UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 19, 2025

ASP Isotopes Inc. |

(Exact name of registrant as specified in its charter) |

Delaware |

|

001-41555 |

|

87-2618235 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

601 Pennsylvania Avenue NW, South Building, Suite 900 Washington, DC |

|

20004 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (202) 756-2245

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Ticker symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 |

|

ASPI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01. Entry into a Material Definitive Agreement.

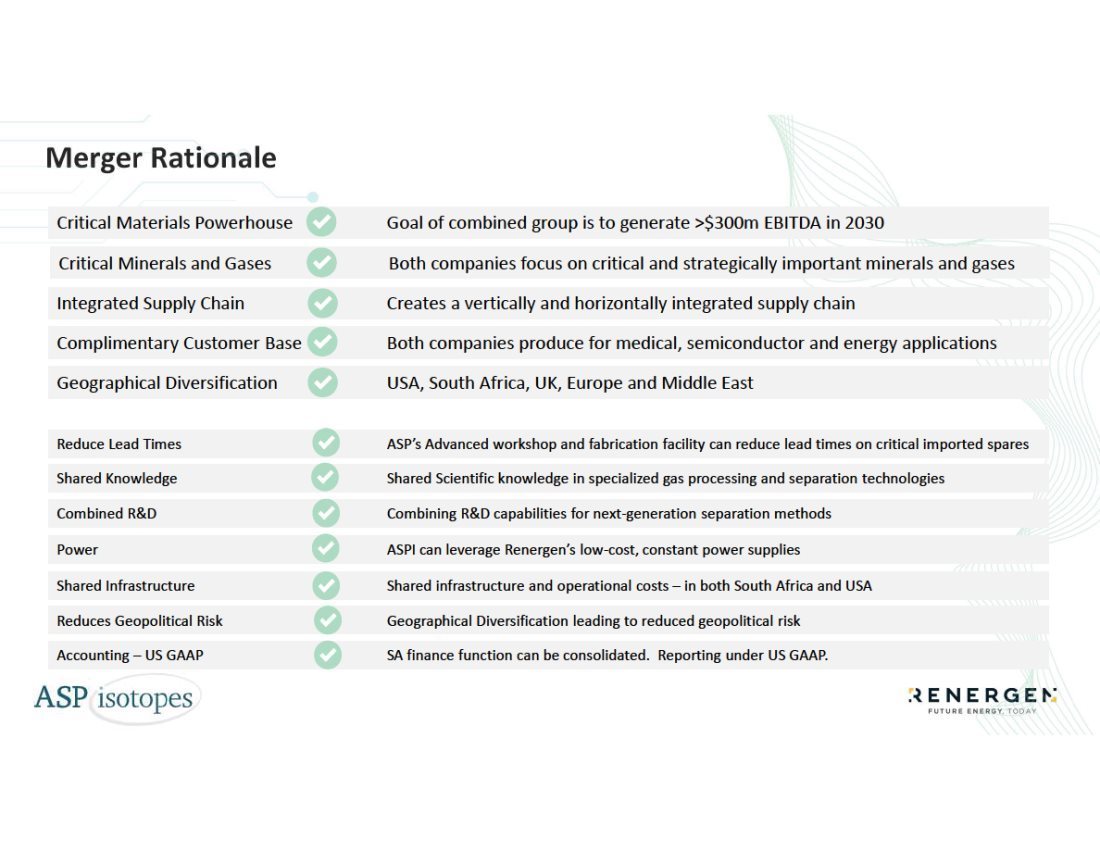

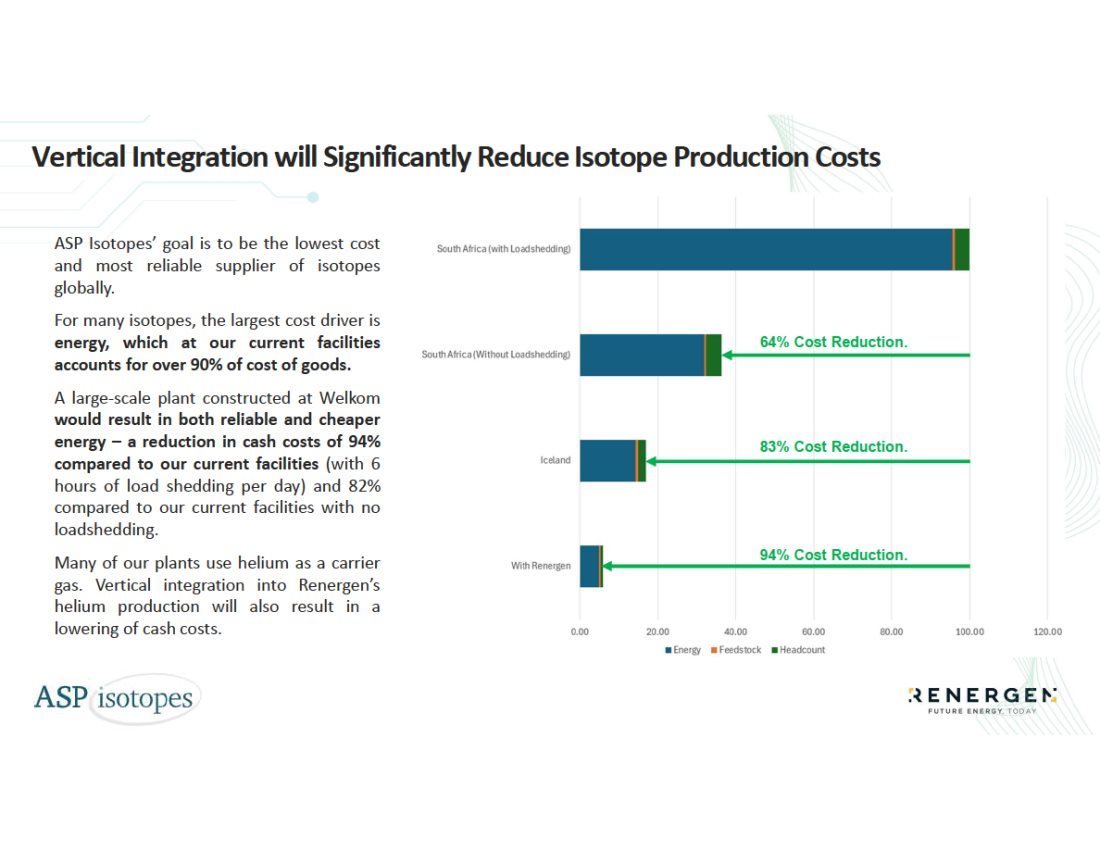

Transaction Overview

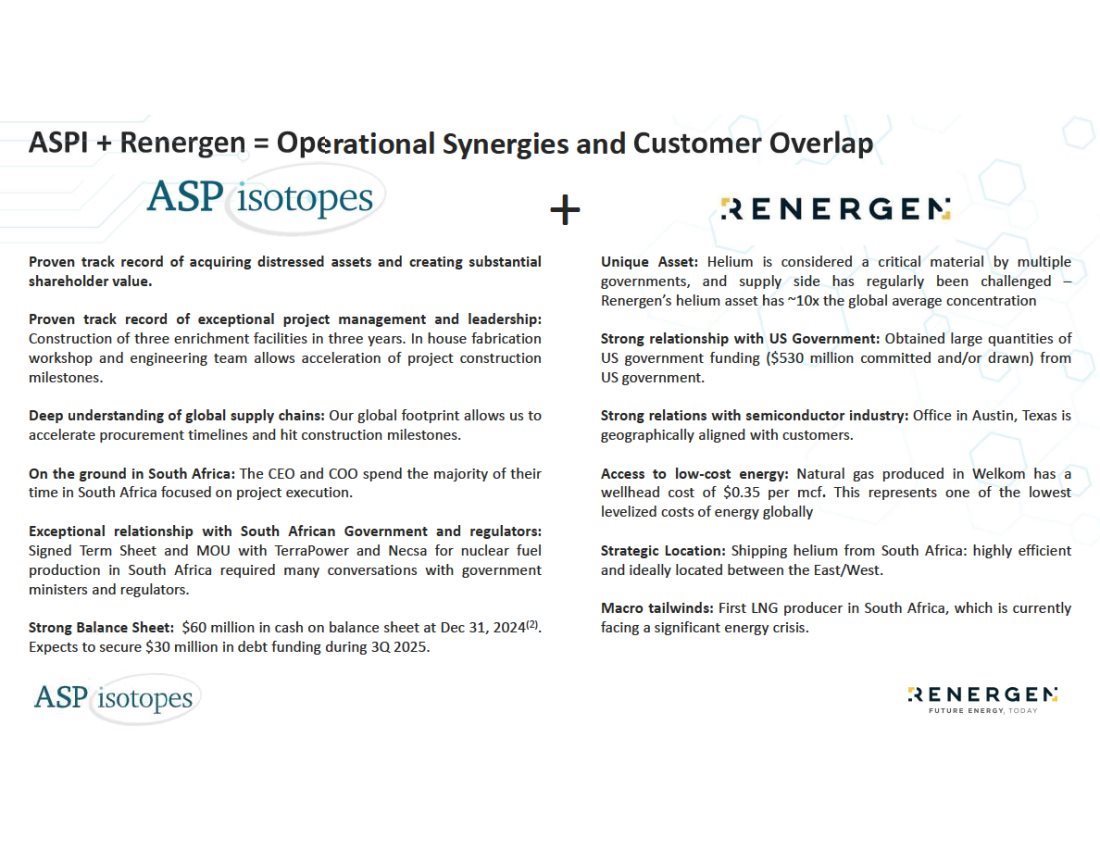

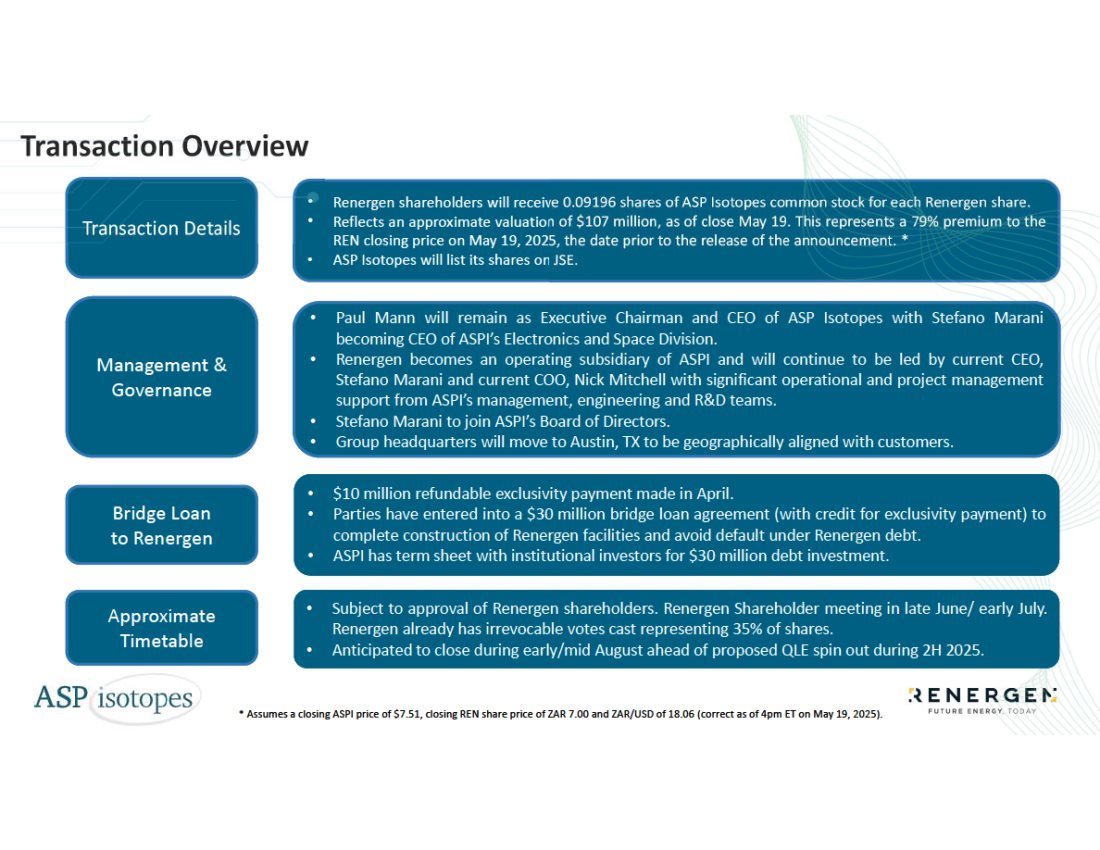

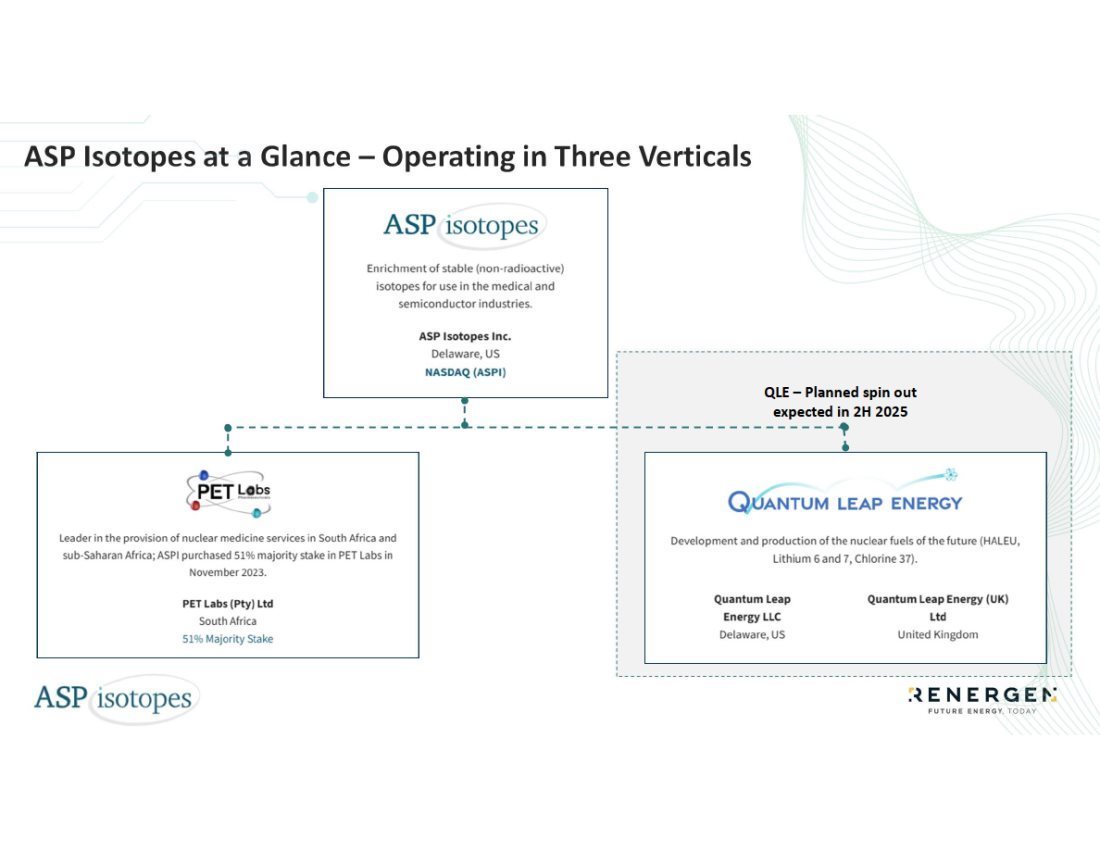

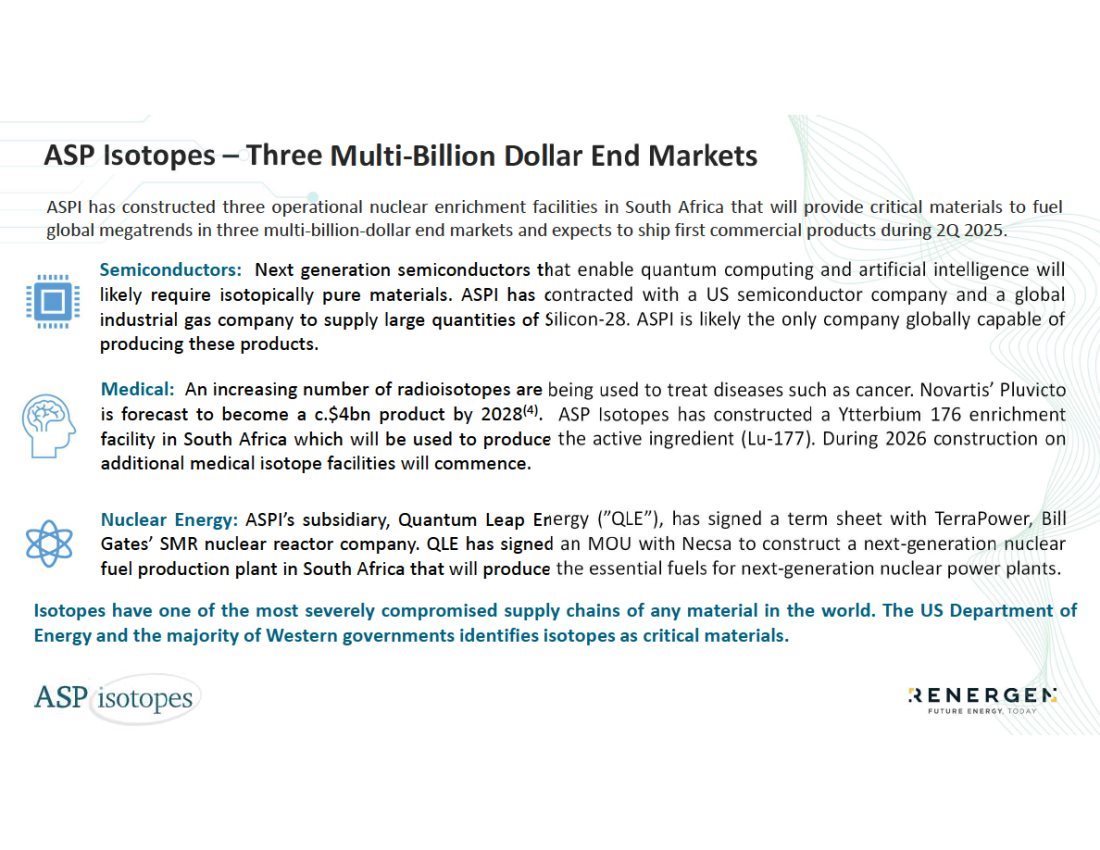

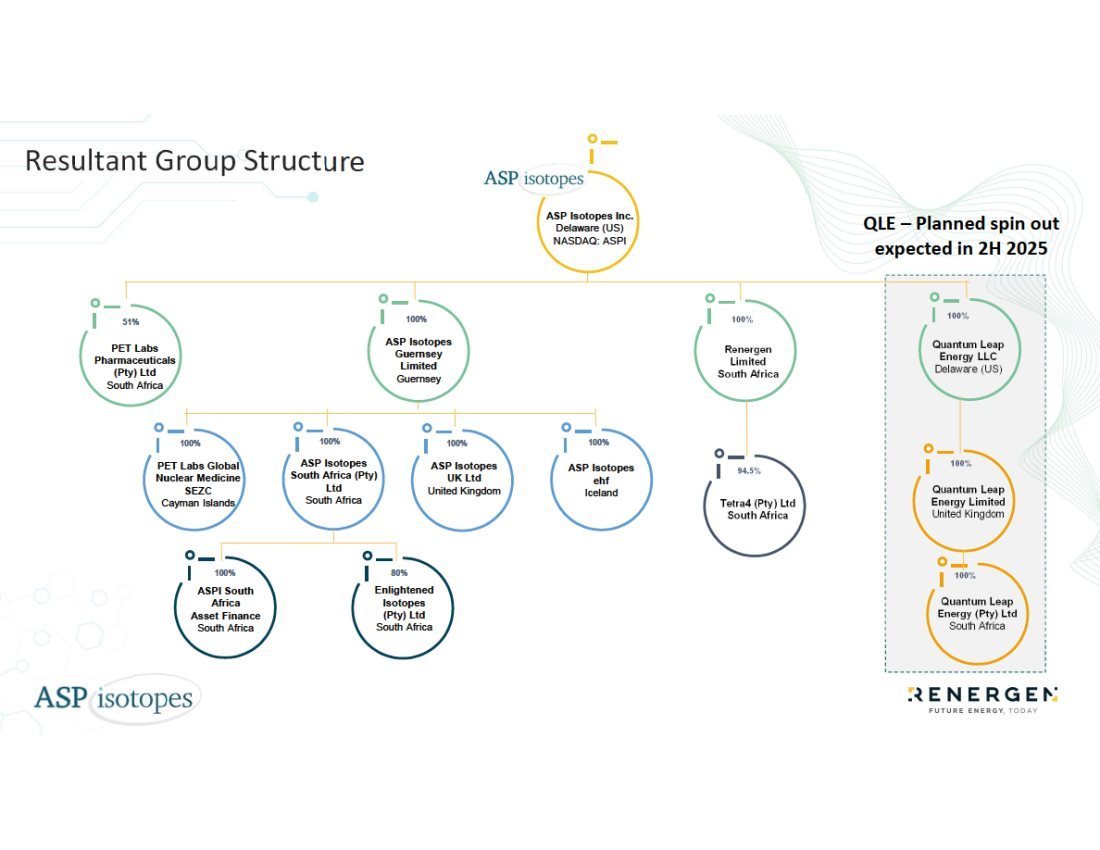

On May 20, 2025, ASP Isotopes Inc., a Delaware corporation (“ASP Isotopes” or the “Company”), entered into agreement (the “Agreement”), by and between the Company and Renergen Limited, a public company incorporated under the laws of the Republic of South Africa focused on production of liquefied helium (LHe) and liquefied natural gas (LNG) (“Renergen”), pursuant to which, subject to the terms and conditions thereof, the Company will make an offer to acquire all of the issued ordinary shares of Renergen (“Renergen Ordinary Shares”), in exchange for shares of common stock, par value $0.01 per share, of the Company (the “Company Common Stock”), as described below (the “Offer”). The Company intends to implement the Offer through the implementation of a scheme of arrangement (the “Scheme”) in accordance with Sections 114 and 115 of the South African Companies Act, No. 71 of 2008 (the “Companies Act”). As a result of the implementation of the Scheme, Renergen will become a wholly owned subsidiary of the Company. If the Scheme lapses or fails, solely due to one or more Scheme conditions not being fulfilled or, where applicable, not being waived, the Company, as part of the same Offer, will make an offer to acquire up to 100% of the Renergen Ordinary Shares from Renergen shareholders by way of general standby offer, which will not be subject to any condition as to acceptances (the “Standby Offer”; and the transactions contemplated by the Agreement, including the Scheme and the Standby Offer, the “Transactions”).

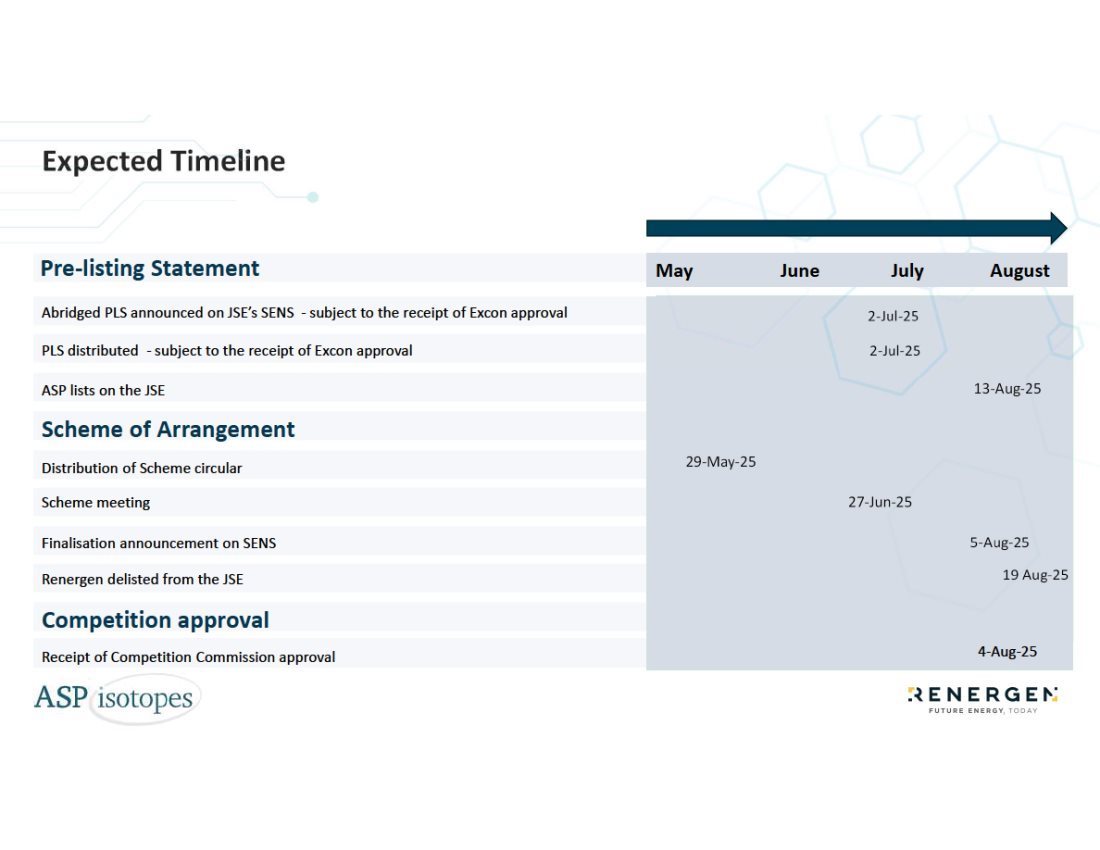

The implementation of the Scheme will result in the delisting of the Renergen Ordinary Shares from the Johannesburg Stock Exchange (the “JSE”), the Australian Securities Exchange and A2X. The Company Common Stock will continue to be listed on The Nasdaq Capital Market and will additionally be listed on the JSE by way of a secondary inward listing (the “Company Secondary Listing”).

