Document

October 22, 2025

Phoenix, Arizona

|

|

|

|

Knight-Swift Transportation Holdings Inc. Reports Third Quarter 2025 Revenue and Earnings

•Third Quarter included $58.0 million in charges for impairment, loss contingency, and large claim settlements

|

Knight-Swift Transportation Holdings Inc. (NYSE: KNX) ("Knight-Swift" or the "Company"), one of the largest and most diversified freight transportation companies, operating the largest full truckload fleet in North America, today reported third quarter 2025 net income attributable to Knight-Swift of $7.9 million and Adjusted Net Income Attributable to Knight-Swift2 of $51.3 million. GAAP earnings per diluted share for the third quarter of 2025 were $0.05, compared to $0.19 for the third quarter of 2024. Adjusted EPS2 was $0.32 for the third quarter of 2025, compared to $0.34 for the third quarter of 2024.

The current quarter included $34.8 million of impairment charges ($28.8 million of trade name impairments as a result of our decision to combine our less-than-truckload (LTL) brands under one trade name and $6.0 million of real property lease and software impairments); a loss contingency of $11.2 million related to the 2024 exit from the third-party carrier insurance business; and $12.0 million of higher insurance and claims costs at U.S. Xpress primarily driven by settlement of two large 2023 U.S. Xpress auto liability claims, one of which occurred prior to our July 2023 acquisition and the other shortly thereafter. The impairments have been adjusted out of our non-GAAP results as shown in the reconciliation schedules following this release; conversely, the loss contingency and claims settlement accruals negatively impacted our Adjusted EPS by $0.10.

During the third quarter of 2025, consolidated total revenue was $1.9 billion, a 2.7% increase from the third quarter of 2024. Consolidated operating income was $50.3 million, a decrease of 38.2% compared to the same quarter last year primarily due to the $34.8 million of impairments, the $11.2 million third-party carrier insurance charge, and the $12.0 million of U.S. Xpress claims costs as noted above. Adjusted Operating Income was $106.0 million, a 4.2% increase year-over-year as earnings growth in our LTL, warehousing, and leasing businesses more than offset the loss contingency and U.S. Xpress claims costs in the current quarter. The consolidated operating ratio for the quarter was 97.4%, and the Adjusted Operating Ratio2 was 93.8%.

•Truckload — 96.2% Adjusted Operating Ratio with revenue, excluding fuel surcharge, down 2.1% on a similar decline in loaded miles. Revenue per loaded mile, excluding fuel surcharge and intersegment transactions, was flat year-over-year. Adjusted Operating Income2 decreased $7.3 million or 15.0% year-over-year, largely as a result of the claims settlements noted above. Excluding the results of U.S. Xpress, the legacy truckload brands operated at a 93.7% Adjusted Operating Ratio.

•LTL — Revenue, excluding fuel surcharge, increased 21.5% year-over-year as shipments per day increased 14.2%, and revenue per hundredweight excluding fuel surcharge increased 6.1%. Adjusted Operating Income increased by 10.1%, marking the first year-over-year improvement in five quarters as volumes remained sequentially stable while operational and cost initiatives begin to gain traction. The Adjusted Operating Ratio was 90.6%, reflecting a 250 basis point sequential improvement over the second quarter, counter to the typical seasonal degradation.

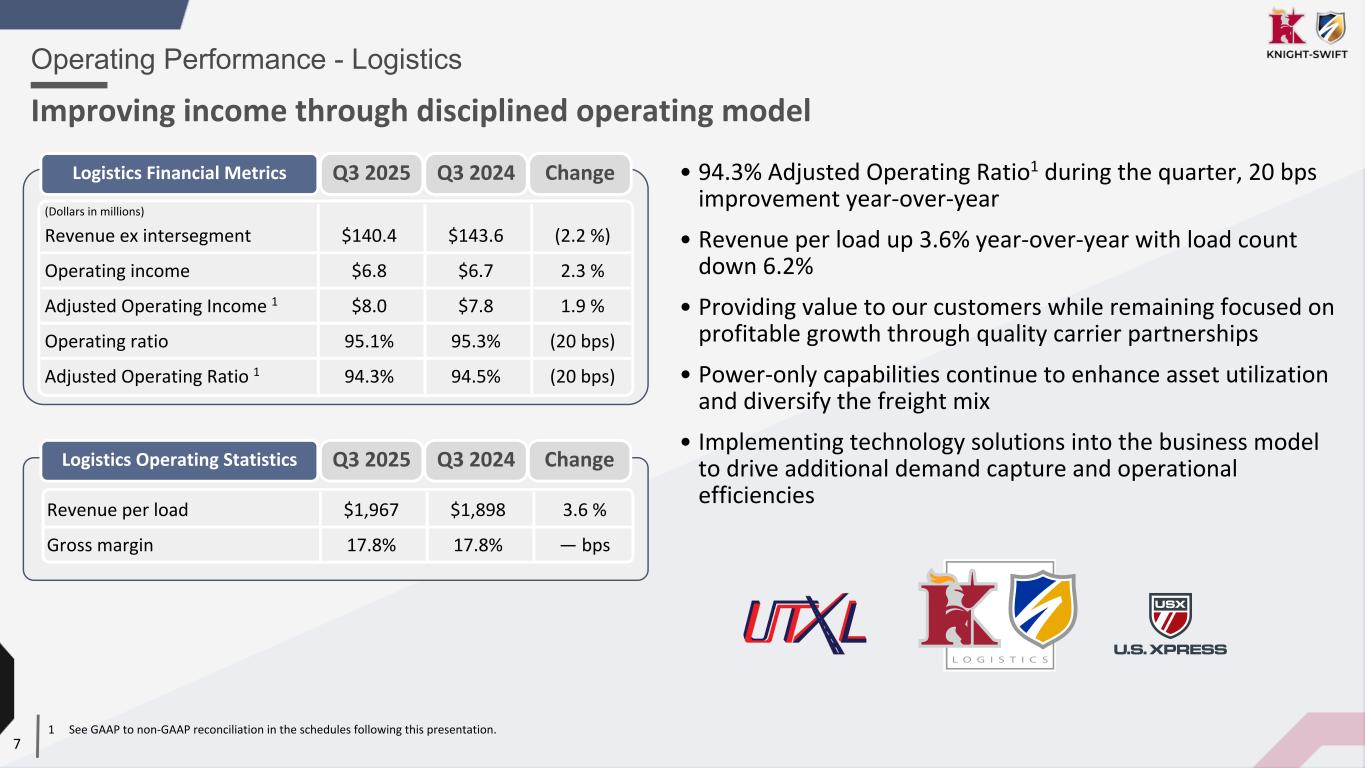

•Logistics — 94.3% Adjusted Operating Ratio with a gross margin of 17.8%. Adjusted Operating Income improved 1.9% year-over-year. Revenue per load increased 3.6% year-over-year.

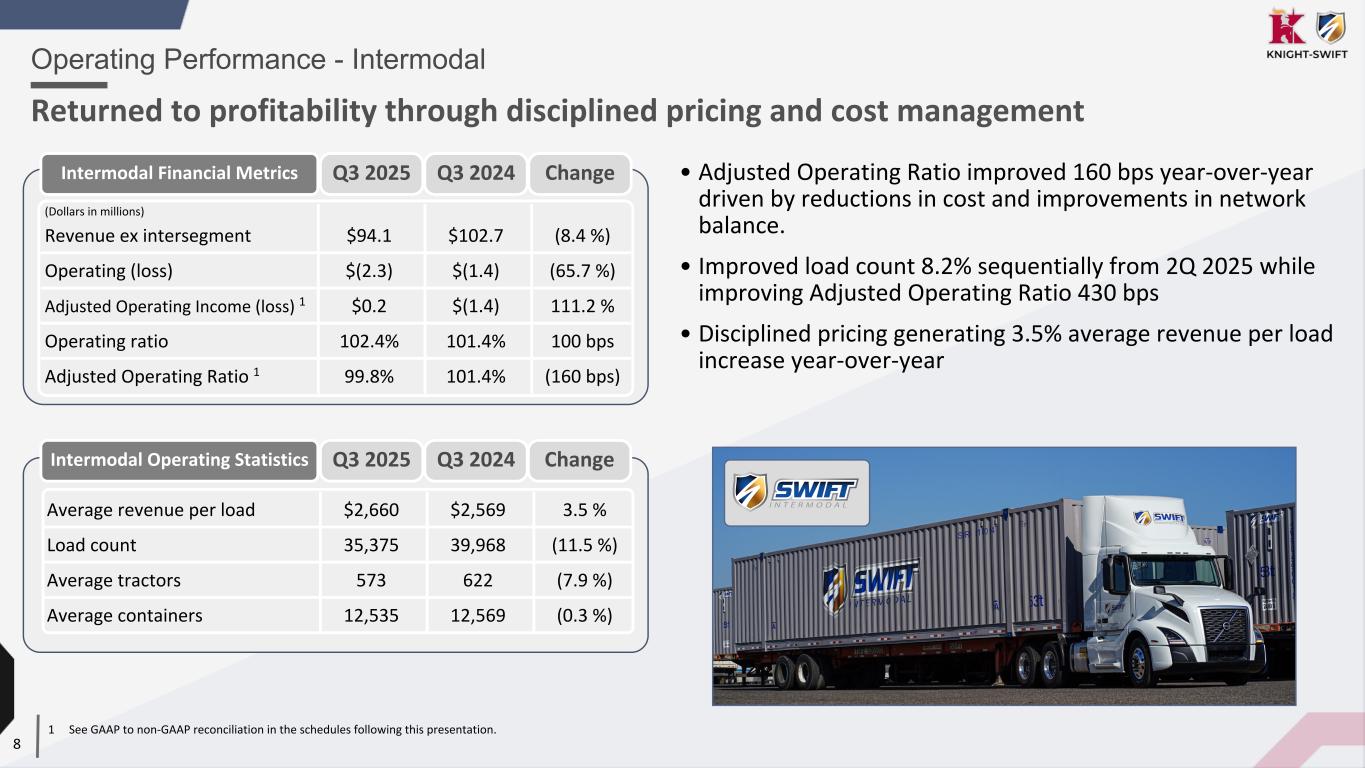

•Intermodal — 99.8% Adjusted Operating Ratio, with revenue per load up 3.5% year-over-year. On a sequential basis, load count grew 8.2%, and revenue per load increased 3.4%.

