Investor Presentation The Leading Ukrainian Digital Operator March 2025

Disclaimer 2 This presentation (the “Presentation”) has been prepared by Cohen Circle Acquisition Corp. I ( “Cohen,” “us” or “we”) and is provided on a confidential basis solely to the recipients that are “accredited investors” (as defined in Rule 506 of Regulation D) (any such recipient, together with its subsidiaries and affiliates, the “Recipient”) solely for their own benefit and internal use for purposes of considering an opportunity to participate in the proposed private placement (the “Potential Transaction”) in connection with the potential initial business combination (the “Initial Business Combination”) of Cohen with PJSC Kyivstar and its subsidiaries (the “Target” or the “Company”), a subsidiary of VEON Ltd. (“VEON”). Any reproduction or distribution of this Presentation, in whole or in part, or the disclosure of its contents, without Cohen’s prior written consent, is prohibited. This disclaimer and the requirement for strict confidentiality shall apply without prejudice to any other confidentiality obligations to which you are subject. By accepting this Presentation, you hereby agree to be bound by and comply with the restrictions contained herein. By accepting and/or by reading this Presentation, the Recipient agrees and undertakes towards Cohen, the Company and VEON that it will not, and will cause its directors, officers, employees, representatives, advisors and consultants (the “Representatives”) not to disclose any type of information relating to Cohen the Company or VEON. By accepting this Presentation, the Recipient agrees to maintain this information in the strictest confidence and to protect and safeguard this Presentation against any unauthorized publication or disclosure. Although Cohen reasonably believes the information contained in this Presentation related to Cohen and the Company is accurate in all material respects as of the date of this Presentation or the date to which the information contained in this Presentation makes reference to, neither Cohen, the Company nor any of its affiliates, directors, officers, shareholders, employees or advisers or any other person, makes any representation or warranty, either expressed or implied, as to the accuracy, completeness or reliability of the information contained herein or any other written, oral or other communications transmitted or otherwise made available to the Recipient in the course of its evaluation of the Potential Transaction. Cohen, the Company and VEON further expressly disclaim any and all liability relating to or resulting from the use of this Presentation based on the accuracy or sufficiency thereof or on any errors, omissions or misstatements, negligent or otherwise, relating thereto. Accordingly, none of Cohen, the Company, VEON nor any of its affiliates, directors, officers, shareholders, employees or advisers or any other person shall be liable for any direct, indirect or consequential loss or damages suffered or incurred by any Recipient as a result of relying on any statement in or omission from this Presentation, and the Recipient hereby expressly disclaims such liability. In addition, the information contained in this Presentation is provided as of the date hereof and may change, and neither Cohen, the Company nor VEON undertakes any obligation to update such information, including in the event that such information becomes inaccurate or incomplete. Except to the extent required by law, neither Cohen, the Company, VEON nor any other person assumes responsibility for the accuracy or completeness of the information contained in this Presentation. Further, the information contained herein is preliminary, based on a range of assumptions, is provided for discussion purposes only, is only a summary of selected key information, is not complete, does not take into account all relevant economic and market factors, does not contain certain material information about the Potential Transaction, including risk factors associated with Cohen, the Company or the Potential Transaction, and is subject to change without notice. This Presentation is not intended to contain all the information that a person may desire in considering the Potential Transaction. Prior to entering into the Potential Transaction, a person should consult with its own advisors (including but not limited to legal, regulatory, tax, business, financial and accounting advisors) to the extent necessary, and make its own investment decision and perform its own independent investigation and analysis of the Potential Transaction. The Recipient should not consider any information in this Presentation to be legal, investment, business, tax or accounting advice or a recommendation. The Recipient agrees that none of Rothschild & Co. (“Rothschild”), Cohen, the Company, VEON or any of their respective affiliates, directors, officers, employees, shareholders, advisors or agents shall have any liability for any misstatement or omission of fact or any opinion expressed herein. Any person consulting this Presentation should also carefully consider the risks and uncertainties described in the “Risk Factors” section of Cohen’s final prospectus dated October 11, 2024 relating to its initial public offering, and subsequent periodic filings with the U.S. Securities and Exchange Commission (the "SEC") on Form 10-Q and Form 10-K. Any actual terms of the opportunity may vary from what is discussed herein and may do so in a material manner. There can be no assurance, and neither Cohen, the Company nor VEON gives any assurance, that Cohen or the Company will achieve the desired results or that any investor will receive any return of or on capital. This Presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration qualification under the securities laws of any such jurisdiction. This opportunity has not been recommended, approved or disapproved by the U.S. Securities and Exchange Commission (the “SEC”) or by the securities regulatory authority of any state or of any other U.S. or non-U.S. jurisdiction, nor has the SEC or any such securities regulatory authority passed upon the accuracy or adequacy of this Presentation. Any representation to the contrary may be a criminal offense. This Presentation contains “forward-looking statements” for purposes of the federal securities laws. Actual results may differ from their expectations, estimates and projections and consequently, you should not rely on those forward-looking statements as predictions of future events or future performance of Cohen, the Company or VEON. These forward-looking statements include, but are not limited to, statements regarding Cohen, the Company, VEON or their respective management teams’ conclusions, expectations, hopes, beliefs, intentions or strategies regarding the future and/or future events or circumstances. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “addressing,” “anticipated,” “become,” “benefit,” “believe,” “creating,” “continues,” “covered,” “driven,” “enabling,” “estimated,” “expected,” “growing,” “implementing,” “improve,” “includes,” “increasing,” “intended,” “may,” “potential,” “projected,” “provide,” “remain,” “resulting,” “shown,” “support,” “will,” and similar expressions may identify forward-looking statements, but the absence of these words or expressions does not mean that a statement is not forward-looking. Forward-looking statements in this Presentation may include, for illustrative and non-exhaustive purposes only, statements about: • Cohen’s ability to engage in and complete the Initial Business Combination; • Cohen’s expectations and estimates regarding the performance of the Company; • Cohen’s expectations and estimates regarding the markets and market participants relevant to the Company; • Cohen’s public securities’ potential liquidity and trading; • Cohen’s financial performance following its initial public offering; • The Company’s projected future operational and financial performance, including anticipated benefits of the Initial Business Combination.

Disclaimer 3 Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Accordingly, any projections, modeling or analysis may differ materially and should not be viewed as factual and should not be relied upon as an accurate or complete prediction of future results, events or circumstances. Further, the information contained in this Presentation may derive, either in whole or in part, from various internal and external sources. No representation or warranty is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or analysis or any other information contained in this Presentation. Any financial information in this Presentation (including specifically the projections) that are forward-looking statements are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond Cohen’s, the Company’s or VEON’s control. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. This presentation includes trademarks, tradenames and service marks, certain of which belong to us and others that are the property of other organizations. Solely for convenience, trademarks, tradenames and service marks referred to in this presentation appear without the ®, TM and SM symbols, but the absence of those symbols is not intended to indicate, in any way, that we will not assert our rights, or that the applicable owner will not assert its rights, to these trademarks, tradenames and service marks to the fullest extent under applicable law. We do not intend our use or display of other parties’ trademarks, tradenames or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of us by, these other parties. The financial information and data contained in this Presentation are based on draft accounts, do not conform to Regulation S-X and are subject to PCAOB audit. For example, information that is shown as “2024P” means preliminary financial information as of the year ended December 31, 2024, which remains subject to completion of a PCAOB audit. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in the final registration statement to be filed with the SEC and the definitive proxy statement/prospectus contained therein in connection with the Initial Business Combination. This presentation includes certain financial and operating measures, including EBITDA, Adjusted EBITDA, Underlying Adj. EBITDA, EBITDA margin, Adjusted EBITDA margin, CAPEX excl. licenses and ROU, and measures calculated based on these measures, that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) or international financial reporting standards (“IFRS”). These non-GAAP/non-IFRS measures, and other measures that are calculated using these non-GAAP/non-IFRS measures, are an addition, and not a substitute for or superior to measures of financial performance prepared in accordance with GAAP or IFRS and should not be considered as an alternative to operating income, net income or any other performance measures derived in accordance with GAAP or IFRS. The Company believes these non-GAAP/non-IFRS measures of financial results provide useful information to management and potential investors regarding certain financial and business trends relating to the Company’s financial condition and results of operations. The Company believes that the use of these non-GAAP/non-IFRS financial measures provides an additional tool for potential investors to use in comparing the Company’s financial condition and results of operations with other similar companies, many of which present similar non-GAAP/non-IFRS financial measures to investors. There are a number of limitations related to the use of these non-GAAP/non-IFRS financial measures and their nearest GAAP/IFRS equivalents. For example, VEON’s definitions of non-GAAP/non-IFRS financial measures may differ from non-GAAP/non-IFRS financial measures used by other companies and therefore the non-GAAP/non-IFRS measures in this Presentation may not be directly comparable to similarly titled measures of other companies. Cohen expresses current intentions only. The Presentation and the information contained in it do not constitute an offer capable of acceptance or intended to otherwise give rise to a binding contract. The Presentation and the information contained in it do not constitute a commitment of Cohen, the Company or VEON to engage in the Initial Business Combination or to underwrite or place any financing or securities in relation to the Initial Business Combination. Unless and until a definitive agreement is entered into regarding the Potential Transaction, Cohen will not be under any obligation whatsoever with respect to the Potential Transaction, including, without limitation, to negotiate terms of the Potential Transaction, except as specifically set forth herein. The information contained in this Presentation is based on present circumstances, economic and market conditions, assumptions, and beliefs. Neither Cohen, the Company nor VEON have any obligation to update this Presentation or correct any inaccuracies or omissions it discovers following the date of this Presentation.

4 Cohen Circle: Industry leading sponsors with an outstanding team Source: Cohen Circle, FactSet N o te s : 1. Reflects Adjusted EBITDA plus addback of $47m management estimate of customer appreciation program’s impact due to cyber attack 2. Return on units based on acquisition consideration paid by First Data of $15.00 per share of CCN common stock and $3.99 per CCN warrant (assumes warrants were issued within 30 days of acquisition closing), per tender offer statements filed by CCN and First Data with the SEC on June 7, 2020 3. Return based on IMXI common stock closing price as of February 28, 2025 4. Return based on PWP common stock closing price as of February 28, 2025 Select portfolio companies +90% return2 From IPO to sale to First Data in July 2017 +53% return3 Since IPO $250M+ Upsized PIPE +131% return4 Since IPO $300M Upsized PIPE Summary Experienced team • 50+ years experience as an operator and investor • Led seven prior closed SPAC mergers • Co-founded Bancorp (NASDAQ: TBBK) and served as CEO from 2000 to 2014 • Founded and served as CEO of JeffBanks until it was sold to Hudson United Bancorp in December 1999 Betsy Cohen Chairman of the Board, CEO and President • 20+ years experience as an operator and investor • Founded asset manager Cohen & Company (NASDAQ:COHN) • Co-founded Bancorp (NASDAQ: TBBK) and served as Chairman of the board of from 2000-2021 • 15+ years experience as an investor, operator, advisor and lawyer • Held the General Counsel role at CardConnect until it was acquired by First Data in 2017 • Served as a Partner at Ledgewood PC and was previously an Attorney at Morgan Lewis Daniel Cohen Co-Founder of Cohen Circle LLC (Sponsor) Amanda Abrams CEO of Sponsor Strong strategic partner Sponsor team brings deep expertise in technology enabled businesses Leader in the SPAC market SPAC pioneer reputed for unlocking value in attractive companies ready for the public market Experienced team Operational and financial expertise with an investor lens to complement Kyivstar Impressive track record Stellar reputation with institutions for selecting quality companies with consistent shareholder returns Transaction proposed at 3.6x EV/2024P Underlying Adj. EBITDA1, offering a significant discount to peers

5 Today’s presenters • Served as CEO of Beeline (Kazakhstan subsidiary of VEON) • Served as CEO of GroupM (large user acquisition marketing company) • Forbes #1 CEO in Ukraine (2020) Oleksandr Komarov CEO (since 2018) • 20+ years with VEON group • Held several senior finance roles at VEON group companies in over 10 markets • Served as board member in the largest VEON group operating company for 5+ years Boris Dolgushin CFO (since 2019)

6 Invest in Kyivstar – Invest in Ukraine Expected to be the only purely Ukrainian investment opportunity to be publicly listed in the U.S.5 Scarcity value Leading digital operator, one of the most recognizable national brands1 and proven leader in Ukraine’s digital infrastructure National Champion Proven leaders with a track record of resilience through war and robust governance World class team Resilient financial profile with $515M Adj. EBITDA, 56% Adj. EBITDA margin and $294M Adj. EBITDA minus CAPEX2, poised for growth with Ukrainian recovery and digital services expansion Highly profitable with multiple levers for growth 4 Significant financial and strategic flexibility – $429 million Cash and cash equivalents with no external debt3,4 Strong balance sheet 5 31 2 25 N o te s : 1. According to quarterly reputation tracking report prepared by marketing agency InMind 2. Adjusted EBITDA, Adjusted EBITDA margin and Adjusted EBITDA minus CAPEX for 2024; CAPEX refers to CAPEX excl. licenses and ROU (refer to p.28-29 for reconciliation of non-IFRS measures) 3. $429m cash and cash equiv. at Kyivstar; defined as $674m Cash and cash equiv., as presented in the combined statements minus Cash and cash equiv. at banks and on hand at VEON Holdings, incl. cash of US$10m retained in accordance with the demerger proposal and an estimated amount of US$235m to cover the repayment of the 2025 Notes 4. No external debt at Kyivstar; VEON Holdings contains 2025 Notes expected to be settled before closing of the business combination as per demerger proposal 5. Upon the successful closing of the business combination

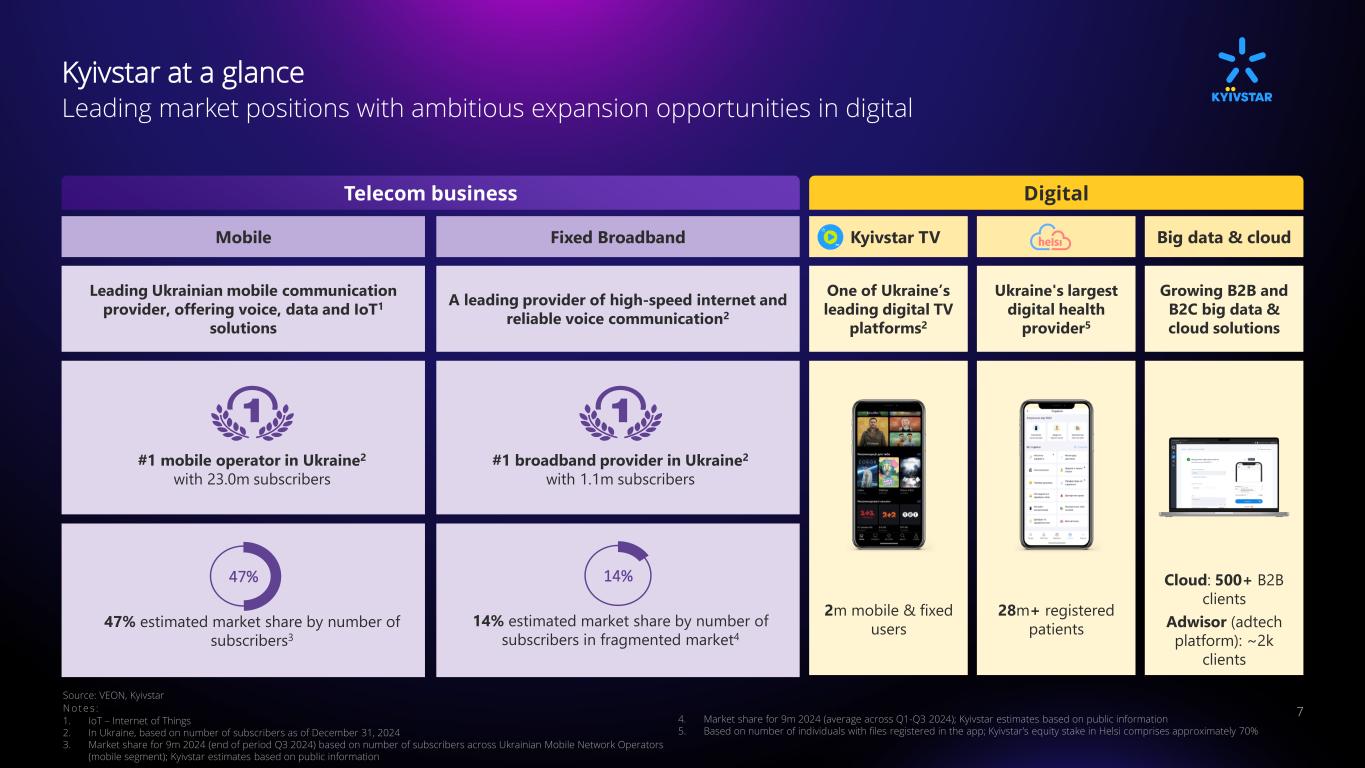

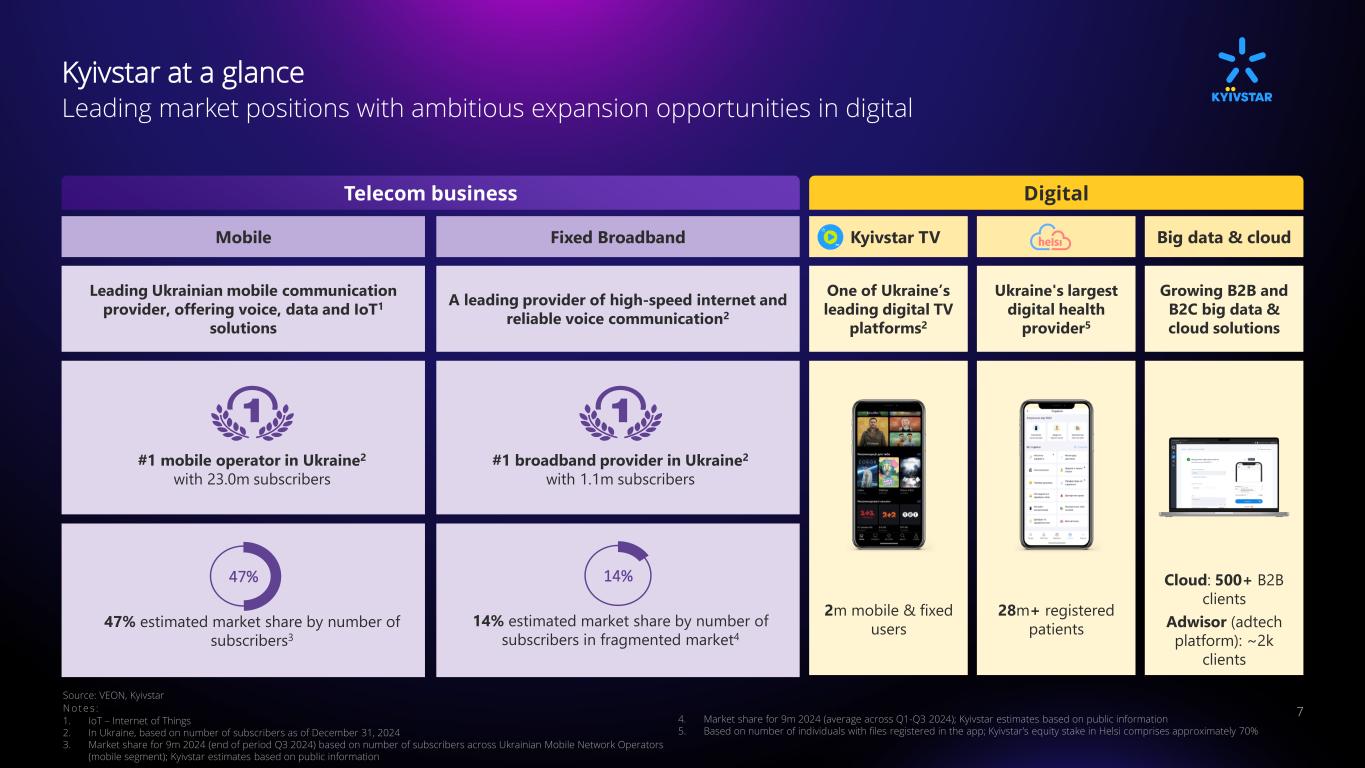

Kyivstar at a glance Leading market positions with ambitious expansion opportunities in digital 7 Telecom business Digital Leading Ukrainian mobile communication provider, offering voice, data and IoT1 solutions A leading provider of high-speed internet and reliable voice communication2 One of Ukraine’s leading digital TV platforms2 Ukraine's largest digital health provider5 Growing B2B and B2C big data & cloud solutions Big data & cloudMobile Fixed Broadband Kyivstar TV #1 mobile operator in Ukraine2 with 23.0m subscribers #1 broadband provider in Ukraine2 with 1.1m subscribers 47% estimated market share by number of subscribers3 47% 14% estimated market share by number of subscribers in fragmented market4 14% 2m mobile & fixed users 28m+ registered patients Cloud: 500+ B2B clients Adwisor (adtech platform): ~2k clients Source: VEON, Kyivstar N o te s : 1. IoT – Internet of Things 2. In Ukraine, based on number of subscribers as of December 31, 2024 3. Market share for 9m 2024 (end of period Q3 2024) based on number of subscribers across Ukrainian Mobile Network Operators (mobile segment); Kyivstar estimates based on public information 4. Market share for 9m 2024 (average across Q1-Q3 2024); Kyivstar estimates based on public information 5. Based on number of individuals with files registered in the app; Kyivstar’s equity stake in Helsi comprises approximately 70%

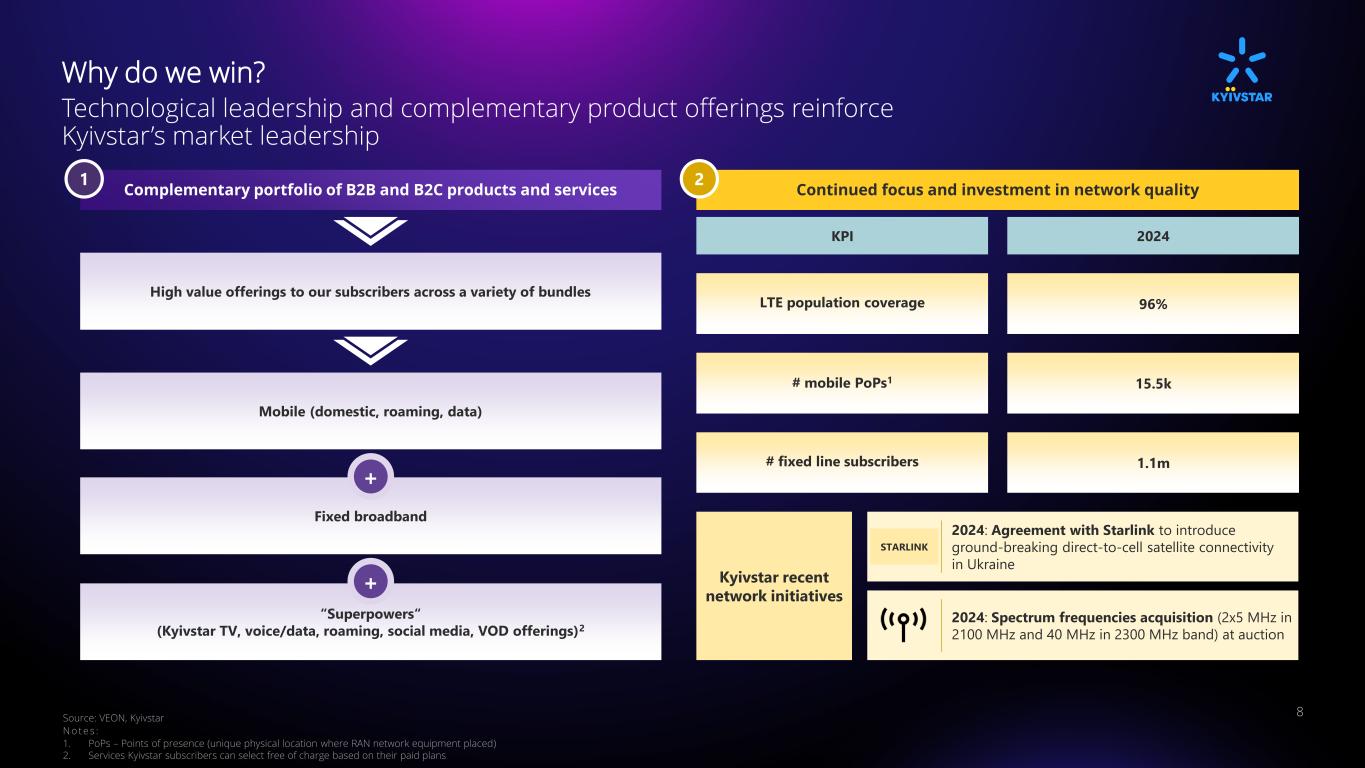

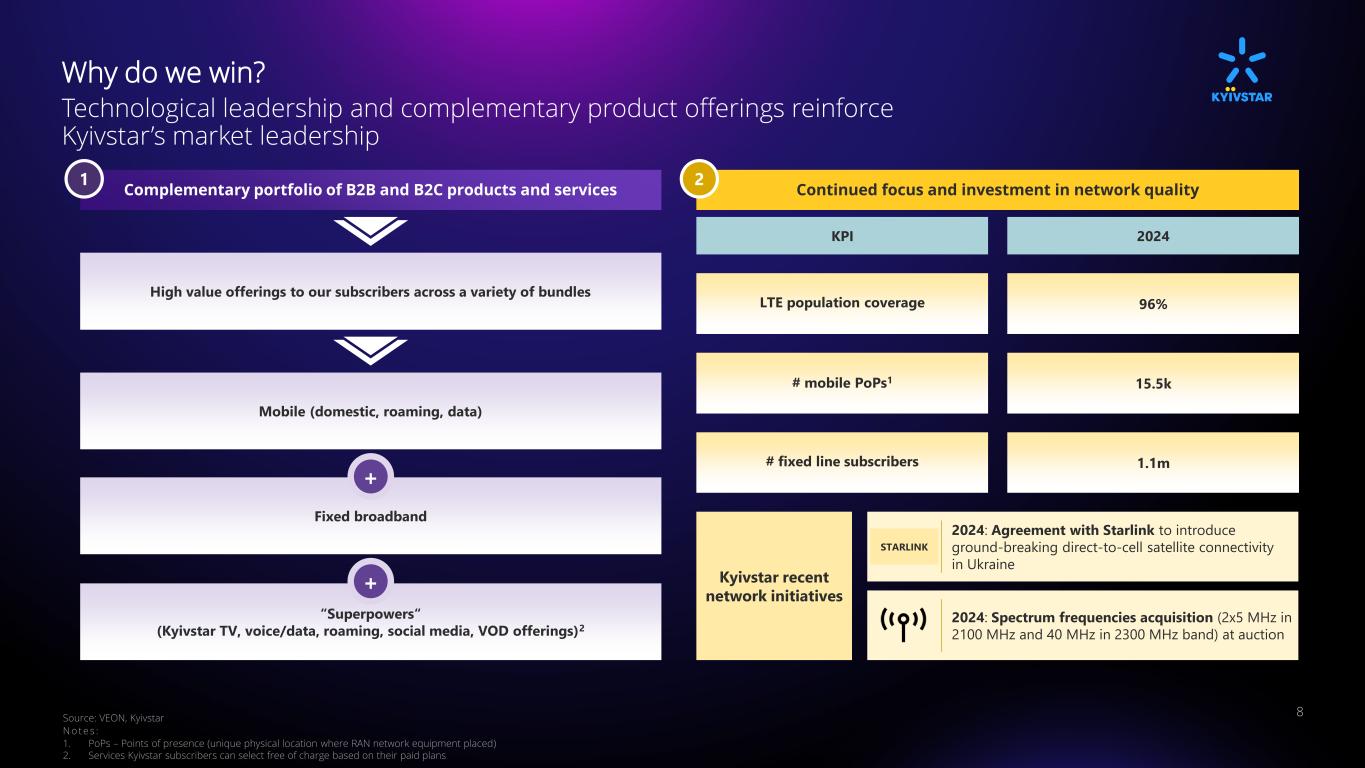

Why do we win? Technological leadership and complementary product offerings reinforce Kyivstar’s market leadership 2024: Agreement with Starlink to introduce ground-breaking direct-to-cell satellite connectivity in Ukraine Continued focus and investment in network quality KPI 2024 Kyivstar recent network initiatives Complementary portfolio of B2B and B2C products and services Mobile (domestic, roaming, data) Fixed broadband + “Superpowers“ (Kyivstar TV, voice/data, roaming, social media, VOD offerings)2 + High value offerings to our subscribers across a variety of bundles 1 2 2024: Spectrum frequencies acquisition (2x5 MHz in 2100 MHz and 40 MHz in 2300 MHz band) at auction Source: VEON, Kyivstar N o te s : 1. PoPs – Points of presence (unique physical location where RAN network equipment placed) 2. Services Kyivstar subscribers can select free of charge based on their paid plans LTE population coverage # mobile PoPs1 # fixed line subscribers 96% 15.5k 1.1m 8 STARLINK

