UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 28, 2024

ATLAS LITHIUM CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 001-41552 | 39-2078861 | ||

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

Rua Buenos Aires, 10 – 14th Floor

Sion, Belo Horizonte, Minas Gerais, Brazil, 30.315-570

(Address of principal executive offices, including zip code)

(833) 661-7900

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| Common Stock, $0.001 par value | ATLX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Registered Offering

On March 28, 2024, Atlas Lithium Corporation (the “Company”) entered into a Securities Purchase Agreement (the “Purchase Agreement”), with an accredited investor (the “Investor”), pursuant to which the Company agreed to sell and issue an aggregate of 1,871,250 shares of its common stock, par value $0.001 per share (the “Registered Shares”) in a registered direct offering (the “Registered Offering”) at a purchase price of $16.0321 per share. The Purchase Agreement contains customary representations and warranties, covenants and indemnification rights and obligations of the Company and the Investor. The closing for the sale of Registered Shares is expected to occur on or about April 4, 2024, subject to customary closing conditions (the “Closing”).

The gross proceeds from the Registered Offering are expected to be approximately $30.0 million before deducting related offering expenses. The Company estimates that the net proceeds from the Registered Offering will be approximately $29.6 million, after deducting offering expenses of $0.4 million. The Company intends to use the net proceeds from the Registered Offering primarily for general corporate purposes, including the development and commercialization of our products, general and administrative expenses, and working capital and capital expenditures.

The Registered Shares are being offered pursuant to a prospectus supplement, and a base prospectus dated September 18, 2023, which is part of a registration statement (“Registration Statement”) on Form S-3 (Registration No. 333-274223) that was declared effective by the Securities and Exchange Commission (the “SEC”) on September 18, 2023. Copies of the prospectus supplement and the accompanying prospectus relating to the Registered Shares will be available on EDGAR by visiting the SEC’s website at www.sec.gov.

At Closing, the Company and the Investor plan to enter into an investor rights agreement, substantially in the form filed as Exhibit 10.2 to this Current Report on Form 8-K (the “Investor Rights Agreements”), pursuant to which, and in connection with the purchase of the Registered Shares, the Company will agree to provide the Investor, among other rights, (i) a pro-rata participation right in future offerings of common stock or equity securities by the Company, and (ii) certain information rights.

The foregoing descriptions of the Purchase Agreement and the Investor Rights Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the agreements, which are filed as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 8-K and are incorporated herein and into the Registration Statement by this reference. The legal opinion of Brownstein Hyatt Farber Schreck, LLP, counsel to the Company, relating to the validity of the Registered Shares to be sold in the Registered Offering is filed as Exhibit 5.1 to this Current Report on Form 8-K and is incorporated herein and into the Registration Statement by this reference.

This Current Report on Form 8-K does not constitute an offer to sell any securities or a solicitation of an offer to buy any securities, nor shall there be any sale of any securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Offtake Agreement

In connection with the Closing, our subsidiary Atlas Lítio Brasil Ltda. (hereinafter “Atlas Brazil”) and the Investor intend to enter into an Offtake and Sales Agreement, substantially in the form filed as Exhibit 10.3 to this Current Report on Form 8-K (the “Offtake Agreement”), pursuant to which Atlas Brazil will agree to sell and deliver to the Investor, and the Investor will agree to purchase and take delivery of, (i) the spot quantity of fifteen thousand (15,000) dry metric tons of Atlas Brazil’s product, and, subject to the fulfillment of certain conditions precedent, (ii) up to sixty thousand (60,000) dry metric tons of Atlas Brazil’s product for each year, up to a total of three hundred thousand (300,000) dry metric tons.

The foregoing description of the terms of the Offtake Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Offtake Agreement, which is attached to this Current Report on Form 8-K as Exhibit 10.3 and is incorporated herein and into the Registration Statement by reference. Unless the context otherwise indicates, references to the “Company” are to Atlas Lithium Corporation and/or its subsidiaries.

Item 7.01. Regulation FD Disclosure.

On March 28, 2024, the Company issued a press release announcing the Registered Offering. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

This information and the information contained in Exhibit 99.1 is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in any such filing, regardless of any general incorporation language in the filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit No. |

Description | |

| 5.1 | Opinion of Brownstein Hyatt Farber Schreck, LLP | |

| 10.1 | Securities Purchase Agreement dated March 28, 2024 | |

| 10.2† | Form of Investor Rights Agreement | |

| 10.3† | Form of Offtake and Sales Agreement | |

| 23.1 | Consent of Brownstein Hyatt Farber Schreck, LLP (included in Exhibit 5.1) | |

| 99.1 | Press Release dated March 28, 2024 | |

| 104 | Cover Page Interactive Data File (embedded with the Inline XRBL document) |

† Certain portions of the exhibit have been omitted in accordance with Item 601(b)(10)(iv) of Regulation S-K. The Company agrees to furnish on a supplemental basis an unredacted copy of the exhibit and its materiality and privacy or confidentiality analyses to the Securities and Exchange Commission upon its request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ATLAS LITHIUM CORPORATION | ||

| Dated: April 1, 2024 | By: | /s/ Marc Fogassa |

| Name: | Marc Fogassa | |

| Title: | Chief Executive Officer | |

Exhibit 5.1

|

Brownstein Hyatt Farber Schreck, LLP 702.382.2101 main 100

North City Parkway, Suite 1600 |

April 1, 2024

Atlas Lithium Corporation

Rua Buenos Aires, 10-14th Floor

Belo Horizonte, Minas Gerais, Brazil 30.315-570

To the addressee set forth above:

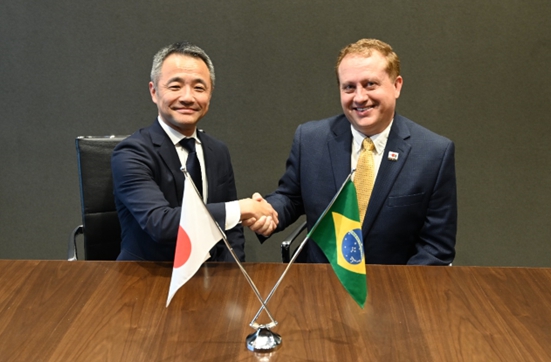

We have acted as local Nevada counsel to Atlas Lithium Corporation, a Nevada corporation (the “Company”), in connection with the issuance and sale by the Company of 1,871,250 shares (the “Shares”) of the Company’s common stock, par value $0.001 per share (the “Common Stock”), pursuant to that certain Securities Purchase Agreement, dated as of March 28, 2024 (the “Purchase Agreement”), by and between the Company and Mitsui & Co., Ltd, a corporation organized under the laws of Japan, as the purchaser, all as more fully described in the Registration Statement on Form S-3 (File No. 333-274223) (as amended through the date hereof, the “Registration Statement”), including the base prospectus dated September 18, 2023, contained therein (the “Base Prospectus”), as supplemented by the prospectus supplement dated April 1, 2024 (the Base Prospectus, as so supplemented, is hereinafter referred to as the “Prospectus”), each as filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”). This opinion letter is being furnished at your request in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Act.

