UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 or 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2025

Commission File Number 001-37982

| AMERICAS GOLD AND SILVER CORPORATION |

| (Translation of registrant’s name into English) |

145 King Street West, Suite 2870

Toronto, Ontario, Canada

M5H 1J8

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F

Form 20-F ☐ Form 40-F ☒

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| AMERICAS GOLD AND SILVER CORPORATION |

|

|

|

|

|

| Date: May 22, 2025 | /s/ Peter McRae |

|

|

| Peter McRae Chief Legal Officer and Senior Vice President Corporate Affairs |

|

| 2 |

INDEX TO EXHIBITS

| 3 |

EXHIBIT 99.1

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS OF

AMERICAS GOLD AND SILVER CORPORATION (the “Company”)

TO BE HELD ON June 24, 2025

Meeting Date, Location and Purpose

Notice is hereby given that the annual and special meeting (the “Meeting”) of shareholders of the Company will be held at 10:00 a.m. EDT on Tuesday June 24, 2025 in The Green Room at 200 King Street West, Main Lobby, Toronto, ON M5H 3T4.

Given security protocols, the Company will be limiting physical access to the Meeting to registered shareholders and formally appointed proxyholders, and will not be permitting any others (including beneficial shareholders that hold their shares through a broker or other intermediary) to attend. To assist the Company and its representatives in confirming a registered shareholder’s or duly appointed proxy holder’s status – for the purpose of attending the Meeting in person – as safely, efficiently, and easily as possible given building access restrictions the Company requests that those eligible persons wishing to attend the meeting in person provide notice of intention to Heidi Koch by email at hkoch@americas-gold.com by 5pm EDT on Friday June 20, 2025. The Company strongly encourages each Shareholder to submit a proxy (“Proxy”) or voting instruction form (“Voting Instruction Form”) as early as possible, in advance of the Meeting. Shareholders and any other interested persons who are unable or not permitted to attend the meeting in person have the opportunity to listen to a live audio-cast of the meeting at 10:00 a.m. (EDT) on June 24, 2025, which audio-cast can be accessed by Zoom Webinar by Online Link URL: https://zoom.us/webinar/register/WN_qb7ur3yETU2tzHhXD5Yn3w; Toll-Free Dial-In USA and Canada: 1-888-788- 0099; International Toll Number: 1-647-374-4685; Meeting ID: 977 7884 9501; Participant Code: No Code - just dial # to join. Please note it is recommended that you dial-in 10 minutes prior to the start of the meeting. This call will be listen-only and shareholders will not be able to vote or speak at, or otherwise participate in, the meeting via the webinar.

The Meeting will be held for the following purposes:

| 1. | to receive the consolidated financial statements of the Company for the year ended December 31, 2024 and the auditors’ report thereon; |

|

|

|

| 2. | to elect directors of the Company for the ensuingyear; |

|

|

|

| 3. | to reappoint auditors of the Company for the ensuing year and to authorize the board of directors of the Company to fix their remuneration; |

|

|

|

| 4. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to re-approve the Company’s deferred share unit plan and approval of the unallocated units thereunder, as more particularly described in the Management Information Circular (the “Circular”); |

|

|

|

| 5. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to re-approve the Company’s share unit plan, as amended by the proposed amendments thereto, and the approval of the unallocated units thereunder, as more particularly described in the Circular; |

| Page | 1 |

| 6. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to re-approve the Company’s stock option plan, as amended by the proposed amendments thereto, and the approval of the unallocated options thereunder, as more particularly described in the Circular; |

|

|

|

| 7. | to consider and, if deemed advisable, to pass, with or without variation, a special resolution authorizing the amendment of the Company’s articles to consolidate the common shares of the Company on such basis as the directors of the Company may determine, provided that the consolidation shall not be greater than on a five-to- one basis, as more particularly described in the Circular; and |

|

|

|

| 8. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

For detailed information with respect to each of the above matters, please refer to the subsection bearing the corresponding title under “Business of the Meeting” in the attached Management Information Circular. Any capitalized terms used and not otherwise defined in this notice have the definitions as set out in the Circular.

Notice-and-Access

The Company is using the notice-and-access provisions (the “Notice-and-Access Provisions”) provided for under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer for the delivery of the Company’s Circular to its Shareholders.

Under Notice-and-Access Provisions, instead of receiving paper copies of the Circular, shareholders will be receiving a notice-and-access notification with information on how they may obtain a copy of the Circular electronically or request a paper copy. Registered shareholders will still receive a proxy form enabling them to vote at the Meeting. The use of notice-and-access in connection with the Meeting helps reduce paper use, as well as the Company’s printing and mailing costs. The Company will arrange to mail paper copies of the Information Circular to those registered shareholders who have existing instructions on their account to receive paper copies of the Company’s Meeting materials. The Company urges Shareholders to review the Circular before voting.

Accessing Meeting Materials online

The Meeting Materials (as defined in the Circular) can be viewed online under the Company’s profile on the System for Electronic Data Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca; on the Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”) at www.sec.gov; or on the Company’s website at www.americas- gold.com/investors/shareholder-meeting-documents/.

Requesting Printed Meeting Materials

Shareholders can request that printed copies of the Meeting Materials be sent to them by postal delivery at no cost to them up to one year from the date the Circular was filed on SEDAR+ and EDGAR, by going to the Company’s website at www.americas-gold.com.

Reference to our website is included in this notice as an inactive textual reference only. Information contained on our website is not incorporated by reference in this notice and should not be considered to be a part of this notice.

To receive the Meeting Materials in advance of the Proxy Deposit Date and Meeting Date, requests for printed copies must be received no later than June 17, 2025.

Shareholders are entitled to vote at the Meeting either in person or by proxy in accordance with the procedures described in the Circular. Registered shareholders who are unable to attend the meeting are requested to read, complete, sign and mail the enclosed form of proxy (“Form of Proxy”) in accordance with the instructions set out in the Form of Proxy accompanying this Notice and in the Circular.

Dated at Toronto, Ontario as of May 15, 2025.

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

| Signed: |

|

|

|

|

| Joseph Andre Paul Huet |

|

|

|

| Chief Executive Officer |

|

| Page | 2 |

EXHIIBIT 99.2

Notice of Meeting and

Management Information Circular

For the Annual and Special Meeting of Shareholders of

Americas Gold and Silver Corporation

To be held on June 24, 2025

May 15, 2025

www.americas-gold.com

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS OF

AMERICAS GOLD AND SILVER CORPORATION (the “Company”)

TO BE HELD ON June 24, 2025

Meeting Date, Location and Purpose

Notice is hereby given that the annual and special meeting (the “Meeting”) of shareholders of the Company will be held at 10:00 a.m. EDT on Tuesday June 24, 2025 in The Green Room at 200 King Street West, Main Lobby, Toronto, ON M5H 3T4.

Given security protocols, the Company will be limiting physical access to the Meeting to registered shareholders and formally appointed proxyholders, and will not be permitting any others (including beneficial shareholders that hold their shares through a broker or other intermediary) to attend. To assist the Company and its representatives in confirming a registered shareholder’s or duly appointed proxy holder’s status – for the purpose of attending the Meeting in person – as safely, efficiently, and easily as possible given building access restrictions the Company requests that those eligible persons wishing to attend the meeting in person provide notice of intention to Heidi Koch by email at hkoch@americas-gold.com by 5pm EDT on Friday June 20, 2025. The Company strongly encourages each Shareholder to submit a proxy (“Proxy”) or voting instruction form (“Voting Instruction Form”) as early as possible, in advance of the Meeting. Shareholders and any other interested persons who are unable or not permitted to attend the meeting in person have the opportunity to listen to a live audio-cast of the meeting at 10:00 a.m. (EDT) on June 24, 2025, which audio-cast can be accessed by Zoom Webinar by Online Link URL: https://zoom.us/webinar/register/WN_qb7ur3yETU2tzHhXD5Yn3w; Toll-Free Dial-In USA and Canada: 1-888-788- 0099; International Toll Number: 1-647-374-4685; Meeting ID: 977 7884 9501; Participant Code: No Code - just dial # to join. Please note it is recommended that you dial-in 10 minutes prior to the start of the meeting. This call will be listen-only and shareholders will not be able to vote or speak at, or otherwise participate in, the meeting via the webinar.

