UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 24, 2025

GOLDEN MATRIX GROUP, INC. |

(Exact name of registrant as specified in its charter) |

Nevada |

|

001-41326 |

|

46-1814729 |

|

(State or other jurisdiction of incorporation or organization) |

|

(Commission file number) |

|

(IRS Employer Identification No.) |

3651 S. Lindell Road, Suite D131

Las Vegas, NV 89103

(Address of principal executive offices)(zip code)

Registrant’s telephone number, including area code: (702) 318-7548

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.00001 Par Value Per Share |

|

GMGI |

|

The NASDAQ Stock Market LLC (The NASDAQ Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On March 24, 2025, Golden Matrix Group, Inc. (the “Company”, “we” and “us”) issued a press release disclosing its results of operations for the twelve-month period ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 2.02 by reference.

The Company also posted a presentation and a webcast relating to its results of operations for the twelve-month period ended December 31, 2024 on its website at https://goldenmatrix.com/quarterly-results/ (which information from such website is not incorporated by reference into this Current Report on Form 8-K), a copy of which presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated into this Item 2.02 by reference.

The information contained in this Current Report and Exhibits 99.1 and 99.2 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The Company is making reference to non-GAAP financial information in the press release, presentation and webcast. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release and presentation.

| 2 |

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. |

|

Description |

|

|

|

|

Press Release of Golden Matrix Group, Inc., dated March 24, 2025 |

|

|

Presentation of Golden Matrix Group, Inc. regarding the twelve-month period ended December 31, 2024 |

|

104 |

|

Inline XBRL for the cover page of this Current Report on Form 8-K |

* Furnished herewith.

| 3 |

The inclusion of any website address in this Form 8-K, and any exhibit hereto, is intended to be an inactive textual reference only and not an active hyperlink. The information contained in, or that can be accessed through, such website is not part of or incorporated into this Form 8-K.

FORWARD-LOOKING STATEMENTS

Certain statements made in this press release contain forward-looking information within the meaning of applicable securities laws, including within the meaning of the Private Securities Litigation Reform Act of 1995 (“forward-looking statements”). Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements.

Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation, the amount, timing, and sources of funding for the Company’s repurchase program, the fact that common share repurchases may not be conducted in the timeframe or in the manner the Company expects, or at all, the ability of the Company to obtain the funding required to pay certain Meridianbet Group acquisition post-closing obligations, the terms of such funding, potential dilution caused thereby and/or covenants agreed to in connection therewith; potential lawsuits regarding the acquisition; dilution caused by the terms of outstanding convertible notes and warrants, the Company’s ability to pay amounts due under convertible notes and covenants associated therewith and penalties which could be due under the convertible notes and securities purchase agreement related thereto for failure to comply with the terms thereof; the business, economic and political conditions in the markets in which the Company operates; the effect on the Company and its operations of the ongoing Ukraine/Russia conflict and the conflict in Israel, changing interest rates and inflation, and risks of recessions; the need for additional financing, the terms of such financing and the availability of such financing; the ability of the Company and/or its subsidiaries to obtain additional gaming licenses; the ability of the Company to manage growth; the Company’s ability to complete acquisitions and the availability of funding for such acquisitions; disruptions caused by acquisitions; dilution caused by fund raising, the conversion of outstanding preferred stock, convertible securities and/or acquisitions; the Company’s ability to maintain the listing of its common stock on the Nasdaq Capital Market; the Company’s expectations for future growth, revenues, and profitability; the Company’s expectations regarding future plans and timing thereof; the Company’s reliance on its management; the fact that the sellers of the Meridianbet Group hold voting control over the Company; related party relationships; the potential effect of economic downturns, recessions, increases in interest rates and inflation, and market conditions, decreases in discretionary spending and therefore demand for our products and services, and increases in the cost of capital, related thereto, among other affects thereof, on the Company’s operations and prospects; the Company’s ability to protect proprietary information; the ability of the Company to compete in its market; the effect of current and future regulation, the Company’s ability to comply with regulations and potential penalties in the event it fails to comply with such regulations and changes in the enforcement and interpretation of existing laws and regulations and the adoption of new laws and regulations that may unfavorably impact our business; the risks associated with gaming fraud, user cheating and cyber-attacks; risks associated with systems failures and failures of technology and infrastructure on which the Company’s programs rely; foreign exchange and currency risks; the outcome of contingencies, including legal proceedings in the normal course of business; the ability to compete against existing and new competitors; the ability to manage expenses associated with sales and marketing and necessary general and administrative and technology investments; and general consumer sentiment and economic conditions that may affect levels of discretionary customer purchases of the Company’s products, including potential recessions and global economic slowdowns. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this press release are reasonable, we provide no assurance that these plans, intentions or expectations will be achieved.

Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described in the Company’s publicly-filed reports, including, but not limited to, under the “Special Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and future periodic reports on Form 10-K and Form 10‑Q. These reports are available at www.sec.gov.

The Company cautions that the foregoing list of important factors is not complete, and does not undertake to update any forward-looking statements except as required by applicable law. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on behalf of the Company are expressly qualified in their entirety by the cautionary statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on the Company’s future results. The forward-looking statements included in this press release are made only as of the date hereof. The Company cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, the Company undertakes no obligation to update these statements after the date of this release, except as required by law, and takes no obligation to update or correct information prepared by third parties that is not paid for by the Company. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

| 4 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

GOLDEN MATRIX GROUP, INC. |

|

|

|

|

|

|

Date: March 24, 2025 |

By: |

/s/ Anthony Brian Goodman |

|

|

|

Anthony Brian Goodman |

|

|

|

Chief Executive Officer |

|

| 5 |

EXHIBIT 99.1

Golden Matrix Group Reports Record 2024 Revenues and Forecasts up to 80% Revenue Growth in Q1 2025

Fourth Quarter Revenue Up 81% to $46 Million and Full-Year Revenue Up

63% to $151 Million

**LAS VEGAS, NV **– Golden Matrix Group Inc. (NASDAQ: GMGI) (“Golden Matrix” or the “Company”), a global developer, licensor, and operator of online gaming platforms, today announced record financial and operational results for the fiscal year ended December 31, 2024.

“2024 has been a pivotal year for Golden Matrix,” said Brian Goodman, CEO. “We successfully scaled our iGaming and sports betting operations, expanded our global footprint, and delivered strong full-year revenue growth of 63%, with 81% revenue growth achieved in the fourth quarter. Our strategic acquisitions of Meridianbet and Classics for a Cause, combined with our AI-powered platform enhancements, position us for sustained success. As we enter 2025, we remain well positioned for growth, with revenues for Q1 2025 estimated to rise by up to 80%. Our focus remains on innovation, profitability, and expanding into high-growth markets.”

Financial Highlights

Golden Matrix reported significant revenue growth, driven by expansion across key gaming markets, increased player engagement, and AI-driven product enhancements.

|

| · | Revenue for the fourth quarter grew 81% to $46 million and full-year Revenue jumped 63% to $151 million, reflecting strong demand and strategic acquisitions. |