In our capacity as such counsel, we are familiar with the proceedings taken and proposed to be taken by the Company in connection with the authorization, issuance and sale of the Shares, as contemplated by the Purchase Agreement and as described in the Registration Statement and the Prospectus. For purposes of this opinion letter, and except to the extent set forth in the opinions below, we have assumed that all such proceedings have been or will be timely completed in the manner presently proposed in the Purchase Agreement and the Registration Statement and the Prospectus.

For purposes of issuing this opinion letter, we have made such legal and factual examinations and inquiries, including an examination of originals or copies certified or otherwise identified to our satisfaction as being true copies of (i) the Registration Statement and the Prospectus, (ii) the Purchase Agreement; (iii) the articles of incorporation and bylaws of the Company; and (iv) such agreements, instruments, resolutions of the board of directors of the Company and committees thereof and other corporate records and documents as we have deemed necessary or appropriate for the purpose of issuing this opinion letter, and we have obtained from officers and other representatives and agents of the Company and from public officials, and have relied upon, such certificates, representations, assurances and public filings, as we have deemed necessary or appropriate.

| Atlas Lithium Corporation |

| April 1, 2024 |

| Page |

Without limiting the generality of the foregoing, in our examination, we have, with your permission, assumed without independent verification: (i) the statements of fact and all representations and warranties set forth in the documents we have reviewed are true and correct as to factual matters, in each case as of the date or dates of such documents and as of the date hereof; (ii) each natural person executing any of the documents we have reviewed has sufficient legal capacity to do so; (iii) all documents submitted to us as originals are authentic, the signatures on all documents that we have reviewed are genuine and all documents submitted to us as certified, conformed, photostatic, facsimile or electronic copies conform to the original document; (iv) all corporate records made available to us by the Company, and all public records we have reviewed, are accurate and complete; and (v) after the issuance of any Shares, the total number of issued and outstanding shares of Common Stock, together with the total number of shares of Common Stock then reserved for issuance or obligated to be issued by the Company pursuant to any agreement or arrangement or otherwise, will not exceed the total number of shares of Common Stock then authorized under the Company’s articles of incorporation.

We are qualified to practice law in the State of Nevada. The opinions set forth herein are expressly limited to and based exclusively on the general corporate laws of the State of Nevada, and we do not purport to be experts on, or to express any opinion with respect to the applicability or effect of, the laws of any other jurisdiction. We express no opinion concerning, and we assume no responsibility as to laws or judicial decisions related to, or any orders, consents or other authorizations or approvals as may be required by, any federal laws, rules or regulations, including, without limitation, any federal securities laws, rules or regulations, or any state securities or “blue sky” laws, rules or regulations.

Based upon the foregoing and in reliance thereon, and having regard to legal considerations and other information that we deem relevant, we are of the opinion that:

1. The Shares have been duly authorized by the Company.

2. If, when and to the extent any Shares are issued and sold in accordance with all applicable terms and conditions set forth in, and in the manner contemplated by, the Purchase Agreement (including payment in full of any and all consideration required for such Shares as prescribed thereunder), and as described in the Registration Statement and Prospectus, such Shares will be validly issued, fully paid and nonassessable.

The opinions expressed herein are also based upon the facts in existence on the date hereof. In delivering this opinion letter to you, we disclaim any obligation to update or supplement the opinions set forth herein or to apprise you of any changes in any laws or facts after the later of the date hereof and the filing date of the Prospectus Supplement. No opinion is offered or implied as to any matter, and no inference may be drawn, beyond the strict scope of the specific issues expressly addressed by the opinions set forth herein.

We hereby consent to the filing, and/or the incorporation by reference, of this opinion letter as an exhibit to the Registration Statement and the Prospectus, and to the reference to our firm therein under the heading “Legal Matters”. In giving such consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

Very truly yours,

/s/ Brownstein Hyatt Farber Schreck, LLP

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this “Agreement”) is dated as of March 28, 2024 between ATLAS LITHIUM CORPORATION, a Nevada corporation listed on the Nasdaq Capital Market (NASDAQ: ATLX) (the “Company”), and MITSUI & CO., LTD., a corporation organized under the laws of Japan (the “Purchaser”). Each of the Company and Purchaser may be referred to herein as, individually, a “Party” and collectively, the “Parties.”

WHEREAS, subject to the terms and conditions set forth in this Agreement, the Company desires to issue and sell to the Purchaser, and the Purchaser desires to purchase from the Company certain shares of Common Stock as more fully described in this Agreement (the “Transaction”);

WHEREAS the Board of Directors has (i) determined that it is in the best interests of the Company and the stockholders of the Company that the Company enter into this Agreement and the other Transaction Documents (as defined in Section 1.1 herein) and consummate the Transaction and the other transactions contemplated hereby and thereby on the terms and subject to the conditions set forth herein and therein, and (ii) approved and declared advisable this Agreement, the other Transaction Documents, the Transaction and the other transactions contemplated hereby and thereby on the terms and subject to the conditions set forth herein and therein; and

WHEREAS, the Purchaser has approved its entry into this Agreement and the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby, including, without limitation, the Transaction, upon the terms and subject to the conditions set forth herein and therein.

NOW, THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration the receipt and adequacy of which are hereby acknowledged, the Company and the Purchaser agree as follows:

ARTICLE I.

DEFINITIONS

1.1 Definitions. In addition to the terms defined elsewhere in this Agreement, for all purposes of this Agreement, the following terms have the meanings set forth in this Section 1.1:

“AAA” has the meaning ascribed to such term in Section 6.8.

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person as such terms are used in and construed under Rule 405 under the Securities Act.

“Anti-Corruption Laws” has the meaning ascribed to such term in Section 3.1(t).

“Apollo Resources” means and Apollo Resources Corporation, a company incorporated under the laws of the Republic of the Marshall Islands.

“Atlas Brasil” means Atlas Lítio Brasil Ltda., a company incorporated under the laws of Brazil.

“Base Prospectus” has the meaning ascribed to such term in Section 3.1(w)(i).

“Board of Directors” means the board of directors of the Company.

“Business Day” means any day other than Saturday, Sunday or other day on which commercial banks are authorized or required by Law to be closed in Boca Raton, Florida or Tokyo, Japan.

“Closing” means the closing of the purchase and sale of the Shares pursuant to Section 2.2.

“Closing Date” means the Trading Day on which all of the Transaction Documents have been executed and delivered by the applicable parties thereto, and all conditions precedent to (i) the Purchaser’s obligations to pay the Subscription Amount and (ii) the Company’s obligations to deliver the Shares, in each case, have been satisfied or waived.

“Code” means the Internal Revenue Code of 1986, as amended.

“Commission” means the United States Securities and Exchange Commission.

“Common Stock” means the common stock of the Company, par value $0.001 per share.

“Common Stock Equivalents” means any securities of the Company which would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, preferred stock, or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Company Fundamental Representations” means the representations and warranties set forth in Section 3.1(a)(i) (Organization and Qualification); Section 3.1(b) (Authorization; Enforcement); Section 3.1(c) (No Conflicts); Section 3.1(f)(i) (Capitalization); and Section 3.1(x) (Brokers).

“Company Properties” has the meaning ascribed to such term in Section 3.1(p)(i).

“DRS” has the meaning ascribed to such term in Section 2.4(a)(iv).

