| Customers Bancorp, Inc. | ||

| Pennsylvania | 001-35542 | 27-2290659 | ||||||

| (State or other jurisdiction of incorporation or organization) |

(Commission File number) | (IRS Employer Identification No.) |

||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

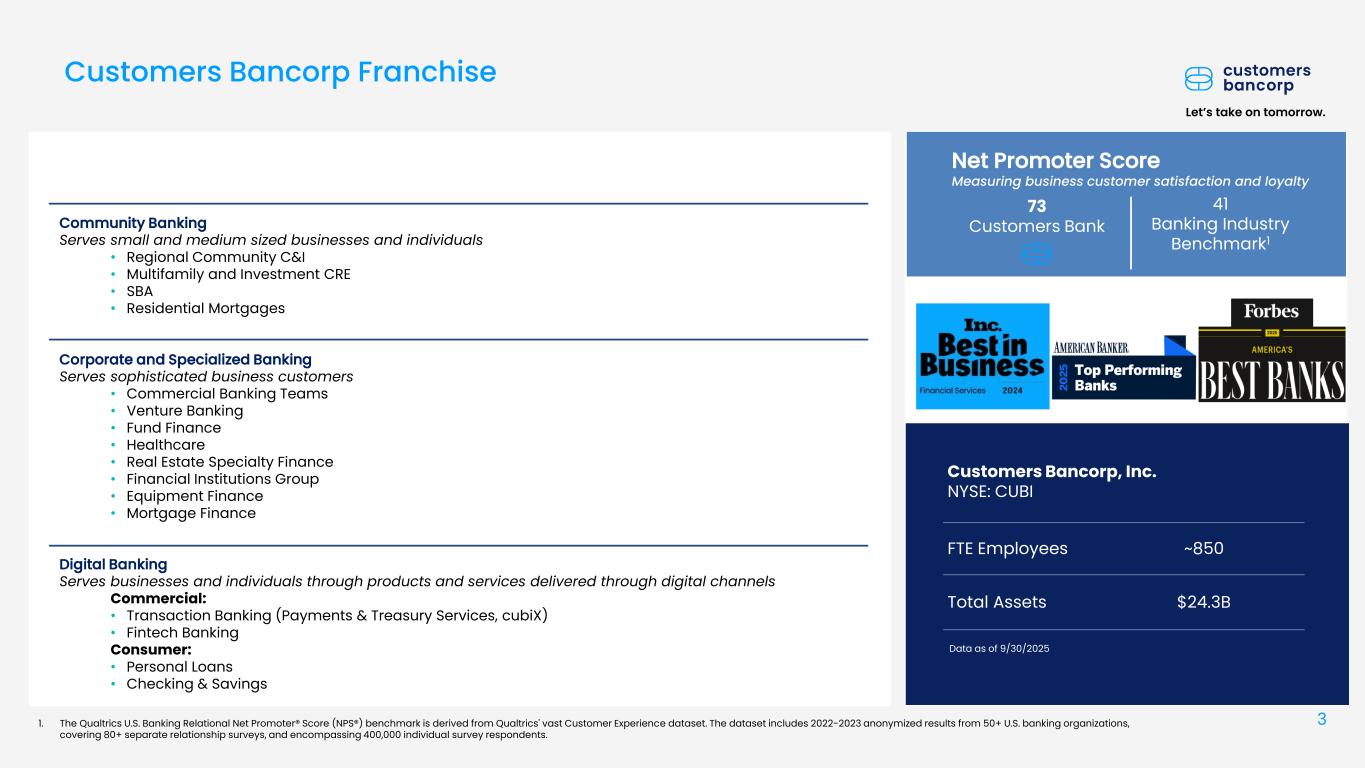

| Title of Each Class | Trading Symbols | Name of Each Exchange on which Registered | ||||||||||||

| Voting Common Stock, par value $1.00 per share | CUBI | New York Stock Exchange | ||||||||||||

| Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series F, par value $1.00 per share |

CUBI/PF | New York Stock Exchange | ||||||||||||

| 5.375% Subordinated Notes due 2034 | CUBB | New York Stock Exchange | ||||||||||||

| Exhibit | Description | |||||||

| Press Release dated October 23, 2025 | ||||||||

| Slide presentation dated October 2025 | ||||||||

| CUSTOMERS BANCORP, INC. | |||||

By: /s/ Mark R. McCollom |

|||||

| Name: Mark R. McCollom | |||||

| Title: Executive Vice President - Chief Financial Officer | |||||

| Exhibit No. | Description | |||||||

| Press Release dated October 23, 2025 | ||||||||

| Slide presentation dated October 2025 | ||||||||

*Non-GAAP measure. Customers’ reasons for the use of the non-GAAP measure and a detailed reconciliation between the non-GAAP measure and the comparable GAAP amount are included at the end of this document. | ||||||||

1 Excludes pre-tax gains on investment securities of $0.3 million. | ||||||||

2 Regulatory capital ratios as of September 30, 2025 are estimates. | ||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||||||||

FINANCIAL HIGHLIGHTS - UNAUDITED |

|||||||||||||||||||||||||||||||||||||||||||||||

(Dollars in thousands, except per share data and stock price data) |

Q3 | Q2 | Q1 | Q4 | Q3 | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||||||||||||

| GAAP Profitability Metrics: | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income available to common shareholders |

$ | 73,726 | $ | 55,846 | $ | 9,523 | $ | 23,266 | $ | 42,937 | $ | 139,095 | $ | 143,163 | |||||||||||||||||||||||||||||||||

Per share amounts: |

|||||||||||||||||||||||||||||||||||||||||||||||

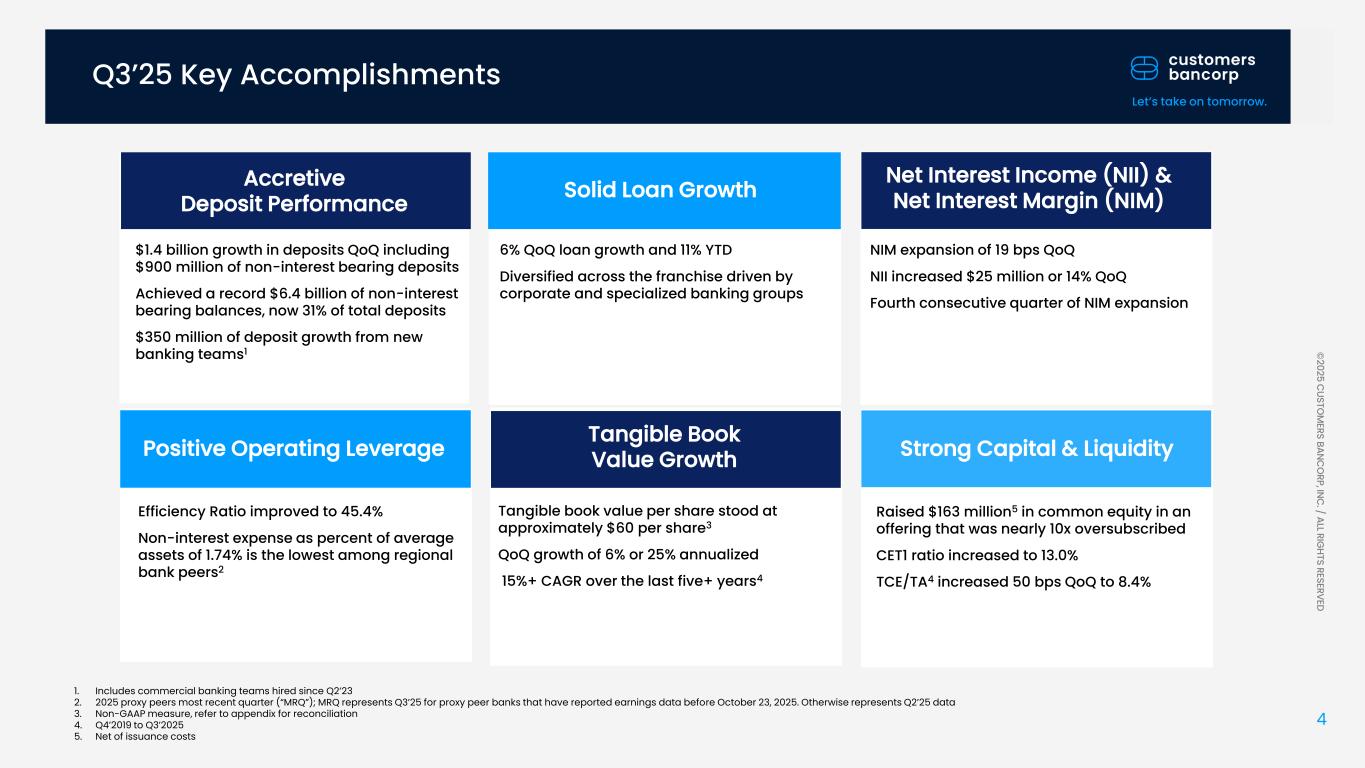

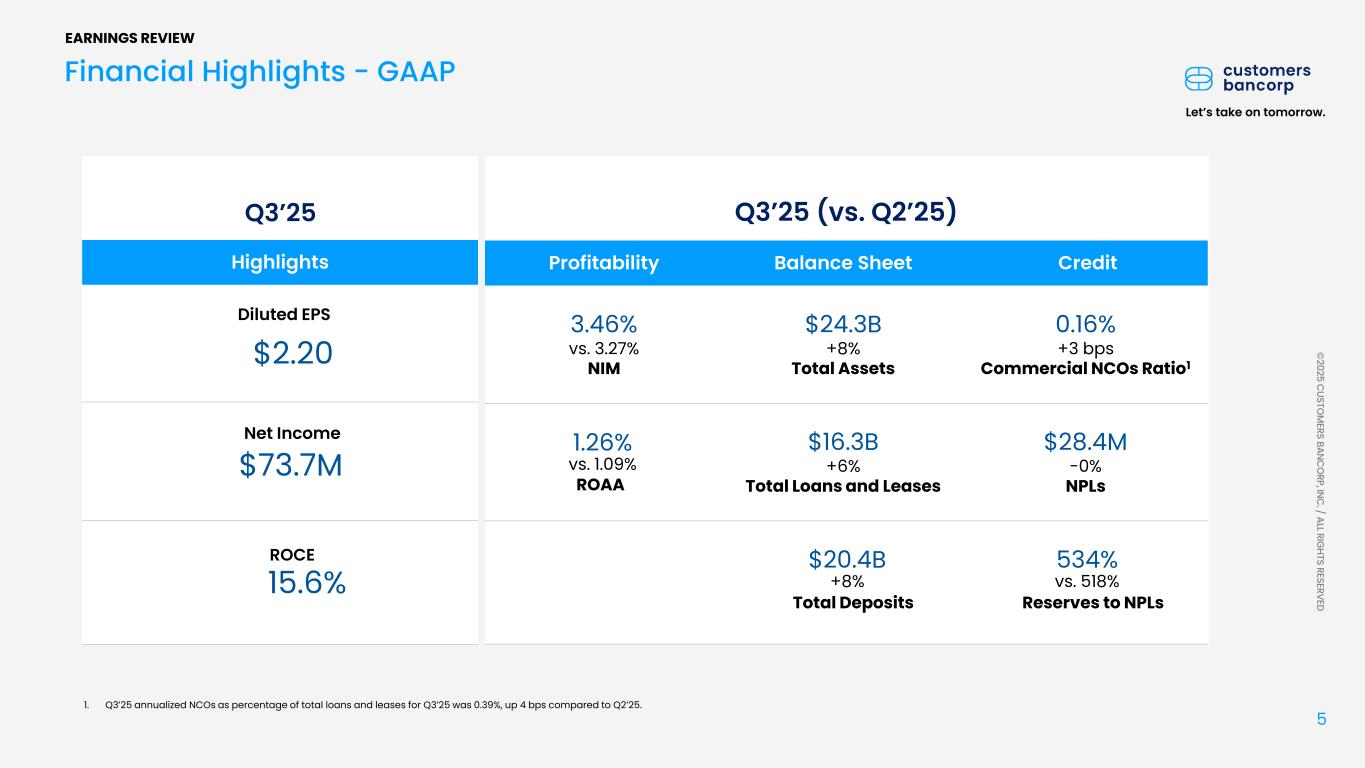

| Earnings per share - diluted | $ | 2.20 | $ | 1.73 | $ | 0.29 | $ | 0.71 | $ | 1.31 | $ | 4.24 | $ | 4.37 | |||||||||||||||||||||||||||||||||

Book value per common share |

$ | 59.83 | $ | 56.36 | $ | 54.85 | $ | 54.20 | $ | 53.07 | $ | 59.83 | $ | 53.07 | |||||||||||||||||||||||||||||||||

Return on average assets (“ROAA”) |

1.26 | % | 1.09 | % | 0.23 | % | 0.48 | % | 0.88 | % | 0.87 | % | 0.97 | % | |||||||||||||||||||||||||||||||||

Return on average common equity (“ROCE”) |

15.57 | % | 12.79 | % | 2.23 | % | 5.50 | % | 10.44 | % | 10.41 | % | 12.10 | % | |||||||||||||||||||||||||||||||||

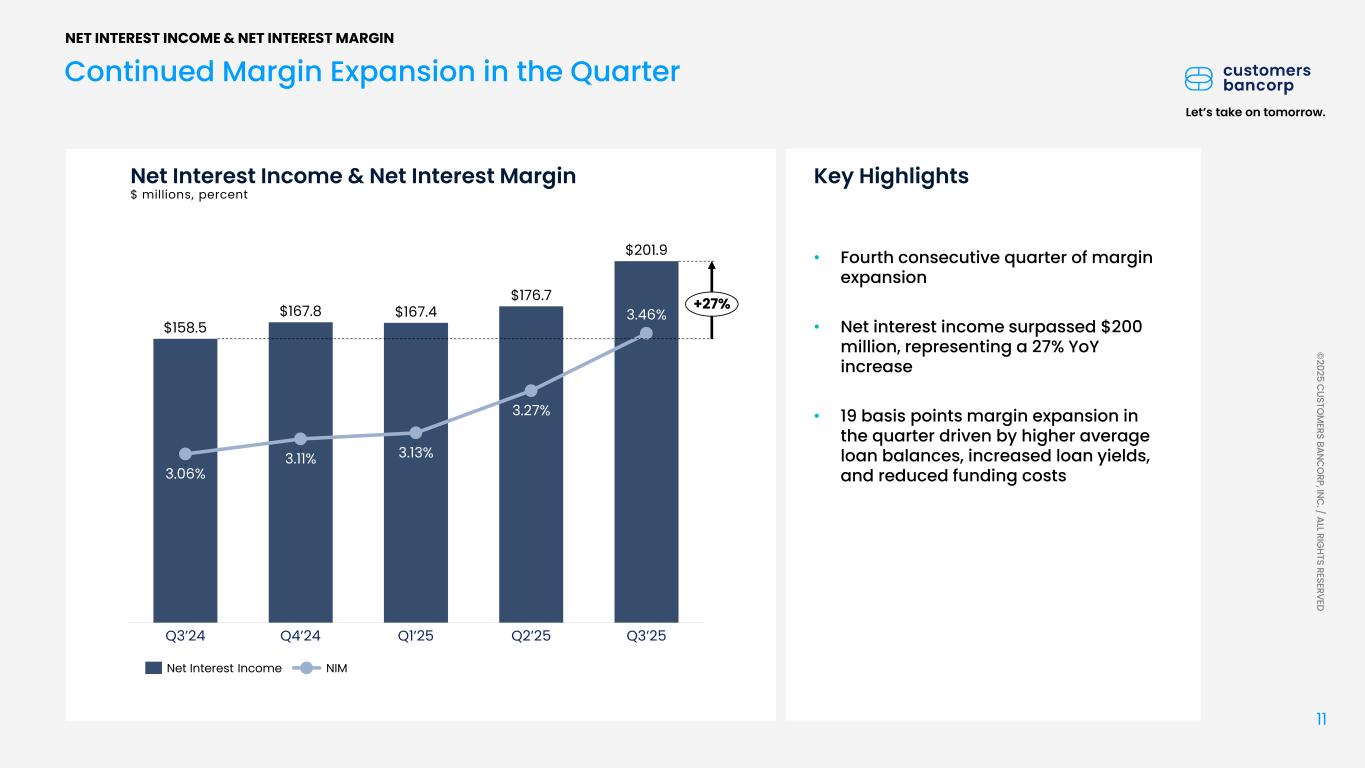

| Net interest margin, tax equivalent | 3.46 | % | 3.27 | % | 3.13 | % | 3.11 | % | 3.06 | % | 3.30 | % | 3.16 | % | |||||||||||||||||||||||||||||||||

