Q1FALSE2024--12-310001475115P5DP5D00014751152024-01-012024-03-310001475115us-gaap:CommonClassAMember2024-04-25xbrli:shares0001475115us-gaap:CommonClassBMember2024-04-2500014751152024-03-31iso4217:USD00014751152023-12-31iso4217:USDxbrli:shares00014751152023-01-012023-03-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001475115us-gaap:TreasuryStockCommonMember2023-12-310001475115us-gaap:AdditionalPaidInCapitalMember2023-12-310001475115us-gaap:RetainedEarningsMember2023-12-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310001475115us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001475115us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001475115us-gaap:RetainedEarningsMember2024-01-012024-03-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310001475115us-gaap:TreasuryStockCommonMember2024-03-310001475115us-gaap:AdditionalPaidInCapitalMember2024-03-310001475115us-gaap:RetainedEarningsMember2024-03-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001475115us-gaap:AdditionalPaidInCapitalMember2022-12-310001475115us-gaap:RetainedEarningsMember2022-12-3100014751152022-12-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-03-310001475115us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001475115us-gaap:RetainedEarningsMember2023-01-012023-03-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001475115us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001475115us-gaap:TreasuryStockCommonMember2023-03-310001475115us-gaap:AdditionalPaidInCapitalMember2023-03-310001475115us-gaap:RetainedEarningsMember2023-03-3100014751152023-03-31eb:segment0001475115us-gaap:CostOfSalesMemberus-gaap:EmployeeSeveranceMember2024-01-012024-03-310001475115eb:ProductDevelopmentMemberus-gaap:EmployeeSeveranceMember2024-01-012024-03-310001475115us-gaap:GeneralAndAdministrativeExpenseMemberus-gaap:EmployeeSeveranceMember2024-01-012024-03-310001475115us-gaap:EmployeeSeveranceMember2024-01-012024-03-310001475115us-gaap:EmployeeSeveranceMember2024-03-310001475115us-gaap:ContractTerminationMember2024-03-3100014751152023-01-012023-12-310001475115eb:CreatorCashMember2024-03-310001475115eb:CreatorCashMember2023-12-310001475115us-gaap:DepositsMemberus-gaap:CashEquivalentsMember2024-03-310001475115us-gaap:ShortTermInvestmentsMemberus-gaap:USTreasurySecuritiesMember2024-03-310001475115us-gaap:DepositsMemberus-gaap:CashEquivalentsMember2023-12-310001475115us-gaap:ShortTermInvestmentsMemberus-gaap:USTreasurySecuritiesMember2023-12-310001475115eb:TicketsSoldOnBehalfOfCreatorsMember2024-03-310001475115eb:TicketsSoldOnBehalfOfCreatorsMember2023-12-310001475115us-gaap:SoftwareDevelopmentMember2024-03-310001475115us-gaap:SoftwareDevelopmentMember2023-12-310001475115us-gaap:FurnitureAndFixturesMember2024-03-310001475115us-gaap:FurnitureAndFixturesMember2023-12-310001475115us-gaap:ComputerEquipmentMember2024-03-310001475115us-gaap:ComputerEquipmentMember2023-12-310001475115us-gaap:LeaseholdImprovementsMember2024-03-310001475115us-gaap:LeaseholdImprovementsMember2023-12-31xbrli:pure0001475115us-gaap:DevelopedTechnologyRightsMember2024-03-310001475115us-gaap:DevelopedTechnologyRightsMember2023-12-310001475115us-gaap:CustomerRelationshipsMember2024-03-310001475115us-gaap:CustomerRelationshipsMember2023-12-310001475115us-gaap:TradeNamesMember2024-03-310001475115us-gaap:TradeNamesMember2023-12-310001475115us-gaap:CostOfSalesMember2024-01-012024-03-310001475115us-gaap:CostOfSalesMember2023-01-012023-03-310001475115us-gaap:SellingAndMarketingExpenseMember2024-01-012024-03-310001475115us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-310001475115us-gaap:ConvertibleDebtMembereb:A75ConvertibleSeniorNotesDue20262026NotesMember2024-03-310001475115us-gaap:ConvertibleDebtMembereb:A50ConvertibleSeniorNotesDue20252025NotesMember2024-03-310001475115us-gaap:ConvertibleDebtMembereb:A75ConvertibleSeniorNotesDue20262026NotesMember2023-12-310001475115us-gaap:ConvertibleDebtMembereb:A50ConvertibleSeniorNotesDue20252025NotesMember2023-12-310001475115us-gaap:ConvertibleDebtMembereb:A75ConvertibleSeniorNotesDue20262026NotesMember2021-03-310001475115us-gaap:ConvertibleDebtMembereb:A50ConvertibleSeniorNotesDue20252025NotesMember2020-06-300001475115us-gaap:ConvertibleDebtMembereb:A75ConvertibleSeniorNotesDue20262026NotesMember2023-03-310001475115us-gaap:ConvertibleDebtMembereb:A75ConvertibleSeniorNotesDue20262026NotesMember2024-01-012024-03-310001475115us-gaap:ConvertibleDebtMembereb:A75ConvertibleSeniorNotesDue20262026NotesMember2023-01-012023-03-310001475115us-gaap:ConvertibleDebtMembereb:A50ConvertibleSeniorNotesDue20252025NotesMember2024-01-012024-03-310001475115us-gaap:ConvertibleDebtMembereb:A50ConvertibleSeniorNotesDue20252025NotesMember2023-01-012023-03-310001475115us-gaap:ConvertibleDebtMembereb:A50ConvertibleSeniorNotesDue20252025NotesMemberus-gaap:FairValueInputsLevel2Member2024-03-310001475115eb:MRGConcertsLtdMRGAndMatthewGibbonsGibbonsMember2022-05-232022-05-230001475115eb:MRGConcertsLtdMRGAndMatthewGibbonsGibbonsMember2022-11-012022-11-010001475115eb:MRGConcertsLtdMRGAndMatthewGibbonsGibbonsMember2023-12-262023-12-260001475115us-gaap:SubsequentEventMembereb:MRGConcertsLtdMRGAndMatthewGibbonsGibbonsMember2024-04-162024-04-1600014751152024-03-1400014751152024-03-142024-03-140001475115us-gaap:SubsequentEventMember2024-04-012024-05-020001475115us-gaap:SubsequentEventMember2024-05-020001475115eb:A2018StockOptionAndIncentivePlanMember2018-08-012018-08-310001475115eb:A2010StockOptionPlanMember2024-03-310001475115eb:A2018StockOptionAndIncentivePlanMember2024-03-310001475115us-gaap:CommonClassAMembereb:A2018StockOptionAndIncentivePlanMember2024-03-310001475115eb:A2004Plan2010Planand2018PlanMemberus-gaap:EmployeeStockOptionMember2024-01-012024-03-310001475115us-gaap:EmployeeStockOptionMember2024-03-310001475115us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001475115eb:RSUsRSAsAndPSUsMember2023-12-310001475115eb:RSUsRSAsAndPSUsMember2023-01-012023-12-310001475115eb:RSUsRSAsAndPSUsMember2024-01-012024-03-310001475115eb:RSUsRSAsAndPSUsMember2024-03-310001475115us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-03-310001475115us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-03-310001475115us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001475115us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001475115us-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-03-310001475115us-gaap:ConvertibleDebtSecuritiesMember2023-01-012023-03-310001475115us-gaap:EmployeeStockOptionMember2024-01-012024-03-310001475115us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001475115us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001475115us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001475115us-gaap:EmployeeStockMember2024-01-012024-03-310001475115us-gaap:EmployeeStockMember2023-01-012023-03-310001475115eb:A50ConvertibleSeniorNotesDue20252025NotesMemberus-gaap:ConvertibleDebtSecuritiesMember2024-01-012024-03-310001475115us-gaap:ConvertibleDebtSecuritiesMembereb:A75ConvertibleSeniorNotesDue20262026NotesMember2024-01-012024-03-310001475115country:US2024-01-012024-03-310001475115country:US2023-01-012023-03-310001475115us-gaap:NonUsMember2024-01-012024-03-310001475115us-gaap:NonUsMember2023-01-012023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