“Environmental Law” means any federal, national, state, county, municipal, provincial, local, foreign, supranational or multinational law, act, regulation, ordinance, code, statute currently in effect in Brazil relating to public or worker health and safety (to the extent relating to exposure to Hazardous Materials), the protection of the environment (including, without limitation, ambient or indoor air, surface water, groundwater, land, wildlife, vegetation and landscape) and environmental conservation units (whether full protection or sustainable use), the preservation areas of local or traditional communities of cultural or historic heritage, or pollution, including, without limitation, any such law relating to Hazardous Materials (and including, without limitation, any Laws relating to Hazardous Materials in lithium spodumene concentrate mined, manufactured or sold by the Company and Atlas Brasil and associated labeling or packaging content requirements or restrictions relating to environmental attributes or as respects product takeback or end-of life requirements).

|

|

“Environmental Permits” means authorizations, approvals, licenses, franchises, clearances, permits, certificates, required under Environmental Laws.

“ERISA” means the Employee Retirement Income Security Act of 1974.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“GAAP” means generally accepted accounting principles, consistently applied, in the United States.

“Government Official” means: (a) any director, officer, employee, or representative of any Governmental Authority; (b) any Person acting in an official capacity for any Governmental Authority; or (c) any political party, party official, or candidate for political office.

“Governmental Authority” (a) any U.S. or foreign national, federal, state, provincial, county municipal, or local government entity, or other subdivision thereof; (b) any public international or multinational organization or authority; (c) any authority, agency, commission, or any entity exercising executive, legislative, judicial, regulatory, police, tribal, taxing, or administrative functions, power or authority of or pertaining to government; or (d) any state-owned or controlled enterprise.

“Hazardous Materials” means any pollutant, contaminant, waste or chemical or any toxic, radioactive, ignitable, corrosive, reactive or otherwise hazardous substance or material, and any substance, waste, or material that is regulated by or for which standards of conduct or liability may be imposed pursuant to Environmental Laws, including, without limitation, petroleum and petroleum byproducts, per- and poly-fluoroalkyl substances, polychlorinated biphenyls, lead, asbestos, noise, radiation, toxic mold, odor and pesticides.

“Indemnitee” has the meaning ascribed to such term in Section 4.3(c).

“Indemnitor” has the meaning ascribed to such term in Section 4.3(c).

“Investor Rights Agreement” has the meaning ascribed to such term in Section 2.4(a)(i).

“Knowledge” of the Company, with respect to any matter in question, means the actual knowledge of the Company’s Chief Executive Officer, Chief Financial Officer, Chief Geological Officer, Vice President of Business Development and the Vice President of Corporate Strategy, in each case, after due inquiry.

“Law” means any U.S. or foreign federal, state, local law, statute, code, constitution, treaty, ordinance, rule, regulation, order, judgment, writ, stipulation, award, injunction, decree or arbitration award or finding.

|

|

“Liens” means any lien, security interest, right of first refusal, deed of trust, mortgage, pledge, encumbrance, restriction on transfer, proxies, voting trusts or agreements, hypothecation, assignment, claim, right of way, defect in title, encroachment, easement, restrictive covenant, charge, deposit arrangement or preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever (including, without limitation, any restriction on the voting interest of any security, any restriction on the transfer of any security (except for those imposed by applicable securities Laws) or other asset or any restriction on the possession, exercise or transfer of any other attribute of ownership of any asset).

“Material Adverse Effect” means any change, event, effect, occurrence or circumstance that, individually or in the aggregate, (i) has had, or would reasonably be expected to have, a material adverse effect on the business, condition (financial or otherwise), results of operations or prospects of the Company and Atlas Brasil, taken as a whole, (ii) prevents or materially impairs or materially delays, or would reasonably be expected to prevent or materially impair or materially delay, the consummation of the Transaction, or (iii) would reasonably be expected to have a material adverse effect on the Company’s or Atlas Brasil’s ability to develop the lithium project in the State of Minas Gerais, Brazil or undertake the production of 270,000 metric tons per year or more of lithium spodumene concentrate by the Company and Atlas Brasil.

“Material Contract” means, with respect to the Company or Atlas Brasil (other than employee benefit plans), any “material contract” (as defined in Item 601(b)(10) of the Regulation S-K promulgated by the Commission) that was filed or is required to be filed with respect to the SEC Reports.

“Nasdaq” means the Nasdaq Capital Market and any successor stock exchange or inter- dealer quotation system operated by the Nasdaq Capital Market or any successor thereto.

“Neves Project” means the project of Atlas Brasil currently under development within the boundaries of the Mining Rights No. 832.925/2008, 833.331/2006 and 833.356/2007, or any similar rights that replaces or succeeds the above referenced mining rights and cover that same area that is currently represented by Mining Rights No. 832.925/2008, 833.331/2006 and 833.356/2007.

“Offtake Agreement” has the meaning ascribed to such term in Section 2.4(a)(ii).

“Per Share Purchase Price” equals $16.0321 per share.

“Permit” has the meaning ascribed to such term in Section 3.1(q)(ii).

“Permitted Liens” means (i) Liens securing liabilities which are reflected or reserved against in the latest consolidated financial statements of the Company to the extent so reflected or reserved; (ii) statutory Liens for Taxes not yet delinquent or which are being contested in good faith through appropriate proceedings and for which adequate reserves have been established on the latest consolidated financial statements of the Company in accordance with GAAP; (iii) landlord’s, mechanic’s, materialmen’s, and other similar statutory Liens arising or incurred in the ordinary course of business for amounts not yet due and payable or which are being contested in good faith if adequate reserves with respect thereto have been established on the latest consolidated financial statements of the Company in accordance with GAAP; (iv) purchase money Liens and Liens securing rental payments under capital lease arrangements; (v) zoning, building codes and other land use Laws regulating the use or occupancy of real property or the activities conducted thereon which are imposed by any Governmental Authority, any violation of which would not be material to the Company and its Subsidiaries taken as a whole; (vi) easements, rights, covenants, conditions and restrictions of record that do not or would not materially impair the use or occupancy of the real property in the operation of the Company’s or Atlas Brasil’s businesses; and (vii) Liens in the form of security deposits or otherwise collateralized with letters of credit or similar instruments.

|

|

“Person” means an individual, corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Preferred Stock” has the meaning ascribed to such term in Section 3.1(f)(i).

“Proceeding” means any civil, criminal or administrative action, claim, suit, arbitration or proceeding, including, without limitation, any appeal therefrom, including any formal investigation that is reasonably expected to result on an action or proceeding as enumerated above.

“Prospectus” has the meaning ascribed to such term in Section 3.1(w)(i).

“Purchaser Fundamental Representations” means the representations and warranties set forth in Section 3.2(a) (Organization; Authority); Section 3.2(f) (No Conflicts); and Section 3.2(h) (Brokers).

“Registration Statement” shall have the meaning ascribed to such term in Section 3.1(w)(i).

“Required Approvals” shall have the meaning ascribed to such term in Section 3.1(d).

“Rule 144” means Rule 144 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“Rule 424” means Rule 424 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“Rules and Regulations” means the respective rules and regulations of the Commission under the Securities Act and the Exchange Act.

