UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 17, 2023

BIOAFFINITY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-41463 | 46-5211056 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification Number) |

22211 W Interstate 10

Suite 1206

San Antonio, Texas 78257

(210) 698-5334

(Address of principal executive offices and Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Stock, par value $.007 per share | BIAF | The Nasdaq Stock Market LLC | ||

| Tradeable Warrants to purchase Common Stock | BIAFW | The Nasdaq Stock Market LLC |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

Amendment to Warrants

On September 17, 2023, Mr. Girgenti, the Cranye Girgenti Testamentary Trust, Gary Rubin, The Harvey Sandler Revocable Trust, a trust of which Mr. Rubin is a co-trustee, Ms. Zannes and Dr. Joyce consented to an amendment of the terms of the outstanding warrants that they own. Such warrants include warrants (i) tradeable warrants (the “Tradeable Warrants”) to purchase 98,198, 39,182, and 39,182 shares of Common Stock owned by Mr. Girgenti, The Harvey Sandler Revocable Trust, and Ms. Zannes, respectively); (ii)non-tradeable warrants (the “Non-Tradeable Warrants”) to purchase 102,286, 40,813, and 40,813 shares of Common Stock owned by Mr. Girgenti, The Harvey Sandler Revocable Trust, and Ms. Zannes, respectively; and (iii) other outstanding warrants (the “Pre-IPO Warrants”) to purchase 469,063, 8,332, 571,373, 23,571, 17,137, and 14,285 shares of Common Stock owned by Mr. Girgenti, the Cranye Girgenti Testamentary Trust, Mr. Rubin, The Harvey Sandler Revocable Trust, Ms. Zannes and Dr. Joyce, respectively. The warrant amendment (the “Warrant Amendment”) provides that such warrants will not be exercisable until the date that we file a certificate of amendment to our certificate of incorporation with the State of Delaware which increases the number of shares of our authorized Common Stock to allow for sufficient authorized and unissued shares of Common Stock for the full exercise of all of the outstanding Pre-IPO Warrants, Tradeable Warrants and Non-Tradeable Warrants of the Company and the issuance of all of the shares of Common Stock underlying such warrants.

Acquisition

On September 18, 2023, bioAffinity Technologies, Inc.’s (the “Company”) wholly-owned subsidiary, Precision Pathology Laboratory Services LLC (“PPLS”), consummated the acquisition (the “Acquisition”) of a clinical anatomic and clinical pathology laboratory and related services business in San Antonio, Texas (the “Laboratory Assets”) pursuant to the terms of an Asset Purchase Agreement (the “Asset Purchase Agreement”) dated September 18, 2023 that PPLS entered into with Village Oaks Pathology Services, P.A., a Texas professional association d/b/a Precision Pathology Services (“Village Oaks Pathology”) and Dr. Roby P. Joyce, M.D. As a result of the Acquisition, the clinical pathology laboratory is owned by PPLS. Dr. Joyce was the Medical Director and Laboratory Director of the clinical pathology laboratory prior to the Acquisition and he continues to serve as Medical Director and Laboratory Director after the Acquisition. The laboratory is accredited by the College of American Pathologists (“CAP”) and certified under the Clinical Laboratory Improvement Amendments of 1988 (“CLIA”). Pursuant to the terms of the Asset Purchase Agreement, PPLS acquired the Laboratory Assets, which included all of the assets owned by Village Oaks other than medical assets, which Laboratory Assets Village Oaks used in connection with its management and operation of a clinical pathology laboratory, now owned by PPLS, and related services business, and assumed certain liabilities and obligations.

Pursuant to the terms of the Asset Purchase Agreement, Village Oaks received $3,500,000 in consideration for the Laboratory Assets purchased by PPLS, of which $1,000,000 was paid by the issuance of 564,972 shares of the Company’s restricted common stock to the Joyce Living Trust, dated March 19, 2013, a trust (the “Trust”) of which Roby Joyce, MD (“Dr. Joyce”), the principal of Village Oaks Pathology, is trustee, which number of shares was determined by dividing $1,000,000 by $1.77, the average of the trading day closing prices for the thirty (30) days prior to September 15, 2023, rounded to the nearest whole share, pursuant to a Subscription Agreement, dated September 18, 2023, by and between the Trust and the Company (the “Subscription Agreement”).

The Asset Purchase Agreement contains customary representations, warranties and covenants made by PPLS and Village Oaks Pathology. Subject to certain customary limitations, Village Oaks Pathology agreed to indemnify PPLS, its successors and assigns, and each of their affiliates, and PPLS’ officers, directors, employees and other authorized agents against certain losses related to, among other things, breaches of Village Oaks Pathology’s representations, warranties, covenants and agreements as well as any excluded liabilities and excluded assets described therein. Subject to certain customary limitations, PPLS also agreed to indemnify Village Oaks Pathology, its successors and assigns, and each of their affiliates, and Village Oaks Pathology’s officers, directors, employees and other authorized agents against certain losses related to, among other things, breaches of PPLS’ representations, warranties, covenants and agreements as well as any assumed liabilities. Upon consummation of the transaction, the following ancillary agreements described below were entered into.

Pursuant to the Asset Purchase Agreement, PPLS assumed all liabilities and obligations under and obtained any and all rights, title and interest of Village Oaks in and to (i) all leases for equipment and personal property related to the Laboratory Assets (the “Assumed Leases”), pursuant to an Assumption Agreement by and between Village Oaks and PPLS (the “Assumption Agreement”) and, (ii) certain other contracts related to the Laboratory Assets, including the license to develop, manufacture, use, market and sell CyPath® Lung (the “Assumed Contracts”) pursuant to the Assumption Agreement; (iii) all accounts payable of Village Oaks as of September 18, 2023 that were incurred in the ordinary course of business consistent with past custom and practice; and (iv) the lease of the premises used in connection with operation of the CLIA-certified and CAP-accredited clinical pathology laboratory, pursuant to an Assignment and Assumption of Lease by and between Village Oaks and PPLS (the “Assignment of Lease”), which Assignment of Lease was consented to by the landlord of the leased premises. The monthly rent is currently $10,143.83 per month and the term of the Lease is five years.

In connection with the Asset Purchase Agreement, PPLS entered into a Management Services Agreement with Village Oaks Pathology (the “Management Services Agreement”) pursuant to which PPLS agreed to provide comprehensive management and administrative services to Village Oaks Pathology in connection with the operation of Village Oaks Pathology’s professional cytopathology, histopathology, clinical and anatomic pathology interpretation medical services practice. PPLS will provide space, equipment, administrative, management and clinical personnel, billing and collection, and related management services to Village Oaks Pathology in exchange for a management fee of 70% of the net revenues received by Village Oaks Pathology from the provision of the medical services. The Management Services Agreement has an initial term of twenty years and provides that upon expiration of the initial term, it will be automatically extended for two additional successive terms of five years each, unless either party delivers written notice of its intention not to extend the term of the agreement not less than ninety days prior to the expiration of the preceding term. The Management Services Agreement also provides that until the fifth anniversary of its effective date, Village Oaks Pathology will not, without the prior written approval of PPLS own, operate or have any financial interest in any other person or entity that operates an independent laboratory or an enterprise within the United States that provides or promotes management or administrative services or any product or services substantially similar to those provided by PPLS.

In connection with the Asset Purchase Agreement, PPLS entered into a Succession Agreement with Village Oaks Pathology and Dr. Joyce (the “Succession Agreement”) pursuant to which Dr. Joyce, as holder of 100% of the issued and outstanding stock of Village Oaks Pathology, is restricted from disposing of his equity interests in Village Oaks Pathology, subject to certain exceptions, without the prior written consent of us and Village Oaks Pathology. The Succession Agreement further provides that the entire equity interest held by Dr. Joyce in Village Oaks Pathology will be automatically assigned and transferred to a successor who meets the Eligibility Requirements of a Designated Physician ( as such terms are defined and described in the Succession Agreement), in the event of, among other things, the death, disability, retirement, or a court’s determination of incompetence of Dr. Joyce, as well as Dr. Joyce’s failure to satisfy the eligibility requirements of a Designated Physician, exclusion or disqualification from participation in the Medicare program, conviction of a felony or crime or moral turpitude, bankruptcy filing, or material breach of the Succession Agreement. In the event of the automatic transfer of Dr. Joyce’s equity interests in Village Oaks Pathology as provided in the Succession Agreement, such agreement provides that the board of directors of Village Oaks Pathology shall nominate a group of three candidates as the Designated Physician who satisfy the Eligibility Requirements. In the event the Company desires not to select any of such candidates, the Company shall select and appoint a successor Designated Physician from any other physician that satisfy the Eligibility Requirements. Subject in all cases to the Management Services Agreement, Dr. Joyce shall not cause any voluntary interruption of the conduct of Village Oaks Pathology’s business and operations, and shall use commercially reasonable efforts to preserve (or assist us in preserving) all rights, privileges and franchises held by Village Oaks Pathology, including the maintenance of all contracts, copyrights, trademarks, licenses and registrations.

In connection with the Asset Purchase Agreement, PPLS entered into a Professional Services Agreement with Village Oaks Pathology (the “Professional Services Agreement”) pursuant to which Village Oaks Pathology agreed to provide pathology interpretation services as requested on behalf of PPLS based on the professional fees approved for the CPT code for the services provided under the Medicare Physician Fee Schedule in the locality where the test is performed. The Professional Services Agreement has an initial term of twenty years and provides that upon expiration of the initial term, it will be automatically extended for successive terms of twelve months each, unless either party delivers written notice of its intention not to extend the term of the agreement not less than thirty days prior to the expiration of the preceding term.

In connection with the Asset Purchase Agreement, the Company also entered into an Executive Employment Agreement with Dr. Joyce (the “Joyce Employment Agreement”), for a term of three years, to serve as the Medical Director and Laboratory Director of PPLS at a base salary of $333,333.34 per year. Pursuant to the Joyce Employment Agreement, Dr. Joyce was also appointed to serve on the Company’s Board of Directors. Dr. Joyce will be eligible to participate in or receive benefits under the Company’s benefit plans generally made available to executives of similar status and responsibilities and will be provided use of a company car. In the event the Joyce Employment Agreement is terminated for any reason, including by Dr. Joyce upon 60 days’ notice, by the Company for cause or by reason of Dr. Joyce’s death, Dr. Joyce (or his estate as applicable) will receive his base salary for the remainder of the three-year employment term. However, the Joyce Employment Agreement provides that if Dr. Joyce breaches any of the restrictive covenants set forth in the Joyce Employment Agreement, including a covenant not to compete during his term of employment and a covenant not to knowingly disclose confidential information, such breach will be grounds for the immediate termination of Dr. Joyce and will result in the forfeiture of all compensation and benefits otherwise due to Dr. Joyce.