|

|

|

|

|

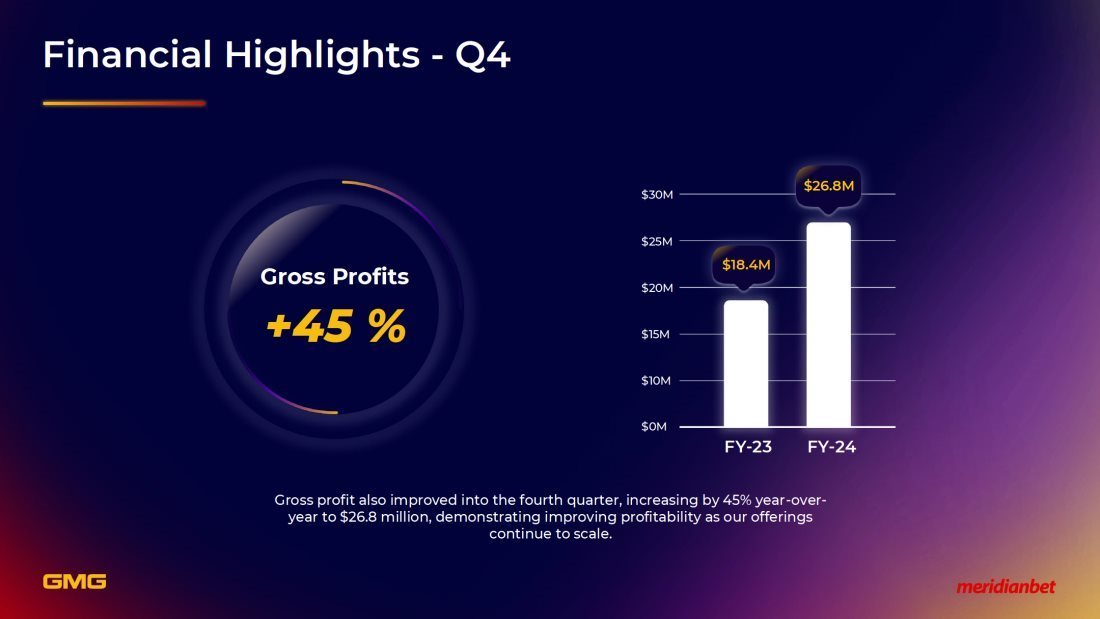

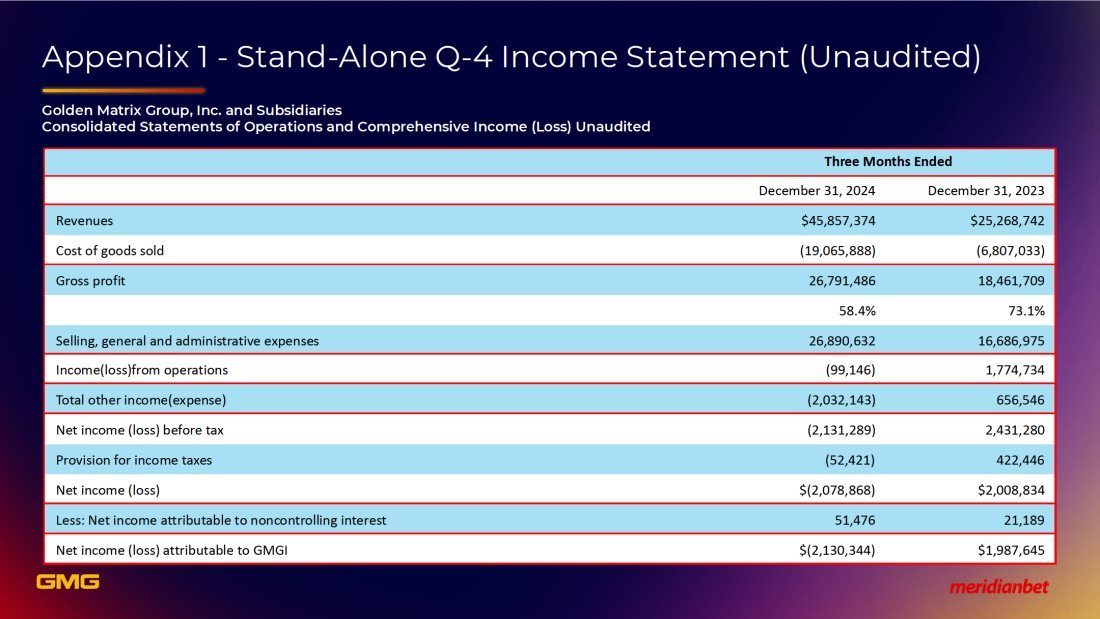

| · | Gross Profit for the fourth quarter rose 45% to $27 million and full-year Gross Profit increased by 30% to $89 million, benefiting from operational efficiencies and high-margin product offerings. |

|

|

|

|

|

| · | Net Income declined 207% for the fourth quarter and 111% for the full year to a Net Loss of $2.1 million and $1.5 million, respectively, primarily due to additional amortization of acquisition-related intangible assets, stock-based compensation, interest expenses, and restructuring expenses. Adjusting for these costs, Adjusted EBITDA rose 69% to $6.5 million in the fourth quarter and 4% to $22.2 million for the full year. |

|

|

|

|

|

| · | Cash reserves stood at $30 million, ensuring financial flexibility for future investments. |

“Our financial results demonstrate our ability to scale efficiently while maintaining profitability,” said Rich Christensen, CFO. “With a strong balance sheet and disciplined capital allocation, we are well-positioned for sustainable long-term value creation. Looking ahead, we will continue optimizing our cost structure and driving operational efficiencies across all divisions.”

| 1 |

Operational Highlights

Golden Matrix’s business segments delivered record performance in 2024, reinforcing the Company’s market leadership in iGaming and sports betting.

