UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission file number: 001-41657

CBL INTERNATIONAL LIMITED

(Exact name of Registrant as specified in its charter)

Cayman Islands

(Jurisdiction of incorporation or organization)

Level 23-2, Menara Permata Sapura

Kuala Lumpur City Centre

50088 Kuala Lumpur

Malaysia

Tel: +603 2706 8280

Fax: +603 2703 2968

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

OTHER INFORMATION

Attached hereto as Exhibit 99.1 is the management’s discussion and analysis of financial condition and results of operations of the Company for the six months ended June 30, 2023 and 2022; attached hereto as Exhibit 99.2 are the unaudited condensed consolidated financial statements of the Company for the six months ended June 30, 2023 and 2022; and attached hereto as Exhibit 99.3 is a press release dated September 14, 2023, announcing the Company’s unaudited financial and operating results for the six months ended June 30, 2023 and 2022.

EXHIBIT INDEX

| Exhibit No. | Description | |

| 99.1 | ||

| 99.2 | Unaudited Condensed Consolidated Financial Statements for the Six Months Ended June 30, 2023 and 2022 | |

| 99.3 | Press Release, dated September 14, 2023 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CBL International Limited | ||

|

||

| By: | /s/ Teck Lim Chia | |

| Name: | Teck Lim Chia | |

| Title: | Chief Executive Officer | |

| Date: September 14, 2023 | ||

Exhibit 99.1

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion and analysis of our financial condition and results of operations in conjunction with our unaudited condensed consolidated financial statements and the related notes for the six months ended June 30, 2023 and 2022 and the audited consolidated financial statements and accompanying notes for the year ended December 31, 2022 included in our annual report on Form 20-F (“2022 Annual Report”) filed with the Securities and Exchange Commission (the “SEC”) on April 26, 2023. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results and the timing of selected events could differ materially from those anticipated in these forward-looking statements as a result of various factors. “CBL” refers to CBL International Limited, our holding company and a Cayman Islands company. “We”, “us”, “our” or the “Company” refers to CBL International Limited and its subsidiaries, unless the context requires otherwise.

Cautionary Note Regarding Forward-Looking Statements

This report contains forward-looking statements. All statements contained in this report other than statements of historical fact, including statements regarding our future results of operations and financial position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe”, “may”, “will”, “estimate”, “continue”, “anticipate”, “intend”, “expect” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements include statements relating to:

| ● | our goal and strategies; | |

| ● | our expansion plans; | |

| ● | the impact of COVID-19 on our operations; | |

| ● | our future business development, financial condition and results of operations; | |

| ● | the liquidity of our securities; | |

| ● | expected changes in our revenues, costs or expenditures; | |

| ● | the trends in, and size of, the bunkering market in the Asia Pacific; | |

| ● | our expectations regarding demand for, and market acceptance of, our products and services; | |

| ● | our expectations regarding our relationships with customers, suppliers, third-party service providers, strategic partners and other stakeholders; | |

| ● | competition in our industry; | |

| ● | our expectation regarding the use of proceeds from our initial public offering (the “IPO”); | |

| ● | laws, regulations, and policies relating to the bunkering industry in the Asia Pacific; and | |

| ● | general economic and business conditions. |

|

|

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in the “Risk Factors”, “Operating and Financial Review and Prospects” and elsewhere in our 2022 Annual Report. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. We are under no duty to update any of these forward-looking statements after the date of this report or to conform these statements to actual results or revised expectations.

A. Operating Results

Business Overview

We are an established marine fuel logistics company providing one-stop solution for vessel refueling, which is referred to as bunkering facilitator in the bunkering industry in the Asia Pacific. We facilitate vessel refueling between ship operators and local physical distributors/traders. We purchase marine fuel from our suppliers and arrange for our suppliers to actually deliver marine fuel to our customers. Since the establishment of our Group in 2015, container liner operators have been identified as our target customers. Container liner operators provide liner services which operate on a schedule with a fixed port rotation and fixed frequency, which is similar to bus operation under which buses go on fixed routes and calling at fixed stops for passengers to board and alight. Knowing the nature of business of our target customers, we persistently strengthen ourselves by (a) expanding our servicing network to cover more ports; and (b) providing more value-added services to tailor for our customers’ growing demands with respect to vessel refueling.

Our services mainly involve (i) making vessel refueling options available to our customers at various ports along their voyages in the Asia Pacific; (ii) arranging vessel refueling activities at competitive pricing to customers; (iii) coordinating vessel refueling to meet customers’ schedules during their various port visits in the Asia Pacific; (iv) providing trade credit to customers in relation to vessel refueling; (v) arranging local physical delivery of marine fuel to meet customers’ schedule; (vi) handling unforeseeable circumstances faced by customers and providing contingency solutions to them in a timely manner; (vii) fulfilling special requests from customers in relation to vessel refueling; and (viii) handling disputes, mainly in relation to quality and quantity issues on marine fuel, if any.

Our supply network, which focuses on expanding our localities of services, is currently covering 45 ports in the Asia Pacific, including South Korea, PRC, Taiwan, Hong Kong, Malaysia, Singapore, the Philippines, Thailand and Vietnam. In addition, we also can provide our services in Japan, Belgium and Turkey. Going forward, we intend to allocate more resources to further expand our supply network, targeting continual market share enhancement. Among our extensive network of 45 ports, 17 are within the top 20 container ports in 2022 in terms of throughput volume globally with Asia Pacific accounting for approximately 45.9% of global marine fuel consumption volume in 2022.

Macroeconomic Environment

Coronavirus (COVID-19) Update

The outbreak of COVID-19, which was declared a pandemic by the World Health Organization in March 2020, has created significant volatility, uncertainty and disruption in the global economy. Nonetheless, notwithstanding the decline of trading and slowdown of economic growth during the first half of 2020 as a result of COVID-19 outbreak, major international container liner operators have achieved great improvement in their business and financial performance and their profitability has seen a significant growth since the third quarter of 2020 amid COVID-19 outbreak. The bunkering industry, particularly distributions in certain ports, indeed were also adversely affected. Nonetheless, given the nature of our business of providing refueling services through our supply network, our flexibility to respond to emergencies occurred in individual ports prevents us from being severely affected by COVID-19 in the fulfilment of our contractual obligations. In case our customers experience port disturbance, we can rearrange refueling of the vessel to the next feasible port under our extensive supply network currently covering 45 ports in Asia Pacific.

Since the second half of 2022, COVID-19 has subsided, and the Asia Pacific Region lifted entirely its epidemic prevention measures in the first quarter of 2023. Now, this far-reaching epidemic can be regarded as over.

|

|

Russia-Ukraine Conflict

With a series of conflicts escalated between Russia and Ukraine since February 2022, sanctions have been imposed by a number of countries towards Russia targeting businesses, monetary exchanges, bank transfers, and imports and exports. Russia has been the second largest exporter of the crude oil for number of years and accounts for more than 20% of the high sulfur fuel oil, very low sulfur fuel oil and marine gasoil supplies globally. The crisis between Russia and Ukraine led to a surge in worldwide crude oil price in the first 7 months of 2022 as significant numbers of traders refused to purchase crude oil originating from Russia, with approximately 70% of Russian crude oil exports having failed to reach a matched buyer, where sellers were struggling to trade Russian oil because of the supply chain difficulties in shipping and payments amid the crisis. Concurrently, the price of bunkering surged globally, which is associated with the risk premium and the on-going flourishing demand around the globe. Our Group serves primarily in a niche position to facilitate the ship operators to get their vessels duly refueled in appropriate ports, in a timely manner and at competitive market price without the need of establishing a procurement network by themselves. During the process, our Group obtains quotations of marine fuel price from respective suppliers and subsequently assesses and add a premium in addition to the bunkering price. As the demand for crude oil in terms of volume is expected to be rising steadily owing to stable downstream demand and considering that our Group operates with a pricing mechanism on a cost-plus fixed fee basis, it is expected that there would be immaterial impact of the Ukraine-Russia crisis on our Group’s operation. However, any significant increase in marine fuel price might tighten the operating cash flows of our Group, which may, in turn, adversely affect our working capital requirements or financial conditions. The Russia -Ukraine Conflict has much less impact on fuel oil price in 2023. For the six months ended June 30,2023, fuel oil price had gone down to the range from approximately US$520 to US$670 per ton as compared with the average price of approximately US$980 per ton for the six months ended June 30.2022.