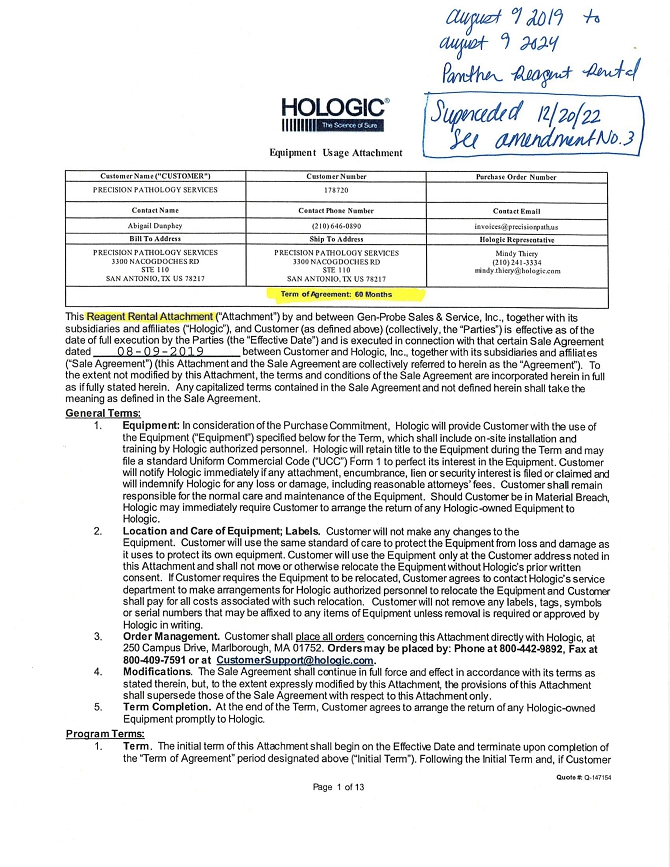

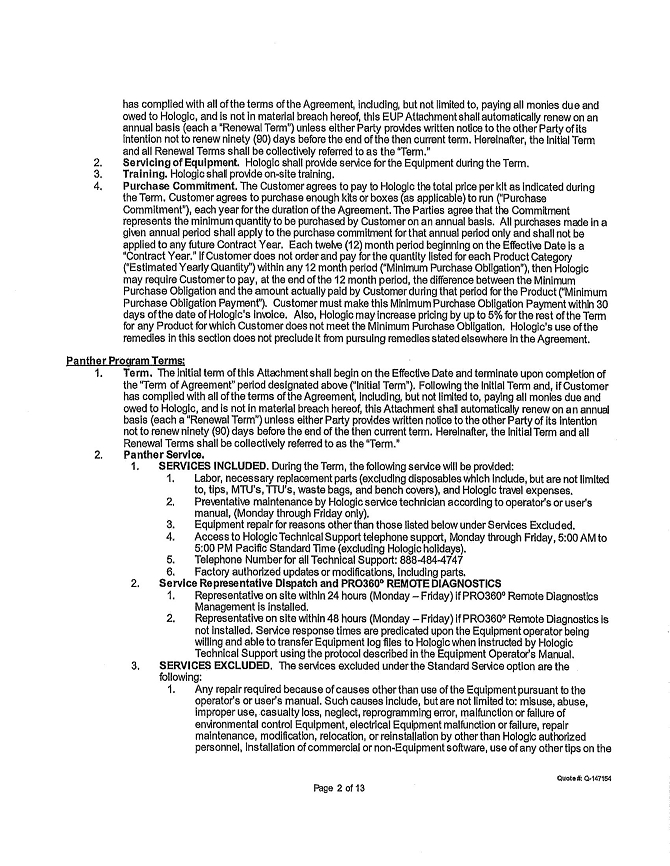

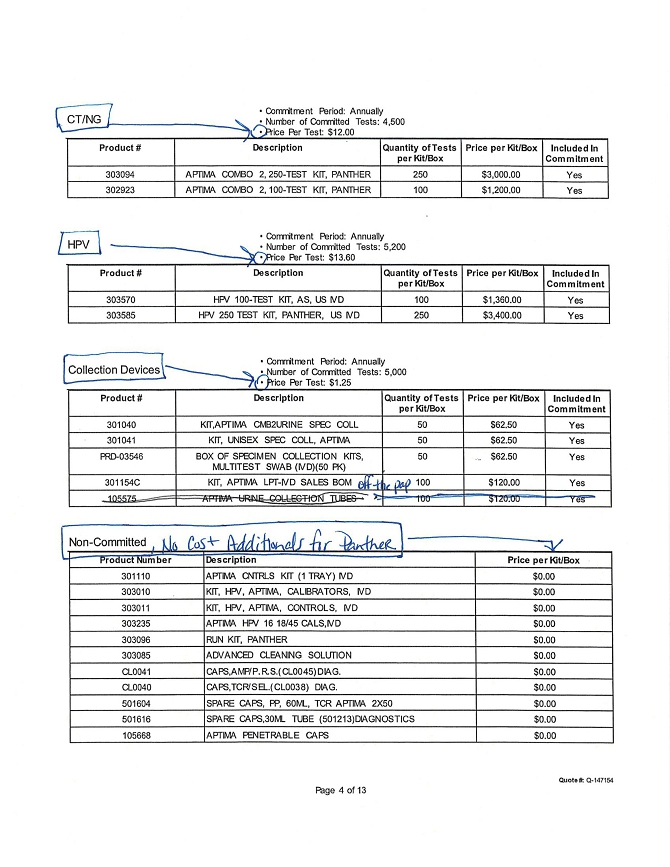

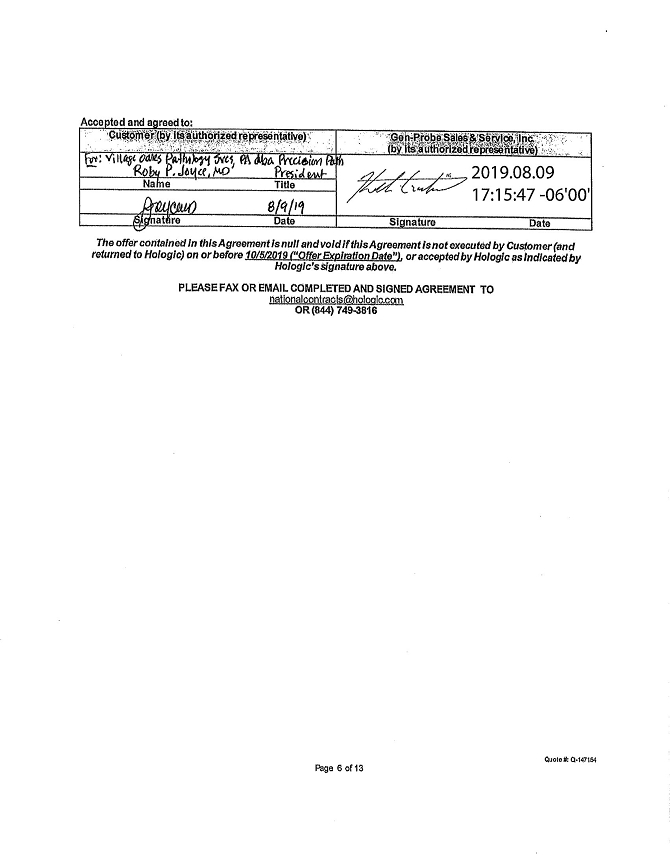

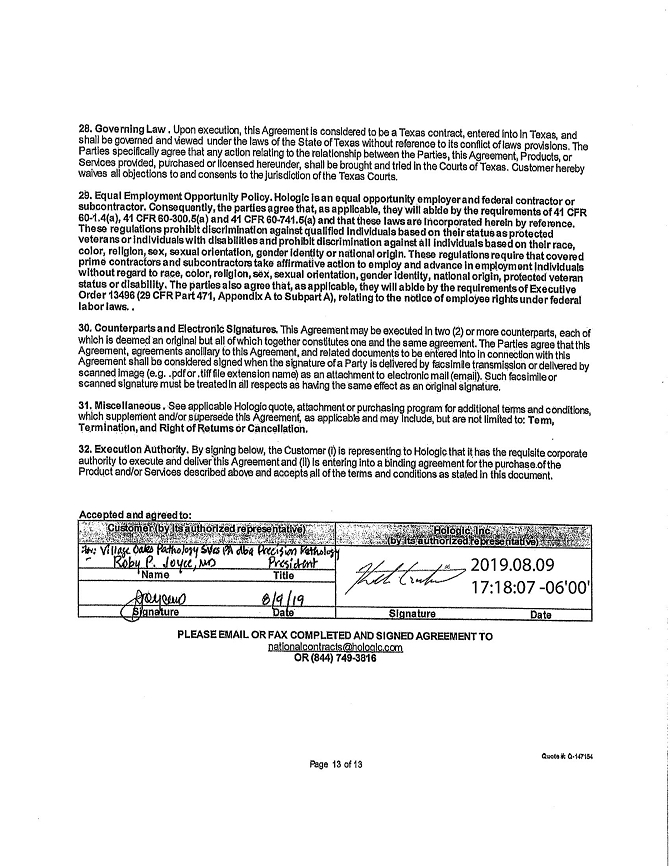

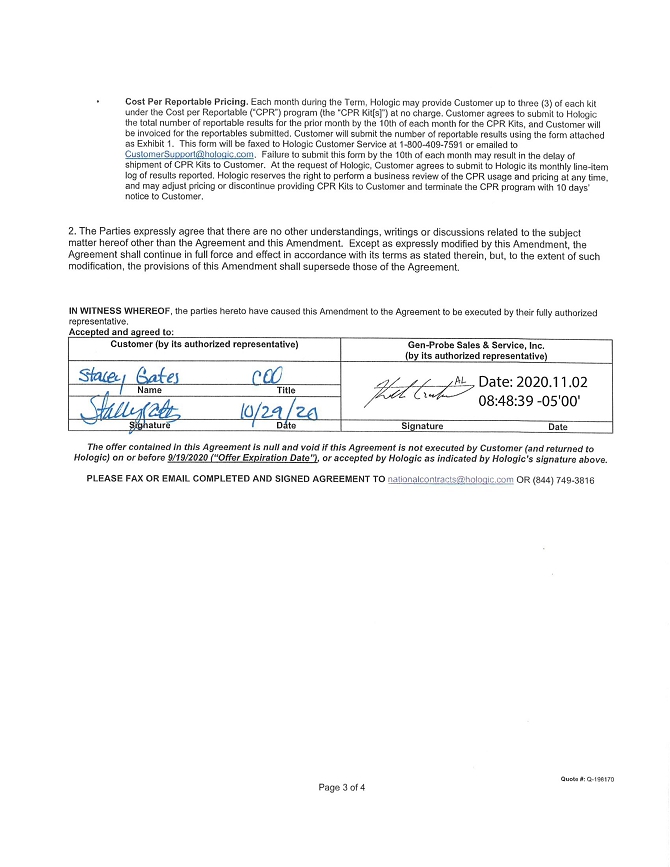

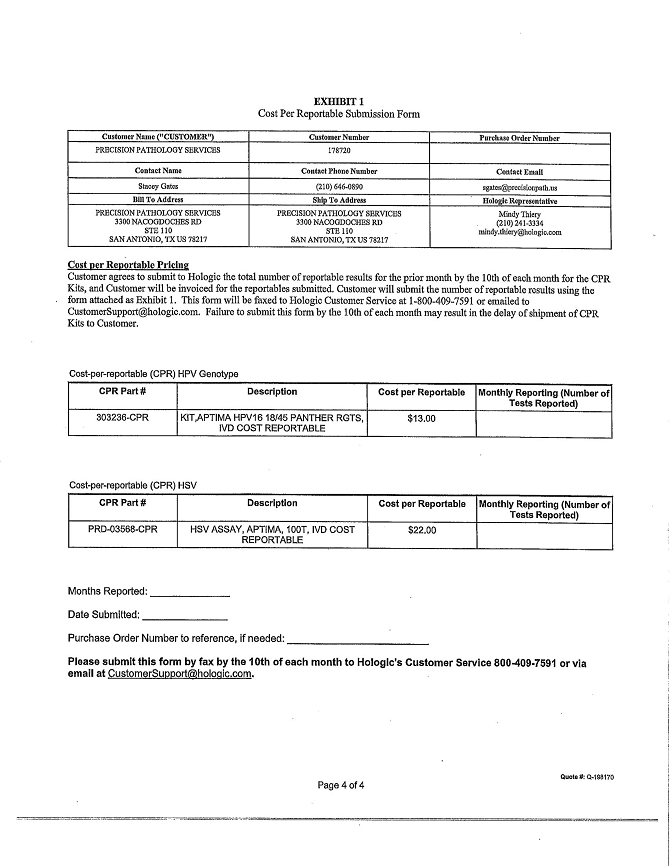

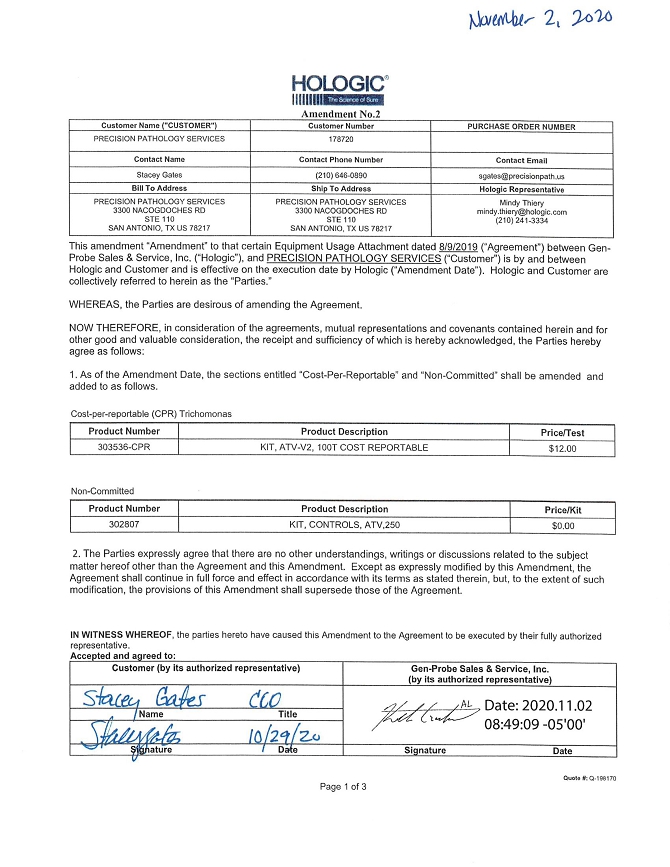

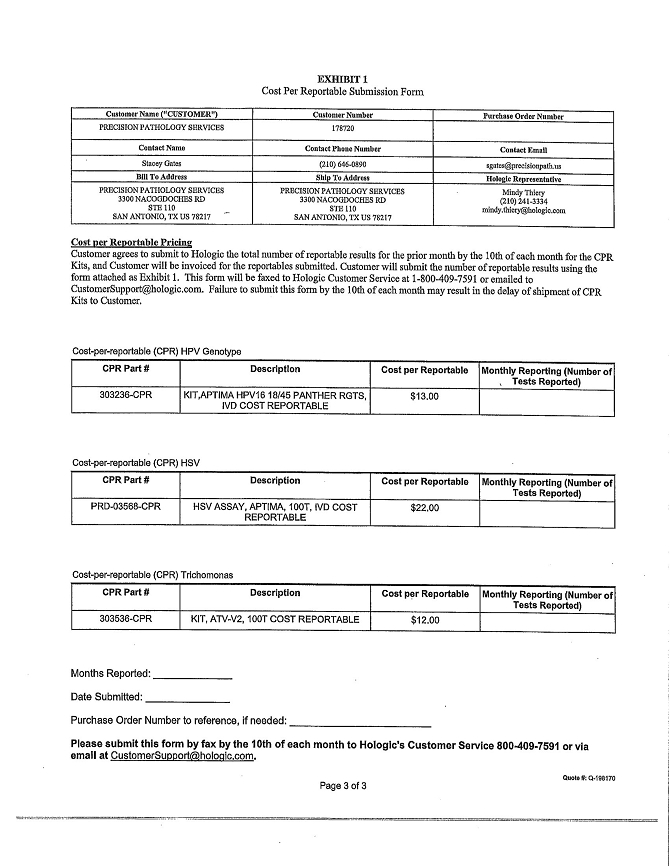

One of the Assumed Leases is Equipment Usage Attachment, dated effective as of August 9, 2019, by and between Gen-Probe Sales & Service, Inc., together with its subsidiaries and affiliates (“Hologic”) and Village Oaks Pathology, as amended by that certain Amendment No. 1 to Equipment Usage Attachment dated November 2, 2020, as further amended by that certain Amendment No. 2 to Equipment Usage Attachment dated November 2, 2020, and as further amended by that certain Amendment No. 3 to Equipment Usage Attachment dated December 21, 2022 (the “Hologic Equipment Lease”), pursuant to which PPLS leases reagent equipment from Hologic and is required to purchase a minimum number of specified testing kits each year. The total monthly minimum purchase commitment PPLS is required to pay Hologic, inclusive of the lease of the reagent equipment, is $16,914 per month. The term of the Hologic Equipment Lease currently expires on December 20, 2027.