FORM 10-Q

____________________________________________________________________________

|

|

|

|

|

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____ to _____

Commission File Number: 001-38658

_______________________________________________________________________________

EVENTBRITE, INC.

(Exact name of registrant as specified in its charter)

________________________________________________________________________________

|

|

|

|

|

|

| Delaware |

14-1888467 |

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

95 Third Street, 2nd Floor,

San Francisco, CA 94103

(Address of principal executive offices) (Zip Code)

(415) 692-7779

(Registrant's telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Class A common stock, $0.00001 par value |

EB |

New York Stock Exchange LLC |

_________________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of April 25, 2024, 81,453,841 shares of Registrant's Class A common stock and 15,661,433 shares of Registrant's Class B common stock were outstanding.

EVENTBRITE, INC.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page |

| SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS |

|

|

|

|

| PART I. FINANCIAL INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PART II. OTHER INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act), that involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "appears," "shall," "should," "expects," "plans," "anticipates," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential," or "continue," or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Quarterly Report on Form 10-Q include, but are not limited to, statements related to our future financial or operational results; our convertible senior notes, our future financial performance, including our revenue, costs of revenue and operating expenses; our anticipated growth and growth strategies, changes in our business model and our corporate strategy and expectations with respect to our restructuring plan; our advance payout program; the sufficiency of our cash, cash equivalents and investments to meet our liquidity needs; our ability to successfully defend litigation brought against us and the potential effect of any current litigation on our business, financial position, results of operations or liquidity.

The outcome of the events described in these forward-looking statements is subject to known and unknown risks, uncertainties and other factors, including those described in the section titled "Risk Factors" and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2023 and this Quarterly Report on Form 10-Q. We caution you that the foregoing list may not contain all of the forward-looking statements made in this Quarterly Report on Form 10-Q. You should not rely upon forward-looking statements as predictions of future events.

All forward-looking statements are based on information and estimates available to the Company at the time of this Quarterly Report on Form 10-Q and are not guarantees of future performance. We undertake no obligation to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q or to reflect new information or the occurrence of unanticipated events, except as required by law.

PART I. FINANCIAL INFORMATION

Item 1. Unaudited Condensed Consolidated Financial Statements

|

|

|

|

|

|

|

|

|

|

|

|

EVENTBRITE, INC. |

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except par value amounts and share data)

(Unaudited)