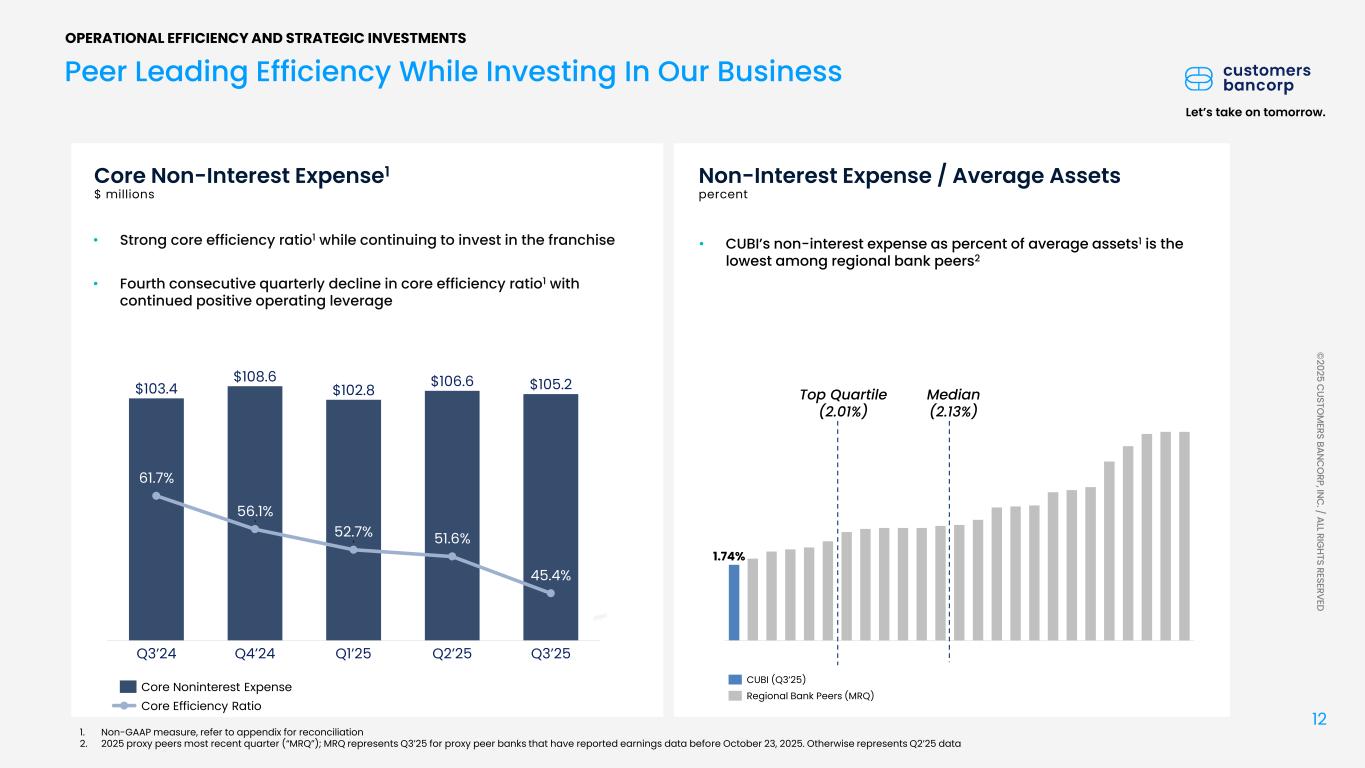

| Efficiency ratio | 45.39 | % | 51.23 | % | 52.94 | % | 56.86 | % | 62.40 | % | 49.62 | % | 55.97 | % | |||||||||||||||||||||||||||||||||

Non-GAAP Profitability Metrics (1): |

|||||||||||||||||||||||||||||||||||||||||||||||

| Core earnings | $ | 73,473 | $ | 58,147 | $ | 50,002 | $ | 44,168 | $ | 43,838 | $ | 181,622 | $ | 138,937 | |||||||||||||||||||||||||||||||||

| Per share amounts: | |||||||||||||||||||||||||||||||||||||||||||||||

| Core earnings per share - diluted | $ | 2.20 | $ | 1.80 | $ | 1.54 | $ | 1.36 | $ | 1.34 | $ | 5.54 | $ | 4.24 | |||||||||||||||||||||||||||||||||

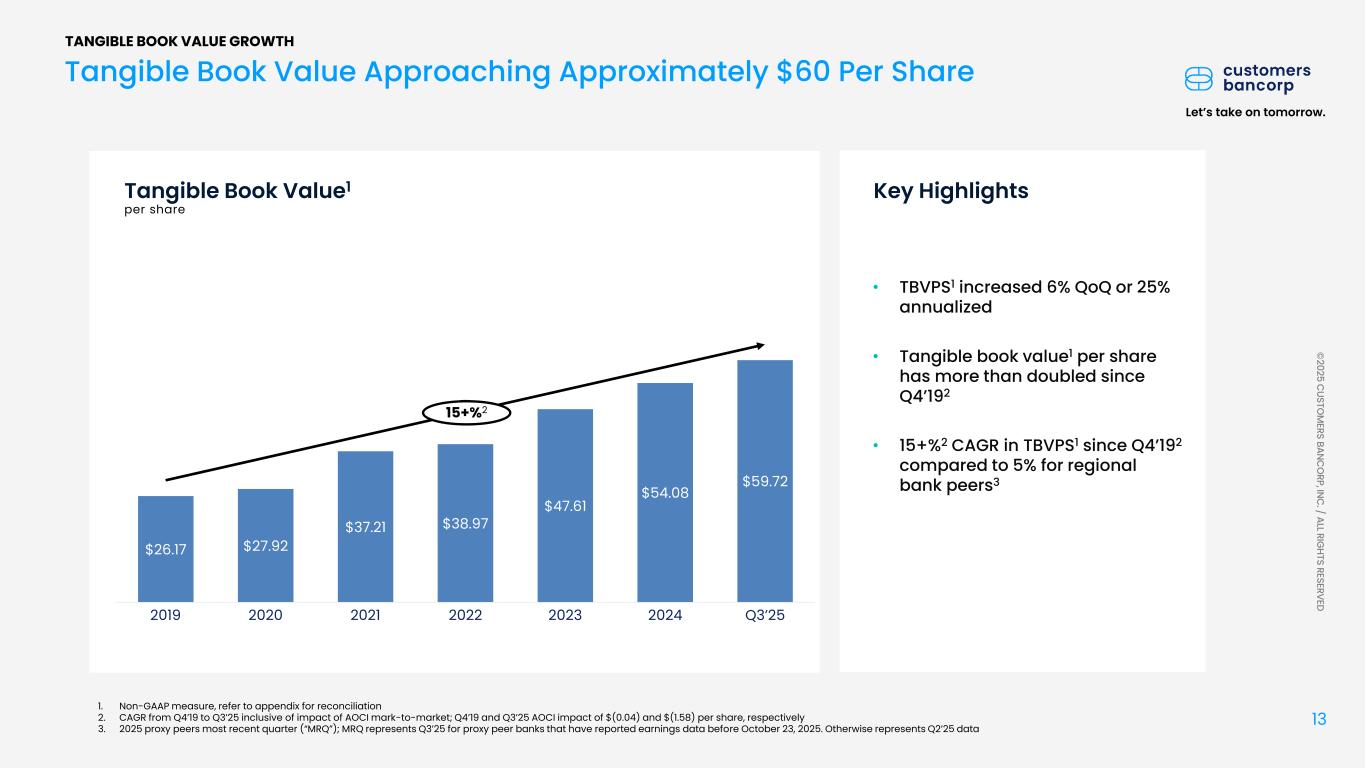

Tangible book value per common share |

$ | 59.72 | $ | 56.24 | $ | 54.74 | $ | 54.08 | $ | 52.96 | $ | 59.72 | $ | 52.96 | |||||||||||||||||||||||||||||||||

| Core ROAA | 1.25 | % | 1.10 | % | 0.97 | % | 0.86 | % | 0.89 | % | 1.11 | % | 0.95 | % | |||||||||||||||||||||||||||||||||

| Core ROCE | 15.52 | % | 13.32 | % | 11.72 | % | 10.44 | % | 10.66 | % | 13.59 | % | 11.74 | % | |||||||||||||||||||||||||||||||||

| Core efficiency ratio | 45.40 | % | 51.56 | % | 52.69 | % | 56.12 | % | 61.69 | % | 49.65 | % | 56.29 | % | |||||||||||||||||||||||||||||||||

Balance Sheet Trends: |

|||||||||||||||||||||||||||||||||||||||||||||||

Total assets |

$ | 24,260,163 | $ | 22,550,800 | $ | 22,423,044 | $ | 22,308,241 | $ | 21,456,082 | $ | 24,260,163 | $ | 21,456,082 | |||||||||||||||||||||||||||||||||

Total cash and investment securities |

$ | 6,997,783 | $ | 6,234,043 | $ | 6,424,406 | $ | 6,797,562 | $ | 6,564,528 | $ | 6,997,783 | $ | 6,564,528 | |||||||||||||||||||||||||||||||||

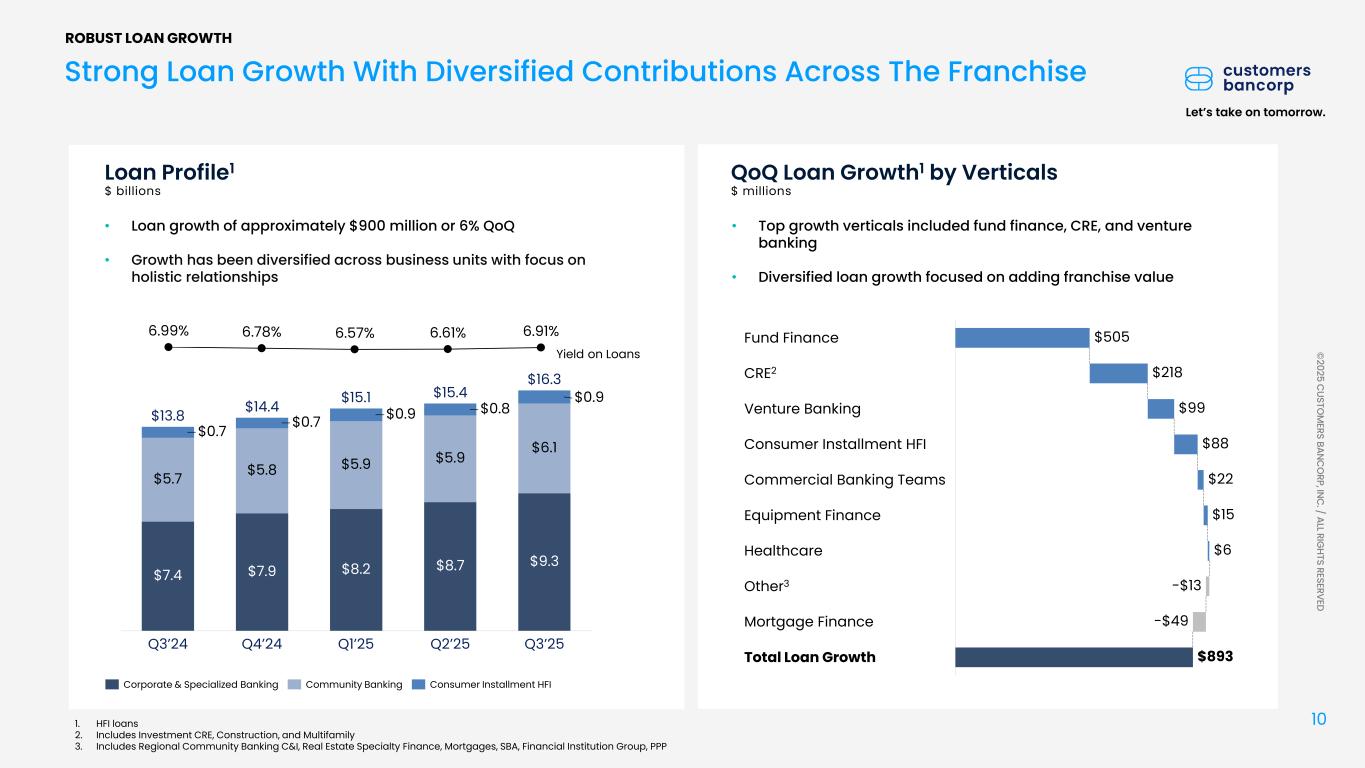

Total loans and leases |

$ | 16,303,147 | $ | 15,412,400 | $ | 15,097,968 | $ | 14,653,556 | $ | 14,053,116 | $ | 16,303,147 | $ | 14,053,116 | |||||||||||||||||||||||||||||||||