To ensure a positive gross profit for each transaction, we price our services on a “cost plus fixed fee” basis, i.e. we are able to obtain a premium, being the difference between the selling price per metric ton of marine fuel sold to our customers and the purchase cost from our suppliers. Therefore, generally speaking, the more quantity of marine fuel we procure for our customers, the more profit we generate. However, our operation is limited by the working capital available to us for a given period of time. If the marine fuel prices increase substantially, we can only purchase less marine fuel from our suppliers with the same level of financial resources and same trade credit offered by our suppliers. Accordingly, assuming there are no other externalities such as financial and political crisis or natural disaster to affect the demand and supply of crude oil or marine fuel globally during 2023, the crude oil price is expected to remain at a similar level as in the second half of 2022 with a fluctuation range of approximately 10% to 15%. To mitigate the effects of working capital limitation and future unexpected increase in marine fuel price, it is our strategy to strengthen the financial resources available to us by utilizing bank facilities and to obtain better trade credit from our suppliers, and we do not anticipate any material impact to our future results of operations in light of the current expected oil price trend.

Financial Summary

Results of Operations

The following provides a summary of our consolidated results of operations for the six months ended June 30, 2023 and 2022 (in thousand dollars):

| For the Six Months Ended June 30, | ||||||||||||||||

|

2023 (Unaudited) |

2022 (Unaudited) |

Changes | % | |||||||||||||

| Revenue | $ | 191,956 | $ | 235,696 | $ | (43,740 | ) | -18.6 | % | |||||||

| Cost of revenue | 187,950 | 231,653 | (43,703 | ) | -18.9 | % | ||||||||||

| Gross profit | 4,006 | 4,043 | (37 | ) | -0.9 | % | ||||||||||

| Operating expenses: | ||||||||||||||||

| Selling and distribution | 601 | 518 | 83 | 16.0 | % | |||||||||||

| General and administrative | 1,910 | 1,978 | (68 | ) | -3.4 | % | ||||||||||

| Total operating costs and expenses | 2,511 | 2,496 | 15 | 0.6 | % | |||||||||||

| Income from operations | 1,495 | 1,547 | (52 | ) | -3.4 | % | ||||||||||

| Other expense: | ||||||||||||||||

| Interest expense, net | 117 | 119 | (2 | ) | -1.7 | % | ||||||||||

| Other expense, net | (22 | ) | (15 | ) | 7 | 46.7 | % | |||||||||

| Total other expense | 95 | 104 | (9 | ) | -8.6 | % | ||||||||||

| Income before provision for income taxes | 1,400 | 1,443 | (43 | ) | -3.0 | % | ||||||||||

| Provision for income taxes | 247 | 354 | (107 | ) | -30.2 | % | ||||||||||

| Net income | 1,153 | 1,089 | 64 | 5.9 | % | |||||||||||

| Basic and diluted earnings per ordinary share* | $ | 0.05 | $ | 0.05 | - | - | ||||||||||

* Gives retroactive effect to reflect the reorganization in August 2022.

|

|

Revenue. Our consolidated revenue decreased by approximately $43,740,000 or 18.6% from approximately $235,696,000 for the six months ended June 30, 2022, to approximately $191,956,000 for the six months ended June 30, 2023. Such a decrease was mainly attributable to the decrease in the marine fuel price but partially offset by the increase in our sales volume of marine fuel sold.

The increase in our sales volume was mainly driven by the decreases in the average marine fuel prices from approximately US$802.8 per metric ton for the six months ended June 30, 2022 to approximately US$604.4 per metric ton for the six months ended June 30, 2023, representing a decrease of approximately 24.7%, and coupled with the increase in our financial resources available to fund our working capital to purchase more marine fuel (in dollar amount) as a result of cash flow generated from our operations in the year of 2022 together with the net proceeds raised from the issuance of new shares in our IPO of our shares for listing on Nasdaq in March 2023 .

Gross profit. Our consolidated gross profit for the six months ended June 30, 2023 was approximately $4,006,000, a slight decrease of $37,000, or 0.9%, compared to the six months ended June 30, 2022, driven by decreased gross profit per ton of marine fuel sold with an effect of $368,000, partially offset by an increase of volume in the amount of $331,000.

Operating expenses. Consolidated operating costs and expenses for the six months ended June 30, 2023, were approximately $2,511,000 a slight decrease of $15,000, or 0.6%, compared to the six months ended June 30, 2022.

Other expenses. For the six months ended June 30, 2023, we had other expenses of approximately $95,000, compared to that of approximately $104,000 for the six months ended June 30, 2022, a decrease of approximately $9,000 was mainly attributable to an increase in currency exchange gain earned during the six months ended June 30, 2023.

Income taxes. For the six months ended June 30, 2023, our income tax provision was approximately $247,000 and our effective income tax rate was 17.6%, as compared to an income tax provision of approximately $354,000 for the six months ended June 30, 2022. The decrease of approximately $107,000 was primarily attributable to a decrease in non-deductible expense for tax purposes.

Net income. Net income increased by approximately $64,000 or 5.9% from approximately $1,089,000 for the six months ended June 30, 2022, to approximately $1,153,000 for the six months ended June 30, 2023.

|

|

Financial Position

The following provides a summary of our consolidated financial positions as of June 30, 2023 and December 31, 2022 (in thousand dollars):

|

As of June 30, 2023 |

As of December 31, 2022 |

|||||||||||||||

| (Unaudited) | (Unaudited) | Changes | % | |||||||||||||

| Assets: | ||||||||||||||||

| Current Assets | ||||||||||||||||

| Cash | $ | 10,431 | $ | 5,033 | $ | 5,398 | 107.3 | % | ||||||||

| Accounts receivable | 30,929 | 18,446 | 12,483 | 67.7 | % | |||||||||||

| Prepayments and other current assets | 11,289 | 254 | 11,035 | 4344.5 | % | |||||||||||

| Total current assets | 52,649 | 23,733 | 28,916 | 121.8 | % | |||||||||||

| Property, plant and equipment, net | 859 | 394 | 465 | 118.0 | % | |||||||||||

| Right-of-use lease assets, net | 280 | 342 | (62 | ) | -18.1 | % | ||||||||||

| Deferred offering costs | - | 1,128 | (1,128 | ) | -100.0 | % | ||||||||||

| Total assets | $ | 53,788 | $ | 25,597 | 28,191 | 110.0 | % | |||||||||

| Liabilities and Shareholders’ Equity: | ||||||||||||||||

| Liabilities | ||||||||||||||||

| Current liabilities | ||||||||||||||||

| Accounts payable | $ | 27,716 | $ | 12,653 | 15,063 | 119.0 | % | |||||||||

| Taxes payable | 314 | 244 | 70 | 28.7 | % | |||||||||||

| Accrued expenses and other current liabilities | 144 | 126 | 18 | 14.3 | % | |||||||||||

