00014792902023FYFALSEhttp://fasb.org/us-gaap/2023#AccountingStandardsUpdate202006MemberP7YP15Y0.03088042.0800014792902023-01-012023-12-3100014792902023-06-30iso4217:USD00014792902024-02-16xbrli:shares00014792902023-10-012023-12-3100014792902023-12-3100014792902022-12-31iso4217:USDxbrli:shares0001479290us-gaap:ProductMember2023-01-012023-12-310001479290us-gaap:ProductMember2022-01-012022-12-310001479290us-gaap:ProductMember2021-01-012021-12-310001479290us-gaap:ServiceMember2023-01-012023-12-310001479290us-gaap:ServiceMember2022-01-012022-12-310001479290us-gaap:ServiceMember2021-01-012021-12-310001479290rvnc:CollaborationRevenueMember2023-01-012023-12-310001479290rvnc:CollaborationRevenueMember2022-01-012022-12-310001479290rvnc:CollaborationRevenueMember2021-01-012021-12-3100014792902022-01-012022-12-3100014792902021-01-012021-12-310001479290us-gaap:CommonStockMember2020-12-310001479290us-gaap:AdditionalPaidInCapitalMember2020-12-310001479290us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001479290us-gaap:RetainedEarningsMember2020-12-3100014792902020-12-3100014792902020-01-012020-12-310001479290srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AdditionalPaidInCapitalMember2020-12-310001479290srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2020-12-310001479290srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001479290us-gaap:CommonStockMember2021-01-012021-12-310001479290us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001479290us-gaap:CommonStockMemberrvnc:AttheMarketOfferingMember2021-01-012021-12-310001479290us-gaap:AdditionalPaidInCapitalMemberrvnc:AttheMarketOfferingMember2021-01-012021-12-310001479290rvnc:AttheMarketOfferingMember2021-01-012021-12-310001479290us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001479290us-gaap:RetainedEarningsMember2021-01-012021-12-310001479290us-gaap:CommonStockMember2021-12-310001479290us-gaap:AdditionalPaidInCapitalMember2021-12-310001479290us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001479290us-gaap:RetainedEarningsMember2021-12-3100014792902021-12-310001479290us-gaap:CommonStockMember2022-01-012022-12-310001479290us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001479290us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001479290us-gaap:RetainedEarningsMember2022-01-012022-12-310001479290us-gaap:CommonStockMember2022-12-310001479290us-gaap:AdditionalPaidInCapitalMember2022-12-310001479290us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001479290us-gaap:RetainedEarningsMember2022-12-310001479290us-gaap:CommonStockMember2023-01-012023-12-310001479290us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001479290us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001479290us-gaap:RetainedEarningsMember2023-01-012023-12-310001479290us-gaap:CommonStockMember2023-12-310001479290us-gaap:AdditionalPaidInCapitalMember2023-12-310001479290us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001479290us-gaap:RetainedEarningsMember2023-12-310001479290rvnc:AtTheMarketOffering2022PlanMember2023-01-012023-12-310001479290srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-12-310001479290srt:ScenarioPreviouslyReportedMember2022-12-31rvnc:distributor0001479290us-gaap:LetterOfCreditMember2023-12-310001479290us-gaap:LetterOfCreditMember2022-12-310001479290us-gaap:VehiclesMember2023-12-310001479290us-gaap:ComputerEquipmentMember2023-12-310001479290rvnc:LabEquipmentAndFurnitureAndFixturesMember2023-12-310001479290rvnc:ManufacturingEquipmentMember2023-12-310001479290us-gaap:LeaseholdImprovementsMember2023-12-310001479290rvnc:ManufacturingEquipmentMember2022-12-310001479290rvnc:ServiceSegmentMember2023-09-012023-09-300001479290us-gaap:SoftwareDevelopmentMember2023-12-310001479290us-gaap:ProductMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001479290us-gaap:TransferredOverTimeMemberus-gaap:ProductMember2023-01-012023-12-310001479290us-gaap:ProductMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001479290us-gaap:TransferredOverTimeMemberus-gaap:ProductMember2022-01-012022-12-310001479290us-gaap:ProductMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001479290us-gaap:TransferredOverTimeMemberus-gaap:ProductMember2021-01-012021-12-310001479290us-gaap:ServiceMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001479290us-gaap:ServiceMemberus-gaap:TransferredOverTimeMember2023-01-012023-12-310001479290us-gaap:ServiceMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001479290us-gaap:ServiceMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310001479290us-gaap:ServiceMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001479290us-gaap:ServiceMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310001479290us-gaap:TransferredAtPointInTimeMemberrvnc:CollaborationRevenueMember2023-01-012023-12-310001479290us-gaap:TransferredOverTimeMemberrvnc:CollaborationRevenueMember2023-01-012023-12-310001479290us-gaap:TransferredAtPointInTimeMemberrvnc:CollaborationRevenueMember2022-01-012022-12-310001479290us-gaap:TransferredOverTimeMemberrvnc:CollaborationRevenueMember2022-01-012022-12-310001479290us-gaap:TransferredAtPointInTimeMemberrvnc:CollaborationRevenueMember2021-01-012021-12-310001479290us-gaap:TransferredOverTimeMemberrvnc:CollaborationRevenueMember2021-01-012021-12-310001479290us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310001479290us-gaap:TransferredOverTimeMember2023-01-012023-12-310001479290us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310001479290us-gaap:TransferredOverTimeMember2022-01-012022-12-310001479290us-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310001479290us-gaap:TransferredOverTimeMember2021-01-012021-12-310001479290rvnc:RHACollectionOfDermalFillersMember2023-01-012023-12-310001479290rvnc:RHACollectionOfDermalFillersMember2022-01-012022-12-310001479290rvnc:RHACollectionOfDermalFillersMember2021-01-012021-12-310001479290rvnc:DAXXIFYMember2023-01-012023-12-310001479290rvnc:DAXXIFYMember2022-01-012022-12-310001479290rvnc:DAXXIFYMember2021-01-012021-12-310001479290us-gaap:ProductMember2023-12-310001479290us-gaap:ProductMember2022-12-310001479290us-gaap:ServiceMember2023-12-310001479290us-gaap:ServiceMember2022-12-310001479290rvnc:ViatrisMember2023-12-310001479290rvnc:ViatrisMember2023-01-012023-12-310001479290rvnc:ViatrisMember2023-01-012023-12-310001479290rvnc:DevelopmentServicesMember2023-01-012023-12-310001479290rvnc:DevelopmentServicesMember2022-01-012022-12-310001479290rvnc:DevelopmentServicesMember2021-01-012021-12-310001479290rvnc:ShanghaiFosunPharmaceuticalIndustrialDevelopmentCo.Ltd.Member2023-12-310001479290rvnc:ShanghaiFosunPharmaceuticalIndustrialDevelopmentCo.Ltd.Member2023-01-012023-12-310001479290rvnc:ShanghaiFosunPharmaceuticalIndustrialDevelopmentCo.Ltd.Member2022-01-012022-12-310001479290rvnc:ShanghaiFosunPharmaceuticalIndustrialDevelopmentCo.Ltd.Member2021-01-012021-12-310001479290rvnc:ViatrisMember2023-12-310001479290rvnc:ViatrisMember2022-12-310001479290rvnc:ShanghaiFosunPharmaceuticalIndustrialDevelopmentCo.Ltd.Member2022-12-310001479290rvnc:CollaborationCustomersMember2023-12-310001479290rvnc:CollaborationCustomersMember2022-12-310001479290rvnc:ServiceSegmentMember2023-01-012023-12-310001479290rvnc:ServiceSegmentMember2023-12-310001479290rvnc:ServiceSegmentMemberrvnc:GoodwillImpairmentMember2023-01-012023-12-310001479290rvnc:ServiceSegmentMemberrvnc:IntangibleAssetImpairmentMember2023-01-012023-12-310001479290