Offer Consideration

On the implementation date of the Scheme (the “Scheme Implementation Date”), the holders of record of Renergen Ordinary Shares, who are registered as such in Renergen’s securities register as of the applicable record date for purposes of the listing requirements of the JSE (the “Scheme Record Date”), will exchange 100% of the issued Renergen Ordinary Shares as of the Scheme Record Date, excluding treasury shares, in exchange for consideration consisting of 0.09196 shares of Company Common Stock for each Renergen Ordinary Share (the “Scheme Consideration” and the shares of Company Common Stock to be issued as the Scheme Consideration or in the Standby Offer, the “Consideration Shares”). Any entitlements to fractions of shares of Company Common Stock that otherwise would be issuable pursuant to the Scheme will be rounded down to the nearest whole number of shares and a cash payment will be made for any fractional shares resulting from such rounding. In no event will the Company issues more than14,270,000 Consideration Shares.

The implementation of the Scheme and the issuance of the Consideration Shares is expected to result in current securityholders of Renergen and current securityholders of the Company owning approximately 16% and 84%, respectively, of the outstanding shares of Company Common Stock immediately following the Scheme Implementation Date.

| 2 |

Governance

The Agreement provides that, in the event that either the Scheme or the Stand-by Offer results in the Company acquiring at least 51% of the issued Renergen Ordinary Shares, after such event, Renergen will become an operating subsidiary of the Company and will continue to be led by Stefano Marani, the current Chief Executive Officer of Renergen, who will join the board of directors of the Company and become the Chief Executive Officer of the Electronics and Space Division of ASP Isotopes. Nick Mitchell, the Chief Operating Officer of Renergen, will become Co-Chief Operating Officer of ASP Isotopes.

Conditions to Closing

The Offer (including the Scheme and the Standby Offer) will be subject to the fulfilment or, where permissible, waiver of the following Offer conditions that, by no later than September 30, 2025: (i) the written consent for the transfer of the Renergen Ordinary Shares in terms of the Offer is obtained from the Industrial Development Corporation of South Africa and the United States International Development Finance Corporation (“Renergen Lenders”) in terms of the change of control provisions under their respective loan and/or funding arrangements with Renergen and subsidiaries of Renergen and that the Renergen Lenders agree not to proceed in foreclosing on outstanding debt due by those subsidiaries, as a result of any breach of covenants, event of default or otherwise, prior to July 31, 2027; (ii) the written consent for the transfer of the Renergen Ordinary Shares in terms of the Offer is obtained from The Standard Bank of South Africa (“SBSA”) in terms of the change of control provisions under its respective loan(s) and/or funding arrangement(s) with Renergen and SBSA agrees to extend the repayment date for the loan(s) and/or funding arrangement(s) to at least March 31, 2026; (iii) AIRSOL SRL agrees to extend the maturity date for the convertible debentures that it holds in Renergen, to at least March 31, 2026; (iv) receipt of required regulatory approvals required to implement the Offer are obtained (except for the requirement that Takeover Panel issue a compliance certificate to Renergen in terms of section 121(b) of the Companies Act); (v) receipt of all regulatory approvals required for the Company Secondary Listing; (vi) approval of applicable competition authorities to implement the Offer; (vii) approval by Renergen’s shareholders of the Shareholder Ratification resolution and the Scheme resolution to be descried in the combined circular to be distributed to Renergen’s shareholders (the “Renergen Shareholder Approval”); and (viii) absence of a material adverse change with respect to Renergen.

Exclusivity Agreement and Bridge Loan

On March 31, 2025, the Company and Renergen entered into an exclusivity agreement (as subsequently amended, the “Exclusivity Agreement”), pursuant to which the parties agreed to discuss and negotiate the proposed transaction on an exclusive basis for a limited period ending on May 31, 2025. Renergen received a refundable exclusivity payment of the ZAR equivalent amount of $10 million, which amount has since been converted into and credited as an advance under a $30 million bridge loan agreement, dated May 19, 2025, by and among the Company, ASP Isotopes South Africa Proprietary Limited, as lender, and Renergen, as borrower (the “Loan Agreement”). Under the Loan Agreement, the Company has agreed to advance two tranches of loan amounts of the ZAR equivalent amount of $10 million each, to be advanced on or before May 31, 2025 and June 30, 2025, such that the total advanced amounts advanced to Renergen will be the ZAR equivalent of $30 million, to enable Renergen to meet key lender payment deadlines and avoid a default by Renergen under its existing loan/funding arrangements.

* * * * * *

| 3 |

The foregoing descriptions of the Agreement and the Loan Agreement are qualified in their entirety by reference to the full text of the Agreement and the Loan Agreement, copies of which are filed as Exhibits 2.1 and 10.1 to this Current Report on 8-K and are incorporated in this Item 1.01 by reference.

Item 3.02. Unregistered Sales of Equity Securities.

The information provided in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The Consideration Shares to be issued pursuant to the Scheme or the Standby Offer to Renergen shareholders in the United States have not been and will not be registered in terms of the U.S. Securities Act 1933, as amended (“Securities Act”) and will be issued in reliance on the exemption from the registration requirements thereof provided by Rule 802 of the Securities Act.

Item 7.01. Regulation FD Disclosure.

On May 20, 2025, the Company and Renergen will be participating in a conference call with investors to discuss the Transactions. An investor presentation containing additional information relating to the Transactions is being furnished as Exhibit 99.1 hereto.

The information in this Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall such information be deemed to be incorporated by reference in any registration statement or other document filed under the Securities Act or the Exchange Act, except as otherwise stated in such filing.

Item 8.01. Other Events.

On May 20, 2025, the Company issued a press release and the Company and Renergen issued a Joint Firm Intention Announcement (“FIA”), announcing the execution of the Agreement and the Transaction. The full text of the press release and FIA, copies of which are attached hereto as Exhibit 99.2 and Exhibit 99.3, respectively, are incorporated herein by reference.

As of May 20, 2025, certain Renergen shareholders collectively holding in excess of 35% of the aggregate issued Renergen Ordinary Shares have provided irrevocable undertakings to vote in favor of the resolutions to be proposed at the Renergen shareholder meeting and accept the Standby Offer in respect of the Renergen Ordinary Shares held by them at the time of the Renergen shareholder meeting.

Additional Information and Where to Find It

This document is not subject to the requirements of Section 14(a) of the U.S. Securities Exchange Act of 1934, as amended. In connection with the Transactions, Renergen intends to prepare a combined circular to be distributed to Renergen shareholders in accordance with the Companies Act and the JSE’s listings requirements with respect to a shareholder meeting at which Renergen shareholders will be asked to vote on the Scheme and other matters required to be approved by Renergen shareholders. Renergen will send the combined circular to its shareholders entitled to vote at the meeting relating to the Transactions. The Company will furnish a Form CB with the SEC no later than the next business day after the date the scheme circular and any other documents are published or otherwise disseminated to Renergen shareholders in connection with the Transactions in accordance with the Companies Act and the JSE’s listings requirements. The Company may file other relevant materials with the SEC in connection with the Transactions. The scheme circular and other relevant materials in connection with the Transactions (when they become available) and any other documents filed by the Company with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) and the Company’s website at www.aspisotopes.com.

| 4 |

Important Notice to Renergen Shareholders in the United States

The Offer or business combination is made for the securities of a non-U.S. company (Renergen, a South African company), by means of the Scheme or the Standby Offer. The Offer is subject to disclosure and procedural requirements in South Africa and other non-U.S. jurisdictions that are different from those of the United States. The financial information relating to Renergen contained in the Circular has been/will be prepared in accordance with IFRS Accounting Standards that may not be comparable to the financial statements and financial information of US companies.

It may be difficult for U.S. holders of Renergen ordinary shares to enforce their rights and any claims they may have arising under the federal securities laws of the United States, since Renergen is incorporated in a non-U.S. jurisdiction, and some or all of its officers and directors may be residents of a non-U.S. jurisdiction. U.S. holders may not be able to sue a non-U.S. company or its officers or directors in a non-U.S. court for violations of the U.S. securities laws. Further, it may be difficult to compel a non-U.S. company and its affiliates to subject themselves to a U.S. court's judgment.

You should be aware that ASP Isotopes may purchase securities otherwise than under the Scheme or Standby Offer, such as in open market or privately negotiated purchases, subject to any restrictions or requirements under South African law.

Forward-Looking Statements

This document contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words like “may,” “will,” “likely,” “should,” “expect,” “anticipate,” “future,” “plan,” “believe,” “intend,” “goal,” “seek,” “estimate,” “project,” “continue,” and variations of such words and similar expressions. These forward-looking statements are not guarantees of future performance and involve risks, assumptions, and uncertainties, including, but not limited to, risks related to: (i) the implementation of the Scheme in the anticipated timeframe or at all; (ii) the satisfaction of the Scheme conditions; (iii) the failure to obtain necessary regulatory and shareholder approvals; (iv) the ability to realize the anticipated benefits of the proposed acquisition of Renergen; (v) the ability to successfully integrate the businesses; (vi) disruption from the proposed acquisition of Renergen making it more difficult to maintain business and operational relationships; (vii) the negative effects of this announcement or the consummation of the proposed acquisition of Renergen on the market price of Renergen’s or ASPI’s securities; (viii) significant transaction costs and unknown liabilities; (ix) litigation or regulatory actions related to the proposed acquisition of Renergen; and (x) such other factors as are set forth in the periodic reports filed by ASPI with the U.S. Securities and Exchange Commission (the “SEC”), including but not limited to those described under the heading “Risk Factors” in its annual reports on Form 10-K, quarterly reports on Form 10-Q and any other filings made with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by these forward-looking statements. Therefore, you should not rely on any of these forward-looking statements.

The forward-looking statements included in this document are made only as of the date of this document, and except as otherwise required by applicable securities law, neither Renergen nor ASPI assume any obligation nor do they intend to publicly update or revise any forward-looking statements to reflect subsequent events or circumstances.

| 5 |

Item 9.01 Financial Statements and Exhibits.

