UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission file number 001-37370

MY SIZE, INC.

(Exact name of registrant as specified in charter)

| Delaware | 51-0394637 | |

| (State

or jurisdiction of Incorporation or organization) |

I.R.S

Employer Identification No. |

| 4 Hayarden, POB 1026, Airport City, Israel | 7010000 | |

| (Address of principal executive offices) | (Zip code) |

+972-3- 6009030

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, par value $0.001 per share | MYSZ | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark whether the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller Reporting Company | ☒ |

| Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ☐ No ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $2,360,756.

Number of shares of common stock outstanding as of March 10, 2024 was 5,091,668.

Documents Incorporated by Reference: None.

Table of Contents

PART I

In this Annual Report on Form 10-K, unless the context requires otherwise, the terms “we,” “our,” “us,” or “the Company” refer to MySize, Inc., a Delaware corporation, and its subsidiaries, including MySize Israel 2014 Ltd. My Size LLC, Orgad International Marketing Ltd., or Orgad, and Naiz Bespoke Technologies, S.L, or Naiz Fit, taken as a whole.

References to “U.S. dollars” and “$” are to currency of the United States of America, and references to “NIS” are to New Israeli Shekels. Unless otherwise indicated, U.S. dollar translations of NIS amounts presented in this Annual Report on Form 10-K for the year ended on December 31, 2023 are translated using the rate of NIS 3.6270 to $1.00.

All information in this Annual Report on Form 10-K relating to shares or price per share reflects the 1-for-25 reverse stock split effected by us on December 8, 2022.

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Any statements in Annual Report on Form 10-K about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common stock and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this Annual Report on Form 10-K. Some of the risks, uncertainties and assumptions that could cause actual results to differ materially from estimates or projections contained in the forward-looking statements include but are not limited to:

| ● | our history of losses and needs for additional capital to fund our operations and our inability to obtain additional capital on acceptable terms, or at all; | |

| ● | risks related to our ability to continue as a going concern; | |

| ● | the new and unproven nature of the measurement technology markets; | |

| ● | our ability to achieve customer adoption of our products; | |

| ● | our ability to realize the benefits of our acquisitions of Orgad and Naiz; | |

| ● | our dependence on assets we purchased from a related party; | |

| ● | our ability to enhance our brand and increase market awareness; | |

| ● | our ability to introduce new products and continually enhance our product offerings; | |

| ● | the success of our strategic relationships with third parties; | |

| ● | information technology system failures or breaches of our network security; | |

| ● | competition from competitors; | |

| ● | our reliance on key members of our management team; | |

| ● | current or future litigation; |

|

|

| ● | current or future unfavorable economic and market conditions and adverse developments with respect to financial institutions and associated liquidity risk; and | |

| ● | security, political and economic instability in the Middle East that could harm our business, including due to the current war between Israel and Hamas. |

The foregoing list sets forth some, but not all, of the factors that could affect our ability to achieve results described in any forward-looking statements. You should read this Annual Report on Form 10-K and the documents that we reference herein and have filed as exhibits to the Annual Report on Form 10-K, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this Annual Report on Form 10-K is accurate as of the date hereof. Because the risk factors referred to in this Annual Report on Form 10-K, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this Annual Report on Form 10-K, and particularly our forward-looking statements, by these cautionary statements.

ITEM 1. BUSINESS

Overview

We are an omnichannel e-commerce platform and provider of AI-driven SaaS measurement solutions, including MySizeID and our recently acquired subsidiaries, Naiz Fit, which provides SaaS technology solutions that solve size and fit issues and AI solutions for smarter design through data driven decisions for fashion ecommerce companies, and Orgad, an online retailer operating in the global markets. To date, we have generated almost all our revenue as a third-party seller on Amazon. Our advanced software and solutions assists us in supply chain, identifying products that can drive growth and provides a user-friendly experience and best customer service.

We are currently focused on driving the commercialization of the Naiz Fit technology which, enables shoppers to generate highly accurate measurements of their body to find the accurate fitting apparel by using our Naiz Fit Widget, a simple questionnaire which uses a database collected over the years and allows buyers to know what size to pick when buying online, reducing returns and increasing conversion rates of sellers.

Naiz Fit syncs the user’s measurement data to a sizing model generated with our proprietary Garment Modelling technology for each item sold on the ecommerce, and only presents items for purchase that match their measurements to ensure a correct fit.

We are positioning ourselves as a consolidator of sizing solutions and new digital experience due to new developments for the fashion industry needs. Our other product offerings include First Look Smart Mirror for physical stores and Smart Catalog to empower brand design teams, which are designed to increase end consumer satisfaction, contributing to a sustainable world and reduce operation costs. We also recently launched True Feedback, a Go-To-market solution that extracts data from our Naiz Community mystery shoppers to fine-tune the customer experience offered to fashion buyers, both online and offline.

|

|

Recent Developments

August 2023 Warrant Repricing

On August 24, 2023, we entered into an inducement offer letter agreement, or the Inducement Letter, with a certain holder, or the Holder, of certain of our then-existing warrants to purchase up to (i) 1,963,994 shares of our common stock issued on January 12, 2023 at an exercise price of $2.805 per share, or the January 2023 Warrants, (ii) 6,864 shares of our common stock issued on January 17, 2020 at an exercise price of $94.00 per share, or the January 2020 Warrants, and (iii) 47,153 shares of our common stock issued on October 28, 2021 at an exercise price of $31.50 per share, having terms ranging from 28 months to five and one-half years, or the October 2021 Warrants, and together with the January 2023 Warrants and the January 2020 Warrants, the Exercised Warrants).

Pursuant to the Inducement Letter, the Holder agreed to exercise for cash the Exercised Warrants to purchase an aggregate of 2,018,012 shares of our common stock at a reduced exercise price of $2.09 per share in consideration of our agreement to issue new common stock purchase warrants, or the New Warrants, to purchase up to an aggregate of 5,367,912 shares of our common stock, at an exercise price of $2.09 per share. The New Warrants became immediately exercisable upon the approval of our stockholders at our annual general meeting of stockholders in December 2023, or the Stockholder Approval Date, until either the five and one-half years with respect to 2,755,800 New Warrants and twenty-eight months with respect to 2,612,112 New Warrants, from the Stockholder Approval Date.

The aggregate gross proceeds from the exercised of the Exercised Warrants was approximately $4.2 million, before deducting placement agent fees and other offering expenses payable by us.