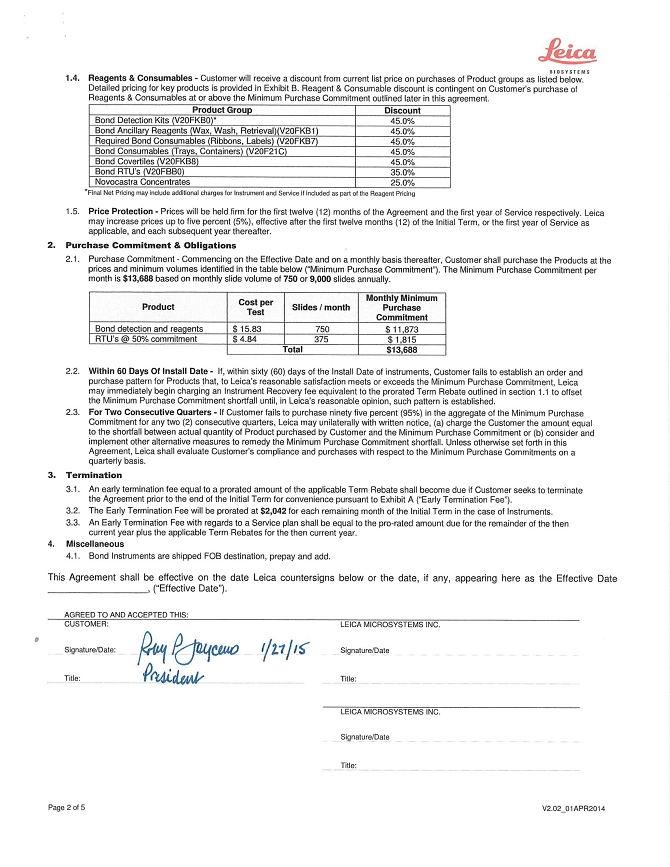

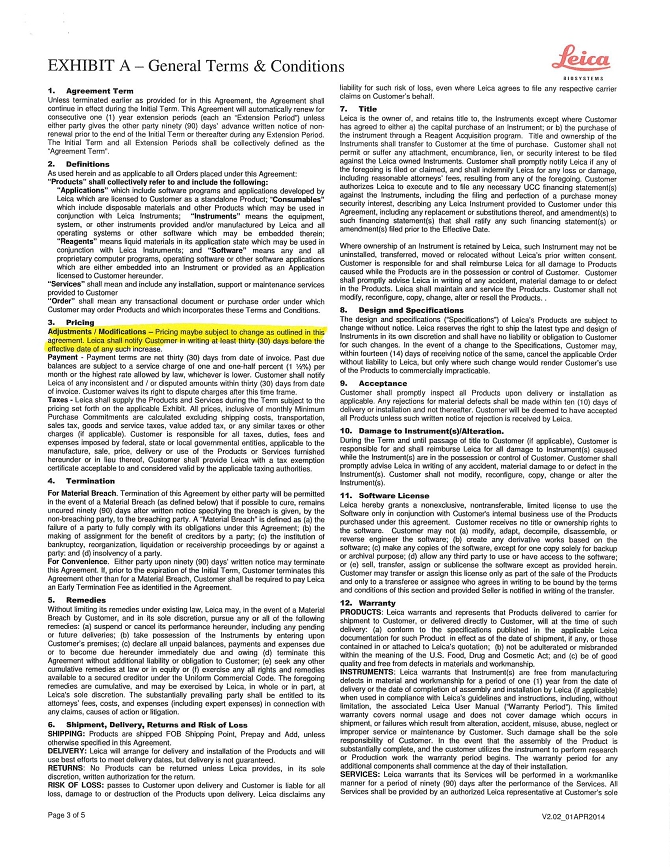

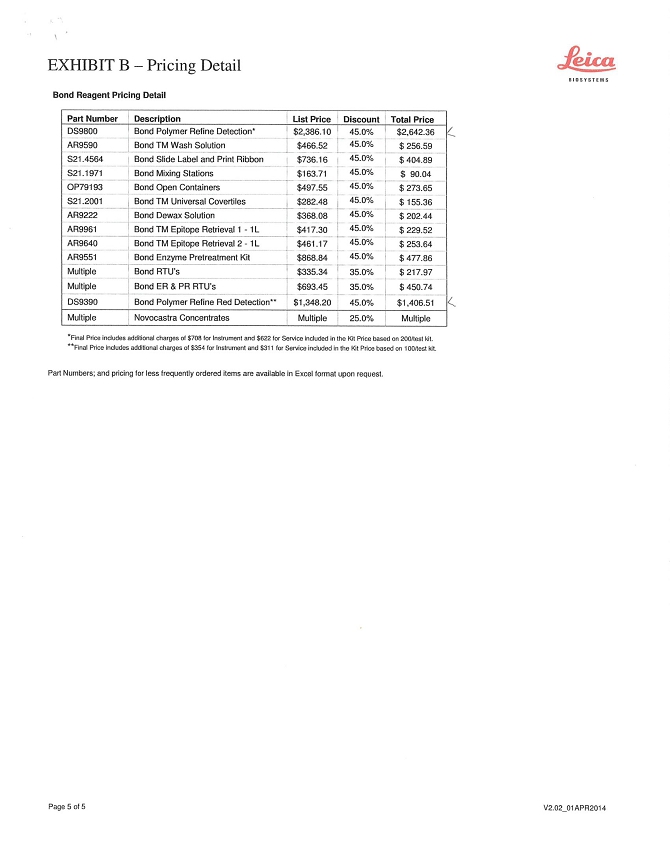

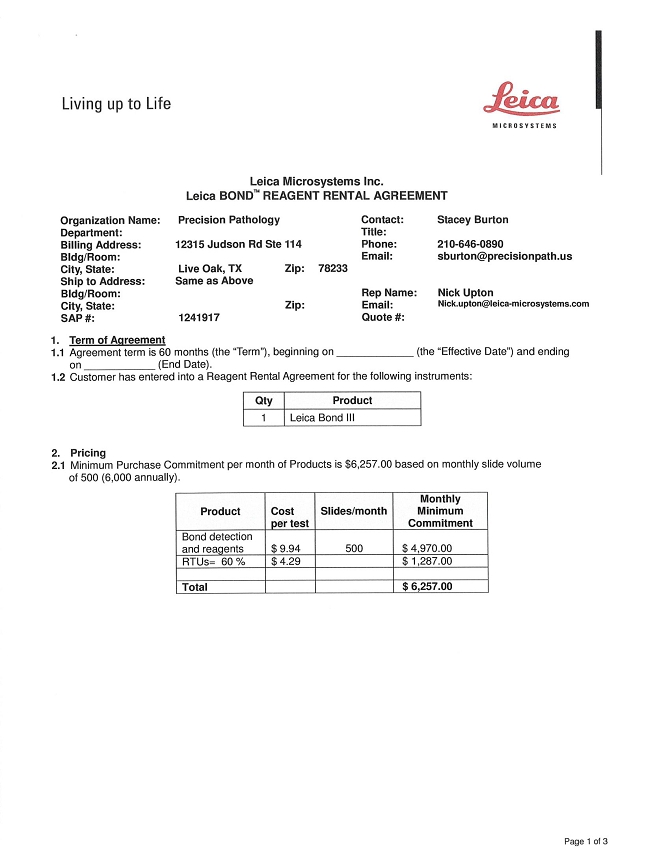

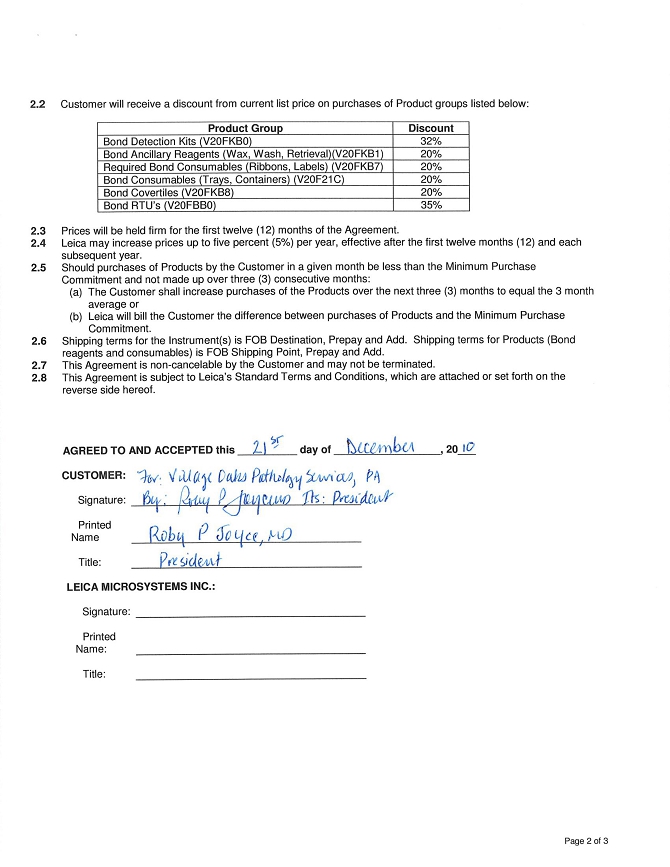

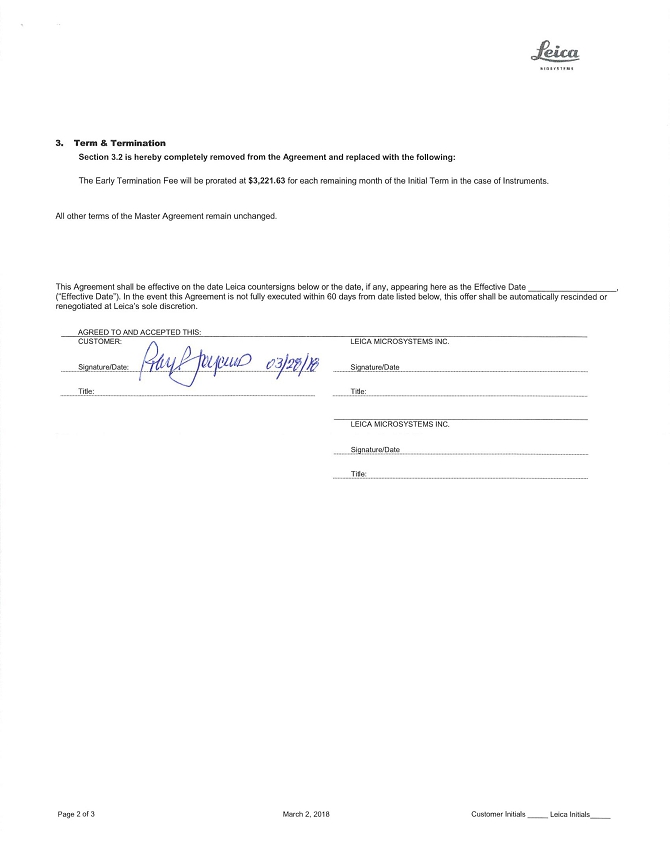

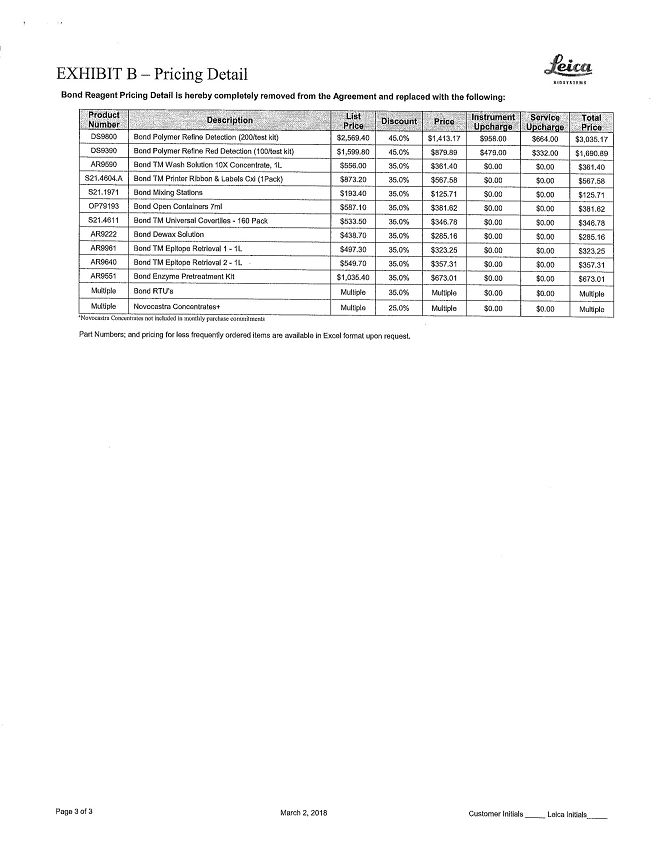

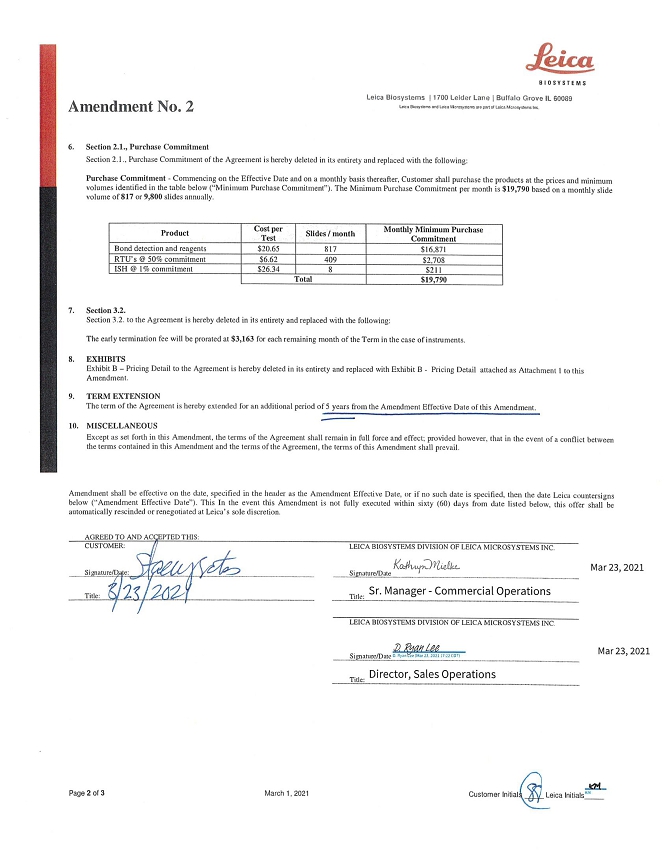

Another of the Assumed Leases is the Master Agreement, dated as of January 29, 2015, by and between Leica Microsystems, Inc. (“Leica”) and Village Oaks Pathology, as amended by Amendment No. 1 to the Master Agreement, dated on or about April 4, 2018, as further amended by that certain Amendment No. 2 to Master Agreement, dated March 23, 2021 (the “Leica Equipment Lease”), pursuant to which PPLS leases reagent equipment from Leica and is required to purchase a minimum number of specified testing kits. The total monthly minimum purchase commitment PPLS is required to pay to Leica, inclusive of the lease of the reagent equipment, is $19,790 per month. The term of the Leica Equipment Lease currently expires on March 23, 2026.

One of the Assumed Contracts is a Strategic Relationship License Agreement, dated December 1, 2022, by and between Pathology Watch, Inc. (“Pathology Watch”) and Village Oaks Pathology (the “License Agreement”). Pursuant to the License Agreement, Pathology Watch granted a license to its digital imaging cloud-based pathology platform to facilitate remote interpretation and billing of pathology specimens by qualified professionals to PPLS for a monthly fee of $25,000. In connection with the License Agreement, Pathology Watch also provides certain support services and marketing vendor services to PPLS for the monthly fee of $38,000, for a total monthly fee paid by PPLS to Precision Watch of $63,000. The License Agreement is for an initial term of twelve months, unless terminated by either party upon 90 days’ notice, and provides that upon expiration of the initial term (or any renewal term), it will be automatically extended for successive twelve month terms, unless either party notifies the other party of its intention not to renew the License Agreement not less than 90 days prior to the expiration of the current term.

In connection with the Asset Purchase Agreement, Dr. Joyce, on behalf of Village Oaks, executed a Bill of Sale (the “Bill of Sale”), pursuant to which all rights, title, and interest of Village Oaks in and to the permits listed on Exhibit A attached thereto, inclusive of the CLIA-certificate and CAP-accreditation, notwithstanding the transfer of the CLIA certificate by operation of law to PPLS upon consummation of the Acquisition, were confirmed to have been transferred and assigned to PPLS.

The foregoing descriptions of the Asset Purchase Agreement, Subscription Agreement, Management Services Agreement, Succession Agreement, Professional Services Agreement, Joyce Employment Agreement, Assignment and Assumption of Lease, Office Lease, Assumption Agreement, Hologic Equipment Lease, Leica Equipment Lease, License Agreement and Bill of Sale are a summary and are qualified in its entirety by reference to the Asset Purchase Agreement, Subscription Agreement, Management Services Agreement, Succession Agreement, Professional Services Agreement, Joyce Employment Agreement, Assignment and Assumption of Lease, Office Lease, Assumption Agreement, Hologic Equipment Lease, Leica Equipment Lease, License Agreement and Bill of Sale, which are attached hereto as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, 10.6, 10.7, 10.8, 10.9, 10.10, 10.11, 10.12 and 10.13 are incorporated by reference herein.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

