Document

HYATT REPORTS THIRD QUARTER 2025 RESULTS

CHICAGO (November 6, 2025) - Hyatt Hotels Corporation ("Hyatt," "the Company," "we," "us," or "our") (NYSE: H) today reported third quarter 2025 results. Highlights include:

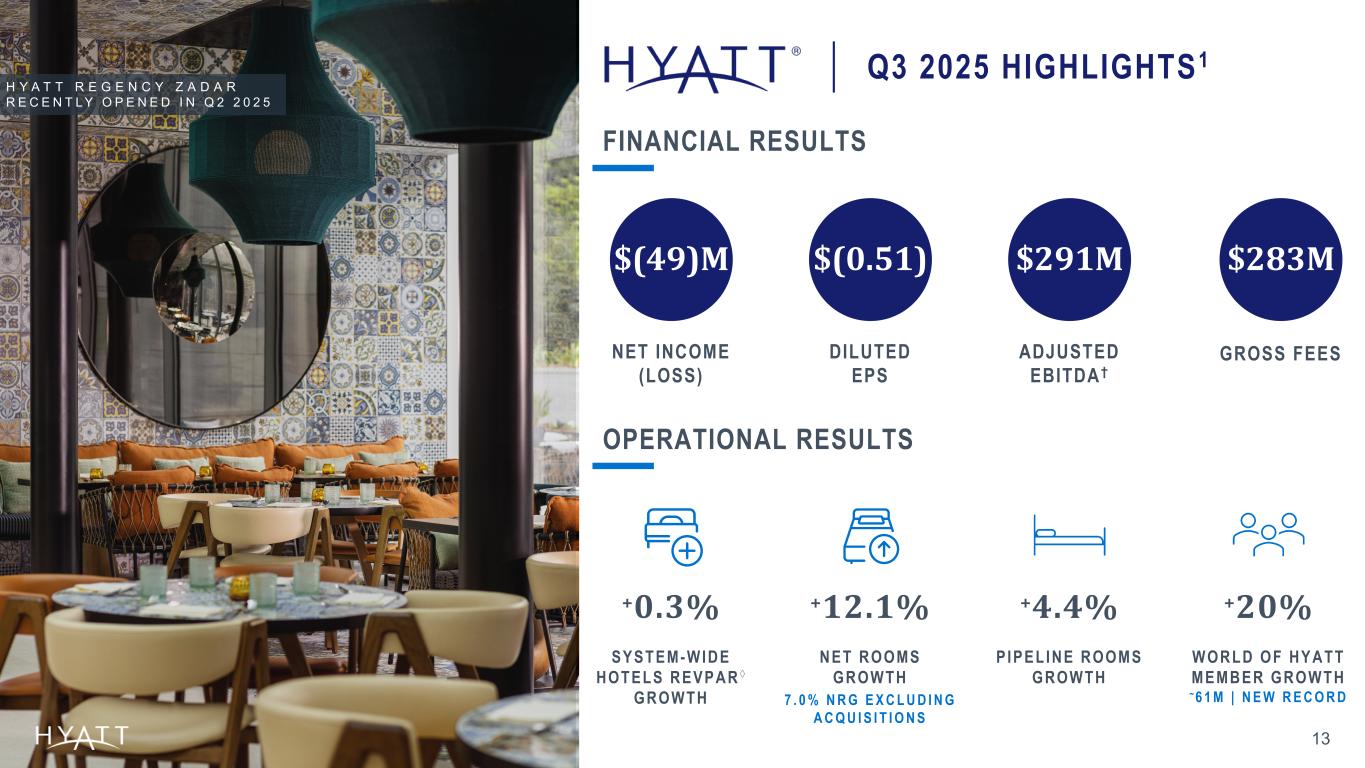

•Comparable system-wide hotels RevPAR increased 0.3%, compared to the third quarter of 2024

•Net rooms growth was 12.1% and net rooms growth excluding acquisitions was 7.0%

•Net income (loss) attributable to Hyatt Hotels Corporation was $(49) million and Adjusted Net Income (Loss) was $(29) million

•Diluted EPS was $(0.51) and Adjusted Diluted EPS was $(0.30)

•Gross fees were $283 million, an increase of 5.9%, compared to the third quarter of 2024

•Adjusted EBITDA was $291 million, an increase of 5.6%, compared to the third quarter of 2024, or an increase of 10.1% after adjusting for assets sold in 2024

•Pipeline of executed management or franchise contracts was approximately 141,000 rooms, an increase of 4.4%, compared to the third quarter of 2024

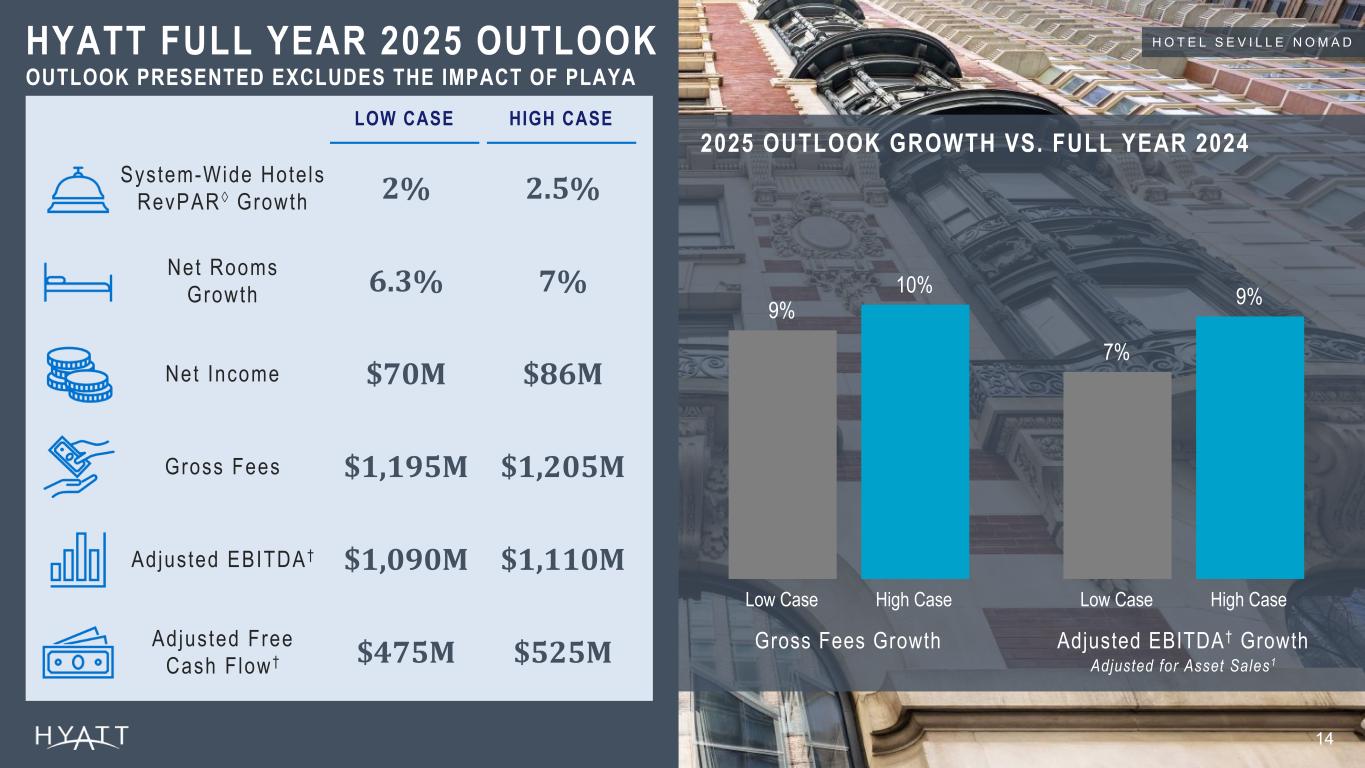

•Full Year 2025 Outlook: The following metrics do not include the impact of the Playa Hotels Acquisition and the pending Playa Real Estate Transaction. Refer to page 3 and the tables beginning on schedule A-11 for the impact of the Playa Hotels Acquisition on the full year outlook, which has been adjusted to reflect the potential impact from Hurricane Melissa.

◦Comparable system-wide hotels RevPAR growth is projected between 2% to 2.5%, compared to the full year 2024

◦Net rooms growth excluding acquisitions is projected between 6.3% to 7.0%, compared to the full year 2024

◦Net income is projected between $70 million and $86 million

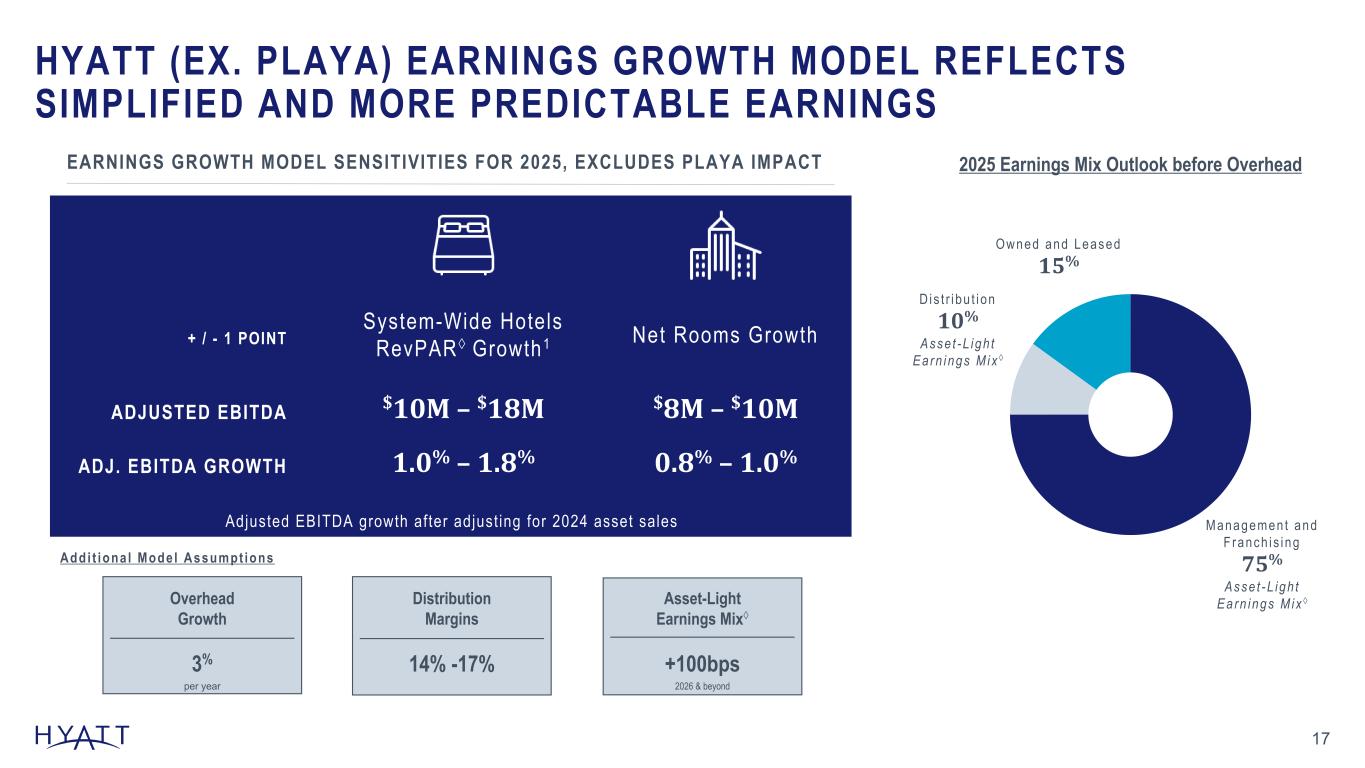

◦Adjusted EBITDA is projected between $1,090 million and $1,110 million, an increase of 7% to 9% after adjusting for assets sold in 2024, compared to the full year 2024