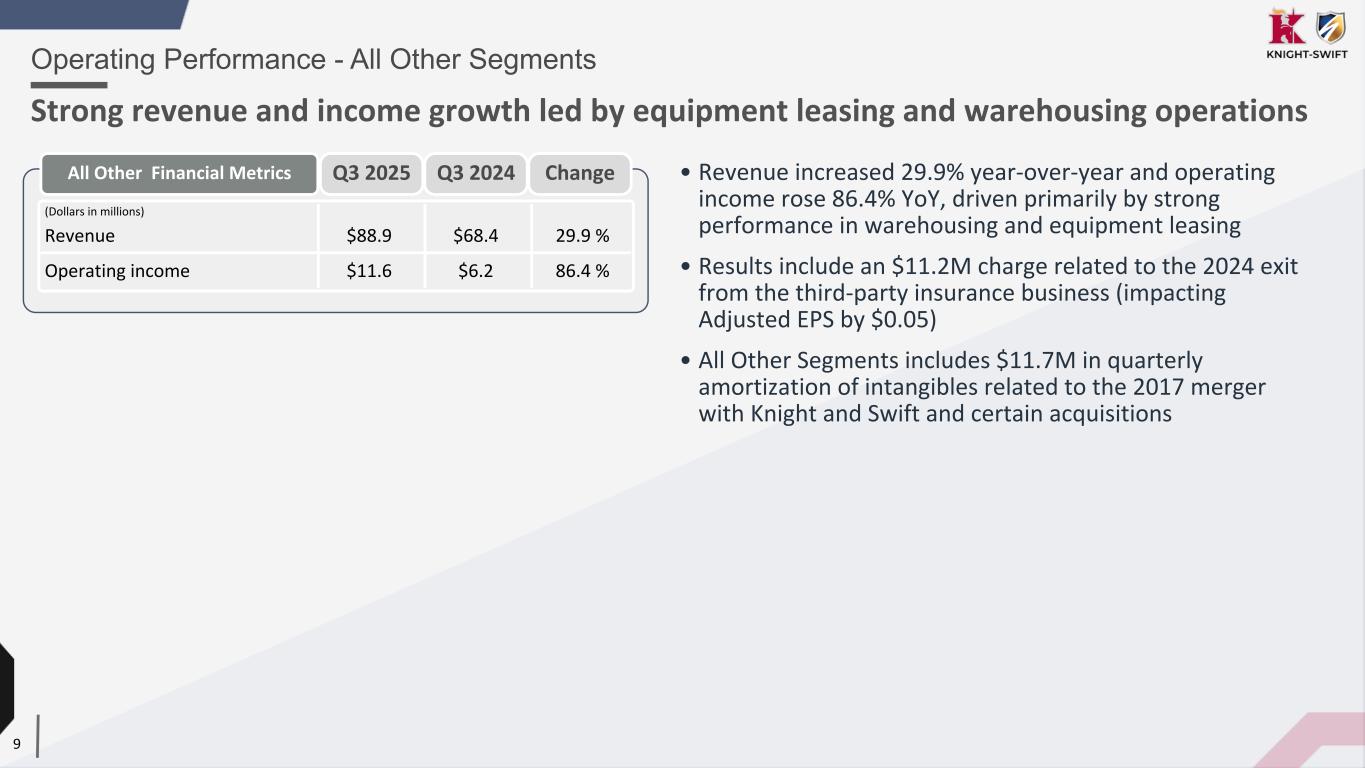

•All Other Segments — Revenue increased 29.9%, and operating income increased 86.4% year-over-year, primarily driven by growth in the warehousing and leasing businesses. Results include an $11.2 million charge related to the 2024 wind-down of the third-party carrier insurance business discussed herein.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, 1 |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands, except per share data) |

| Total revenue |

$ |

1,927,057 |

|

|

$ |

1,876,676 |

|

|

2.7 |

% |

| Revenue, excluding truckload and LTL fuel surcharge |

$ |

1,720,889 |

|

|

$ |

1,680,893 |

|

|

2.4 |

% |

| Operating income |

$ |

50,326 |

|

|

$ |

81,420 |

|

|

(38.2) |

% |

Adjusted Operating Income 2 |

$ |

105,951 |

|

|

$ |

101,726 |

|

|

4.2 |

% |

| Net income attributable to Knight-Swift |

$ |

7,861 |

|

|

$ |

30,464 |

|

|

(74.2) |

% |

Adjusted Net Income Attributable to Knight-Swift 2 |

$ |

51,281 |

|

|

$ |

54,447 |

|

|

(5.8) |

% |

| Earnings per diluted share |

$ |

0.05 |

|

|

$ |

0.19 |

|

|

(73.7) |

% |

Adjusted EPS 2 |

$ |

0.32 |

|

|

$ |

0.34 |

|

|

(5.9) |

% |

|

|

|

|

|

|

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our GAAP and non-GAAP results for the quarter include certain items that impact the comparability of year-over-year results. These items include a 15.0 percentage point increase in the effective tax rate on our GAAP results year-over-year. Further, the prior year third quarter included a $1.0 million impairment and a $12.1 investment write-off, both of which were excluded from our non-GAAP results. As noted above, our GAAP results for the current quarter include a loss contingency of $11.2 million, $12.0 million of higher insurance and claims costs at U.S. Xpress, and impairment charges totaling $34.8 million. Of these items, only the $34.8 million of impairment charges are excluded from our non-GAAP results. Our GAAP results for the current quarter also include a $2.0 million write-off of deferred debt-issuance costs related to the refinance of our senior credit facility during the quarter, which is excluded from our non-GAAP results.

Adam Miller, CEO of Knight-Swift, commented, "We are proud of the resilience, commitment, and collaboration of our people who continue to overcome the challenges presented by a volatile operating environment. While volumes have remained stable in our truckload business, the industry is still dealing with an oversupply of capacity that has been gradually exiting the market. We have remained focused on reducing our costs and providing a high level of service to position our brands to support our customers with one-way over-the-road capacity at scale while offering robust dedicated solutions. While the market balance between supply and demand has remained challenging to carriers, we believe there are several potential catalysts that may accelerate the exit of capacity over the next few quarters. The resumption of enforcement of the English language proficiency requirement and the recent actions taken by the FMCSA to enhance the qualifications and controls for issuance and renewal of non-domiciled CDLs, as well as the revocation of those that were issued improperly, could meaningfully impact capacity, particularly in the one-way over-the-road market. This may take time to develop, but in the meantime, we are diligently working to refine our execution in the current market while positioning our businesses to amplify the opportunities that the next cycle will produce.

"We are also excited to share that we are adopting the strong and historically significant AAA Cooper brand across our entire LTL business. The consolidated branding recognizes that we are already one business, operating seamlessly on one system through one network to present a cohesive solution to our customers, while simplifying administration and communication. We are pleased with the growth of our LTL business and continue to focus on building out our network and improving margins."

Other Income — We recorded $3.6 million of income within "Other income, net" in the third quarter of 2025, compared to $3.2 million of income in the third quarter of 2024.

Income Taxes — The effective tax rate on our GAAP results was 47.0% for the third quarter of 2025, compared to 32.0% for the third quarter of 2024. The effective tax rate on our non-GAAP results was 29.6% for the third quarter of 2025, compared to 29.3% for the third quarter of 2024. The effective rate for the current quarter was higher than previously projected due to combining our LTL legal entities.

Dividend — On August 6, 2025, our board of directors declared a quarterly cash dividend of $0.18 per share of our common stock. The dividend was payable to the Company's stockholders of record as of September 5, 2025, and was paid on September 22, 2025.

|

|

|

| Segment Financial Performance |

Truckload Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue, excluding fuel surcharge and intersegment transactions |

$ |

1,084,363 |

|

|

$ |

1,107,461 |

|

|

(2.1 |

%) |

| Operating income |

$ |

35,901 |

|

|

$ |

45,356 |

|

|

(20.8 |

%) |

Adjusted Operating Income 1 |

$ |

41,227 |

|

|

$ |

48,505 |

|

|

(15.0 |

%) |

| Operating ratio |

97.1 |

% |

|

96.4 |

% |

|

70 |

bps |

Adjusted Operating Ratio 1 |

96.2 |

% |

|

95.6 |

% |

|

60 |

bps |

|

|

|

|

|

|

1See GAAP to non-GAAP reconciliation in the schedules following this release.

Our diverse Truckload segment consists of our irregular route, dedicated, refrigerated, expedited, flatbed, and cross-border truckload operations across our brands with approximately 15,400 irregular route tractors and nearly 5,900 dedicated tractors.

In a market where freight patterns continued to deviate from normal seasonality, our Truckload segment produced revenue that was down modestly year-over-year, driven by a 2.3% decrease in loaded miles. Revenue per loaded mile, excluding fuel surcharge and intersegment transactions, was stable year-over-year and sequentially recovered part of the dip seen in the second quarter. Adjusted Operating Income declined $7.3 million year-over-year, largely as a result of $12.0 million of higher insurance and claims costs at U.S. Xpress ($0.05 negative impact to Adjusted EPS) primarily driven by settling two large U.S. Xpress accident claims from 2023, one of which occurred prior to our July 2023 acquisition and the other shortly thereafter. These accidents occurred prior to integration of U.S. Xpress' hiring, safety, and claims management practices, which have since begun to produce meaningful improvements in safety metrics. The third quarter combined Adjusted Operating Ratio was 60 basis points higher year-over-year as the settlements noted above offset ongoing progress on our cost structure. Excluding U.S. Xpress, the legacy truckload brands operated at a 93.7% Adjusted Operating Ratio. Miles per tractor improved 4.2% year-over-year as a result of our efforts to drive productivity and reduce underutilized assets. We continue to make tangible progress improving our cost structure to position our business to generate meaningful returns as market conditions recover.

