UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 40-F

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022 |

|

Commission File Number 001-35254 |

Avino Silver & Gold Mines Ltd. |

(Exact name of Registrant as specified in its charter) |

British Columbia, Canada

(Jurisdiction of Incorporation or Organization)

Primary Standard Industrial Classification Code Number |

|

I.R.S. Employer Identification Number |

1041 |

|

N/A |

Suite 900, 570 Granville Street, Vancouver

British Columbia, V6C 3P1, Canada

604-682-3701

(Address and telephone number of Registrant’s principal executive offices)

National Registered Agents, Inc.

1015 15th Street, N.W., Suite 1000

Washington, DC 20005

(202) 572-3133

(Name, address (including zip code) and telephone number (including area code)

of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, without Par Value |

|

ASM |

|

NYSE American, LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: N/A

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: N/A

For annual reports, indicate by check mark the information filed with this Form:

☒ Annual information form ☒ Audited annual financial statements

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

There were 118,349,090 common shares, without par value, issued and outstanding as of December 31, 2022.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 2.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging Growth Company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY NOTE

Avino Silver & Gold Mines Ltd. (“we”, “us”, “our”, or the “Company”) is a Canadian corporation that is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this annual report on Form 40-F (“Annual Report”) pursuant to Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in accordance with disclosure requirements in effect in Canada, which are different from those of the United States.

FORWARD LOOKING STATEMENTS

This Annual Report, including the Exhibits incorporated by reference into Annual Report, contains “forward-looking information” and “forward-looking statements” within the meaning of applicable Canadian and U.S. securities legislation. These forward-looking statements reflect our current view about future plans, intentions or expectations and include, in particular, statements about our plans, strategies and prospects and may be identified by terminology such as “may,” “will,” “should,” “expect,” “scheduled,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “aim,” “potential,” or “continue” or the negative of those terms or other comparable terminology. These forward-looking statements are subject to risks, uncertainties and assumptions about us. Although we believe that our plans, intentions and expectations are reasonable, we may not achieve our plans, intentions or expectations.

Important factors that could cause actual results to differ materially from the forward-looking statements we make in this Annual Report are set forth under the caption “Risk Factors” contain in our Annual Information Form filed as Exhibit 99.1. We undertake no obligation to update any of the forward-looking statements after the date of this Annual Report to conform those statements to reflect the occurrence of unanticipated events, except as required by applicable law. You should read this Annual Report with the understanding that our actual future results, levels of activity, performance and achievements may be materially different from what we expect. We qualify all our forward-looking statements by these cautionary statements.

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted, under a multijurisdictional disclosure system adopted by the United States, to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company prepares its financial statements, which are filed with this Annual Report in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. Therefore, they are not comparable in all respects to financial statements of United States companies that are prepared in accordance with United States generally accepted accounting principles.

MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES

Unless otherwise indicated, all mineral resource and mineral reserve estimates included in the documents incorporated by reference into this Annual Report have been prepared in accordance with Canadian National Instrument 43-101 (“NI 43-101”) and the Canadian Institute of Mining and Metallurgy Classification System. NI 43-101 is a rule developed by the Canadian securities administrators, which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ from the requirements of the United States Securities and Exchange Commission (the “SEC”). Accordingly, mineral resource and mineral reserve estimates, and other scientific and technical information, contained in the documents incorporated by reference into this Annual Report may not be comparable to similar information disclosed by companies that have mining operations and report information pursuant SEC regulations.

RESOURCE AND RESERVE ESTIMATES

The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), which references the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves (“CIM Standards”), adopted by the CIM Council, as amended.

| 2 |

Until recently, the CIM Standards differed significantly from standards in the United States. The SEC adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements for issuers whose securities are registered with the SEC under the Exchange Act. These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be “substantially similar” to the corresponding definitions under the CIM Standards, as required under NI 43-101.

United States investors are cautioned that while the above terms are “substantially similar” to the corresponding CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

United States investors are also cautioned that while the SEC now recognizes “indicated mineral resources” and “inferred mineral resources”, no assurance can be given that the mineralization in these categories will be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “indicated mineral resources” or “inferred mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the “inferred mineral resources” exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

Accordingly, information contained in this Annual Report on Form 40-F and the documents incorporated by reference herein containing descriptions of the Company’s mineral deposits may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

PRINCIPAL DOCUMENTS

The following documents are part of, and are hereby incorporated by reference in, this Annual Report on Form 40-F (“Annual Report”):

A. |

Annual Information Form |

Annual Information Form or the fiscal year ended December 31, 2022, see Exhibit 99.1 to this Annual Report.

B. |

Audited Annual Financial Statements |

Audited Consolidated Financial Statements for the fiscal year ended December 31, 2022 and 2021, and notes thereto, together with the report of the independent registered public accounting firm thereon, see Exhibit 99.2 of this Annual Report.

| 3 |

C. |

Management's Discussion and Analysis |

Management's Discussion and Analysis of Financial Condition and Results of Operations for the fiscal year ended December 31, 2022, see Exhibit 99.3 of this Annual Report; and

D. |

Technical Report |

NI 43-101 Technical Report: Mineral Resource Estimate Update for the Avino Property, Durango, Mexico, 43-101 Technical Report, dated February 16, 2023. See Exhibit 99.4 of this Annual Report.

CONTROLS AND PROCEDURES

A. |

Certifications. |

The required certifications for the Principal Executive Officer and Principal Financial Officer are attached as Exhibits 99.6, 99.7, 99.8 and 99.9 to this Annual Report.

B. |

Disclosure Controls and Procedures. |

As required by paragraph (b) of Rules 13a-15 or 15d-15 under the Exchange Act, our principal executive officer and principal financial officer evaluated our Company’s disclosure controls and procedures (as defined in rules 13a-15(e) and 15d-15(e) of the Exchange Act) as of the end of the period covered by this Annual Report. Based on the evaluation, these officers concluded that as of the end of the period covered by this Annual Report, our disclosure controls and procedures were not effective to ensure that the information required to be disclosed by our Company in reports it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time period specified in the rules and forms of the Securities and Exchange Commission. These disclosure controls and procedures include controls and procedures designed to ensure that such information is accumulated and communicated to our Company’s management, including our Company’s principal executive officer and principal financial officer, to allow timely decisions regarding required disclosure. As discussed below, management has identified a material weakness in internal control over financial reporting due to the design of management review controls over non-routine transactions, as well as lack of requisite skills or available resources. As a result of this material weakness, management has determined that the Company’s disclosure controls and procedures were not effective as of end of the period covered by this Annual Report.

In addition, because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within our Company have been detected.

C. |

Management's Annual Report on Internal Control Over Financial Reporting. |

Management is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange Act) for our Company. Our Company’s internal control over financial reporting is designed to provide reasonable assurance, not absolute assurance, regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with International Financial Reporting Standards. Internal control over financial reporting includes those policies and procedures that: (i) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our Company’s assets; (ii) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with International Financial Reporting Standards, and that our Company’s receipts and expenditures are being made only in accordance with authorizations of our management and directors; and (iii) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of assets that could have a material effect on our financial statements.

| 4 |

For the purposes of Exchange Act Rules 13a-15(e), 13a-15(f), 15d-15(e), and 15d-15(f), management, including our principal executive officer and principal financial officer, conducted an evaluation of the design and operation of our internal controls over financial reporting as of December 31, 2022, based on the criteria set forth in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. This evaluation included review of the documentation of controls, evaluation of the design effectiveness of controls, testing of the operating effectiveness of controls and a conclusion on this evaluation.