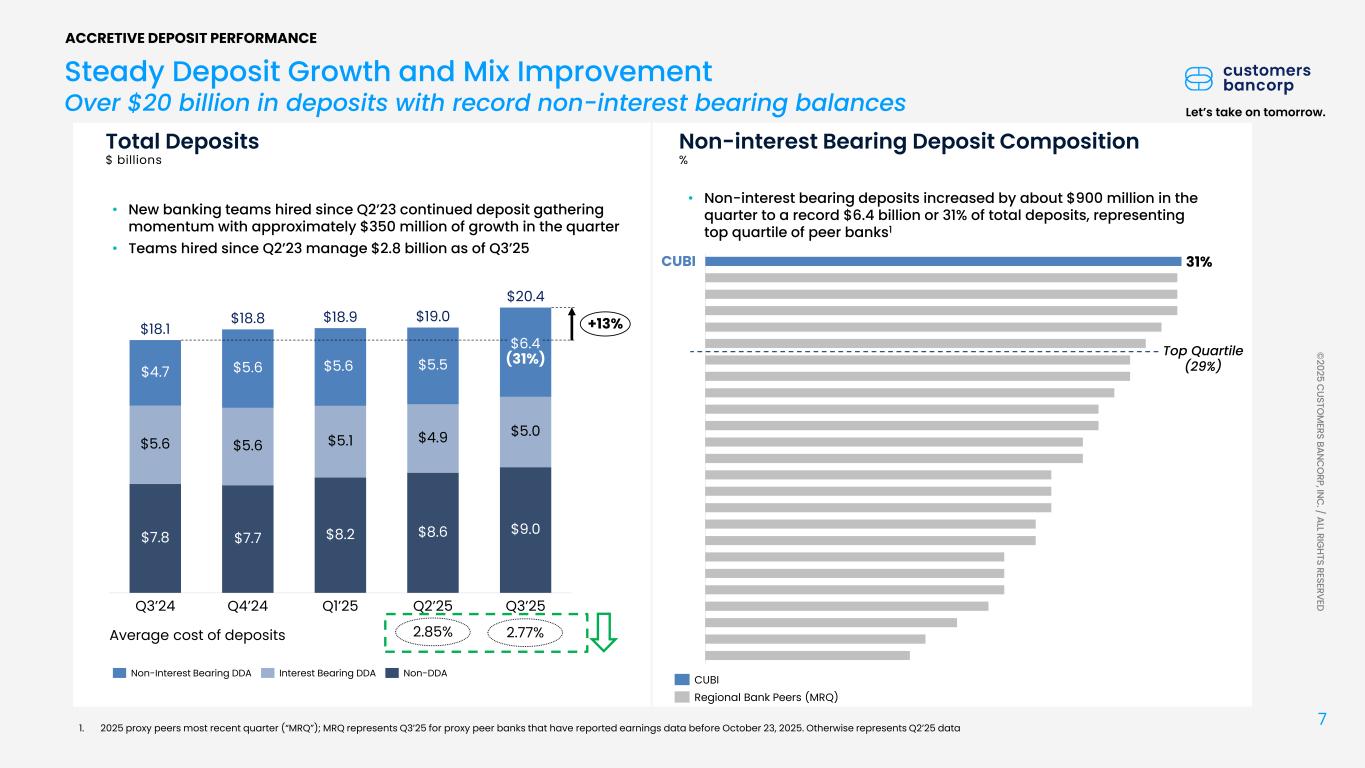

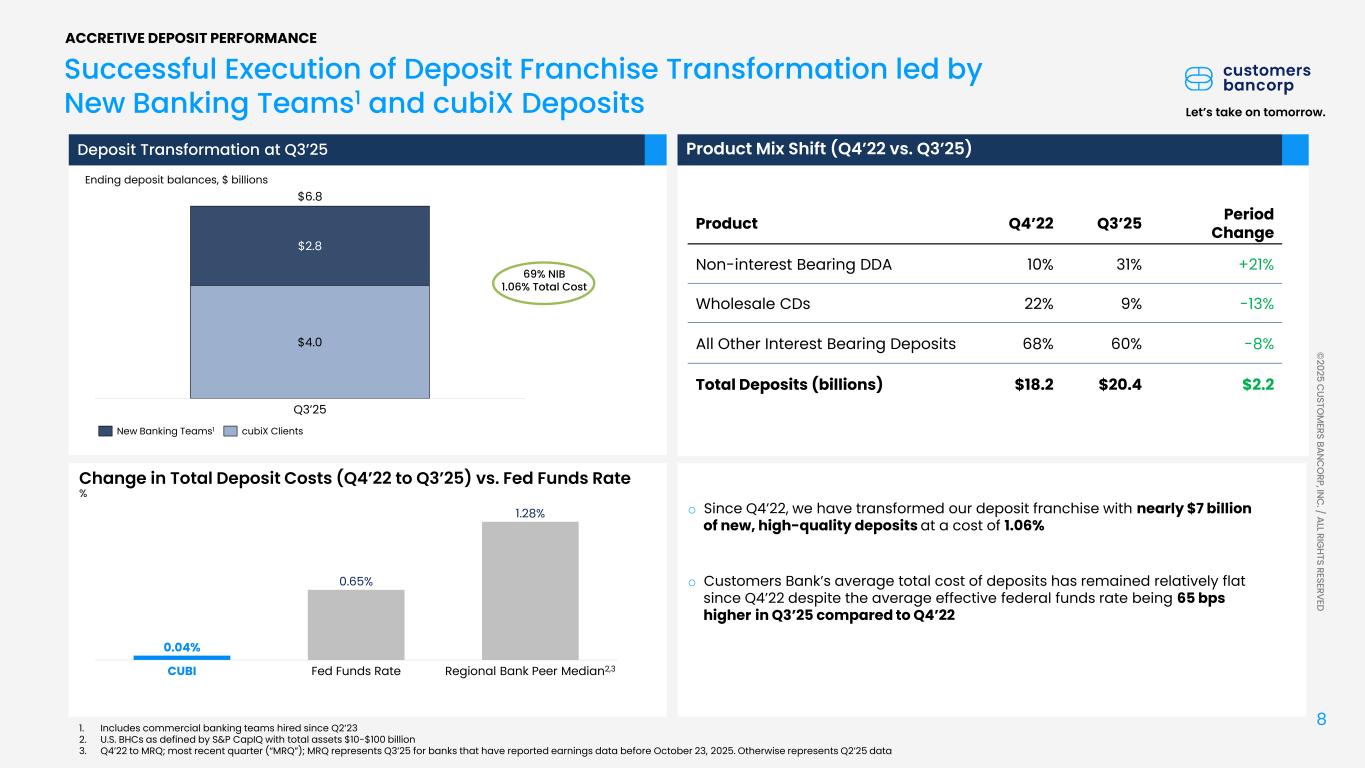

Non-interest bearing demand deposits |

$ | 6,380,879 | $ | 5,481,065 | $ | 5,552,605 | $ | 5,608,288 | $ | 4,670,809 | $ | 6,380,879 | $ | 4,670,809 | |||||||||||||||||||||||||||||||||

Total deposits |

$ | 20,405,023 | $ | 18,976,018 | $ | 18,932,925 | $ | 18,846,461 | $ | 18,069,389 | $ | 20,405,023 | $ | 18,069,389 | |||||||||||||||||||||||||||||||||

| Asset Quality: | |||||||||||||||||||||||||||||||||||||||||||||||

| Net charge-offs | $ | 15,371 | $ | 13,115 | $ | 17,144 | $ | 14,612 | $ | 17,044 | $ | 45,630 | $ | 53,723 | |||||||||||||||||||||||||||||||||

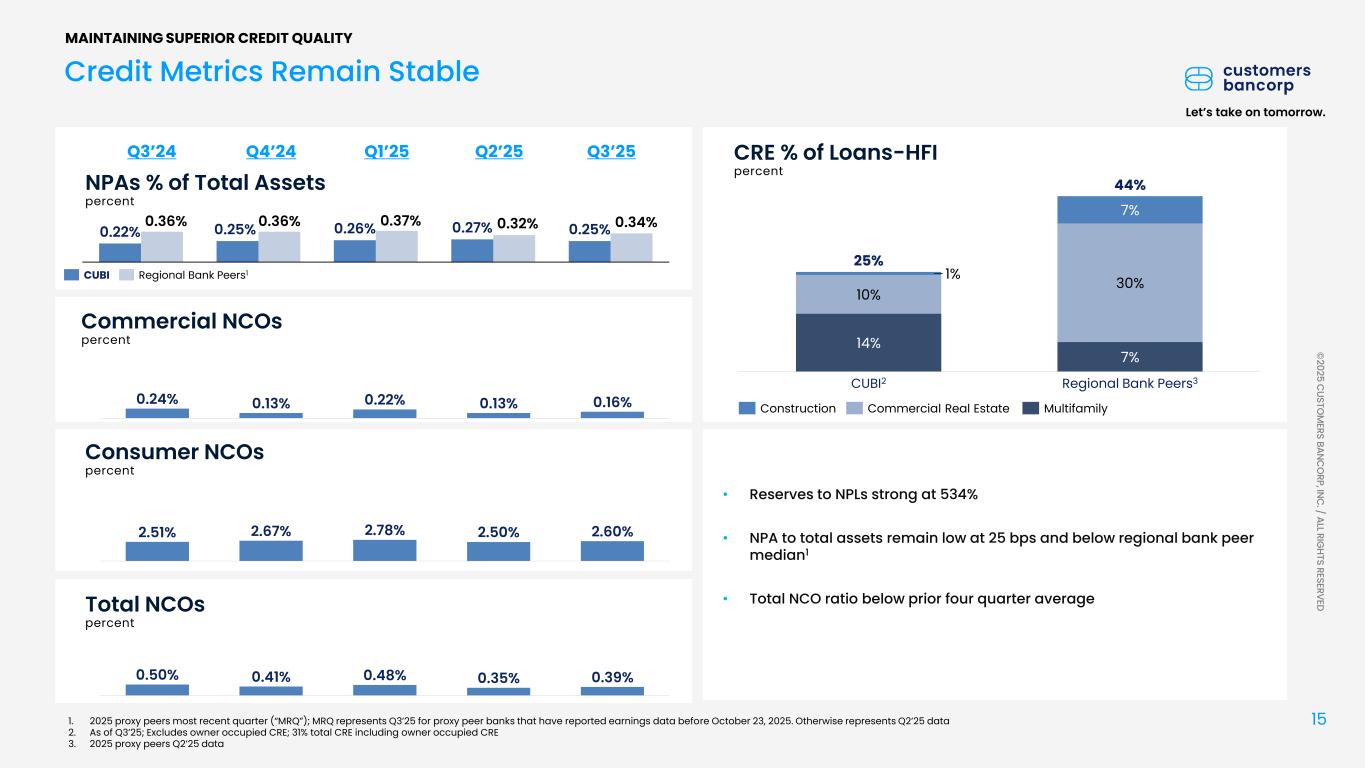

| Annualized net charge-offs to average total loans and leases | 0.39 | % | 0.35 | % | 0.48 | % | 0.41 | % | 0.50 | % | 0.40 | % | 0.54 | % | |||||||||||||||||||||||||||||||||

Nonaccrual / non-performing loans (“NPLs”) |

$ | 28,421 | $ | 28,443 | $ | 43,513 | $ | 43,275 | $ | 47,326 | $ | 28,421 | $ | 47,326 | |||||||||||||||||||||||||||||||||

NPLs to total loans and leases |

0.17 | % | 0.18 | % | 0.29 | % | 0.30 | % | 0.34 | % | 0.17 | % | 0.34 | % | |||||||||||||||||||||||||||||||||

Reserves to NPLs |

534.14 | % | 518.29 | % | 324.22 | % | 316.06 | % | 281.36 | % | 534.14 | % | 281.36 | % | |||||||||||||||||||||||||||||||||

Non-performing assets (“NPAs”) |

$ | 61,057 | $ | 60,778 | $ | 57,960 | $ | 55,807 | $ | 47,326 | $ | 61,057 | $ | 47,326 | |||||||||||||||||||||||||||||||||

NPAs to total assets |

0.25 | % | 0.27 | % | 0.26 | % | 0.25 | % | 0.22 | % | 0.25 | % | 0.22 | % | |||||||||||||||||||||||||||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||||||||

FINANCIAL HIGHLIGHTS - UNAUDITED (CONTINUED) |

|||||||||||||||||||||||||||||||||||||||||||||||

(Dollars in thousands, except per share data and stock price data) |

Q3 | Q2 | Q1 | Q4 | Q3 | Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||||||||||||

Capital Metrics: |

|||||||||||||||||||||||||||||||||||||||||||||||

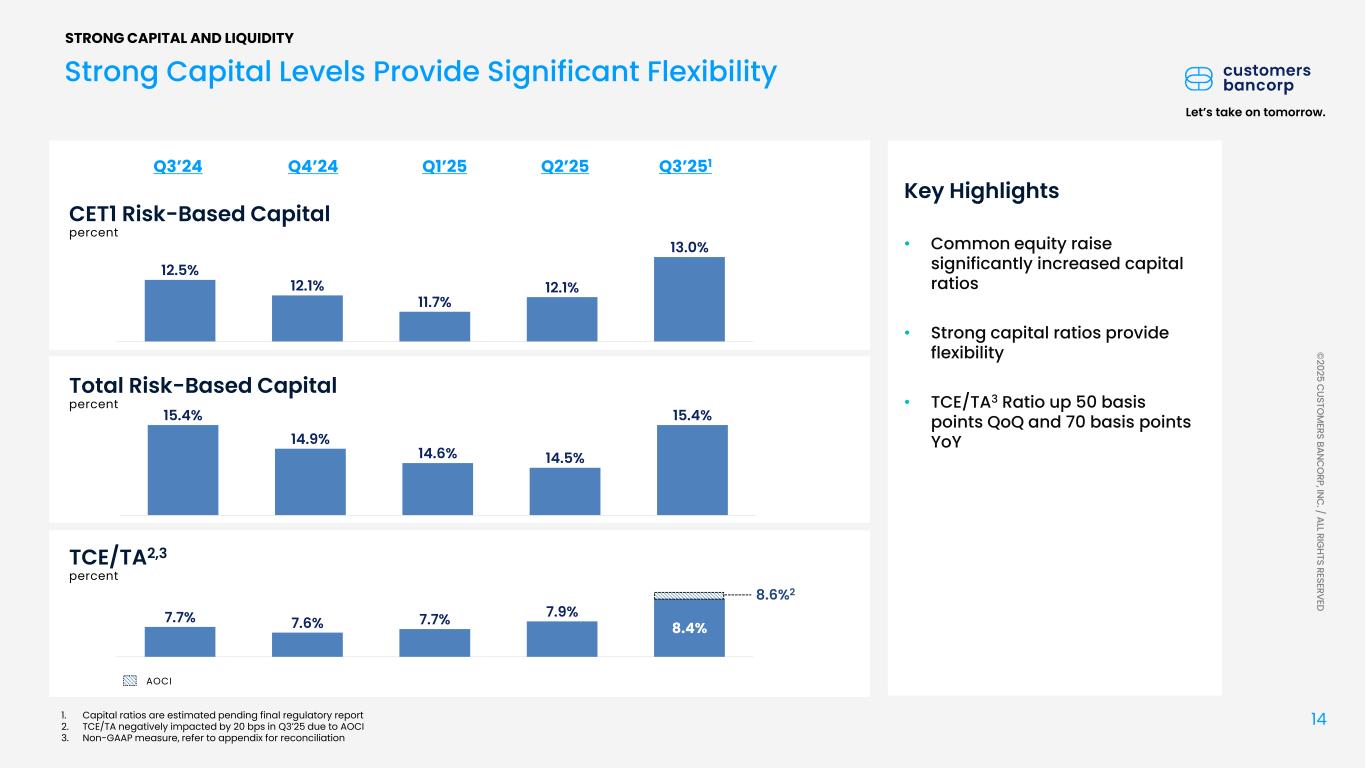

Common equity to total assets |

8.4 | % | 7.9 | % | 7.7 | % | 7.6 | % | 7.8 | % | 8.4 | % | 7.8 | % | |||||||||||||||||||||||||||||||||

Tangible common equity to tangible assets (1) |

8.4 | % | 7.9 | % | 7.7 | % | 7.6 | % | 7.7 | % | 8.4 | % | 7.7 | % | |||||||||||||||||||||||||||||||||

Common equity Tier 1 capital ratio (2) |

13.0 | % | 12.05 | % | 11.72 | % | 12.09 | % | 12.46 | % | 13.0 | % | 12.46 | % | |||||||||||||||||||||||||||||||||

Total risk based capital ratio (2) |

15.4 | % | 14.49 | % | 14.61 | % | 14.88 | % | 15.36 | % | 15.4 | % | 15.36 | % | |||||||||||||||||||||||||||||||||

Customers Bank Capital Ratios (2): |

|||||||||||||||||||||||||||||||||||||||||||||||

| Common equity Tier 1 capital to risk-weighted assets | 13.3 | % | 13.00 | % | 12.40 | % | 12.96 | % | 13.64 | % | 13.3 | % | 13.64 | % | |||||||||||||||||||||||||||||||||

| Total capital to risk-weighted assets | 14.6 | % | 14.43 | % | 13.92 | % | 14.34 | % | 15.06 | % | 14.6 | % | 15.06 | % | |||||||||||||||||||||||||||||||||

| Tier 1 capital to average assets (leverage ratio) | 8.8 | % | 8.86 | % | 8.43 | % | 8.65 | % | 9.08 | % | 8.8 | % | 9.08 | % | |||||||||||||||||||||||||||||||||

Share amounts: |

|||||||||||||||||||||||||||||||||||||||||||||||

| Average shares outstanding - basic | 32,340,813 | 31,585,390 | 31,447,623 | 31,346,920 | 31,567,797 | 31,794,547 | 31,563,660 | ||||||||||||||||||||||||||||||||||||||||

| Average shares outstanding - diluted | 33,460,055 | 32,374,061 | 32,490,572 | 32,557,621 | 32,766,488 | 32,778,447 | 32,773,365 | ||||||||||||||||||||||||||||||||||||||||

Shares outstanding |

34,163,506 | 31,606,934 | 31,479,132 | 31,346,507 | 31,342,107 | 34,163,506 | 31,342,107 | ||||||||||||||||||||||||||||||||||||||||