LTL Segment 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue, excluding fuel surcharge |

$ |

340,489 |

|

|

$ |

280,181 |

|

|

21.5 |

% |

| Operating (loss) income |

$ |

(1,693) |

|

|

$ |

24,556 |

|

|

(106.9 |

%) |

Adjusted Operating Income 2 |

$ |

32,056 |

|

|

$ |

29,119 |

|

|

10.1 |

% |

| Operating ratio |

100.4 |

% |

|

92.5 |

% |

|

790 |

bps |

Adjusted Operating Ratio 2 |

90.6 |

% |

|

89.6 |

% |

|

100 |

bps |

|

|

|

|

|

|

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2See GAAP to non-GAAP reconciliation in the schedules following this release.

Our LTL segment grew revenue, excluding fuel surcharge, 21.5% and grew shipments per day 14.2% year-over-year, as we lapped the acquisition of DHE on July 30, 2024. Revenue per hundredweight, excluding fuel surcharge, increased 6.1%, while revenue per shipment, excluding fuel surcharge, increased by 6.6%. Weight per shipment increased 0.4% for the first year-over-year increase in this metric since our 2021 entry into this business. The $1.7 million operating loss is due to the $28.8 million trade name impairment as a result of our decision to combine our LTL brands under the AAA Cooper trade name. Adjusted Operating Income increased 10.1%, marking the first year-over-year improvement in five quarters as volumes remained sequentially stable while operational and cost initiatives begin to gain traction. The Adjusted Operating Ratio was 90.6% for the third quarter, which was an improvement of 250 basis points from the second quarter, counter to the typical seasonal degradation.

During the third quarter, we opened one new service center and replaced two more with larger sites, bringing our growth in door count to 8.5% year-to-date and 10.2% year-over-year. As previously noted, we expect our pace of facility expansion will be slower in the near term than in 2024 and believe ongoing bid activities will provide further opportunities to grow shipment volume and improve efficiencies. Our near-term focus is to drive both revenue and margin expansion in the business through strong service, disciplined pricing, and cost efficiency. We continue to look for both organic and inorganic opportunities to geographically expand our footprint within the LTL market.

Logistics Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue |

$ |

140,404 |

|

|

$ |

143,581 |

|

|

(2.2 |

%) |

| Operating income |

$ |

6,837 |

|

|

$ |

6,684 |

|

|

2.3 |

% |

Adjusted Operating Income 1 |

$ |

8,001 |

|

|

$ |

7,848 |

|

|

1.9 |

% |

| Operating ratio |

95.1 |

% |

|

95.3 |

% |

|

(20 |

bps) |

Adjusted Operating Ratio 1 |

94.3 |

% |

|

94.5 |

% |

|

(20 |

bps) |

|

|

|

|

|

|

1See GAAP to non-GAAP reconciliation in the schedules following this release.

The Logistics segment Adjusted Operating Ratio improved to 94.3%, and Adjusted Operating Income improved 1.9% while gross margin of 17.8% was flat year-over-year. Revenue decreased 2.2% year-over-year, driven by a 6.2% decline in load count, partially offset by a 3.6% increase in revenue per load. We remain disciplined on price and diligent in carrier qualification to provide value to customers while maintaining profitability. We continue to leverage our power-only capabilities to complement our asset business, build a broader and more diversified freight portfolio, and to enhance the returns on our capital assets.

Intermodal Segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue |

$ |

94,083 |

|

|

$ |

102,679 |

|

|

(8.4 |

%) |

| Operating loss |

$ |

(2,298) |

|

|

$ |

(1,387) |

|

|

(65.7 |

%) |

Adjusted Operating Income (Loss) 1 |

$ |

156 |

|

|

$ |

(1,387) |

|

|

111.2 |

% |

| Operating ratio |

102.4 |

% |

|

101.4 |

% |

|

100 |

bps |

Adjusted Operating Ratio 1 |

99.8 |

% |

|

101.4 |

% |

|

(160 |

bps) |

|

|

|

|

|

|

The Intermodal segment produced an operating loss of $2.3 million, which includes a $2.5 million impairment charge for a software project. Excluding this charge, the Adjusted Operating Ratio improved 160 basis points year-over-year to 99.8%, driven by a 3.5% increase in revenue per load as well as cost reductions and improvements in network balance. Revenue declined 8.4% year-over-year as a result of an 11.5% decrease in load count, partially offset by the increase in revenue per load. On a sequential basis, the Adjusted Operating Ratio improved 430 basis points on an 11.9% increase in revenue driven by an 8.2% growth in load count and a 3.4% increase in revenue per load over the second quarter results as bid awards continue taking effect. We remain focused on delivering excellent service and driving appropriate returns through cost control, network balance, equipment utilization, and growing our load count with disciplined pricing.

All Other Segments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

2025 |

|

2024 |

|

Change |

|

(Dollars in thousands) |

| Revenue |

$ |

88,880 |

|

|

$ |

68,438 |

|

|

29.9 |

% |

|

|

|

|

|

|

| Operating Income |

$ |

11,579 |

|

|

$ |

6,211 |

|

|

86.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All Other Segments include support services provided to our customers, independent contractors, and third-party carriers, including equipment leasing, warehousing, trailer parts manufacturing, insurance, equipment maintenance, and warranty services. All Other Segments also include certain corporate expenses (such as legal settlements and accruals, as well as $11.7 million in quarterly amortization of intangibles related to the 2017 merger between Knight and Swift and certain acquisitions).

Revenue within our All Other Segments for the third quarter increased 29.9%, and operating income increased 86.4% year-over-year, primarily driven by growth in our warehousing and leasing businesses. Additionally, the current quarter results include a loss contingency of $11.2 million ($0.05 negative impact to Adjusted EPS) representing estimated additional premiums related to our 2024 transfer to another insurance carrier of the outstanding auto liability claims from the third-party carrier insurance business we closed in March 2024. The transfer of these claims was completed in two separate tranches, each of which carried the potential for up to $14.0 million of additional premium being owed, as well as potential recovery of some premiums paid, depending on claim development over the succeeding four-year period. The charge in the current quarter exhausts the additional premium exposure on the first tranche.

|

|

|

| Consolidated Liquidity, Capital Resources, and Earnings Guidance |

Cash Flow Sources (Uses) 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Year-to-Date September 30, |

| |

2025 |

|

2024 |

|

Change |

|

(In thousands) |

| Net cash provided by operating activities |

$ |

543,431 |

|

|

$ |

524,741 |

|

|

$ |

18,690 |

|

| Net cash used in investing activities |

(424,510) |

|

|

(619,020) |

|

|

194,510 |

|

| Net cash used in financing activities |

(189,137) |

|

|

(54,495) |

|

|

(134,642) |

|

Net decrease in cash, restricted cash, and equivalents 2 |

$ |

(70,216) |

|

|

$ |

(148,774) |

|

|

$ |

78,558 |

|

| Net capital expenditures |

$ |

(407,339) |

|

|

$ |

(408,492) |

|

|

$ |

1,153 |

|

|

|

|

|

|

|

1For information regarding comparability of the reported results due to acquisitions, refer to footnote 1 of the Condensed Consolidated Statements of Comprehensive Income in the schedules following this release.

2"Net decrease in cash, restricted cash, and equivalents" is derived from changes within "Cash and cash equivalents," "Cash and cash equivalents – restricted," and the long-term portion of restricted cash included in "Other long-term assets" in the condensed consolidated balance sheets.

Liquidity and Capitalization — As of September 30, 2025, we had a balance of $1.0 billion of unrestricted cash and available liquidity and $7.1 billion of stockholders' equity. The face value of our debt, net of unrestricted cash ("Net Debt") was $2.7 billion as of September 30, 2025. Free Cash Flow3 for the year-to-date period ended September 30, 2025, was $136.1 million, reflecting $543.4 million in operating cash flows and $407.3 million of cash capital expenditures, net of disposal proceeds, as over 40% of our projected 2025 net cash capital expenditures occurred during the third quarter. From a financing perspective, we paid down $112.4 million in finance lease liabilities, paid down $118.8 million on operating lease liabilities, and had $471.0 million of net borrowings on our 2025 Revolver and accounts receivable securitization, $360 million of which was used to pay down outstanding term loan balances, during the year-to-date period ended September 30, 2025. On July 8, 2025, the Company entered into a $2.5 billion unsecured credit facility (the "2025 Debt Agreement"), replacing the Company's previous $2.3 billion unsecured credit facility (the "2021 Debt Agreement") and the Company’s previous $250 million unsecured term loan (the “2023 Term Loan”).

Equipment and Capital Expenditures — Gain on sale of operating assets was $20.9 million in the third quarter of 2025, compared to $9.2 million in the same quarter of 2024. The average age of the tractor fleet within our Truckload segment was 2.7 years in the third quarter of 2025, compared to 2.6 years in the same quarter of 2024. The average age of the tractor fleet within our LTL segment was 3.9 years in the third quarter of 2025 and 4.2 years in the same quarter of 2024. We expect net cash capital expenditures for full-year 2025 will be in the range of $475 million - $525 million, which is a reduction from our previous range of $525 million - $575 million. Our expected net cash capital expenditures primarily represent replacements of existing tractors and trailers and investments in our terminal network, driver amenities, and technology, and exclude acquisitions.

________

3See GAAP to non-GAAP reconciliations in the schedules following this release.

Guidance — We expect that Adjusted EPS1 will range from $0.34 to $0.40 for the fourth quarter of 2025. In general, the above guidance for the fourth quarter assumes current conditions remain fairly stable and we experience limited seasonality. Our expected Adjusted EPS1 range is based on the current truckload, LTL, and general market conditions, recent trends, and the current beliefs, assumptions, and expectations of management, as follows:

Truckload

•Truckload Segment revenue fairly stable sequentially with operating margins improving 250 - 350 basis points sequentially,

•Revenue per loaded mile improves low single-digit percent sequentially on seasonal opportunities,

•Tractor count stable and utilization down modestly sequentially.

