1-23 AGENDA AND EXPLANATORY NOTES FOR THE 2025 SHAREHOLDERS’ MEETING OF FERROVIAL SE To be held on Thursday 24 April 2025 at 2:00 p.m. CEST in H'ART Museum, Amstel 51, 1018 EJ, Amsterdam, the Netherlands

2-23 AGENDA FOR THE 2025 SHAREHOLDERS’ MEETING OF FERROVIAL SE ("FERROVIAL") 1. Opening 2. Financial year 2024 2a. Report of the Board on Ferrovial’s financial and non-financial (ESG) performance for the financial year 2024 (discussion item) 2b. Policy on additions to reserves and on dividends (discussion item) 2c. Remuneration report for the financial year 2024 (advisory voting item) 2d. Adoption of the annual accounts for the financial year 2024 (voting item) 3. Climate Strategy Report for the financial year 2024 (advisory voting item) 4. Discharge of the Directors in respect of the performance of their duties during the financial year 2024 (voting item) 5. Composition of the Board of Directors: Director re-appointments 5a. Proposal to re-appoint Mr. Rafael del Pino y Calvo-Sotelo as Executive Director (voting item) 5b. Proposal to re-appoint Mr. Óscar Fanjul Martín as Non-Executive Director (voting item) 5c. Proposal to re-appoint Ms. María del Pino y Calvo-Sotelo as Non-Executive Director (voting item) 5d. Proposal to re-appoint Mr. José Fernando Sánchez-Junco Mans as Non-Executive Director (voting item) 5e. Proposal to re-appoint Mr. Bruno Vito Benito Di Leo Allen as Non-Executive Director (voting item) 5f. Proposal to re-appoint Ms. Hildegard Maria Wortmann as Non-Executive Director (voting item) 5g. Proposal to re-appoint Ms. Alicia Reyes Revuelta as Non-Executive Director (voting item) 6. Amendment of the Directors' Remuneration Policy (voting item) 7. Appointment of external auditor and assurance services provider 7a. Proposal to appoint PriceWaterhouseCoopers Accountants N.V. as Ferrovial’s statutory external auditor for the financial years 2025 – 2027 (voting item) 7b. Proposal to appoint PriceWaterhouseCoopers Accountants N.V. as Ferrovial’s assurance services provider to perform an assurance review and issue an assurance opinion in an

3-23 assurance statement on Ferrovial's statutory sustainability report for the financial years 2025 – 2027 (voting item) 8. Authorization of the Board to issue ordinary shares 8a. Authorization of the Board to issue ordinary shares for general purposes (voting item) 8b. Authorization of the Board to issue ordinary shares for purposes of scrip dividend (voting item) 9. Authorization of the Board to limit or to exclude pre-emptive rights 9a. Authorization of the Board to limit or to exclude pre-emptive rights for ordinary shares for general purposes (voting item) 9b. Authorization of the Board to limit or to exclude pre-emptive rights for ordinary shares for purposes of scrip dividend (voting item) 10. Authorization of the Board to acquire ordinary shares (voting item) 11. Cancellation of ordinary shares (voting item) 12. Closing

4-23 EXPLANATORY NOTES TO THE AGENDA FOR THE 2025 SHAREHOLDERS’ MEETING OF FERROVIAL 1. Opening 2. Financial year 2024 2a. Report of the Board on Ferrovial’s financial and non-financial (ESG) performance for the financial year 2024 (discussion item) Presentation by Ferrovial’s board of directors (the "Board") on the financial and non- financial (ESG) performance of Ferrovial in the financial year 2024. The management report, including non-financial information, prepared by the Board is contained in Ferrovial's annual report for the financial year 2024 (the "Annual Report 2024"). For further details please refer to the Annual Report 2024. 2b. Policy on additions to reserves and on dividends (discussion item) The Board will explain Ferrovial’s reserves and dividend policy. In accordance with previous practice, the Board intends to implement one or more interim dividends in 2025 that would be distributed to the shareholders by way of a flexible dividend scheme (scrip dividend) for a cash equivalent amount of around 570 million euro. Shareholders would have the option of receiving their dividend in the form of additional shares in Ferrovial or, alternatively, in cash. If the Board, in its sole discretion, does not consider it advisable to implement such a flexible dividend in view of market conditions, the conditions of Ferrovial itself, or any other circumstances, it may elect not to distribute such dividend. The Board, in its sole discretion, may also decide to pay additional dividends or to pay a dividend in cash only or shares only. 2c. Remuneration report for the financial year 2024 (advisory voting item) Ferrovial has prepared the remuneration report for the Board for the financial year 2024 in accordance with applicable statutory requirements. Pursuant to Dutch law, the remuneration report for the financial year 2024 is submitted to Ferrovial's 2025 Shareholders’ Meeting for an advisory vote. The remuneration report for the financial year 2024 has been published as part of the Annual Report 2024 and has also been made available separately on Ferrovial’s website (www.ferrovial.com). 2d. Adoption of the annual accounts for the financial year 2024 (voting item) It is proposed to adopt the annual accounts for the financial year 2024 as drawn up by the Board.

5-23 EY Accountants B.V. has audited the annual accounts for the financial year 2024 and has issued an auditor's report thereon. The auditor is available for questions regarding the audit of the annual accounts for the financial year 2024. 3. Climate Strategy Report for the financial year 2024 (advisory voting item) Ferrovial's climate strategy report for the financial year 2024 (the "Climate Strategy Report") has been made available on Ferrovial's website (www.ferrovial.com). The Climate Strategy Report is consistent with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD). It contains information on: (i) the update of Ferrovial’s emission reduction plan in accordance with SBTi as approved by the Board, (ii) the evolution of greenhouse gas emissions (carbon footprint) with respect to the levels of such emissions foreseen in the forementioned climate emission reduction plan, which includes the targets for reducing greenhouse gas emissions for the years 2025 and 2030; and (iii) the actions to be undertaken to achieve the targets established in the aforementioned plan (2030 and 2050 horizons). Ferrovial has taken into account stakeholder feedback, e.g. with respect to the ambition and alignment of the decarbonization roadmap with 1,5ºC trajectory, the update of the baseline to 2020 and governance, and will continue to engage with stakeholders, including by way of the results of the advisory vote, in order to contribute positively to its climate strategy. The calculation methodology is based mainly on the Greenhouse Gas Protocol, also maintaining compliance with the ISO 14064-1 standard (specification with guidance at the organization level for quantification and reporting of greenhouse gas emissions and removals). The Climate Strategy Report has been verified by an independent body, in accordance with specific internationally approved greenhouse gas emissions auditing standards (ISAE 3410 - International Standard on Assurance Engagements on Greenhouse Gas Statements). In recognition of Ferrovial's past practices, the Board has decided, at its discretion, to submit the Climate Strategy Report to the 2025 Shareholders’ Meeting for a non-binding advisory vote. Accordingly, although shareholders are invited to cast their vote on this item to indicate their support for the Climate Strategy Report, the vote will not carry any legal consequences. 4. Discharge of the Directors in respect of the performance of their duties during the financial year 2024 (voting item) It is proposed to grant discharge from all liability to: (i) the Executive Directors of Ferrovial in office in the financial year 2024 in respect of the performance of their duties; and (ii) the Non-Executive Directors of Ferrovial in office in the financial year 2024 in respect of the performance of their duties, as such performance is apparent from the Annual Report 2024 or other public disclosures prior to the adoption of the annual accounts for the financial year 2024. 5. Composition of the Board of Directors: Re-appointment of Directors