January 2023 Financing

On January 10, 2023, we entered into a securities purchase agreement, or the RD Purchase Agreement, pursuant to which we agreed to sell and issue in the RD Offering an aggregate of 162,000 of our shares of common stock, or the RD Shares, and pre-funded warrants, or the Pre-funded Warrants, to purchase up to 279,899 shares of common stock and, in a concurrent private placement, unregistered warrants to purchase up to 883,798 shares of common stock, or the RD Warrants, consisting of Series A warrants, or Series A Warrants, to purchase up to 441,899 shares of common stock and Series B warrants, or Series B Warrants, to purchase up to 441,899 shares of common stock, at an offering price of $3.055 per RD Share and associated Series A and Series B Warrants and an offering price of $3.054 per Pre-funded Warrant and associated Series A and Series B Warrants.

In addition, we entered into a securities purchase agreement, or the PIPE Purchase Agreement, and together with the RD Purchase Agreement, the Purchase Agreements, pursuant to which we agreed to sell and issue in the PIPE Offering an aggregate of up to 540,098 unregistered Pre-funded Warrants and unregistered warrants to purchase up to an aggregate of 1,080,196 shares of common stock, or the PIPE Warrants and together with the RD Warrants, the Warrants, consisting of Series A Warrants to purchase up to 540,098 shares of common stock and Series B Warrants to purchase up to 540,098 shares of common stock at an offering price of $3.054 per Pre-funded Warrant and associated Series A and Series B Warrants.

The Pre-funded Warrants are immediately exercisable at an exercise price of $0.001 per share and will not expire until exercised in full. The Warrants are immediately exercisable upon issuance at an exercise price of $2.805 per share, subject to adjustment as set forth therein. The Series A Warrants have a term of five and one-half years from the date of issuance and the Series B Warrants have a term of 28 months from the date of issuance. The Warrants may be exercised on a cashless basis if there is no effective registration statement registering the shares underlying the warrants.

Nasdaq Minimum Bid Price Deficiency

On November 3, 2023, we were notified, or the Notification Letter, by the Nasdaq Listing Qualifications that we are not in compliance with the minimum bid price requirements set forth in Nasdaq Listing Rule 5550(a)(2), or the Rule, for continued listing on The Nasdaq Capital Market.

The Notification Letter provides that the Company has 180 calendar days, or until May 1, 2024, to regain compliance with the Rule. To regain compliance, the bid price of our common stock must have a closing bid price of at least $1.00 per share for a minimum of 10 consecutive business days. In the event we do not regain compliance by May 1, 2024, we may then be eligible for additional 180 days if we meet the continued listing requirement for market value of publicly held shares and all other initial listing standards for The Nasdaq Capital Market, with the exception of the bid price requirement, and will need to provide written notice of its intention to cure the deficiency during the second compliance period. If we do not qualify for the second compliance period or fail to regain compliance during the second compliance period, then Nasdaq will notify us of its determination to delist our common stock, at which point we will have an opportunity to appeal the delisting determination to a Hearings Panel.

|

|

Warehouse Fire

On January 2, 2023, Orgad experienced a fire at its warehouse in Israel. We are not aware of any casualties or injuries associated with the fire. We shifted Orgad’s operation to its headquarters. The value of the inventory that was in the warehouse was approximately $640,000. We believe that this incident did not affect the future sales results of Orgad for the year of 2023. The inventory was not insured, we and the lessor signed an agreement to settle the issue in which we paid to the lessor an amount of $50,000 to cover his loss.

Our Solution

Our cloud-based software platform provides highly accurate sizing and measurement with broad applications including the online fashion/apparel industry, logistics and courier services and home DIY. Currently, we are mainly focusing on the e-commerce fashion/apparel industry. This proprietary technology is driven by several patented algorithms which are able to calculate and record measurements in a variety of novel ways. Although specific functionality varies by product, we believe that our core solutions address the need for highly accurate measurements in a variety of consumer friendly, every day uses. On top of this anthropometric technologies, understanding the complexity of the fashion industry, we have also developed our own garment modelling technologies based on both products specifications and physical garment try-ons, guaranteeing the scalability of our solution while maximizing accuracy and adaptability of our technology for each retailer and e-tailer.

We have developed a complete Platform that includes several solutions or products inside it, such as, Naiz Fit Size Form for the ecommerce team, Smart catalogue for the product & design team,True Feedback for the Go-to-Market and Marketing teams and First Look Smart Mirror plus bring Your own Device for the Retail teams.

| ● | Size Form Enables shoppers to generate highly accurate measurements of their body to find proper fitting clothes and accessories, through the use of a simple questionnaire integrated on our retailers ecommerce. Size Form syncs the user’s measurement data to a sizing model we create for each SKU and presents the right size and fit for the customer. MySizeID is available for license by retailers and accessible by consumers through a web page. Currently used by more than 100 international brands. |

|

|

| ● | First Look Smart Mirror and Bring Your Own Device. Enables the size recommendations but inside the brick and mortar stores, allowing customers to filter the whole physical store by their size and fit. Both as part of a Magic Mirror experience or embedded into the buyer’s smartphone, our technologies also allow to generate “goes with” and “similar items” recommendations to increase up-sell and cross-sell while boosting brand loyalty by creating ultra-personalized shopping experiences. |

|

|

|

|

|

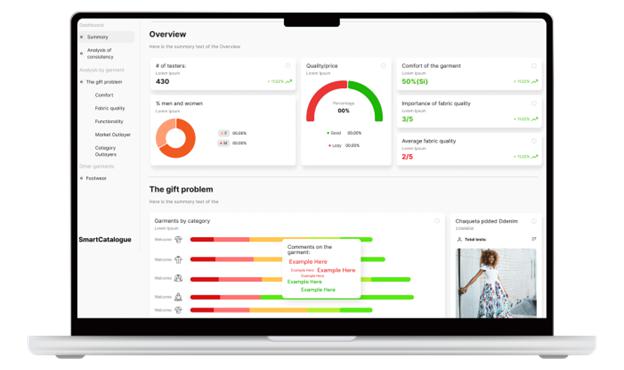

| ● | Smart Catalogue. Helping Product & Design team build the next collections based on actionable data and not just their intuition. Our AI acts as an assistant to these teams by analyzing the data generated by the rest our solutions suite, from sizes recommended to purchases and returns, including the qualitative feedback generated by our Naiz Community mystery shoppers. Smart Catalogue is able to suggest the launch of new sizes, detect new product niches and makes sure brands adapt their assortment to their customer base. |

|

| ● |

True Feedback Allows Marketing and Go To Market teams to use our Naiz Community testers to not only try on their garments and report fitting information to our technology, but also perform tasks defined by the retailer’s teams to unlock key insights from their shopping and brand experiences. |

|

|

|

The following are some select key features of our solutions:

| ● | Integration Capability. We design our solutions to be flexible and configurable, allowing our clients to match their use of our algorithms and software with their specific business processes and workflows. Our platform has been organically developed from a common code base, data structure and user interface, providing a consistent user experience with powerful features that are easily adaptable to our clients’ needs. The Naiz Fit Platform can be integrated in less than 6 weeks; | |

| ● | Intuitive user experience. Our intuitive, easy-to-use interface is based on current technology, multiple focus groups and automatically adapts to users’ devices, including mobile platforms, thereby significantly increasing accessibility of our solutions; | |

| ● | Big Data Generation. While we supply to the user the information he/she requires, we gather certain vital information such as body measurement and package volume which can be used anonymously to help the retailer acquire predictive size information on stocking, operations and consumers that may be in between sizes. All the information is being gathered and stored on our servers where it can be used by retailers; | |

| ● | Non-Invasive. In taking measurements using our solution, the smartphone camera is not utilized; instead, the measurements are captured by scanning the smartphone over the consumer’s body or package, thus ensuring greater privacy. |

