| Texas | 001-38280 | 20-8339782 | ||||||

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) | ||||||

| £ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| £ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| £ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| £ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class |

Trading

Symbol(s)

|

Name of each exchange on which registered | ||||||||||||

| Common stock, par value $0.01 per share | STEL | New York Stock Exchange | ||||||||||||

| Exhibit Number | Description of Exhibit | ||||

| 99.1 | |||||

| 99.2 | |||||

| 99.3 | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

STELLAR BANCORP, INC. |

||||||||

| Date: October 25, 2024 | By: | /s/ Paul P. Egge | ||||||

| Paul P. Egge | ||||||||

| Chief Financial Officer | ||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||

| September 30 | June 30 | March 31 | December 31 | September 30 | |||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| ASSETS | |||||||||||||||||||||||||||||

| Cash and due from banks | $ | 103,735 | $ | 110,341 | $ | 74,663 | $ | 121,004 | $ | 94,970 | |||||||||||||||||||

| Interest-bearing deposits at other financial institutions | 412,482 | 379,909 | 325,079 | 278,233 | 207,302 | ||||||||||||||||||||||||

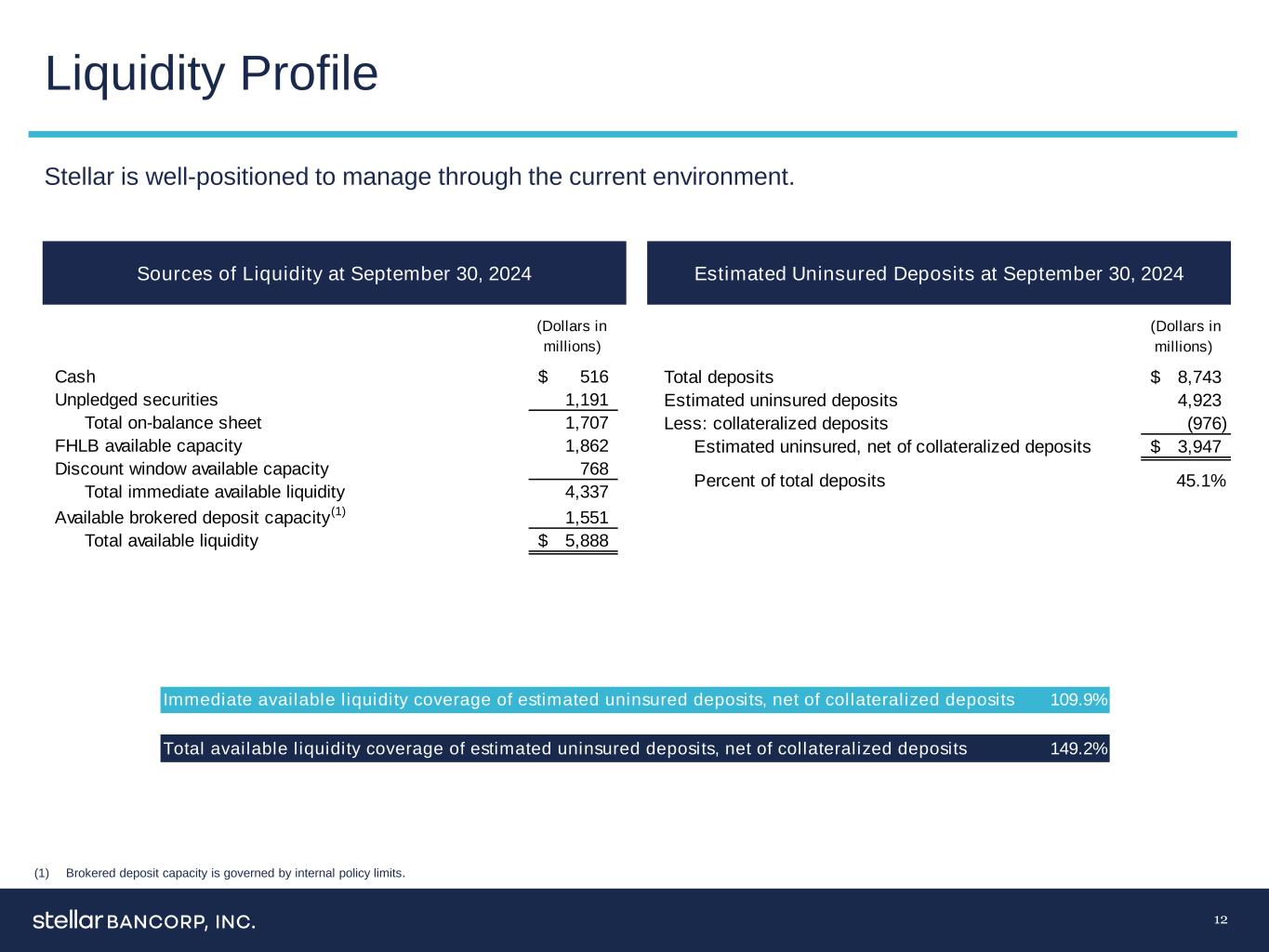

| Total cash and cash equivalents | 516,217 | 490,250 | 399,742 | 399,237 | 302,272 | ||||||||||||||||||||||||

| Available for sale securities, at fair value | 1,691,752 | 1,630,971 | 1,523,100 | 1,395,680 | 1,414,952 | ||||||||||||||||||||||||

| Loans held for investment | 7,551,124 | 7,713,897 | 7,908,111 | 7,925,133 | 8,004,528 | ||||||||||||||||||||||||

| Less: allowance for credit losses on loans | (84,501) | (94,772) | (96,285) | (91,684) | (93,575) | ||||||||||||||||||||||||

| Loans, net | 7,466,623 | 7,619,125 | 7,811,826 | 7,833,449 | 7,910,953 | ||||||||||||||||||||||||

| Accrued interest receivable | 39,473 | 43,348 | 45,466 | 44,244 | 43,536 | ||||||||||||||||||||||||

| Premises and equipment, net | 113,742 | 113,984 | 115,698 | 118,683 | 119,332 | ||||||||||||||||||||||||

| Federal Home Loan Bank stock | 20,123 | 15,089 | 16,050 | 25,051 | 29,022 | ||||||||||||||||||||||||

| Bank-owned life insurance | 106,876 | 106,262 | 105,671 | 105,084 | 104,699 | ||||||||||||||||||||||||

| Goodwill | 497,318 | 497,318 | 497,318 | 497,318 | 497,318 | ||||||||||||||||||||||||

| Core deposit intangibles, net | 98,116 | 104,315 | 110,513 | 116,712 | 122,944 | ||||||||||||||||||||||||

| Other assets | 79,537 | 103,001 | 103,838 | 111,681 | 120,432 | ||||||||||||||||||||||||