6-23 The Directors Mr. Rafael del Pino y Calvo-Sotelo, Mr. Óscar Fanjul Martín, Ms. María del Pino y Calvo-Sotelo, Mr. José Fernando Sánchez-Junco Mans, Mr. Bruno Vito Benito Di Leo Allen, Ms. Hildegard Maria Wortmann and Ms. Alicia Reyes Revuelta (together, the “Nominated Directors”) were re-appointed or appointed by the general shareholders' meeting of Ferrovial, S.A. held on 7 April 2022. On 16 June 2023, Ferrovial, S.A. was merged into Ferrovial International SE which was renamed Ferrovial SE (the “Merger”). Upon completion of the Merger, each director of Ferrovial S.A. was appointed as Director of Ferrovial for a term ending at the end of the annual general meeting held in the year in which his or her term as director of Ferrovial S.A. would (absent the Merger) have ended. As a result, the current terms of the Nominated Directors will lapse at the end of the 2025 Shareholders’ Meeting to be held on 24 April 2025. The general meeting appoints Directors pursuant to a nomination thereto by the Board, in accordance with article 8.2 of Ferrovial’s articles of association (the “Articles of Association”). The Board has nominated the Nominated Directors, following a recommendation thereto by the Board’s Nomination and Remuneration Committee in accordance with article 31 of the Regulations of the Board of Directors. Regarding all proposed Non-Executive Directors (contained in items 5b to 5g), the Board has evaluated positively: (i) their proven experience and extensive professional career; (ii) their extensive knowledge of the Ferrovial group and the sector and markets in which it operates; (iii) the evaluation of their performance; (iv) their availability to carry out their duties as Directors; and (v) their positive contribution to the Board and the Committees of which they are members in their current capacities. The nominations are made taking into account the Board of Directors’ Profile Policy, the Rotation Schedule for Non-Executive Directors, and the Diversity and Inclusion Policy, all of which are available on Ferrovial’s website (www.ferrovial.com). Of the Nominated Directors, Mr. Óscar Fanjul Martín, Mr. José Fernando Sánchez-Junco Mans, Mr. Bruno Vito Benito Di Leo Allen, Ms. Hildegard Maria Wortmann and Ms. Alicia Reyes Revuelta qualify as independent in accordance with the Dutch Corporate Governance Code (the "Code") and the listing rules of the Nasdaq Stock Market LLC (“Nasdaq”). Following re-appointment of the Nominated Directors, the Non-Executive Directors will comprise of six male Non-Executive Directors and four female Non-Executive Directors, in compliance with applicable gender diversity regulations. Each of the Nominated Directors is nominated for re-appointment for a term of three years, starting on the date of the 2025 Shareholders’ Meeting (24 April 2025) and ending at the end of the annual general meeting held in the third calendar year following the year of appointment, in accordance with article 8.2.3 of the Articles of Association. 5a. Proposal to re-appoint Mr. Rafael del Pino y Calvo-Sotelo as Executive Director (voting item) Mr. Rafael del Pino y Calvo-Sotelo has been Chairman of the Board (the “Chairman”) since 2000 and, before that, he was Ferrovial's Chief Executive Officer since 1992. Within the Group, he has also been Chairman of Cintra, our Toll Roads Business Division subsidiary (1998-2009). Other past directorships include Uralita, a Spanish construction materials company (1996- 2002); Banesto, a Spanish bank owned by Banco Santander (2003-2012); and the Zurich

7-23 Insurance Group, a Swiss insurance company (2012-2014). In addition to his directorship roles, Mr. Del Pino is a member of the MIT Corporation, MIT Energy Initiative’s External Advisory Board, and MIT Sloan European Advisory Board, as well as of the IESE Business School’s International Advisory Board. He is also a member of the Royal Academy of Engineering of Spain since 2014. Mr. Del Pino holds a degree in Civil Engineering from Universidad Politécnica de Madrid and an MBA from MIT Sloan School of Management. He is 66 years old. The Board, following the recommendation of the Nomination and Remuneration Committee, considers there are compelling reasons to nominate Mr. Del Pino for re- appointment as Executive Director, allowing Mr. Del Pino to continue in his role as Chairman: • Mr. Del Pino has an extraordinary knowledge of the Ferrovial group and the sectors in which it operates. His role in the development, growth and internationalization of the group has been key. Under his leadership, initiative, and drive Ferrovial has become one of the leading and most prestigious global infrastructure operators, exponentially increasing its value over the years in which he has held the position of Chairman. o Over the 1999-2024 period, Ferrovial's share price has increased by 608%, compared to 16% for the IBEX-35 index, and its total shareholder return has grown by 1570%. o Mr. Del Pino’s role has been key in the process of reaching the U.S. listing milestone. Ferrovial's ordinary shares began trading in the U.S. on the Nasdaq Global Select Market in May 2024, granting Ferrovial access to the world’s largest investors community. Maintaining Mr. Del Pino as Executive Director and Chairman aims to allow Ferrovial to continue its path of success and excellence. The Board believes Mr. Del Pino is uniquely qualified to lead Ferrovial to achieve the targets set out in its current strategic plan, in the preparation of which Mr. Del Pino has played a decisive role. In his role as Executive Director and Chairman, he provides clear leadership for Ferrovial internally and externally. With regard to his work as Chairman, the Board considers that Mr. Del Pino has: (i) effectively and efficiently led discussions and deliberations, ensuring that sufficient time is devoted to reflection and debate of strategic issues; (ii) encouraged constructive debate and the active participation of Directors during Board meetings; and (iii) ensured that Directors have sufficient advance notice of the information necessary for deliberation and the adoption of resolutions on the matters to be discussed. The Board is of the opinion that Mr. Del Pino fits well in the Board of Directors’ Profile Policy. • Ferrovial’s governance has been structured to provide such checks, balances and counterweights that allow the Board to operate with the appropriate independence from the management team and to preserve its independent supervisory role. These measures include:

8-23 o Ferrovial has separate roles for the Chairman and the CEO to ensure that the executive responsibilities are not concentrated in the Chairman but are subject to a functional division. The Chairman focuses mainly on responsibilities more closely linked to strategic decisions and institutional representation of Ferrovial, while the CEO, Mr. Ignacio Madridejos, oversees the day-to-day management of the business and chairs Ferrovial group's management committee, comprising the senior managers of the corporate areas and the heads of the different business divisions. o In order to provide a counterbalance to the role of the executive Chairman, the Board has created two important positions to share the functions that are typically performed by a non-executive chairman: the Lead Director and the Vice-Chairman. o The position of Lead Director is held by Mr. Juan Hoyos, an independent Non- Executive Director. The Lead Director, in particular, can exercise the functions assigned to the Chairman (voorzitter) under the Code and generally those functions associated with a non-executive chairman, ensuring an appropriate balance of responsibilities in the Board, such as having the power to request the convening of the Board or include new items on the agenda of a Board meeting already convened; coordinate and convene the Non-Executive Directors; direct, if applicable, the periodic evaluation of the Chairman; chair meetings of the Board in the absence of the Chairman and Vice-Chairman; and give voice to the concerns of the Non-Executive Directors. In addition, the Lead Director has, together with the Chairman, the powers to ensure, among other things, that: a) the Board has proper contact with the general meeting; b) there is sufficient time for deliberation and decision-making by the Board; c) the Non-Executive Directors receive all information that is necessary for the proper performance of their duties in a timely fashion; d) the Board and its committees function properly; e) the functioning of individual Directors is assessed at least annually; f) the general meeting proceeds in an orderly and efficient manner; g) effective communication with shareholders is assured; and h) the Non- Executive Directors are involved closely, and at an early stage, in any merger or acquisition processes. o The position of Vice-Chairman is held by Mr. Óscar Fanjul, an independent Non- Executive Director. The Vice-Chairman may substitute the Chairman in the event of the latter's absence or inability to act and acts as a point of contact regarding the functioning of the Lead Director. o The Board has a high degree of independence: currently, 9 of the 12 Directors are Independent Directors under Dutch and U.S. rules, which represents 75% of the total Directors. In addition, the Audit and Control Committee and Nomination and Remuneration Committee comprise for 100% of independent Non-Executive Directors. In the Board's opinion, these measures reflect an adequate system of checks and balances and, consequently, a balanced distribution of powers and responsibilities within the Board.