“Sanctions” means U.S. Laws governing economic sanctions, including those administered by the U.S. Treasury Department’s Office of Foreign Assets Control codified at 31 C.F.R. Part 500 et. seq., and the U.S. Department of State.

“SEC Reports” shall have the meaning ascribed to such term in Section 3.1(g).

|

|

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Series A Preferred Stock” means the Series A Convertible Preferred Stock, par value $0.001 per share.

“Series D Preferred Stock” means the Series D Convertible Preferred Stock, par value $0.001 per share.

“Shares” means the shares of Common Stock issued or issuable to the Purchaser pursuant to this Agreement.

“Short Sales” means all “short sales” as defined in Rule 200 of Regulation SHO under the Exchange Act (but shall not be deemed to include locating and/or borrowing shares of Common Stock).

“Stock Incentive Plan” means the Company’s 2023 Stock Incentive Plan as duly adopted by the Board of Directors and approved by the Company’s issued and outstanding voting capital stock pursuant to which consultants, employees, officers or directors of the Company have been or may be granted from time to time shares of Common Stock, options and/or other securities of the Company exercisable or exchangeable for or convertible into shares of Common Stock for services rendered to the Company.

“Subscription Amount” means, as to the Purchaser, the aggregate amount to be paid for Shares purchased hereunder, in United States dollars and in immediately available funds. The Subscription Amount shall be equivalent to USD $30 million.

“Subsidiary” means, with respect to any Person, any corporation of which a majority of the total voting power of shares of stock entitled to vote in the election of directors, managers or trustees thereof is at the time owned or controlled, directly or indirectly, by such Person or one or more of the other Subsidiaries of such Person or a combination thereof or any partnership, association or other business entity of which a majority of the partnership or other similar ownership interest is at the time owned or controlled, directly or indirectly, by such Person or one or more Subsidiaries of such Person or a combination thereof. For purposes of this definition, a Person is deemed to have a majority ownership interest in a partnership, association or other business entity if such Person is allocated a majority of the gains or losses of such partnership, association or other business entity or is or controls the managing director, managing member or general (or equivalent) partner of such partnership, association or other business entity.

“Tax” or “Taxes” means any taxes and similar assessments, fees, and other governmental charges imposed by any Governmental Authority, including, without limitation, income, profits, gross receipts, net proceeds, ad valorem, value added, turnover, sales, use, property, personal property (tangible and intangible), stamp, excise, duty, franchise, capital stock, transfer, payroll, employment, severance, and estimated tax, and any unclaimed property or escheat obligations, together with any interest and any penalties, additions to tax or additional amounts imposed by any Governmental Authority, whether disputed or not, and any secondary liabilities for any of the foregoing amounts payable as a transferee or successor, by assumption or by contract or by operation of law.

|

|

“Trade Compliance Laws” means (a) U.S. Laws governing the exportation of goods, technology, software, and services, including the Export Administration Regulations (15 C.F.R. § 730 et seq.); and (b) Sanctions.

“Trading Day” means a day on which the principal Trading Market is open for trading.

“Trading Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the Nasdaq Capital Market, the New York Stock Exchange or OTC (or any successors to any of the foregoing).

“Transaction Documents” means this Agreement, the Investor Rights Agreement, the Offtake Agreement and all exhibits and schedules thereto and any other documents or agreements executed in connection with the Transaction.

“Transfer Agent” means VStock Transfer, LLC, the current transfer agent of the Company, with a mailing address of 18 Lafayette Place, Woodmere, NY 11598, and any successor transfer agent of the Company.

“U.S. Person” has the meaning ascribed to such term in Section 3.2(b).

ARTICLE II.

PURCHASE AND SALE

2.1 Sale and Purchase. On the Closing Date, upon the terms and subject to the conditions set forth herein, the Company agrees to issue and sell to the Purchaser, and the Purchaser agrees to purchase from the Company, the Shares. At Closing, the Purchaser’s Subscription Amount shall be delivered by wire transfer of immediately available funds to the account designated by the Company pursuant to Section 2.4(a)(iii) below, and the Company shall deliver to the Purchaser the Shares as determined pursuant to Section 2.4(a). The Company shall issue the Shares and cause the Shares to be delivered by the Transfer Agent to a designee of the Purchaser via DRS (as defined below).

2.2 Closing. The Closing shall occur virtually at the offices of the Company or such other location as the parties shall mutually agree on the Closing Date, which shall be no later than the second (2nd) Business Day after the satisfaction or waiver (to the extent permitted hereunder) of the last to be satisfied or waived of the conditions set forth in Section 2.4 and Section 2.5 (other than those conditions that by their terms are to be satisfied at the Closing, but subject to the satisfaction or waiver to the extent permitted hereunder of such conditions) or such other time and date as the parties mutually agree in writing.

2.3 Adjustments. If between the date of this Agreement and the Closing Date the outstanding shares of Common Stock shall have been changed into a different number of shares or a different class by reason of the occurrence of any stock split, reverse stock split, stock dividend (including, without limitation, any dividend or other distribution of securities convertible into Common Stock), reorganization, recapitalization, reclassification, combination, exchange of shares or other like change, the Per Share Purchase Price, Subscription Amount and Shares to be delivered pursuant to this Article II shall be appropriately adjusted to reflect such stock split, reverse stock split, stock dividend (including, without limitation, any dividend or other distribution of securities convertible into Common Stock), reorganization, recapitalization, reclassification, combination, exchange of shares or other like change.

|

|

2.4 Deliveries.

(a) On or prior to the Closing Date, the Company shall deliver or cause to be delivered to the Purchaser the following:

(i) the Investor Rights Agreement duly executed by the Company in the form attached hereto as Exhibit A (the “Investor Rights Agreement”);

(ii) the Offtake Agreement duly executed by Atlas Brasil in the form attached hereto as Exhibit B (the “Offtake Agreement”);

(iii) the Company’s wire instructions, on Company letterhead and executed by the Chief Executive Officer or Chief Financial Officer;

(iv) a copy of the irrevocable instructions to the Transfer Agent instructing the Transfer Agent to deliver on an expedited basis via The Depository Trust Company Direct Registration System (“DRS”) a number of Shares equal to the Subscription Amount divided by the Per Share Purchase Price, registered in the name of the Purchaser;

(v) a certificate of the Company, validly executed for and on behalf of the Company and in its name by a duly authorized officer thereof, certifying that the conditions set forth in Section 2.5(b) have been satisfied; and

(vi) a certificate executed by the Secretary of the Company, signing in such capacity (i) certifying that attached thereto are true and complete copies of the resolutions duly adopted by the Board of Directors authorizing the execution and delivery of this Agreement and the other Transaction Documents and the consummation of the transactions contemplated hereby and thereby (including, without limitation, the Transaction), which authorization shall be in full force and effect on and as of the date of such certificate, and (ii) certifying and attesting to the office, incumbency, due authority and specimen signatures of each Person who executed this Agreement and the other Transaction Documents for or on behalf of the Company.

(b) On or prior to the Closing Date, the Purchaser shall deliver or cause to be delivered to the Company the following:

(i) the Investor Rights Agreement duly executed by the Purchaser;

(ii) the Offtake Agreement duly executed by the Purchaser;

(iii) the Subscription Amount, which shall be delivered by wire transfer of immediately available funds to the Company’s bank account set forth on the Company’s wire transfer instructions referenced in Section 2.4(a)(iii) above; and

|

|

(iv) a certificate of the Purchaser, validly executed for and on behalf of the Purchaser and in its name by the authorized signatory of this Agreement, certifying that the conditions set forth in Section 2.5(a) have been satisfied.

