UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of February 2025

Commission file number: 001-39978

| CN ENERGY GROUP. INC. |

Building 2-B, Room 206, No. 268 Shiniu Road

Liandu District, Lishui City, Zhejiang Province

The People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

On January 20, 2025, CN Energy Group. Inc. (the “Company”), entered into a Share Transfer Agreement (the “Agreement”) with Asia Rubber Resources Limited (“Asia Rubber Resources”). Pursuant to the Agreement, the Company agreed to transfer 100% of its equity in Clean Energy Holdings Limited to Asia Rubber Resources (the “Transfer”) for a total purchase price of HKD10,000 (approximately $1,280.94).

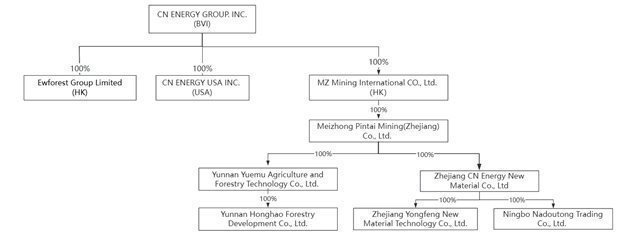

The new corporate structure of the Company after the Transfer is demonstrated in the diagram below.

The foregoing descriptions of the Agreement are summaries of certain material terms of the Agreement, do not purport to be complete and are qualified in their entirety by reference to the agreement, which are attached hereto as Exhibit 99.1.

EXHIBITS

| Exhibit No. |

| Description |

|

|

|

|

|

|

| 2 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| CN Energy Group. Inc. |

|

|

|

|

|

|

|

| Date: February 5, 2024 | By: | /s/ Wenhua Liu |

|

|

| Name: | Wenhua Liu |

|

|

| Title: | Interim Chief Executive Officer |

|

| 3 |

EXHIBIT 99.1

Portions of this exhibit, marked by [***], have been omitted pursuant to Item 601(b)(10)(iv) of

Regulation S-K on the basis that the Company customarily and actually treats that information as

private or confidential and the omitted information is not material.

[This is an English translation of the original agreement written in Chinese]

[Note] The Company assumes no responsibility for this translation or for direct, indirect, or other forms of damages arising from the translation. This document has been translated from the Chinese original for reference purposes only. In the event of any discrepancy between this translated document and the Chinese original, the original shall prevail.

| The Agreement on the Transfer of Shares

Transferred by CN Energy Group Inc

Transferee: Asia Rubber Resources Limited |

| ___________________________________________________________

With respect to [Clean Energy Holdings Limited]

Equity transfer agreements

No.: 2025-1- -1

___________________________________________________________ |

On January , 2025

| 1 |

SHARE TRANSFER AGREEMENT

This Share Transfer Agreement (hereinafter referred to as "this Agreement") is entered into on [January, , 2025], in Lishui, Zhejiang, by and among the following parties:

Transferor (Party A): CN Energy Group Inc.

Transferee (Party B): Asia Rubber Resources Limited

Target Company (Party C): Clean Energy Holdings Limited

(The above-mentioned Party A and Party B are collectively referred to as "Parties" and individually as "a Party.")

Article I. Transfer and Acceptance of Equity

1.1 Party A agrees to transfer to Party B, and Party B agrees to accept, 100% of the equity held by Party A in the Target Company (hereinafter referred to as the "Target Equity"), along with all shareholder rights and obligations associated with the Target Equity, in accordance with the terms of this Agreement.

