UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number 1-38519

AgeX Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 82-1436829 | |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

1101 Marina Village Parkway, Suite 201

Alameda, California 94501

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (510) 671-8370

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of exchange on which registered | ||

| Common Stock, par value $0.0001 per share | AGE | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes ☐ No ☒

The approximate aggregate market value of shares of voting common stock held by non-affiliates computed by reference to the price at which shares of common stock were last sold as of June 30, 2023 was $18.7 million. Shares held by each executive officer and director and by each person who beneficially owns more than 5% of the outstanding common stock have been excluded in that such persons may under certain circumstances be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 14, 2024, there were outstanding 2,500,664 shares of common stock, par value $0.0001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None

AgeX Therapeutics, Inc.

Table of Contents

|

|

IMPORTANT PRELIMINARY NOTE

Planned Merger with Serina Therapeutics, Inc. and Related Transactions

On August 29, 2023, AgeX entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with Serina Therapeutics, Inc. (“Serina”), and Canaria Transaction Corporation, a wholly owned subsidiary of AgeX (“Merger Sub”). Upon the terms and subject to the satisfaction of the conditions described in the Merger Agreement, Merger Sub will be merged with and into Serina, with Serina surviving as a wholly owned subsidiary of AgeX (the “Merger”). At a special meeting of AgeX stockholders on March 14, 2024 (the “Special Meeting”), AgeX stockholders approved certain proposals required for consummation of the Merger pursuant to the terms of the Merger Agreement. Serina stockholders have also approved the Merger. There is no assurance that all conditions to the Merger will be met or waiver and that the Merger will be consummated. AgeX stockholders will face a number of risks related to the terms of the Merger Agreement and the Merger, some of which risks are described in this Annual Report on Form 10-K (“Report”). References to the “Combined Company” in this Report mean AgeX after the Merger through which AgeX will have acquired Serina.

On March 14, 2024 AgeX effected a 1 for 35.17 reverse stock split of its common stock (the “Reverse Stock Split”) by filing an amendment to its certificate of incorporation, as approved by AgeX stockholders at the Special Meeting. The Reverse Stock Split resulted in approximately 2,500,000 shares of AgeX common stock being outstanding immediately upon the filing of the amendment to the certificate of incorporation. Except for references to authorized but unissued shares of AgeX common stock, and except as may be otherwise stated in the notes to financial statements, numbers of shares of AgeX common stock issued and outstanding, or issuable upon the exercise of options or warrants or upon conversion of convertible indebtedness, and AgeX common stock prices, referenced in this Report reflect the effect of the Reverse Stock Split, and such amounts shown in the case of historical information, including amounts shown in the consolidated financial statements and notes thereto, have been retroactively adjusted to reflect the effect of the Reverse Stock Split.

On March 19, 2024, AgeX issued to each holder of AgeX common stock as of the dividend record date, March 18, 2024, three warrants (“Post-Merger Warrants”) for each five shares of AgeX common stock held by such stockholder. Each Post-Merger Warrant will be exercisable for one unit of AgeX (“AgeX Unit”) at a price equal to $13.20 per unit and will expire on July 31, 2025. Each AgeX Unit will consist of (i) one share of AgeX common stock and (ii) one warrant (“Incentive Warrant”). Each Incentive Warrant will be exercisable for one share of AgeX common stock at a price equal to $18.00 per warrant and will expire on the four-year anniversary of the closing date of the Merger.

Immediately following the Merger, equity holders of Serina immediately prior to the closing of the Merger are expected to own approximately 75% of the outstanding shares of common stock of the Combined Company, and stockholders of AgeX immediately prior to the closing of the Merger are expected to own approximately 25% of the outstanding shares of common stock of the Combined Company, in each case, on a pro forma fully diluted basis, subject to certain assumptions and exclusions, including the Actual Closing Price (as defined in the Merger Agreement) of AgeX common stock being equal to or greater than $12.00 per share, giving effect to the Reverse Stock Split and excluding the impact of any Post-Merger Warrant, Incentive Warrant or the issuance of any share of AgeX common stock upon exercise of any Post-Merger Warrant or Incentive Warrant.

Concurrently with the execution of the Merger Agreement, AgeX, Serina, and AgeX’s controlling stockholder Juvenescence Limited (“Juvenescence”) entered into a Side Letter, which will become effective immediately prior to the closing of the Merger. The Side Letter provides, among other things, that (i) effective immediately before the consummation of the Merger, Juvenescence will cancel all out of the money AgeX warrants held by Juvenescence; (ii) Juvenescence will exercise all Post-Merger Warrants it holds to provide the Combined Company an additional $15 million in capital according to the following schedule: (x) at least one-third on or before May 31, 2024, (y) at least one-third on or before November 30, 2024, and (z) at least one-third on or before June 30, 2025; (iii) Juvenescence will not sell any shares of AgeX Series A Preferred Stock or AgeX Series B Preferred Stock and will take all actions necessary to convert all of such Preferred Stock into AgeX common stock before a Reverse Stock Split that will occur before the Merger; (iv) Juvenescence will release all security interests, guarantees, pledges, assignments and other forms of collateral that it may have in AgeX’s assets pursuant to the terms of Juvenescence loans to AgeX; and (v) Juvenescence will consent to a newly formed subsidiary of AgeX assuming AgeX’s obligations with respect to loan agreements and promissory notes governing loans payable to Juvenescence, including obligations for amounts currently owed and future advances of loan funds, and Juvenescence shall release AgeX from those loan obligations. Juvenescence’s covenant regarding retaining ownership of and converting the Preferred Stock into AgeX common stock has been satisfied through the conversion of the Preferred Stock into AgeX common stock on February 1, 2024.

Prior to the closing of the Merger, all assets of AgeX other than certain “Legacy Assets” will be transferred into a recently formed subsidiary of AgeX “UniverXome Bioengineering, Inc. (“UniverXome”). In consideration of the transfer of such assets, UniverXome will assume (i) all indebtedness of AgeX issued to Juvenescence that has not been previously converted into AgeX Series A Preferred Stock or AgeX Series B Preferred Stock, which will be secured by the Legacy Assets and (ii) all other liabilities of AgeX in existence as of the effective time of the Merger (other than certain transaction expenses related to the Merger).

|

|

Serina currently has a pipeline of small molecule candidates targeting central nervous system (“CNS”) indications, enabled by the company’s proprietary POZ PlatformTM delivery technology. In addition to advancing Serina’s wholly owned pipeline assets, Serina is working with pharma partners currently advancing pre-clinical studies exploring POZ polymer lipid-nanoparticles (“LNPs”) in next generation LNP delivered RNA vaccines. In addition, Serina is advancing a lead drug candidate, SER-252 (POZ-apomorphine) for the treatment of advanced Parkinson’s Disease through pre-clinical studies towards the goal of an investigational new drug submission or “IND” to the Food and Drug Administration for the initiation of a Phase I clinical trial during the fourth quarter of 2024. Serina has two other pipeline assets that are positioned to enter IND enabling studies, SER-227 (POZ-buprenorphine) for certain post-operative pain indications, and SER-228 (POZ-cannabidiol) for treatment refractory epilepsy indications. Serina is also focused on expanding its LNP and anti-body drug conjugate partnering collaborations.