(1) Customers’ reasons for the use of these non-GAAP measures and a detailed reconciliation between the non-GAAP measures and the comparable GAAP amounts are included at the end of this document. |

|||||||||||||||||||||||||||||||||||||||||||||||

(2) Regulatory capital ratios are estimated for Q3 2025 and actual for the remaining periods. In accordance with regulatory capital rules, Customers elected to apply the CECL capital transition provisions which delayed the effects of CECL on regulatory capital for two years until January 1, 2022, followed by a three-year transition period. The cumulative CECL capital transition impact as of December 31, 2021 which amounted to $61.6 million was phased in at 25% per year beginning on January 1, 2022 through December 31, 2024. As of September 30, 2025, our regulatory capital ratios reflected the full effect of CECL on regulatory capital. |

|||||||||||||||||||||||||||||||||||||||||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS - UNAUDITED | |||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| Q3 | Q2 | Q1 | Q4 | Q3 | September 30, | ||||||||||||||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | 2025 | 2024 | |||||||||||||||||||||||||||||||||||

| Interest income: | |||||||||||||||||||||||||||||||||||||||||

| Loans and leases | $ | 272,131 | $ | 246,869 | $ | 231,008 | $ | 230,534 | $ | 228,659 | $ | 750,008 | $ | 670,923 | |||||||||||||||||||||||||||

| Investment securities | 36,091 | 37,381 | 34,339 | 39,638 | 46,265 | 107,811 | 140,653 | ||||||||||||||||||||||||||||||||||

| Interest earning deposits | 49,639 | 39,972 | 42,914 | 48,147 | 44,372 | 132,525 | 142,695 | ||||||||||||||||||||||||||||||||||

| Loans held for sale | 1,589 | 1,806 | 4,761 | 9,447 | 10,907 | 8,156 | 36,626 | ||||||||||||||||||||||||||||||||||

| Other | 2,029 | 1,973 | 1,887 | 2,140 | 1,910 | 5,889 | 7,031 | ||||||||||||||||||||||||||||||||||

| Total interest income | 361,479 | 328,001 | 314,909 | 329,906 | 332,113 | 1,004,389 | 997,928 | ||||||||||||||||||||||||||||||||||

| Interest expense: | |||||||||||||||||||||||||||||||||||||||||

| Deposits | 141,983 | 134,045 | 131,308 | 144,974 | 155,829 | 407,336 | 458,338 | ||||||||||||||||||||||||||||||||||

| FHLB advances | 12,945 | 12,717 | 11,801 | 12,595 | 12,590 | 37,463 | 39,512 | ||||||||||||||||||||||||||||||||||

| Subordinated debt | 3,251 | 3,229 | 3,212 | 3,349 | 3,537 | 9,692 | 8,960 | ||||||||||||||||||||||||||||||||||

| Other borrowings | 1,388 | 1,307 | 1,142 | 1,167 | 1,612 | 3,837 | 4,535 | ||||||||||||||||||||||||||||||||||

| Total interest expense | 159,567 | 151,298 | 147,463 | 162,085 | 173,568 | 458,328 | 511,345 | ||||||||||||||||||||||||||||||||||

| Net interest income | 201,912 | 176,703 | 167,446 | 167,821 | 158,545 | 546,061 | 486,583 | ||||||||||||||||||||||||||||||||||

| Provision for credit losses | 26,543 | 20,781 | 28,297 | 21,194 | 17,066 | 75,621 | 52,257 | ||||||||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 175,369 | 155,922 | 139,149 | 146,627 | 141,479 | 470,440 | 434,326 | ||||||||||||||||||||||||||||||||||

| Non-interest income: | |||||||||||||||||||||||||||||||||||||||||

| Commercial lease income | 11,536 | 11,056 | 10,668 | 10,604 | 10,093 | 33,260 | 30,058 | ||||||||||||||||||||||||||||||||||

| Loan fees | 11,443 | 9,106 | 7,235 | 8,639 | 8,011 | 27,784 | 18,524 | ||||||||||||||||||||||||||||||||||

| Bank-owned life insurance | 2,165 | 2,249 | 4,660 | 2,125 | 2,049 | 9,074 | 7,317 | ||||||||||||||||||||||||||||||||||

| Mortgage finance transactional fees | 1,298 | 1,175 | 933 | 1,010 | 1,087 | 3,406 | 3,091 | ||||||||||||||||||||||||||||||||||

| Net gain (loss) on sale of loans and leases | — | — | 2 | (852) | (14,548) | 2 | (14,776) | ||||||||||||||||||||||||||||||||||

| Net gain (loss) on sale of investment securities | 186 | (1,797) | — | (26,260) | — | (1,611) | (749) | ||||||||||||||||||||||||||||||||||

| Impairment loss on debt securities | — | — | (51,319) | — | — | (51,319) | — | ||||||||||||||||||||||||||||||||||

| Unrealized gain on equity method investments | — | — | — | 389 | — | — | 11,041 | ||||||||||||||||||||||||||||||||||

| Other | 3,563 | 7,817 | 3,331 | 3,954 | 1,865 | 14,711 | 6,319 | ||||||||||||||||||||||||||||||||||

| Total non-interest income (loss) | 30,191 | 29,606 | (24,490) | (391) | 8,557 | 35,307 | 60,825 | ||||||||||||||||||||||||||||||||||

| Non-interest expense: | |||||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 48,723 | 45,848 | 42,674 | 47,147 | 47,717 | 137,245 | 128,689 | ||||||||||||||||||||||||||||||||||

| Technology, communication and bank operations | 10,415 | 10,382 | 11,312 | 13,435 | 13,588 | 32,109 | 51,719 | ||||||||||||||||||||||||||||||||||

| Commercial lease depreciation | 9,463 | 8,743 | 8,463 | 8,933 | 7,811 | 26,669 | 23,610 | ||||||||||||||||||||||||||||||||||

| Professional services | 12,281 | 13,850 | 11,857 | 13,473 | 9,048 | 37,988 | 21,505 | ||||||||||||||||||||||||||||||||||

| Loan servicing | 4,167 | 4,053 | 4,630 | 4,584 | 3,778 | 12,850 | 11,325 | ||||||||||||||||||||||||||||||||||

| Occupancy | 4,370 | 3,551 | 3,412 | 3,335 | 2,987 | 11,333 | 8,454 | ||||||||||||||||||||||||||||||||||

| FDIC assessments, non-income taxes and regulatory fees | 8,505 | 11,906 | 11,750 | 10,077 | 7,902 | 32,161 | 31,607 | ||||||||||||||||||||||||||||||||||

| Advertising and promotion | 636 | 461 | 528 | 1,645 | 908 | 1,625 | 2,844 | ||||||||||||||||||||||||||||||||||

| Other | 6,657 | 7,832 | 8,145 | 7,746 | 10,279 | 22,634 | 26,886 | ||||||||||||||||||||||||||||||||||

| Total non-interest expense | 105,217 | 106,626 | 102,771 | 110,375 | 104,018 | 314,614 | 306,639 | ||||||||||||||||||||||||||||||||||

| Income before income tax expense (benefit) | 100,343 | 78,902 | 11,888 | 35,861 | 46,018 | 191,133 | 188,512 | ||||||||||||||||||||||||||||||||||

| Income tax expense (benefit) | 24,598 | 17,963 | (1,024) | 8,946 | (725) | 41,537 | 33,958 | ||||||||||||||||||||||||||||||||||

| Net income | 75,745 | 60,939 | 12,912 | 26,915 | 46,743 | 149,596 | 154,554 | ||||||||||||||||||||||||||||||||||

| Preferred stock dividends | 2,019 | 3,185 | 3,389 | 3,649 | 3,806 | 8,593 | 11,391 | ||||||||||||||||||||||||||||||||||

| Loss on redemption of preferred stock | — | 1,908 | — | — | — | 1,908 | — | ||||||||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 73,726 | $ | 55,846 | $ | 9,523 | $ | 23,266 | $ | 42,937 | $ | 139,095 | $ | 143,163 | |||||||||||||||||||||||||||

| Basic earnings per common share | $ | 2.28 | $ | 1.77 | $ | 0.30 | $ | 0.74 | $ | 1.36 | $ | 4.37 | $ | 4.54 | |||||||||||||||||||||||||||

| Diluted earnings per common share | 2.20 | 1.73 | 0.29 | 0.71 | 1.31 | 4.24 | 4.37 | ||||||||||||||||||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

CONSOLIDATED BALANCE SHEET - UNAUDITED | |||||||||||||||||||||||||||||

(Dollars in thousands) | |||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | |||||||||||||||||||||||||

ASSETS |

|||||||||||||||||||||||||||||

| Cash and due from banks | $ | 57,951 | $ | 72,986 | $ | 62,146 | $ | 56,787 | $ | 39,429 | |||||||||||||||||||

| Interest earning deposits | 4,127,688 | 3,430,525 | 3,366,544 | 3,729,144 | 3,048,593 | ||||||||||||||||||||||||

| Cash and cash equivalents | 4,185,639 | 3,503,511 | 3,428,690 | 3,785,931 | 3,088,022 | ||||||||||||||||||||||||

| Investment securities, at fair value | 2,010,820 | 1,877,406 | 2,057,555 | 2,019,694 | 2,412,069 | ||||||||||||||||||||||||

| Investment securities held to maturity | 801,324 | 853,126 | 938,161 | 991,937 | 1,064,437 | ||||||||||||||||||||||||

| Loans held for sale | 30,897 | 32,963 | 37,529 | 204,794 | 275,420 | ||||||||||||||||||||||||

| Loans and leases receivable | 14,673,636 | 13,719,829 | 13,555,820 | 13,127,634 | 12,527,283 | ||||||||||||||||||||||||

| Loans receivable, mortgage finance, at fair value | 1,486,978 | 1,536,254 | 1,366,460 | 1,321,128 | 1,250,413 | ||||||||||||||||||||||||

| Loans receivable, installment, at fair value | 111,636 | 123,354 | 138,159 | — | — | ||||||||||||||||||||||||

| Allowance for credit losses on loans and leases | (151,809) | (147,418) | (141,076) | (136,775) | (133,158) | ||||||||||||||||||||||||

| Total loans and leases receivable, net of allowance for credit losses on loans and leases | 16,120,441 | 15,232,019 | 14,919,363 | 14,311,987 | 13,644,538 | ||||||||||||||||||||||||

| FHLB, Federal Reserve Bank, and other restricted stock | 103,290 | 100,590 | 96,758 | 96,214 | 95,035 | ||||||||||||||||||||||||

| Accrued interest receivable | 106,379 | 101,481 | 105,800 | 108,351 | 115,588 | ||||||||||||||||||||||||

| Bank premises and equipment, net | 15,340 | 5,978 | 6,653 | 6,668 | 6,730 | ||||||||||||||||||||||||

| Bank-owned life insurance | 303,212 | 300,747 | 298,551 | 297,641 | 295,531 | ||||||||||||||||||||||||

| Other real estate owned | 12,432 | 12,306 | — | — | — | ||||||||||||||||||||||||

| Goodwill and other intangibles | 3,629 | 3,629 | 3,629 | 3,629 | 3,629 | ||||||||||||||||||||||||

| Other assets | 566,760 | 527,044 | 530,355 | 481,395 | 455,083 | ||||||||||||||||||||||||

| Total assets | $ | 24,260,163 | $ | 22,550,800 | $ | 22,423,044 | $ | 22,308,241 | $ | 21,456,082 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||

| Demand, non-interest bearing deposits | $ | 6,380,879 | $ | 5,481,065 | $ | 5,552,605 | $ | 5,608,288 | $ | 4,670,809 | |||||||||||||||||||

| Interest bearing deposits | 14,024,144 | 13,494,953 | 13,380,320 | 13,238,173 | 13,398,580 | ||||||||||||||||||||||||

| Total deposits | 20,405,023 | 18,976,018 | 18,932,925 | 18,846,461 | 18,069,389 | ||||||||||||||||||||||||

| FHLB advances | 1,195,437 | 1,195,377 | 1,133,456 | 1,128,352 | 1,117,229 | ||||||||||||||||||||||||

| Other borrowings | 99,173 | 99,138 | 99,103 | 99,068 | 99,033 | ||||||||||||||||||||||||

| Subordinated debt | 182,718 | 182,649 | 182,579 | 182,509 | 182,439 | ||||||||||||||||||||||||

| Accrued interest payable and other liabilities | 251,753 | 234,060 | 210,421 | 215,168 | 186,812 | ||||||||||||||||||||||||

| Total liabilities | 22,134,104 | 20,687,242 | 20,558,484 | 20,471,558 | 19,654,902 | ||||||||||||||||||||||||

| Preferred stock | 82,201 | 82,201 | 137,794 | 137,794 | 137,794 | ||||||||||||||||||||||||

| Common stock | 36,161 | 36,123 | 35,995 | 35,758 | 35,734 | ||||||||||||||||||||||||

| Additional paid in capital | 662,252 | 572,473 | 570,172 | 575,333 | 571,609 | ||||||||||||||||||||||||

| Retained earnings | 1,465,106 | 1,391,380 | 1,335,534 | 1,326,011 | 1,302,745 | ||||||||||||||||||||||||

| Accumulated other comprehensive income (loss), net | (51,089) | (71,325) | (67,641) | (96,560) | (106,082) | ||||||||||||||||||||||||

| Treasury stock, at cost | (68,572) | (147,294) | (147,294) | (141,653) | (140,620) | ||||||||||||||||||||||||

| Total shareholders’ equity | 2,126,059 | 1,863,558 | 1,864,560 | 1,836,683 | 1,801,180 | ||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 24,260,163 | $ | 22,550,800 | $ | 22,423,044 | $ | 22,308,241 | $ | 21,456,082 | |||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE BALANCE SHEET / NET INTEREST MARGIN - UNAUDITED | |||||||||||||||||||||||||||||||||||||||||||||||||||||

(Dollars in thousands) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2025 | June 30, 2025 | September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest Income or Expense | Average Yield or Cost (%) |

Average Balance | Interest Income or Expense | Average Yield or Cost (%) | Average Balance | Interest Income or Expense | Average Yield or Cost (%) | |||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest earning deposits | $ | 4,409,220 | $ | 49,639 | 4.47% | $ | 3,565,168 | $ | 39,972 | 4.50% | $ | 3,224,940 | $ | 44,372 | 5.47% | ||||||||||||||||||||||||||||||||||||||

Investment securities (1) |

2,931,351 | 36,091 | 4.88% | 2,890,878 | 37,381 | 5.19% | 3,706,974 | 46,265 | 4.97% | ||||||||||||||||||||||||||||||||||||||||||||

| Loans and leases: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial & industrial: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Specialized lending loans and leases (2) |

7,317,299 | 136,652 | 7.41% | 6,785,684 | 126,854 | 7.50% | 5,805,389 | 124,667 | 8.54% | ||||||||||||||||||||||||||||||||||||||||||||

Other commercial & industrial loans (2) |

1,492,155 | 35,475 | 9.43% | 1,484,528 | 25,862 | 6.99% | 1,533,057 | 24,654 | 6.40% | ||||||||||||||||||||||||||||||||||||||||||||

| Mortgage finance loans | 1,478,871 | 18,454 | 4.95% | 1,501,484 | 18,349 | 4.90% | 1,267,656 | 17,723 | 5.56% | ||||||||||||||||||||||||||||||||||||||||||||

| Multifamily loans | 2,306,373 | 25,931 | 4.46% | 2,317,381 | 25,281 | 4.38% | 2,071,340 | 21,147 | 4.06% | ||||||||||||||||||||||||||||||||||||||||||||

| Non-owner occupied commercial real estate loans | 1,635,937 | 24,148 | 5.86% | 1,581,087 | 23,003 | 5.84% | 1,411,533 | 21,065 | 5.94% | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgages | 551,436 | 6,647 | 4.78% | 537,008 | 6,344 | 4.74% | 525,285 | 6,082 | 4.61% | ||||||||||||||||||||||||||||||||||||||||||||

| Installment loans | 938,890 | 26,413 | 11.16% | 879,972 | 22,982 | 10.48% | 1,029,812 | 24,228 | 9.36% | ||||||||||||||||||||||||||||||||||||||||||||

Total loans and leases (3) |

15,720,961 | 273,720 | 6.91% | 15,087,144 | 248,675 | 6.61% | 13,644,072 | 239,566 | 6.99% | ||||||||||||||||||||||||||||||||||||||||||||

| Other interest-earning assets | 140,011 | 2,029 | 5.75% | 133,824 | 1,973 | 5.91% | 118,914 | 1,910 | 6.39% | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 23,201,543 | 361,479 | 6.19% | 21,677,014 | 328,001 | 6.07% | 20,694,900 | 332,113 | 6.39% | ||||||||||||||||||||||||||||||||||||||||||||

| Non-interest-earning assets | 729,180 | 685,975 | 535,504 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 23,930,723 | $ | 22,362,989 | $ | 21,230,404 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest checking accounts | $ | 4,983,168 | $ | 48,105 | 3.83% | $ | 4,935,587 | $ | 47,245 | 3.84% | $ | 5,787,026 | $ | 65,554 | 4.51% | ||||||||||||||||||||||||||||||||||||||

| Money market deposit accounts | 4,360,446 | 42,980 | 3.91% | 4,137,035 | 40,397 | 3.92% | 3,676,994 | 42,128 | 4.56% | ||||||||||||||||||||||||||||||||||||||||||||

| Other savings accounts | 1,485,652 | 14,724 | 3.93% | 1,325,639 | 12,767 | 3.86% | 1,563,970 | 18,426 | 4.69% | ||||||||||||||||||||||||||||||||||||||||||||

| Certificates of deposit | 3,108,831 | 36,174 | 4.62% | 2,852,645 | 33,636 | 4.73% | 2,339,937 | 29,721 | 5.05% | ||||||||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits (4) |

13,938,097 | 141,983 | 4.04% | 13,250,906 | 134,045 | 4.06% | 13,367,927 | 155,829 | 4.64% | ||||||||||||||||||||||||||||||||||||||||||||

| Borrowings | 1,429,981 | 17,584 | 4.88% | 1,417,370 | 17,253 | 4.88% | 1,334,905 | 17,739 | 5.29% | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 15,368,078 | 159,567 | 4.12% | 14,668,276 | 151,298 | 4.14% | 14,702,832 | 173,568 | 4.70% | ||||||||||||||||||||||||||||||||||||||||||||

Non-interest-bearing deposits (4) |

6,362,360 | 5,593,581 | 4,557,815 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total deposits and borrowings | 21,730,438 | 2.91% | 20,261,857 | 2.99% | 19,260,647 | 3.59% | |||||||||||||||||||||||||||||||||||||||||||||||

| Other non-interest-bearing liabilities | 239,969 | 221,465 | 195,722 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 21,970,407 | 20,483,322 | 19,456,369 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,960,316 | 1,879,667 | 1,774,035 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 23,930,723 | $ | 22,362,989 | $ | 21,230,404 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income | 201,912 | 176,703 | 158,545 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax-equivalent adjustment | 360 | 366 | 392 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest earnings | $ | 202,272 | $ | 177,069 | $ | 158,937 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest spread | 3.27% | 3.07% | 2.80% | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Net interest margin | 3.46% | 3.27% | 3.05% | ||||||||||||||||||||||||||||||||||||||||||||||||||

