UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-41657

CBL INTERNATIONAL LIMITED

(Registrant’s Name)

Level 23-2, Menara Permata Sapura

Kuala Lumpur City Centre

50088 Kuala Lumpur

Malaysia

Tel: +603 2706 8280

Fax: +603 2703 2968

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

CBL International Limited (the “Company”), together with its subsidiaries (the “Group”), today announced to hold the annual general meeting of shareholders of the Company on November 6, 2023.

EXHIBITS

| Exhibit No. | Description | |

| 99.1 | Notice of Annual General Meeting of Shareholders of CBL International Limited to be held on November 6, 2023 (the “2023 AGM”) | |

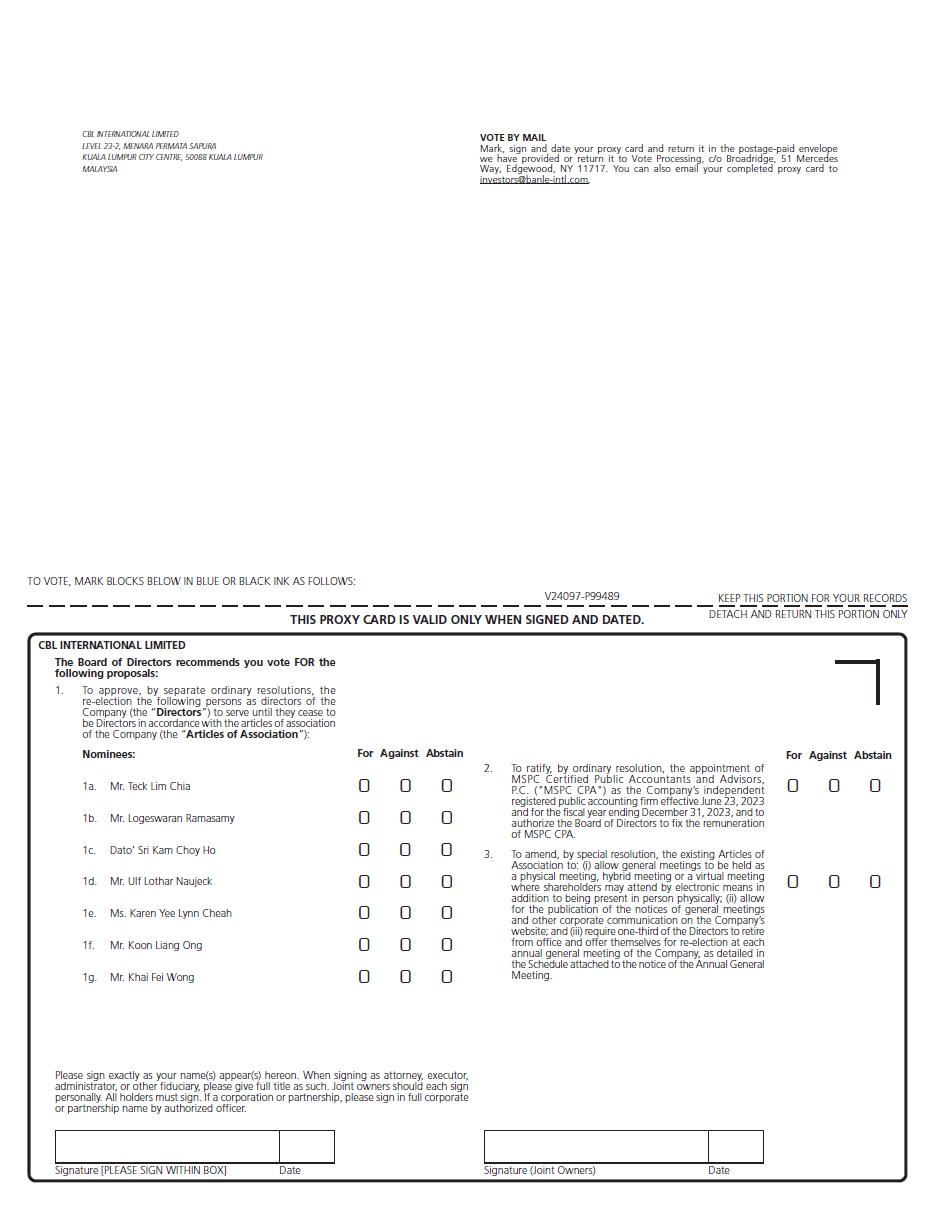

| 99.2 | Form of Proxy Card for the 2023 AGM |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CBL International Limited | ||