2.5 Closing Conditions.

(a) The obligations of the Company hereunder in connection with the Closing are subject to the following conditions being met:

(i) Other than the Purchaser Fundamental Representations, the Purchaser’s representations and warranties contained herein shall be true and correct in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) as of the date of this Agreement and on the Closing Date (unless as of a specific date therein in which case they shall be accurate as of such date);

(ii) the Purchaser Fundamental Representations shall be true and correct in all respects (without giving effect to any materiality or Material Adverse Effect qualifications set forth therein) as of the date of this Agreement and on the Closing Date (unless as of a specific date therein in which case they shall be accurate as of such date);

(iii) all obligations, covenants and agreements of the Purchaser required to be performed at or prior to the Closing Date shall have been performed;

(iv) no stop order suspending the effectiveness of the Registration Statement shall have been issued and no Proceedings for that purpose or pursuant to Section 8A under the Securities Act, shall have been instituted or, to the Knowledge of the Company or the knowledge of the Purchaser, shall be contemplated by the Commission; and

(v) the delivery by the Purchaser of the items set forth in Section 2.4(b) of this Agreement.

(b) The respective obligations of the Purchaser hereunder in connection with the Closing are subject to the following conditions being met:

(i) other than the Company Fundamental Representations, the representations and warranties of the Company contained herein shall be true and correct in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) as of the date of this Agreement and on the Closing Date (unless as of a specific date therein in which case they shall be accurate as of such date);

(i) the Company Fundamental Representations shall be true and correct in all respects (without giving effect to any materiality or Material Adverse Effect qualifications set forth therein) as of the date of this Agreement and on the Closing Date (unless as of a specific date therein in which case they shall be accurate as of such date);

(ii) no stop order suspending the effectiveness of the Registration Statement shall have been issued and no Proceedings for that purpose or pursuant to Section 8A under the Securities Act, shall have been instituted or, to the Knowledge of the Company or the knowledge of the Purchaser, shall be contemplated by the Commission;

|

|

(iii) the Company shall have filed an application for listing of the Shares on Nasdaq prior to the Closing;

(iv) all filings with the Commission required by Rule 424 under the Securities Act to have been filed prior to the issuance of the Shares shall have been made within the applicable time period prescribed for such filing by Rule 424;

(v) all obligations, covenants and agreements of the Company required to be performed at or prior to the Closing Date shall have been performed;

(vi) the Company shall have delivered the items set forth in Section 2.4(a) of this Agreement;

(vii) there shall have been no Material Adverse Effect with respect to the Company since the date hereof;

(viii) all Required Approvals shall have been obtained; and

(ix) from the date hereof to the Closing Date, trading in the Common Stock shall not have been suspended by the Commission or the Company’s principal Trading Market, and, at any time prior to the Closing Date, trading in securities generally as reported by Bloomberg L.P. shall not have been suspended or limited, or minimum prices shall not have been established on securities whose trades are reported by such service, or on any Trading Market, nor shall a banking moratorium have been declared either by the United States or New York State authorities.

ARTICLE III.

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. The Company hereby makes the following representations and warranties to the Purchaser as of the date hereof and as of the Closing Date:

(a) Organization and Qualification.

(i) The Company is a corporation duly organized, validly existing and in good standing under the Laws of the jurisdiction of its incorporation, with the requisite corporate power and authority to own and operate its properties and assets and to carry on its business as currently conducted. The Company is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned or leased by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, has not had and would not reasonably be expected to have a Material Adverse Effect.

|

|

(ii) A true and complete list of the Company’s Subsidiaries is set forth on Schedule 3.1(a)(ii). Atlas Brasil is a legal entity duly organized, validly existing and in good standing under the Laws of the jurisdiction of its incorporation or formation, with the requisite corporate power and authority to own and operate its properties and assets and to carry on its business as currently conducted. Atlas Brasil is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned or leased by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, has not had and would not reasonably be expected to have a Material Adverse Effect. Prior to the date hereof, the Purchaser has been provided with complete and correct copies of each of the Company’s and Atlas Brasil’s organizational documents, and each as so delivered is in full force and effect.

(b) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and each of the other Transaction Documents, including, without limitation, the Transaction, and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement and the other Transaction Documents by the Company, the performance by the Company of its covenants and obligations hereunder and the consummation by it of the Transaction and the other transactions contemplated hereby and thereby have been duly authorized and approved by all necessary action on the part of the Company and no further action is required by the Company, the Board of Directors or the Company’s stockholders in connection herewith or therewith other than in connection with the Required Approvals. This Agreement and each of the Transaction Documents have been (or upon delivery will have been) duly executed and delivered by the Company and constitute or, when delivered in accordance with the terms hereof and thereof, will constitute, the legal, valid and binding obligation of the Company enforceable against the Company in accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other Laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by Laws relating to the availability of specific performance, injunctive relief or other equitable.

(c) No Conflicts. The execution, delivery and performance by the Company of this Agreement and the other Transaction Documents, the issuance and sale of the Shares and the consummation by it of the transactions contemplated hereby and thereby do not and will not (i) conflict with or violate any provision of the Company’s certificate or articles of incorporation, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of the Company, or give to others any rights of termination, amendment, anti-dilution or similar adjustments, acceleration or cancellation (with or without notice, lapse of time or both) of, any Material Contract to which the Company is a party or by which any property or asset of the Company is bound or affected, or (iii) subject to the Required Approvals, conflict with or result in a violation of any applicable Law or other restriction of any court or Governmental Authority to which the Company is subject, or by which any property or asset of the Company is bound or affected; except in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected to result in a Material Adverse Effect.

|

|

(d) Filings, Consents and Approvals. Neither the Company nor Atlas Brasil is required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state, local or other Governmental Authority or other Person in connection with the execution, delivery and performance by the Company of this Agreement or any other Transaction Documents, other than such filings as are required to be made under applicable federal and state securities Laws and in compliance with any applicable requirements of Nasdaq (collectively, the “Required Approvals”).

(e) Issuance of the Shares. The Shares are duly authorized and, when issued and paid for in accordance with the applicable Transaction Documents, will be duly and validly issued, fully paid and nonassessable, free and clear of all Liens imposed by the Company. The Company has reserved from its duly authorized capital stock the maximum number of shares of Common Stock issuable pursuant to this Agreement.

(f) Capitalization.