Our Growth Strategy

We aim to drive revenue primarily through penetration of the U.S., Europe and Latin American markets through a business to business (B2B) model in the verticals we are targeting. We are pursuing the following growth strategies:

| ● | Sign Additional Commercial Agreements with U.S. Retailers. While we are already giving service in the U.S. through our international customers selling there, we are in various stages of discussions with U.S. Tier 1 retailers for the deployment of our size recommendation and measurement technology with a view to entering into additional commercial agreements with the rest of the Naiz Platform solutions. |

|

|

| ● | Pursue a Two-Pronged Commercialization Strategy. We are seeking to accelerate adoption of our solutions both through direct agreements with e-commerce websites, we also opened our Partners Program to add a new sales channel. While we seek to directly enter into partnerships with companies selling their own apparel, we also started working with key partners for the fashion industry such as Global-e, Scalapay, Bcome, BigBlue, Analytical Ways, Retail Rocket, Shippy Pro or Connectif. Furthermore, with the release of our FirstLook Smart Mirror, which we are offering to brick and mortar stores to digitize the physical stores, Naiz Fit is now available for online retailers utilizing the Magento, SalesForce, WooCoomerce, Shopify, Lightspeed, PrestaShop, Bitrix and Wix platforms and to brick and mortar stores through GK Software POS solution. | |

| ● | Ongoing Investment in our Technology Platform. We continue to invest in building new software capabilities and extending our platform to bring the power of accurate measurement to a broader range of applications. In particular, we seek not only to deliver size recommendations but to provide a robust, end-to-end,artificial intelligence, or AI-driven platform that inspires consumer confidence and drives revenue growth by providing a superior consumer journey to both online and the brick and mortar stores. |

| ● | Grow our database. As the usage of our measurement apps increases, our database of information including user behavior and body measurements generates valuable statistics. Such data can be used in the big data market for targeted advertising and for blind consumer data mining. | |

| ● | Identify and acquire synergistic businesses. In order to reduce our time to market and obtain complementary technologies, we are seeking to acquire technologies and businesses that are synergistic to our product offering. We completed an acquisition of Orgad which operates an omnichannel e-commerce platform and Naiz which provides SaaS technology solutions that solve size and fit issues for fashion companies. |

Market Opportunity

The global e-commerce market is expected to total $8.8 trillion in 2024, and the industry is expected to grow significantly in the coming years with no signs of slowing down. Market specialists expect a compound annual growth rate of 15.80% from 2024 to 2029: according to data from Mordor Intelligence, the market is expected to reach $18.81 trillion by 2029. In addition, it is expected that by 2024, 21.2% of total retail sales will happen online. While many sectors have found ways to increase revenue through e-commerce, e-commerce is still plagued by issues that cut into profits and negatively impact the bottom line, such as customer returns, low consumer conversion, and associated restocking and shipping costs.

Fashion/Apparel

Since the onset of the COVID-19 pandemic, an immense shift to digital was recorded, with 85.9% growth vs. pre-pandemic, according to Mastercard, and over 2 billion people worldwide who shop online, according to data from Oberlo. In November 2023, online shoppers broke records with $12.4 billion in spending on Cyber Monday, driving 9.6% year-over-year growth and making the day the biggest online shopping day of all time, according to Adobe Analytics.

In 2021, fashion companies invested between 1.6% and 1.8% of their revenues in technology, according to McKinsey, and are expected to double the investment by 2030 in order to keep up with digital natives and keep a competitive edge. Personalization in e-commerce and hybrid connectivity in brick-and-mortar retail are two key themes in the future of fashtech, according to McKinsey’s 2022 State of Fashion Technology.

|

|

In the upcoming years, inflation is expected to impact the fashion world. As prices for goods increase, the challenge will be to inspire confidence in consumers, via different smart digital tools. Brands will need to embrace creative digital tools and new channels to deepen customer relationships, and as McKinsey forecasts in their State of Fashion report for 2023, they will need to execute on priorities such as sustainability and digital acceleration.

The global fashion e-commerce market size is expected to grow from $744.4 billion in 2022 to $821.19 billion in 2023 at a compound annual growth rate of 10.3%. In 2027, the market size is expected to grow to $1,222.32 billion, at a compound annual growth rate of 10.5%, according to BRC.

Based on the importance which shoppers attribute to free shipping - 50% of cart abandonment rate is due to extra shipping costs (Baymard Institute) - the need for fashion retailers to substantiate the optimal size for a customer, thus minimizing returns, has never been more crucial.

As brands move online or significantly expand their online presence, we believe that developing innovative ways to connect with shoppers, both online and offline, has become a top priority.

Naiz Fit

Naiz Fit has a unique value proposition, based on a robust subscription B2B SaaS model, by being the only size and fit solution in the market giving brands an all in-one solution to address not only the ecommerce sizing challenge, but having a solution for each phase in the garment value chain.

Figure 1: Screenshot of the Solution Suite of Naiz Fit Platform

In 2023, we released the Naiz Fit Platform, moving from being a product to a platform with the ability to address many more challenges that fashion companies are facing throughout their whole value chain, increasing the potential contract value of each lead.

|

|

Figure 2: Diagra showing the data flow and technologies operating all over the value chain of any fashion retailer

Orgad

Overview

Orgad is a technology-enabled consumer products company that uses machine learning and data analytics to develop, market and sell products in e-commerce retailing in the global markets. Orgad has been operating as a third-party seller on www.amazon.com since 2016. To date, Orgad has generated practically all of its revenue as a third-party seller on www.amazon.com and only a negligible amount of revenue from operations on other channels. We manage more than 5,000 stock-keeping units (“SKUs”). Product categories include footwear, apparels, and accessories. Our primary strategy is to bring most of our vendors product selections to the customers. We have advanced software that assists us in identifying product gaps so we can keep such products in stock year-round including the entirety of the last quarter (holiday season) of the calendar year.

|

|

Business Model

There are three main types of business models on Amazon: wholesale, private label and retail arbitrage. Our business model is wholesale, also known as reselling, which refers to buying products in bulk directly from the brand or manufacturer at a wholesale price and making a profit by selling the product on Amazon. We sell merchandise on Amazon and the sales are fulfilled by Amazon. We pay Amazon fees for allowing us to sell on their platform.