Exhibit No. |

|

Description |

|

||

|

||

|

||

|

||

|

||

104 |

|

Cover Page Interactive Date File (embedded within the Inline XBRL document) |

| 6 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

ASP ISOTOPES INC. |

|

|

|

|

|

|

Date: May 20, 2025 |

By: |

/s/ Paul Mann |

|

|

Name: |

Paul Mann |

|

|

Title: |

Chief Executive Officer |

|

| 7 |

EXHIBIT 2.1

| To: | The Directors (Renergen Board) Renergen Limited |

| Address: | Sandton Gate, Second Floor, |

|

| 25 Minerva Avenue, |

|

| Glenadrienne, Sandton, |

|

| Gauteng, 2196 |

| Attention: | The Chairman |

Dear Sirs

FIRM INTENTION BY ASP ISOTOPES INC. (ASPI) TO MAKE AN OFFER TO ACQUIRE ALL ISSUED ORDINARY SHARES IN RENERGEN LIMITED (THE COMPANY) (ASPI AND THE COMPANY COLLECTIVELY REFERRED TO AS THE PARTIES, AND EACH A PARTY) (OTHER THAN SHARES HELD IN TREASURY BY SUBSIDIARIES OF THE COMPANY, IF ANY), FROM THE COMPANY’S SHAREHOLDERS

1. Introduction

|

| a. | Capitalised terms used in this letter and not otherwise defined, shall have the same meaning assigned to such terms under the South African Companies Act, 2008, as amended (Companies Act). |

|

|

|

|

|

| b. | We refer to the confidential negotiations between representatives of ASPI and representatives of the Company in respect of a proposed transaction in terms of which ASPI intends to acquire all the ordinary shares of no par value in the Company (other than shares held in treasury by subsidiaries of the Company (Treasury Shares), if any) (Target Shares) from the existing shareholders of the Company (Renergen Shareholders), in consideration for the issue by ASPI of new ASPI common stock (Consideration Shares) to the Renergen Shareholders. |

|

|

|

|

|

| c. | ASPI is pleased to present this letter to the Renergen Board confirming ASPI’s firm intention (as contemplated in Chapter 5 of the Companies Act, and Chapter 5 of the Companies Regulations, 2011 (Companies Regulations)) to make an offer (Offer) on the following terms: |

|

| i. | ASPI will offer to acquire 100% of the Target Shares from Renergen Shareholders by way of a scheme of arrangement (Scheme) to be proposed by the independent directors of the Renergen Board (Renergen Independent Board) between the Company and the Renergen Shareholders in accordance with section 114(1)(d) of the Companies Act; and |

|

|

|

|

|

| ii. | if the Scheme lapses or fails solely due to one or more of the Scheme Conditions, contemplated under paragraph 5.c, not being fulfilled and, where applicable, waived, ASPI, as part of the same Offer, will automatically and without further actions being required from it, make an offer to acquire up to 100% of the Target Shares from Renergen Shareholders by way of general stand-by offer which will not be subject to any condition as to acceptances (Stand-by Offer), |

|

|

|

|

|

| which firm intention Offer is subject only to receiving written confirmation from the Renergen Independent Board, by no later than 20 May 2025, by the counter signature and return of a signed copy of this letter to ASPI, that the Company will cooperate with ASPI to implement the Offer and that the Renergen Board will propose the Scheme to the Renergen Shareholders, in accordance with the terms of this letter. |

|

|

| d. | The purpose of this letter is to set out the terms and conditions of the Offer, including the Scheme and the Stand-by Offer (collectively the Transaction). Should this letter be counter signed in accordance with paragraph 1.c above, no further agreements need to be concluded between ASPI and the Company to undertake the Transaction. |

| 1 |

2. Transaction mechanism

|

| a. | The Scheme will be implemented on the basis that: |

|

| i. | the Scheme will constitute an affected transaction as defined in section 117(1)(c) of the Companies Act and will be regulated in terms of the Companies Act, the Companies Regulations and by the Takeover Regulations Panel (TRP) and by the JSE Limited (JSE); |

|

|

|

|

|

| ii. | the Scheme will be implemented in terms of section 114 of the Companies Act and will be proposed by the Renergen Board between the Company and the Renergen Shareholders, including Renergen Shareholders holding Target Shares on the Australian Securities Exchange (ASX); |

|

|

|

|

|

| iii. | if the Scheme is approved and becomes unconditional, Renergen Shareholders will receive the Consideration Shares at the ratio of 0.09196 Consideration Shares for every 1 (one) Target Share held on the record date for participation in the Scheme (Consideration Ratio) provided that: |

|

| 1. | the number of Consideration Shares will be rounded down to the nearest whole number resulting in allocations of whole Consideration Shares only; |

|

|

|

|

|

| 2. | in respect of any fractional entitlements that arise, ASPI will make a cash payment to such Renergen Shareholders in accordance with the JSE Listings Requirements and will retain sufficient funds in escrow to make such fractional entitlement cash payments, in accordance with the Companies Regulations; and |

|

|

|

|

|

| 3. | ASPI will deposit an amount of ZAR4,500,000 into an escrow account, administered by Tiaan Smuts Attorneys Incorporated for the sole purpose of settling any fractional entitlements and deliver an irrevocable unconditional cash confirmation to the TRP in respect thereof, as contemplated in Regulation 111(4) of the Takeover Regulations; |

|

|

|

|

|

| 4. | the Consideration Ratio has been calculated on the basis that there will be 155 170 891 Target Shares capable of participating in the Scheme, which includes (i) the Target Shares in issue on the date of this letter and (ii) the Target Shares which the Company is obliged to issue in terms of the Renergen Bonus Share Plan, approved in 2017 (Bonus Share Plan). Subject to rounding down to the nearest whole number, a maximum of 14,270,000 Consideration Shares will be issued by ASPI as the Scheme consideration or the Standby Offer consideration, therefore should there be more than 155 170 891 Target Shares in issue or, which are required to be issued, on the record date for participation in the Scheme or on the opening date of the Standby Offer, the Consideration Ratio will be adjusted downwards on a pro rata basis to reflect same; |

|

| iv. | if any Target Shares are required to be issued to AIRSOL SRL in terms of Renergen’s convertible debentures or for any other reason, the Consideration Ratio will be adjusted downward on a pro rata basis to reflect same, as the maximum Consideration Shares shall at all times be capped at 14,270,000 Consideration Shares; |

|

|

|

|

|

| v. | in anticipation of the Transaction being implemented, ASPI will seek a secondary inward listing of the ASPI common stock on the JSE (Secondary Listing) and the Consideration Shares offered to holders of Target Shares recorded in the JSE share register of the Company will be listed on the JSE; |

| 2 |

|

| vi. | a combined circular to Renergen Shareholders in relation to the Scheme as contemplated in regulation 106(2) and (3) of the Companies Regulations (Circular) will be prepared, the distribution of which will be subject to conditions precedent set out in paragraph 4 below; |

|

|

|

|

|

| vii. | the Scheme will be subject to the conditions precedent set out in paragraph 5.a and 5.c below. If the conditions precedent set out in paragraph 5.a and 5.c below are not fulfilled or, where permissible, waived by the longstop date (or any extended longstop date) set out in paragraph 5 below, the Scheme will fail and will not be implemented; |

|

|

|

|

|

| viii. | should the Circular be posted and all the conditions precedent set out in paragraph 5.a and 5.c below be fulfilled, or, where permissible, waived, and the Scheme becomes operative, ASPI will issue the Consideration Shares to Renergen Shareholders and make the cash payments for fractional entitlements in consideration for the transfer of the Target Shares to ASPI as set out in paragraph iii above for each Target Share held on the record date for the Scheme; |

|

|

|

|

|

| ix. | after the implementation of the Scheme, ASPI will hold 100% of the issued shares in the Company, and the Renergen Shareholders will hold no more than 14,270,000 Consideration Shares (subject to rounding down to the nearest whole number) in ASPI; |

|

|

|

|

|

| x. | following implementation of the Scheme, the Company will de-list from the JSE, A2X and the ASX; and |

|

|

|

|

|

| xi. | other than for purposes of complying with its obligations under or pursuant to the Bonus Share Plan existing as at the date of signature of this Offer, the Company will not, from the date of signature of this Offer by ASPI until the Scheme (or the Stand-by Offer, if applicable) is implemented: |

|

| 1. | declare any dividends or make any other distributions whatsoever to Renergen Shareholders; or |

|

|

|

|

|

| 2. | issue any shares, options, convertible instruments or other equity-linked securities whatsoever, (whether to existing shareholders or to any other person), |

|

|

|

|

|

| without the prior written consent of ASPI (which shall not be unreasonably withheld or delayed). |

|

|

| b. | If the Scheme lapses or fails solely due to any one or more of the Scheme Conditions, contemplated under paragraph 5.c not being fulfilled and, where applicable, waived (Stand-by Offer Trigger Event), the Stand-by Offer will be implemented as follows: |

|

| i. | the Stand-by Offer will be regulated in terms of the Companies Act, the Companies Regulations and by the TRP, JSE and ASX (to the extent applicable); |

|

|

|

|

|

| ii. | the Stand-by Offer will automatically become effective and open for acceptance by the Renergen Shareholders with effect from the date and time that a Stand-by Offer Trigger Event occurs; |

|

|

|

|

|

| iii. | the consideration payable for each Target Share in respect of which the Stand-by Offer is accepted will be equal to the consideration offered by ASPI in terms of the Scheme as set out in paragraph 2.a.iii above; |

|

|

|

|

|

| iv. | the provisions of paragraphs 2a.iii and 2a.iv will apply to the Stand-by Offer mutatis mutandis; |

| 3 |

|

| v. | in anticipation of the Transaction being implemented, ASPI will seek the Secondary Listing, and the Consideration Shares offered to holders of Target Shares recorded in the South African share register of the Company will be listed on the JSE; |