| Derivative liabilities | 9 | 109 | (100 | ) | -91.7 | % | ||||||||||

| Short-term lease liabilities | 126 | 124 | 2 | 1.6 | % | |||||||||||

| Total current liabilities | 28,309 | 13,256 | 15,053 |

113.6 |

% | |||||||||||

| Long-term lease liabilities | 165 | 229 | (64 | ) | -27.9 | % | ||||||||||

| Total liabilities | 28,474 | 13,485 | 14,989 | 111.2 |

% | |||||||||||

| Commitment and contingencies | - | - | ||||||||||||||

| Shareholders’ equity: | ||||||||||||||||

| Ordinary shares, $0.0001 par value, 500,000,000 shares authorized, 21,250,000 shares issued and outstanding as of December 31, 2022, and 2021* | $ | 3 | $ | 2 | 1 | 50.0 | % | |||||||||

| Additional paid-in capital | 12,536 | 488 | 12,048 | 2468.9 | % | |||||||||||

| Retained earnings | 12,775 | 11,622 | 1,153 | 9.9 | % | |||||||||||

| Total shareholders’ equity | 25,314 | 12,112 | 13,202 | 109.0 | % | |||||||||||

| Total liabilities and shareholders’ equity | $ | 53,788 | $ | 25,597 | 28,191 | 110.1 | % | |||||||||

| * | Gives retroactive effect to reflect the reorganization in August 2022. |

Cash. Our consolidated cash balance increased by approximately $5,398,000 from approximately $5,033,000 as of December 31, 2022, to approximately $10,431,000 as of June 30, 2023. Such an increase was mainly attributable to the receipt of net proceeds of$13,557,000 in relation to the issuance of new shares in the IPO of our shares for listing on Nasdaq in March 2023. Certain portions of the proceeds were utilized to place deposits with suppliers for the purchases of bunkers from them.

Accounts receivable. Our consolidated accounts receivable balance increased by approximately $12,483,000 from approximately $18,446,000 as of December 31, 2022, to approximately $30,929,000 as of June 30, 2023. First of all, the sales volume in June 2023 was higher than that in December 2022. In this connection, the credit sales to customers in the month of June 2023 were higher than that in December 2022 in the amount of $8,383,000 thus accounts receivable increased by $8,383,000. In addition, the accounts receivable as of December 31, 2022, were further reduced as we sold certain receivable to a bank by drawing down $4,100,000 from a non-recourse factoring facility. that turned the account receivable into cash balance, while as of June 30, 2023, we did not draw down any amount from such facility, and thus no reduction in account receivable balance.

Prepayments and other current assets. Our consolidated prepayments and other current assets balance increased by approximately $11,035,000 from approximately $254,000 as of December 31, 2022, to approximately $11,289,000 as of June 30, 2023. The increase was mainly attributable to the deposits placed with suppliers for the purchases of bunkers from them.

|

|

Deferred offering costs. The deferred offering costs balance decreased by approximately $1,128,000 from approximately $1,128,000 as of December 31, 2022, to nil as of June 30, 2023. Incidental professional expenses and costs, such as legal fees, accountancy, etc. were incurred in the course of the IPO of the Company and recorded as deferred offering costs. As of December 31, 2022, the cumulative deferred offering costs incurred were approximately $1,128,000, which were fully capitalized and set off against the proceeds received from the issuance of new shares in March 2023.

Accounts payable. The consolidated accounts payable balance increased by approximately $15,063,000 from approximately $12,653,000 as of December 31, 2022, to approximately $27,716,000 as of June 30, 2023. The increase was mainly attributable to the difference between the volume of bunkers purchased from suppliers in the month of June 2023 and that purchased in December 2022. The quantity of marine fuel purchased to fulfil the June 2023 sales order was higher than that in December 2022. In this connection, the amount of credit purchases increased in the month of June 2023 as compared to that in December 2022 in the amount of $14,247,000.

Shareholders’ equity. The consolidated total shareholders’ equity increased by approximately $13,202,000 from approximately $12,112,000 as of December 31, 2022, to approximately $25,314,000 as of June 30, 2023. The increase was mainly attributable to the additional paid-in capital of approximately $12,000,000 in relation to the issuance of new shares in the IPO of our shares for listing on Nasdaq in March 2023.

Obligations and commitments

As of June 30, 2023, our contractual obligations were as follows (in thousand dollars):

| Current | Long-Term | Total | ||||||||||

| Operating lease obligations | $ | 126 | $ | 165 | $ | 291 | ||||||

| Derivatives obligations | 9 | - | 9 | |||||||||

| Total | $ | 135 | $ | 165 | $ | 300 | ||||||

Debt and interest obligations include principal and interest payments on fixed-rate and variable-rate, fixed-term debt based on their maturity dates.

We enter into lease arrangements for the use of offices for our operations. See Note 11. Leases of the Unaudited Interim Financial Statements.

As part of our risk management program, we enter into derivative instruments intended to mitigate risks associated with changes in commodity prices. Our obligations associated with these derivative instruments fluctuate based on changes in the fair value of the derivatives. See Note 4. Derivative Instruments of the Unaudited Interim Financial Statements.

From time to time, we fix purchase commitments associated with our risk management program, as well as a purchase contract with our suppliers, under which we agreed to purchase a certain quantity of marine fuel at future market prices. As of December 31, 2022, we did not enter into such purchase agreements with any supplier. See Note 8. Commitments and Contingencies for additional information.

Working capital and Liquidity

Cash is primarily used to fund working capital to support our operations.

|

|

Cash Flows

The following table reflects the major categories of cash flows for the six months ended June 30, 2023 and 2022 (in thousand dollars). For additional details, please see the Consolidated Statements of Cash Flows.

| For the Six Months Ended June 30 , | Changes | % | ||||||||||||||

|

2023 (Unaudited) |

2022 (Unaudited) |

|||||||||||||||

| Net cash provided by (used in) operating activities | $ | (7,237 | ) | $ | 759 | $ | (7,996 | ) | -1053.5 | % | ||||||

| Net cash provided by (used in) investing activities | (542 | ) | (8 | ) | (534 | ) | 6675.0 | % | ||||||||

| Net cash provided by (used in) financing activities | 13,177 | 720 | 12,457 | 1730.1 | % | |||||||||||

| Change in cash | 5,398 | 1,471 | 3,927 | 267.0 | % | |||||||||||

| Cash at beginning of period | 5,033 | 3,035 | ||||||||||||||

| Cash at end of period | 10,431 | 4,506 | ||||||||||||||

Operating Activities. Net cash used in operating activities of $7,237,000 for the six months ended June 30, 2023, compared to that provided by operating activities of $759,000 for the six months ended June 30, 2022. The decrease in net cash generated from operating activities was primarily due to the following:

| a) | Change in accounts receivable was approximately $12,483,000 net cash outflow for the six months ended June 30, 2023, as compared to that for the same period ended June 30, 2022 in the amount of approximately $5,170,000 net cash outflow, resulting in an increase in net cash used in operating activities in the amount of approximately $7,313,000 in this respect. The increase in net cash outflow in relation to accounts receivable was mainly attributable to the difference between the accounts receivable balance as of June 30, 2023 in the amount of approximately $30,929,000 and that as of June 30, 2022 in the amount of approximately $23,214,000. More credit sales were made in June 2023 as compared to that in June 2022. |