|

|

March 31, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

579,940 |

|

|

$ |

489,200 |

|

| Funds receivable |

35,290 |

|

|

48,773 |

|

| Short-term investments, at amortized cost |

113,703 |

|

|

153,746 |

|

| Accounts receivable, net |

3,314 |

|

|

2,814 |

|

| Creator signing fees, net |

651 |

|

|

634 |

|

| Creator advances, net |

5,626 |

|

|

2,804 |

|

| Prepaid expenses and other current assets |

11,276 |

|

|

13,880 |

|

| Total current assets |

749,800 |

|

|

711,851 |

|

|

|

|

|

| Creator signing fees, net noncurrent |

1,282 |

|

|

1,303 |

|

| Property and equipment, net |

10,989 |

|

|

9,384 |

|

| Operating lease right-of-use assets |

1,100 |

|

|

177 |

|

| Goodwill |

174,388 |

|

|

174,388 |

|

| Acquired intangible assets, net |

11,223 |

|

|

13,314 |

|

| Other assets |

3,375 |

|

|

2,913 |

|

| Total assets |

$ |

952,157 |

|

|

$ |

913,330 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable, creators |

$ |

356,863 |

|

|

$ |

303,436 |

|

| Accounts payable, trade |

651 |

|

|

1,821 |

|

| Chargebacks and refunds reserve |

8,718 |

|

|

8,088 |

|

| Accrued compensation and benefits |

8,746 |

|

|

17,522 |

|

| Accrued taxes |

7,136 |

|

|

8,796 |

|

| Operating lease liabilities |

1,937 |

|

|

1,523 |

|

| Other accrued liabilities |

19,505 |

|

|

16,425 |

|

| Total current liabilities |

403,556 |

|

|

357,611 |

|

| Accrued taxes, noncurrent |

4,362 |

|

|

4,526 |

|

| Operating lease liabilities, noncurrent |

1,922 |

|

|

1,768 |

|

| Long-term debt |

358,194 |

|

|

357,668 |

|

|

|

|

|

| Total liabilities |

768,034 |

|

|

721,573 |

|

| Commitments and contingencies (Note 17) |

|

|

|

| Stockholders’ equity |

|

|

|

Preferred stock, $0.00001 par value; 100,000,000 shares authorized, no shares issued or outstanding as of March 31, 2024 and December 31, 2023 |

— |

|

|

— |

|

Common stock, $0.00001 par value; 1,100,000,000 shares authorized; 99,216,121 shares issued and outstanding as of March 31, 2024; 101,276,416 shares issued and outstanding as of December 31, 2023 |

1 |

|

|

1 |

|

| Additional paid-in capital |

1,019,101 |

|

|

1,007,190 |

|

Treasury stock, at cost; 2,652,174 shares of common stock as of March 31, 2024 and no shares as of December 31, 2023 |

(15,055) |

|

|

— |

|

| Accumulated deficit |

(819,924) |

|

|

(815,434) |

|

| Total stockholders’ equity |

184,123 |

|

|

191,757 |

|

| Total liabilities and stockholders’ equity |

$ |

952,157 |

|

|

$ |

913,330 |

|

|

|

|

|

(See accompanying Notes to Unaudited Condensed Consolidated Financial Statements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EVENTBRITE, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

| (in thousands, except per share data) |

| (Unaudited) |

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

| Net revenue |

$ |

86,252 |

|

|

$ |

77,914 |

|

|

|

|

|

| Cost of net revenue |

25,032 |

|

|

26,395 |

|

|

|

|

|

| Gross profit |

61,220 |

|

|

51,519 |

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

| Product development |

26,684 |

|

|

26,564 |

|

|

|

|

|

| Sales, marketing and support |

20,869 |

|

|

17,060 |

|

|

|

|

|

| General and administrative |

21,237 |

|

|

21,718 |

|

|

|

|

|

| Total operating expenses |

68,790 |

|

|

65,342 |

|

|

|

|

|

| Loss from operations |

(7,570) |

|

|

(13,823) |

|

|

|

|

|

| Interest income |

7,407 |

|

|

5,453 |

|

|

|

|

|

| Interest expense |

(2,800) |

|

|

(2,752) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense), net |

(1,253) |

|

|

(953) |

|

|

|

|

|

| Loss before income taxes |

(4,216) |

|

|

(12,075) |

|

|

|

|

|

| Income tax provision (benefit) |

274 |

|

|

611 |

|

|

|

|

|

| Net loss |

$ |

(4,490) |

|

|

$ |

(12,686) |

|

|

|

|

|

| Net loss per share, basic and diluted |

$ |

(0.05) |

|

|

$ |

(0.13) |

|

|

|

|

|

| Weighted-average number of shares outstanding used to compute net loss per share, basic and diluted |

99,109 |

|

|

99,503 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(See accompanying Notes to Unaudited Condensed Consolidated Financial Statements)

EVENTBRITE, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(in thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock-Class A |

|

Common Stock-Class B |

|

Treasury Stock |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Total Stockholders’ Equity |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

| Balance at December 31, 2023 |

85,614,983 |

|

|

$ |

1 |

|

|

15,661,433 |

|

|

$ |

— |

|

|

— |

|

|

$ |

— |

|

|

$ |

1,007,190 |

|

|

$ |

(815,434) |

|

|

$ |

191,757 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Issuance of restricted stock awards |

9,665 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Issuance of common stock for settlement of RSUs |

887,751 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

— |

|

| Shares withheld related to net share settlement |

(305,537) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,612) |

|

|

— |

|

|

(2,612) |

|

| Repurchase of common stock |

(2,652,174) |

|

|

— |

|

|

— |

|

|

— |

|

|

2,652,174 |

|

|

(15,055) |

|

|

— |

|

|

— |

|

|

(15,055) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

14,523 |

|

|

— |

|

|

14,523 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(4,490) |

|

|

(4,490) |

|

| Balance at March 31, 2024 |

83,554,688 |

|

|

$ |

1 |

|

|

15,661,433 |

|

|

$ |

— |

|

|

2,652,174 |

|

|

$ |

(15,055) |

|

|

$ |

1,019,101 |

|

|

$ |

(819,924) |

|

|

$ |

184,123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock-Class A |

|

Common Stock-Class B |

|

Treasury Stock |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Total Stockholders’ Equity |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

|

|

| Balance at December 31, 2022 |

81,529,265 |

|

|

$ |

1 |

|

|

17,640,167 |

|

|

$ |

— |

|

|

— |

|

|

$ |

— |

|

|

$ |

955,509 |

|

|

$ |

(788,955) |

|

|

$ |

166,555 |

|

| Issuance of common stock upon exercise of stock options |

77,378 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

463 |

|

|

— |

|

|

463 |

|

| Issuance of restricted stock awards |

10,375 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Issuance of common stock for settlement of RSUs |

551,060 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Shares withheld related to net share settlement |