LTL

•LTL Segment revenue, excluding fuel surcharge, growth between 10% - 15% year-over-year in fourth quarter,

•Similar Adjusted Operating Ratio as prior year fourth quarter.

Logistics

•Logistics Segment revenue and Adjusted Operating Income increase mid-teens percent sequentially.

Intermodal

•Intermodal Segment load count improves mid single-digit percent sequentially,

•Adjusted Operating Ratio fairly stable sequentially.

All Other

•All Other Segments operating income, before including the $11.7 million quarterly intangible asset amortization, approximately break even in fourth quarter.

Additional

•Gain on sale to be in the range of $18 million to $23 million in fourth quarter,

•Net interest expense declines modestly sequentially in fourth quarter,

•Net cash capital expenditures for full-year 2025 expected range of $475 million - $525 million,

•Expected effective tax rate on adjusted income before taxes of approximately 23% to 24% for fourth quarter.

The factors described under "Forward-Looking Statements," among others, could cause actual results to materially vary from this guidance. Further, we cannot estimate on a forward-looking basis, the impact of certain income and expense items on our earnings per share, because these items, which could be significant, may be infrequent, are difficult to predict, and may be highly variable. As a result, we do not provide a corresponding GAAP measure for, or reconciliation to, our Adjusted EPS1 guidance.

________

1Our calculation of Adjusted EPS starts with GAAP diluted earnings per share and adds back the after-tax impact of intangible asset amortization (which is expected to be approximately $0.35 for full-year 2025), as well as non-cash impairments and certain other unusual items, if any.

Knight-Swift will host a conference call to discuss the earnings release, the results of operations, and other matters following its earnings press release on Wednesday, October 22, 2025, at 4:30 p.m. EDT. An online, real-time webcast of the quarterly conference call will be available on the Company's website at investor.knight-swift.com. Please note that since the call is expected to begin promptly as scheduled, you will need to join a few minutes before that time. Slides to accompany this call will also be posted on the Company’s website and will be available to download just before the scheduled conference call. To view the slides or listen to the webcast, please visit investor.knight-swift.com, "Knight-Swift Q3 2025 Earnings."

Knight-Swift Transportation Holdings Inc. is one of North America's largest and most diversified freight transportation companies, providing multiple full truckload, LTL, intermodal, and logistics services. Knight-Swift uses a nationwide network of business units and terminals in the United States and Mexico to serve customers throughout North America. In addition to operating one of the country's largest tractor fleets, Knight-Swift also contracts with third-party equipment providers to provide a broad range of transportation services to our customers while creating quality driving jobs for our driving associates and successful business opportunities for independent contractors.

|

|

|

| Investor Relations Contact Information |

Adam Miller, Chief Executive Officer, Andrew Hess, Chief Financial Officer, or Brad Stewart, Treasurer & SVP Investor Relations: (602) 606-6349

|

|

|

| Forward-Looking Statements |

This press release contains statements that may constitute forward-looking statements, usually identified by words such as "anticipates," "believes," "estimates," "plans,'' "projects," "expects," "hopes," "intends," "strategy," "design", ''focus," "outlook," "foresee," "will," "could," "should," "may," "feel", "goal," "continue," or similar expressions. Such statements are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical or current fact, are statements that could be deemed forward-looking statements, including without limitation: any projections of or guidance regarding earnings, earnings per share, Adjusted EPS, revenues, cash flows, dividends, share repurchases, leverage ratio, capital expenditures (including the nature and funding thereof), gain on sale, tax rates, capital structure, capital allocation, liquidity, or other financial items; any statement of plans, strategies, and objectives of management for future operations; any statements concerning proposed acquisition plans, new services, or growth strategies or opportunities; any statements regarding future economic, industry, or Company conditions, environment, or performance, including, without limitation, expectations regarding future trade policy or tariffs, supply or demand, volume, capacity, rates, costs, inflation, or seasonality; future performance or growth of any of our reportable segments, including expected revenues, costs, utilization, or rates within our Truckload segment, expected network, door count, volumes, capacity, revenue, costs, or margin within our LTL segment, expected freight portfolio, pricing, profitability, or return on capital assets within our Logistics segment, and expected pricing, costs, freight portfolio, equipment utilization, or volumes within our Intermodal segment; any statements under “Guidance”; and any statements of belief and any statement of assumptions underlying any of the foregoing.

Forward-looking statements are inherently uncertain, and are based upon the current beliefs, assumptions, and expectations of management and current market conditions, which are subject to significant risks and uncertainties as set forth in the Risk Factors section of Knight-Swift's Annual Report on Form 10-K for the year ended December 31, 2024, and various disclosures in our press releases, stockholder reports, and Current Reports on Form 8-K. If the risks or uncertainties ever materialize, or the beliefs, assumptions, or expectations prove incorrect, our business and results of operations may differ materially from those expressed or implied by such forward-looking statements. The forward-looking statements in this press release speak only as of the date hereof, and we disclaim any obligation to update or revise any forward-looking statements to reflect actual results or changes in the factors affecting the forward-looking information.

|

|

|

Condensed Consolidated Statements of Comprehensive Income (Unaudited) 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Year-to-Date September 30, |

| |

2025 |

|

2024 |

|

2025 |

|

2024 |

|

(In thousands, except per share data) |

| Revenue: |

|

|

|

|

|

|

|

| Revenue, excluding truckload and LTL fuel surcharge |

$ |

1,720,889 |

|

|

$ |

1,680,893 |

|

|

$ |

5,026,053 |

|

|

$ |

4,935,408 |

|

Truckload and LTL fuel surcharge |

206,168 |

|

|

195,783 |

|

|

587,306 |

|

|

610,389 |

|

| Total revenue |

1,927,057 |

|

|

1,876,676 |

|

|

5,613,359 |

|

|

5,545,797 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Salaries, wages, and benefits |

755,278 |

|

|

726,358 |

|

|

2,231,519 |

|

|

2,111,143 |

|

| Fuel |

221,807 |

|

|

213,489 |

|

|

632,619 |

|

|

670,651 |

|

| Operations and maintenance |

142,437 |

|

|

142,418 |

|

|

414,779 |

|

|

415,302 |

|

| Insurance and claims |

116,497 |

|

|

86,510 |

|

|

294,003 |

|

|

314,394 |

|

| Operating taxes and licenses |

33,263 |

|

|

32,220 |

|

|

102,154 |

|

|

93,923 |

|

| Communications |

7,047 |

|

|

8,411 |

|

|

21,811 |

|

|

24,208 |

|

| Depreciation and amortization of property and equipment |

179,036 |

|

|

178,598 |

|

|

533,053 |

|

|

539,313 |

|

| Amortization of intangibles |

19,246 |

|

|

18,922 |

|

|

57,738 |

|

|

56,009 |

|

| Rental expense |

41,647 |

|

|

42,322 |

|

|

127,709 |

|

|

129,248 |

|

| Purchased transportation |

284,386 |

|

|

295,261 |

|

|

827,402 |

|

|

859,286 |

|

| Impairments |

34,805 |

|

|

1,008 |

|

|

45,417 |

|

|

10,867 |

|

| Miscellaneous operating expenses |

41,282 |

|

|

49,739 |

|

|

135,550 |

|

|

156,018 |

|

| Total operating expenses |

1,876,731 |

|

|

1,795,256 |

|

|

5,423,754 |

|

|

5,380,362 |

|

| Operating income |

50,326 |

|

|

81,420 |

|

|

189,605 |

|

|

165,435 |

|

| Other income (expenses): |

|

|

|

|

|

|

|

| Interest income |

2,690 |

|

|

4,005 |

|

|

8,760 |

|

|

12,844 |

|

| Interest expense |

(40,934) |

|

|

(44,398) |

|

|

(122,015) |

|

|

(126,116) |

|

| Other income, net |

3,638 |

|

|

3,169 |

|

|

27,826 |

|

|

17,049 |

|

| Total other income (expenses), net |

(34,606) |

|

|

(37,224) |

|

|

(85,429) |

|

|

(96,223) |

|

| Income before income taxes |

15,720 |

|

|

44,196 |

|

|

104,176 |

|

|

69,212 |

|

| Income tax expense |

7,388 |

|

|

14,137 |

|

|

31,684 |

|

|

22,253 |

|

| Net income |

8,332 |

|

|

30,059 |

|

|

72,492 |

|

|

46,959 |

|

| Net (income) loss attributable to noncontrolling interest |

(471) |

|

|

405 |

|

|

251 |

|

|

1,170 |

|

| Net income attributable to Knight-Swift |

$ |

7,861 |

|

|

$ |

30,464 |

|

|

$ |

72,743 |

|

|

$ |

48,129 |

|

| Other comprehensive (loss) income |

(96) |

|

|

995 |

|

|

258 |

|

|

998 |

|

| Comprehensive income |

$ |

7,765 |

|

|

$ |

31,459 |

|

|

$ |

73,001 |

|

|

$ |

49,127 |

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.05 |

|

|

$ |

0.19 |

|

|

$ |

0.45 |

|

|

$ |

0.30 |

|

| Diluted |

$ |

0.05 |

|

|

$ |

0.19 |

|

|

$ |

0.45 |

|

|

$ |

0.30 |

|

|

|

|

|

|

|

|

|

| Dividends declared per share: |

$ |

0.18 |

|

|

$ |

0.16 |

|

|

$ |

0.54 |

|

|

$ |

0.48 |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

162,305 |

|

|

161,861 |

|

|

162,137 |

|

|

161,687 |

|

| Diluted |

162,647 |

|

|

162,233 |

|

|

162,537 |

|

|

162,120 |

|

_________

1The reported results do not include the results of operations of DHE prior to its acquisition by Knight-Swift on July 30, 2024 in accordance with the accounting treatment applicable to the transaction.