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Company’s annual or interim financial statements will not be prevented or detected on a timely basis.

Based on this evaluation, management concluded that as of December 31, 2022, the Company’s internal controls over financial reporting, as defined in Rule 13a-15(f) and 15d-15(f) under the Exchange Act) were not effective as a result of a material weakness related to the design of management review controls over non-routine transactions, as well as lack of requisite skills or available resources, as of December 31, 2022. The Company has identified and is in the process of implementing remediation efforts to improve the effectiveness of our internal control over financial reporting. We are acquiring access to additional technical accounting research tools and are implementing a more formal process for the analysis and review of the proper application of IFRS accounting for non-routine transactions, as well as instituting additional diligence procedures in reviewing non-routine transactions.

While we believe the steps taken to date and those planned for implementation will improve the effectiveness of our internal control over financial reporting, we have not completed all remediation efforts. We will not be able to fully remediate the material weakness until these controls have been designed, implemented and management has determined through testing, that they have been operating effectively for a sufficient period of time.

Deloitte LLP, the Company’s independent registered public accounting firm, who audited and reported on our consolidated financial statements, has issued an attestation report on the effectiveness of our internal control over financial reporting as of December 31, 2022. The attestation report is included within the consolidated financial statements in this Annual Report on Form 40-F.

Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, if any, within our company have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake.

D. |

Attestation Report of the Independent Registered Public Accounting Firm. |

See Exhibit 99.2 of this Annual Report.

E. |

Changes in Internal Control Over Financial Reporting. |

During the year ended December 31, 2022, there were no changes in the Company’s internal control over financial reporting that have materially affected, or are reasonable likely to materially affect, its internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

The Company was not required by Rule 104 of Regulation BTR to send any notices to any of its directors or executive officers during the fiscal year ended December 31, 2022.

AUDIT COMMITTEE FINANCIAL EXPERT

Following are the members of the Audit Committee:

Peter Bojtos |

|

|

Independent |

|

|

Financial expert |

Ronald Andrews |

|

|

Independent |

|

|

Financial expert |

Jasman Yee |

|

|

Independent |

|

|

Financial expert |

The Company’s Board of Directors has determined that Mr. Peter Bojtos, Mr. Ronald Andrews, and Mr. Jasman Yee are qualified as Audit Committee Financial Experts. Mr. Bojtos, Mr. Ronald Andrews, and Mr. Yee are independent as determined by the NYSE American rules.

An Audit Committee Financial Expert must possess five attributes: (i) an understanding of IFRS and financial statements; (ii) the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves; (iii) experience preparing auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities; (iv) an understanding of internal controls and procedures for financial reporting; and (v) an understanding of audit committee functions.

| 5 |

Mr. Bojtos is a professional engineer with over 48 years of worldwide experience in the mining industry. He has an extensive background in corporate management as well as in all facets of the industry from exploration through the feasibility study stage to mine construction, operations and decommissioning. Mr. Bojtos graduated from the University of Leicester, England in 1972, following which he worked at open-pit iron-ore and underground base-metal and uranium mines in West Africa, the United States and Canada. Following that, he worked in Toronto for Kerr Addison Mines Ltd., a Noranda Group company, in increasingly senior management and officer positions for 12 years. From 1990 to 1992 he was the President & CEO of RFC Resource Finance Corp. developing a zinc mine in Washington State. From 1992 to 1993 Mr. Bojtos was the President & CEO of Consolidated Nevada Goldfields Corp. which operated precious metal mines in the United States. From 1993 to 1995 he was Chairman & CEO of Greenstone Resources Ltd, constructing and operating several gold mines in Central America. From 2017 to 2019 he was president of Pembridge Resources plc. He has served on over two dozen public company boards from 1996 to present.

Mr. Andrews has a Bachelor of Science degree in horticulture from Washington State University and a Master’s degree in Political Science. Mr. Andrews is the owner and operator of Andrews Orchards and sells and distributes agricultural chemicals and fertilizers. Mr. Andrews has acted as director and chairman of the audit committee of several public mining companies.

Mr. Yee is a professional metallurgist with BASc, P.Eng (BC) 1970 graduate of the University of British Columbia with a degree in chemical engineering, a 1974 graduate of Toronto’s Ryerson Polytechnical Institute with a degree in economics, and holds a certificate for completing the Canadian Securities Course.

CODE OF ETHICS

The Company has adopted a Code of Ethics that applies to all directors, officers, consultants and employees of the Company.

This Code of Ethics covers a wide range of financial and non-financial business practices and procedures. This Code of Ethics does not cover every issue that may arise, but it sets out basic principles to guide all executive and staff of the Company. If a law or regulation conflicts with a policy in this Code of Ethics, then personnel must comply with such law or regulation. If any person has any questions about this Code of Ethics or potential conflicts with a law or regulation, they should refer to the Company’s Whistleblower Policy.

All executive and staff should recognize that they hold an important role in the overall corporate governance and ethical standards of the Company. Each person is capable and empowered to ensure that the Company’s, its shareholders’ and other stakeholders’ interests are appropriately balanced, protected and preserved. Accordingly, the Code of Ethics provides principles to which all personnel are expected to adhere and advocate. The Code of Ethics embodies rules regarding individual and peer responsibilities, as well as responsibilities to the Company, the shareholders, other stakeholders, and the public generally.

A copy of the Code of Ethics and Whistleblower Policy has been filed as an exhibit with the SEC and are available at the Company’s website at www.avino.com. You may obtain a copy of the Code of Ethics and Whistleblower Policy upon request by contacting the Company’s Corporate Secretary at Suite 900, 570 Granville Street, Vancouver, British Columbia V6C 3P1, Canada.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The Company’s independent auditor for the fiscal year ended December 31, 2022, was Deloitte LLP (Vancouver, Canada PCAOB ID No. 1208), Chartered Professional Accountants, and for the fiscal year ended December 31, 2021, was Manning Elliott LLP, Chartered Professional Accountants.

At the request of the Company, Manning Elliott LLP, Chartered Professional Accountants (the “Former Auditor”) resigned as auditor of the Company effective August 8, 2022. The audit committee of the board of directors of the Company (the “Audit Committee”) has considered the Former Auditor’s resignation and has recommended that Deloitte LLP, Chartered Professional Accountants (the “New Auditor”) be appointed to fill the vacancy in the office of auditor created by the resignation of the Former Auditor until the next annual meeting of shareholders of the Company. The Board of Directors of the Company has considered and acknowledged the Former Auditor’s resignation and on recommendation of the Audit Committee, has appointed the New Auditor as auditor of the Company to hold office until the next annual meeting of shareholders of the Company. The Former Auditor audited the Company’s financial statements for the year ended December 31, 2021, and did not expressed any modified opinions in its report on such financial statements of the Company and from that date until the date of the resignation of the Former Auditor.

| 6 |

The following summarizes the significant professional services rendered by Deloitte LLP, Chartered Professional Accountants and Manning Elliott LLP, Chartered Professional Accountants, respectively, for the years ended December 31, 2022, and 2021.