| b) | Change in prepayments and other current assets was approximately $11,035,000 net cash outflow for the six months ended June 30, 2023. For the six months ended June 30, 2022, change in prepayments and other current assets was approximately $683,000 net cash inflow, resulting in an increase in net cash used in operating activities in the amount of approximately $11,718,000. Prepayment as of June 30, 2023, principally represents deposits made to suppliers in aggregate of approximately $10,980,000 for the purchase of marine fuel which was necessary for the ongoing supply of goods for our bunkering business. |

| c) | Change in accounts payable was approximately $15,064,000 net cash inflow for the six months ended June 30, 2023. For the six months ended June 30, 2022, change in accounts payable was approximately $4,351,000 net cash inflow, resulting in an increase in net cash provided by operating activities in the amount of approximately $10,713,000. The increase in net cash outflow in relation to accounts payable was mainly attributable to i) the difference between the accounts payable balance as of June 30, 2023 in the amount of approximately $27,716,000 and that as of June 30, 2022 in the amount of approximately $22,649,000. More credit purchases were made in June 2023 as compared to that in June 2022 and ii) the difference between the opening balance of accounts payable for the periods ended June 30, 2023 and 2022 in an amount of $5,774,000. The opening balance of accounts payable for the periods ended June 30, 2023 was approximately $12,523,000 while that for the period ended June 30, 2022 was approximately $18,297,000. |

Investing Activities. Net cash used in investing activities of $542,000 for the six months ended June 30, 2023, consisted of payments for design and construction of the Group’s new management information system and the acquisition of a new motor vehicle during the period. Net cash used in investing activities for the six months ended June 30, 2022, was $8,000. It consisted mainly of the purchase of office equipment and furniture.

Financing Activities. The net proceeds in the amount of approximately $13,200,000 raised from the IPO of the Company in March 2023 provided net cash inflow to the Group. For the six months ended June 30, 2022, net cash inflow in financing activities in the amount of $720,000 were advances provided from a related party.

Liquidity and Capital Resources

Liquidity to fund working capital is a significant priority for the Group’s bunker business. Our views concerning liquidity are based on currently available information and if circumstances change significantly, the future availability of trade credit or other sources of financing may be reduced, and our liquidity would be adversely affected accordingly.

Sources of Liquidity and Factors Impacting Our Liquidity

Our liquidity, consisting principally of cash and availability under our credit facility (i.e. our accounts receivable factoring facilities provided by a commercial bank), fluctuates based on a number of factors, including the timing of receipts from our customers and payments to our suppliers, changes in fuel prices, as well as our financial performance.

|

|

We rely on our equity, trade credit from suppliers and facilities provided by banks as important sources of liquidity for working capital requirements for our operations. Future market volatility, generally, and any persistent weakness in global energy markets may adversely affect our ability to access capital and credit markets or to obtain funds at reasonable interest rates or on other advantageous terms. In addition, since our business is impacted by the availability of trade credit to fund fuel purchases, an actual or perceived decline in our liquidity or business generally could cause our suppliers to reduce our credit lines, which in turns may otherwise materially modify our payment terms.

During times of high fuel prices, our customers may not be able to purchase as much fuel from us because of their credit limits with us and the resulting adverse impact on their business could cause them to be unable to make payments owed to us for fuel purchased on credit. Furthermore, when fuel prices increase our working capital requirements increase and our own credit limits could prevent us from purchasing enough fuel from our suppliers to meet our customers’ demands, or we could be required to prepay for fuel purchases, any of which would adversely impact our liquidity.

However, extended periods of low fuel prices, particularly when coupled with low price volatility, can have a favorable effect on our results of operations and overall profitability. This can occur due to lower working capital requirements for the same trade volume. In other words, under low fuel price environments, the same amount of capital enables us to conduct more business as a result of lower working capital requirements.

The Company manages its capital to ensure that the Company will be able to continue as a going concern while maximizing the return to stakeholders through the optimization of the balance between debt and equity.

The Company reviews the capital structure on an ongoing basis. As a part of this review, the directors consider the cost of capital and the risks associated with each class of capital. The Company will balance its overall capital structure through the payment of dividends, new share issues and the issue of new debt or the repayment of existing debt.

In March 2023, the shares of the Company were successfully listed in Nasdaq and the net proceeds of approximately $13.2 million were raised with the new shares issued. This provides us with a new source of capital to fund our business and expansion.

Based on the information currently available, we believe that our cash as of June 30, 2023, and available funds from our credit facility, as described below, together with cash flows generated by operations, are sufficient to fund our working capital and capital expenditure requirements for at least the next twelve months.

Receivables Purchase Agreements. We also have a non-recourse accounts receivable purchase program with a commercial bank that allows us to sell a specified amount of qualifying accounts receivable and receive cash consideration equal to the total balance, less an associated fee. The accounts receivable purchase program provides the constituent bank with the ability to accept customers from this program with the level of risk exposure the bank is willing to accept with respect to particular customers. The fees the bank charge us to purchase the receivables from these customers can also be impacted for these reasons.

|

|

Exhibit 99.2

INDEX TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

CBL INTERNATIONAL LIMITED AND ITS SUBSIDIARIES

TABLE OF CONTENTS

| F- |

CBL INTERNATIONAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. dollars, except for the number of shares)

| June 30, | December 31, | |||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Assets: | ||||||||

| Current Assets | ||||||||

| Cash | $ | 10,430,980 | $ | 5,032,890 | ||||

| Accounts receivable | 30,929,095 | 18,446,176 | ||||||

| Prepayments and other current assets | 11,288,887 | 253,779 | ||||||

| Total current assets | 52,648,962 | 23,732,845 | ||||||

| Property, plant and equipment, net | 859,160 | 394,090 | ||||||

| Right-of-use lease assets, net | 279,886 | 341,625 | ||||||

| Deferred offering costs | - | 1,128,453 | ||||||

| Total assets | $ | 53,788,008 | $ | 25,597,013 | ||||

| Liabilities and Shareholders’ Equity: | ||||||||

| Liabilities | ||||||||

| Current liabilities | ||||||||

| Accounts payable | $ | 27,716,215 | $ | 12,652,514 | ||||

| Taxes payable | 314,017 | 244,096 | ||||||

| Accrued expenses and other current liabilities | 143,618 | 125,701 | ||||||

| Derivative liabilities | 8,688 | 109,346 | ||||||

| Short-term lease liabilities | 126,046 | 124,095 | ||||||

| Total current liabilities | 28,308,584 | 13,255,752 | ||||||

| Long-term lease liabilities | 165,532 | 229,076 | ||||||

| Total liabilities | 28,474,116 | 13,484,828 | ||||||

| Commitment and contingencies | - | - | ||||||

| Shareholders’ equity: | ||||||||

| Ordinary shares, $0.0001 par value, 500,000,000 shares authorized, 25,000,000 shares issued and outstanding as of June 30, 2023 and 21,250,000 shares as of December 31, 2022* | 2,500 | 2,125 | ||||||

| Additional paid-in capital | 12,536,085 | 488,198 | ||||||

| Retained earnings | 12,775,307 | 11,621,862 | ||||||

| Total shareholders’ equity | 25,313,892 | 12,112,185 | ||||||

| Total liabilities and shareholders’ equity | $ | 53,788,008 | $ | 25,597,013 | ||||

| * | Gives retroactive effect to reflect the reorganization in August 2022. |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F- |