|

|

|

| Condensed Consolidated Balance Sheets (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

December 31, 2024 |

|

(In thousands) |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

192,677 |

|

|

$ |

218,261 |

|

| Cash and cash equivalents – restricted |

101,677 |

|

|

147,684 |

|

|

|

|

|

Trade receivables, net of allowance for doubtful accounts of $37,349 and $37,797, respectively |

864,539 |

|

|

803,696 |

|

| Contract balance – revenue in transit |

8,687 |

|

|

7,238 |

|

| Prepaid expenses |

116,851 |

|

|

123,089 |

|

| Assets held for sale |

69,295 |

|

|

82,993 |

|

| Income tax receivable |

79,376 |

|

|

37,260 |

|

|

|

|

|

| Other current assets |

35,181 |

|

|

28,520 |

|

| Total current assets |

1,468,283 |

|

|

1,448,741 |

|

| Property and equipment, net |

4,755,248 |

|

|

4,703,385 |

|

| Operating lease right-of-use assets |

297,060 |

|

|

372,841 |

|

| Goodwill |

3,962,142 |

|

|

3,962,142 |

|

| Intangible assets, net |

1,970,565 |

|

|

2,057,044 |

|

|

|

|

|

| Other long-term assets |

165,425 |

|

|

154,379 |

|

| Total assets |

$ |

12,618,723 |

|

|

$ |

12,698,532 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

251,567 |

|

|

$ |

329,697 |

|

| Accrued payroll and purchased transportation |

213,761 |

|

|

194,875 |

|

| Accrued liabilities |

58,337 |

|

|

64,100 |

|

| Claims accruals – current portion |

268,831 |

|

|

249,953 |

|

Finance lease liabilities and long-term debt – current portion |

204,731 |

|

|

288,428 |

|

| Operating lease liabilities – current portion |

107,952 |

|

|

120,715 |

|

| Accounts receivable securitization – current portion |

— |

|

|

458,983 |

|

| Total current liabilities |

1,105,179 |

|

|

1,706,751 |

|

| Revolving line of credit |

707,000 |

|

|

232,000 |

|

Long-term debt – less current portion |

1,052,969 |

|

|

1,445,313 |

|

| Finance lease liabilities – less current portion |

479,883 |

|

|

457,303 |

|

| Operating lease liabilities – less current portion |

209,788 |

|

|

274,549 |

|

| Accounts receivable securitization |

455,200 |

|

|

— |

|

| Claims accruals – less current portion |

340,981 |

|

|

335,880 |

|

| Deferred tax liabilities |

941,123 |

|

|

919,814 |

|

| Other long-term liabilities |

205,540 |

|

|

210,117 |

|

| Total liabilities |

5,497,663 |

|

|

5,581,727 |

|

| Stockholders’ equity: |

|

|

|

| Common stock |

1,624 |

|

|

1,619 |

|

| Additional paid-in capital |

4,473,069 |

|

|

4,446,726 |

|

| Accumulated other comprehensive loss |

(184) |

|

|

(442) |

|

| Retained earnings |

2,637,231 |

|

|

2,661,064 |

|

| Total Knight-Swift stockholders' equity |

7,111,740 |

|

|

7,108,967 |

|

| Noncontrolling interest |

9,320 |

|

|

7,838 |

|

| Total stockholders’ equity |

7,121,060 |

|

|

7,116,805 |

|

| Total liabilities and stockholders’ equity |

$ |

12,618,723 |

|

|

$ |

12,698,532 |

|

|

|

|

| Segment Operating Statistics (Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Year-to-Date September 30, |

|

2025 |

|

2024 |

|

Change |

|

2025 |

|

2024 |

|

Change |

| Truckload |

|

|

|

|

|

|

|

|

|

|

|

Average revenue per tractor |

$ |

50,864 |

|

|

$ |

48,543 |

|

|

4.8 |

% |

|

$ |

149,014 |

|

|

$ |

143,753 |

|

|

3.7 |

% |

| Non-paid empty miles percentage |

13.8 |

% |

|

14.1 |

% |

|

(30 |

bps) |

|

14.0 |

% |

|

14.1 |

% |

|

(10) |

bps |

| Average length of haul (miles) |

368 |

|

|

378 |

|

|

(2.6 |

%) |

|

370 |

|

|

386 |

|

|

(4.1 |

%) |

| Miles per tractor |

21,337 |

|

|

20,469 |

|

|

4.2 |

% |

|

62,697 |

|

|

60,870 |

|

|

3.0 |

% |

| Average tractors |

21,319 |

|

|

22,814 |

|

|

(6.6 |

%) |

|

21,513 |

|

|

22,986 |

|

|

(6.4 |

%) |

Average trailers 1 |

89,366 |

|

|

90,935 |

|

|

(1.7 |

%) |

|

89,672 |

|

|

92,642 |

|

|

(3.2 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

LTL 2 3 |

|

|

|

|

|

|

|

|

|

|

|

| Shipments per day |

25,028 |

|

|

21,907 |

|

|

14.2 |

% |

|

24,437 |

|

|

20,397 |

|

|

19.8 |

% |

| Weight per shipment (pounds) |

1,005 |

|

|

1,001 |

|

|

0.4 |

% |

|

990 |

|

|

1,005 |

|

|

(1.5 |

%) |

| Average length of haul (miles) |

673 |

|

|

592 |

|

|

13.7 |

% |

|

660 |

|

|

584 |

|

|

13.0 |

% |

| Revenue per shipment |

$ |

215.07 |

|

|

$ |

202.20 |

|

|

6.4 |

% |

|

$ |

212.84 |

|

|

$ |

201.56 |

|

|

5.6 |

% |

| Revenue xFSC per shipment |

$ |

185.27 |

|

|

$ |

173.83 |

|

|

6.6 |

% |

|

$ |

184.30 |

|

|

$ |

172.67 |

|

|

6.7 |

% |

| Revenue per hundredweight |

$ |

21.39 |

|

|

$ |

20.21 |

|

|

5.8 |

% |

|

$ |

21.50 |

|

|

$ |

20.05 |

|

|

7.2 |

% |

| Revenue xFSC per hundredweight |

$ |

18.43 |

|

|

$ |

17.37 |

|

|

6.1 |

% |

|

$ |

18.61 |

|

|

$ |

17.18 |

|

|

8.3 |

% |

Average tractors 4 |

4,221 |

|

|

3,730 |

|

|

13.2 |

% |

|

4,146 |

|

|

3,505 |

|

|

18.3 |

% |

Average trailers 5 |

11,016 |

|

|

9,888 |

|

|

11.4 |

% |

|

10,985 |

|

|

9,160 |

|

|

19.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Logistics |

|

|

|

|

|

|

|

|

|

|

|

Revenue per load - Brokerage only |

$ |

1,967 |

|

|

$ |

1,898 |

|

|

3.6 |

% |

|

$ |

1,980 |

|

|

$ |

1,828 |

|

|

8.3 |

% |

| Gross margin - Brokerage only |

17.8 |

% |

|

17.8 |

% |

|

— |

bps |

|

18.2 |

% |

|

17.5 |

% |

|

70 |

bps |

|

|

|

|

|

|

|

|

|

|

|

|

| Intermodal |

|

|

|

|

|

|

|

|

|

|

|

Average revenue per load |

$ |

2,660 |

|

|

$ |

2,569 |

|

|

3.5 |

% |

|

$ |

2,607 |

|

|

$ |

2,599 |

|

|

0.3 |

% |

| Load count |

35,375 |

|

|

39,968 |

|

|

(11.5 |

%) |

|

103,268 |

|

|

110,905 |

|

|

(6.9 |

%) |

| Average tractors |

573 |

|

|

622 |

|

|

(7.9 |

%) |

|

599 |

|

|

615 |

|

|

(2.6 |

%) |

| Average containers |

12,535 |

|

|

12,569 |

|

|

(0.3 |

%) |

|

12,541 |

|

|

12,577 |

|

|

(0.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Third quarter 2025 and 2024 includes 9,965 and 8,510 trailers, respectively, related to leasing activities recorded within our All Other Segments. The year-to-date period ending September 30, 2025 and 2024 includes 9,862 and 8,718 trailers, respectively, related to leasing activities recorded within our All Other Segments.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3Operating statistics within the LTL segment exclude dedicated and other businesses.

4Our LTL tractor fleet includes 677 and 615 tractors from ACT's and MME's dedicated and other businesses for the third quarter of 2025 and 2024, respectively. Our LTL tractor fleet includes 668 and 613 tractors from ACT's and MME's dedicated and other businesses for the year-to-date period ending September 30, 2025 and 2024, respectively.

5Our LTL trailer fleet includes 1,236 and 843 trailers from ACT's and MME's dedicated and other businesses for the third quarter of 2025 and 2024, respectively. Our LTL trailer fleet includes 1,097 and 831 trailers from ACT's and MME's dedicated and other businesses for the year-to-date period ending September 30, 2025 and 2024, respectively.

|

|

|

| Non-GAAP Financial Measures and Reconciliations |

The terms "Adjusted Net Income Attributable to Knight-Swift," "Adjusted Operating Income," "Adjusted Operating Expenses," "Adjusted EPS," "Adjusted Operating Ratio," and "Free Cash Flow," as we define them, are not presented in accordance with GAAP. These financial measures supplement our GAAP results in evaluating certain aspects of our business. We believe that using these measures improves comparability in analyzing our performance because they remove the impact of items from our operating results that, in our opinion, do not reflect our core operating performance. Management and the board of directors focus on Adjusted Net Income Attributable to Knight-Swift, Adjusted EPS, Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio as key measures of our performance, all of which are reconciled to the most comparable GAAP financial measures and further discussed below. Management and the board of directors use Free Cash Flow as a key measure of our liquidity. Free Cash Flow does not represent residual cash flow available for discretionary expenditures. We believe our presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts the same information that we use internally for purposes of assessing our core operating performance.