rvnc:ServiceSegmentMemberus-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001479290rvnc:ServiceSegmentMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001479290rvnc:FintechPlatformMember2022-12-310001479290rvnc:FintechPlatformMember2023-01-012023-12-310001479290rvnc:FintechPlatformMember2023-12-310001479290us-gaap:USTreasurySecuritiesMember2023-12-310001479290us-gaap:USTreasurySecuritiesMember2022-12-310001479290us-gaap:CommercialPaperMember2023-12-310001479290us-gaap:CommercialPaperMember2022-12-310001479290us-gaap:MoneyMarketFundsMember2023-12-310001479290us-gaap:MoneyMarketFundsMember2022-12-310001479290us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2023-12-310001479290us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMember2022-12-310001479290rvnc:CorporateBondMember2023-12-310001479290rvnc:CorporateBondMember2022-12-310001479290us-gaap:CashEquivalentsMember2023-12-310001479290us-gaap:CashEquivalentsMember2022-12-310001479290us-gaap:OtherCurrentAssetsMember2023-12-310001479290us-gaap:OtherCurrentAssetsMember2022-12-310001479290us-gaap:MeasurementInputDiscountRateMember2022-12-31xbrli:pure0001479290rvnc:ServiceSegmentMember2022-01-012022-12-310001479290rvnc:ProductSegmentMember2021-12-310001479290rvnc:ServiceSegmentMember2021-12-310001479290rvnc:ProductSegmentMember2022-01-012022-12-310001479290rvnc:ProductSegmentMember2022-12-310001479290rvnc:ServiceSegmentMember2022-12-310001479290rvnc:ProductSegmentMember2023-01-012023-12-310001479290rvnc:ProductSegmentMember2023-12-310001479290us-gaap:DistributionRightsMember2023-12-310001479290us-gaap:SoftwareDevelopmentMember2023-12-310001479290us-gaap:DevelopedTechnologyRightsMember2023-12-310001479290us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310001479290us-gaap:DevelopedTechnologyRightsMember2022-12-310001479290us-gaap:DistributionRightsMember2022-12-310001479290us-gaap:SoftwareDevelopmentMember2022-12-310001479290us-gaap:CustomerRelatedIntangibleAssetsMember2022-12-310001479290rvnc:OtherSoftwareMember2022-12-310001479290rvnc:DevelopedInProgressMember2022-12-310001479290us-gaap:DevelopedTechnologyRightsMember2022-01-012022-12-310001479290srt:RevisionOfPriorPeriodReclassificationAdjustmentMember2022-01-012022-12-31rvnc:option_to_extend_lease_term0001479290srt:MinimumMember2023-12-310001479290srt:MaximumMember2023-12-3100014792902017-03-012017-03-3100014792902022-05-3100014792902023-01-310001479290rvnc:ExpansionPremisesAndSecondExpansionPremisesMember2023-09-3000014792902021-04-012021-04-300001479290rvnc:PCISupplyAgreementMember2021-04-012021-04-300001479290rvnc:PCISupplyAgreementMember2023-12-310001479290us-gaap:ConvertibleDebtMemberrvnc:TwentyTwentySevenNotesMember2023-12-310001479290us-gaap:ConvertibleDebtMemberrvnc:TwentyTwentySevenNotesMember2022-12-310001479290us-gaap:ConvertibleDebtMember2023-12-310001479290us-gaap:ConvertibleDebtMember2022-12-310001479290us-gaap:ConvertibleDebtMemberrvnc:TwentyTwentySevenNotesMember2020-02-290001479290us-gaap:ConvertibleDebtMemberrvnc:TwentyTwentySevenNotesMember2020-02-012020-02-290001479290rvnc:DebtConversionTermsOneMemberus-gaap:ConvertibleDebtMemberrvnc:TwentyTwentySevenNotesMember2020-02-012020-02-29rvnc:trading_day0001479290rvnc:DebtConversionTermsTwoMemberus-gaap:ConvertibleDebtMemberrvnc:TwentyTwentySevenNotesMember2020-02-012020-02-29rvnc:businessDay00014792902020-02-012020-02-2900014792902020-02-2900014792902020-02-102020-02-100001479290rvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:NotesPayableOtherPayablesMember2022-03-310001479290rvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:NotesPayableOtherPayablesMember2023-08-300001479290rvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodTwoMemberus-gaap:NotesPayableOtherPayablesMember2023-08-310001479290rvnc:NotePurchaseAgreementMemberus-gaap:NotesPayableOtherPayablesMember2023-08-310001479290rvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:NotesPayableOtherPayablesMember2023-08-310001479290rvnc:NotePurchaseAgreementMembersrt:MaximumMemberus-gaap:NotesPayableOtherPayablesMember2023-08-310001479290rvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodThreeMemberus-gaap:NotesPayableOtherPayablesMember2022-06-300001479290rvnc:NotePurchaseAgreementMemberus-gaap:NotesPayableOtherPayablesMember2022-06-300001479290rvnc:NotePurchaseAgreementMemberrvnc:LondonInterbankOfferedRateLIBOR1Membersrt:MinimumMemberus-gaap:NotesPayableOtherPayablesMember2022-03-012022-03-310001479290rvnc:NotePurchaseAgreementMembersrt:MaximumMemberrvnc:LondonInterbankOfferedRateLIBOR1Memberus-gaap:NotesPayableOtherPayablesMember2022-03-012022-03-310001479290rvnc:DebtInstrumentPrincipalAmortizationPeriodOneMemberrvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:NotesPayableOtherPayablesMember2022-03-180001479290rvnc:DebtInstrumentPrincipalAmortizationPeriodTwoMemberrvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:NotesPayableOtherPayablesMember2022-03-180001479290rvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberus-gaap:NotesPayableOtherPayablesMemberrvnc:DebtInstrumentPrincipalAmortizationPeriodThreeMember2022-03-180001479290rvnc:NotePurchaseAgreementMemberus-gaap:DebtInstrumentRedemptionPeriodOneMemberrvnc:DebtInstrumentPrincipalAmortizationPeriodFourMemberus-gaap:NotesPayableOtherPayablesMember2022-03-180001479290us-gaap:NotesPayableOtherPayablesMemberrvnc:TwentyTwentySevenNotesMember2022-03-180001479290rvnc:NotePurchaseAgreementMemberus-gaap:NotesPayableOtherPayablesMember2022-03-180001479290rvnc:NotePurchaseAgreementMemberus-gaap:NotesPayableOtherPayablesMember2022-03-182022-03-180001479290us-gaap:ConvertibleDebtMemberrvnc:TwentyTwentySevenNotesMember2020-02-292020-02-29rvnc:equity_compensation_plan0001479290srt:WeightedAverageMemberus-gaap:EmployeeStockOptionMemberrvnc:TwoThousandAndFourteenInducementPlanMember2023-01-012023-12-310001479290us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMemberrvnc:TwoThousandAndFourteenInducementPlanMember2023-01-012023-12-310001479290us-gaap:ShareBasedCompensationAwardTrancheOneMemberrvnc:RestrictedStockAndRestrictedStockUnitsMemberrvnc:TwoThousandAndFourteenInducementPlanMember2023-01-012023-12-310001479290rvnc:RestrictedStockAndRestrictedStockUnitsMemberrvnc:TwoThousandAndFourteenInducementPlanMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-01-012023-12-310001479290rvnc:RestrictedStockAndRestrictedStockUnitsMemberrvnc:TwoThousandAndFourteenInducementPlanMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-01-012023-12-310001479290rvnc:TwoThousandAndFourteenEquityIncentivePlanMember2023-01-012023-12-310001479290rvnc:TwoThousandAndFourteenEquityIncentivePlanMember2023-01-010001479290us-gaap:StockCompensationPlanMemberrvnc:TwoThousandAndFourteenEquityIncentivePlanMember2023-01-012023-12-310001479290rvnc:StockAwardMemberrvnc:TwoThousandAndFourteenEquityIncentivePlanMember2023-01-012023-12-310001479290rvnc:TwoThousandAndFourteenEquityIncentivePlanMember2023-12-310001479290rvnc:TwoThousandAndFourteenEquityIncentivePlanMember2020-07-230001479290rvnc:TwoThousandAndFourteenInducementPlanMember2023-01-012023-12-310001479290rvnc:TwoThousandAndFourteenInducementPlanMember2023-12-310001479290rvnc:HintMDMemberrvnc:A2017EquityIncentivePlanHintMDPlanMember2020-07-230001479290rvnc:HintMDMemberrvnc:A2017EquityIncentivePlanHintMDPlanMember2023-01-012023-12-310001479290rvnc:HintMDMemberrvnc:A2017EquityIncentivePlanHintMDPlanMember2023-12-310001479290rvnc:TwoThousandAndFourteenEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2023-01-012023-12-310001479290rvnc:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2021-01-010001479290rvnc:TwoThousandAndFourteenEmployeeStockPurchasePlanMember2022-01-010001479290rvnc:TwoThousandAndFourteenEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2023-12-310001479290rvnc:RestrictedStockAndRestrictedStockUnitsMemberrvnc:UnvestedRestrictedStockAwardsMember2022-12-310001479290rvnc:RestrictedStockAndRestrictedStockUnitsMemberrvnc:UnvestedRestrictedStockAwardsMember2023-01-012023-12-310001479290rvnc:RestrictedStockAndRestrictedStockUnitsMemberrvnc:UnvestedRestrictedStockAwardsMember2023-12-310001479290us-gaap:RestrictedStockMember2022-01-012022-12-310001479290us-gaap:RestrictedStockMember2021-01-012021-12-310001479290us-gaap:RestrictedStockMember2023-01-012023-12-310001479290rvnc:UnvestedRestrictedStockAwardsMemberrvnc:PerformanceStockAwardsAndPerformanceStockUnitsMember2022-12-310001479290rvnc:UnvestedRestrictedStockAwardsMemberrvnc:PerformanceStockAwardsAndPerformanceStockUnitsMember2023-01-012023-12-310001479290rvnc:UnvestedRestrictedStockAwardsMemberrvnc:PerformanceStockAwardsAndPerformanceStockUnitsMember2023-12-310001479290rvnc:PerformanceStockAwardsAndPerformanceStockUnitsMember2022-01-012022-12-310001479290rvnc:PerformanceStockAwardsAndPerformanceStockUnitsMember2021-01-012021-12-310001479290rvnc:PerformanceStockAwardsAndPerformanceStockUnitsMember2023-01-012023-12-310001479290us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001479290us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001479290us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001479290rvnc:A2014ESPPMemberus-gaap:EmployeeStockMember2023-01-012023-12-310001479290rvnc:A2014ESPPMemberus-gaap:EmployeeStockMember2022-01-012022-12-310001479290rvnc:A2014ESPPMemberus-gaap:EmployeeStockMember2021-01-012021-12-310001479290us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001479290us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001479290us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001479290us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001479290us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001479290us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001479290rvnc:CostOfProductRevenueMember2023-01-012023-12-310001479290rvnc:CostOfProductRevenueMember2022-01-012022-12-310001479290rvnc:CostOfProductRevenueMember2021-01-012021-12-310001479290rvnc:RestrictedStockAndRestrictedStockUnitsMember2023-12-310001479290rvnc:RestrictedStockAndRestrictedStockUnitsMember2023-01-012023-12-310001479290rvnc:PerformanceStockUnitsMember2023-12-310001479290rvnc:PerformanceStockUnitsMember2023-01-012023-12-310001479290rvnc:PerformanceStockAwardsAndPerformanceStockUnitsMember2023-12-310001479290rvnc:SharebasedPaymentArrangementTrancheFiveMember2023-01-012023-12-310001479290rvnc:FollowOnOfferingMember2022-09-012022-09-300001479290rvnc:FollowOnOfferingMember2022-09-300001479290us-gaap:OverAllotmentOptionMember2022-09-012022-09-300001479290rvnc:AtTheMarketOffering2020PlanMember2020-11-012020-11-300001479290rvnc:AtTheMarketOffering2020PlanMember2022-01-012022-05-100001479290srt:WeightedAverageMemberrvnc:AtTheMarketOffering2020PlanMember2022-01-012022-05-100001479290rvnc:AtTheMarketOffering2022PlanMember2022-05-102022-05-100001479290rvnc:AtTheMarketOffering2022PlanMember2023-04-012023-06-300001479290rvnc:AtTheMarketOffering2022PlanMembersrt:WeightedAverageMember2023-06-300001479290rvnc:AtTheMarketOffering2022PlanMember2023-07-012023-12-310001479290rvnc:AtTheMarketOffering2022PlanMember2023-01-012023-03-310001479290us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-12-310001479290us-gaap:ConvertibleDebtSecuritiesMember2022-01-012022-12-310001479290us-gaap:ConvertibleDebtSecuritiesMember2021-01-012021-12-310001479290us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001479290us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001479290us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001479290us-gaap:PhantomShareUnitsPSUsMember2023-01-012023-12-310001479290us-gaap:PhantomShareUnitsPSUsMember2022-01-012022-12-310001479290us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-12-310001479290us-gaap:RestrictedStockMember2023-01-012023-12-310001479290us-gaap:RestrictedStockMember2022-01-012022-12-310001479290us-gaap:RestrictedStockMember2021-01-012021-12-310001479290us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-12-310001479290us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2023-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2023-12-310001479290us-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001479290us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2022-12-310001479290us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentCorporationsAndAgenciesSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2022-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommercialPaperMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMemberus-gaap:FairValueInputsLevel1Member2022-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2022-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateBondSecuritiesMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001479290us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001479290us-gaap:DomesticCountryMember2023-12-310001479290us-gaap:CaliforniaFranchiseTaxBoardMember2023-12-310001479290rvnc:OtherStatesMember2023-12-310001479290us-gaap:TaxYear2017Memberus-gaap:DomesticCountryMember2023-12-310001479290us-gaap:DomesticCountryMemberus-gaap:ResearchMember2023-12-310001479290us-gaap:CaliforniaFranchiseTaxBoardMemberus-gaap:ResearchMember2023-12-310001479290rvnc:OrphanDrugCreditCarryforwardMember2023-12-310001479290rvnc:TeoxaneAgreementMember2020-01-012020-01-310001479290rvnc:TeoxaneAgreementMember2020-09-012020-09-300001479290rvnc:TeoxaneAgreementMember2023-12-310001479290rvnc:BotulinumToxinResearchAssociatesInc.Member2023-12-3100014792902022-12-30rvnc:patentrvnc:segment0001479290rvnc:ServiceSegmentMemberus-gaap:IntersegmentEliminationMember2023-01-012023-12-310001479290rvnc:ServiceSegmentMemberus-gaap:IntersegmentEliminationMember2022-01-012022-12-310001479290rvnc:ServiceSegmentMemberus-gaap:IntersegmentEliminationMember2021-01-012021-12-310001479290rvnc:ProductSegmentMember2021-01-012021-12-310001479290rvnc:ServiceSegmentMember2021-01-012021-12-310001479290us-gaap:OperatingSegmentsMemberrvnc:ProductSegmentMember2023-01-012023-12-310001479290us-gaap:OperatingSegmentsMemberrvnc:ProductSegmentMember2022-01-012022-12-310001479290us-gaap:OperatingSegmentsMemberrvnc:ProductSegmentMember2021-01-012021-12-310001479290rvnc:ServiceSegmentMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001479290rvnc:ServiceSegmentMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001479290rvnc:ServiceSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001479290us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001479290us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001479290us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001479290srt:ScenarioForecastMemberus-gaap:RestrictedStockUnitsRSUMemberrvnc:TwoThousandAndFourteenEquityIncentivePlanMember2024-01-012024-03-310001479290srt:ScenarioForecastMemberus-gaap:PhantomShareUnitsPSUsMemberrvnc:TwoThousandAndFourteenEquityIncentivePlanMember2024-01-012024-03-31

