UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2025

ASP Isotopes Inc. |

(Exact name of registrant as specified in its charter) |

Delaware |

|

001-41555 |

|

87-2618235 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

601 Pennsylvania Avenue NW, South Building, Suite 900 Washington, DC |

|

20004 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (202) 756-2245

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 |

|

ASPI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 7.01. Regulation FD Disclosure.

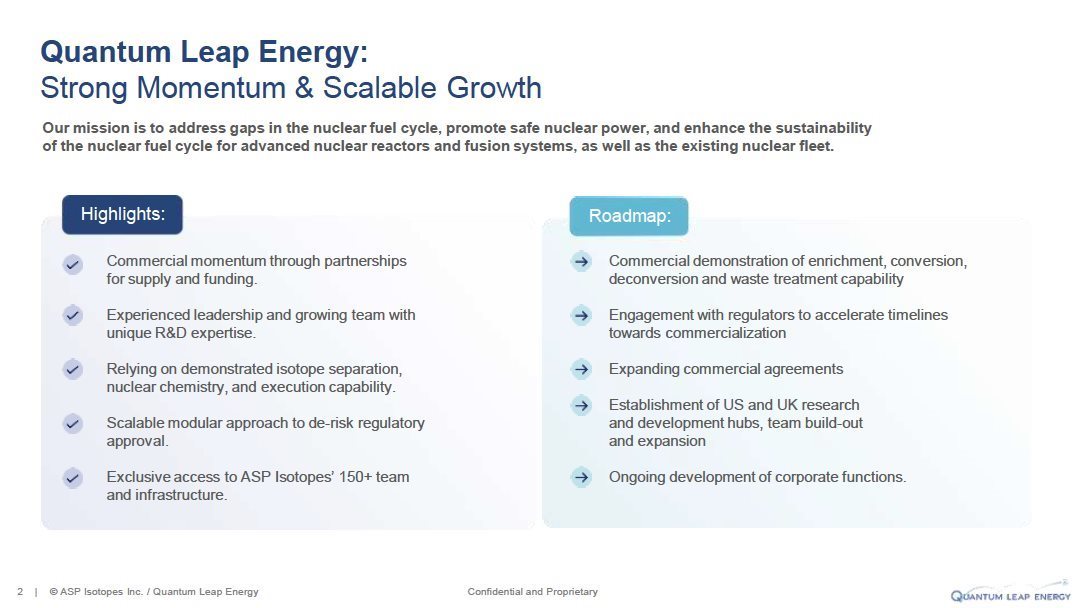

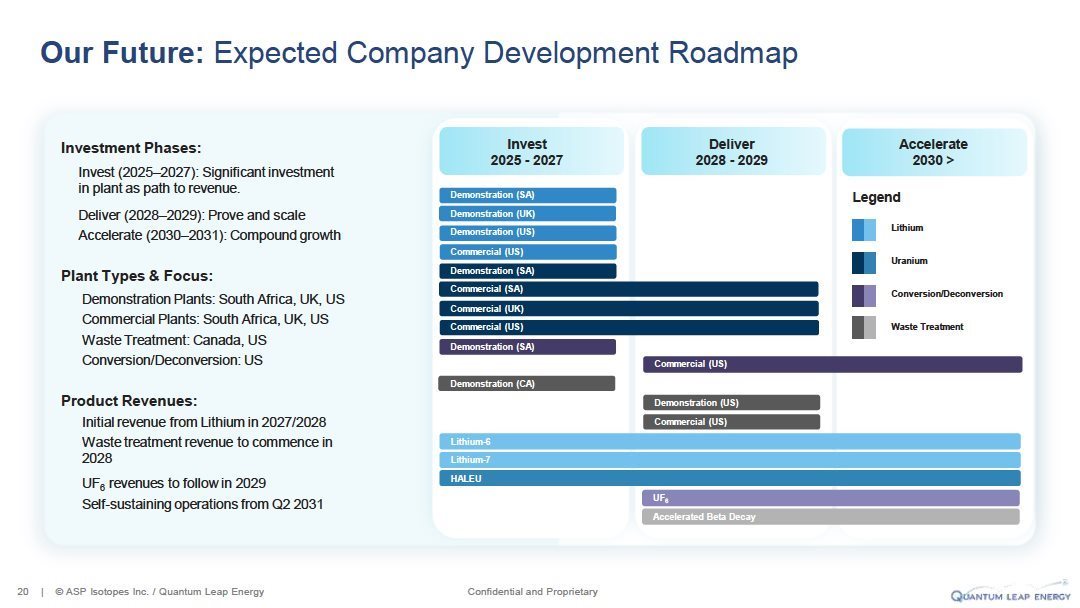

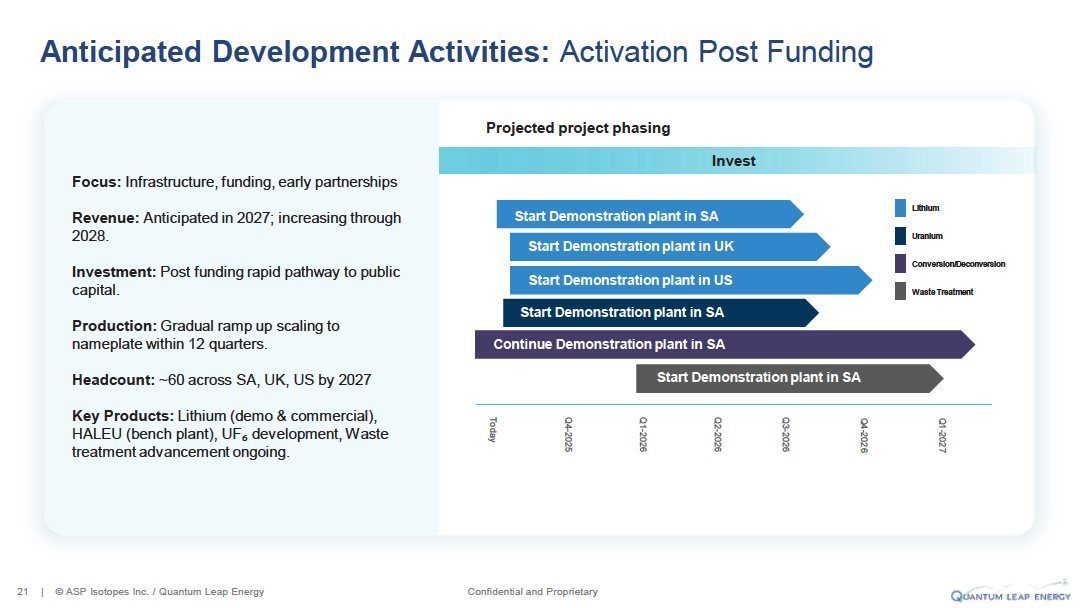

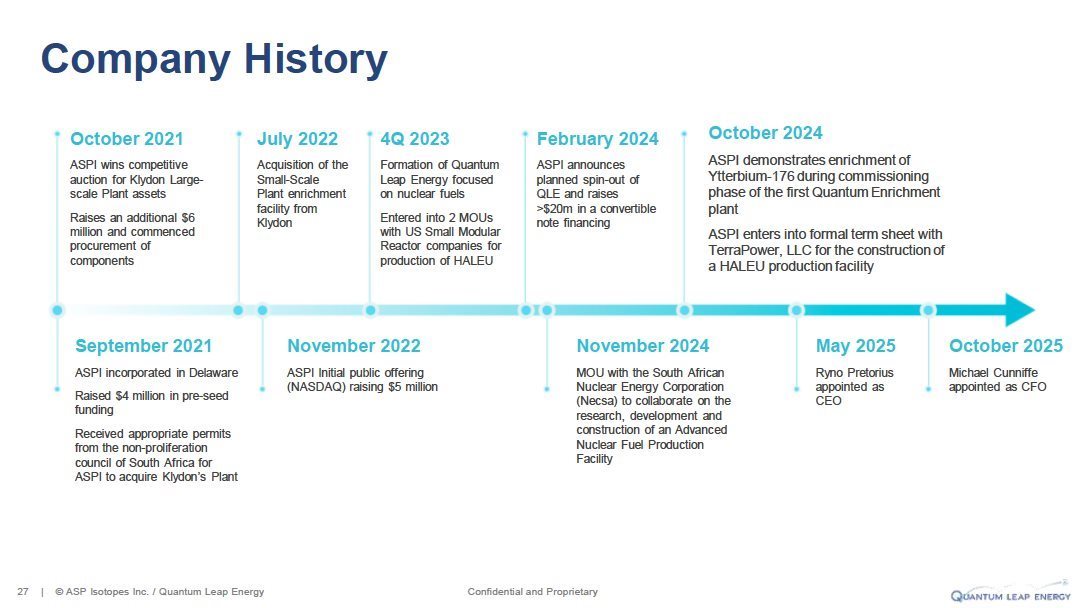

On November 7, 2025, Quantum Leap Energy LLC (“QLE”), a wholly-owned subsidiary of ASP Isotopes Inc. (the “Company”), issued an investor presentation that provides an overview of QLE’s business. A copy of the investor presentation is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Also on November 7, 2025, the Company announced that QLE has commenced an offering of QLE convertible promissory notes (the “QLE Notes”) in a private placement to accredited investors and to certain non-U.S. persons in transactions outside of the United States in reliance on Regulation S under the Securities Act of 1933 (the “QLE Notes Offering”). QLE has entered into a definitive convertible note purchase agreement with certain investors for an initial closing of $64.3 million of QLE Notes that was led by American Ventures LLC, with the Company also making a significant investment in the QLE Notes. QLE may issue additional QLE Notes in subsequent closings to investors who are non-U.S. persons in transactions outside of the United States in reliance on Regulation S promulgated under the Securities Act of 1933, as amended (the “Securities Act”). A copy of the press release announcing the QLE Notes Offering is attached to this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by reference.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