Adjusted Net Income Attributable to Knight-Swift, Adjusted Operating Income, Adjusted Operating Expenses, Adjusted EPS, Adjusted Operating Ratio, and Free Cash Flow, are not substitutes for their comparable GAAP financial measures, such as net income, cash flows from operating activities, operating margin, or other measures prescribed by GAAP. There are limitations to using non-GAAP financial measures. Although we believe that they improve comparability in analyzing our period to period performance, they could limit comparability to other companies in our industry if those companies define these measures differently. Because of these limitations, our non-GAAP financial measures should not be considered measures of income generated by our business or discretionary cash available to us to invest in the growth of our business. Management compensates for these limitations by primarily relying on GAAP results and using non-GAAP financial measures on a supplemental basis.

|

|

|

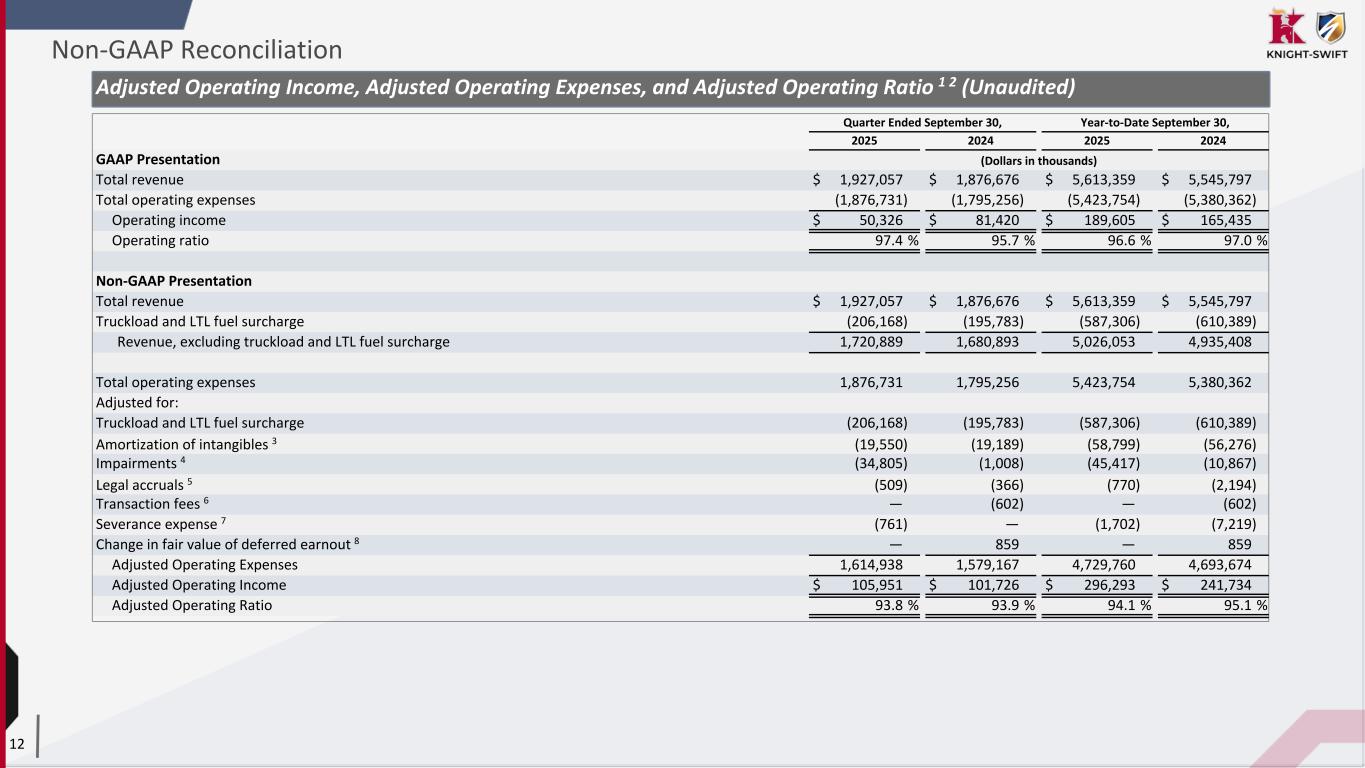

Non-GAAP Reconciliation (Unaudited): |

Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio 1 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Year-to-Date September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP Presentation |

(Dollars in thousands) |

| Total revenue |

$ |

1,927,057 |

|

|

$ |

1,876,676 |

|

|

$ |

5,613,359 |

|

|

$ |

5,545,797 |

|

| Total operating expenses |

(1,876,731) |

|

|

(1,795,256) |

|

|

(5,423,754) |

|

|

(5,380,362) |

|

| Operating income |

$ |

50,326 |

|

|

$ |

81,420 |

|

|

$ |

189,605 |

|

|

$ |

165,435 |

|

| Operating ratio |

97.4 |

% |

|

95.7 |

% |

|

96.6 |

% |

|

97.0 |

% |

|

|

|

|

|

|

|

|

| Non-GAAP Presentation |

|

|

|

|

|

|

|

| Total revenue |

$ |

1,927,057 |

|

|

$ |

1,876,676 |

|

|

$ |

5,613,359 |

|

|

$ |

5,545,797 |

|

| Truckload and LTL fuel surcharge |

(206,168) |

|

|

(195,783) |

|

|

(587,306) |

|

|

(610,389) |

|

| Revenue, excluding truckload and LTL fuel surcharge |

1,720,889 |

|

|

1,680,893 |

|

|

5,026,053 |

|

|

4,935,408 |

|

|

|

|

|

|

|

|

|

| Total operating expenses |

1,876,731 |

|

|

1,795,256 |

|

|

5,423,754 |

|

|

5,380,362 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Truckload and LTL fuel surcharge |

(206,168) |

|

|

(195,783) |

|

|

(587,306) |

|

|

(610,389) |

|

Amortization of intangibles 3 |

(19,550) |

|

|

(19,189) |

|

|

(58,799) |

|

|

(56,276) |

|

Impairments 4 |

(34,805) |

|

|

(1,008) |

|

|

(45,417) |

|

|

(10,867) |

|

Legal accruals 5 |

(509) |

|

|

(366) |

|

|

(770) |

|

|

(2,194) |

|

Transaction fees 6 |

— |

|

|

(602) |

|

|

— |

|

|

(602) |

|

|

|

|

|

|

|

|

|

Severance expense 7 |

(761) |

|

|

— |

|

|

(1,702) |

|

|

(7,219) |

|

Change in fair value of deferred earnout 8 |

— |

|

|

859 |

|

|

— |

|

|

859 |

|

| Adjusted Operating Expenses |

1,614,938 |

|

|

1,579,167 |

|

|

4,729,760 |

|

|

4,693,674 |

|

| Adjusted Operating Income |

$ |

105,951 |

|

|

$ |

101,726 |

|

|

$ |

296,293 |

|

|

$ |

241,734 |

|

| Adjusted Operating Ratio |

93.8 |

% |

|

93.9 |

% |

|

94.1 |

% |

|

95.1 |

% |

|

|

|

|

|

|

|

|

1 Pursuant to the requirements of Regulation G, this table reconciles consolidated GAAP operating ratio to consolidated non-GAAP Adjusted Operating Ratio.

2 Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in the 2017 Merger, the ACT acquisition, the U.S. Xpress acquisition, and other acquisitions, as well as the non-cash amortization expense related to the fair value of favorable leases assumed in the DHE acquisition included within "Rental expense" in the condensed consolidated statements of comprehensive income.

4 "Impairments" reflects the non-cash impairment:

•Third quarter 2025 impairments reflect the non-cash impairments of tradenames associated with the decision to rebrand the MME and DHE brands of our LTL businesses under the AAA Cooper brand (within the LTL segment), as well as certain discontinued software projects (within the Intermodal Segment), and certain real property leases (within the Truckload Segment). Second quarter 2025 impairments reflects non-cash impairments related to certain real property owned and leased (within the Truckload Segment). First quarter 2025 reflects non-cash impairments related to certain real property leases (within the Truckload segment).

•Third quarter and year-to-date 2024 reflects the non-cash impairments of building improvements, certain revenue equipment held for sale, leases, and other equipment (within the Truckload segment and All Other Segments).

5 "Legal accruals" are included in "Miscellaneous operating expenses" in the condensed consolidated statements of comprehensive income and reflect the following:

•First and third quarter 2025 legal expense reflects the increased estimated exposure for accrued legal matters based on recent settlement agreements.

• Year-to-date 2024 legal expense reflects the increased estimated exposures for accrued legal matters based on recent settlement agreements.

6 "Transaction fees" reflects certain legal and professional fees associated with the July 30, 2024 acquisition of DHE. The transaction fees are included within "Miscellaneous operating expenses" in the condensed statements of comprehensive income.

7 "Severance expense" is included within "Salaries, wages, and benefits" in the condensed statements of comprehensive income.