◦Capital returns to shareholders is projected to be approximately $350 million, through a combination of dividends and share repurchases

Subsequent to the end of the third quarter, the Company announced an expanded agreement with Chase that rewards World of Hyatt cardmembers for stays across Hyatt's global portfolio. The impact to Adjusted EBITDA related to the economics of the credit card programs and similar third-party relationships is expected to more than double from 2025 to 2027 with anticipated continued growth in future years.

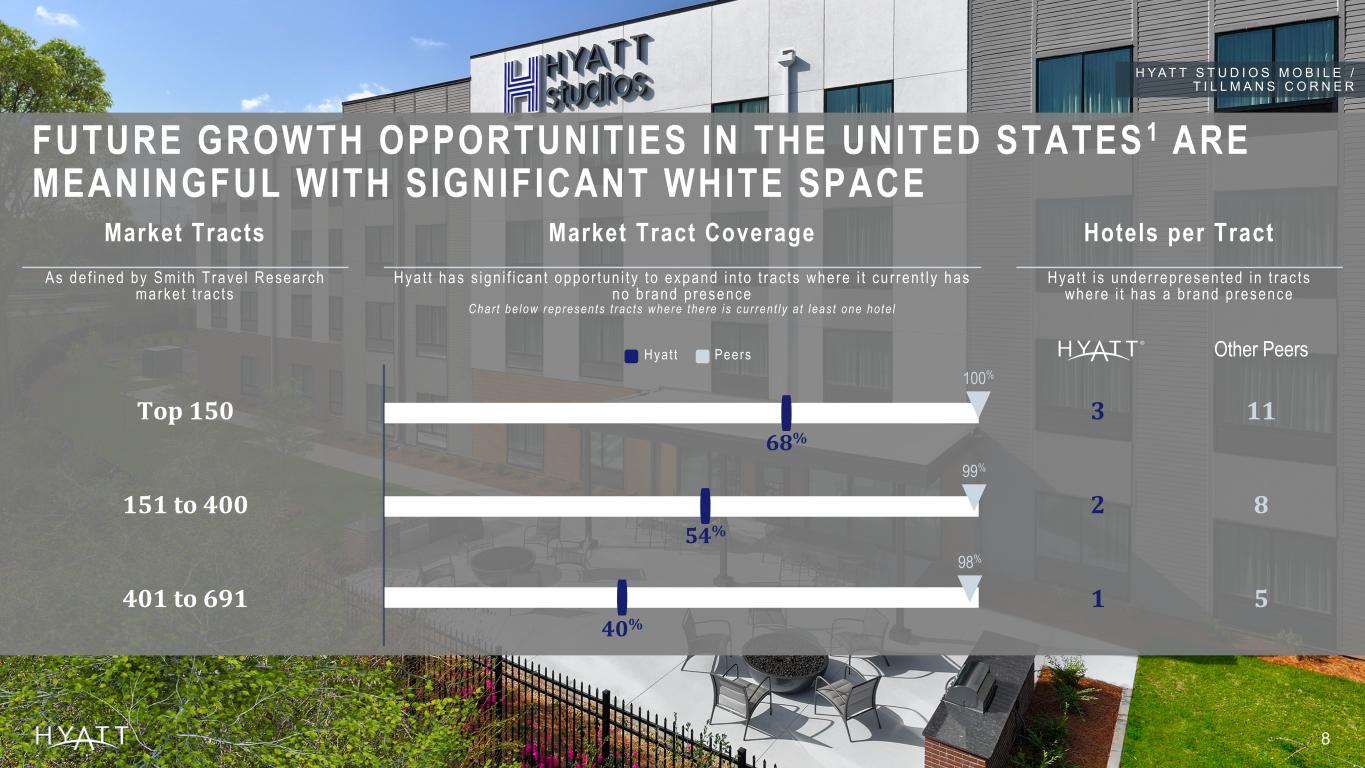

Mark S. Hoplamazian, President and Chief Executive Officer of Hyatt, said, “Our third quarter results reflect the strength of our core fee business and our disciplined approach to cost management. As we continue our evolution to a brand-led organization, we are focused on elevating guest experiences, deepening customer loyalty through World of Hyatt, and expanding into high-growth segments and geographies. Looking into the fourth quarter and beyond, we believe our high-end customer base, robust pipeline with significant white space for growth, and rapidly expanding loyalty program position us to drive sustained growth and create long-term value for our shareholders.”

Refer to the table on schedule A-9 for a summary of special items impacting Adjusted Net Income (Loss) and Adjusted Diluted EPS for the three and nine months ended September 30, 2025.

Note: All RevPAR and ADR growth percentage changes are in constant dollars. All Net Package RevPAR and Net Package ADR growth percentage changes are in reported dollars. This release includes references to non-GAAP financial measures. Refer to the non-GAAP reconciliations included in the schedules and the definitions of the non-GAAP measures presented beginning on schedule A-6.

Third Quarter Operational Commentary

•Luxury chain scales drove RevPAR growth in the third quarter. Leisure transient RevPAR was the strongest area of growth while group RevPAR growth was negatively impacted by approximately 100 bps due to the timing of the Rosh Hashanah holiday which occurred in the third quarter this year compared to the fourth quarter last year.

•Net Package RevPAR increased 7.6% in the third quarter compared to the third quarter last year, further illustrating the strong performance of luxury all inclusive travel.

•Gross fees increased 5.9% in the quarter, compared to the third quarter last year or 6.3% excluding the impact of the Playa Hotels Acquisition.

◦Base management fees: increased 10%, driven by managed hotel RevPAR growth outside of the United States and the contribution of newly-opened hotels.

◦Incentive management fees: grew 2%, led by newly-opened hotels and hotel performance in Asia Pacific excluding Greater China.

◦Franchise and other fees: expanded 4%, due to non-RevPAR fee contributions and newly-opened hotels, offset by the elimination of fees from the 8 Hyatt Ziva and Hyatt Zilara properties that were part of the Playa Hotels Acquisition.

•Owned and leased segment Adjusted EBITDA increased 7%, compared to the third quarter of 2024, after adjusting for assets sold in 2024 and the impact of the Playa Hotels Acquisition. Comparable owned and leased margin decreased by 40 bps in the third quarter, compared to the same period in 2024.

•Distribution segment Adjusted EBITDA declined compared to the third quarter of 2024, due to lower booking volumes and the lapping of a one-time benefit from ALG Vacations travel credits last year which was not offset by higher pricing and effective cost management.

Openings and Development

During the third quarter, the Company:

•Opened 5,163 rooms. Notable openings included:

◦Park Hyatt Kuala Lumpur in the tallest skyscraper in Asia Pacific, Park Hyatt Johannesburg, Secrets Playa Esmeralda Resort and Spa in Punta Cana, and Hyatt Regency Times Square, the first Hyatt Regency property in Manhattan and our 30th property in New York City.

•Announced a new master franchise agreement with HomeInns Hotel Group. Under this agreement, HomeInns Hotel Group plans to open 50 Hyatt Studios branded hotels over the next several years and develop a robust pipeline to fuel future growth across China.

Transactions

The Company has provided the following updates on the Playa Real Estate Transaction and the 15 properties acquired from the Playa Hotels Acquisition:

•We expect to close on the Playa Real Estate Transaction to sell 14 properties by the end of the year and use the proceeds to repay the amounts outstanding under the $1.7 billion delayed draw term loan used to finance a portion of the Playa Hotels Acquisition. Concurrent with the sale, the Company will enter into 50-year management agreements for 13 of the 14 properties. The remaining property is subject to a separate contractual arrangement.

•On September 18, 2025, one property in Playa del Carmen was sold to a separate third-party buyer for approximately $22 million. Net proceeds of the sale were used to repay a portion of the delayed draw term loan.