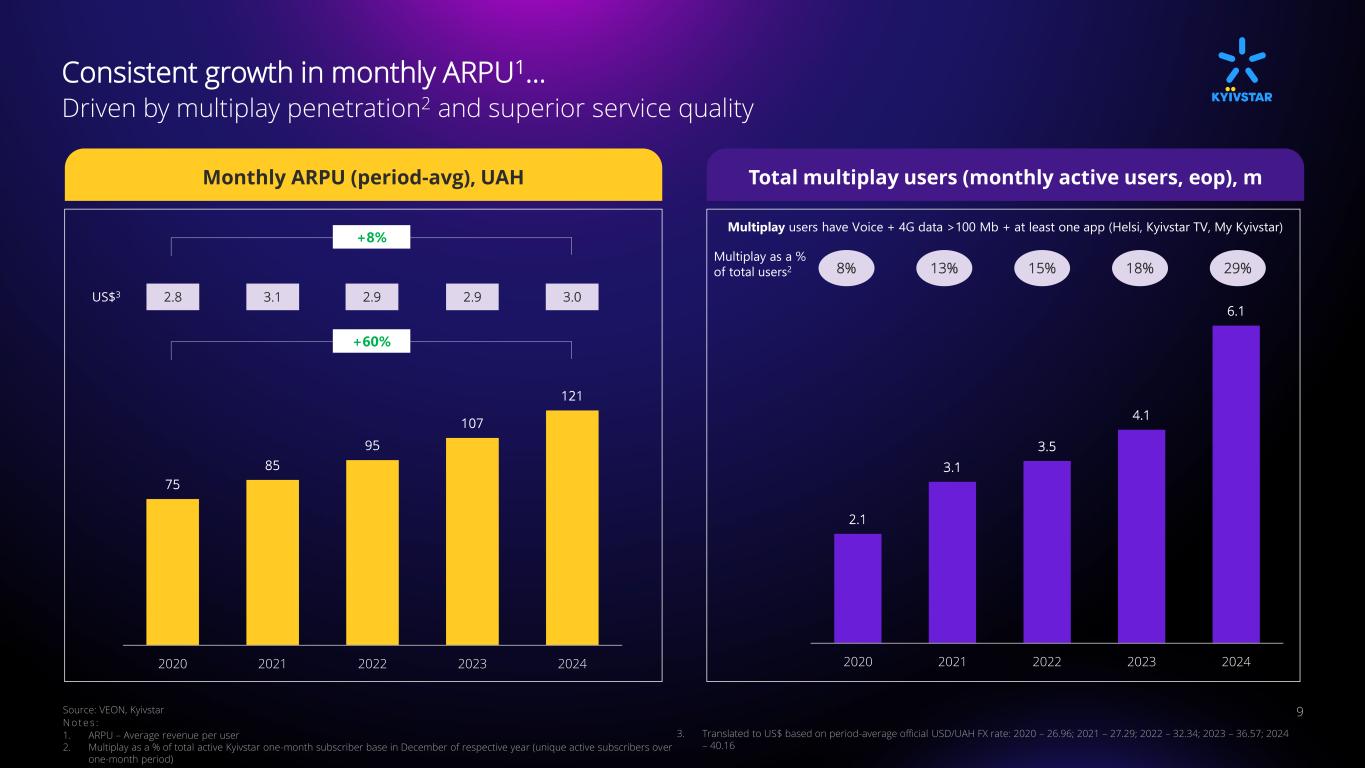

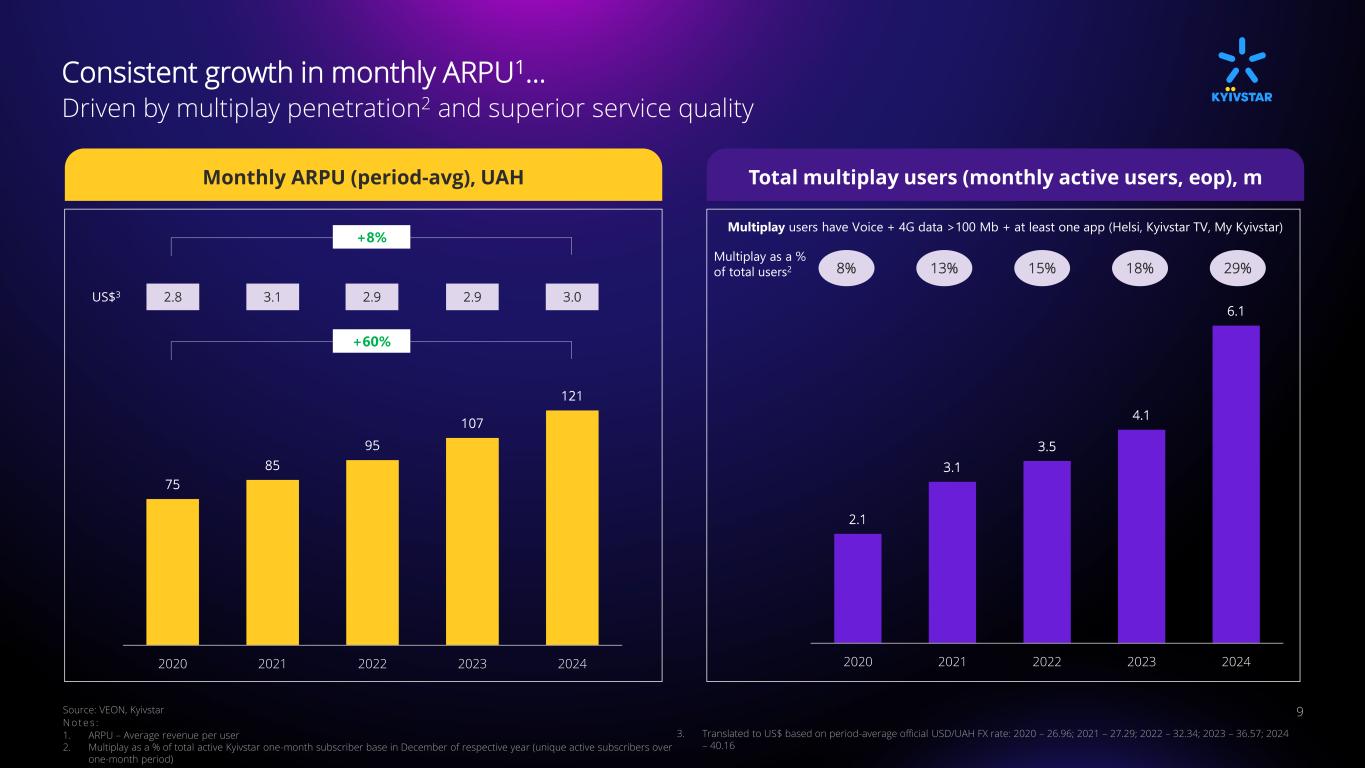

2.1 3.1 3.5 4.1 6.1 2020 2021 2022 2023 2024 75 85 95 107 121 2020 2021 2022 2023 2024 Consistent growth in monthly ARPU1… Driven by multiplay penetration2 and superior service quality 9 8% 13% 15% 18% 29% Multiplay as a % of total users2 Monthly ARPU (period-avg), UAH Source: VEON, Kyivstar N o te s : 1. ARPU – Average revenue per user 2. Multiplay as a % of total active Kyivstar one-month subscriber base in December of respective year (unique active subscribers over one-month period) 3. Translated to US$ based on period-average official USD/UAH FX rate: 2020 – 26.96; 2021 – 27.29; 2022 – 32.34; 2023 – 36.57; 2024 – 40.16 Multiplay users have Voice + 4G data >100 Mb + at least one app (Helsi, Kyivstar TV, My Kyivstar) US$3 Total multiplay users (monthly active users, eop), m +60% +8% 2.9 3.02.8 3.1 2.9

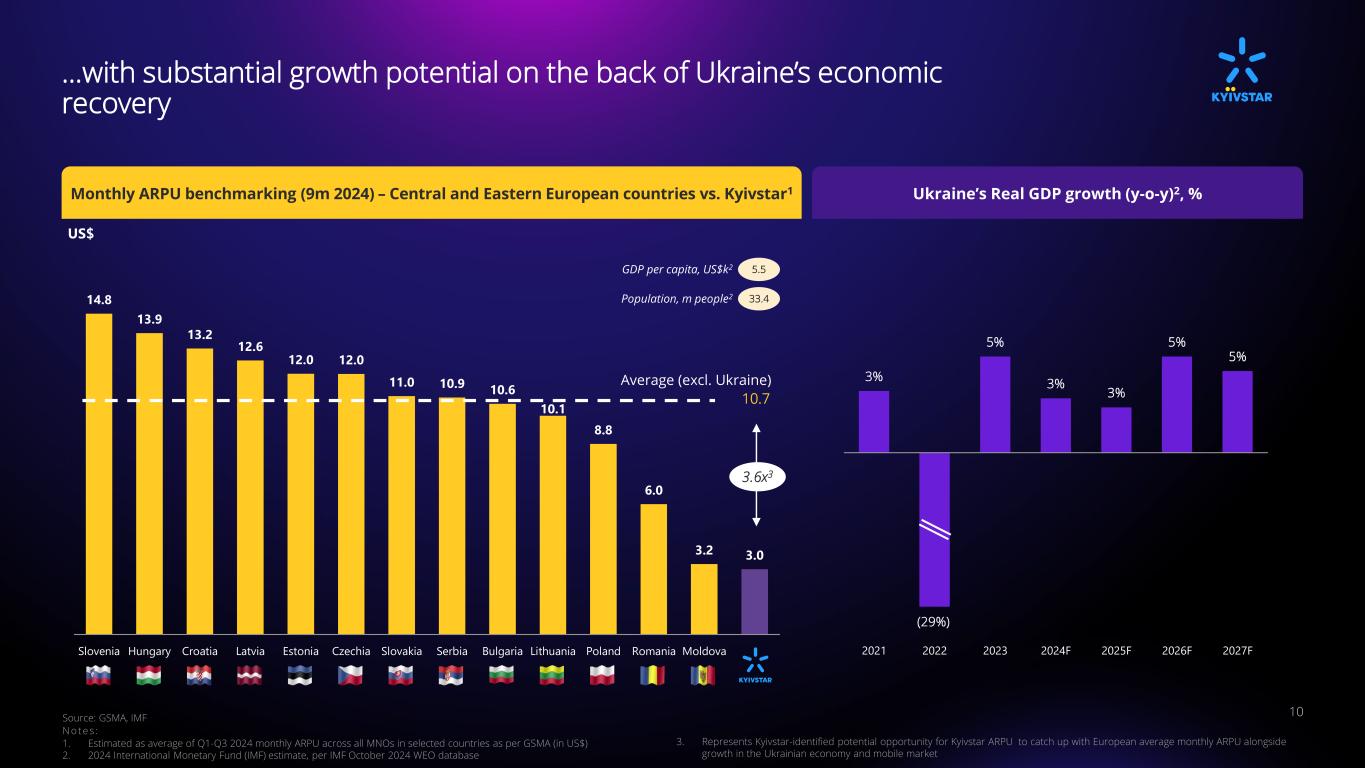

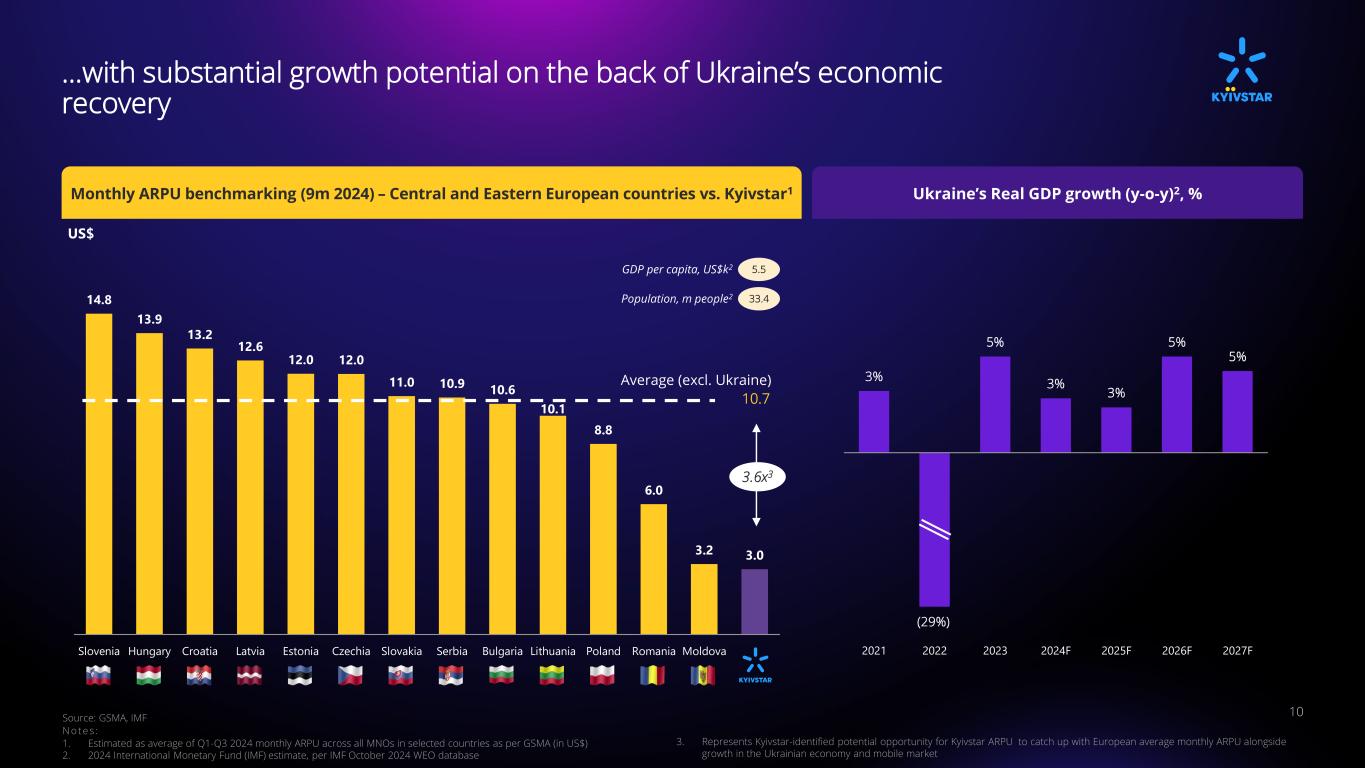

Source: GSMA, IMF N o te s : 1. Estimated as average of Q1-Q3 2024 monthly ARPU across all MNOs in selected countries as per GSMA (in US$) 2. 2024 International Monetary Fund (IMF) estimate, per IMF October 2024 WEO database 3. Represents Kyivstar-identified potential opportunity for Kyivstar ARPU to catch up with European average monthly ARPU alongside growth in the Ukrainian economy and mobile market 14.8 13.9 13.2 12.6 12.0 12.0 11.0 10.9 10.6 10.1 8.8 6.0 3.2 3.0 Slovenia Hungary Croatia Latvia Estonia Czechia Slovakia Serbia Bulgaria Lithuania Poland Romania Moldova Ukraine A x is T it le Axis Title 3% 5% 3% 3% 5% 5% 2021 2022 2023 2024F 2025F 2026F 2027F Axis Title …with substantial growth potential on the back of Ukraine’s economic recovery 10 Monthly ARPU benchmarking (9m 2024) – Central and Eastern European countries vs. Kyivstar1 10.7 Average (excl. Ukraine) 3.6x3 Ukraine’s Real GDP growth (y-o-y)2, % (29%) 5.5 33.4 GDP per capita, US$k2 Population, m people2 US$

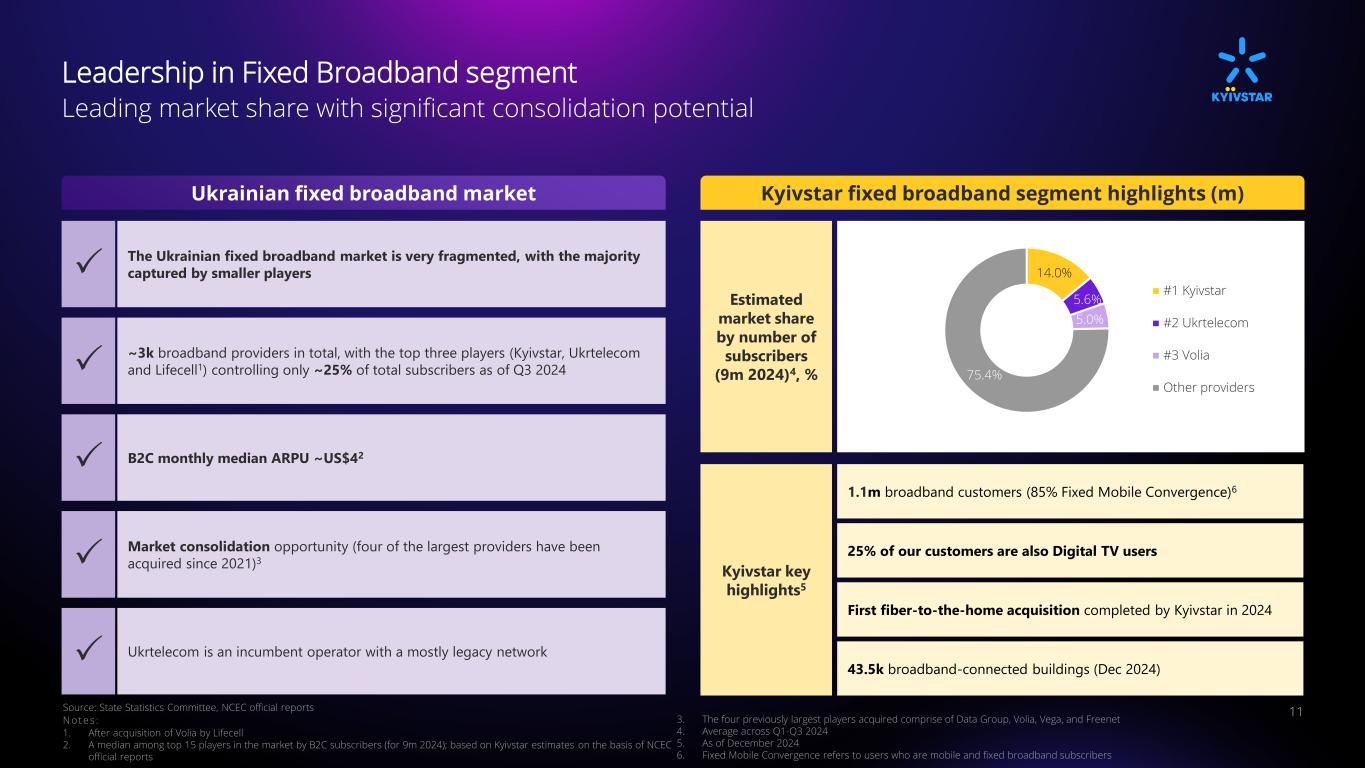

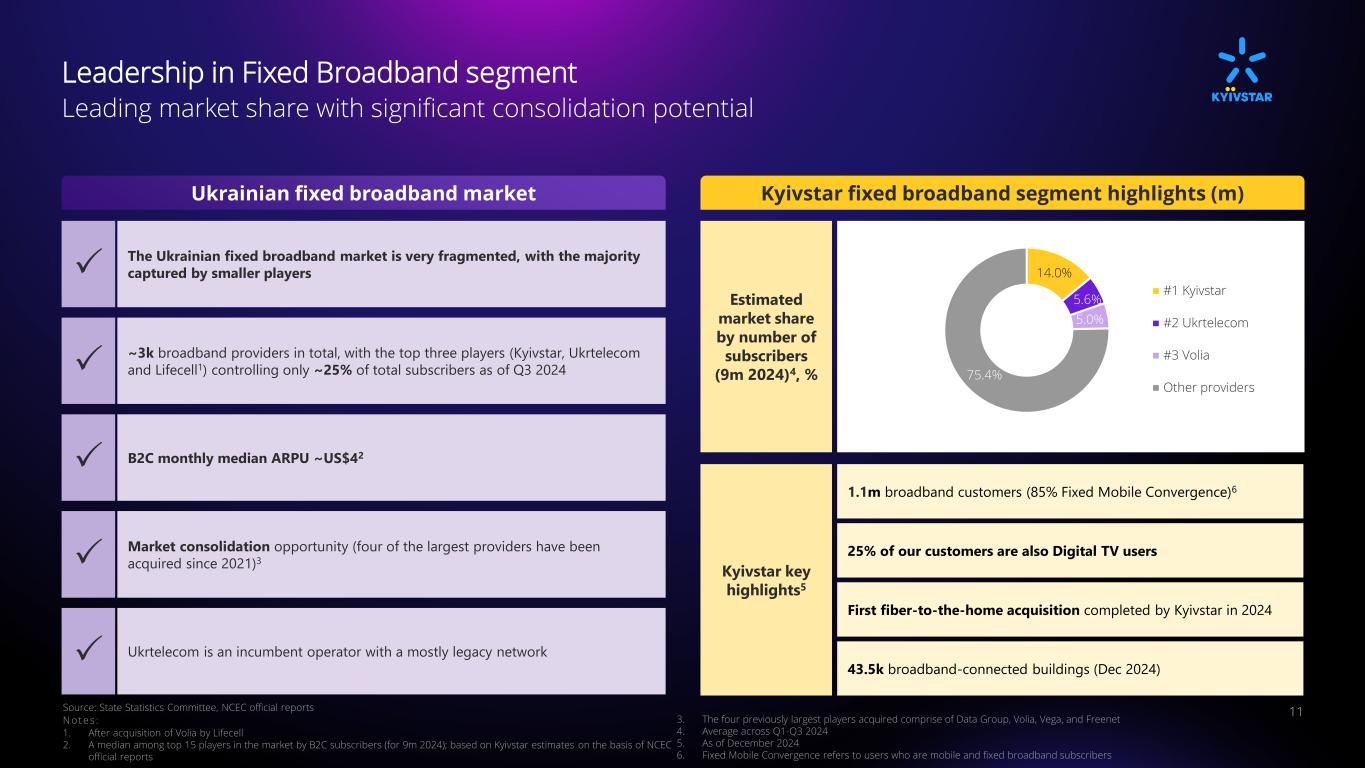

Leadership in Fixed Broadband segment 11Source: State Statistics Committee, NCEC official reports N o te s : 1. After acquisition of Volia by Lifecell 2. A median among top 15 players in the market by B2C subscribers (for 9m 2024); based on Kyivstar estimates on the basis of NCEC official reports 3. The four previously largest players acquired comprise of Data Group, Volia, Vega, and Freenet 4. Average across Q1-Q3 2024 5. As of December 2024 6. Fixed Mobile Convergence refers to users who are mobile and fixed broadband subscribers Estimated market share by number of subscribers (9m 2024)4, % Kyivstar key highlights5 1.1m broadband customers (85% Fixed Mobile Convergence)6 25% of our customers are also Digital TV users First fiber-to-the-home acquisition completed by Kyivstar in 2024 43.5k broadband-connected buildings (Dec 2024) The Ukrainian fixed broadband market is very fragmented, with the majority captured by smaller players Leading market share with significant consolidation potential Ukrainian fixed broadband market Kyivstar fixed broadband segment highlights (m) ~3k broadband providers in total, with the top three players (Kyivstar, Ukrtelecom and Lifecell1) controlling only ~25% of total subscribers as of Q3 2024 B2C monthly median ARPU ~US$42 Market consolidation opportunity (four of the largest providers have been acquired since 2021)3 Ukrtelecom is an incumbent operator with a mostly legacy network 14.0% 5.6% 5.0% 75.4% #1 Kyivstar #2 Ukrtelecom #3 Volia Other providers