(193,445) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1,822) |

|

|

— |

|

|

(1,822) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

12,365 |

|

|

— |

|

|

12,365 |

|

| Net loss |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(12,686) |

|

|

(12,686) |

|

| Balance at March 31, 2023 |

81,974,633 |

|

|

$ |

1 |

|

|

17,640,167 |

|

|

$ |

— |

|

|

— |

|

|

$ |

— |

|

|

$ |

966,515 |

|

|

$ |

(801,641) |

|

|

$ |

164,875 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(See accompanying Notes to Unaudited Condensed Consolidated Financial Statements) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EVENTBRITE, INC. |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (in thousands, Unaudited) |

|

Three Months Ended March 31, |

|

2024 |

|

2023 |

|

|

| Cash flows from operating activities |

|

|

|

|

|

| Net loss |

$ |

(4,490) |

|

|

$ |

(12,686) |

|

|

|

| Adjustments to reconcile net loss to net cash provided by operating activities: |

|

|

|

|

|

| Depreciation and amortization |

3,594 |

|

|

3,531 |

|

|

|

| Stock-based compensation expense |

13,962 |

|

|

12,094 |

|

|

|

| Amortization of debt discount and issuance costs |

526 |

|

|

498 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized (gain) loss on foreign currency exchange |

(1,222) |

|

|

(1,133) |

|

|

|

| Accretion on short-term investments |

(1,877) |

|

|

(1,552) |

|

|

|

| Non-cash operating lease expenses |

133 |

|

|

1,875 |

|

|

|

| Amortization of creator signing fees |

194 |

|

|

210 |

|

|

|

| Changes related to creator advances, creator signing fees, and allowance for credit losses |

423 |

|

|

(727) |

|

|

|

| Provision for chargebacks and refunds |

5,046 |

|

|

4,717 |

|

|

|

| Other |

155 |

|

|

314 |

|

|

|

| Changes in operating assets and liabilities |

|

|

|

|

|

| Accounts receivable |

(899) |

|

|

(543) |

|

|

|

| Funds receivable |

13,668 |

|

|

17,835 |

|

|

|

| Creator signing fees and creator advances |

(3,036) |

|

|

665 |

|

|

|

| Prepaid expenses and other assets |

2,142 |

|

|

(237) |

|

|

|

| Accounts payable, creators |

52,002 |

|

|

57,699 |

|

|

|

| Accounts payable |

(1,151) |

|

|

(125) |

|

|

|

| Chargebacks and refunds reserve |

(4,416) |

|

|

(4,621) |

|

|

|

| Accrued compensation and benefits |

(8,776) |

|

|

142 |

|

|

|

| Accrued taxes |

(2,020) |

|

|

(4,580) |

|

|

|

| Operating lease liabilities |

(488) |

|

|

(1,058) |

|

|

|

| Other accrued liabilities |

7 |

|

|

2,848 |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

63,477 |

|

|

75,166 |

|

|

|

| Cash flows from investing activities |

|

|

|

|

|

| Purchases of short-term investments |

(84,113) |

|

|

(94,679) |

|

|

|

| Maturities of short-term investments |

126,033 |

|

|

— |

|

|

|

| Purchases of property and equipment |

(316) |

|

|

(286) |

|

|

|

| Capitalized internal-use software development costs |

(2,257) |

|

|

(1,484) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

39,347 |

|

|

(96,449) |

|

|

|

| Cash flows from financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Repurchase of common stock |

(12,010) |

|

|

— |

|

|

|

| Proceeds from exercise of stock options |

— |

|

|

463 |

|

|

|

| Taxes paid related to net share settlement of equity awards |

(2,612) |

|

|

(1,822) |

|

|

|

|

|

|

|

|

|

| Principal payments on finance lease obligations |

— |

|

|

(1) |

|

|

|

| Net cash used in financing activities |

(14,622) |

|

|

(1,360) |

|

|

|

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

2,538 |

|

|

1,797 |

|

|

|

| Net increase in cash, cash equivalents and restricted cash |

90,740 |

|

|

(20,846) |

|

|

|

| Cash, cash equivalents and restricted cash |

|

|

|

|

|

| Beginning of period |

489,200 |

|

|

540,174 |

|

|

|

| End of period |

$ |

579,940 |

|

|

$ |

519,328 |

|

|

|

| Supplemental cash flow data |

|

|

|

|

|

| Interest paid |

$ |

798 |

|

|

$ |

798 |

|

|

|

| Income taxes paid, net of refunds |

169 |

|

|

(15) |

|

|

|

| Non-cash investing and financing activities |

|

|

|

|

|

|

|

|

|

|

|

| Operating lease right-of-use assets obtained in exchange for operating lease liabilities |

$ |

1,011 |

|

|

— |

|

|

|

| Reduction of right-of-use assets due to modification or exit |

$ |

— |

|

|

$ |

1,039 |

|

|

|

Other accrued liability recorded for treasury stock purchases |

$ |

3,004 |

|

|

— |

|

|

|

|

|

|

|

|

|

(See accompanying Notes to Unaudited Condensed Consolidated Financial Statements) |

|

|

EVENTBRITE, INC.

Notes to Unaudited Condensed Consolidated Financial Statements

1. Overview and Basis of Presentation

Description of Business

Eventbrite, Inc. (Eventbrite or the Company) operates a two-sided marketplace that connects millions of creators and consumers every month to share their passions, artistry, and causes through live experiences. Creators use the Company's highly-scalable self-service ticketing and marketing tools to plan, promote, and sell tickets to their events and event seekers use the Company's website and mobile application to discover and purchase tickets to experiences they love.

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP) and the applicable rules and regulations of the Securities and Exchange Commission (SEC) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements.

The accompanying unaudited condensed consolidated financial statements have been prepared on the same basis as the audited consolidated financial statements and, in the opinion of management, reflect all adjustments of a normal and recurring nature considered necessary to state fairly the Company's consolidated financial position, results of operations and cash flows for the interim periods. The condensed consolidated balance sheet at December 31, 2023 has been derived from audited consolidated financial statements as of that date. All intercompany transactions and balances have been eliminated. The interim results for the three months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024 or for any other future annual or interim period.

The information included in this Quarterly Report on Form 10-Q should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Quantitative and Qualitative Disclosures About Market Risk" and the Consolidated Financial Statements and notes thereto included in Items 7, 7A and 8, respectively, in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 (2023 Form 10-K).