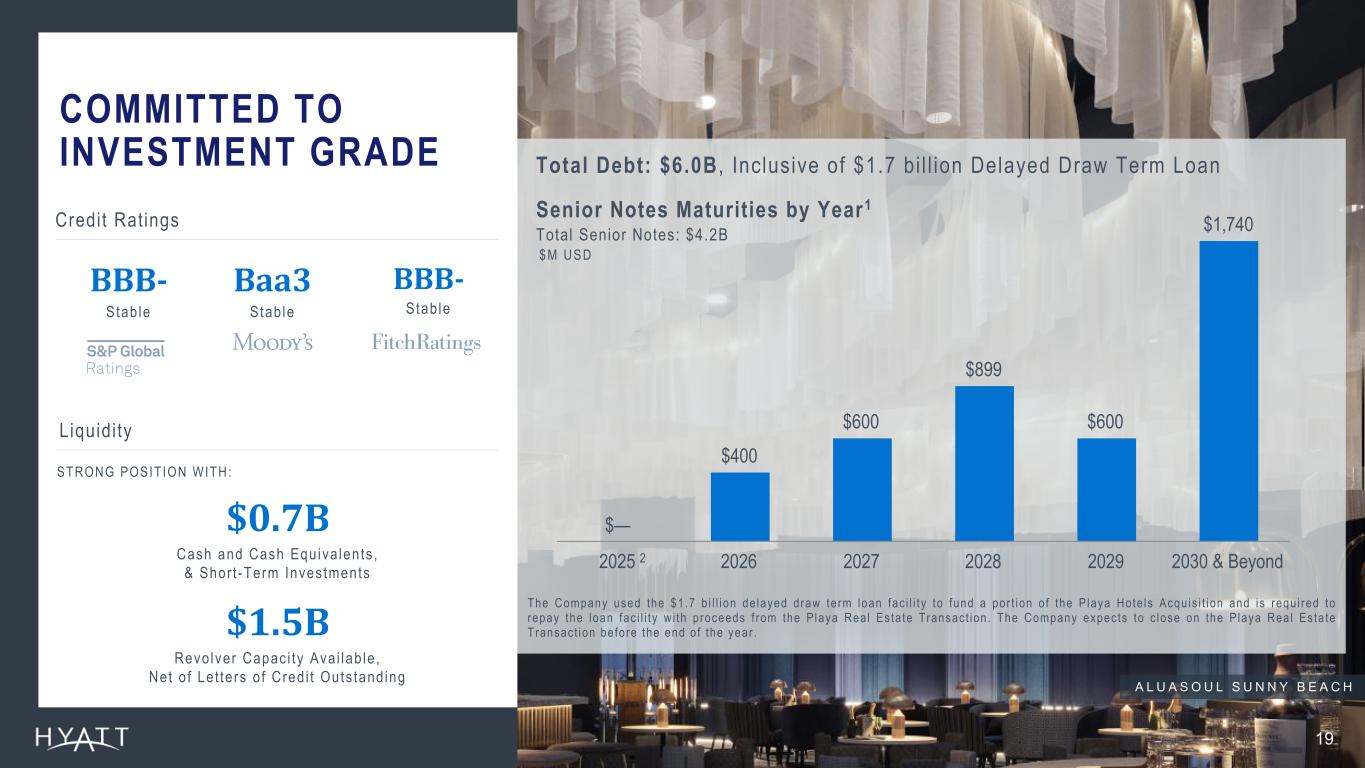

Balance Sheet and Liquidity

As of September 30, 2025, the Company reported the following:

•Total debt of $6.0 billion, inclusive of the $1.7 billion delayed draw term loan facility.

•Total liquidity of $2.2 billion, inclusive of:

◦$749 million of cash and cash equivalents, and short-term investments, and

◦$1,497 million of borrowing capacity under Hyatt's revolving credit facility, net of letters of credit outstanding.

•Total remaining share repurchase authorization of $792 million. The Company repurchased $30 million of Class A common stock during the third quarter.

•The Company's board of directors has declared a cash dividend of $0.15 per share for the fourth quarter of 2025. The dividend is payable on December 8, 2025 to Class A and Class B stockholders of record as of November 24, 2025.

2025 Outlook

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 Full Year Outlook, excluding the impact of the Playa Hotels Acquisition and Playa Real Estate Transaction |

|

|

2025 Outlook |

|

2024 Reported |

|

Change vs. 2024 |

System-Wide Hotels RevPAR Growth |

|

|

|

|

|

2% to 2.5% |

| Net Rooms Growth |

|

|

|

|

|

6.3% to 7% |

| (in millions) |

|

|

|

|

|

|

| Net income attributable to Hyatt Hotels Corporation |

|

$70 - $86 |

|

$1,296 |

|

(95)% to (93)% |

| Gross Fees |

|

$1,195 - $1,205 |

|

$1,099 |

|

9% to 10% |

Adjusted G&A Expenses1 |

|

$440 - $445 |

|

$444 |

|

(1)% to —% |

Adjusted EBITDA1 |

|

$1,090 - $1,110 |

|

$1,0162 |

|

7% to 9%2 |

| Capital Expenditures |

|

Approx. $150 |

|

$170 |

|

Approx. (12)% |

Adjusted Free Cash Flow1 |

|

$475 - $525 |

|

$540 |

|

(12)% to (3)% |

Capital Returns to Shareholders3 |

|

Approx. $350 |

|

|

|

|

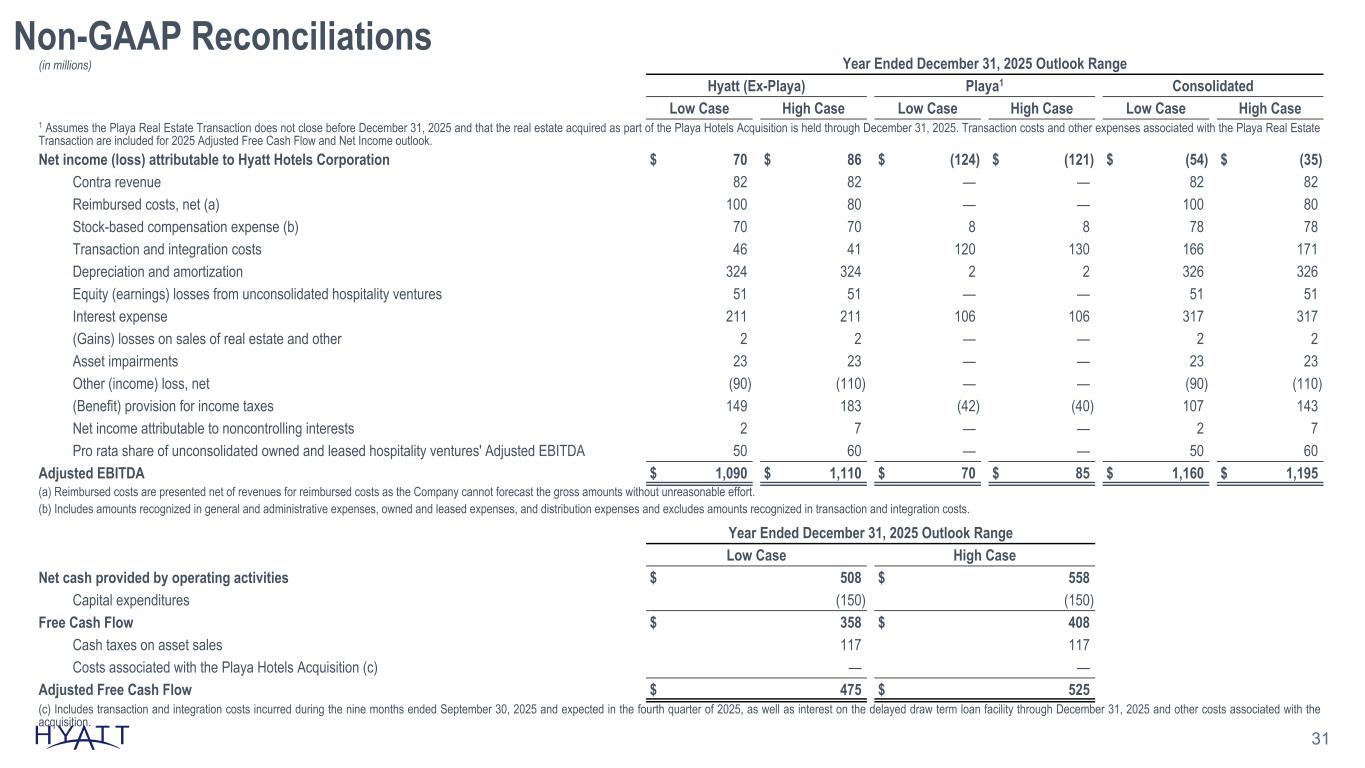

1 Refer to the tables on schedule A-11 for a reconciliation of estimated net income (loss) attributable to Hyatt Hotels Corporation to Adjusted EBITDA, G&A expenses to Adjusted G&A Expenses, and net cash provided by operating activities to Free Cash Flow and Adjusted Free Cash Flow.

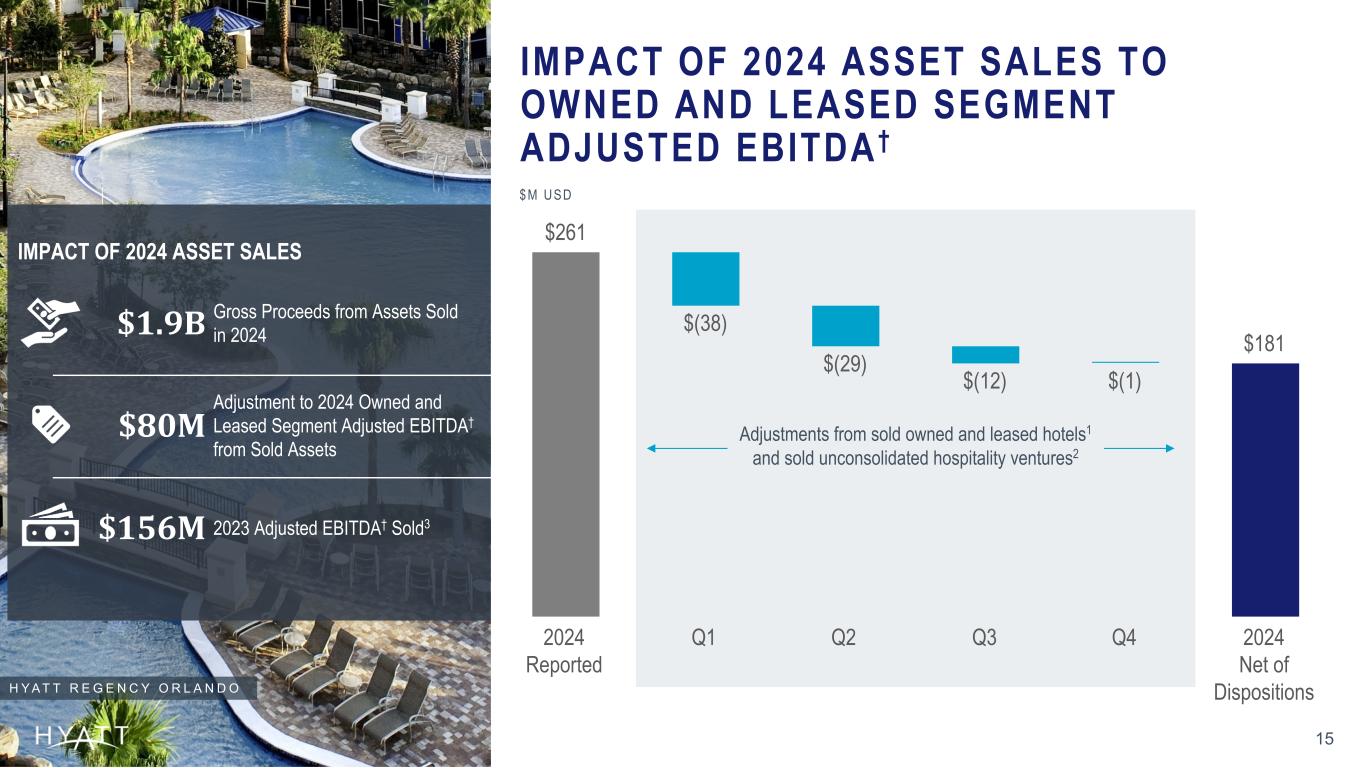

2 Reflects a reduction of $80 million to 2024 owned and leased segment Adjusted EBITDA to account for the impact of sold hotels. Refer to schedule A-10 for further details.