The information set forth under Item 1.01 above of this Current Report on Form 8-K is incorporated by reference in this Item 2.01, as applicable.

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation Under an Off-balance Sheet Arrangement of a Registrant. |

The information set forth under Item 1.01 above of this Current Report on Form 8-K is incorporated by reference in this Item 2.03, as applicable.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information set forth under Item 1.01 above of this Current Report on Form 8-K is incorporated by reference in this Item 3.02, as applicable. The shares of common stock issued to the Trust were issued in a transaction exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”) in reliance on Section 4(a)(2) thereof and Rule 506(b) of Regulation D thereunder. The Investor represented that it was an “accredited investor,” as defined in Regulation D, and was acquiring the shares for investment only and not with a view towards, or for resale in connection with, the public sale or distribution thereof.

| Item 5.02 | Departures of Directors of Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

The information set forth under Item 1.01 above of this Current Report on Form 8-K is incorporated by reference in this Item 5.02, as applicable.

Roby P. Joyce, MD, age 75, was appointed to serve on the Company’s Board of Directors on September 18, 2023, contingent upon and effective as of the consummation of the Acquisition. As previously described in Item 1.01, in connection with the Asset Purchase Agreement, the Company also entered into the Joyce Employment Agreement, for a term of three years, pursuant to which he serves as the Medical Director and Laboratory Director of PPLS at a base salary of $333,333.34 per year. He is also the owner of Village Oaks Pathology, the medical professional association whose pathologists work with PPLS. Dr. Joyce is board-certified in anatomic and clinical pathology by the College of American Pathologists and is a Diplomat in the American Board of Pathology. He is also board-certified in neurology by the American Academy of Neurology and is a Diplomat in the American Board of Psychiatry and Neurology. Dr. Joyce founded Village Oaks Pathology in 2007, where he created and operated a successful pathology laboratory that developed CyPath® Lung as a laboratory developed test (“LDT”). In addition, he has served in various capacities at Northeast Methodist Hospital in San Antonio, including Chairman of the Board of Trustees and Chief of Staff of the Methodist Healthcare System. Throughout a career in pathology that spans more than 40 years, he has been a highly regarded speaker at medical and scientific conferences, has served in leadership roles on dozens of professional organizations and committees, and has served as lead or co-author of numerous scientific articles. Dr. Joyce received his medical degree from Louisiana State University, where he also received a BS in zoology. He performed his internship at Fitzsimons Army Medical Center in Denver, his residency in neurology at the Letterman Army Medical Center at the University of California Moffett Hospital in San Francisco, and his residency in pathology at Brooke Army Medical Center in San Antonio. As previously described in Item 1.01, as principal of Village Oaks Pathology, Dr. Joyce has a direct material interest in the Acquisition. As consideration for the Acquisition, PPLS paid $3,500,000, of which $2,500,000 was paid to Village Oaks Pathology in cash and $1,000,000 was paid by the issuance of 564,972 shares of the Company’s restricted common stock to the Trust, of which Dr. Joyce is trustee.