|

| · | Meridianbet reported a 14% growth of full-year revenue to $106 million, with online revenue up 18% to $80 million and retail revenue up 4% to $23 million, reflecting strong user engagement and acquisition. |

|

|

|

|

|

| · | GMAG B2B gaming platform saw wagering volume surge 84% to $4.7 billion, driven by AI-powered engagement tools and high-margin content expansion. |

|

|

|

|

|

| · | RKings Competitions achieved record ticket sales, with revenue increasing 23% year-on-year, solidifying its dominance in the U.K. tournament sector. |

|

|

|

|

|

| · | Classics for a Cause surpassed 10,000 VIP members, generating $300,000 a month in recurring revenue, with two million orders expected soon. |

|

|

|

|

|

| · | MexPlay continued strong revenue momentum, with Gross Gaming Revenue rising 9% quarter-over-quarter, reinforcing its expansion in Latin America. |

|

|

|

|

|

| · | Expanse Studios delivered 174% revenue growth in 2024, expanding its portfolio to 55 proprietary games by year-end, including 4 new titles launched during the year such as top-performers “Beach Penalties” and “Super Heli”. |

“Across all business units, we continue to see exceptional momentum,” said Mr. Goodman. “From our AI-driven gaming solutions to the expansion of proprietary platforms, we are enhancing engagement, profitability, and market leadership.”

2025 Outlook and Strategic Priorities

As Golden Matrix enters 2025, the Company is well-positioned to build upon its success by focusing on long-term growth, operational efficiency, and expansion into high-value gaming markets. For the first quarter of 2025, Golden Matrix expects revenue of $42 million–$45 million representing year-over-year growth of between 69% and 80%.

With a solid foundation in technology, AI-driven gaming innovation, and a strengthened financial position, the Company is set to drive sustainable profitability and increased shareholder value.

Key strategic priorities include:

|

| · | Expanding into new regulated markets, including Latin America and Europe. |

|

|

|

|

|

| · | Enhancing AI-driven gaming innovation to drive personalized betting and gaming experiences. |

|

|

|

|

|

| · | Strengthening operational efficiencies to maximize margins and scalability. |

|

|

|

|

|

| · | Pursuing strategic acquisitions to increase market share and product offerings. |

| 2 |

“We are confident in our ability to deliver another strong year of revenue growth, market expansion, and profitability in 2025,” concluded Mr. Christensen.

* Adjusted EBITDA is a non-GAAP financial measure. See also “Non-GAAP Financial Measures” and “Reconciliation of Net Income to Adjusted Earnings excluding Interest Expense, Interest Income, Tax, Depreciation Expense, Amortization Expense, Stock-based Compensation Expense and Restructuring Costs", included in the tables at the end of this release.

In terms of GAAP accounting and Meridianbet being the accounting acquirer, the comparisons presented are correctly stated and are reflective of our new structure. Comparisons presented in terms of GAAP are the consolidated Company’s results against Meridianbet Group historical results and not against Golden Matrix Group’s, historical results.

The full visual presentation and the earnings call can be accessed at 8:00am ET on the Golden Matrix Group IR website at https://goldenmatrix.com/events-presentations/.

For more information, please visit goldenmatrix.com.

About Golden Matrix

Golden Matrix Group, based in Las Vegas NV, is an established B2B and B2C gaming technology company operating across multiple international markets. The B2B division of Golden Matrix develops and licenses proprietary gaming platforms for its extensive list of clients and RKings, its B2C division, operates a high-volume eCommerce site enabling end users to enter paid-for competitions on its proprietary platform in authorized markets. The Company also owns and operates MEXPLAY, a regulated online casino in Mexico.

Meridianbet Group, founded in 2001 and acquired by Golden Matrix in 2024, is a well-established online sports betting and gaming group, licensed and currently operating in 15 jurisdictions across Europe, Africa and South America. Meridianbet Group’s successful business model utilizes proprietary technology and scalable systems, thus allowing it to operate in multiple countries and currencies and with an omni-channel approach to markets, including retail, desktop online and mobile.