3 The Company expects to return capital to shareholders through a combination of cash dividends on its common stock and share repurchases.

•System-wide RevPAR outlook implies fourth quarter growth of 0.5% at the low end of our range and 2.5% at the high end of our range, and reflects an improvement in group business in the United States in the fourth quarter.

•Net income outlook projected year over year decline is driven by 2024 gains on sale of real estate and other.

•Adjusted EBITDA outlook is projected between $1,090 million - $1,110 million, growing between 7% to 9% compared to the full year 2024 after adjusting for assets sold in 2024.

•Adjusted Free Cash Flow growth compared to full year 2024 is impacted by elevated levels of interest expense and cash taxes.

•The Company has increased its 2025 outlook for capital returns to shareholders and is projected to return approximately $350 million of capital to shareholders through a combination of cash dividends on its common stock and share repurchases.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2025 Full Year Outlook, including the impact of the Playa Hotels Acquisition |

|

|

Hyatt (Ex-Playa) |

|

Playa4 |

|

Consolidated |

System-Wide Hotels RevPAR Growth |

|

2% to 2.5% |

|

—% |

|

2% to 2.5% |

| Net Rooms Growth |

|

6.3% to 7% |

|

0.7% |

|

7% to 7.7% |

| (in millions) |

|

|

|

|

|

|

| Net income attributable to Hyatt Hotels Corporation |

|

$70 - $86 |

|

$(124) - $(121) |

|

$(54) - $(35) |

| Gross Fees |

|

$1,195 - $1,205 |

|

Approx. $(5) |

|

$1,190 - $1,200 |

Adjusted G&A Expenses5 |

|

$440 - $445 |

|

$6 - $7 |

|

$446 - $452 |

Adjusted EBITDA5 |

|

$1,090 - $1,110 |

|

$70 - $85 |

|

$1,160 - $1,195 |

| Capital Expenditures |

|

Approx. $150 |

|

$75 |

|

Approx. $225 |

Adjusted Free Cash Flow5 |

|

$475 - $525 |

|

$(25) |

|

$450 - $500 |

Capital Returns to Shareholders6 |

|

Approx. $350 |

|

$— |

|

Approx. $350 |

4 Assumes the Playa Real Estate Transaction does not close before December 31, 2025 and that the real estate acquired as part of the Playa Hotels Acquisition is held through December 31, 2025. Transaction costs and other expenses associated with the Playa Real Estate Transaction are included for 2025 Adjusted Free Cash Flow and net income.

5 Refer to the tables beginning on schedule A-11 for a reconciliation of estimated net income (loss) attributable to Hyatt Hotels Corporation to Adjusted EBITDA, G&A expenses to Adjusted G&A Expenses, and net cash provided by operating activities to Free Cash Flow and Adjusted Free Cash Flow.

6 The Company expects to return capital to shareholders through a combination of cash dividends on its common stock and share repurchases.

Other than with respect to the Playa Hotels Acquisition, as noted above, no disposition or acquisition activity beyond what has been completed as of the date of this release has been included in the 2025 outlook. The Company's 2025 outlook is based on a number of assumptions that are subject to change and many of which are outside the control of the Company. If actual results vary from these assumptions, the Company's expectations may change. There can be no assurance that Hyatt will achieve these results.

Conference Call Information

The Company will hold an investor conference call this morning, November 6, 2025, at 9:00 a.m. CT.

Participants may listen to a simultaneous webcast of the conference call, which may be accessed through the Company's website at investors.hyatt.com. Alternatively, participants may access the live call by dialing: 800.715.9871 (U.S. Toll-Free) or 646.307.1963 (International Toll Number) using conference ID# 2303828 approximately 15 minutes prior to the scheduled start time.

A replay of the call will be available Thursday, November 6, 2025 at 12:00 p.m. CT until Thursday, November 13, 2025 at 10:59 p.m. CT by dialing: 800.770.2030 (U.S. Toll-Free) or 647.362.9199 (International Toll Number) using conference ID# 2303828. An archive of the webcast will be available on the Company's website for 90 days.

Investor Contacts

•Adam Rohman, 312.780.5834, adam.rohman@hyatt.com

•Ryan Nuckols, 312.780.5784, ryan.nuckols@hyatt.com

Media Contact

•Franziska Weber, 312.780.6106, franziska.weber@hyatt.com

Forward-Looking Statements

Forward-Looking Statements in this press release, which are not historical facts, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include statements about the Company's plans, strategies, outlook, the number of properties expected to open in the future, the expected timing and payment of dividends, the Company's 2025 outlook (including and excluding the Playa Hotels Acquisition), including the Company's expected System-wide Hotels RevPAR Growth, Net Rooms Growth, Net Income, Gross Fees, Adjusted G&A Expenses, Adjusted EBITDA, Capital Expenditures, and Adjusted Free Cash Flow, the planned Playa Real Estate Transaction and our ability to reduce our owned real estate asset base within targeted timeframes and at expected values, the Company's anticipated benefits from its expanded collaboration with Chase, planned credit card portfolio expansion, expected Adjusted EBITDA growth related to the economics of the credit card programs and similar third-party relationships, financial performance and prospective or future events and involve known and unknown risks that are difficult to predict. As a result, the Company's actual results, performance or achievements may differ materially from those expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions. Such forward-looking statements are necessarily based upon estimates and assumptions that, while considered reasonable by the Company and the Company's management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: the effects that the announcement or pendency of the planned Playa Real Estate Transaction may have on us, the occurrence of any event, change or other circumstance that could give rise to the termination of the share purchase agreement for the Playa Real Estate Transaction; the effects that any termination of the share purchase agreement for the Playa Real Estate Transaction may have on us or our business; failure to successfully complete the planned Playa Real Estate Transaction; legal proceedings that may be instituted related to the planned Playa Real Estate Transaction; significant and unexpected costs, charges or expenses related to the planned Playa Real Estate Transaction; inability to obtain regulatory or governmental approvals or to obtain such approvals on satisfactory conditions; general economic uncertainty in key global markets and a worsening of global economic conditions or low levels of economic growth; the rate and pace of economic recovery following economic downturns; global supply chain constraints and interruptions, rising costs of construction-related labor and materials, and increases in costs due to inflation or other factors that may not be fully offset by increases in revenues in our business; risks affecting the luxury, resort, and all-inclusive lodging segments; levels of spending in business, leisure, and group segments, as well as consumer confidence; declines in occupancy and average daily rate; limited visibility with respect to future bookings; loss of key personnel; domestic and international political and geopolitical conditions, including political or civil unrest or changes in trade policy; the impact of global tariff policies or regulations; hostilities, or fear of hostilities, including future terrorist attacks, that affect travel; travel-related accidents; natural or man-made disasters, weather and climate-related events, such as hurricanes, earthquakes, tsunamis, tornadoes, droughts, floods, wildfires, oil spills, nuclear incidents, and global outbreaks of pandemics or contagious diseases, or fear of such outbreaks; our ability to successfully achieve specified levels of operating profits at hotels that have performance tests or guarantees in favor of our third-party owners; the impact of hotel renovations and redevelopments; risks associated with our capital allocation plans, share repurchase program, and dividend payments, including a reduction in, or elimination or suspension of, repurchase activity or dividend payments; the seasonal and cyclical nature of the real estate and hospitality businesses; changes in distribution arrangements, such as through internet travel intermediaries; changes in the tastes and preferences of our customers; relationships with colleagues and labor unions and changes in labor laws; the financial condition of, and our relationships with, third-party owners, franchisees, and hospitality venture partners; the possible inability of third-party owners, franchisees, or development partners to access the capital necessary to fund current operations or implement our plans for growth; risks associated with potential acquisitions and dispositions and our ability to successfully integrate completed acquisitions with existing operations or realize anticipated synergies; failure to successfully complete proposed transactions, including the failure to satisfy closing conditions or obtain required approvals; our ability to successfully complete dispositions of certain of our owned real estate assets within targeted timeframes and at expected values; our ability to maintain effective internal control over financial reporting and disclosure controls and procedures; declines in the value of our real estate assets; unforeseen terminations of our management and hotel services agreements or franchise agreements; changes in federal, state, local, or foreign tax law; increases in interest rates, wages, and other operating costs; foreign exchange rate fluctuations or currency restructurings; risks associated with the introduction of new brand concepts, including lack of acceptance of new brands or

innovation; general volatility of the capital markets and our ability to access such markets; changes in the competitive environment in our industry, industry consolidation, and the markets where we operate; our ability to successfully grow the World of Hyatt loyalty program and manage the Unlimited Vacation Club paid membership program; cyber incidents and information technology failures; outcomes of legal or administrative proceedings; and violations of regulations or laws related to our franchising business and licensing businesses and our international operations; and other risks discussed in the Company's filings with the SEC, including our annual reports on Form 10-K and quarterly reports on Form 10-Q, which filings are available from the SEC. All forward-looking statements attributable to the Company or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. We caution you not to place undue reliance on any forward-looking statements, which are made only as of the date of this press release. We do not undertake or assume any obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable law. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Non-GAAP Financial Measures

The Company refers to certain financial measures that are not recognized under U.S. generally accepted accounting principles (GAAP) in this press release, including: Adjusted Net Income (Loss); Adjusted Diluted EPS; Adjusted EBITDA; Adjusted G&A Expenses; Free Cash Flow; and Adjusted Free Cash Flow. See the schedules to this earnings release, including the "Definitions" section, for additional information and reconciliations of such non-GAAP financial measures.