(i) The authorized capital stock of the Company consists of (i) 200,000,000 shares of Common Stock, and (ii) 10,000,000 shares of preferred stock, par value $0.001 per share, of the Company (the “Preferred Stock”), one of which is designated as Series A Preferred Stock and 1,000,000 of which are designated as Series D Preferred Stock. As of the date of this Agreement: (A) 12,769,581 shares of Common Stock were issued and outstanding; (B) one share of Series A Preferred Stock was issued and outstanding; (C) no shares of Series D Preferred Stock were issued and outstanding, (D) up to 2,074,373 shares of Common Stock issuable in respect of the issued and outstanding Common Stock Equivalents, including those committed under the Company’s Stock Incentive Plan, and (E) no shares of Common Stock were held by the Company as treasury shares. As of the date of this Agreement, the Company has no shares of capital stock reserved for or otherwise subject to issuance, other than pursuant to the exercise of employee stock options and/or the issuance of shares of Common Stock to qualified participants pursuant to the Company’s Stock Incentive Plan, or pursuant to agreements with certain advisors and consultants set forth on Schedule 3.1(f)(i) and pursuant to the conversion and/or exercise of Common Stock Equivalents outstanding. No Person has any right of first refusal, preemptive right, right of participation, or any similar right to participate in the transactions contemplated by the Transaction Documents. Except pursuant to the Stock Incentive Plan and the agreements listed in Schedule 3.1(f)(i), there are no outstanding options, warrants, scrip rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities, rights or obligations convertible into or exercisable or exchangeable for, or giving any Person any right to subscribe for or acquire, any shares of Common Stock or contracts, commitments, understandings or arrangements by which the Company is or may become bound to issue additional shares of Common Stock or Common Stock Equivalents. The issuance and sale of the Shares will not obligate the Company to issue shares of Common Stock, Common Stock Equivalents, shares of Preferred Stock or other securities to any Person (other than the Purchaser). There are no outstanding securities or instruments of the Company with any provision that adjusts the exercise, conversion, exchange or reset price of such security or instrument upon an issuance of securities by the Company. There are no outstanding securities or instruments of the Company that contain any redemption or similar provisions, and there are no contracts, commitments, understandings or arrangements by which the Company is or may become bound to redeem a security of the Company. All of the outstanding shares of capital stock of the Company are duly authorized, validly issued, fully paid, and nonassessable, and have been issued in compliance with applicable federal securities Laws in all material respects, and none of such outstanding shares was issued in violation of any preemptive rights or similar rights to subscribe for or purchase securities. No further approval or authorization of any stockholder, the Board of Directors or others is required for the issuance and sale of the Shares. Except as set forth on Schedule 3.1(f)(i), there are no stockholders agreements, voting agreements or other similar agreements with respect to the Company’s capital stock to which the Company is a party.

|

|

(ii) Schedule 3.1(a)(ii) sets forth the percentage interest owned by the Company in each of its significant Subsidiaries (as defined under Regulation S-X of the Securities Act). The Company owns, directly or indirectly, the capital stock or equity interests of each of the Subsidiaries set forth on Schedule 3.1(a)(ii) free and clear of any Liens, except for Permitted Liens. Neither the Company nor Atlas Brasil has any arrangement, agreement or contract pursuant to which it is obligated to make any investment (in the form of a loan, capital contribution or otherwise) in any Person (other than the Company with respect to its Subsidiaries).

(g) SEC Reports. The Company has filed or furnished all reports, schedules, forms, statements and other documents required to be filed by the Company under the Securities Act and the Exchange Act, including, without limitation, pursuant to Section 13(a) or 15(d) thereof, and other applicable securities Laws, since January 10, 2023 (the foregoing materials, including, without limitation, the exhibits thereto and documents incorporated by reference therein, being collectively referred to herein as the “SEC Reports”) on a timely basis or has received a valid extension of such time of filing and has filed any such SEC Reports prior to the expiration of any such extension. As of their respective dates, the SEC Reports complied in all material respects with the requirements of the Securities Act and the Exchange Act, as applicable, and none of the SEC Reports, when filed, contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements therein, in the light of the circumstances under which they were made, not misleading. The Company has never been an issuer subject to Rule 144(i) under the Securities Act. True, correct and complete copies of all SEC Reports have been publicly filed in the Electronic Data Gathering, Analysis and Retrieval database of the Commission.

(h) No Rights Agreement. Except as contemplated under the agreements listed in Schedule 3.1(h), no Person has any right to cause the Company to effect the registration under the Securities Act of any securities of the Company.

(i) Listing and Maintenance Requirements. The Common Stock is registered pursuant to Section 12(b) or 12(g) of the Exchange Act, and the Company has taken no action designed to, or which to its knowledge is likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act nor has the Company received any notification that the Commission is contemplating terminating such registration. The Company has not, in the twelve (12) months preceding the date hereof, received written notice from any Trading Market on which the Common Stock is or has been listed or quoted to the effect that the Company is not in compliance with the listing or maintenance requirements of such Trading Market.

|

|

(j) Company Financial Statements.

(i) The consolidated financial statements (including, without limitation, any related notes and schedules) of the Company filed with the SEC Reports: (i) were prepared in accordance Regulation S-X under the Exchange Act and with GAAP (except as may be indicated in the notes thereto or as otherwise permitted by Form 10-Q with respect to any financial statements filed on Form 10-Q); (ii) complied, as of their respective date of filing with the Commission in all material respects, with the published rules and regulations of the Commission with respect thereto; and (iii) fairly present, in all material respects, the financial position of the Company on a consolidated basis as of the dates thereof and the consolidated results of operations and cash flows for the periods then ended (subject, in the case of the unaudited financial statements, to normal and recurring year-end and audit adjustments). Except as have been described in the SEC Reports, there are no off-balance sheet arrangements of the type required to be disclosed pursuant to Instruction 8 to Item 303(b) of Regulation S-K.

(ii) Except as is not required in reliance on exemptions from various reporting requirements by virtue of the Company’s status as a “smaller reporting company” within the meaning of the Exchange Act, at all times since October 20, 2023, the Company has established and maintained, “disclosure controls and procedures” and “internal control over financial reporting” (in each case as defined pursuant to Rule 13a-15 and Rule 15d-15 promulgated under the Exchange Act) that (i) are with respect to disclosure controls and procedures, reasonably designed to ensure that all material information (both financial and non-financial) required to be disclosed by the Company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the Commission and that all such material information required to be disclosed is accumulated and communicated to the management of the Company to allow timely decisions regarding required disclosure and to enable the chief executive officer and chief financial officer of the Company to make the certifications required under the Exchange Act with respect to such reports, and (ii) with respect to internal control over financial reporting, sufficient in all material respects to provide reasonable assurance (A) that transactions are recorded as necessary to permit preparation of financial statements in conformity with GAAP, (B) that transactions are executed only in accordance with the authorization of management and (C) regarding prevention or timely detection of the unauthorized acquisition, use or disposition of the properties or assets of the Company and Atlas Brasil, in each case, that could have a material effect on the Company’s consolidated financial statements.

(iii) The Company has established and maintains a system of internal accounting controls that are effective in providing reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with GAAP. Neither the Company nor the Company’s independent registered public accounting firm, has identified or been made aware of: (i) any significant deficiency or material weakness in the system of internal control over financial reporting used by the Company on a consolidated basis that has not been subsequently remediated; or (ii) any fraud that involves the Company’s management or other employees who have a role in the preparation of financial statements or the internal control over financial reporting utilized by the Company on a consolidated basis. Since [October 20], 2023, neither the Company nor any director, officer, employee, auditor, accountant or representative of the Company or Atlas Brasil has received any written complaint, allegation, assertion, or claim (or otherwise has been informed) that the Company has engaged in improper or illegal accounting or auditing practices or maintains improper or inadequate internal accounting controls.

|

|

(k) Undisclosed Liabilities. The Company has no liabilities of a nature required to be reflected or reserved against on a balance sheet prepared in accordance with GAAP or notes thereto, other than liabilities: (a) reflected or otherwise reserved against in the latest consolidated financial statements of the Company (including, without limitation, the notes thereto) included in the SEC Reports filed prior to the date of this Agreement, (b) arising pursuant to this Agreement or incurred in connection with the Transaction; or (c) incurred in the ordinary course of business; in each case that, individually or in the aggregate, have not had, and would not reasonably be expected to have, a Material Adverse Effect.