Financial Year Ending December 31 |

Audit Fees1 |

Audit Related Fees2 |

Tax Fees3 |

All Other Fees4 |

20225 |

C$543,560 |

C$25,923 |

Nil |

Nil |

20216 |

C$375,000 |

Nil |

Nil |

C$68,512 |

1 “Audit Fees” include fees necessary to perform the audit of the Company’s consolidated financial statements. Audit Fees include quarterly reviews, fees for review of tax provisions and for accounting consultations on matters reflected in the financial statements. Audit Fees also include audit or other attest services required by legislation or regulation, such as comfort letters, consents, reviews of securities filings and statutory audits.

2 “Audit-Related Fees” include services that are traditionally performed by the auditor. These audit-related services include audit or attest services not required by legislation or regulation.

3 “Tax Fees” include fees for all tax services other than those included in “Audit Fees” and “Audit- Related Fees”.

4 “All Other Fees” include fees relating to the aggregate fees billed in each of the last two fiscal years for products and services provided by the Company’s external auditor, other than the services reported under footnotes 1 to 3 above.

5 Deloitte LLP was the auditor for the year ended December 31, 2022, and the table represents the fees billed by them.

6 Manning Elliott LLP was the auditor for the year ended December 31, 2021, and the table represents the fees billed by them.

AUDIT COMMITTEE PRE-APPROVAL POLICIES AND PROCEDURES

The Company’s Audit Committee pre-approves all services provided by its independent auditors. All services and fees described above were reviewed and pre-approved by the Audit Committee.

OFF BALANCE ARRANGEMENTS

The Company has no off-balance sheet arrangements. See Management's Discussion and Analysis of Financial Condition and Results of Operations for the fiscal year ended December 31, 2022, for an analysis of material cash requirements from known contractual and other obligations.

MINE SAFETY DISCLOSURE

The Company does not operate any mine in the United States and has no mine safety incidents to report for the year ended December 31, 2022.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

None.

CONSENT TO SERVICE OF PROCESS

The Company has previously filed with the SEC an Appointment of Agent for Service of Process and Undertaking on Form F-X with respect to the class of securities in relation to which the obligation to file this Form 40-F arises. Any change to the name or address of the Company's agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

| 7 |

EXHIBITS

| 8 |

SIGNATURE

Pursuant to the requirements of the Exchange Act, the registrant hereby certifies that it meets all of the requirements for filing this Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereto duly authorized.

|

Avino Silver & Gold Mines, Ltd. |

|

|

|

|

|

|

Date: March 31, 2023 |

By: |

/s/ David Wolfin |

|

|

|

David Wolfin, President, Chief Executive Officer and Director |

|

|

|

(Principal Executive Officer”) |

|

| 9 |

EXHIBIT INDEX

10 |

EXHIBIT 99.1

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2022

DATED MARCH 31, 2023

| 1 |

ANNUAL INFORMATION FORM

FOR THE FINANCIAL YEAR ENDED DECEMBER 31, 2022

TABLE OF CONTENTS

| PRELIMINARY NOTES |

| 3 |

|

| CORPORATE STRUCTURE |

| 6 |

|

| GENERAL DEVELOPMENT OF THE BUSINESS |

| 7 |

|

| DESCRIPTION OF THE BUSINESS |

| 11 |

|

| MINERAL RESOURCE ESTIMATES |

| 20 |

|

| MATERIAL MINERAL PROJECTS |

| 20 |

|

| RISK FACTORS |

| 21 |

|

| DIVIDENDS |

| 32 |

|

| GENERAL DESCRIPTION OF CAPITAL STRUCTURE |

| 33 |

|

| MARKET FOR SECURITIES |

| 33 |

|

| DIRECTORS AND OFFICERS |

| 34 |

|

| CEASE TRADE ORDERS, BANKRUPTCIES, PENALTIES OR SANCTIONS |

| 36 |

|

| CONFLICTS OF INTEREST |

| 37 |

|

| PROMOTERS |

| 37 |

|

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

| 37 |

|

| INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS |

| 38 |

|

| TRANSFER AGENT AND REGISTRAR |

| 38 |

|

| MATERIAL CONTRACTS |

| 38 |

|

| NAMES AND INTERESTS OF EXPERTS |

| 38 |

|

| AUDIT COMMITTEE INFORMATION |

| 39 |

|

| ADDITIONAL INFORMATION |

| 40 |

|

|

|

|

|

|

| APPENDIX “A” - DEFINITIONS, TECHNICAL TERMS, ABBREVIATIONS |

| A1 |

|

| APPENDIX “B” - AUDIT COMMITTEE CHARTER |

| B1 |

|

| APPENDIX “C” - MATERIAL MINERAL PROJECTS |

| C1 |

|

| 2 |

PRELIMINARY NOTES

Effective Date of Information

All information in this annual information form (this “AIF”) of Avino Silver and Gold Mines Ltd. (“Avino Silver & Gold” or the “Company”) is as at December 31, 2022, unless otherwise indicated. This AIF is dated March 31, 2023.

Additional Information

Additional information is provided in the Company’s audited consolidated financial statements for the years ended December 31, 2022 and 2021 (the “2022 Annual Financial Statements”) and Management’s Discussion and Analysis dated March 28, 2023 for the year ended December 31, 2022 (the “2022 Annual MD&A”), each of which has been filed on the Company’s profile on the System for Electronic Document Analysis and Retrieval (“SEDAR”) (www.sedar.com). Additional information, including directors’ and officers’ remuneration and indebtedness and information concerning the principal holders of the Company’s securities, and securities authorized for issuance under equity compensation plans, where applicable, will be contained in the Company’s Management Information Circular to be filed in connection with its upcoming annual meeting of shareholders for 2023 (the “2023 Circular”). This information, including the 2022 Annual MD&A and the 2022 Annual Financial Statements, and other additional information relating to the Company may be found in the Company’s public filings with provincial securities regulatory authorities which can be found on the Company’s profile on the SEDAR website at www.sedar.com and with the U.S. Securities and Exchange Commission (the “SEC”) on the Electronic Data-Gathering, Analysis and Retrieval (“EDGAR”) website at www.sec.gov/edgar.html or, in the case of the 2023 Circular, will be made available in accordance with the time requirements of Canadian and U.S. securities laws.

Non-IFRS Measures

The Company has included certain non-IFRS and other financial measures, which the Company believes, that together with measures determined in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”), provide investors with an improved ability to evaluate the underlying performance of the Company. Non-IFRS financial measures do not have any standardized meaning prescribed under IFRS, and therefore they may not be comparable to similar non-IFRS and other financial performance measures employed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Reconciliations and descriptions can be found under the heading, “Non-IFRS Measures” of the 2022 MD&A, which section is incorporated by reference herein and is available on SEDAR at www.sedar.com.

Interpretation and Definitions

A glossary of certain technical terms, abbreviations and measurement conversions is set forth in Appendix “A”.