The companies’ sophisticated software automatically declines any gaming or redemption requests from within the United States, in strict compliances with current US law.

| 3 |

Non-GAAP Financial Measures

Adjusted EBITDA or AEBITDA, is a “non-GAAP financial measures” presented as a supplemental measure of the Company’s performance. Adjusted EBITDA, Net Debt and Net Debt Leverage are not presented in accordance with accounting principles generally accepted in the United States, or GAAP. Adjusted EBITDA represents net income before interest expense, interest income, taxes, depreciation and amortization, and also excludes stock-based compensation expense and restructuring costs. Net Debt is defined as total debt less cash and cash equivalents. Net Debt Leverage Ratio is defined as net debt as of the balance sheet date divided by annualized adjusted EBITDA for the quarter then ended. We believe that using Net Debt and Net Debt Leverage Ratio is useful to investors in determining our leverage ratio since we could choose to use cash and cash equivalents to retire debt. Adjusted EBITDA is presented because we believe it provides additional useful information to investors due to the various noncash items during the period. Adjusted EBITDA, Net Debt and Net Debt Leverage are not recognized in accordance with GAAP, are unaudited, and have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of the Company’s results as reported under GAAP. Some of these limitations are: Adjusted EBITDA, Net Debt and Net Debt Leverage do not reflect cash expenditures, or future requirements for capital expenditures, or contractual commitments; Adjusted EBITDA, Net Debt and Net Debt Leverage do not reflect changes in, or cash requirements for, working capital needs; Adjusted EBITDA, Net Debt and Net Debt Leverage do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on debt or cash income tax payments; although depreciation and amortization are noncash charges, the assets being depreciated and amortized will often have to be replaced in the future, and Adjusted EBITDA, Net Debt and Net Debt Leverage do not reflect any cash requirements for such replacements; and other companies in this industry may calculate Adjusted EBITDA, Net Debt and Net Debt Leverage differently than the Company does, limiting their usefulness as a comparative measure. The Company’s presentation of these measures should not be construed as an inference that future results will be unaffected by unusual or nonrecurring items. For more information on these non-GAAP financial measures, please see the section titled “Reconciliation of Net Income to Adjusted Earnings excluding Interest Expense, Interest Income, Depreciation Expense, Amortization Expense, Stock-based Compensation Expense and Restructuring Costs” and “Reconciliation of Net Debt and Leverage Calculation”, included at the end of this release.

FORWARD-LOOKING STATEMENTS

Certain statements made in this press release contain forward-looking information within the meaning of applicable securities laws, including within the meaning of the Private Securities Litigation Reform Act of 1995 (“forward-looking statements”). Words such as “strategy,” “expects,” “continues,” “plans,” “anticipates,” “believes,” “would,” “will,” “estimates,” “intends,” “projects,” “goals,” “targets” and other words of similar meaning are intended to identify forward-looking statements but are not the exclusive means of identifying these statements.

Important factors that may cause actual results and outcomes to differ materially from those contained in such forward-looking statements include, without limitation, the amount, timing, and sources of funding for the Company’s repurchase program, the fact that common share repurchases may not be conducted in the timeframe or in the manner the Company expects, or at all, the ability of the Company to obtain the funding required to pay certain Meridianbet Group acquisition post-closing obligations, the terms of such funding, potential dilution caused thereby and/or covenants agreed to in connection therewith; potential lawsuits regarding the acquisition; dilution caused by the terms of an outstanding convertible note and warrants, the Company’s ability to pay amounts due under the convertible note and covenants associated therewith and penalties which could be due under the convertible note and securities purchase agreement related thereto for failure to comply with the terms thereof; the business, economic and political conditions in the markets in which the Company operates; the effect on the Company and its operations of the ongoing Ukraine/Russia conflict and the conflict in Israel, changing interest rates and inflation, and risks of recessions; the need for additional financing, the terms of such financing and the availability of such financing; the ability of the Company and/or its subsidiaries to obtain additional gaming licenses; the ability of the Company to manage growth; the Company’s ability to complete acquisitions and the availability of funding for such acquisitions; disruptions caused by acquisitions; dilution caused by fund raising, the conversion of outstanding preferred stock, convertible securities and/or acquisitions; the Company’s ability to maintain the listing of its common stock on the Nasdaq Capital Market; the Company’s expectations for future growth, revenues, and profitability; the Company’s expectations regarding future plans and timing thereof; the Company’s reliance on its management; the fact that the sellers of the Meridianbet Group hold voting control over the Company; related party relationships; the potential effect of economic downturns, recessions, increases in interest rates and inflation, and market conditions, decreases in discretionary spending and therefore demand for our products and services, and increases in the cost of capital, related thereto, among other affects thereof, on the Company’s operations and prospects; the Company’s ability to protect proprietary information; the ability of the Company to compete in its market; the effect of current and future regulation, the Company’s ability to comply with regulations and potential penalties in the event it fails to comply with such regulations and changes in the enforcement and interpretation of existing laws and regulations and the adoption of new laws and regulations that may unfavorably impact our business; the risks associated with gaming fraud, user cheating and cyber-attacks; risks associated with systems failures and failures of technology and infrastructure on which the Company’s programs rely; foreign exchange and currency risks; the outcome of contingencies, including legal proceedings in the normal course of business; the ability to compete against existing and new competitors; the ability to manage expenses associated with sales and marketing and necessary general and administrative and technology investments; and general consumer sentiment and economic conditions that may affect levels of discretionary customer purchases of the Company’s products, including potential recessions and global economic slowdowns. Although we believe that our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this press release are reasonable, we provide no assurance that these plans, intentions or expectations will be achieved.