If the Merger is completed, the Combined Company will primarily focus on developing Serina’s product candidates and it is anticipated that the Combined Company will not continue to develop AgeX product candidates, other than potentially the development program of NeuroAirmid Therapeutics, Inc. described elsewhere in this Report. If the Merger is not completed, we expect AgeX to continue to execute on its current business strategies described under the section titled “Pre-Merger Business Strategy” below while seeking out and evaluating potential strategic alternatives with respect to our assets and development programs, which may include a merger, business combination, investment into AgeX, sale or other disposition of assets or other strategic transaction. In such case, we may not be successful in executing such strategies or identifying or implementing any such strategic alternatives, and there is a risk that Juvenescence may decide to stop funding our operations, which would likely result in our delisting and dissolution.

Summary of Risk Factors

Below is a summary of the material factors that make an investment in our common shares speculative or risky. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below under the heading “Risk Factors” in Item 1A of Part I of this Report and should be carefully considered, together with other information in this Report and our other filings with the Securities and Exchange Commission (the “SEC”) before making investment decisions regarding our common shares.

Risks Related to Our Financial Condition and Capital Resources

| ● | AgeX needs additional financing to execute its operating plan and continue to operate; | |

| ● | As a discovery-stage development company with incurred operating losses and limited capital resources, AgeX anticipates that it will incur continued losses for the foreseeable future and will need to continue to raise capital to finance our operations and is unable to predict whether it will achieve or sustain profitability; | |

| ● | AgeX is highly leveraged, carrying a significant amount of indebtedness, including indebtedness secured by its assets, that will become due and payable over the next three years and there is no assurance that AgeX will be able to refinance those obligations as they become due; | |

| ● | The terms of our loans from Juvenescence and a related Security Agreement could make it more difficult for us to raise additional capital from other sources; | |

| ● | Raising additional capital may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates; | |

| ● | Unless AgeX common stock continues to be listed on a national securities exchange, it will become subject to “penny stock” rules that impose restrictive sales practice requirements; | |

| ● | Delays in, or failing to complete the Merger could materially and adversely affect AgeX’s results of operations, business, financial condition or stock price; | |

| ● | If the Merger is not approved or does not occur, AgeX may not be successful in the execution of its current business strategies or identifying and implementing any strategic alternatives with respect to its assets and development programs, and any future strategic alternatives could have negative consequences; | |

| ● | As a major stockholder and creditor of AgeX, Juvenescence, will be able to substantially influence AgeX and exert control over matters subject to stockholder approval; and |

|

|

| ● | We are a discovery-stage development company with limited capital resources and have incurred operating losses since our inception. We anticipate that we will incur continued losses for the foreseeable future and will need to continue to raise capital to finance our operations, and we do not know if we will ever attain profitability. |

| ● | The report of our independent registered public accounting firm expresses substantial doubt about our ability to continue as a going concern. We need additional financing to execute our operating plan and continue to operate as a going concern. |

| ● | We are highly leveraged, carrying a significant amount of indebtedness, including indebtedness secured by our assets, that will become due and payable over the next three years and there is no assurance that we will be able to refinance those obligations as they become due. |

| ● | The terms of our outstanding loans from Juvenescence and a related Amended and Restated Security Agreement with Juvenescence could make it more difficult for us to raise additional capital from other sources. |

| ● | Raising additional capital may cause dilution to our stockholders, restrict our operations or require us to relinquish rights to our technologies or product candidates. |

Risks Related to Our Relationship with Juvenescence

| ● | Conflicts of interest may arise from our relationship with Juvenescence, which owns approximately 75.6% of our common stock and is a significant creditor and will be able to substantially influence us and exert control over matters subject to stockholder approval and the election of directors prior to the Merger. |

Risks Related to the Merger

| ● | The relative proportion of the Combined Company that AgeX stockholders will own immediately following the closing of the Merger is not adjustable based on the market price of AgeX common stock unless the Actual Closing Price of AgeX common stock, determined in the manner provided in the Merger Agreement, is less than $12.00 per share. If the Actual Closing Price of AgeX common stock is less than $12.00 per share, AgeX has the option to issue additional AgeX common stock to Serina stockholders in the amount necessary to equal the Target Merger Consideration Minimum, determined in the manner provided in the Meger Agreement, which, in such circumstances, could proportionally decrease the amount of the Combined Company that AgeX stockholders would own immediately following the closing of the Merger. Accordingly, the Merger consideration at the closing of the Merger may have a greater or lesser value than at the time the Merger Agreement was signed; |

| ● | Failure to complete the Merger may result in AgeX or Serina paying a termination fee or reimbursement of expenses to the other party and could harm the common stock price of AgeX and future business and operations of each company; |

| ● | If the conditions to the closing of the Merger are not satisfied or waived, the Merger may not occur or the closing of the Merger could be delayed; |

| ● | The Merger may be completed even though material adverse changes may result from the announcement of the Merger, industry-wide changes and/or other causes; |

| ● | Some executive officers and directors of AgeX and Serina have interests in the Merger that are different from the respective stockholders of AgeX and Serina and that may influence them to support or approve the Merger without regard to the interests of the respective stockholders of AgeX and Serina; |

| ● | Juvenescence owns a significant majority of AgeX capital stock and will be able to substantially influence AgeX and exert control over the AgeX Proposals; |

| ● | AgeX stockholders may not realize a benefit from the Merger commensurate with the ownership interest dilution they will experience in connection with the Merger; |

| ● | If the Merger is not completed, the market price of AgeX common stock may decline significantly; |

| ● | The market price of the Combined Company’s common stock following the Merger may decline as a result of the Merger; |

| ● | AgeX stockholder will have a reduced ownership and voting interest in, and will exercise less influence over the management of, the Combined Company following the closing of the Merger as compared to their current ownership and voting interest in AgeX before the Merger; |

| ● | During the pendency of the Merger Agreement, AgeX may be limited in its ability to enter into a business combination with another party on more favorable terms because of restrictions in the Merger Agreement, which could adversely affect AgeX’s business prospects; |

| ● | Certain provisions of the Merger Agreement may discourage third parties from submitting competing proposals, including proposals that may be superior to the transactions contemplated by the Merger Agreement; |

|

|

| ● | Because the lack of a public market for Serina’s capital stock makes it difficult to evaluate the fair market value of Serina’s capital stock, the value of the AgeX common stock to be issued to Serina stockholders may be more or less than the fair market value of Serina common stock; |

| ● | Litigation has been filed and additional litigation could in the future arise in connection with the Merger, against AgeX, the AgeX Board, Serina or the Serina Board, which could be costly, prevent the consummation of the Merger, divert management’s attention and otherwise materially harm AgeX’s, Serina’s or the Combined Company’s business. |

| ● | If the Merger is not completed we would not be able to pursue the development and commercialization of Serina’s technologies and product pipeline. |

| ● | If the Merger is not approved or does not occur, we may not be successful in the execution of our current business strategies or identifying and implementing any strategic alternatives with respect to our assets and development programs, and any future strategic alternatives could have negative consequences. |

Risks Related to the Reverse Stock Split

| ● | The Reverse Stock Split may not increase the Combined Company’s stock price over the long-term. |

| ● | The Reverse Stock Split may decrease the liquidity of AgeX common stock or the Combined Company’s common stock. |

| ● | The Reverse Stock Split may lead to a decrease in the Combined Company’s overall market capitalization. |

