UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 15, 2023

MARATHON DIGITAL HOLDINGS, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada | 001-36555 | 01-0949984 | ||

| (State

or other jurisdiction of incorporation) |

(Commission

File Number) |

(IRS

Employer Identification No.) |

| 101

NE Third Avenue, Suite 1200 Fort Lauderdale, FL |

33301 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (800) 804-1690

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock | MARA | The Nasdaq Capital Market |

ITEM 1.01 Entry into a Material Definitive Agreement

On December 15, 2023, Marathon Digital Holdings, Inc., a Nevada corporation (the “Company”), entered into a Purchase and Sale Agreement (the “Purchase Agreement”) by and among GC Data Center Parent, LLC, a Delaware limited liability company (“Seller”), GC Data Center Equity Holdings, LLC, a Delaware limited liability company (“Target” and together with its subsidiaries, the “Target Company Group”), solely for purposes of Section 10.18 and Article X thereunder, GC Portfolio Holdings I, LLC, a Delaware limited liability company “Seller Guarantor”), MARA USA Corporation, a Delaware corporation and wholly owned subsidiary of the Company (“Buyer”) and, solely for purposes of Section 10.17 and Article X thereunder, the Company. Pursuant to the Purchase Agreement and subject to the terms and conditions set forth therein, (a) Buyer will purchase from Seller 100% of the issued and outstanding equity interests of the Target (the “Transaction”), and (b) the Company will unconditionally and irrevocably guarantee all of Buyer’s liabilities and obligations under the Purchase Agreement, including, as, if and to the extent due, Buyer’s liabilities and obligations under the Purchase Agreement (the “Limited Guarantee”).

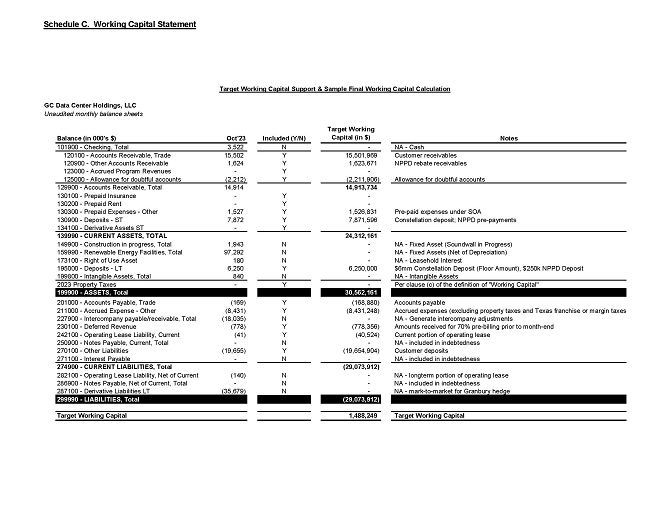

The base purchase price for the Transaction is $178.65 million, subject to customary purchase price adjustments (the “Purchase Price”). Buyer expects to have at the closing of the Transaction (the “Closing”) sufficient cash, available lines of credit or other sources of immediately available funds to pay the Purchase Price in accordance with the terms of the Purchase Agreement and all other amounts to be paid by Buyer thereunder or in connection therewith.