CBL INTERNATIONAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

(Expressed in U.S. dollars, except for the number of shares)

| For the Six Months Ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Revenue | $ | 191,955,811 | $ | 235,696,705 | ||||

| Cost of revenue | 187,949,993 | 231,653,262 | ||||||

| Gross profit | 4,005,818 | 4,043,443 | ||||||

| Operating expenses: | ||||||||

| Selling and distribution | 601,149 | 517,724 | ||||||

| General and administrative | 1,909,922 | 1,978,613 | ||||||

| Total operating costs and expenses | 2,511,071 | 2,496,337 | ||||||

| Income from operations | 1,494,747 | 1,547,106 | ||||||

| Other (income) expense: | ||||||||

| Interest expense, net | 116,434 | 119,230 | ||||||

| Currency exchange (gain) loss | (21,818 | ) | (14,812 | ) | ||||

| Total other expenses | 94,616 | 104,418 | ||||||

| Income before provision for income taxes | 1,400,131 | 1,442,688 | ||||||

| Provision for income taxes | 246,686 | 353,792 | ||||||

| Net income | $ | 1,153,445 | $ | 1,088,896 | ||||

| Comprehensive income | $ | 1,153,445 | $ | 1,088,896 | ||||

| Basic and diluted earnings per ordinary share* | $ | 0.05 | $ | 0.05 | ||||

| Weighted average number of ordinary shares outstanding - basic and diluted* | 25,000,000 | 21,250,000 | ||||||

| * | Gives retroactive effect to reflect the reorganization in August 2022. |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F- |

CBL INTERNATIONAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

(Expressed in U.S. dollars, except for the number of shares)

| Ordinary shares* |

Ordinary shares amount |

Additional paid-in capital |

Retained earnings |

Total shareholders’ equity |

||||||||||||||||

| Balance as of December 31, 2021 | 21,250,000 | $ | 2,125 | $ | 488,198 | $ | 7,936,862 | $ | 8,427,185 | |||||||||||

| Net income | - | - | - | 1,088,896 | 1,088,896 | |||||||||||||||

| Balance as of June 30, 2022 | 21,250,000 | $ | 2,125 | $ | 488,198 | $ | 9,025,758 | $ | 9,516,081 | |||||||||||

| Ordinary shares* |

Ordinary shares amount |

Additional paid-in capital |

Retained earnings |

Total shareholders’ equity |

||||||||||||||||

| Balance as of December 31, 2022 | 21,250,000 | $ | 2,125 | $ | 488,198 | $ | 11,621,862 | $ | 12,112,185 | |||||||||||

| Issuance of new ordinary shares | 3,750,000 | 375 | 12,047,887 | - | 12,048,262 | |||||||||||||||

| Net income | - | - | - | 1,153,445 | 1,153,445 | |||||||||||||||

| Balance as of June 30, 2023 | 25,000,000 | $ | 2,500 | $ | 12,536,085 | $ | 12,775,307 | $ | 25,313,892 | |||||||||||

| * | Gives retroactive effect to reflect the reorganization in August 2022. |

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F- |

CBL INTERNATIONAL LIMITED AND ITS SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Expressed in U.S. dollars)

| For the Six Months Ended June 30, | ||||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Cash Flows from operating activities: | ||||||||

| Net income | $ | 1,153,445 | $ | 1,088,896 | ||||

| Adjustment to reconcile net income to net cash (used in) provided by operating activities: | ||||||||

| Depreciation and amortization | 76,679 | 42,376 | ||||||

| Depreciation of right-of-use assets | 61,740 | 36,029 | ||||||

| Change in fair value of derivatives | (100,658 | ) | (311,277 | ) | ||||

| Changes in operating assets and liabilities | ||||||||

| Accounts receivable | (12,482,919 | ) | (5,170,468 | ) | ||||

| Prepayments and other current assets | (11,035,107 | ) | 683,199 | |||||

| Due from related parties | - | (271,413 | ) | |||||

| Accounts payable | 15,063,701 | 4,351,464 | ||||||

| Accrued expenses and other liabilities | 17,919 | (3,241 | ) | |||||

| Lease liabilities | (61,593 | ) | (36,115 | ) | ||||

| Taxes payable | 69,921 | 349,639 | ||||||

| Net cash provided by (used in) operating activities | (7,236,872 | ) | 759,089 | |||||

| Cash flows from investing activities: | ||||||||

| Purchase of property, plant and equipment | (541,750 | ) | (7,909 | ) | ||||

| Net cash (used in) provided by investing activities | (541,750 | ) | (7,909 | ) | ||||

| Cash flows from financing activities: | ||||||||

| Advance from a related party | - | 719,773 | ||||||

| Proceeds from issuance of new ordinary shares | 13,176,716 | - | ||||||

| Net cash provided by financing activities | 13,176,716 | 719,773 | ||||||

| Net increase (decrease) in cash | 5,398,094 | 1,470,953 | ||||||

| Cash at the beginning of the period | 5,032,890 | 3,035,321 | ||||||

| Cash at the end of the year | $ | 10,430,984 | $ | 4,506,274 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION: | ||||||||

| Cash paid during the period for: | ||||||||

| Interest | $ | 138,086 | $ | 119,270 | ||||

| Income taxes | $ | 176,765 |

$ | 4,210 | ||||

The accompanying notes are an integral part of these unaudited consolidated financial statements.

| F- |

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Expressed in U.S. dollars, unless stated otherwise)