| By: | /s/ Teck Lim Chia | |

| Name: | Teck Lim Chia | |

| Date: October 4, 2023 | Title: | Chief Executive Officer |

Exhibit 99.1

CBL INTERNATIONAL LIMITED

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 6, 2023

To the Shareholders of CBL International Limited:

NOTICE IS HEREBY GIVEN that an annual general meeting (the “Annual General Meeting”) of shareholders (the “Shareholders”) of CBL International Limited (the “Company”), an exempted Cayman Islands company, will be held at Level 23-2, Menara Permata Sapura, Kuala Lumpur City Centre, 50088 Kuala Lumpur, Malaysia on November 6, 2023, at 9.30 a.m., Malaysia time, for the purposes of considering and voting upon, and if thought fit, passing and approving the following resolutions:

| 1. | To approve, by separate ordinary resolutions, the re-election of the following persons as directors of the Company (the “Directors”) to serve until they cease to be Directors in accordance with the articles of association of the Company (the “Articles of Association”): |

| a. | Mr. Teck Lim Chia | |

| b. | Mr. Logeswaran Ramasamy | |

| c. | Dato’ Sri Kam Choy Ho | |

| d. | Mr. Ulf Lothar Naujeck | |

| e. | Ms. Karen Yee Lynn Cheah | |

| f. | Mr. Koon Liang Ong | |

| g. | Mr. Khai Fei Wong |

| 2. | To ratify, by ordinary resolution, the appointment of MSPC Certified Public Accountants and Advisors, P.C. (“MSPC CPA”) as the Company’s independent registered public accounting firm effective June 23, 2023 and for the fiscal year ending December 31, 2023, and to authorize the board of Directors to fix the remuneration of MSPC CPA. |

| 3. | To amend, by special resolution, the existing Articles of Association to: (i) allow general meetings to be held as a physical meeting, hybrid meeting or a virtual meeting where shareholders may attend by electronic means in addition to being present in person physically; (ii) allow for the publication of the notices of general meetings and other corporate communication on the Company’s website; and (iii) require one-third of the Directors to retire from office and offer themselves for re-election at each annual general meeting of the Company, details of which are set out in the Schedule hereto attached. |

| 4. | To transact such other business as may properly come before the meeting. |

You can find more information about each of these items in the attached proxy statement. Only Shareholders registered in the register of members at the close of business on September 29, 2023, New York time, can vote at the Annual General Meeting or at any adjournment that may take place.

We cordially invite all Shareholders to attend the Annual General Meeting in person.

|

|

However, Shareholders entitled to attend and vote are entitled to appoint a proxy to attend and vote instead of such holders. A proxy need not be a Shareholder. If you are a Shareholder and whether or not you expect to attend the Annual General Meeting in person, please mark, date, sign and return the enclosed form of proxy as promptly as possible to ensure your representation and the presence of a quorum at the Annual General Meeting. If you send in your form of proxy and then decide to attend the Annual General Meeting to vote in person, you may still do so. Your proxy is revocable in accordance with the procedures set forth in the proxy statement. The enclosed form of proxy is to be delivered to the attention of Teck Lim Chia, Chief Executive Officer, CBL International Limited, Level 23-2, Menara Permata Sapura, Kuala Lumpur City Centre, 50088 Kuala Lumpur, Malaysia, and must arrive no later than the time for holding the Annual General Meeting or any adjournment thereof. This notice of the Annual General Meeting of Shareholders and the attached proxy statement are also available through our website at www.banle-intl.com.