Reclassifications

Certain reclassifications may have been made to the Company's prior year’s condensed consolidated financial statements to conform to the Company's current year presentation. These reclassifications had no effect on the Company's previously reported loss before income taxes.

Significant Accounting Policies

There have been no changes to the Company's significant accounting policies described in the 2023 Form 10-K that have had a material impact on the Company's unaudited condensed consolidated financial statements and related notes.

Use of Estimates

In order to conform with U.S. GAAP, the Company is required to make certain estimates, judgments and assumptions when preparing its condensed consolidated financial statements. These estimates, judgments and assumptions affect the reported assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenue and expenses during the reported periods. These estimates include, but are not limited to, the recoverability of creator signing fees and creator advances, chargebacks and refunds reserve, certain assumptions used in the valuation of equity awards, assumptions used in determining the fair value of business combinations, the allowance for credit losses, and indirect tax reserves. The Company evaluates these estimates on an ongoing basis. Actual results could differ from those estimates and such differences could be material to the Company’s condensed consolidated financial statements.

Comprehensive Loss

For all periods presented, comprehensive loss equaled net loss. Therefore, the condensed consolidated statements of comprehensive loss have been omitted from the unaudited condensed consolidated financial statements.

Segment Information

The Company’s Chief Executive Officer (CEO) is the chief operating decision maker. The Company's CEO reviews discrete financial information presented on a consolidated basis for purposes of allocating resources and evaluating the Company’s financial performance. Accordingly, the Company has determined that it operates as a single operating segment and has one reportable segment.

2. Restructuring

In February 2023, the Board of Directors of the Company approved a restructuring plan (the Plan) designed to reduce operating costs, drive efficiencies by consolidating development and support talent into regional hubs, and enable investment for potential long-term growth.

The Company incurred costs of $0.1 million in connection with the Plan during the three months ended March 31, 2024, which consisted of costs related to severance and other employee termination benefits.

A summary of the restructuring related costs for the three months ended March 31, 2024 as follows (in thousands):

|

|

|

|

|

|

|

Severance and other termination benefits |

| Cost of net revenue |

$ |

59 |

|

| Product development |

42 |

|

|

|

| General and administrative |

34 |

|

| Total |

$ |

135 |

|

The restructuring related costs incurred to date were $16.4 million, which consists of $12.0 million in costs related to severance, and other employee termination benefits, and $4.4 million primarily related to lease abandonment costs.

The following table is a summary of the changes in the restructuring related liabilities, included within accrued compensation and benefits and other accrued liabilities on the condensed consolidated balance sheets, associated with the Plan (in thousands):

|

|

|

|

|

|

|

|

|

| Balance as of January 1, 2023 |

|

$ |

— |

|

| Restructuring related costs accrued |

|

16,294 |

|

Cash payment |

|

(9,770) |

|

Non-cash items applied |

|

(4,388) |

|

| Balance as of December 31, 2023 |

|

2,136 |

|

| Restructuring related costs accrued |

|

135 |

|

| Cash payment |

|

$ |

(1,944) |

|

| Balance as of March 31, 2024 |

|

$ |

327 |

|

3. Revenue Recognition

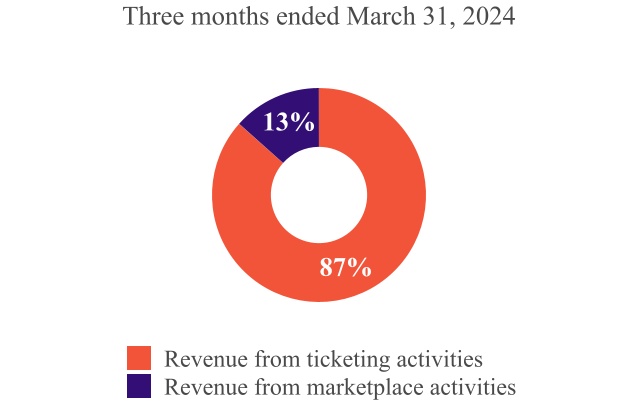

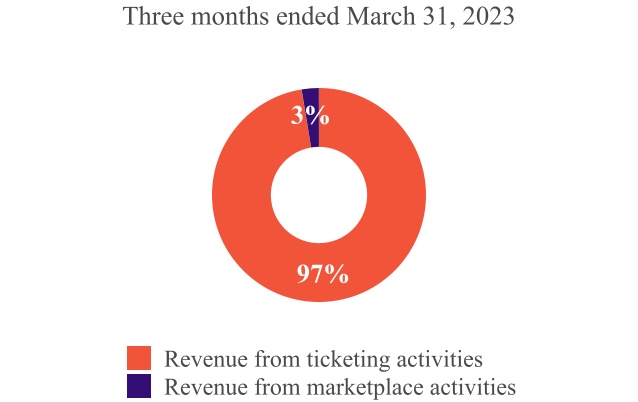

The Company derives its revenues from a mix of marketplace activities. Revenue is primarily derived from ticketing fees and payment processing fees. The Company also derives a portion of revenues from organizer fees and advertising services. The Company's customers are event creators who use the Company's platform to sell tickets and market events to consumers. Revenue is recognized when or as control of the promised goods or services is transferred to customers, in an amount that reflects the consideration the Company expects to receive in exchange for those goods or services.

Ticketing Revenue

For ticketing services, the Company's service provides a platform to the event creator and consumer to transact. The Company's performance obligation is to facilitate and process that transaction and issue the ticket, and ticketing revenue is recognized by the Company when the ticket is sold. The amount that the Company earns for its ticketing services is fixed which typically consists of a flat fee and a percentage-based fee per ticket. As a result, the Company records ticketing revenue on a net basis related to its ticketing service fees.

For payment processing services, the Company provides the event creator with the choice of whether to use Eventbrite Payment Processing (EPP) or to use a third-party payment processor, referred to as Facilitated Payment Processing (FPP).