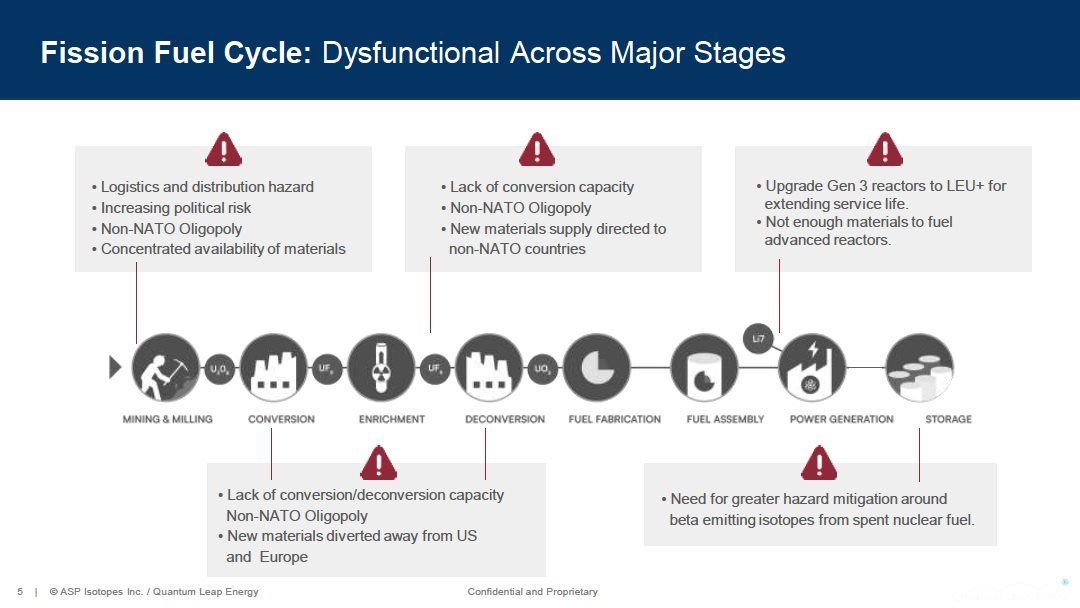

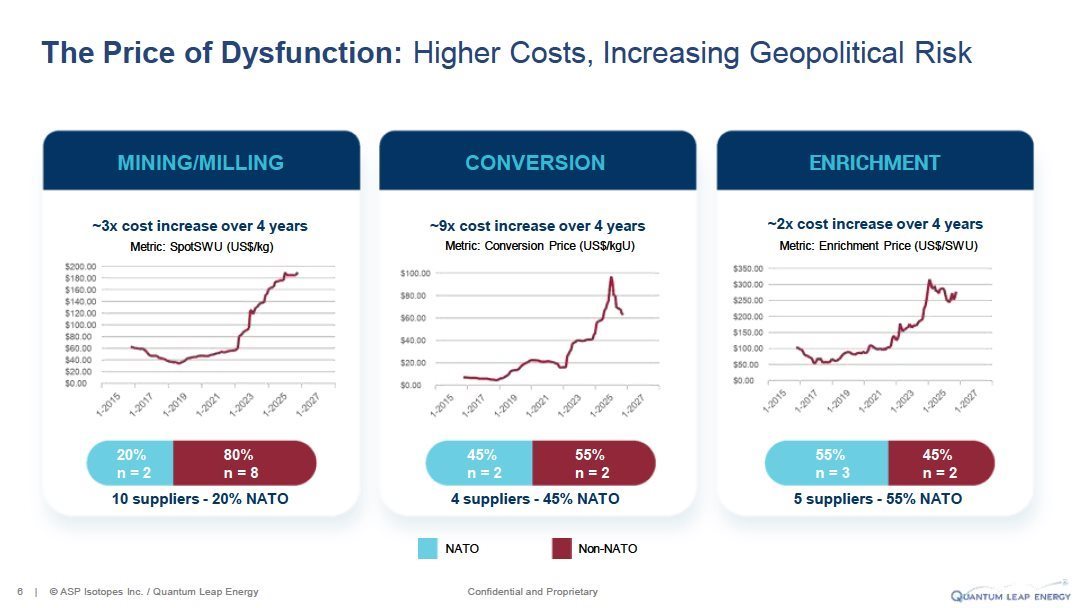

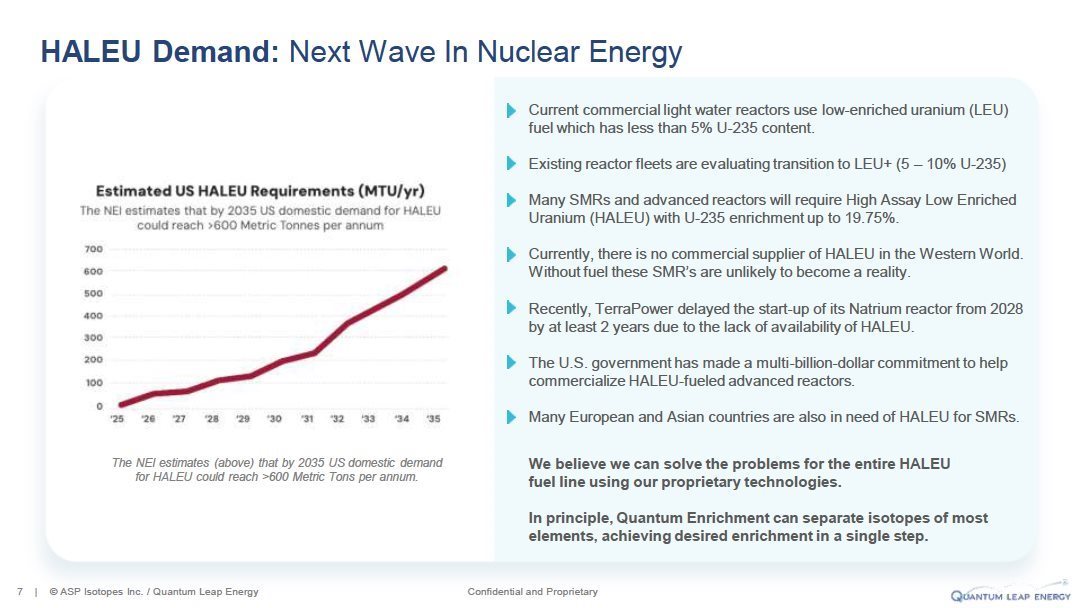

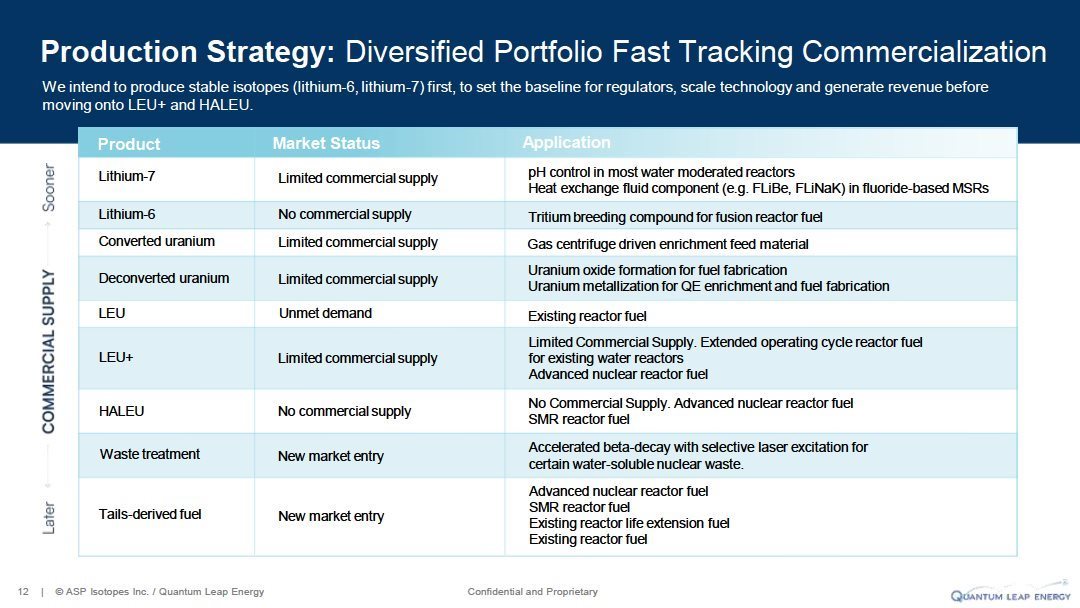

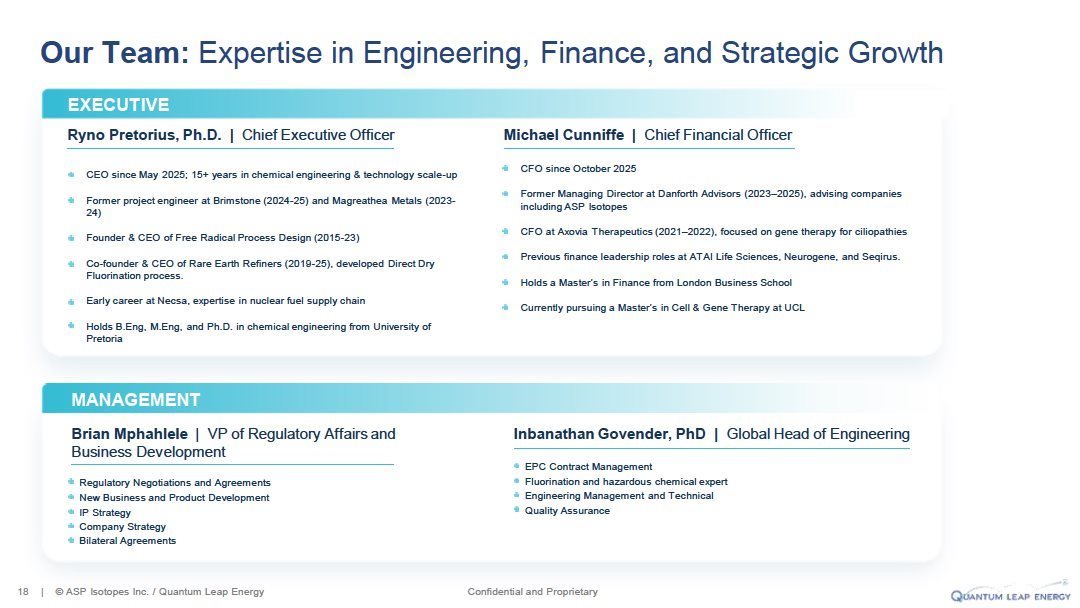

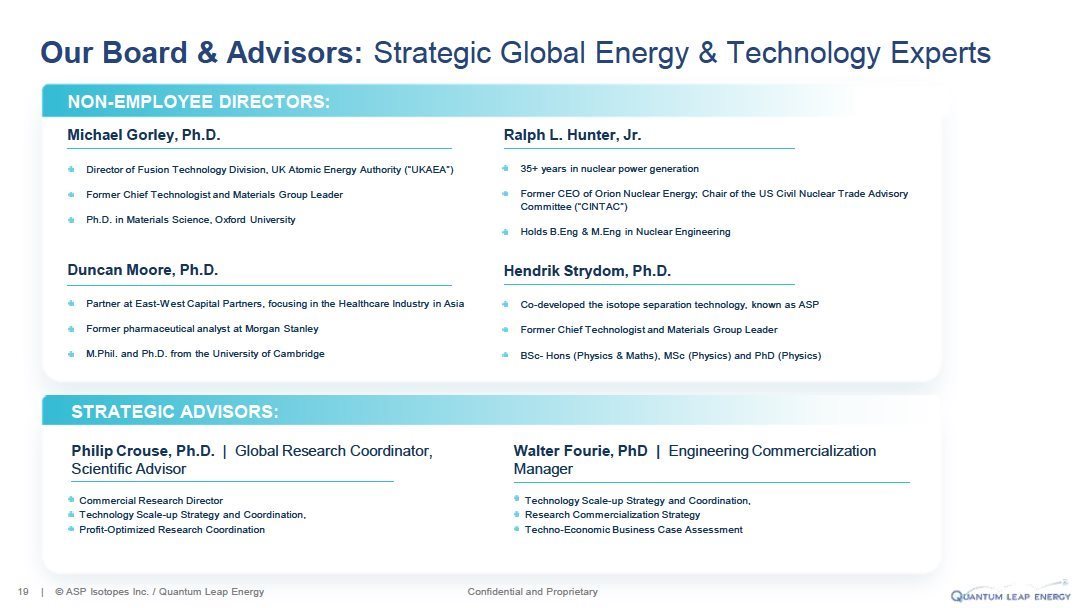

Statements contained herein or in Exhibits 99.1 and 99.2 to this Current Report on Form 8-K relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, QLE’s ability to consummate the QLE Notes Offering; QLE’s financial performance and its ability to generate sufficient revenue to achieve and sustain profitability; QLE’s ability to obtain required regulatory approvals, complete its research and development activities and manufacture, market and sell the products that it may produce; QLE’s ability to achieve success with new technological developments, including the development and deployment of SMRs and advanced nuclear reactors; the anticipated growth of QLE’s target markets for HALEU, Lithium 6 and Lithium 7, and its ability to penetrate these markets; QLE’s future capital requirements and sources and uses of cash; QLE’s ability to obtain funding for its operations and future growth; the ability to recognize the anticipated benefits of acquisitions; QLE’s inability to compete effectively; risks associated with the current economic environment; risks associated with QLE’s international operations; geopolitical risk and changes in applicable laws or regulations; and QLE’s inability to hire or retain skilled employees and the loss of any of its key personnel. These forward-looking statements involve known and unknown risks, uncertainties, and other factors, many of which may be beyond the QLE’s control, that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by any forward-looking statements.

All forward-looking statements speak only as of the date hereof. The Company and QLE undertake no obligation to revise or update any forward-looking statements except as may be required by applicable law.

Item 9.01. Financial Statements and Exhibits.

Exhibit No. |