Risks Related to Our Business Operations

| ● | Due to our limited financial resources, we have reduced our staffing, eliminated our research laboratory facilities, and eliminated in-house research and product development work. We will seek opportunities to outsource or license product development and commercialization but there is no assurance that we will be able to do so successfully. |

| ● | We may expend our limited resources to pursue one or more particular product candidates or indications and fail to pursue product candidates or indications that may be more profitable or for which there is a greater likelihood of success. |

| ● | We have not tested any of our product candidates in clinical trials. Success in early development and preclinical studies or clinical trials may not be indicative of results obtained in later preclinical studies and clinical trials. |

| ● | Our choice of product candidates and our development plans for our product candidates are subject to change based on a variety of factors, and if we abandon development of a product candidate we may not be able to develop or acquire a replacement product candidate. |

| ● | We may determine to expand our organization and obtain laboratory facilities if we are able to raise sufficient capital to do so, and we may experience difficulties in managing this growth, which could disrupt our operations. |

| ● | The commercial success of any of our current or future product candidates will depend upon the degree of market acceptance by physicians, patients, third-party payors, and others in the medical community. |

| ● | If the market opportunities for our product candidates are smaller than we believe they are, we may not meet our revenue expectations and, even assuming approval of a product candidate, our business may suffer. |

| ● | We will face risks related to the manufacture of medical products for any product candidates that we develop. |

| ● | Any cell-based products that receive regulatory approval may be difficult and expensive to manufacture on a commercial scale. |

| ● | If we fail to meet our obligations under license agreements, we may lose our rights to key technologies on which our business depends. |

| ● | The development and commercialization of new drugs to address obesity and type 2 diabetes may substantially limit or eliminate the prospects for AgeX’s prospective AGEX-BAT1 product. |

|

|

Risks Related to Our Industry

| ● | We face significant competition in an environment of rapid technological change and the possibility that our competitors may achieve regulatory approval before us or develop therapies that are more advanced or effective than ours, which may harm our business and financial condition, and our ability to successfully market or commercialize our product candidates. |

| ● | The regulatory approval processes of the United States Food and Drug Administration (the “FDA”) and comparable foreign authorities are lengthy, time consuming and inherently unpredictable, and if we are ultimately unable to obtain regulatory approval for our product candidates, our business will be substantially harmed. |

| ● | If we encounter difficulties enrolling patients in clinical trials, our clinical development activities could be delayed or otherwise adversely affected. |

| ● | Even if we obtain FDA approval for any of our product candidates in the United States, we may never obtain approval for or commercialize it in any other jurisdiction, which would limit our ability to realize its full market potential. |

| ● | Even if a product candidate receives regulatory approval, we will be subject to ongoing regulatory obligations and continued regulatory review, which may result in significant additional expense, and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our product candidates. |

| ● | Our product candidates may cause serious adverse events or undesirable side effects or have other properties which may delay or prevent their regulatory approval, limit the commercial profile of an approved label, or, result in significant negative consequences following marketing approval, if any. |

| ● | We face potential product liability, and, if successful claims are brought against us, we may incur substantial liability and costs. If the use or misuse of our product candidates harm patients or is perceived to harm patients even when such harm is unrelated to our product candidates, our regulatory approvals could be revoked or could otherwise be negatively impacted, and we could be subject to costly and damaging product liability claims. |

| ● | Our insurance policies are expensive and protect us only from some business risks, which leaves us exposed to significant uninsured liabilities. |

| ● | The price and sale of any product candidates that be marketed may be limited by health insurance coverage and government regulation. |

| ● | Enacted and future healthcare legislation, including the Affordable Care Act or ACA, may increase the difficulty and cost to obtain marketing approval of and commercialize our product candidates and may affect the prices we may set. |

Risks Related to our Dependence on Third Parties

| ● | We may become dependent on future collaborations to develop and commercialize our product candidates and to provide the regulatory compliance, sales, marketing, and distribution capabilities required for the success of our business. |

| ● | We have no marketing, sales, or distribution resources for the commercialization of any products or technologies that we might successfully develop. |

| ● | We do not have the ability to independently conduct clinical trials required to obtain regulatory approvals for our product candidates and intend to rely on third parties to conduct, supervise and monitor our clinical trials. |

Risks Related to Intellectual Property

| ● | If we are unable to obtain and enforce patents and to protect our trade secrets, others could use our technology to compete with us, which could limit opportunities for us to generate revenues by licensing our technology and selling our products. |

| ● | There is no certainty that our pending or future patent applications will result in the issuance of patents. |

| ● | The process of applying for and obtaining patents can be expensive and slow. |

| ● | Our patents may not protect our technologies or products from competition. |

| ● | We may not be able to enforce our intellectual property rights throughout the world. |

| ● | We may be subject to patent infringement claims that could be costly to defend, which may limit our ability to use disputed technologies, and which could prevent us from pursuing research and development or commercialization of some of our technologies or products, require us to pay licensing fees to have freedom to operate and/or result in monetary damages or other liability for us. |

|

|

Risks Pertaining to Our Common Stock

| ● | There is a limited history to the public trading of our common stock and there is no assurance that a market for our common stock will be sustained. |

| ● | Because we are engaged in the development of pharmaceutical and cell therapy products, the price of shares of our common stock may rise and fall rapidly. |

| ● | Because we do not pay dividends, our stock may not be a suitable investment for anyone who needs to earn dividend income. |

| ● | Securities analysts may not initiate coverage or continue to cover our common stock, and this may have a negative impact on the market price of our shares. |

| ● | You may experience dilution of your ownership interests if we issue additional shares of common stock or preferred stock. |

| ● | Unless our common stock continues to be listed on a national securities exchange, it will become subject to the so-called “penny stock” rules that impose restrictive sales practice requirements. |

Risks Related to the Combined Company

| ● | The Combined Company will need to raise additional financing in the future to fund its operations, which may not be available to it on favorable terms or at all; | |

| ● | The market price of the Combined Company’s common stock is expected to be volatile, and the market price of the common stock may drop following the Merger; |

| ● | The Combined Company will incur costs and demands upon management as a result of complying with the laws, rules and regulations affecting public companies; | |

| ● | Anti-takeover provisions in the Combined Company’s governance documents and under Delaware law could make an acquisition of the Combined Company more difficult and may prevent attempts by the Combined Company stockholders to replace or remove the Combined Company management; and | |

| ● | If the Combined Company fails to attract and retain management and other key personnel, it may be unable to continue to successfully develop or commercialize its product candidates or otherwise implement its business plan. | |

| ● | If the Merger is consummated, the Combined Company will face other risks that are substantially the same as or similar risks faced by AgeX. |

Special Note Regarding Forward-Looking Statements

Certain statements contained herein are forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not historical fact (including, but not limited to statements that contain words such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “pro forma,” “should,” “would” should also be considered to be forward-looking statements. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization of potential products, uncertainty in the results of clinical trials or regulatory approvals, need and ability to obtain future capital, and maintenance of intellectual property rights. Actual results may differ materially from the results anticipated in these forward-looking statements and as such should be evaluated together with the many uncertainties that affect the businesses of AgeX, particularly those mentioned in the cautionary statements found in AgeX’s filings with the SEC. AgeX disclaims any intent or obligation to update these forward-looking statements.

|

|

The forward-looking statements in this Report include, among other things, statements about:

| ● | the strategies, prospects, plans, operations, expectations and objectives of management of AgeX if the Merger is not consummated or of the Combined Company following the closing of the Merger; | |

| ● | the progress, scope or duration of the development of product candidates or programs; | |

| ● | the benefits that may be derived from, or the commercial or market opportunity of, the product candidates of AgeX, Serina and the Combined Company; | |

| ● | the ability of AgeX and the Combined Company to protect intellectual property rights; | |

| ● | the ability of AgeX and the Combined Company to maintain compliance with NYSE American listing standards; | |

| ● | the anticipated operations, financial position, losses, costs or expenses of AgeX if the Merger is not consummated or the Combined Company following the closing of the Merger; | |

| ● | statements regarding future economic conditions or performance; | |

| ● | statements concerning proposed products or product candidates; | |

| ● | the approval and closing of the Merger, including the timing of the Merger, whether conditions to the completion of the Merger will be met or waived, the exchange ratio, and relative ownership levels of the Combined Company as of the closing of the Merger; | |

| ● | the expected benefits of and potential value created by the Merger for the stockholders of AgeX; and | |

| ● | statements of belief and any statement of assumptions underlying any of the foregoing. |

For a discussion of the factors that may cause AgeX, Serina or the Combined Company’s actual results, performance or achievements following closing of the Merger to differ materially from any future results, performance or achievements expressed or implied in such forward-looking statements, and for a discussion of risk associated with the ability of AgeX and Serina to complete the Merger and the effect of the Merger on the business of AgeX, Serina and the Combined Company following the completion of the Merger, see “Risk Factors.” Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in reports filed with the SEC by AgeX.