The Meeting will be held for the following purposes:

| 1. | to receive the consolidated financial statements of the Company for the year ended December 31, 2024 and the auditors’ report thereon; |

|

|

|

| 2. | to elect directors of the Company for the ensuingyear; |

|

|

|

| 3. | to reappoint auditors of the Company for the ensuing year and to authorize the board of directors of the Company to fix their remuneration; |

|

|

|

| 4. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to re-approve the Company’s deferred share unit plan and approval of the unallocated units thereunder, as more particularly described in the Management Information Circular (the “Circular”); |

|

|

|

| 5. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to re-approve the Company’s share unit plan, as amended by the proposed amendments thereto, and the approval of the unallocated units thereunder, as more particularly described in the Circular; |

| Page | 2 |

| 6. | to consider and, if deemed advisable, to pass, with or without variation, an ordinary resolution to re-approve the Company’s stock option plan, as amended by the proposed amendments thereto, and the approval of the unallocated options thereunder, as more particularly described in the Circular; |

|

|

|

| 7. | to consider and, if deemed advisable, to pass, with or without variation, a special resolution authorizing the amendment of the Company’s articles to consolidate the common shares of the Company on such basis as the directors of the Company may determine, provided that the consolidation shall not be greater than on a five-to- one basis, as more particularly described in the Circular; and |

|

|

|

| 8. | to transact such other business as may properly come before the Meeting or any adjournment or postponement thereof. |

For detailed information with respect to each of the above matters, please refer to the subsection bearing the corresponding title under “Business of the Meeting” in the attached Management Information Circular. Any capitalized terms used and not otherwise defined in this notice have the definitions as set out in the Circular.

Notice-and-Access

The Company is using the notice-and-access provisions (the “Notice-and-Access Provisions”) provided for under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer for the delivery of the Company’s Circular to its Shareholders.

Under Notice-and-Access Provisions, instead of receiving paper copies of the Circular, shareholders will be receiving a notice-and-access notification with information on how they may obtain a copy of the Circular electronically or request a paper copy. Registered shareholders will still receive a proxy form enabling them to vote at the Meeting. The use of notice-and-access in connection with the Meeting helps reduce paper use, as well as the Company’s printing and mailing costs. The Company will arrange to mail paper copies of the Information Circular to those registered shareholders who have existing instructions on their account to receive paper copies of the Company’s Meeting materials. The Company urges Shareholders to review the Circular before voting.

Accessing Meeting Materials online

The Meeting Materials (as defined in the Circular) can be viewed online under the Company’s profile on the System for Electronic Data Analysis and Retrieval (“SEDAR+”) at www.sedarplus.ca; on the Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”) at www.sec.gov; or on the Company’s website at www.americas- gold.com/investors/shareholder-meeting-documents/.

Requesting Printed Meeting Materials

Shareholders can request that printed copies of the Meeting Materials be sent to them by postal delivery at no cost to them up to one year from the date the Circular was filed on SEDAR+ and EDGAR, by going to the Company’s website at www.americas-gold.com.

Reference to our website is included in this notice as an inactive textual reference only. Information contained on our website is not incorporated by reference in this notice and should not be considered to be a part of this notice.

To receive the Meeting Materials in advance of the Proxy Deposit Date and Meeting Date, requests for printed copies must be received no later than June 17, 2025.

Shareholders are entitled to vote at the Meeting either in person or by proxy in accordance with the procedures described in the Circular. Registered shareholders who are unable to attend the meeting are requested to read, complete, sign and mail the enclosed form of proxy (“Form of Proxy”) in accordance with the instructions set out in the Form of Proxy accompanying this Notice and in the Circular.

Dated at Toronto, Ontario as of May 15, 2025.

|

| BY ORDER OF THE BOARD OF DIRECTORS |

|

|

|

|

|

|

|

|

| Signed: |

|

|

|

|

| Joseph Andre Paul Huet |

|

|

|

| Chief Executive Officer |

|

| Page | 3 |

| Management Information Circular Summary

| Meeting Information |

||||

| This summary highlights information contained elsewhere in this Circular. It does not contain all the information that you should consider. Please read the entire Circular carefully before voting. |

| Date: | Tuesday June 24, 2025 |

||

|

|

| Time: | 10:00 a.m. EDT |

||

| Voting Recommendations |

| Place: | The Green Room at |

||

|

|

|

| 200 King Street West, Main Lobby , Toronto, ON M5H 3T4 |

||

|

|

|

|

|

|

|

| Proposal |

| Board Recommendation |

| Record Date You are entitled to vote at the meeting if you were a holder of common shares at the close of business on May 9, 2025.

Vote Deadline To make sure that your vote is counted, please ensure your vote is received by 10:00 a.m. EDT on June 20, 2025 or 48 hours (excluding Saturdays, Sundays or holidays) before the time of any adjourned or postponed Meeting.

How You Can Accessthe Meeting Materials Online Americas Gold and Silver Corporation has decided to deliver the Meeting Materials by posting them online at www.americas- gold.com/investors/shareholder- meeting-documents/

The use of this alternative means of delivery is more environmentally friendly as it will help reduce paper use.

The Meeting Materials will be available on the Company’s website as of May 22, 2025 and will remain on the website for one year thereafter.

|

|

|

|

|

|

|

||

| Elect directors of the Company for the ensuing year |

| FOR |

|

||

|

|

|

|

|

||

| Re-appoint auditors of the Company for the ensuing year at a remuneration to be fixed by the board of directors of the Company |

| FOR |

|

||

|

|

|

|

|

||

| Re-approve the Company’s deferred share unit plan |

| FOR |

|

||

|

|

|

|

|

||

| Re-approve the Company’s share unit plan, as amended by the proposed amendments thereto |

| FOR |

|

||

|

|

|

|

|

||

| Re-approve the Company’s stock option plan, as amended by the proposed amendments thereto |

|

FOR |

|

||

|

|

|

|

|

||

| Authorize the amendment of the Company’s articles to consolidate the Common Shares of the Company |

|

FOR |

|

||

|

Attending the Annual and Special Meeting If you plan to attend the Meeting, please follow the instructions starting on page 2 (Notice of Meeting) and page 8 of this Circular. |

|

||||

| Governance Highlights |

| and Policy |

|

|

|

|

|

|

| ✓ | 87.5% Independent Board | ✓ | In-camera sessions at Board and committee meetings |

| ✓ | Individual election of all directors | ✓ | Annual Board, committee and director evaluations |

| ✓ | Independent committees | ✓ | Orientation package for new directors |

| ✓ | Majority Voting Statutory Requirement |

|

|

| Page | 4 |

Director Nominees

|

Name |

Age |

Independent |

Director Since |

2024 Committees |

2024 Board attendance |

No. of other public boards |

| JOSEPH ANDRE PAUL HUET Chairman and Chief Executive Officer |

56 |

|

20241 |

S&T |

N/A |

2 |

| SCOTT HAND Lead Director |

82 |

· |

20241 |

CCG |

N/A |

1 |

| PETER GOUDIE Director |

76 |

· |

20241 |

CCG |

N/A |

1 |

| TARA HASSAN Director |

42 |

· |

20252 |

N/A |

N/A |

1 |

| MERI VERLI Director |

63 |

· |

20253 |

N/A |

N/A |

1 |

| BRADLEY R. KIPP Director |

61 |

· |

2014 |

AC (Chair) |

100% |

N/A |

| GORDON E. PRIDHAM Director |

69 |

· |

20084 |

AC, CCG |

100% |

N/A |

| 1. | Joined the Board effective December 19, 2024 after the closing of the Galena Consolidation Transaction | AC = | Audit Committee of the Company. |

| 2. | Joined the Board effective April 21, 2025 | CCG = | Compensation and Corporate Governance Committee of the Company. |

| 3. | Director Nominee, expected to join board after shareholder vote | S&T = | Sustainability and Technical Committee of the Company. |

| 4. | Previously Director of U.S. Silver & Gold since 2012 and U.S. Silver Corp. since 2008. |

|

|

| Page | 5 |

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

MANAGEMENT INFORMATION CIRCULAR

AND

PROXY STATEMENT

TABLE OF CONTENTS

| SOLICITATION OF PROXIES |

| 7 |

|

| Notice-and-Access |

| 8 |

|

| Appointment of Proxies |

| 9 |

|

| Voting by Registered Shareholders |

| 9 |

|

| Voting by Non-Registered Shareholders |

| 10 |

|

| Voting Shares and Principal Holders Thereof |

| 12 |

|

| BUSINESS OF THE MEETING |

| 13 |

|

| Item 1 – Presentation of Audited Financial Statements |

| 13 |

|

| Item 2 – Election of Directors |

| 13 |

|

| Item 3 – Appointment of Auditor |

| 22 |

|

| Item 4 – Re-Approval of Deferred Share Unit Plan |

| 22 |

|

| Item 5 – Re-Approval of Share Unit Plan (formerly the RSU Plan) and Approval of the Proposed Share Unit Plan Amendment |