The advantages of selling via a wholesale model:

| ● | Purchase lower unit quantities with wholesale orders than private label products. | |

| ● | Selling wholesale is less time intensive and easier to scale than sourcing products via retail arbitrage. | |

| ● | More brands will want to work with us because we can provide broader Amazon presence. |

The challenges of selling via a wholesale model:

| ● | Fierce competition on listing for Buy Box on amazon.com (as described below). | |

| ● | Developing and maintaining relationships with brand manufacturers. |

Market Description/Opportunities

According to Statista, total retail sales increased 23% to $7.24 trillion in 2023 from $5.57 trillion in 20201. U.S. ecommerce sales increased 18% to $960.15 billion in 2021 from $811.56 billion in 2020.

Amazon accounted for nearly 40% of all e-commerce in the United States and that makes Amazon the biggest ecommerce giant currently in the market.

Among more than 2.5 million active third-party sellers on Amazon in 20233, we believe we have several competitive advantages:

| ● | We have strong operations and sales teams experienced in listing, shipment, advertising, reconciliation and sales. By delivering high quality results and enhancing procedures through the process, our teams are competitive. | |

| ● | We believe our software system gives us an advantage over our competition. The system is highly customized to our business model; it collects and processes large amounts of data every day to optimize our operation and sales. Through advanced software, we can identify products that we can lead in various categories. | |

| ● | We are focused on three main categories which makes us more competitive in front of our suppliers and logistics. |

Research and Development

Our research and development team are responsible for the research, algorithm, design, development, and testing of all aspects of our measurement platform technology. We invest in these efforts to continuously improve, innovate, and add new features to our solutions.

We incurred research and development expenses of approximately $1.0 million in 2023 and $1.7 million in 2022, relating to the development of its applications and technologies. The decrease from the corresponding period primarily resulted from to a decrease in salaries expenses due to reduced headcount and a decrease in subcontractor expenses.

|

|

In 2023, the R&D department experienced significant success in their efforts to improve the performance of their size recommendation system. Through a combination of optimized algorithms and the incorporation of cutting-edge technologies, the team was able to achieve a threefold increase in the system’s speed. This breakthrough not only makes the system one of the fastest and most accurate on the market, but also reduced the operation costs, making it more cost-effective for businesses to use. Additionally, the solution is now highly scalable, allowing it to easily adapt to the needs of businesses of any size. The R&D team is now focused on further improving the system and exploring new applications for the technology.

Proprietary Rights

We rely on a combination of patent, copyright, trademark and trade secret laws in the United States and other jurisdictions, as well as contractual protections, to protect our proprietary technology.

As of December 31, 2023, we owned 16 issued patents: six in Europe, four in the U.S., three in Japan two in Canada and one in Israel which expire between January 20, 2033 and August 18, 2036, and we have two additional patent applications in process. As of such date, we do not have any registered trademarks.

We cannot provide any assurance that our proprietary rights with respect to our products will be viable or have value in the future since the validity, enforceability and type of protection of proprietary rights in software-related industries are uncertain and still evolving.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy aspects of our products or to obtain and use information that we regard as proprietary. Policing unauthorized use of our products is difficult, and while we are unable to determine the extent to which piracy of our software products exists, software piracy can be expected to be a persistent problem. In addition, the laws of some foreign countries do not protect proprietary rights to as great an extent as do the laws of the United States, and effective copyright, trademark, trade secret and patent protection may not be available in those jurisdictions. Our means of protecting our proprietary rights may not be adequate to protect us from the infringement or misappropriation of such rights by others.

Further, in recent years, there has been significant litigation in the United States involving patents and other intellectual property rights, particularly in the software and Internet-related industries. We can become subject to intellectual property infringement claims as the number of our competitors grows and our products and services overlap with competitive offerings. These claims, even if not meritorious, could be expensive to defend and could divert management’s attention from operating our business. If we become liable to third parties for infringing their intellectual property rights, we could be required to pay a substantial award of damages and to develop non-infringing technology, obtain a license or cease selling the products that contain the infringing intellectual property. We may be unable to develop non-infringing technology or obtain a license on commercially reasonable terms, if at all.

Government Regulation

We are subject to a number foreign and domestic laws and regulations that involve matters central to our business. These laws and regulations may involve privacy, data protection, intellectual property, or other subjects. Many of the laws and regulations to which we are subject are still evolving and being tested in courts and could be interpreted in ways that could harm our business. In addition, the application and interpretation of these laws and regulations often are uncertain, particularly in the new and rapidly evolving industry in which we operate. Because global laws and regulations have continued to develop and evolve rapidly, it is possible that we, our products, or our platform may not be, or may not have been, compliant with each such applicable law or regulation.

|

|

In particular, we are subject to a variety of federal, state and international laws and regulations governing the processing of personal data. Many U.S. states have passed laws requiring notification to data subjects when there is a security breach of personally identifiable data. There are also a number of legislative proposals pending before the U.S. Congress, various state legislative bodies and foreign governments concerning data protection. In addition, data protection laws in Europe and other jurisdictions outside the United States can be more restrictive than those within the United States, and the interpretation and application of these laws are still uncertain and in flux.

For example, the General Data Protection Regulation, or GDPR, which took effect on May 25, 2018, enhances data protection obligations for entities that process personal data about individuals, including obligations to cooperate with European data protection authorities, implement security measures and keep records of personal data processing activities. Noncompliance with the GDPR can trigger fines equal to the greater of €20 million or 4% of global annual revenue. In addition, the California Consumer Privacy Act of 2018, or CCPA, effective as of January 1, 2020, gives California residents expanded rights to access and require deletion of their personal information, opt out of certain personal information sharing, and receive detailed information about how their personal information is used. The CCPA provides for civil penalties for violations, as well as a private right of action for data breaches, that is expected to increase data breach litigation. Further, failure to comply with the Israeli Privacy Protection Law of 1981, and its regulations, as well as the guidelines of the Israeli Privacy Protection Authority, may expose us to administrative fines, civil claims (including class actions) and in certain cases criminal liability. Current pending legislation may result in a change of the current enforcement measures and sanctions. Given the breadth and depth of changes in data protection obligations, meeting the requirements of GDPR and other applicable laws and regulations has required significant time and resources, including a review of our technology and systems currently in use against the requirements of GDPR and other applicable laws and regulations. We have taken various steps to prepare for complying with GDPR and other applicable laws and regulations however there can be no assurance that these steps are sufficient to assure compliance. Further, additional EU laws and regulations (and member states’ implementations thereof) further govern the protection of individuals and of electronic communications. If our efforts to comply with GDPR or other applicable laws and regulations are not successful, we may be subject to penalties and fines that would adversely impact our business and results of operations, and our ability to use personal data of individuals could be significantly impaired.