If any of these risks or uncertainties materializes or any of these assumptions proves incorrect, the results of AgeX, or the Combined Company following completion of the Merger, could differ materially from the forward-looking statements. All forward-looking statements in this Report are current only as of the date on which the statements were made. AgeX does not undertake any obligation (and expressly disclaim any such obligation) to publicly update any forward-looking statement to reflect events or circumstances after the date on which any statement is made or to reflect the occurrence of unanticipated events, except as required by applicable law.

In addition, statements that “AgeX believes” believes” and similar statements reflect AgeX’s beliefs and opinions on the relevant subject. These statements are based upon information available to AgeX as of the date of this Report, and while AgeX believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that AgeX has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

Industry and Market Data

This Report contains market data and industry forecasts that were obtained from industry publications, third-party market research and publicly available information. These publications generally state that the information contained therein has been obtained from sources believed to be reliable. While we believe that the information from these publications is reliable, we have not independently verified such information.

This Report also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this Report from our own research as well as from industry and general publications, surveys and studies conducted by third parties, some of which may not be publicly available. Such data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. We caution you not to give undue weight to such projections, assumptions and estimates.

|

|

PART I

References to “ AgeX,” “our” or “us” mean AgeX Therapeutics, Inc.

In this Annual Report on Form 10-K, the description or discussion of any contract or agreement is a summary only and is qualified in all respects by reference to the full text of the applicable contract or agreement.

Item 1. Business

Development of Our Business

During the twelve months ended December 31, 2023, the following significant developments related to our business have occurred:

On August 29, 2023, we entered into the Merger Agreement with Serina, and a wholly owned subsidiary of AgeX (“Merger Sub”). Upon the terms and subject to the satisfaction of the conditions described in the Merger Agreement, the Merger will be consummated through the merger of Merger Sub with and into Serina, with Serina surviving as a wholly owned subsidiary of AgeX. There is no assurance the conditions to the Merger will be met and that the Merger will be consummated. See “IMPORANT PRELIMINARY NOTE — Planned Merger with Serina Therapeutics, Inc. and Related Transactions,” “Risk Factors,” and “Directors, Executive Officers, and Corporate Governance” in this Report for additional information about the Merger.

Serina currently has a pipeline of small molecule candidates targeting central nervous system (“CNS”) indications, enabled by the company’s proprietary POZ PlatformTM delivery technology. In addition to advancing Serina’s wholly owned pipeline assets, Serina is working with pharma partners currently advancing pre-clinical studies exploring POZ polymer lipid-nanoparticles (“LNPs”) in next generation LNP delivered RNA vaccines. In addition, Serina is advancing a lead drug candidate, SER-252 (POZ-apomorphine) for the treatment of advanced Parkinson’s Disease through pre-clinical studies towards the goal of an investigational new drug submission or “IND” to the Food and Drug Administration for the initiation of a Phase I clinical trial during the fourth quarter of 2024. Serina has two other pipeline assets that are positioned to enter IND enabling studies, SER-227 (POZ-buprenorphine) for certain post-operative pain indications, and SER-228 (POZ-cannabidiol) for treatment refractory epilepsy indications. Serina is also focused on expanding its LNP and anti-body drug conjugate partnering collaborations.

If the Merger is completed, the Combined Company consisting of AgeX and Serina as a subsidiary after the Meger will primarily focus on developing Serina’s product candidates and it is anticipated that the Combined Company will not continue to develop the AgeX product candidates and technologies, and will not pursue the business strategy, discussed below in this Report, other than potentially the neural stem cell development program of NeuroAirmid Therapeutics, Inc. (“NeuroAirmid”).

In connection with our sponsored Huntington’s Disease research program at the University of California at Irvine (“UCI”), we and certain researchers who contributed to the Huntington’s Disease research work formed NeuroAirmid to pursue clinical studies of the use of derived neural stem cell to treat that disease. The new subsidiary is still in the organizational stage and commencement of clinical study work will depend NeuroAirmid obtaining a license from UCI to use a UCI patent and on NeuroAirmid’s ability to obtain financing through grants or third-party investment. We presently own 50% of the issued and outstanding shares of NeuroAirmid,

Overview of AgeX’s Current, Pre-Merger Business

We are a biotechnology company focused on the development and commercialization of novel therapeutics targeting human aging and degenerative diseases. Our mission is to apply our comprehensive experience in fundamental biological processes of human aging to a broad range of age-associated medical conditions. We believe that demand for therapeutics addressing such conditions is on the rise, commensurate with the demographic shift of aging in the United States and many other industrialized countries.

Our proprietary technology, based on telomerase-mediated cellular immortality and regenerative biology, allows us to utilize telomerase-expressing regenerative pluripotent stem cells (“hES cells” or “PSCs”) for the manufacture of cell-based therapies to regenerate tissues afflicted with age-related chronic degenerative disease. We own or have licenses to a number of patents and patent applications used in the generation of these product candidates, including intellectual property related to PureStem® technology. Our technology platform also includes UniverCyte™ which uses the HLA-G gene to potentially confer low immune observability to cells, so as to suppress rejection of transplanted cells and tissues. AgeX plans to use or license the use of this patented technology to produce genetically-modified master cell banks of pluripotent stem cells that can then be differentiated into any young cell type of the human body that now express the immune tolerogenic molecule.

Our product candidates in the discovery stage include two cell-based therapies derived from telomerase-positive PSCs and two product candidates derived from our proprietary tissue regeneration (iTRTM) technology. We have also sponsored a research program to derive neural stem cells from PSCs to treat degenerative diseases such as Huntington’s Disease. We will need to conduct or sponsor research and development work, or license our technology to other biotechnology or pharma companies interested in furthering research and development in order to develop these cell- and drug-based therapies, each targeting large unmet needs in age-related medicine.

|

|

Overview of Our Product Candidates

Our product pipeline includes two cell-based and two iTR-based product candidates in development.

Our lead cell-based therapeutic candidates in development are AGEX-BAT1 and AGEX-VASC1:

| ● | AGEX-BAT1 is our lead cell therapy product candidate in the discovery stage of development utilizing PSC-derived brown adipocytes for the treatment of certain age-related metabolic disorders such as Type II (adult-onset) diabetes and obesity. | |

| ● | AGEX-VASC1 is a cell-based therapy in the discovery stage of development comprised of young regenerative vascular-forming cells. AGEX-VASC1 may restore vascular support in aged ischemic tissues such as in peripheral vascular disease and ischemic heart disease. |

Our lead small molecule drug-based therapeutic candidate for iTRTM in discovery is AGEX-iTR1547 and our lead biologic candidate for iTR is AGEX-iTR1550:

| ● | AGEX-iTR1547 is a drug-based formulation and AGEX-iTR1550 (also known as Renelon™) is a gene delivery technology, both of which are in the discovery stage of development. Initial indications for use may include scarless wound repair. |

Our research related to the reprogramming of aging has also led to novel insights into cancer. We have filed patent applications on inventions that relate to these discoveries. These technologies may provide novel targets for cancer therapy and diagnosis. One such cancer therapeutic in the early stages of development is designated “EPROTM” (embryonic promoter-regulated oncolysis). EPRO is an oncolytic gene therapy strategy that may provide a novel means of selectively destroying an array of different types of cancer cells. Successful development of EPRO will be dependent, in part, on the availability of financing and licensing or joint development opportunities.