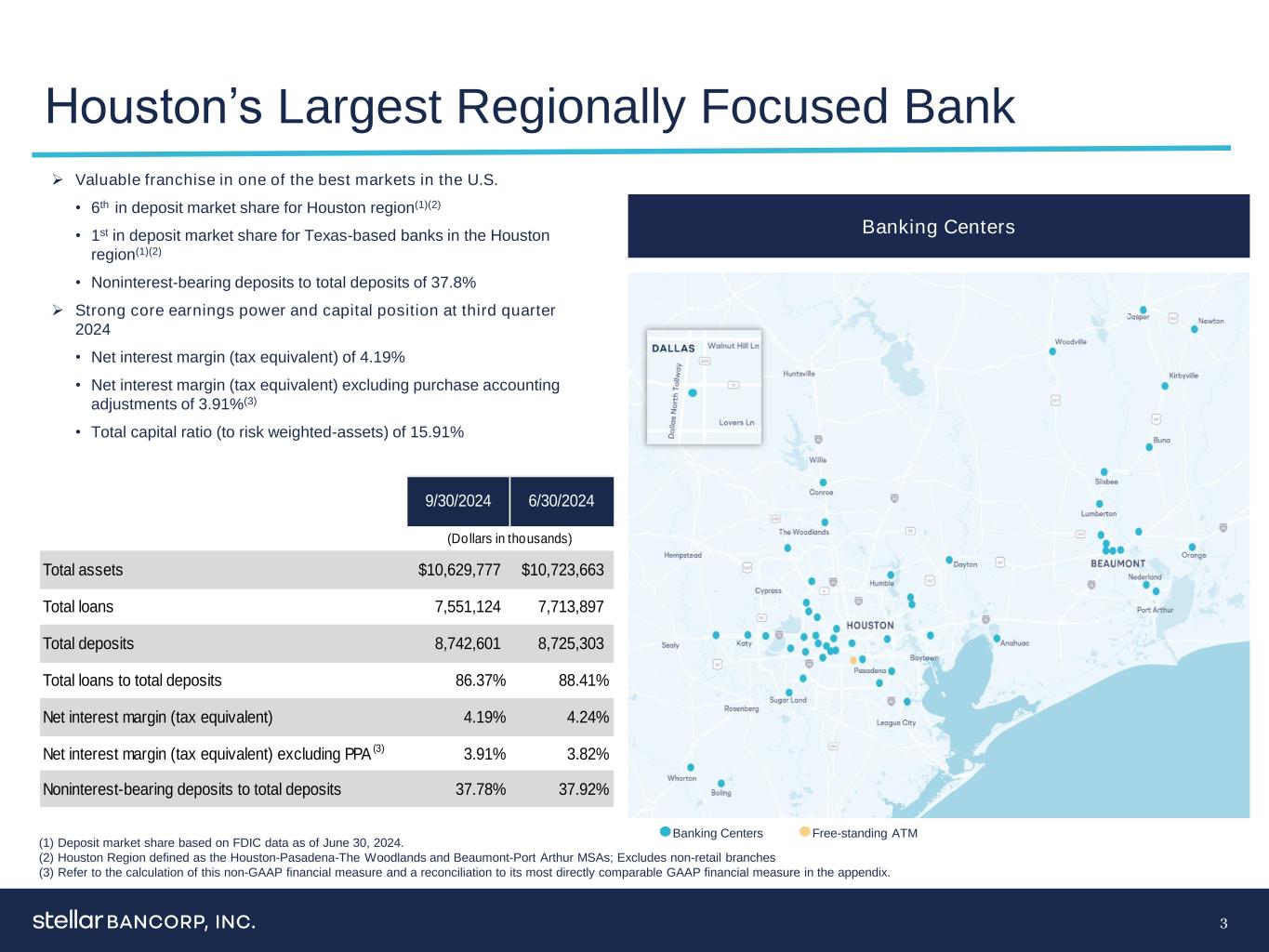

| Total assets | $ | 10,629,777 | $ | 10,723,663 | $ | 10,729,222 | $ | 10,647,139 | $ | 10,665,460 | |||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||||||||||||||||||||

| LIABILITIES: | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

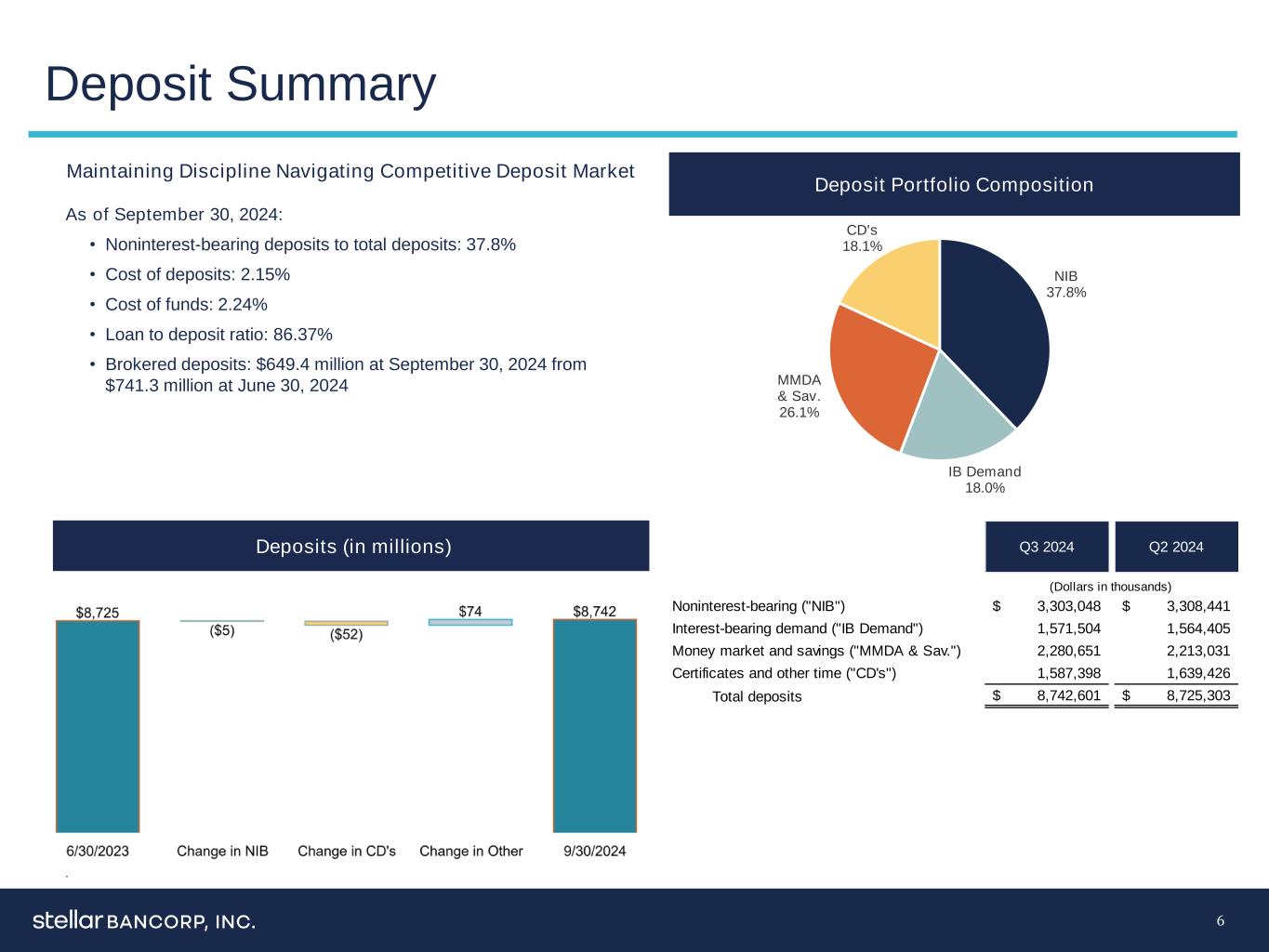

| Noninterest-bearing | $ | 3,303,048 | $ | 3,308,441 | $ | 3,323,149 | $ | 3,546,815 | $ | 3,656,288 | |||||||||||||||||||

| Interest-bearing | |||||||||||||||||||||||||||||

| Demand | 1,571,504 | 1,564,405 | 1,576,261 | 1,659,999 | 1,397,492 | ||||||||||||||||||||||||

| Money market and savings | 2,280,651 | 2,213,031 | 2,203,767 | 2,136,777 | 2,128,950 | ||||||||||||||||||||||||

| Certificates and other time | 1,587,398 | 1,639,426 | 1,691,539 | 1,529,876 | 1,503,891 | ||||||||||||||||||||||||

| Total interest-bearing deposits | 5,439,553 | 5,416,862 | 5,471,567 | 5,326,652 | 5,030,333 | ||||||||||||||||||||||||

| Total deposits | 8,742,601 | 8,725,303 | 8,794,716 | 8,873,467 | 8,686,621 | ||||||||||||||||||||||||

| Accrued interest payable | 16,915 | 12,327 | 12,227 | 11,288 | 7,612 | ||||||||||||||||||||||||

| Borrowed funds | 60,000 | 240,000 | 215,000 | 50,000 | 323,981 | ||||||||||||||||||||||||

| Subordinated debt | 110,064 | 109,964 | 109,864 | 109,765 | 109,665 | ||||||||||||||||||||||||

| Other liabilities | 74,074 | 70,274 | 66,717 | 81,601 | 76,735 | ||||||||||||||||||||||||

| Total liabilities | 9,003,654 | 9,157,868 | 9,198,524 | 9,126,121 | 9,204,614 | ||||||||||||||||||||||||

| SHAREHOLDERS’ EQUITY: | |||||||||||||||||||||||||||||

| Common stock | 535 | 536 | 536 | 533 | 533 | ||||||||||||||||||||||||

| Capital surplus | 1,238,619 | 1,238,477 | 1,235,221 | 1,232,627 | 1,231,686 | ||||||||||||||||||||||||

| Retained earnings | 474,905 | 447,948 | 425,130 | 405,945 | 385,600 | ||||||||||||||||||||||||

| Accumulated other comprehensive loss | (87,936) | (121,166) | (130,189) | (118,087) | (156,973) | ||||||||||||||||||||||||

| Total shareholders’ equity | 1,626,123 | 1,565,795 | 1,530,698 | 1,521,018 | 1,460,846 | ||||||||||||||||||||||||