Competition

We operate in a highly competitive industry that is characterized by constant change and innovation. Changes in the applications and the programing languages used to develop applications, devices, operating systems, and technology landscape result in evolving customer requirements. Our competitors include True Fit, Fit analytics and 3DLook.

The principal competitive factors in our market include the following:

| ● | High Accuracy Size Recommendations: the highest accuracy and the lowest margin of error by combining patented technology including AI and ML, size chart or spec data, and Naiz Fit property body data measurement and garment modelling technologies; |

| ● | Integration |

| ○ | Fast 4-6 week integration including size chart review, product try-ons and sizing mapping | |

| ○ | Easy 1 line of “all included” script implementation for your ecommerce and a regular product feed is all we need to launch Naiz Platform |

| ● | Technical Advantages |

| ○ | Very small library that weighs ±50kb (minimum widget loading time on product page) |

|

|

| ○ | Ultra-Fast loading and size recommendation presenting | |

| ○ | Restful API option (API integration with any website or app) |

| ● | Optimizations |

| ○ | Adjustments of size charts based on performance through try-on tests, purchase and returns analysis | |

| ○ | Widget usage analysis by Brands Specialists and BI teams | |

| ○ | Automatic pairing of sizing models with products/collections for an SKU-based size recommendation for each individual customer |

| ● | User Experience |

| ○ | Easy to use interface (10-15 seconds to receive size recommendations) | |

| ○ | Option to add/deduct questions to/from widget wizards | |

| ○ | Users automatically receive size recommendations on all products after initial usage |

| ● | Product and platform features, architecture, reliability, privacy and security, performance, effectiveness, and supported environments; | |

| ● | Product extensibility and ability to integrate with other technology infrastructures; | |

| ● | Digital operations expertise; | |

| ● | Ease of use of products and platform capabilities included in Naiz Platform; | |

| ● | Total cost of ownership; | |

| ● | Adherence to industry standards and certifications; | |

| ● | Strength of sales and marketing efforts internally led and guaranteeing efficiency on acquisition costs; | |

| ● | Brand awareness and reputation boosted by our comprehensive platform focused on fashion; and | |

| ● | Focus on customer success with dedicated team |

We believe we generally compete favorably with our competitors on the basis of these factors. We expect competition to increase as other established and emerging companies enter our markets, as customer requirements evolve, and as new products and technologies are introduced. We expect this to be particularly true as size recommendation for online fashion is a big challenge for the whole industry, making it attractive for new companies to join this space.

Many of our competitors have substantially greater financial, technical, and other resources, greater name recognition, larger sales and marketing budgets, broader distribution, and larger and more mature intellectual property portfolios.

|

|

Human Capital Management

As of March 9, 2024, we had a total of 25 employees, of which 22 were full-time employees, including 11 in sales and marketing, 4 in technology and development and 10 in administration and finance.

None of our employees are represented by a collective bargaining agreement, nor have we experienced any work stoppage. We consider our relationship with our employees to be good. Our future success depends on our continuing ability to attract and retain highly qualified engineers, sales and marketing, account management, and senior management personnel.

We also believe we have built a strong sales team focused on expanding into new markets through the acquisition of Naiz Fit and our current team.

We believe that our future success will depend, in part, on our continued ability to attract, hire and retain qualified personnel. In particular, we depend on the skills, experience and performance of our senior management and research personnel. We compete for qualified personnel with other hi-tech companies, as well as universities and non-profit research institutions.

We provide competitive compensation and benefits programs to help meet the needs of our employees. In addition to salaries, these programs (which vary by country/region and employment classification) include incentive compensation plan, pension, and insurance benefits, paid time off, among others. We also use targeted equity-based grants with vesting conditions to facilitate retention of personnel, particularly for our key employees.

The success of our business is fundamentally connected to the well-being of our people. Accordingly, we implemented an hybrid work policy in which the employees can work from home twice a week.

We consider our employees to be a key factor to our success and we are focused on attracting and retaining the best employees at all levels of our business. Inclusion and diversity is a strategic, business priority. We employ people based on relevant qualifications, demonstrated skills, performance and other job-related factors. We do not tolerate unlawful discrimination related to employment, and strive to ensure that employment decisions related to recruitment, selection, evaluation, compensation, and development, among others, are not influenced by race, color, religion, gender, age, ethnic origin, nationality, sexual orientation, marital status, or disability. Continuous monitoring to ensure pay equity has been a focus in 2023. We have continued to improve gender balance in 2023 with a focus on increasing the representation of women hired as new college graduates. We are committed to creating a trusting environment where all ideas are welcomed and employees feel comfortable and empowered to draw on their unique experiences and backgrounds.

We consider our relations with our employees to be good.

Company Information

Our principal executive offices are located at HaYarden 4 St., POB 1026, Airport City, Israel 7010000, and our telephone number is +972-3-600-9030. Our website address is www.mysizeid.com. Any information contained on, or that can be accessed through, our website is not incorporated by reference into, nor is it in any way a part of, this Annual Report on Form 10-K.

We use our website (www.mysizeid.com) as a channel of distribution of Company information. The information we post through this channel may be deemed material. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. The contents of our website are not, however, a part of this Annual Report on Form 10-K.

Corporate History

We were incorporated in the State of Delaware on September 20, 1999 under the name Topspin Medical, Inc. In December 2013, we changed our name to Knowledgetree Ventures Inc. Subsequently, in February 2014, we changed our name to MySize, Inc. In 2020, we created a subsidiary in the Russian Federation, My Size LLC.

|

|

From inception through 2012, we were engaged in research and development of a medical magnetic resonance imaging, or MRI, technology for interventional cardiology and in the development of MRI technology for use in the diagnosis and treatment of prostate cancer. In January 2012, we acquired Metamorefix Ltd., or Metamorefix. Metamorefix was incorporated in 2007, and was engaged in the development of innovative solutions for the rehabilitation of tissues, particularly skin tissues. By the end of 2012, we ceased operations and in January 2013, we sold our entire ownership interest in Metamorefix.

In September 2013, Ronen Luzon, our Chief Executive Officer, acquired control of the Company from Asher Shmuelevitch, according to which Mr. Luzon purchased 70,238 shares of common stock from Mr. Shmuelevitch, which shares represented approximately 40% of the issued and outstanding capital stock of the Company at such time, thus becoming a controlling shareholder of the Company. In connection with the acquisition, Mr. Luzon reached a settlement with our then creditors pursuant to which the main creditor, Mr. Shmuelevitch, was paid a total sum of approximately $140,000 in consideration for a full and final waiver of any and all his claims that he may have relating to any monetary indebtedness of the Company to the creditors.