|

|

|

|

|

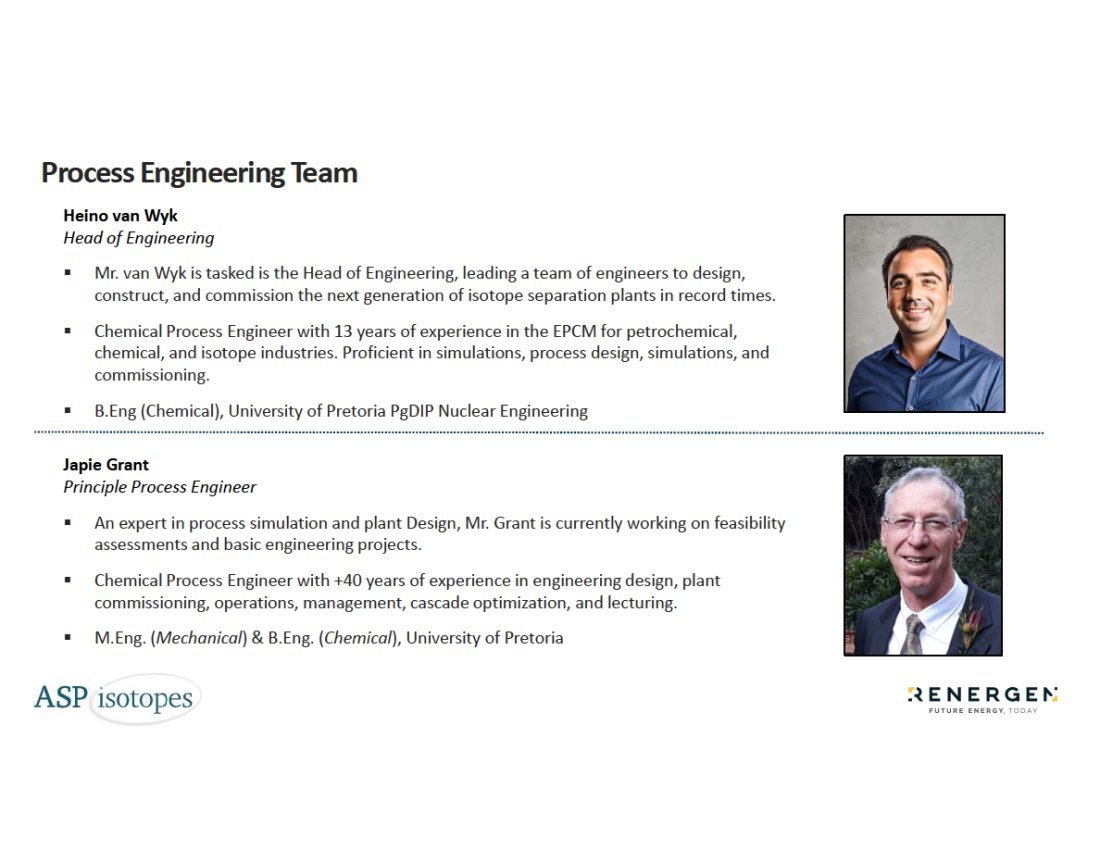

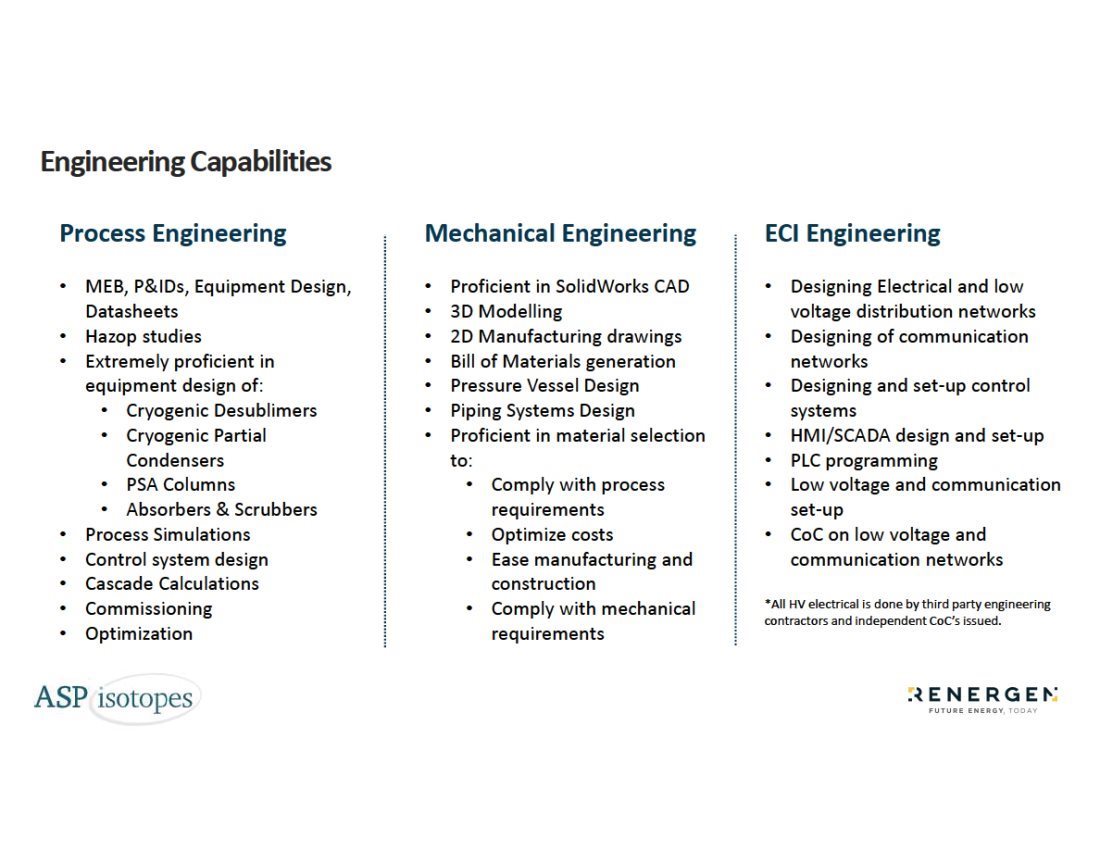

| vi. | In the event that either the Scheme or the Stand-by Offer results in ASPI acquiring at least 51% (fifty one percent) of the issued shares in the Company after such event, Renergen will become an operating subsidiary of ASPI and will continue to be led by current CEO, Stefano Marani, who will join the ASPI board and become the CEO of the Electronics and Space Division of ASPI. Nick Mitchell will become Co-COO for the group alongside Robert Ainscow. Multiple members of ASPI’s engineering team and project management team may transition to Renergen as needed to ensure timely completion of phase 1C and phase 2. |

|

|

|

|

|

| vii. | ASPI will ensure the equitable treatment of holders of share appreciation rights under the existing Renergen Equity-Settled Share Appreciation Rights Plan 2021, as required in terms of the Companies Regulations. |

3. General undertakings

|

| a. | To the extent that it is within their respective control, ASPI and the Company agree to implement the Transaction and the Secondary Listing in accordance with the terms of this letter, the provisions of the Companies Act and the provisions of Chapter 5 of the Companies Regulations. |

|

|

|

|

|

| b. | Each of ASPI and the Company shall use its reasonable endeavours to implement the actions contemplated in the Transaction within the periods contemplated in the Transaction timetable to be set out in the announcement and Circular. |

|

|

|

|

|

| c. | If by reason of law any step forming part of the Transaction is not achievable, ASPI and the Company shall use their reasonable endeavours toidentify, agree upon and implement replacement steps which (i) to the extent permissible by law, have the same, or substantially the same, effect as the step that could not be achieved by reason of law, and (ii) do not alter the economic effect of the Transaction. |

4. Posting conditions

|

| a. | The posting of the Circular to Renergen Shareholders will be subject to the fulfilment of the conditions that (Posting Conditions), by no later than 30 June 2025: |

|

| i. | the Independent Expert (as defined below) has delivered its opinion in respect of the Offer consideration to the Renergen Independent Board of the Company, in accordance with section 114 of the Companies Act and regulations 90 and 110 of the Companies Regulations; |

|

|

|

|

|

| ii. | the Independent Expert has delivered to the Company an opinion that the terms and conditions, including the consideration offered to Renergen Shareholders under the Offer, are reasonable to Renergen Shareholders; and |

|

|

|

|

|

| iii. | following receipt of the above opinion from the Independent Expert, the Renergen Independent Board has recommended that Renergen Shareholders vote in favour of the Scheme, or alternatively, accept the Stand-by Offer; |

|

|

|

|

|

| iv. | all requisite approvals have been received from the JSE, ASX, the TRP and the Financial Surveillance Department of the South African Reserve Bank (FinSurv) for the posting of the Circular, to the extent required. |

| 4 |

|

| b. | The Posting Conditions cannot be waived. |

|

|

|

|

|

| c. | Subject to regulatory requirements, ASPI will be entitled to extend the date for the fulfilment of the Posting Conditions by up to 45 (forty five) days, in its sole discretion, upon written notice to the Company. Any extension longer than the aforementioned period, must be agreed in writing by ASPI and the Company. |

5. Offer conditions

|

| a. | The Transaction will be subject to the fulfilment (or waiver in terms of paragraph 5.d below) of the following conditions precedent (Offer Conditions): |

|

| i. | the written consent for the transfer of the Target Shares in terms of the Offer is obtained from the Industrial Development Corporation of South Africa and the United States International Development Finance Corporation (Lenders) in terms of the change of control provisions under their respective loan and/or funding arrangements with the Company and subsidiaries of the Company and that the Lenders agree not to proceed in foreclosing on outstanding debt due by those subsidiaries, as a result of any breach of covenants, event of default or otherwise, prior to 31 July 2027; |

|

|

|

|

|

| ii. | the written consent for the transfer of the Target Shares in terms of the Offer is obtained from The Standard Bank of South Africa (SBSA) in terms of the change of control provisions under its respective loan(s) and/or funding arrangement(s) with the Company and SBSA agrees to extend the repayment date for the loan(s) and/or funding arrangement(s) to at least 31 March 2026; |

|

|

|

|

|

| iii. | AIRSOL SRL agrees to extend the maturity date for the convertible debentures that it holds in Renergen, to at least 31 March 2026; |

|

|

|

|

|

| iv. | that all regulatory approvals, except for the requirement that Takeover Panel issue a compliance certificate to Renergen in terms of section 121(b) of the Companies Act, required to implement the Transaction are obtained, including receipt of (i) FinSurv granting the requisite approvals as provided for in the South African Exchange Control Regulations (in terms of the South African Currency and Exchanges Act, 1933) to implement the Transaction (ii) the JSE granting all requisite approvals under the JSE Listings Requirements in respect of the Transaction, and (iii) the ASX and Australian Securities & Investments Commission granting all requisite approvals in respect of the Transaction (to the extent required); |

|

|

|

|

|

| v. | that all regulatory approvals required for the Secondary Listing of ASPI common stock are obtained, including (i) the FinSurv granting the requisite approvals as provided for in the South African Exchange Control Regulations (in terms of the South African Currency and Exchanges Act, 1933) to implement the Secondary Listing of ASPI common stock, and (ii) the JSE granting all requisite approvals under the JSE Listings Requirements in respect of the Secondary Listing of ASPI common stock; |

|

|

|

|

|

| vi. | that the relevant competition authorities have granted such approvals under the Competition Act, 1998 and any other laws applicable in order to implement the Transaction, either unconditionally or subject to conditions acceptable to ASPI in its sole discretion; |

|

|

|

|

|

| vii. | a Material Adverse Change (as defined below) has not occurred by the date on which the last of the conditions to the Scheme or the Stand-by Offer, other than this condition, has been fulfilled or waived; |

|

|

|

|

|

| For purposes of this paragraph 5.a.vii, the term “Material Adverse Change” shall mean: |

| 5 |

|

| 1. | the Company having committed a breach of any of its material undertakings set out in paragraph 7 (Conduct of Business Undertakings) and, where such breach is capable of being remedied, not having remedied such breach within 30 (thirty) business days of receipt of written notice from ASPI requiring it to do so (and in any event by no later than the date on which the last of the conditions to the Scheme or the Stand-by Offer, other than this condition in paragraph viii, has been fulfilled or waived); |

|

|

|

|

|

| 2. | any event, change or circumstance (or any series of combination thereof) that has occurred, or may reasonably be expected to occur which, individually or in aggregate, will have, or is reasonably likely to have a material adverse effect on the business, operations, financial condition or prospects of the Company and/or a subsidiary of the Company. For the purposes of this clause “materially adverse effect” shall mean anything that is expected to result in a reduction of at least 20% (twenty percent) in the Renergen group’s enterprise/equity value, comprising the total equity value (as per the Consolidated Statement of Financial Position in Renergen’s most recently published results (SOFP)) plus interest bearing borrowings (as per the SOFP), excluding the impact of any funding provided by ASPI to Renergen, as determined by an auditor or independent expert appointed by the Parties on agreement within 3 days of receipt of notification from the Company or if there is no agreement then by the most senior officer for the time being of the South African Institute of Chartered Accountants. The Company shall promptly notify ASPI in writing upon becoming aware of any actual or potential Material Adverse Change. A reduction in enterprise/equity value will not constitute a material adverse effect to the extent it results from: |

|

| a. | any event, change or circumstance which is temporary in nature; |

|

| b. | changes in accounting standards; or |

|

| c. | any fact fairly disclosed in writing to ASPI prior to the date of this Offer. |

|

| viii. | the funding arrangement entered into between Renergen and ASPI is ratified by Renergen Shareholders by way of an ordinary resolution at a general meeting called for such purpose prior to the Scheme Meeting; |

|

| b. | In order to comply with section 121(b) of the Companies Act and regulation 102(13) of the Companies Regulations, notwithstanding the fulfilment of the conditions, the Offer shall not be implemented unless and until the Takeover Panel has issued a compliance certificate in respect of the Offer in terms of section 119(4)(b) of the Companies Act. |

|

|

|

|

|

| c. | In addition to the Offer Conditions, the Scheme will be subject to (and will only become operative on the relevant operational date upon) the fulfilment (or waiver in terms of paragraph 5.d below) of the following conditions precedent (Scheme Conditions): |

|

| i. | either: |

|

| 1. | no Renergen Shareholder (i) gives notice objecting to the resolution required to approve the Scheme in terms of section 115(2) of the Companies Act (Scheme Resolution), as contemplated in section 164(3) of the Companies Act, and (ii) votes against the Scheme Resolution at the general meeting to be convened by the Company to approve the Scheme Resolution (General Meeting); or |

|

|

|

|

|

| 2. | if any Renergen Shareholder gives notice objecting to the Scheme Resolution as contemplated in section 164(3) of the Companies Act and then votes against the Scheme Resolution at the General Meeting, that no Renergen Shareholders exercise their Appraisal Rights, by giving valid demands in terms of sections 164(5) to 164(8) of the Companies Act; |

| 6 |

|

| ii. | the Scheme Resolution is approved by the requisite majority of votes of the Renergen Shareholders at the General Meeting as contemplated in section 115(2) of the Companies Act; |

|

|

|

|

|

| iii. | to the extent required in terms of section 115(3)(a) of the Companies Act, the High Court of South Africa (Court) approves the implementation of the Scheme Resolution; |

|

|

|

|

|

| iv. | if any person who voted against the Scheme Resolution applies to Court for a review of the Scheme Resolution in terms of section 115(3)(b) and section 115(6) of the Companies Act, either: |

|

| 1. | leave to apply to Court for any such review is refused; or |

|

| 2. | if leave is so granted, the Court refuses to set aside the Scheme Resolution; |

|

| v. | the Scheme Resolution is not withdrawn or treated as a nullity; |

|

| d. | The longstop date in respect of the fulfilment (or waiver, where applicable) of the Offer Conditions and the Scheme Conditions is 30 September 2025. ASPI may, by notice in writing to the Company, waive: |

|

| i. | the Offer Conditions in paragraphs 5.a.i, 5.a.ii, 5.a.iii and 5.a.vii; and |

|

| ii. | the Scheme Conditions in paragraph 5.c.i. |

|

| e. | Subject to regulatory requirements, ASPI will be entitled to extend the date for the fulfilment of the Offer Conditions and the Scheme Conditions by up to 60 (sixty) days, in its sole discretion, upon written notice to the Company. Any extension longer than the aforementioned period must be agreed in writing by ASPI and the Company. |

|

|

|

|

|

| f. | The making of the Stand-by Offer will be subject to the occurrence of a Standby Offer Trigger Event, and the Stand-by Offer will only become operative on the relevant operational date, subject to the fulfilment (or waiver by ASPI to the extent permissible) of the Offer Conditions. |