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 10,629,777 | $ | 10,723,663 | $ | 10,729,222 | $ | 10,647,139 | $ | 10,665,460 | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||

| September 30 | June 30 | March 31 | December 31 | September 30 | September 30 | September 30 | |||||||||||||||||||||||||||||||||||

| INTEREST INCOME: | |||||||||||||||||||||||||||||||||||||||||

| Loans, including fees | $ | 132,372 | $ | 135,885 | $ | 134,685 | $ | 139,114 | $ | 138,948 | $ | 402,942 | $ | 398,608 | |||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||||||||

| Taxable | 13,898 | 11,923 | 9,293 | 9,622 | 9,493 | 35,114 | 28,872 | ||||||||||||||||||||||||||||||||||

| Tax-exempt | 814 | 816 | 818 | 418 | 437 | 2,448 | 2,135 | ||||||||||||||||||||||||||||||||||

| Deposits in other financial institutions | 4,692 | 3,555 | 3,627 | 3,021 | 2,391 | 11,874 | 9,027 | ||||||||||||||||||||||||||||||||||

| Total interest income | 151,776 | 152,179 | 148,423 | 152,175 | 151,269 | 452,378 | 438,642 | ||||||||||||||||||||||||||||||||||

| INTEREST EXPENSE: | |||||||||||||||||||||||||||||||||||||||||

| Demand, money market and savings deposits | 29,440 | 28,399 | 27,530 | 25,033 | 23,557 | 85,369 | 62,302 | ||||||||||||||||||||||||||||||||||

| Certificates and other time deposits | 18,073 | 18,758 | 15,084 | 15,075 | 13,282 | 51,915 | 26,211 | ||||||||||||||||||||||||||||||||||

| Borrowed funds | 840 | 1,700 | 1,774 | 4,154 | 5,801 | 4,314 | 13,653 | ||||||||||||||||||||||||||||||||||

| Subordinated debt | 1,916 | 1,912 | 1,917 | 1,983 | 1,908 | 5,745 | 5,647 | ||||||||||||||||||||||||||||||||||

| Total interest expense | 50,269 | 50,769 | 46,305 | 46,245 | 44,548 | 147,343 | 107,813 | ||||||||||||||||||||||||||||||||||

| NET INTEREST INCOME | 101,507 | 101,410 | 102,118 | 105,930 | 106,721 | 305,035 | 330,829 | ||||||||||||||||||||||||||||||||||

| (Reversal of) provision for credit losses | (5,985) | (1,935) | 4,098 | 1,047 | 2,315 | (3,822) | 7,896 | ||||||||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 107,492 | 103,345 | 98,020 | 104,883 | 104,406 | 308,857 | 322,933 | ||||||||||||||||||||||||||||||||||

| NONINTEREST INCOME: | |||||||||||||||||||||||||||||||||||||||||

| Service charges on deposit accounts | 1,594 | 1,648 | 1,598 | 1,520 | 1,620 | 4,840 | 4,544 | ||||||||||||||||||||||||||||||||||

| Gain (loss) on sale of assets | 432 | (64) | 513 | 198 | — | 881 | 192 | ||||||||||||||||||||||||||||||||||

| Bank-owned life insurance | 614 | 591 | 587 | 573 | 551 | 1,792 | 1,605 | ||||||||||||||||||||||||||||||||||

| Debit card and ATM income | 551 | 543 | 527 | 542 | 935 | 1,621 | 4,454 | ||||||||||||||||||||||||||||||||||

| Other | 3,111 | 2,698 | 3,071 | 4,053 | 1,589 | 8,880 | 6,881 | ||||||||||||||||||||||||||||||||||

| Total noninterest income | 6,302 | 5,416 | 6,296 | 6,886 | 4,695 | 18,014 | 17,676 | ||||||||||||||||||||||||||||||||||

| NONINTEREST EXPENSE: | |||||||||||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 41,123 | 39,061 | 41,376 | 40,464 | 39,495 | 121,560 | 116,570 | ||||||||||||||||||||||||||||||||||

| Net occupancy and equipment | 4,570 | 4,503 | 4,390 | 4,572 | 4,455 | 13,463 | 12,360 | ||||||||||||||||||||||||||||||||||

| Depreciation | 1,911 | 1,948 | 1,964 | 1,955 | 1,952 | 5,823 | 5,629 | ||||||||||||||||||||||||||||||||||

| Data processing and software amortization | 5,706 | 5,501 | 4,894 | 5,000 | 4,798 | 16,101 | 14,526 | ||||||||||||||||||||||||||||||||||

| Professional fees | 1,714 | 1,620 | 2,662 | 3,867 | 997 | 5,996 | 4,088 | ||||||||||||||||||||||||||||||||||

| Regulatory assessments and FDIC insurance | 1,779 | 2,299 | 1,854 | 5,169 | 1,814 | 5,932 | 5,863 | ||||||||||||||||||||||||||||||||||

| Amortization of intangibles | 6,212 | 6,215 | 6,212 | 6,247 | 6,876 | 18,639 | 20,636 | ||||||||||||||||||||||||||||||||||

| Communications | 827 | 847 | 937 | 743 | 663 | 2,611 | 2,053 | ||||||||||||||||||||||||||||||||||

| Advertising | 878 | 891 | 765 | 1,004 | 877 | 2,534 | 2,623 | ||||||||||||||||||||||||||||||||||

| Acquisition and merger-related expenses | — | — | — | 3,072 | 3,421 | — | 12,483 | ||||||||||||||||||||||||||||||||||

| Other | 6,346 | 8,331 | 6,356 | 5,848 | 5,400 | 21,033 | 15,722 | ||||||||||||||||||||||||||||||||||

| Total noninterest expense | 71,066 | 71,216 | 71,410 | 77,941 | 70,748 | 213,692 | 212,553 | ||||||||||||||||||||||||||||||||||

| INCOME BEFORE INCOME TAXES | 42,728 | 37,545 | 32,906 | 33,828 | 38,353 | 113,179 | 128,056 | ||||||||||||||||||||||||||||||||||

| Provision for income taxes | 8,837 | 7,792 | 6,759 | 6,562 | 7,445 | 23,388 | 24,825 | ||||||||||||||||||||||||||||||||||

| NET INCOME | $ | 33,891 | $ | 29,753 | $ | 26,147 | $ | 27,266 | $ | 30,908 | $ | 89,791 | $ | 103,231 | |||||||||||||||||||||||||||

| EARNINGS PER SHARE | |||||||||||||||||||||||||||||||||||||||||

| Basic | $ | 0.63 | $ | 0.56 | $ | 0.49 | $ | 0.51 | $ | 0.58 | $ | 1.68 | $ | 1.94 | |||||||||||||||||||||||||||

| Diluted | $ | 0.63 | $ | 0.56 | $ | 0.49 | $ | 0.51 | $ | 0.58 | $ | 1.68 | $ | 1.94 | |||||||||||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||

| September 30 | June 30 | March 31 | December 31 | September 30 | September 30 | September 30 | |||||||||||||||||||||||||||||||||||

| (Dollars and share amounts in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 33,891 | $ | 29,753 | $ | 26,147 | $ | 27,266 | $ | 30,908 | $ | 89,791 | $ | 103,231 | |||||||||||||||||||||||||||

| Earnings per share, basic | $ | 0.63 | $ | 0.56 | $ | 0.49 | $ | 0.51 | $ | 0.58 | $ | 1.68 | $ | 1.94 | |||||||||||||||||||||||||||

| Earnings per share, diluted | $ | 0.63 | $ | 0.56 | $ | 0.49 | $ | 0.51 | $ | 0.58 | $ | 1.68 | $ | 1.94 | |||||||||||||||||||||||||||

| Dividends per share | $ | 0.13 | $ | 0.13 | $ | 0.13 | $ | 0.13 | $ | 0.13 | $ | 0.39 | $ | 0.39 | |||||||||||||||||||||||||||

Return on average assets(A) |

1.27 | % | 1.13 | % | 0.98 | % | 1.02 | % | 1.14 | % | 1.13 | % | 1.28 | % | |||||||||||||||||||||||||||

Return on average equity(A) |

8.49 | % | 7.78 | % | 6.88 | % | 7.33 | % | 8.34 | % | 7.73 | % | 9.52 | % | |||||||||||||||||||||||||||

Return on average tangible equity(A)(B) |

13.63 | % | 12.82 | % | 11.47 | % | 12.61 | % | 14.47 | % | 12.67 | % | 16.86 | % | |||||||||||||||||||||||||||

Net interest margin (tax equivalent)(A)(C) |

4.19 | % | 4.24 | % | 4.26 | % | 4.40 | % | 4.37 | % | 4.23 | % | 4.55 | % | |||||||||||||||||||||||||||

Net interest margin (tax equivalent) excluding PAA(A)(B)(C) |

3.91 | % | 3.82 | % | 3.91 | % | 3.91 | % | 3.87 | % | 3.88 | % | 4.07 | % | |||||||||||||||||||||||||||

Efficiency ratio(D) |

66.18 | % | 66.63 | % | 66.18 | % | 69.21 | % | 63.50 | % | 66.33 | % | 61.02 | % | |||||||||||||||||||||||||||