1. Organization and Principal Business

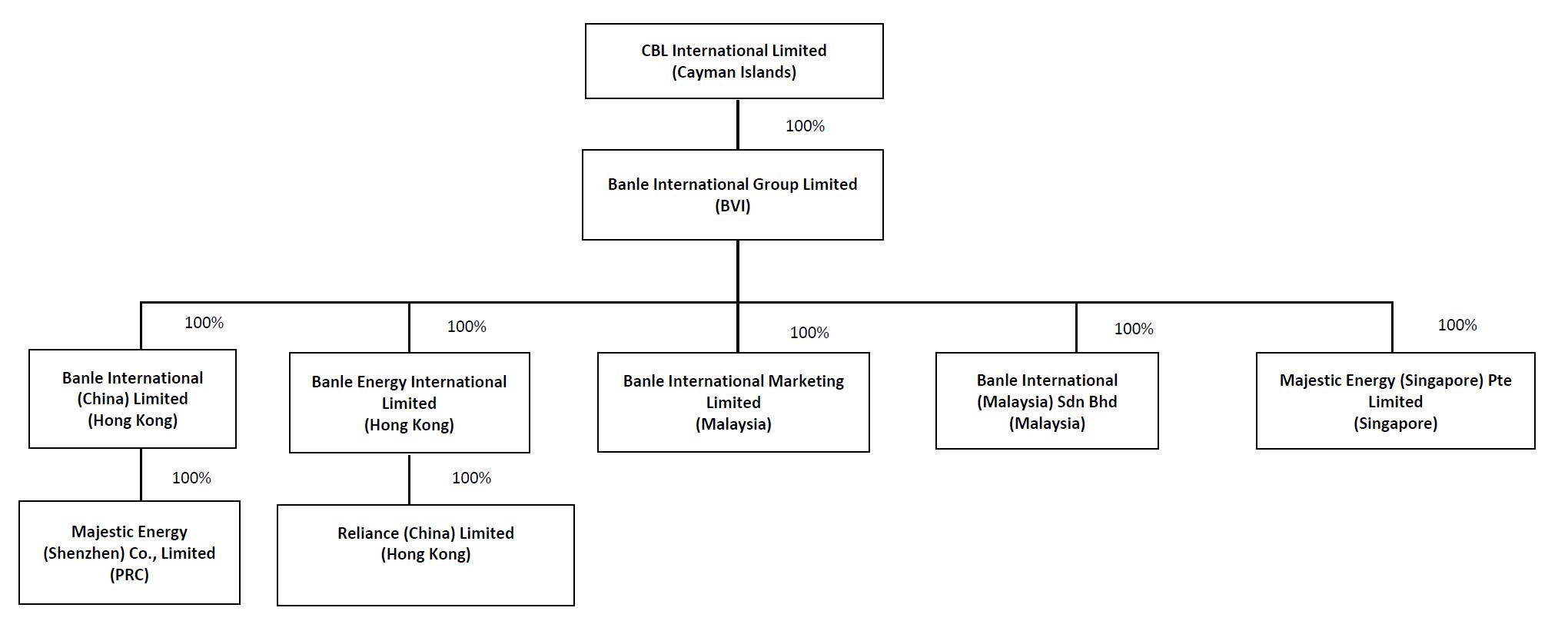

CBL International Limited (“CBL International”) was incorporated on February 8, 2022 in the Cayman Islands. CBL International is a holding company without any operations and it wholly owns Banle International Group Limited (“Banle BVI”) which was incorporated in the British Virgin Islands (collectively, the “Company”).

The Company is a marine fuel logistics company providing a one-stop solution for vessel refueling in the Asia Pacific region. As a bunkering facilitator, the Company expedites vessel refueling between ship operators and local physical distributors/traders of marine fuel. The Company purchases marine fuel from its suppliers and arranges its suppliers to deliver marine fuel to its customers, principally the container liner operators.

Business Reorganization and CBL International

A reorganization of the Company’s legal entity structure was completed in August 2022. The reorganization involved the incorporation of CBL International in February 2022, and the acquisition of Banle BVI by CBL International in August 2022. This transaction was treated as a recapitalization of the Company under common control and the financial statements give retroactive effect to this transaction.

Banle BVI was set up in July 2020 with 50,000 shares at $1.00 per share issued to Mr. Chia. In February 2021, Banle BVI issued 490,323 shares in total, of comprised 304,000 shares to CBL (Asia) Limited (“CBL (Asia)”) and 186,323 shares to Straits Energy Resources Berhad (“Straits”). The 50,000 shares originally issued to Mr. Chia were surrendered and cancelled at the same time.

CBL International was incorporated in the Cayman Islands with limited liability in February 2022, by issuing and allotting 50,000 shares at par value of $0.01 per share to Mr. Chia. In March 2022, each issued and unissued share was subdivided into 100 shares. Each share par value was reduced to $0.0001, and the authorized share capital was amended to 500,000,000 shares with $0.0001 par value per share. The number of shares held by Mr. Chia increased from 50,000 to 5,000,000 with a par value of $0.0001 each.

In August 2022, CBL (Asia) and Straits, as vendors, and CBL International, as purchaser, entered into a sale and purchase agreement, pursuant to which CBL International acquired the entire issued share capital of Banle BVI from its existing shareholders, CBL (Asia) and Straits, in consideration of which CBL International issued and allotted 13,175,000 shares and 8,075,000 shares, credited as fully paid, to CBL (Asia) and Straits, respectively. Upon completion of issuance and allotment of the shares to CBL (Asia) and Straits, the 5,000,000 shares of CBL International issued to Mr. Chia were surrendered and cancelled; and CBL International became the 100% shareholder of Banle BVI and itself being owned 62% by CBL (Asia) and 38% by Straits.

| F- |

On March 23, 2023, the Company consummated the initial public offering of 3,325,000 ordinary shares, par value of $0.0001 per share at a price of $4.00 per share (the “Offering”), The Company’s underwriters exercised their over-allotment option in part for an additional 425,000 ordinary shares on March 27, 2023 (“Over-allotment Option”). The Over-allotment Option was closed with the Offering. Upon completion of the Offering, the ordinary share capital of the Company became $2,500, representing 25,000,000 shares of $0.0001 par value.

The total number of ordinary shares issued and outstanding as of June 30, 2023 was 25,000,000 shares. The Company’s ordinary shares began trading on the Nasdaq Capital Market on March 23, 2023 under the ticker symbol “BANL”.

Upon completion of issuance of the shares under the Offering, CBL International is effectively owned 52.7% by CBL (Asia), 32.3% by Straits and 15.0% by public shareholders.

2. Basis of Presentation, New Accounting Standards, and Significant Accounting Policies

The Unaudited Condensed Consolidated Financial Statements and related notes include all the accounts of the Company and its wholly owned subsidiaries. The Unaudited Condensed Consolidated Financial Statements are prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), for the purposes of filing the 2023 Interim Report on Form 6-K (“2023 6-K Report”). Accordingly, they do not include all the information and footnotes required by U.S. GAAP for complete financial statements. However, except as disclosed herein, there has been no material change in the information disclosed in the Notes included in our 2022 Annual Report on Form 20-F (“2022 20-F Report”). All intercompany transactions have been eliminated in consolidation.

The information included in this 2023 6-K Report should be read in conjunction with the Consolidated Financial Statements and accompanying Notes included in our 2022 20-F Report. Certain amounts in the Unaudited Condensed Consolidated Financial Statements and accompanying Notes may not add due to rounding; however, all percentages have been calculated using unrounded amounts.

New Accounting Standards

Adoption of New Accounting Standards

Disclosure of Supplier Finance Program Obligations. In September 2022, Accounting Standards Update (“ASU”) 2022-04 was issued to require the buyer in a supplier finance program to disclose the key terms of the program, outstanding confirmed amounts as of the end of the period, a rollforward of such amounts during each annual period, and a description of where in the financial statements outstanding amounts are presented. The amendments do not affect the recognition, measurement or financial statement presentation of supplier finance program obligations. The amendments are effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. The amendments should be applied retrospectively to each period in which a balance sheet is presented, except for the rollforward, which should be applied prospectively. Early adoption was permitted. The Company did not adopt ASU 2022-04 in the first half of 2023 as we consider that it is not applicable to the Company.

Accounting Standards Issued but Not Yet Adopted

There are no recently issued accounting standards not yet adopted by us that are expected, upon adoption, to have a material impact on the Company’s Consolidated Financial Statements or processes.

Significant Accounting Policies

There have been no significant changes in the Company’s accounting policies from those disclosed in our 2022 20-F Report. The significant accounting policies we use for interim financial reporting are disclosed in Note 2 Summary of Significant Accounting Policies of the accompanying Notes to the Consolidated Financial Statements included in our 2022 20-F Report.

| F- |

3. Accounts Receivable

Accounts receivable represent trade receivables from customers. We extend credit to our customers on an unsecured basis. Our exposure to credit losses depends on the financial conditions of them and macroeconomic factors beyond our controls, such as global economic conditions or adverse impacts in the industries we serve, changes in oil prices and political instability. The health of our accounts receivable is continuously monitored, taking into consideration both changes in our customers’ financial conditions and macroeconomic events. We adjust credits limits based upon payment history and creditworthiness of our customers. Because we extend credit on an unsecured basis to most of customers, there is possibility that any accounts receivable not collected may ultimately need to be written off.