(l) Material Contracts.

(i) Except as set forth on Schedule 3.1(l), neither the Company nor Atlas Brasil, is a party to any of the following contracts:

(1) any material joint venture, partnership or similar contract with respect to lithium exploration or mining or the development of a lithium project in the State of Minas Gerais, Brazil in partnership with any Person other than the Company and its Subsidiaries;

(2) any offtake with respect to lithium exploration or mining or the development of a lithium project in the State of Minas Gerais, Brazil;

(3) any contract containing any covenant (i) limiting the right of the Company or Atlas Brasil to engage in any line of business or any geographic area that is material to the Company and Atlas Brasil, including, without limitation, the State of Minas Gerais, Brazil or (ii) materially limiting the rights of the Company or Atlas Brasil pursuant to any “minimum requirement,” “most favored nation” or “exclusivity” provisions;

(4) any contract that is a settlement agreement imposing material future limitations on the operation of Company or Atlas Brasil or that includes the admission of wrongdoing by the Company or Atlas Brasil or any of their respective officers or directors;

(5) any material contract with any Governmental Authority; or

(6) any contract that relates to the acquisition or disposition of any business, assets or properties (whether by merger, sale of stock, sale of assets or otherwise), for aggregate consideration under such contract in excess of $10 million other than in the ordinary course of business.

(ii) (A) each Material Contract is valid and binding on the Company or Atlas Brasil, as applicable, and to the Knowledge of the Company, each other party thereto, and is in full force and effect, except where the failure to be valid, binding or in full force and effect would not, individually or in the aggregate, result in a Material Adverse Effect, (B) the Company and Atlas Brasil, and, to the Knowledge of the Company, any other party thereto, have performed all obligations required to be performed by it under each Material Contract, except where such nonperformance would not, individually or in the aggregate, result in a Material Adverse Effect, (C) neither the Company nor Atlas Brasil have received written notice of the existence of any breach or default on the part of the Company or Atlas Brasil under any Material Contract and (D) to the Knowledge of the Company, the counterparty under such Material Contract is not in breach or default thereof that would result in a Material Adverse Effect.

|

|

(m) Environmental Matters. Except as has not had, and would not reasonably be expected to have, a Material Adverse Effect: (a) the Company and Atlas Brasil are and, since January 1, 2021 (or earlier if unresolved), have been, in compliance with all applicable Environmental Laws, which compliance includes obtaining, maintaining and renewing, as applicable, all Environmental Permits to develop and operate the lithium project in State of Minas Gerais, Brazil; (b) since January 1, 2021 (or earlier if unresolved), no notice of violation or other notice, report, order, directive or other information has been received by the Company or Atlas Brasil related to any Environmental Law, Environmental Permit or Hazardous Material that would reasonably be expected to have a Material Adverse Effect; (c) no Proceeding is pending or, to the Knowledge of the Company, threatened against the Company or Atlas Brasil relating to any Environmental Law, Environmental Permit or Hazardous Material; (d) neither the Company nor Atlas Brasil has transported, manufactured, distributed, handled, stored, treated, released, disposed or arranged for disposal of, or exposed any Person to, any Hazardous Materials, in a manner that has resulted in an investigation or required cleanup by, or otherwise resulted in the liability of, the Company or Atlas Brasil; (e) since the date the Company or Atlas Brasil, as applicable, became the owner or exclusive lessor of a certain property, no Hazardous Material has been discharged, disposed of, dumped, injected, pumped, deposited, spilled, leaked, emitted or released at, on, under, to, in or from (A) any property now owned or leased by or (B) any property to which any Hazardous Material has been transported for disposal, recycling or treatment by or on behalf of, in each case the Company or Atlas Brasil; and (f) neither the Company nor Atlas Brasil have assumed, provided an indemnity with respect to or otherwise become subject to the liability of any other Person under Environmental Laws.

(n) Employment Law. Except as has not had, and would not reasonably be expected to have, a Material Adverse Effect, the Company and Atlas Brasil are in compliance in all material respects with applicable Laws with respect to employment and labor practices (including applicable Laws regarding wage and hour requirements, immigration status, discrimination in employment, employee health and safety, collective bargaining, terms and conditions of employment, classification of independent contractors and exempt and non-exempt employees, harassment, retaliation, whistleblowing, disability rights or benefits, equal opportunity, plant closures and layoffs, employee trainings and notices, workers’ compensation, labor relations, employee leave issues, COVID-19, affirmative action and unemployment insurance).

(o) Litigation. Except as has not had, and would not reasonably be expected to have, a Material Adverse Effect, there are no Proceedings pending or, to the Knowledge of the Company, threatened against or involving the Company or Atlas Brasil, or affecting the business, including the development and operation of the Neves Project, properties or other assets of the Company or Atlas Brasil, or that could prevent, delay or materially adversely affect the consummation of the Transaction.

|

|

(p) Interest in Properties.

(i) Each of the Company and Atlas Brasil, as the case may be, (i) is the sole legal and beneficial owner, and has valid and sufficient right, title and interest free and clear of any Lien (other than Permitted Liens) to the mining rights (excepting the paramount title of the relevant Governmental Authority in any mining rights) to the interest in, or exploration for minerals on the Neves Project, as are necessary to perform the operations of the business of Atlas Brasil as presently owned and conducted or contemplated to be conducted on the Neves Project, which mining rights are in force, regular, in good standing and in compliance with applicable Laws, and have been validly applied for or acquired by Atlas Brasil; (ii) has valid and sufficient right, title and interest free and clear of any Lien (other than Permitted Liens) to the surface rights that are necessary to perform the operations of the business of Atlas Brasil on the Neves Project as presently owned and conducted or contemplated to be conducted, which surface rights are in force, regular and have been validly acquired by Atlas Brasil; and (iii) is the sole legal and beneficial owner, and has valid and sufficient right, title and interest free and clear of any Lien (other than Permitted Liens) to the other mining rights (excepting the paramount title of the relevant Governmental Authority in any mining rights) listed in Schedule 3.1(p)(i), which mining rights have been validly applied for or acquired by Atlas Brasil and are in force, regular, in good standing and in compliance with applicable Laws, except as has not had and would not reasonably be expected to have a Material Adverse Effect (the rights and assets described in clauses (i), (ii) and (iii), collectively, the “Company Properties”).

(ii) Except as has not had, and would not reasonably be expected to have, a Material Adverse Effect, each of the Company and Atlas Brasil has duly and timely satisfied all of the obligations required to be satisfied, performed and observed by it under, and there exists no default or event of default or event, occurrence, debt, condition or act which has happened, occurred or was due, as applicable, and is or would become a default or event of default by the Company or Atlas Brasil under any agreement or applicable Law pertaining to their respective Company Properties (whether or not notice of default has been delivered) and each such lease, contract or other agreement is enforceable and in full force and effect.