***

| 3 |

Currency and Exchange Rate

Unless otherwise indicated, in this AIF all references to “dollar” or the use of the symbol “$” are to the United States dollar and all references to “C$” are to the Canadian dollar. The daily average exchange rate for Canadian dollars in terms of the United States dollar on December 31, 2022 and March 30, 2023 as reported by the Bank of Canada was 1.3544 and 1.3533, respectively.

| United States Dollars into Canadian Dollars |

2022 |

2021 |

2020 |

| Closing | 1.3544 | 1.2678 | 1.2732 |

| Average | 1.3017 | 1.2537 | 1.3412 |

| High | 1.3856 | 1.2942 | 1.4496 |

| Low | 1.2451 | 1.2040 | 1.2718 |

Forward‐Looking Statements

Statements contained in this AIF that are not current or historical factual statements may constitute “forward-looking information” or “forward-looking statements” within the meaning of applicable Canadian and United States securities laws (“forward-looking statements”). These forward-looking statements are presented for the purpose of assisting the Company’s securityholders and prospective investors in understanding management’s views regarding those future outcomes and may not be appropriate for other purposes. When used in this AIF, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. All such forward-looking statements are subject to important risks, uncertainties and assumptions. These statements are forward-looking because they are based on current expectations, estimates and assumptions. It is important to know that: (i) unless otherwise indicated, forward-looking statements in this AlF and its appendices describe expectations as at the date hereof; and (ii) actual results and events could differ materially from those expressed or implied. Capitalized terms used but not defined in this “Forward-Looking Statements” section of the AIF shall have the meaning ascribed to such term elsewhere in the AIF.

Specific forward-looking statements in this AIF include, but are not limited to: any objectives, expectations, intentions, plans, results, levels of activity, goals or achievements; estimates of mineral resources; the realization of mineral resource estimates; the impairment of mineral properties and non-producing properties; the timing and amount of estimated future production, production guidance, costs of production, capital expenditures, costs and timing of development; the success of exploration and development activities.

With respect to underground development improvements, equipment procurement and the drilling program and expected results thereof; material uncertainties that may impact the Company’s liquidity in the short term; the effects of COVID-19; changes in accounting policies not yet in effect; permitting timelines; government regulation of mining operations; environmental risks; labour relations, employee recruitment and retention; the timing and possible outcomes of pending disputes or litigation; negotiations or regulatory investigations; exchange rate fluctuations; cyclical or seasonal aspects of our business; our dividend policy; capital expenditures; the Company’s ability to operate mine; statements relating to the future financial condition, assets, liabilities (contingent or otherwise), business, operations or prospects of the Company; the suspension of certain operating metrics such as cash costs and all-in sustaining costs; the liquidity of the Common Shares; and other events or conditions that may occur in the future.

Inherent in the forward-looking statements are known and unknown risks, uncertainties and other factors beyond the Company’s ability to control or predict that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in its industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements.

| 4 |

Some of the risks and other factors (some of which are beyond the Company’s control) that could cause results to differ materially from those expressed in the forward-looking statements and information contained in this AIF include, but are not limited to: risks associated with market fluctuations in commodity prices; risks related to changing global economic conditions, which may affect the Company’s results of operations and financial condition including the market reaction to the COVID-19 pandemic; actual and potential risks and uncertainties relating to the ultimate geographic spread of COVID-19, the severity of the disease and the duration of the COVID-19 pandemic and issues relating to its resurgence and/or the emergence of new strains of COVID-19, including potential material adverse effects on the Company’s business, operations and financial performance; actions that have been and may be taken by governmental authorities to contain COVID-19 or to treat its impact on the Company’s business; the actual and potential negative impacts of COVID-19 on the global economy and financial markets; risks related to mineral resources, development and production and the Company’s ability to sustain or increase present production; risks related to global financial and economic conditions; risks related to government regulation and environmental compliance; risks related to mining property claims and titles, and surface rights and access; risks related to labour relations, disputes and/or disruptions, employee recruitment and retention; the Company’s material properties are located in Mexico and are subject to changes in political and economic conditions and regulations in that country; risks related to the Company’s relationship with the communities where it operates; risks related to actions by certain non-governmental organizations; substantially all of the Company’s assets are located outside of Canada, which could impact the enforcement of civil liabilities obtained in Canadian and U.S. courts; risks related to currency fluctuations that may adversely affect the financial condition of the Company; the Company may need additional capital in the future and may be unable to obtain it or to obtain it on favourable terms; risks associated with the Company’s outstanding debt and its ability to make scheduled payments of interest and principal thereon; the Company may engage in hedging activities; risks associated with the Company’s business objectives; risks relating to mining and exploration activities and future mining operations; operational risks and hazards inherent in the mining industry; risks related to competition in the mining industry; risks relating to negative operating cash flows; risks relating to the possibility that the Company’s working capital requirements may be higher than anticipated and/or its revenue may be lower than anticipated over relevant periods; and risks relating to climate change and the legislation governing it.

The list above is not exhaustive of the factors that may affect any of the Company’s forward-looking statements. Investors and others should carefully consider these and other factors and not place undue reliance on the forward-looking statements. The forward-looking statements contained in this AIF represent the Company’s views only as of the date such statements were made. Forward-looking statements contained in this AIF are based on management’s plans, estimates, projections, beliefs and opinions as at the time such statements were made and the assumptions related to these plans, estimates, projections, beliefs and opinions may change. Although forward-looking statements contained in this AIF are based on what management considers to be reasonable assumptions based on information currently available to it, there can be no assurances that actual events, performance or results will be consistent with these forward- looking statements, and management’s assumptions may prove to be incorrect. Some of the important risks and uncertainties that could affect forward-looking statements are described further in the AIF. The Company cannot guarantee future results, levels of activity, performance or achievements, should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, the actual results or developments may differ materially from those contemplated by the forward-looking statements. The Company does not undertake to update any forward-looking statements, even if new information becomes available, as a result of future events or for any other reason, except to the extent required by applicable securities laws.

***

| 5 |

CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated by Memorandum of Association under the laws of the Province of British Columbia on May 15, 1968, and on August 22, 1969, by virtue of an amalgamation with Ace Mining Company Ltd., became a public company whose common shares are registered under the Exchange Act, changing its name to Avino Mines & Resources Limited. On April 12, 1995, the Company changed its corporate name to International Avino Mines Ltd. and effected a reverse stock split of one common share for every five common shares outstanding. On August 29, 1997, the Company changed its corporate name to Avino Silver & Gold Mines Ltd., its current name, to better reflect the business of the Company of exploring for and mining silver and gold.

The Company is a reporting issuer in all Provinces of Canada, except for Quebec, a foreign private issuer in the United States, and is listed on the Toronto Stock Exchange, under the symbol “ASM”, on the NYSE-American under the symbol “ASM”, and on the Berlin and Frankfurt Stock Exchanges under the symbol “GV6”. The principal executive office of the Company is located at Suite 900, 570 Granville Street, Vancouver, British Columbia V6C 3P1, and its telephone number is 604-682-3701.

The Company is a natural resource company primarily engaged in the extracting and processing of silver and to a lesser extent, gold and copper and the acquisition and exploration of natural resource properties. The Company’s principal business activities have been the exploration for and extracting and processing of silver, gold and copper at mineral properties located in the State of Durango, Mexico. The Company also owns other exploration and evaluation assets in British Columbia and the Yukon, Canada.

The Common Shares trade on the Toronto Stock Exchange (the “TSX”) under the symbol “ASM.TO” and on the NYSE American under the symbol “ASM”.