In February 2014, My Size Israel, our wholly owned subsidiary, entered into a Purchase Agreement, or the Purchase Agreement, with Shoshana Zigdon, who at the time was a beneficial owner of more than 20% of our outstanding shares, with respect to the acquisition by us of certain rights related to the collection of data for measurement purposes including rights in the venture, the method and a patent application that had been filed by the Seller (PCT/IL2013/050056), or the Assets. In consideration for the sale of the Assets, we agreed to pay to Ms. Zigdon, 18% of our operating profit, directly or indirectly connected with the Assets together with value-added tax in accordance with the law for a period of seven years from the end of the development period of the aforementioned venture. In addition to the foregoing, the Purchase Agreement provided that all developments, improvements, knowledge and know-how developed and/or accumulated by us after the execution of the Purchase Agreement will be owned by us. Further, Ms. Zigdon agreed not to compete, directly or indirectly, with us in any matter relating to the Assets for a period of seven years from the end of the development period of the venture.

On May 26, 2021, we, My Size Israel, and Ms. Zigdon entered into an Amendment to Purchase Agreement, or the Amendment, which made certain amendments to the Purchase Agreement. Pursuant to the Amendment, Ms. Zigdon agreed to irrevocably waive (i) the right to repurchase certain assets related to the collection of data for measurement purposes that My Size Israel acquired from Ms. Zigdon under the Purchase Agreement and upon which our business is substantially dependent, or the Assets, and (ii) all past, present and future rights in any of the intellectual property rights sold, transferred and assigned to My Size Israel under the Purchase Agreement and any modifications, amendments or improvements made thereto, including, without limitation, any compensation, reward or any rights to royalties or to receive any payment or other consideration whatsoever in connection with such intellectual property rights, or the Waiver. In consideration of the Waiver, we issued 100,000 shares of common stock to Ms. Zigdon.

In February 2022, we completed the acquisition of Orgad and in October 2022, we completed the acquisition of Naiz Fit.

In September 2005, we commenced trading on the Tel Aviv Stock Exchange, or TASE. Between 2007 and 2012 we reported as a public company with the SEC. In August 2012, we suspended our reporting obligations. In mid-2015 we resumed reporting as a public company. On July 25, 2016, our common stock began publicly trading on the Nasdaq Capital Market, or Nasdaq, under the symbol “MYSZ”.

On December 27, 2023 our shareholders approved a voluntary delisting of our common stock from trading on the TASE. On January 11, 2024, the TASE issued a notice confirming our request to delist our common stock from the TASE, noting that the last day of trading of our common stock on the TASE will be with the last day of trading on March 27, 2024 and that the delisting our common stock is expected to take effect on March 31, 2024. All of the shares of our common stock on the TASE are expected to be transferred to the Nasdaq where they will continue to be traded.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors and the other information in this Annual Report on Form 10-K before investing in our common stock. Our business and results of operations could be seriously harmed by any of the following risks. The risks set out below are not the only risks we face. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition and/or operating results. If any of the following events occur, our business, financial condition and results of operations could be materially adversely affected. In such case, the value and trading price of our common stock could decline, and you may lose all or part of your investment.

|

|

Summary Risk Factors

The principal factors and uncertainties that make investing in our ordinary shares risky, include, among others:

Risks Related to Our Financial Position and Capital Requirements

| ● | We have historically incurred significant losses and there can be no assurance when, or if, we will achieve or maintain profitability. | |

| ● | It is difficult to forecast our future performance, which may cause our financial results to fluctuate unpredictably. | |

| ● | We will need to raise additional capital to meet our business requirements in the future, which is likely to be challenging, could be highly dilutive and may cause the market price of our common stock to decline. | |

| ● | The report of our independent registered public accounting firm contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. |

Risks Related to Our Company and Our Business

| ● | The market for our measurement technology is new and unproven, may experience limited growth and is highly dependent on U.S. retailers and online third-party resellers adopting our flagship product, MySizeID. |

| ● | Failure to effectively develop and expand our sales and marketing capabilities could harm our ability to grow our business and achieve broader market acceptance of our products. | |

| ● | We expect our sales cycle to be long and unpredictable and require considerable time and expense before executing a customer agreement, which may make it difficult to project when, if at all, we will obtain new customers and when we will generate revenue from those customers. | |

| ● | We acquired Orgad and Naiz and may in the future engage in additional acquisitions, joint ventures or collaborations which may increase our capital requirements, dilute our shareholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks. We may not realize the benefits of these acquisitions, joint ventures or collaborations. | |

| ● | If we are not able to enhance our brand and increase market awareness of our company and products, then our business, results of operations and financial condition may be adversely affected. | |

| ● | If we do not develop enhancements to our products and introduce new products that achieve market acceptance, our business, results of operations and financial condition could be adversely affected. | |

| ● | The mobile technology industry is subject to rapid technological change and, to compete, we must continually enhance our mobile device applications and custom development services. | |

| ● | Our growth depends, in part, on the success of our strategic relationships with third parties. | |

| ● | Changes in economic conditions could materially affect our business, financial condition and results of operations. | |

| ● | We rely upon third parties to provide distribution for our applications, and disruption in these services could harm our business. |

|

|

| ● | We rely on third-party hosting and cloud computing providers to operate certain aspects of our business. Any failure, disruption or significant interruption in our network or hosting and cloud services could adversely impact our operations and harm our business. | |

| ● | Real or perceived errors, failures, or bugs in our products could adversely affect our operating results and growth prospects. | |

| ● | We could be harmed by improper disclosure or loss of sensitive or confidential company, employee, or customer data, including personal data. | |

| ● | A material breach in security relating to our information systems and regulation related to such breaches could adversely affect us. | |

| ● | Our products and our business are subject to a variety of U.S. and international laws and regulations, including those regarding privacy, data protection and information security, and our customers may be subject to regulations related to the handling and transfer of certain types of sensitive and confidential information. Any failure of our products to comply with or enable our customers to comply with applicable laws and regulations would harm our business, results of operations and financial condition. | |

| ● | We may not be able to adequately protect our intellectual property, which, in turn, could harm the value of our brands and adversely affect our business. | |

| ● | We may face intense competition and expect competition to increase in the future, which could limit us in developing a customer base and generating revenue. | |

| ● | Our business operations and future development could be significantly disrupted if we lose key members of our management team. |

| ● | If we are able to expand our operations, we may be unable to successfully manage our future growth. |

Risks Related to Our Operations in Israel

| ● | Our headquarters and most of our operations are located in Israel, and therefore, political, economic and military conditions in Israel may affect our operations and results. |

Risks Related to Our Common Stock

| ● | A more active, liquid trading market for our common stock may not develop, and the price of our common stock may fluctuate significantly. | |

| ● | Our business, operating results and growth rates may be adversely affected by current or future unfavorable economic and market conditions and adverse developments with respect to financial institutions and associated liquidity risk; | |

| ● | Sales by our stockholders of a substantial number of shares of our common stock in the public market could adversely affect the market price of our common stock. | |

| ● | Our securities are traded on more than one market which may result in price variations. | |

| ● | We are a former “shell company” and as such are subject to certain limitations not generally applicable to other public companies. |

|

|

Risks Related to Our Financial Position and Capital Requirements

We have historically incurred significant losses and there can be no assurance when, or if, we will achieve or maintain profitability.