The Company had accounts receivable of approximately $30,929,095 and $18,446,176 as of June 30, 2023 and December 31, 2022, respectively, of which accounts receivable from the top five customers accounted for approximately $23,958,875 and $9,253,060 As of June 30, 2023 and December 31, 2022 accounted for approximately 77.5% (the largest of which accounted for 25.0%) and 50.2% (the largest of which accounted for 22.4%) of total accounts receivable, respectively. The Company has no allowance for doubtful accounts as of June 30, 2023 and December 31, 2022 and no bad debt expense for the six months then ended.

Subsequent to June 30, 2023, all accounts receivable as of June 30, 2023 have been collected.

As of June 30, 2023, the Company did not sell any accounts receivable to a bank under a non-recourse factoring arrangement. As of December 31, 2022, accounts receivable in the amount of $4,134,637 were sold to a bank under a non-recourse factoring arrangement.

4. Derivative Instruments

The Company values its derivative instruments using alternative pricing sources and market observable inputs, and accordingly the Company classifies the valuation techniques that use these inputs as Level 2.

The following table presents the gross fair value of the Company’s derivative instruments not designated as hedging instruments and their locations on the consolidated balance sheets:

Schedule of Derivative Instruments

| As of June 30, 2023 (Unaudited) | ||||||||||||||||

| Derivative liabilities | Level 1 input | Level 2 input | Level 3 input | Total fair value | ||||||||||||

| Commodity contracts | $ | - | $ | 8,688 | $ | - | $ | 8,688 | ||||||||

| As of December 31, 2022 (Unaudited) | ||||||||||||||||

| Derivative liabilities | Level 1 input | Level 2 input | Level 3 input | Total fair value | ||||||||||||

| Commodity contracts | $ | - | $ | 109,346 | $ | - | $ | 109,346 | ||||||||

The following table summarizes the gross notional values of the Company’s commodity contracts used for risk management purposes that were outstanding as of June 30, 2023, and December 31, 2022:

Schedule of Gross Notional Value

| As of June 30, | As of December 31, | |||||||||||||

| Derivative Instruments | Units | 2023 | Units | 2022 | ||||||||||

| Commodity contracts | ||||||||||||||

| Long | Metric ton | 4,550 | Metric ton | 3,600 | ||||||||||

| Short | - | - | Metric ton | 500 | ||||||||||

The following table presents the effect and financial statement location of the Company’s derivative instruments not designated as hedging instruments on the Company’s consolidated statements of income and comprehensive income:

The following are the amounts of realized and unrealized gain during the six months ended June 30, 2023 and 2022:

Schedule of Realized and Unrealized Gain

| Location | 2023 | 2022 | ||||||||

| (Unaudited) | (Unaudited) | |||||||||

| Realized and unrealized gain from commodity contracts | Cost of revenue | $ | 239,452 | $ | 1,594,504 | |||||

| F- |

5. Prepayment and other current assets

Prepayment and other current assets as of June 30, 2023, and December 31, 2022, consist of the following:

Schedule of prepayment and other current assets

| As of June 30, | As of December 31, | |||||||

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Prepayments | $ | 11,215,181 | $ | 167,677 | ||||

| Deposit | 73,706 | 86,102 | ||||||

| Total | $ | 11,288,887 | $ | 253,779 | ||||

Prepayments as of June 30, 2023, principally represent advance payments made to suppliers in an aggregated amount of approximately $10,980,000 for the purchase of marine fuel.

6. Property, Plant and Equipment

The details of property and equipment are as follows:

Schedule of Property Plant and Equipment

|

As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | (Unaudited) | |||||||

| Office equipment, furniture and fixtures | $ | 375,262 | $ | 363,167 | ||||

| Less: accumulated depreciation and amortization | 76,572 | 22,284 | ||||||

| Office equipment, furniture and fixtures, net | $ | 298,690 | $ | 340,883 | ||||

During the six months ended June 30, 2023 and 2022, the Company recorded depreciation charges of approximately $54,000 and $55,000, respectively.

The details of motor vehicle are as follows:

Schedule of Property Plant and Equipment

|

As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | (Unaudited) | |||||||

| Motor vehicle | $ | 190,787 | $ | 98,632 | ||||

| Less: accumulated depreciation | 99,717 | 84,542 | ||||||

| Motor vehicle, net | $ | 91,070 | $ | 14,090 | ||||

During the six months ended June 30, 2023, and 2022, the Company recorded depreciation charges of approximately $15,000 and $21,000 respectively.

The details of computer software costs are as follows:

Schedule of Property Plant and Equipment

|

As of June 30, 2023 |

As of December 31, 2022 |

|||||||

| (Unaudited) | (Unaudited) | |||||||

| Computer software | $ | 517,655 | $ | 80,155 | ||||

| Less: accumulated amortization | 48,255 | 41,038 | ||||||

| Computer software costs, net | $ | 469,400 | $ | 39,117 | ||||

During the six months ended June 30, 2023, and 2022, the Company recorded amortization charges related to computer software of approximately $7,000 and $13,000 respectively.

| F- |

7. Interest Income and Interest Expense

In 2021, the Company entered into a factoring agreement for $4.8 million with a commercial bank to purchase certain accounts receivable on a non-recourse basis. As of June 30, 2023, the factoring facility was increased to $13.6 million. As invoices were factored with the bank, they were not recorded as accounts receivable in the Company’s consolidated financial statements. As of June 30, 2023, accounts receivable factored were nil ($4.1 million as of December 31, 2022).

As of June 30, 2023, the unused portion of the financing facilities was approximately $13.6 million ($9.5 million as of December 31, 2022).

The interest rates under the factoring agreement range from 1.2% to 1.25% (2022: 1.2% to 1.25%) over the bank’s cost of funds per annum.

The following table provides additional information about the Company’s interest income, interest expense and other financing costs, net for the six months ended June 30, 2023, and 2022:

Schedule of Interest Income and Interest Expense

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Interest income | $ | 21,652 | $ | 39 | ||||

| Interest expense on lease liabilities | (4,987 | ) | (1,435 | ) | ||||

| Interest expense on factoring arrangement | (133,099 | ) | (117,834 | ) | ||||

| Total | $ | (116,434 | ) | $ | (119,230 | ) | ||

8. Commitments and Contingencies

Sales and Purchase Commitments

As of June 30, 2023, the Company has committed to sell to certain customers a minimum of 102,450 MT to a maximum of 166,600 MT bunkers with delivery to be made in third quarter of 2023. As of June 30, 2023, the Company has committed to buy from certain suppliers a minimum of 57,000 MT to a maximum of 75,000 MT bunkers to be delivered in third quarter of 2023.

Contingencies

The Company is subject to legal proceedings and regulatory actions in the ordinary course of business. The results of such proceedings cannot be predicted with certainty, and the Company does not anticipate that the final outcome arising out of any such matter will have a material adverse effect on its consolidated financial position, cash flows or results of operations. As of June 30, 2023, and December 31, 2022, the Company is not a party to any material legal or administrative proceedings and did not have any significant contingencies.

9. Income Taxes

British Virgin Islands

Under the current laws of the British Virgin Islands, the Company is not subject to any income tax.

Hong Kong

Under the two-tiered profit tax rate regime of Hong Kong Profits Tax, the first HK$2,000,000 (approximately $258,000), profits will be taxed at 8.25%, and profits above HK$2,000,000 will be taxed at 16.5%. For the six months ended June 30, 2023, and 2022, the Company had $1,632,263 and $2,196,734, respectively, of income subject to the Hong Kong Profits Tax.

| F- |

Malaysia

Malaysia Income Tax is calculated at 24% of the estimated assessable profits for the relevant year. For the six months ended June 30, 2023, and 2022, the Company had $19,235 and $8,232, respectively, of income subject to the Malaysia Income Tax.