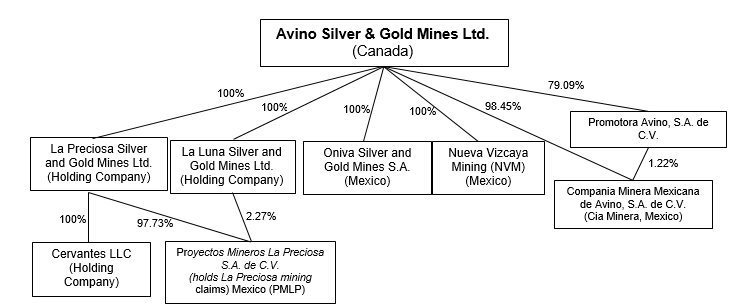

Inter-Corporate Relationships

The organizational chart below indicates the inter-corporate relationships between the Company and its material subsidiaries (and includes their jurisdiction of organization) as of the date hereof. Unless otherwise indicated, all such subsidiaries are wholly owned.

| 6 |

GENERAL DEVELOPMENT OF THE BUSINESS

Overview

Avino Silver & Gold Mines Ltd. (the “Company” or “Avino”) was incorporated in 1968 under the laws of the Province of British Columbia, Canada. The Company is engaged in the production and sale of silver, gold, and copper and the acquisition, exploration, and advancement of mineral properties.

The Company’s head office and principal place of business is Suite 900, 570 Granville Street, Vancouver, BC, Canada. The Company is a reporting issuer in Canada and the United States, and trades on the Toronto Stock Exchange (“TSX”), the NYSE American, and the Frankfurt and Berlin Stock Exchanges.

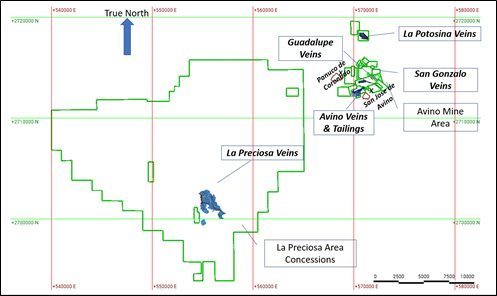

In Durango, Mexico, the Company operates the Avino Mine which produces copper, silver and gold at the historic Avino property in the state of Durango, Mexico (the “Avino Property”), after declaring commercial production effective July 1, 2015. As of today, the Company continues to produce from the Avino Mine. Also in Durango, the Company also holds 100% interest in Proyectos Mineros La Preciosa S.A. de C.V . (“La Preciosa”), a Mexican corporation which owns the La Preciosa property in Durango, Mexico (the “La Preciosa Property”), located approximately 20 kms southwest of the Avino Property. The Avino Property and La Preciosa Property are referred to collectively herein as the “Property”.

In British Columbia, Canada, the Company previously owned Bralorne Gold Mines Ltd. (“Bralorne”), a British Columbia company, which owns the past producing Bralorne Gold Mine in British Columbia, as a wholly-owned subsidiary. On December 13, 2019, the Company completed the sale of Bralorne to Talisker. The sale includes the Bralorne Gold Mine and is part of the Company’s plan to focus on its core mining operations in Mexico. For more information regarding the sale, please see below under the heading, “Three Year History – Fiscal 2020”.

Avino’s remaining Mexican properties, as well as its Canadian properties, are all in the exploration stage. In order to determine if a commercially viable mineral deposit exists in any of these properties, further geological work will need to be done, and based upon the results of that work a final evaluation will need to be made to conclude on economic and legal feasibility. The Company is currently focusing on extracting and processing resources at the Avino Mine and continuing to advance the La Preciosa Property. The Company’s three other Canadian properties are not deemed to be material and are subject to care and maintenance for further exploration and evaluation, if any.

Three Year History

Fiscal 2020

On December 13, 2019, Avino closed an agreement to sell all of the issued and outstanding shares of Bralorne to Talisker for:

|

| (i) | A cash consideration of C$8.7 million; |

|

|

|

|

|

| (ii) | The issuance of 12,580,000 common shares of Talisker (the “Talisker Shares”); |

|

|

|

|

|

| (iii) | The issuance of 6,290,000 share purchase warrants (the “Talisker Warrants”) exercisable at C$0.25 per share for a period of three years after the Closing Date |

In addition, as part of the sale of Bralorne to Talisker, Avino also assigned all of its rights and obligations to the nine BRX mineral claims to Talisker. As a result of the sale, Avino acquired the Talisker Shares, representing 9.9% of the total issued and outstanding shares of Talisker, and the Talisker Shares and Talisker Warrants represent 14.85% of Talisker on a fully diluted basis assuming the exercise of the Talisker Warrants. The Talisker Shares and Talisker Warrants were acquired by Avino for investment purposes.

| 7 |

On February 25, 2020, the Company exercised its Talisker Warrant to purchase 6,290,000 common shares. On that same date, the Company sold 3,000,000 common shares of Talisker. As a result of these transactions, the Company, as of February 25, 2020, held 15,870,000 common shares of Talisker representing approximately 9.6% of Talisker common shares at that time.

On April 2, 2020, the Company announced it is temporarily suspending operations at the Avino Mine in Durango, Mexico until the end of April, 2020 to comply with the Mexican Government’s order that comprises all non-essential businesses including the mining industry, to help fight against COVID-19. The Avino Mine will transition to care and maintenance utilizing a reduced workforce to protect current mining operations, employees and the local communities while production operations are temporarily suspended.

On June 1, 2020, the Company announced it is starting a phased ramp-up of operational activities today at its Avino Mine near Durango, Mexico. On May 15, 2020, the Mexican Federal Government authorized the resumption of mining activities as of June 1, 2020, for municipalities that present low or no known cases of COVID-19, subject to criteria defined by the Secretariat of Health.

On July 10, 2020, the Company reported that members from the Mexican mining union have blocked the entrance to the Avino Mine near Durango, Mexico. The group includes the Company’s unionized workers. The Company remains receptive to having good-faith discussions with representatives of the authorized union. As a result of the strike at the site, the Company has temporarily halted mining and mill processing operations.

On August 13, 2020, the Company announced that its board of directors has determined to proceed with an option agreement dated August 12, 2020 (the “Option Agreement”) with Gray Rock Resources Ltd. (“Gray Rock”), as optionee. Pursuant to the terms of the Option Agreement, Gray Rock was granted the exclusive right to acquire an 100% interest in the Ana Maria and El Laberinto properties in Mexico (the “Option”).

On October 8, 2020, the Company announced that, through continued good faith negotiations, the Company and the Mexican Mining Union have reached an agreement and the strike at the mine has ended.

In 2020, the Company issued approximately 6.73 million common shares in an at-the-market offering under prospectus supplement for gross proceeds of approximately $4.94 million. The Company paid a 3% cash commission of approximately $0.15 million, for net proceeds of $4.79 million. The Company also issued approximately 4.2 million common shares following the exercise of warrants for cash proceeds of approximately $3.36 million, 464,122 common shares upon exercise of broker warrants for cash proceeds of $0.3 million, and 48,000 common shares upon exercise of stock options for cash proceeds of $28 thousand.

