0001466593falseFY2023http://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrentP3Yhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrent00014665932023-01-012023-12-3100014665932023-06-30iso4217:USD00014665932024-01-31xbrli:shares00014665932023-12-3100014665932022-12-31iso4217:USDxbrli:shares0001466593ottr:ElectricMember2023-01-012023-12-310001466593ottr:ElectricMember2022-01-012022-12-310001466593ottr:ElectricMember2021-01-012021-12-310001466593ottr:ProductSalesMember2023-01-012023-12-310001466593ottr:ProductSalesMember2022-01-012022-12-310001466593ottr:ProductSalesMember2021-01-012021-12-3100014665932022-01-012022-12-3100014665932021-01-012021-12-310001466593us-gaap:CommonStockMember2020-12-310001466593us-gaap:AdditionalPaidInCapitalMember2020-12-310001466593us-gaap:RetainedEarningsMember2020-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-3100014665932020-12-310001466593us-gaap:CommonStockMember2021-01-012021-12-310001466593us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001466593us-gaap:RetainedEarningsMember2021-01-012021-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001466593us-gaap:CommonStockMember2021-12-310001466593us-gaap:AdditionalPaidInCapitalMember2021-12-310001466593us-gaap:RetainedEarningsMember2021-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-3100014665932021-12-310001466593us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001466593us-gaap:CommonStockMember2022-01-012022-12-310001466593us-gaap:RetainedEarningsMember2022-01-012022-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001466593us-gaap:CommonStockMember2022-12-310001466593us-gaap:AdditionalPaidInCapitalMember2022-12-310001466593us-gaap:RetainedEarningsMember2022-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001466593us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001466593us-gaap:CommonStockMember2023-01-012023-12-310001466593us-gaap:RetainedEarningsMember2023-01-012023-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001466593us-gaap:CommonStockMember2023-12-310001466593us-gaap:AdditionalPaidInCapitalMember2023-12-310001466593us-gaap:RetainedEarningsMember2023-12-310001466593us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31ottr:segment0001466593ottr:ElectricPlantMember2023-01-012023-12-310001466593ottr:ElectricPlantMember2022-01-012022-12-310001466593ottr:ElectricPlantMember2021-01-012021-12-310001466593ottr:ElectricPlantMemberus-gaap:EquipmentMembersrt:MinimumMember2023-01-012023-12-310001466593ottr:ElectricPlantMemberus-gaap:EquipmentMembersrt:MaximumMember2023-01-012023-12-310001466593us-gaap:EquipmentMemberottr:NonelectricPlantMembersrt:MinimumMember2023-12-310001466593us-gaap:EquipmentMemberottr:NonelectricPlantMembersrt:MaximumMember2023-12-310001466593ottr:BuildingAndLeaseholdImprovementsMemberottr:NonelectricPlantMembersrt:MinimumMember2023-12-310001466593ottr:BuildingAndLeaseholdImprovementsMemberottr:NonelectricPlantMembersrt:MaximumMember2023-12-31ottr:plantottr:lineottr:reportingUnit0001466593srt:MinimumMember2023-12-310001466593srt:MaximumMember2023-12-31ottr:plan0001466593us-gaap:RelatedPartyMemberottr:ContributionObligationMember2023-12-31ottr:foundation0001466593us-gaap:RelatedPartyMemberottr:ContributionObligationMember2021-12-310001466593us-gaap:RelatedPartyMemberottr:ContributionObligationMember2022-12-310001466593us-gaap:RelatedPartyMemberottr:ContributionObligationMember2023-01-012023-12-310001466593us-gaap:RelatedPartyMemberottr:ContributionObligationMember2022-01-012022-12-310001466593ottr:ContributionObligationPaidMemberus-gaap:RelatedPartyMember2022-12-310001466593ottr:ContributionObligationPaidMemberus-gaap:RelatedPartyMember2021-12-310001466593ottr:ContributionObligationPaidMemberus-gaap:RelatedPartyMember2023-12-310001466593ottr:ContributionObligationPaidMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001466593ottr:ContributionObligationPaidMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001466593ottr:ContributionObligationPaidMemberus-gaap:RelatedPartyMember2021-01-012021-12-310001466593ottr:LigniteSalesAgreementMemberottr:CoyoteCreekMiningCompanyLLCCCMCMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:LigniteSalesAgreementMemberottr:CoyoteCreekMiningCompanyLLCCCMCMemberottr:OtterTailPowerCompanyMember2023-01-012023-12-31xbrli:pure0001466593us-gaap:OperatingSegmentsMemberottr:ElectricMember2023-01-012023-12-310001466593us-gaap:OperatingSegmentsMemberottr:ElectricMember2022-01-012022-12-310001466593us-gaap:OperatingSegmentsMemberottr:ElectricMember2021-01-012021-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2023-01-012023-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2022-01-012022-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2021-01-012021-12-310001466593ottr:PlasticsMemberus-gaap:OperatingSegmentsMember2023-01-012023-12-310001466593ottr:PlasticsMemberus-gaap:OperatingSegmentsMember2022-01-012022-12-310001466593ottr:PlasticsMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001466593us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001466593us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001466593us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001466593us-gaap:OperatingSegmentsMemberottr:ElectricMember2023-12-310001466593us-gaap:OperatingSegmentsMemberottr:ElectricMember2022-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2023-12-310001466593us-gaap:OperatingSegmentsMemberottr:ManufacturingMember2022-12-310001466593ottr:PlasticsMemberus-gaap:OperatingSegmentsMember2023-12-310001466593ottr:PlasticsMemberus-gaap:OperatingSegmentsMember2022-12-310001466593us-gaap:CorporateNonSegmentMember2023-12-310001466593us-gaap:CorporateNonSegmentMember2022-12-310001466593ottr:RetailResidentialMemberottr:ElectricMember2023-01-012023-12-310001466593ottr:RetailResidentialMemberottr:ElectricMember2022-01-012022-12-310001466593ottr:RetailResidentialMemberottr:ElectricMember2021-01-012021-12-310001466593ottr:RetailCommercialAndIndustrialMemberottr:ElectricMember2023-01-012023-12-310001466593ottr:RetailCommercialAndIndustrialMemberottr:ElectricMember2022-01-012022-12-310001466593ottr:RetailCommercialAndIndustrialMemberottr:ElectricMember2021-01-012021-12-310001466593ottr:RetailOtherMemberottr:ElectricMember2023-01-012023-12-310001466593ottr:RetailOtherMemberottr:ElectricMember2022-01-012022-12-310001466593ottr:RetailOtherMemberottr:ElectricMember2021-01-012021-12-310001466593ottr:ElectronicProductRetailMemberottr:ElectricMember2023-01-012023-12-310001466593ottr:ElectronicProductRetailMemberottr:ElectricMember2022-01-012022-12-310001466593ottr:ElectronicProductRetailMemberottr:ElectricMember2021-01-012021-12-310001466593ottr:ElectricMemberus-gaap:ElectricTransmissionMember2023-01-012023-12-310001466593ottr:ElectricMemberus-gaap:ElectricTransmissionMember2022-01-012022-12-310001466593ottr:ElectricMemberus-gaap:ElectricTransmissionMember2021-01-012021-12-310001466593ottr:WholesaleMemberottr:ElectricMember2023-01-012023-12-310001466593ottr:WholesaleMemberottr:ElectricMember2022-01-012022-12-310001466593ottr:WholesaleMemberottr:ElectricMember2021-01-012021-12-310001466593ottr:ElectricMemberottr:ElectricProductOtherMember2023-01-012023-12-310001466593ottr:ElectricMemberottr:ElectricProductOtherMember2022-01-012022-12-310001466593ottr:ElectricMemberottr:ElectricProductOtherMember2021-01-012021-12-310001466593ottr:ElectricMember2023-01-012023-12-310001466593ottr:ElectricMember2022-01-012022-12-310001466593ottr:ElectricMember2021-01-012021-12-310001466593ottr:ManufacturingMemberottr:MetalPartsAndToolingMember2023-01-012023-12-310001466593ottr:ManufacturingMemberottr:MetalPartsAndToolingMember2022-01-012022-12-310001466593ottr:ManufacturingMemberottr:MetalPartsAndToolingMember2021-01-012021-12-310001466593ottr:ManufacturingMemberottr:PlasticProductsMember2023-01-012023-12-310001466593ottr:ManufacturingMemberottr:PlasticProductsMember2022-01-012022-12-310001466593ottr:ManufacturingMemberottr:PlasticProductsMember2021-01-012021-12-310001466593ottr:ManufacturingMemberottr:ScrapMetalMember2023-01-012023-12-310001466593ottr:ManufacturingMemberottr:ScrapMetalMember2022-01-012022-12-310001466593ottr:ManufacturingMemberottr:ScrapMetalMember2021-01-012021-12-310001466593ottr:ManufacturingMember2023-01-012023-12-310001466593ottr:ManufacturingMember2022-01-012022-12-310001466593ottr:ManufacturingMember2021-01-012021-12-310001466593ottr:PlasticsMember2023-01-012023-12-310001466593ottr:PlasticsMember2022-01-012022-12-310001466593ottr:PlasticsMember2021-01-012021-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2023-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2022-12-310001466593ottr:AlternativeRevenueProgramRidersMember2023-12-310001466593ottr:AlternativeRevenueProgramRidersMember2022-12-310001466593ottr:AssetRetirementObligationsMember2023-12-310001466593ottr:AssetRetirementObligationsMember2022-12-310001466593ottr:DeferredIncomeTaxesMember2023-12-310001466593ottr:DeferredIncomeTaxesMember2022-12-310001466593ottr:FuelClauseAdjustmentsMember2023-12-310001466593ottr:FuelClauseAdjustmentsMember2022-12-310001466593ottr:RegulatoryAssetDerivativeInstrumentsMember2023-12-310001466593ottr:RegulatoryAssetDerivativeInstrumentsMember2022-12-310001466593ottr:OtherRegulatoryAssetsMember2023-12-310001466593ottr:OtherRegulatoryAssetsMember2022-12-310001466593ottr:DeferredIncomeTaxesMember2023-12-310001466593ottr:DeferredIncomeTaxesMember2022-12-310001466593ottr:PlantRemovalObligationsMember2023-12-310001466593ottr:PlantRemovalObligationsMember2022-12-310001466593ottr:FuelClauseAdjustmentMember2023-12-310001466593ottr:FuelClauseAdjustmentMember2022-12-310001466593ottr:AlternativeRevenueProgramRidersMember2023-12-310001466593ottr:AlternativeRevenueProgramRidersMember2022-12-310001466593ottr:NorthDakotaPTCRefundsMember2023-12-310001466593ottr:NorthDakotaPTCRefundsMember2022-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2023-12-310001466593ottr:PensionAndOtherPostretirementBenefitPlansMember2022-12-310001466593ottr:OtherRegulatoryLiabilitiesMember2023-12-310001466593ottr:OtherRegulatoryLiabilitiesMember2022-12-310001466593ottr:NDPSCMemberottr:NorthDakotaRateCaseMember2023-11-022023-11-020001466593us-gaap:ElectricGenerationEquipmentMemberottr:ElectricPlantMember2023-12-310001466593us-gaap:ElectricGenerationEquipmentMemberottr:ElectricPlantMember2022-12-310001466593ottr:ElectricPlantMemberottr:TransmissionPlantMember2023-12-310001466593ottr:ElectricPlantMemberottr:TransmissionPlantMember2022-12-310001466593ottr:ElectricPlantMemberottr:DistributionPlantMember2023-12-310001466593ottr:ElectricPlantMemberottr:DistributionPlantMember2022-12-310001466593ottr:ElectricPlantMemberottr:GeneralPlantMember2023-12-310001466593ottr:ElectricPlantMemberottr:GeneralPlantMember2022-12-310001466593ottr:ElectricPlantMemberottr:ElectricPlantInServiceMember2023-12-310001466593ottr:ElectricPlantMemberottr:ElectricPlantInServiceMember2022-12-310001466593ottr:ElectricPlantMemberus-gaap:ConstructionInProgressMember2023-12-310001466593ottr:ElectricPlantMemberus-gaap:ConstructionInProgressMember2022-12-310001466