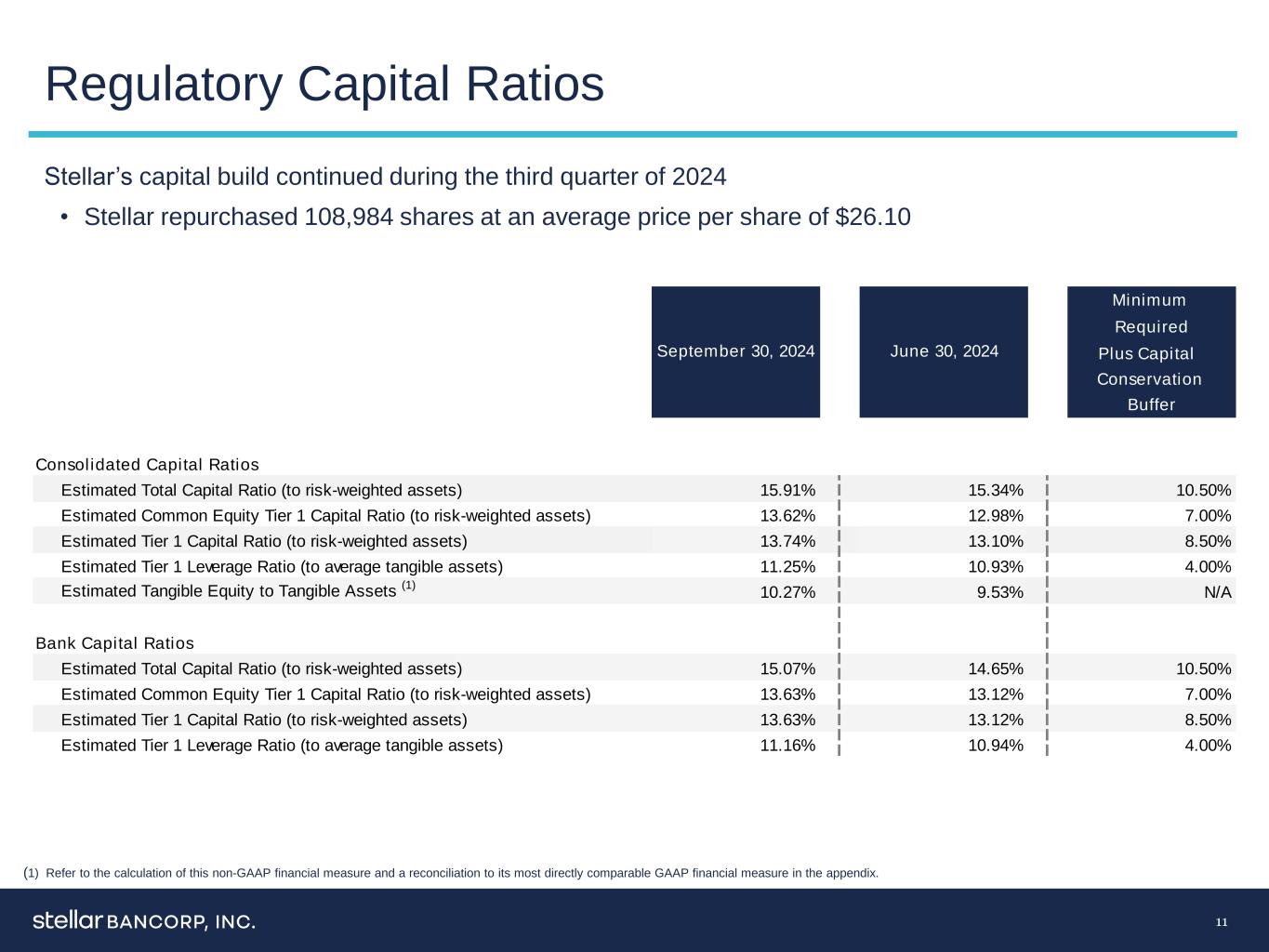

| Capital Ratios | |||||||||||||||||||||||||||||||||||||||||

| Stellar Bancorp, Inc. (Consolidated) | |||||||||||||||||||||||||||||||||||||||||

| Equity to assets | 15.30 | % | 14.60 | % | 14.27 | % | 14.29 | % | 13.70 | % | 15.30 | % | 13.70 | % | |||||||||||||||||||||||||||

Tangible equity to tangible assets(B) |

10.27 | % | 9.53 | % | 9.12 | % | 9.04 | % | 8.37 | % | 10.27 | % | 8.37 | % | |||||||||||||||||||||||||||

| Estimated Total capital ratio (to risk-weighted assets) | 15.91 | % | 15.34 | % | 14.62 | % | 14.02 | % | 13.61 | % | 15.91 | % | 13.61 | % | |||||||||||||||||||||||||||

Estimated Common equity Tier 1 capital (to risk weighted assets) |

13.62 | % | 12.98 | % | 12.29 | % | 11.77 | % | 11.30 | % | 13.62 | % | 11.30 | % | |||||||||||||||||||||||||||

Estimated Tier 1 capital (to risk-weighted assets) |

13.74 | % | 13.10 | % | 12.41 | % | 11.89 | % | 11.41 | % | 13.74 | % | 11.41 | % | |||||||||||||||||||||||||||

Estimated Tier 1 leverage (to average tangible assets) |

11.25 | % | 10.93 | % | 10.55 | % | 10.18 | % | 9.82 | % | 11.25 | % | 9.82 | % | |||||||||||||||||||||||||||

| Stellar Bank | |||||||||||||||||||||||||||||||||||||||||

| Estimated Total capital ratio (to risk-weighted assets) | 15.07 | % | 14.65 | % | 14.13 | % | 13.65 | % | 13.32 | % | 15.07 | % | 13.32 | % | |||||||||||||||||||||||||||

Estimated Common equity Tier 1 capital (to risk-weighted assets) |

13.63 | % | 13.12 | % | 12.61 | % | 12.20 | % | 11.80 | % | 13.63 | % | 11.80 | % | |||||||||||||||||||||||||||

Estimated Tier 1 capital (to risk-weighted assets) |

13.63 | % | 13.12 | % | 12.61 | % | 12.20 | % | 11.80 | % | 13.63 | % | 11.80 | % | |||||||||||||||||||||||||||

Estimated Tier 1 leverage (to average tangible assets) |

11.16 | % | 10.94 | % | 10.72 | % | 10.44 | % | 10.15 | % | 11.16 | % | 10.15 | % | |||||||||||||||||||||||||||

| Other Data | |||||||||||||||||||||||||||||||||||||||||

| Weighted average shares: | |||||||||||||||||||||||||||||||||||||||||

| Basic | 53,541 | 53,572 | 53,343 | 53,282 | 53,313 | 53,485 | 53,211 | ||||||||||||||||||||||||||||||||||

| Diluted | 53,580 | 53,608 | 53,406 | 53,350 | 53,380 | 53,531 | 53,300 | ||||||||||||||||||||||||||||||||||

| Period end shares outstanding | 53,446 | 53,564 | 53,551 | 53,291 | 53,322 | 53,446 | 53,322 | ||||||||||||||||||||||||||||||||||

| Book value per share | $ | 30.43 | $ | 29.23 | $ | 28.58 | $ | 28.54 | $ | 27.40 | $ | 30.43 | $ | 27.40 | |||||||||||||||||||||||||||

Tangible book value per share(B) |

$ | 19.28 | $ | 18.00 | $ | 17.23 | $ | 17.02 | $ | 15.76 | $ | 19.28 | $ | 15.76 | |||||||||||||||||||||||||||

| Employees - full-time equivalents | 1,040 | 1,045 | 1,007 | 998 | 1,008 | 1,040 | 1,008 | ||||||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2024 | June 30, 2024 | September 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest Earned/ Interest Paid |

Average Yield/Rate | Average Balance | Interest Earned/ Interest Paid |

Average Yield/Rate | Average Balance | Interest Earned/ Interest Paid |

Average Yield/Rate | |||||||||||||||||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-Earning Assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