| 24 |

|

| Item 6 – Re-Approval of Stock Option Plan and Approval of the Proposed Stock Option Plan Amendments |

| 25 |

|

| Item 7 – Share Consolidation |

| 26 |

|

| STATEMENT OF EXECUTIVE & DIRECTOR COMPENSATION. |

| 32 |

|

| Compensation Discussion and Analysis |

| 32 |

|

| Director Compensation |

| 45 |

|

| SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

| 51 |

|

| DIRECTORS’ AND OFFICERS’ INSURANCE AND INDEMNIFICATION |

| 51 |

|

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES |

| 52 |

|

| Board of Directors and Independence from Management |

| 52 |

|

| Performance Assessment |

| 53 |

|

| Meetings of the Board and Committees of the Board |

| 53 |

|

| Meetings of Independent Directors |

| 54 |

|

| Board Mandate |

| 54 |

|

| Position Descriptions |

| 54 |

|

| Other Company Directorships |

| 55 |

|

| Orientation and Continuing Education |

| 55 |

|

| Nomination of Directors |

| 56 |

|

| Risk Management |

| 57 |

|

| Ethical Business Conduct |

| 55 |

|

| Shareholder Engagement |

| 58 |

|

| Whistleblower Policy |

| 58 |

|

| Corporate Disclosure and Securities Trading Policy |

| 58 |

|

| Board Committees |

| 59 |

|

| ADDITIONAL DISCLOSURE ON EQUITY PLANS |

| 60 |

|

| INDEBTEDNESS OF DIRECTORS AND OFFICERS |

| 68 |

|

| INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON |

| 68 |

|

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

| 68 |

|

| ADDITIONAL INFORMATION |

| 68 |

|

| BOARD APPROVAL |

| 69 |

|

| FORWARD-LOOKING STATEMENTS |

| 70 |

|

| SCHEDULE “A” BOARD MANDATE |

| 72 |

|

| SCHEDULE “B” DEFERRED SHARE UNIT PLAN |

| 73 |

|

| SCHEDULE “C” SHARE UNIT PLAN |

| 74 |

|

| SCHEDULE “D” STOCK OPTION PLAN |

| 75 |

|

| Page | 6 |

MANAGEMENT INFORMATION CIRCULAR

In this Circular all information provided is current as of May 9, 2025, unless otherwise indicated.

In this Circular, unless otherwise specified or the context otherwise requires, all references to $ are to U.S. dollars and all references to “CDN $” are to Canadian dollars.

SOLICITATION OF PROXIES

THIS CIRCULAR IS FURNISHED IN CONNECTION WITH THE SOLICITATION, BY OR ON BEHALF OF THE MANAGEMENT OF AMERICAS GOLD AND SILVER CORPORATION (“AMERICAS GOLD” OR THE “COMPANY”), OF PROXIES TO BE USED AT THE COMPANY’S ANNUAL AND SPECIAL MEETING (THE “MEETING”) OF THE HOLDERS (THE “SHAREHOLDERS”) OF COMMON SHARES (“COMMON SHARES”) OF THE COMPANY TO BE HELD AT A TIME AND PLACE AND FOR THE PURPOSES SET FORTH IN THE ACCOMPANYING NOTICE OF MEETING (THE “NOTICE OF MEETING”) OR AT ANY ADJOURNMENT THEREOF.

The Company will be hosting the Meeting in The Green Room at 200 King Street West, Main Lobby, Toronto, ON M5H 3T4.

Given security protocols, the Company will be limiting physical access to the Meeting to registered shareholders and formally appointed proxyholders, and will not be permitting any others (including beneficial shareholders that hold their shares through a broker or other intermediary) to attend. To assist the Company and its representatives in confirming a registered shareholder’s or duly appointed proxy holder’s status – for the purpose of attending the Meeting in person – as safely, efficiently, and easily as possible given building access restrictions, the Company requests that those eligible persons wishing to attend the meeting in person provide notice of intention to Heidi Koch by email at hkoch@americas-gold.com by 5pm EDT on Friday June 20, 2025. The Company strongly encourages each Shareholder to submit a proxy (“Proxy”) or voting instruction form (“Voting Instruction Form”) as early as possible, in advance of the Meeting. Shareholders and any other interested persons who are unable or not permitted to attend the meeting in person have the opportunity to listen to a live audio-cast of the meeting at 10:00 a.m. (EDT) on June 24, 2025, which audio-cast can be accessed by Zoom Webinar by Online Link URL: https://zoom.us/webinar/register/WN_qb7ur3yETU2tzHhXD5Yn3w; Toll-Free Dial-In USA and Canada: (888) 788- 0099; International Toll Number: +1 (647) 374-4685; Meeting ID: 977 7884 9501; Participant Code: No Code - just dial # to join. Please note it is recommended that you dial-in 10 minutes prior to the start of the meeting. This call will be listen-only and shareholders will not be able to vote or speak at, or otherwise participate in, the meeting via the webinar.

| Page | 7 |

As a Shareholder of Americas Gold, you have the right to vote your Common Shares in respect of the Share Consolidation (as defined below). To help you make an informed decision, please carefully read this Circular, which h contains a description of the Share Consolidation and other relevant information. Information contained in this Circular should not be construed as financial, legal or tax advice and you are urged to consult your own professional advisors in connection therewith.

References in this Circular to the Meeting include any adjournment or postponement thereof. While it is expected that the solicitation will be made by mail, proxies may be solicited personally or by telephone by directors, officers and employees of the Company. The Company may also use the services of a proxy advisory firm. The aggregate fees for any advisory proxy firm would be borne by the Company.

The record date for the Meeting is May 9, 2025 (the “Record Date”). The Record Date is the date for the determination of Shareholders entitled to receive notice of, and to vote at, the Meeting. Duly completed and executed proxies must be received by the Company’s transfer agent at the address indicated on the enclosed envelope no later than 10:00

a.m. EDT on June 20, 2025, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned or postponed Meeting (the “Proxy Deposit Date”).

Notice-and-Access

The Company has elected to use Notice-and-Access Provisions provided for under National Instrument 51-102 – Continuous Disclosure Obligations and National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer for the delivery of meeting materials to its Shareholders.

The Notice-and-Access Provisions are rules developed by the Canadian Securities Administrators to reduce the volume of materials that must be physically mailed to Shareholders by allowing a reporting issuer to post the relevant meeting materials for a meeting of Shareholders online. The Company believes that the use of the Notice-and-Access Provisions reduces paper waste and mailing costs to the Company.

In order for the Company to utilize Notice-and-Access to deliver proxy-related materials by posting the Circular, the Company’s financial statements for the year ending December 31, 2024 and accompanying Management’s Discussion and Analysis (together and with any other required documentation to be provided to Shareholders in connection with the Meeting, the “Meeting Materials”) electronically on a website that is not the System for Electronic Data Analysis and Retrieval (“SEDAR+”), the Company must send a notice to Shareholders, including non-registered Shareholders, indicating that the Meeting Materials have been posted and explaining how a Shareholder can access them or obtain, from the Company, a paper copy of the Meeting Materials. The Meeting Materials have been posted in full on the Company’s website at https://www.americas-gold.com/investors/shareholder-meeting-documents/ and under the Company’s SEDAR+ profile at www.sedarplus.ca and on the Electronic Data Gathering, Analysis and Retrieval system (“EDGAR”) at www.sec.gov.

Although the Company has elected to use the Notice-and-Access Provisions, both registered Shareholders and non- registered Shareholders (beneficial holders) will receive a package that will include either a form of proxy (“Form of Proxy”) (in the case of registered Shareholders) or a Voting Instruction Form (in the case of non-registered Shareholders), among other materials (collectively, the “Printed Materials”). Shareholders may receive multiple packages of these Printed Materials if a Shareholder holds their Common Shares through one or more intermediary (“Intermediary”), or if a Shareholder is both a registered Shareholder and a non-registered Shareholder or beneficial Shareholder.