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

|

|

|

|

|

|

|

|

|

FORM 10-K |

|

|

|

|

|

|

|

|

|

|

| (Mark One) |

|

|

|

|

|

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2023 |

|

|

or |

|

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from ___ to ___ |

|

|

Commission File No. 001-36297 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revance Therapeutics, Inc. |

|

|

(Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

77-0551645 |

|

|

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

1222 Demonbreun Street, Suite 2000, Nashville, Tennessee, 37203 |

|

|

(Address, including zip code, of principal executive offices) |

|

|

|

|

|

|

|

|

(615) 724-7755 |

|

|

(Registrant’s telephone number, including area code) |

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

| Title of Each Class |

Trading Symbol(s) |

Name of Exchange on Which Registered |

| Common Stock, par value $0.001 per share |

RVNC |

The Nasdaq Global Market LLC |

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None |

|

|

|

|

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐ |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

Large accelerated filer ☒ |

Accelerated filer ☐ |

Emerging growth company ☐ |

| Non-accelerated filer ☐ |

Smaller reporting company ☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒ |

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐ |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). □ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒ |

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was $2.2 billion, based on the closing price of the registrant’s common stock on the Nasdaq Global Market of $25.31 per share for such date. |

Number of shares outstanding of the registrant's common stock, par value $0.001 per share, as of February 16, 2024: 88,214,054 |

|

|

|

|

|

|

| DOCUMENTS INCORPORATED BY REFERENCE |

Certain portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A, not later than April 29, 2024, in connection with the registrant’s 2024 Annual Meeting of the Stockholders are incorporated herein by reference into Part III of this Annual Report on Form 10-K. |

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 1 |

|

|

| Item 1A |

|

|

| Item 1B |

|

|

Item 1C |

|

|

| Item 2 |

|

|

| Item 3 |

|

|

| Item 4 |

|

|

|

|

|

|

| Item 5 |

|

|

| Item 6 |

|

|

| Item 7 |

|

|

| Item 7A |

|

|

| Item 8 |

|

|

| Item 9 |

|

|

| Item 9A |

|

|

| Item 9B |

|

|

| Item 9C |

|

|

|

|

|

|

| Item 10 |

|

|

| Item 11 |

|

|

| Item 12 |

|

|

| Item 13 |

|

|

| Item 14 |

|

|

|

|

|

|

| Item 15 |

|

|

| Item 16 |

|

|

|

|

DEFINED TERMS

Unless expressly indicated or the context requires otherwise, the terms “Revance,” “Company,” “we,” “us,” and “our,” in this Annual Report on Form 10-K (this “Report”) refer to Revance Therapeutics, Inc., a Delaware corporation, and, where appropriate, its wholly-owned subsidiaries. We also have used several other terms in this Report, the consolidated financial statement and accompanying notes included herein, most of which are explained or defined below.

“2014 EIP” means the Company’s 2014 Equity Incentive Plan.

“2014 ESPP” means the Company’s 2014 Employee Stock Purchase Plan.

“2014 IN” means the Company’s 2014 Inducement Plan.

“2020 ATM Agreement” means the Sales Agreement by and between Revance and Cowen, dated November 2020, and terminated on May 10, 2022.

“2022 ATM Agreement” means the Sales Agreement by and between Revance and Cowen, dated May 10, 2022.

“2024 Proxy Statement” means our proxy statement for the 2024 Annual Meeting of the Stockholders.

“2027 Notes” means Revance’s 1.75% Convertible Senior Notes due 2027.

“ABPS” means Ajinomoto Althaea, Inc., doing business as Ajinomoto Bio-Pharma Services, a contract development and manufacturing organization.

“ABPS Services Agreement” means the Technology Transfer, Validation and Commercial Fill/Finish Services Agreement by and between the Company and ABPS, dated March 14, 2017, as amended on December 18, 2020 and February 26, 2024.

“ACA” means the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010.

“Allergan” means Allergan, Inc.

“Amortization Trigger” has the meaning set forth in the Note Purchase Agreement.

“Athyrium” means Athyrium Buffalo LP.

“ATM” means at-the-market offering program.

“BIAM” means a biosimilar initial advisory meeting.

“BLA” means a biologics license application.

“BPCIA” means the Biologics Price Competition and Innovation Act of 2009.

“BTRX” means Botulinum Toxin Research Associates, Inc.

“Business Associates” means companies that create, receive, maintain, or transmit PHI for or on behalf of a covered entity.

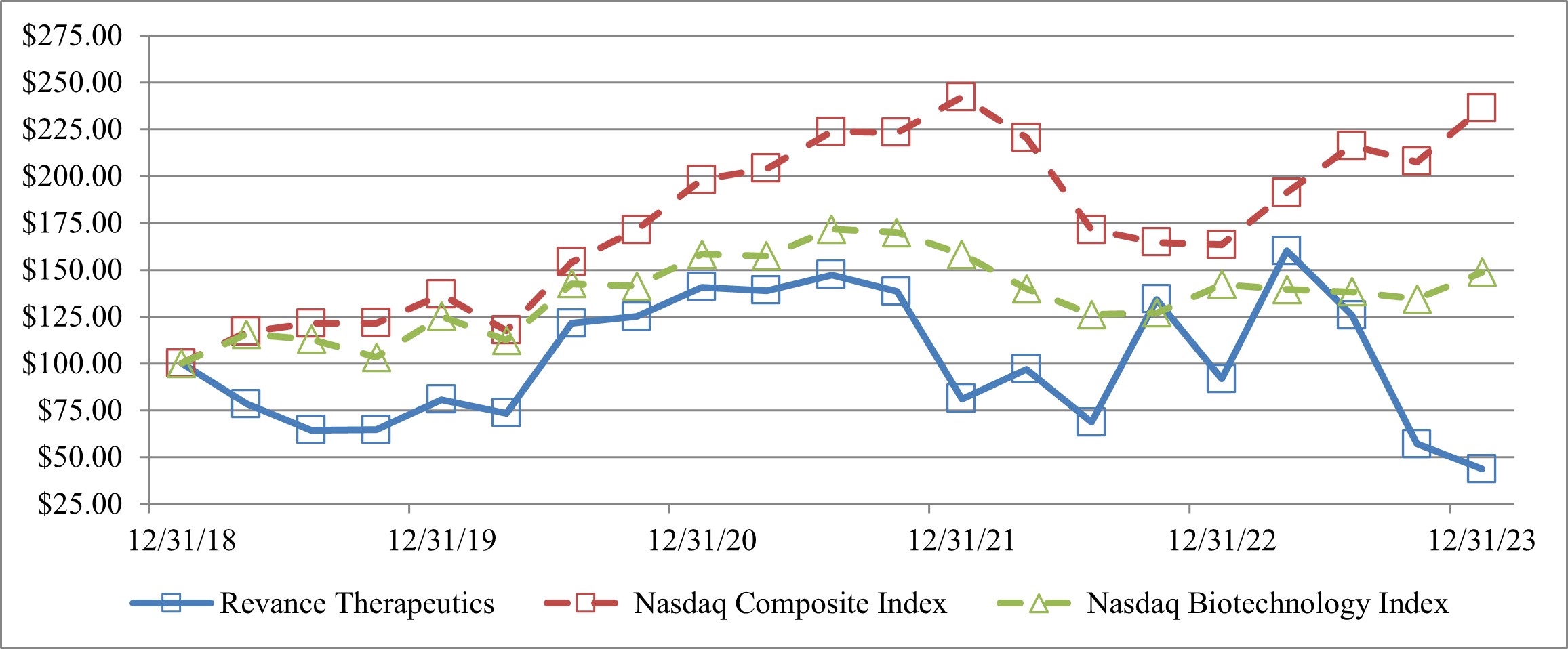

“CCMP” means the Nasdaq Composite Index.

“CCPA” means the California Consumer Privacy Act of 2018.

“cGMPs” means the current good manufacturing practices regulations enforced by the FDA.

“CIS” means the Center for Internet Security.

“CMS” means the Centers for Medicare & Medicaid Services.

“CODM” means the chief operating decision maker.

“Consolidated Teoxane Distribution Net Product Sales” has the meaning set forth in the Note Purchase Agreement.

“consumers” means the patients of our aesthetic practice customers.

“Continuation Decision” means Viatris’ decision under the Viatris Agreement as to whether to continue the biosimilar development program beyond the initial development plan and the BIAM.

“Cowen” means Cowen and Company, LLC.

“CPRA” means the California Privacy Rights Act of 2020.

“CRL” means a complete response letter from the FDA.

“CROs” means contract research organizations.

“DAXXIFY®” means (DaxibotulinumtoxinA-lanm) for injection.

“DAXXIFY® GL Approval” means the FDA approval in September 2022 of DAXXIFY® in the United States for the temporary improvement of moderate to severe glabellar lines in adults.

“DGCL” means the Delaware General Corporation Law.

“DRG” means Clarivate Plc, formerly known as Decision Resources Group.

“DTC” means the Depository Trust Company.

“EEA” means the European Economic Area.

“EMA” means the European Medicines Agency.