Our currently marketed research products include human embryonic stem or hES cells produced under Good Manufacturing Practice (“cGMP” and hES-derived cells for research:

Overview of Our Technology Platforms

The technology underlying our product development programs is based on telomerase-mediated cellular immortality and regenerative biology. By “telomerase-mediated cellular immortality” we refer to the fact that cells that express sufficient levels of a protein called telomerase are capable of replicating without limit. By “regenerative biology,” we refer to novel methods to regenerate tissues afflicted with age-related chronic degenerative disease such as peripheral vascular disease and ischemic heart disease as well as age-related metabolic disorders such as those associated with Type II diabetes and obesity, as well as others. We utilize telomerase-expressing regenerative pluripotent stem cells, or PSCs, for the manufacture of cell-based therapies. We own or have licensed numerous patents and patent applications covering methods and compositions relating to this technology platform.

We believe our core technology platforms provide us with a strong foundation for successfully addressing many of the diseases of ageing by focusing on broad therapeutic applicability and commercially scalable technologies:

1. PureStem®: AgeX’s allogeneic cell derivation and manufacturing platform, based on human embryonic progenitors, which are cells in state of development between embryonic stem cells and adult cells. We believe PureStem has the potential to solve several major challenges faced by the cell therapy industry by generating cellular therapeutics which would:

| ● | be commercialized as “off-the-shelf” products; |

| ● | be pure and industrially scalable; |

| ● | have lower cost of goods per unit; |

| ● | be amenable to traditional pharmaceutical supply chain logistics; |

| ● | have the potential for acceptable reimbursement prices, unlike the relatively expensive autologous products; and |

| ● | have higher clinical adoption from expected cost savings and more simplified processes. |

|

|

In addition, we believe PureStem cells may have advantages over mesenchymal stem cells (MSCs), which may only survive transiently in the body and exert any short-term benefit by releasing paracrine factors, which may limit their potential of MSCx.

MSCs neither engraft nor become specialized cells. On the other hand, cells derived from PureStem progenitors will be engineered to be young, not prone to the disadvantages associated with older cells, and are expected to become permanently engrafted in the body to deliver a true regenerative outcome. To date, AgeX has isolated more than 200 cell types from PureStem.

2. UniverCyte™: AgeX’s pioneering technology designed to genetically modify allogeneic donor cells to potentially become hypoimmunogenic/universal, so they can potentially be transplanted into all patients in an off-the- shelf manner, without the normal need for human leukocyte antigen (HLA) matching between donor and receipt or immunosuppression. UniverCyte utilizes a potent molecule called HLA-G. HLA is a group of related proteins that helps the immune system distinguish the body’s own proteins from proteins made by foreign invaders such as viruses and bacteria. HLA-G’s only known physiological role in nature is to prevent destruction of a semi-allogeneic fetus by the maternal immune system. We believe that UniverCyte could potentially avoid immune rejection of transplanted cells, solving a major challenge facing the allogeneic cell therapy industry. In addition to utilizing UniverCyte™ for its own future cell therapy products, AgeX may make UniverCyte™ available to other cell therapy companies through licensing arrangements.

3. Induced Tissue Regeneration (iTRTM): The aim of iTR is to return aged cells back to a youthful state, thereby inducing a capacity for scarless regeneration characteristic of early developing tissues, without reverting cells to pluripotency. This technology is sometimes referred to as “partial reprogramming” or “epigenetic reprogramming of aging.” We believe this novel approach may trigger complete regeneration of cells, and potentially even complex tissues, damaged as a result of age-related degenerative processes or trauma. The premise behind iTR is that aging, and in turn degenerative diseases of old age, are a result of the loss of two characteristics of cells; namely, replicative immortality and regenerative capacity. These two characteristics are present in embryonic cells but are lost at the embryonic to fetal transition (EFT). With this loss, humans can no longer generate new cells or repair damaged cells scarlessly and in sufficient numbers to maintain health. We discovered that cells begin expressing the gene COX7A1 at the EFT when regeneration is commonly lost. Therefore, we believe the gene may be a key inhibitor of cellular regeneration. For example, we have discovered that restoring a regenerative pattern of COX7A1 gene expression may facilitate hair regeneration in mouse models. In addition, we have invented multiple platforms for delivering iTR using small molecules as well as biologic strategies such as those using gene therapy to transiently express reprogramming factors. We have filed patent applications on the use of iTR in a wide array of degenerative conditions including cancer.

4. ESI Cell Lines: AgeX has six clinical-grade human embryonic stem cell lines, they are distinguished as the first clinical-grade human pluripotent stem cell lines created under current Good Manufacturing Practice as described in Cell Stem Cell (2007;1:490-4). They are listed on the NIH Stem Cell Registry in the USA and are among the best characterized and documented stem cell lines in the world. ESI-053 is among only a few pluripotent stem cell lines from which a derived cell therapy product candidate has been granted FDA IND clearance for human studies. The FDA cleared an IND application from ImStem Biotechnology, one of our sublicensees, for a MSC product derived from ESI-053 for multiple sclerosis. This was believed to be the first MSC product derived from a pluripotent stem line to be accepted for a human trial by the FDA. The ESI cell lines are available as research or clinical grade product, and have been offered since 2006.

Pre-Merger Business Strategy

We believe our four proprietary platform technologies, PureStem® for cell derivation and manufacturing, UniverCyte™ for generation of hypoimmunogenic cells and iTRTM for reversing the age of cells already in the body present AgeX with a multiplicity of attractive opportunities which we may pursue. Given these platform technologies may be highly desirable to multiple academic and biopharma companies due to their broad applicability and potentially important clinical and commercial benefits, AgeX plans to pursue different business models for these platforms:

| ● | Co-Development and Licensing: Our PureStem® and UniverCyte™ technologies as well as our ESI cell lines may have applications in the development of a broad range of cell therapy products. We will seek opportunities to license these AgeX technologies to other cell therapy or biopharma companies to bring in early revenue streams, especially for therapies that AgeX does not presently intend to develop. |

| ● | Cellular Therapy: AgeX presently does not have the laboratory and research staff required to conduct in-house research and development for its product candidates, including AGEX-BAT1 and AGEX-VASC1. Instead, AgeX may conduct research and development of those product candidates through a variety of alternative strategies, including but not limited to, sponsoring research and development work at research laboratories at universities or other educational institutions, entering into co-development and marketing arrangements with researchers or other companies in the cell therapy or biopharma industry, and engaging contract service providers to conduct research and development and manufacturing for AgeX for particular product candidates. Our sponsored Huntington’s Disease research program at UCI has led to the organization of an AgeX subsidiary, NeuroAirmid, of which we equally owned with certain UCI researchers, to pursue clinical studies of the use of derived neural stem cell to treat that disease. The new subsidiary is still in the organizational stage and commencement of clinical study work will depend on its ability to obtain financing through grants or third-party investment. |

|

|

| ● | Reverse Bioengineering, Inc. (Reverse Bio): Partial cellular reprogramming using our iTRTM technology may one day allow us to revert aged or diseased cells inside the body back to a more youthful, healthy and functional state. We incorporated Reverse Bio as an AgeX subsidiary to develop our iTRTM platform. Reverse Bio is intended to allow for a dedicated focus on iTRTM in terms of equity financing and advancing our iTRTM technology to proof-of-concept in an animal model. We have assigned to Reverse Bio our patent portfolio for iTR development, but the future operations of Reverse Bio will depend in large measure on its ability to raise its own capital. |