Should a Shareholder receive multiple packages, a Shareholder should repeat the steps to vote through a proxy, appoint a proxyholder or attend the Meeting, if desired, separately for each package to ensure that all their Common Shares are voted at the Meeting.

| Page | 8 |

Appointment of Proxies

THE PERSONS SPECIFIED IN THE ENCLOSED FORM OF PROXY ARE AUTHORIZED REPRESENTATIVES OF THE COMPANY. EACH SHAREHOLDER HAS THE RIGHT TO APPOINT AS PROXYHOLDER A PERSON OR COMPANY (WHO NEED NOT BE A SHAREHOLDER OF THE COMPANY) TO ATTEND, ACT AND VOTE FOR SUCH SHAREHOLDER AT THE MEETING OTHER THAN THOSE NAMED IN THE ENCLOSED FORM OF PROXY.

The Company has determined that those registered and beneficial Shareholders with existing instructions on their account to receive printed materials will receive a printed copy of the Meeting Materials together with the Notice of Meeting and Form of Proxy or Voting Instruction Form.

The Company will deliver copies of the applicable proxy-related Meeting Materials directly to registered and non- objecting beneficial Shareholders, through the services of its registrar and transfer agent, Computershare Investor Services Inc.

Any Shareholder who wishes to receive a paper copy of the Meeting Materials must contact the Company’s transfer agent, Computershare Investor Services Inc. at 100 University Avenue, 8th Floor, Toronto, ON M5J 2Y1, by telephone at 1-866-964-0492 (toll free from Canada and U.S.) or 1-514-982-7555 (International). In order to ensure that a paper copy of the Circular can be delivered to a requesting Shareholder in time for such Shareholder to review the Circular and return a proxy or Voting Instruction Form prior to the deadline to receive proxies, it is strongly suggested that a Shareholder ensure their request is received no later than June17, 2025.

All Shareholders may call the toll-free number for Computershare Investor Services Inc. listed above in order to obtain additional information regarding Notice-and-Access or to obtain a paper copy of the Meeting Materials, up to and including the date of the Meeting, including any adjournment or postponement of the Meeting.

Voting by Registered Shareholders

A registered Shareholder appointing a proxyholder may indicate the manner in which the appointed proxyholder can vote with respect to any specific item by checking the space opposite the item on the Form of Proxy. If the Shareholder submitting the Form of Proxy wishes to confer a discretionary authority with respect to any item of business, then the space opposite the item should be left blank. The Common Shares represented by the Form of Proxy submitted by a Shareholder will be voted or withheld from voting in accordance with the directions, if any, given in the Form of Proxy. If the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly.

Voting Common Shares by Proxy

Registered shareholders at the close of business on May 9, 2025 may vote their proxies as follows:

| Online: | Go to the website indicated on the Form of Proxy and follow the instructions on the screen. If you return your proxy via the internet, you can appoint another person, who need not be a Shareholder, to represent you at the Meeting by inserting such person’s name in the blank space provided. Complete and submit your Voting Instruction Form and submit your vote. |

| By Mail: | Complete the Form of Proxy and return it in the envelope provided. If you return your proxy by mail you can appoint another person, who need not be a Shareholder, to represent you at the Meeting by inserting such person’s name in the blank space provided in the Form of Proxy. Complete your voting instructions and date, sign and return the proxy. |

| Page | 9 |

Deadline for Receipt of Proxies

All duly completed and executed Forms of Proxy must be received, via mail or internet, by the Proxy Deposit Date. Notwithstanding the foregoing, the Chair of the Meeting has the sole discretion to accept proxies received after such deadline but is under no obligation to do so. A registered Shareholder attending the Meeting has the right to vote in person and if he does so, his proxy is nullified with respect to the matters such person votes upon and any subsequent matters thereafter to be voted upon at the Meeting or any adjournment or postponement thereof.

Revocation of Proxies

A proxy submitted pursuant to this solicitation may be revoked in any manner permitted by law and by written notice, signed by the Shareholder or by the Shareholder’s attorney authorized in writing (or, if the Shareholder is a corporation, by a duly authorized officer or attorney), and deposited with the Company’s transfer agent, Computershare Investor Services Inc., 100 University Avenue, 8th Floor, Toronto, ON M5J 2Y1, at any time up to and including the last business day preceding the date of the Meeting, or any adjournment or postponement thereof, at which the proxy is to beused.

A proxy submitted pursuant to this solicitation may also be revoked prior to the commencement of voting by attending the Meeting in person and registering with the scrutineers as a registered Shareholder personally present. The revocation of a proxy does not affect any matter on which a vote has been taken before the revocation.

Exercise of Discretion by Proxies

The persons named in the enclosed Form of Proxy will vote the Common Shares in respect of which they are appointed in accordance with the direction of the Shareholders appointing them. In the absence of such direction, the relevant Common Shares will be voted in favour of the passing of all the resolutions described below.

The enclosed Form of Proxy confers discretionary authority on the persons named in the proxy with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting. At the time of printing of this Circular, the Company’s management team (“Management”) knows of no such amendments, variations or other matters to come before the Meeting. However, if amendments or variations to any other matters which are not now known to Management should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgment of the named proxies.

Voting by Non-Registered Shareholders

Only registered Shareholders of the Company or the persons they appoint as their proxies are permitted to vote at the Meeting. Most Shareholders of the Company are “non-registered” shareholders because the Common Shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the Common Shares. Common Shares held by brokers or their agents or nominees can only be voted (for or against resolutions) upon the instructions of the non- registered shareholder. Without specific instructions, a broker and its agents and nominees are prohibited from voting Common Shares for the broker’s clients. Therefore, non-registered shareholders should ensure that instructions respecting the voting of their Common Shares are communicated to the appropriate person or that the Common Shares are duly registered in their name.

| Page | 10 |

Applicable regulatory policy requires intermediaries/brokers to seek voting instructions from non-registered shareholders in advance of Shareholders’ meetings. Every intermediary/broker has its own mailing procedures and provides its own return and voting instructions to clients, which should be carefully followed by non- registered Shareholders in order to ensure that their Common Shares are voted at the Meeting. Common Shares beneficially owned by a non-registered Shareholder are registered either:

| i. | in the name of an intermediary that the non-registered shareholder deals with in respect of the Common Shares of the Company (intermediaries include, amongst others, banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or |

|

|

|

| ii. | in the name of a clearing agency (such as CDS Clearing and Depository Services Inc. in Canada or The Depository Trust & Clearing Corporation in the United States) of which the intermediary is a participant. |

In accordance with applicable securities law requirements, the Company will distribute copies of the Notice of Meeting and the Form of Proxy (which includes a place to request copies of the Company’s annual and/or interim financial statements and MD&A or to waive the receipt of the annual and/or interim financial statements and MD&A) together with the Meeting Materials in the case of certain non-registered Shareholders to the clearing agencies and intermediaries for distribution to non-registered Shareholders.

Intermediaries are required to forward the applicable proxy-related materials to non-registered Shareholders unless a non-registered Shareholder has waived the right to receive them. Intermediaries often use service companies to forward the proxy-related materials to non-registered Shareholders. Generally, non-registered Shareholders who have not waived the right to receive proxy-related materials will either:

| i. | be given a Voting Instruction Form which is not signed by the intermediary and which, when properly completed and signed by the non-registered Shareholder and returned to the intermediary or its service company, will constitute voting instructions which the intermediary must follow. Typically, the Voting Instruction Form will consist of a one-page pre-printed form; or |

|

|

|

| ii. | be given a Form of Proxy which has already been signed by the intermediary (typically by a stamped signature), which is restricted as to the number of Common Shares beneficially owned by the non-registered Shareholder but which is otherwise not completed by the intermediary. Because the intermediary has already signed the Form of Proxy, this Form of Proxy is not required to be signed by the non-registered Shareholder when submitting the proxy. In this case, the non-registered Shareholder who wishes to submit a proxy should carefully follow the instructions of their intermediary, including those regarding when and where the completed proxy is to be delivered. |

In either case, the purpose of these procedures is to permit non-registered Shareholders to direct the voting of the Common Shares of the Company that they beneficially own. Since only registered Shareholders and their proxies may attend and vote at the Meeting, if a non-registered Shareholder attends the Meeting the Company will have no record of the non-registered Shareholder’s shareholding or of his, her or its entitlement to vote unless the non- registered Shareholder’s nominee has appointed the non-registered Shareholder as proxyholder. Therefore, a non- registered Shareholder who receives one of the above forms and wishes to vote at the Meeting in person (or have another person attend and vote on behalf of the non-registered Shareholder) should strike out the names of the persons listed and insert the non-registered Shareholder’s or such other person’s name in the blank space provided. In either case, non-registered Shareholders should carefully follow the instructions of their intermediary, including those regarding when and where the proxy or Voting Instruction Form is to be delivered.

| Page | 11 |

A non-registered Shareholder who has submitted a proxy may revoke it by contacting the intermediary through which the non-registered Shareholder’s Common Shares are held and following the instructions of the intermediary respecting the revocation of proxies.