“ERC” means employee retention credit.

“ERM” means enterprise risk management,

“ESG” means environmental, social and governance.

“ESPP” means the Company's Employee Stock Purchase Plan.

“EU GDPR” means the European Union General Data Protection Regulation.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

“Expansion Premises” means the additional 30,591 square feet added to the initial premises pursuant to the Nashville Lease.

“FCA” means the False Claims Act.

“FDA” means the United States Food and Drug Administration.

“FDCA” means the Federal Food, Drug and Cosmetic Act.

“Fintech Platform” means OPUL® and the HintMD Platform.

“First Amendment” means the first amendment to the Note Purchase Agreement by and among the Company, HintMD and Athyrium, dated August 8, 2023.

“First Tranche” means the Notes Payable issued to the Purchasers in an aggregate principal amount of $100.0 million on March 18, 2022.

“Fosun” means Shanghai Fosun Pharmaceutical Industrial Development Co., Ltd., a wholly-owned subsidiary of Shanghai Fosun Pharmaceutical (Group) Co., Ltd.

“Fosun License Agreement” means the License Agreement by and between Revance and Fosun, dated December 4, 2018, as amended on February 15, 2020.

“Fosun Territory” means mainland China, Hong Kong and Macau.

“FTC Act” means the Federal Trade Commission Act.

“FY 2022 Annual Report” means our Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on February 28, 2023.

“GAAP” means U.S. generally accepted accounting principles.

“GCP” means good clinical practice.

“GLPs” means the FDA’s good laboratory practices.

“HCP” means Health Care Provider.

“HHS” means the U.S. Department of Health and Human Services.

“HintMD” means Hint, Inc., our wholly owned subsidiary.

“HintMD Acquisition” means Revance’s acquisition of HintMD, completed on June 23, 2020.

“HintMD Plan” means the Hint, Inc. 2017 Equity Incentive Plan.

“HintMD Platform” means the legacy HintMD fintech platform.

“HIPAA” means the Health Insurance Portability and Accountability Act, as amended by HITECH, and each other implementing regulation.

“HIPAA Privacy Rule” means the national standards to protect individuals' PHI imposed by HIPAA.

“HITECH” means the U.S. Health Information Technology for Economic and Clinical Health Act, which was enacted as part of the American Recovery and Reinvestment Act of 2009.

“IND” means an investigational new drug application.

“Indenture” means the indenture, by and between Revance and U.S. Bank National Association, as trustee, dated February 14, 2020.

“injector” means a professional licensed to inject our Products, including physicians.

“IPR” means inter partes review.

“IRA” means the Inflation Reduction Act of 2022.

“IRB” means the institutional review board.

“IRC” means the Internal revenue code.

“LCL” means lateral canthal lines or “crow’s feet”.

“market-based PSAs” means performance stock awards subject to market-based vesting conditions.

“market-based PSUs” means performance stock units subject to market-based vesting conditions.

“MAS” means the Modified Ashworth Score.

“Maturity Date” means September 18, 2026, the maturity date of the Notes Payable set forth in the Note Purchase Agreement.

“Medy-Tox” means Medy-Tox, Inc.

“Merz” means Merz Pharmaceuticals GmbH.

“Minimum Cash Covenant” means the financial covenant under the Note Purchase Agreement to maintain at least $30.0 million of unrestricted cash and cash equivalents in accounts subject to a control agreement in favor of Athyrium at all times.

“Nashville Lease” means the office lease by and between Revance and 1222 Demonbreun, LP, dated November 19, 2020, as amended on January 4, 2021, July 1, 2021 and January 13, 2023.

“NBI” means the Nasdaq Biotechnology Index.

“neuromodulator” means injectable botulinum toxins and neurotoxins.

“NMPA” means China's National Medical Products Association.

“NOL” means net operating loss.

“Note Purchase Agreement” means the note purchase agreement by and between Revance; Athyrium, as administrative agent; the Purchasers, including Athyrium; and HintMD, as a guarantor, dated March 18, 2022.

“Notes Payable” means notes payable by Revance pursuant to the Note Purchase Agreement.

“NPA Effective Date” means the effective date of the Note Purchase Agreement, March 18, 2022.

“OCR” means the U.S. Department of Health and Human Services Office for Civil Rights.

“onabotulinumtoxinA biosimilar” means a biosimilar to the branded biologic product (onabotulinumtoxinA) marketed as BOTOX®.

“OPUL®” means the OPUL® Relational Commerce Platform.

“PAS” means prior approval supplement.

“PCI” means PCI Pharma Services, which acquired Lyophilization Services of New England, Inc. in December 2021. References to PCI throughout this Report includes Lyophilization Services of New England, Inc., as applicable.

“PCI Supply Agreement” means the Commercial Supply Agreement by and between Revance and PCI (as successor in interest to Lyophilization Services of New England, Inc.), dated April 6, 2021.

“PDUFA” means Prescription Drug User Fee Act.

“performance-based PSAs” means performance stock awards subject to performance-based vesting conditions.

“performance-based PSUs” means performance stock units subject to performance-based vesting conditions.

“PGIC” means the Physician Global Impression of Change.

“PHI” means protected health information, as defined by HIPAA.

“PMA” means premarket approval by the FDA.

“PNT” means preserved network technology.

“PrevU” means the early experience program for DAXXIFY®.

“Products” means DAXXIFY® and the RHA Collection® of dermal fillers.

“Product Segment” means the business that includes the research, development and commercialization of our Products and product candidates.

“PSA” means a performance stock award.

“PSU” means a performance stock unit.

“Public Health Service Act” means the U.S. Public Health Services Act of 1944, as amended, including the Patient Protection and Affordable Care Act.

“Purchasers” means Athyrium and its successors and assigns.

“QSR” means the Quality System Regulations.

“REMS” means a Risk Evaluation Mitigation Strategy.

“RHA® Collection of dermal fillers” means RHA® 2, RHA® 3 and RHA® 4, which have been approved by the FDA for the correction of moderate to severe dynamic facial wrinkles and folds; and RHA® Redensity.

“RHA® Pipeline Products” means future hyaluronic acid filler advancements and products by Teoxane.

“RHA® Redensity” means a dermal filler, which has been approved by the FDA for the treatment of moderate to severe dynamic perioral rhytids (lip lines).

“RSAs” means restricted stock awards.

“RSUs” means restricted stock units.

“SASB” means the Sustainability Accounting Standards Board.

“SEC” means the U.S. Securities and Exchange Commission.

“Securities Act” means the U.S. Securities Act of 1933, as amended.

“Second Expansion Premises” means the additional 17,248 square feet added to the current premises pursuant to the Nashville Lease.

“Second Tranche” means the Notes Payable issued to the Purchasers in an aggregate principal amount of $50.0 million on August 28, 2023.

“Services” means the Fintech Platform business.

“Service Segment” means the business that includes the development and commercialization of the Fintech Platform.

“SMG” means the suprahypertonic muscle group.

“Stock Awards” means RSAs, PSAs, RSUs and PSUs.

“TCPA” means the Telephone Consumer Protection Act.

“Third Tranche” means the uncommitted tranche of additional Notes Payable in an aggregate amount of up to $150.0 million, available until March 31, 2024, subject to the satisfaction of certain conditions set forth in the Note Purchase Agreement.

“Teoxane” means Teoxane SA.

“Teoxane Agreement” means the exclusive distribution agreement by and between Revance and Teoxane, dated January 10, 2020, as amended on September 30, 2020, December 22, 2020 and December 22, 2022.

“UFLs” means upper facial lines.

“UK GDPR” means the United Kingdom General Data Protection Regulation.

“USPTO” means U.S. Patent and Trademark Office.

“Viatris” means Viatris Inc., formerly known as Mylan Ireland Ltd.

“Viatris Agreement” means the Collaboration and License Agreement by Revance and Viatris, dated February 28, 2018, as amended by the Viatris Amendment.

“Viatris Amendment” means Amendment #1 to the Viatris Agreement by Revance and Viatris, dated August 22, 2019.

“Zero-cost Inventory” means DAXXIFY® inventory produced prior to the DAXXIFY® GL Approval for the temporary improvement of glabellar lines in early September 2022, for which the related manufacturing costs were incurred and expensed to research and development expense prior to the FDA approval..