Fiscal 2021

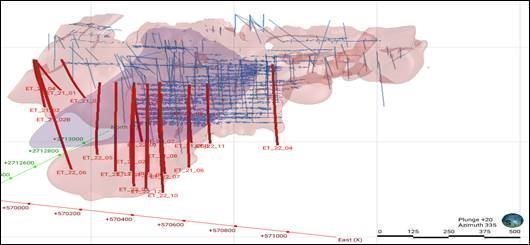

On January 13, 2021, the Company announced an updated mineral resource estimate for the Company’s Avino Property located near Durango in west-central Mexico. The updated estimate includes the Avino Property’s Avino Mine (Elena Tolosa – “ET”) vein systems, the San Gonzalo Mine, and the Avino Property’s Oxide Tailings.

On January 29, 2021, the Company announced that it had entered into a sales agreement with Cantor Fitzgerald & Co. (the “Designated Agent”), H.C. Wainwright & Co., LLC, Roth Capital Partners, LLC, and A.G.P./Alliance Global Partners (collectively, with the Designated Agent, the “Agents”), as agents or as principals, for the distribution of the Offered Shares in the United States up to the aggregate sales amount of $25.0 million (the “Maximum Amount”), in accordance with the terms of the Sales Agreement (the “Offering”). Pursuant to the Offering, the Company sold, through the Designated Agent, approximately 10.3 million common shares at average price per share of $1.87 for gross proceeds of approximately $19.2 million.

| 8 |

On August 3, 2021, the Company announced that mining operations had restarted at its Avino Mine.

On October 27, 2021, the Company announced that it has entered into a share purchase agreement (the “La Preciosa Transaction”) with Coeur Mining Inc. (“Coeur”) to acquire through the purchase of shares of certain holding companies, the La Preciosa Property. The La Preciosa Property is located adjacent to the Avino Mine in the state of Durango, Mexico. The La Preciosa Transaction closed on March 21, 2022.

The Company acquired the La Preciosa property for consideration of $20,000,000, of which $15,000,000 was paid at the closing of the La Preciosa Transaction and the remaining $5,000,000 was payable pursuant to a non-interest bearing promissory note, which was paid before the first anniversary of the closing date.

Avino also issued to Coeur 14,000,000 common shares and share purchase warrants exercisable to acquire up to 7,000,000 common shares at $1.09 per share until September 23, 2023.

Additional cash consideration of $8.75 million will be payable by the Company to Coeur within 12 months of initial production of the La Preciosa Property. Avino may elect to pay up to half of the contingent cash consideration in Avino shares, subject to certain limitations. Coeur will retain ownership of a 1.25% net smelter royalty on the Gloria and Abundancia areas of the La Preciosa Property, and a 2.00% gross value royalty on all areas of the La Preciosa Property, other than the Gloria and Abundancia areas. The Company has also agreed to pay Coeur $0.25 per silver equivalent ounce (subject to inflationary adjustment) of new mineral reserves (as defined by NI 43-101) discovered and declared outside of the current mineral resource area at the La Preciosa Property, subject to a cap of $50 million, and any such payments will be credited against any existing or future payments owing on the gross value royalty.

So long as Coeur holds 10% or more of the outstanding shares of Avino, Coeur has the option to nominate one director for election to the Avino board or designate a board observer. At closing, Coeur has also been granted pre-emptive rights to maintain its equity ownership position in Avino and has entered into a voting agreement with Avino.

The completion of the La Preciosa Transaction was subject to a number of customary conditions precedent, as well as, the authorization of the Mexican Federal Economic Commission. The Toronto Stock Exchange provided approval of the project and the NYSE American has approved the listing of the common shares and warrants to be issued in the La Preciosa Transaction.

Fiscal 2022

On March 21, 2022, the Company announced the closing of the La Preciosa Transaction. The La Preciosa Property hosts of one of the largest undeveloped primary silver resources in Mexico and is located adjacent to Avino’s existing operations at the Avino Property. Avino believes that the La Preciosa Transaction has a strong rationale given the close proximity of the La Preciosa Property to Avino’s existing mine and infrastructure which could yield numerous financial and operational synergies, including reducing the environmental footprint associated with the development of a stand alone La Preciosa operation.

On April 7, 2022, the Company announced the results from the Oxide Tailings Project that sits within our tailings storage facility #1 (“TSF#1”) on the Avino Property. The 2021 drill program included 110 drill holes for a total of 3,645 metres of drilling. The drilling follows up the 2015/2016 campaign for which the 2016 NI 43-101 Preliminary Economic Assessment (“PEA”) is based on, which can be found on Avino’s SEDAR profile. The drill density of the current program should be sufficient to upgrade most of the existing inferred mineral resources to the measured and indicated categories, and to potentially expand the resources. Furthermore, a comprehensive sampling program is underway for an upcoming metallurgical testing program. Once completed and assuming results are conclusive, the existing PEA will be used as the framework for an updated study with the intention of increasing confidence to the Pre-Feasibility Study level.

| 9 |

On May 2, 2022, the Company announced that in with its strategic plans to become an intermediate producer in Mexico, the Company has granted Endurance Gold Corporation (“Endurance”) the right to acquire an option to earn 100% ownership of the former Minto Gold Mine, Olympic and Kelvin gold prospects contained within a parcel of crown grants and mineral claims (the “Olympic Claims”). The Olympic Claims are owned by Avino and are located on the north and south shores of BC Hydro’s Carpenter Lake Reservoir in the Bridge River Valley, east of the Royal Shear trend.

Under the terms of the letter agreement, Endurance can earn a 100% interest in the Olympic Claims if they pay Avino a total cash consideration in the aggregate amount of C$100,000, issue up to a total of 1,500,000 common shares (‘Shares’) of Endurance and incur exploration expenditures in the aggregate amount of C$300,000; all of which is to be incurred by December 31, 2024.

In the event that Endurance earns the 100% interest, the Olympic Claims will be subject to a 2% net smelter return royalty (“NSR”), of which 1% NSR can be purchased by the Endurance for C$750,000 and the remaining balance of the NSR can be purchased for C$1,000,000.

As part of the final requirement to earn its interest, Endurance agreed to grant to Avino 750,000 share purchase warrants (“Warrants”) by December 31, 2024, that offer Avino the option to purchase additional shares in the Company for a period of three years from the date of issuance. The exercise price of the Warrants will be set at a 25% premium to the 20-day VWAP share price at the issuance date. During the Option, if Endurance is successful in defining a compliant mineral resource of at least 500,000 gold-equivalent ounces on the Olympic Claims then Endurance will be obliged to pay Avino a C$1,000,000 discovery bonus.

The Option agreement is subject to the TSX Venture Exchange acceptance, and any Shares or Warrants to be issued will be subject to a four-month hold period on issuance as per the policies of the TSX Venture Exchange.

Continuing Operations and Actual and Anticipated Impact of COVID-19

The Company’s business, operations and financial condition could be materially adversely affected by the outbreak of epidemics, pandemics or other health crises, such as the outbreak of COVID-19 that was designated as a pandemic by the World Health Organization on March 11, 2020. The international response to the spread of COVID-19 has led to significant restrictions on travel, temporary business closures, quarantines, global stock market volatility and a general reduction in consumer activity. Such public health crises can result in operating, supply chain and project development delays and disruptions, global stock market and financial market volatility, declining trade and market sentiment, reduced movement of people and labour shortages, and travel and shipping disruption and shutdowns, including as a result of government regulation and prevention measures, or a fear of any of the foregoing, all of which could affect commodity prices, interest rates, credit risk and inflation. In addition, the current COVID-19 pandemic, and any future emergence and spread of similar pathogens could have an adverse impact on global economic conditions which may adversely impact the Company’s operations, and the operations of suppliers, contractors and service providers, including smelter and refining service providers, and the demand for the Company’s production.