In all cases it is important that the Voting Instruction Form or Form of Proxy be received by the intermediary or its agent sufficiently in advance of the deadline set forth in the Notice of Meeting to enable the intermediary or its agent to provide voting instructions on your behalf before thedeadline.

Voting Shares and Principal Holders Thereof

As of the Record Date, the Company had 652,356,884 Common Shares issued and outstanding. Each Common Share carries the right to one vote on all matters to be acted on at the Meeting. Each registered Shareholder on the Record Date will be entitled to vote at the Meeting or any adjournment or postponement thereof. All such registered Shareholders are entitled to attend and vote in person at the Meeting, the Common Shares held by them or, provided a completed and executed proxy has been delivered to the Company’s transfer agent by the Proxy Deposit Date, to attend and vote by proxy at the Meeting the Common Shares held by them.

To the knowledge of the directors and officers of the Company, as of the Record Date, there are no persons or companies who beneficially own, directly or indirectly, or exercise control or direction over, securities carrying more than 10% of the voting rights attached to any class of voting securities of the Company, other than, Mr. Eric Sprott, who directly or indirectly, beneficially owns or exercises control or discretion over 120,259,8491 Common shares representing approximately 18% of the issued and outstanding Common Shares as of the Record Date.

****

___________________________

1 Based on the Early Warning Report of Mr. Eric Sprott dated December 19, 2024.

| Page | 12 |

BUSINESS OF THE MEETING

Item 1 – Presentation of Audited Financial Statements

Copies of the Company’s audited financial statements for the financial year ended December 31, 2024, together with the auditors’ report thereon, have been made available or mailed to any registered and beneficial shareholders that have duly requested them and will be submitted to the Meeting. No vote is required nor will be taken on the financial statements, and the auditor’s report thereon and receipt of such financial statements will not constitute approval or disapproval of any matters referred to therein.

Copies of the audited financial statements may be obtained by contacting the Company’s registered office at Suite 2870, 145 King Street West, Toronto, Ontario M5H 1J8, by visiting the Company’s website at https://www.americas- gold.com/investors/shareholder-meeting-documents/, or by going to the Company’s profile on SEDAR+ at www.sedarplus.ca or on EDGAR at www.sec.gov.

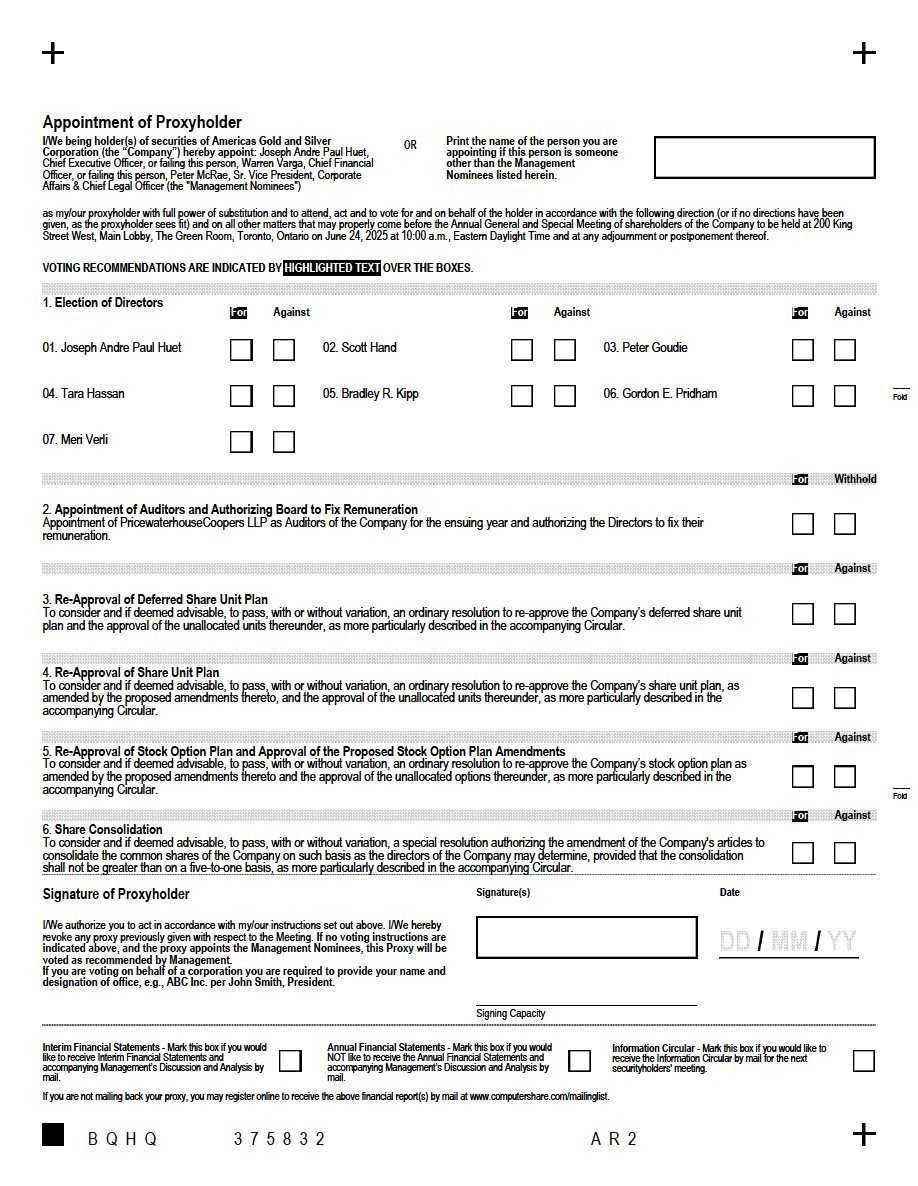

Item 2 – Election of Directors

There are currently seven (7) directors on the Board (one of whom is not standing for re-election at the Meeting) and one director nominee for a total of seven nominees for election at the Meeting. Under the by-laws of the Company, directors of the Company are elected annually. Each director will hold office until the next annual meeting or until the successor of such director is duly elected or appointed in accordance with the by-laws.

In the absence of instruction to the contrary, the persons named in the accompanying Form of Proxy intend to vote FOR the election of each of the individuals nominated for election as a director and named herein (each, a “Nominee”).

The election of directors at the Meeting will be governed by the majority voting requirements under the Canada Business Corporations Act (the “CBCA”), which came into force on August 31, 2022. Specifically, the CBCA requires that, for elections at which there is only one candidate nominated for each position available on the Board, shareholders vote “for” or “against” individual directors (rather than “for” or “withhold”) and each candidate is elected only if they receive a majority of votes cast in their favour. The CBCA provides that if an incumbent director is not elected in those circumstances, the director may continue in office until the earlier of (i) the 90th day after the day of the election, and (ii) the day on which their successor is appointed or elected.

Six of the Nominees presently serve as directors of the Company and have served since the dates set forth in the tables below.

Management does not contemplate that any of the Nominees will be unable to serve as director, but if that should occur for any reason prior to the Meeting, the Common Shares represented by properly executed proxies to be voted in favour of such Nominee(s) may be voted by the person(s) designated by Management in the enclosed Form of Proxy, in their discretion, in favour of another nominee.