Revance®, the Revance logos, DAXXIFY®, OPUL® and other trademarks or service marks of Revance appearing in this Report are the property of Revance. This Report contains additional trade names, trademarks and service marks of others, which are the property of their respective owners.

We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report, including the documents incorporated by reference herein, contains forward-looking statements within the meaning of Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Exchange Act. All statements other than statements of historical facts contained in this Report and the documents incorporated by reference herein, including statements regarding our future financial condition, regulatory approvals, business strategy and plans and objectives of management for future operations, are forward-looking statements. The words “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements. In addition, any statements that refer to our financial outlook or projected performance, profitability expectations, anticipated growth, milestone expectations, future expenses and cash flows, anticipated working capital requirements, market forecasts, capital expenditures, cash preservation plans, liquidity and financing requirements and the impact of inflationary pressures on our business; our ability to implement our operating plan; the impact of the DAXXIFY® pricing strategy on adoption and our sales; our ability to comply with our debt obligations; our ability to draw on the Third Tranche; our future financing plans and strategies; our future responses to macroeconomic and geopolitical factors; our ability to successfully commercialize and maintain regulatory approvals for DAXXIFY®; our ability to obtain, and the timing relating to, regulatory submissions and approvals with respect to our drug product candidates and third-party manufacturers, including with respect to the PAS for the PCI manufacturing facility, DAXXIFY® for indications other than glabellar lines and cervical dystonia, and the RHA® Pipeline Products; our opportunity in therapeutics; our ability to secure and maintain favorable third party reimbursement for our Products; the process and timing of, and ability to complete, the current and anticipated future pre-clinical and clinical development of our product candidates including the outcome of such clinical studies and trials; development of an onabotulinumtoxinA biosimilar, which would compete in the existing short-acting neuromodulator marketplace; the process and our ability to effectively and reliably manufacture supplies of DAXXIFY®; our ability to manufacture or receive sufficient supply of our Products in order to meet commercial demand; expectations regarding DAXXIFY® Zero-cost Inventory and the ERC; our ability to successfully compete in the dermal filler and neuromodulator markets; the design of our clinical studies; the markets for our current and future products and services; our business strategy, plans and prospects, including our commercialization plans related to DAXXIFY® and the RHA® Collection of dermal fillers, including the timing for the launch of DAXXIFY® for the treatment of cervical dystonia and the new RHA® 3 indication; the potential benefits of DAXXIFY®, the RHA® Collection of dermal fillers and our drug product candidates; the potential safety, efficacy and duration of DAXXIFY® for consumers and patients; our ability to maintain and seek out new strategic third-party collaborations to support our goals; the extent to which our Products are considered innovative or differentiated; consumer preferences related to our Products; the rate and degree of economic benefit, commercial acceptance, market, competition and/or size and growth potential of DAXXIFY®, the RHA® Collection of dermal fillers and our other drug product candidates, if approved; our ability to set a new standard in healthcare; our ability to build and expand valuable aesthetic and therapeutic franchises; the wind down of all activities related to the Fintech Platform; patent defensive measures; timing related to our ongoing litigation matters; our ability to defend ourselves in ongoing litigation; international expansion, including with respect to NMPA approval of DAXXIFY® for cervical dystonia and glabellar lines; anticipated milestone payments; our human capital, social and environmental performance and goals; our ability to expand our operations to support the commercialization of our Products and attract and retain qualified personnel to support our business; our ability to comply with applicable laws and regulations; our ability to protect the Company from cybersecurity threats, including the impact of security failures and/or breaches; and our ability to enhance our competitive position through strategic collaborations are forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of known and unknown risks, uncertainties and assumptions, including risks described in

Part 1. Item 1A. “Risk Factors” and elsewhere in this Report.

You should not rely upon forward-looking statements as predictions of future events. These forward-looking statements represent our estimates and assumptions only as of the date of this Report. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason to conform these statements to actual results or to changes in our expectations. You should read this Report, together with the information incorporated herein by reference, with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

Summary of Risk Factors

Investing in our common stock involves risks. See

Part I. Item 1A. “Risk Factors” in this Report for a discussion of the following principal risks and other risks that make an investment in Revance speculative or risky.

•Our success as a company, including our ability to finance our business and generate revenue, and our future growth is substantially dependent on the clinical and commercial success of our Products. If we are unable to successfully commercialize our Products, complete the development and regulatory approval process of our product candidates, and maintain regulatory approval of our Products we may not be able to generate sufficient revenue to continue our business.

•DAXXIFY® and any future product candidates, if approved, may not achieve market acceptance among injectors, HCPs, consumers and patients, and may not be commercially successful, which would adversely affect our operating results and financial condition.

•We have incurred significant losses since our inception and we anticipate that we will continue to incur GAAP operating losses for the foreseeable future and may not achieve or maintain profitability in the future. Our prior losses, combined with expected future losses, may adversely affect the market price of our common stock, our ability to raise capital and our ability to maintain compliance with our debt covenants. We may require substantial additional funding to continue to operate our business and achieve our goals and a failure to obtain the necessary capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our product development, other operations or commercialization efforts.

•If we are not able to effectively and reliably manufacture DAXXIFY® or any future product candidates at sufficient scale and appropriate cost, including through any third-party manufacturers, as well as acquire supplies of the RHA® Collection of dermal fillers from Teoxane, our product development, regulatory approval, commercialization and sales efforts and our ability to generate revenue may be adversely affected.

•DAXXIFY®, the RHA® Collection of dermal fillers and any future product candidates will face significant competition, including from companies that enjoy significant competitive advantages, such as substantially greater financial, research and development, regulatory, manufacturing, marketing resources and expertise, greater brand recognition and more established relationships. Our failure to effectively compete may prevent us from achieving significant market penetration and expansion.

•We use third-party collaborators, including Teoxane, Viatris, Fosun, ABPS and PCI to help us develop, validate, manufacture and/or commercialize our products. Our ability to commercialize our products could be impaired or delayed if these collaborations are unsuccessful.

•Macroeconomic and geopolitical factors and a public health crisis, such as the COVID-19 pandemic, have and may continue to adversely affect our business, as well as those of third-parties on which we rely for significant manufacturing, clinical or other business operations. They may also impact disposable income levels, which could reduce consumer spending and lower demand for our products.

•We are subject to uncertainty relating to pricing and reimbursement. Failure to obtain or maintain adequate coverage, pricing and reimbursement for DAXXIFY® for therapeutics uses, or our other future approved products, if any, could have a material adverse impact on our ability to commercialize such products. Even if coverage and reimbursement is provided, acceptance of any approved product may vary among HCPs, healthcare organizations and administrators and others in the healthcare community, which could impact our ability to realize a return on our investment and reduce demand for our products.

•Reports of adverse events or safety concerns involving our Products could delay or prevent the Company or Teoxane from maintaining regulatory approval for such Products, or obtaining additional regulatory approval for additional indications or future product candidates. The denial, delay or withdrawal of any such approval would negatively impact commercialization and could have a material adverse effect on our ability to generate revenue, business prospects, and results of operations.

•Unfavorable publicity relating to one or more of our Products, whether related to aesthetic or therapeutic indications, may affect the public perception of our entire portfolio of Products.

•Clinical drug development involves a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials may not be predictive of future trial results or actual consumer outcomes.

•If our efforts to protect our intellectual property related to DAXXIFY®, the RHA® Collection of dermal fillers or any future product candidates are not adequate, we may not be able to compete effectively. Additionally, we are currently and in the future may become involved in lawsuits or administrative proceedings to defend against claims that we infringe the intellectual property of others and to protect or enforce our patents or other intellectual property or the patents of our licensors, which could be expensive and time-consuming and would have a material adverse effect on our ability to generate revenue if we are unsuccessful.

•Servicing our debt, including the 2027 Notes and Notes Payable, requires a significant amount of cash to pay our substantial debt. If we are unable to generate sufficient cash flow, we may be required to adopt one or more alternatives, such as selling assets, restructuring debt or obtaining additional equity capital on terms that may be onerous or highly dilutive.

•We are currently, and in the future may be, subject to securities class action and stockholder derivative actions. If other stockholder derivative actions, additional securities class actions or other lawsuits are brought against us, including product liability actions, and we cannot successfully defend ourselves, we may incur substantial liabilities or be required to limit commercialization of our products. Even a successful defense would require significant financial and management resources.