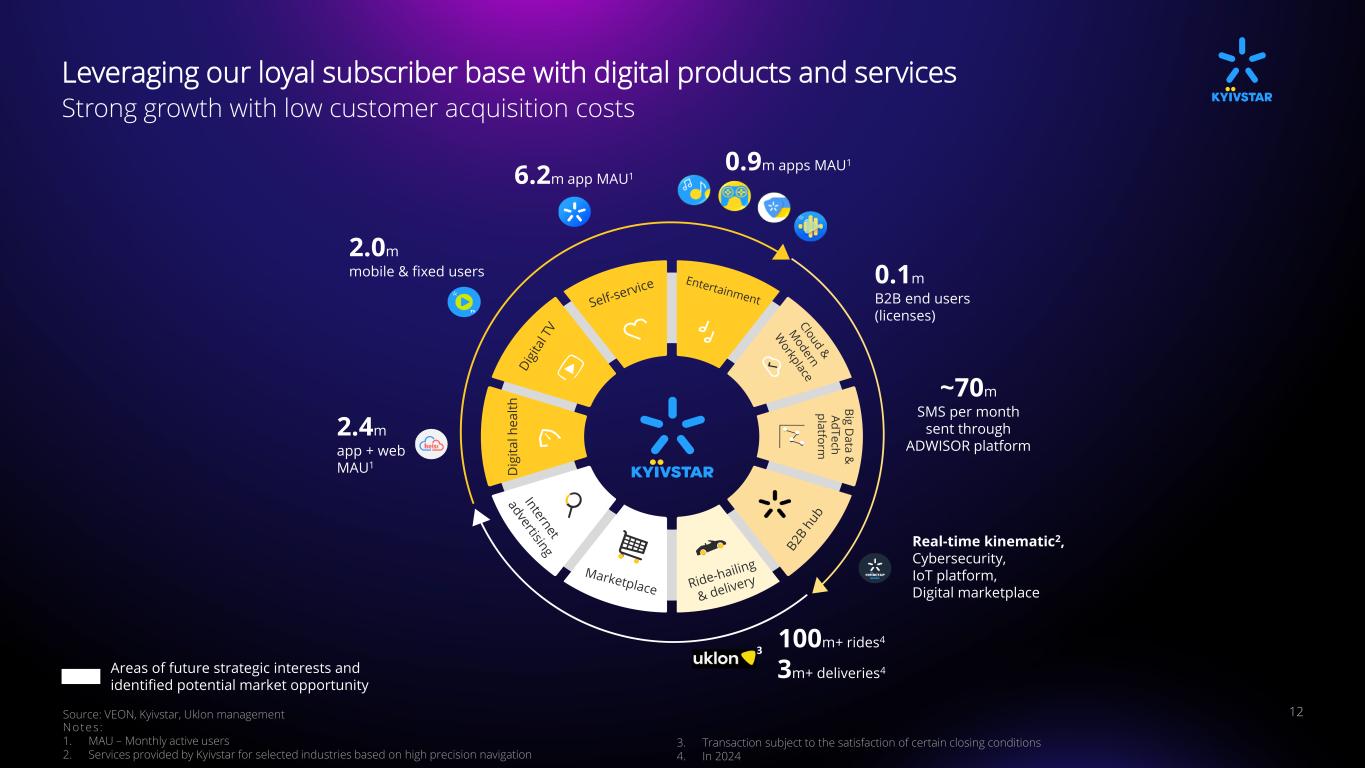

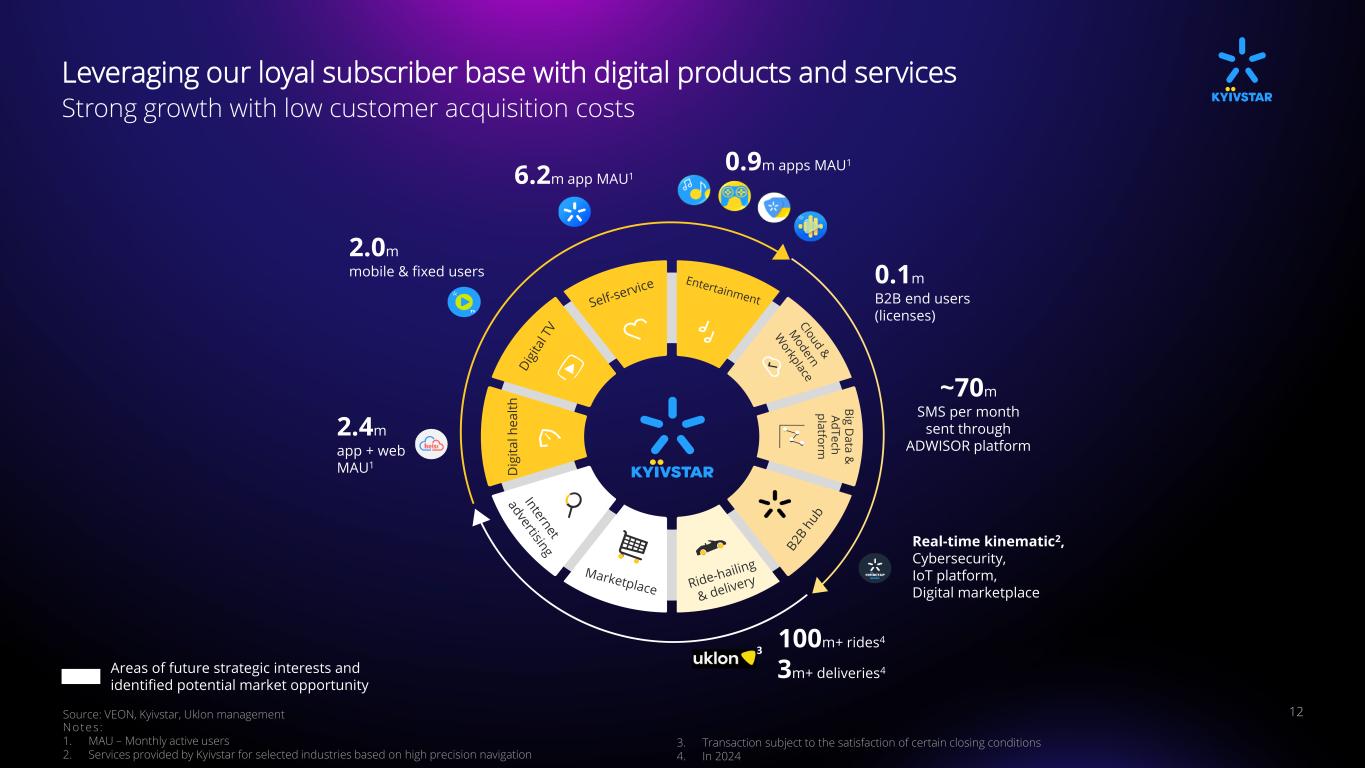

Leveraging our loyal subscriber base with digital products and services 12 Strong growth with low customer acquisition costs B ig D a ta & A d T e ch p la tfo rm 2.0m mobile & fixed users 6.2m app MAU1 0.1m B2B end users (licenses) 0.9m apps MAU1 Real-time kinematic2, Cybersecurity, IoT platform, Digital marketplace 2.4m app + web MAU1 ~70m SMS per month sent through ADWISOR platform Source: VEON, Kyivstar, Uklon management Notes : 1. MAU – Monthly active users 2. Services provided by Kyivstar for selected industries based on high precision navigation 3. Transaction subject to the satisfaction of certain closing conditions 4. In 2024 Areas of future strategic interests and identified potential market opportunity 100m+ rides4 3m+ deliveries4 3

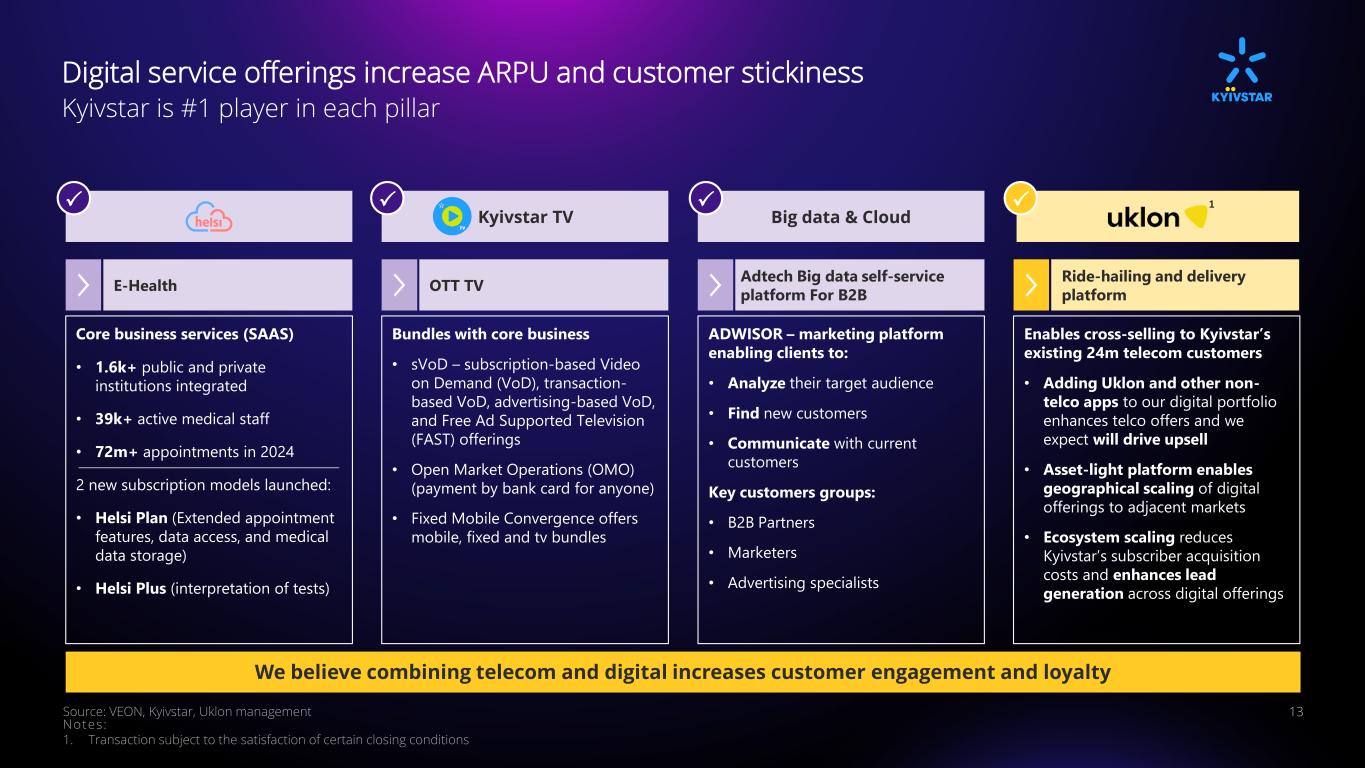

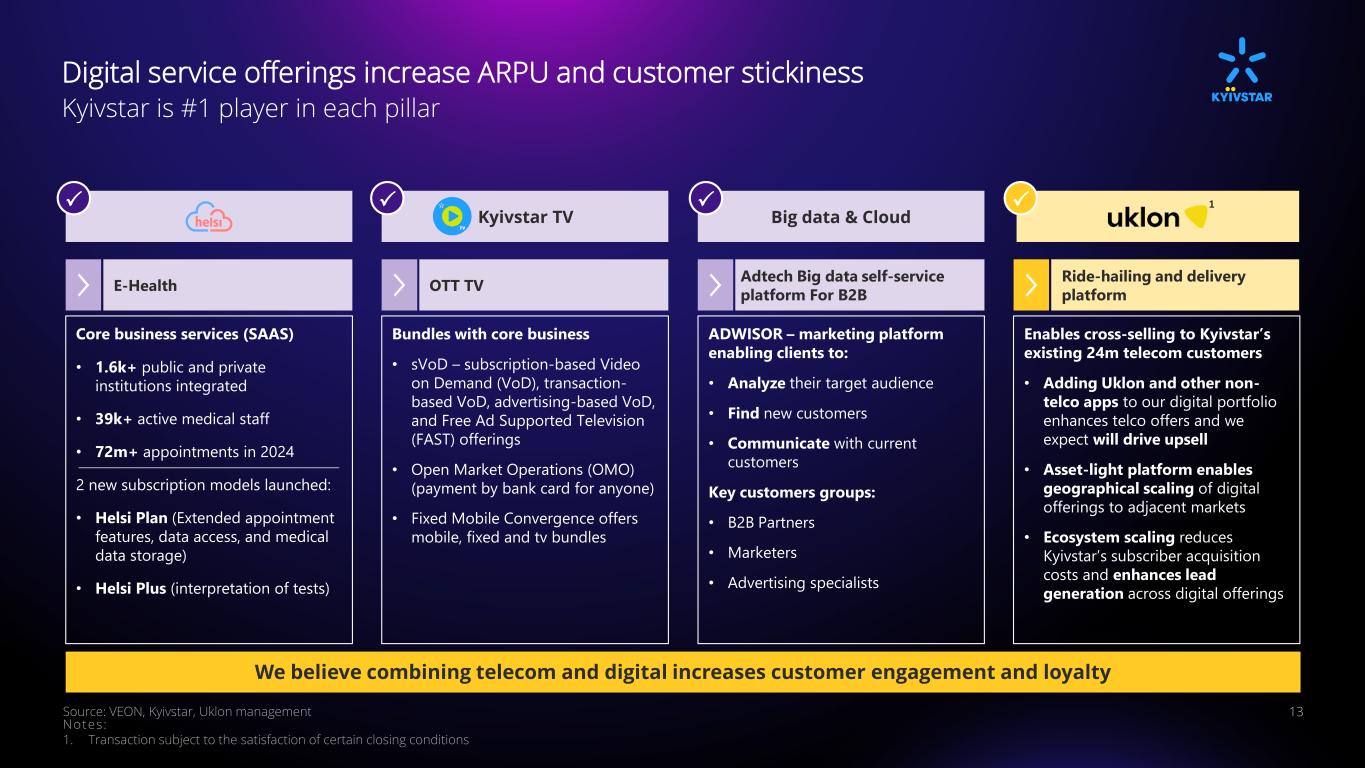

Enables cross-selling to Kyivstar’s existing 24m telecom customers • Adding Uklon and other non- telco apps to our digital portfolio enhances telco offers and we expect will drive upsell • Asset-light platform enables geographical scaling of digital offerings to adjacent markets • Ecosystem scaling reduces Kyivstar’s subscriber acquisition costs and enhances lead generation across digital offerings Digital service offerings increase ARPU and customer stickiness 13 Kyivstar is #1 player in each pillar Source: VEON, Kyivstar, Uklon management Notes: 1. Transaction subject to the satisfaction of certain closing conditions Kyivstar TV Bundles with core business • sVoD – subscription-based Video on Demand (VoD), transaction- based VoD, advertising-based VoD, and Free Ad Supported Television (FAST) offerings • Open Market Operations (OMO) (payment by bank card for anyone) • Fixed Mobile Convergence offers mobile, fixed and tv bundles OTT TV Core business services (SAAS) • 1.6k+ public and private institutions integrated • 39k+ active medical staff • 72m+ appointments in 2024 2 new subscription models launched: • Helsi Plan (Extended appointment features, data access, and medical data storage) • Helsi Plus (interpretation of tests) E-Health Big data & Cloud ADWISOR – marketing platform enabling clients to: • Analyze their target audience • Find new customers • Communicate with current customers Key customers groups: • B2B Partners • Marketers • Advertising specialists Adtech Big data self-service platform For B2B Ride-hailing and delivery platform We believe combining telecom and digital increases customer engagement and loyalty 1

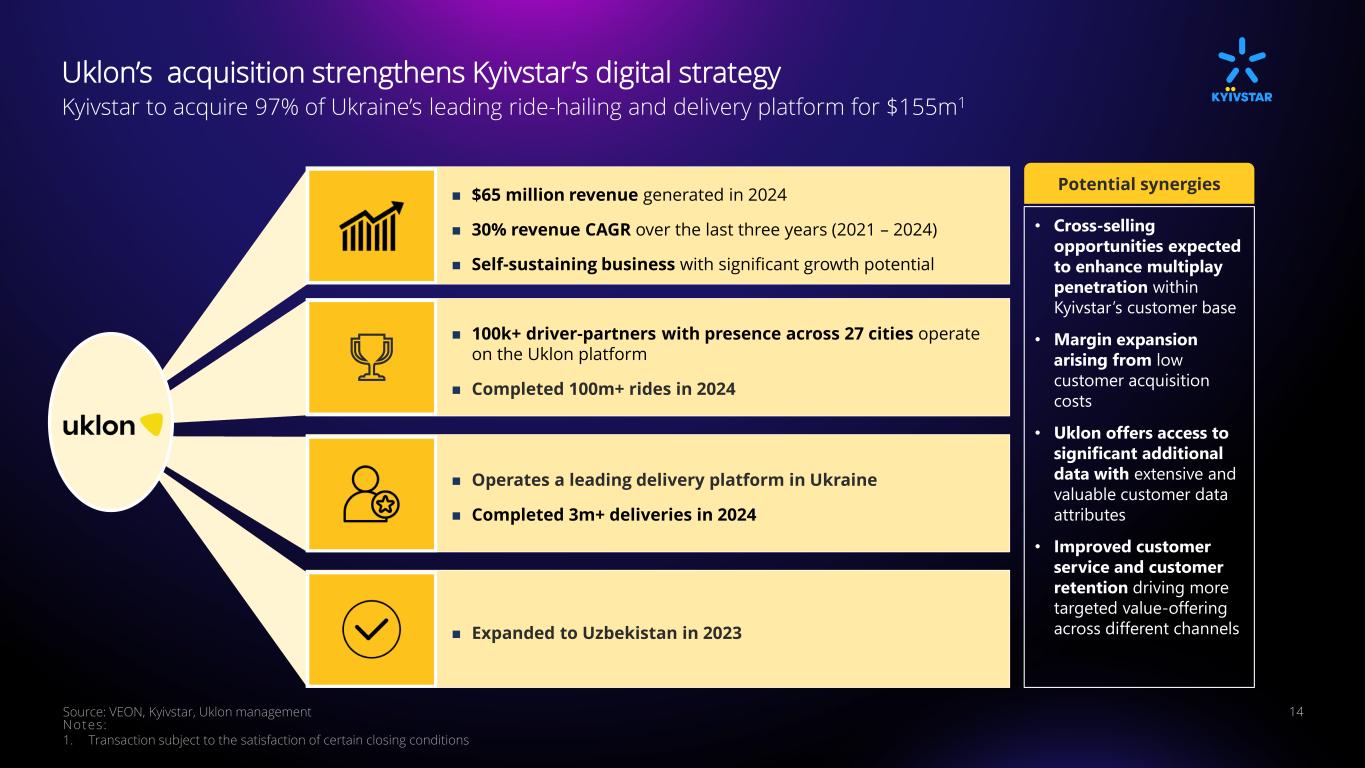

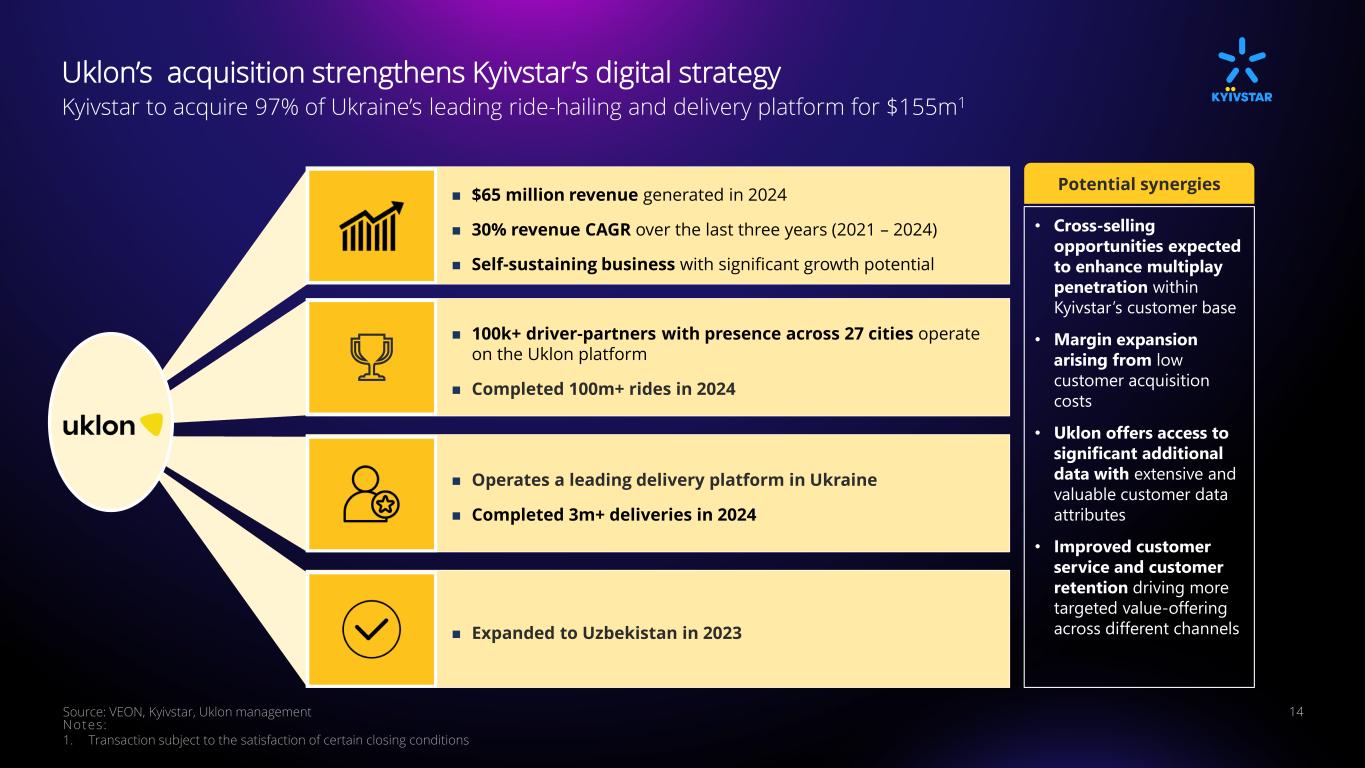

Uklon’s acquisition strengthens Kyivstar’s digital strategy 14 Kyivstar to acquire 97% of Ukraine’s leading ride-hailing and delivery platform for $155m1 Source: VEON, Kyivstar, Uklon management Notes: 1. Transaction subject to the satisfaction of certain closing conditions • Cross-selling opportunities expected to enhance multiplay penetration within Kyivstar’s customer base • Margin expansion arising from low customer acquisition costs • Uklon offers access to significant additional data with extensive and valuable customer data attributes • Improved customer service and customer retention driving more targeted value-offering across different channels ◼ Operates a leading delivery platform in Ukraine ◼ Completed 3m+ deliveries in 2024 ◼ 100k+ driver-partners with presence across 27 cities operate on the Uklon platform ◼ Completed 100m+ rides in 2024 ◼ $65 million revenue generated in 2024 ◼ 30% revenue CAGR over the last three years (2021 – 2024) ◼ Self-sustaining business with significant growth potential ◼ Expanded to Uzbekistan in 2023 Potential synergies