The following tables contain brief biographies for each of the Nominees, including their principal occupations, business or employment within the past five years, name, province or state and country of residence, age, independence status, board and committee attendance record, other public board memberships, date they first became a director of the Company and number of Common Shares, other securities and stock options beneficially owned by each Nominee or the person’s associates or affiliates as at May 9, 2025. The statement as to the Common Shares, stock options and other securities beneficially owned, directly or indirectly, or over which control or direction is exercised by the Nominees as at Record Date in each instance has been provided by the respective Nominee. The DSUs represent a deferred payment of the director’s board fees and are redeemable for cash or Common Shares of the Company (in the Company’s discretion) at the time of resignation from the Board based on the value of the Common Shares at the time of redemption.

| Page | 13 |

| Joseph Andre Paul Huet |

|||||

| Chairman of the Board Reno, Nevada |

|||||

| Age: 56 | Status: Non- Independent | Director since: December 19, 2024 |

|||

|

Mr. Huet is the Chairman and Chief Executive Officer of Americas Gold. Mr. Huet served as the Executive Chairman of Karora Resources Inc. from February 25, 2019 until July 18, 2019, when he was appointed Chairman and interim Chief Executive Officer. The “interim” portion of his title was removed in August 2019, and Mr. Huet served as Chairman and Chief Executive Officer of Karora Resources Inc. until its acquisition by Westgold Resources Limited in August 2024. Previously, Mr. Huet was President, Chief Executive Officer and Director of Klondex Mines from 2012 - 2018, until its acquisition by Hecla Mining Company. Mr. Huet has a strong command of capital markets and has served in all levels of engineering and operations of Mining. Mr. Huet graduated with Honors from the Mining Engineering Technology program at Haileybury School of Mines in Ontario, and successfully completed the Stanford Executive program at the Stanford School of Business. In 2013 Mr. Huet was nominated for the Premiers Award in Ontario for outstanding College graduates; he is currently a member of OACETT as an applied Science Technologist and an Accredited Director.

Mr. Huet serves as Chair of the Board and Chair of the S&T Committee (as defined below).

|

|||||

| Common Shares Held | 21,380,934 |

||||

|

|

|||||

| Other Securities Held |

|||||

| Type | Securities Held (#) |

||||

| RSUs (cash or share settled) | 5,750,000 |

||||

| Options Held | 4,250,000 |

||||

|

|

|||||

| Americas Board and Committee Membership 2024 | Attendance at Americas Board and Committee Meetings 2024 |

| Other Public Board Memberships |

||

| Board S&T Committee | N/A N/A | Culico Metals Inc. New Found Gold Corp. |

|||

| Page | 14 |

| SCOTT HAND |

|||||

| Lead Director Ontario, Canada |

|||||

| Age: 82 | Status: Independent | Director since: December 19, 2024 |

|||

|

Mr. Hand is a founder and Executive Chairman of Kharrouba Copper Company Inc. (copper mining and processing in Morocco) and Lead Director of Boyd Biomedical LLC (services and products to the medical and life science industries in the U.S.). He is a former Lead Director (and prior to that, Executive Chairman) of Karora Resources Inc. (sold to Westgold Resources Limited in 2024), director of Culico Metals Inc., Fronteer Gold Inc. (sold to Newmont Mining in 2011), Legend Gold Corp., Chinalco Mining Corporation International (copper mining in Peru) and Manulife Financial Corporation. Mr. Hand was the Chairman and Chief Executive Officer of Inco Limited from April 2002 until he retired from Inco in January 2007. Prior to that, Mr. Hand was President of Inco Limited and held positions in Strategic Planning, Business Development and Law. Mr. Hand received a Bachelor of Arts degree from Hamilton College in 1964, a Juris Doctorate degree from Cornell University in 1969 and an Honorary degree from Memorial University of Newfoundland and Labrador in 2005. He served in the United States Peace Corps in Ethiopia from 1964 to 1966.

Mr. Hand serves as a member of the CCG Committee.

|

|||||

| Common Shares Held | 1,795,879 |

||||

|

|

|||||

| Other Securities Held |

|||||

| Type | Securities Held (#) |

||||

| DSUs | 1,285,498 |

||||

| Options | 250,000 |

||||

|

|

|||||

| Americas Board and Committee Membership 2024 | Attendance at Americas Board and Committee Meetings 2024 |

| Other Public Board Memberships |

||

| Board CCG Committee | N/A N/A | Boyd Biomedical LLC |

|||

| Page | 15 |

| PETER GOUDIE |

||||

| Director New South Wales, Australia |

||||

| Age: 76 | Status: Indepen dent | Director since: December 19, 2024 |

||

|

Mr. Goudie is currently retired from full-time employment. Mr. Goudie currently serves as a director of Culico Metals Inc. and served as a director of Karora Resources Inc. from July 2008 to August 2024. He was Executive Vice President (Marketing) of Inco Limited and then Vale Inco from January 1997 to February 2008. In that role Mr. Goudie was also responsible for the strategy, negotiation, construction and operation of Inco’s joint venture production projects in Asia. He was employed with Inco since 1970 in increasingly more senior accounting and financial roles in Australia, Indonesia, Singapore and Hong Kong, before becoming Managing Director (later President and Managing Director) of Inco Pacific Ltd. in Hong Kong in 1988. He is an Australian CPA.

Mr. Goudie serves as Chair of the CCG Committee.

|

||||

| Common Shares Held | 1,795,879 |

|||

|

|

||||

| Other Securities Held |

||||

| Type | Securities Held (#) |

|||

| DSUs | 919,236 |

|||

| Options | 250,000 |

|||

|

|

||||

| Americas Board and Committee Membership 2024 | Attendance at Americas Board and Committee Meetings 2024 |

| Other Public Board Memberships |

|

| Board CCG Committee (Chair) | N/A N/A | Culico Metals Inc. |

||

| Page | 16 |

| TARA HASSAN |

||||

| Director Vancouver, British Columbia |

||||

| Age: 42 | Status: Indepen dent | Director since: April 21, 2025 |

||

|

Ms. Hassan was most recently the Senior Vice President, Corporate Development of SilverCrest Metals Limited and is currently a director of Orezone Gold Corporation. She was formerly a Board Director of Maverix Metals Inc. until its sale to TripleFlag Metals Corp. in 2023 and Vice Chair of Association for Mineral Exploration British Columbia. Ms. Hassan is a mining engineer with 20 years of industry experience including mine operations, project development, capital markets and mining technology. She spent the bulk of her career as an equity research analyst covering the precious metals sector. During her time as an analyst Ms. Hassan worked at a range of investment dealers from boutique to large banks, with her research focused on small to mid-capital explorers, developers and producers in the precious metals space.

Before entering the financial services industry, Ms. Hassan worked as a mining engineer for Inco and Placer Dome. At these companies, she held operating, engineering and project-focused roles, working at eight different mines and gaining experience in a wide variety of underground and open-pit mining situations. Ms. Hassan is a Professional Engineer (Ontario) and holds a Bachelor of Science degree in Mining Engineering from Queen’s University in Kingston, Ontario.

It is expected that Ms. Hassan will be nominated to the S&T Committee after the shareholder vote.

|

||||

| Common Shares Held | N/A |

|||

|

|

||||

| Other Securities Held |

||||

| Type | Securities Held (#) |

|||

| DSUs | 300,000 |

|||

| Options | 100,000 |

|||

|

|

||||

| Americas Board and Committee Membership 2024 | Attendance at Americas Board and Committee Meetings 2024 |

| Other Public Board Memberships |

|

| Board S&T Committee | N/A N/A | Orezone Gold Corporation |

||

| Page | 17 |

| MERI VERLI |

||||

| Director Nominee Toronto, Ontario |

||||

| Age: 63 | Status: Independent | Director since: N/A |

||

|

Ms. Verli is currently a director and Chair of the Audit Committee of Culico Metals and was formerly a Board Director and Chair of the Audit Committee of Karora Resources from 2022 until its merger in 2024.

Ms. Verli is an experienced senior financial executive with extensive background in financial management and reporting, mergers and acquisitions, risk management and strategy development. Ms. Verli is currently serving as Senior Advisor, Business Improvements at Discovery Silver since July 2024 and previously has served as Strategic Advisor at Agnico Eagle Mines following Kirkland Lake Gold’s merger with Agnico, Senior Vice President, Business Operation Management Systems and Senior Vice President, Finance and Treasury at Kirkland Lake Gold and previously served as CFO of McEwen Mining and Vice President, Finance at Lake Shore Gold.

Ms. Verli is a Chartered Professional Accountant and holds a PhD in Economic Sciences, a Bachelor of Geology and Engineering and Bachelor of Economics degrees from the University of Tirana, Albania.