593ottr:ElectricPlantMember2023-12-310001466593ottr:ElectricPlantMember2022-12-310001466593us-gaap:EquipmentMemberottr:NonelectricPlantMember2023-12-310001466593us-gaap:EquipmentMemberottr:NonelectricPlantMember2022-12-310001466593ottr:BuildingsAndLeaseholdImprovementsMemberottr:NonelectricPlantMember2023-12-310001466593ottr:BuildingsAndLeaseholdImprovementsMemberottr:NonelectricPlantMember2022-12-310001466593ottr:NonelectricPlantMemberus-gaap:LandMember2023-12-310001466593ottr:NonelectricPlantMemberus-gaap:LandMember2022-12-310001466593ottr:NonelectricPlantMemberottr:NonelectricOperationsPlantMember2023-12-310001466593ottr:NonelectricPlantMemberottr:NonelectricOperationsPlantMember2022-12-310001466593us-gaap:ConstructionInProgressMemberottr:NonelectricPlantMember2023-12-310001466593us-gaap:ConstructionInProgressMemberottr:NonelectricPlantMember2022-12-310001466593ottr:NonelectricPlantMember2023-12-310001466593ottr:NonelectricPlantMember2022-12-310001466593ottr:BigStonePlantMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:BigStonePlantMember2023-12-310001466593ottr:CoyoteStationMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:CoyoteStationMember2023-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStoneSouthEllendaleMultiValueProjectMember2023-12-310001466593ottr:BigStoneSouthEllendaleMultiValueProjectMember2023-12-310001466593ottr:FargoProjectMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:FargoProjectMember2023-12-310001466593ottr:BigStoneSouthBrookingsMultiValueProjectMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:BigStoneSouthBrookingsMultiValueProjectMember2023-12-310001466593ottr:BrookingsProjectMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:BrookingsProjectMember2023-12-310001466593ottr:BemidjiProjectMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:BemidjiProjectMember2023-12-310001466593ottr:JamestownProjectMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:JamestownProjectMember2023-12-310001466593ottr:BigStoneSouthAlexandriaMultiValueProjectMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:BigStoneSouthAlexandriaMultiValueProjectMember2023-12-310001466593ottr:AlexandriaProjectMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:AlexandriaProjectMember2023-12-310001466593ottr:BigStonePlantMemberottr:OtterTailPowerCompanyMember2022-12-310001466593ottr:BigStonePlantMember2022-12-310001466593ottr:CoyoteStationMemberottr:OtterTailPowerCompanyMember2022-12-310001466593ottr:CoyoteStationMember2022-12-310001466593ottr:OtterTailPowerCompanyMemberottr:BigStoneSouthEllendaleMultiValueProjectMember2022-12-310001466593ottr:BigStoneSouthEllendaleMultiValueProjectMember2022-12-310001466593ottr:FargoProjectMemberottr:OtterTailPowerCompanyMember2022-12-310001466593ottr:FargoProjectMember2022-12-310001466593ottr:BigStoneSouthBrookingsMultiValueProjectMemberottr:OtterTailPowerCompanyMember2022-12-310001466593ottr:BigStoneSouthBrookingsMultiValueProjectMember2022-12-310001466593ottr:BrookingsProjectMemberottr:OtterTailPowerCompanyMember2022-12-310001466593ottr:BrookingsProjectMember2022-12-310001466593ottr:BemidjiProjectMemberottr:OtterTailPowerCompanyMember2022-12-310001466593ottr:BemidjiProjectMember2022-12-310001466593ottr:ManufacturingMember2023-12-310001466593ottr:ManufacturingMember2022-12-310001466593ottr:PlasticsMember2023-12-310001466593ottr:PlasticsMember2022-12-310001466593us-gaap:CustomerRelationshipsMember2023-12-310001466593us-gaap:OtherIntangibleAssetsMember2023-12-310001466593us-gaap:CustomerRelationshipsMember2022-12-310001466593us-gaap:OtherIntangibleAssetsMember2022-12-310001466593srt:ParentCompanyMember2023-12-310001466593ottr:OtterTailPowerCompanyMember2023-12-310001466593srt:ParentCompanyMember2022-12-310001466593ottr:OtterTailPowerCompanyMember2022-12-310001466593ottr:OtterTailCorporationCreditAgreementMember2023-12-310001466593ottr:OtterTailCorporationCreditAgreementMember2022-12-310001466593ottr:OTPCreditAgreementMember2023-12-310001466593ottr:OTPCreditAgreementMember2022-12-310001466593ottr:OTPCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001466593ottr:OtterTailCorporationCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001466593ottr:OtterTailCorporationCreditAgreementMemberus-gaap:LetterOfCreditMember2023-12-310001466593ottr:OTPCreditAgreementMemberus-gaap:LetterOfCreditMember2023-12-310001466593ottr:BenchmarkRateMembersrt:MinimumMember2023-01-012023-12-310001466593ottr:BenchmarkRateMembersrt:MaximumMember2023-01-012023-12-310001466593ottr:The355GuaranteedSeniorNotesDueDecember152026Member2023-12-310001466593ottr:The355GuaranteedSeniorNotesDueDecember152026Member2022-12-310001466593ottr:SeniorUnsecuredNotes637SeriesCDueAugust202027Member2023-12-310001466593ottr:SeniorUnsecuredNotes637SeriesCDueAugust202027Member2022-12-310001466593ottr:SeniorUnsecuredNotes468SeriesADueFebruary272029Member2023-12-310001466593ottr:SeniorUnsecuredNotes468SeriesADueFebruary272029Member2022-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueOctober102029Member2023-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueOctober102029Member2022-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueFebruary252030Member2023-12-310001466593ottr:SeniorUnsecuredNotes307SeriesADueFebruary252030Member2022-12-310001466593ottr:SeniorUnsecuredNotes322SeriesBDueAugust202030Member2023-12-310001466593ottr:SeniorUnsecuredNotes322SeriesBDueAugust202030Member2022-12-310001466593ottr:SeniorUnsecuredNotes274SeriesADueNovember292031Member2023-12-310001466593ottr:SeniorUnsecuredNotes274SeriesADueNovember292031Member2022-12-310001466593ottr:SeniorUnsecuredNotes647SeriesDDueAugust202037Member2023-12-310001466593ottr:SeniorUnsecuredNotes647SeriesDDueAugust202037Member2022-12-310001466593ottr:SeniorUnsecuredNotes352SeriesBDueOctober102039Member2023-12-310001466593ottr:SeniorUnsecuredNotes352SeriesBDueOctober102039Member2022-12-310001466593ottr:SeniorUnsecuredNotes362SeriesCDueFebruary252040Member2023-12-310001466593ottr:SeniorUnsecuredNotes362SeriesCDueFebruary252040Member2022-12-310001466593ottr:SeniorUnsecuredNotes547SeriesBDueFebruary272044Member2023-12-310001466593ottr:SeniorUnsecuredNotes547SeriesBDueFebruary272044Member2022-12-310001466593ottr:SeniorUnsecuredNotes407SeriesADueFebruary72048Member2023-12-310001466593ottr:SeniorUnsecuredNotes407SeriesADueFebruary72048Member2022-12-310001466593ottr:SeniorUnsecuredNotes382SeriesCDueOctober102049Member2023-12-310001466593ottr:SeniorUnsecuredNotes382SeriesCDueOctober102049Member2022-12-310001466593ottr:SeniorUnsecuredNotes392SeriesDDueFebruary252050Member2023-12-310001466593ottr:SeniorUnsecuredNotes392SeriesDDueFebruary252050Member2022-12-310001466593ottr:SeniorUnsecuredNotes369SeriesBDueNovember292051Member2023-12-310001466593ottr:SeniorUnsecuredNotes369SeriesBDueNovember292051Member2022-12-310001466593ottr:SeniorUnsecuredNotes377SeriesADueMay202052Member2023-12-310001466593ottr:SeniorUnsecuredNotes377SeriesADueMay202052Member2022-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-12-31ottr:year0001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-01-012023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanReturnEnhancementMembersrt:MinimumMemberottr:PermittedRange35To60PercentMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanReturnEnhancementMembersrt:MaximumMemberottr:PermittedRange35To60PercentMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanReturnEnhancementMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanReturnEnhancementMember2022-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRange40To80PercentMemberottr:DefinedBenefitPlanRiskManagementMembersrt:MinimumMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:PermittedRange40To80PercentMemberottr:DefinedBenefitPlanRiskManagementMembersrt:MaximumMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanRiskManagementMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanRiskManagementMember2022-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanAlternativesMembersrt:MinimumMemberottr:PermittedRange0To20PercentMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanAlternativesMembersrt:MaximumMemberottr:PermittedRange0To20PercentMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanAlternativesMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:DefinedBenefitPlanAlternativesMember2022-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2022-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2023-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMember2023-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2023-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001466593us-gaap:FixedIncomeFundsMember2023-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:DefinedBenefitPlanHybridFundsMember2023-12-310001466593us-gaap:FairValueInputsLevel2Memberottr:DefinedBenefitPlanHybridFundsMember2023-12-310001466593us-gaap:FairValueInputsLevel3Memberottr:DefinedBenefitPlanHybridFundsMember2023-12-310001466593us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberottr:DefinedBenefitPlanHybridFundsMember2023-12-310001466593ottr:DefinedBenefitPlanHybridFundsMember2023-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2023-12-310001466593us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2023-12-310001466593us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2023-12-310001466593us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001466593us-gaap:USTreasuryAndGovernmentMember2023-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMember2023-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMemberus-gaap:FairValueInputsLevel2Member2023-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMemberus-gaap:FairValueInputsLevel3Member2023-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMember2023-12-310001466593us-gaap:FairValueInputsLevel1Member2023-12-310001466593us-gaap:FairValueInputsLevel2Member2023-12-310001466593us-gaap:FairValueInputsLevel3Member2023-12-310001466593us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:FairValueInputsLevel3Member2022-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001466593us-gaap:DefinedBenefitPlanEquitySecuritiesMember2022-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel2Member2022-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001466593us-gaap:FixedIncomeFundsMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001466593us-gaap:FixedIncomeFundsMember2022-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:DefinedBenefitPlanHybridFundsMember2022-12-310001466593us-gaap:FairValueInputsLevel2Memberottr:DefinedBenefitPlanHybridFundsMember2022-12-310001466593us-gaap:FairValueInputsLevel3Memberottr:DefinedBenefitPlanHybridFundsMember2022-12-310001466593us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberottr:DefinedBenefitPlanHybridFundsMember2022-12-310001466593ottr:DefinedBenefitPlanHybridFundsMember2022-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:USTreasuryAndGovernmentMember2022-12-310001466593us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel2Member2022-12-310001466593us