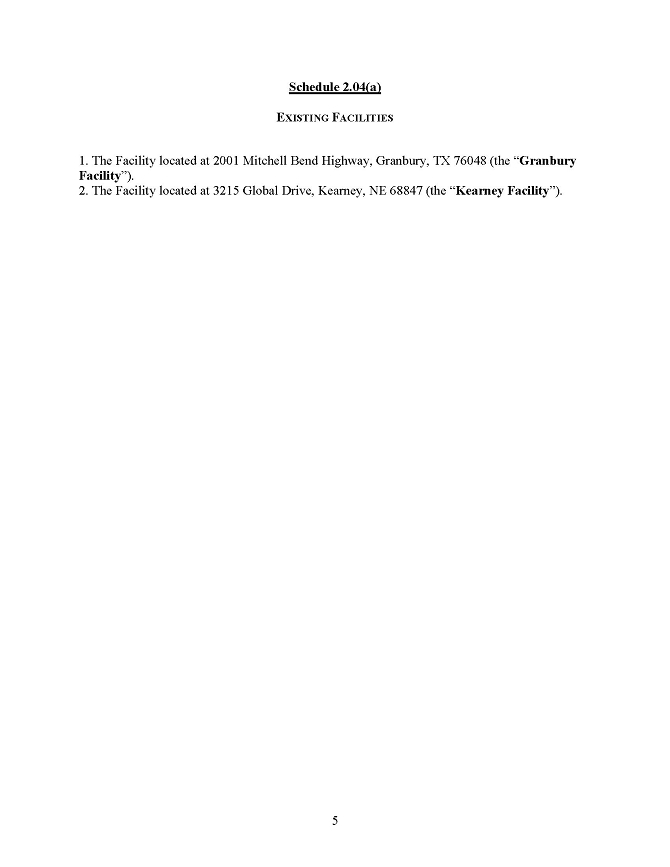

In addition to the Purchase Price, and as further consideration for the Transaction, if, on or prior to the third annual anniversary of the Closing, under certain circumstances, Buyer will be required to pay an earn-out payment (the “Expansion Payment”) to Seller if the Target determines to expand the existing data center facilities operated by the Target (the “Existing Facilities”). The Expansion Payment, if any, shall be in an amount equal to $50,000 multiplied by each megawatt (“MW”) of incremental capacity at the Existing Facilities for which construction has achieved notice to proceed on or prior to the third annual anniversary of the Closing, up to a maximum amount of $15 million.

In addition if, on or prior to the third annual anniversary of the Closing, the Target receives the consent of the Electric Reliability Council of Texas, Inc. (“ERCOT”) to energize (or similar) additional MW of load at its facility in Granbury, TX, Buyer shall be required to pay an earnout in an amount to be determined based on the number of additional MW of load approved.

The Purchase Agreement contains customary representations and warranties made by the parties, and also contains customary covenants and agreements. This includes customary indemnification obligations of Buyer and Seller. Seller Guarantor will unconditionally and irrevocably guarantee, as primary obligor and not merely as surety, all of Seller’s indemnification obligations under the Purchase Agreement.

The closing of the Transaction is subject to customary closing conditions, including (i) the expiration or early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and all waiting periods (and any extensions thereof), clearances, approvals or consents (as applicable) under any other antitrust laws applicable to the consummation of the Transactions shall have expired, been terminated or been obtained (as applicable) and remain in full force and effect to the extent applicable, (ii) no governmental authority having enacted, entered, promulgated or enforced any law (that is final, non-appealable, and has not been vacated, withdrawn or overturned) prohibiting or making illegal the consummation of the Transactions and no proceeding having been commenced that would reasonably be expected to result in the foregoing, (iii) the accuracy of each party’s representations and warranties (subject to certain materiality and other exceptions) and (iv) each party’s compliance with or waiver of its covenants and agreements contained in the Purchase Agreement (subject to certain materiality and other exceptions). The closing of the Transaction is not subject to any financing contingency. The Purchase Agreement contains termination rights that could be exercised by Seller and Buyer in certain circumstances. Upon termination of the Purchase Agreement under specified circumstances, Buyer will be required to pay Seller a reverse termination fee of $9,012,500. At Closing, the Existing Facilities will be operated by a third-party operator.

This summary of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the full text thereof, a copy of which is attached as Exhibit 2.1 to this Current Report on Form 8-K and incorporated into this Item 1.01 by reference.

The representations, warranties and covenants contained in the Purchase Agreement described above were made only for purposes of such agreement and as of the specified dates set forth therein, were solely for the benefit of the parties to the Purchase Agreement, may be subject to limitations agreed upon by those parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between those parties instead of establishing particular matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Investors should not rely on these representations, warranties or covenants or any descriptions thereof as characterizations of the actual state of facts or conditions of the Company, Seller or the Target Company Group or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations, warranties and covenants may change after the date of the agreement containing them, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

ITEM 8.01 Other Events

Press Release

On December 19, 2023, the Company issued a press release announcing the transactions described in this Current report on Form 8-K. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K and other reports filed by Registrant from time to time with the Securities and Exchange Commission (collectively, the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, Registrant’s management as well as estimates and assumptions made by Registrant’s management. When used in the Filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to Registrant or Registrant’s management identify forward-looking statements. Such statements reflect the current view of Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to Registrant’s industry, Registrant’s operations and results of operations and any businesses that may be acquired by Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although Registrant believes that the expectations reflected in the forward-looking statements are reasonable, Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits