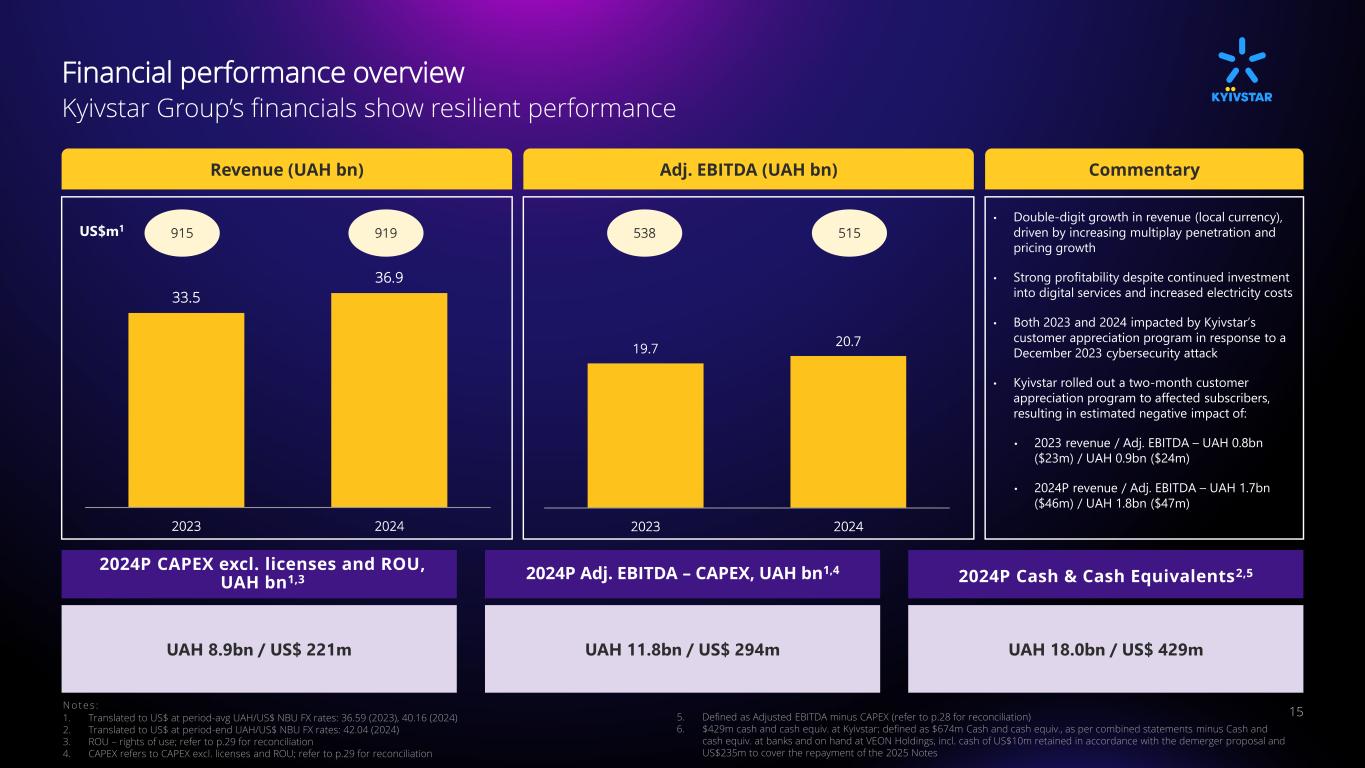

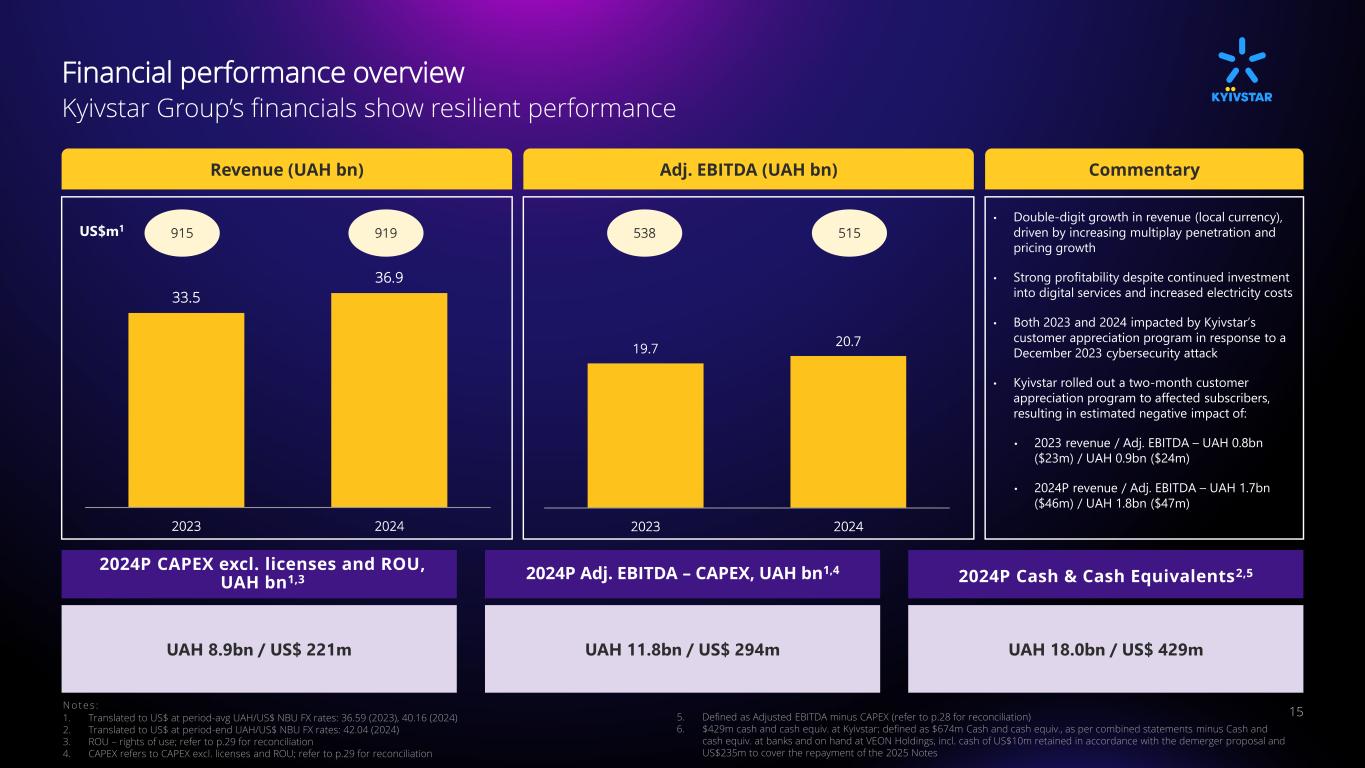

19.7 20.7 2023 2024 33.5 36.9 2023 2024 Financial performance overview 15 Kyivstar Group’s financials show resilient performance N o te s : 1. Translated to US$ at period-avg UAH/US$ NBU FX rates: 36.59 (2023), 40.16 (2024) 2. Translated to US$ at period-end UAH/US$ NBU FX rates: 42.04 (2024) 3. ROU – rights of use; refer to p.29 for reconciliation 4. CAPEX refers to CAPEX excl. licenses and ROU; refer to p.29 for reconciliation 5. Defined as Adjusted EBITDA minus CAPEX (refer to p.28 for reconciliation) 6. $429m cash and cash equiv. at Kyivstar; defined as $674m Cash and cash equiv., as per combined statements minus Cash and cash equiv. at banks and on hand at VEON Holdings, incl. cash of US$10m retained in accordance with the demerger proposal and US$235m to cover the repayment of the 2025 Notes UAH 18.0bn / US$ 429mUAH 11.8bn / US$ 294m UAH 8.9bn / US$ 221m 515538US$m1 • Double-digit growth in revenue (local currency), driven by increasing multiplay penetration and pricing growth • Strong profitability despite continued investment into digital services and increased electricity costs • Both 2023 and 2024 impacted by Kyivstar’s customer appreciation program in response to a December 2023 cybersecurity attack • Kyivstar rolled out a two-month customer appreciation program to affected subscribers, resulting in estimated negative impact of: • 2023 revenue / Adj. EBITDA – UAH 0.8bn ($23m) / UAH 0.9bn ($24m) • 2024P revenue / Adj. EBITDA – UAH 1.7bn ($46m) / UAH 1.8bn ($47m) 919915 2024P Adj. EBITDA – CAPEX, UAH bn1,42024P CAPEX excl. licenses and ROU, UAH bn1,3 2024P Cash & Cash Equivalents2,5 Revenue (UAH bn) Adj. EBITDA (UAH bn) Commentary

Growth strategy and management priorities 16 Kyivstar’s medium-term growth strategy focuses on deepening mobile market leadership and expansion of digital services Telecom business Digital Serve as a key player in restoring and developing digital ecosystem in Ukraine Target significant organic growth in digital revenues, complemented by acquisitions Grow digital offerings organically and through adjacent acquisitions, by focusing on increasing multiplay penetration Leverage our loyal customer base to develop and launch, new and existing digital products Fixed broadband market share growth via organic expansion and acquisitions Consistent growth in ARPU continuing price leadership in the market Maintain paying subscriber base and grow share of multiplay users Sustain mobile market leadership and large market share

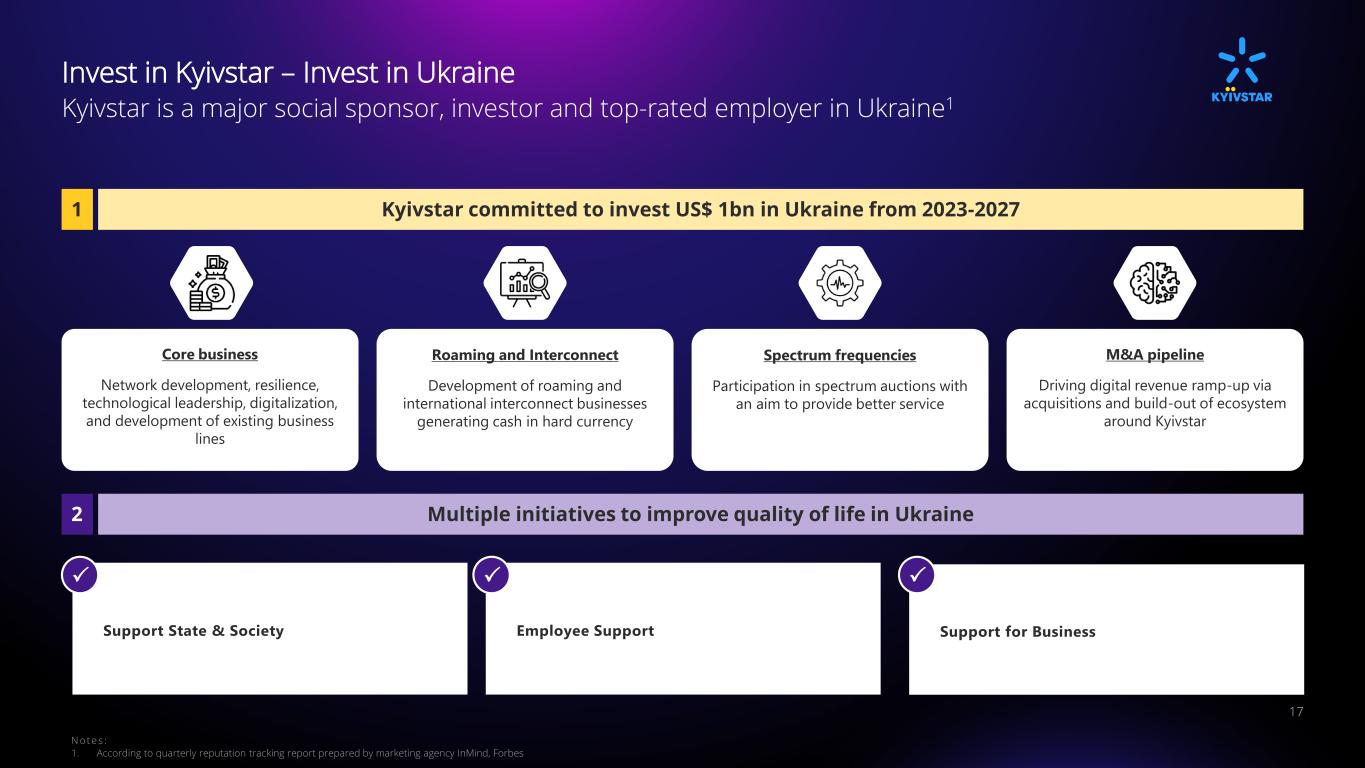

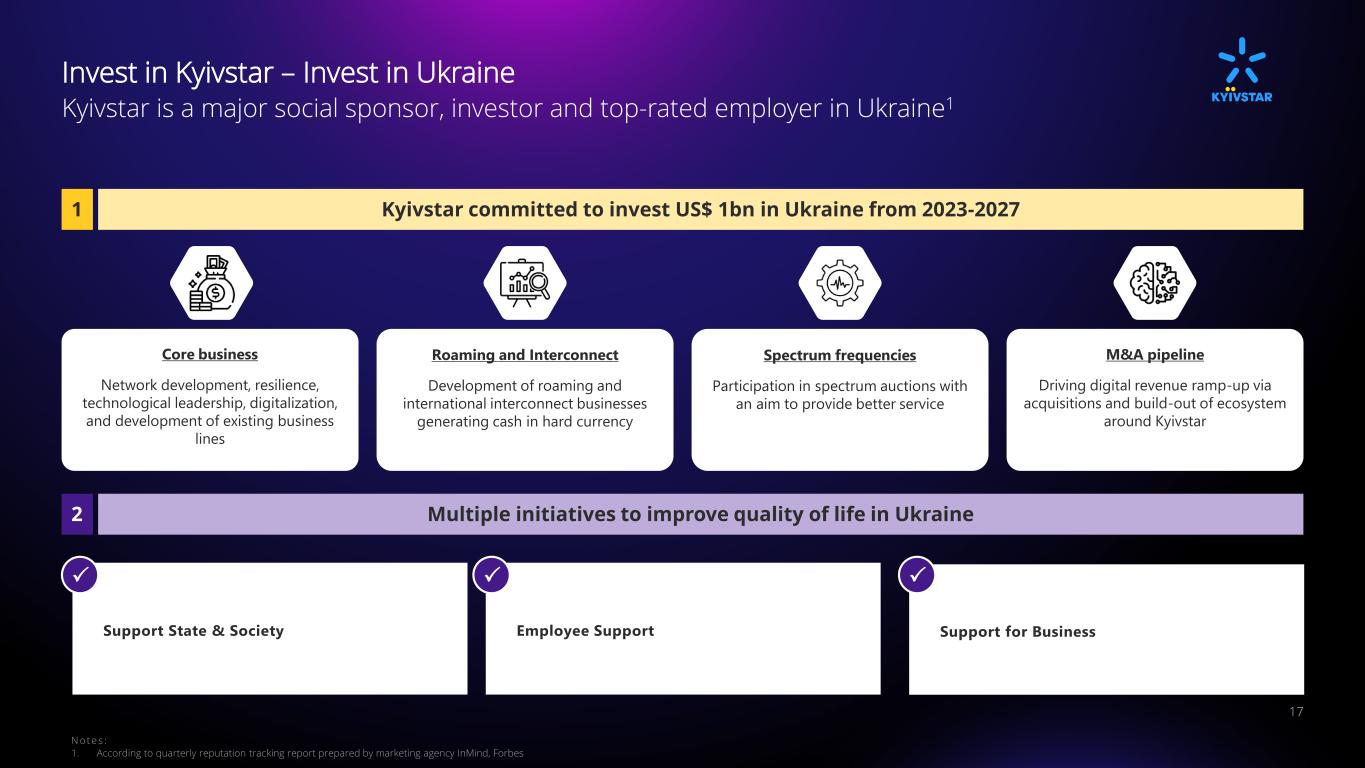

Invest in Kyivstar – Invest in Ukraine 17 Kyivstar is a major social sponsor, investor and top-rated employer in Ukraine1 Kyivstar committed to invest US$ 1bn in Ukraine from 2023-20271 Roaming and Interconnect Development of roaming and international interconnect businesses generating cash in hard currency M&A pipeline Driving digital revenue ramp-up via acquisitions and build-out of ecosystem around Kyivstar Spectrum frequencies Participation in spectrum auctions with an aim to provide better service Core business Network development, resilience, technological leadership, digitalization, and development of existing business lines Multiple initiatives to improve quality of life in Ukraine2 Support State & Society Employee Support Support for Business N o te s : 1. According to quarterly reputation tracking report prepared by marketing agency InMind, Forbes

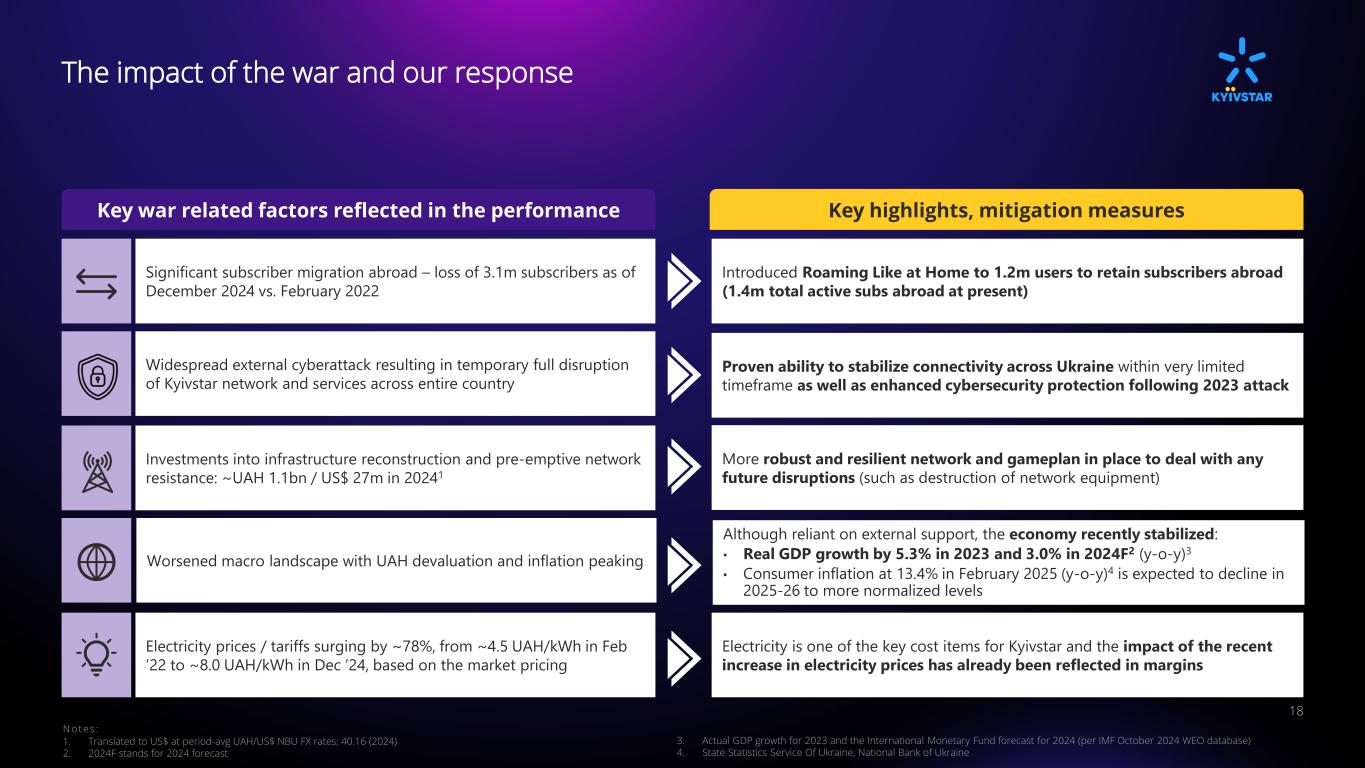

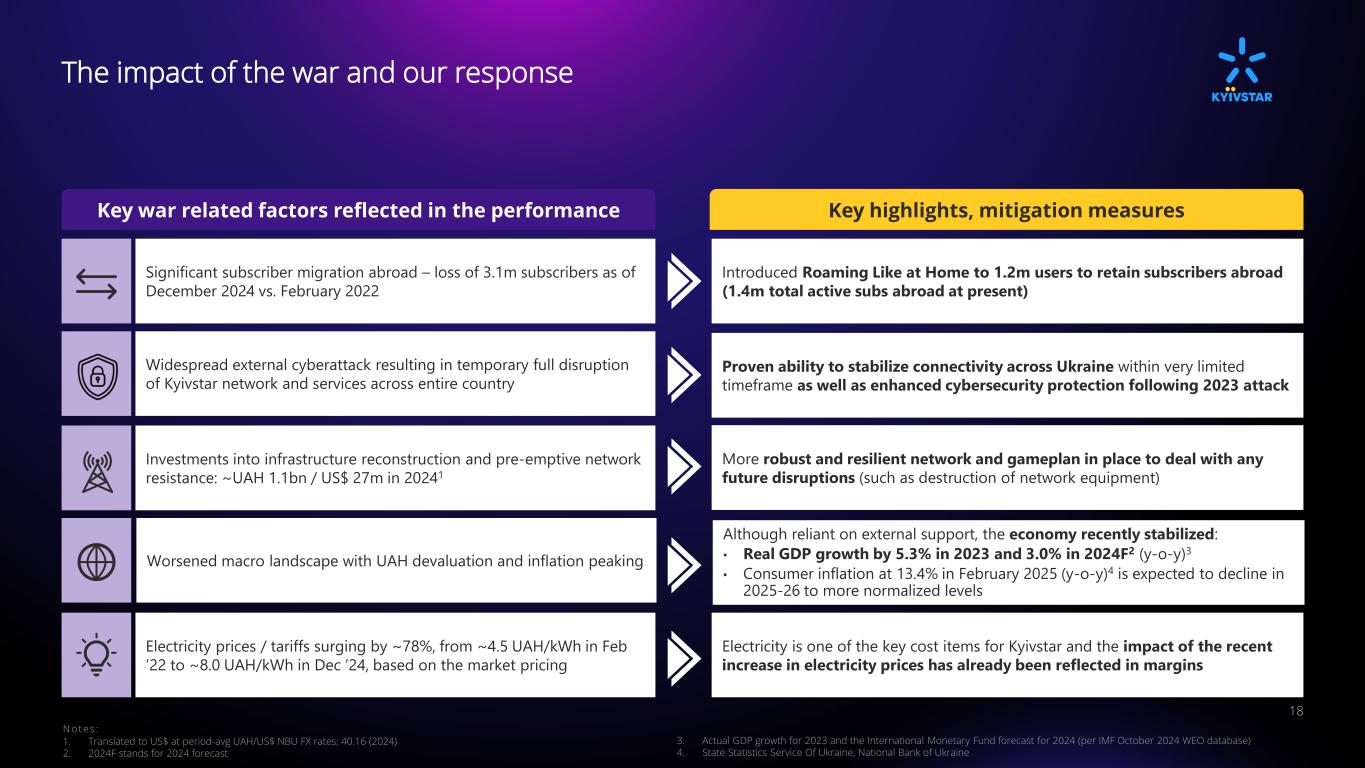

18 The impact of the war and our response Key war related factors reflected in the performance Key highlights, mitigation measures N o te s : 1. Translated to US$ at period-avg UAH/US$ NBU FX rates: 40.16 (2024) 2. 2024F stands for 2024 forecast 3. Actual GDP growth for 2023 and the International Monetary Fund forecast for 2024 (per IMF October 2024 WEO database) 4. State Statistics Service Of Ukraine, National Bank of Ukraine Introduced Roaming Like at Home to 1.2m users to retain subscribers abroad (1.4m total active subs abroad at present) Significant subscriber migration abroad – loss of 3.1m subscribers as of December 2024 vs. February 2022 More robust and resilient network and gameplan in place to deal with any future disruptions (such as destruction of network equipment) Investments into infrastructure reconstruction and pre-emptive network resistance: ~UAH 1.1bn / US$ 27m in 20241 Electricity is one of the key cost items for Kyivstar and the impact of the recent increase in electricity prices has already been reflected in margins Electricity prices / tariffs surging by ~78%, from ~4.5 UAH/kWh in Feb ’22 to ~8.0 UAH/kWh in Dec ’24, based on the market pricing Although reliant on external support, the economy recently stabilized: • Real GDP growth by 5.3% in 2023 and 3.0% in 2024F2 (y-o-y)3 • Consumer inflation at 13.4% in February 2025 (y-o-y)4 is expected to decline in 2025-26 to more normalized levels Worsened macro landscape with UAH devaluation and inflation peaking Proven ability to stabilize connectivity across Ukraine within very limited timeframe as well as enhanced cybersecurity protection following 2023 attack Widespread external cyberattack resulting in temporary full disruption of Kyivstar network and services across entire country