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueInputsLevel3Member2022-12-310001466593us-gaap:USTreasuryAndGovernmentMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001466593us-gaap:USTreasuryAndGovernmentMember2022-12-310001466593us-gaap:FairValueInputsLevel1Memberottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMember2022-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMemberus-gaap:FairValueInputsLevel2Member2022-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMemberus-gaap:FairValueInputsLevel3Member2022-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMemberus-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001466593ottr:DefinedBenefitPlanOtherSEIEnergyDebtCollectiveFundMember2022-12-310001466593us-gaap:FairValueInputsLevel1Member2022-12-310001466593us-gaap:FairValueInputsLevel2Member2022-12-310001466593us-gaap:FairValueInputsLevel3Member2022-12-310001466593us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2022-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2021-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2022-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2021-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2022-01-012022-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2023-01-012023-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2022-01-012022-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-01-012022-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2023-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsToAge39Member2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsToAge39Member2022-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge40To49Member2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge40To49Member2022-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge50AndOlderMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge50AndOlderMember2022-12-310001466593ottr:ParticipantsAge40To49NonUnionEmployeeMember2023-12-310001466593ottr:ParticipantsAge50AndOlderNonUnionEmployeeMember2023-12-310001466593us-gaap:PensionPlansDefinedBenefitMember2021-01-012021-12-310001466593ottr:ExecutiveSurvivorAndSupplementalRetirementPlanMember2021-01-012021-12-310001466593us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2021-01-012021-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsToAge39Member2023-01-012023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsToAge39Member2022-01-012022-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsToAge39Member2021-01-012021-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge40To49Member2023-01-012023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge40To49Member2022-01-012022-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge40To49Member2021-01-012021-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge50AndOlderMember2023-01-012023-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge50AndOlderMember2022-01-012022-12-310001466593us-gaap:PensionPlansDefinedBenefitMemberottr:ParticipantsAge50AndOlderMember2021-01-012021-12-310001466593us-gaap:StateAndLocalJurisdictionMember2023-12-310001466593ottr:TaxYears2024To2029Memberus-gaap:StateAndLocalJurisdictionMember2023-12-310001466593ottr:TaxYears2030To2037Memberus-gaap:StateAndLocalJurisdictionMember2023-12-310001466593us-gaap:StateAndLocalJurisdictionMemberottr:TaxYears2038To2043Member2023-12-310001466593ottr:ConstructionProgramsMemberottr:OtterTailPowerCompanyMember2023-01-012023-12-310001466593ottr:OTPLandEasementsMemberottr:OtterTailPowerCompanyMember2023-01-012023-12-310001466593ottr:ConstructionProgramAndOtherCommitmentsMembersrt:SubsidiariesMember2023-12-310001466593ottr:OtterTailPowerCompanyMemberottr:CapacityAndEnergyRequirementsMember2023-12-310001466593ottr:CoalPurchaseCommitmentsMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:FederalEnergyRegulatoryCommissionMemberottr:OtterTailPowerCompanyMember2023-12-310001466593us-gaap:CumulativePreferredStockMember2023-12-310001466593ottr:CumulativePreferenceSharesMember2023-12-310001466593us-gaap:CumulativePreferredStockMember2022-12-310001466593ottr:SecondShelfRegistrationMember2021-05-032021-05-030001466593ottr:SecondShelfRegistrationMember2023-01-012023-12-310001466593ottr:SecondShelfRegistrationMember2023-12-310001466593srt:MinimumMemberottr:OtterTailPowerCompanyMemberottr:MinnesotaPublicUtilitiesCommissionMember2023-01-012023-12-310001466593srt:MaximumMemberottr:OtterTailPowerCompanyMemberottr:MinnesotaPublicUtilitiesCommissionMember2023-01-012023-12-310001466593srt:MaximumMemberottr:OtterTailPowerCompanyMember2023-12-310001466593ottr:OtterTailPowerCompanyMember2023-01-012023-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2020-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2020-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-01-012021-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-01-012021-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2021-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-01-012022-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-12-310001466593us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001466593us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2023-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2023-01-012023-12-310001466593ottr:The1999EmployeeStockPurchasePlanMembersrt:MinimumMember2023-01-012023-12-310001466593ottr:The1999EmployeeStockPurchasePlanMembersrt:MaximumMember2023-01-012023-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2022-01-012022-12-310001466593ottr:The1999EmployeeStockPurchasePlanMember2021-01-012021-12-310001466593ottr:The2023StockIncentivePlanMember2023-04-300001466593ottr:The2023StockIncentivePlanMember2023-04-012023-04-300001466593ottr:The2023StockIncentivePlanMember2023-12-310001466593ottr:The2023StockIncentivePlanMember2023-01-012023-12-310001466593ottr:The2023StockIncentivePlanMember2022-01-012022-12-310001466593ottr:The2023StockIncentivePlanMember2021-01-012021-12-310001466593srt:MinimumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001466593srt:MaximumMemberus-gaap:RestrictedStockMember2023-01-012023-12-310001466593us-gaap:RestrictedStockMember2023-01-012023-12-310001466593us-gaap:RestrictedStockMember2022-12-310001466593us-gaap:RestrictedStockMember2023-12-310001466593us-gaap:RestrictedStockMember2022-01-012022-12-310001466593us-gaap:RestrictedStockMember2021-01-012021-12-310001466593us-gaap:PerformanceSharesMember2023-01-012023-12-310001466593us-gaap:PerformanceSharesMembersrt:MinimumMember2023-01-012023-12-310001466593us-gaap:PerformanceSharesMembersrt:MaximumMember2023-01-012023-12-310001466593us-gaap:PerformanceSharesMember2023-12-31ottr:measure0001466593us-gaap:PerformanceSharesMember2022-01-012022-12-310001466593us-gaap:PerformanceSharesMember2021-01-012021-12-310001466593us-gaap:PerformanceSharesMember2022-12-310001466593us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001466593us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001466593us-gaap:EmployeeStockOptionMember2021-01-012021-12-31utr:MWh0001466593us-gaap:SwapMember2023-01-012023-12-310001466593us-gaap:SwapMember2022-01-012022-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberottr:GovernmentDebtSecuritiesMember2023-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberottr:GovernmentDebtSecuritiesMember2023-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberottr:GovernmentDebtSecuritiesMember2023-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001466593us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberottr:GovernmentDebtSecuritiesMember2022-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberottr:GovernmentDebtSecuritiesMember2022-12-310001466593us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberottr:GovernmentDebtSecuritiesMember2022-12-310001466593us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001466593us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001466593us-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001466593us-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001466593srt:ParentCompanyMemberus-gaap:RelatedPartyMember2023-12-310001466593srt:ParentCompanyMemberus-gaap:RelatedPartyMember2022-12-310001466593srt:ParentCompanyMemberus-gaap:RelatedPartyMember2023-01-012023-12-310001466593srt:ParentCompanyMemberus-gaap:RelatedPartyMember2022-01-012022-12-310001466593srt:ParentCompanyMemberus-gaap:RelatedPartyMember2021-01-012021-12-310001466593srt:ParentCompanyMember2023-01-012023-12-310001466593srt:ParentCompanyMember2022-01-012022-12-310001466593srt:ParentCompanyMember2021-01-012021-12-310001466593us-gaap:NonrelatedPartyMembersrt:ParentCompanyMember2023-01-012023-12-310001466593us-gaap:NonrelatedPartyMembersrt:ParentCompanyMember2022-01-012022-12-310001466593us-gaap:NonrelatedPartyMembersrt:ParentCompanyMember2021-01-012021-12-310001466593srt:ParentCompanyMember2021-12-310001466593srt:ParentCompanyMember2020-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailPowerCompanyMemberottr:OtterTailCorporationMember2023-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMemberottr:NorthernPipeProductsIncMember2023-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMemberottr:VinyltechCorporationMember2023-12-310001466593us-gaap:RelatedPartyMemberottr:BTDManufacturingIncMemberottr:OtterTailCorporationMember2023-12-310001466593ottr:TOPlasticsIncMemberus-gaap:RelatedPartyMemberottr:OtterTailCorporationMember2023-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMemberottr:VaristarCorporationMember2023-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailAssuranceLimitedMemberottr:OtterTailCorporationMember2023-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMember2023-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailPowerCompanyMemberottr:OtterTailCorporationMember2022-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMemberottr:NorthernPipeProductsIncMember2022-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMemberottr:VinyltechCorporationMember2022-12-310001466593us-gaap:RelatedPartyMemberottr:BTDManufacturingIncMemberottr:OtterTailCorporationMember2022-12-310001466593ottr:TOPlasticsIncMemberus-gaap:RelatedPartyMemberottr:OtterTailCorporationMember2022-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMemberottr:VaristarCorporationMember2022-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailAssuranceLimitedMemberottr:OtterTailCorporationMember2022-12-310001466593us-gaap:RelatedPartyMemberottr:OtterTailCorporationMember2022-12-310001466593us-gaap:AllowanceForCreditLossMember2022-12-310001466593us-gaap:AllowanceForCreditLossMember2023-01-012023-12-310001466593us-gaap:AllowanceForCreditLossMember2023-12-310001466593us-gaap:AllowanceForCreditLossMember2021-12-310001466593us-gaap:AllowanceForCreditLossMember2022-01-012022-12-310001466593us-gaap:AllowanceForCreditLossMember2020-12-310001466593us-gaap:AllowanceForCreditLossMember2021-01-012021-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2020-12-310001466593us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ Annual Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2023 or

☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number 0-53713

OTTER TAIL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Minnesota

(State or other jurisdiction of incorporation or organization)

|

27-0383995

(I.R.S. Employer Identification No.)

|

|

|

|

215 South Cascade Street, Box 496, Fergus Falls, Minnesota

(Address of principal executive offices)

|

56538-0496

(Zip Code)

|

Registrant's telephone number, including area code: 866-410-8780

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Shares, par value $5.00 per share |

OTTR |

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Large Accelerated Filer ☑ |

|

Accelerated Filer ☐ |

|

|

| |

Non-Accelerated Filer ☐ |

|

Smaller Reporting Company ☐ |

|

Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of June 30, 2023, the aggregate market value of common stock held by non-affiliates was $3,646,181,401.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date: 41,710,521 Common Shares ($5 par value) as of January 31, 2024.

DOCUMENTS INCORPORATED BY REFERENCE

The Registrant's definitive Proxy Statement for its 2024 Annual Meeting of Shareholders is incorporated by reference into Part III of this Form 10-K.

|

|

|

|

|

|

|

|

|

| |

Description |

Page |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| ITEM 1. |

|

|

| ITEM 1A. |

|

|

| ITEM 1B. |

|

|

| ITEM 1C. |

|

|

| ITEM 2. |

|

|

| ITEM 3. |

|

|

| ITEM 3A. |

|

|

| ITEM 4. |

|

|

|

|

|

| ITEM 5. |

|

|

| ITEM 6. |

|

|

| ITEM 7. |

|

|

| ITEM 7A. |

|

|

| ITEM 8. |

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|

|

| ITEM 9. |

|

|

| ITEM 9A. |

|

|

| ITEM 9B. |

|

|

| ITEM 9C. |

|

|

|

|

|

| ITEM 10. |

|

|

| ITEM 11. |

|

|

| ITEM 12. |

|

|

| ITEM 13. |

|

|

| ITEM 14. |

|

|

|

|

|

| ITEM 15. |

|

|

| ITEM 16. |

|

|

|

|

|

The following abbreviations or acronyms are used in the text.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AFUDC |