Net interest margin tax equivalent (5) |

3.46% | 3.27% | 3.06% | ||||||||||||||||||||||||||||||||||||||||||||||||||

(1) For presentation in this table, average balances and the corresponding average yields for investment securities are based upon historical cost, adjusted for amortization of premiums and accretion of discounts. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Includes owner occupied commercial real estate loans. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

(3) Includes non-accrual loans, the effect of which is to reduce the yield earned on loans and leases, and deferred loan fees. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

(4) Total costs of deposits (including interest bearing and non-interest bearing) were 2.77%, 2.85% and 3.46% for the three months ended September 30, 2025, June 30, 2025 and September 30, 2024, respectively. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

(5) Tax-equivalent basis, using an estimated marginal tax rate of 26% for the three months ended September 30, 2025, June 30, 2025 and September 30, 2024, presented to approximate interest income as a taxable asset. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||

| AVERAGE BALANCE SHEET / NET INTEREST MARGIN - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||||||||

(Dollars in thousands) |

|||||||||||||||||||||||||||||||||||

| Nine Months Ended | |||||||||||||||||||||||||||||||||||

| September 30, 2025 | September 30, 2024 | ||||||||||||||||||||||||||||||||||

Average Balance |

Interest Income or Expense | Average Yield or Cost (%) | Average Balance | Interest Income or Expense | Average Yield or Cost (%) | ||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest earning deposits | $ | 3,946,022 | $ | 132,525 | 4.49% | $ | 3,471,011 | $ | 142,695 | 5.49% | |||||||||||||||||||||||||

Investment securities (1) |

2,973,600 | 107,811 | 4.85% | 3,736,770 | 140,653 | 5.03% | |||||||||||||||||||||||||||||

| Loans and leases: | |||||||||||||||||||||||||||||||||||

| Commercial & industrial: | |||||||||||||||||||||||||||||||||||

Specialized lending loans and leases (2) |

6,862,095 | 384,457 | 7.49% | 5,507,963 | 361,234 | 8.76% | |||||||||||||||||||||||||||||

Other commercial & industrial loans (2) |

1,506,324 | 85,270 | 7.57% | 1,575,815 | 76,487 | 6.48% | |||||||||||||||||||||||||||||

| Mortgage finance loans | 1,411,814 | 51,555 | 4.88% | 1,151,173 | 45,640 | 5.30% | |||||||||||||||||||||||||||||

| Multifamily loans | 2,299,335 | 74,876 | 4.35% | 2,100,501 | 63,863 | 4.06% | |||||||||||||||||||||||||||||

| Non-owner occupied commercial real estate loans | 1,589,446 | 68,715 | 5.78% | 1,385,685 | 61,714 | 5.95% | |||||||||||||||||||||||||||||

| Residential mortgages | 539,762 | 19,219 | 4.76% | 522,876 | 17,745 | 4.53% | |||||||||||||||||||||||||||||

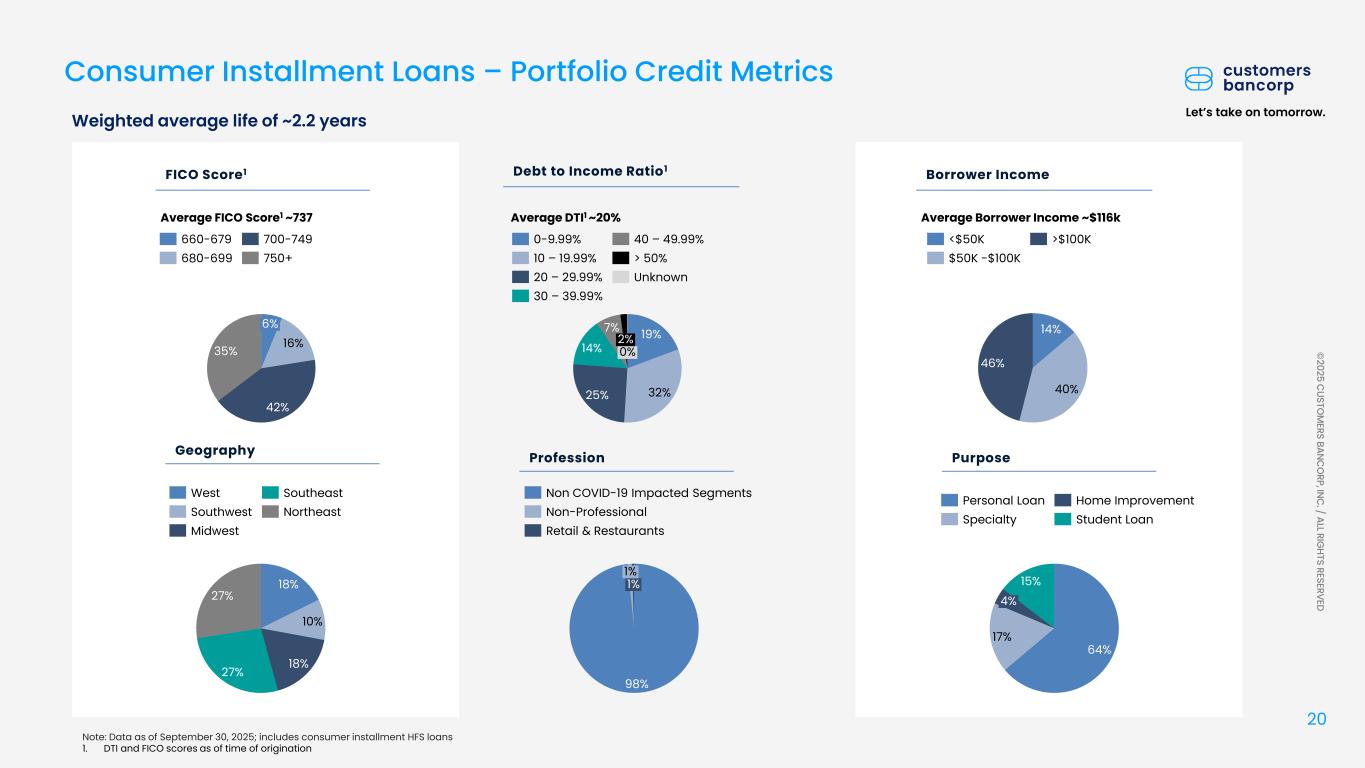

| Installment loans | 919,021 | 74,072 | 10.78% | 1,131,633 | 80,866 | 9.55% | |||||||||||||||||||||||||||||

Total loans and leases (3) |

15,127,797 | 758,164 | 6.70% | 13,375,646 | 707,549 | 7.07% | |||||||||||||||||||||||||||||

| Other interest-earning assets | 133,921 | 5,889 | 5.88% | 112,365 | 7,031 | 8.36% | |||||||||||||||||||||||||||||

| Total interest-earning assets | 22,181,340 | 1,004,389 | 6.05% | 20,695,792 | 997,928 | 6.44% | |||||||||||||||||||||||||||||

| Non-interest-earning assets | 694,136 | 487,991 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 22,875,476 | $ | 21,183,783 | |||||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||||||||

| Interest checking accounts | $ | 5,090,947 | $ | 145,253 | 3.81% | $ | 5,682,240 | $ | 191,132 | 4.49% | |||||||||||||||||||||||||

| Money market deposit accounts | 4,128,528 | 121,144 | 3.92% | 3,419,880 | 117,106 | 4.57% | |||||||||||||||||||||||||||||

| Other savings accounts | 1,322,135 | 38,182 | 3.86% | 1,708,625 | 61,008 | 4.77% | |||||||||||||||||||||||||||||

| Certificates of deposit | 2,905,047 | 102,757 | 4.73% | 2,374,982 | 89,092 | 5.01% | |||||||||||||||||||||||||||||

Total interest-bearing deposits (4) |

13,446,657 | 407,336 | 4.05% | 13,185,727 | 458,338 | 4.64% | |||||||||||||||||||||||||||||

| Borrowings | 1,398,401 | 50,992 | 4.88% | 1,431,520 | 53,007 | 4.95% | |||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 14,845,058 | 458,328 | 4.13% | 14,617,247 | 511,345 | 4.67% | |||||||||||||||||||||||||||||

Non-interest-bearing deposits (4) |

5,891,249 | 4,626,580 | |||||||||||||||||||||||||||||||||

| Total deposits and borrowings | 20,736,307 | 2.95% | 19,243,827 | 3.55% | |||||||||||||||||||||||||||||||

| Other non-interest-bearing liabilities | 235,938 | 221,278 | |||||||||||||||||||||||||||||||||

| Total liabilities | 20,972,245 | 19,465,105 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,903,231 | 1,718,678 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 22,875,476 | $ | 21,183,783 | |||||||||||||||||||||||||||||||

| Net interest income | 546,061 | 486,583 | |||||||||||||||||||||||||||||||||

| Tax-equivalent adjustment | 1,089 | 1,179 | |||||||||||||||||||||||||||||||||

| Net interest earnings | $ | 547,150 | $ | 487,762 | |||||||||||||||||||||||||||||||

| Interest spread | 3.10% | 2.89% | |||||||||||||||||||||||||||||||||

| Net interest margin | 3.29% | 3.15% | |||||||||||||||||||||||||||||||||

Net interest margin tax equivalent (5) |

3.30% | 3.16% | |||||||||||||||||||||||||||||||||

(1) For presentation in this table, average balances and the corresponding average yields for investment securities are based upon historical cost, adjusted for amortization of premiums and accretion of discounts. | |||||||||||||||||||||||||||||||||||

| (2) Includes owner occupied commercial real estate loans. | |||||||||||||||||||||||||||||||||||

(3) Includes non-accrual loans, the effect of which is to reduce the yield earned on loans and leases, and deferred loan fees. | |||||||||||||||||||||||||||||||||||

(4) Total costs of deposits (including interest bearing and non-interest bearing) were 2.82% and 3.44% for the nine months ended September 30, 2025 and 2024, respectively. | |||||||||||||||||||||||||||||||||||

(5) Tax-equivalent basis, using an estimated marginal tax rate of 26% for the nine months ended September 30, 2025 and 2024, presented to approximate interest income as a taxable asset. | |||||||||||||||||||||||||||||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| PERIOD END LOAN AND LEASE COMPOSITION - UNAUDITED | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | |||||||||||||||||||||||||

| Loans and leases held for investment | |||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial & industrial: | |||||||||||||||||||||||||||||

| Specialized lending | $ | 7,083,620 | $ | 6,454,661 | $ | 6,070,093 | $ | 5,842,420 | $ | 5,468,507 | |||||||||||||||||||

Other commercial & industrial |

1,056,173 | 1,037,684 | 1,062,933 | 1,062,631 | 1,087,222 | ||||||||||||||||||||||||

Mortgage finance |

1,577,038 | 1,625,764 | 1,477,896 | 1,440,847 | 1,367,617 | ||||||||||||||||||||||||

| Multifamily | 2,356,590 | 2,247,282 | 2,322,123 | 2,252,246 | 2,115,978 | ||||||||||||||||||||||||

| Commercial real estate owner occupied | 1,058,741 | 1,065,006 | 1,139,126 | 1,100,944 | 981,904 | ||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 1,582,332 | 1,497,385 | 1,438,906 | 1,359,130 | 1,326,591 | ||||||||||||||||||||||||

| Construction | 123,290 | 98,626 | 154,647 | 147,209 | 174,509 | ||||||||||||||||||||||||

| Total commercial loans and leases | 14,837,784 | 14,026,408 | 13,665,724 | 13,205,427 | 12,522,328 | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Residential | 514,544 | 520,570 | 496,772 | 496,559 | 500,786 | ||||||||||||||||||||||||

| Manufactured housing | 28,749 | 30,287 | 31,775 | 33,123 | 34,481 | ||||||||||||||||||||||||

| Installment: | |||||||||||||||||||||||||||||

| Personal | 570,768 | 457,728 | 493,276 | 463,854 | 453,739 | ||||||||||||||||||||||||

| Other | 320,405 | 344,444 | 372,892 | 249,799 | 266,362 | ||||||||||||||||||||||||

| Total installment loans | 891,173 | 802,172 | 866,168 | 713,653 | 720,101 | ||||||||||||||||||||||||

| Total consumer loans | 1,434,466 | 1,353,029 | 1,394,715 | 1,243,335 | 1,255,368 | ||||||||||||||||||||||||

| Total loans and leases held for investment | $ | 16,272,250 | $ | 15,379,437 | $ | 15,060,439 | $ | 14,448,762 | $ | 13,777,696 | |||||||||||||||||||

| Loans held for sale | |||||||||||||||||||||||||||||

| Commercial: | |||||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | $ | 4,700 | $ | — | $ | — | $ | — | $ | — | |||||||||||||||||||

| Total commercial loans and leases | 4,700 | — | — | — | — | ||||||||||||||||||||||||

| Consumer: | |||||||||||||||||||||||||||||

| Residential | 2,229 | 5,180 | 1,465 | 1,836 | 2,523 | ||||||||||||||||||||||||

| Installment: | |||||||||||||||||||||||||||||

| Personal | 23,728 | 27,682 | 36,000 | 40,903 | 55,799 | ||||||||||||||||||||||||

| Other | 240 | 101 | 64 | 162,055 | 217,098 | ||||||||||||||||||||||||

| Total installment loans | 23,968 | 27,783 | 36,064 | 202,958 | 272,897 | ||||||||||||||||||||||||

| Total consumer loans | 26,197 | 32,963 | 37,529 | 204,794 | 275,420 | ||||||||||||||||||||||||

| Total loans held for sale | $ | 30,897 | $ | 32,963 | $ | 37,529 | $ | 204,794 | $ | 275,420 | |||||||||||||||||||

| Total loans and leases portfolio | $ | 16,303,147 | $ | 15,412,400 | $ | 15,097,968 | $ | 14,653,556 | $ | 14,053,116 | |||||||||||||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

| PERIOD END DEPOSIT COMPOSITION - UNAUDITED | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | |||||||||||||||||||||||||

| Demand, non-interest bearing | $ | 6,380,879 | $ | 5,481,065 | $ | 5,552,605 | $ | 5,608,288 | $ | 4,670,809 | |||||||||||||||||||

| Demand, interest bearing | 5,050,437 | 4,912,839 | 5,137,961 | 5,553,698 | 5,606,500 | ||||||||||||||||||||||||

| Total demand deposits | 11,431,316 | 10,393,904 | 10,690,566 | 11,161,986 | 10,277,309 | ||||||||||||||||||||||||

| Savings | 1,554,533 | 1,375,072 | 1,327,854 | 1,131,819 | 1,399,968 | ||||||||||||||||||||||||

| Money market | 4,339,371 | 4,206,516 | 4,057,458 | 3,844,451 | 3,961,028 | ||||||||||||||||||||||||

| Time deposits | 3,079,803 | 3,000,526 | 2,857,047 | 2,708,205 | 2,431,084 | ||||||||||||||||||||||||

| Total deposits | $ | 20,405,023 | $ | 18,976,018 | $ | 18,932,925 | $ | 18,846,461 | $ | 18,069,389 | |||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

ASSET QUALITY - UNAUDITED | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of September 30, 2025 | As of June 30, 2025 | As of September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||