Level 23-2, Menara Permata Sapura,

Kuala Lumpur City Centre,

50088 Kuala Lumpur, Malaysia

Telephone: +603 2706 8280

| By Order of the Board | |

| /s/ Teck Lim Chia | |

| Teck Lim Chia | |

| Chief Executive Officer | |

| October 4, 2023 |

|

|

CBL INTERNATIONAL LIMITED

PROXY STATEMENT

FOR

ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 6, 2023

Date, Time and Place of the Annual General Meeting

The enclosed proxy is solicited by the board (the “Board”) of directors (the “Directors”) of CBL International Limited (the “Company”), an exempted Cayman Islands company, in connection with the annual general meeting of shareholders of the Company (the “Annual General Meeting”) to be held at Level 23-2, Menara Permata Sapura, Kuala Lumpur City Centre, 50088 Kuala Lumpur, Malaysia on November 6, 2023 at 9.30 a.m. at Malaysia time, and any adjournments thereof, for the purposes set forth in the accompanying notice of Annual General Meeting.

Record Date, Share Ownership and Quorum

Only record holders (the “Shareholders”) of the ordinary shares of the Company (the “Ordinary Shares”) as of the close of business on September 29, 2023, New York time, are entitled to vote at the Annual General Meeting. As of September 29, 2023, 25,000,000 of our Ordinary Shares, par value US$0.0001 per share were issued and outstanding. Two or more Shareholders which represent, in aggregate, not less than 50% of the paid up voting shares of the Company present in person or by proxy or, if a corporation or other non-natural person, by its authorized representative shall be a quorum for all purposes.

Difference between Holding Shares as a “Shareholder of Record” and “Beneficial Owner” (or in “Street Name”)

Most Shareholders are considered “beneficial owners” of their shares, that is, they hold their shares through a brokerage firm, bank, dealer or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially or in “street name”.

Shareholder of record

If, on the record date, your Ordinary Shares were registered directly in your name with our transfer agent, VStock Transfer, LLC, then you are the “shareholder of record” with respect to those Ordinary Shares. As a shareholder of record, you may vote at the Annual General Meeting or vote by proxy.

Beneficial Owner

If, on the record date, your Ordinary Shares were held in an account at a brokerage firm, bank, dealer or other nominee, then you are the “beneficial owner” of shares held in “street name”. The brokerage firm, bank, dealer or other nominee holding your Ordinary Shares is considered the shareholder of record for purposes of voting at the Annual General Meeting; provided, however, as a beneficial owner, you have the right to direct your brokerage firm, bank, dealer or other nominee on how to vote the shares in your account.

Voting

Each Ordinary Share shall be entitled to one (1) vote on all matters subject to the vote at the Annual General Meeting.

At the Annual General Meeting, every Shareholder present in person or by proxy may vote the fully paid Ordinary Shares held by such Shareholder. The chairman of the Annual General Meeting will exercise his rights under the articles of association of the Company and request that each of the resolutions proposed be voted upon through a poll. The affirmative vote of a simple majority of the votes cast by the Shareholders will be required to pass each of the proposed resolutions submitted to a vote at the Annual General Meeting except with the proposed resolution to amend the articles of association of the Company (the “Articles of Association”) which requires the affirmative vote of not less than two-thirds of the votes cast of such Shareholders.

Voting by Shareholders

Shareholders whose shares are registered in their own names may vote by attending the Annual General Meeting in person or by completing, dating, signing and returning the enclosed form of proxy by email at investors@banle-intl.com or by post in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. The form of proxy must arrive no later than the time for holding the Annual General Meeting or any adjournment thereof.

When proxies are properly completed, dated, signed and returned by Shareholders, the Ordinary Shares they represent, unless the proxies are revoked, will be voted at the Annual General Meeting in accordance with the instructions of the Shareholder. If no specific instructions are given by such Shareholders, the proxy holder will have discretion to vote on each proposal and as to other matters that may properly come before the Annual General Meeting. Abstentions and broker non-votes will be counted as present for purposes of determining whether a quorum is present.