Allowance for Funds Used During Construction |

|

kwh |

kilowatt-hour |

AME |

Available Maximum Energy |

|

LSA |

Lignite Sales Agreement |

| ARO |

Asset Retirement Obligation |

|

MDT |

Metering and Distribution Technology |

| ARP |

Alternative Revenue Program |

|

MISO |

Midcontinent Independent System Operator |

ASC |

Accounting Standards Codification |

|

MW |

Megawatt |

| BTD |

BTD Manufacturing, Inc. |

|

MPUC |

Minnesota Public Utilities Commission |

| CCMC |

Coyote Creek Mining Company, L.L.C. |

|

NAV |

Net Asset Value |

| CCS |

Carbon Capture and Sequestration |

|

NDDEQ |

North Dakota Department of Environmental Quality |

| CDD |

Cooling Degree Day |

|

NDPSC |

North Dakota Public Service Commission |

| CIS |

Critical Security Controls |

|

NERC |

North American Electric Reliability Corporation |

CO2 |

Carbon dioxide |

|

Northern Pipe |

Northern Pipe Products, Inc. |

| COSO |

Committee of Sponsoring Organizations of the Treadway Commission |

|

OTC |

Otter Tail Corporation |

ECO |

Energy Conservation and Optimization Rider |

|

OTP |

Otter Tail Power Company |

| EEI |

Edison Electric Institute |

|

Paris Agreement |

United Nations Framework Convention on Climate Change |

| EEP |

Energy Efficiency Plan |

|

PFAS |

Polyfluoroalkyl substances |

| EGU |

Electric Generating Unit |

|

PIR |

Phase-in Rider |

| EPA |

Environmental Protection Agency |

|

PSLRA |

Private Securities Litigation Reform Act of 1995 |

| ERISA |

Employee Retirement Income Security Act of 1974 |

|

PTCs |

Production tax credits |

| ESSRP |

Executive Survivor and Supplemental Retirement Plan |

|

PVC |

Polyvinyl chloride |

| EUIC |

Electric Utility Infrastructure Costs Rider |

|

RHR |

Regional Haze Rule |

| FASB |

Financial Accounting Standards Board |

|

ROE |

Return on equity |

| FCA |

Fuel Clause Adjustment |

|

REC |

Renewable Energy Certificate |

| FERC |

Federal Energy Regulatory Commission |

|

RRR |

Renewable Resource Rider |

FOB |

Free on Board |

|

SDPUC |

South Dakota Public Utilities Commission |

| GCR |

Generation Cost Recovery Rider |

|

SEC |

Securities and Exchange Commission |

| GHG |

Greenhouse Gas |

|

SIP |

State implementation plan |

| HDD |

Heating Degree Day |

|

SOFR |

Secured Overnight Financing Rate |

| ICSP |

Information and Cybersecurity Program |

|

T.O. Plastics |

T.O. Plastics, Inc. |

| IRP |

Integrated Resource Plan |

|

TCR |

Transmission Cost Recovery Rider |

| ITCs |

Investment Tax Credits |

|

TSR |

Total Shareholder Return |

| kV |

kiloVolt |

|

VIE |

Variable Interest Entity |

| kW |

kiloWatt |

|

Vinyltech |

Vinyltech Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| WHERE TO FIND MORE INFORMATION |

|

|

We make available free of charge at our website (www.ottertail.com) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy and information statements, Forms 3, 4 and 5 filed on behalf of directors and executive officers and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (SEC). These reports are also available on the SEC's website (www.sec.gov). Information on our and the SEC's websites is not deemed to be incorporated by reference into this report on Form 10-K.

|

|

|

| FORWARD-LOOKING INFORMATION |

This report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the PSLRA). When used in this Form 10-K and in future filings by the Company with the SEC, in the Company’s press releases and in oral statements, words such as “anticipate,” “believe,” "can,"“could,” “estimate,” “expect,” "future," "goal," “intend,” "likely," “may,” “outlook,” “plan,” “possible,” “potential,” "predict," "probable," "projected ," “should,” "target," “will,” “would” or similar expressions are intended to identify forward-looking statements within the meaning of the PSLRA. Such statements are based on current expectations and assumptions and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements. Such risks and uncertainties include the various factors set forth in Item 1A. Risk Factors of this report on Form 10-K and in our other SEC filings.

PART I

Otter Tail Corporation (OTC) has interests in diversified operations that include an electric utility and manufacturing and plastic pipe businesses with corporate offices located in Fergus Falls, Minnesota and Fargo, North Dakota.

We classify our five operating companies into three reportable segments consistent with our business strategy and management structure. The following table depicts our three segments and the subsidiary entities included within each segment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ELECTRIC SEGMENT |

|

MANUFACTURING SEGMENT |

|

PLASTICS SEGMENT |

| Otter Tail Power Company (OTP) |

|

BTD Manufacturing, Inc. (BTD) |

|

Northern Pipe Products, Inc. (Northern Pipe) |

|

|

T.O. Plastics, Inc. (T.O. Plastics) |

|

Vinyltech Corporation (Vinyltech) |

Electric includes the generation, purchase, transmission, distribution and sale of electric energy in western Minnesota, eastern North Dakota and northeastern South Dakota. Otter Tail Power (OTP), our largest operating subsidiary and primary business since 1907, serves more than 133,000 customers in more than 400 communities across a predominantly rural and agricultural service territory.

Manufacturing consists of businesses engaged in the following manufacturing activities: contract machining; metal parts stamping; fabrication and painting; and production of plastic thermoformed horticultural containers, life science and industrial packaging, material handling components and extruded raw material stock. These businesses have manufacturing facilities in Georgia, Illinois and Minnesota and sell products primarily in the United States.

Plastics consists of businesses producing polyvinyl chloride (PVC) pipe at plants in North Dakota and Arizona. The PVC pipe is sold primarily in the western half of the United States and Canada.

Throughout the remainder of this report, we use the terms "Company", "us", "our", or "we" to refer to OTC and its subsidiaries collectively. We will also refer to our Electric, Manufacturing and Plastics segments and our individual subsidiaries as indicated above.

INVESTMENT AND GROWTH STRATEGY

We maintain a moderate risk profile by investing in rate base growth opportunities in our Electric segment and organic growth opportunities in our Manufacturing and Plastics segments (collectively, our manufacturing platform). This strategy and risk profile are designed to provide a more predictable and growing earnings stream, support quality credit ratings, and provide for dividend payments.

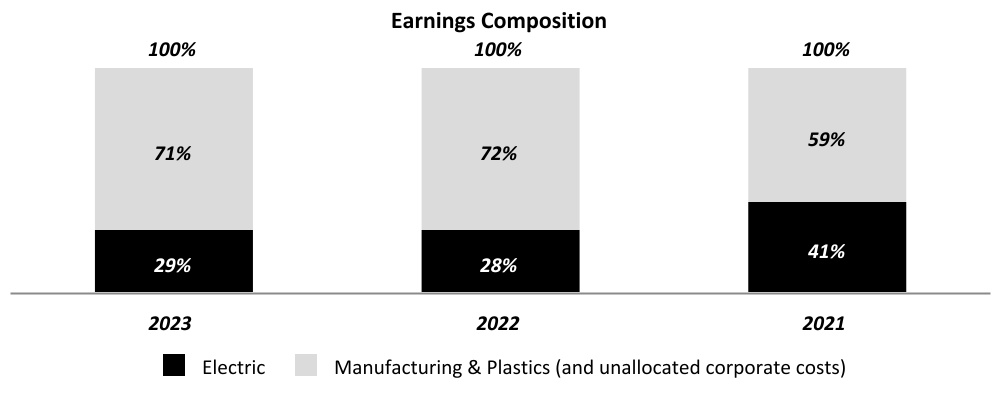

Our long-term focus remains on executing our strategy to grow our business and achieving operational, commercial and talent excellence to strengthen our position in the markets we serve. Our long-term financial objectives include achieving a compounded annual growth rate in earnings per share in the range of 5 - 7%, with a long-term earnings mix of approximately 65% from our Electric segment and 35% from our manufacturing platform. We also are targeting an annual increase in our dividend to be in the range of 5 - 7%. We expect our earnings growth and cash flow generation to be driven by rate base investments in our Electric segment and from existing capacities and planned investments within our Manufacturing and Plastics segments.

Over the past three years, we delivered earnings growth well in excess of our 5 - 7% target due to unique industry conditions within the PVC pipe industry, which led to extraordinary revenue, earnings and cash flow growth in our Plastics Segment. We expect these industry conditions to gradually normalize over the course of 2024 and into 2025. As they do, we expect earnings and cash flow generation within our Plastics segment to moderate from current levels. Once these industry conditions have normalized, we expect to achieve our long-term financial objectives as outlined above.

We will continue to review our business portfolio to identify additional opportunities to improve our risk profile, enhance our credit metrics and generate additional sources of cash to support the organic growth opportunities in our Electric, Manufacturing, and Plastics segments. We will also evaluate opportunities to allocate capital to potential acquisitions. We are a committed long-term owner and do not acquire companies in pursuit of short-term gains. However, we will divest of businesses which no longer fit into our strategy and risk profile over the long term.