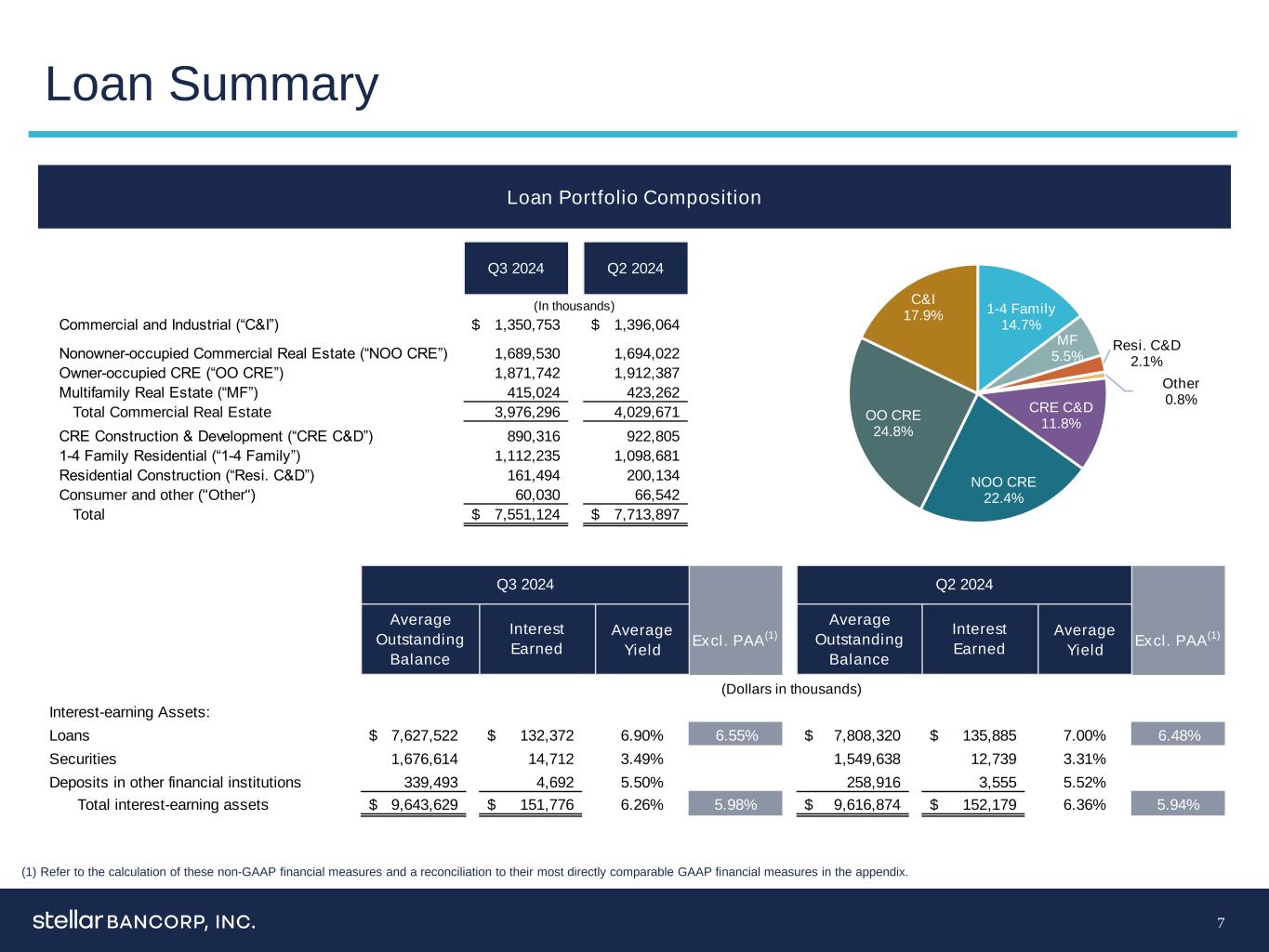

| Loans | $ | 7,627,522 | $ | 132,372 | 6.90 | % | $ | 7,808,320 | $ | 135,885 | 7.00 | % | $ | 8,043,706 | $ | 138,948 | 6.85 | % | |||||||||||||||||||||||||||||||||||

| Securities | 1,676,614 | 14,712 | 3.49 | % | 1,549,638 | 12,739 | 3.31 | % | 1,471,916 | 9,930 | 2.68 | % | |||||||||||||||||||||||||||||||||||||||||

| Deposits in other financial institutions | 339,493 | 4,692 | 5.50 | % | 258,916 | 3,555 | 5.52 | % | 181,931 | 2,391 | 5.21 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-earning assets | 9,643,629 | $ | 151,776 | 6.26 | % | 9,616,874 | $ | 152,179 | 6.36 | % | 9,697,553 | $ | 151,269 | 6.19 | % | ||||||||||||||||||||||||||||||||||||||

| Allowance for credit losses on loans | (94,785) | (96,306) | (99,892) | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 1,077,422 | 1,103,297 | 1,143,634 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total assets | $ | 10,626,266 | $ | 10,623,865 | $ | 10,741,295 | |||||||||||||||||||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-Bearing Liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 1,606,736 | $ | 12,458 | 3.08 | % | $ | 1,545,096 | $ | 12,213 | 3.18 | % | $ | 1,400,508 | $ | 10,415 | 2.95 | % | |||||||||||||||||||||||||||||||||||

| Money market and savings deposits | 2,254,767 | 16,982 | 3.00 | % | 2,227,393 | 16,186 | 2.92 | % | 2,166,610 | 13,142 | 2.41 | % | |||||||||||||||||||||||||||||||||||||||||

| Certificates and other time deposits | 1,620,908 | 18,073 | 4.44 | % | 1,694,536 | 18,758 | 4.45 | % | 1,400,367 | 13,282 | 3.76 | % | |||||||||||||||||||||||||||||||||||||||||

| Borrowed funds | 49,077 | 840 | 6.81 | % | 112,187 | 1,700 | 6.09 | % | 411,212 | 5,801 | 5.60 | % | |||||||||||||||||||||||||||||||||||||||||

| Subordinated debt | 110,007 | 1,916 | 6.93 | % | 109,910 | 1,912 | 7.00 | % | 109,608 | 1,908 | 6.91 | % | |||||||||||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 5,641,495 | $ | 50,269 | 3.54 | % | 5,689,122 | $ | 50,769 | 3.59 | % | 5,488,305 | $ | 44,548 | 3.22 | % | ||||||||||||||||||||||||||||||||||||||

| Noninterest-Bearing Liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 3,303,726 | 3,308,633 | 3,695,592 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Other liabilities | 93,127 | 87,986 | 86,389 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities | 9,038,348 | 9,085,741 | 9,270,286 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,587,918 | 1,538,124 | 1,471,009 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 10,626,266 | $ | 10,623,865 | $ | 10,741,295 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest rate spread | 2.72 | % | 2.77 | % | 2.97 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income and margin | $ | 101,507 | 4.19 | % | $ | 101,410 | 4.24 | % | $ | 106,721 | 4.37 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest income and net interest margin (tax equivalent) | $ | 101,578 | 4.19 | % | $ | 101,482 | 4.24 | % | $ | 106,919 | 4.37 | % | |||||||||||||||||||||||||||||||||||||||||

| Cost of funds | 2.24 | % | 2.27 | % | 1.92 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Cost of deposits | 2.15 | % | 2.16 | % | 1.69 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Nine Months Ended September 30, | |||||||||||||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest Earned/ Interest Paid |

Average Yield/Rate | Average Balance | Interest Earned/ Interest Paid |

Average Yield/Rate | ||||||||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||||||||

| Interest-Earning Assets: | |||||||||||||||||||||||||||||||||||

| Loans | $ | 7,790,957 | $ | 402,942 | 6.91 | % | $ | 7,957,911 | $ | 398,608 | 6.70 | % | |||||||||||||||||||||||

| Securities | 1,556,462 | 37,562 | 3.22 | % | 1,525,808 | 31,007 | 2.72 | % | |||||||||||||||||||||||||||

| Deposits in other financial institutions | 287,960 | 11,874 | 5.51 | % | 251,475 | 9,027 | 4.80 | % | |||||||||||||||||||||||||||

| Total interest-earning assets | 9,635,379 | $ | 452,378 | 6.27 | % | 9,735,194 | $ | 438,642 | 6.02 | % | |||||||||||||||||||||||||

| Allowance for credit losses on loans | (94,236) | (96,570) | |||||||||||||||||||||||||||||||||

| Noninterest-earning assets | 1,104,426 | 1,148,847 | |||||||||||||||||||||||||||||||||

| Total assets | $ | 10,645,569 | $ | 10,787,471 | |||||||||||||||||||||||||||||||

| Liabilities and Shareholders' Equity | |||||||||||||||||||||||||||||||||||

| Interest-Bearing Liabilities: | |||||||||||||||||||||||||||||||||||

| Interest-bearing demand deposits | $ | 1,616,313 | $ | 36,949 | 3.05 | % | $ | 1,478,547 | $ | 28,141 | 2.54 | % | |||||||||||||||||||||||

| Money market and savings deposits | 2,211,148 | 48,420 | 2.93 | % | 2,291,588 | 34,161 | 1.99 | % | |||||||||||||||||||||||||||

| Certificates and other time deposits | 1,586,623 | 51,915 | 4.37 | % | 1,164,572 | 26,211 | 3.01 | % | |||||||||||||||||||||||||||

| Borrowed funds | 98,374 | 4,314 | 5.86 | % | 333,220 | 13,653 | 5.48 | % | |||||||||||||||||||||||||||

| Subordinated debt | 109,909 | 5,745 | 6.98 | % | 109,508 | 5,647 | 6.89 | % | |||||||||||||||||||||||||||

| Total interest-bearing liabilities | 5,622,367 | $ | 147,343 | 3.50 | % | 5,377,435 | $ | 107,813 | 2.68 | % | |||||||||||||||||||||||||

| Noninterest-Bearing Liabilities: | |||||||||||||||||||||||||||||||||||

| Noninterest-bearing demand deposits | 3,379,096 | 3,878,760 | |||||||||||||||||||||||||||||||||

| Other liabilities | 92,527 | 81,894 | |||||||||||||||||||||||||||||||||

| Total liabilities | 9,093,990 | 9,338,089 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,551,579 | 1,449,382 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders' equity | $ | 10,645,569 | $ | 10,787,471 | |||||||||||||||||||||||||||||||

| Net interest rate spread | 2.77 | % | 3.34 | % | |||||||||||||||||||||||||||||||

| Net interest income and margin | $ | 305,035 | 4.23 | % | $ | 330,829 | 4.54 | % | |||||||||||||||||||||||||||

| Net interest income and net interest margin (tax equivalent) | $ | 305,266 | 4.23 | % | $ | 331,549 | 4.55 | % | |||||||||||||||||||||||||||

| Cost of funds | 2.19 | % | 1.56 | % | |||||||||||||||||||||||||||||||

| Cost of deposits | 2.09 | % | 1.34 | % | |||||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 2024 | 2023 | ||||||||||||||||||||||||||||

| September 30 | June 30 | March 31 | December 31 | September 30 | |||||||||||||||||||||||||

| (Dollars in thousands) | |||||||||||||||||||||||||||||

| Period-end Loan Portfolio: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 1,347,876 | $ | 1,392,435 | $ | 1,451,462 | $ | 1,409,002 | $ | 1,474,600 | |||||||||||||||||||

| Paycheck Protection Program (PPP) | 2,877 | 3,629 | 4,293 | 5,100 | 5,968 | ||||||||||||||||||||||||