It is expected that Ms. Verli will be nominated to the Audit Committee after the shareholder vote.

|

||||

| Common Shares Held | N/A |

|||

|

|

||||

| Other Securities Held |

||||

| Type | Securities Held (#) |

|||

| DSUs | N/A |

|||

| Options | N/A |

|||

|

|

||||

| Americas Board and Committee Membership 2024 | Attendance at Americas Board and Committee Meetings 2024 |

| Other Public Board Memberships |

|

| Board Audit Committee | N/A N/A | Culico Metals Inc. |

||

****

| Page | 18 |

| BRADLEY R. KIPP |

|||||

| Director Ontario, Canada |

|||||

| Age: 60 | Status: Independ ent | Director since: June 12, 2014 |

|||

|

Mr. Kipp is currently a director and the Chair of the Audit Committee of Americas Gold (since June 2014); a director of Haventree Bank since June 2008 (a federally regulated Schedule I Bank supervised by the Office of the Superintendent of Financial Institutions); and was the Chair of the Audit Committee of Haventree Bank until May 2024, when he rotated off as Chair upon reaching the term limit. Mr. Kipp was a director of Shiny Health & Wellness Corp. (previously ShinyBud Corp.) (TSXV: SNYB); he resigned as a director in September of 2024. Mr. Kipp has over 30 years’ experience specializing in operations, corporate finance and public company reporting in the financial services and mining sector. As part of these activities, he has been Chief Financial Officer and/or a director of several public companies listed on the Toronto and London AIM exchanges. Mr. Kipp is a member of the Chartered Professional Accountants of Canada and a member of the Chartered Financial Analyst Institute.

|

|||||

| Common Shares Held | N/A |

||||

|

|

|||||

| Other Securities Held |

|||||

| Type | Securities Held (#) |

||||

| DSUs | 1,283,846 |

||||

| Options | 1,055,000 |

||||

|

|

|||||

| Americas Board and Committee Membership 2024 | Attendance at Americas Board and Committee Meetings 2024 |

| Other Public Board Memberships |

||

| Board Audit Committee (Chair) | 8 of 8 5 of 5 | N/A |

|||

| Page | 19 |

| GORDON E. PRIDHAM |

||||||

| Director Ontario, Canada |

||||||

| Age: 67 | Status: Independ ent | Director since: November 10, 2008 (Director of Americas Silver since December 23, 2014; Previously Director of U.S. Silver & Gold since August 13, 2012 and U.S. Silver Corp. since November 10, 2008) |

||||

|

Mr. Pridham is Principal of Edgewater Capital. Mr. Pridham has over 25 years of experience in investment banking, capital markets, and corporate banking. He has worked in New York, Calgary, Toronto and Hong Kong for global financial institutions and has financed and advised companies in public and private markets across a broad range of industry sectors. He has served on over 17 boards of which he has chaired five. He is a graduate of the University of Toronto and the Institute of Corporate Directors program.

Mr. Pridham is a member of the Audit Committee.

|

||||||

| Common Shares Held | 253,161 |

|||||

|

|

||||||

| Other Securities Held |

||||||

| Type | Securities Held (#) |

|||||

| DSUs | 1,245,050 |

|||||

| Options | 1,055,000 |

|||||

|

|

||||||

| Americas Board and Committee Membership 2024 | Attendance at Americas Board and Committee Meetings 2024 |

| Other Public Board Memberships |

|||

| Board Audit Committee | 8 of 8 5 of 5 | N/A |

||||

| Page | 20 |

Corporate Cease Trade Orders, Bankruptcies and Insolvencies

Except as disclosed below, as at the date of this Circular and within the 10 years before the date of this Circular, none of the Nominees:

| (a) | is, or has been, a director or officer of any company (including the Company), that while that person was acting in that capacity: |

|

| (i) | was the subject of a cease trade order or similar order or an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days (an “Order”) while the Nominee was serving as a director or chief executive officer or chief financial officer of the relevant company; |

|

|

|

|

|

| (ii) | was the subject of an Order that was issued after the Nominee ceased to be a director, chief executive officer or chief financial officer and that resulted from an event that occurred while the Nominee was acting as a director, chief executive officer or chief financial officer of the company; |

|

|

|

|

|

| (iii) | became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets while the Nominee was serving as a director or officer of the relevant company or within a year of the Nominee ceasing to act in that capacity; or |

| (b) | has become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the Nominee. |

Mr. Kipp was a director of a wholly-owned subsidiary of Shiny Health & Wellness Corp. (“Shiny Health”), Shiny Bud Inc. (“Shiny Bud”), when, on May 28, 2024, Shiny Bud filed a Notice of Intention to Make a Proposal pursuant to the provisions of the Bankruptcy and Insolvency Act (Canada) (the “BIA”). On June 5, 2024, the Ontario Securities Commission issued a cease trade order in respect of each security of Shiny Health for not filing certain annual disclosure. Such cease trade order remains in effect. Subsequently, on November 25, 2024, Shiny Health made an assignment into bankruptcy pursuant to the BIA.

Mr. Pridham, a Board member of the Company and a Nominee, was Chairman on the Board of CHC Student Housing Inc. (“CHC”) when CHC was subject to a management cease trade order that was in effect for more than 30 consecutive days. On May 5, 2017, the Ontario Securities Commission (the “OSC”) issued a management cease trade order against the securities of CHC until CHC prepared and filed its annual audited financial statements, management’s discussion and analysis and related certifications for the period ended December 31, 2016. On July 4, 2017, the OSC revoked the management cease trade order after CHC filed all required records.

Penalties and Sanctions

To the Company’s knowledge, none of the Nominees has been subject to: (i) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (ii) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable Shareholder in deciding whether to vote for a proposed director.

Additional Information regarding the Board

For additional information regarding the Company’s Board, including compensation, corporate governance practices, independence and directorships of other public company boards, see “Statement of Executive & Director Compensation – Director Compensation” and “Statement of Corporate Governance Practices”.

| Page | 21 |

Item 3 – Appointment of Auditor

The current auditors of the Company are PricewaterhouseCoopers LLP, Chartered Accountants, Toronto, Ontario (“PwC”). At the Meeting, the holders of Common Shares will be requested to appoint PwC as auditors of the Company to hold office until the next annual meeting of Shareholders or until a successor is appointed, and to authorize the Board to fix the auditors’ remuneration.

Unless authority to do so is withheld or in the absence of instruction to the contrary, the persons named in the accompanying Form of Proxy intend to vote FOR the re-appointment of PwC as auditor of the Company until the close of the next annual meeting of shareholders and to authorize the directors to fix theirremuneration.

External Auditor’s Service Fees

The fees billed by the Company’s external auditor in the last two fiscal years for audit fees are as follows:

| Financial Year | Audit Fees2 (C$) | Audit Related Fees3 (C$) | Tax Fees4 (C$) | All Other Fees5 (C$) |

| 2023 | 647,000 | Nil | Nil | Nil |

| 2024 | 904,150 | Nil | Nil | Nil |

Additional information with respect to external auditor fees for past services is available in our annual information form for the year ended December 31, 2024 under the heading “Audit Committee – External Auditor Service Fees”, which can be accessed under the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

Item 4 – Re-Approval of Deferred Share Unit Plan

The Company has adopted a DSU Plan (as defined below) for directors, officers and employees of the Company, prepared in compliance with the policies of the Toronto Stock Exchange (the “TSX”) and approved by the Company’s shareholders. See “Additional Disclosure – Long-Term Incentive Plans – Deferred Share Unit Plan” for a summary description of the DSU Plan.

On May 7, 2025, the Board approved the amendment and restatement of the DSU Plan to incorporate (a) amendments to reflect recent developments in applicable Canadian market practice, and best corporate governance practices, including to enable the Company to clawback or recoup any DSUs issued or payments made under the DSU Plan and

(b) amendments of a “housekeeping” or administrative nature (the “DSU Plan Housekeeping Amendments”). In accordance with Section 8.2 of the DSU Plan, the DSU Plan Housekeeping Amendments did not require shareholder approval.

Since the adoption of the DSU Plan, the Board granted an aggregate of 8,432,574 DSUs to directors of the Company in lieu of fees. The number of DSUs granted on a quarterly basis is calculated based on the fees owed for the applicable quarter, divided by the VWAP of the Common Shares of the Company for the 5 days preceding the end of each quarter, with an increase to the number of DSUs to be granted at a factor of 1.25 of the fees earned. As of the date hereof, there are 7,145,147 DSUs outstanding and the Common Shares issuable on settlement of the outstanding DSUs represent approximately 1.09% of the currently issued and outstanding Common Shares.