Xavier Reveles, age 54, who has served as the Company’s Vice President of Operations as an employee at will since September 2022, was appointed to serve as the Company’s Chief Operating Officer on September 18, 2023, contingent upon and effective as of the consummation of the Acquisition. In connection with such appointment, Mr. Reveles’ annual base salary was increased from $150,000 to $175,000, effective September 18, 2023. The Company does not have an employment agreement with Mr. Reveles, but the Company intends to enter into an employment agreement with him, the form, terms and conditions of the which shall be substantially the same as the Company’s current executive officers other than salary and title, pursuant to which he will earn his increased annual base salary of $175,000 per year. He has 30 years of experience as a clinical cytogeneticist skilled in the design/concept and management of CAP CLIA clinical laboratories, coding, CPT reimbursement valuations, and the development of LDTs. Mr. Reveles is board certified by the American Society of Clinical Pathology as a clinical specialist in cytogenetics. He joined bioAffinity as Director of Operations in 2017. Prior to joining bioAffinity, Mr. Reveles created the Oncopath Laboratory – START Cancer Center (“Oncopath”) in San Antonio, Texas, and served as Laboratory Director. During his tenure at Oncopath, he commercialized eight LDTs, including bringing to market a proprietary cancer specific gene oligo array he designed for the deletions and amplifications of specific oncogenes for solid tumors. As the Director of the Cytogenetics Laboratory at UT Health San Antonio, Mr. Reveles’ research included molecular evaluation of disease progression in prostate, breast and ovarian cancer, schizophrenia, diabetes and other constitutional genetic syndromes. He was a lecturer and instructor for the UT Health Graduate, Medical, and Allied Health Schools and the director of the NCI San Antonio Cancer Institute (SACI) Genetics and Cytogenetics Core facility. After leaving academia, Mr. Reveles was a genomic specialist for CombiMatrix Diagnostics, Irvine, CA, a diagnostic biotech company where he validated pre-natal, post-natal, and cancer gene arrays for commercialization as LDTs. Mr. Reveles is (co)author of 20 publications and six abstracts in peer-reviewed journals and is a member of the Association for Molecular Pathology.

| Item 9.01 | Financial Statements and Exhibits. |

(a) Financial Statements of Business Acquired.

The audited financial statements of Village Oaks Pathology as of and for the year ended December 31, 2022 and 2021 are filed herewith as Exhibit 99.1 and are incorporated herein by reference.

The unaudited financial statements of Village Oaks Pathology as of and for the six months ended June 30, 2023 and 2022 are filed herewith as Exhibit 99.2 and are incorporated herein by reference.

(b) Pro Forma Financial Information.

The unaudited pro forma combined financial statements of the Company after giving effect to the Acquisition consisting of the unaudited condensed combined balance sheet as of June 30, 2023 and December 31, 2022 and the unaudited pro forma combined statement of operations as of and for the six months ended June 30, 2023 and December 31, 2022 are attached hereto as Exhibit 99.3 and are incorporated herein by reference.

| (d) | Exhibits |

The following exhibits are furnished with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| BIOAFFINITY TECHNOLOGIES, INC. | ||

| By: | /s/ Maria Zannes | |

| Maria Zannes | ||

| President and Chief Executive Officer | ||

Dated: September 20, 2023

Exhibit 4.1

AMENDMENT TO COMMON SHARE WARRANTS

This AMENDMENT TO COMMON SHARE WARRANTS (this “Amendment”) is entered into as of September 17, 2023, by and between bioAffinity Technologies, Inc., a Delaware corporation (the “Company”), and [ ] (the “Holder”).

WHEREAS, the Holder is the holder of the following Common Share Purchase Warrants (each, a “Warrant” and together the “Warrants”): (1) a Warrant issued on December 2, 2021 to purchase [ ] shares of the Company’s common stock, par value $0.007 per share (the “Common Stock”);

WHEREAS, pursuant to Section 8.1 of the Warrants, the Warrants may be modified or amended with the written consent of the Company and the Holder; and

WHEREAS, the Company and the Holder desire to amend the Warrants as set forth in this Amendment.

NOW, THEREFORE, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Company and the Holder hereby agree as follows:

1. The first sentence of Section 1 is hereby amended by adding the definition of “Issuance Date” such that the end of the first sentence in Section 1 shall read: “have been issued this Purchase Warrant on ________ (the “Issuance Date”)” with the blank to be replaced by the date that was used to define the term “Commencement Date” in such Warrant.

2. The second sentence of Section 1 is hereby amended by deleting the definition of “Commencement Date” and the date defined as such and replacing such date and definition with the following:

and after the date on which the amendment to the Company’s Amended and Restated Certificate of Incorporation is filed with and accepted by the Secretary of State of the State of Delaware which increases the number of shares of the Company’s authorized common stock to allow for full sufficient authorized and unissued shares of common stock for the full exercise of this Purchase Warrant and all outstanding warrants and the issuance of all of the shares of common stock underlying such warrants (the “Share Increase Date”),

3. The reference to “Commencement Date” in Section 5.1.4 shall be deleted and replaced with “Issuance Date.”

4. The first sentence of Section 6 is hereby amended and restated in its entirety as follows:

6. Reservation and Listing. From and after the Share Increase Date, the Company shall at all times reserve and keep available out of its authorized Shares, solely for the purpose of issuance upon exercise of the Purchase Warrants, such number of Shares or other securities, properties or rights as shall be issuable upon the exercise thereof.

5. The following new Section 8.7 is added to the Warrants:

8.7 The Holder acknowledges and agrees that the Company currently does not have sufficiently authorized and unissued and otherwise unreserved common stock for the purpose of issuing all of the Shares upon the exercise of this Purchase Warrant and will not exercise this Purchase Warrant for Shares to the extent the shares of common stock issuable upon exercise of this Purchase Warrant will be in excess of the Company’s available authorized and unissued and unreserved common stock. The Company shall no later than at its next annual meeting of stockholders submit to its stockholders a proposal for the approval of an increase in the number of authorized shares of common stock in an amount not less than the maximum amount of Shares issuable upon exercise of this Purchase Warrant and all other outstanding warrants without giving effect to any limitation on exercise set forth herein or therein (the “Stockholder Resolution”). In connection with such meeting, the Company shall provide each stockholder with a proxy statement and shall use its reasonable best efforts to solicit its stockholders’ approval of such increase in authorized shares of common stock and to cause its board of directors to recommend to the stockholders that they approve such proposal. If, despite the Company’s reasonable best efforts, approval of the Stockholder Resolution is not obtained at such meeting, the Company shall cause an additional stockholder meeting to be held upon request of the Holder but no sooner than ninety (90) calendar days after any meeting until approval of the Stockholder Resolution is obtained.

6. Except as amended by this Amendment, the Warrants remain unaltered and shall remain in full force and effect.

7. This Amendment may be executed in any number of counterparts, each of which will be deemed an original and all of which together will constitute one and the same instrument. Signatures delivered by facsimile, electronic mail (including as a PDF file) or other transmission method shall be deemed to be original signatures, shall be valid and binding, and, upon delivery, shall constitute due execution of this Amendment.

8. The terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the Company and the Holder.

9. This Agreement shall be governed, construed and interpreted in accordance with the laws of the state of Delaware, without giving effect to principles of conflicts of law.

IN WITNESS WHEREOF, each of the Company and the Holder has caused this Amendment to be executed by its officer thereunto duly authorized as of the date first above indicated.

| COMPANY: | ||

| bioAffinity Technologies, Inc. | ||

| By: | ||

| Name: | Maria Zannes | |

| Title: | Chief Executive Officer | |

| HOLDER: | ||

SCHEDULE OF WARRANT HOLDERS AND WARRANTS

| Name of Holder | Date of Original Warrant* | Number of Shares of Common Stock Issuable Upon Exercise of Warrant | Exercise Price of Warrant | |||||||

| U/W Cranye Girgenti Testamentary TR FBO Scott Girgenti | November 22, 2021 | 5,952 | $ | 5.25 | ||||||

| U/W Cranye Girgenti Testamentary TR FBO Scott Girgenti | July 20, 2022 | 2,380 | $ | 5.25 | ||||||

| Steven Girgenti | November 22, 2021 | 5,952 | $ | 5.25 | ||||||

| Steven Girgenti | November 22, 2021 | 120,743 | $ | 5.25 | ||||||

| Steven Girgenti | November 22, 2021 | 47,619 | $ | 5.25 | ||||||

| Steven Girgenti | November 22, 2021 | 47,619 | $ | 5.25 | ||||||

| Steven Girgenti | December 2, 2021 | 4,275 | $ | 5.25 | ||||||

| Steven Girgenti | December 2, 2021 | 35,714 | $ | 5.25 | ||||||

| Steven Girgenti | December 2, 2021 | 11,904 | $ | 5.25 | ||||||

| Steven Girgenti | December 2, 2021 | 2,380 | $ | 5.25 | ||||||

| Steven Girgenti | December 2, 2021 | 9,523 | $ | 5.25 | ||||||

| Steven Girgenti | December 9, 2021 | 23,809 | $ | 5.25 | ||||||

| Steven Girgenti | July 20, 2022 | 123,811 | $ | 5.25 | ||||||

| Steven Girgenti | August 11, 2022 | 35,714 | $ | 5.25 | ||||||

| Gary Rubin | November 22, 2021 | 12,241 | $ | 5.25 | ||||||

| Gary Rubin | July 20, 2022 | 4,896 | $ | 5.25 | ||||||

| The Harvey Sandler Revocable Trust | November 22, 2021 | 47,619 | $ | 5.25 | ||||||

| The Harvey Sandler Revocable Trust | November 22, 2021 | 205,746 | $ | 5.25 | ||||||

| The Harvey Sandler Revocable Trust | November 22, 2021 | 73,809 | $ | 5.25 | ||||||

| The Harvey Sandler Revocable Trust | November 22, 2021 | 29,761 | $ | 5.25 | ||||||

| The Harvey Sandler Revocable Trust | November 22, 2021 | 51,190 | $ | 5.25 | ||||||

| The Harvey Sandler Revocable Trust | July 20, 2022 | 163,248 | $ | 5.25 | ||||||

| Maria Zannes | August 11, 2022 | 23,571 | $ | 5.25 | ||||||

| The Joyce Living Trust | November 22, 2021 | 14,285 | $ | 5.25 | ||||||

| The Joyce Living Trust | July 20, 2022 | 5,714 | $ | 5.25 | ||||||

* Definition of “Issuance Date” in Warrant, as amended by Agreement

Exhibit 4.2

AMENDMENT TO INITIAL PUBLIC OFFERING WARRANTS

This AMENDMENT TO INITIAL PUBLIC OFFERING WARRANTS (this “Amendment”) is entered into as of September 17, 2023, by and between bioAffinity Technologies, Inc., a Delaware corporation (the “Company”), and [ ] (the “Holder”).

WHEREAS, the Holder is the holder of the following warrants that were issued in connection with the Holder’s purchase of [ ] Units in the Company’s initial public offering (each, a “Warrant” and together the “Warrants”): (1) one five-year tradeable warrant to purchase [ ] shares of the Company’s common stock, par value $0.007 per share (the “Common Stock”), issued on September 6, 2022, at an exercise price of $7.35 per share, and (2) one five-year non-tradeable warrant to purchase [ ] shares of Common Stock, issued on September 6, 2022, at an exercise price of $7.656 per share; and

WHEREAS, pursuant to Section 5(l) of the Warrants, the Warrants may be modified or amended or the provisions thereof waived with the written consent of the Company and the Holder; and

WHEREAS, the Company and the Holder desire to amend the Warrants as set forth in this Amendment.