Availability of Information on Hyatt's Website and Social Media Channels

Investors and others should note that Hyatt routinely announces material information to investors and the marketplace using U.S. Securities and Exchange Commission (SEC) filings, press releases, public conference calls, webcasts, and the Hyatt Investor Relations website. The Company uses these channels as well as social media channels (e.g., the Hyatt Facebook account (facebook.com/hyatt); the Hyatt Instagram account (instagram.com/hyatt); the Hyatt LinkedIn account (linkedin.com/company/hyatt); the Hyatt TikTok account (tiktok.com/@hyatt); the Hyatt X account (x.com/hyatt); and the Hyatt YouTube account (youtube.com/user/hyatt)) as a means of disclosing information about the Company's business to its guests, customers, colleagues, investors, and the public. While not all of the information that the Company posts to the Hyatt Investor Relations website or on the Company's social media channels is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media, and others interested in Hyatt to review the information that it shares at the Investor Relations link located at the bottom of the page on hyatt.com and on the Company's social media channels. Users may automatically receive email alerts and other information about the Company when enrolling an email address by visiting "Investor Email Alerts" in the "Resources" section of Hyatt's website at investors.hyatt.com. The contents of these websites are not incorporated by reference into this press release or any report or document Hyatt files with the SEC, and any references to the websites are intended to be inactive textual references only.

About Hyatt Hotels Corporation

Hyatt Hotels Corporation, headquartered in Chicago, is a leading global hospitality company guided by its purpose – to care for people so they can be their best. As of September 30, 2025, the Company's portfolio included more than 1,450 hotels and all-inclusive properties in 82 countries across six continents. The Company's offering includes brands in the Luxury Portfolio, including Park Hyatt®, Alila®, Miraval®, Impression by Secrets, and The Unbound Collection by Hyatt®; the Lifestyle Portfolio, including Andaz®, Thompson Hotels®, The Standard®, Dream® Hotels, The StandardX, Breathless Resorts & Spas®, JdV by Hyatt®, Bunkhouse® Hotels, and Me and All Hotels; the Inclusive Collection, including Zoëtry® Wellness & Spa Resorts, Hyatt Ziva®, Hyatt Zilara®, Secrets® Resorts & Spas, Dreams® Resorts & Spas, Hyatt Vivid® Hotels & Resorts, Sunscape® Resorts & Spas, Alua Hotels & Resorts®, and Bahia Principe Hotels & Resorts; the Classics Portfolio, including Grand Hyatt®, Hyatt Regency®, Destination by Hyatt®, Hyatt Centric®, Hyatt Vacation Club®, and Hyatt®; and the Essentials Portfolio, including Caption by Hyatt®, Unscripted by Hyatt, Hyatt Place®, Hyatt House®, Hyatt Studios®, Hyatt Select, and UrCove. Subsidiaries of the Company operate the World of Hyatt® loyalty program, ALG Vacations®, Mr & Mrs Smith, Unlimited Vacation Club®, Amstar® DMC destination management services, and Trisept Solutions® technology services. For more information, please visit www.hyatt.com.

Hyatt Hotels Corporation

Table of Contents

Financial Information

(unaudited)

|

|

|

|

|

|

| Schedule |

Page |

|

A - 1 |

|

A - 2 |

|

A - 4 |

|

A - 6 |

Adjustments to Owned and Leased Segment from Sold Assets |

A - 10 |

|

A - 11 |

|

A - 12 |

|

A - 13 |

Percentages on the following schedules may not recompute due to rounding. Not meaningful percentage changes are presented as "NM".

Hyatt Hotels Corporation

Condensed Consolidated Statements of Income (Loss)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except per share amounts) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| REVENUES: |

|

|

|

|

|

|

|

| Base management fees |

$ |

107 |

|

|

$ |

97 |

|

|

$ |

334 |

|

|

$ |

295 |

|

| Incentive management fees |

53 |

|

|

52 |

|

|

191 |

|

|

170 |

|

| Franchise and other fees |

123 |

|

|

119 |

|

|

366 |

|

|

340 |

|

| Gross fees |

283 |

|

|

268 |

|

|

891 |

|

|

805 |

|

| Contra revenue |

(34) |

|

|

(27) |

|

|

(69) |

|

|

(56) |

|

| Net fees |

249 |

|

|

241 |

|

|

822 |

|

|

749 |

|

| Owned and leased |

429 |

|

|

287 |

|

|

952 |

|

|

910 |

|

| Distribution |

192 |

|

|

221 |

|

|

769 |

|

|

818 |

|

| Other revenues |

13 |

|

|

13 |

|

|

35 |

|

|

58 |

|

| Revenues for reimbursed costs |

903 |

|

|

867 |

|

|

2,734 |

|

|

2,511 |

|

| Total revenues |

1,786 |

|

|

1,629 |

|

|

5,312 |

|

|

5,046 |

|

|

|

|

|

|

|

|

|

| DIRECT AND GENERAL AND ADMINISTRATIVE EXPENSES: |

|

|

|

|

|

|

|

| General and administrative |

138 |

|

|

126 |

|

|

416 |

|

|

412 |

|

| Owned and leased |

346 |

|

|

228 |

|

|

786 |

|

|

716 |

|

| Distribution |

169 |

|

|

182 |

|

|

654 |

|

|

690 |

|

| Other direct costs |

22 |

|

|

19 |

|

|

66 |

|

|

81 |

|

| Transaction and integration costs |

25 |

|

|

8 |

|

|

130 |

|

|

26 |

|

| Depreciation and amortization |

83 |

|

|

81 |

|

|

245 |

|

|

257 |

|

| Reimbursed costs |

905 |

|

|

881 |

|

|

2,756 |

|

|

2,570 |

|

| Total direct and general and administrative expenses |

1,688 |

|

|

1,525 |

|

|

5,053 |

|

|

4,752 |

|

|

|

|

|

|

|

|

|

| Net gains (losses) and interest income from marketable securities held to fund rabbi trusts |

22 |

|

|

18 |

|

|

41 |

|

|

46 |

|

| Equity earnings (losses) from unconsolidated hospitality ventures |

(34) |

|

|

(13) |

|

|

(40) |

|

|

32 |

|

| Interest expense |

(90) |

|

|

(50) |

|

|

(230) |

|

|

(128) |

|

| Gains (losses) on sales of real estate and other |

— |

|

|

514 |

|

|

(2) |

|

|

1,267 |

|

| Asset impairments |

(9) |

|

|

(35) |

|

|

(23) |

|

|

(52) |

|

| Other income (loss), net |

(4) |

|

|

70 |

|

|

68 |

|

|

152 |

|

| Income (loss) before income taxes |

(17) |

|

|

608 |

|

|

73 |

|

|

1,611 |

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

(33) |

|

|

(137) |

|

|

(103) |

|

|

(259) |

|

| Net income (loss) |

$ |

(50) |

|

|

$ |

471 |

|

|

$ |

(30) |

|

|

$ |

1,352 |

|

| Net income (loss) attributable to noncontrolling interests |

$ |

(1) |

|

|

$ |

— |

|

|

$ |

2 |

|

|

$ |

— |

|

| Net income (loss) attributable to Hyatt Hotels Corporation |

$ |

(49) |

|

|

$ |

471 |

|

|

$ |

(32) |

|

|

$ |

1,352 |

|

|

|

|

|

|

|

|

|

| EARNINGS (LOSSES) PER CLASS A AND CLASS B SHARE: |

|

|

|

|

|

|

|

Net income (loss) attributable to Hyatt Hotels Corporation—Basic |

$ |

(0.51) |

|

|

$ |

4.75 |

|

|

$ |

(0.34) |

|

|

$ |

13.38 |

|

Net income (loss) attributable to Hyatt Hotels Corporation—Diluted |

$ |

(0.51) |

|

|

$ |

4.63 |

|

|

$ |

(0.34) |

|

|

$ |

13.04 |

|

|

|

|

|

|

|

|

|

| Basic weighted-average shares outstanding |

95.5 |

|

99.1 |

|

95.7 |

|

101.0 |

| Diluted weighted-average shares outstanding |

95.5 |

|

101.7 |

|

95.7 |

|

103.6 |

Hyatt Hotels Corporation

Comparable System-wide Hotels Operating Statistics by Geography

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

| (in constant $) |

RevPAR |

|

Occupancy |

|

ADR |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| System-wide hotels (a) |

$ |

146.24 |

|

0.3 |

% |

|

72.8 |

% |

0.4 |

% pts |

|

$ |

200.90 |

|

(0.2) |

% |

| United States |

$ |

149.44 |

|

(1.6) |

% |

|

72.0 |

% |

(0.9) |

% pts |

|

$ |

207.49 |

|

(0.4) |

% |

| Americas (excluding United States) |

$ |

158.60 |

|

3.9 |

% |

|

68.7 |

% |

0.1 |

% pts |

|

$ |

230.77 |

|

3.7 |

% |

| Greater China |

$ |

89.61 |

|

1.7 |

% |

|

76.2 |

% |

2.8 |

% pts |

|

$ |

117.56 |

|

(2.1) |

% |

| Asia Pacific (excluding Greater China) |

$ |

144.08 |

|

5.1 |

% |

|

74.0 |

% |

2.6 |

% pts |

|

$ |

194.82 |

|

1.4 |

% |

| Europe |

$ |

232.52 |

|

1.2 |

% |

|

76.2 |

% |

1.4 |

% pts |

|

$ |

305.30 |

|

(0.6) |

% |

| Middle East & Africa |

$ |

104.82 |

|

8.5 |

% |

|

66.9 |

% |

2.0 |

% pts |

|

$ |

156.57 |

|

5.2 |

% |

|

|

|

|

|

|

|

|

|

| Owned and leased hotels (b) |

$ |

232.33 |

|

2.7 |

% |

|

74.3 |

% |

(0.9) |

% pts |

|

$ |

312.54 |

|

4.0 |

% |

|

|

|

|

|

|

|

|

|

| (in reported $) |

Net Package RevPAR |

|

Occupancy |

|

Net Package ADR |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| System-wide all-inclusive resorts (c) |

$ |

194.56 |

|

7.6 |

% |

|

73.7 |

% |

2.0 |

% pts |

|

$ |

263.97 |

|

4.6 |

% |

| Americas (excluding United States) |

$ |

188.26 |

|

4.2 |

% |

|

66.9 |

% |

2.9 |

% pts |

|

$ |

281.51 |

|

(0.3) |

% |

| Europe (d) |

$ |

208.68 |

|

15.4 |

% |

|

89.0 |

% |

0.3 |

% pts |

|

$ |

234.47 |

|

15.0 |

% |

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

| (in constant $) |

RevPAR |

|

Occupancy |

|

ADR |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| System-wide hotels (a) |