_____________________________

| 2 | “Audit Fees” include fees necessary to perform the audit of the Company’s consolidated financial statements. Audit Fees include quarterly reviews, fees for review of tax provisions and for accounting consultations on matters reflected in the financial statements. Audit Fees also include audit or other attest services required by legislation or regulation, such as comfort letters, consents, reviews of securities filings and statutory audits. |

| 3 | “Audit-Related Fees” include services that are traditionally performed by the auditor. These audit- related services include due diligence assistance, accounting consultations on proposed transactions, internal control reviews and audit or attest services not required by legislation or regulation. |

| 4 | “Tax Fees” include fees for all tax services other than those included in “Audit Fees” and “Audit- Related Fees”. This category includes fees for filing tax returns for U.S. subsidiary, tax compliance, tax planning and tax advice. Tax planning and tax advice includes assistance with tax audits and appeals, tax advice related to mergers and acquisitions, and requests for rulings or technical advice from tax authorities. |

| 5 | “All Other Fees” include fees relating to the aggregate fees billed in each of the last two fiscal years for products and services provided by the Company’s external auditor, other than the services reported under clauses 1 to 3 above. |

| Page | 22 |

In accordance with the requirements of the TSX, every three years after adoption, all unallocated options, rights and other entitlements under a security based compensation arrangement which does not have a fixed maximum number of securities issuable thereunder (commonly referred to as “rolling plans”), must be approved by the majority of the issuer’s securityholders. Since the DSU Plan does not have a fixed maximum number of securities issuable pursuant thereto and was last approved by Shareholders on June 29, 2022, Shareholders are required to approve all unallocated DSUs issuable pursuant to the DSU Plan by no later than June 29, 2025. Accordingly, Shareholders are being asked at the Meeting to pass an ordinary resolution, with or without variation, approving all unallocated DSUs, rights or other entitlements under the DSU Plan.

Shareholders will therefore be asked at the Meeting to pass the following ordinary resolution, with or without variation, relating to the approval as described above:

“BE IT RESOLVED THAT:

| 1. | All unallocated DSUs, rights or other entitlements under the DSU Plan of the Company be and are hereby approved and the Company shall have the ability to grant awards under the DSU Plan until June 24, 2028 and the DSU Plan be and is hereby re-approved; and |

|

|

|

| 2. | Any one director or officer of the Company is hereby authorized and directed for and on behalf of the Company to execute or cause to be executed and to deliver or cause to be delivered all such documents, and to do or cause to be done all such acts and things, as such director or officer may deem necessary or desirable in connection with the foregoing resolutions.” |

The full text of the DSU Plan is set out in Schedule “B” appended to this Circular. The DSU Plan will be available for inspection and placed before the Shareholders for approval at the Meeting.

The TSX requires that the resolution approving all unallocated options, rights or other entitlements under the DSU Plan be passed by the affirmative vote of at least a majority of the votes cast, by proxy or in person at the Meeting.

The TSX has conditionally approved the re-approval of the DSU Plan (and the unallocated DSUs, rights and entitlements thereunder), subject to approval of the ordinary resolution in respect of the re-approval of the DSU Plan (and the unallocated DSUs, rights and entitlements thereunder) by a majority of votes cast on the resolution at the Meeting and satisfaction of its other usual conditions. As a result, the holders of Common Shares will be asked at the Meeting to approve the aforementioned ordinary resolution.

Unless the shareholder directs that his or her Common Shares should be voted against the foregoing resolution, the persons named in the enclosed form of proxy intend to vote FOR the resolution approving the unallocated DSUs under the DSU Plan of the Company.

| Page | 23 |

Item 5 – Re-Approval of Share Unit Plan (formerly the RSU Plan) and Approval of the Proposed Share Unit Plan Amendment

The Company is proposing to adopt a Share Unit Plan (as defined below; formerly the Restricted Share Unit Plan) to allow the Company to settle awards of restricted share units and performance share units in cash or by issuing Common Shares, prepared in compliance with the policies of the TSX. See “Additional Disclosure – Long-Term Incentive Plans – Share Unit Plans” for a summary description of the Share Unit Plan.

In connection with the Meeting, the Company is proposing to amend and restate the existing Share Unit Plan, subject to approval by shareholders at the Meeting, to amend section 5.2 (Amendments) thereof (the “Proposed Share Unit Plan Amendment”), which requires shareholder approval under the mandatory requirements of the TSX, and (a) incorporate the ability of the Company to issue PSUs, (b) amendments to reflect recent developments in applicable Canadian employment case law, market practice, and best corporate governance practices, including to (i) clarify the impact of termination of a Unit Participant (as defined below) employment on their outstanding RSUs and/or PSUs (each, as defined below), as applicable; and (ii) enable the Company to clawback or recoup any RSUs or PSUs issued or payments made under the Share Unit Plan, and (c) amendments of a “housekeeping” or administrative nature.

In accordance with the requirements of the TSX, every three years after adoption, all unallocated options, rights and other entitlements under a security based compensation arrangement which does not have a fixed maximum number of securities issuable thereunder (commonly referred to as “rolling plans”), must be approved by the majority of the issuer’s securityholders. Since the Share Unit Plan does not have a fixed maximum number of securities issuable pursuant thereto and was last approved by Shareholders on June 29, 2022, Shareholders are required to approve all unallocated options issuable pursuant to the Share Unit Plan by no later than June 29, 2025. Accordingly, Shareholders are being asked at the Meeting to pass an ordinary resolution with or without variation, approving all unallocated RSUs, rights or other entitlements under the Share Unit Plan.

Shareholders will therefore be asked at the Meeting to pass the following ordinary resolution, with or without variation, relating to the approval as described above:

“BE IT RESOLVED THAT:

| 1. | The Proposed Share Unit Plan Amendment (as defined in the Circular), all as more particularly described in the Circular under the heading “Item 5 – Re-Approval of Share Unit Plan and Approval of the Proposed Share Unit Plan Amendments”, be and is hereby approved. |

|

|

|

| 2. | The Share Unit Plan (being the amended and restated share unit plan effective May 7, 2025, which reflects the Proposed Share Unit Plan Amendment) be and is hereby approved. |

|

|

|

| 3. | All unallocated RSUs, PSUs, rights or other entitlements under the Share Unit Plan of the Company be and are hereby approved and the Company shall have the ability to grant awards under the Share Unit Plan until June 24, 2028 and the Share Unit Plan be and is hereby re-approved; and |

|

|

|

| 4. | Any one director or executive officer of the Company is hereby authorized and directed for and on behalf of the Company to execute or cause to be executed and to deliver or cause to be delivered all such documents, and to do or cause to be done all such acts and things, as such director or executive officer may deem necessary or desirable in connection with the foregoing resolutions.” |

| Page | 24 |

The full text of the Share Unit Plan is set out in Schedule “C” appended to this Circular. The Share Unit Plan will be available for inspection and placed before the Shareholders for approval at the Meeting.

The TSX requires that the resolution approving all unallocated options, rights or other entitlements under the Share Unit Plan be passed by the affirmative vote of at least a majority of the votes cast, by proxy or in person at the Meeting.

The TSX has conditionally approved the re-approval of the Share Unit Plan (and the unallocated RSUs, PSUs, rights and entitlements thereunder), subject to approval of the ordinary resolution in respect of the re-approval of the Share Unit Plan (and the unallocated RSUs, PSUs, rights and entitlements thereunder) and the Proposed Share Unit Plan Amendment by a majority of votes cast on the resolution at the Meeting and satisfaction of its other usual conditions. As a result, the holders of Common Shares will be asked at the Meeting to approve the aforementioned ordinary resolution.

Unless the shareholder directs that his or her Common Shares should be voted against the foregoing resolution, the persons named in the enclosed form of proxy intend to vote FOR the resolution approving the Share Unit Plan and the unallocated RSUs and PSUs under the Share Unit Plan of the Company.

Item 6 – Re-Approval of Stock Option Plan and Approval of the Proposed Stock Option Plan Amendments

The Company is proposing to adopt a Stock Option Plan (as defined below) for officers, directors, employees and consultants of the Company, prepared in compliance with the policies of the TSX. See “Additional Disclosure – Long- Term Incentive Plans – Stock Option Plan” for a summary description of the Stock Option Plan.

In connection with the Meeting, the Company is proposing to amend and restate the existing Stock Option Plan, subject to approval by shareholders at the Meeting, to amend section 1.5 (Amendment and Termination) thereof (the “Proposed Stock Option Plan Amendments”), which requires shareholder approval under the mandatory requirements of the TSX, and make certain other amendments that, in accordance with Section 1.5(c) of the Stock Option Plan, do not require shareholder approval (a) to reflect recent developments in applicable Canadian employment case law, market practice, and best corporate governance practices, including to (i) clarify the impact of termination of a SOP Participant’s (as defined below) employment on their outstanding Options; (ii) update the definitions of “Change of Control” and “Fair Market Value”; and (iii) enable the Company to clawback or recoup any Shares issued or payments made under the Stock Option Plan and (b) amendments of a “housekeeping” or administrative nature.