NOW, THEREFORE, in consideration of the mutual agreements contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Company and the Holder hereby agree as follows:

1. The first sentence of the Warrants is hereby amended to insert the following after (the “Holder”):

was issued this Warrant on September 6, 2022 (the “Issuance Date”) and such Holder

2. The first sentence of the Warrants is hereby further amended to amend the definition of “Initial Exercise Date” by deleting the words “the date hereof” and replacing such words with the following:

the date on which the amendment to the Company’s Amended and Restated Certificate of Incorporation is filed with and accepted by the Secretary of State of the State of Delaware which increases the number of shares of the Company’s authorized Common Stock to allow for full sufficient authorized and unissued shares of Common Stock for the full exercise of this Warrant and all outstanding warrants and the issuance of all of the shares of Common Stock underlying such warrants (the “Share Increase Date”),

3. The “Termination Date” of the Warrants is hereby amended to be the date that is the fifth year anniversary of the Issuance Date, provided that, if such date is not a Trading Day, insert the immediately following Trading Day.

4. The definition of “Warrant Agent Agreement” is hereby amended to replace the words “Initial Exercise Date” with “Issuance Date”.

5. The first sentence of Section 5(d) is hereby amended and restated in its entirety as follows:

The Company covenants that, from and after the Share Increase Date, it will reserve from its authorized and unissued Common Stock a sufficient number of shares to provide for the issuance of the Warrant Shares upon the exercise of any purchase rights under this Warrant.

5. The following new Section 5(p) is added to the Warrants:

(p) The Holder acknowledges and agrees that the Company currently does not have sufficiently authorized and unissued and otherwise unreserved Common Stock for the purpose of issuing all of the Warrant Shares upon the exercise of this Warrant and will not exercise this Warrant for Warrant Shares to the extent the shares of Common Stock issuable upon exercise of this Warrant will be in excess of the Company’s available authorized and unissued and unreserved Common Stock. The Company shall no later than at its next annual meeting of stockholders submit to its stockholders a proposal for the approval of an increase in the number of authorized shares of Common Stock in an amount not less than the maximum amount of Warrant Shares issuable upon exercise of this Warrant and all other outstanding warrants without giving effect to any limitation on exercise set forth herein or therein (the “Stockholder Resolution”). In connection with such meeting, the Company shall provide each stockholder with a proxy statement and shall use its reasonable best efforts to solicit its stockholders’ approval of such increase in authorized shares of Common Stock and to cause its board of directors to recommend to the stockholders that they approve such proposal. If, despite the Company’s reasonable best efforts, approval of the Stockholder Resolution is not obtained at such meeting, the Company shall cause an additional stockholder meeting to be held upon request of the Holder but no sooner than ninety (90) calendar days after any meeting until approval of the Stockholder Resolution is obtained.

6. Except as amended by this Amendment, the Warrants remain unaltered and shall remain in full force and effect.

7. This Amendment may be executed in any number of counterparts, each of which will be deemed an original and all of which together will constitute one and the same instrument. Signatures delivered by facsimile, electronic mail (including as a PDF file) or other transmission method shall be deemed to be original signatures, shall be valid and binding, and, upon delivery, shall constitute due execution of this Amendment.

8. The terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the Company and the Holder.

9. This Agreement shall be governed, construed and interpreted in accordance with the laws of the state of New York, without giving effect to principles of conflicts of law.

IN WITNESS WHEREOF, each of the Company and the Holder has caused this Amendment to be executed by its officer thereunto duly authorized as of the date first above indicated.

| COMPANY: | ||

| bioAffinity Technologies, Inc. | ||

| By: | ||

| Name: | Maria Zannes | |

| Title: | Chief Executive Officer | |

| HOLDER: | ||

SCHEDULE OF WARRANT HOLDERS AND WARRANTS

| Name of Holder | Date of Original Warrant | Number of Shares Issuable Upon Exercise of Warrant |

Exercise Price of Warrant | |||||

| Steven Girgenti | September 6, 2022 | 40,916 Tradeable Warrants | $ | 7.35 | ||||

| Steven Girgenti | September 6, 2022 | 40,916 Non-Tradeable Warrants | $ | 7.656 | ||||

| Maria Zannes | September 6, 2022 | 16,326 Tradeable Warrants | $ | 7.35 | ||||

| Maria Zannes | September 6, 2022 | 16,326 Non-Tradeable Warrants | $ | 7.656 | ||||

| The Harvey Sandler Revocable Trust | September 6, 2022 | 16,326 Tradeable Warrants | $ | 7.35 | ||||

| The Harvey Sandler Revocable Trust | September 6, 2022 | 16,326 Non-Tradeable Warrants | $ | 7.656 | ||||

Exhibit 10.1

ASSET PURCHASE AGREEMENT

BY AND AMONG

PRECISION PATHOLOGY LABORATORY SERVICES, LLC

VILLAGE OAKS PATHOLOGY SERVICES, P.A.,

AND

ROBY P. JOYCE, M.D.

Effective as of

SEPTEMBER 18, 2023

TABLE OF CONTENTS

| ARTICLE1 | ||

| DEFINITIONS | ||

| ARTICLE 2 | ||

| PURCHASE OF NON-MEDICAL ASSETS | ||

| 2.1 | Purchase and Sale | 1 |

| 2.2 | Allocation | 4 |

| 2.3 | Assumed Liabilities | 4 |

| 2.4 | Excluded Assets | 5 |

| 2.5 | Excluded Liabilities | 5 |

| 2.6 | Fair Market Value | 6 |

| 2.7 | Withholding Tax | 6 |

| 2.8 | Escrow Amount | 6 |

| 2.9 | Agreement Not to Undergo a Change of Control or Dissolve | 7 |

| ARTICLE 3 | ||

| THE CLOSING | ||

| 3.1 | Closing | 7 |

| 3.2 | Seller Closing Deliverables | 7 |

| 3.3 | Buyer Closing Deliverables | 9 |

| ARTICLE 4 | ||

| REPRESENTATIONS AND WARRANTIES OF THE SELLER | ||

| 4.1 | Organization and Good Standing | 9 |

| 4.2 | Due Authorization; Capacity | 10 |

| 4.3 | No Violation; No Consents | 10 |

| 4.5 | Financial Statements | 10 |

| 4.6 | Title to Purchased Assets | 11 |

| 4.7 | Certain Remuneration and Self-Referrals | 11 |

| 4.8 | Assigned Contracts | 11 |

| 4.9 | Taxes | 12 |

| 4.10 | Litigation and Proceedings | 12 |

| 4.11 | Employees and Independent Contractors | 12 |

| 4.12 | Employee Benefit Matters | 13 |

| 4.13 | Compliance with Law | 14 |

| 4.14 | Permits and Licenses | 15 |

| 4.15 | Intellectual Property | 15 |

| 4.16 | Payor Participation | 15 |

| 4.17 | Conduct Business in the Ordinary Course | 16 |

| 4.18 | No Brokers or Finders | 16 |

| 4.19 | Solvency | 16 |

| 4.20 | Full Disclosure | 16 |

| 4.21 | No Other Representations or Warranties | 16 |

| - |

| ARTICLE 5 | ||

| REPRESENTATIONS AND WARRANTIES OF THE BUYER | ||

| 5.1 | Organization and Good Standing | 17 |

| 5.2 | Due Authorization | 17 |

| 5.3 | No Conflicts | 17 |

| 5.4 | No Finders or Brokers | 17 |

| ARTICLE 6 | ||

| INDEMNIFICATION | ||

| 6.1 | Survival | 18 |

| 6.2 | Indemnification by the Buyer | 18 |

| 6.3 | Indemnification by Seller | 18 |

| 6.4 | Certain Limitations | 18 |

| 6.5 | Indemnification Procedures | 19 |

| 6.6 | Payments | 19 |

| 6.7 | Characterization of Indemnity Payment for Tax Purposes | 19 |

| 6.8 | Cumulative Remedies | 20 |

| ARTICLE 7 | ||

| COVENANTS | ||

| 7.1 | Further Assurances | 20 |

| 7.2 | Certain Consents | 20 |

| 7.3 | Certain Employee Matters | 20 |

| 7.4 | Post-Closing Access | 21 |

| 7.5 | Confidentiality Covenants of Seller and Certain Other Persons | 22 |

| 7.6 | Non-Competition; Non-Solicitation | 23 |

| 7.7 | Transfer Taxes and Payment of Other Taxes | 25 |

| 7.8 | Receivables | 25 |

| 7.9 | Post-Closing Filing Obligations | 25 |

| 7.10 | New Lease | 25 |

| ARTICLE8 | ||

| MISCELLANEOUS | ||

| 8.1 | Publicity | 26 |

| 8.2 | Expenses | 26 |

| 8.3 | Notices | 26 |

| 8.4 | Offset and Withholding | 27 |

| 8.5 | Governing Law; Venue | 27 |

| 8.6 | Headings | 27 |

| 8.7 | Entire Agreement | 27 |

| 8.8 | Successors and Assigns | 27 |

| 8.9 | Amendment; No Waiver | 27 |

| 8.10 | Severability | 27 |

| 8.11 | Assignment; No Third Party Beneficiary | 28 |

| 8.12 | Further Assurances | 28 |

| 8.13 | Attorneys’ Fees | 28 |

| 8.14 | Interpretation of Agreement | 28 |

| 8.15 | Counterparts | 28 |

| - |

ASSET PURCHASE AGREEMENT

This Asset Purchase Agreement (the “Agreement”) is entered into and made effective as of September 18, 2023, by and among (i) Precision Pathology Laboratory Services, LLC, a Texas limited liability company (the “Buyer”), (ii) Dr. Roby P. Joyce, M.D. (“Owner”) and (iii) Village Oaks Pathology Services, P.A., a Texas professional association d/b/a Precision Pathology Services (the “Seller”). Each of the Buyer and the Seller may be referred to herein, individually, as a “Party” and, collectively, as the “Parties.”

WHEREAS, the Seller owns certain Purchased Assets (as hereinafter defined) used, useful or held for use in connection with its ownership, management, and operation of the clinical anatomic and clinical pathology testing laboratory division or segment of Seller and related services business, other than the medical practice of Seller (the “Business”);

WHEREAS, Owner is the sole owner of Seller and will receive direct and indirect benefits under this Agreement; and

WHEREAS, the Buyer desires to purchase, and Seller desires to sell, the Purchased Assets on the terms and conditions set forth in this Agreement.

NOW, THEREFORE, for and in consideration of the mutual covenants and agreements contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Buyer and the Seller hereby agree as follows:

ARTICLE 1

DEFINITIONS

Capitalized terms used in this Agreement have the respective meaning assigned such terms in Appendix I attached to this Agreement and incorporated herein.