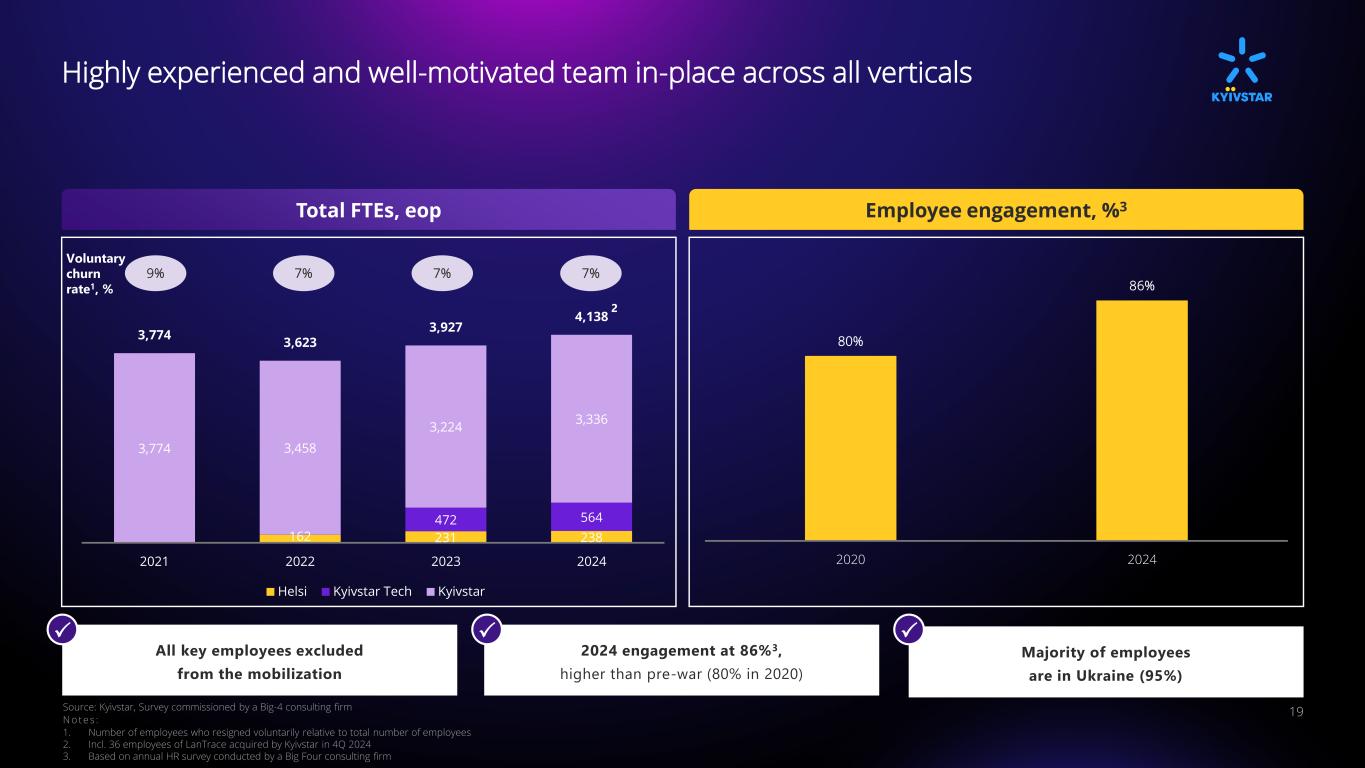

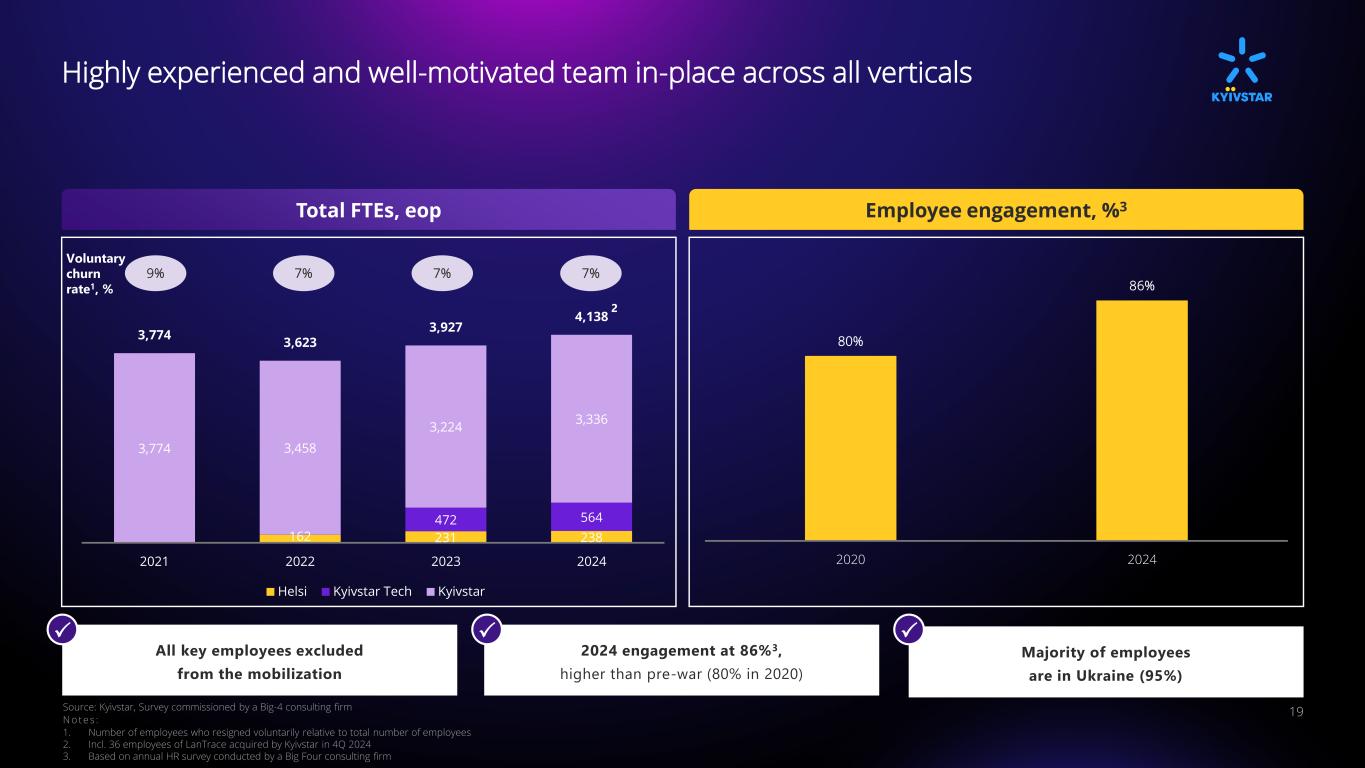

Highly experienced and well-motivated team in-place across all verticals 19 Total FTEs, eop Employee engagement, %3 Source: Kyivstar, Survey commissioned by a Big-4 consulting firm N o te s : 1. Number of employees who resigned voluntarily relative to total number of employees 2. Incl. 36 employees of LanTrace acquired by Kyivstar in 4Q 2024 3. Based on annual HR survey conducted by a Big Four consulting firm Voluntary churn rate1, % 2 9% 7% 7% 7% 162 231 238 472 564 3,774 3,458 3,224 3,336 3,774 3,623 3,927 4,138 2021 2022 2023 2024 Helsi Kyivstar Tech Kyivstar 2 All key employees excluded from the mobilization Majority of employees are in Ukraine (95%) 2024 engagement at 86%3, higher than pre-war (80% in 2020) 80% 86% 2020 2024

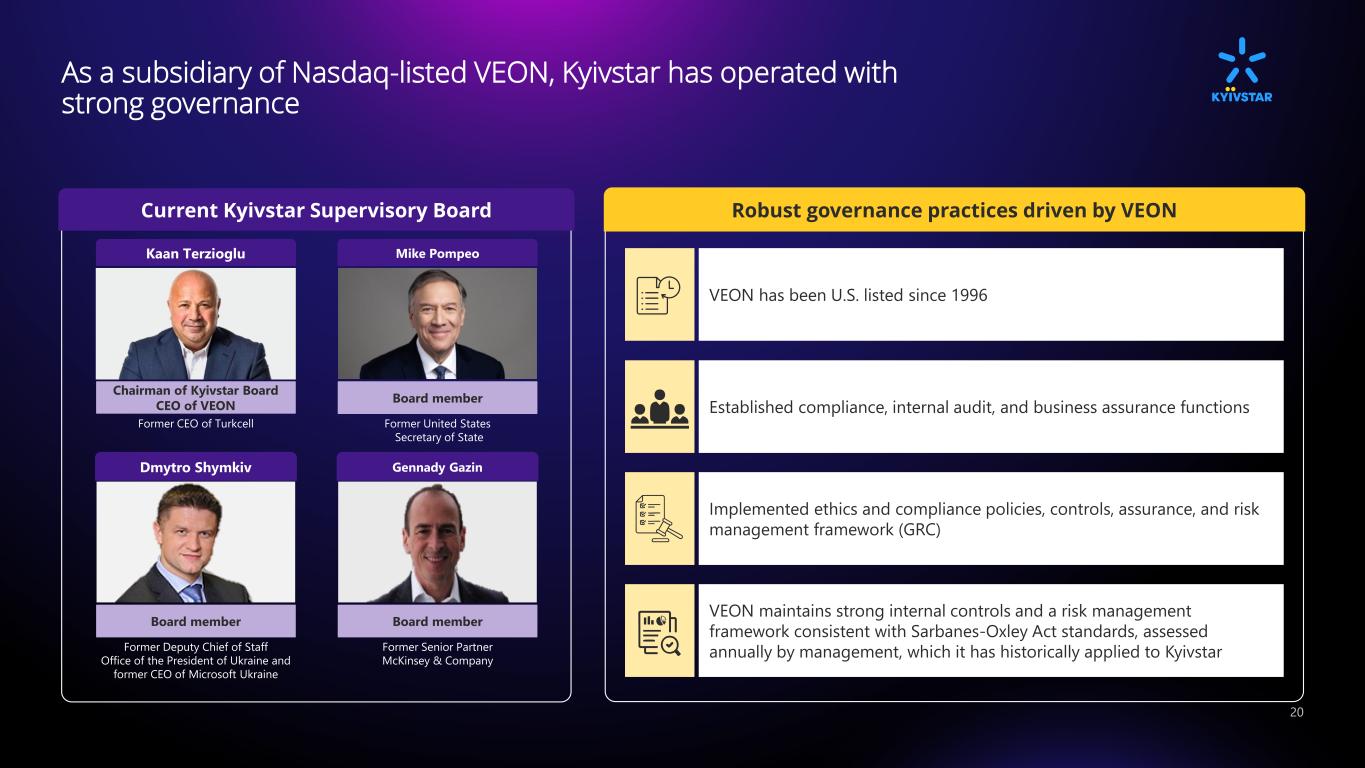

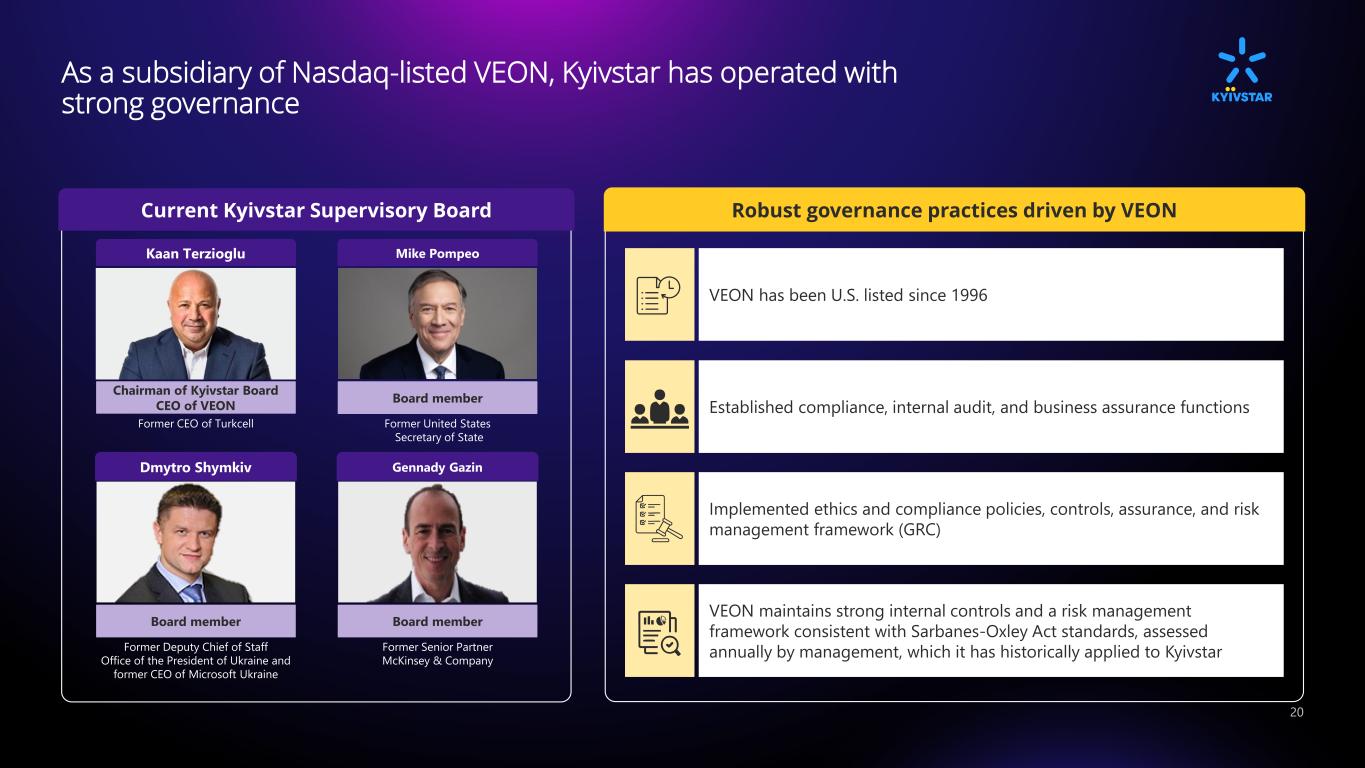

As a subsidiary of Nasdaq-listed VEON, Kyivstar has operated with strong governance 20 Current Kyivstar Supervisory Board Robust governance practices driven by VEON Kaan Terzioglu Dmytro Shymkiv Chairman of Kyivstar Board CEO of VEON Board member Former Deputy Chief of Staff Office of the President of Ukraine and former CEO of Microsoft Ukraine Former CEO of Turkcell Mike Pompeo Gennady Gazin Board member Board member Former Senior Partner McKinsey & Company Former United States Secretary of State VEON has been U.S. listed since 1996 Established compliance, internal audit, and business assurance functions Implemented ethics and compliance policies, controls, assurance, and risk management framework (GRC) VEON maintains strong internal controls and a risk management framework consistent with Sarbanes-Oxley Act standards, assessed annually by management, which it has historically applied to Kyivstar

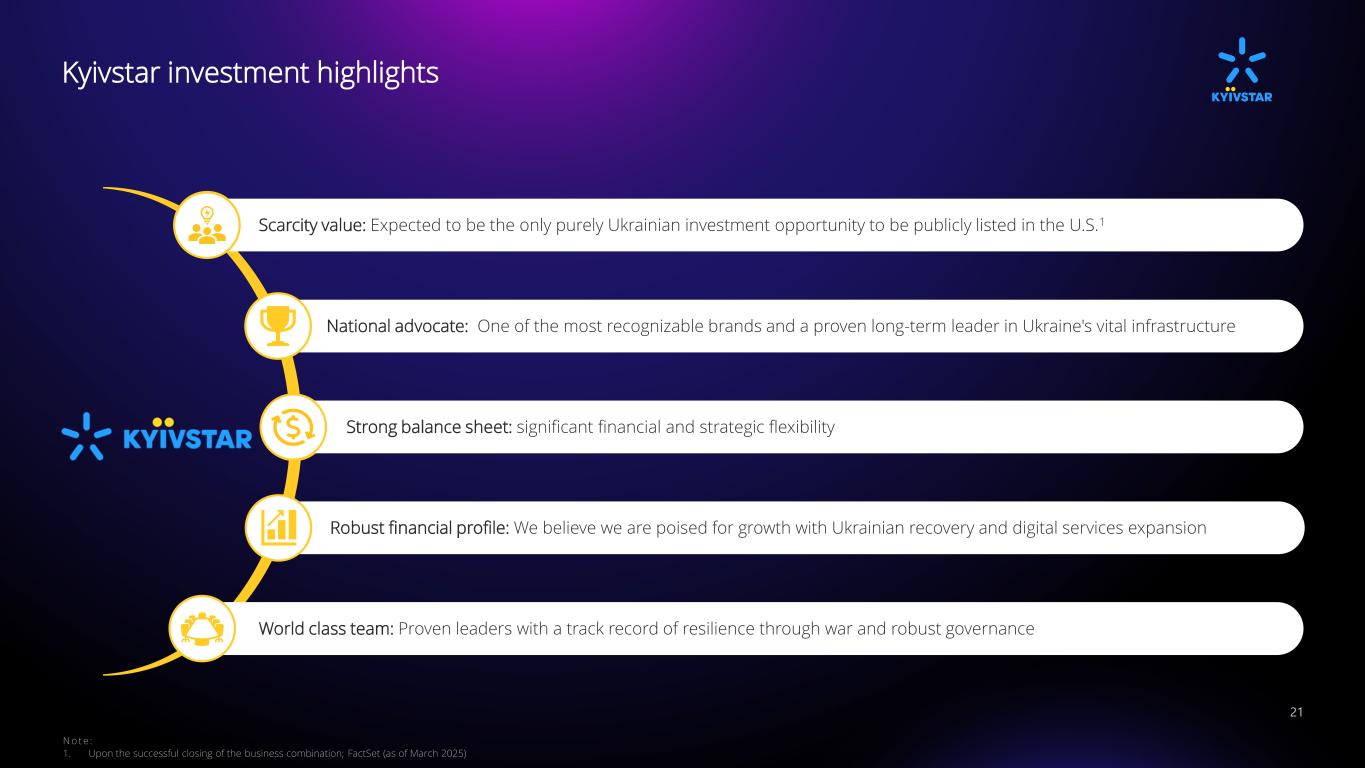

Kyivstar investment highlights World class team: Proven leaders with a track record of resilience through war and robust governance Robust financial profile: We believe we are poised for growth with Ukrainian recovery and digital services expansion Strong balance sheet: significant financial and strategic flexibility Scarcity value: Expected to be the only purely Ukrainian investment opportunity to be publicly listed in the U.S.1 National advocate: One of the most recognizable brands and a proven long-term leader in Ukraine's vital infrastructure 21 N o te : 1. Upon the successful closing of the business combination; FactSet (as of March 2025)

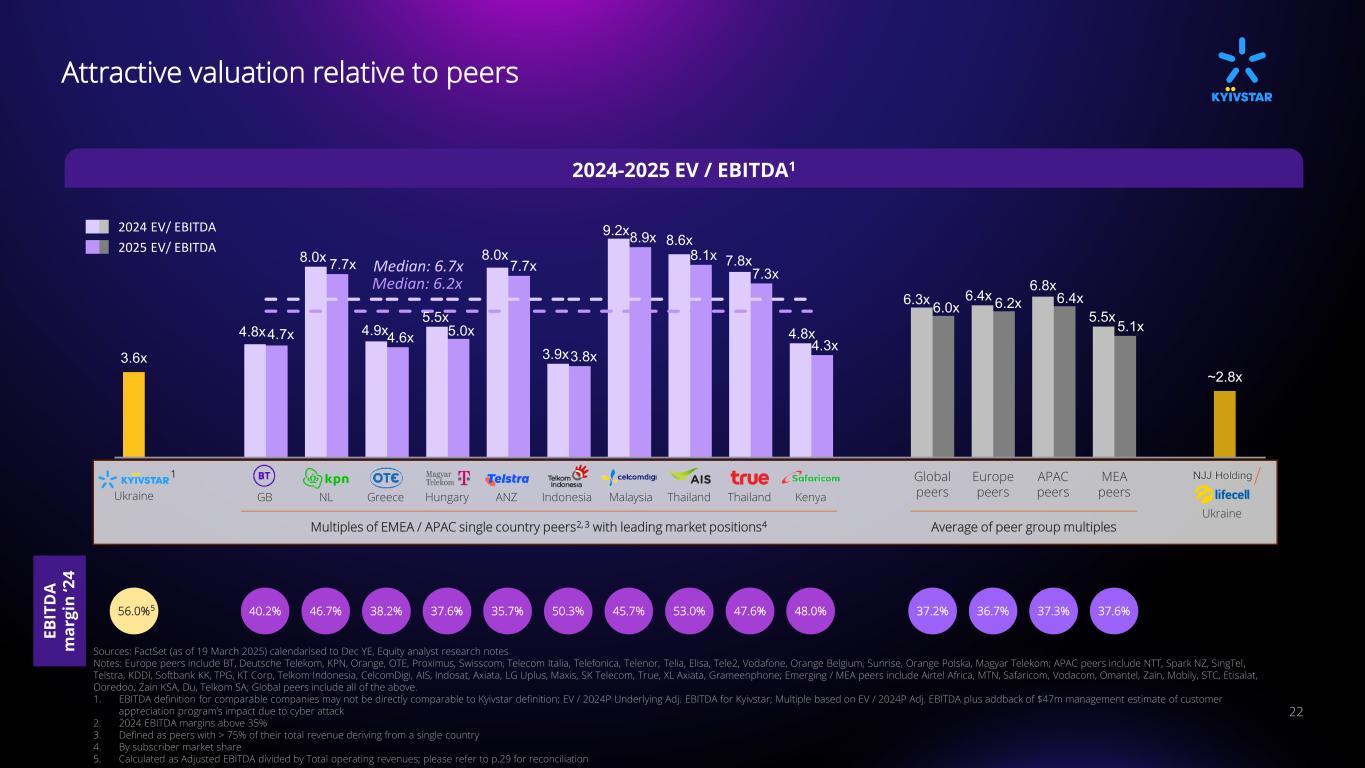

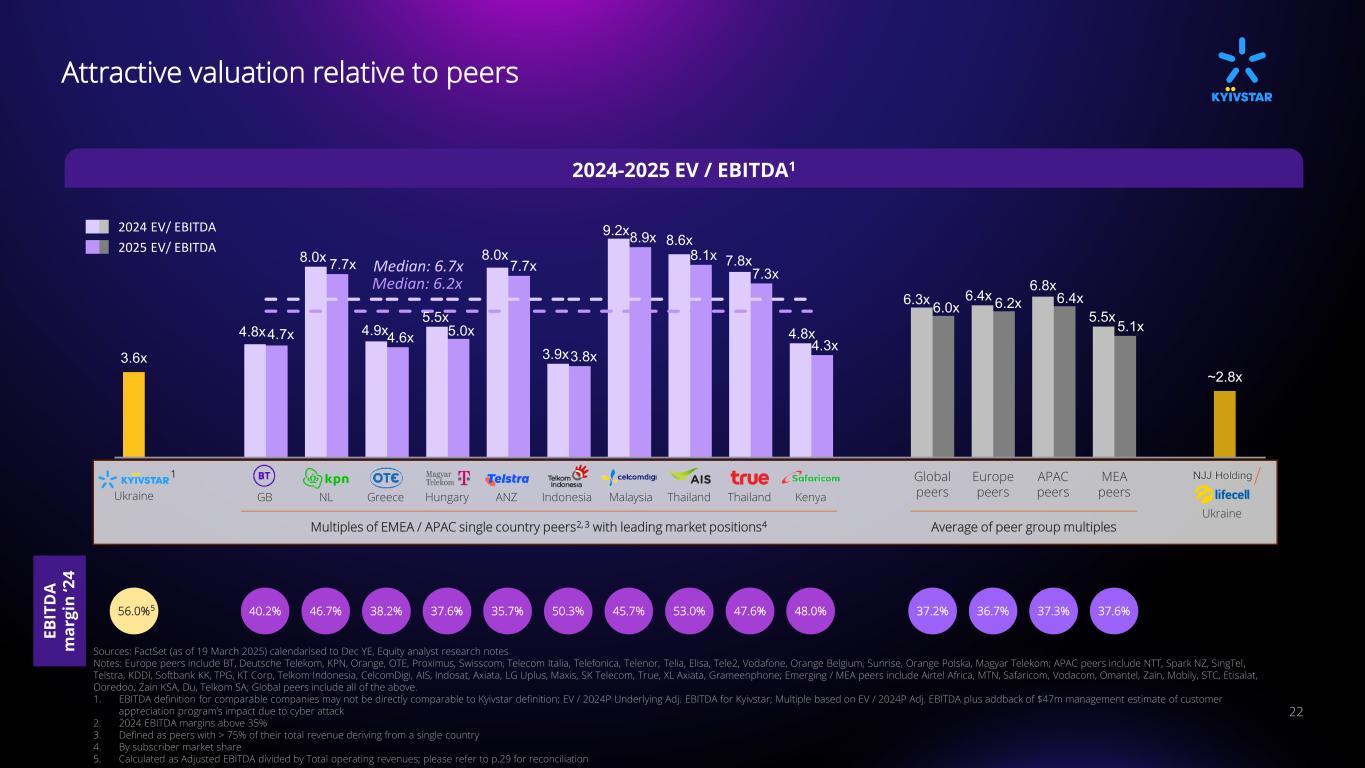

3.6x 4.8x 8.0x 4.9x 5.5x 8.0x 3.9x 9.2x 8.6x 7.8x 4.8x 6.3x 6.4x 6.8x 5.5x ~2.8x 4.7x 7.7x 4.6x 5.0x 7.7x 3.8x 8.9x 8.1x 7.3x 4.3x 6.0x 6.2x 6.4x 5.1x Attractive valuation relative to peers 22 2024-2025 EV / EBITDA1 Median: 6.7x Sources: FactSet (as of 19 March 2025) calendarised to Dec YE, Equity analyst research notes Notes: Europe peers include BT, Deutsche Telekom, KPN, Orange, OTE, Proximus, Swisscom, Telecom Italia, Telefonica, Telenor, Telia, Elisa, Tele2, Vodafone, Orange Belgium, Sunrise, Orange Polska, Magyar Telekom; APAC peers include NTT, Spark NZ, SingTel, Telstra, KDDI, Softbank KK, TPG, KT Corp, Telkom Indonesia, CelcomDigi, AIS, Indosat, Axiata, LG Uplus, Maxis, SK Telecom, True, XL Axiata, Grameenphone; Emerging / MEA peers include Airtel Africa, MTN, Safaricom, Vodacom, Omantel, Zain, Mobily, STC, Etisalat, Ooredoo, Zain KSA, Du, Telkom SA; Global peers include all of the above. 1. EBITDA definition for comparable companies may not be directly comparable to Kyivstar definition; EV / 2024P Underlying Adj. EBITDA for Kyivstar; Multiple based on EV / 2024P Adj. EBITDA plus addback of $47m management estimate of customer appreciation program’s impact due to cyber attack 2. 2024 EBITDA margins above 35% 3. Defined as peers with > 75% of their total revenue deriving from a single country 4. By subscriber market share 5. Calculated as Adjusted EBITDA divided by Total operating revenues; please refer to p.29 for reconciliation 1 Ukraine Global peers Europe peers APAC peers MEA peersGreece Malaysia Thailand Thailand Kenya Ukraine GB NL Hungary ANZ E B IT D A m a rg in ‘2 4 37.2%40.2% 46.7% 48.0%38.2% 37.6% 35.7% 50.3% 45.7% 53.0% 47.6% 37.6%36.7% 37.3%56.0% Indonesia Average of peer group multiplesMultiples of EMEA / APAC single country peers2, 3 with leading market positions4 Median: 6.2x 2025 EV/ EBITDA 2024 EV/ EBITDA 5