|

Description |

|

Corporate Overview of Quantum Leap Energy LLC, dated October 2025. |

|

|

||

104 |

|

Cover Page Interactive Date File (embedded within the Inline XBRL document) |

2 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

ASP ISOTOPES INC. |

|

|

|

|

|

|

Date: November 7, 2025 |

By: |

/s/ Donald G. Ainscow |

|

|

Name: |

Donald G. Ainscow |

|

|

Title: |

Executive Vice President, General Counsel and Secretary |

|

3 |

EXHIBIT 99.1

EXHIBIT 99.2

Quantum Leap Energy LLC Announces Private Placement of Convertible Notes Led by American Ventures LLC

WASHINGTON, Nov. 7, 2025 (GLOBE NEWSWIRE) – Quantum Leap Energy LLC (“QLE”), a wholly-owned subsidiary of ASP Isotopes Inc. NASDAQ: ASPI (“ASP Isotopes” or “ASPI” or the “Company”), an advanced materials company focused on developing technologies and processes for the production of isotopes for multiple industries, today announced that QLE has commenced an offering of QLE’s convertible notes in a private placement to accredited investors and certain non-U.S. persons. QLE has entered into a definitive convertible note purchase agreement with certain investors for an initial closing of US$64.3 million aggregate principal amount of QLE’s convertible notes (the "Notes").

The issuance of Notes pursuant to the offering will result in the automatic conversion of QLE’s outstanding convertible promissory notes originally issued in March 2024 and June 2024 (together, the “2024 Convertible Notes”), pursuant to their terms.

The Notes will be unsecured and may be convertible into common equity securities of QLE, prior to maturity, and upon the occurrence of certain events, including an initial public offering, direct listing or a future equity financing, in each case at a price per share equal to the lower of 80% of the per share price in the applicable transaction or the per share value of one share of QLE’s common equity based on a set valuation cap.