| 4 |

Other important factors that may cause actual results and outcomes to differ materially from those contained in the forward-looking statements included in this communication are described in the Company’s publicly-filed reports, including, but not limited to, under the “Special Note Regarding Forward-Looking Statements,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s periodic and current filings with the SEC, including the Form 10-Qs and Form 10-Ks, including, but not limited to, the Company’s Annual Report on Form 10-K for the year ended December 31, 2024 and its Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, and future periodic reports on Form 10-K and Form 10‑Q. These reports are available at www.sec.gov.

The Company cautions that the foregoing list of important factors is not complete, and does not undertake to update any forward-looking statements except as required by applicable law. All subsequent written and oral forward-looking statements attributable to the Company or any person acting on behalf of the Company are expressly qualified in their entirety by the cautionary statements referenced above. Other unknown or unpredictable factors also could have material adverse effects on the Company’s future results. The forward-looking statements included in this press release are made only as of the date hereof. The Company cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. Finally, the Company undertakes no obligation to update these statements after the date of this release, except as required by law, and takes no obligation to update or correct information prepared by third parties that is not paid for by the Company. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Connect with us:

X - https://twitter.com/gmgi_official

Instagram - https://www.instagram.com/goldenmatrixgroup/

ICR

Investors:

Brett Milotte

Brett.Milotte@icrinc.com

Press:

Greg Michaels

Gregory.Michaels@icrinc.com

| 5 |

Golden Matrix Group, Inc. and Subsidiaries

Consolidated Balance Sheets

|

|

| As of |

|

| As of |

|

||

|

|

| December 31, 2024 |

|

| December 31, 2023 |

|

||

| ASSETS |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

||

| Current assets: |

|

|

|

|

|

|

||

| Cash and cash equivalents |

| $ | 30,125,944 |

|

| $ | 20,405,296 |

|

| Accounts receivable, net |

|

| 6,061,281 |

|

|

| 2,674,967 |

|

| Accounts receivable – related parties |

|

| 666,545 |

|

|

| 399,580 |

|

| Taxes receivable |

|

| 734,630 |

|

|

| 997,778 |

|

| Inventory |

|

| 3,937,854 |

|

|

| 133,905 |

|

| Prepaid expenses |

|

| 955,456 |

|

|

| 328,400 |

|

| Other current assets, net |

|

| 2,584,771 |

|

|

| 1,989,476 |

|

| Total current assets |

|

| 45,066,481 |

|

|

| 26,929,402 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Goodwill & intangible assets, net |