9-23 o Finally, the role of an executive chairman such as the Chairman is in line with U.S. practice, where Ferrovial is also listed and where a relevant part of its business and assets, and the majority of its value, are located. At the date of the publication of this agenda and explanatory notes, Mr. Del Pino (indirectly) holds 155,481,565 ordinary shares in the share capital of Ferrovial. 5b. Proposal to re-appoint Mr. Óscar Fanjul Martín as Non-Executive Director (voting item) Mr. Óscar Fanjul Martín has been a Director since 2015, Vice-Chairman of the Board since 2020, and a member of its Executive Committee since his appointment as a member of the Board. He has also been a member of the Audit and Control Committee since 2016 and is its Chairman since 2019. Finally, he was Lead Director between June 2018 and May 2020. Mr. Fanjul also serves as a director of Marsh & McLennan Companies, a U.S. professional services firm (since 2001); as a non-executive director of Cellnex, a Spanish telecommunications company (since 2023), and as its chairman (since 2024); and as a non-executive chairman of HWK, an asset management firm specialized in technology (since 2024). He is a trustee of the Center of Monetary and Financial Studies of the Bank of Spain (since 1999), the Spanish branch of the Aspen Institute (since 2011), and the Norman Foster Foundation (since 2019). Previously, Mr. Fanjul was the founding chairman and CEO of Repsol, a Spanish global multi-energy provider (1985-1996). He has also served as chairman of NH Hotel Group, a Spanish multinational hotel company (1997- 1999), and Hidroelectrica del Cantabrico, a Spanish electricity producer (1999-2001). He has held the position of vice-chairman at LafargeHolcim, a Swiss construction materials company, both prior to (2009-2015), and after (2015-2021), Lafarge and Holcim’s merger in 2015, and has been a director at Unilever (1996-2004), the Spanish financial institution BBVA (1998-2002), Acerinox, a Spanish steel manufacturer (2001-2016), the London Stock Exchange (2001-2013) and Areva, a French nuclear energy conglomerate (2008- 2012). Mr. Fanjul holds a degree in economics. He is 75 years old. The Board nominates Mr. Fanjul particularly because of his extensive knowledge of Ferrovial and its group, and he has actively contributed to its consolidation as a global operator in the infrastructure sector. Mr. Fanjul’s curriculum vitae shows his solid training, with a high specialization in economic and finance fields. He has extensive business experience in a wide range of sectors of activity similar to and other than Ferrovial, with a broad international presence in many of the countries where the Ferrovial group operates. Regarding the work and dedication of Mr. Fanjul since his re-appointment at the 2022 general shareholders' meeting of Ferrovial, S.A. and up to the present date, the Board considers that he has maintained a high level of performance, attending meetings and contributing effectively to the Board, the Executive Committee, and the Audit and Control Committee. The Board is of the opinion that Mr. Fanjul fits well in the Board of Directors’ Profile Policy.

10-23 Mr. Fanjul qualifies as independent in accordance with the Code and the Nasdaq listing rules. At the date of the publication of this agenda and explanatory notes, Mr. Fanjul (directly) holds 47,030 ordinary shares in the share capital of Ferrovial. 5c. Proposal to re-appoint Ms. María del Pino y Calvo-Sotelo as Non-Executive Director (voting item) Ms. María del Pino y Calvo-Sotelo has been a Director since 2006 and is a member of the Executive Committee of the Board since the same year. She is also chairperson of the Fundación Rafael del Pino, a Spanish private non-profit organization (since 2008), and chairperson of Chart Inversiones SICAV S.A., a Spanish collective investment vehicle (since 2022). Since 2008, Ms. del Pino has also been a member of the board of trustees of the Fundación Princesa de Asturias, the honorary consultancy body of a Spanish non-profit organization. Furthermore, since 2017, Ms. del Pino has also been the chief executive officer and chairperson of Menosmares, S.L. (“Menosmares”), a holding company under her control. Ms. del Pino acts as legal representative of Menosmares on several boards, including: Lolland S.A., a holding company of which Menosmares is a joint director (since 2016); the board of directors of Casa Grande de Cartagena, S.A.U., a holding company of which Menosmares is rotating chairman and vice-chairman (since 2017); the board of directors of Polan S.A., a Spanish real estate company focused on the rental of office space and parking and of which Menosmares is rotating chairman and vice-chairman (since 2017); and the board of directors of Pactio Gestión, SGIIC, S.A.U., a Spanish investment management firm of which Menosmares is vice-chairman (since 2017). Previously, she was also chairperson of Altais Invest SICAV S.A. (1998-2022), a Spanish collective investment vehicle. She has been a member of the Governing Board of the Association for the Progress of Management, as well as a trustee of the Codespa Foundation and the Scientific Foundation of the Spanish Cancer Association. Ms. del Pino holds a degree in Economics and Business Administration from Universidad Complutense de Madrid and a Management Development Program (PDD) from IESE Business School. She is 68 years old. The Board nominates Ms. Del Pino particularly because of her extensive knowledge of Ferrovial and its group, having contributed to its significant development and internationalization and to its consolidation as a global infrastructure operator. It is clear from the curriculum vitae of Ms. Del Pino that she has the appropriate knowledge and extensive experience, both in Ferrovial and in areas outside Ferrovial’s activity, to perform the duties of her position. Regarding the work and dedication of Ms. Del Pino since her re- appointment at the 2022 general shareholders' meeting of Ferrovial, S.A. to date, the Board considers that she has maintained a high level of performance, attending meetings and contributing effectively to the Board and the Executive Committee. The Board is of the opinion that Ms. Del Pino fits well in the Board of Directors’ Profile Policy. The Board has considered that in case of re-appointment, Ms. Del Pino’s term (including her term at Ferrovial, S.A.) will exceed the maximum term of 12 years as recommended by the Code. Nevertheless, the Board believes that, in addition to her qualifications as outlined

11-23 above, it is advisable to have on the Board a mix of experienced members and members more recently appointed. This approach enriches the debate, provides a plurality of views, and allows for a better exercise of the Board’s and Committees functions. The time spent on the Board has provided Ms. Del Pino with deep knowledge on Ferrovial and its group that is invaluable in her functioning as a Director. At the date of the publication of this agenda and explanatory notes, Ms. Del Pino holds (directly and indirectly) 62,438,916 ordinary shares in the share capital of Ferrovial. 5d. Proposal to re-appoint Mr. José Fernando Sánchez-Junco Mans as Non-Executive Director (voting item) Mr. José Fernando Sánchez-Junco Mans has been a Director since 2009, a member of the Executive Committee since 2010, and of the Nomination and Remuneration Committee since December 2014, of which he was its Chairman between 2016 and 2021. He was Lead Director from 2012 to 2018, and Director of Cintra, the subsidiary that heads Ferrovial Toll Roads Business Division, from 2004 to 2009. He is currently Chairman of Villabuena Inversiones S.L., a Spanish private wealth management firm, since 2007, and an honorary Chairman of Maxam Group, a Spanish technology and chemical multinational company, since 2020. Previously, Mr. Sánchez- Junco served in various roles at the Maxam Group, including as former sole administrator (1990-1994), executive chairman and chief executive officer (1994-2020), and as executive/non-executive director (1990-2021); he was also the founder and chairman of the board of trustees of the Maxam Foundation (2006-2022), a Spanish private non-profit organization. He was a member of the State Corp of Industrial Engineers (1978-1990), managing director of the iron, steel, and naval industries (1985-1988) and a managing director of industry (1988-1990) at the Spanish Ministry of Industry and Energy. He served as independent director of Alantra (2002-2012), a Spanish investment banking and asset management company, and as independent director on the board of Uralita (1993-2002). Mr. Sánchez-Junco has also been a director and honorary member of the board of trustees of the Museo de la Minería y la Industria de Asturias (2017-2022), an autonomous government-owned museum. Mr. Sánchez-Junco holds a degree in Industrial Engineering from the Universidad Politécnica de Cataluña, Barcelona and is an International Senior Management Program graduate of the Harvard Business School. He is 77 years old. The Board nominates Mr. Sánchez-Junco particularly because of his deep knowledge of Ferrovial and its group, having contributed to its important development and internationalization, and to its consolidation as a global operator in the infrastructure sector. The curriculum of Mr. Sánchez-Junco also shows his extensive training, with a solid knowledge of business and commercial strategy. Likewise, he has broad professional and international experience in business and industrial sectors which bring to the Board of Directors a plurality of points of view, help to enrich the debate within it, and contribute to the better exercise of the governing body’s responsibilities. With regard to the work and dedication of Mr. Sánchez-Junco from his re-appointment at the 2022 general shareholders' meeting of Ferrovial, S.A. to date, the Board considers that he has maintained a high level of performance, attending meetings and contributing effectively to