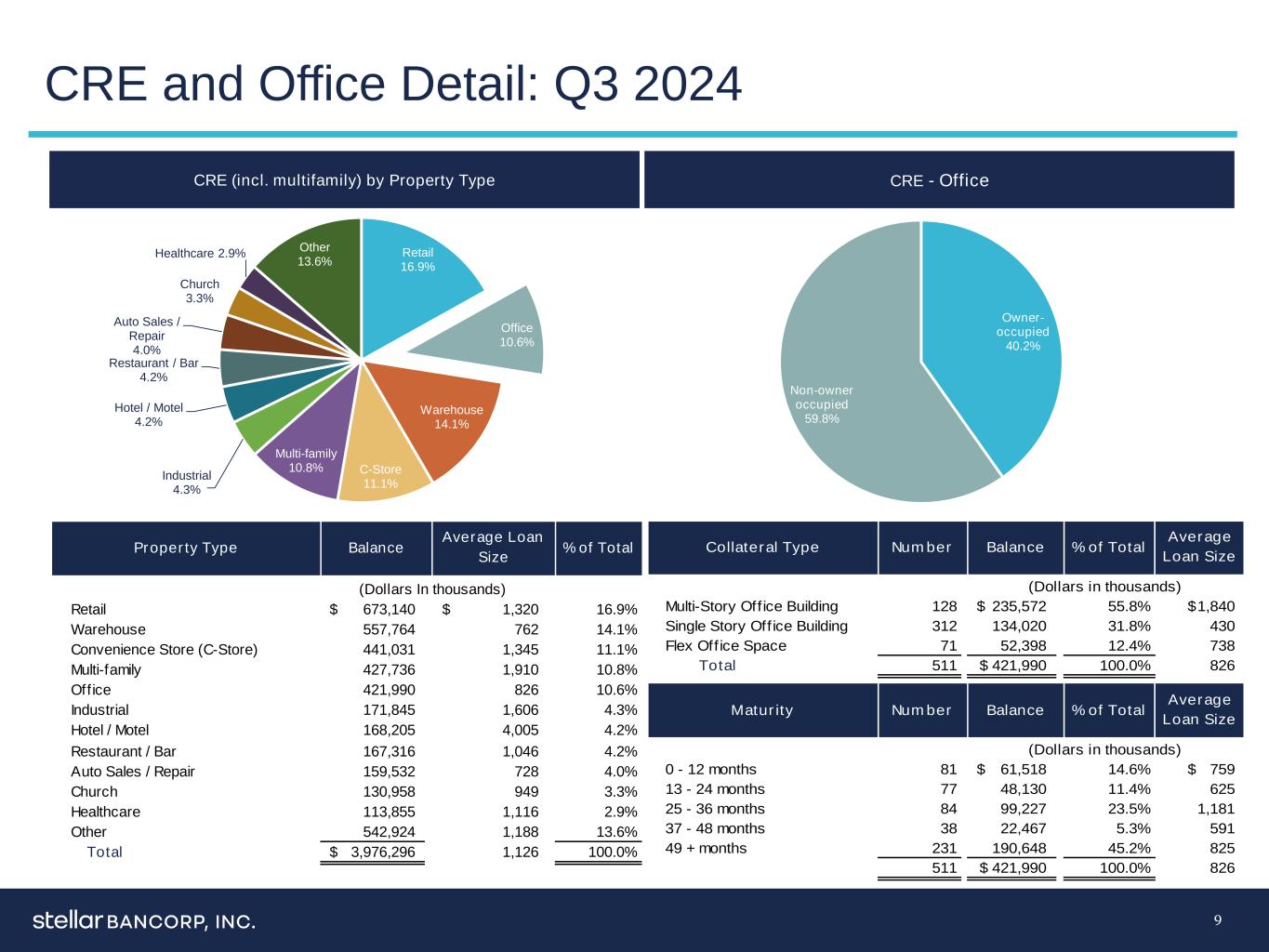

| Real estate: | |||||||||||||||||||||||||||||

| Commercial real estate (including multi-family residential) | 3,976,296 | 4,029,671 | 4,049,885 | 4,071,807 | 4,076,606 | ||||||||||||||||||||||||

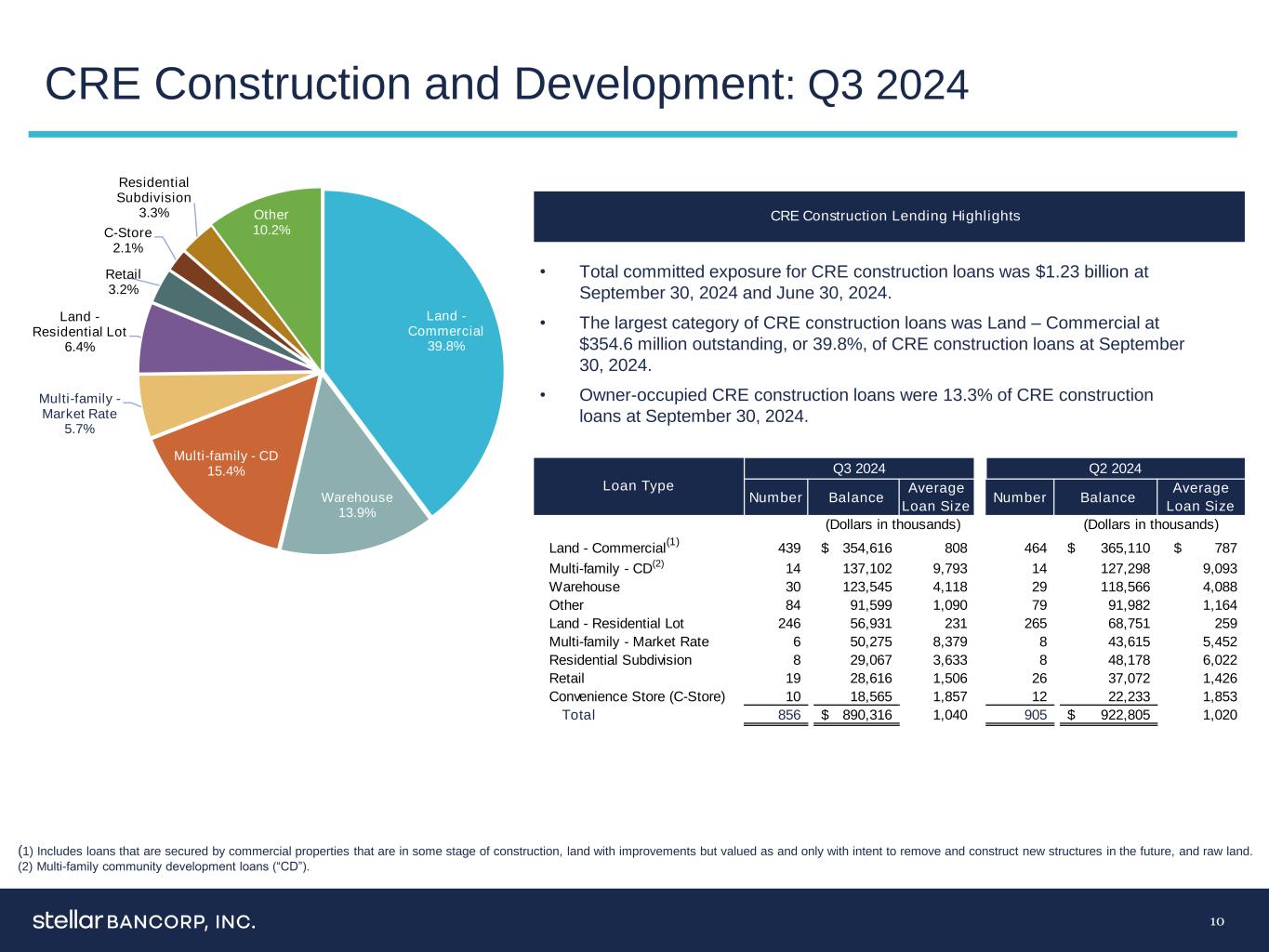

| Commercial real estate construction and land development | 890,316 | 922,805 | 1,039,443 | 1,060,406 | 1,078,265 | ||||||||||||||||||||||||