We maintain a set of criteria used in evaluating the strategic fit of our operating businesses. The operating company should:

•Maintain a minimum level of net earnings and a return on invested capital in excess of the Company’s weighted-average cost of capital,

•Have a strategic differentiation from competitors and a sustainable cost advantage,

•Operate within a stable and growing industry and be able to quickly adapt to changing economic cycles, and

•Have a strong management team committed to operational and commercial excellence.

Our actual mix of earnings for the years ended December 31, 2023, 2022 and 2021 was as follows:

HUMAN CAPITAL

Our employees are a critical resource and an integral part of our success. We strive to provide an environment of opportunity and accountability where people are valued and empowered to do their best work. We are focused on the health and safety of our employees and creating a culture of inclusion, excellence and learning, and our executive annual incentive plan reflects those commitments. We monitor various metrics and objectives associated with i) employee safety, ii) workforce stability, iii) management and workforce demographics, including gender, racial and ethnic diversity, iv) leadership development and succession planning and v) productivity. We have established the following in furtherance of these efforts:

Safety - Safety is one of our core values. In managing our business, we focus on the safety of our employees and have implemented safety programs and management practices to promote a culture of safety. Safety is also a metric used and evaluated in determining annual incentive compensation. We continually monitor the Occupational Safety and Health Administration Total Recordable Incident Rate (number of work-related injuries per 100 employees for a one-year period) and Lost Time Incident Rate (number of employees who lost time due to work-related injuries per 100 employees for a one-year period). New cases are reported and evaluated for corrective action during monthly safety meetings attended by safety professionals at all locations. Our 2023 Total Recordable Incident Rate was 1.70, compared to 2.08 in 2022 and our Lost Time Incident Rate was 0.53 in 2023, compared to 0.49 in 2022.

Employee and Leadership Development, Succession Planning and Training Programs - We invest in training and professional development for various levels of employees, management and leaders throughout the Company to ensure all have the necessary training and skills to perform their work well, and to build enterprise-wide understanding of our culture, strategy and processes. Annual succession planning, individual development planning, mentoring, and supervisory and leadership development programs all play a role in ensuring a capable leadership team now and in the future. Our skill progression and technical training programs help to retain a stable and skilled workforce.

Workforce Stability - Recruiting, retaining and developing employees is an important factor in our continued success and growth. We regularly evaluate our recruiting programs, employee retention and turnover rates.

Employee Engagement - To enhance the effectiveness of our workforce and to help our companies continue to be places where our employees choose to work and thrive, we have undertaken a multi-year series of employee engagement surveys. We use the feedback to help shape the employee programs of our organization.

Human Rights - We are committed to the protection of our employee’s freedom of expression and freedom of organization and assembly.

Diversity, Equity, and Inclusion - We expect, and are committed to, diversity, equity and inclusion as part of who we are, what we value, and how we achieve individual, business and community success. We hold every employee accountable for their behavior in maintaining a workplace free of discrimination and harassment. We have implemented education initiatives for all employees, aimed at inclusive leadership and a respectful workplace, focused on identities and culture, unconscious bias, the power of diverse teams and culturally sensitive conversations. We have implemented initiatives to improve upon our demographic profile, including revised hiring processes and a commitment to diverse slates of interview candidates.

Code of Business Ethics - We require employees to complete training on several topics associated with our code of business ethics to reinforce our commitment to compliance with laws, regulations and values that guide who we are and how we do business.

As of December 31, 2023, we employed 2,655 full-time employees as shown in the table below:

|

|

|

|

|

|

| Segment/Organization |

Employees |

|

|

| Electric Segment |

|

OTP (1) |

790 |

|

| Manufacturing Segment |

|

| BTD |

1,458 |

|

| T.O. Plastics |

192 |

|

| Segment Total |

1,650 |

|

| Plastics Segment |

|

| Northern Pipe |

98 |

|

| Vinyltech |

80 |

|

| Segment Total |

178 |

|

| Corporate |

37 |

|

| Total |

2,655 |

|

(1) Includes all full-time employees of Otter Tail Power Company, including employees working at jointly owned facilities. Labor costs associated with employees working at jointly owned facilities are allocated to each of the co-owners based on their ownership interest. |

|

At December 31, 2023, 378 employees of OTP were represented by local unions of the International Brotherhood of Electrical Workers under two separate collective bargaining agreements expiring on August 31, 2026 and October 31, 2026. OTP has not experienced any strike, work stoppage or strike vote, and considers its present relations with employees to be good. None of the employees of our other operating companies are represented by local unions.

The demographics of our workforce, including our Board of Directors, as of December 31, 2023 was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

% Female |

|

% Racially and Ethnically Diverse |

|

|

|

|

Board of Directors |

36 |

% |

|

9 |

% |

| CEO Direct Reports |

33 |

% |

|

— |

% |

| Management |

21 |

% |

|

4 |

% |

| Non-Management Employees |

15 |

% |

|

15 |

% |

|

|

|

|

|

|

|

|

|

|

| ELECTRIC |

Contribution to Operating Revenues: 39% (2023), 38% (2022), 40% (2021) |

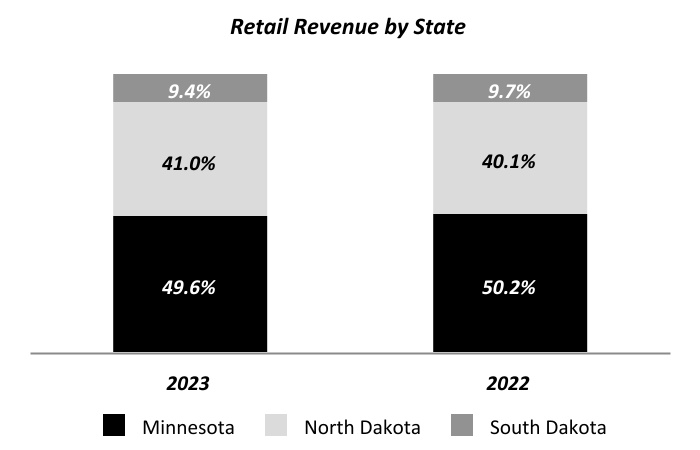

OTP, headquartered in Fergus Falls, Minnesota, is a vertically integrated, regulated utility with generation, transmission and distribution facilities to serve its more than 133,000 residential, commercial and industrial customers in a service area encompassing approximately 70,000 square miles of western Minnesota, eastern North Dakota and northeastern South Dakota.

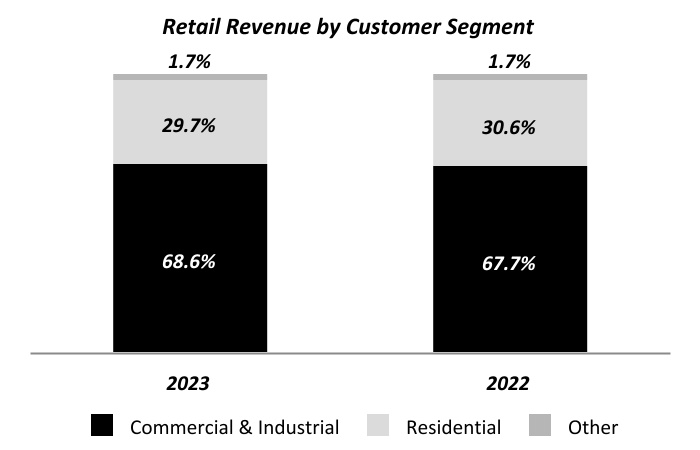

CUSTOMERS

Our service territory is predominantly rural and agricultural and includes over 400 communities, most of which have populations of less than 10,000. While our customer base includes relatively few large customers, sales to commercial and industrial customers are significant, with two customers accounting for 21% of segment operating revenues for the year ended December 31, 2023 and 16% for the year ended December 31, 2022.

The following charts summarize our retail electric revenues by state and by customer segment for the years ended December 31, 2023 and 2022:

In addition to retail revenue, our Electric segment also generates operating revenues from the transmission of electricity for others over the transmission assets we wholly or jointly own with other transmission service providers, and from the sale of electricity we generate and sell into the wholesale electricity market.

COMPETITIVE CONDITIONS

Retail electric sales are made to customers in assigned service territories. As a result, most retail customers do not have the ability to choose their electric supplier. Competition is present in some areas from municipally owned systems, rural electric cooperatives and, in certain respects, from on-site generators and co-generators. Electricity also competes with other forms of energy.

Competition also arises from customers supplying their own power through distributed generation, which is the generation of electricity on-site or close to where it is needed in small facilities designed to meet local needs. Distributed energy resources can include combined heat and power, solar photovoltaic, wind, battery storage, thermal storage and demand-response technologies.

The degree of competition may vary from time to time depending on relative costs and supplies of other forms of energy and advances in technology. Irrespective of the competitive environment, we are focused on providing value to our customers and ensuring our retail rates remain among the lowest in the region and in the nation.