Under the EPP option, the Company is the merchant of record and is responsible for processing the transaction and collecting the face value of the ticket and all associated fees at the time the ticket is sold. The Company is also responsible for remitting these amounts collected, less the Company's fees, to the event creator. For EPP services, the Company determined that it is the principal in providing the service as the Company is responsible for fulfilling the promise to process the payment and has discretion in establishing the price of its service. As a result, the Company records revenue on a gross basis related to its EPP service fees. Costs incurred for processing the ticketing transactions are included in cost of net revenues in the condensed consolidated statements of operations. Under the FPP option, the Company is not responsible for processing the transaction or collecting the face value of the ticket and associated fees. In this case, the Company records revenue on a net basis related to its FPP service fees.

Revenue is presented net of indirect taxes, customer refunds, payment chargebacks, estimated uncollectible amounts, creator royalties, and amortization of creator signing fees. As part of our commercial agreements, the Company offers upfront payments to qualifying creators entering into new or renewed ticketing arrangements in order to incentivize them to organize certain events on the Company's platform or obtain exclusive rights to ticket their events.

If an event is canceled by a creator, then any obligations to provide refunds to event attendees are the responsibility of that creator. If a creator is unwilling or unable to fulfill their refund obligations, the Company may, at its discretion, provide attendee refunds.

Advertising Revenue

Advertising revenue represents services that enable creators to promote featured content on the Eventbrite platform or mobile application. The Company considers that it satisfies its performance obligation as it provides the services to customers and recognizes revenue as advertising impressions are displayed to consumers.

Organizer Fee Revenue

In the second quarter of 2023, the Company expanded access to its comprehensive suite of event marketing tools to all creators and introduced new pricing plans and subscription packages to creators when publishing events on the Eventbrite marketplace. Under the new pricing plans, the Company charges an organizer fee under two plan options.

The Flex plan is charged per event. The Company considers that it satisfies its performance obligation as it provides services to creators to publish their event on the Eventbrite marketplace and recognizes revenue, based on the ticket capacity selected, at that point-in-time. The Pro plan is a monthly or annual subscription to publish unlimited events. The Company considers that it satisfies its performance obligation as it provides the subscribed services under the plan and recognizes revenue ratably over the subscription period. Organizer fees are nonrefundable.

4. Cash, Cash Equivalents and Restricted Cash

The Company considers all highly liquid financial instruments, including bank deposits, money market funds and U.S. Treasury securities with an original maturity of three months or less at the date of purchase, to be cash equivalents. Due to the short-term nature of the instruments, the carrying amounts reported in the condensed consolidated balance sheets approximate their fair value.

Cash and cash equivalents balances include the face value of tickets sold on behalf of creators and their share of service charges, which are to be remitted to the creators. Such balances were $324.8 million and $259.2 million as of March 31, 2024 and December 31, 2023, respectively. These ticketing proceeds are legally unrestricted, and the Company invests a portion of ticketing proceeds in U.S. Treasury bills with original maturities greater than three months and less than one year. These amounts due to creators are included in accounts payable, creators on the condensed consolidated balance sheets.

During 2023, the Company issued letters of credit relating to contracts entered into with other parties under lease agreements and other agreements which were collateralized with cash. This cash was classified as noncurrent restricted cash on the condensed consolidated balance sheets. The following table provides a reconciliation of cash and cash equivalents and restricted cash reported within the condensed consolidated balance sheets that sum to the total of the same amounts shown in the condensed consolidated statements of cash flows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

March 31, 2023 |

| Cash and cash equivalents |

$ |

579,940 |

|

|

$ |

489,200 |

|

|

$ |

518,446 |

|

| Restricted cash |

— |

|

|

— |

|

|

882 |

|

| Total cash, cash equivalents and restricted cash |

$ |

579,940 |

|

|

$ |

489,200 |

|

|

$ |

519,328 |

|

5. Short-term Investments

The Company invests certain of its excess cash in short-term debt instruments which consist of U.S. Treasury bills with original maturities greater than three months and less than one year. All short-term investments are classified as held-to-maturity and are recorded and held at amortized cost. Investments are considered to be impaired when a decline in fair value is deemed to be other-than-temporary. Once a decline in fair value is determined to be other-than-temporary, the carrying value of an instrument is adjusted to its fair value on a non-recurring basis. No such fair value impairment was recognized during the three months ended March 31, 2024 and year ended December 31, 2023.

The following tables summarize the Company's financial instruments that were measured at fair value on a non-recurring basis (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

| Description |

Classification |

|

Amortized cost |

|

Gross unrecognized holding gains |

|

Gross unrecognized holdings losses |

|

Aggregate fair value |

| Savings deposits |

Cash equivalents |

|

$ |

93,926 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

93,926 |

|

|

|

|

|

|

|

|

|

|

|

| US Treasury securities |

Short-term investments |

|

113,703 |

|

|

— |

|

|

(13) |

|

|

113,690 |

|

|

|

|

$ |

207,629 |

|

|

$ |

— |

|

|

$ |

(13) |

|

|

$ |

207,616 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

| Description |

Classification |

|

Amortized cost |

|

Gross unrecognized holding gains |

|

Gross unrecognized holdings losses |

|

Aggregate fair value |

| Savings deposits |

Cash equivalents |

|

$ |

51,487 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

51,487 |

|

|

|

|

|

|

|

|

|

|

|

| US Treasury securities |

Short-term investments |

|

153,746 |

|

|

17 |

|

|

(12) |

|

|

153,751 |

|

|

|

|

$ |

205,233 |

|

|

$ |

17 |

|

|

$ |

(12) |

|

|

$ |

205,238 |

|

|

|

|

|

|

|

|

|

|

|

6. Funds Receivable

Funds receivable represents cash-in-transit from third-party payment processors that is received by the Company within approximately five business days from the date of the underlying ticketing transaction. For periods ending on a weekend or a bank holiday, the funds receivable balance will typically be higher than for periods ending on a weekday, as the Company settles payment processing activity on business days. The funds receivable balance includes the face value of tickets sold on behalf of creators and their share of service charges, which amounts are to be remitted to the creators. Such amounts were $32.1 million and $44.2 million as of March 31, 2024 and December 31, 2023, respectively.