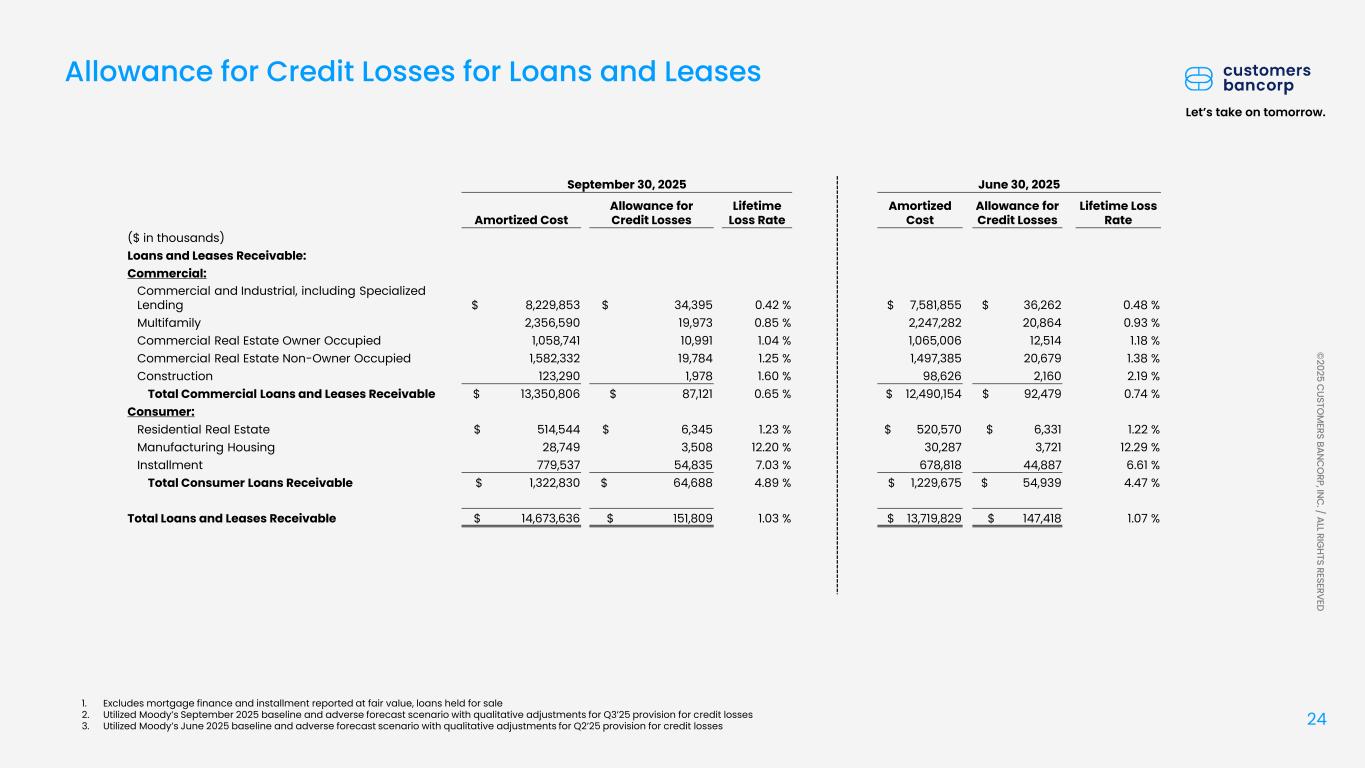

| Loan type | Total loans | Allowance for credit losses | Total reserves to total loans | Total loans | Allowance for credit losses | Total reserves to total loans | Total loans | Allowance for credit losses | Total reserves to total loans | ||||||||||||||||||||||||||||||||||||||||||||

Commercial: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Commercial & industrial, including specialized lending |

$ | 8,229,853 | $ | 34,395 | 0.42 | % | $ | 7,581,855 | $ | 36,262 | 0.48 | % | $ | 6,672,933 | $ | 25,191 | 0.38 | % | |||||||||||||||||||||||||||||||||||

| Multifamily | 2,356,590 | 19,973 | 0.85 | % | 2,247,282 | 20,864 | 0.93 | % | 2,115,978 | 18,090 | 0.85 | % | |||||||||||||||||||||||||||||||||||||||||

| Commercial real estate owner occupied | 1,058,741 | 10,991 | 1.04 | % | 1,065,006 | 12,514 | 1.18 | % | 981,904 | 10,913 | 1.11 | % | |||||||||||||||||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 1,582,332 | 19,784 | 1.25 | % | 1,497,385 | 20,679 | 1.38 | % | 1,326,591 | 17,303 | 1.30 | % | |||||||||||||||||||||||||||||||||||||||||

| Construction | 123,290 | 1,978 | 1.60 | % | 98,626 | 2,160 | 2.19 | % | 174,509 | 1,606 | 0.92 | % | |||||||||||||||||||||||||||||||||||||||||

| Total commercial loans and leases receivable | 13,350,806 | 87,121 | 0.65 | % | 12,490,154 | 92,479 | 0.74 | % | 11,271,915 | 73,103 | 0.65 | % | |||||||||||||||||||||||||||||||||||||||||

Consumer: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential | 514,544 | 6,345 | 1.23 | % | 520,570 | 6,331 | 1.22 | % | 500,786 | 5,838 | 1.17 | % | |||||||||||||||||||||||||||||||||||||||||

| Manufactured housing | 28,749 | 3,508 | 12.20 | % | 30,287 | 3,721 | 12.29 | % | 34,481 | 4,080 | 11.83 | % | |||||||||||||||||||||||||||||||||||||||||

| Installment | 779,537 | 54,835 | 7.03 | % | 678,818 | 44,887 | 6.61 | % | 720,101 | 50,137 | 6.96 | % | |||||||||||||||||||||||||||||||||||||||||

| Total consumer loans receivable | 1,322,830 | 64,688 | 4.89 | % | 1,229,675 | 54,939 | 4.47 | % | 1,255,368 | 60,055 | 4.78 | % | |||||||||||||||||||||||||||||||||||||||||

Loans and leases receivable held for investment |

14,673,636 | 151,809 | 1.03 | % | 13,719,829 | 147,418 | 1.07 | % | 12,527,283 | 133,158 | 1.06 | % | |||||||||||||||||||||||||||||||||||||||||

| Loans receivable, mortgage finance, at fair value | 1,486,978 | — | — | % | 1,536,254 | — | — | % | 1,250,413 | — | — | % | |||||||||||||||||||||||||||||||||||||||||

| Loans receivable, installment, at fair value | 111,636 | — | — | % | 123,354 | — | — | % | — | — | — | % | |||||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 30,897 | — | — | % | 32,963 | — | — | % | 275,420 | — | — | % | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases portfolio | $ | 16,303,147 | $ | 151,809 | 0.93 | % | $ | 15,412,400 | $ | 147,418 | 0.96 | % | $ | 14,053,116 | $ | 133,158 | 0.95 | % | |||||||||||||||||||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||||||||||||||

ASSET QUALITY - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of September 30, 2025 | As of June 30, 2025 | As of September 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Loan type | Non accrual /NPLs | Total NPLs to total loans | Total reserves to total NPLs | Non accrual /NPLs | Total NPLs to total loans | Total reserves to total NPLs | Non accrual /NPLs | Total NPLs to total loans | Total reserves to total NPLs | ||||||||||||||||||||||||||||||||||||||||||||

Commercial: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Commercial & industrial, including specialized lending |

$ | 4,430 | 0.05 | % | 776.41 | % | $ | 4,218 | 0.06 | % | 859.70 | % | $ | 4,615 | 0.07 | % | 545.85 | % | |||||||||||||||||||||||||||||||||||

| Multifamily | — | — | % | — | % | — | — | % | — | % | 11,834 | 0.56 | % | 152.86 | % | ||||||||||||||||||||||||||||||||||||||

| Commercial real estate owner occupied | 3,932 | 0.37 | % | 279.53 | % | 7,005 | 0.66 | % | 178.64 | % | 8,613 | 0.88 | % | 126.70 | % | ||||||||||||||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | — | — | % | — | % | 62 | 0.00 | % | 33353.23 | % | 763 | 0.06 | % | 2267.76 | % | ||||||||||||||||||||||||||||||||||||||

| Construction | — | — | % | — | % | — | — | % | — | % | — | — | % | — | % | ||||||||||||||||||||||||||||||||||||||

| Total commercial loans and leases receivable | 8,362 | 0.06 | % | 1041.87 | % | 11,285 | 0.09 | % | 819.49 | % | 25,825 | 0.23 | % | 283.07 | % | ||||||||||||||||||||||||||||||||||||||

Consumer: |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

| Residential | 7,631 | 1.48 | % | 83.15 | % | 8,234 | 1.58 | % | 76.89 | % | 7,997 | 1.60 | % | 73.00 | % | ||||||||||||||||||||||||||||||||||||||

| Manufactured housing | 1,315 | 4.57 | % | 266.77 | % | 1,608 | 5.31 | % | 231.41 | % | 1,869 | 5.42 | % | 218.30 | % | ||||||||||||||||||||||||||||||||||||||

| Installment | 4,225 | 0.54 | % | 1297.87 | % | 4,944 | 0.73 | % | 907.91 | % | 6,328 | 0.88 | % | 792.30 | % | ||||||||||||||||||||||||||||||||||||||

| Total consumer loans receivable | 13,171 | 1.00 | % | 491.14 | % | 14,786 | 1.20 | % | 371.56 | % | 16,194 | 1.29 | % | 370.85 | % | ||||||||||||||||||||||||||||||||||||||

| Loans and leases receivable | 21,533 | 0.15 | % | 705.01 | % | 26,071 | 0.19 | % | 565.45 | % | 42,019 | 0.34 | % | 316.90 | % | ||||||||||||||||||||||||||||||||||||||

| Loans receivable, mortgage finance, at fair value | — | — | % | — | % | — | — | % | — | % | — | — | % | — | % | ||||||||||||||||||||||||||||||||||||||

| Loans receivable, installment, at fair value | 1,872 | 1.68 | % | — | % | 1,961 | 1.59 | % | — | % | — | — | % | — | % | ||||||||||||||||||||||||||||||||||||||

| Loans held for sale | 5,016 | 16.23 | % | — | % | 411 | 1.25 | % | — | % | 5,307 | 1.93 | % | — | % | ||||||||||||||||||||||||||||||||||||||

| Total loans and leases portfolio | $ | 28,421 | 0.17 | % | 534.14 | % | $ | 28,443 | 0.18 | % | 518.29 | % | $ | 47,326 | 0.34 | % | 281.36 | % | |||||||||||||||||||||||||||||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||||||||||||||

| NET CHARGE-OFFS/(RECOVERIES) - UNAUDITED | |||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||

| Q3 | Q2 | Q1 | Q4 | Q3 | Nine Months Ended September 30, | ||||||||||||||||||||||||||||||||||||

2025 |

2025 |

2025 |

2024 |

2024 |

2025 | 2024 | |||||||||||||||||||||||||||||||||||

Loan type |

|||||||||||||||||||||||||||||||||||||||||

| Commercial & industrial, including specialized lending | $ | 2,180 | $ | 3,871 | $ | 3,231 | $ | 3,653 | $ | 5,056 | $ | 9,282 | $ | 14,393 | |||||||||||||||||||||||||||

| Multifamily | — | — | 3,834 | — | 2,167 | 3,834 | 4,073 | ||||||||||||||||||||||||||||||||||

| Commercial real estate owner occupied | 335 | 411 | 16 | 339 | 4 | 762 | 26 | ||||||||||||||||||||||||||||||||||

| Commercial real estate non-owner occupied | 3,073 | — | — | 145 | — | 3,073 | — | ||||||||||||||||||||||||||||||||||

| Construction | — | (3) | (3) | — | (3) | (6) | (10) | ||||||||||||||||||||||||||||||||||

| Residential | 25 | (4) | — | (18) | (21) | 21 | (23) | ||||||||||||||||||||||||||||||||||

| Installment | 9,758 | 8,840 | 10,066 | 10,493 | 9,841 | 28,664 | 35,264 | ||||||||||||||||||||||||||||||||||

| Total net charge-offs (recoveries) from loans held for investment | $ | 15,371 | $ | 13,115 | $ | 17,144 | $ | 14,612 | $ | 17,044 | $ | 45,630 | $ | 53,723 | |||||||||||||||||||||||||||

| CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

LOANS AND LEASES RISK RATINGS - UNAUDITED | |||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| September 30, | June 30, | March 31, | December 31, | September 30, | |||||||||||||||||||||||||

| 2025 | 2025 | 2025 | 2024 | 2024 | |||||||||||||||||||||||||

Loans and leases (1) risk ratings: |

|||||||||||||||||||||||||||||

Commercial loans and leases |

|||||||||||||||||||||||||||||

| Pass | $ | 12,927,467 | $ | 12,047,656 | $ | 11,815,403 | $ | 11,403,930 | $ | 10,844,500 | |||||||||||||||||||

Special Mention |

187,794 | 174,587 | 189,155 | 175,055 | 178,026 | ||||||||||||||||||||||||

Substandard |

230,079 | 256,849 | 276,018 | 282,563 | 218,921 | ||||||||||||||||||||||||

| Total commercial loans and leases | 13,345,340 | 12,479,092 | 12,280,576 | 11,861,548 | 11,241,447 | ||||||||||||||||||||||||

| Consumer loans | |||||||||||||||||||||||||||||

| Performing | 1,308,987 | 1,209,377 | 1,242,753 | 1,227,359 | 1,240,581 | ||||||||||||||||||||||||

| Non-performing | 13,843 | 20,298 | 13,803 | 15,976 | 14,787 | ||||||||||||||||||||||||

| Total consumer loans | 1,322,830 | 1,229,675 | 1,256,556 | 1,243,335 | 1,255,368 | ||||||||||||||||||||||||

Loans and leases receivable (1) |

$ | 14,668,170 | $ | 13,708,767 | $ | 13,537,132 | $ | 13,104,883 | $ | 12,496,815 | |||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP MEASURES - UNAUDITED | |||||||||||||||||||||||||||||

|

Core Earnings and Adjusted Core Earnings - Customers Bancorp

|

Nine Months Ended

September 30,

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | USD |

Per share |

USD |

Per share |

USD |

Per share |

USD |

Per share |

USD |

Per share |

USD |

Per share |

USD |

Per share |

||||||||||||||||||||||||||||||||||||||||||||||||

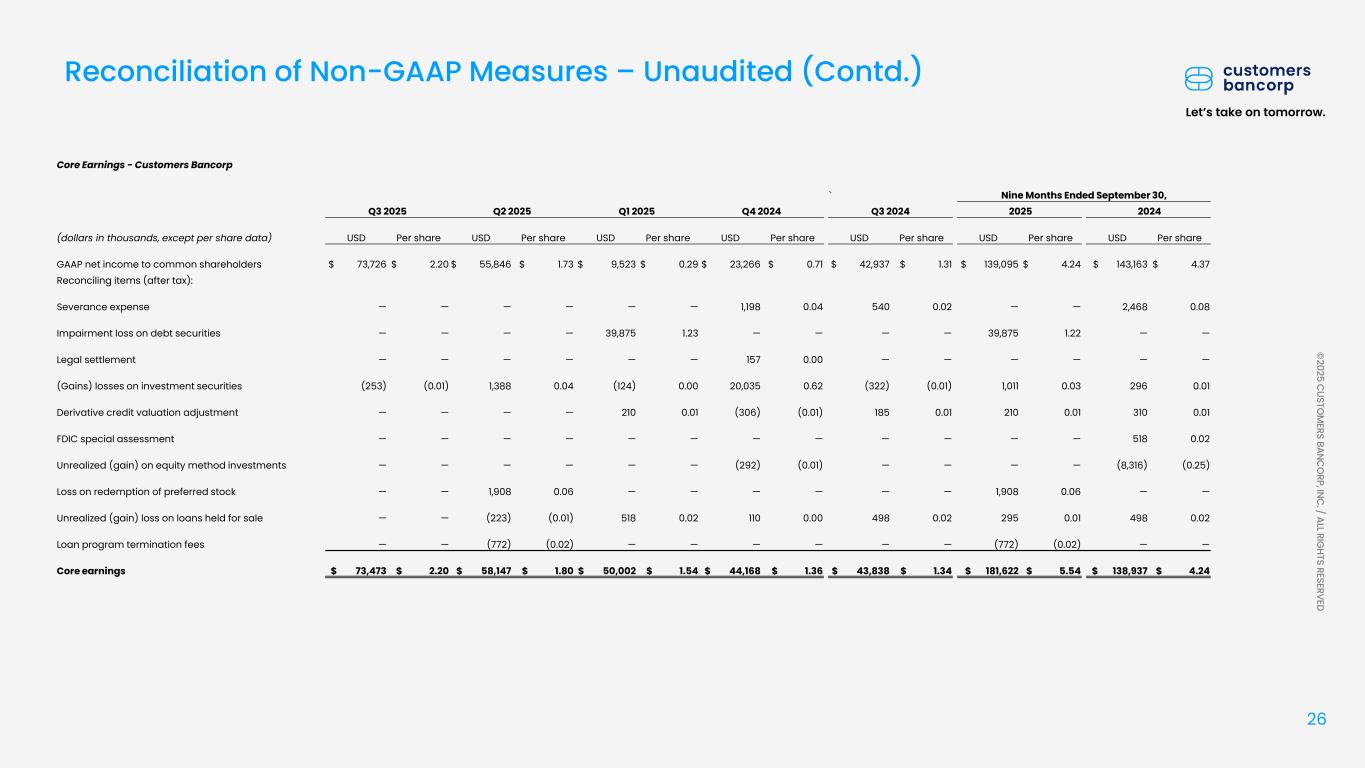

| GAAP net income to common shareholders | $ | 73,726 | $ | 2.20 | $ | 55,846 | $ | 1.73 | $ | 9,523 | $ | 0.29 | $ | 23,266 | $ | 0.71 | $ | 42,937 | $ | 1.31 | $ | 139,095 | $ | 4.24 | $ | 143,163 | $ | 4.37 | ||||||||||||||||||||||||||||||||||

| Reconciling items (after tax): | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Severance expense | — | — | — | — | — | — | 1,198 | 0.04 | 540 | 0.02 | — | — | 2,468 | 0.08 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Impairment loss on debt securities | — | — | — | — | 39,875 | 1.23 | — | — | — | — | 39,875 | 1.22 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Legal settlement | — | — | — | — | — | — | 157 | 0.00 | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| (Gains) losses on investment securities | (253) | (0.01) | 1,388 | 0.04 | (124) | 0.00 | 20,035 | 0.62 | (322) | (0.01) | 1,011 | 0.03 | 296 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Derivative credit valuation adjustment | — | — | — | — | 210 | 0.01 | (306) | (0.01) | 185 | 0.01 | 210 | 0.01 | 310 | 0.01 | ||||||||||||||||||||||||||||||||||||||||||||||||

| FDIC special assessment | — | — | — | — | — | — | — | — | — | — | — | — | 518 | 0.02 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized (gain) on equity method investments | — | — | — | — | — | — | (292) | (0.01) | — | — | — | — | (8,316) | (0.25) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loss on redemption of preferred stock | — | — | 1,908 | 0.06 | — | — | — | — | — | — | 1,908 | 0.06 | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Unrealized (gain) loss on loans held for sale | — | — | (223) | (0.01) | 518 | 0.02 | 110 | 0.00 | 498 | 0.02 | 295 | 0.01 | 498 | 0.02 | ||||||||||||||||||||||||||||||||||||||||||||||||

| Loan program termination fees | — | — | (772) | (0.02) | — | — | — | — | — | — | (772) | (0.02) | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||

| Core earnings | $ | 73,473 | $ | 2.20 | $ | 58,147 | $ | 1.80 | $ | 50,002 | $ | 1.54 | $ | 44,168 | $ | 1.36 | $ | 43,838 | $ | 1.34 | $ | 181,622 | $ | 5.54 | $ | 138,937 | $ | 4.24 | ||||||||||||||||||||||||||||||||||