8 "Change in fair value of deferred earnout" reflects the benefit for the change in fair value of a deferred earnout related to various acquisitions, which is recorded in "Miscellaneous operating expenses".

|

|

|

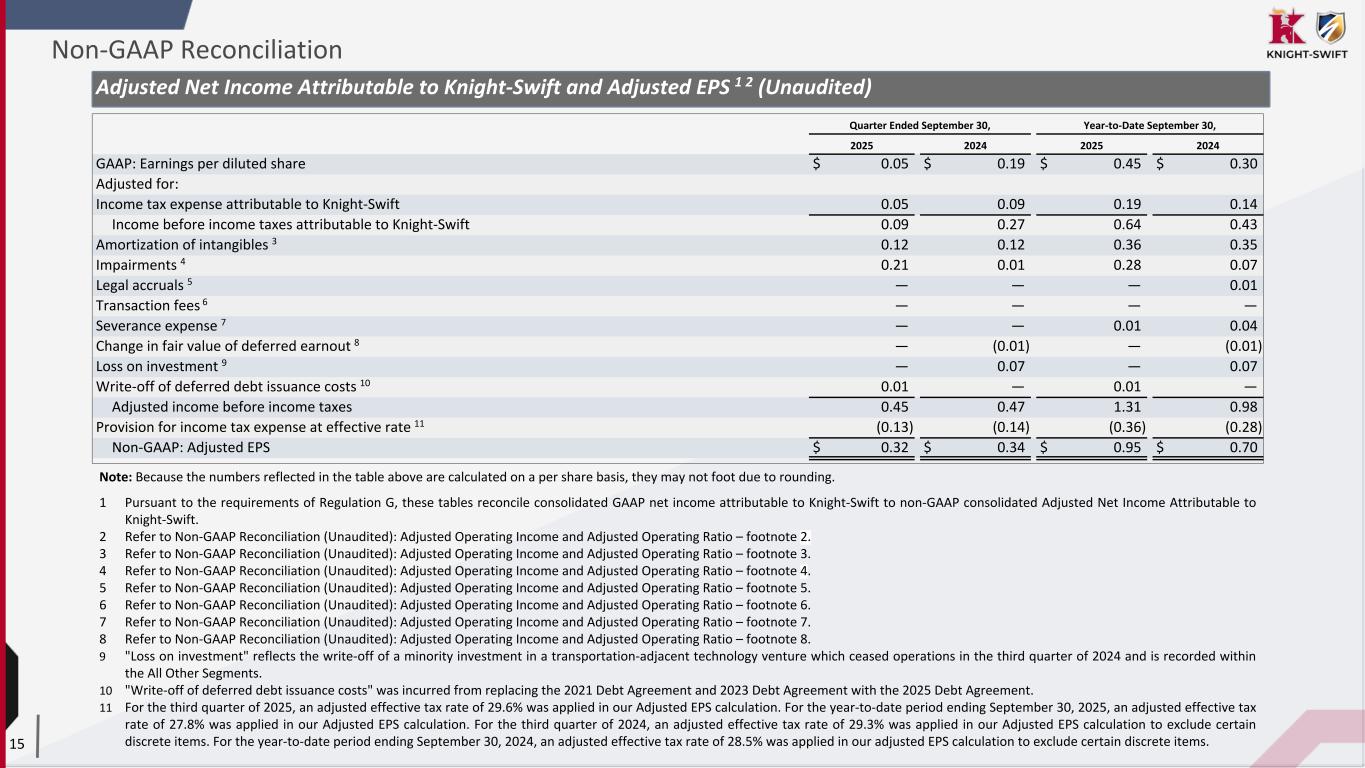

Non-GAAP Reconciliation (Unaudited): |

Adjusted Net Income Attributable to Knight-Swift and Adjusted EPS 1 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Year-to-Date September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

(Dollars in thousands, except per share data) |

| GAAP: Net income attributable to Knight-Swift |

$ |

7,861 |

|

|

$ |

30,464 |

|

|

$ |

72,743 |

|

|

$ |

48,129 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Income tax expense attributable to Knight-Swift |

7,388 |

|

|

14,137 |

|

|

31,684 |

|

|

22,253 |

|

| Income before income taxes attributable to Knight-Swift |

15,249 |

|

|

44,601 |

|

|

104,427 |

|

|

70,382 |

|

Amortization of intangibles 3 |

19,550 |

|

|

19,189 |

|

|

58,799 |

|

|

56,276 |

|

Impairments 4 |

34,805 |

|

|

1,008 |

|

|

45,417 |

|

|

10,867 |

|

Legal accruals 5 |

509 |

|

|

366 |

|

|

770 |

|

|

2,194 |

|

Transaction fees 6 |

— |

|

|

602 |

|

|

— |

|

|

602 |

|

|

|

|

|

|

|

|

|

Severance expense 7 |

761 |

|

|

— |

|

|

1,702 |

|

|

7,219 |

|

Change in fair value of deferred earnout 8 |

— |

|

|

(859) |

|

|

— |

|

|

(859) |

|

Loss on investment 9 |

— |

|

|

12,107 |

|

|

— |

|

|

12,107 |

|

Write-off of deferred debt issuance costs 10 |

2,020 |

|

|

— |

|

|

2,020 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Adjusted income before income taxes |

72,894 |

|

|

77,014 |

|

|

213,135 |

|

|

158,788 |

|

Provision for income tax expense at effective rate 11 |

(21,613) |

|

|

(22,567) |

|

|

(59,303) |

|

|

(45,192) |

|

| Non-GAAP: Adjusted Net Income Attributable to Knight-Swift |

$ |

51,281 |

|

|

$ |

54,447 |

|

|

$ |

153,832 |

|

|

$ |

113,596 |

|

|

|

|

|

|

|

|

|

Note: Because the numbers reflected in the table below are calculated on a per share basis, they may not foot due to rounding.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Year-to-Date September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP: Earnings per diluted share |

$ |

0.05 |

|

|

$ |

0.19 |

|

|

$ |

0.45 |

|

|

$ |

0.30 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Income tax expense attributable to Knight-Swift |

0.05 |

|

|

0.09 |

|

|

0.19 |

|

|

0.14 |

|

| Income before income taxes attributable to Knight-Swift |

0.09 |

|

|

0.27 |

|

|

0.64 |

|

|

0.43 |

|

Amortization of intangibles 3 |

0.12 |

|

|

0.12 |

|

|

0.36 |

|

|

0.35 |

|

Impairments 4 |

0.21 |

|

|

0.01 |

|

|

0.28 |

|

|

0.07 |

|

Legal accruals 5 |

— |

|

|

— |

|

|

— |

|

|

0.01 |

|

Transaction fees 6 |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

Severance expense 7 |

— |

|

|

— |

|

|

0.01 |

|

|

0.04 |

|

Change in fair value of deferred earnout 8 |

— |

|

|

(0.01) |

|

|

— |

|

|

(0.01) |

|

Loss on investment 9 |

— |

|

|

0.07 |

|

|

— |

|

|

0.07 |

|

Write-off of deferred debt issuance costs 10 |

0.01 |

|

|

— |

|

|

0.01 |

|

|

— |

|

|

|

|

|

|

|

|

|

| Adjusted income before income taxes |

0.45 |

|

|

0.47 |

|

|

1.31 |

|

|

0.98 |

|

Provision for income tax expense at effective rate 11 |

(0.13) |

|

|

(0.14) |

|

|

(0.36) |

|

|

(0.28) |

|

| Non-GAAP: Adjusted EPS |

$ |

0.32 |

|

|

$ |

0.34 |

|

|

$ |

0.95 |

|

|

$ |

0.70 |

|

|

|

|

|

|

|

|

|

1Pursuant to the requirements of Regulation G, these tables reconcile consolidated GAAP net income attributable to Knight-Swift to non-GAAP consolidated Adjusted Net Income Attributable to Knight-Swift and consolidated GAAP diluted earnings per share to non-GAAP consolidated Adjusted EPS.

2Refer to Condensed Consolidated Statements of Comprehensive Income — footnote 1.

3Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 3.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 4.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 5.

6Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 6.

7Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 7.

8Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 8.

9"Loss on investment" reflects the write-off of a minority investment in a transportation-adjacent technology venture which ceased operations in the third quarter of 2024 and is recorded within the All Other Segments.

10"Write-off of deferred debt issuance costs" was incurred from replacing the 2021 Debt Agreement and 2023 Debt Agreement with the 2025 Debt Agreement.

11For the third quarter of 2025, an adjusted effective tax rate of 29.6% was applied in our Adjusted EPS calculation. For the year-to-date period ending September 30, 2025, an adjusted effective tax rate of 27.8% was applied in our Adjusted EPS calculation. For the third quarter of 2024, an adjusted effective tax rate of 29.3% was applied in our Adjusted EPS calculation to exclude certain discrete items. For the year-to-date period ending September 30, 2024, an adjusted effective tax rate of 28.5% was applied in our adjusted EPS calculation to exclude certain discrete items.