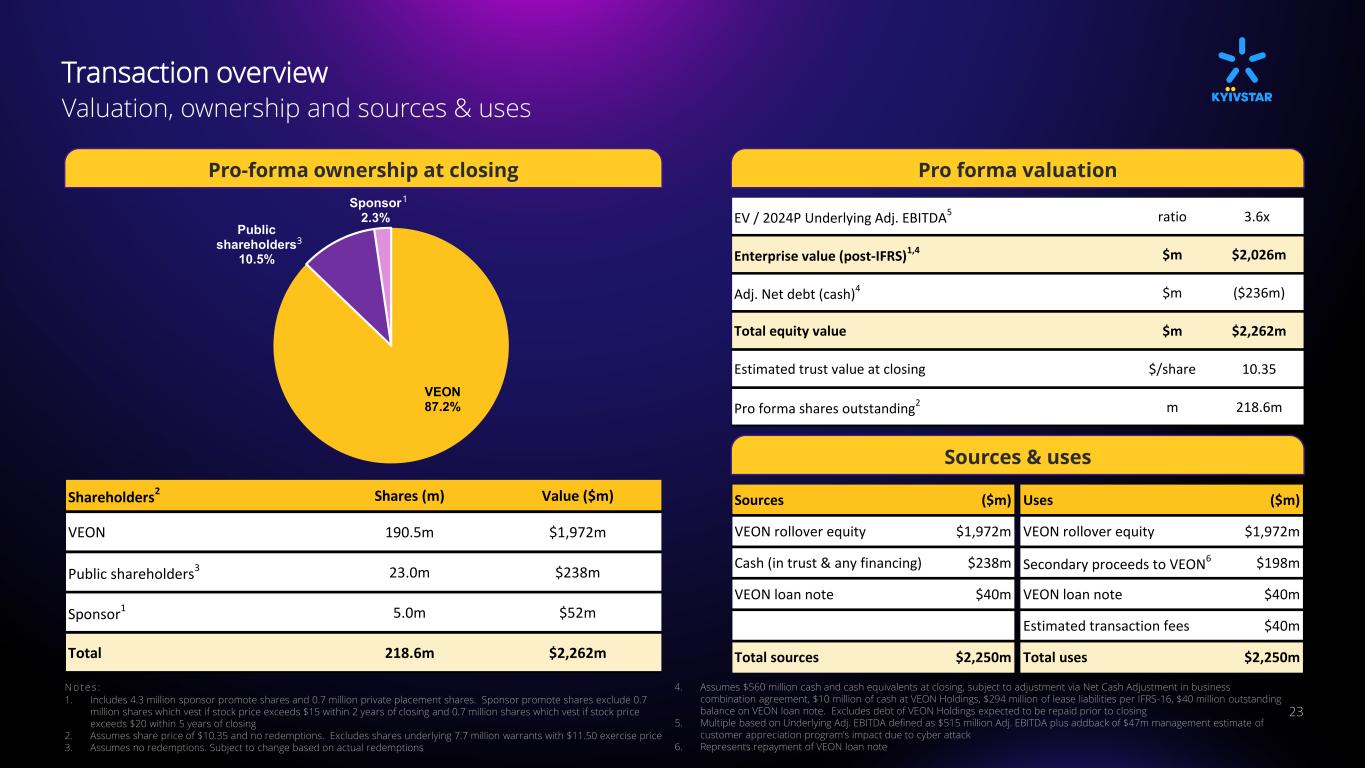

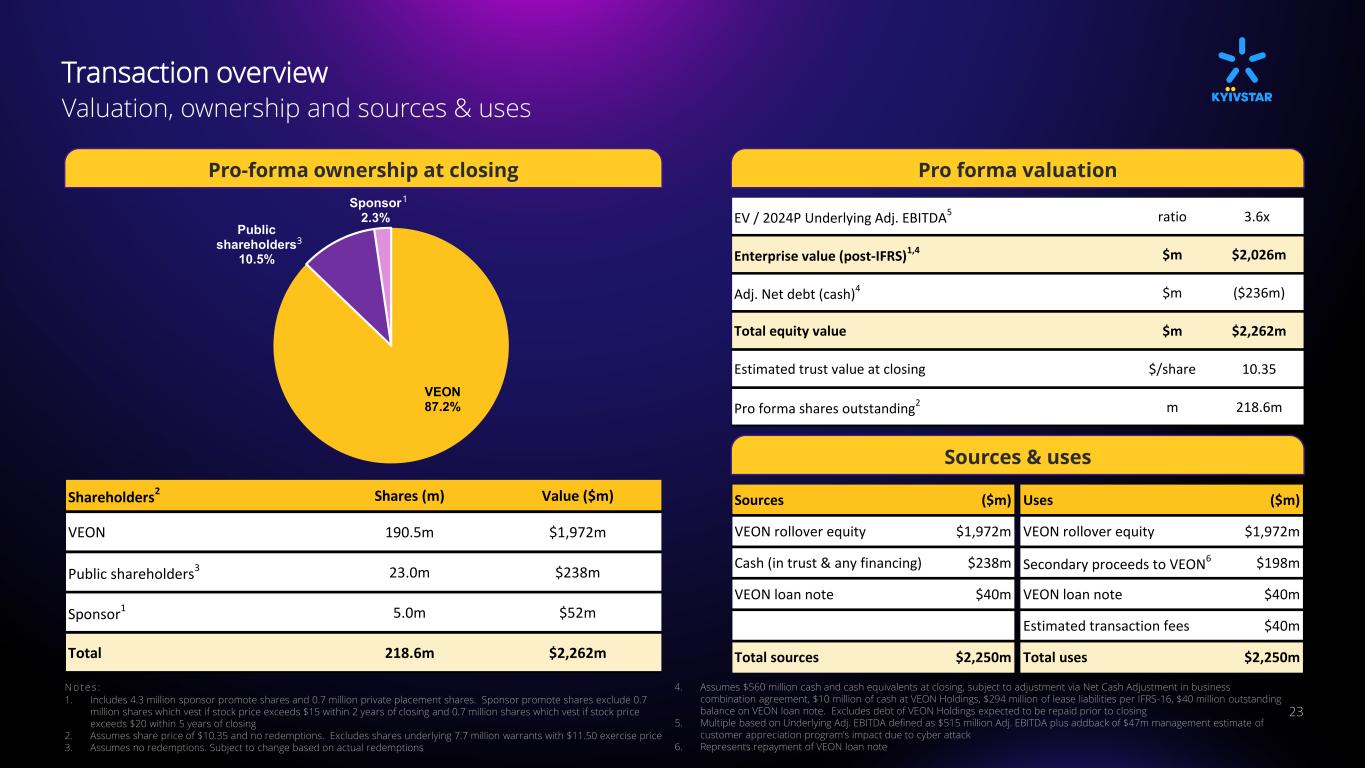

Pro forma valuation Transaction overview Valuation, ownership and sources & uses 23 Pro-forma ownership at closing N o te s : 1. Includes 4.3 million sponsor promote shares and 0.7 million private placement shares. Sponsor promote shares exclude 0.7 million shares which vest if stock price exceeds $15 within 2 years of closing and 0.7 million shares which vest if stock price exceeds $20 within 5 years of closing 2. Assumes share price of $10.35 and no redemptions. Excludes shares underlying 7.7 million warrants with $11.50 exercise price 3. Assumes no redemptions. Subject to change based on actual redemptions 4. Assumes $560 million cash and cash equivalents at closing, subject to adjustment via Net Cash Adjustment in business combination agreement, $10 million of cash at VEON Holdings, $294 million of lease liabilities per IFRS-16, $40 million outstanding balance on VEON loan note. Excludes debt of VEON Holdings expected to be repaid prior to closing 5. Multiple based on Underlying Adj. EBITDA defined as $515 million Adj. EBITDA plus addback of $47m management estimate of customer appreciation program’s impact due to cyber attack 6. Represents repayment of VEON loan note Sources & uses Shareholders 2 Shares (m) Value ($m) VEON 190.5m $1,972m Public shareholders3 23.0m $238m Sponsor 1 5.0m $52m Total 218.6m $2,262m 1 3 EV / 2024P Underlying Adj. EBITDA 5 ratio 3.6x Enterprise value (post-IFRS)1,4 $m $2,026m Adj. Net debt (cash)4 $m ($236m) Total equity value $m $2,262m Estimated trust value at closing $/share 10.35 Pro forma shares outstanding 2 m 218.6m VEON 87.2% Public shareholders 10.5% Sponsor 2.3% Sources ($m) Uses ($m) VEON rollover equity $1,972m VEON rollover equity $1,972m Cash (in trust & any financing) $238m Secondary proceeds to VEON 6 $198m VEON loan note $40m VEON loan note $40m Estimated transaction fees $40m Total sources $2,250m Total uses $2,250m

24 Appendix

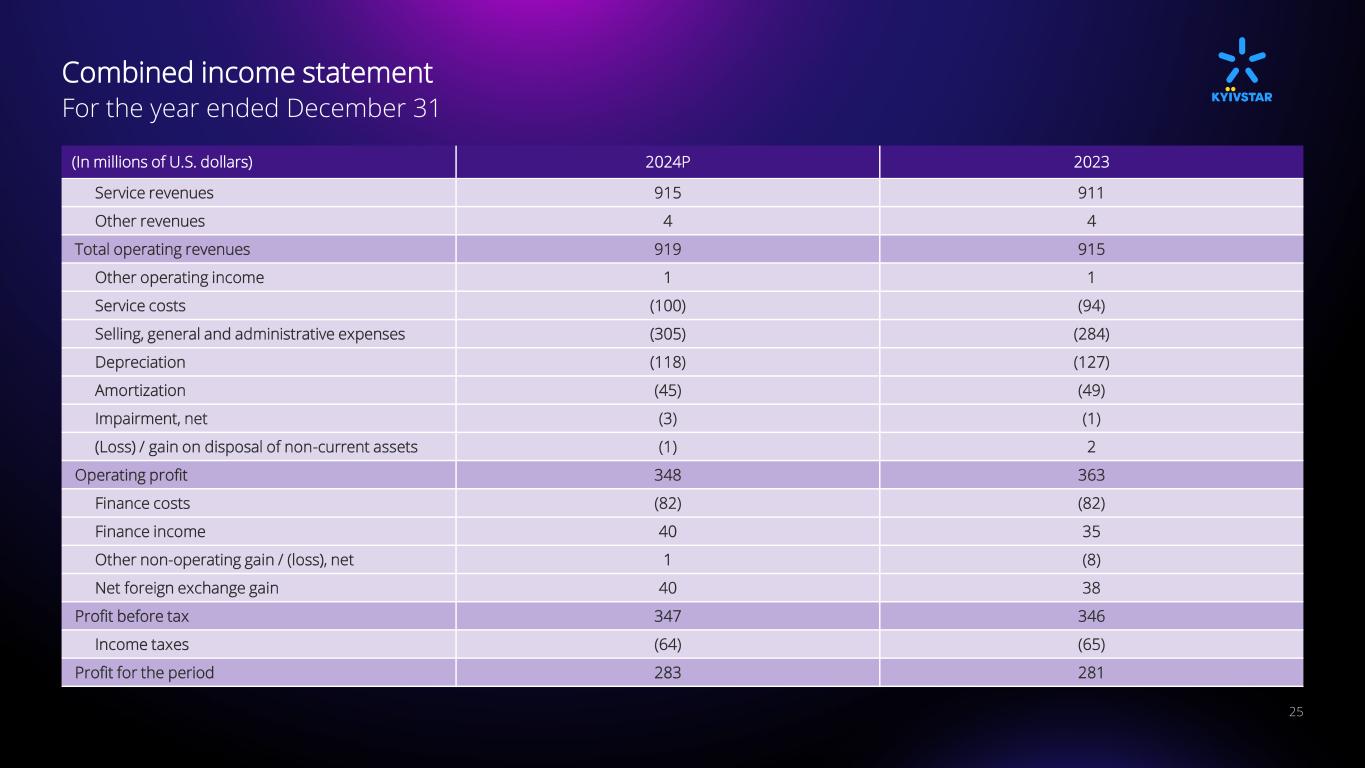

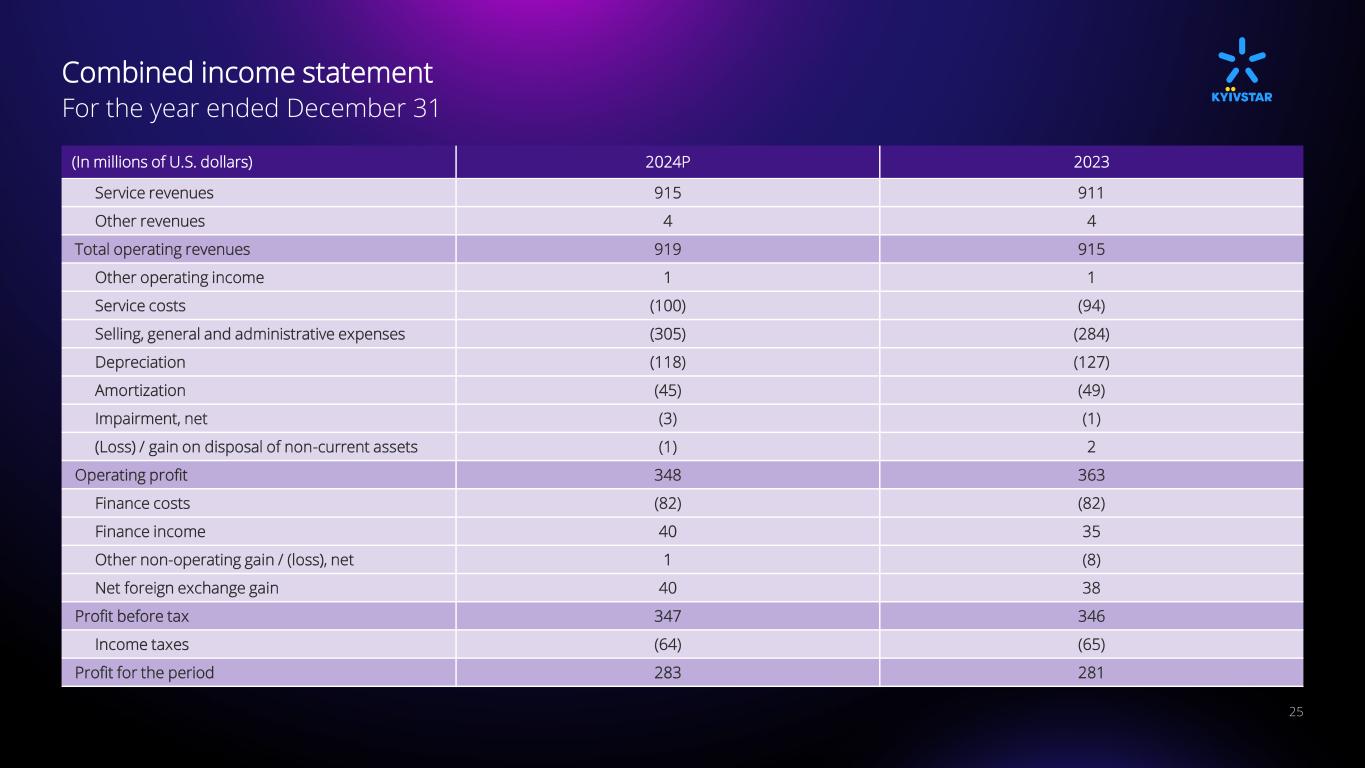

Combined income statement 25 For the year ended December 31 (In millions of U.S. dollars) 2024P 2023 Service revenues 915 911 Other revenues 4 4 Total operating revenues 919 915 Other operating income 1 1 Service costs (100) (94) Selling, general and administrative expenses (305) (284) Depreciation (118) (127) Amortization (45) (49) Impairment, net (3) (1) (Loss) / gain on disposal of non-current assets (1) 2 Operating profit 348 363 Finance costs (82) (82) Finance income 40 35 Other non-operating gain / (loss), net 1 (8) Net foreign exchange gain 40 38 Profit before tax 347 346 Income taxes (64) (65) Profit for the period 283 281

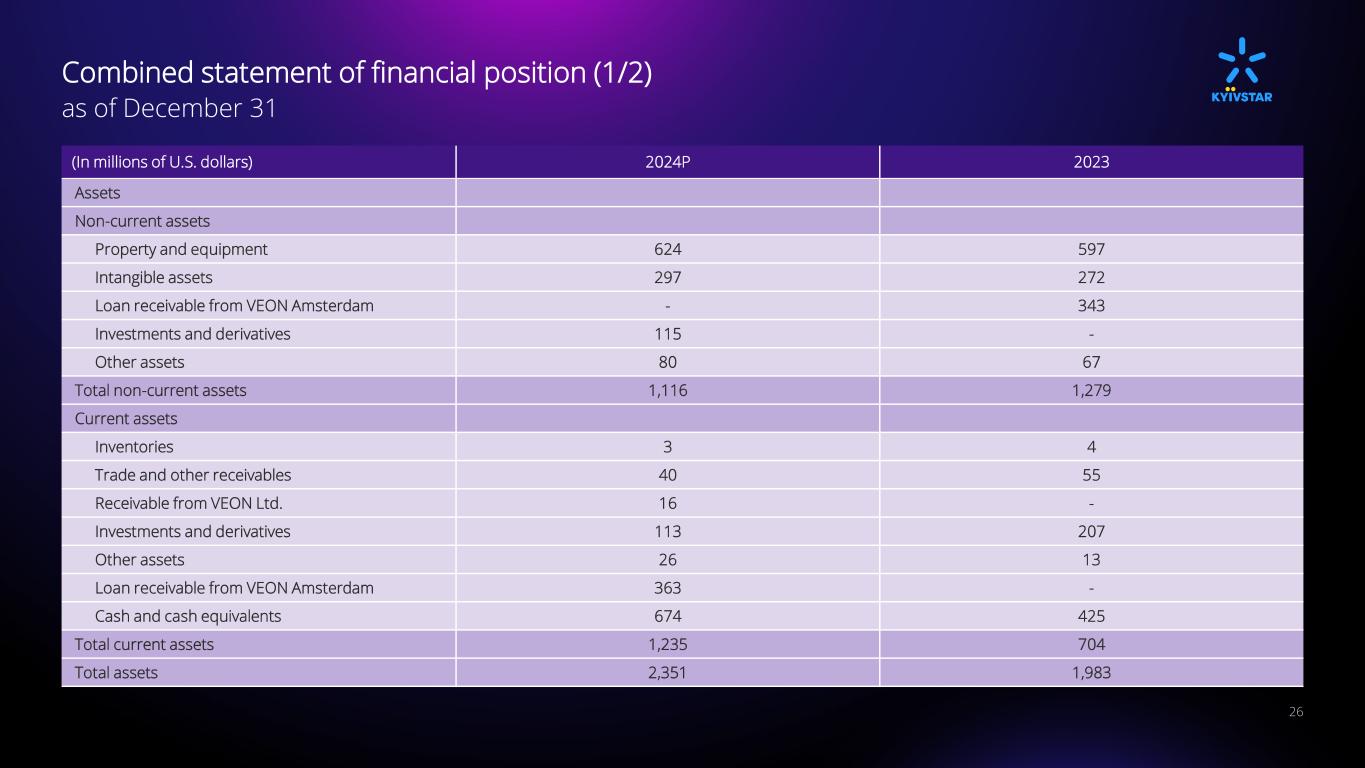

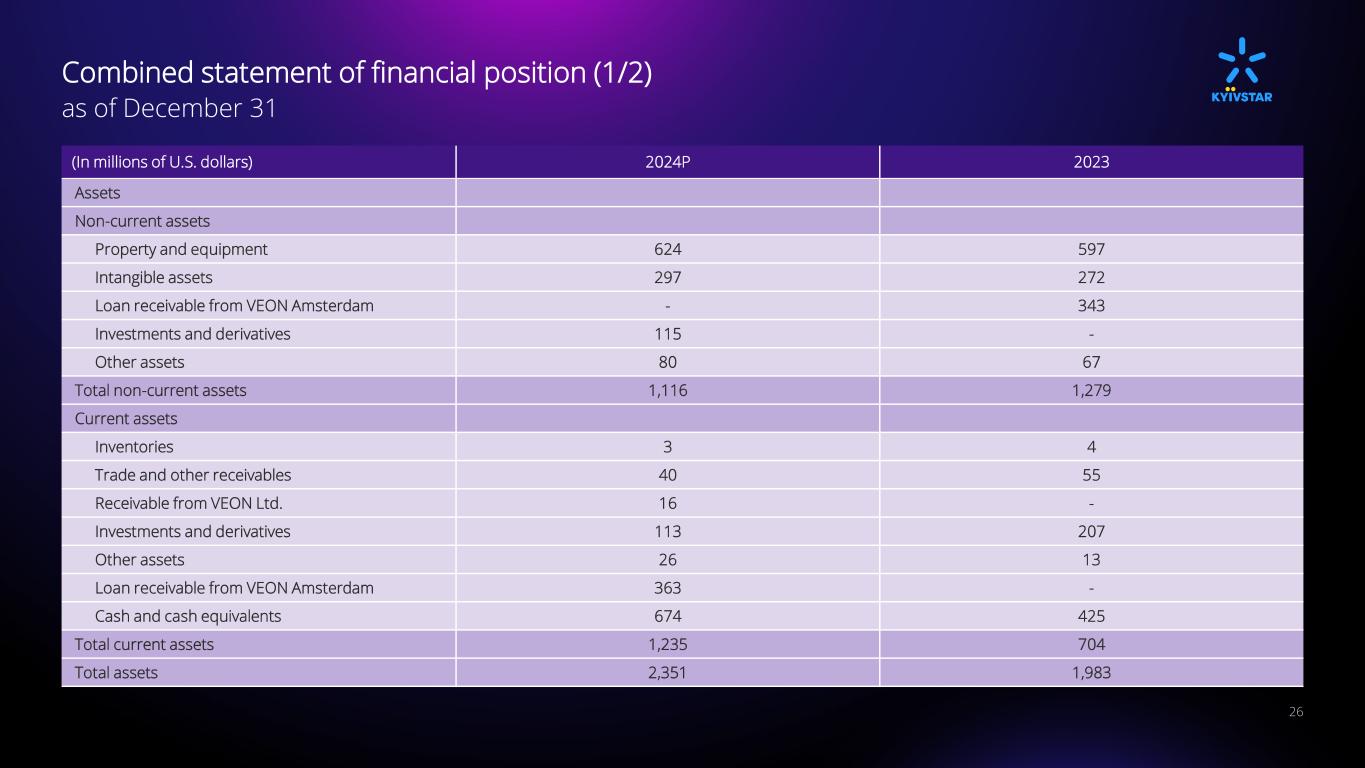

Combined statement of financial position (1/2) 26 as of December 31 (In millions of U.S. dollars) 2024P 2023 Assets Non-current assets Property and equipment 624 597 Intangible assets 297 272 Loan receivable from VEON Amsterdam - 343 Investments and derivatives 115 - Other assets 80 67 Total non-current assets 1,116 1,279 Current assets Inventories 3 4 Trade and other receivables 40 55 Receivable from VEON Ltd. 16 - Investments and derivatives 113 207 Other assets 26 13 Loan receivable from VEON Amsterdam 363 - Cash and cash equivalents 674 425 Total current assets 1,235 704 Total assets 2,351 1,983

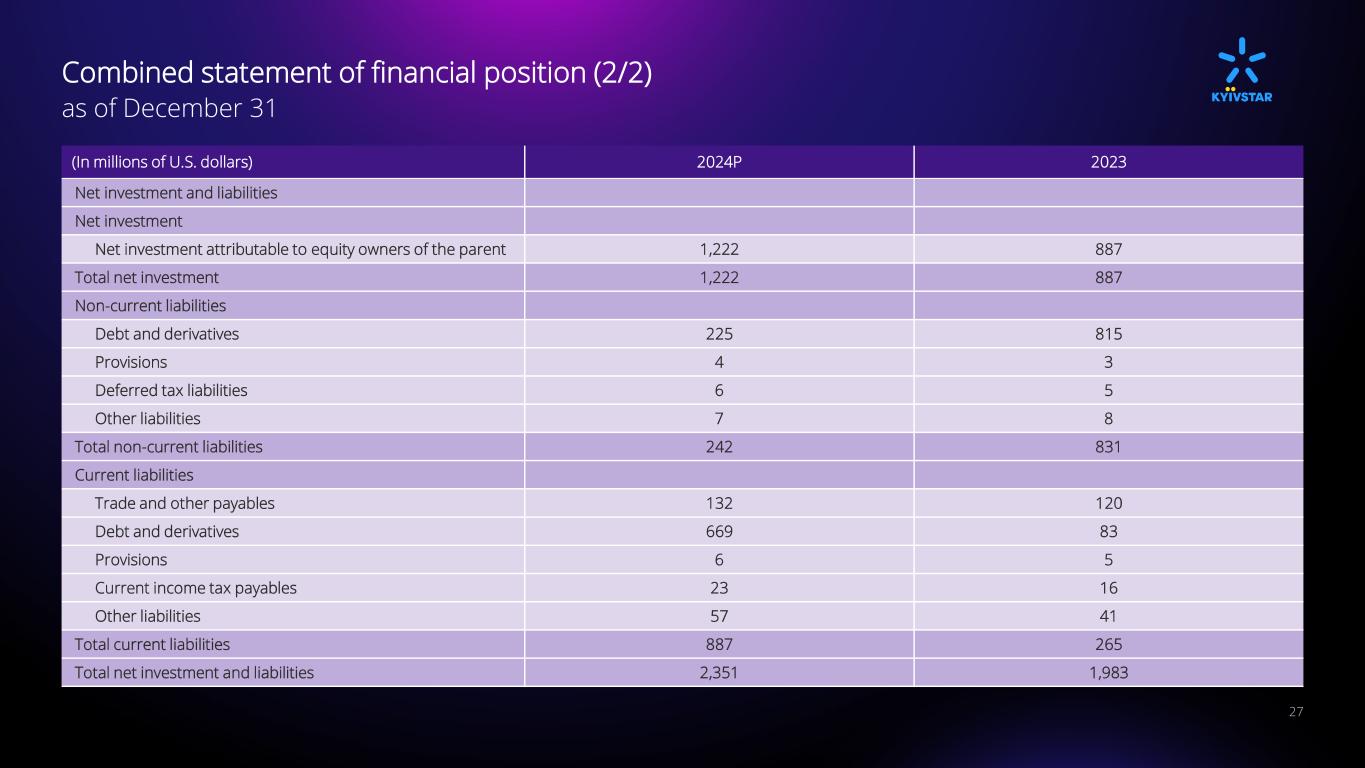

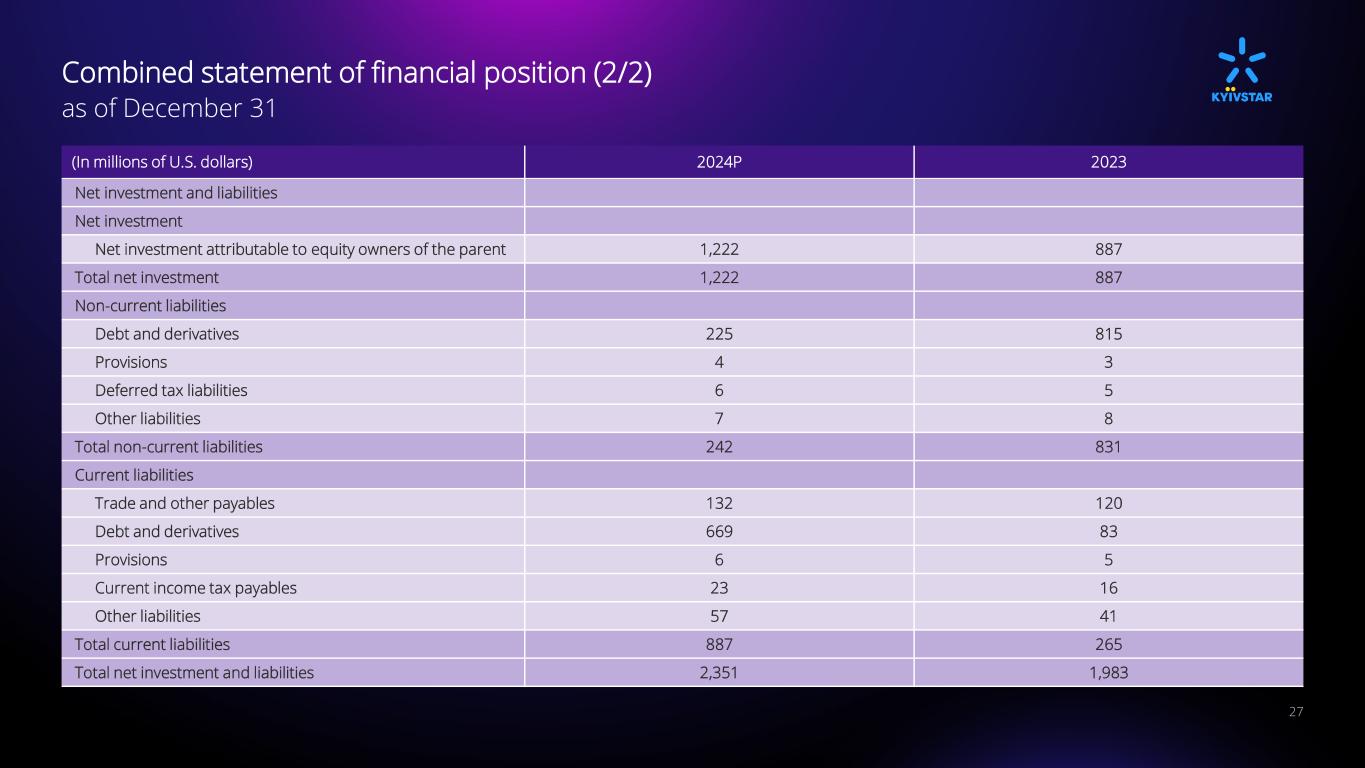

Combined statement of financial position (2/2) 27 as of December 31 (In millions of U.S. dollars) 2024P 2023 Net investment and liabilities Net investment Net investment attributable to equity owners of the parent 1,222 887 Total net investment 1,222 887 Non-current liabilities Debt and derivatives 225 815 Provisions 4 3 Deferred tax liabilities 6 5 Other liabilities 7 8 Total non-current liabilities 242 831 Current liabilities Trade and other payables 132 120 Debt and derivatives 669 83 Provisions 6 5 Current income tax payables 23 16 Other liabilities 57 41 Total current liabilities 887 265 Total net investment and liabilities 2,351 1,983