12-23 the Board, the Executive Committee, and the Nomination and Remuneration Committee. The Board is of the opinion that Mr. Sánchez-Junco fits well in the Board of Directors’ Profile Policy. The Board has considered that in case of re-appointment, Mr. Sánchez-Junco’s term (including his term at Ferrovial, S.A.) will exceed the maximum term of 12 years as recommended by the Code. Nevertheless, the Board believes that, in addition to his qualifications as outlined above, it is advisable to have on the Board a mix of experienced members and members more recently appointed. This approach enriches the debate, provides a plurality of views, and allows for a better exercise of the Board’s and Committees' functions. The time spent on the Board has provided Mr. Sánchez-Junco with deep knowledge of Ferrovial and its group that is invaluable in his functioning as a Director. Mr. Sánchez-Junco qualifies as independent in accordance with the Code and the Nasdaq listing rules. At the date of the publication of this agenda and explanatory notes, Mr. Sánchez-Junco (directly) holds 186,692 ordinary shares in the share capital of Ferrovial. 5e. Proposal to re-appoint Mr. Bruno Vito Benito Di Leo Allen as Non-Executive Director (voting item) Mr. Bruno Vito Benito Di Leo Allen has been a Director since 2018, and member of the Nomination and Remuneration Committee since 2019, being appointed Chairman of this Committee on 16 December 2021. He is a managing director and chief executive officer of Bearing North LLC, an independent advisory firm focused on business expansion and senior executive counseling in strategy and operations. He is also a non-executive director of Cummins, a U.S. engine manufacturing multinational company (since 2015), as well as a member of the IESE’s International Advisory Board in Spain (since 2013) and of the Deming Center Advisory Board of Columbia Business School (since 2012). Previously, he held various executive roles at IBM Corporation, a U.S. technology multinational company, including as a general manager for IBM Latin America (2002-2004), general manager of IBM Europe (2005-2008), general manager of the growth markets unit (2008-2011), and senior vice-president of global markets (2012-2018). Mr. Di Leo resides in the United States and has a broad and specific knowledge of the U.S. market, which is strategic for Ferrovial. Mr. Di Leo has a degree in Business Administration from Universidad Ricardo Palma and a postgraduate degree from Escuela Superior de Administración de Negocios. He is 67 years old. The Board nominates Mr. Di Leo particularly because of his extensive knowledge of Ferrovial and its group, having contributed to its consolidation and maintenance as a global infrastructure operator. The curriculum of Mr. Di Leo shows his wide background, with strong knowledge in diverse sectors. Thanks to his long professional career, he has acquired in-depth knowledge in key areas for the proper performance of his duties on the Board of Directors, such as business strategy and commercial management. His broad international background in senior positions in sectors relevant to Ferrovial and its group

13-23 guarantees the contribution of pluralistic views to the discussion of issues on the Board. His experience in the field of new technologies and innovation stands out, given his extensive career in the multinational IBM and his former responsibilities as Director of Taiger, a company based in Singapore dedicated to creating artificial intelligence (AI) solutions. With regard to the work and dedication of Mr. Di Leo from his re-appointment at the 2022 general shareholders' meeting of Ferrovial, S.A. to date, the Board considers that he has maintained a high level of performance, attending the meetings and contributing effectively to the Board and the Nomination and Remuneration Committee. The Board is of the opinion that Mr. Di Leo fits well in the Board of Directors’ Profile Policy. Mr. Di Leo qualifies as independent in accordance with the Code and the Nasdaq listing rules. At the date of the publication of this agenda and explanatory notes, Mr. Di Leo does not hold shares in the share capital of Ferrovial. 5f. Proposal to re-appoint Ms. Hildegard Maria Wortmann as Non-Executive Director (voting item) Ms. Hildegard Maria Wortmann has been a Director since 2021. Ms. Wortmann was a member of the extended executive committee of Volkswagen Group, a German automotive manufacturer multinational company (2022-2024), and a member of the board of management of Audi AG, a German automotive manufacturer multinational company (2019-2024). She also served as a non-executive director of Volkswagen Financial Services AG (2021-2024), and of Porsche Holding GmbH, a German holding multinational company within the Volkswagen Group; Porsche Austria GmbH, the Austrian branch of automotive manufacturer Porsche; and of Porsche Retail GmbH (2022-2024). Previously, Ms. Wortmann was a non-executive director of the supervisory board of CARIAD SE (2022-2023), a German automotive software company and subsidiary of Volkswagen Group, and a member of the management board of the Volkswagen Group (2022). Ms. Wortmann has also worked in various management positions at BMW Group (1998-2019), a German automotive manufacturer multinational company, including as a senior vice president for product management (2010-2017), a senior vice president for the brand (2016-2017), and a chief executive officer for the Asia-Pacific region (2018-2019). She also held various management positions at Unilever in Germany and London (1990- 1998). Ms. Wortmann holds a degree in Business Administration from the University of Münster (Germany) and an MBA from the University of London (UK). She is 58 years old. The Board nominates Ms. Wortmann particularly because of her proven knowledge in innovation, digitalization, and business strategy, which are key elements of the Ferrovial group's strategy. It is clear from her career that she has extensive managerial and executive experience in large industrial and business groups (Audi, BMW, and Unilever have a global presence), as well as wide international experience within them. Regarding the work and dedication of Ms. Wortmann since her confirmation and appointment at the 2022 general shareholders' meeting of Ferrovial, S.A. to date, the Board considers that she has maintained a high level of performance, attending meetings and contributing effectively

14-23 to the Board. The Board is of the opinion that Ms. Wortmann fits well in the Board of Directors’ Profile Policy. Ms. Wortmann qualifies as independent in accordance with the Code and the Nasdaq listing rules. At the date of the publication of this agenda and explanatory notes, Ms. Wortmann does not hold shares in share capital of Ferrovial. 5g. Proposal to re-appoint Ms. Alicia Reyes Revuelta as Non-Executive Director (voting item) Ms. Alicia Reyes Revuelta has been a Director since 2021 and is a member of the Audit and Control Committee. Ms. Reyes is also currently an Independent Director of Banco Sabadell, a Spanish financial institution, and one of the Group’s lenders, since 2020; an independent non-executive director of KBC Group, a Belgian bank-insurance group, and its affiliates KBC Bank N.V. and KBC Global Services, since 2022; a member of the General and Supervisory Board of Energias de Portugal (EDP), since 2024; a trustee of Fareshare UK, a U.K. charity, since 2020, and a Guest Professor at the Institute of Finance and Technology in University College London (UCL). Previously, Ms. Reyes was president and chief executive officer of Momentus Securities, a FINRA member firm (2023); director and the chief executive officer of Wells Fargo Securities International Limited, a U.K. broker-dealer part of U.S. financial services multinational company Wells Fargo, and Wells Fargo Securities Europe SA (2016- 2019), also part of Wells Fargo; non-executive director of TSB Bank (2021-2022), a U.K. financial institution; global head of structuring in the investment banking division and global head of insurance solutions and strategic equity derivatives of Barclays Capital (2006- 2014), a U.K. brokerage firm and investment advisor part of Barclays PLC; country manager for Spain and Portugal of Bear Stearns, a U.S. investment bank (2002-2006); and chief investment officer of Telecom Ventures (1998-2002), the Spanish multinational Abengoa’s venture capital fund specialized in technology. She also worked for Deutsche Bank (1996-1998), a German financial institution, as an associate in the relative value group. Ms. Reyes holds a degree in Law, Economics and Business Administration from the Universidad Pontificia de Comillas (ICADE) in Madrid and a PhD (summa cum laude) in quantitative methods and financial markets from the same university. She is 53 years old. The Board nominates Ms. Reyes particularly because of her extensive managerial and executive background in large financial and industrial groups (Deutsche Bank, Abengoa, Barclays and Wells Fargo have a worldwide presence), and vast international experience can be derived from her career. She also has good knowledge of several of the main markets in which the Ferrovial group operates, such as the U.S. and the U.K. Her academic background and professional responsibilities prove that she has extensive financial and capital markets knowledge, as well as strategic vision and analytical and conceptual skills. Regarding the work and effective dedication of Ms. Reyes since her confirmation and appointment at the 2022 general shareholders' meeting of Ferrovial, S.A. and up to the present date, the Board notes that she has maintained a high level of performance,

15-23 attending and actively participating in the meetings, both on the Board and the Audit and Control Committees. Ms. Reyes qualifies as independent in accordance with the Code and the Nasdaq listing rules. At the date of the publication of this agenda and explanatory notes, Ms. Reyes does not hold shares in share capital of Ferrovial. 6. Amendment of the Directors' Remuneration Policy (voting item) It is proposed by the Board, following the recommendation of the Nomination and Remuneration Committee, to adopt an amended Directors' Remuneration Policy in accordance with article 8.5 of the Articles of Association. The full text of the proposed Directors' Remuneration Policy has been made available on Ferrovial's website (www.ferrovial.com). If adopted by the 2025 General Meeting, the amended Directors' Remuneration Policy will be effective as per 1 January 2025. The proposed amendments have been prepared by the Nomination and Remuneration Committee. As part of its preparations, a benchmark was performed as detailed below. In addition, Ferrovial engaged with various stakeholders, including shareholders and proxy advisors, to obtain their views, including through bilateral meetings and as expressed by shareholders through their vote on the annual remuneration report, which received 96.65% votes in favor during the 2024 shareholders’ meeting. For example, stakeholders considered that payment in shares is agreeable provided that non-performance conditions are imposed, or that an increase in the remuneration may be justified by an appropriate rationale. Ferrovial very much values the views of stakeholders in this respect and it considers stakeholder engagement a continuous process that is ongoing. The Directors’ Remuneration Policy provides the remuneration framework for Executive Directors and Non-Executive Directors, and other considerations for determining the remuneration of the members of the Board. The proposed amendments apply to the fixed remuneration of the Executive Directors (as set out in Chapter 2 of the Directors’ Remuneration Policy) and to the remuneration of the Directors in their capacity as such (as set out in Chapter 3 of such Policy). The main proposed changes to the Directors’ Remuneration Policy are set out below, as well as the rationale for such changes. The annex of the Directors' Remuneration Policy also includes a summary of these amendments and their rationale. 1. Increase in the fixed remuneration of the Chairman and the Chief Executive Officer It is proposed to increase (i) the Chairman’s fixed remuneration by 10%, from EUR 1,500,000 to EUR 1,650,000; and (ii) the Chief Executive Officer’s fixed remuneration by 10.3%, from EUR 1,450,000 to EUR 1,600,000.