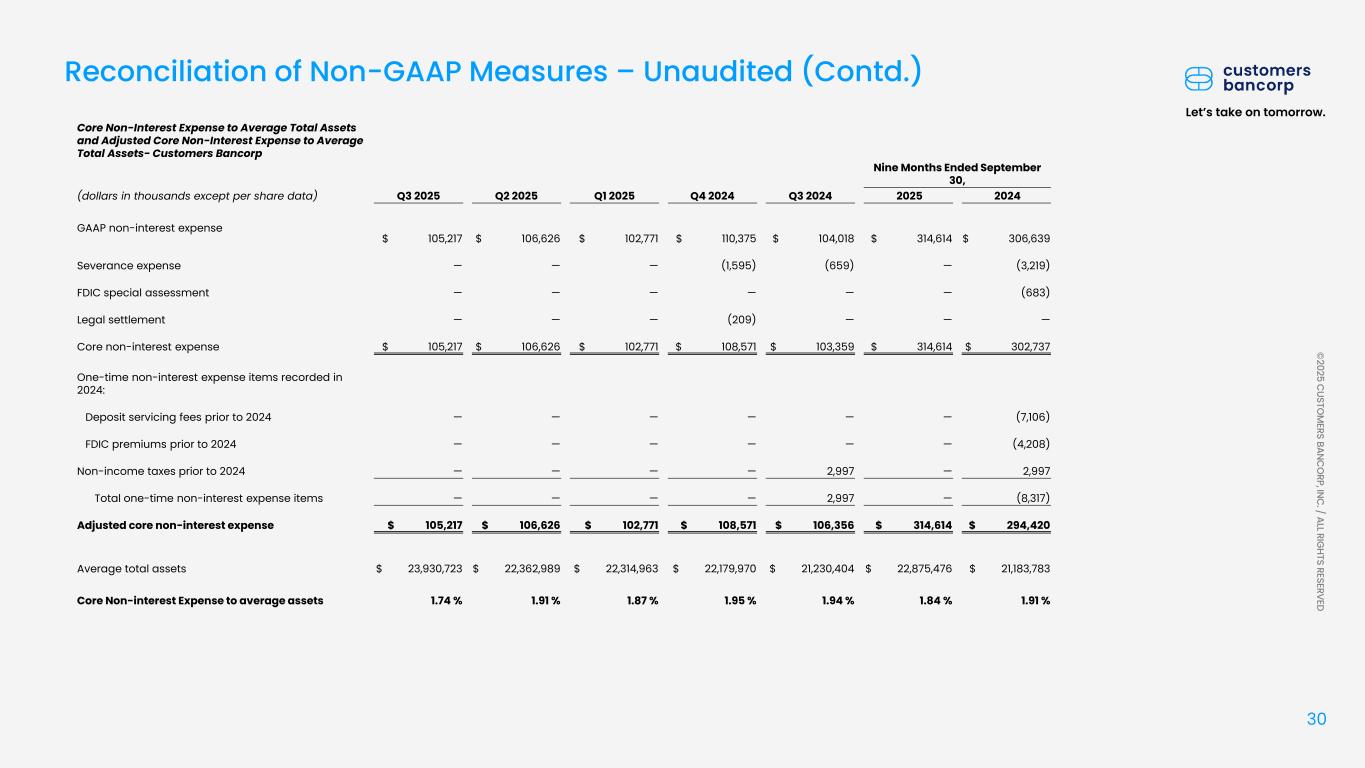

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP MEASURES - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

Core Return on Average Assets and Adjusted Core Return on Average Assets - Customers Bancorp |

Nine Months Ended

September 30,

|

||||||||||||||||||||||||||||||||||||||||

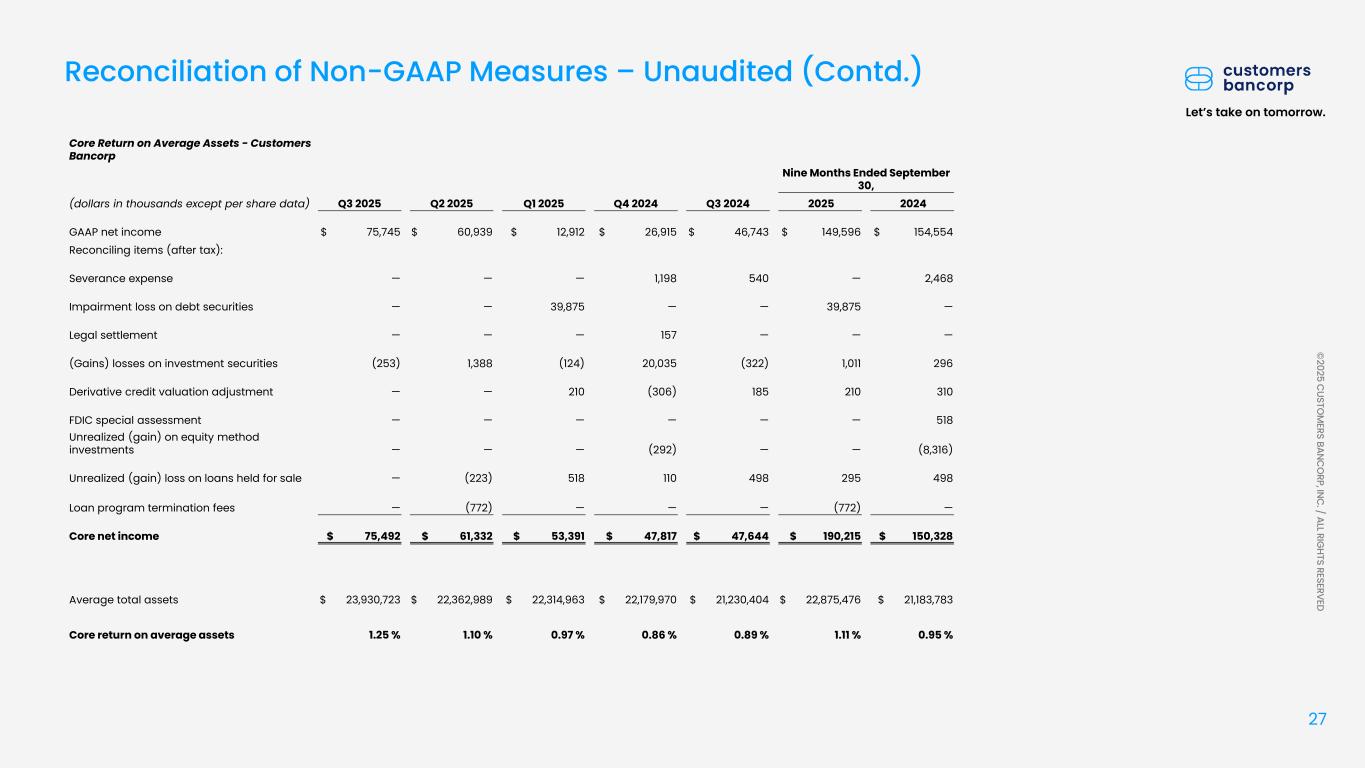

| (Dollars in thousands, except per share data) | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||||

| GAAP net income | $ | 75,745 | $ | 60,939 | $ | 12,912 | $ | 26,915 | $ | 46,743 | $ | 149,596 | $ | 154,554 | |||||||||||||||||||||||||||

| Reconciling items (after tax): | |||||||||||||||||||||||||||||||||||||||||

| Severance expense | — | — | — | 1,198 | 540 | — | 2,468 | ||||||||||||||||||||||||||||||||||

| Impairment loss on debt securities | — | — | 39,875 | — | — | 39,875 | — | ||||||||||||||||||||||||||||||||||

| Legal settlement | — | — | — | 157 | — | — | — | ||||||||||||||||||||||||||||||||||

| (Gains) losses on investment securities | (253) | 1,388 | (124) | 20,035 | (322) | 1,011 | 296 | ||||||||||||||||||||||||||||||||||

| Derivative credit valuation adjustment | — | — | 210 | (306) | 185 | 210 | 310 | ||||||||||||||||||||||||||||||||||

| FDIC special assessment | — | — | — | — | — | — | 518 | ||||||||||||||||||||||||||||||||||

| Unrealized (gain) on equity method investments | — | — | — | (292) | — | — | (8,316) | ||||||||||||||||||||||||||||||||||

| Unrealized (gain) loss on loans held for sale | — | (223) | 518 | 110 | 498 | 295 | 498 | ||||||||||||||||||||||||||||||||||

| Loan program termination fees | — | (772) | — | — | — | (772) | — | ||||||||||||||||||||||||||||||||||

Core net income |

$ | 75,492 | $ | 61,332 | $ | 53,391 | $ | 47,817 | $ | 47,644 | $ | 190,215 | $ | 150,328 | |||||||||||||||||||||||||||

Average total assets |

$ | 23,930,723 | $ | 22,362,989 | $ | 22,314,963 | $ | 22,179,970 | $ | 21,230,404 | $ | 22,875,476 | $ | 21,183,783 | |||||||||||||||||||||||||||

| Core return on average assets | 1.25 | % | 1.10 | % | 0.97 | % | 0.86 | % | 0.89 | % | 1.11 | % | 0.95 | % | |||||||||||||||||||||||||||

Core Return on Average Common Equity and Adjusted Core Return on Average Common Equity - Customers Bancorp |

Nine Months Ended

September 30,

|

||||||||||||||||||||||||||||||||||||||||

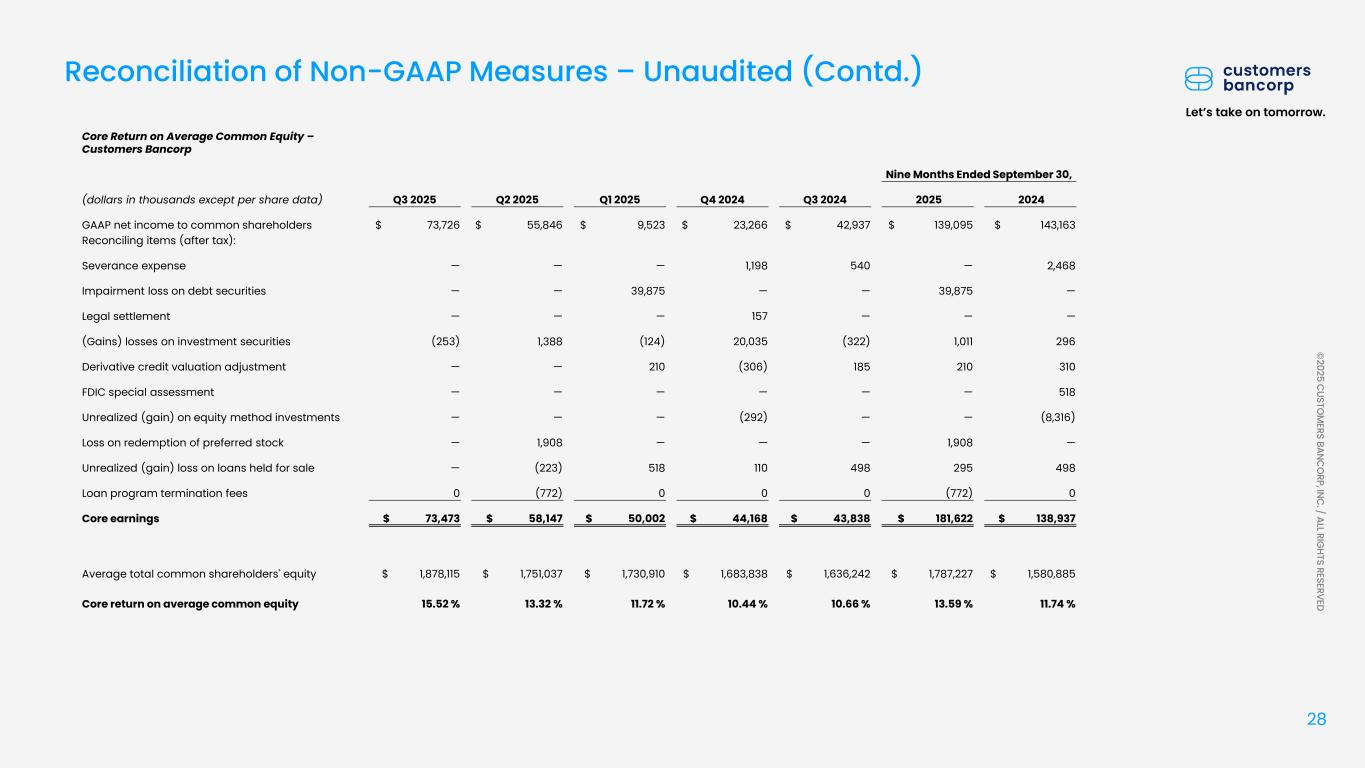

| (Dollars in thousands, except per share data) | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||||

| GAAP net income to common shareholders | $ | 73,726 | $ | 55,846 | $ | 9,523 | $ | 23,266 | $ | 42,937 | $ | 139,095 | $ | 143,163 | |||||||||||||||||||||||||||

| Reconciling items (after tax): | |||||||||||||||||||||||||||||||||||||||||

| Severance expense | — | — | — | 1,198 | 540 | — | 2,468 | ||||||||||||||||||||||||||||||||||

| Impairment loss on debt securities | — | — | 39,875 | — | — | 39,875 | — | ||||||||||||||||||||||||||||||||||

| Legal settlement | — | — | — | 157 | — | — | — | ||||||||||||||||||||||||||||||||||

| (Gains) losses on investment securities | (253) | 1,388 | (124) | 20,035 | (322) | 1,011 | 296 | ||||||||||||||||||||||||||||||||||

| Derivative credit valuation adjustment | — | — | 210 | (306) | 185 | 210 | 310 | ||||||||||||||||||||||||||||||||||

| FDIC special assessment | — | — | — | — | — | — | 518 | ||||||||||||||||||||||||||||||||||

| Unrealized (gain) on equity method investments | — | — | — | (292) | — | — | (8,316) | ||||||||||||||||||||||||||||||||||

| Loss on redemption of preferred stock | — | 1,908 | — | — | — | 1,908 | — | ||||||||||||||||||||||||||||||||||

| Unrealized (gain) loss on loans held for sale | — | (223) | 518 | 110 | 498 | 295 | 498 | ||||||||||||||||||||||||||||||||||

| Loan program termination fees | — | (772) | — | — | — | (772) | — | ||||||||||||||||||||||||||||||||||

| Core earnings | $ | 73,473 | $ | 58,147 | $ | 50,002 | $ | 44,168 | $ | 43,838 | $ | 181,622 | $ | 138,937 | |||||||||||||||||||||||||||