| 1-4 family residential (including home equity) | 1,112,235 | 1,098,681 | 1,049,316 | 1,047,174 | 1,024,945 | ||||||||||||||||||||||||

| Residential construction | 161,494 | 200,134 | 252,573 | 267,357 | 289,553 | ||||||||||||||||||||||||

| Consumer and other | 60,030 | 66,542 | 61,139 | 64,287 | 54,591 | ||||||||||||||||||||||||

| Total loans held for investment | $ | 7,551,124 | $ | 7,713,897 | $ | 7,908,111 | $ | 7,925,133 | $ | 8,004,528 | |||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Noninterest-bearing | $ | 3,303,048 | $ | 3,308,441 | $ | 3,323,149 | $ | 3,546,815 | $ | 3,656,288 | |||||||||||||||||||

| Interest-bearing | |||||||||||||||||||||||||||||

| Demand | 1,571,504 | 1,564,405 | 1,576,261 | 1,659,999 | 1,397,492 | ||||||||||||||||||||||||

| Money market and savings | 2,280,651 | 2,213,031 | 2,203,767 | 2,136,777 | 2,128,950 | ||||||||||||||||||||||||

| Certificates and other time | 1,587,398 | 1,639,426 | 1,691,539 | 1,529,876 | 1,503,891 | ||||||||||||||||||||||||

| Total interest-bearing deposits | 5,439,553 | 5,416,862 | 5,471,567 | 5,326,652 | 5,030,333 | ||||||||||||||||||||||||

| Total deposits | $ | 8,742,601 | $ | 8,725,303 | $ | 8,794,716 | $ | 8,873,467 | $ | 8,686,621 | |||||||||||||||||||

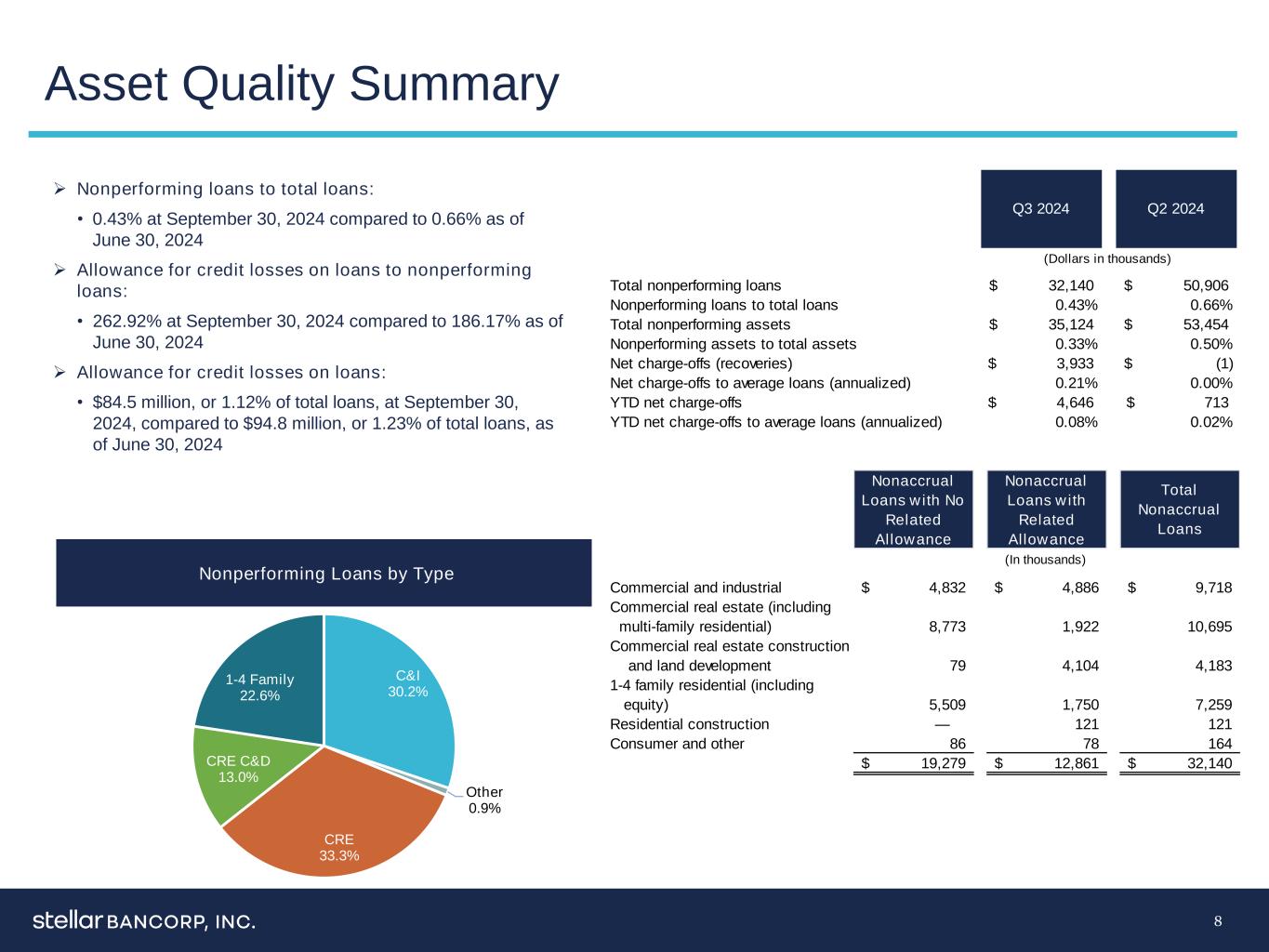

| Asset Quality: | |||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 32,140 | $ | 50,906 | $ | 57,129 | $ | 39,191 | $ | 38,291 | |||||||||||||||||||

| Accruing loans 90 or more days past due | — | — | — | — | — | ||||||||||||||||||||||||

| Total nonperforming loans | 32,140 | 50,906 | 57,129 | 39,191 | 38,291 | ||||||||||||||||||||||||

| Other real estate | 2,984 | 2,548 | — | — | — | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 35,124 | $ | 53,454 | $ | 57,129 | $ | 39,191 | $ | 38,291 | |||||||||||||||||||

| Net charge-offs (recoveries) | $ | 3,933 | $ | (1) | $ | 714 | $ | 2,577 | $ | 8,116 | |||||||||||||||||||

| Nonaccrual loans: | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 9,718 | $ | 18,451 | $ | 15,465 | $ | 5,048 | $ | 14,991 | |||||||||||||||||||

| Real estate: | |||||||||||||||||||||||||||||

| Commercial real estate (including multi-family residential) | 10,695 | 18,094 | 21,268 | 16,699 | 13,563 | ||||||||||||||||||||||||

| Commercial real estate construction and land development | 4,183 | 1,641 | 8,406 | 5,043 | 170 | ||||||||||||||||||||||||

| 1-4 family residential (including home equity) | 7,259 | 12,454 | 10,368 | 8,874 | 8,442 | ||||||||||||||||||||||||

| Residential construction | 121 | 155 | 1,410 | 3,288 | 635 | ||||||||||||||||||||||||

| Consumer and other | 164 | 111 | 212 | 239 | 490 | ||||||||||||||||||||||||

| Total nonaccrual loans | $ | 32,140 | $ | 50,906 | $ | 57,129 | $ | 39,191 | $ | 38,291 | |||||||||||||||||||

| Asset Quality Ratios: | |||||||||||||||||||||||||||||

| Nonperforming assets to total assets | 0.33 | % | 0.50 | % | 0.53 | % | 0.37 | % | 0.36 | % | |||||||||||||||||||

| Nonperforming loans to total loans | 0.43 | % | 0.66 | % | 0.72 | % | 0.49 | % | 0.48 | % | |||||||||||||||||||

| Allowance for credit losses on loans to nonperforming loans | 262.92 | % | 186.17 | % | 168.54 | % | 233.94 | % | 244.38 | % | |||||||||||||||||||

| Allowance for credit losses on loans to total loans | 1.12 | % | 1.23 | % | 1.22 | % | 1.16 | % | 1.17 | % | |||||||||||||||||||

| Net charge-offs to average loans (annualized) | 0.21 | % | 0.00 | % | 0.04 | % | 0.13 | % | 0.40 | % | |||||||||||||||||||

| Three Months Ended | Nine Months Ended | ||||||||||||||||||||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||||||||||||||||||||

| September 30 | June 30 | March 31 | December 31 | September 30 | September 30 | September 30 | |||||||||||||||||||||||||||||||||||

| (Dollars and share amounts in thousands, except per share data) | |||||||||||||||||||||||||||||||||||||||||

| Net income | $ | 33,891 | $ | 29,753 | $ | 26,147 | $ | 27,266 | $ | 30,908 | $ | 89,791 | $ | 103,231 | |||||||||||||||||||||||||||

| Add: Provision for credit losses | (5,985) | (1,935) | 4,098 | 1,047 | 2,315 | (3,822) | 7,896 | ||||||||||||||||||||||||||||||||||

| Add: Provision for income taxes | 8,837 | 7,792 | 6,759 | 6,562 | 7,445 | 23,388 | 24,825 | ||||||||||||||||||||||||||||||||||

| Pre-tax, pre-provision income | $ | 36,743 | $ | 35,610 | $ | 37,004 | $ | 34,875 | $ | 40,668 | $ | 109,357 | $ | 135,952 | |||||||||||||||||||||||||||

| Total average assets | $ | 10,626,266 | $ | 10,623,865 | $ | 10,686,789 | $ | 10,626,373 | $ | 10,741,295 | $ | 10,645,569 | $ | 10,787,471 | |||||||||||||||||||||||||||