$ |

144.25 |

|

2.5 |

% |

|

71.0 |

% |

1.1 |

% pts |

|

$ |

203.30 |

|

1.0 |

% |

| United States |

$ |

148.65 |

|

1.1 |

% |

|

70.8 |

% |

— |

% pts |

|

$ |

209.92 |

|

1.0 |

% |

| Americas (excluding United States) |

$ |

175.90 |

|

2.2 |

% |

|

69.2 |

% |

(1.0) |

% pts |

|

$ |

254.17 |

|

3.6 |

% |

| Greater China |

$ |

85.18 |

|

1.4 |

% |

|

71.9 |

% |

3.4 |

% pts |

|

$ |

118.48 |

|

(3.5) |

% |

| Asia Pacific (excluding Greater China) |

$ |

148.34 |

|

7.9 |

% |

|

73.1 |

% |

3.0 |

% pts |

|

$ |

202.89 |

|

3.5 |

% |

| Europe |

$ |

190.28 |

|

3.3 |

% |

|

69.5 |

% |

1.3 |

% pts |

|

$ |

273.78 |

|

1.3 |

% |

| Middle East & Africa |

$ |

135.09 |

|

10.6 |

% |

|

69.0 |

% |

3.9 |

% pts |

|

$ |

195.79 |

|

4.4 |

% |

|

|

|

|

|

|

|

|

|

| Owned and leased hotels (b) |

$ |

218.23 |

|

5.1 |

% |

|

71.9 |

% |

0.4 |

% pts |

|

$ |

303.35 |

|

4.4 |

% |

|

|

|

|

|

|

|

|

|

| (in reported $) |

Net Package RevPAR |

|

Occupancy |

|

Net Package ADR |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| System-wide all-inclusive resorts (c) |

$ |

225.33 |

|

7.9 |

% |

|

77.2 |

% |

3.7 |

% pts |

|

$ |

291.86 |

|

2.7 |

% |

| Americas (excluding United States) |

$ |

246.53 |

|

6.1 |

% |

|

74.4 |

% |

4.3 |

% pts |

|

$ |

331.36 |

|

— |

% |

| Europe (d) |

$ |

165.61 |

|

15.8 |

% |

|

85.1 |

% |

2.3 |

% pts |

|

$ |

194.56 |

|

12.6 |

% |

(a) Consists of hotels that the Company manages, franchises, owns, leases, or provides services to, excluding all-inclusive properties.

(b) Excludes unconsolidated hospitality ventures and all-inclusive leased properties.

(c) Consists of all-inclusive properties that the Company manages, leases, or provides services to.

(d) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

Hyatt Hotels Corporation

Comparable System-wide Hotels Operating Statistics by Brand

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

RevPAR |

|

Occupancy |

|

ADR |

| (in constant $) |

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| Composite Luxury (a)(b) |

$ |

201.83 |

|

2.6 |

% |

|

71.7 |

% |

1.5 |

% pts |

|

$ |

281.52 |

|

0.6 |

% |

| Andaz |

$ |

219.63 |

|

(0.6) |

% |

|

77.7 |

% |

2.0 |

% pts |

|

$ |

282.57 |

|

(3.2) |

% |

| Grand Hyatt |

$ |

166.97 |

|

2.3 |

% |

|

73.2 |

% |

3.0 |

% pts |

|

$ |

228.07 |

|

(1.9) |

% |

| Park Hyatt |

$ |

283.97 |

|

4.8 |

% |

|

67.5 |

% |

0.5 |

% pts |

|

$ |

420.89 |

|

4.1 |

% |

| The Unbound Collection by Hyatt |

$ |

257.09 |

|

4.8 |

% |

|

70.1 |

% |

0.4 |

% pts |

|

$ |

366.82 |

|

4.2 |

% |

|

|

|

|

|

|

|

|

|

| Composite Upper Upscale (a)(c) |

$ |

143.66 |

|

0.1 |

% |

|

71.4 |

% |

— |

% pts |

|

$ |

201.30 |

|

0.1 |

% |

| Hyatt Centric |

$ |

152.76 |

|

(0.2) |

% |

|

76.3 |

% |

0.1 |

% pts |

|

$ |

200.21 |

|

(0.3) |

% |

| Hyatt Regency |

$ |

141.11 |

|

(0.2) |

% |

|

70.4 |

% |

(0.2) |

% pts |

|

$ |

200.36 |

|

0.1 |

% |

| JdV by Hyatt |

$ |

128.10 |

|

3.6 |

% |

|

70.7 |

% |

1.7 |

% pts |

|

$ |

181.20 |

|

1.1 |

% |

|

|

|

|

|

|

|

|

|

| Composite Upscale & Upper Midscale (a)(d) |

$ |

108.53 |

|

(2.4) |

% |

|

75.5 |

% |

0.1 |

% pts |

|

$ |

143.72 |

|

(2.5) |

% |

| Hyatt House |

$ |

127.58 |

|

(2.4) |

% |

|

78.5 |

% |

0.1 |

% pts |

|

$ |

162.55 |

|

(2.5) |

% |

| Hyatt Place |

$ |

107.87 |

|

(2.4) |

% |

|

74.4 |

% |

— |

% pts |

|

$ |

145.06 |

|

(2.4) |

% |

| UrCove |

$ |

43.63 |

|

(2.9) |

% |

|

81.3 |

% |

1.4 |

% pts |

|

$ |

53.67 |

|

(4.5) |

% |

|

|

|

|

|

|

|

|

|

|

Net Package RevPAR |

|

Occupancy |

|

Net Package ADR |

| (in reported $) |

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| Composite All-inclusive (e)(f) |

$ |

194.56 |

|

7.6 |

% |

|

73.7 |

% |

2.0 |

% pts |

|

$ |

263.97 |

|

4.6 |

% |

| Dreams Resorts & Spas |

$ |

195.76 |

|

3.2 |

% |

|

71.9 |

% |

0.8 |

% pts |

|

$ |

272.43 |

|

2.1 |

% |

| Secrets Resorts & Spas |

$ |

232.62 |

|

7.1 |

% |

|

68.7 |

% |

3.1 |

% pts |

|

$ |

338.43 |

|

2.1 |

% |

| Alua Hotels & Resorts |

$ |

188.76 |

|

15.2 |

% |

|

91.6 |

% |

1.2 |

% pts |

|

$ |

206.00 |

|

13.7 |

% |

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, |

|

RevPAR |

|

Occupancy |

|

ADR |

| (in constant $) |

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| Composite Luxury (a)(b) |

$ |

204.31 |

|

5.3 |

% |

|

71.1 |

% |

2.2 |

% pts |

|

$ |

287.25 |

|

2.0 |

% |

| Andaz |

$ |

229.61 |

|

5.5 |

% |

|

76.0 |

% |

3.6 |

% pts |

|

$ |

302.22 |

|

0.6 |

% |

| Grand Hyatt |

$ |

178.91 |

|

4.1 |

% |

|

72.9 |

% |

2.7 |

% pts |

|

$ |

245.44 |

|

0.2 |

% |

| Park Hyatt |

$ |

300.32 |

|

8.9 |

% |

|

69.1 |

% |

2.3 |

% pts |

|

$ |

434.37 |

|

5.2 |

% |

| The Unbound Collection by Hyatt |

$ |

209.65 |

|

6.1 |

% |

|

65.4 |

% |

1.5 |

% pts |

|

$ |

320.78 |

|

3.8 |

% |

|

|

|

|

|

|

|

|

|

| Composite Upper Upscale (a)(c) |

$ |

140.57 |

|

1.9 |

% |

|

69.6 |

% |

0.8 |

% pts |

|

$ |

202.11 |

|

0.8 |

% |

| Hyatt Centric |

$ |

158.09 |

|

2.6 |

% |

|

75.7 |

% |

1.3 |

% pts |

|

$ |

208.87 |

|

0.8 |

% |

| Hyatt Regency |

$ |

138.34 |

|

1.6 |

% |

|

68.7 |

% |

0.6 |

% pts |

|

$ |

201.33 |

|

0.7 |

% |

| JdV by Hyatt |

$ |

113.47 |

|

3.7 |

% |

|

65.5 |

% |

2.4 |

% pts |

|

$ |

173.21 |

|

(0.1) |

% |

|

|

|

|

|

|

|

|

|

| Composite Upscale & Upper Midscale (a)(d) |

$ |

104.89 |

|

(0.5) |

% |

|

72.7 |

% |

0.5 |

% pts |

|

$ |

144.22 |

|

(1.2) |

% |

| Hyatt House |

$ |

123.23 |

|

(0.9) |

% |

|

75.6 |

% |

0.3 |

% pts |

|

$ |

163.00 |

|

(1.2) |

% |

| Hyatt Place |

$ |

104.48 |

|

(0.2) |

% |

|

71.8 |

% |

0.4 |

% pts |

|

$ |

145.46 |

|

(0.9) |

% |

| UrCove |

$ |

40.29 |

|

(1.5) |

% |

|

76.4 |

% |

3.1 |

% pts |

|

$ |

52.77 |

|

(5.5) |

% |

|

|

|

|

|

|

|

|

|

|

Net Package RevPAR |

|

Occupancy |

|

Net Package ADR |

| (in reported $) |

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

|

2025 |

vs. 2024 |

| Composite All-inclusive (e)(f) |

$ |

225.33 |

|

7.9 |

% |

|

77.2 |

% |

3.7 |

% pts |

|

$ |

291.86 |

|

2.7 |

% |

| Dreams Resorts & Spas |

$ |

231.00 |

|

3.6 |

% |

|

76.2 |

% |

1.2 |

% pts |

|

$ |

303.01 |

|

1.9 |

% |

| Secrets Resorts & Spas |

$ |

302.51 |

|

8.4 |

% |

|

74.4 |

% |

4.1 |

% pts |

|

$ |

406.69 |

|

2.5 |

% |

| Alua Hotels & Resorts |

$ |

141.05 |

|

15.7 |

% |

|

88.4 |

% |

2.0 |

% pts |

|

$ |

159.49 |

|

13.0 |

% |

(a) Chain scale classification as defined by Smith Travel Research.

(b) Includes Alila, Andaz, Destination by Hyatt, Grand Hyatt, Miraval, Park Hyatt, The Unbound Collection by Hyatt, and Thompson Hotels.

(c) Includes Dream Hotels, Hyatt, Hyatt Centric, Hyatt Regency, and JdV by Hyatt.

(d) Includes Caption by Hyatt, Hyatt House, Hyatt Place, Me and All Hotels, and UrCove.