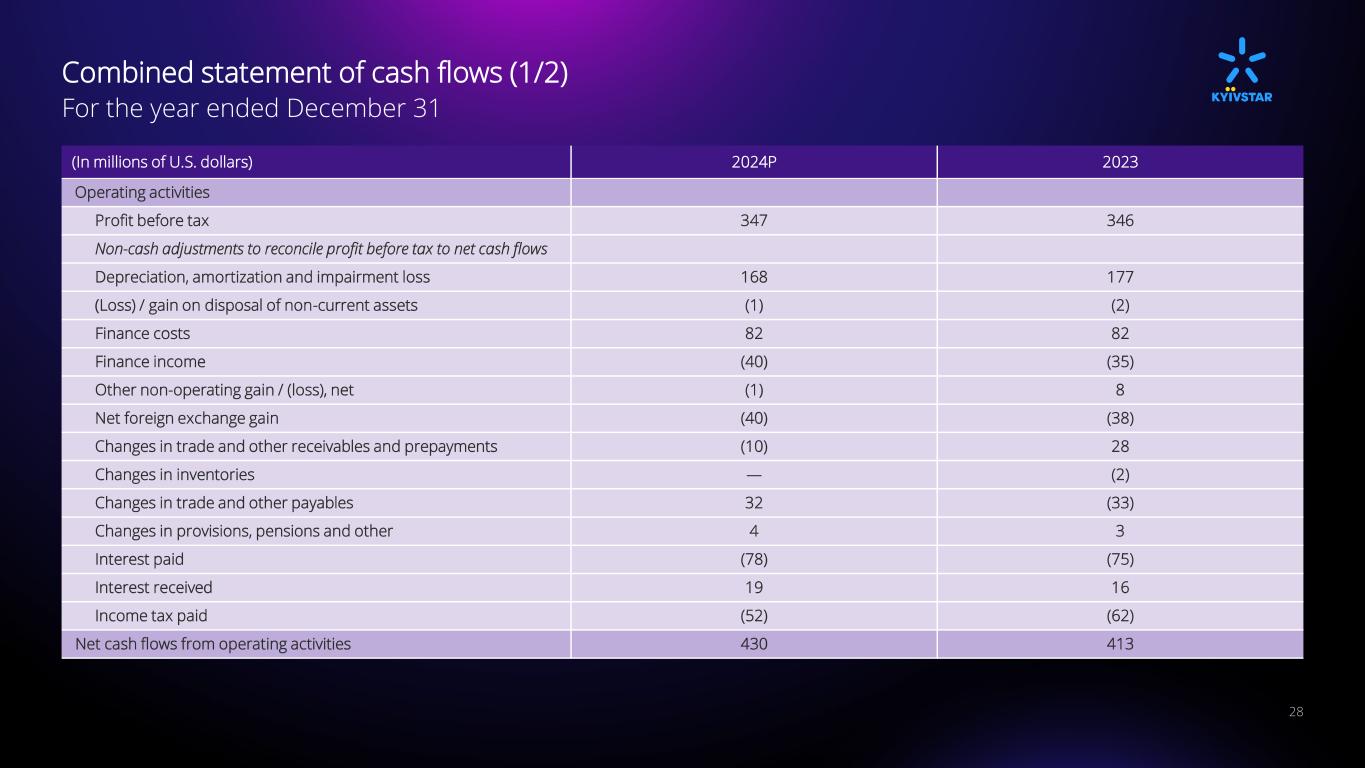

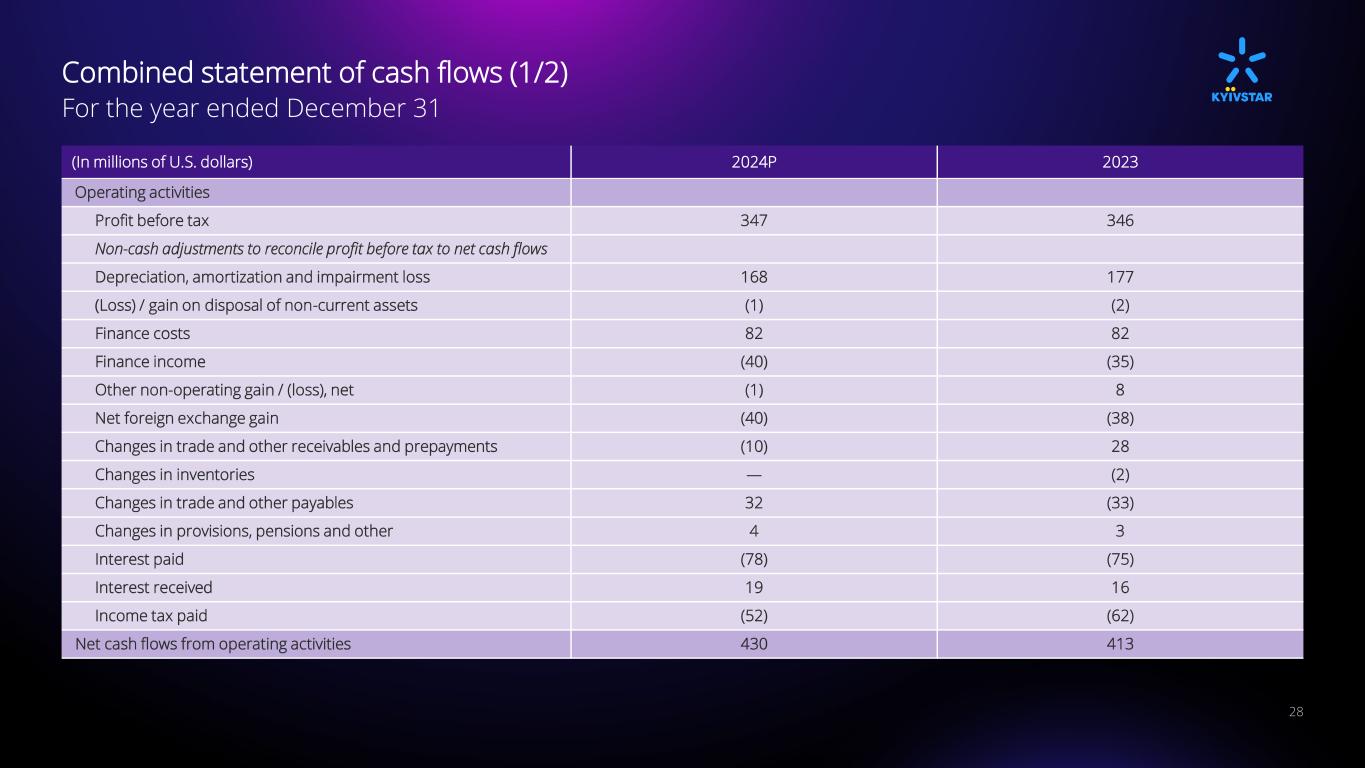

Combined statement of cash flows (1/2) 28 For the year ended December 31 (In millions of U.S. dollars) 2024P 2023 Operating activities Profit before tax 347 346 Non-cash adjustments to reconcile profit before tax to net cash flows Depreciation, amortization and impairment loss 168 177 (Loss) / gain on disposal of non-current assets (1) (2) Finance costs 82 82 Finance income (40) (35) Other non-operating gain / (loss), net (1) 8 Net foreign exchange gain (40) (38) Changes in trade and other receivables and prepayments (10) 28 Changes in inventories — (2) Changes in trade and other payables 32 (33) Changes in provisions, pensions and other 4 3 Interest paid (78) (75) Interest received 19 16 Income tax paid (52) (62) Net cash flows from operating activities 430 413

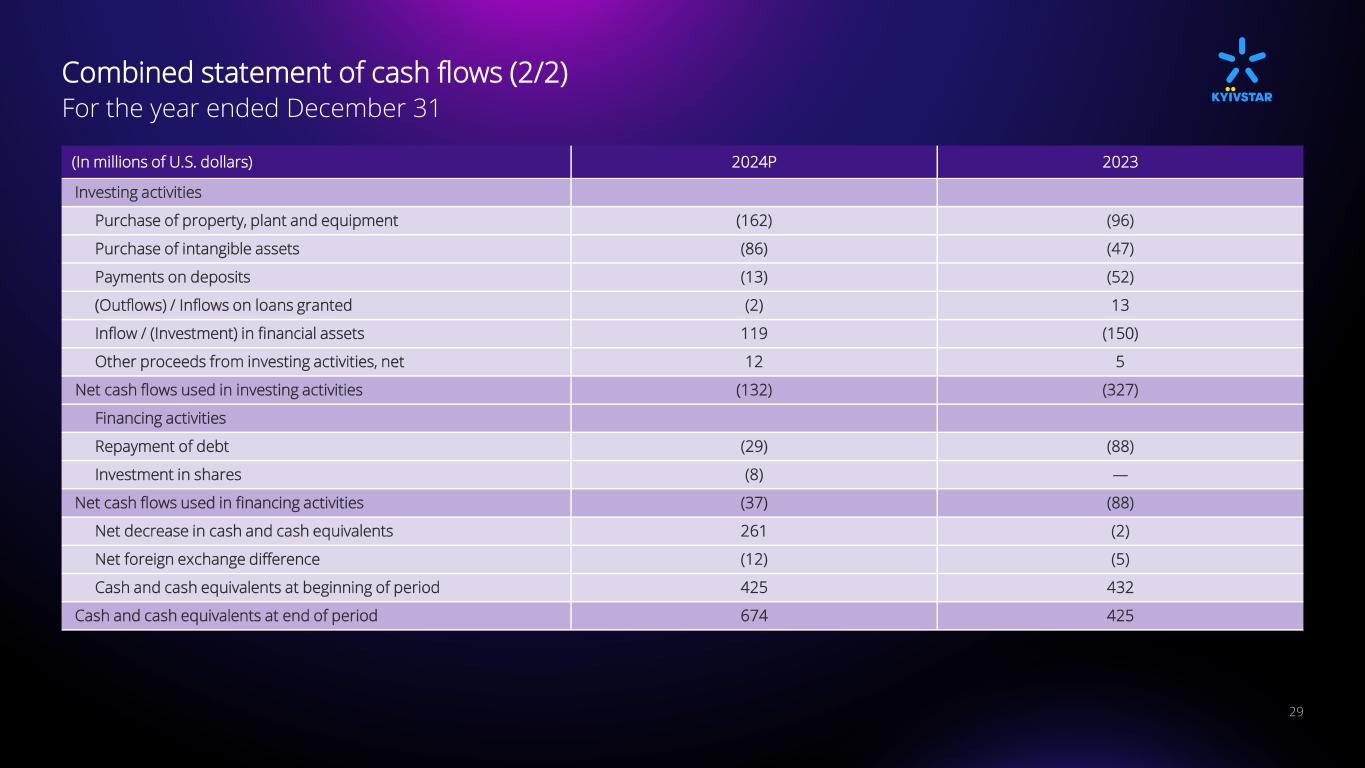

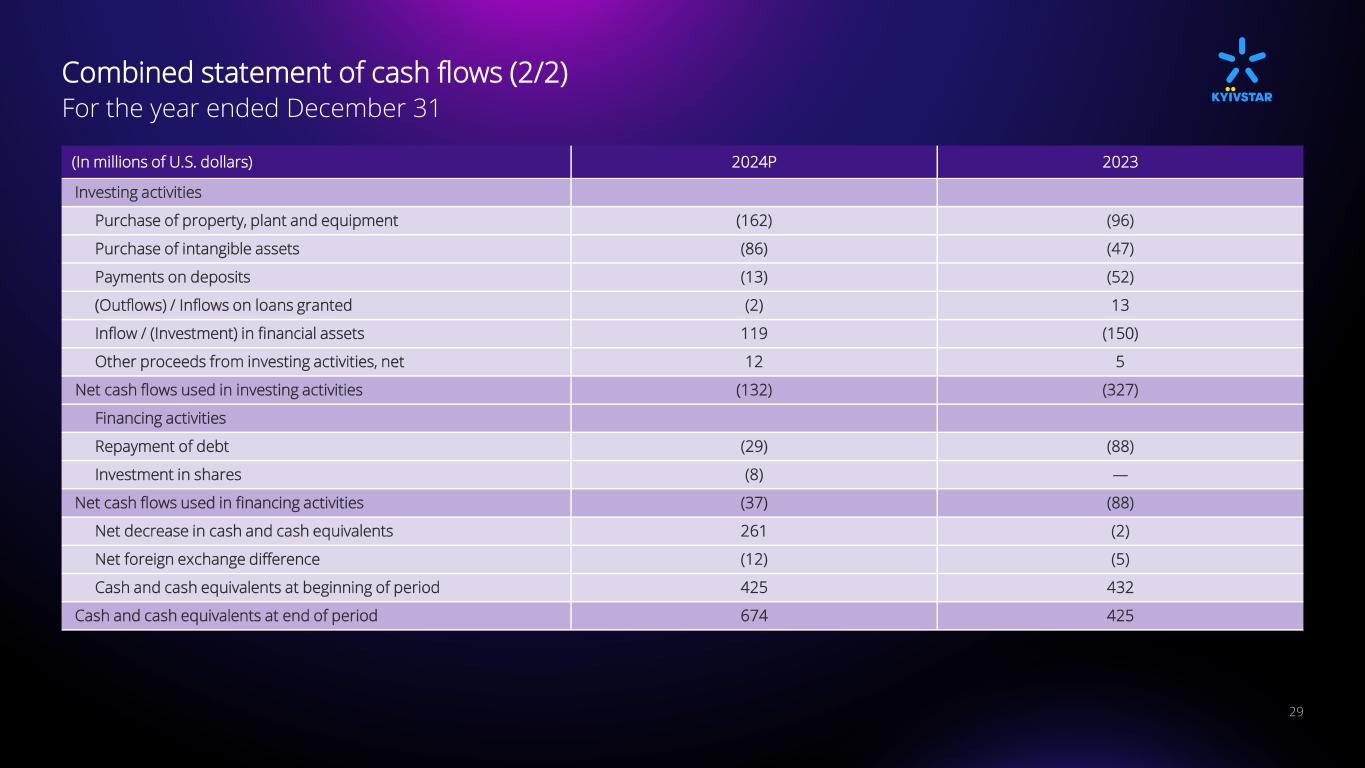

Combined statement of cash flows (2/2) 29 For the year ended December 31 (In millions of U.S. dollars) 2024P 2023 Investing activities Purchase of property, plant and equipment (162) (96) Purchase of intangible assets (86) (47) Payments on deposits (13) (52) (Outflows) / Inflows on loans granted (2) 13 Inflow / (Investment) in financial assets 119 (150) Other proceeds from investing activities, net 12 5 Net cash flows used in investing activities (132) (327) Financing activities Repayment of debt (29) (88) Investment in shares (8) — Net cash flows used in financing activities (37) (88) Net decrease in cash and cash equivalents 261 (2) Net foreign exchange difference (12) (5) Cash and cash equivalents at beginning of period 425 432 Cash and cash equivalents at end of period 674 425

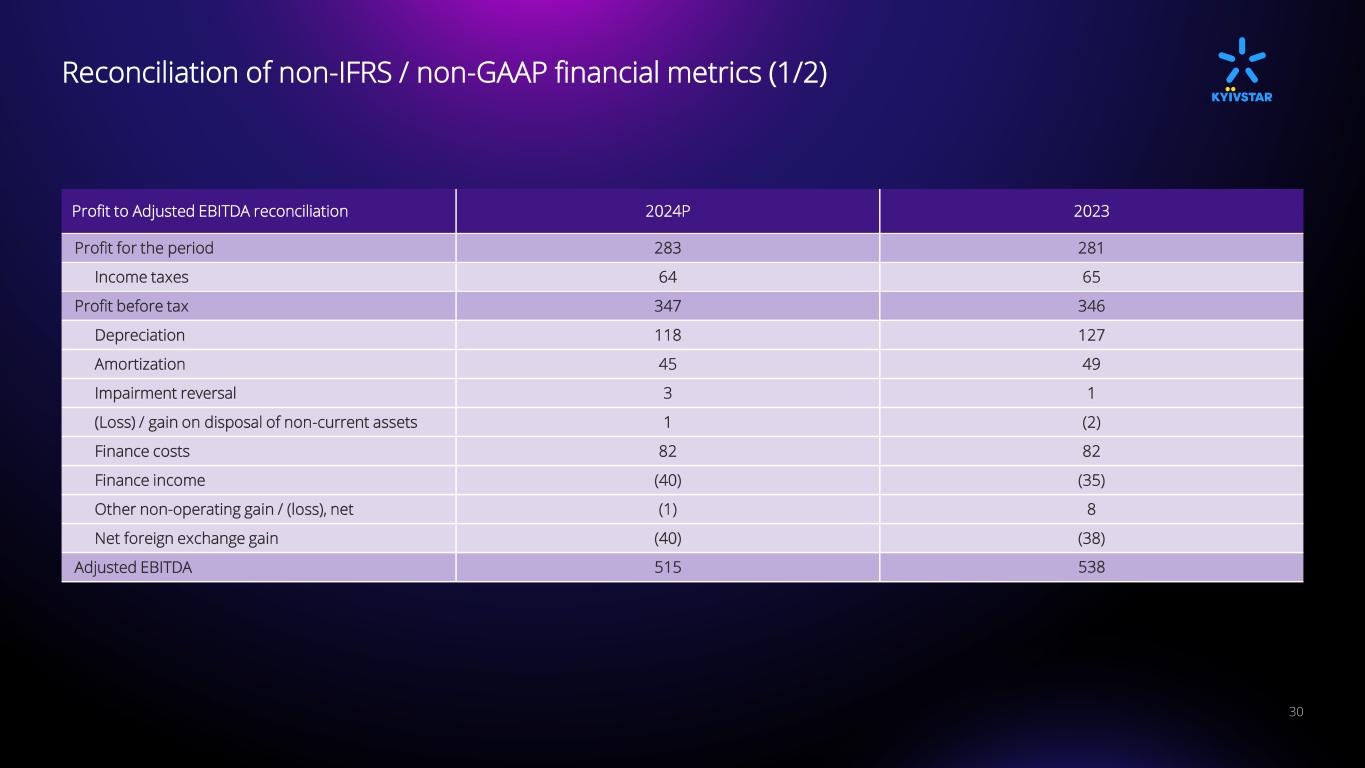

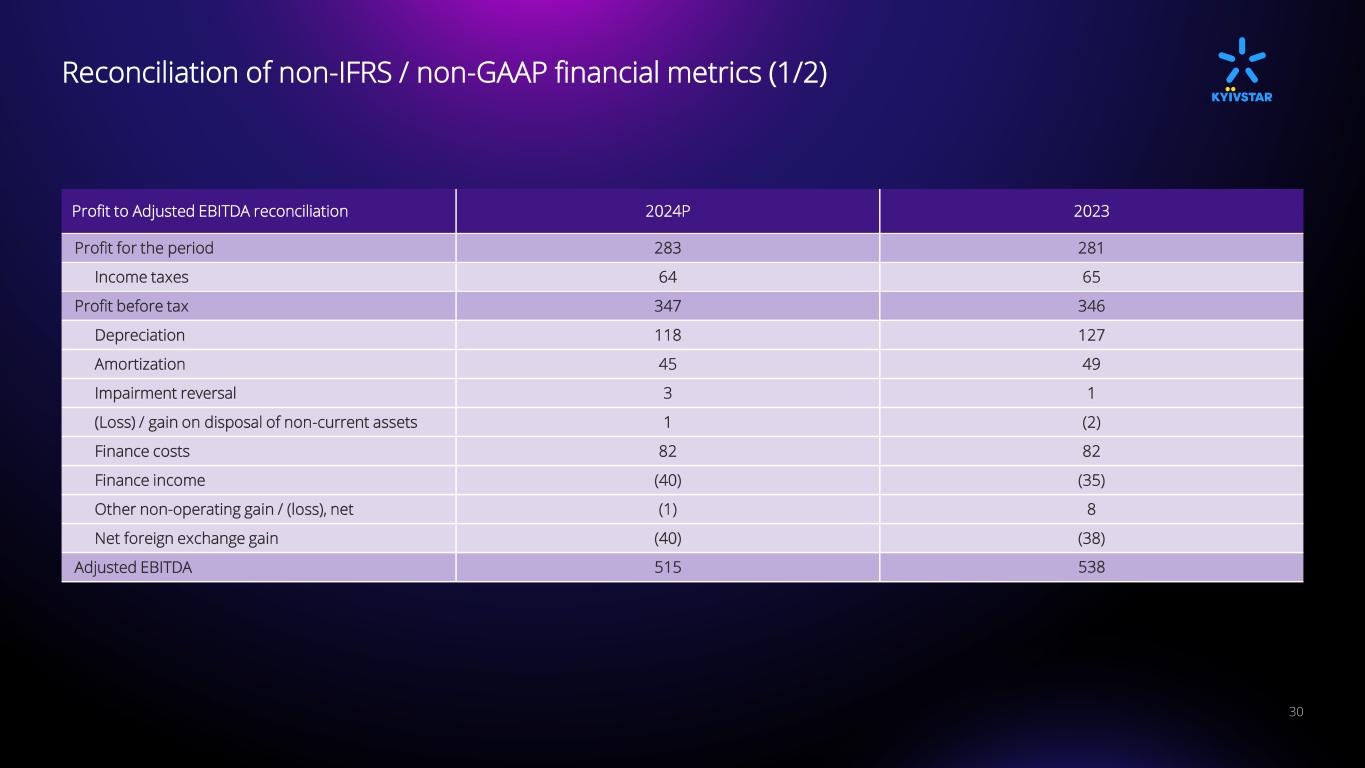

Reconciliation of non-IFRS / non-GAAP financial metrics (1/2) 30 Profit to Adjusted EBITDA reconciliation 2024P 2023 Profit for the period 283 281 Income taxes 64 65 Profit before tax 347 346 Depreciation 118 127 Amortization 45 49 Impairment reversal 3 1 (Loss) / gain on disposal of non-current assets 1 (2) Finance costs 82 82 Finance income (40) (35) Other non-operating gain / (loss), net (1) 8 Net foreign exchange gain (40) (38) Adjusted EBITDA 515 538

