 2026. We do not own any real estate property. This facility leverages a semi-automated production process for battery module and pack assembly. We currently have two production lines with another line currently in construction. We continue to have the capability to expand our production volumes and line quantities to support increased volumes of new products we intend to introduce soon. On February 8, 2022, we entered into a 124-month lease for an additional 390,240 square foot warehouse, which is scheduled to complete construction in the second half of 2024 in Reno, Nevada. We intend to utilize this facility for the existing pack assembly business and new cell manufacturing business.

On April 12, 2024, we entered into the Fernley Lease Agreement pursuant to which we agreed to lease an approximately 64,000 square foot facility (the “Premises”) in Fernley, Nevada, to be used for general, warehousing, assembly/light manufacturing, painting of products, storage fulfillment, distribution of our products, and other uses as permitted under in the Fernley Lease Agreement.

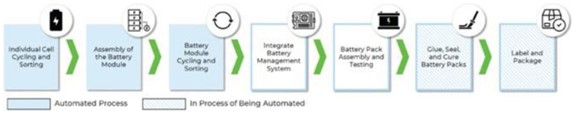

Our manufacturing process is divided into two aspects – (1) module assembly and (2) battery assembly. We use a combination of trained employees and automated processes to increase production capacity and lower costs while maintaining the same level of quality our customers expect from our products. Module assembly is a significantly automated process, implementing custom-designed equipment and systems to suit our production needs. This includes cycling of individual cells to detect faulty components and to enable sorting by capacity. Our custom-designed automated welders spot weld individual cells that are assembled into specified module jigs based on the desired amp hour. Completed modules are then fully discharged, recharged fully, and sorted by capacity. Battery assembly is performed largely by hand by our trained employees, although we continue to look for innovative ways to integrate automation into this process. Our proprietary battery management system is thoroughly tested for quality cutoffs, then mounted onto individual modules, before the modules are bolted into its casing. We aim to automate the battery management system testing and installation process, which we expect could increase production capacity fourfold. We are currently implementing an automated process for the gluing and sealing process, which would incorporate a two-robot system for gluing and epoxying, as well as a glue pallet system to move finished batteries. After the assembled batteries are tested and sealed, they are processed for outbound distribution.

Supplier Relationships

We have a well-established, global supply chain that underlies the sourcing of the components for our products, although we source domestically wherever possible. We aim to maintain approximately six months’ worth of all components, other than cells, which we pre-order in advance for the year to ensure adequate supply. For nearly all of our components, other than our battery management system, we ensure that we have alternative suppliers available. Our battery management system is sourced from a single supplier based in China who we have a nearly 10-year relationship with and who manufactures this component exclusively for us based on our proprietary design. Our cells are sourced from two different, carefully selected cell manufacturers in China who are able to meet our demanding quality standards. As a result of our long-standing relationships with these suppliers, we are able to source LFP cells on favorable terms and within reasonable lead-times.

As we look toward the production of our traditional and solid-state cells, we have signed a Commercial Offtake Agreement with a lithium mining company and a lithium recycling company, both located in Nevada for the supply of lithium.

Customers; RV OEM Strategic Arrangements

We currently serve more than 23,000 customers in North America. Our existing customers consist of leading OEMs (such as Keystone, THOR, REV Group and Airstream); distributors (who purchase large quantities of batteries from us and sell to consumers); upfitters (who augment or customize vehicles for specific needs); and retail customers (who purchase from us directly). For the years ended December 31, 2023 and 2022, OEM sales represented 42.7% and 39.2% of our total revenues, respectively.

We have deep, long-standing relationships with many of our customers. We also have a diverse customer base, with our top 10 customers accounting for 39.6% of our revenue for the year ended December 31, 2023, in which only one customer accounted for more than 10% of our revenue. Our customers primarily utilize our products for RVs, marine vessels and off-grid residences. We work directly with OEMs to ensure compatibility with existing designs and also collaborate on custom designs for new applications.

|

|

The RV market is characterized by low barriers to entry. In North America, there are two large publicly traded RV companies, THOR Industries and REV Group, in addition to a number of independent RV OEMs. THOR and REV each own a number well-known RV OEM brands and their related companies. These brands compete on a number of factors such as format (e.g., motorized or towable), price, design, value, quality and service. On November 19, 2021, we entered into a long-term Manufacturing Supply Agreement with Keystone, a member of the THOR group and the largest towable RV OEM in North America (the “Supply Agreement”). Under the Supply Agreement, we will be the exclusive supplier to Keystone for certain of its future LFP battery requirements, solidifying our long standing relationship with Keystone.

In July 2022, we strengthened our ties with the THOR group of RV OEMs when (i) THOR Industries made a $15,000,000 strategic investment in us and (ii) we agreed to enter into a future, mutually agreed distribution arrangement and joint IP development arrangement. This arrangement helps facilitate our ongoing efforts to drive adoption of our products (leveraging the trend of LFP batteries increasingly replacing lead-acid batteries) by, among other things, increasing the number of RV OEMs that “design in” our batteries as original equipment and entering into arrangements with members of the various OEM dealer networks to stock our batteries for service and for aftermarket replacement sales. Once the distribution agreement has been negotiated and signed, during a to-be-agreed transition period, we will use commercially reasonable efforts to cease marketing and selling our products to other RV OEMs and suppliers to RV OEMs in North America. Although the full distribution agreement with THOR has not been executed and is subject to negotiation in the future, its terms are expected to include: (i) an initial term of 24 months, which THOR may renew for successive one-year periods; (ii) a requirement that we be the sole provider of lithium-ion batteries to the US-based THOR family of companies for THOR sales in the United States, subject to agreed exceptions; (iii) favored pricing for products and negotiated rebates or other incentives; (iv) a requirement that THOR and its North American OEMs be our exclusive RV OEM customers for our products in North America, subject to agreed exceptions; and (v) agreeable terms with respect to registered and unregistered intellectual property rights and technology rights (which do not include our existing intellectual property, including our solid-state battery technologies and related IP rights), including necessary licenses between the parties, third party licenses, and allocation of ownership of any intellectual property rights and/or technology rights developed as a result of development efforts jointly undertaken between THOR and us, subject to certain limitations.

We continue to seek to grow our customer base within our existing segments; however, we also believe that our products are well suited to address the needs in additional segments, including residential, commercial and/or industrial standby power, long-haul trucking, industrial vehicles (such as forklifts, material handling equipment and compact construction equipment) and specialty vehicles (such as emergency vehicles, utility vehicles and municipal vehicles) and we will seek to expand our market share in these segments in the future.

Sales and Marketing