The income tax provision for the six months ended June 30, 2023, and 2022, consists of the following:

Schedule of Income Before Income Taxes

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Current: | ||||||||

| Hong Kong | $ | 242,070 | $ | 351,816 | ||||

| Malaysia | 4,616 | 1,976 | ||||||

| Total | $ | 246,686 | $ | 353,792 | ||||

| Deferred | - | - | ||||||

| Total | $ | 246,686 | $ | 353,792 | ||||

The following is a reconciliation of the Company’s total income tax expense to the income before income taxes for the six months ended June 30, 2023, and 2022, respectively.

Schedule of Components of Income Tax Expense

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Income before provision for income taxes | $ | 1,400,131 | $ | 1,442,688 | ||||

| Tax at the domestic income tax rate of 16.5% | 231,022 | 238,044 | ||||||

| Tax effect of Hong Kong graduated rates | (10,645 | ) | (10,645 | ) | ||||

| Non-taxable gain | (16,609 | ) | - | |||||

| Foreign tax rate differentials | 1,443 | 618 | ||||||

| Non-deductible expenses for tax purpose | 19,767 | 125,775 | ||||||

| Unrecognized tax benefit | 21,708 | - | ||||||

| Income tax expense | $ | 246,686 | $ | 353,792 | ||||

10. Revenue Disaggregation

Geographic Information

The following table breaks down revenue for the six months ended June 30, 2023, and 2022, respectively by geographic location of the Company’s revenue. The geographical location is based on the locations at which the marine fuel is delivered to the customers.

Schedule of Revenue by Geographic Location

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| China | $ | 100,988,136 | $ | 114,427,297 | ||||

| Hong Kong | 63,594,042 | 102,130,078 | ||||||

| Malaysia | 21,358,117 | 12,684,443 | ||||||

| Singapore | 2,989,753 | 3,356,084 | ||||||

| South Korea | 2,848,406 | - | ||||||

| Other | 177,357 | 3,098,803 | ||||||

| Total: | $ | 191,955,811 | $ | 235,696,705 | ||||

Other includes primarily Vietnam, Taiwan, and Thailand.

| F- |

11. Finance and Operating Leases

The Company leases offices. The leases are for periods of two to five years.

For the six months ended June 30, 2023, and 2022, the Company recognized the following total lease cost related to the Company’s lease arrangements:

Schedule of Lease Cost

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Finance lease and operating lease costs | 66,726 | 37,465 | ||||||

| Expenses relating to short-term leases | 5,510 | 11,210 | ||||||

| Total lease cost | $ | 72,236 | $ | 48,675 | ||||

During the six months ended June 30, 2023, the Company entered into new a lease for the rental of property which has not commenced as of June 30, 2023. In this connection, no right-of-use assets and lease liabilities were recognized.

As of June 30, 2023, the Company’s remaining lease payments are as follows:

Schedule of Remaining Lease Payments

| Leases | ||||

| (Unaudited) | ||||

| 2023 | $ | 66,581 | ||

| 2024 | 133,161 | |||

| 2025 | 102,090 | |||

| Total remaining lease payments (undiscounted) | 301,832 | |||

| Less: imputed interest | 10,254 | |||

| Present value of lease liabilities | $ | 291,578 | ||

Supplemental balance sheet information related to leases:

Schedule of Supplemental Balance Sheet Information

| Classification |

As of June 30, 2023 |

As of December 31, 2022 |

||||||||

| (Unaudited) | (Unaudited) | |||||||||

| Assets: | ||||||||||

| Operating lease assets | Right-of-use lease assets | $ | 279,886 | $ | 341,625 | |||||

| Operating leases | ||||||||||

| Lease Liability - current | Current liabilities – lease liabilities | $ | 126,046 | $ | 124,095 | |||||

| Lease liability – non-current | Non-current liabilities – lease liabilities | $ | 165,532 | $ | 229,076 | |||||

Other information related to leases for the six months ended June 30, 2023 and 2022:

Schedule of Other Information Related to Leases

| 2023 | 2022 | |||||||

| (Unaudited) | (Unaudited) | |||||||

| Weighted-average remaining lease term (years) - operating leases | 1.3 | 1.2 | ||||||

| Weighted-average discount rate - operating leases | 3.2 | % | 2.9 | % | ||||

| Cash paid for amounts included in the measurement of lease liabilities: | ||||||||

| Operating cash flows from finance leases | $ | - | $ | - | ||||

| Operating cash flows from operating leases | $ | 61,594 | $ | 36,115 | ||||

| F- |

Exhibit 99.3

Press Release

For immediate release

UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS FOR THE SIX MONTHS ENDED JUNE 30, 2023 AND 2022

Kuala Lumpur September 14, 2023 (GLOBE NEWSWIRE) – CBL International Limited (Nasdaq: BANL) (the “Company”) has filed with Securities and Exchange Commission (“SEC”) the Form 6-K Account Report for the unaudited condensed consolidated financial statements for the six months ended June 30, 2023 and 2022. Please see below the financial highlight.

FINANCIAL HIGHLIGHT

| - | Net income increased by approximately 5.9% or $64,000 from approximately $1,089,000 for the six months ended June 30, 2022, to approximately $1,153,000 for the six months ended June 30, 2023. |

| - | The Group’s consolidated gross profit for the six months ended June 30, 2023 was approximately $4,006,000, representing a slight decrease as compared to the six months ended June 30, 2022 of approximately $4,043,000, such slight change was mainly due to the combination factors of the gross profit per ton of marine fuel sold and the partially offset effect by the increase in sales volume. The increase in sales volume was mainly attributable to the comparative lower average marine fuel prices for the six months ended June 30, 2023 as compared to the corresponding period last year and coupled with the increase in the financial resources available, which, in turns, strengthened the Group’s ability to purchase additional marine fuel (in dollar amount) as a result. |

| - | Due to the decrease in marine fuel price which was partially offset by the increase in sales volume, the Group’s consolidated revenue decreased by approximately 18.6% or $43,741,000 from approximately $235,696,000 for the six months ended June 30, 2022, to approximately $191,956,000 for the six months ended June 30, 2023. |

| - | Basic and diluted earnings per ordinary share is approximately $0.05. |

| - | Total shareholders’ equity of the Company increased by approximately $13,202,000 from approximately $12,112,000 as of December 31, 2022, to approximately $25,314,000 as of June 30, 2023. |

For details of the account report for the unaudited condensed consolidated financial statements for the six months ended June 30, 2023 and 2022, please refer to https://investors.banle-intl.com for Form 6-K filed with SEC on September 14, 2023.

- End -

About CBL International Limited

Established in 2015, CBL International Limited (Nasdaq: BANL) is the listing vehicle of Banle Group, an established marine fuel logistic company in Asia Pacific providing customers with one stop solution for vessel refuelling. The main market of Banle Group is the Asia Pacific market with business activities taking place in 55+ ports of Japan, Korea, China, Hong Kong, Taiwan, Vietnam, Malaysia, Singapore, Thailand, and other countries like Turkey, Belgium.

Forward-Looking Information and Statements

Certain statements in this announcement are forward-looking statements, by their nature, subject to significant risks and uncertainties. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs, including the expectation that the offering will be successfully completed. Investors can identify these forward-looking statements by words or phrases such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC.

CBL INTERNATIONAL LIMITED

(Incorporated in Cayman Islands with limited liabilities)

For more information, please contact:

CBL International Limited

Email: investors@banle-intl.com