Beneficial owners can only vote through their brokerage firm, bank, dealer or other nominee, or in person at the Annual General Meeting if they have been appointed proxy by their brokerage firm, bank, dealer or other nominee. Beneficial owners should follow the voting instruction to be provided by their brokerage firm, bank, dealer or other nominee for directing the relevant brokerage firm, bank, dealer or other nominee to vote the shares in the beneficial owners’ account.

Please refer to this proxy statement for information related to the proposed resolutions.

Revocability of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by delivering a written notice of revocation or a duly executed proxy bearing a later date or, if you hold Ordinary Shares, by attending the meeting and voting in person. A written notice of revocation must be delivered to the attention of CBL International Limited.

|

|

PROPOSALS

Background

We are asking Shareholders to pass the following resolutions (“Proposals”):

| 1. | To approve, by separate ordinary resolutions, the re-election of the following persons as Directors to serve until they cease to be Directors in accordance with the Articles of Association: |

| a. | Mr. Teck Lim Chia | |

| b. | Mr. Logeswaran Ramasamy | |

| c. | Dato’ Sri Kam Choy Ho | |

| d. | Mr. Ulf Lothar Naujeck | |

| e. | Ms. Karen Yee Lynn Cheah | |

| f. | Mr. Koon Liang Ong | |

| g. | Mr. Khai Fei Wong |

The nominees listed below have been nominated by the Nominating and Corporate Governance Committee and approved by our Board to stand for re-election as Directors.

| Directors and Executive Officer | Age | Position / Title | ||

| Mr. Teck Lim Chia | 56 | Chairman and Chief Executive Officer | ||

| Mr. Logeswaran Ramasamy | 51 | Director | ||

| Dato’ Sri Kam Choy Ho | 60 | Director | ||

| Mr. Ulf Lothar Naujeck | 62 | Independent Director | ||

| Ms. Karen Yee Lynn Cheah | 55 | Independent Director | ||

| Mr. Koon Liang Ong | 45 | Independent Director | ||

| Mr. Khai Fei Wong | 42 | Independent Director |

Mr. Teck Lim Chia, aged 56, is the chairman of our Board and chief executive officer since inception of our Group, and is primarily responsible for overseeing the strategy and decision making of our Group. He has over 16 years of experience in the oil and gas related industries and business management. Before founding our Group, Mr. Chia was employed by BrightOil Group, a company based in Shenzhen, PRC which was principally engaged in the fuel oil business from April 2006 to June 2008, with his last position held as general director. From June 2008 to September 2011, he served as an executive director of BrightOil Group’s listing company which was listed on The Stock Exchange of Hong Kong Limited and principally engaged in the international supply of fuel oil and bunkering business. From October 2011 to January 2017, Mr. Chia served as a director of an oil trading company. Mr. Chia received a bachelor’s degree in business administration management from the Oklahoma State University in December 1988 and a master’s degree in public administration from the University of Management & Technology in June 2012.

Mr. Logeswaran Ramasamy, aged 51, has been appointed as our Director since March 2023, and is primarily responsible for the overall operations and management of Banle Marketing, and market development in the South East Asia region. Mr. Ramasamy joined our Group in October 2020. Mr. Ramasamy graduated from the Northern University of Malaysia (University Utara Malaysia) with a bachelor’s degree in business administration in July 1997. From September 1997 to March 1998, he worked as a management trainee of Aurora Tankers Sdn. Bhd. From April 1998 to April 2002, he served at KL Maritime (M) Sdn. Bhd., with his last position held as head of shipbroking operation. From March 2003 to May 2004, he was a shipbroker at EverGreen Milestone Sdn. Bhd. From June 2004 to February 2006, he was a shipbroker at Nautica Chartering Sdn. Bhd. From March 2006 to March 2015, he was the chief operating officer at KIC Oil & Gas Sdn. Bhd. Since June 2015, he served as a director of KL Bunkering (M) Sdn. Bhd.