]6. Transaction Circular

|

| a. | Notwithstanding anything to the contrary in this letter, but subject to compliance with applicable law, each of ASPI and the Company undertakes to the other of them that it will not distribute any circular or notification to the Renergen Shareholders relating to the Transaction (including the firm intention announcement to be released in terms of regulation 101 of the Companies Regulations (Firm Intention Announcement) and the Circular) without the prior written consent of the other Party, such consent not to be unreasonably withheld, conditioned or delayed. |

|

|

|

|

|

| b. | Save for the Pre-listing Statement required for the Secondary Listing which will be prepared by ASPI’s advisor, the Company’s advisors have been instructed to prepare (i) the Circular and (ii) all submissions, applications and documents required to be furnished to the TRP, FinSurv and the JSE in order to procure the fulfilment of the Posting Conditions (Circular Documentation). |

|

|

|

|

|

| c. | ASPI undertakes to provide the Company promptly with all assistance and information that is reasonably requested by the Company in order to procure the fulfilment of the Posting Conditions. |

|

|

|

|

|

| d. | ASPI and the Company shall procure that their advisors: |

| 7 |

|

| i. | submit drafts and revised drafts of the Circular Documentation to each other’s advisors with reasonably sufficient time, having regard to the nature, length and completeness of the submission process, for review and comment; |

|

| ii. | take into account any reasonable comments from each other and their legal advisors for the purposes of preparing revised drafts of the Circular Documentation, provided that the Renergen Independent Board shall form its own opinion on the Transaction and the consideration being offered, taking into account the opinion of an Independent Expert; |

|

| iii. | to the extent applicable, provide copies of all documents and communications made to or received from the TRP, FinSurv and the JSE in connection with Circular Documentation. |

7. Conduct of business undertakings

|

| a. | Each Party undertakes to the other Party that it shall, and that it shall procure that each other member of the Party’s group shall, during the period between the date of signature of this letter by the Renergen Independent Board (Signature Date) and the earlier of: (a) implementation of the Scheme or the Stand-by Offer; and (b) the date on which it is announced on SENS that the Transaction has failed: |

|

| i. | carry on its business in all material respects in the ordinary course, consistent with past practice, and in accordance with its policies and strategies in order to maintain the respective businesses values and protect shareholder value; |

|

| ii. | exercise its reasonable endeavours to preserve and protect its rights and assets; |

|

| iii. | continue to conduct its business under the same name/s, and in all material respects on the same basis and in the same manner, as it did immediately prior to the Signature Date; |

|

| iv. | not enter into any arrangement prohibiting or restricting its right or ability to operate or compete in any market; |

|

| v. | not adopt a plan of liquidation or resolutions providing for its liquidation; |

|

| vi. | continue to comply with all applicable laws in all material respects; |

|

| vii. | obtain and maintain in full force and effect all material approvals required for the conduct of its business, in the places and in the manner in which that business is carried on as at the Signature Date; |

|

| viii. | not change, or cause or permit a change of, the nature or scope of any substantial part of its business in any material respect, or cease or suspend, or threaten or propose to cease or suspend, to carry on all or a substantial part of its business; |

|

| ix. | not dispose of, or enter into any agreement (whether oral, in writing or otherwise and whether or not subject to conditions precedent) to dispose of, whether by one transaction or a series of transactions, the whole or a substantial or material part of its business, save for transactions that have been disclosed to Renergen; and |

|

| x. | not declare, distribute or pay any distribution. |

|

| b. | The Company undertakes to ASPI that it shall, and that it shall procure that each other member of the Company's group shall, during the period between the Signature Date and the earlier of: (a) implementation of the Scheme or the Standby Offer; and (b) the date on which it is announced on SENS that the Transaction has failed: |

|

| i. | not, other than for purposes of complying with its obligations under the Bonus Share Plan, the Share Appreciation Plan or the agreements to be concluded with participants of the Share Appreciation Rights Plan in accordance with paragraph 5.a.vii above, issue, or cause or permit to be issued, any securities, and not dispose of, or cause or permit to be disposed of, any shares held in treasury; |

|

| ii. | not make or undertake any capital expenditure in amounts exceeding ZAR278,000,000, unless provided for in the budget of the Company as approved by the Renergen Board as at the Signature Date; |

|

| iii. | not make any material changes to its insurance or pension arrangements otherwise in the ordinary course of business; |

| 8 |

|

| iv. | not repurchase any shares; |

|

| v. | not, other than in terms of any funding provided by ASPI to Renergen or otherwise in the ordinary course of business, incur, create, assume or otherwise become liable for any indebtedness (or any other material liability or obligation, including pursuant to any debt financing, leasing or off-balance sheet financing arrangements or any hedging arrangements); |

|

| vi. | not, otherwise than in the ordinary course of business, create any encumbrance over any of its material assets; |

|

| vii. | not enter into a partnership or other joint venture with a third party that will constitute a Category 1 or 2 transaction as defined in the JSE Listings Requirements; |

|

| viii. | not, otherwise in the ordinary course of business, give any guarantee, indemnity or other agreement to secure an obligation of a third party, which shall specifically exclude any member of the Company's group; |

|

| ix. | not grant or make any new awards in terms of or for purposes of any share option, share incentive or phantom share plan, other than in the ordinary course of business and in accordance with the Company’s long-term incentive plans in force as at the Signature Date; |

|

| x. | not initiate, settle or abandon any claims, litigation, arbitration or other proceedings or make any admissions of liability by or on behalf of any member/s of the Company's group with an aggregate value in excess of ZAR150 million; |

|

| xi. | not alter, or agree to alter, any of its constitutional documents in any material respect; |

|

| xii. | not alter, amend or vary its accounting policies, unless required by applicable laws or accounting requirements; and |

|

| xiii. | not: |

|

| 1. | terminate, save for breach of contract, poor performance or pursuant to disciplinary action, the employment or office of any of its directors, officers or senior employees; |

|

| 2. | other than in the ordinary course of business and subject to obtaining the requisite waivers and/or consents from the relevant counterparties in relation to the Transaction, enter into any material contract (whether or not subject to conditions precedent) which contain any change of control provisions; and |

|

| 3. | materially alter the terms of employment or engagement of any of its directors, officers or senior employees including materially increasing their compensation or benefits (including any that are payable on death, leaving employment or retirement), other than in the ordinary course of business. |

|

| c. | Nothing set out in this paragraph 7 shall limit or restrict either Party’s ability to: |

|

| i. | take steps necessary to implement or otherwise give effect to the Transaction; |

|

| ii. | conduct its business in the ordinary course; |

|

| iii. | take steps necessary to prevent or otherwise deal with any emergency that arises or could reasonably be expected to arise. |

8. Share-Based Schemes and Options

The Company confirms that, there are no other equity-based compensation plans except for the Bonus Share Plan and the Share Appreciation Rights Plan, and that it shall ensure that before the issue of the Scheme Circular, all rights under the Bonus Share Plan are vested and all eligible shares are issued and included in the total Target Shares in circulation for the implementation of the Scheme or the Stand-by Offer.

| 9 |

9. Warranties by the Renergen Board

The Company represents, warrants and covenants to ASPI as follows:

|

| a. | Upon the counter signature of this letter, the content has been approved and accepted by the Renergen Independent Board. |

|

|

|

|

|

| b. | The Company will conduct its business as per the business plan that was presented to ASPI prior to signing this letter, and as otherwise contemplated in this letter, and in line with the normal course of business until the earlier of: (i) implementation of the Scheme or the Stand-by Offer; and (ii) the date on which the Transaction fails. |

|

|

|

|

|

| c. | On the date hereof, the Company is a foreign private issuer within the meaning of Rule 405 under the U.S. Securities Act of 1933, as amended (the Securities Act), and U.S. holders (as defined in Rule 800(h) of the Securities Act) of the Company hold no more than 10% of the Target Shares, as calculated in accordance with Rule 802 under the Securities Act. The Company will provide to ASPI any information reasonably requested by ASPI so as to permit the Company to determine whether the exemptions provided under Rule 802 of the Securities Act and Rule 14d-1 of the U.S. Securities Exchange Act of 1934, as amended, are available. |

10. Warranties by ASPI

This letter has received the requisite internal approvals from the ASPI board, ASPI shareholders and applicable regulators (to the extent required).

11. Breach

In the event of any of the Parties (Defaulting Party) committing a breach of any of the terms of this Offer letter, including the undertakings set out in paragraph 7 (Conduct of Business Undertakings), and failing to remedy such breach within a period of 30 (thirty) business days after receipt of a written notice from the other Party (Aggrieved Party) calling upon the Defaulting Party so to remedy, then the Aggrieved Party shall be entitled, at its sole discretion and without prejudice to any of its other rights in law, to claim specific performance of the terms of this Agreement and/or to claim and recover damages from the Defaulting Party, provided that no Party shall be entitled to cancel the Offer.

12. Legal Jurisdiction

The provisions of this letter shall be governed by and construed in accordance with the laws of the Republic of South Africa. Furthermore, the Parties hereby irrevocably and unconditionally consent to the non-exclusive jurisdiction of the High Court of South Africa, Gauteng Local Division, Johannesburg in regard to all matters arising from this letter.

13. Confidentiality

|

| a. | The Parties have entered into a confidentiality agreement on or about 24 January 2025 which shall govern, inter alia, the provisions of this letter. |

|

|

|

|

|

| b. | Notwithstanding the provisions of paragraph 13.a above, by their signatures hereto the Parties acknowledge and agree that the contents of this letter and the Transaction are strictly confidential, may constitute inside information (as defined in the Financial Markets Act, 2012 and the United States Securities Exchange Act, 1934) in relation to ASPI and the Company, and may not be disclosed by either Party to any party whatsoever, except to the extent required by law or to professional advisers and employees who need to know such information, provided that such persons have been made aware of the confidential nature thereof and the contents of this paragraph 13. However, the Parties agree that the details of the Transaction will be disclosed as required in the Firm Intention Announcement and in compliance with applicable legal and regulatory requirements. |

14. Announcements

From the date of last signature on this letter, neither party will make or publish any announcements pertaining to the Transaction, without first consulting with the other Party in order to enable them in good faith to attempt to agree the content of such announcement, to the extent possible.

| 10 |

By their signatures below, the parties hereby accept the terms and conditions of this letter.