(iii) (A) the Company and Atlas Brasil have the exclusive right to deal with the Company Properties; (B) other than as set forth on Schedule 3.1(p)(iii), no Person of any nature whatsoever other than the Company or Atlas Brasil has any interest in the Company Properties or the production or profits therefrom or any right to acquire or otherwise obtain any such interest in the Company Properties from the Company or Atlas Brasil; (C) other than as contemplated by this Agreement, the Offtake Agreement and the Investor Rights Agreement, and except as set forth on Schedule 3.1(p)(iii), there are no options, back-in rights, earn-in rights, rights of first refusal, off-take rights or obligations, royalty rights, streaming rights, or other rights of any nature whatsoever which would affect the Company’s or Atlas Brasil’s interests in the Company Properties, and no such rights are, to the Knowledge of the Company, threatened; (D) neither the Company nor Atlas Brasil has received any notice, whether written or oral, from any Governmental Authority or any other Person of any revocation or intention to revoke, diminish or challenge its interest in the Company Properties; and (E) the Company Properties are in good standing under and comply with all Laws and all work required to be performed has been performed and all Taxes, fees, statutory or contractual royalties, expenditures and all other payments in respect thereof have been paid or incurred and all filings in respect thereof have been made.

|

|

(iv) There are no adverse Proceedings that have been commenced or are pending or, to the Knowledge of the Company, that are threatened, affecting or which could affect the Company’s or Atlas Brasil’s right, title or interest in the Company Properties or the ability of the Company or Atlas Brasil to explore or develop the Company Properties and the Neves Project, including, without limitation, the title to or ownership by the Company or Atlas Brasil of the foregoing, or which might involve the possibility of any judgment or liability affecting the Company Properties or the Neves Project.

(v) None of the directors or officers of the Company or Atlas Brasil holds any right, title or interest in, nor has taken any action to obtain, directly or indirectly, any right, title and interest in any of Company Properties or in any permit, surface right, mineral right, water right, lease, license or other right to explore for, exploit, develop, mine or produce minerals from or in any manner in relation to the Company Properties.

(vi) No Person has any written or oral agreement or option or any right or privilege capable of becoming an agreement or option for the purchase from the Company or Atlas Brasil of any of the assets of the Company or Atlas Brasil. Except as set forth on Schedule 3.1(p)(vi), neither the Company nor Atlas Brasil is obligated under any prepayment contract or other prepayment arrangement to deliver mineral products at some future time without then receiving full payment therefor.

(q) Compliance with Laws.

(i) Each of the Company, Atlas Brasil and Apollo Resources is in compliance in all material respects with all Laws that are applicable to the Company, Atlas Brasil and Apollo Resources or to the conduct of the business or operations of the Company, Atlas Brasil and Apollo Resources, except for such noncompliance that, individually or in the aggregate, has not had, and would not reasonably be expected to have, a Material Adverse Effect.

(ii) Except as has not had, and would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, as of the date of this Agreement: (i) the Company and Atlas Brasil have all licenses, franchises, permits, certificates, consents, approvals, authorizations, designations, waivers, exemptions, deviations and registrations from Governmental Authorities (collectively, “Permits”) necessary for the ownership and operation of its business as presently conducted, and each such Permits is in full force and effect; (ii) the Company and Atlas Brasil are in compliance with the terms of all Permits necessary for the ownership and operation of its businesses; and (iii) since January 1, 2021 to the date of this Agreement, neither the Company nor Atlas Brasil has received written notice from any Governmental Authority alleging any conflict with or breach of any such Permits.

(r) Related Party Transactions. Except as described in the annual report on Form 10-K for fiscal year ended December 31, 2023, filed with the Commission on March 27, 2024, there are no agreements, commitments, contracts, transactions, arrangements or understandings between the Company or Atlas Brasil, on the one hand, and any Affiliate of the Company (including, without limitation, any director or executive officer) thereof, but not including, without limitation, any wholly owned Subsidiary of the Company, on the other hand, that would be required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the Commission in the Company’s Form 10-K or proxy statement pertaining to an annual meeting of stockholders or information statement, as applicable, that have not been disclosed in the SEC Reports.

|

|

(s) Acknowledgment Regarding Purchaser’s Purchase of Shares. The Company acknowledges and agrees that the Purchaser is acting solely in the capacity of an arm’s length purchaser with respect to the Transaction Documents and the transactions contemplated thereby. The Company further acknowledges that the Purchaser is not acting as a financial advisor or fiduciary of the Company (or in any similar capacity) with respect to the Transaction Documents and the transactions contemplated thereby and any advice given by the Purchaser or any of its representatives or agents in connection with the Transaction Documents and the transactions contemplated thereby is merely incidental to the Purchaser’s purchase of the Shares. The Company further represents to the Purchaser that the Company’s decision to enter into this Agreement and the other Transaction Documents has been based solely on the independent evaluation of the transactions contemplated hereby by the Company and its representatives.

(t) CFIUS. Neither the Company nor any of its Subsidiaries or Affiliates is a “U.S. business” that designs, develops, fabricates, manufactures, produces, or tests one or more “critical technologies” as defined in Section 721 of the Defense Production Act of 1950, as amended (50 U.S.C. § 4565), including all implementing regulations thereof.

(u) Anti-Bribery. Each of the Company, Atlas Brasil and Apollo Resources, and their respective directors, officers, managing members, employees, and, to the Knowledge of the Company, their respective agents, representatives, or other Persons acting on behalf of the Company, Atlas Brasil and Apollo Resources, are, and have been for the past five (5) years, in compliance with the anti-bribery and anti-corruption Laws of each jurisdiction in which the Company, Atlas Brasil and Apollo Resources operate or have operated, including the U.S. Foreign Corrupt Practices Act of 1977, as amended, and Brazilian Laws Nos. 8492/1992, 12846/2013 and Articles 332 to 337 of the Brazilian Criminal Code (Decree-law No. 2848/1940), as amended (collectively, “Anti-Corruption Laws”). In the past five (5) years, the Company, Atlas Brasil and Apollo Resources, and their respective directors, officers, managing members, employees, and, to the Knowledge of the Company, their respective agents, representatives, or other Persons acting on behalf of the Company, Atlas Brasil and Apollo Resources, have not paid, given, offered or promised to pay, authorized the payment or transfer, any monies or anything of value, directly or indirectly, to any Government Official or any other Person for the purpose of corruptly influencing any act or decision of such Government Official, any Governmental Authority, or any other Person, to obtain or retain business, to direct business to any Person, or to secure any other improper benefit or advantage. In the past five (5) years, there have been no false or fictitious entries made in the books or records of the Company, Atlas Brasil and Apollo Resources, relating to any illegal payment or secret or unrecorded fund and none of the Company, its Subsidiaries or Affiliates has established or maintained a secret or unrecorded fund. To the Knowledge of the Company, none of the Company, Atlas Brasil or Apollo Resources is, or in the past five (5) years has been, subject to any Proceeding, or made any disclosures to any Governmental Authority related to any applicable Anti-Corruption Laws.

|

|