| Exhibit No. | Description of Exhibit | |

| 2.1† | Purchase and Sale Agreement, dated December 15, 2023, by and among GC Data Center Parent, LLC, GC Data Center Equity Holdings, LLC, GC Portfolio Holdings I, LLC, a Delaware limited liability company, MARA USA Corporation, and Marathon Digital Holdings, Inc. | |

| 99.1 | Press Release of Marathon Digital Holdings, Inc., dated as of December 19, 2023 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| † | The schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5) and Item 1.01, Instruction 4 of Form 8-K. The Registrant agrees to furnish supplementally a copy of all omitted schedules to the Securities and Exchange Commission upon its request. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: December 18, 2023

| MARATHON DIGITAL HOLDINGS, INC. | ||

| By: | /s/ Zabi Nowaid | |

| Name: | Zabi Nowaid | |

| Title: | General Counsel | |

Exhibit 2.1

Exhibit 99.1

Marathon Digital Holdings Enters Definitive Agreement To Acquire Multiple Bitcoin Mining Sites for $179 Million

- First Fully Owned Sites Provide Immediate Expansion Opportunities, Operational Efficiencies, and Increase Marathon’s Bitcoin Mining Portfolio 56% to 910 Megawatts of Capacity

- Webcast and Conference Call Scheduled for Today, December 19, at 9:00 am ET (Registration Link Here)

Fort Lauderdale, FL – December 19, 2023 – Marathon Digital Holdings, Inc. (NASDAQ:MARA) (“Marathon” or “Company”), a leader in supporting and securing the Bitcoin ecosystem, has entered into a definitive purchase agreement to acquire two currently operational Bitcoin mining sites, totaling 390 megawatts of capacity, from subsidiaries of Generate Capital, PBC (“Generate”) for a total of $178.6 million, or $458,000 per megawatt, to be paid in cash from Marathon’s balance sheet.

This transaction represents Marathon’s first fully owned sites and marks the Company’s official transition from an asset-light organization to one that manages a diversified and resilient portfolio of Bitcoin mining operations. Currently, Marathon’s Bitcoin mining portfolio consists of 584 megawatts of capacity, 3% of which resides in sites that are owned and/or operated by the Company, and 97% of which is hosted by third parties. Following the close of this transaction, Marathon’s Bitcoin mining portfolio will consist of approximately 910 megawatts of capacity, 45% of which will reside on sites directly owned by the Company, and 55% of which will be hosted by third parties. In addition, the expansion opportunities at these sites substantially increase Marathon’s Bitcoin mining pipeline and provide the Company with the potential to double its current operational hash rate to approximately 50 exahashes of total operating capacity over the next 18-24 months.

With the acquisition of these sites, Marathon will take ownership of approximately 390 megawatts of operational capacity, 82 megawatts (21%) of which are currently vacant and available for immediate expansion, 244 megawatts (63%) of which are currently occupied by other Bitcoin mining tenants, and 64 megawatts (16%) of which are already occupied by Marathon and ripe for operational optimizations through energy hedging and other means. The transaction is expected to reduce the cost per coin of Marathon’s current operations at these sites by approximately 30%. In the near term, the Company intends to fill 82 megawatts of capacity currently available at the sites with its own miners. Hosting clients currently occupy 244 megawatts of capacity and, as these existing hosting clients depart the sites, the Company intends to use available capacity for its own miners to further increase its hash rate and maximize operational efficiencies. Marathon currently has 7 exahashes of miners on order, the first tranche of which is set to be delivered and installed in January 2024.

Under the terms of the agreement, Generate will transfer ownership of the data centers in Granbury, Texas and Kearney, Nebraska, both of which have third-party operators, to Marathon in exchange for $178.6 million, or $458,000 per megawatt (subject to certain adjustments), which will be paid in cash from Marathon’s balance sheet. The transaction is subject to customary closing conditions and is expected to close in the first quarter of 2024.

Management Commentary

“For the past year, Marathon has been vertically integrating as we transition into a more sophisticated and mature organization with a diversified portfolio of Bitcoin mining technologies and assets, and the acquisition of these sites is the next step in that evolution,” said Fred Thiel, Marathon’s chairman and CEO. “By acquiring the sites in Granbury, Texas and Kearney, Nebraska from Generate, we have an opportunity to reduce our bitcoin production costs at these sites, to capitalize on energy hedging opportunities, and to expand our operational capacity.