Pre-tax, pre-provision return on average assets(B) |

1.38 | % | 1.35 | % | 1.39 | % | 1.30 | % | 1.50 | % | 1.37 | % | 1.68 | % | |||||||||||||||||||||||||||

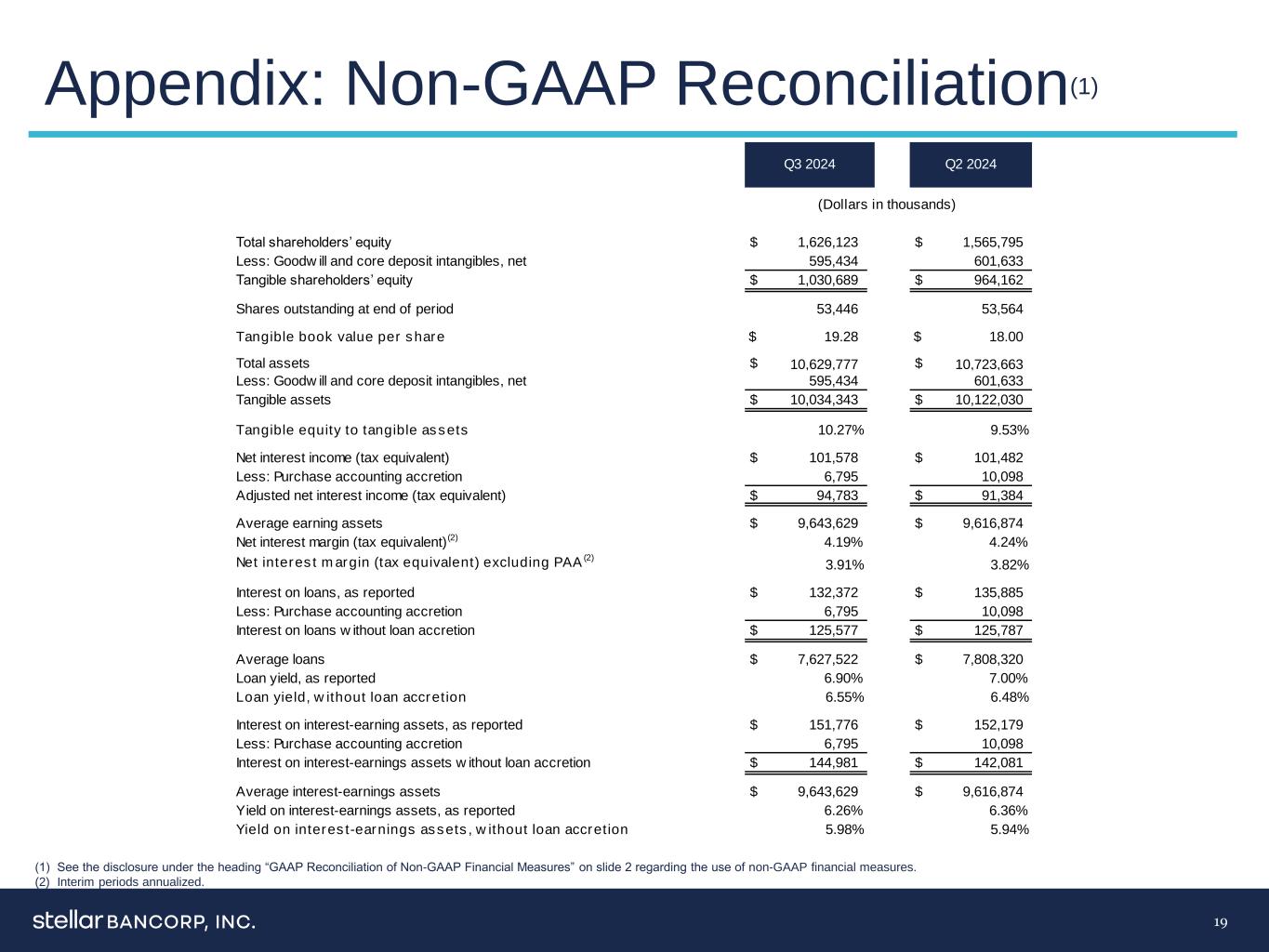

| Total shareholders’ equity | $ | 1,626,123 | $ | 1,565,795 | $ | 1,530,698 | $ | 1,521,018 | $ | 1,460,846 | $ | 1,626,123 | $ | 1,460,846 | |||||||||||||||||||||||||||

| Less: Goodwill and core deposit intangibles, net | 595,434 | 601,633 | 607,831 | 614,030 | 620,262 | 595,434 | 620,262 | ||||||||||||||||||||||||||||||||||

| Tangible shareholders’ equity | $ | 1,030,689 | $ | 964,162 | $ | 922,867 | $ | 906,988 | $ | 840,584 | $ | 1,030,689 | $ | 840,584 | |||||||||||||||||||||||||||

| Shares outstanding at end of period | 53,446 | 53,564 | 53,551 | 53,291 | 53,322 | 53,446 | 53,322 | ||||||||||||||||||||||||||||||||||

| Tangible book value per share | $ | 19.28 | $ | 18.00 | $ | 17.23 | $ | 17.02 | $ | 15.76 | $ | 19.28 | $ | 15.76 | |||||||||||||||||||||||||||

| Average shareholders’ equity | $ | 1,587,918 | $ | 1,538,124 | $ | 1,528,298 | $ | 1,475,377 | $ | 1,471,009 | $ | 1,551,579 | $ | 1,449,382 | |||||||||||||||||||||||||||

| Less: Average goodwill and core deposit intangibles, net | 598,866 | 604,722 | 611,149 | 617,236 | 623,864 | 604,890 | 630,890 | ||||||||||||||||||||||||||||||||||

| Average tangible shareholders’ equity | $ | 989,052 | $ | 933,402 | $ | 917,149 | $ | 858,141 | $ | 847,145 | $ | 946,689 | $ | 818,492 | |||||||||||||||||||||||||||

Return on average tangible equity(B) |

13.63 | % | 12.82 | % | 11.47 | % | 12.61 | % | 14.47 | % | 12.67 | % | 16.86 | % | |||||||||||||||||||||||||||

| Total assets | $ | 10,629,777 | $ | 10,723,663 | $ | 10,729,222 | $ | 10,647,139 | $ | 10,665,460 | $ | 10,629,777 | $ | 10,665,460 | |||||||||||||||||||||||||||

| Less: Goodwill and core deposit intangibles, net | 595,434 | 601,633 | 607,831 | 614,030 | 620,262 | 595,434 | 620,262 | ||||||||||||||||||||||||||||||||||

| Tangible assets | $ | 10,034,343 | $ | 10,122,030 | $ | 10,121,391 | $ | 10,033,109 | $ | 10,045,198 | $ | 10,034,343 | $ | 10,045,198 | |||||||||||||||||||||||||||

| Tangible equity to tangible assets | 10.27 | % | 9.53 | % | 9.12 | % | 9.04 | % | 8.37 | % | 10.27 | % | 8.37 | % | |||||||||||||||||||||||||||

| Net interest income (tax equivalent) | $ | 101,578 | $ | 101,482 | $ | 102,207 | $ | 106,121 | $ | 106,919 | $ | 305,266 | $ | 331,549 | |||||||||||||||||||||||||||

| Less: Purchase accounting accretion | 6,795 | 10,098 | 8,551 | 11,726 | 12,400 | 25,444 | 35,076 | ||||||||||||||||||||||||||||||||||

| Adjusted net interest income (tax equivalent) | $ | 94,783 | $ | 91,384 | $ | 93,656 | $ | 94,395 | $ | 94,519 | $ | 279,822 | $ | 296,473 | |||||||||||||||||||||||||||

| Average earning assets | $ | 9,643,629 | $ | 9,616,874 | $ | 9,645,544 | $ | 9,576,927 | $ | 9,697,553 | $ | 9,635,379 | $ | 9,735,194 | |||||||||||||||||||||||||||

| Net interest margin (tax equivalent) excluding PAA | 3.91 | % | 3.82 | % | 3.91 | % | 3.91 | % | 3.87 | % | 3.88 | % | 4.07 | % | |||||||||||||||||||||||||||