7. Accounts Receivable, Net

Accounts receivable, net is comprised of invoiced amounts to customers who use a third-party facilitated payment processor (FPP). In evaluating the Company’s ability to collect outstanding receivable balances, the Company considers various factors including the age of the balance, the creditworthiness of the customer and the customer’s current financial condition. Accounts receivable deemed uncollectible are charged against the allowance for credit losses when identified. The following table summarizes the Company’s accounts receivable balance (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

| Accounts receivable, customers |

$ |

4,237 |

|

|

$ |

3,524 |

|

| Allowance for credit losses |

(923) |

|

|

(710) |

|

| Accounts receivable, net |

$ |

3,314 |

|

|

$ |

2,814 |

|

8. Creator Signing Fees, Net

Creator signing fees are incentives that are offered and paid by the Company to secure exclusive ticketing and payment processing rights with certain creators. Creator signing fees are presented net of reserves on the condensed consolidated balance sheet. The benefit the Company receives by securing exclusive ticketing and payment processing rights with certain creators from creator signing fees is inseparable from the customer relationship with the creators and accordingly the amortization of these fees is recorded as a reduction of revenue in the condensed consolidated statements of operations.

As of March 31, 2024, the balance of creator signing fees, net is being amortized over a weighted-average remaining contract life of 2.3 years on a straight-line basis. The following table summarizes the activity in creator signing fees for the periods indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

| Balance, beginning of period |

$ |

1,937 |

|

|

$ |

1,748 |

|

|

|

|

|

| Creator signing fees paid |

221 |

|

|

— |

|

|

|

|

|

| Amortization of creator signing fees |

(194) |

|

|

(210) |

|

|

|

|

|

| Write-offs and other adjustments |

(31) |

|

|

410 |

|

|

|

|

|

| Balance, end of period |

$ |

1,933 |

|

|

$ |

1,948 |

|

|

|

|

|

Creator signing fees are classified as follows on the condensed consolidated balance sheet as of the dates indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

March 31, 2023 |

| Creator signing fees, net |

$ |

651 |

|

|

$ |

634 |

|

|

$ |

792 |

|

| Creator signing fees, net noncurrent |

1,282 |

|

|

1,303 |

|

|

1,156 |

|

| Total creator signing fees |

$ |

1,933 |

|

|

$ |

1,937 |

|

|

$ |

1,948 |

|

9. Creator Advances, Net

Creator advances are incentives that are offered by the Company which provide the creator with funds in advance of the event. Creator advances are presented net of reserves on the condensed consolidated balance sheet. These are subsequently recovered by withholding amounts due to the Company from the sale of tickets for the event until the creator payment has been fully recovered.

The following table summarizes the activity in creator advances for the periods indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

| Balance, beginning of period |

$ |

2,804 |

|

|

$ |

721 |

|

|

|

|

|

| Creator advances paid |

2,987 |

|

|

— |

|

|

|

|

|

| Creator advances recouped |

(173) |

|

|

(302) |

|

|

|

|

|

| Write-offs and other adjustments |

8 |

|

|

165 |

|

|

|

|

|

Balance, end of period |

$ |

5,626 |

|

|

$ |

584 |

|

|

|

|

|

10. Accounts Payable, Creators

Accounts payable, creators consists of unremitted ticket sale proceeds, net of Eventbrite service fees and applicable taxes. Amounts are remitted to creators within five business days subsequent to the completion of the related event. Creators may apply to receive a portion of these proceeds prior to completion of their events.

For qualified creators, the Company passes ticket sales proceeds to the creator prior to the event, subject to certain limitations. Internally, the Company refers to these payments as advance payouts. When an advance payout is made, the Company reduces its cash and cash equivalents with a corresponding decrease to its accounts payable, creators. As of March 31, 2024 and December 31, 2023, advance payouts outstanding was $153.9 million and $115.3 million, respectively.

11. Chargebacks and Refunds Reserve

The terms of the Company's standard merchant agreement obligate creators to reimburse attendees who are entitled to refunds. The Company records estimates for refunds and chargebacks of its fees as contra-revenue. When the Company provides advance payouts, it assumes risk that the event may be canceled, fraudulent, or materially not as described, resulting in significant chargebacks and refund requests. See Note 10, “Accounts Payable, Creators.” If the creator is insolvent, has spent the proceeds of the ticket sales for event-related costs, has canceled the event, or has engaged in fraudulent activity, the Company may not be able to recover its losses from these events, and such unrecoverable amounts could equal the value of the transaction or transactions settled to the creator prior to the event that is disputed, plus any associated chargeback fees not assumed by the creator. The Company records reserves for estimated advance payout losses as an operating expense classified within sales, marketing and support.

Reserves are recorded based on the Company's assessment of various factors, including the amounts paid and outstanding to creators in conjunction with the advance payout program, macroeconomic conditions, and actual chargeback and refund activity trends. The chargebacks and refunds reserve was $8.7 million and $8.1 million, which primarily includes reserve balances for estimated advance payout losses of $5.4 million and $6.0 million, as of March 31, 2024 and December 31, 2023, respectively.

The Company will adjust reserves in the future to reflect best estimates of future outcomes. The Company cannot predict the outcome of or estimate the possible recovery or range of recovery from these matters. It is possible that the reserve amount will not be sufficient and the Company's actual losses could be materially different from its current estimates.