|

| 127,642,576 |

|

|

| 15,107,422 |

|

| Property, plant & equipment, net |

|

| 27,431,207 |

|

|

| 27,826,594 |

|

| Investments |

|

| 218,147 |

|

|

| 237,828 |

|

| Deposits |

|

| 5,706,319 |

|

|

| 5,586,495 |

|

| Operating lease right-of-use assets |

|

| 7,643,504 |

|

|

| 4,147,375 |

|

| Other non-current assets |

|

| 9,359 |

|

|

| 17,864 |

|

| Total non-current assets |

|

| 168,651,112 |

|

|

| 52,923,578 |

|

| Total assets |

| $ | 213,717,593 |

|

| $ | 79,852,980 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

| $ | 12,912,300 |

|

| $ | 11,285,740 |

|

| Accounts payable - related parties |

|

| 19,655 |

|

|

| 12,605 |

|

| Current portion of operating lease liability |

|

| 2,378,896 |

|

|

| 2,299,317 |

|

| Current portion of long-term loan– related party |

|

| 501,591 |

|

|

| - |

|

| Current portion of long-term loan |

|

| 16,789,650 |

|

|

| - |

|

| Taxes payable |

|

| 3,774,418 |

|

|

| 3,394,556 |

|

| Other current liabilities |

|

| 1,090,063 |

|

|

| 581,644 |

|

| Deferred revenues |

|

| 1,095,463 |

|

|

| - |

|

| Contingent liability |

|

| 626,450 |

|

|

| - |

|

| Current portion of consideration payable – related parties |

|

| 22,520,460 |

|

|

| - |

|

| Current portion of consideration payable |

|

| 1,841,597 |

|

|

| - |

|

| Total current liabilities |

|

| 63,550,543 |

|

|

| 17,573,862 |

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Non-current portion of operating lease liability |

|

| 5,193,847 |

|

|

| 1,795,870 |

|

| Non-current portion of long-term loan |

|

| 14,364,246 |

|

|

| - |

|

| Other non-current liabilities |

|

| 6,658,377 |

|

|

| 496,699 |

|

| Non-current portion of consideration payable – related parties |

|

| 15,000,000 |

|

|

| - |

|

| Total non-current liabilities |

|

| 41,216,470 |

|

|

| 2,292,569 |

|

| Total liabilities |

| $ | 104,767,013 |

|

| $ | 19,866,431 |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock: $0.00001 par value; 20,000,000 shares authorized |

|

| - |

|

|

| - |

|

| Preferred stock, Series B: $0.00001 par value, 1,000 shares designated, 1,000 and 0 shares issued and outstanding, respectively |

|

| - |

|

|

| - |

|

| Preferred stock, Series C: $0.00001 par value, 1,000 shares designated, 1,000 and 1,000 shares issued and outstanding, respectively |

|

| - |

|

|

| - |

|

| Common stock: $0.00001 par value; 300,000,000 shares authorized; 129,242,993 and 83,475,190 shares issued and outstanding, respectively |

| $ | 1,292 |

|

| $ | 835 |

|

| Stock payable |

|

| 5,711,807 |

|

|

| - |

|

| Stock payable – related party |

|

| 211,162 |

|

|

| - |

|

| Additional paid-in capital |

|

| 50,313,125 |

|

|

| 3,044,894 |

|

| Treasury stock, at cost (December 2024 – 59,796 shares) |

|

| (121,430 | ) |

|

| - |

|

| Accumulated other comprehensive income (loss) |

|

| (8,089,854 | ) |

|

| (3,307,578 | ) |

| Accumulated earnings |

|

| 57,046,892 |

|

|

| 59,296,675 |

|

| Total shareholders’ equity of GMGI |

|

| 105,072,994 |

|

|

| 59,034,826 |

|

| Noncontrolling interests |

|

| 3,877,586 |

|

|

| 951,723 |

|

| Total equity |

|

| 108,950,580 |

|

|

| 59,986,549 |

|

| Total liabilities and equity |

| $ | 213,717,593 |

|

| $ | 79,852,980 |

|

| 6 |

Golden Matrix Group, Inc. and Subsidiaries

Consolidated Statements of Operations and Comprehensive Income (Loss)

|

|

| Twelve Months Ended |

|

|||||

|

|

| December 31, |

|

|||||

|

|

| 2024 |

|

| 2023 |

|

||

|

|

|

|

|

|

|

|

||

| Revenues |

| $ | 151,115,532 |

|

| $ | 92,993,521 |

|

| Cost of goods sold |

|

| (62,543,407 | ) |

|

| (24,750,293 | ) |

| Gross profit |

|

| 88,572,125 |

|

|

| 68,243,228 |

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

|

| 85,828,421 |

|

|

| 54,483,998 |

|

| Income (loss) from operations |

|

| 2,743,704 |

|

|

| 13,759,230 |

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

| Interest expense |

|

| (3,521,288 | ) |

|

| (36,163 | ) |

| Interest earned |

|

| 218,145 |

|

|

| 97,820 |

|

| Foreign exchange gain (loss) |

|

| (494,825 | ) |

|

| 72,459 |

|

| Other income |

|

| 2,262,782 |

|

|

| 1,572,256 |

|

| Total other income (expense) |

|

| (1,535,186 | ) |

|

| 1,706,372 |

|

| Net income (loss) before tax |

|

| 1,208,518 |

|

|

| 15,465,602 |

|

| Provision for income taxes |

|

| 2,618,367 |

|

|

| 1,570,716 |

|

| Net income (loss) |

| $ | (1,409,849 | ) |

| $ | 13,894,886 |

|

| Less: Net income attributable to noncontrolling interest |

|

| 70,400 |

|

|

| 192,348 |

|

| Net income (loss) attributable to GMGI |

| $ | (1,480,249 | ) |

| $ | 13,702,538 |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average ordinary shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