The Notes will mature on the fifth anniversary of the initial closing, unless converted in accordance with their terms prior to such date. QLE may not repay the Notes prior to maturity, unless a change of control transaction occurs.

QLE intends to use the net proceeds from the offering to build and develop laser enrichment production facilities, as well as for general corporate purposes. Neither QLE nor the Company will receive any proceeds from the automatic conversion of the 2024 Convertible Notes into Notes.

The offering was led by ASPI and American Ventures LLC, with capital contributions from both Eric Trump and Donald Trump Jr. The initial closing of the offering is expected to be on or about November 10, 2025, subject to satisfaction of customary closing conditions.

The Notes are being offered to institutional investors that qualify as “accredited investors” (within the meaning of Rule 501(a) of the United States Securities Act of 1933, as amended (the "Securities Act")) or investors that are not a person in the United States or a U.S. Person (within the meaning of Rule 902(k) of Regulation S promulgated under the Securities Act). The Notes and the common equity securities of QLE deliverable upon conversion of the Notes (if any) have not been and will not be registered under the Securities Act or any other applicable securities laws, and may not be sold or otherwise transferred in the United States except under an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with any other applicable securities laws.

| 1 |

QLE may issue additional Notes in subsequent closings to investors who are non-U.S. persons in transactions outside of the United States in reliance on Regulation S under the Securities Act.

Canaccord Genuity acted as placement agent in the United States and Ocean Wall Limited acted as placement agent outside the United States.

This press release shall not constitute an offer to sell or a solicitation of an offer to purchase any securities, nor shall there be a sale of the securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

About ASP Isotopes Inc.