•As our business and operations continue to grow, we may need to expand our development, manufacturing, regulatory, sales, marketing and distribution capabilities. If and when we expand such capabilities, we may encounter difficulties in managing our growth, which could disrupt our operations.

•We have undertaken, and may in the future undertake, restructuring plans to adjust our investment priorities and manage our operating expenses, which plans may not result in the savings or operational efficiencies anticipated and could result in total costs and expenses that are greater than expected.

•If we are not successful in discovering, developing, acquiring and commercializing additional product candidates other than our current Products, our ability to expand our business and achieve our strategic objectives may be impaired.

•We have experienced and may experience in the future compromises or failures of our information technology systems or data, or those of third parties upon which we rely, which could adversely affect our business. Despite significant efforts to secure against such threats, it is impossible to entirely mitigate these risks.

•Changes in and failures to comply with applicable laws, regulations and standards may adversely affect our business, operations and financial performance.

•If we fail to attract and retain qualified personnel at all levels and functions, we may be unable to successfully execute our objectives.

PART I

ITEM 1. BUSINESS

Overview

Revance is a biotechnology company focused on developing and commercializing innovative aesthetic and therapeutic offerings. Revance’s portfolio includes DAXXIFY® (DaxibotulinumtoxinA-lanm) for injection and the RHA® Collection of dermal fillers in the U.S. Revance has also partnered with Viatris to develop a biosimilar to onabotulinumtoxinA for injection and Fosun to commercialize DAXXIFY® in China.

Key 2023 Developments

Revance Aesthetics

For the year ended December 31, 2023, we generated $224.9 million in revenue from the sale of our Products and our Services. As of December 31, 2023, we had over 7,000 aesthetic accounts across our Products business, and of those accounts, over 3,000 accounts ordered DAXXIFY®.

DAXXIFY®

In September 2022, we received DAXXIFY® GL Approval. DAXXIFY® is an acetylcholine release inhibitor and neuromuscular blocking agent indicated for the temporary improvement in the appearance of moderate to severe glabellar lines associated with corrugator and/or procerus muscle activity in adult patients.

Following DAXXIFY® GL Approval, we trained a group of faculty members on DAXXIFY® as part of PrevU, our early experience program for the product, which we initiated in December 2022. PrevU focused on providing practices with product education, tools for practice integration, and the opportunity to gain real-world clinical insights for DAXXIFY® with the goal of optimizing aesthetic outcomes. We completed the PrevU program in March 2023, which was followed by the targeted commercial launch of DAXXIFY®. Based on real-world learnings and customer feedback, in September 2023, we introduced new pricing for DAXXIFY®, which priced the product to be more competitive with BOTOX®. For the year ended December 31, 2023, we recognized $84.0 million in product revenue from the sale of DAXXIFY®.

RHA® Collection of Dermal Fillers

In July 2023, the FDA approved the expansion of RHA® 4’s label to include cannula use. In October, the FDA approved Teoxane’s PMA to expand the indication for RHA 3® to include injection into the vermillion body, vermillion border and oral commissure for lip augmentation and lip fullness in adults aged 22 years and older. RHA® 3 was previously approved for the correction of moderate to severe dynamic wrinkles and folds, such as nasolabial folds. The Company anticipates launching the new indication in mid-year 2024.

For the year ended December 31, 2023, we recognized $128.6 million in product revenue from the sale of the RHA® Collection of dermal fillers.

Revance Therapeutics

In August 2023, the FDA approved DAXXIFY® for the treatment of cervical dystonia in adults, and in September 2023, we initiated PrevU, our early experience program for the product. As with our early experience program for aesthetics, PrevU focuses on providing practices with product education, tools for practice integration, and the opportunity to gain real-world clinical insights for DAXXIFY® with the goal of optimizing therapeutic outcomes. As of the date of this Report, coverage for DAXXIFY® for the treatment of cervical dystonia has been secured for more than 140 million commercial lives, which includes 25 of the top 30 payors in the country, representing over 50% of commercial lives covered. In January 2024, the Company received a permanent J-Code for DAXXIFY®. We expect the commercial launch to begin in mid-year 2024.

CMO Partnerships

In March 2023, the FDA approved our PAS submission for the ABPS manufacturing facility. Following approval, the ABPS manufacturing facility began serving as our primary commercial drug product supply source for DAXXIFY®. In February 2024, we entered into an amendment to the ABPS Services Agreement, which extended the term of the ABPS Services Agreement through December 31, 2027.

Fosun Partnership

In April and July 2023, the NMPA accepted Fosun’s BLA for DaxibotulinumtoxinA for Injection for the improvement of glabellar lines and treatment of cervical dystonia, respectively. The anticipated approvals for both indications are expected in 2024.

Exit of the Fintech Platform Business

In September 2023, we commenced a plan to exit the Fintech Platform business because the significant costs and resources required to support OPUL® no longer aligned with the Company’s capital allocation priorities. The exit and restructuring activities predominantly included a reduction in OPUL® personnel headcount, the termination of OPUL® research and development activities and a reduction of outside services expenses related to OPUL®. Substantially all payment processing activities for OPUL® customers ended on January 31, 2024. We are currently in the process of completing activities to wind-down the remaining OPUL® platform operations, which we expect to be complete by March 31, 2024.

Disciplined Capital Allocation

In 2023, our capital resources were focused on supporting our strategic priorities, which included: (i) continuing to drive revenue growth by increasing adoption of DAXXIFY® and the RHA® Collection of dermal fillers; (ii) initiating DAXXIFY® cervical dystonia PrevU program and pre-launch activities; and (iii) maximizing supply chain efficiencies by leveraging and scaling commercial production of DAXXIFY® through ABPS. To align our operations with our capital allocation priorities, the Company made the decision to exit its Fintech Platform business. We will continue to assess expense management and the timing of capital allocation measures as it relates to our therapeutics pipeline activities and international regulatory investments for DAXXIFY®.

For additional information, see Part II, Item 7. “Management's Discussion and Analysis of Financial Condition and Results of Operations—

Liquidity and Capital Resources.”

Our Strategy

Our objective is to set a new standard in healthcare by elevating patient and physician experiences through the development, acquisition and commercialization of innovative aesthetic and therapeutic offerings, including DAXXIFY® and the RHA® Collection of dermal fillers.

Key elements of our strategy are:

•We aim to leverage the unique formulation and clinical profile of DAXXIFY® to build valuable aesthetic and therapeutic franchises.

•We aim to grow market share by utilizing our innovative and differentiated portfolio of Products to appeal to consumers seeking elevated aesthetic outcomes.

•We aim to leverage DAXXIFY® to pursue a therapeutics program that will advance the treatment of multiple indications, with a current focus on muscle movement disorders, including cervical dystonia and upper limb spasticity. We also plan to evaluate our pipeline for other indications, such as migraine.

•We have and will continue to selectively evaluate partnerships, distribution opportunities, joint development agreements and acquisitions to expand our aesthetic and therapeutic franchises and enhance our competitive position:

◦Our Teoxane partnership enabled us to enter the U.S. dermal filler market and has provided the foundation for DAXXIFY® and potential future product commercialization.

◦We have the potential to enter the second largest neuromodulator market, China, as a result of our Fosun License Agreement.

◦We have entered into the Viatris Agreement, which provides us with the potential to participate in the short-acting neuromodulator market.

The Botulinum Toxin Opportunity

Botulinum toxin is a protein and neurotoxin produced by clostridium botulinum. Since 1989, botulinum toxin has been used to treat a variety of aesthetic and therapeutic indications in the U.S. and globally. Botulinum toxin blocks neuromuscular transmission by binding to receptor sites on motor or sympathetic nerve terminals, entering the nerve terminals, and inhibiting the release of acetylcholine. This inhibition occurs as the neurotoxin cleaves SNAP-25, a protein integral to the successful docking and release of acetylcholine from vesicles situated within nerve endings. When injected intramuscularly at therapeutic doses, botulinum toxin produces partial chemical denervation of the muscle resulting in a localized reduction in muscle activity. Throughout this Report, we use neuromodulators to refer to botulinum toxins and neurotoxins.