ARTICLE 2

PURCHASE OF NON-MEDICAL ASSETS

2.1 Purchase and Sale.

(a) On the terms and subject to the conditions set forth in this Agreement, at the Closing, the Seller shall sell, assign, convey, transfer, and deliver to the Buyer, free and clear of all Encumbrances, and the Buyer shall purchase, all of the Seller’s right, title, and interest in, to, and under all assets of the Seller relating to or used, useful or held for use in connection with the Business (collectively, the “Purchased Assets”), including, without limitation, the following assets, but specifically excluding the Excluded Assets:

(i) all of the assets listed or described on Schedule 2.1(a)(i);

| - |

(ii) all of the following in any jurisdiction throughout the world: (i) patents, patent applications and patent disclosures; (ii) trademarks, service marks, trade dress, trade names (including, the trade name “Precision Pathology Services”), logos and slogans (and all translations, adaptations, derivations and combinations of the foregoing), Internet domain names, IP addresses, internet and mobile account names (including social media names, “tags,” and “handles”) and other source indicators, together with all goodwill associated with each of the foregoing; (iii) copyrights and copyrightable works, including computer software and all source code, executable code and documentation used in or related to same; (iv) registrations and applications for any of the foregoing; (v) confidential information, proprietary information and trade secrets, including know how, ideas, inventions, designs, technology, tools, methods, specifications, technical data, databases, data collections, customer lists, supplier lists, pricing and cost information and business and marketing plans and proposals; (vi) rights of privacy and publicity; (vii) other similar proprietary and intangible rights; and (viii) all causes of action (resulting from past and future infringement thereof), damages, and remedies relating to any and all of the foregoing;

(iii) all accounts receivable, notes receivable, rebate receivables, bid, performance, lease, utility or other deposits, employee advances, draws and other miscellaneous receivable of the Business, whether billed or unbilled, including any security, claim, remedy or right used in or related to any of the foregoing;

(iv) all cash or cash equivalents in the operating accounts of Seller as of the Closing Date (“Cash in Bank Amount”);

(v) the entire operating assets of the Business, all tangible personal property located at the Laboratory Premises and/or used, useful in, held for use in or relating to the Business or its operations, including, without limitation, all vehicles, machinery, equipment (including, medical, office and other equipment), furniture, fixtures, finishings, computer equipment, telephones, tools, spare parts and medical instruments, together with any and all warranties thereon (to the extent same are assignable);

(vi) all inventory, raw materials, packaging, supplies, parts, disposables, consumables and other inventories located at the Laboratory Premises or used, useful in, held for use in or relating to the Business or its operations, including, but not limited to, medical supplies, bandages, and office materials, together with any and all warranties thereon (to the extent same are assignable);

(vii) all rights of Seller in and to the Laboratory Lease and all rights of Seller in and to any leases for equipment and personal property used in connection with the operation of the Business listed on Schedule 2.1(a)(vii) (all such assumed leases and the Laboratory Lease, the “Assumed Leases”);

(viii) all right, title and interest in and to the Contracts listed on Schedule 2.1(a)(viii) (the “Assumed Contracts”);

(ix) subject to applicable Law, the originals, or copies if originals are not readily available, of all documents, books, records, operating manuals, policies and procedures, forms and files in Seller’s possession with respect to the operation of the Business and the Purchased Assets, including original paper and electronic equipment records, construction plans and specifications, medical and administrative libraries, financial records, and other records and files relating to the ownership and operation of the Business, but specifically excluding personnel records;

| - |

(x) to the extent assignable, all of the Seller’s rights in and relating to computer programs and software (including billing, discharge and electronic medical records software) licensed by the Seller in connection with the Business (collectively, the “Licensed Intellectual Property”);

(xi) all telephone numbers and listings used in connection with the operation of the Business; (for the avoidance of doubt not including owners and other physicians telephone numbers whether or not used in the Business)

all general intangibles and other intangible assets related to or connected with the Business, including (A) refunds, rights of offset and credits and deposits, (B) all Permits required for the conduct of the Business, for the operation thereof, or for the ownership and use of the Purchased Assets (to the extent the same are transferable under applicable Laws), (C) any claims, Actions, causes of action, rights of recovery, defenses or other action being pursued by, or available to Seller, to the extent related to the Business or the Purchased Assets, and (D) rights under warranties, indemnities and all similar rights against third parties to the extent related to any of the Purchased Assets.

(xii) all prepaid expenses and other deposits and advance payments of Seller with respect to the Business;

(xiii) all other property of every kind, character or description, tangible and intangible, known or unknown, owned or leased by Seller and used or held for use in the operation of the Business, whether or not described in this Agreement (other than the Excluded Assets);

(xiv) all additions, substitutions, replacements, repossessions, and products of any of the properties and Purchased Assets described above; and

(xv) the Business as a going concern, including all goodwill thereof.

(b) As full and complete consideration for the sale, assignment, conveyance, transfer, and delivery to the Buyer of the Purchased Assets, free and clear of all Encumbrances, the Buyer shall pay the Seller $3,500,000.00 (the “Purchase Price”). Subject to adjustment as herein provided, the Purchase Price will be payable as follows:

(i) on the Closing Date, the Buyer shall pay, in immediately available funds, to the Seller an amount equal to the Closing Payment, subject to adjustment; and

(ii) the issuance by bioAffinity Technologies, Inc., a Delaware corporation and parent of Buyer (“Parent”), of 564,972 shares of Parent common stock (“Parent Equity”), currently listed and traded as “BIAF” on the NASDAQ Capital Market, which share number was determined by dividing $1,000,000.00 by the average of the trading day closing prices for the thirty (30) days prior to September 15, 2023, rounded to the nearest whole share. The Seller acknowledges and agrees that the Parent Equity is restricted and not registered for resale; however, Parent, in its sole discretion, may register the Parent Equity in conjunction with Parent’s next financing following the Closing Date in which Parent registers its common stock. The Seller hereby instructs Purchaser to cause the Parent to issue the Parent Equity to Owner, as trustee of the Joyce Living Trust, upon receipt and acceptance by Parent of the duly executed Subscription Agreement.

| - |

2.2 Allocation. The Buyer and the Seller shall mutually agree on the appropriate allocation of the Purchase Price and all other applicable capitalized costs and other relevant items in a manner complying with Section 1060 of the Tax Code and the Treasury Regulations promulgated thereunder in accordance with this Section 2.2 (the “Allocation”). The Buyer shall prepare the Allocation within sixty (60) days after the Closing Date, or as soon as is reasonably practicable thereafter, and shall deliver a copy thereof to the Seller for its review and comment. If the Seller notifies the Buyer in writing that the Seller objects to one or more items reflected in the Allocation and sets forth the Buyer’s proposal regarding such item(s), the Seller and the Buyer shall negotiate in good faith to resolve such dispute; provided, however, that if the Seller and the Buyer are unable to resolve any dispute with respect to the Allocation within ninety (90) days following the Closing Date, such dispute shall be resolved by the Independent Accountant who, acting as an expert and not arbitrator, shall resolve the disputed items only and make any adjustments to the Allocation. The Independent Accountant shall only decide the specific items under dispute by the Parties and its decision for each disputed item must be within the range of values assigned to each such item in the draft Allocation prepared by the Buyer and the notice of objection submitted by the Seller, respectively. The fees and expenses of the Independent Accountant shall be borne equally by the Seller and the Buyer. The Buyer shall also prepare any revisions to the Allocation from time to time that may be required by Section 1060 of the Tax Code and the Treasury Regulations thereunder (for example, to account for any adjustments to the Purchase Price or other relevant items) and shall promptly provide any such revisions to the Seller for its review and comment, which comments (if any) Buyer shall consider in good faith. The Buyer and the Seller agree that all Tax Returns of the Buyer and the Seller shall be prepared consistently with the Allocation as finally prepared and/or revised by Buyer.

2.3 Assumed Liabilities. Upon the terms and subject to the conditions of this Agreement, the Buyer agrees, effective at the Closing, to assume only the following liabilities and obligations of the Seller (the “Assumed Liabilities”):

(a) all liabilities and obligations of the Seller under any Assumed Leases or Assumed Contracts, to the extent that any such liabilities and obligations accrue and first arise or are scheduled to be performed after the effectiveness of the Closing for reasons other than any breach, violation or default thereof by the Seller (excluding Excluded Liabilities and any liability for work performed prior to the effectiveness of the Closing);

(b) all accounts payable of the Seller at the Closing incurred in the ordinary course of business consistent with past custom and practice (including with respect to quantity and frequency) (“Ordinary Course of Business”) and set forth on the Seller’s Closing balance sheet, provided that the amount of such accounts payable shall not include any liabilities associated with any breach of contract, tort or violation of Law; and

(c) all cost and expenses associated with the conversion of QuickBooks Enterprise Desktop edition to QuickBooks Online edition.

| - |

2.4 Excluded Assets. The following assets of Seller (collectively the “Excluded Assets”) are not part of the sale and purchase contemplated hereunder, are excluded from the Purchased Assets and shall remain the property of the Seller after the Closing:

(a) the assets listed on Schedule 2.4(a), none of which are tangible personal property used in the Business;

(b) the Medical Assets;

(c) any Employee Retention Credit Refund;

(d) any Contract of Seller other than an Assumed Contract or Assumed Lease;

(e) any and all Employee Benefit Plans;

(f) that certain Certificate of Deposit issued by Broadway National Bank currently in the name of the Seller with a value of approximately $100,823.00 as of December 31, 2022; and

(g) all physician, including Owner, mobile phone telephone numbers.

For the avoidance of doubt, any artwork or personal effects at the Laboratory Premises owned by Owner, rather than Seller, are excluded from the purchase by Buyer.

2.5 Excluded Liabilities. The Buyer shall not and does not assume any of, and Seller shall remain solely liable for and cause to be paid and satisfied when due, all Liabilities of the Seller and its Affiliates other than the Assumed Liabilities (the “Excluded Liabilities”), including:

(a) any Taxes (i) imposed on Seller or its Affiliates for any taxable period, (ii) imposed with respect to the Excluded Assets for any taxable period, or (iii) relating to the Business (including the Purchased Assets) for any period (or portion thereof) ending on or prior to the Closing Date, including any Taxes imposed as a result of the transactions contemplated herein;

(b) any Liabilities or obligations of Seller relating to the Excluded Assets;

(c) any Liability or obligation of Seller arising or incurred in connection with the negotiation, preparation and execution of this Agreement and the consummation of the transactions contemplated hereby, including fees and expenses of its counsel, accountants and other advisors, and any Liabilities of Seller for commissions or fees owed to any finder or broker retained by Seller in connection with the transactions contemplated hereby;

(d) any Liability or obligation resulting from any formal or informal, written or unwritten, agreement with respect to employee compensation, severance pay, bonus, partner distributions, pension, retirement, profit sharing, health or medical benefit, welfare plan, or any other employee benefit or fringe benefit plan and any stock option arrangements, warrants or employment agreements for services, including any Liabilities or obligations under an Employee Benefit Plan;

(e) any Liability or obligation (actual or alleged) of Seller to Persons or properties arising from the ownership, possession or operation of the Business or any of the Purchased Assets prior to the Closing Date;

| - |

(f) any Liabilities in respect of any pending or threatened Action arising out of, relating to or otherwise in respect of the operation of the Business, the Medical Assets, or the Purchased Assets to the extent such Action relates to such operation on or prior to the Closing Date, including any Actions brought by any present or former employees, independent contractors, consultants, customers, vendors or patients of Seller;

(g) any Liabilities of Seller for any present or former employees, officers, partners, retirees, independent contractors or consultants of Seller, including, without limitation, any Liabilities associated with any pre-Closing claims for wages or other benefits, bonuses, workers’ compensation, severance, retention, termination or other payments;

(h) any Liabilities to indemnify, reimburse or advance amounts to any present or former officer, director, employee or agent of Seller (including with respect to any breach of fiduciary obligations by same);

(i) any Liabilities under any Contracts of Seller (other than the Assumed Contracts and Assumed Leases) or any other Contracts of Seller (i) which are not validly and effectively assigned to the Buyer pursuant to this Agreement; (ii) which do not conform to the representations and warranties with respect thereto contained in this Agreement; or (iii) to the extent such Liabilities arise out of or relate to a breach by Seller of such Contracts prior to Closing;

(j) any Liabilities associated with debt, loans or credit facilities of Seller and/or the Business owing to financial institutions, including but not limited to, any debt pursuant to the Economic Injury Disaster Loan Program or Paycheck Protection Program; and

(k) any Liabilities arising out of, in respect of or in connection with the failure by Seller or any of its Affiliates to comply with any Law (including any failure to comply with Healthcare Laws) or Governmental Authority.

2.6 Fair Market Value. The Parties agree that the Purchase Price represents the fair market value of the Purchased Assets in an arm’s length transaction and has not been determined in a manner that takes into account the volume or value of any referrals or business otherwise generated or to be generated between the Parties or any of their Affiliates for which payment may be made, in whole or in part, under Medicare or any state health care program, as defined under Section 1128B of the Social Security Act.

2.7 Withholding Tax. The Buyer shall be entitled to deduct and withhold from the Purchase Price all Taxes that the Buyer is required to deduct and withhold under any provision of Tax Law. All such withheld amounts shall be treated as delivered to the Seller hereunder.