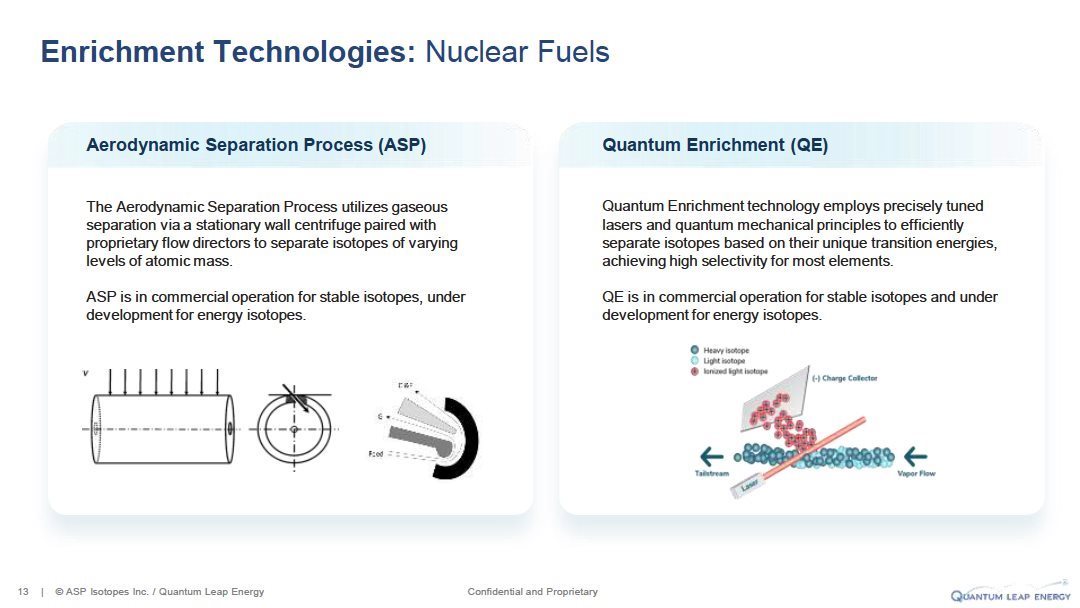

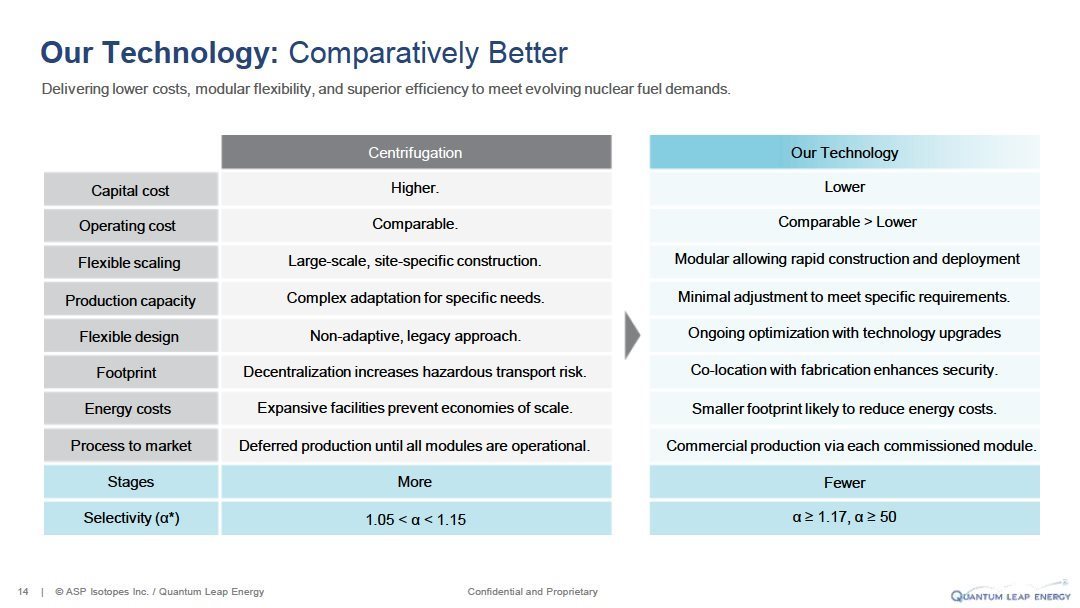

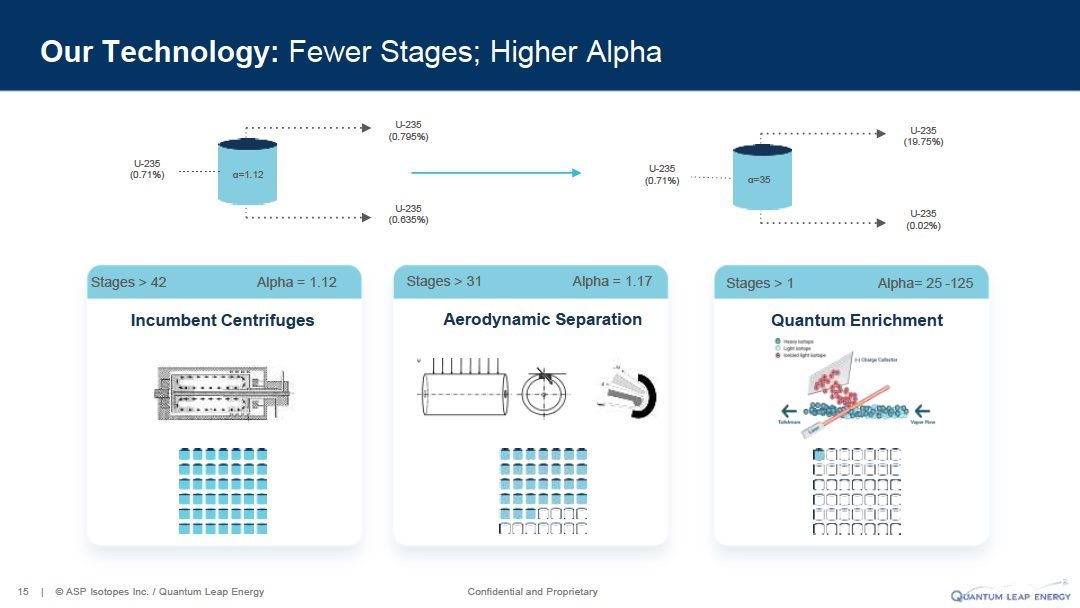

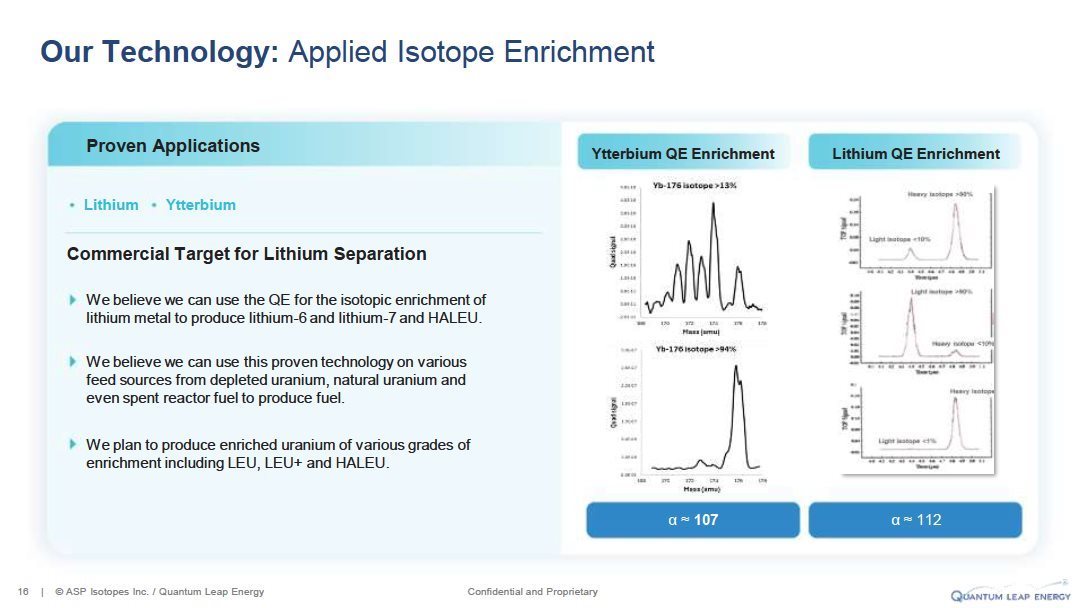

ASP Isotopes Inc. is a development stage advanced materials company dedicated to the development of technology and processes to produce isotopes for use in multiple industries. The Company employs proprietary technology, the Aerodynamic Separation Process (“ASP technology”). The Company’s initial focus is on producing and commercializing highly enriched isotopes for the healthcare and technology industries. The Company also plans to enrich isotopes for the nuclear energy sector using Quantum Enrichment technology that the Company is developing. The Company has isotope enrichment facilities in Pretoria, South Africa, dedicated to the enrichment of isotopes of elements with a low atomic mass (light isotopes).