|

|

|

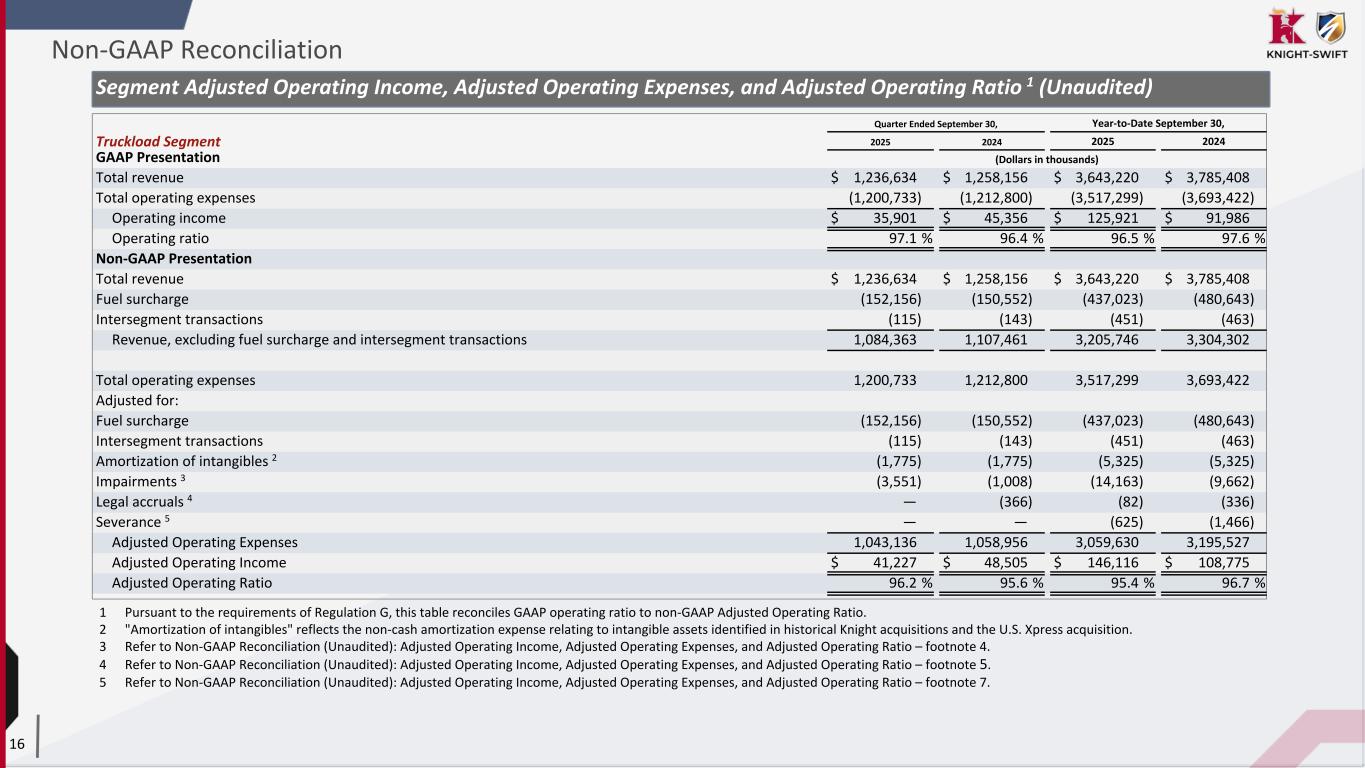

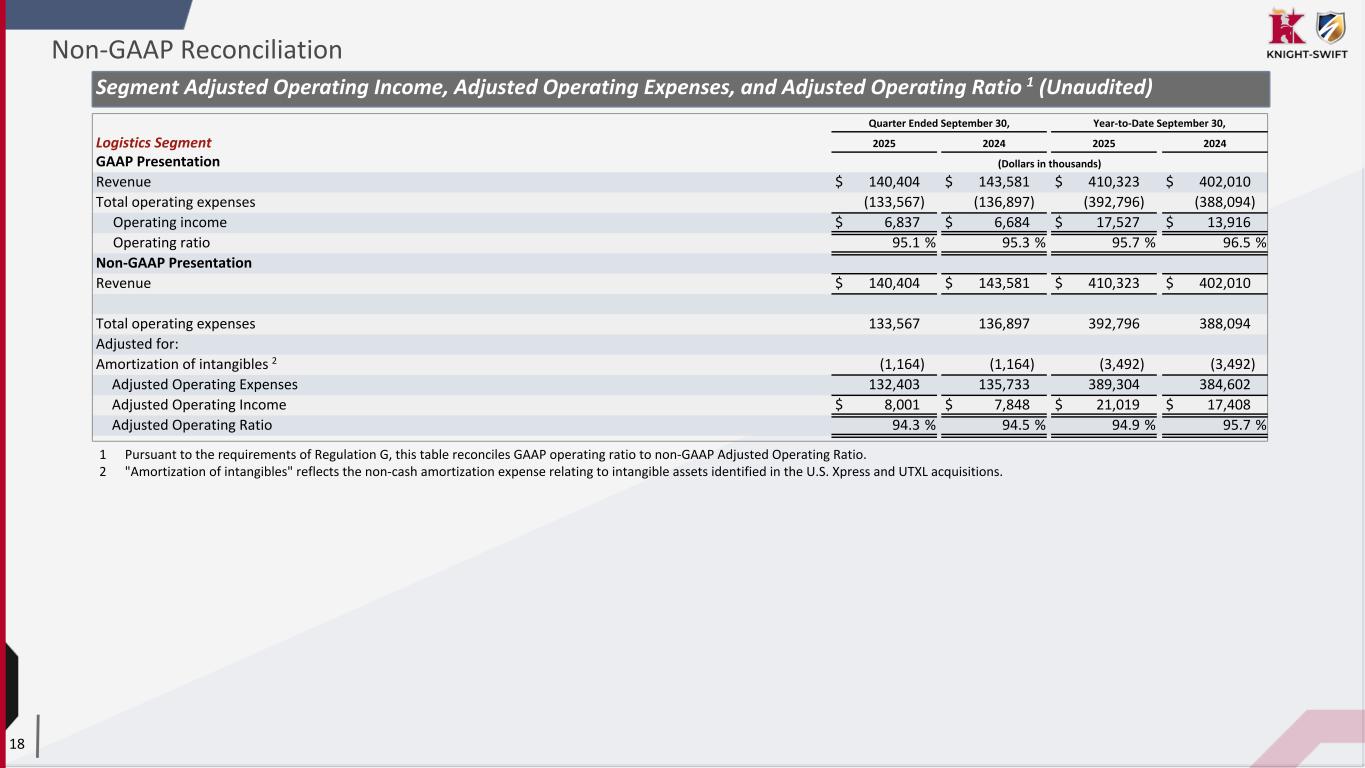

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Year-to-Date September 30, |

| Truckload Segment |

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP Presentation |

(Dollars in thousands) |

| Total revenue |

$ |

1,236,634 |

|

|

$ |

1,258,156 |

|

|

$ |

3,643,220 |

|

|

$ |

3,785,408 |

|

| Total operating expenses |

(1,200,733) |

|

|

(1,212,800) |

|

|

(3,517,299) |

|

|

(3,693,422) |

|

| Operating income |

$ |

35,901 |

|

|

$ |

45,356 |

|

|

$ |

125,921 |

|

|

$ |

91,986 |

|

| Operating ratio |

97.1 |

% |

|

96.4 |

% |

|

96.5 |

% |

|

97.6 |

% |

| Non-GAAP Presentation |

|

|

|

|

|

|

|

| Total revenue |

$ |

1,236,634 |

|

|

$ |

1,258,156 |

|

|

$ |

3,643,220 |

|

|

$ |

3,785,408 |

|

| Fuel surcharge |

(152,156) |

|

|

(150,552) |

|

|

(437,023) |

|

|

(480,643) |

|

| Intersegment transactions |

(115) |

|

|

(143) |

|

|

(451) |

|

|

(463) |

|

| Revenue, excluding fuel surcharge and intersegment transactions |

1,084,363 |

|

|

1,107,461 |

|

|

3,205,746 |

|

|

3,304,302 |

|

|

|

|

|

|

|

|

|

| Total operating expenses |

1,200,733 |

|

|

1,212,800 |

|

|

3,517,299 |

|

|

3,693,422 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Fuel surcharge |

(152,156) |

|

|

(150,552) |

|

|

(437,023) |

|

|

(480,643) |

|

| Intersegment transactions |

(115) |

|

|

(143) |

|

|

(451) |

|

|

(463) |

|

Amortization of intangibles 2 |

(1,775) |

|

|

(1,775) |

|

|

(5,325) |

|

|

(5,325) |

|

Impairments 3 |

(3,551) |

|

|

(1,008) |

|

|

(14,163) |

|

|

(9,662) |

|

Legal accruals 4 |

— |

|

|

(366) |

|

|

(82) |

|

|

(336) |

|

|

|

|

|

|

|

|

|

Severance 5 |

— |

|

|

— |

|

|

(625) |

|

|

(1,466) |

|

| Adjusted Operating Expenses |

1,043,136 |

|

|

1,058,956 |

|

|

3,059,630 |

|

|

3,195,527 |

|

| Adjusted Operating Income |

$ |

41,227 |

|

|

$ |

48,505 |

|

|

$ |

146,116 |

|

|

$ |

108,775 |

|

| Adjusted Operating Ratio |

96.2 |

% |

|

95.6 |

% |

|

95.4 |

% |

|

96.7 |

% |

|

|

|

|

|

|

|

|

1 Pursuant to the requirements of Regulation G, this table reconciles GAAP operating ratio to non-GAAP Adjusted Operating Ratio.

2 "Amortization of intangibles" reflects the non-cash amortization expense relating to intangible assets identified in historical Knight acquisitions and the U.S. Xpress acquisition.

3Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 4.

4Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 5.

5Refer to Non-GAAP Reconciliation (Unaudited): Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio – footnote 7.

|

|

|

Non-GAAP Reconciliation (Unaudited): |

Segment Adjusted Operating Income, Adjusted Operating Expenses, and Adjusted Operating Ratio 1 — (Continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Year-to-Date September 30, |

LTL Segment 2 |

2025 |

|

2024 |

|

2025 |

|

2024 |

| GAAP Presentation |

(Dollars in thousands) |

| Total revenue |

$ |

394,501 |

|

|

$ |

325,412 |

|

|

$ |

1,133,756 |

|

|

$ |

914,012 |

|

| Total operating expenses |

(396,194) |

|

|

(300,856) |

|

|

(1,104,422) |

|

|

(836,120) |

|

| Operating (loss) income |

$ |

(1,693) |

|

|

$ |

24,556 |

|

|

$ |

29,334 |

|

|

$ |

77,892 |

|

| Operating ratio |

100.4 |

% |

|

92.5 |

% |

|

97.4 |

% |

|

91.5 |

% |

| Non-GAAP Presentation |

|

|

|

|

|

|

|

| Total revenue |

$ |

394,501 |

|

|

$ |

325,412 |

|

|

$ |

1,133,756 |

|

|

$ |

914,012 |

|

| Fuel surcharge |

(54,012) |

|

|

(45,231) |

|

|

(150,283) |

|

|

(129,746) |

|

|

|

|

|

|

|

|

|

| Revenue, excluding fuel surcharge |

340,489 |

|

|

280,181 |

|

|

983,473 |

|

|

784,266 |

|

|

|

|

|

|

|

|

|

| Total operating expenses |

396,194 |

|

|

300,856 |

|

|

1,104,422 |

|

|

836,120 |

|

| Adjusted for: |

|

|

|

|

|

|

|

| Fuel surcharge |

(54,012) |

|

|

(45,231) |

|

|

(150,283) |

|

|

(129,746) |

|

|

|

|

|

|

|

|

|

Amortization of intangibles 3 |

(4,949) |

|

|

(4,563) |

|

|

(14,996) |

|

|

(12,403) |

|

Impairments 4 |

(28,800) |