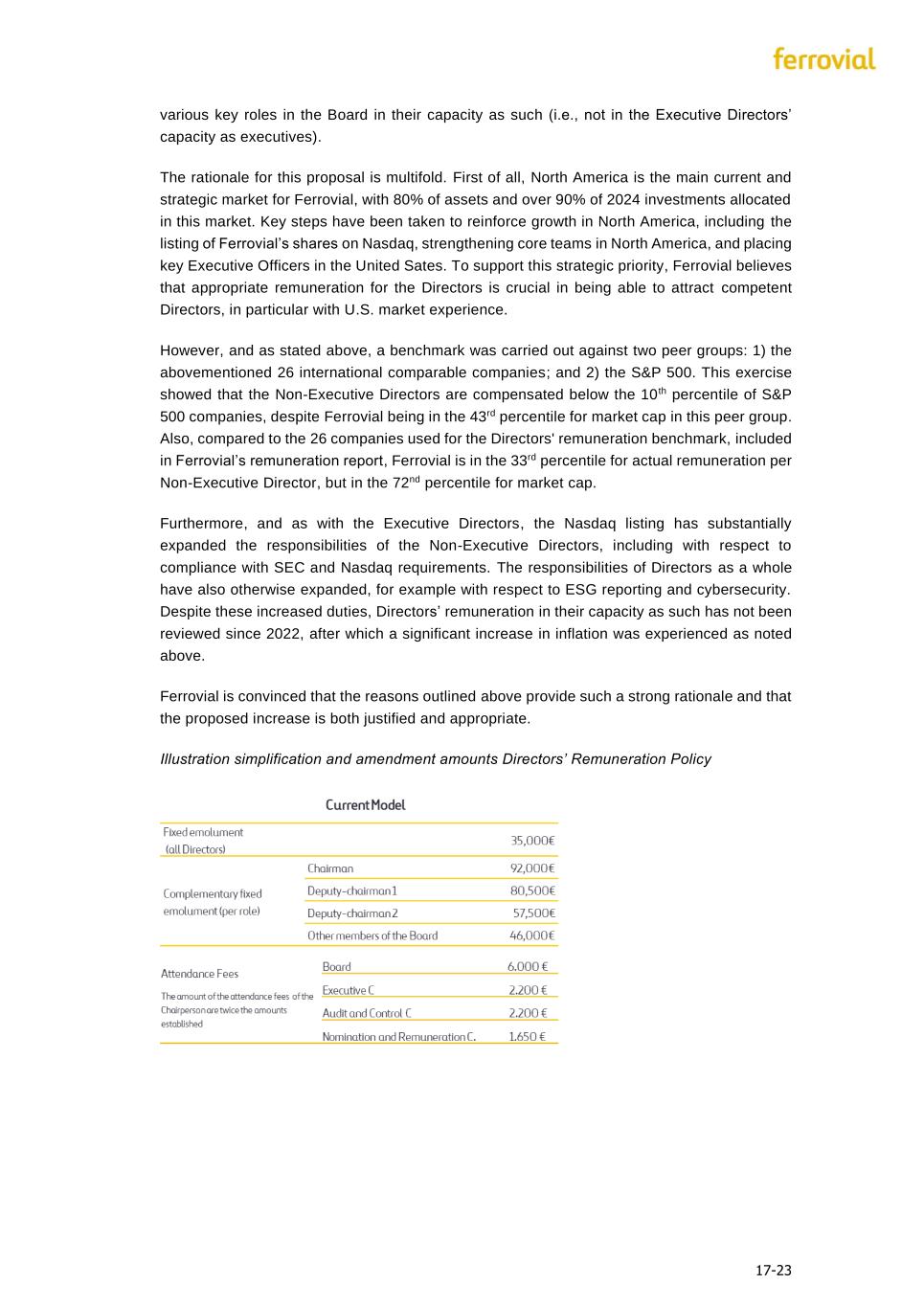

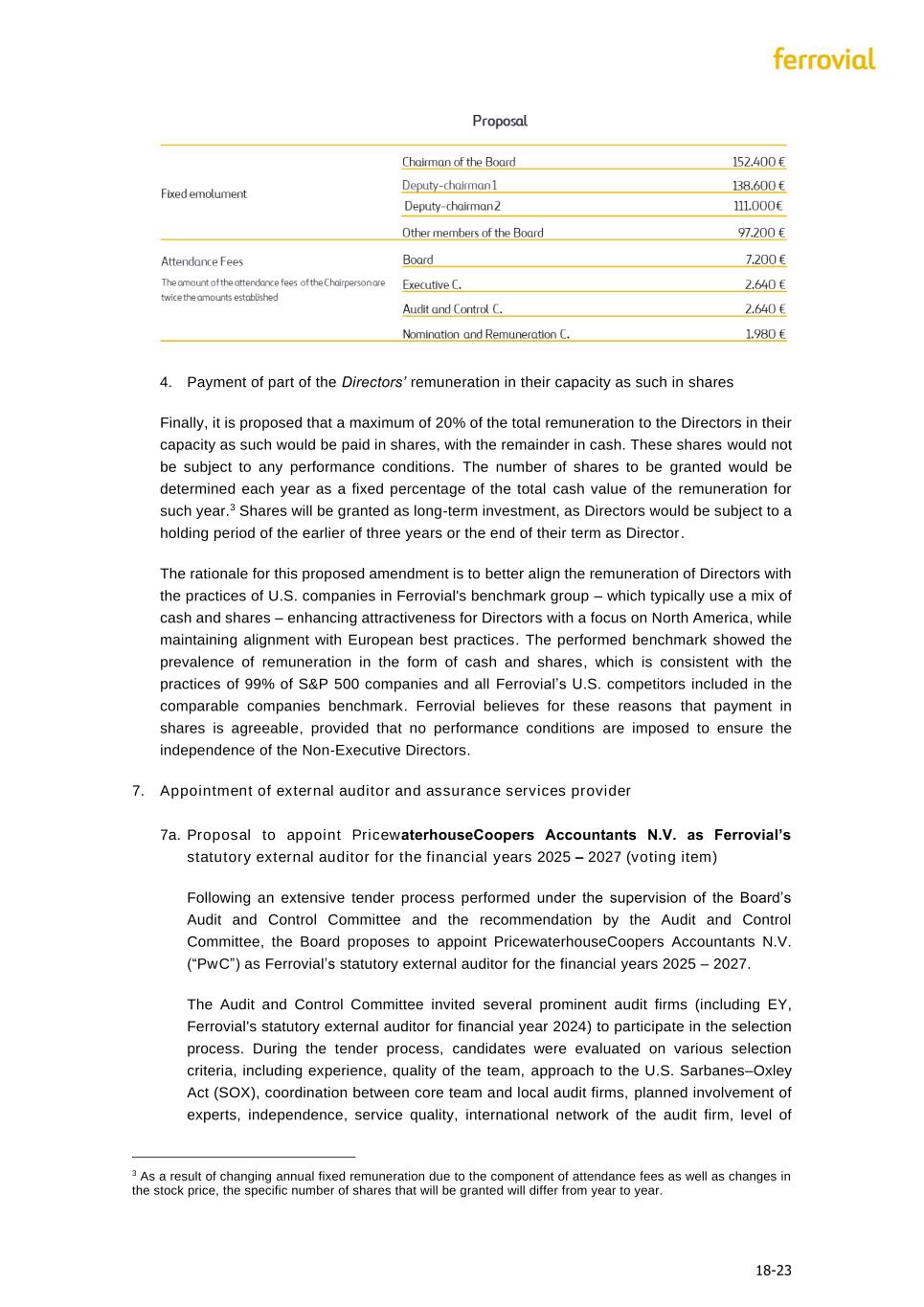

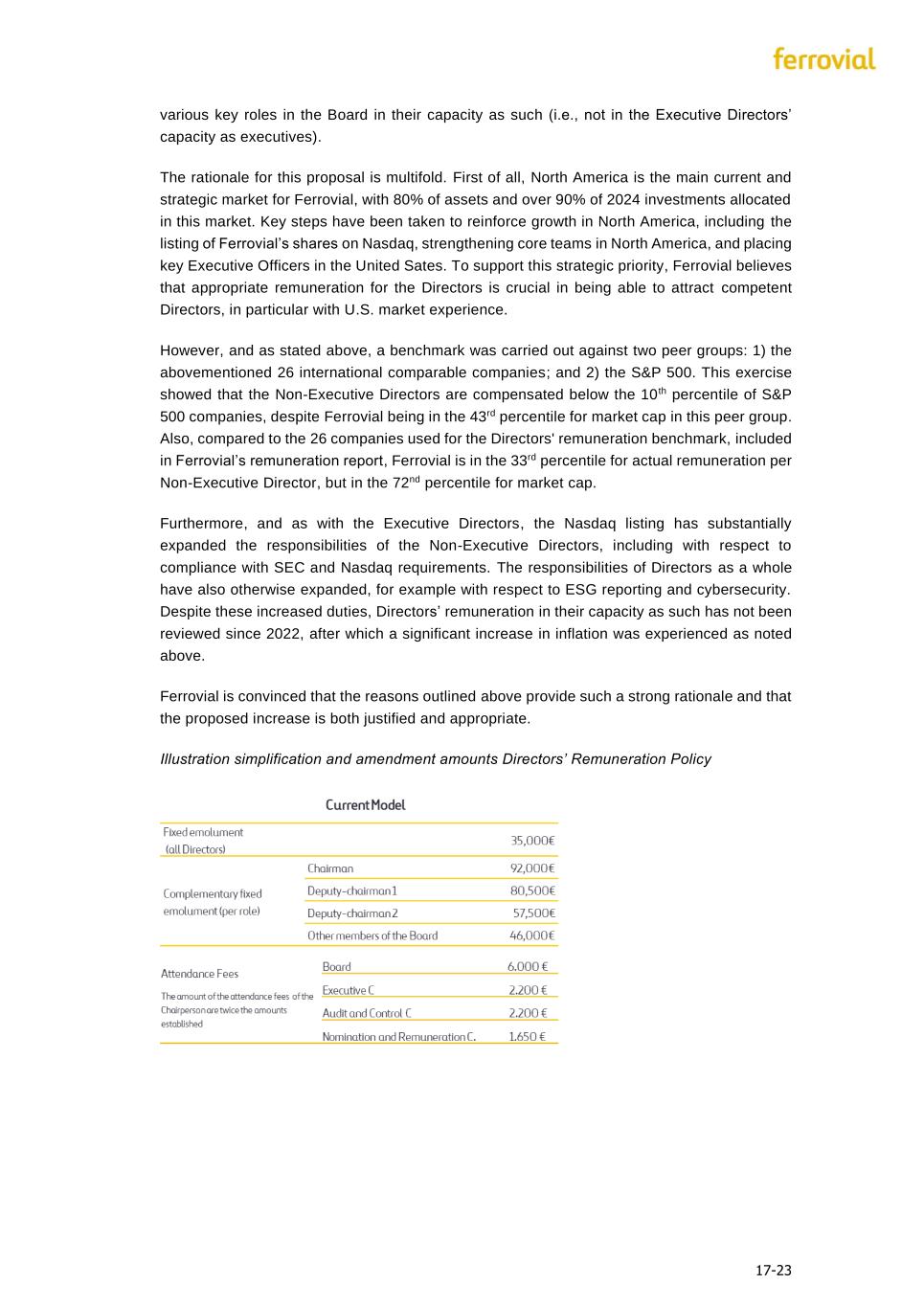

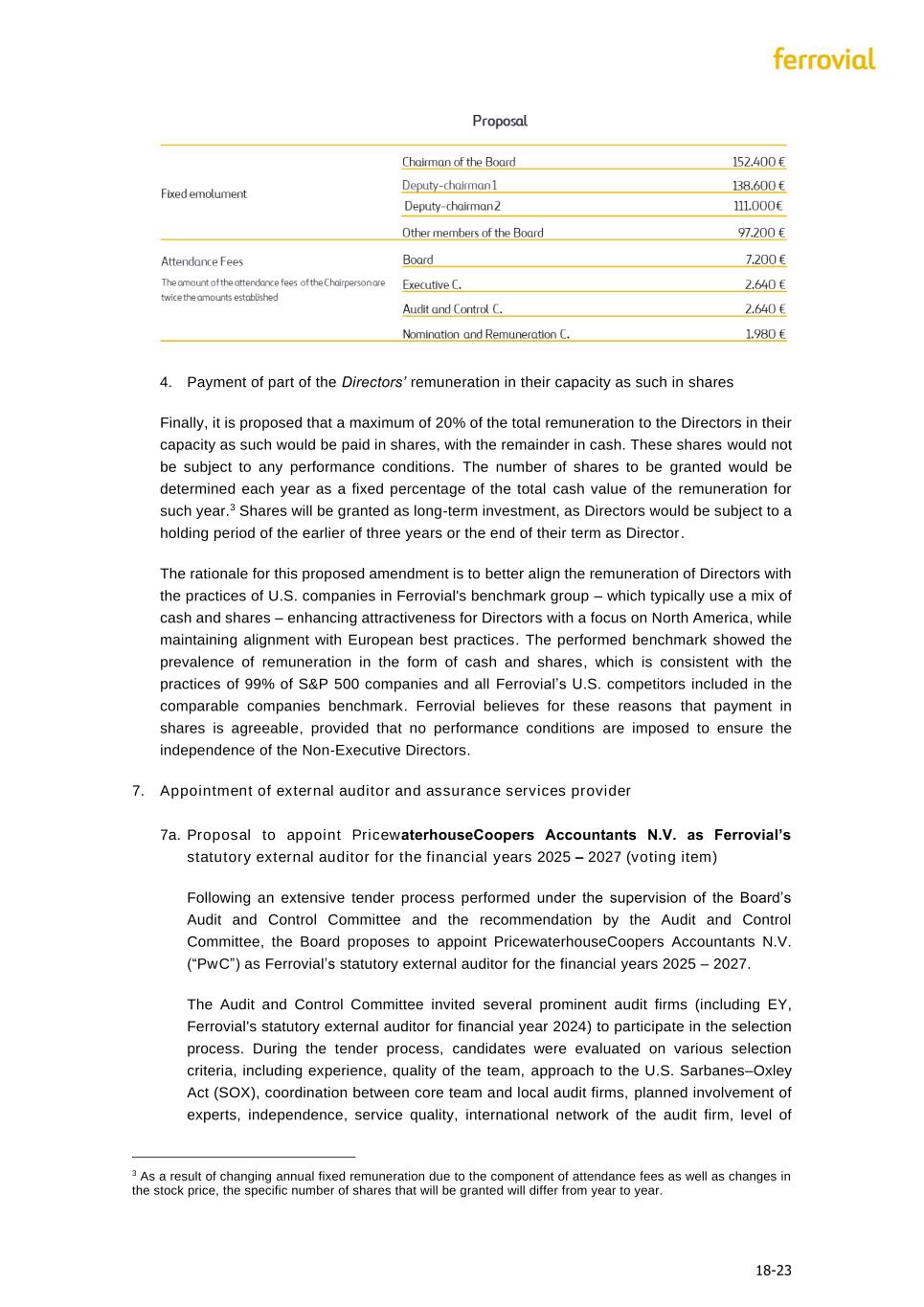

16-23 There are several reasons that justify this proposal. The current corporate and listing structure of Ferrovial leads to a significant increase in the complexity of the Executive Directors' roles, along with new responsibilities related to the listings in the U.S., Spain, and the Netherlands. These include compliance with SEC and Nasdaq requirements, such as those arising from Sarbanes Oxley Act, and corporate governance requirements of various regulatory bodies and stock exchanges. In addition, the increased international footprint of Ferrovial entails an increase of complexity in developing and implementing Ferrovial strategy. The Chairman's remuneration has not been reviewed since 2021, during which time the compound inflation in both Spain and the Netherlands has exceeded 18%. Additionally, the average cumulative increase in remuneration for Ferrovial employees in Ferrovial’s main markets (Spain, Poland, the U.K., the U.S., Canada) has been 18.5%. Furthermore, the remuneration of the Chief Executive Officer has not been reviewed since 2023, during which time the compound inflation in Spain and the Netherlands has exceeded 5% and 6% respectively, and the average accumulated increase in remuneration for Ferrovial employees in our main markets has been 8.5%. Finally, the benchmark carried out against 26 international comparable companies, including a mix of i) IBEX-35 and AEX 25 companies similar in size to Ferrovial, ii) international competitors of Ferrovial, and iii) U.S. companies in Construction/Engineering/Infrastructures sectors (most of them smaller than Ferrovial), with 70% of peers being European, and over 65% being competitors of Ferrovial, shows that the total remuneration1 of both Executive Directors is in 27th percentile, despite Ferrovial being in 72th percentile for market cap. Ferrovial is convinced that the reasons outlined above provide such a strong rationale and that the proposed increase is both justified and appropriate. 2. Simplification of the structure of the Directors’ remuneration in their capacity as such The current structure of remuneration for Directors in their capacity as such comprises a fixed emolument and complementary fixed allocation. It is proposed to merge these two elements into a single fixed fee, equivalent to the combined total of the previous two elements, to be paid partially on a quarterly basis, and the remaining amount at the end of the year.2 The rationale for this change is to simplify and make the remuneration structure clearer for both Directors and stakeholders, aligning with best corporate governance practices in this respect. 3. Amendment of the total Directors’ remuneration in their capacity as such It is proposed to increase the maximum amount of annual remuneration for all Directors for their membership of the Board and its committees by 20%, from in aggregate EUR 1.9 million to EUR 2.28 million. The increase would be applied uniformly across all remuneration components (i.e., fixed fee and attendance fees) and to all Directors in their capacity as such (i.e., not in the Executive Directors’ capacity as executives). For illustrative purposes only, the table at the end of this agenda item sets out what this amendment would entail in total fees for 1 Benchmarking takes into account the concepts of base salary, annual bonus, long term incentive, board fees and pensions of the 26 companies included. 2 Directors also receive fixed amounts as attendance fees depending on the number of meetings attended in any given year. This structure is not affected by the proposed simplification.