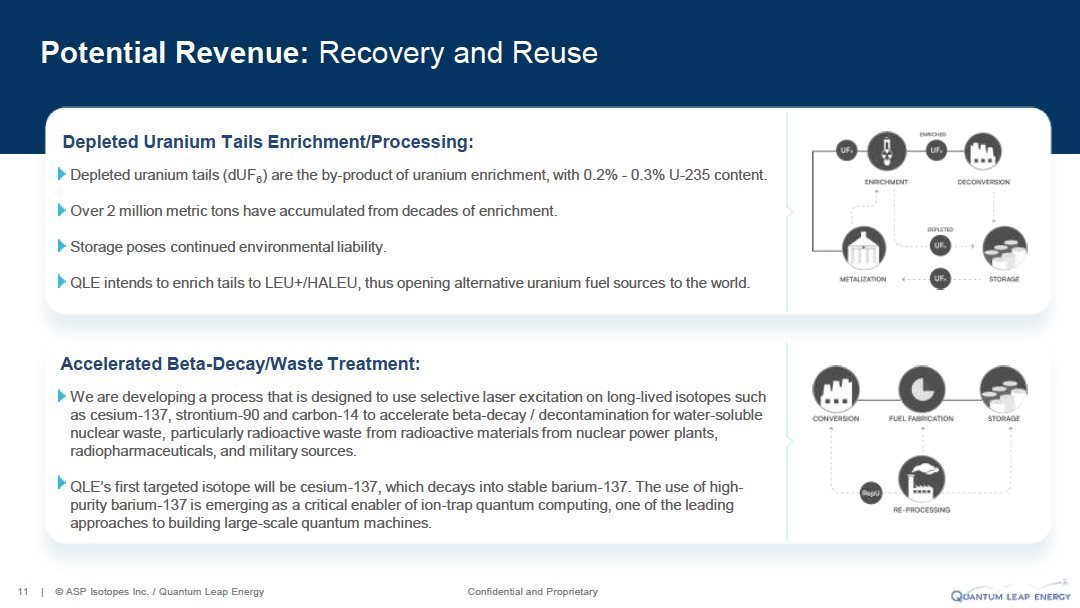

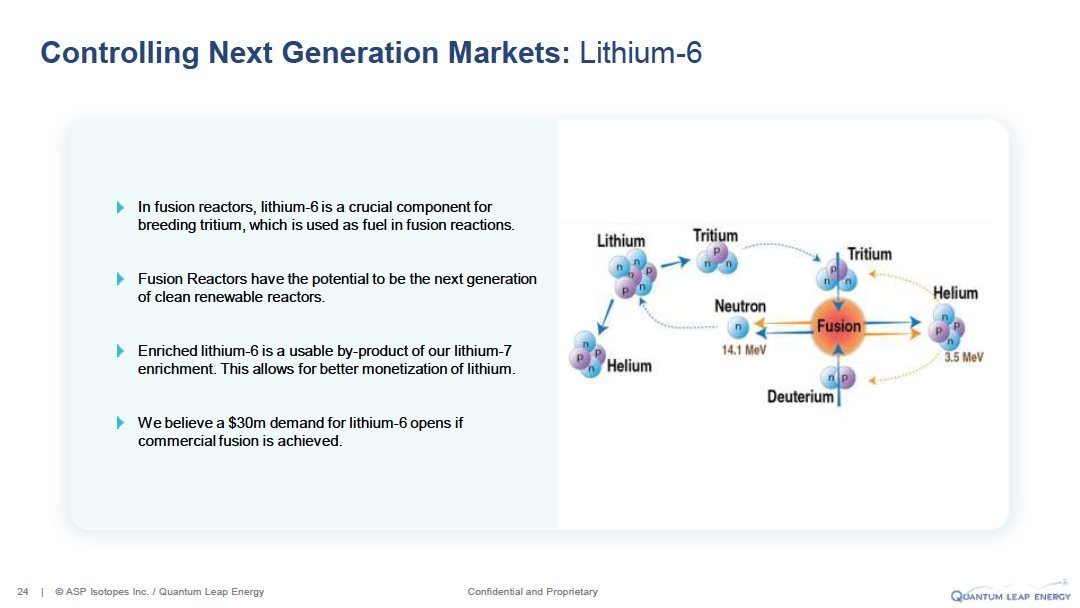

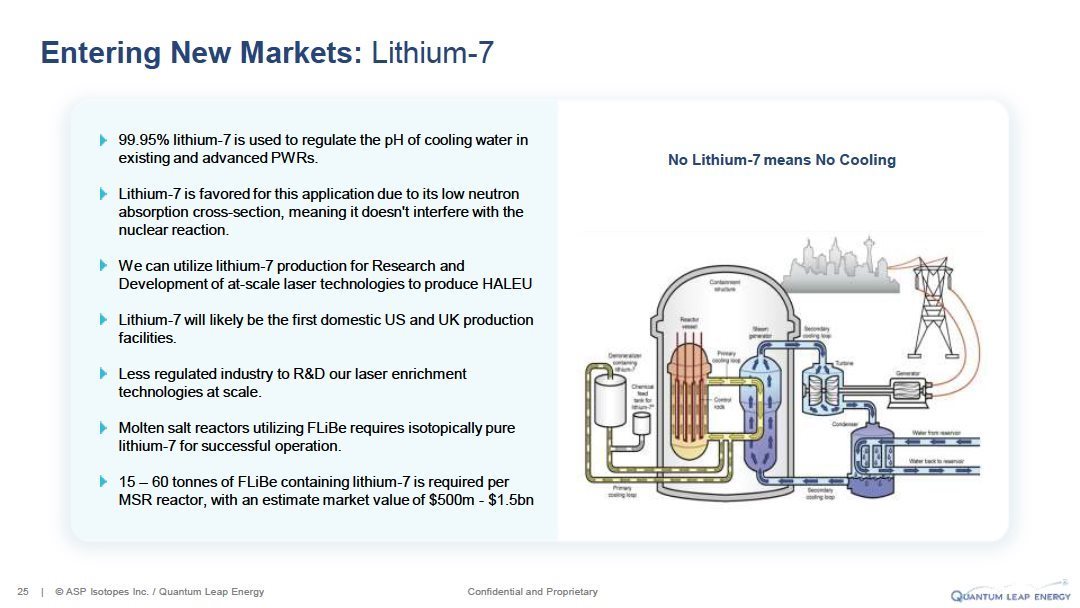

There is a growing demand for isotopes such as Silicon-28, which will enable quantum computing, and Molybdenum-100, Molybdenum-98, Zinc-68, Ytterbium-176, and Nickel-64 for new, emerging healthcare applications, as well as Chlorine-37, Lithium-6, and Uranium-235 for green energy applications. We believe the ASP technology (Aerodynamic Separation Process) is ideal for enriching low and heavy atomic mass molecules. For more information, please visit www.aspisotopes.com.

Forward Looking Statements

This press release may contain “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy, and other future conditions. Forward-looking statements can be identified by words such as “believes,” “plans,” “anticipates,” “expects,” “estimates,” “projects,” “will,” “may,” “might,” and words of a similar nature. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results, financial condition, and events may differ materially from those indicated in the forward-looking statements based upon a number of factors. Forward-looking statements are not a guarantee of future performance or developments. You are strongly cautioned that reliance on any forward-looking statements involves known and unknown risks and uncertainties. Therefore, you should not rely on any of these forward-looking statements. There are many important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements, including, but not limited to: risks and uncertainties related to the Company’s proposed offering of convertible notes of Quantum Leap Energy LLC, or factors that result in changes to the Company’s anticipated results of operations related to its products and technologies. These and other risks and uncertainties are described more fully in Part I, Item 1A. “Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 and any amendments thereto, and in the Company’s subsequent reports and filings with the U.S. Securities and Exchange Commission. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. No information in this press release should be interpreted as an indication of future success, revenues, results of operation, or stock price. All forward-looking statements herein are qualified by reference to the cautionary statements set forth herein and should not be relied upon.

Contacts

Jason Assad– Investor relations

Email: JAssad@ASPIsotopes.com

| 2 |