Average total common shareholders’ equity |

$ | 1,878,115 | $ | 1,751,037 | $ | 1,730,910 | $ | 1,683,838 | $ | 1,636,242 | $ | 1,787,227 | $ | 1,580,885 | |||||||||||||||||||||||||||

| Core return on average common equity | 15.52 | % | 13.32 | % | 11.72 | % | 10.44 | % | 10.66 | % | 13.59 | % | 11.74 | % | |||||||||||||||||||||||||||

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP MEASURES - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

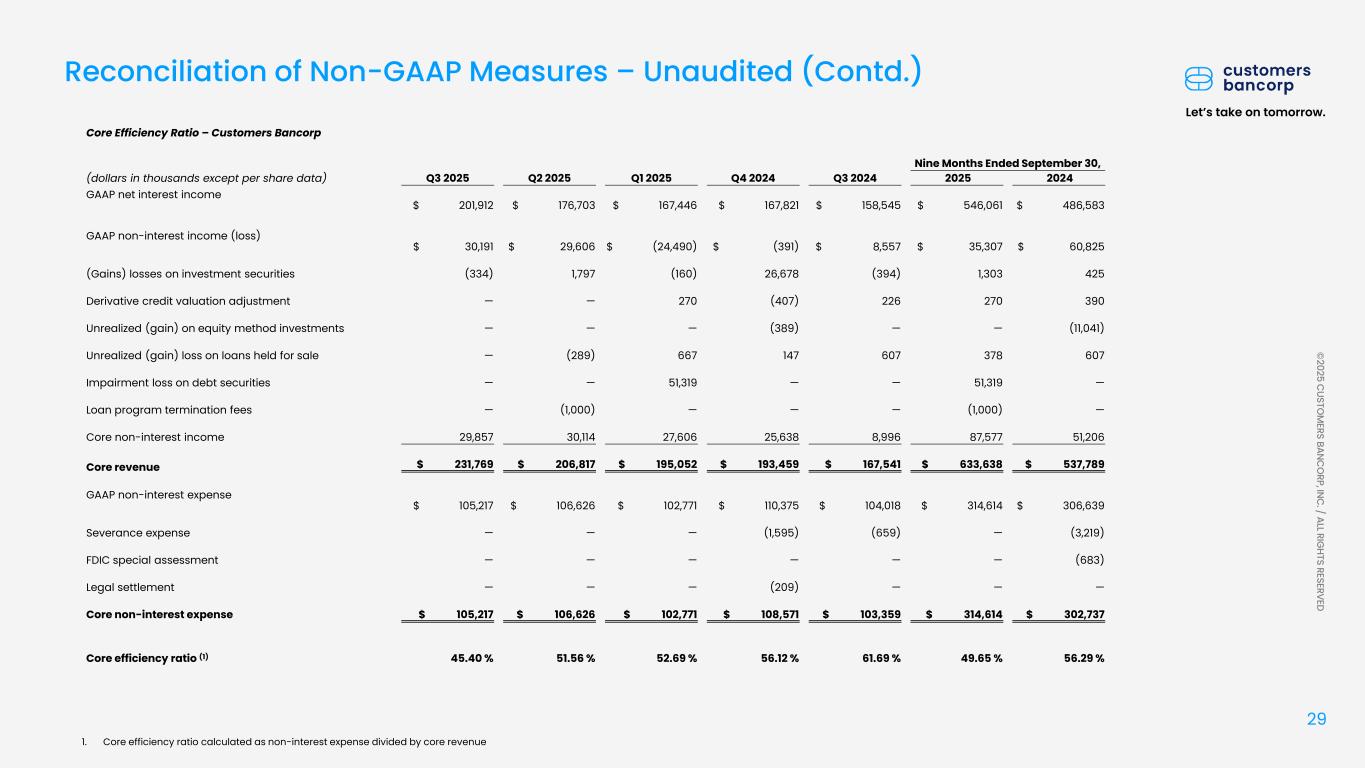

Core Efficiency Ratio and Adjusted Core Efficiency Ratio - Customers Bancorp |

Nine Months Ended

September 30,

|

||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | 2025 | 2024 | ||||||||||||||||||||||||||||||||||

| GAAP net interest income | $ | 201,912 | $ | 176,703 | $ | 167,446 | $ | 167,821 | $ | 158,545 | $ | 546,061 | $ | 486,583 | |||||||||||||||||||||||||||

GAAP non-interest income (loss) |

$ | 30,191 | $ | 29,606 | $ | (24,490) | $ | (391) | $ | 8,557 | $ | 35,307 | $ | 60,825 | |||||||||||||||||||||||||||

| (Gains) losses on investment securities | (334) | 1,797 | (160) | 26,678 | (394) | 1,303 | 425 | ||||||||||||||||||||||||||||||||||

| Derivative credit valuation adjustment | — | — | 270 | (407) | 226 | 270 | 390 | ||||||||||||||||||||||||||||||||||

| Unrealized (gain) on equity method investments | — | — | — | (389) | — | — | (11,041) | ||||||||||||||||||||||||||||||||||

| Unrealized (gain) loss on loans held for sale | — | (289) | 667 | 147 | 607 | 378 | 607 | ||||||||||||||||||||||||||||||||||

| Impairment loss on debt securities | — | — | 51,319 | — | — | 51,319 | — | ||||||||||||||||||||||||||||||||||

| Loan program termination fees | — | (1,000) | — | — | — | (1,000) | — | ||||||||||||||||||||||||||||||||||

| Core non-interest income | 29,857 | 30,114 | 27,606 | 25,638 | 8,996 | 87,577 | 51,206 | ||||||||||||||||||||||||||||||||||

| Core revenue | $ | 231,769 | $ | 206,817 | $ | 195,052 | $ | 193,459 | $ | 167,541 | $ | 633,638 | $ | 537,789 | |||||||||||||||||||||||||||

| GAAP non-interest expense | $ | 105,217 | $ | 106,626 | $ | 102,771 | $ | 110,375 | $ | 104,018 | $ | 314,614 | $ | 306,639 | |||||||||||||||||||||||||||

| Severance expense | — | — | — | (1,595) | (659) | — | (3,219) | ||||||||||||||||||||||||||||||||||

| FDIC special assessment | — | — | — | — | — | — | (683) | ||||||||||||||||||||||||||||||||||

| Legal settlement | — | — | — | (209) | — | — | — | ||||||||||||||||||||||||||||||||||

| Core non-interest expense | $ | 105,217 | $ | 106,626 | $ | 102,771 | $ | 108,571 | $ | 103,359 | $ | 314,614 | $ | 302,737 | |||||||||||||||||||||||||||

Core efficiency ratio (1) |

45.40 | % | 51.56 | % | 52.69 | % | 56.12 | % | 61.69 | % | 49.65 | % | 56.29 | % | |||||||||||||||||||||||||||

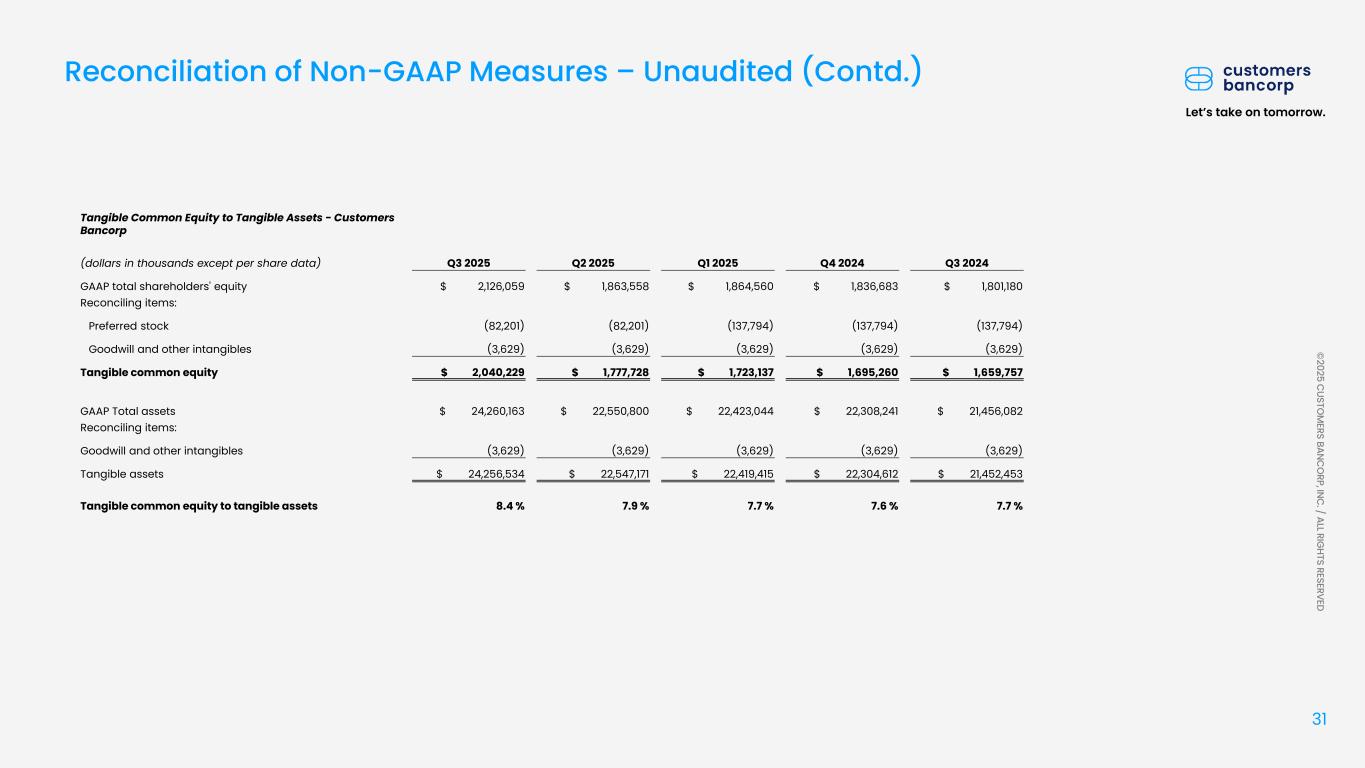

| Tangible Common Equity to Tangible Assets - Customers Bancorp | |||||||||||||||||||||||||||||

| (Dollars in thousands, except per share data) | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | ||||||||||||||||||||||||

GAAP total shareholders’ equity |

$ | 2,126,059 | $ | 1,863,558 | $ | 1,864,560 | $ | 1,836,683 | $ | 1,801,180 | |||||||||||||||||||

| Reconciling items: | |||||||||||||||||||||||||||||

| Preferred stock | (82,201) | (82,201) | (137,794) | (137,794) | (137,794) | ||||||||||||||||||||||||

| Goodwill and other intangibles | (3,629) | (3,629) | (3,629) | (3,629) | (3,629) | ||||||||||||||||||||||||

| Tangible common equity | $ | 2,040,229 | $ | 1,777,728 | $ | 1,723,137 | $ | 1,695,260 | $ | 1,659,757 | |||||||||||||||||||

| GAAP total assets | $ | 24,260,163 | $ | 22,550,800 | $ | 22,423,044 | $ | 22,308,241 | $ | 21,456,082 | |||||||||||||||||||

| Reconciling items: | |||||||||||||||||||||||||||||

| Goodwill and other intangibles | (3,629) | (3,629) | (3,629) | (3,629) | (3,629) | ||||||||||||||||||||||||

| Tangible assets | $ | 24,256,534 | $ | 22,547,171 | $ | 22,419,415 | $ | 22,304,612 | $ | 21,452,453 | |||||||||||||||||||

| Tangible common equity to tangible assets | 8.4 | % | 7.9 | % | 7.7 | % | 7.6 | % | 7.7 | % | |||||||||||||||||||

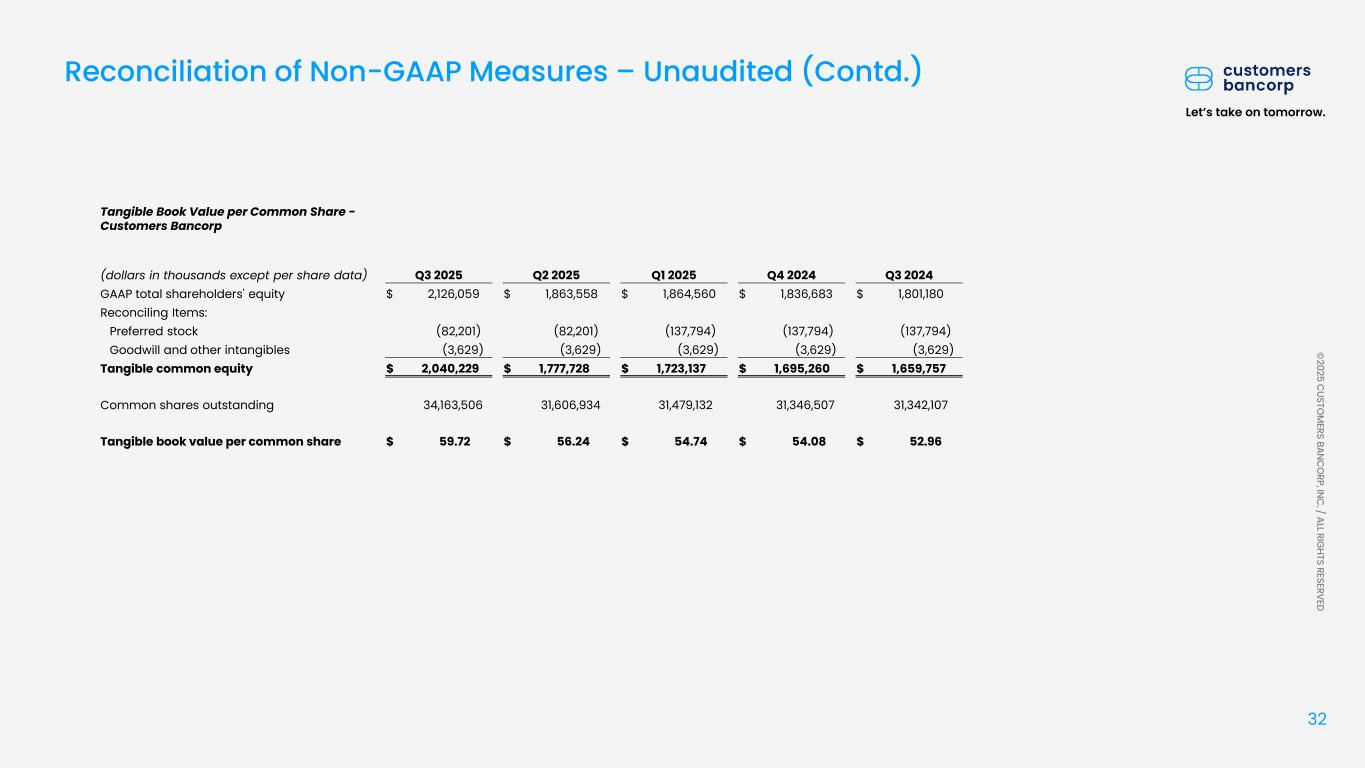

CUSTOMERS BANCORP, INC. AND SUBSIDIARIES | |||||||||||||||||||||||||||||

RECONCILIATION OF GAAP TO NON-GAAP MEASURES - UNAUDITED (CONTINUED) | |||||||||||||||||||||||||||||

(Dollars in thousands, except per share data) | |||||||||||||||||||||||||||||

| Tangible Book Value per Common Share - Customers Bancorp | |||||||||||||||||||||||||||||

| (Dollars in thousands, except share and per share data) | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 | ||||||||||||||||||||||||

GAAP total shareholders’ equity |

$ | 2,126,059 | $ | 1,863,558 | $ | 1,864,560 | $ | 1,836,683 | $ | 1,801,180 | |||||||||||||||||||

| Reconciling Items: | |||||||||||||||||||||||||||||

| Preferred stock | (82,201) | (82,201) | (137,794) | (137,794) | (137,794) | ||||||||||||||||||||||||

| Goodwill and other intangibles | (3,629) | (3,629) | (3,629) | (3,629) | (3,629) | ||||||||||||||||||||||||

| Tangible common equity | $ | 2,040,229 | $ | 1,777,728 | $ | 1,723,137 | $ | 1,695,260 | $ | 1,659,757 | |||||||||||||||||||

| Common shares outstanding | 34,163,506 | 31,606,934 | 31,479,132 | 31,346,507 | 31,342,107 | ||||||||||||||||||||||||

| Tangible book value per common share | $ | 59.72 | $ | 56.24 | $ | 54.74 | $ | 54.08 | $ | 52.96 | |||||||||||||||||||