17-23 various key roles in the Board in their capacity as such (i.e., not in the Executive Directors’ capacity as executives). The rationale for this proposal is multifold. First of all, North America is the main current and strategic market for Ferrovial, with 80% of assets and over 90% of 2024 investments allocated in this market. Key steps have been taken to reinforce growth in North America, including the listing of Ferrovial’s shares on Nasdaq, strengthening core teams in North America, and placing key Executive Officers in the United Sates. To support this strategic priority, Ferrovial believes that appropriate remuneration for the Directors is crucial in being able to attract competent Directors, in particular with U.S. market experience. However, and as stated above, a benchmark was carried out against two peer groups: 1) the abovementioned 26 international comparable companies; and 2) the S&P 500. This exercise showed that the Non-Executive Directors are compensated below the 10 th percentile of S&P 500 companies, despite Ferrovial being in the 43rd percentile for market cap in this peer group. Also, compared to the 26 companies used for the Directors' remuneration benchmark, included in Ferrovial’s remuneration report, Ferrovial is in the 33rd percentile for actual remuneration per Non-Executive Director, but in the 72nd percentile for market cap. Furthermore, and as with the Executive Directors, the Nasdaq listing has substantially expanded the responsibilities of the Non-Executive Directors, including with respect to compliance with SEC and Nasdaq requirements. The responsibilities of Directors as a whole have also otherwise expanded, for example with respect to ESG reporting and cybersecurity. Despite these increased duties, Directors’ remuneration in their capacity as such has not been reviewed since 2022, after which a significant increase in inflation was experienced as noted above. Ferrovial is convinced that the reasons outlined above provide such a strong rationale and that the proposed increase is both justified and appropriate. Illustration simplification and amendment amounts Directors’ Remuneration Policy

18-23 4. Payment of part of the Directors’ remuneration in their capacity as such in shares Finally, it is proposed that a maximum of 20% of the total remuneration to the Directors in their capacity as such would be paid in shares, with the remainder in cash. These shares would not be subject to any performance conditions. The number of shares to be granted would be determined each year as a fixed percentage of the total cash value of the remuneration for such year.3 Shares will be granted as long-term investment, as Directors would be subject to a holding period of the earlier of three years or the end of their term as Director. The rationale for this proposed amendment is to better align the remuneration of Directors with the practices of U.S. companies in Ferrovial's benchmark group – which typically use a mix of cash and shares – enhancing attractiveness for Directors with a focus on North America, while maintaining alignment with European best practices. The performed benchmark showed the prevalence of remuneration in the form of cash and shares, which is consistent with the practices of 99% of S&P 500 companies and all Ferrovial’s U.S. competitors included in the comparable companies benchmark. Ferrovial believes for these reasons that payment in shares is agreeable, provided that no performance conditions are imposed to ensure the independence of the Non-Executive Directors. 