We realized a net loss of approximately $6.4 million and $8.3 million for the years ended December 31, 2023 and 2022 and had an accumulated deficit of $60 million as of December 31, 2023. Because of the numerous risks and uncertainties associated with the development and commercialization of our products and business, we are unable to predict the extent of any future losses or when we will become profitable, if at all. Expected future operating losses will have an adverse effect on our cash resources, shareholders’ equity and working capital. Our failure to become and remain profitable could depress the value of our stock and impair our ability to raise capital, expand our business, maintain our development efforts, or continue our operations. A decline in our value could also cause you to lose all or part of your investment in us.

It is difficult to forecast our future performance, which may cause our financial results to fluctuate unpredictably.

We have been developing measurement technology since 2014. Since then, our operating history has been primarily limited to research and development, pilot studies, raising capital, and more recently acquisitions and sales and marketing efforts. Because we do not yet have an established commercial operating history, and because the market for our products may rapidly evolve, it is hard for us to predict our future performance. Therefore, it may be difficult to evaluate our business and prospects. We have not yet demonstrated an ability to profitably commercialize our products. Consequently, any predictions about our future performance may not be accurate, and you may not be able to fully assess our ability to complete development and/or commercialize our products, and any future products.

We will need to raise additional capital to meet our business requirements in the future, which is likely to be challenging, could be highly dilutive and may cause the market price of our common stock to decline.

Based on our projected cash flows and the cash balances as of the date of this Annual Report on Form 10-K, our existing cash is insufficient to fund operations for a period of more than 12 months. As a result, there is substantial doubt about our ability to continue as a going concern. In order to meet our business objectives in the future, we will need to raise additional capital, which may not be available on reasonable terms or at all. Additional capital would be used to accomplish the following:

| ● | finance our current operating expenses; | |

| ● | pursue growth opportunities; | |

| ● | hire and retain qualified management and key employees; | |

| ● | respond to competitive pressure; | |

| ● | comply with regulatory requirements; and | |

| ● | maintain compliance with applicable laws. |

Current conditions in the capital markets are such that traditional sources of capital may not be available to us when needed or may be available only on unfavorable terms. Our ability to raise additional capital, if needed, will depend on conditions in the capital markets, economic conditions, and a number of other factors, many of which are outside our control, and on our financial performance. Accordingly, we cannot assure you that we will be able to successfully raise additional capital at all or on terms that are acceptable to us. If we cannot raise additional capital when needed, it may have a material adverse effect on our business, results of operations and financial condition.

|

|

To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities could result in substantial dilution for our current stockholders. The terms of any securities issued by us in future capital transactions may be more favorable to new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, which may have a further dilutive effect on the holders of any of our securities then-outstanding. We may issue additional shares of our common stock or securities convertible into or exchangeable or exercisable for our common stock in connection with hiring or retaining personnel, option or warrant exercises, future acquisitions or future placements of our securities for capital-raising or other business purposes. The issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our common stock to decline and existing stockholders may not agree with our financing plans or the terms of such financings. In addition, we may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we issue, such as convertible notes and warrants, which may adversely impact our financial condition. Furthermore, any additional debt or equity financing that we may need may not be available on terms favorable to us, or at all. If we are unable to obtain such additional financing on a timely basis, we may have to curtail our development activities and growth plans and/or be forced to sell assets, perhaps on unfavorable terms, or we may have to cease our operations, which would have a material adverse effect on our business, results of operations and financial condition.

Management has concluded that there is substantial doubt about our ability to continue as a going concern which could prevent us from obtaining new financing on reasonable terms or at all.

We have incurred significant losses and negative cash flows from operations and have an accumulated deficit that raises substantial doubt about its ability to continue as a going concern. Our audited consolidated financial statements for the year ended December 31, 2023 were prepared under the assumption that we would continue our operations as a going concern. Our independent registered public accounting firm has included a “going concern” explanatory paragraph in its report on our financial statements for the year ended December 31, 2023. If we are unable to improve our liquidity position, by, among other things, raising capital through public or private offerings or reducing our expenses, we may exhaust our cash resources and will be unable to continue our operations. If we cannot continue as a viable entity, our shareholders would likely lose most or all of their investment in us.

Risks Related to Our Company and Our Business

The market for our measurement technology is new and unproven, may experience limited growth.

The market for our measurement technology is relatively new and unproven and is subject to a number of risks and uncertainties. We believe that our future success will depend in large part on market adoption of Naiz Fit and online third-party resellers. In order to grow our business, we intend to focus on educating retailers and resellers and other potential customers about the benefits of our measurement technology, expanding the functionality of our products and bringing new products to market to increase market acceptance and use of our technology. Our ability to develop and expand the market that our products address depends upon a number of factors, including the cost savings, performance and perceived value associated with such products. The market for our products could fail to develop or there could be a reduction in interest or demand for our products as a result of a lack of consumer acceptance, technological challenges, competing products and services, weakening economic conditions and other causes. We may never successfully commercialize our products and if our products fail to achieve market acceptance, this would have a material adverse effect on our business, results of operations and financial condition.

Failure to effectively develop and expand our sales and marketing capabilities could harm our ability to grow our business and achieve broader market acceptance of our products.

Our ability to achieve customer adoption, especially among U.S. retailers will depend, in part, on our ability to effectively organize, focus and train our sales and marketing personnel. We have limited experience selling to U.S. retailers and only recently established a U.S. sales force. We believe that there is significant competition for experienced sales professionals with the skills and industry knowledge that we require. Our ability to achieve significant revenue growth in the future will depend, in part, on our ability to recruit, train and retain a sufficient number of experienced sales professionals, particularly those with experience selling to U.S. retailers. In addition, even if we are successful in hiring qualified sales personnel, new hires require significant training and experience before they achieve full productivity, particularly for sales efforts targeted at U.S. retailers and new markets. Because we only recently started sales efforts, we cannot predict whether, or to what extent, our sales efforts will be successful.

|

|

We expect our sales cycle to be long and unpredictable and require considerable time and expense before executing a customer agreement, which may make it difficult to project when, if at all, we will obtain new customers and when we will generate revenue from those customers.