1.2 The shareholding structure of the Target Company before the transfer is as follows:

|

Name/name of shareholder | Prior to the transfer of shares, the |

||

| Contributions | percentage of contribution |

||

| Contribution | Contribution |

||

| CN ENERGY GROUP INC. | HK$10,000 | 0 | 100% |

Article II. Transfer Price and Payment

2.1 According to the Asset Valuation Report (Report No. [2024] 10XX) issued by Hangzhou Zhenggong Asset Appraisal Partnership, based on the valuation benchmark date of November 30, 2024, the net asset value of GLOBAL CLEAN ENERGY LIMITED was determined to be RMB -516,616.86 (negative five hundred sixteen thousand six hundred sixteen yuan and eighty-six cents).

| 2 |

2.2 After mutual negotiation, the total transfer price for the Target Equity is agreed to be 10,000 HKD.

2.3 The transfer price will be paid in one installment:

|

| · | Within 15 days after the signing of this Agreement, Party B shall pay 10,000 HKD to Party A. |

Article III. Delivery of Equity and Handover of the Target Company

3.1 Transition Period: The period from the signing of this Agreement until the Closing Date shall be regarded as the transition period. During the transition period:

|

| · | Any equity-derived dividends or income from the Target Equity shall belong to Party A, and any losses incurred shall also be borne by Party A. |

|

| · | Party A shall not dispose of the Target Equity or any assets owned by the Target Company without the prior written consent of Party B. Any exercise of shareholder rights or obligations by Party A related to the Target Equity during this period must also receive prior written consent from Party B. Otherwise, Party B has the right to unilaterally terminate this Agreement and require Party A to assume liability for breach of contract. |

3.2 During the transition period, Party A shall ensure that the Target Company maintains its normal operational status and does not, without the prior written consent of Party B:

|

| · | 3.2.1 Enter into any contracts, agreements, commitments, or other legal documents, nor provide guarantees or loans on behalf of the Target Company; |

|

| · | 3.2.2 Dispose of any assets owned by the Target Company; |

|

| · | 3.2.3 Transfer intellectual property, trademarks, trade names, or other intangible assets owned by the Target Company; |

|

| · | 3.2.4 Provide any form of guarantee to the shareholders of the Target Company or to any third party. |

3.3 During the transition period, any dividends or income derived from the Target Equity shall belong to Party A.

| 3 |

3.4 Handover of the Target Company: After the signing of this Agreement, Party A shall ensure that the original management team of the Target Company transfers the following documents and items to Party B:

|

| · | A. Corporate seals, financial seals, legal representative seals, and company stamps; |

|

| · | B. Financial documents, including vouchers, ledgers, financial statements, and bank account details; |

|

| · | C. Business licenses, basic account information, and asset ownership certificates; |

|

| · | D. Contracts, files, drawings, technical materials, or other important documents deemed necessary by Party B. |

3.5 The transition period by definition will last until the day before the Closing Date, the management shall be under joint control of Party A and Party B starting from the Closing Date.

3.6 The Closing Date shall be the date when Party A receives the transfer payment. Party A shall complete the shareholder change registration and amendments to the company’s articles of association within two (2) weeks after receiving the payment, as required and instructed by Party B.

Article IV. Accounts Receivable and Accounts Payable

4.1 Liabilities and Contingent Liabilities: Party A shall fully disclose all liabilities and/or contingent liabilities of the Target Company and its subsidiaries as of the Closing Date. Party B acknowledges and agrees to accept such liabilities.

4.2 Party B shall be responsible for managing all liabilities of the Target Company after the Closing Date, and Party A and its affiliates shall bear no further compensation responsibilities.

Article V. Taxes and Fees

5.1 Each Party shall bear its respective taxes and fees incurred from the equity transfer specified in this Agreement.

Article VI. Representations and Warranties of Party A

6.1 The Target Company is a legally registered corporate entity with independent legal status, conducting business lawfully, and assuming civil liability with its assets.

6.2 Party A is a legally established and validly existing enterprise under Hong Kong law with the ability to assume civil liability independently.

6.3 The transfer of the Target Equity by Party A under this Agreement will not:

|

| · | (i) Conflict with any agreements, contracts, or legal documents to which Party A is a party, nor constitute a breach thereof; |

|

| · | (ii) Violate any applicable laws, regulations, rules, orders, judgments, or decisions of competent authorities. |

| 4 |

6.4 Upon signing this Agreement, Party A guarantees that it will not transfer the Target Equity to any third party or dispose of its interest in the Target Company in a manner conflicting with this Agreement.