Sustainability Performance

In August 2022, the Company announce that it has received for the first time, the ESR “Empresa Socialmente Responsible ESR 2022” Award granted by the Mexican Center for Philanthropy (El Centro Mexicano para la Filantropia or Cemefi, and the Alliance for Corporate Social Responsibility (Alizanza por la Responsabilidad Social Empresarial or (AliaRSE)).

The ESR® Award is obtained through a diagnostic process based on indicators reviewed and endorsed annually by a committee of experts in the various CSR areas, supported with documentary evidence, an assessment differentiated by company size and by maturity levels, and an external verification process.

| 10 |

DESCRIPTION OF THE BUSINESS

Summary

The Company is engaged in the evaluation, acquisition, exploration, development and operation of precious metals and polymetallic mineral properties, primarily those already producing or with the potential for near- term production. The Company’s geographic focus is Mexico. The Company owns and operates the Avino Mine on the Avino Property in Durango, Mexico and owns the La Preciosa Property in Durango, Mexico.

Principal Product

The Company produces copper concentrates containing silver, gold and copper. The Company believes that because of the availability of alternate processing and commercialization options for its concentrates, it is not dependent on a particular purchaser with regard to the sale of its products.

Production

The Company operates the 100% owned Avino Mine on the Avino Property located near in the State of Durango, Mexico. The Company previously produced a silver-gold concentrate from the San Gonzalo Mine on the same property; however, in 2019, the Company ceased production operations at San Gonzalo to focus on the Avino Mine.

The Avino Mine produces a copper concentrate containing copper, silver and gold. Ore mined at the Avino Mine is milled on the Avino Property.

In the second quarter of 2016, the Company declared that effective April 1, 2016, extracting and processing resources at levels intended by management had been achieved at the Avino Mine following an advancement and test period of 19 months. The decision was based on the following criteria:

|

| · | All critical capital components have been acquired and installed to achieve desired mining and processing results; |

|

|

|

|

|

| · | The necessary labor force, including production and development mining contractors, has been secured to mine and process at planned levels of output; |

|

|

|

|

|

| · | The mill has consistently processed at levels above design capacity and budgeted production levels of 1,250 tpd with consistent recoveries and grades; and |

|

|

|

|

|

| · | The Company entered into a long-term sales agreement with Samsung C&T U.K. Limited (“Samsung”). Further, Samsung has provided Avino with a term facility which has provided capital to facilitate further expansion and development of the Avino Mine. |

Subsequently, on July 11, 2018, upon further review of the Company’s experience at the Avino and San Gonzalo mines, the Company concluded to change its accounting policy under IFRS 6 and IAS 16 in accounting for the Company’s Exploration and Evaluation Assets and Development Costs, including the determination that the Company commenced production effective July 1, 2015. The voluntary change in accounting policy was intended to provide investors with a better reflection of the Company’s business activities to enhance the comparability of the Company’s financial statements to the Company’s peers and to make the Company’s financial statements more relevant to the economic decision-making needs of users.

As a result of applying the change in accounting policy, we have determined that we would have been deemed to be in the production phase effective July 1, 2015. Accordingly, we have retrospectively applied this change in accounting policy for (i) the year ended December 31, 2015; (ii) the year ended December 31, 2016; and (iii) the year ended December 31, 2017.

| 11 |

Consolidated Results and Developments

Financial Results

|

|

| 2022 | 2021 | 2020 |

|||

| Revenue from mining operations |

| $ | 44,187 | $ | 11,228 | $ | 16,022 |

| Cost of sales |

| 29,125 | 7,681 | 15,832 |

|||

| Mine operating income |

| 15,062 | 3,547 | 190 |

|||

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|||

| General and administrative expenses |

| 5,156 | 3,566 | 2,902 |

|||

| Share-based payments |

| 2,024 | 1,469 | 1,857 |

|||

| Income (loss) before other items |

| 7,882 | (1,488) | (4,569) |

|||

|

|

|

|

|

|

|

|

|

| Other items |

|

|

|

|

|||

| Interest and other income |

| 20 | 178 | 332 |

|||

| Unrealized gain (loss) on long-term investments |

| (2,103) | (423) | (124) |

|||

| Fair value adjustment on warrant liability |

| 2,395 | 1,581 | (650) |

|||

| Realized loss on warrants exercised |

|

| - |

| (1,106) |

| (2,733) |

| Foreign exchange loss |

| (17) | (61) | (811) |

|||

| Project evaluation expenses |

|

| (81) |

| (176) |

| - |

| Finance cost |

| (273) | (52) | (211) |

|||

| Accretion of reclamation provision |

| (44) | (47) | (99) |

|||

| Interest expense |

|

| (99) |

| (24) |

| (25) |

| Income (loss) from continuing operations before income taxes | 7,680 | (1,618) | (8,890) |

||||

| Income taxes: |

|

|

|

||||

| Current income tax expense |

| (1,144) | (27) | (161) |

|||

| Deferred income tax (expense) recovery |

| (3,440) | (412) | 1,569 |

|||

| Income tax (expense) recovery | (4,584) | (439) | 1,408 |

||||

| Net income (loss) from continuing operations | 3,096 | (2,057) | (7,482) |

||||

| Loss from discontinued operations and on disposal |

| - |

| - |

| (169) |

|

| Net income (loss) |

|

| 3,096 |

| (2,057) |

| (7,651) |

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

|

|

|

|

|

| Currency translation differences | (254) | (159) | (247) |

||||

| Total comprehensive income (loss) |

| $ | 2,842 | $ | (2,216) | $ | (7,898) |

| Earnings (loss) per share from continuing operations |

|

|

|

|

|

|

|

| Basic & Diluted |

|

| $0.03 |

| $(0.02) |

| $(0.09) |

| Earnings (loss) per share |

|

|

|

|

|

||

| Basic & Diluted |

| $0.03 | $(0.02) | $(0.09) |

|||

| Weighted average number of common shares outstanding |

|

|

|

| |||

| Basic | 114,372,371 | 100,161,357 | 83,180,069 |

||||

| Diluted | 117,615,898 | 100,161,357 | 83,180,069 |

||||

| 12 |

Financial Results – Year ended December 31, 2022, compared to year ended December 31, 2021

Revenues

The Company recognized revenues net of penalties, treatment costs and refining charges, of $44.2 million on the sale of Avino Mine bulk copper/silver/gold concentrate, compared to revenues of $11.2 million for year ended December 31, 2021, an increase of $33.0 million, or 294%. The increase is a direct result of a full year of revenues during 2022 compared to only 4 months of revenues in 2021, following the restart of mining operations in August 2021. The Company sold 2.45 million silver equivalent payable ounces in 2022, compared to 525 thousand silver equivalent payable ounces in 2021, representing an increase of 367%.