In this market segment, the decision to adopt our products may require the approval of multiple technical and business decision makers, including security, compliance, procurement, operations and IT. In addition, while U.S. retailers may be willing to deploy our products on a limited basis, before they will commit to deploying our products at scale, they often require extensive education about our products and significant customer support time, engage in protracted pricing negotiations and seek to secure readily available development resources. As a result, it is difficult to predict when we will obtain new customers and begin generating revenue from these customers. As part of our sales cycle, we may incur significant expenses before executing a definitive agreement with a prospective customer and before we are able to generate any revenue from such agreement. We have no assurance that the substantial time and money spent on our sales efforts will generate significant revenue. If conditions in the marketplace generally or with a specific prospective customer change negatively, it is possible that no definitive agreement will be executed, and we will be unable to recover any of these expenses. If we are not successful in targeting, supporting and streamlining our sales processes and if revenue expected to be generated from a prospective customer is not realized in the time period expected or not realized at all, our ability to grow our business, and our operating results and financial condition may be adversely affected. If our sales cycles lengthen, our future revenue could be lower than expected, which would have an adverse impact on our operating results and could cause our stock price to decline.

We acquired Orgad and Naiz and may in the future engage in additional acquisitions, joint ventures or collaborations which may increase our capital requirements, dilute our shareholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks. We may not realize the benefits of these acquisitions, joint ventures or collaborations.

In order to reduce time to market and obtain complementary technologies, we are seeking to acquire technologies and businesses that are synergistic to our product offering. For example, during 2022, we acquired Orgad, which operates an omnichannel e-commerce platform, and Naiz Fit, which provides SaaS technology solutions that solve size and fit issues for fashion ecommerce companies. We evaluate from time to time various acquisitions and collaborations, including licensing or acquiring technologies, intellectual property rights, or businesses. The process for acquiring a company may take from several months up to a year and costs can vary greatly. We may also compete with others to acquire companies, and such competition may result in decreased availability of, or an increase in price for, suitable acquisition candidates. In addition, we may not be able to consummate acquisitions or investments that we have identified as crucial to the implementation of our strategy for other commercial or economic reasons. As a result, it may be more difficult for us to identify suitable acquisition or investment targets or to consummate acquisitions or investments on acceptable terms or at all. If we are not able to execute on any acquisition, we may not be able to achieve a future growth strategy and may lose market share.

In addition, the acquisition of Orgad, Naiz Fit and any potential future acquisition, joint venture or collaboration may entail numerous potential risks, including:

| ● | increased operating expenses and cash requirements; | |

| ● | the assumption of additional indebtedness or contingent liabilities; | |

| ● | assimilation of operations, intellectual property and products of an acquired company, including difficulties associated with integrating new personnel; | |

| ● | the diversion of our management’s attention from our existing programs and initiatives in pursuing such a strategic merger or acquisition; | |

| ● | retention of key employees, the loss of key personnel, and uncertainties in our ability to maintain key business relationships; |

|

|

| ● | risks and uncertainties associated with the other party to such a transaction, including the prospects of that party and their existing technologies; and | |

| ● | our inability to generate revenue from acquired technologies or products sufficient to meet our objectives in undertaking the acquisition or even to offset the associated acquisition and maintenance costs. |

All of the foregoing risks may be magnified as the cost, size or complexity of an acquisition or acquired company increases, or where the acquired company’s products, market or business are materially different from ours, or where more than one integration is occurring simultaneously or within a concentrated period of time. We may not be able to obtain the necessary regulatory approvals, including those of antitrust authorities and foreign investment authorities, in countries where we seek to consummate acquisitions or make investments. For those and other reasons, we may ultimately fail to consummate an acquisition, even if we announce the intended acquisition.

In addition, we may require significant financing to complete an acquisition or investment, whether through bank loans, raising of equity or debt or otherwise. We cannot assure you that such financing options will be available to us on reasonable terms, or at all. If we are not able to obtain such necessary financing, it could have an impact on our ability to consummate a substantial acquisition or investment and execute a future growth strategy. Alternatively, we may issue a significant number of shares as consideration for an acquisition, which would have a dilutive effect on our existing shareholders. For example, in partial consideration for the acquisition of Orgad, we agreed to issue up to 111,602 shares of our common stock and in the Naiz acquisition we issued 240,000 shares of our common stock. Furthermore, if we undertake acquisitions, we may incur large one-time expenses and acquire intangible assets that could result in significant future amortization expense.

If we are not able to enhance our brand and increase market awareness of our company and products, then our business, results of operations and financial condition may be adversely affected.

We believe that enhancing the “Naiz Fit” brand identity and increasing market awareness of our company and products, is critical to achieving widespread acceptance of our products. Our ability to successfully develop new retailers may be adversely affected by a lack of awareness or acceptance of our brand. To the extent that we are unable to foster name recognition and affinity for our brand, our growth may be significantly delayed or impaired. The successful promotion of our brand will depend largely on our continued marketing efforts, market adoption of our products, and our ability to successfully differentiate our products from competing products and services. Our brand promotion may not be successful or result in revenue generation. Any incident that erodes consumer affinity for our brand could significantly reduce our brand value and damage our business. If consumers perceive or experience a reduction in quality, or in any way believe we fail to deliver a consistently positive experience, our brand value could suffer and our business may be adversely affected.

In particular, adverse weather conditions can impact guest traffic at our retailers, and, in more severe cases, cause temporary retail closures, sometimes for prolonged periods. Our business is subject to seasonal fluctuations, with retail sales typically higher during certain months, such as December. Adverse weather conditions during our most favorable months or periods may exacerbate the effect of adverse weather on consumer traffic and may cause fluctuations in our operating results from quarter-to-quarter within a fiscal year.

If we do not develop enhancements to our products and introduce new products that achieve market acceptance, our business, results of operations and financial condition could be adversely affected.

Our ability to attract new customers depends in part on our ability to enhance and improve our existing products, increase adoption and usage of our products and introduce new products. The success of any enhancements or new products depends on several factors, including timely completion, adequate quality testing, actual performance quality, and overall market acceptance. Enhancements and new products that we develop may not be introduced in a timely or cost-effective manner, may contain errors or defects, may have interoperability difficulties with our platform or other products or may not achieve the broad market acceptance necessary to generate significant revenue. Furthermore, our ability to increase the usage of our products depends, in part, on the development of new use cases for our products and may be outside of our control. If we are unable to successfully enhance our existing products to meet evolving customer requirements, increase adoption and usage of our products, develop new products, then our business, results of operations and financial condition would be adversely affected.

|

|

The mobile technology industry is subject to rapid technological change and, to compete, we must continually enhance our mobile Apps and custom development services.