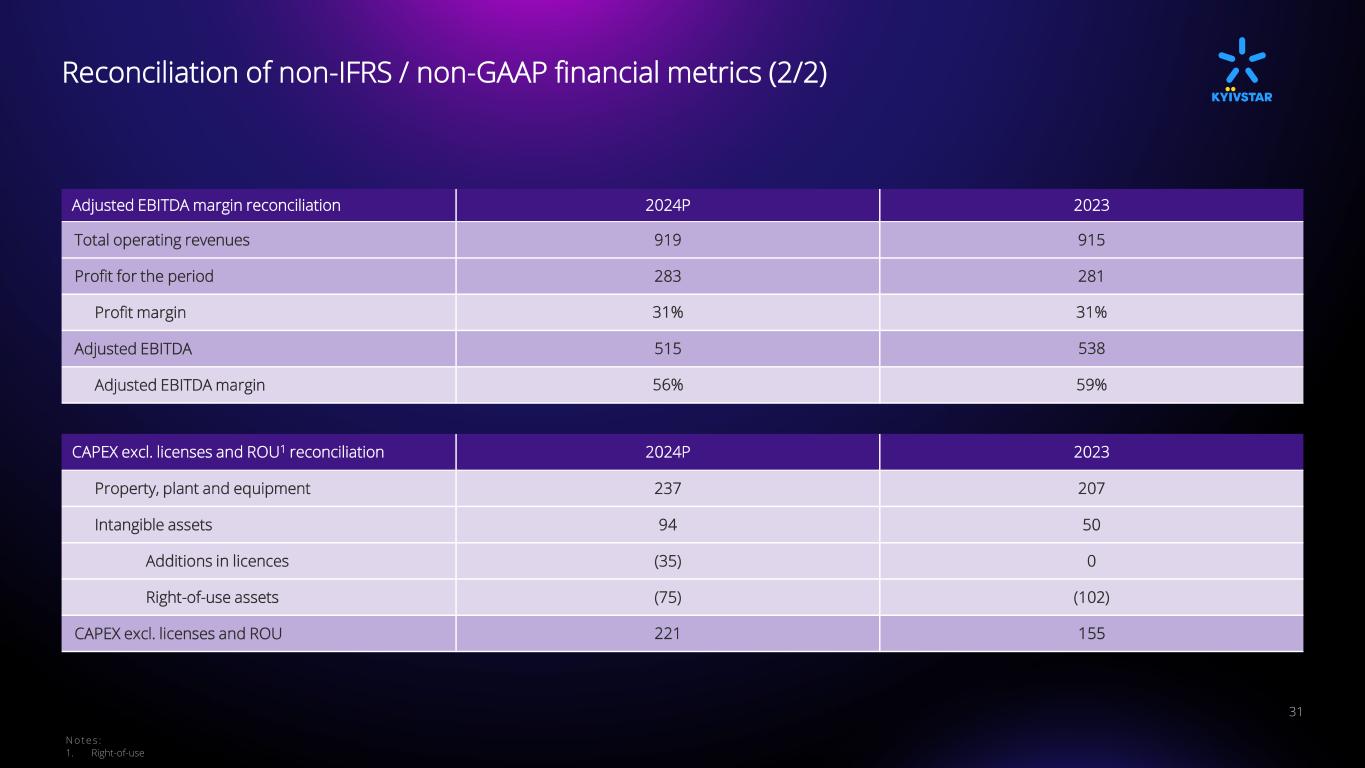

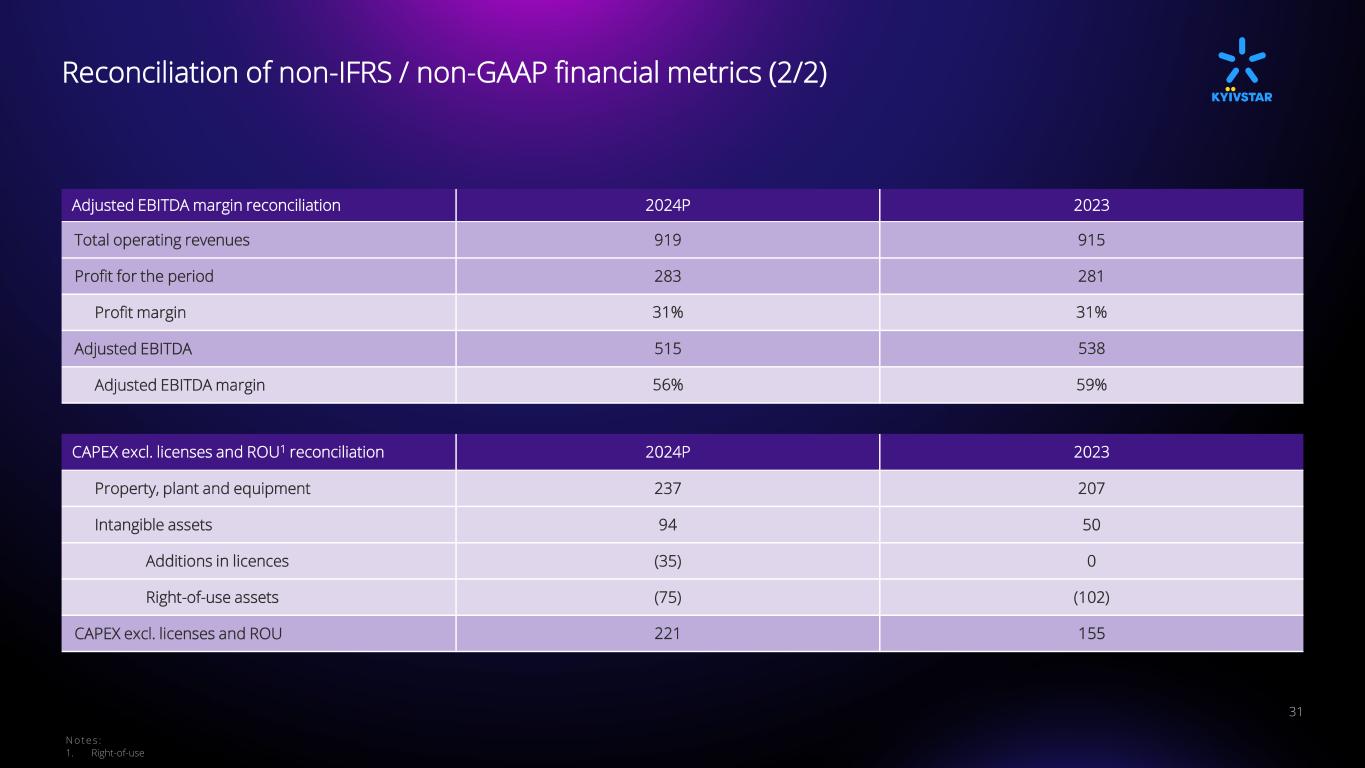

Reconciliation of non-IFRS / non-GAAP financial metrics (2/2) 31 N o te s : 1. Right-of-use Adjusted EBITDA margin reconciliation 2024P 2023 Total operating revenues 919 915 Profit for the period 283 281 Profit margin 31% 31% Adjusted EBITDA 515 538 Adjusted EBITDA margin 56% 59% CAPEX excl. licenses and ROU1 reconciliation 2024P 2023 Property, plant and equipment 237 207 Intangible assets 94 50 Additions in licences (35) 0 Right-of-use assets (75) (102) CAPEX excl. licenses and ROU 221 155

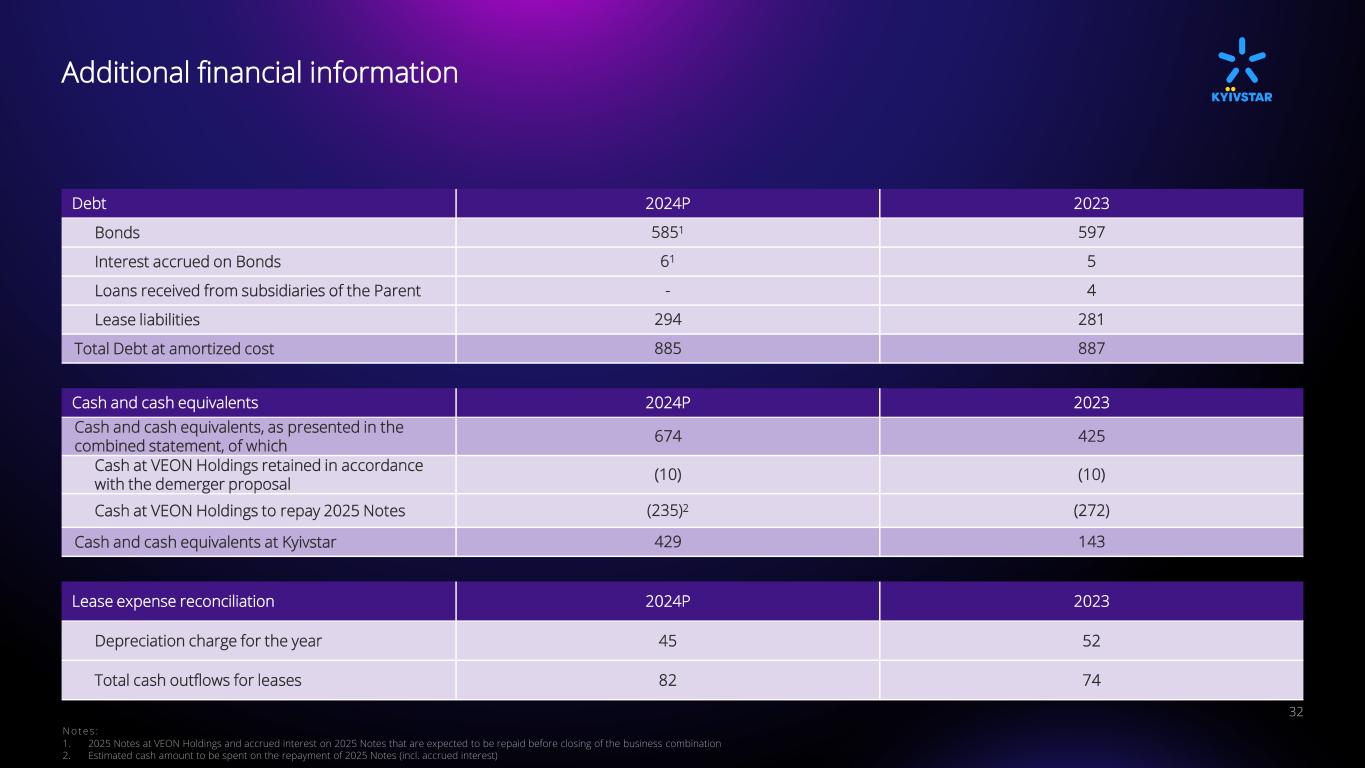

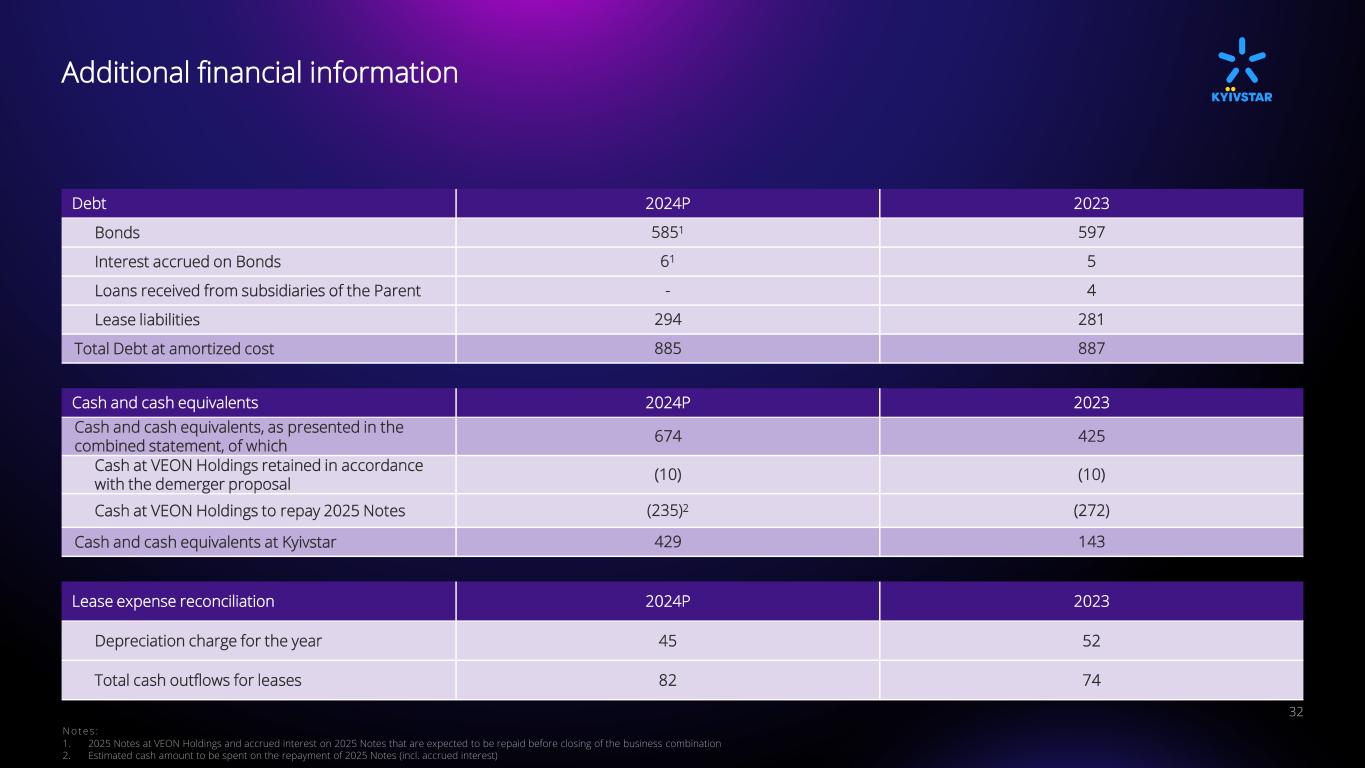

Additional financial information 32 N o te s : 1. 2025 Notes at VEON Holdings and accrued interest on 2025 Notes that are expected to be repaid before closing of the business combination 2. Estimated cash amount to be spent on the repayment of 2025 Notes (incl. accrued interest) Debt 2024P 2023 Bonds 5851 597 Interest accrued on Bonds 61 5 Loans received from subsidiaries of the Parent - 4 Lease liabilities 294 281 Total Debt at amortized cost 885 887 Cash and cash equivalents 2024P 2023 Cash and cash equivalents, as presented in the combined statement, of which 674 425 Cash at VEON Holdings retained in accordance with the demerger proposal (10) (10) Cash at VEON Holdings to repay 2025 Notes (235)2 (272) Cash and cash equivalents at Kyivstar 429 143 Lease expense reconciliation 2024P 2023 Depreciation charge for the year 45 52 Total cash outflows for leases 82 74

Risks related to the business and industry of Kyivstar (1/3) 33 Risks Related to the War in Ukraine • Our network infrastructure, equipment, systems and other assets are subject to disruption, damage and failure as a result of the war. • We have experienced, and may continue to experience, disruptions to our operations as a result of the war. • We may incur substantial additional operating costs arising from the war. • We may face the risk of nationalization or confiscation of our operations and assets. • Our independent auditors have included a going concern emphasis paragraph in their opinion as a result of the effects of the ongoing war in Ukraine. • We have suffered reputational harm as a result of the ongoing war in Ukraine. • We have seen and may continue to see changes in customer demand due to migration and population shifts. Risks Related to our Market • We operate in a highly competitive market, and as a result may have difficulty expanding our customer base or retaining existing customers. • Investing in frontier markets, where our operations are located, is subject to greater risks than investing in more developed markets, including significant political, legal and economic risks. • We may be unable to keep pace with technological changes and evolving industry standards, which could harm our competitive position and, in turn, materially harm our business. • We may be unable to secure the spectrum or licenses required to remain competitive, and high acquisition and deployment costs for 5G may adversely affect our ability to provide or maintain high quality services and increase our operating expenses. • The telecommunications industry is highly capital intensive and requires substantial and ongoing expenditures of capital. • There are alleged health risks and zoning limitations related to our base transceiver stations which may adversely affect our ability to provide services at certain areas Risks Related to Liquidity and Capital • We may not be able to raise additional capital, or we may only be able to raise additional capital at significantly increased costs. • Our indebtedness and debt service obligations could decrease our cash flow, which could adversely affect our business and financial condition.

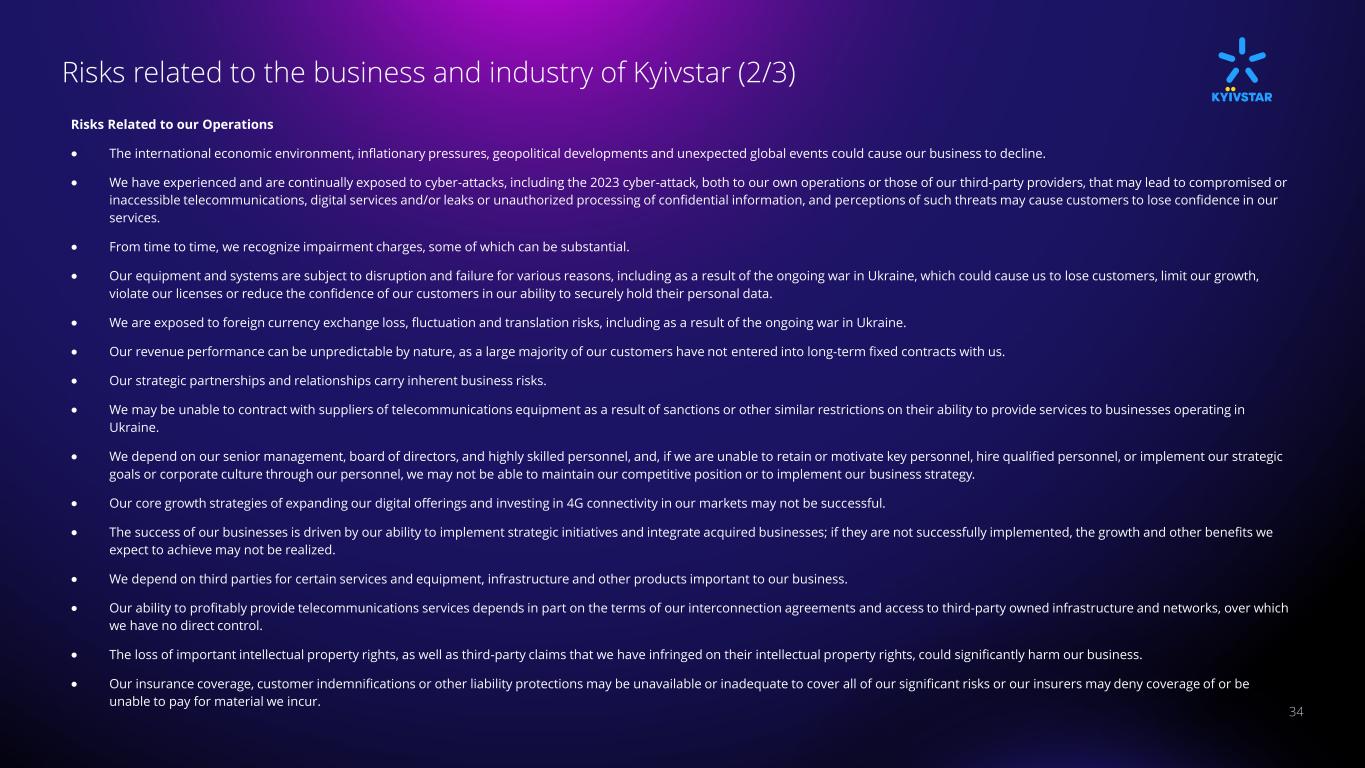

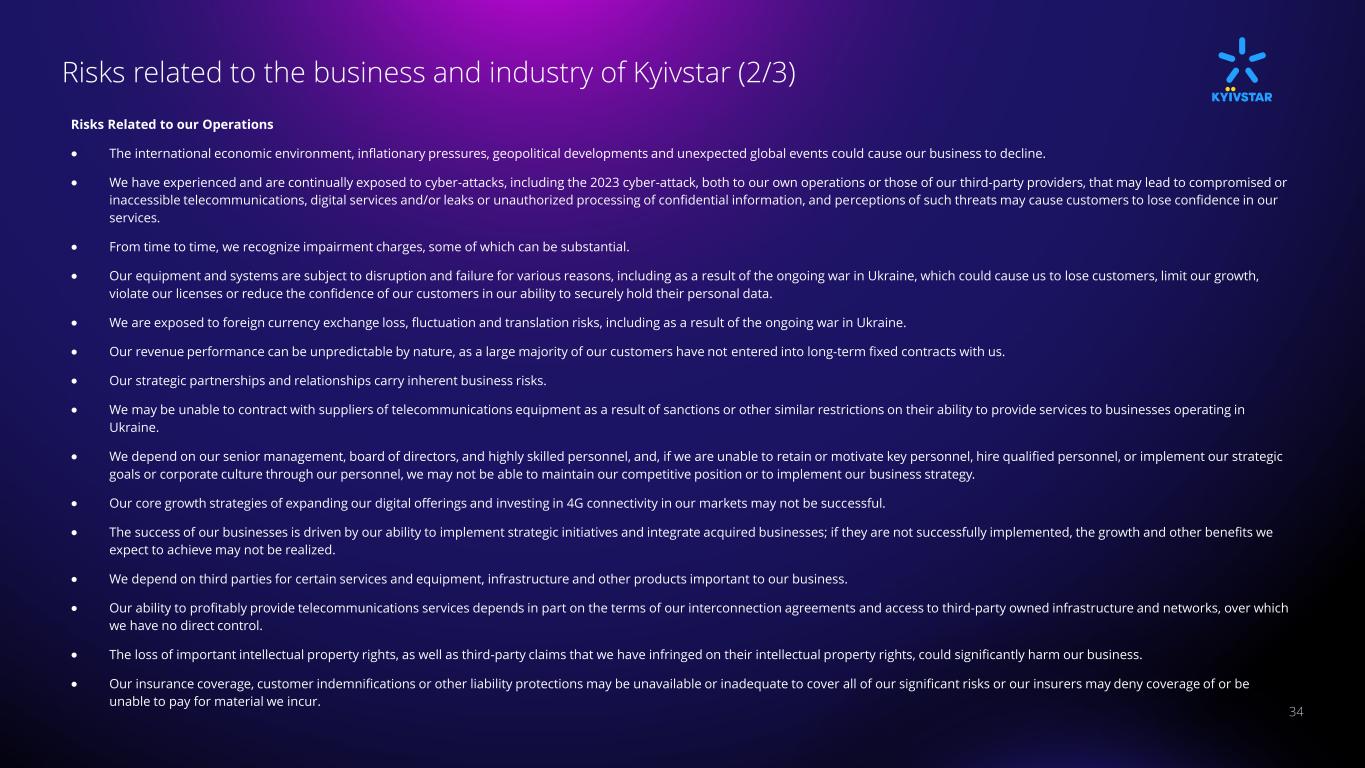

Risks related to the business and industry of Kyivstar (2/3) 34 Risks Related to our Operations • The international economic environment, inflationary pressures, geopolitical developments and unexpected global events could cause our business to decline. • We have experienced and are continually exposed to cyber-attacks, including the 2023 cyber-attack, both to our own operations or those of our third-party providers, that may lead to compromised or inaccessible telecommunications, digital services and/or leaks or unauthorized processing of confidential information, and perceptions of such threats may cause customers to lose confidence in our services. • From time to time, we recognize impairment charges, some of which can be substantial. • Our equipment and systems are subject to disruption and failure for various reasons, including as a result of the ongoing war in Ukraine, which could cause us to lose customers, limit our growth, violate our licenses or reduce the confidence of our customers in our ability to securely hold their personal data. • We are exposed to foreign currency exchange loss, fluctuation and translation risks, including as a result of the ongoing war in Ukraine. • Our revenue performance can be unpredictable by nature, as a large majority of our customers have not entered into long-term fixed contracts with us. • Our strategic partnerships and relationships carry inherent business risks. • We may be unable to contract with suppliers of telecommunications equipment as a result of sanctions or other similar restrictions on their ability to provide services to businesses operating in Ukraine. • We depend on our senior management, board of directors, and highly skilled personnel, and, if we are unable to retain or motivate key personnel, hire qualified personnel, or implement our strategic goals or corporate culture through our personnel, we may not be able to maintain our competitive position or to implement our business strategy. • Our core growth strategies of expanding our digital offerings and investing in 4G connectivity in our markets may not be successful. • The success of our businesses is driven by our ability to implement strategic initiatives and integrate acquired businesses; if they are not successfully implemented, the growth and other benefits we expect to achieve may not be realized. • We depend on third parties for certain services and equipment, infrastructure and other products important to our business. • Our ability to profitably provide telecommunications services depends in part on the terms of our interconnection agreements and access to third-party owned infrastructure and networks, over which we have no direct control. • The loss of important intellectual property rights, as well as third-party claims that we have infringed on their intellectual property rights, could significantly harm our business. • Our insurance coverage, customer indemnifications or other liability protections may be unavailable or inadequate to cover all of our significant risks or our insurers may deny coverage of or be unable to pay for material we incur.

Risks related to the business and industry of Kyivstar (3/3) 35 Risks Related to Regulatory and Legal Matters • The telecommunications industry is a highly regulated industry, and we are subject to an extensive variety of laws and operate in an uncertain judicial and regulatory environment, which may result in unanticipated outcomes that could harm our business. • Violations of and changes to applicable sanctions and embargo laws, including export control restrictions, may harm our business. • We could be subject to tax claims and repeated tax audits that could harm our business. • Changes in tax treaties, laws, rules or interpretations, including our determination of the recognition and recoverability of deferred tax assets, could harm our business, and the unpredictable tax systems and our performance may give rise to significant uncertainties and risks that could complicate our tax and business decisions. • The changes in regulatory requirements in banking and other financial systems and currency control requirements in certain countries restrict our activities, including in relation to the ongoing war between Russia and Ukraine. • Laws restricting foreign investment could materially harm our business. • New or proposed changes to laws or new interpretations of existing laws may harm our business. • We may not be able to detect and prevent fraud or other misconduct by our employees, joint venture partners, non-controlled subsidiaries, representatives, agents, suppliers, customers or other third parties. • We are subject to anti-corruption laws. • We collect and process sensitive personal data and are therefore subject to evolving data privacy laws and heightened regulatory obligations that may require us to incur substantial costs and implement certain changes to our business practices that may adversely affect our results of operations. • We are, and may in the future be, involved in, associated with, or otherwise subject to legal liability in connection with disputes and litigation with regulators, competitors and third parties, which when concluded, could harm our business. • Our licenses are granted for specific periods and may be suspended, revoked or we may be unable to extend or replace these licenses upon expiration and we may be fined or penalized for alleged violations of law, regulations or license terms. • It may not be possible for us to procure in a timely manner, or at all, the permissions and registrations required for our base stations. General Risk Factors Related to Kyivstar • Our business may be adversely impacted by work stoppages and other labor matters, including mobilization. • Adoption of new accounting standards and regulatory reviews could affect reported results and financial position.