According to DRG, the global market opportunity for neuromodulators was estimated to be $8.1 billion in 2023 compared to $7.4 billion in 2022 and is projected to reach approximately $12.0 billion by 2028, registering a compounded annual growth rate of approximately 8.1% from 2023 to 2028. DRG estimates that the market opportunity for aesthetic indications and therapeutic indications in 2023 is approximately 60% and 40%, respectively. We expect continued growth to be driven by demographics, changing lifestyle, new indications and product launches in new geographies.

For information on competition we face in these markets, please see “—

Product Competition” below.

The Opportunity for Neuromodulators for Aesthetic Indications

Injectable neuromodulator treatments are the single largest cosmetic procedure in the U.S. and globally. In the U.S., neuromodulators have been approved to treat three aesthetic indications, glabellar lines, forehead lines and LCLs. According to DRG, in 2023, 16.1 million neuromodulator aesthetic procedures were performed in the U.S. and 49 million neuromodulator aesthetic procedures were performed globally, which represents an increase of 8.2% and 8.65%, respectively, over 2022. Also, according to DRG, the aesthetic neuromodulator market opportunity was estimated to be $2.8 billion in the U.S. and $4.9 billion globally in 2023, compared to $2.5 billion and $4.5 billion, respectively, in 2022. The aesthetic neuromodulator market is projected to reach approximately $4.4 billion in the U.S. and $7.3 billion globally by 2028, registering five-year compounded annual growth rates of approximately 9.2% and 8.3%, respectively, from 2023 to 2028.

We believe that we are positioned to take advantage of this growing market opportunity due to the performance profile of DAXXIFY®, which has been shown to include long duration, fast-onset and the appearance of improved skin quality. In our SAKURA Phase 3 clinical program for the treatment of glabellar lines, DAXXIFY® demonstrated a median time to the loss of none or mild wrinkle severity of 24 weeks (6 months) and a median time to return to baseline wrinkle severity of approximately 28 weeks (7 months), as documented on the prescribing information. According to the prescribing information from other neuromodulators on the market, median duration of effect of these products ranges between three to four months. We believe that DAXXIFY®’s attributes will provide more satisfaction and value to consumers, and ultimately drive increased adoption of DAXXIFY®.

The Opportunity for Neuromodulators for Therapeutic Indications

In the U.S., neuromodulators have been approved for the treatment of cervical dystonia, upper limb spasticity (adult and pediatric), lower limb spasticity, chronic migraine headache, urinary incontinence, overactive bladder, blepharospasm, strabismus, hyperhidrosis and neurogenic detrusor overactivity (adult and pediatric). In addition, neuromodulator products are being evaluated in clinical trials for other therapeutic indications, including acne, rosacea, skin and wound healing, scar reduction, hair loss, major depressive disorder, atrial fibrillation and several musculoskeletal and neurological conditions.

We are currently pursuing the commercialization of DAXXIFY® for the treatment of cervical dystonia and the development of DAXXIFY® for upper limb spasticity because we believe there is opportunity to improve injectable neuromodulator outcomes and overall health system costs in muscle movement disorders. Muscle movement disorders are neurological conditions that affect a person’s ability to control muscle activity in one or more areas of the body. Cervical dystonia is a painful and disabling chronic condition in which the neck muscles contract involuntarily, causing abnormal movements and awkward posture of the head and neck. Cervical dystonia affected approximately 60,000 people in the U.S. According to DRG, the U.S. market opportunity for cervical dystonia in 2023 was approximately $372.8 million and is expected to grow to approximately $521.2 million by 2028, registering a five-year compounded annual growth rate of approximately 6.93% from 2023 to 2028.

Muscle spasticity happens after the body’s nervous system has been damaged, most commonly by a stroke, trauma or disease. Muscle spasticity can be painful and may have a significant effect on a person’s quality of life. Certain tasks, like getting dressed or bathing, become difficult, and a person’s self-esteem may be affected by an abnormal posture. Spasticity affected approximately 500,000 people in the U.S. and approximately 12 million people globally. According to DRG, the global spasticity market in 2023 was approximately $906 million and is expected to grow to $1.4 billion by 2028.

Although currently approved neuromodulators have demonstrated safety and efficacy in clinical trials for the treatment of muscle movement disorders, such neuromodulator injections must be repeated every three to four months. According to the peer-reviewed article Patient Perspectives on the Therapeutic Profile of Botulinum Neurotoxin Type A in Cervical Dystonia, published in the Journal of Neurology in 2020, out of cervical dystonia patients surveyed, 88% of patients treated with botulinum neurotoxin type A products experienced symptom reemergence between treatment sessions, with a mean time to reemergence of approximately 10.5 weeks. In addition, most botulinum neurotoxin type A labels recommend waiting at least 12 weeks prior to re-treatment. We believe there is a significant need for a long-lasting injectable neuromodulator, which has the potential to offer consumers and payors more value by reducing the frequency of visits while also allowing consumers to achieve more durable symptom relief between injection cycles. We believe that DAXXIFY® has the potential to provide these benefits. In 2021, we completed the ASPEN-1 Phase 3 clinical program for the treatment of cervical dystonia and the JUNIPER Phase 2 clinical trial for the treatment of upper limb spasticity. In the ASPEN-1 Phase 3 clinical trial, DAXXIFY® demonstrated a median duration of effect of 24.0 weeks in one treatment group and 20.3 weeks in another treatment group. In the JUNIPER Phase 2 clinical trial, DAXXIFY® demonstrated a median duration of at least 24 weeks across all three doses. See “—

Our Product — DAXXIFY for Therapeutic Indications.”

The Hyaluronic Acid Dermal Filler Opportunity

Dermal fillers are injected into the superficial and deep layers of the skin to restore volume, smooth lines, provide facial lift and contour, plump the lips or improve the appearance of facial scars commonly caused by acne. Hyaluronic acid dermal fillers represent approximately 91% of the total U.S. dermal filler market, and according to the 2022 ASPS, hyaluronic acid dermal fillers were the second most common aesthetic injectable procedure in United States in 2022. Hyaluronic acid is naturally found in the body, primarily in the skin, joints and connective tissue. With age, human skin loses its ability to produce hyaluronic acid, resulting in the loss of volume, firmness and elasticity. Hyaluronic acid dermal fillers are manufactured from synthesized hyaluronic acid cross-linked to significantly enhance durability in the skin. These products can restore lost volume for six to 12 months or longer before the body gradually and naturally absorbs the hyaluronic acid. Most hyaluronic acid dermal fillers also contain lidocaine to help minimize discomfort during and after treatment.

DRG estimated that 3.3 million dermal filler procedures were performed in the U.S. in 2023. According to DRG, the U.S. market opportunity for hyaluronic acid dermal fillers was estimated to be $1.5 billion in 2023 and is projected to reach approximately $2.1 billion by 2028, registering a compounded annual growth rate of approximately 7.5% from 2023 to 2028.

Access to the RHA® Collection of dermal fillers not only enables us to compete in the U.S. dermal filler market, but also supports the launch of DAXXIFY® and provides a foundation for other potential aesthetic product offerings. We believe there are long term revenue and cost synergy opportunities with neuromodulators and hyaluronic acid dermal fillers. We believe our ability to offer a comprehensive aesthetics portfolio, including DAXXIFY® and the RHA® Collection of dermal fillers, positions us to compete with established competitors.

For information on competition we face in this market, please see “—

Product Competition” below.

Product Pipeline Summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product/Product Candidate |

|

Indication |

|

Phase |

DAXXIFY® |

|

Glabellar lines |

|

FDA approved September 2022 |

|

DAXXIFY® |

|

Cervical dystonia |

|

FDA approved August 2023 |

|

RHA® Redensity |

|

Perioral rhytids |

|

FDA approved December 2021 |

|

RHA® 2 |

|

Facial wrinkles and folds (such as nasolabial folds) |

|

FDA approved October 2017 |

|

RHA® 3 |

|

Facial wrinkles and folds (such as nasolabial folds |

|

FDA approved October 2017 |

|

Vermillion body, vermillion border and oral commissure |

|

FDA approved January 2024 |

RHA® 4 |

|

Facial wrinkles and folds (such as nasolabial folds) |

|

FDA approved October 2017 |

|

DAXXIFY® |