| 113,511,706 |

|

|

| 83,475,190 |

|

| Diluted |

|

| 113,511,706 |

|

|

| 83,475,190 |

|

| Net earnings (losses) per ordinary share attributable to GMGI: |

|

|

|

|

|

|

|

|

| Basic |

| $ | (0.01 | ) |

| $ | 0.16 |

|

| Diluted |

| $ | (0.01 | ) |

| $ | 0.16 |

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

| $ | (1,409,849 | ) |

| $ | 13,894,886 |

|

| Foreign currency translation adjustments |

|

| (4,782,276 | ) |

|

| (825,774 | ) |

| Comprehensive income (loss) |

|

| (6,192,125 | ) |

|

| 13,069,112 |

|

| Less: Net income attributable to noncontrolling interest |

|

| 70,400 |

|

|

| 192,348 |

|

| Comprehensive income (loss) attributable to GMGI |

| $ | (6,262,525 | ) |

| $ | 12,876,764 |

|

| 7 |

Reconciliation of U.S. GAAP Net Income (Loss) to EBITDA and Adjusted EBITDA (Unaudited)

|

|

| Twelve Months Period Ended |

|

|||||

|

|

| December 31, 2024 |

|

| December 31, 2023 |

|

||

| Net income (loss) |

| $ | (1,409,849 | ) |

| $ | 13,894,886 |

|

| + Interest expense |

|

| 3,521,288 |

|

|

| 36,163 |

|

| - Interest income |

|

| (218,145 | ) |

|

| (97,820 | ) |

| + Taxes |

|

| 2,618,367 |

|

|

| 1,570,716 |

|

| + Depreciation |

|

| 4,416,495 |

|

|

| 3,519,083 |

|

| + Amortization |

|

| 6,373,696 |

|

|

| 1,898,027 |

|

| EBITDA |

| $ | 15,301,852 |

|

| $ | 20,821,055 |

|

| + Stock-based compensation |

|

| 4,707,313 |

|

|

| - |

|

| + Restructuring costs |

|

| 2,184,397 |

|

|

| 427,223 |

|

| Adjusted EBITDA |

| $ | 22,193,562 |

|

| $ | 21,248,278 |

|

Reconciliation of U.S. GAAP Net Income (Loss) to EBITDA and Adjusted EBITDA (Unaudited)

|

|

| Three Months Period Ended |

|

|||||

|

|

| December 31, 2024 |

|

| December 31, 2023 |

|

||

| Net income (loss) |

| $ | (2,078,868 | ) |

| $ | 2,008,834 |

|

| + Interest expense |

|

| 2,694,240 |

|

|

| 4,233 |

|

| - Interest income |

|

| (55,122 | ) |

|

| (62,288 | ) |

| + Taxes |

|

| (52,421 | ) |

|

| 422,446 |

|

| + Depreciation |

|

| 1,243,022 |

|

|

| 848,825 |

|

| + Amortization |

|

| 2,056,173 |

|

|

| 540,574 |

|

| EBITDA |

| $ | 3,807,024 |

|

| $ | 3,762,624 |

|

| + Stock-based compensation |

|

| 1,454,510 |

|

|

| - |

|

| + Restructuring costs |

|

| 1,278,111 |

|

|

| 113,524 |

|

| Adjusted EBITDA |

| $ | 6,539,645 |

|

| $ | 3,876,148 |

|

| 8 |

EXHIBIT 99.2

| 1 |

| 2 |

| 3 |

| 4 |

| 5 |

| 6 |

| 7 |

| 8 |

| 9 |

| 10 |

| 11 |

| 12 |

| 13 |

| 14 |

| 15 |

| 16 |

| 17 |

| 18 |

| 19 |

| 20 |

| 21 |

| 22 |

| 23 |

| 24 |

| 25 |

| 26 |

| 27 |

| 28 |