|

|

Dato’ Sri Kam Choy Ho, aged 60, has been appointed as our Director since March 2023, and is primarily responsible for advising on strategy, policy, performance and other general matters of our Group. He has over 24 years of experience in the commercial management of vessels in the shipping industry. Apart from our Group, he has been a director of R.H. Pacific Shipping (Agencies) Limited (previously known as Hotama Pacific Shipping (Agencies) Limited) since August 1997, a company that primarily engages in shipping and transportation of bulk/bagged cargo, and he is responsible for supervising the business operation and general management. He joined Straits Energy Resources Berhad (previously known as Straits Inter Logistics Berhad), shares of which are listed on the ACE Market of Bursa Malaysia Securities Berhad (stock code: 0080), in August 2016 as a non-independent and non-executive director and was re-designated as an executive director in January 2017. He is currently the group managing director, and is responsible for the overall business management and strategic development.

Mr. Ulf Lothar Naujeck, aged 62, has been appointed as our independent Director since March 2023 and he is also the chairman of compensation committee and a member of the nominating and corporate governance committee. Mr. Naujeck has over 25 years of experience in procurement and management. From July 1994 to July 2019, he was employed by Hapag-Lloyd AG, an international container liner operator, with his last position as a senior director of purchasing and supply. Mr. Naujeck graduated from the University of Hagen (FernUniversität in Hagen) with a diploma in business in September 2001.

Ms. Karen Yee Lynn Cheah, aged 55, has been appointed as our independent Director since March 2023 and she is also the chairperson of the nominating and corporate governance committee, and a member of the audit committee and compensation committee. Ms. Cheah is a solicitor in Malaysia and has over 26 years of practice experience in the legal field. She was admitted to the Malaysian Bar in 1995 and commenced full practice since then. Ms. Cheah’s current primary focus is in information technology and data privacy, mergers & acquisition, regulatory compliance, foreign direct investments, corporate and commercial contracts, real estate transactions, banking and finance, private wealth management, as well as non-contentious tax areas. Ms. Cheah was the Honorary Secretary and Treasurer of the Malayisan Bar from 2015 to 2017. Ms. Cheah is currently the president of the Malaysian Bar and the chairman of the Malaysian Bar Council. Ms. Cheah obtained a bachelor’s degree in laws from the University of London in 1993 and the Malaysian Certificate in Legal Practice in 1994.

Mr. Koon Liang Ong, aged 45, has been appointed as our independent Director since March 2023 and he is also the chairman of the audit committee and a member of the compensation committee. Mr. Ong has over 22 years of experience in providing auditing, taxation, liquidation and other assurance services to companies in Malaysia. He joined Ong & Wong Chartered Accountants in September 2000 as a junior associate and is currently an audit partner of the firm. Mr. Ong has served as a director of O & W Tax Consultants Sdn. Bhd. since April 2013 up to the present. Mr. Ong has been a member of the Association of Chartered Certified Accountant in Malaysia since July 2004, a member of the Malaysian Institute of Accountants since August 2005, an approved auditor of the Ministry of Finance Malaysia since February 2013 and a member of the Chartered Tax Institute of Malaysia since March 2014. Mr. Ong graduated from the University of Manchester in June 2000 with a bachelor of arts in economic and social studies (major in accounting).

Mr. Khai Fei Wong, aged 42, has been appointed as our independent Director since March 2023 and he is also a member of the audit committee and nominating and corporate governance committee. Mr. Wong has over 14 years of experience in auditing, taxation and corporate secretarial matters. He began his professional career in June 2008 with Indah Secretarial (KL) Sdn Bhd (formerly known as Cheng & Co Secretarial Sdn Bhd) as a secretarial assistant. In July 2013, Mr. Wong set up a corporate secretarial firm which principally engages in provision of corporate secretarial, dissolution and tax advisory services. Mr. Wong has served a manager of OKL Taxation Services Sdn Bhd since 2020. Mr. Wong has been a licensed company secretary of the Companies Commission of Malaysia since July 2014, an associate member of the Chartered Tax Institute of Malaysia since October 2020 and a licensed tax agent of the Inland Revenue Board of Malaysia since December 2021. Mr. Wong graduated from the University of Sheffield in July 2003 with a bachelor’s degree in arts.