7. Appointment of external auditor and assurance services provider 7a. Proposal to appoint PricewaterhouseCoopers Accountants N.V. as Ferrovial’s statutory external auditor for the financial years 2025 – 2027 (voting item) Following an extensive tender process performed under the supervision of the Board’s Audit and Control Committee and the recommendation by the Audit and Control Committee, the Board proposes to appoint PricewaterhouseCoopers Accountants N.V. (“PwC”) as Ferrovial’s statutory external auditor for the financial years 2025 – 2027. The Audit and Control Committee invited several prominent audit firms (including EY, Ferrovial's statutory external auditor for financial year 2024) to participate in the selection process. During the tender process, candidates were evaluated on various selection criteria, including experience, quality of the team, approach to the U.S. Sarbanes–Oxley Act (SOX), coordination between core team and local audit firms, planned involvement of experts, independence, service quality, international network of the audit firm, level of 3 As a result of changing annual fixed remuneration due to the component of attendance fees as well as changes in the stock price, the specific number of shares that will be granted will differ from year to year.

19-23 innovation in the audit approach, competitiveness of the fees and transition plan. Candidates prepared written proposals which were presented in one of the meetings of the Audit and Control Committee. Based on all information available, the Audit and Control Committee concluded to recommend PwC as the most suitable and preferred candidate. The Board has followed the Audit and Control Committee's recommendation and preference, and has decided to nominate PwC for appointment as Ferrovial's auditor for the financial years 2025 - 2027. The decisive factors to recommend the appointment of PwC were a stronger SOX audit team with more experience auditing Foreign Private Issuers, and more competitive fees. The Audit and Control Committee confirmed that its recommendation is free from influence by a third party and that no clause of a contract as referred to in Article 16, paragraph 6 of the EC Regulation (537/2014) restricts the resolution of the 2025 General Meeting. 7b. Proposal to appoint PricewaterhouseCoopers Accountants N.V. as Ferrovial’s assurance services provider to perform an assurance review and issue an assurance opinion in an assurance statement on Ferrovial's statutory sustainability report for the financial years 2025 - 2027 (voting item) The Board, following advice by the Audit and Control Committee, proposes to appoint PwC as Ferrovial’s assurance services provider to perform an assurance review and issue an assurance opinion in an assurance statement on Ferrovial's statutory sustainability report for the financial years 2025 – 2027, in so far as required by the implementation into Dutch law of the Corporate Sustainability Reporting Directive (Directive (EU) 2022/2464), given PwC’s expertise in the subject matter and the expected synergies of the duties of external auditor and assurance services provider being performed by the same firm. 8. Authorization of the Board to issue ordinary shares 8a. Authorization of the Board to issue ordinary shares for general purposes (voting item) The Board believes it is in Ferrovial 's interest to be able to be flexible and react quickly, if and when deemed appropriate, to circumstances that require the issuance of ordinary shares. In accordance with article 3.2.1 of the Articles of Association, it is proposed to designate the Board as the corporate body authorized to issue ordinary shares in Ferrovial’s share capital and to grant rights to subscribe for ordinary shares in Ferrovial's share capital, up to a maximum of 10% of Ferrovial 's issued share capital at the date of the 2025 AGM. The authorization may be used for any and all purposes. This authorization will be valid for a period of 18 months from the date of the 2025 AGM, and therefore up to and including 23 October 2026. If adopted, this designation will replace the current designation of the Board as authorized corporate body to issue ordinary shares in Ferrovial’s share capital and to grant rights to subscribe for ordinary shares in Ferrovial's share capital for general purposes, which was granted by the 2024 shareholders’ meeting on 11 April 2024 for a period of 18 months.