(e) Includes Alua Hotels & Resorts, Breathless Resorts & Spas, Dreams Resorts & Spas, Hyatt Zilara, Hyatt Ziva, Impressions by Secrets, Secrets Resorts & Spas, Sunscape Resorts & Spas, and Zoëtry Wellness & Spa Resorts. Includes two non-branded managed properties.

(f) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

Hyatt Hotels Corporation

Properties and Rooms by Geography

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

Managed (a) |

|

Franchised |

|

Owned and Leased (b) |

|

Total |

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

| Geography: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| United States |

179 |

|

64,328 |

|

535 |

|

97,988 |

|

14 |

|

5,672 |

|

728 |

|

167,988 |

| Americas (excluding United States) |

36 |

|

9,749 |

|

47 |

|

7,300 |

|

4 |

|

1,197 |

|

87 |

|

18,246 |

| Greater China |

109 |

|

32,621 |

|

93 |

|

15,998 |

|

— |

|

|

— |

|

|

202 |

|

48,619 |

| Asia Pacific (excluding Greater China) |

134 |

|

32,363 |

|

11 |

|

3,368 |

|

— |

|

|

— |

|

|

145 |

|

35,731 |

| Europe |

54 |

|

12,310 |

|

71 |

|

11,930 |

|

4 |

|

1,059 |

|

129 |

|

25,299 |

| Middle East & Africa |

46 |

|

10,737 |

|

4 |

|

779 |

|

— |

|

|

— |

|

|

50 |

|

11,516 |

| System-wide hotels (c) |

558 |

|

162,108 |

|

761 |

|

137,363 |

|

22 |

|

7,928 |

|

1,341 |

|

307,399 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Americas (excluding United States) |

93 |

|

39,016 |

|

— |

|

|

— |

|

|

14 |

|

|

5,507 |

|

|

107 |

|

44,523 |

| Europe (d) |

40 |

|

12,126 |

|

— |

|

|

— |

|

|

9 |

|

2,299 |

|

49 |

|

14,425 |

| System-wide all-inclusive resorts |

133 |

|

51,142 |

|

— |

|

|

— |

|

|

23 |

|

7,806 |

|

156 |

|

58,948 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| System-wide (e) |

691 |

|

213,250 |

|

761 |

|

137,363 |

|

45 |

|

15,734 |

|

1,497 |

|

366,347 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mr & Mrs Smith (f) |

|

|

|

|

|

|

|

|

|

|

|

|

1,232 |

|

41,204 |

| Hyatt Vacation Club |

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

1,997 |

| Residential |

|

|

|

|

|

|

|

|

|

|

|

|

41 |

|

4,458 |

(a) Includes properties that the Company manages or provides services to.

(b) Figures do not include unconsolidated hospitality ventures.

(c) Figures do not include all-inclusive properties.

(d) Certain resorts in Europe operate under a hybrid all-inclusive model, which includes various all-inclusive package options as well as rooms-only options.

(e) Figures do not include Hyatt Vacation Club, Mr & Mrs Smith, and certain residential units.

(f) Represents unaffiliated Mr & Mrs Smith properties available through Hyatt.com. As of September 30, 2025, the Mr & Mrs Smith platform included approximately 2,400 properties (or approximately 107,000 rooms) that pay commissions through the Company's distribution segment revenues.

Hyatt Hotels Corporation

Properties and Rooms by Brand

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

Managed (a) |

|

Franchised |

|

Owned and Leased (b) |

|

Total |

| Brands by Chain Scale: |

Properties |

|

Rooms |

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

|

Properties |

|

Rooms |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Luxury (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Alila |

17 |

|

1,947 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

17 |

|

1,947 |

| Andaz |

28 |

|

6,504 |

|

1 |

|

715 |

|

2 |

|

507 |

|

31 |

|

7,726 |

| Destination by Hyatt |

11 |

|

2,375 |

|

11 |

|

4,431 |

|

— |

|

|

— |

|

|

22 |

|

6,806 |

| Grand Hyatt |

61 |

|

32,232 |

|

3 |

|

1,331 |

|

2 |

|

904 |

|

66 |

|

34,467 |

| Miraval |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3 |

|

383 |

|

3 |

|

383 |

| Park Hyatt |

47 |

|

8,664 |

|

— |

|

|

— |

|

|

3 |

|

549 |

|

50 |

|

9,213 |

| The Unbound Collection by Hyatt |

18 |

|

3,111 |

|

35 |

|

6,128 |

|

— |

|

|

— |

|

|

53 |

|

9,239 |

| Thompson Hotels |

16 |

|

3,329 |

|

2 |

|

472 |

|

— |

|

|

— |

|

|

18 |

|

3,801 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Upper Upscale (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bunkhouse Hotels |

10 |

|

476 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

10 |

|

476 |

| Dream Hotels |

4 |

|

808 |

|

1 |

|

178 |

|

— |

|

|

— |

|

|

5 |

|

986 |

| Hyatt |

7 |

|

1,206 |

|

6 |

|

969 |

|

1 |

|

1,298 |

|

14 |

|

3,473 |

| Hyatt Centric |

35 |

|

7,236 |

|

34 |

|

6,814 |

|

1 |

|

138 |

|

70 |

|

14,188 |

| Hyatt Regency |

173 |

|

72,547 |

|

62 |

|

22,385 |

|

6 |

|

3,355 |

|

241 |

|

98,287 |

| JdV by Hyatt |

15 |

|

2,043 |

|

41 |

|

6,318 |

|

— |

|

|

— |

|

|

56 |

|

8,361 |

| The Standard |

7 |

|

1,142 |

|

3 |

|

|

580 |

|

|

— |

|

|

— |

|

|

10 |

|

1,722 |

| The StandardX |

2 |

|

187 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2 |

|

187 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Upscale & Upper Midscale (c) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Caption by Hyatt |

2 |

|

390 |

|

2 |

|

|

377 |

|

|

— |

|

|

— |

|

|

4 |

|

767 |

| Hyatt House |

24 |

|

3,365 |

|

119 |

|

16,765 |

|

— |

|

|

— |

|

|

143 |

|

20,130 |

| Hyatt Place |

80 |

|

13,746 |

|

362 |

|

51,539 |

|

4 |

|

794 |

|

446 |

|

66,079 |

| Me and All Hotels |

— |

|

|

— |

|

|

8 |

|

1,364 |

|

— |

|

|

— |

|

|

8 |

|

1,364 |

| Hyatt Studios |

— |

|

|

— |

|

|

1 |

|

122 |

|

— |

|

|

— |

|

|

1 |

|

122 |

| UrCove |

— |

|

|

— |

|

|

67 |

|

9,615 |

|

— |

|

|

— |

|

|

67 |

|

9,615 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| All-inclusive |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Bahia Principe Hotels & Resorts |

21 |

|

11,668 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

21 |

|

11,668 |

| Breathless Resorts & Spas |

6 |

|

2,311 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

6 |

|

2,311 |

| Dreams Resorts & Spas |

32 |

|

13,792 |

|

— |

|

|

— |

|

|

2 |

|

|

912 |

|

|

34 |

|

14,704 |

| Hyatt Zilara |

1 |

|

291 |

|

— |

|

|

— |

|

|

3 |

|

|

1,029 |

|

|

4 |

|

1,320 |

| Hyatt Ziva |

1 |

|

438 |

|

— |

|

|

— |

|

|

5 |

|

|

2,140 |

|

|

6 |

|

2,578 |

| Impression by Secrets |

2 |

|

323 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2 |

|

323 |

| Secrets Resorts & Spas |

27 |

|

10,265 |

|

— |

|

|

— |

|

|

1 |

|

|

356 |

|

|

28 |

|

10,621 |

| Zoëtry Wellness & Spa Resorts |

7 |

|

540 |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

7 |

|

540 |

| Hyatt Vivid Hotels & Resorts |

1 |

|

400 |

|

— |

|

|

— |

|

|

1 |

|

|

524 |

|

|

2 |

|

924 |

| Sunscape Resorts & Spas |

8 |

|

3,689 |

|

— |

|

|

— |

|

|

1 |

|

|

458 |

|

|

9 |

|

4,147 |

| Alua Hotels & Resorts |

22 |

|

6,217 |

|

— |

|

|

— |

|

|

9 |

|

2,299 |

|

31 |

|

8,516 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

6 |

|

2,008 |

|

3 |

|

7,260 |

|

1 |

|

|

88 |

|

|

10 |

|

9,356 |

| System-wide (d) |

691 |

|

213,250 |

|

761 |

|

137,363 |

|

45 |

|

15,734 |

|

1,497 |

|

366,347 |

(a) Includes properties that the Company manages or provides services to.

(b) Figures do not include unconsolidated hospitality ventures.

(c) Chain scale classification as defined by Smith Travel Research.

(d) Includes eight properties that Hyatt currently intends to rebrand to the respective brand at a future date.

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Financial Measure: Reconciliation of Net Income (Loss) Attributable to Hyatt Hotels Corporation to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net income (loss) attributable to Hyatt Hotels Corporation |

$ |

(49) |

|

|

$ |

471 |

|

|

$ |

(32) |

|

|

$ |

1,352 |

|

| Contra revenue |

34 |

|

|

27 |

|

|

69 |

|

|

56 |

|

| Revenues for reimbursed costs |

(903) |

|

|

(867) |

|

|

(2,734) |

|

|

(2,511) |

|

| Reimbursed costs |

905 |

|

|

881 |

|

|

2,756 |

|

|

2,570 |

|

| Stock-based compensation expense (a) |

14 |

|

|

9 |

|

|

59 |

|

|

55 |

|

| Transaction and integration costs |

25 |

|

|

8 |

|

|

130 |

|

|

26 |

|

| Depreciation and amortization |

83 |

|

|

81 |

|

|

245 |

|

|

257 |

|

| Equity (earnings) losses from unconsolidated hospitality ventures |

34 |

|

|

13 |

|

|

40 |

|

|

(32) |

|

| Interest expense |

90 |

|

|

50 |

|

|

230 |

|

|

128 |

|

| (Gains) losses on sales of real estate and other |

— |

|

|

(514) |

|

|

2 |

|

|

(1,267) |

|

| Asset impairments |

9 |

|

|

35 |

|

|

23 |

|

|

52 |

|

| Other (income) loss, net |

4 |

|

|

(70) |

|

|

(68) |

|

|

(152) |

|

| Provision for income taxes |

33 |

|

|

137 |

|

|

103 |

|

|

259 |

|

| Net income (loss) attributable to noncontrolling interests |

(1) |

|

|

— |

|

|

2 |

|

|

— |

|

| Pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA |

13 |

|

|

14 |

|

|

42 |

|

|

48 |

|

| Adjusted EBITDA |

$ |

291 |

|

|

$ |

275 |

|

|

$ |

867 |

|

|

$ |

841 |

|

(a) Includes amounts recognized in general and administrative expenses, owned and leased expenses, and distribution expenses and excludes amounts recognized in transaction and integration costs.