“This transaction increases the size of our Bitcoin mining portfolio by 56% from 584 megawatts to 910 megawatts of capacity, and it also provides us with a roadmap to double our current operational hash rate to approximately 50 exahashes over the next 18-24 months. We look forward to applying the operational expertise and the innovative technologies we have successfully developed and deployed at sites across the globe to our first fully owned and operated sites in the U.S.”

Salman Khan, Marathon’s chief financial officer, added, “We have spent the past year strengthening our balance sheet by increasing our cash position, adding to our bitcoin holdings, and reducing our debt to prepare for the halving and to ensure we can capitalize on accretive opportunities as they present themselves. This transaction is part of that long-term strategy and is made possible by the strategic efforts we have made to improve our balance sheet. By reducing our current operating costs at these sites by 30% and providing us with ample expansion opportunities, this transaction is immediately accretive to our organization. With our strong balance sheet, we were able to quickly advance the mutually beneficial purchase agreement of these assets without having to add debt or issue future equity. By transitioning ownership of the sites to Marathon, Generate will be able to continue their focus on greening data centers, and Marathon will own physical assets that reduce our bitcoin production costs and provide us with ample room to grow.”

David Hirsch, Principal at Generate Capital, commented, “Marathon has been an excellent partner and an essential part of the success of the data centers in Granbury, Texas and Kearney, Nebraska. With this transaction, Marathon strengthens its position as a leader in the Bitcoin ecosystem, and Generate can redeploy resources to continue its sustainability leadership with other initiatives at the nexus of digital and energy infrastructure. This agreement plays to both organizations’ strengths and long-term strategies.”

Webcast and Conference Call

Marathon Digital Holdings will hold a webcast and conference call today, December 19, at 9:00 a.m. Eastern time to discuss the transaction.

To register to participate in the conference call, or to listen to the live audio webcast, please use this link. The webcast will also be broadcast live and available for replay via the investor relations section of the Company’s website.

Webcast and Conference Call Details

Date: Today, December 19, 2023

Time: 9:00 a.m. Eastern time (6:00 a.m. Pacific time)

Registration link: LINK

If you have any difficulty connecting with the conference call, please contact Marathon’s investor relations team at ir@mara.com.

Investor Presentation

In conjunction with this press release, Marathon has published a presentation that includes additional information about the transaction. The presentation, titled Building the Bitcoin Mining Portfolio – The Acquisition of Marathon’s First Fully Owned Sites, is available in investor relations section of the Company’s website under Presentations.

Advisors

Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal advisor to Marathon in connection with the transaction and Kirkland & Ellis LLP is serving as legal advisor to Generate.

Investor Notice

Investing in our securities involves a high degree of risk. Before making an investment decision, you should carefully consider the risks, uncertainties and forward-looking statements described under “Risk Factors” in Item 1A of our most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 16, 2023. If any of these risks were to occur, our business, financial condition or results of operations would likely suffer. In that event, the value of our securities could decline, and you could lose part or all of your investment. The risks and uncertainties we describe are not the only ones facing us. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations. In addition, our past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results in the future. Future changes in the network-wide mining difficulty rate or Bitcoin hash rate may also materially affect the future performance of Marathon’s production of bitcoin. Additionally, all discussions of financial metrics assume mining difficulty rates as of December 2023. See “Forward-Looking Statements” below.

Forward-Looking Statements

Statements made in this press release include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the use of words such as “may,” “will,” “plan,” “should,” “expect,” “anticipate,” “estimate,” “continue,” or comparable terminology. Such forward-looking statements are inherently subject to certain risks, trends and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate and involve factors that may cause actual results to differ materially from those projected or suggested. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed above together with the additional factors under the heading “Risk Factors” in the Company’s Annual Reports on Form 10-K, as may be supplemented or amended by the Company’s Quarterly Reports on Form 10-Q. The Company assumes no obligation to update or supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise.

About Marathon Digital Holdings

Marathon is a digital asset technology company that focuses on supporting and securing the Bitcoin ecosystem. The Company is currently in the process of becoming one of the largest and most sustainably powered Bitcoin mining operations in North America.

For more information, visit www.mara.com, or follow us on:

Twitter: @MarathonDH

LinkedIn: www.linkedin.com/company/marathon-digital-holdings

Facebook: www.facebook.com/MarathonDigitalHoldings

Instagram: @marathondigitalholdings

Marathon Digital Holdings Company Contact:

Telephone: 800-804-1690

Email: ir@mara.com

Marathon Digital Holdings Media Contact:

Email: marathon@wachsman.com