The increase in revenues were partially offset by lower metal prices in 2022 compared to 2021. Metal prices for revenues recognized during the period were $21.51 per ounce of silver, $1,788 per ounce of gold, and $8,552 per tonne of copper, in the prior year quarter, compared to $23.18, $1,802, and $9,524, respectively, for the same period in 2021.

Cost of Sales & Mine Operating Income

Cost of sales was $28.8 million, compared to $7.7 million in 2021, an increase of $21.1 million, or 275%. The increase in cost of sales is inline with the increase in ounces sold and revenues noted above and is directly attributable to mining operations being active during the full year ended December 31, 2022.

In 2022, tonnes milled increased by 228%, and total silver equivalent ounces produced increased by 215%, when compared to 2021. This is a direct result of full mining operations for the twelve-month period in 2022 when compared to four months of production mining operations in 2021. Further, a write down of equipment was recorded for the period totaling $0.3 million, compared with $Nil in prior year.

Mine operating income was $15.4 million, compared to mine operating income of $3.5 million, an increase of $11.9 million. This is a direct result of the items noted above.

General and Administrative Expenses & Share-Based Payments

General and administrative expenses was $5.1 million, compared to $3.6 million in 2021, with the increases coming from the increased corporate activity surrounding ramp up procedures and the acquisition of La Preciosa.

Share-based payments was $2.0 million, compared to $1.5 million in 2021, a increase of $0.5 million. Movements in share-based payments are a direct result of the 2022 option and RSU grants carrying a higher expense when compared to the vesting of option and RSU issuances from 2020 and prior years, as well as the fact that there were no grants in 2021.

Other Items

Other items totaled $0.5 million in losses for the period, an increase of $0.4 million compared to a loss of $0.1 million related to other items in the comparable period in 2021.

Unrealized loss on long-term investments was $2.1 million, an increase of $1.7 million compared to a loss of $0.4 million in 2021. This is a direct result of fluctuations in the Company’s investment in shares of Talisker Resources from period to period, as well as the Company’s investment in shares of Silver Wolf Exploration.

Fair value adjustment on warrant liability was a gain of $2.4 million, a favourable change of $0.8 million compared to a gain of $1.6 million in 2021. The fair value adjustment on the Company’s warrant liability relates to the issuance of US dollar-denominated warrants, which are re-valued each reporting period, and the value fluctuates with changes in the US-Canadian dollar exchange rate, and in the variables used in the valuation model, such as the Company’s US share price, and expected share price volatility.

| 13 |

Realized loss on warrants exercised was $Nil, a positive movement of $1.1 million compared to $1.1 million in 2021. During the current period, no warrants were exercised compared to 1.0 million warrants exercised in the comparable period in 2021.

Finance costs totaled $0.3 million in losses for the year, an increase of $0.2 million compared to a loss of $0.1 million in 2021. This is a direct result of the unwinding of the fair value adjustment on the note payable, which was issued in Q1 2022. There were no corresponding fair value adjustments to notes payable in 2021.

The remaining Other Items resulted in a loss of $0.2 million, fairly unchanged compared to a loss of $0.1 million for the same remaining Other items in 2021.

Current and Deferred Income Taxes

Current income tax expense increase to $1.1 million compared to under $0.1 million in income tax expense for the prior year period. Given the return to profitable mining operations, the higher amount of current income tax expenses in 2022 is a result of income generated in the current period and relates primarily to the special mining duties tax on profits in Mexico.

Deferred income tax expense was $3.4 million, a change of $3.0 million compared to a expense of $0.4 million for the comparable period in 2021. Deferred income tax fluctuates due to movements in taxable and deductible temporary differences related to the special mining duty in Mexico and to changes in inventory, plant, equipment and mining properties, and exploration and evaluation assets, amongst other factors. The changes in current income taxes and deferred income taxes during the current and comparable periods primarily relate to movements in the tax bases and mining profits and/or losses in Mexico.

Net Income/Loss

Net income from all operations was $3.1 million for the period, or $0.03 per share, compared to a loss of $2.1 million, or $0.02 per share during the comparable period in 2021. The changes are a result of the items noted above, which are primarily increases in revenues and mine operating income, and movements in the fair value adjustment of the warrant liability and realized loss on warrants exercised. The positive movement in net income/loss was partially offset by increases to share-based payments, an increase to general and administrative expenses and an increased unrealized loss on investments, as well as increased current and deferred income tax expense, as noted above.

Financial Results – Year ended December 31, 2021, compared to year ended December 31, 2020

Revenues

The Company recognized revenues net of penalties, treatment costs and refining charges, of $11.2 million on the sale of Avino Mine bulk copper/silver/gold concentrate, compared to revenues of $16.0 million for year ended December 31, 2020, a decrease of $4.8 million. The decrease in revenues is a direct result of the shutdown of mining operations until August 2021, as well as additional COVID-19 protocols, with the only revenues in the current period being from sales that occurred in the second half of 2021 and from the finalization of provisionally priced invoices.

Metal prices for revenues recognized during the period were $23.18 per ounce of silver, $1,802 per ounce of gold, and $9,524 per tonne of copper, in the prior year quarter, compared to $23.73, $1,885, and $6,610, respectively, for the same period in 2020.

| 14 |

Cost of Sales & Mine Operating Income

Cost of sales was $7.7 million, compared to $15.8 million in 2020, a decrease of $8.1 million. The decrease in cost of sales is attributable to lower production costs by $6.5 million as a result of lower tonnages mined and milled. Further, the Company incurred $0.8 million in stand-by costs, compared to $2.4 million in the comparable period for 2020, a decrease of $1.6 million. Depreciation and depletion remained consistent with 2020 at $2.0 million for the period.

Mine operating income was $3.5 million, compared to mine operating income of $0.2 million, an increase of $3.3 million. This was a direct result of higher feed grade for silver, gold, and copper, and increased metal prices for copper when compared to 2020,as well as the factors noted above.

General and Administrative Expenses & Share-Based Payments

General and administrative expenses was $3.6 million, compared to $2.9 million in 2020, an increase of $0.7 million The increase is attributable to increased administrative and support activity following the restart of mining operations in Q3 2021, as well as the cost reduction measures put into place following the government mandated COVID-19 shutdown in Q2 2020.

Share-based payments was $1.5 million, compared to $1.9 million in 2020, a decrease of $0.4 million. The decrease is a direct result of no option or RSU grants occurring during 2021, whereas there were grants for both in 2020. Any share-based payment expense in 2021 related to options vesting in Q1-Q3 2021, as well as the three-year vesting period for RSUs issued in previous years.

Other Items

Other items totaled $0.1 million in losses for the period, a favourable change of $4.2 million compared to a loss of $4.3 million related to other items in the comparable period in 2020.

Unrealized loss on long-term investment was $0.4 million, a decrease of $0.3 million compared to a loss of $0.1 million in 2020. This is a direct result of fluctuations in the Company’s investment in shares of Talisker Resources from period to period, as well as the Company’s investment in shares of Silver Wolf Exploration.

Fair value adjustment on warrant liability was a gain of $1.6 million, a favourable change of $2.3 million compared to a loss of $0.7 million in 2020. The fair value adjustment on the Company’s warrant liability relates to the issuance of US dollar-denominated warrants, which are re-valued each reporting period, and the value fluctuates with changes in the US-Canadian dollar exchange rate, and in the variables used in the valuation model, such as the Company’s US share price, and expected share price volatility.