The following table presents our average retail rate per kilowatt-hour (kwh) by customer class and in total for the years ended December 31, 2023 and 2022:

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue per kwh |

2023 |

|

2022 |

|

|

|

|

| Residential |

10.82 |

¢ |

|

10.99 |

¢ |

| Commercial & Industrial |

7.02 |

¢ |

|

7.54 |

¢ |

| Total Retail |

7.90 |

¢ |

|

8.41 |

¢ |

Wholesale electricity markets are competitive under the Federal Energy Regulatory Commission (FERC) open access transmission tariffs, which require utilities to provide nondiscriminatory access to all wholesale users. In addition, the FERC has established a competitive process for the construction and operation of certain new electric transmission facilities under federal regulation. Certain states have laws which provide the incumbent transmission owner the right of first refusal to construct and own new transmission facilities.

OTP has franchises to operate as an electric utility in substantially all of the incorporated municipalities it serves. Franchise rights generally require periodic renewal. No franchises are required to serve unincorporated communities in any of the three states OTP serves.

GENERATION AND PURCHASED POWER

OTP primarily relies on company-owned generation, supplemented by power purchase agreements, to supply the energy to meet our customer needs. Wholesale market purchases and sales of electricity are used as necessary to balance supply and demand. Our mix of owned generation and wholesale market energy purchases to meet customer demand are impacted by wholesale energy prices and the relative cost of each energy source.

As of December 31, 2023, OTP’s wholly or jointly owned plants and facilities, as well as in place power purchase agreements, and their dependable kilowatt (kW) capacity were:

|

|

|

|

|

|

|

|

|

|

|

Capacity /

Purchased Power

in kW |

|

|

|

| Owned Generation: |

|

|

| Baseload Plants |

|

|

Big Stone Plant(1) |

|

256,900 |

|

Coyote Station(2) |

|

148,400 |

|

| Total Baseload Plants |

|

405,300 |

|

| Combustion Turbine and Small Diesel Units |

|

|

| Astoria Station |

|

249,700 |

|

| All Other |

|

102,800 |

|

| Total Combustion Turbine and Small Diesel Units |

|

352,500 |

|

| Owned Wind Facilities (rated at nameplate) |

|

|

Merricourt |

|

150,000 |

|

Ashtabula III |

|

62,400 |

|

Luverne |

|

49,500 |

|

Ashtabula |

|

48,000 |

|

Langdon |

|

40,500 |

|

| Total Owned Wind Facilities |

|

350,400 |

|

Hoot Lake Solar |

|

49,900 |

|

| Hydroelectric Facilities |

|

2,600 |

|

| Total Owned Generation Capacity |

|

1,160,700 |

|

| Power Purchase Agreements: |

|

| Purchased Wind Power (rated at nameplate and greater than 2,000 kW) |

|

| Edgeley |

|

21,000 |

|

| Langdon |

|

19,500 |

|

| Total Purchased Wind |

|

40,500 |

|

| Total Generating Capacity |

|

1,201,200 |

|

|

|

|

(1) Reflects OTP's 53.9% ownership percentage of jointly owned facility. |

|

|

(2) Reflects OTP's 35.0% ownership percentage of jointly owned facility. |

|

|

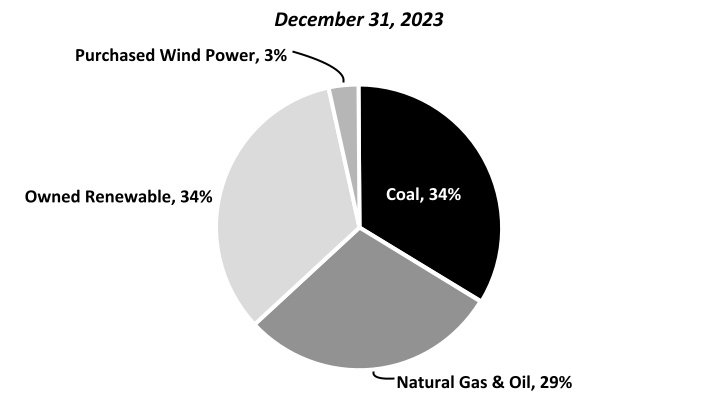

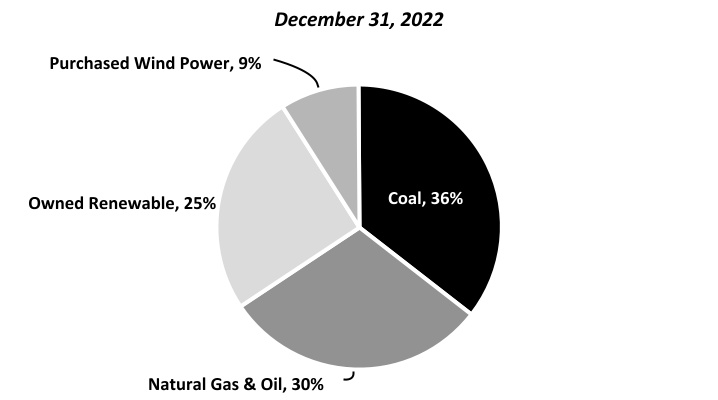

The following charts summarize the percentage of our generating capacity by source, including owned and jointly owned facilities and through power purchase arrangements, as of December 31, 2023 and 2022:

Under Midcontinent Independent System Operator (MISO) requirements, OTP is required to provide sufficient capacity through wholly or jointly owned generating capacity or power purchase agreements to meet its monthly weather-normalized forecast demand, plus a reserve obligation. MISO operates under a seasonal resource adequacy construct in which generation resources are accredited and planning reserve margin requirements are implemented on a seasonal basis. Current planning reserve margin requirements range between 7.4% and 25.5%, depending on the season.

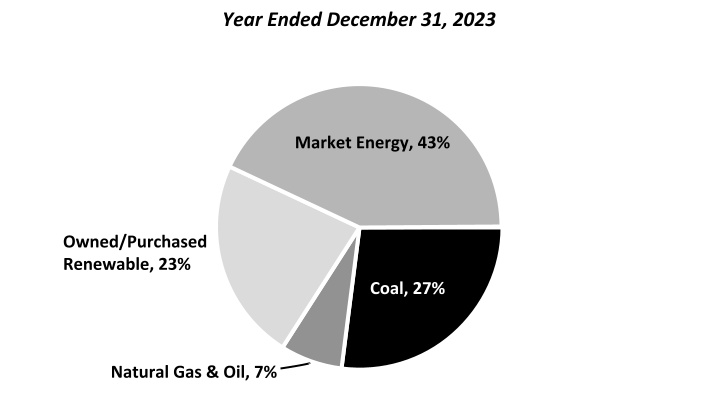

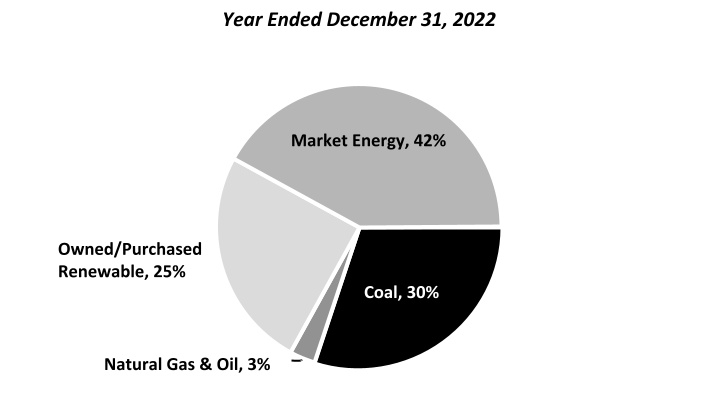

The following charts summarize the percentage of retail kwh sold by source during the years ended December 31, 2023 and 2022:

Capacity Additions

As part of our investment plan to meet our future energy needs, the following projects have been recently undertaken, completed, or acquired:

Ashtabula III Wind Farm is a 62-megawatt (MW) wind farm located in eastern North Dakota. The facility was purchased for approximately $50 million in January 2023. Prior to the purchase of the wind farm assets, we were purchasing the wind-generated electricity from the wind farm pursuant to a power purchase agreement.

Hoot Lake Solar is a 49-MW solar farm constructed on and around our Hoot Lake Plant property in Fergus Falls, Minnesota, with a total cost of approximately $60 million. The facility was placed into commercial operation in August 2023.

Wind Energy Facility Upgrades consisting of the replacement and upgrade of hubs, gearboxes, blades, generators and other components of our Ashtabula, Ashtabula III, Langdon and Luverne wind facilities at a total cost of approximately $230 million. Once complete, we expect the increased energy production from these facilities will be equivalent to an additional 40-MW of generation. We anticipate the repowering of our Langdon facility will be completed in 2024 and the remaining facilities to be completed in 2025. Once complete, the energy production from each of these facilities is eligible for production tax credits (PTCs) over a ten-year period. We expect these projects will lower customer costs through a combination of fuel savings and the tax credit benefits afforded to our customers.