Each of these models may provide particular benefits to AgeX in terms of financing and efficiency of operations. However, each alternative has potential disadvantages as well. If AgeX out-licenses its technology it will avoid the costs and risks of research and development, clinical trials, regulatory approval, manufacturing, and commercialization of product candidates, but the revenues AgeX would receive from commercialization of products developed under those arrangements would likely be limited to royalties on product sales and potentially licensing fees and milestone payments representing a relatively small portion of total product revenues. Similarly, co-development and marketing or similar arrangements would permit AgeX to share costs and risks but would also require AgeX to share revenues from the product candidates that may be successfully developed and commercialized. See elsewhere in this Report for information about certain risks associated with reliance on arrangements with third parties for research, product development, clinical trials, manufacturing, and commercializing product candidates.

We plan to finance our iTRTM and AGEX-BAT1 research and development through Reverse Bio. To the extent that such financing is obtained through the sale of capital stock or other equity securities to investors or other biopharma companies by Reverse Bio, or the sale of Reverse Bio shares held by AgeX, our equity interest in Reverse Bio and our iTRTM and AGEX-BAT1 business would be diluted.

However, if the Merger is completed, the Combined Company will primarily focus on developing Serina’s product candidates and it is anticipated that the Combined Company will not continue to develop our product candidates, other than potentially the development program of NeuroAirmid, which is described below under “Other AgeX Products and Product Candidates — Neural Stem Cells.”

AgeX Technology Platforms

PureStem® Technology

Regulatory approval of cell- and tissue-based products require high standards of quality control. In the case of stem cell-derived products, there is a high standard for ensuring the known identity, purity, and reproducibility of the cells to be administered. PSCs provide certain advantages over adult stem cell products when used in the manufacture of cell-based therapeutics for the treatment of age-related disease. These advantages include:

| ● | The replicative immortality of the PSCs which facilitates the indefinite scale-up of PSC master cell banks for the manufacture of uniform product, as well as an immortal substrate for targeted genetic modifications. |

| ● | Since most PSCs maintain long and stable telomere lengths, the replicative capacity of derived differentiated cell types is typically longer (younger) than adult or even fetal-derived cells. |

| ● | Using PureStem® technology, it is possible to clonally expand hundreds of purified, identified, and reproducibly scalable cell types that retain regenerative potential (have not passed the regeneration limit). |

PureStem® technology is based on the observation that embryonic anlagen of many tissues in the human body are naturally comprised of highly proliferative cells with relatively long telomere length. Therefore, it is possible to generate clonal lineages of these cells in vitro. Cells derived from adult tissues commonly permanently cease to divide after a certain number of doublings, a condition known as senescence. In addition, adult and even fetal tissues largely contain differentiated cells often with limited or no capacity of replication in vitro. As a result, the clonal expansion of human embryonic progenitor cell types allows not only a novel and more facile point of scalability but also generates populations of cells that are multipotent instead of pluripotent, and therefore markedly easier to define identity, purity, and potency.

We have studied the fate of over 200 diverse PureStem cell lines in thousands of differentiation conditions. This was accomplished by thawing individual cryopreserved PureStem cell lines, culturing them in the laboratory, and then exposing the cells to factors that differentiate cells such as protein growth and differentiation factors, hormones, and small molecules implicated in causing cells to change from one type of cell into another (differentiation). Using individual cells from the over 200 diverse PureStem cell lines previously isolated and cryopreserved, we treated the diverse cells with thousands of differentiation conditions, prepared RNA, and determined the gene expression pattern of the cells using gene expression microarrays. These experiments have shown that the PureStem cell lines display site-specific markers that identify not only the type of cells, but also where in the body the cells would normally reside. Therefore, in the example of cartilage cells, it was possible to produce diverse types of cartilage in this manner. We have licensed from our former parent company Lineage PureStem applications outside of orthopedics, medical aesthetics, and certain ophthalmological applications.

|

|

We have chosen two PureStem applications for our initial product development based on unmet medical need along with other factors. The first product candidates are AGEX-BAT1, brown adipose tissue or BAT cells for the treatment of metabolic disorders such as obesity or Type II diabetes, and AGEX-VASC1, vascular endothelial progenitors for the treatment of age-related ischemic disease such as that leading to peripheral vascular disease and ischemic heart disease.

UniverCyte™

Our UniverCyte™ technology uses a proprietary, novel, modified form of HLA-G and is intended to permit donor cells to be transplanted into patients without donor-patient tissue matching and without administering immunosuppressant medication. Immunosuppressive drugs can reduce patient resistance to infectious diseases and cancers as well as cause organ and other toxicities. Reducing or eliminating the need for immunosuppressants after cell transplantation by use of hypoimmunogenic cells may make therapies universally available. We plan to use or license the use of this patented technology to produce genetically-modified master cell banks of pluripotent stem cells that can then be differentiated into any young cell type of the human body that now express the immune tolerogenic molecule.

AgeX Products and Product Candidates

AgeX Therapeutic Product Candidates

AGEX-BAT1 - Brown Adipose Tissue (BAT) Progenitors

Brown adipose tissue (BAT) is abundant early in life but lost precipitously with age. This tissue is believed to generate heat through expression of a gene called UCP1. In addition, the high levels of glucose and lipid uptake by the tissue is believed to balance metabolism in young people. In contrast, central obesity and Type II diabetes has been correlated with low levels of BAT.

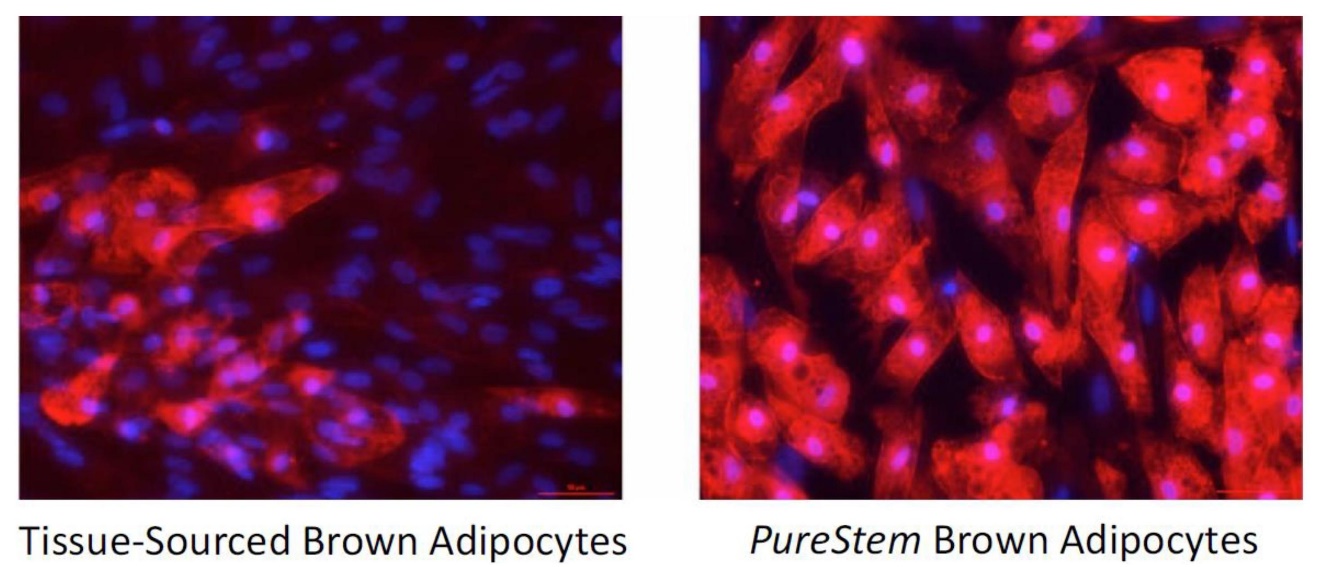

Figure 6. Human tissue-derived BAT cells (left) stained red for the presence of UCP1 show a minority of cells being true BAT cells. PureStem-derived AGEX-BAT1 cells are uniformly UCP1 positive.