2.8 Escrow Amount.

(a) On the Closing Date, Buyer shall deposit the Escrow Amount with J.P. Morgan Chase Bank, N.A. (the “Escrow Agent”) to be held in an account established by the Escrow Agent pursuant to the terms of a mutually agreed upon form of Escrow Agreement to be entered into by the Seller, Buyer and Escrow Agent at Closing (the “Escrow Agreement”). The Escrow Amount shall be released on the terms of the Escrow Agreement and used solely to satisfy the Seller’s contingent and non-contingent post-Closing obligations under this Agreement, including Seller’s liabilities for indemnification matters arising under Section 6.3.

| - |

(b) On the date which is twelve (12) months following the Closing Date, Seller and Buyer will jointly instruct the Escrow Agent to release from escrow one-half of the then current balance of Escrow Amount, minus the aggregate amount of all pending indemnification claims by the Buyer Indemnified Parties pursuant to Section 6.3 (such amount, the “Pending Claims Amount,” and the amount of the Escrow Amount to be paid by Buyer to Seller, the “Escrow Release Amount”), and on the date which is twenty-four (24) months following the Closing Date, the Seller and Buyer will jointly instruct Escrow Agent to release from escrow the remaining Escrow Amount minus any Pending Claims Amount. In each case the Escrow Release Amount shall be released to an account or accounts designated in writing by the Seller in accordance with the Escrow Agreement.

2.9 Agreement Not to Undergo a Change of Control or Dissolve. Seller covenants that it shall not dissolve nor undergo a Change of Control, unless such dissolution or Change of Control is pursuant to the terms of the Management Services Agreement and Succession Agreement, each to be entered into at Closing by and among Buyer, Owner and the Seller, provided however, unless otherwise agreed upon in writing by Buyer, the Seller shall have paid, satisfied or discharged all of its Liabilities, or made adequate provision for payment, satisfaction or discharge thereof including the performance of its obligations under the Assumed Contracts to which the Seller is a party, if any. Further, the Seller shall not make any distributions to its owners that could result in its being insolvent or unable to pay, satisfy or discharge its Liabilities.

ARTICLE 3

THE CLOSING

3.1 Closing. Subject to the terms and conditions of this Agreement, the closing of the transactions contemplated by this Agreement (the “Closing”) shall take place as of the Effective Time. The Closing shall be accomplished by electronic transmission and exchange of all signatures and other Closing documents and deliverables, as required herein.

3.2 Seller Closing Deliverables. At the Closing, the Seller shall deliver (or shall have delivered), or cause to be delivered, to the Buyer the following:

(a) an executed and notarized Bill of Sale, in form and substance mutually acceptable to the Buyer and Seller (the “Bill of Sale”);

(b) an executed Assignment and Assumption Agreement with respect to the Assumed Contracts and the Assumed Leases, in form and substance mutually acceptable to the Buyer and Seller (the “Assumption Agreement”);

(c) an executed Assignment and Assumption of Lease (the “Assignment and Assumption of Lease”), by and between the Seller and Buyer, whereby the Seller will assign, transfer and convey to Buyer, free and clear of all Encumbrances, all of the Seller’s right, title and interest in and to the Laboratory Lease, and an executed consent to assignment from the Landlord consenting to the assignment of the Laboratory Lease to Buyer, all in form and substance mutually acceptable to Buyer and the Seller;

| - |

(d) an executed Professional Services Agreement, in form and substance mutually acceptable to the Buyer and Seller (the “Professional Services Agreement”);

(e) an executed Management Services Agreement, in form and substance mutually acceptable to the Buyer and Seller (the “Management Services Agreement”);

(f) an executed Succession Agreement, in form and substance mutually acceptable to the Buyer, Seller and Owner (the “Succession Agreement”);

(g) an executed Escrow Agreement;

(h) an executed Executive Employment Agreement, in form and substance mutually acceptable to Owner and Buyer (the “Executive Employment Agreement”);

(i) an Employment Agreement, by and between Buyer and Maya Thukrail-Hair, duly executed by Maya Thukrail-Hair, in form and substance satisfactory to Buyer;

(j) an executed Subscription Agreement, in a form provided by Parent and completed by Owner as Trustee of the Joyce Living Trust in a manner satisfactory to Parent, regarding the Parent Equity that Seller has directed to be issued to the Joyce Living Trust as part of the Purchase Price (the “Subscription Agreement”);

(k) evidence of transfer to accounts designated by Buyer of the Cash in Bank Amount;

(l) Certificates of fact issued by the Secretary of State of the State of Texas and account status issued by the Texas Comptroller of Public Accounts for the Seller and dated within ten (10) days prior to the Closing Date;

(m) Certificates from the Seller pursuant to Treasury Regulations Section 1.1445-2(b) that the Seller is not a foreign person within the meaning of Section 1445 of the Tax Code duly executed by the Seller, in form and substance reasonably satisfactory to the Buyer;

(n) a duly completed Form 01-917 Statement of Occasional Sale promulgated by the Texas Comptroller of Public Accounts executed by Seller;

(o) Resolutions of the Seller authorizing the execution and delivery of this Agreement and the other Transaction Documents to which Seller is a party and the signature and incumbency of the officer of Seller authorized to execute and deliver this Agreement and the other Transaction Documents to which Seller is a party, certified as true and accurate as of the Closing by an appropriate officer of Seller;

(p) Payoff letters from lenders and creditors of the Seller providing for the payoff and release of all Encumbrances on the Purchased Assets, except for the Flow Cytometer Lease which is being assumed by Buyer, and otherwise in form and substance satisfactory to Buyer;

(q) Copies of consents set forth in Schedule Section 1.01(i) duly executed by the Person providing such consent; and

| - |

(r) Such other documents or instruments as the Buyer reasonably requests and are reasonably necessary to consummate the transactions contemplated by this Agreement.

3.3 Buyer Closing Deliverables. At the Closing, the Buyer shall deliver (or shall have delivered), or cause to be delivered, to the Seller the following:

(a) the Closing Payment;

(b) the Parent Equity issued by Parent;

(c) Assumption Agreement, duly executed by the Buyer;

(d) Assignment and Assumption of Lease duly executed by Buyer;

(e) Professional Services Agreement duly executed by Buyer;

(f) Management Services Agreement duly executed by Buyer;

(g) Succession Agreement duly executed by Buyer;

(h) Escrow Agreement duly executed by Buyer;

(i) Executive Employment Agreement duly executed by Parent;

(j) Resolutions of the Buyer authorizing the execution and delivery of this Agreement and the Transaction Documents to which Buyer is a party and the signature and incumbency of the officer of the Buyer authorized to execute and deliver this Agreement and the other Transaction Documents to which Buyer is a party, certified as true and correct as of the Closing by an appropriate officer of the Buyer;

(k) Resolutions of Parent authorizing the issuance of the Parent Equity and the election of Owner to the Board of Directors of Parent, certified as true and correct as of the Closing by an appropriate officer of the Parent; and

(l) Such other documents or instruments as Seller reasonably requests and are necessary to consummate the transactions contemplated by this Agreement.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF THE SELLER

As a material inducement for the Buyer to enter into this Agreement and to consummate the transactions contemplated hereby, the Seller and Owner, jointly and severally, hereby make the following representations, warranties, and covenants, each of which is relied upon by the Buyer regardless of any investigation made or information obtained by the Buyer or its Affiliates.

4.1 Organization and Good Standing. The Seller is a professional association, duly organized, validly existing and in good standing under the laws of the state of Texas. The Seller has full power and authority to own, operate or lease the properties and Purchased Assets now owned, operated or leased by it and to carry on its business (including the Business) as currently conducted. The Seller (a) does not (i) have any direct or indirect subsidiaries, (ii) own any equity interests in any other Person, or (iii) except as disclosed on Schedule 4.1(a)(iii), provide medical or healthcare services through any other Person.

| - |

4.2 Due Authorization; Capacity. The Seller is duly empowered and authorized, and the Owner has the legal capacity, to enter into this Agreement and the other transaction documents to which the Seller or Owner, respectively, is a party, to carry out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby. The execution, delivery, and performance of this Agreement and all other agreements, instruments, certificates, and documents executed and delivered by or on behalf of the Seller and the consummation of the transactions contemplated hereby by the Seller have been duly authorized, and no other approvals or authorizations are necessary in connection therewith. This Agreement and all other agreements, instruments, certificates, and documents executed and delivered by or on behalf of the Seller or Owner (assuming due authorization, execution and delivery by the Buyer)are the valid and binding obligations of the Seller and Owner, as the case may be, enforceable against the Seller and Owner in accordance with their respective terms.

4.3 No Violation; No Consents.

(a) The execution, delivery, and performance of this Agreement and the consummation of the transactions contemplated hereby will not (i) conflict with or result in a violation or breach of, or default under, any provision of the organizational documents of the Seller; (ii) constitute a breach or violation of any applicable Law, or any Contract to which the Seller is a party to which any of the Purchased Assets is subject; (iii) violate, conflict with or result in any breach of, result in any modification of the effect of, otherwise give any contracting party the right to terminate, or constitute (or with notice or lapse of time or both constitute) a default under, any Contract which is either binding upon or enforceable against the Seller, the Business, or the Purchased Assets; (iv) result in the imposition or creation of any Encumbrance on any of the Purchased Assets; or (v) breach, impair, or in any way limit any Permit of the Seller or the Business.

(b) Except for the consents and notice requirements specifically listed and described in Schedule 4.3(b), the execution and delivery of this Agreement by the Seller and the consummation of the transactions provided herein by the Seller will not require any consent, review, approval, Permit, waiver, notice, governmental order, declaration, filing with or other process of any Governmental Authority or of any party to any Contract to which the Seller is a party or by which any of the Purchased Assets is subject or may be bound.

4.5 Financial Statements.

(a) Complete copies of the financial statements consisting of (i) the audited balance sheet of the Business as at December 31, in each of the years, 2021 and 2022 and the related statements of income and retained earnings, shareholders’ equity, and cash flow for the years then ended and (ii) unaudited statements of income and retained earnings, shareholders’ equity, and cash flow for the period ending June 30, 2023 (the “Financial Statements”) are included in Schedule 4.5. The Financial Statements have been prepared in accordance with generally accepted accounting principles in effect in the United States from time to time, applied on a consistent basis throughout the period involved. The Financial Statements fairly present in all material respects the financial condition of the Business as of the respective dates they were prepared and the results of the operations of the Business for the periods indicated. The balance sheet of the Business as of December 31, 2022 is referred to herein as the “Balance Sheet” and the date thereof as the “Balance Sheet Date”.

| - |

(b) Seller has no Liabilities with respect to the Business, except (i) those which are adequately reflected or reserved against in the Balance Sheet as of the Balance Sheet Date, and (ii) those which have been incurred in the ordinary course of business consistent with past practice since the Balance Sheet Date and which are not, individually or in the aggregate, material in amount.

(c) Except as set forth on Schedule 4.5, since the Balance Sheet Date, and other than in the Ordinary Course of Business, there has not been any change, event, condition, or development that is, or could reasonably be expected to be, individually or in the aggregate, materially adverse to: (a) the business, results of operations, condition (financial or otherwise), or assets of the Business; or (b) the value of the Purchased Assets.

4.6 Title to Purchased Assets. The Seller has good and valid title to, or a valid leasehold interest in, all of the Purchased Assets, free and clear of Encumbrances as of the Closing Date. The Purchased Assets constitute all of the operating assets and tangible personal property currently in existence that are being used or are usable in connection with the Business (with the exclusion of the Excluded Assets). The Purchased Assets are sufficient for the continued conduct of the Business after the Closing in substantially the same manner as conducted prior to the Closing and constitute all of the rights, property, and assets necessary to conduct the Business as currently conducted. None of the Excluded Assets are material to the Business.

4.7 Certain Remuneration and Self-Referrals. Neither the Seller nor any employee of the Seller, or, to the Seller’s Knowledge, any other Person has, at any time, directly or indirectly, (a) paid, delivered or received or agreed to pay, deliver or receive any fee, commission or other sum of money, item of property or remuneration of any kind, directly or indirectly, overtly or covertly, in cash or in kind, however characterized, to or from any Person to induce or reward the referral or any business or which is in any manner related to the operations or business of the Seller (including the Business) which is illegal under any applicable federal, state or local anti-kickback or fee splitting Law, or (b) submitted any claim for reimbursement to any third party payor, including any governmental payors, in connection with any referrals that violated any applicable federal, state, or local self-referral, kickback or bribery Law.