6.5 Party A shall cooperate with Party B to complete the registration changes for the Target Equity transfer within the timeline agreed upon in this Agreement.

Article VII. Representations and Warranties of Party B

7.1 Party B is a legally established and validly existing enterprise under Hong Kong law with the ability to assume civil liability independently.

7.2 Party B’s execution and performance of this Agreement fall within its corporate authority and operational scope. All necessary approvals and authorizations have been obtained, and no restrictions from laws, corporate articles, or agreements apply.

7.3 The transfer of the Target Equity by Party B under this Agreement will not:

|

| · | (i) Violate its corporate articles or organizational documents; |

|

| · | (ii) Conflict with or constitute a breach of any agreements, contracts, or legal documents to which Party B is a party; |

|

| · | (iii) Violate any applicable laws, regulations, rules, or orders, judgments, or decisions of competent authorities. |

Article VIII. Confidentiality

8.1 Both Parties agree to maintain the confidentiality of this Agreement and related matters. Without prior written consent from the other Party, no Party shall disclose any information related to this Agreement to third parties, except as required by law.

Article IX. Effectiveness, Amendments, and Supplements

9.1 This Agreement shall become effective upon the signing or stamping by both Parties.

9.2 Any amendments to the terms of this Agreement must be made in writing and agreed upon by both Parties.

9.3 Any matters not covered by this Agreement may be supplemented through written agreements, which shall have the same legal force as this Agreement.

9.4 If there is a conflict between this Agreement and any supplemental agreements or amendments, the supplemental agreements or amendments shall prevail.

| 5 |

Article X. Termination

10.1 Any Party may unilaterally terminate this Agreement if circumstances arise that render the purpose of this Agreement impossible to achieve.

Article XI. Breach of Contract

11.1 The breaching Party shall take immediate remedial actions and compensate the non-breaching Party for any resulting losses.

Article XII. Dispute Resolution and Severability

12.1 Any disputes relating to the validity, performance, breach, or termination of this Agreement shall be resolved through amicable negotiations. If negotiations fail, disputes may be submitted to the courts or arbitration institutions in Hong Kong.

12.2 If any clause in this Agreement is deemed invalid or unenforceable, it shall not affect the validity or enforceability of the remaining clauses, provided the invalid clause does not significantly affect the overall intent of the Agreement.

Article XIII. Force Majeure

13.1 Force majeure includes, but is not limited to, war, riots, strikes, pandemics (including COVID-19), fires, floods, earthquakes, storms, tides, or other natural disasters, as well as other unforeseen and uncontrollable events.

13.2 Affected Parties shall not be liable for losses resulting from failure or delay in performing contractual obligations due to force majeure. If force majeure delays performance for more than 40 days, either Party may unilaterally terminate this Agreement, and all Parties shall bear their own respective losses.

Article XIV. Notices and Delivery

14.1 The contact information and addresses of the Parties are listed in the annex to this Agreement.

14.2 Any notices, requests, instructions, or other documents under this Agreement shall be sent to the addresses listed in the annex. If a Party changes its contact information, it shall notify the other Parties at least seven (7) working days in advance.

Article XV. Miscellaneous

15.1 The section headings in this Agreement are for convenience only and shall not affect its interpretation.

15.2 The annex to this Agreement is attached hereto and shall be executed together with this Agreement.

15.3 This Agreement is executed in six (6) copies, with each Party retaining two (2) copies.

The following is for signature only:

| 6 |

(This page is the signature page of the Equity Transfer Agreement)

THIS AGREEMENT is executed as of the date set forth on the first page of this Agreement by:

Party A (seal): CN ENERGY GROUP INC.

Party A's representative (signature or stamp):

Party B (stamped):

Party B's representative (signature or stamp).

Party C (Stamp): GLOBAL CLEAN ENERGY LIMITED

| 7 |