The table below provides a breakdown for Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2025 |

|

2024 |

|

2025 |

|

2024 |

|

| Management and franchising |

$ |

226 |

|

|

$ |

210 |

|

|

$ |

700 |

|

|

$ |

635 |

|

|

| Owned and leased |

83 |

|

|

63 |

|

|

174 |

|

|

204 |

|

|

| Distribution |

21 |

|

|

38 |

|

|

113 |

|

|

120 |

|

|

| Overhead |

(38) |

|

|

(36) |

|

|

(120) |

|

|

(119) |

|

|

| Eliminations |

(1) |

|

|

— |

|

|

— |

|

|

1 |

|

|

| Adjusted EBITDA |

$ |

291 |

|

|

$ |

275 |

|

|

$ |

867 |

|

|

$ |

841 |

|

|

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Financial Measure: Reconciliation of Net Income (Loss) Attributable to Hyatt Hotels Corporation to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

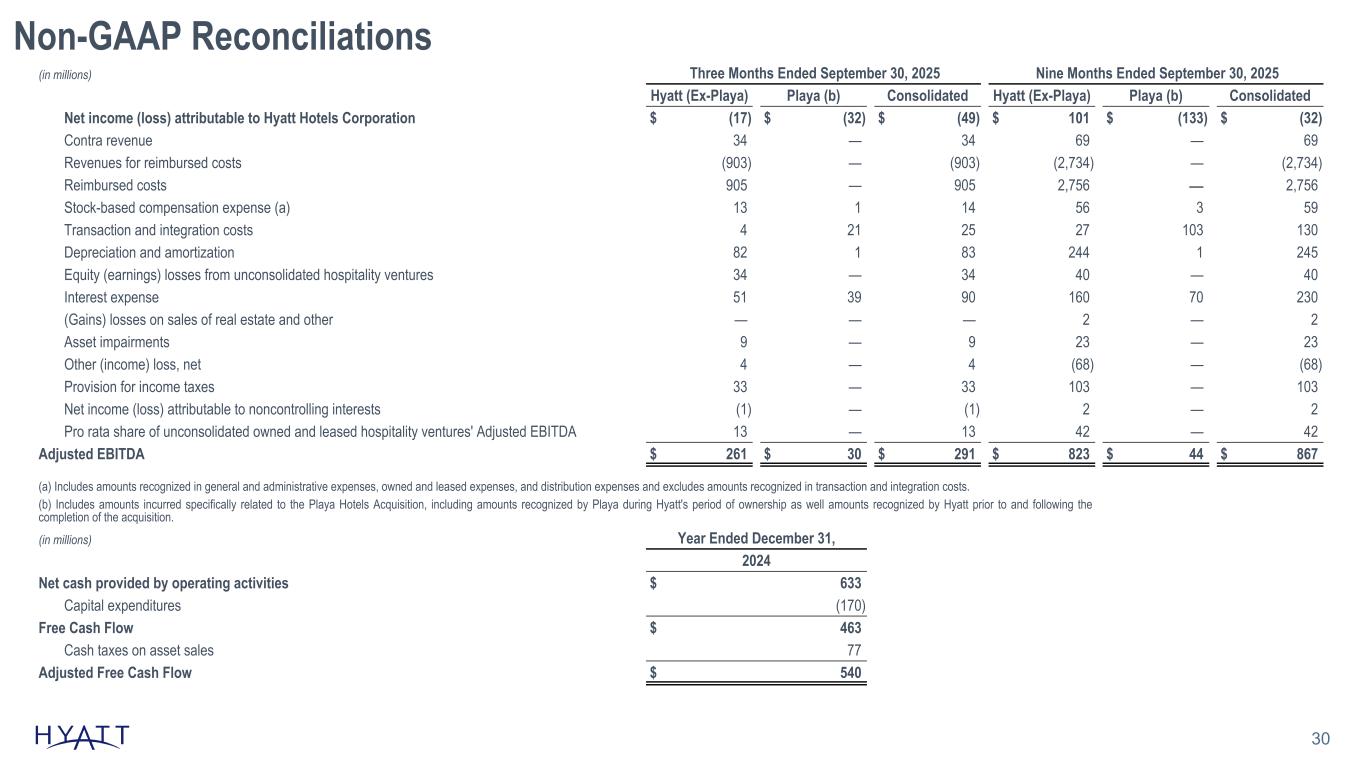

Three Months Ended September 30, 2025 |

|

Hyatt (Ex-Playa) |

|

Playa (b) |

|

Consolidated |

| Net income (loss) attributable to Hyatt Hotels Corporation |

$ |

(17) |

|

|

$ |

(32) |

|

|

$ |

(49) |

|

| Contra revenue |

34 |

|

|

— |

|

|

34 |

|

| Revenues for reimbursed costs |

(903) |

|

|

— |

|

|

(903) |

|

| Reimbursed costs |

905 |

|

|

— |

|

|

905 |

|

| Stock-based compensation expense (a) |

13 |

|

|

1 |

|

|

14 |

|

| Transaction and integration costs |

4 |

|

|

21 |

|

|

25 |

|

| Depreciation and amortization |

82 |

|

|

1 |

|

|

83 |

|

| Equity (earnings) losses from unconsolidated hospitality ventures |

34 |

|

|

— |

|

|

34 |

|

| Interest expense |

51 |

|

|

39 |

|

|

90 |

|

|

|

|

|

|

|

| Asset impairments |

9 |

|

|

— |

|

|

9 |

|

| Other (income) loss, net |

4 |

|

|

— |

|

|

4 |

|

| Provision for income taxes |

33 |

|

|

— |

|

|

33 |

|

| Net loss attributable to noncontrolling interests |

(1) |

|

|

— |

|

|

(1) |

|

| Pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA |

13 |

|

|

— |

|

|

13 |

|

| Adjusted EBITDA |

$ |

261 |

|

|

$ |

30 |

|

|

$ |

291 |

|

|

|

|

|

|

|

| (a) Includes amounts recognized in general and administrative expenses, owned and leased expenses, and distribution expenses and excludes amounts recognized in transaction and integration costs. |

| (b) Includes amounts incurred specifically related to the Playa Hotels Acquisition, including amounts recognized by Playa during Hyatt's period of ownership as well amounts recognized by Hyatt prior to and following the completion of the acquisition. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Nine Months Ended September 30, 2025 |

|

Hyatt (Ex-Playa) |

|

Playa (d) |

|

Consolidated |

| Net income (loss) attributable to Hyatt Hotels Corporation |

$ |

101 |

|

|

$ |

(133) |

|

|

$ |

(32) |

|

| Contra revenue |

69 |

|

|

— |

|

|

69 |

|

| Revenues for reimbursed costs |

(2,734) |

|

|

— |

|

|

(2,734) |

|

| Reimbursed costs |

2,756 |

|

|

— |

|

|

2,756 |

|

| Stock-based compensation expense (c) |

56 |

|

|

3 |

|

|

59 |

|

| Transaction and integration costs |

27 |

|

|

103 |

|

|

130 |

|

| Depreciation and amortization |

244 |

|

|

1 |

|

|

245 |

|

| Equity (earnings) losses from unconsolidated hospitality ventures |

40 |

|

|

— |

|

|

40 |

|

| Interest expense |

160 |

|

|

70 |

|

|

230 |

|

| (Gains) losses on sales of real estate and other |

2 |

|

|

— |

|

|

2 |

|

| Asset impairments |

23 |

|

|

— |

|

|

23 |

|

| Other (income) loss, net |

(68) |

|

|

— |

|

|

(68) |

|

| Provision for income taxes |

103 |

|

|

— |

|

|

103 |

|

| Net income attributable to noncontrolling interests |

2 |

|

|

— |

|

|

2 |

|

| Pro rata share of unconsolidated owned and leased hospitality ventures' Adjusted EBITDA |

42 |

|

|

— |

|

|

42 |

|

| Adjusted EBITDA |

$ |

823 |

|

|

$ |

44 |

|

|

$ |

867 |

|

|

|

|

|

|

|

| (c) Includes amounts recognized in general and administrative expenses, owned and leased expenses, and distribution expenses and excludes amounts recognized in transaction and integration costs. |

| (d) Includes amounts incurred specifically related to the Playa Hotels Acquisition, including amounts recognized by Playa during Hyatt's period of ownership as well amounts recognized by Hyatt prior to and following the completion of the acquisition. |

Hyatt Hotels Corporation

Reconciliation of Non-GAAP Financial Measure: G&A Expenses to Adjusted G&A Expenses

Results of operations as presented on the condensed consolidated statements of income (loss) include expenses recognized with respect to deferred compensation plans funded through rabbi trusts. Certain of these expenses are recognized in G&A expenses and are completely offset by the corresponding net gains (losses) and interest income from marketable securities held to fund rabbi trusts, thus having no net impact to our net income (loss). G&A expenses also include expenses related to stock-based compensation. Below is a reconciliation of this measure excluding the impact of our rabbi trust investments and stock-based compensation expense.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| G&A expenses |

$ |

138 |

|

|

$ |

126 |

|

|

$ |

416 |

|

|

$ |

412 |

|

| Less: Rabbi trust impact |

(22) |

|

|

(17) |

|

|

(40) |

|

|

(43) |

|

| Less: Stock-based compensation expense |

(13) |

|

|

(9) |

|

|

(54) |

|

|

(52) |

|

| Adjusted G&A Expenses |

$ |

103 |

|

|

$ |

100 |

|

|

$ |

322 |

|

|

$ |

317 |

|

The table below provides a breakdown for Adjusted G&A Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions) |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Management and franchising |

$ |

62 |

|

|

$ |

62 |

|

|

$ |

194 |

|

|

$ |

185 |

|

| Owned and leased |

3 |

|

|

2 |

|

|

8 |

|

|

7 |

|

| Distribution |

— |

|

|

— |

|

|

— |

|

|

6 |

|

| Overhead |

38 |

|

|

36 |

|

|

120 |

|

|

119 |

|

| Adjusted G&A Expenses |

$ |

103 |

|

|

$ |

100 |

|

|

$ |

322 |

|

|

$ |

317 |

|

Hyatt Hotels Corporation