20-23 8b. Authorization of the Board to issue ordinary shares for purposes of scrip dividends (voting item) As explained under agenda item 2b, the Board intends to resolve on one or more interim scrip dividends, that would allow shareholders to elect receiving cash dividend or dividend in the form of ordinary shares in Ferrovial's share capital. In order to enable the Board to resolve on the issue of such number of ordinary shares in Ferrovial's share capital as needed to implement such scrip dividend or scrip dividends, it is proposed, in accordance with article 3.2.1 of the Articles of Association, to designate the Board as the corporate body authorized to issue ordinary shares in Ferrovial’s share capital and to grant rights to subscribe for ordinary shares in Ferrovial’s share capital, up to a maximum of 5% of Ferrovial 's issued share capital at the date of the 2025 AGM. The authorization may be used solely for the implementation of one or more scrip dividends as may be resolved on by the Board. This authorization will be valid for a period of 18 months from the date of the 2025 AGM and therefore up to and including 23 October 2026. If adopted, this designation will replace the current designation of the Board as the authorized corporate body to issue ordinary shares in Ferrovial's share capital and to grant rights to subscribe for ordinary shares in Ferrovial's share capital in connection with scrip dividends, which was granted by the 2024 shareholders’ meeting on 11 April 2024 for a period of 18 months. 9. Authorization of the Board to limit or exclude pre-emptive rights 9a. Authorization of the Board to limit or to exclude pre-emptive rights for ordinary shares for general purposes (voting item) The Board believes that it is in Ferrovial's interest to be able to be flexible and react quickly, if and when deemed appropriate, to circumstances that require the issuance of ordinary shares with a limitation or exclusion of pre-emptive rights, without prior approval from the general meeting. In accordance with article 3.4.2 of the Articles of Association, it is proposed to designate the Board as the corporate body authorized to limit or exclude pre-emptive rights in connection with the issue of and/or the granting of rights to subscribe for ordinary shares in Ferrovial's share capital, up to a maximum of 10% of Ferrovial's issued share capital at the date of the 2025 AGM. The authorization may be used for any and all purposes. This authorization will be valid for a period of 18 months from the date of the 2025 AGM, and therefore up to and including 23 October 2026; If adopted, this designation will replace the current designation of the Board as the authorized corporate body to resolve on the limitation or exclusion of pre-emptive rights for general purposes, which was granted by the 2024 shareholders’ meeting on 11 April 2024 for a period of 18 months. 9b. Authorization of the Board to limit or to exclude pre-emptive rights for ordinary shares for purposes of scrip dividends (voting item)

21-23 As explained under agenda item 2b, the Board intends to resolve on one or more interim scrip dividends that would allow shareholders to elect to receive a cash dividend or a dividend in the form of ordinary shares in Ferrovial's share capital. In order to enable the Board to resolve on the issue of such number of ordinary shares in Ferrovial's share capital as needed to implement such scrip dividend or scrip dividends, it is proposed to, in accordance with article 3.4.2 of the Articles of Association, designate the Board as the corporate body authorized to limit or exclude pre-emptive rights in connection with the issue of and/or the granting of rights to subscribe for ordinary shares in Ferrovial's share capital, up to a maximum of 5% of Ferrovial's issued share at the date of the 2025 AGM. The authorization may be used solely for the implementation of one or more scrip dividends as may be resolved on by the Board. This authorization will be valid for a period of 18 months from the date of the 2025 AGM, and therefore up to and including 23 October 2026. If adopted, this designation will replace the current designation of the Board as the authorized corporate body to resolve on the limitation or exclusion of pre-emptive rights in connection with scrip dividends, which was granted by the 2024 shareholders’ meeting on 11 April 2024 for a period of 18 months. 10. Authorization of the Board to acquire ordinary shares (voting item) The Board believes that it is in Ferrovial’s interest to have the flexibility to be able to acquire ordinary shares in Ferrovial’s share capital, amongst other reasons, to enable Ferrovial to carry out share repurchase programs if the Board considers such share repurchase programs to be in the interest of Ferrovial and its stakeholders. Therefore, it is proposed that, in accordance with Article 4 of the Articles of Association and without prejudice to the provisions of Section 2:98 of the Dutch Civil Code, the Board is delegated the authority to resolve to acquire ordinary shares in Ferrovial’s share capital. The authorization may be used for any and all corporate purposes, and acquisitions may be made on the market or in any other manner. Ferrovial may acquire ordinary shares under this authorization up to an amount equal to 10% of Ferrovial's issued share capital as at the date of the 2025 AGM, provided that following the acquisition Ferrovial, together with its subsidiaries, does not hold more than 10% of Ferrovial's issued share capital. The minimum price that Ferrovial may pay for each share to be acquired will be the nominal value of such share. The maximum price, excluding expenses (including fees to be paid to banks assisting Ferrovial in any repurchases), that Ferrovial may pay for each share to be acquired, will be an amount equal to 110% of the market price of the ordinary shares. The market price is defined as the higher of (i) the price of ordinary shares at the time of repurchase and (ii) the closing price of the ordinary shares on the trading day prior to the date of acquisition, in each case on the exchange on which they are acquired (or in case of shares not acquired on an exchange, the exchange as designated by the Board). In case of a self-tender offer or an accelerated repurchase program, the Board may decide that the market price is defined as the arithmetic average of the daily VWAP (volume-weighted

22-23 average price) of the ordinary shares on the exchange on which they are acquired (or in case of shares not acquired on an exchange, the exchange as designated by the Board) over a period of at least one trading day. Any determination of prices at any exchange, as well as any foreign exchange rate where applicable, will be based on the information provided by a source selected by the Board. This authorization will be valid for a period of 18 months from the date of the 2025 AGM, and therefore up to and including 23 October 2026. If adopted, this authorization will replace the current authorization of the Board to repurchase ordinary shares in Ferrovial's share capital, which was granted by the 2024 shareholders’ meeting on 11 April 2024 for a period of 18 months. 11. Cancellation of ordinary shares (voting item) In order to enable the Board to implement a cancellation of ordinary shares in Ferrovial 's share capital as may be held by Ferrovial from time to time, it is proposed that the 2025 Shareholders’ Meeting resolves, in the manner further set out in this proposal, to cancel ordinary shares in Ferrovial's share capital as these may be held by Ferrovial from time to time. The number of ordinary shares that will be cancelled will be determined by the Board. The cancellation may be implemented by the Board in one or more tranches. This resolution will lapse 18 months after the date of the 2025 AGM and therefore up to and including 23 October 2026. If adopted, this resolution will replace the current resolution to cancel ordinary shares in Ferrovial 's share capital, adopted by the 2024 shareholders’ meeting on 11 April 2024 for a period of 18 months. 12. Closing

23-23 Forward-Looking Statements This agenda and explanatory notes (together the “AGM Agenda Materials”) contain forward- looking statements; any express or implied statements contained in the AGM Agenda Materials that are not statements of historical fact may be deemed to be forward-looking statements, including, without limitation, statements regarding the company’s reserves and dividend policy, and the company’s future performance and the associated role of members of its senior leadership, as well as statements that include the words “expect,” “believe,” “aim,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. Forward-looking statements are neither promises nor guarantees, but involve known and unknown risks and uncertainties that could cause actual results to differ materially from those projected, including, without limitation: risks related to our diverse geographical operations; risks related to our acquisitions, divestments and other strategic transactions that we may undertake; the impact of competitive pressures in our industry and pricing, including the lack of certainty and costs in winning competitive tender processes; general economic and political conditions and events and the impact they may have on us, including, but not limited to, increases in inflation rates and rates of interest, increased costs for materials, and other ongoing impacts resulting from the Russia/Ukraine and the Middle East conflicts; the fact that our business is derived from a small number of major projects; cyber threats or other technology disruptions; our ability to obtain adequate financing in the future as needed; our ability to maintain compliance with the continued listing requirements of Euronext Amsterdam, the Nasdaq Global Select Market and the Spanish Stock Exchanges; lawsuits and other claims by third parties or investigations by various regulatory agencies that we may be subject to; our ability to comply with our ESG commitments or other sustainability demands; the impact of any changes in existing or future tax regimes or regulations; and the other important factors discussed under the caption “Risk Factors” in our registration statement on Form 20-F filed with the U.S. Securities and Exchange Commission (“SEC”) on February 27, 2025 which is available on the SEC website at www.sec.gov, as such factors may be updated from time to time in our other filings with the SEC. Any forward-looking statements contained in the AGM Agenda Materials speak only as of the date hereof and accordingly undue reliance should not be placed on such statements. We disclaim any obligation or undertaking to update or revise any forward-looking statements contained in the AGM Agenda Materials, whether as a result of new information, future events or otherwise, other than to the extent required by applicable law. Forward-looking statements in the AGM Agenda Materials are made pursuant to the safe harbor provisions contained in the U.S. Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by relevant safe harbor provisions for forward-looking statements (or their equivalent) of any applicable jurisdiction.