SIGNED at New York City on this the 19th day of May 2025.

|

| For and on behalf of |

|

|

|

|

|

|

| ASP ISOTOPES INC. |

|

|

|

|

|

|

| /s/ Paul Mann |

|

|

| Name: Paul Mann |

|

|

| Capacity: Chief Executive Officer |

|

|

| Who warrants his authority hereto |

|

SIGNED at Sydney on this the 20th day of May 2025.

|

| For and on behalf of |

|

|

|

|

|

|

| RENERGEN LIMITED |

|

|

|

|

|

|

| /s/ David King |

|

|

| Name: David King |

|

|

| Capacity: Director and Chairman |

|

|

| Who warrants his authority hereto |

|

| 11 |

EXHIBIT 10.1

TERM LOAN FACILITY AGREEMENT

Between

ASP ISOTOPES INCORPORATED

and

ASP ISOTOPES SOUTH AFRICA PROPRIETARY LIMITED

and

RENERGEN LIMITED

| Page 1 |

Table of Contents

| 1. | PARTIES |

| 3 |

|

|

|

|

|

|

|

| 2. | BACKGROUND |

| 3 |

|

|

|

|

|

|

|

| 3. | DEFINITIONS |

| 3 |

|

|

|

|

|

|

|

| 4. | THE FACILITY |

| 11 |

|

|

|

|

|

|

|

| 5. | TERMINATION OF EXCLUSIVETY AGREEMENT |

| 12 |

|

|

|

|

|

|

|

| 6. | ADVANCECONDITIONS |

| 12 |

|

|

|

|

|

|

|

| 7. | ADVANCES |

| 13 |

|

|

|

|

|

|

|

| 8. | DRAWDOWNNOTICES |

| 13 |

|

|

|

|

|

|

|

| 9. | INTEREST |

| 14 |

|

|

|

|

|

|

|

| 10. | REPAYMENT OF INTEREST AND THE LOAN |

| 14 |

|

|

|

|

|

|

|

| 11. | CANCELLATION |

| 15 |

|

|

|

|

|

|

|

| 12. | CESSION AND ASSIGNMENT |

| 15 |

|

|

|

|

|

|

|

| 13. | CHANGE IN CIRCUMSTANCES |

| 15 |

|

|

|

|

|

|

|

| 14. | SANCTIONS |

| 16 |

|

|

|

|

|

|

|

| 15. | UNDERTAKINGS |

| 17 |

|

|

|

|

|

|

|

| 16. | WARRANTIES AND REPRESENTATIONS |

| 18 |

|

|

|

|

|

|

|

| 17. | INDEMNITY |

| 20 |

|

|

|

|

|

|

|

| 18. | EVENT OF DEFAULT |

| 20 |

|

|

|

|

|

|

|

| 19. | PAYMENT MECHANICS |

| 22 |

|

|

|

|

|

|

|

| 20. | NOTICES AND LEGAL PROCESS |

| 23 |

|

|

|

|

|

|

|

| 21. | ARBITRATION |

| 24 |

|

|

|

|

|

|

|

| 22. | GOVERNINGLAW |

| 24 |

|

|

|

|

|

|

|

| 23. | GENERAL AND MISCELLANEOUS |

| 25 |

|

|

|

|

|

|

|

| SCHEDULE1 |

| 28 |

|

|

|

|

|

|

|

|

| SCHEDULE 2 |

| 29 |

|

|

| Page 2 |

| 1. | PARTIES |

|

|

|

| This Agreement is made between: |

| 1.1. | ASP Isotopes South Africa Proprietary Limited (Registration Number: 2021/701779/07) a private company with limited liability incorporated in accordance with the Law of South Africa (Lender); |

|

|

|

| 1.2. | ASP Isotopes Incorporated, a corporation incorporated in the state of Delaware, USA (ASPI); and |

|

|

|

| 1.3. | Renergen Limited (Registration Number: 2014/195093/06) a public company, with limited liability incorporated in accordance with the Law of South Africa (Borrower); |

|

|

|

| each hereinafter referred to individually as a Party and collectively as the Parties. |

|

|

|

|

| 2. | BACKGROUND |

|

|

|

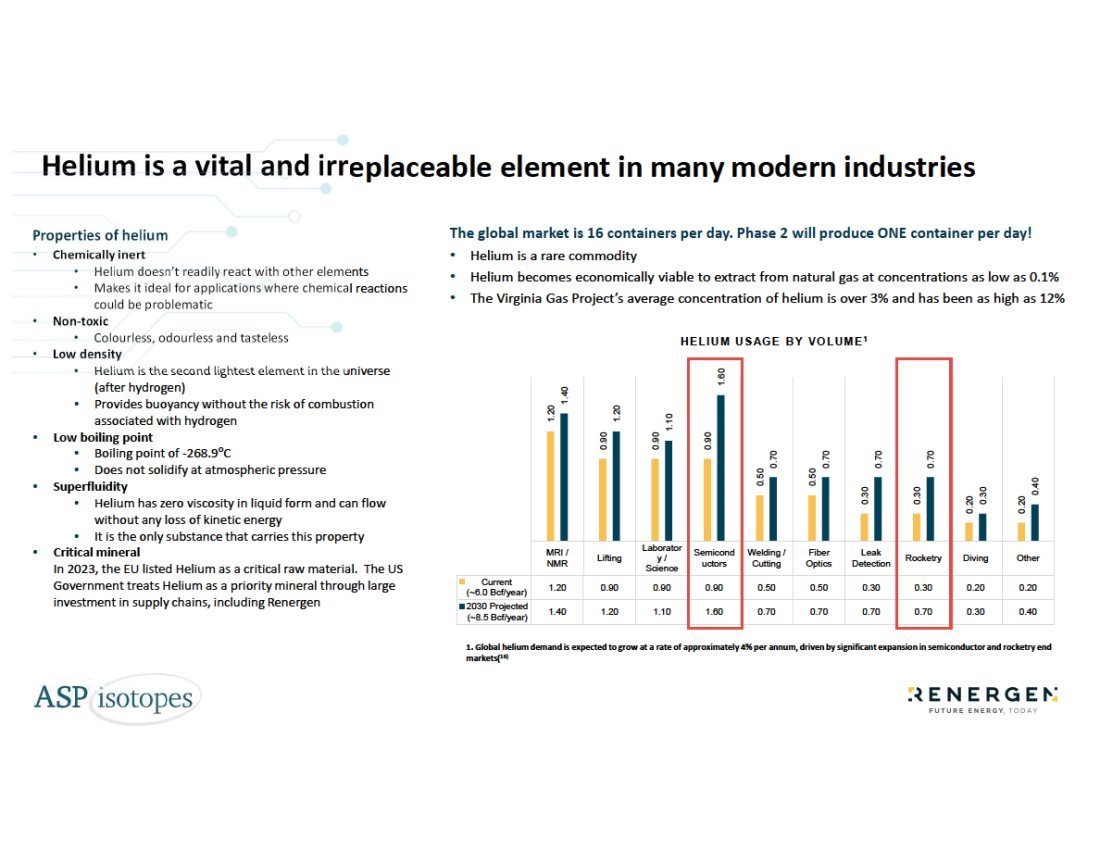

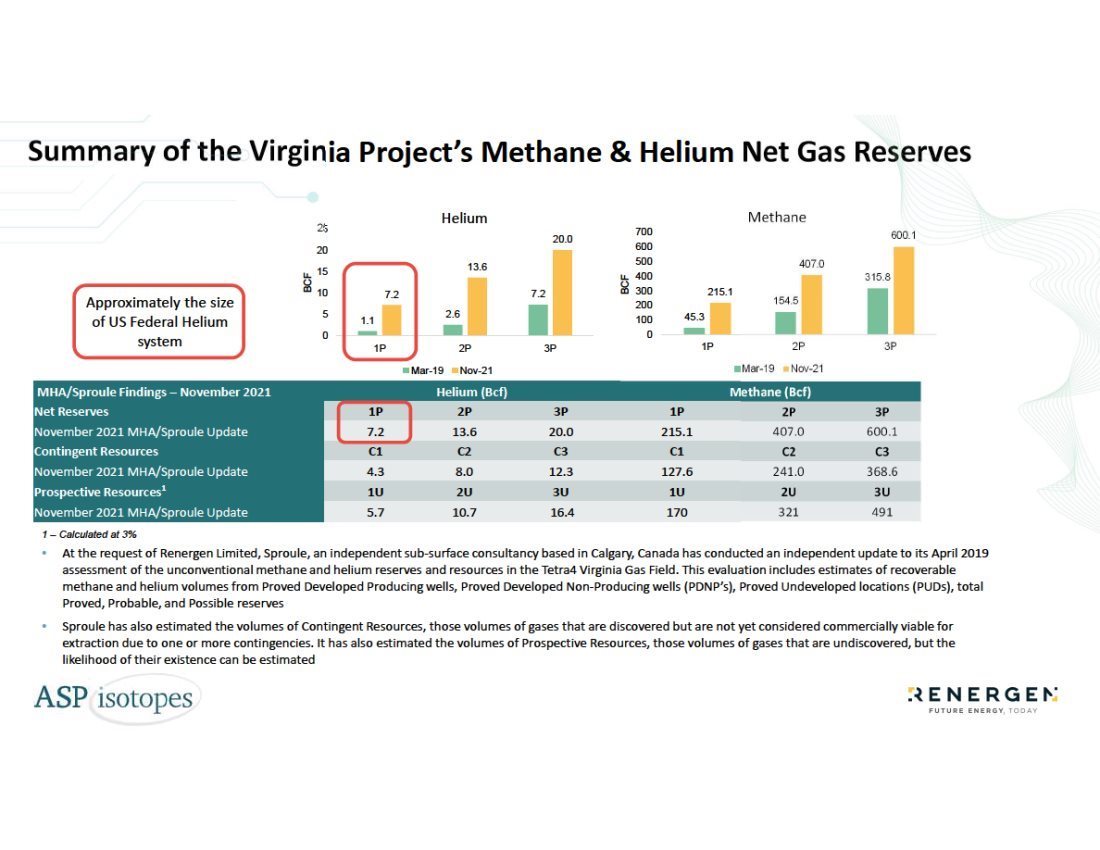

| 2.1. | The Borrower is a South African energy company specialising in natural gas and helium extraction, currently listed on the JSE, the Australian Securities Exchange and A2X, and requires funding for its operations. |

|

|

|

| 2.2. | The Borrower’s financial position faces significant liquidity concerns due to delays in implementing its Phase 1 Virginia Gas Project, and it requires interim funding while the transaction is being implemented. |

|

|

|

| 2.3. | ASPI, the Lender’s parent company is considering and planning a secondary listing of its shares on the JSE with the intention, if approved, to issue shares in itself on the JSE to all shareholders of the Borrower, in exchange for the transfer of all shares held in the Borrower by its shareholders to ASPI by way of the Scheme, failing which, to make a standby general offer to the Borrower’s shareholders to exchange their shares held in the Borrower for new shares to be issued to them by the Lender. |

|

|

|

| 2.4. | In anticipation of the above, the Lender wishes to provide a loan facility to the Borrower. |

|

|

|

| 2.5. | This Agreement formalises the terms and conditions between the Parties. |

|

|

|

| 3. | DEFINITIONS |

|

|

|

| 3.1. | Unless otherwise expressly stated, or the context otherwise requires, the words and expressions listed below shall, when used in this Agreement, bear the meanings ascribed to them as follows: |

|

|

|

| 3.1.1. | Advance shall mean each advance or drawdown made or to be made by the Lender to the Borrower under the Facility; |

|

|

|

| 3.1.2. | Advance Conditions shall mean the conditions to be satisfied for any Advance as set out in Schedule 1; |

|

|

|

| 3.1.3. | Advance Date shall mean any date on which an amount under the Facility is Advanced by the Lender to the Borrower which date shall be the date on which the Lender confirms in writing to the Borrower that all of the Advance Conditions for such Advance has been fulfilled or, if applicable, waived or deferred in accordance with the provisions of clause 6.1.2; |

| Page 3 |

| 3.1.4. | Agreement shall mean this term loan facility including all schedules thereto; |

|

|

|

| 3.1.5. | Business Day shall mean a day other than a Saturday, a Sunday or official public holiday in South Africa; |

|

|

|

| 3.1.6. | Companies Act shall mean the Companies Act, 2008; |

|

|

|

| 3.1.7. | Constitutional Documents shall mean in respect of any entity incorporated or established in South Africa at any time, the then current and up-to-date memorandum of incorporation of such entity or, in the case of a trust, the trust deed of such trust and the letters of authority issued to the trustees of such trust; |

|

|

|

| 3.1.8. | Default Interest Rate shall mean the higher of the Interest Rate plus 2% (two percent) per annum or the Repo Rate plus 2% (two percent) per annum; |

|

|

|

| 3.1.9. | DFC means the United States International Development Finance Corporation, an agency of the United States of America, being the successor in interest to OPIC pursuant to the Better Utilization of Investments Leading to Development Act of 2018, 22 U.S.C. §§9601 et seq. |

|

|

|

| 3.1.10. | District of Columbia shall mean the federal district of the United States of America established pursuant to Article I, Section 8 of the United States Constitution, also known as Washington, D.C., which serves as the seat of the federal government of the USA; |

|

|

|

| 3.1.11. | Dollar or US$ means the lawful currency for the time being of the USA; |

|

|

|

| 3.1.12. | Drawdown Notice shall mean each written notice delivered by the Borrower to the Lender requesting payment of Advances in respect of the Facility Amount in accordance with the provisions of clause 8, which requests shall be substantially similar to, and contain, at a minimum, the particularity indicated in the draft notice attached hereto marked as Schedule 2; |