12. Property and Equipment, Net

Property and equipment, net consisted of the following as of the dates indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

| Capitalized internal-use software development costs |

|

$ |

65,433 |

|

|

$ |

62,615 |

|

| Furniture and fixtures |

|

179 |

|

|

179 |

|

| Computers and computer equipment |

|

3,905 |

|

|

3,617 |

|

| Leasehold improvements |

|

924 |

|

|

924 |

|

|

|

|

|

|

| Property and equipment |

|

70,441 |

|

|

67,335 |

|

| Less: Accumulated depreciation and amortization |

|

(59,452) |

|

|

(57,951) |

|

| Property and equipment, net |

|

$ |

10,989 |

|

|

$ |

9,384 |

|

The Company recorded the following amounts related to depreciation of fixed assets and capitalized internal-use software development costs during the periods indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

| Depreciation expense |

$ |

207 |

|

|

$ |

479 |

|

|

|

|

|

| Amortization of capitalized internal-use software development costs |

1,296 |

|

|

822 |

|

|

|

|

|

13. Leases

Operating Leases

The Company has operating leases primarily for office space. Operating lease right-of-use assets and operating lease liabilities are recognized at the lease commencement date based on the present value of the lease payments over the lease term. Right-of-use assets also include adjustments related to prepaid or deferred lease payments and lease incentives. In calculating the present value of the lease payments, the Company utilizes its incremental borrowing rate, as the rates implicit in the leases were not readily determinable. The incremental borrowing rate is estimated to approximate the interest rate on a collateralized basis with similar terms and payments, and in economic environments where the leased asset is located.

The components of operating lease costs were as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

| Operating lease costs |

$ |

133 |

|

|

$ |

1,875 |

|

|

|

|

|

| Sublease income |

— |

|

|

(52) |

|

|

|

|

|

| Total operating lease costs, net |

$ |

133 |

|

|

$ |

1,823 |

|

|

|

|

|

As of March 31, 2024, the Company's operating leases had a weighted-average remaining lease term of 2.0 years and a weighted-average discount rate of 4.6%.

As of March 31, 2024, maturities of operating lease liabilities were as follows (in thousands):

|

|

|

|

|

|

|

Operating Leases |

| The remainder of 2024 |

$ |

1,546 |

|

| 2025 |

2,117 |

|

| 2026 |

372 |

|

|

|

| Total future operating lease payments |

4,035 |

|

|

|

| Less: Imputed interest |

(176) |

|

| Total operating lease liabilities |

$ |

3,859 |

|

|

|

| Operating lease liabilities, current |

$ |

1,937 |

|

| Operating lease liabilities, noncurrent |

1,922 |

|

| Total operating lease liabilities |

$ |

3,859 |

|

14. Goodwill and Acquired Intangible Assets, Net

The carrying amounts of the Company's goodwill was $174.4 million as of March 31, 2024 and December 31, 2023. The Company tests goodwill for impairment at least annually, in the fourth quarter, or whenever events or changes in circumstances would more likely than not reduce the fair value of its single reporting unit below its carrying value. The Company did not record any goodwill impairment during the three months ended March 31, 2024.

Acquired intangible assets consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

Cost |

|

Accumulated Amortization |

|

Net Book Value |

|

Cost |

|

Accumulated Amortization |

|

Net Book Value |

| Developed technology |

$ |

22,396 |

|

|

$ |

(21,885) |

|

|

$ |

511 |

|

|

$ |

22,396 |

|

|

$ |

(21,679) |

|

|

$ |

717 |

|

| Customer relationships |

74,884 |

|

|

(64,172) |

|

|

10,712 |

|

|

74,884 |

|

|

(62,287) |

|

|

12,597 |

|

| Tradenames |

1,350 |

|

|

(1,350) |

|

|

— |

|

|

1,350 |

|

|

(1,350) |

|

|

— |

|

| Acquired intangible assets, net |

$ |

98,630 |

|

|

$ |

(87,407) |

|

|

$ |

11,223 |

|

|

$ |

98,630 |

|

|

$ |

(85,316) |

|

|

$ |

13,314 |

|

The following table set forth the amortization expense recorded related to acquired intangible assets during the periods indicated (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

2023 |

|

|

|

|

| Cost of net revenue |

$ |

206 |

|

|

$ |

203 |

|

|

|

|

|

| Sales, marketing and support |

1,885 |

|

|

2,027 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total amortization of acquired intangible assets |

$ |

2,091 |

|

|

$ |

2,230 |

|

|

|

|

|

As of March 31, 2024, the total expected future amortization expense of acquired intangible assets by year is as follows (in thousands):

|

|

|

|

|

|

| The remainder of 2024 |

$ |

6,209 |

|

| 2025 |

5,014 |

|

|

|

| Total expected future amortization expense |

$ |

11,223 |

|

|

|

|

|

15. Fair Value Measurement

The Company measures its financial assets and liabilities at fair value at each reporting date using a fair value hierarchy that requires the Company to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s classification within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. Three levels of inputs may be used to measure fair value:

Level 1 – Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

Level 2 – Other inputs that are directly or indirectly observable in the marketplace.

Level 3 – Unobservable inputs that are supported by little or no market activity.

The Company’s cash equivalents, funds receivable, accounts receivable, accounts payable and other current liabilities approximate their fair value. All of these financial assets and liabilities are Level 1, except for debt. See Note 16, “Debt,” for details regarding the fair value of the Company's convertible senior notes.

16. Debt

As of March 31, 2024 and December 31, 2023, long-term debt consisted of the following (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

December 31, 2023 |

|

2026 Notes |

|

2025 Notes |

|

Total |

|

2026 Notes |

|

2025 Notes |

|

Total |

| Outstanding principal balance |

$ |

212,750 |

|

|

$ |

150,000 |

|

|

$ |

362,750 |

|

|

$ |

212,750 |

|

|

$ |

150,000 |

|

|

$ |

362,750 |

|

| Less: Debt issuance costs |

(2,606) |

|

|

(1,950) |

|

|

(4,556) |

|

|

(2,864) |

|

|

(2,218) |

|

|

(5,082) |

|

| Carrying amount, long-term debt |

$ |

210,144 |

|

|

$ |

148,050 |

|

|

$ |

358,194 |

|

|

$ |

209,886 |

|

|

$ |

147,782 |

|

|

$ |

357,668 |

|

The following tables set forth the total interest expense recognized related to the term loans and the convertible notes for the periods indicated (in thousands):

|

|

|

|

|