The demonstration in published literature in the public domain that the transplantation of BAT from young mice to obese diabetic mice resulted in weight loss and increased insulin sensitivity has led to a search for a source of industrially-scalable clinical grade BAT cells as well as an appropriate matrix for lipotransfer. There currently is no FDA-approved matrix for cell transplantation. As shown in Figure 6, the AGEX-BAT1 progenitors strongly express the BAT marker UCP1 when induced to differentiate and show a relatively high degree of purity compared to human tissue-derived BAT.

We entered into a Sponsored Research Agreement with Ohio State University using AGEX-BAT1 in mice to determine whether transplantation of AgeX-BAT1 cells may lead to improvements in diet-induced obesity, metabolic health including glucose metabolism, and cardiac function. For purposes of this proof of concept work, two different cell transplant matrices were tested, HyStem® and a 3-D silk scaffold. We consider this work to be an early stage study and expect to conduct or sponsor additional research on the potential therapeutic benefits of AGEX-BAT1.

|

|

A number of new GLP-1 receptor agonist drugs, including Mounjaro, Ozempic, Rybelsus, and Trulicity for treating type 2 diabetes, and Wegovy and Zepbound for weight management, have entered the market. Ozempic is also being used off label for weight loss. The attention and acceptance that these new drugs have attained in the medical field for the treatment of type 2 diabetes and chronic weight management may substantially limit or eliminate the prospects for developing and commercializing any product based on AGEX-BAT1, brown adipose tissue, for those uses. Although the GLP-1 receptor agonist drugs may in certain patients be contraindicated, carry unacceptable medical risks, lead to intolerable side effects, or may not be satisfactorily effective, it is not clear whether those patients would constitute a large enough market for an alternative therapy to warrant the time and expense of developing AGEX-BAT1 for the uses addressed by the products currently on the market. Further, it is likely that the administration of a AGEX-BAT1 cell therapy product would entail a surgical implant procedure which would be expensive and would pose risks to the patient related to the surgical procedure that are not faced by users of the injectable or pill GLP-1 receptor agonist drugs currently on the market.

AGEX-VASC1 - Vascular Progenitors

PureStem® technology can also yield highly purified embryonic vascular components. As shown below, select clonal lines express markers such as VE-Cadherin (CDH5) and PECAM1, as well as VWF and other markers of venous, arterial, and lymphatic endothelium. Flow cytometry shows purity indistinguishable from 100%.

In addition to vascular endothelial cells, we have characterized vascular smooth muscle cell progenitors. This makes it possible for us to construct two of the key cellular components of arterial vessels, such as those compromised in coronary artery disease.

Figure 7. PureStem-derived vascular endothelial cell lines are capable of regenerating young vasculature (bottom left) and appear to have essentially 100% purity by fluorescence activated cell sorting analysis.

Leveraging our assets in pluripotency and bioinformatics, we have performed research manipulating cellular immortality and regenerative biology in human cells. In 2010, our scientists while at Lineage demonstrated the reversal of the developmental aging of human cells using transcriptional reprogramming technology. In 2017, we published certain markers of the Weismann barrier, and the high prevalence of a reversion back before the Weismann barrier in diverse cancer cell types cultured in vitro.

|

|

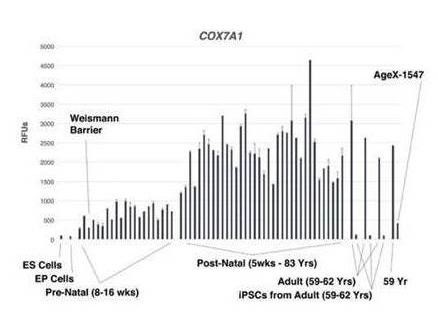

We extended this research to determine whether reprogramming can be modified to only reverse the aging of cells back before the Weismann Barrier, not back to pluripotency. We have utilized for example the gene COX7A1 as a marker of cells that have lost regenerative potential (crossed the Weismann Barrier). As shown in Figure 8, our proprietary formulation AGEX-iTR1547 has demonstrated initial capability of reducing the expression of the marker gene COX7A1 back to before the Weismann Barrier without reverting the cells to pluripotency. When implemented in vivo, this partial reprogramming, or iTR, would be expected to induce tissue regeneration, and when combined with telomerase, may be able to modulate both cellular immortality and regenerative biology for therapeutic effect. In addition to the small molecule product candidate designated iTR1547, we have invented biological interventions based, for example, on gene therapy. Our inventions relating to iTR biologics disclose both DNA and RNA-based strategies. Our gene delivery iTR product candidate is designated iTR1550. We are performing research to optimize AGEX-iTR1547 and in parallel a gene delivery formulation designated AGEX-iTR1550 in order to initiate preclinical studies of one or both of the agents on the scarless regeneration of the skin.

Figure 8. PSCs such as ES Cells and PureStem EP Cells display a regenerative capacity like cells that have not crossed the Weismann Barrier. During pre- and post-natal development, skin cells become increasingly incapable of scarless regeneration as reflected in increasing COX7A1 expression. iPS cell reprograming reverts cells back to pluripotency, while AgeX-iTR1547 reverts cells back only to a point prior to the Weismann Barrier (regenerative state).

Status and Development Plan

The product candidates we have chosen are in the discovery stage of development. Prior to filing an investigational new drug application (IND) for the initiation of clinical trials of our initial product candidates, AGEX-BAT1, AGEX-VASC1, and AGEX-ITR1547/AGEX-iTR1550, a number of important research and development goals will need to be achieved, including discovery-level research for the qualification of reagents used in the manufacture of the product, completion of the standard operating procedures (SOPs) to be used, completion of the methods and documentation for characterization of the product; and producing and testing the genetic modifications in the master cell banks of the pluripotent stem cells under cGMP in order to produce product that will not illicit immune rejection following transplantation. In addition, we will be required to expand the numbers of the pluripotent stem cell master cell banks for future use; produce working cell banks from which the product will be manufactured for clinical trials; produce the relevant product under cGMP conditions; and expand the number of relevant cells and cryopreserve them under cGMP conditions. In addition, we will be required to design the pre-clinical studies including the study endpoints, perform biosafety testing and release the first clinical batch based on preliminary characterization results, and complete full product characterization. Biosafety testing will necessarily include pilot testing in animals such as (NOD/SCID) mice, dosing spiking studies at early and later endpoints, tumorgenicity and biodistribution studies to determine whether the cells form undesired tumors or migrate to inappropriate sites respectively in the animal. Lastly, we will need to define the clinical trial and regulatory strategy and hold various meetings with the U.S. Food and Drug Administration (FDA), as well as successfully submit an IND to the FDA and receive clearance to begin trials. Thereafter, we will need to demonstrate safety and efficacy of the product in human clinical trials in Phase I and II trials, and continued safety and efficacy for achieving the desired endpoint in Phase III trials, potentially then leading to product registration. See “Risk Factors—Risks Related to Our Business Operations” for discussion of risks relating to product development and clinical trials. These include, but are not limited to, failure to successfully complete the aforementioned studies due to the failure of the product, processes, or skills of our employees, unforeseen delays in the development process, failure to raise requisite financing, or failure to receive permission from the FDA to advance product development. To the extent we license development of one or more product candidates to third parties or enter into collaboration arrangements for product development, our licensees or collaborators would need to undertake and achieve the foregoing goals.