ENERGY TRANSITION

OTP is committed to transitioning to a lower-carbon and increasingly clean energy future, while maintaining affordable and reliable electricity to serve our customers. We have developed the following goals in furtherance of our efforts to support the energy transition:

Own or purchase energy generation that is 55% renewable by 2030.

Reduce carbon emissions from owned generation resources 50% by 2030 from 2005 levels.

Reduce carbon emissions from owned generation resources 97% by 2050 from 2005 levels.

We have based these goals on our December 2023 supplemental Integrated Resource Plan (IRP) filing in Minnesota. While modified from our previously published goals, they reflect current market conditions, including the impact of higher natural gas prices, and higher than originally forecasted dispatch levels of our co-owned, coal-fired power plants.

We have undertaken numerous initiatives to reduce our carbon footprint and mitigate greenhouse gas (GHG) emissions in the process of generating electricity for our customers. Our recent initiatives include retiring the 140-MW coal-fired Hoot Lake Plant, adding the 150-MW Merricourt Wind Energy Center and the 49-MW Hoot Lake Solar facility to our resource mix and sponsoring energy conservation programs. We anticipate our Minnesota retail sales will be 80% carbon free by 2030, in compliance with Minnesota clean energy requirements.

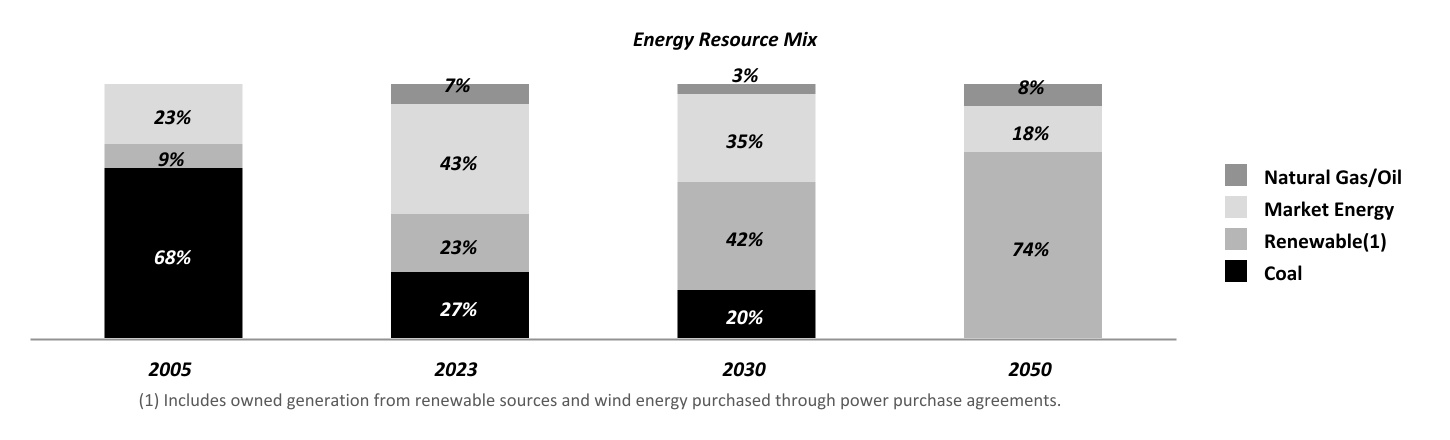

From 2005 through 2023, we have reduced our carbon dioxide (CO2) emissions approximately 39% and increased the amount of renewable generation resources we own or purchase through power purchase agreements by approximately 420-MW. We currently own or contract energy generation that is 37% renewable.

The following chart depicts our energy resource mix, which is the electricity we used to serve our customers in 2005 and 2023, and the projected mix in 2030 and 2050. The amounts include energy generated from owned resources, procured through power purchase agreements and energy purchased in the wholesale market:

RESOURCE MATERIALS

Coal is the principal fuel burned at our jointly owned Big Stone and Coyote Station generating plants. Coyote Station, a mine-mouth facility, burns North Dakota lignite coal. Big Stone Plant burns western subbituminous coal transported by rail. We source coal for our coal-fired power plants through requirements contracts which do not include minimum purchase requirements but do require all coal necessary for the operation of the respective plant to be purchased from the counterparty. Our coal supply contracts for our Big Stone Plant and Coyote Station have expiration dates in 2024 and 2040, respectively.

The supply agreement between the Coyote Station owners, including OTP, and the coal supplier includes provisions requiring the Coyote Station owners to purchase the membership interests and pay off or assume loan and lease obligations of the coal supplier, as well as complete mine closing and post-mining reclamation, in the event of certain early termination events and at the expiration of the coal supply agreement in 2040. See below and Note 1 to our consolidated financial statements included in this report on Form 10-K for additional information.

Coal is transported to Big Stone Plant by rail and is provided under a common carrier rate which includes a mileage-based fuel surcharge.

We purchase natural gas for use at our combustion turbine facilities based on anticipated short-term resource needs. We procure natural gas from multiple vendors at spot prices in a liquid market primarily under firm delivery contracts.

TRANSMISSION AND DISTRIBUTION

Our transmission and distribution assets deliver energy from energy generation sources to our customers. In addition, we earn revenue from the transmission of electricity over our wholly or jointly owned transmission assets for others under approved rate tariffs. As of December 31, 2023, we were the sole or joint owner of approximately 14,000 miles of transmission and distribution lines.

Midcontinent Independent System Operator

MISO is an independent, non-profit organization that operates the transmission facilities owned by other entities, including OTP, within its regional jurisdiction and administers energy and generation capacity markets. MISO has operational control of our transmission facilities above 100 kilovolts (kV). MISO seeks to optimize the efficiency of the interconnected system, provide solutions to regional planning needs and minimize risk to reliability through its security coordination, long-term regional planning, market monitoring, scheduling and tariff administration functions.

Transmission Additions

In 2022, MISO approved several projects within the first tranche of its long-range transmission plan, which includes two new 345 kV transmission projects. OTP will have a varying level of ownership interest in these projects, which will be completed over several years and are at various stages of planning and development:

Jamestown-Ellendale includes the construction of a new 345 kV transmission line in southeastern North Dakota spanning approximately 95 miles from Jamestown, North Dakota to Ellendale, North Dakota. This project is in the initial stages of planning and development. This jointly owned project is expected to be completed in 2028 and our capital investment is estimated to be approximately $230 million.

Big Stone South-Alexandria-Big Oaks includes the construction of a new 345 kV transmission line in eastern South Dakota and western Minnesota and the addition of a second circuit to an existing 345 kV line in central Minnesota. The new transmission line will span approximately 100 miles between Big Stone, South Dakota and Alexandria, Minnesota. A second circuit will be added to the existing transmission line spanning from Alexandria, Minnesota to Big Oaks, Minnesota. This project is in the initial stages of planning and development. This jointly owned project is expected to be completed in 2031 and our capital investment is estimated to be approximately $190 million.

SEASONALITY

Electricity demand is affected by seasonal weather differences, with peak demand occurring in the summer and winter months. As a result, our Electric segment operating results regularly fluctuate on a seasonal basis. In addition, fluctuations in electricity demand within the same season but between years can impact our operating results.

We monitor the level of heating and cooling degree days in a period to assess the impact of weather-related effects on our operating results between periods.

PUBLIC UTILITY REGULATION

OTP is subject to regulation of rates and other matters in each of the three states in which it operates and by the federal government for, among other matters, the interstate transmission of electricity. OTP operates under approved retail electric tariff rates in all three states it serves. Tariff rates are designed to recover plant investments, a return on those investments, and operating costs. In addition to determining rate tariffs, state regulatory commissions also authorize return on equity (ROE), capital structure, and depreciation rates of our plant investments. Decisions by our regulators significantly impact our operating results, financial position, and cash flows.

Below is a summary of the regulatory agencies with jurisdiction of electric rates over OTP covered by each regulatory agency:

|

|

|

|

|

|

|

|

|

|

|

| Regulatory |

|

|

|

|

| Agency |

|

|

|

Areas of Regulation |

|

|

|

|

|

Minnesota Public Utilities Commission

(MPUC)

|

|

|

|

Retail rates, issuance of securities, depreciation rates, capital structure, public utility services, construction of major facilities, establishment of exclusive assigned service areas, contracts with subsidiaries and other affiliated interests and other matters.

Selection or designation of sites for new generating plants (50,000 kW or more) and routes for transmission lines (100 kV or more).

Review and approval of fifteen-year Integrated Resource Plan.

|

North Dakota Public Service Commission

(NDPSC) |

|

|

|