| 2. | To ratify, by ordinary resolution, the appointment of MSPC Certified Public Accountants and Advisors, P.C. (“MSPC CPA”) as the Company’s independent registered public accounting firm effective June 23, 2023 and for the fiscal year ending December 31, 2023, and to authorize the Board to fix the remuneration of MSPC CPA. |

|

|

The audit committee of the Board (the “Audit Committee”), which is composed entirely of independent Directors, has selected MSPC CPA, independent registered public accounting firm, to audit our financial statements effective June 23, 2023 and for the fiscal year ending December 31, 2023. Ratification of the appointment of MSPC CPA by Shareholders is not required by law. However, as a matter of good corporate practice, such appointment is being submitted to the Shareholders for ratification at the Annual General Meeting. If the Shareholders do not ratify the appointment, the Board and the Audit Committee will reconsider whether or not to retain MSPC CPA, but may, in their discretion, retain MSPC CPA. Even if the appointment is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such change would be in the best interests of the Company and its shareholders.

Representatives from MSPC CPA will not be in attendance at the Annual General Meeting.

There is no change or disagreements with the independent registered public accounting firms on accounting and financial disclosure.

The following table sets forth, for each of the years indicated, the fees expensed by MSPC CPA:

|

For the year ending December 31, 2023 |

||||

| Fee for the audit of the consolidated financial statements of the Group for the year ending December 31, 2023 and for the year ended December 31, 2022 | US$270,000 | |||

| Fee for the high-level review of the consolidated financial statements of the Group for the six months ended June 30, 2023 and 2022 | US$10,000 | |||

| Fee for the audit of the individual subsidiaries for the year ending December 31, 2023 | US$40,000 | |||

| 3. | To amend, by special resolution, the Articles of Association to: (i) allow general meetings to be held as a physical meeting, hybrid meeting or a virtual meeting where shareholders may attend by electronic means in addition to being present in person physically; (ii) allow for the publication of the notices of general meetings and other corporate communication on the Company’s website; and (iii) require one third of the Directors to retire from office and offer themselves for re-election at each annual general meeting of the Company, as detailed in the Schedule attached to the notice of the Annual General Meeting. |

If our Shareholders approve this Proposal, our Board will have the authority to instruct the registered office to file the notice to amend the Articles of Association with the Cayman Islands Registrar of Companies at any time after the approval of this Proposal.

| 4. | To transact such other business as may properly come before the meeting. |

Vote Required and Board Recommendation

If a quorum is present, (i) the affirmative vote of a simple majority of the votes cast by the Shareholders present in person or represented by proxy and entitled to vote at the Annual General Meeting will be required to approve the Proposals 1, 2 and 4; and (ii) the affirmative vote of a two-thirds majority of the votes cast by the Shareholders present in person or represented by proxy and entitled to vote at the Annual General Meeting will be required to approve the Proposal 3.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE PROPOSALS.

OTHER MATTERS

We know of no other matters to be submitted to the Annual General Meeting. If any other matters properly come before the Annual General Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as our Board may recommend.

| By Order of the Board | |

/s/ Teck Lim Chia |

|

| Teck Lim Chia | |

| Chief Executive Officer | |

|

Date: October 4, 2023 |

|

|

CBL INTERNATIONAL LIMITED

SCHEDULE TO NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

PROPOSED AMENDMENTS TO ARTICLES OF ASSOCIATION

“RESOLVED AS A SPECIAL RESOLUTION THAT the articles of association of the Company be amended in the following manner:

Article 1.2

By adding the following new paragraph (i):

| “(j) | Sections 8 and 19 of the Electronic Transaction Act (Revised) of the Cayman Islands, shall not apply to these Articles to the extent it imposes obligations or requirements in addition to those set out in these Articles.” |

Article 10.1

By inserting the words “(where applicable) and/or in such form” after the word “place” so that the revised Article 10.1 will read as follows:

“10.1 The Company may, but shall not (unless required by the Designated Stock Exchange Rules) be obligated to, in each year hold a general meeting as an annual general meeting, which, if held, shall be convened at such time and place (where applicable) and/or in such form as may be determined by the Board, in accordance with these Articles.”