|

|

Because our product candidates are still in the discovery stage, our choice of product candidates and development plans are subject to change based on a variety of factors. We may determine to abandon the development of one or more of our product candidates, or we may prioritize the development of one or more product candidates, or we may select or acquire and prioritize the development of new product candidates. Our choice and prioritization of product candidates for development will be influenced by a variety of factors, including but not limited to:

| ● | Results of our laboratory research and any animal and clinical trials that we or any licensees or collaborators may conduct; |

| ● | Our ability to enter into licensing or collaborative arrangements with other biotechnology or biopharma companies or universities with their own laboratory facilities and research staffs to conduct research and development of one or more product candidates; |

| ● | Our analysis of third-party competitive and alternative technology that may lead us to conclude that our product candidates or technologies may be non-competitive or obsolete; |

| ● | Our analysis of market demand and market prices for the products we plan to develop could lead us to conclude that market conditions are not favorable for receiving an adequate return on our investment in product development and commercialization; |

| ● | The amount of capital that we will have for our development programs and our projected costs for those programs; |

| ● | The issuance of patents to third parties that might block our use of the same or similar technology to develop a product candidate; and |

| ● | The views of the FDA and comparable foreign regulatory agencies on the pre-clinical product characterization studies required to file an IND in order to initiate human clinical testing of a therapeutic product candidate or to attain marketing approval for that product candidate, or to obtain an investigational device exemption for clinical trials, or clearance for a 510(k) application to market a medical device. |

Other AgeX Products and Product Candidates

Neural Stem Cells

AgeX has sponsored a research and development program at UCI for the manufacture of neural stem cells for use in the treatment of Huntington’s Disease and potentially other neurological diseases and disorders. AgeX has also collaborated with a research group at UCI studying the potential use of exosomes and other extracellular vesicles for the treatment of adverse neurocognitive effects of cancer chemotherapy and radiation therapy on brain function. The neural stem cell sponsored research and development program led to the creation of NeuroAirmid, which is a subsidiary of AgeX co-owned with certain of the UCI researchers and in which UCI will also receive an equity interest as partial consideration for granting to NeuroAirmid a license to use a UCI patent and certain specified technical information, materials, or data (“Associated Technology”) created in the laboratory of the inventors of the licensed patent.

UCI has made an IND submission to the FDA for the use of neural stem cells in a clinical trial for the treatment of Huntington’s Disease. The FDA has removed a clinical hold on the IND permitting a clinical trial to proceed. UCI and NeuroAirmid will apply to the California Institute for Regenerative Medicine (CIRM) for a $12,000,000 CLIN2 grant to fund the proposed clinical trial.

There can be no assurance that: (i) NeuroAirmid and UCI will successfully conclude negotiations and enter into a license agreement providing NeuroAirmid with a license to use a UCI patent needed for NeuroAirmid’s development and production of its planned therapeutic neural stem cell product, (ii) CIRM will provide a grant to finance a clinical trial or that the amount of any grant that may be awarded will ultimately be sufficient to complete the initial phase of the clinical trial; (iii) NeuroAirmid will be able to raise capital needed to finance its operations that will not be funded by a CIRM clinical trial grant or to finance any further clinical trials after any initial CIMR grant funding is exhausted; and (iv) if a clinical trial is commenced, it will lead to the successful clinical development and subsequent FDA marketing approval of a therapeutic cellular product for the treatment of Huntington’s Disease or any other neurological disease or disorder.

|

|

ESI BIO Research Products

We, through our ESI BIO research product division, market a number of products related to pluripotent stem cells including research-grade as well as cGMP-grade human PSC lines. We plan to contract with third parties where the third parties to allow them to utilize cGMP PSC lines in defined fields of application in exchange for certain compensation including the payment of royalties to us if they are successful in developing and commercializing a product.

Subsidiaries

AgeX has five subsidiaries, Reverse Bio, ReCyte Therapeutics, Inc. (“ReCyte”), NeuroAirmid, UniverXome Bioengineering, Inc. (“UniverXome”), and Merger Sub. Reverse Bio, ReCyte and NeuroAirmid are early stage pre-clinical research and development companies. UniverXome was organized to hold AgeX assets related to our current core technologies and research and development programs other than NeuroAirmid if the Meger is consummated.

AgeX intends to develop its iTRTM platform and AGEX-BAT1 through Reverse Bio. Reverse Bio will allow for a dedicated focus on iTRTM in terms of equity financing and advancing the iTRTM technology to proof-of-concept in an animal model. AgeX’s patent portfolio for iTR and AGEX-BAT1 development have been assigned to Reverse Bio, but the future operations of Reverse Bio will depend in large measure on its ability to raise its own capital. ReCyte is involved in stem cell-derived endothelial and cardiovascular related progenitor cells for the treatment of vascular disorders and ischemic conditions. AgeX owns 100%, 94.8%, and 50% of the outstanding capital stock of Reverse Bio, ReCyte, and NeuroAirmid, respectively. We expect that our ownership interests in Reverse Bio and NeuroAirmid will be diluted if those subsidiaries are successful in obtaining financing from investors or product development collaborators. All material intercompany accounts and transactions have been eliminated in consolidation.

Manufacturing

We presently do not have any manufacturing facilities and we will need to rely on third party contract manufacturers for the production of our cell lines and product candidates and to comply with quality manufacturing processes and controls.

Facilities

Our principal place of business is located at 1101 Marina Village Parkway, Suite 201, Alameda, California, which we use for office purposes only. We do not have our own research laboratory facilities.

Commercialization Plan

With the exception of our research product sales which generate a trivial amount of revenues, we currently have no commercialized or marketed products such as FDA-approved drugs in our portfolio. As a result, we have not yet assembled an infrastructure for sales and marketing. At the point in time, if ever, that our product candidates approach clearance or approval, we plan to develop a commercial plan that may initially include strategic marketing partnerships.

Intellectual Property

Patents and Trade Secrets

We rely primarily on patents and contractual obligations with employees and third parties to protect our proprietary rights. We have sought, and intend to continue to seek, appropriate patent protection for important and strategic components of our proprietary technologies by filing patent applications in the U.S. and certain foreign countries. There are no assurances that any of our intellectual property rights will guarantee protection or market exclusivity for our products and product candidates. We also use license agreements both to access technologies developed by other companies and universities and to convey certain intellectual property rights to others. Our financial success will be dependent, in part, on our ability to obtain commercially valuable patent claims, to protect and enforce our intellectual property rights, and to operate without infringing upon the proprietary rights of others if we are unable to obtain enabling licenses.

The patents for our core programs are summarized below.

AGEX-BAT1

Brown Adipose Tissue (BAT) Progenitor Cells: The pending patent applications related to BAT progenitor cells, which are owned by AgeX, include U.S. and international patent applications. The applications are directed to the differentiation of pluripotent stem cells (including hES cells) into progenitor cell types capable of making the cellular components of brown fat. The patents also describe culture and purification methods. The approximate expiration dates of the BAT patents, if issued, will range from 2034 to 2036.

|

|

AGEX-VASC1