|

|

|

| 3.1.13. | Environmental Law shall mean all applicable Law concerning or relating to conservation, planning and development, pollution, emissions, discharges, releases or threatened releases of any hazardous substance, the release of any toxic waste or radioactive or any other dangerous substance, ecological degradation, the promotion of sustainable development and any health and safety practices and the protection of human health including (but not limited to) the National Environmental Management Act, 1998, the Atmospheric Pollution Prevention Act, 1965, the National Environmental Management: Air Quality Act, 2004, the Environment Conservation Act, 1989, the Minerals and Petroleum Resources Development Act, 2002, the National Water Act, 1998, the National Environmental Management Biodiversity Act, 2004, the National Environmental Protected Areas Act, 2003, the National Environmental Management: Waste Act, 2008, the National Heritage Resources Act, 1999, the Nuclear Energy Act, 1999, the National Radioactive Waste Disposal Institute Act, 2008 and the Occupational Health and Safety Act, 1993; |

|

|

|

| 3.1.14. | Event of Default shall mean any of the events or circumstances specified in clause 18; |

| Page 4 |

| 3.1.15. | Exclusivity Agreement shall mean the exclusivity agreement entered into between the Lender and Renergen on 31 March 2025, as amended and restated, pursuant to which the Lender advanced US$ 10 000 000 (ten million Dollars) as an exclusivity fee to Renergen; |

|

|

|

| 3.1.16. | Existing Funding Agreements means: |

|

|

|

| 3.1.16.1. | the written facility agreement dated on or about 20 December 2021 between IDC (as lender) and Tetra4 (as borrower), pursuant to which IDC made a facility in a principal amount of ZAR160,704,000 (one hundred and sixty million seven hundred and four thousand Rand) available to Tetra4, as amended; |

|

|

|

| 3.1.16.2. | the written facility agreement dated on or about 20 August 2019 between OPIC, whose assets and liabilities were subsequently transferred to DFC (as lender) and Tetra4 (as borrower), pursuant to which a facility in a principal amount of USD40,000,000 (forty million United States Dollars) was advanced to Tetra4, as amended from time to time prior to the Signature Date, as amended; |

|

|

|

| 3.1.16.3. | the written loan agreement dated 30 August 2024 between the Standard Bank of South Africa (as lender) and Renergen Limited (as borrower), pursuant to which the Standard Bank of South Africa advanced a loan in a principal amount of R155,000,000 (one hundred and fifty-five million Rand) to Renergen |

|

|

|

| 3.1.17. | Facility shall mean the term loan facility of a maximum amount equal to the Facility Amount to be made available by the Lender to the Borrower for the Facility Purpose on the terms and conditions set out in this Agreement; |

|

|

|

| 3.1.18. | Facility Amount shall mean the ZAR equivalent of US$ 30 000 000 (thirty million Dollars), to be converted by the Lender on the day of any Advance based on the ZAR to Dollar conversion ratio to purchase ZAR as quoted by its South African bank on such Advance Date; |

|

|

|

| 3.1.19. | Facility Purpose shall be to fund the operating costs of the Borrower, the servicing of certain debt, required capital investment and expenses in the ordinary course of business; |

|

|

|

| 3.1.20. | FICA shall mean the Financial Intelligence Centre Act, 2001; |

|

|

|

| 3.1.21. | Final Repayment Date shall mean 30 September 2025; |

|

|

|

| 3.1.22. | Finance Documents shall mean one, more or all of: |

|

|

|

| 3.1.22.1. | this Agreement; |

|

|

|

| 3.1.22.2. | the Exclusivity Agreement; and |

|

|

|

| 3.1.22.3. | any amendments to the agreements referred to above; |

|

|

|

| 3.1.23. | Financial Indebtedness shall mean any obligation (whether present or future) for the payment or repayment of money incurred in respect of: |

|

|

|

| 3.1.23.1. | moneys borrowed or raised and debt balances; |

|

|

|

| 3.1.23.2. | any debenture, bond, note, loan stock or other security or similar acknowledgement of debt; |

| Page 5 |

| 3.1.23.3. | any liability under bankers acceptances; |

|

|

|

| 3.1.23.4. | receivables sold or discounted (otherwise than on a non-recourse basis); |

|

|

|

| 3.1.23.5. | the acquisition cost of any asset to the extent payable before or after the time of acquisition or possession by the party liable where the advance or deferred payment is arranged primarily as a method of raising finance or financing the acquisition of that asset; |

|

|

|

| 3.1.23.6. | any lease, hire agreement, credit sale agreement, hire purchase agreement, conditional sale agreement or instalment sale and purchase agreement, which should be treated in accordance with IFRS as a finance or capital lease or in the same way as a finance or capital lease, but excluding operating leases; |

|

|

|

| 3.1.23.7. | the net mark to market value of any currency swaps, interest rate swaps, foreign exchange transactions, caps, floors or collar arrangements; |

|

|

|

| 3.1.23.8. | amounts raised under any other transaction having the commercial effect of a borrowing or raising of money excluding amounts owed to trade creditors arising in the ordinary course of business on normal trade credit terms and which do not bear interest (and for the avoidance of doubt, amounts owing to trade creditors which do bear interest shall be included as part of Financial Indebtedness); |

|

|

|

| 3.1.23.9. | any put option, repurchase agreement, call option or other transaction of any kind which has the commercial effect of borrowing or obtaining credit or granting security; |

|

|

|

| 3.1.23.10. | any amount raised by the issue of preference shares or other shares with preferential rights to dividends or upon a winding-up together with, on any date on which Financial Indebtedness is determined, all amounts in excess of the amount raised by the issue of such preference shares which would, if the preference shares were to be redeemed on such date, be required to be paid in respect of or upon such redemption (and such amounts shall be included in such determination whether or not a legally enforceable obligation in respect of such payment exists at that time); |

|

|

|

| 3.1.23.11. | any other indebtedness of any nature whatsoever; and |

|

|

|

| 3.1.23.12. | any guarantee, indemnity or similar assurance against financial loss of any person (including any guarantee, indemnity or similar assurance issued in respect of any Financial Indebtedness of such person of the nature contemplated in clauses |

|

|

|

|

| 3.1.23.1 to 3.1.23.12); |

|

|

|

| 3.1.24. | Governmental Authority shall mean any government, governmental department, governmental body, commission, board, bureau, agency, regulatory authority, judicial or administrative body whether national, state, provincial or local, having jurisdiction over the matter or matters in question; |

|

|

|

| 3.1.25. | Group shall mean the Borrower and all of its subsidiaries from time to time; |

|

|

|

| 3.1.26. | IDC means Industrial Development Corporation of South Africa Limited, a corporation established under section 2 of the Industrial Development Corporation Act, 1940; |

| Page 6 |

| 3.1.27. | IFRS shall mean the International Financial Reporting Standards; |

|

|

|

| 3.1.28. | Insolvency Event shall mean the occurrence of any of the following events in relation to any person including a trust: |

|

|

|

| 3.1.28.1. | becoming subject to a scheme of arrangement or compromise with its creditors as envisaged under the provisions of the Companies Act without the prior written consent of the Lender, other than the contemplated Listing; |

|

|

|

| 3.1.28.2. | being wound-up, liquidated or deregistered, whether provisionally or finally and whether voluntarily or compulsorily; |

|

|

|

| 3.1.28.3. | compromising or attempting to compromise with all of its creditors or a moratorium is agreed or declared in respect of or affecting all or a material part of its Financial Indebtedness; |

|

|

|

| 3.1.28.4. | committing an act of insolvency, in terms of the Insolvency Act, 1936, where it is a natural person or a trust; |

|

|

|

| 3.1.28.5. | its members meeting to resolve or resolving that it be wound-up, liquidated or deregistered; |

|

|

|

| 3.1.28.6. | initiating or resolving to initiate business rescue proceedings as defined in section 128 of the Companies Act (whether such proceeding are initiated by the Borrower or by any third party); |

|

|

|

| 3.1.28.7. | it is unable to (or admits inability) to pay its debts generally as they fall due or is (or admits to being) otherwise insolvent or stops, suspends or threatens to stop or suspend payment of all or a material part of its debts; or |

|

|

|

| 3.1.28.8. | is financially distressed as defined in the Companies Act; |

|

|

|

| 3.1.29. | Interest Period shall mean each of the periods commencing on a Reset Date and ending on the day preceding the next Reset Date (both days inclusive) provided that: |

|

|

|

| 3.1.29.1. | the first Interest Period shall commence on the Advance Date and shall end on the day preceding the succeeding Reset Date (both days inclusive); and |

|

|

|

| 3.1.29.2. | the final Interest Period shall commence on the Reset Date immediately preceding the Final Repayment Date and end on the day preceding the Final Repayment Date (both days inclusive); |

|

|

|

| 3.1.30. | Interest Rate shall mean interest calculated at the Prime Rate; |

|

|

|

| 3.1.31. | JSE shall mean the Johannesburg Stock Exchange operated by JSE Limited (registration number: 2005/022939/06), a public company duly incorporated in accordance with the Law of South Africa and licensed as an exchange under the Financial Markets Act, 2012; |

|

|

|

| 3.1.32. | Law shall mean the common law and any present or future constitution, decree, judgment, legislation, measure, requirement, order, ordinance, regulation, statute, treaty, directive or rule having the force of law, issued, passed or promulgated by any Governmental Authority; |

| Page 7 |

| 3.1.33. | Listing shall mean both (a) the shares of ASPI being admitted to trading on the JSE and (b) the approval of all of the applicable conditions relating to the Scheme; |

|

|

|

| 3.1.34. | Loan shall mean the aggregate of any Advances made in terms of the Facility, including accrued Interest thereon, that has not been repaid to the Lender; |

|

|

|

| 3.1.35. | Loan Period shall mean the period commencing on the Advance Date and terminating on the date on which all of the Outstandings are fully and finally, unconditionally and irrevocably repaid by the Borrower to the Lender; |

|

|

|

| 3.1.36. | Material Adverse Change shall mean the consequence/s of any event, circumstance or matter or a combination of events, circumstances or matters, which has or is reasonably likely to have a material adverse effect on: |

|

|

|

| 3.1.36.1. | the ability of either the Borrower, to perform its obligations in terms of the Finance Documents; |

|

|

|

| 3.1.36.2. | the validity of any of the Finance Documents; |

|

|

|

| 3.1.36.3. | the validity or enforceability of, or the effectiveness or the ranking of the rights and remedies of the Lender under any of the Finance Documents; |

|

|

|

| 3.1.37. | the business, operations, assets or financial condition of the Borrower; |

|

|

|

| 3.1.38. | Outstandings shall mean at any time, the aggregate of the Loan and any other amounts owed by the Borrower to the Lender under this Agreement; |

|

|

|

| 3.1.39. | Prime Rate shall mean the publicly quoted basic rate of interest (per cent, per annum, compounded monthly in arrears and calculated on a 365 day year) from time to time published by FirstRand Bank Limited as being its prime overdraft rate, as certified by any manager of such bank, whose appointment and designation need not be proved; |

|

|

|

| 3.1.40. | Repo Rate shall mean on any particular day, the repo tender rate on that day as published by the SARB; |

|

|

|

| 3.1.41. | Reset Date shall mean the Advance Date and the 7th (seventh) Business Day of every month thereafter during the Loan Period; |

|

|

|

| 3.1.42. | Sanctioned Entity shall mean: |

|

|

|

| 3.1.42.1. | a person, country or territory which is listed on a Sanctions List or is subject to Sanctions; or |

|

|

|

| 3.1.42.2. | a person which is ordinarily resident in a country or territory which is listed on a Sanctions List or is subject to Sanctions; |

|

|

|

| 3.1.43. | Sanctioned Transaction shall mean the use of the proceeds of the Facility for the purpose of financing or providing any credit, directly or indirectly, to: |

|

|

|

| 3.1.43.1. | a Sanctioned Entity; or |

| Page 8 |

| 3.1.43.2. | any other person or entity, if a member of the Group has actual knowledge that the person or entity proposes to use the proceeds of the financing or credit for the purpose of financing or providing any credit, directly or indirectly, to a Sanctioned Entity, |

|

|

|

| 3.1.43.3. | in each case to the extent that to do so is prohibited by, or would cause any breach of, Sanctions; |

|

|

|

| 3.1.44. | Sanctions shall mean trade, economic or financial sanctions, laws, regulations, embargoes or restrictive measures imposed, administered or enforced from time to time by any Sanctions Authority; |

|

|

|

| 3.1.45. | Sanctions Authority shall mean: |

|

|

|

| 3.1.45.1. | the United Nations; |

|

|

|

| 3.1.45.2. | the European Union; |

|

|

|