Article 10.2

By inserting the following sentences at the end of the existing provision:

“Notwithstanding any provisions in these Articles, any general meeting or any class meeting may be held by means of such telephone, electronic or other communication facilities as to permit all persons participating in the meeting to communicate with each other, and participation in such a meeting shall constitute presence at such meeting. Unless otherwise determined by the Directors, the manner of convening and the proceedings at a general meeting set out in these Articles shall, mutatis mutandis, apply to a general meeting held wholly by or in-combination with electronic means.”

Article 10.11

| (a) | By inserting the words “save for an electronic meeting) after the word “place” in sub-paragraph (a); |

| (b) | By adding the following new sub-paragraph (c): |

“if the meeting is to be a hybrid meeting or an electronic meeting, a statement to that effect and with details of the electronic facilities for attendance and participation by electronic means at the meeting or where such details will be made available by the Company prior to the meeting”

| (c) | By re-numbering existing sub-paragraphs (c) and (d) to (d) and (e) respectively; |

|

|

Article 11.6

By deleting this Article in its entirety and replacing it with the following:

“11.6 lf it appears to the chairman of the meeting that

| (a) | the electronic facilities at the place of the meeting have become inadequate or are otherwise not sufficient to allow the meeting to be conducted substantially in accordance with these Articles; or | |

| (b) | in the case of an electronic meeting or a hybrid meeting, electronic facilities being made available by the Company have become inadequate; or | |

| (c) | it is not possible to ascertain the view of those present or to give all persons entitled to do so a reasonable opportunity to communicate and/or vote at the meeting; or | |

| (d) | there is violence or the threat of violence, unruly behaviour or other disruption occurring at the meeting or it is not possible to secure the proper and orderly conduct of the meeting |

then, without prejudice to any other power which the chairman of the meeting may have under these Articles or at common law, the chairman may, at his/her absolute discretion, without the consent of the meeting, and before or after the meeting has started and irrespective of whether a quorum is present, interrupt or adjourn the meeting (including adjournment for indefinite period). All business conducted at the meeting up to the time of such adjournment shall be valid.”

Article 11.10

By inserting the following sentence at the beginning of this provision:

“Votes (whether on a show of hands or by way of poll) may be cast by such means, electronic or otherwise, as the Directors or the chairman of the meeting may determine. “

Article 14.12

By deleting the entire Article in its entirety and replacing it with the following:

| 14.12 | “Unless re-appointed pursuant to the provisions of Article 14.5 or removed from office pursuant to the provisions of Article 14.13, each Director shall be subject to the following: |

| 14.12.1 | Notwithstanding any other provisions in the Articles, at each annual general meeting one third of the Directors for the time being (or, if their number is not a multiple of three (3), the number nearest to but not greater than one third) shall retire from office by rotation provided that every Director shall be subject to retirement at an annual general meeting at least once every three years. |

| 14.12.2 | A retiring Director shall be eligible for re-election by ordinary resolution of the members of the Company. The Directors to retire by rotation shall include (so far as necessary to ascertain the number of directors to retire by rotation) any Director who wishes to retire and not to offer himself for re-election. Any further Directors so to retire shall be those of the other Directors subject to retirement by rotation who have been longest in office since their last re-election or appointment and so that as between persons who became or were last re-elected Directors on the same day those to retire shall (unless they otherwise agree among themselves) be determined by lot. |

| 14.12.3 | Unless otherwise provided by the rules of the Designated Stock Exchange, no person other than a Director retiring at the meeting shall, unless recommended by the Directors for election, be eligible for election as a Director at any general meeting.” |

Article 28.4

By deleting this Article in its entirety and replacing it with the following:

“28.4 Subject to the Act, the Designated Stock Exchange Rules and to any other rules which the Company is bound to follow, the Company may also send any notice or other document pursuant to these Articles to a Member by publishing that notice or other document on the Company’s website or the website of the Designated Stock Exchanges.”“

|

|

Exhibit 99.2