Document

BALLARD POWER SYSTEMS INC.

ANNUAL INFORMATION FORM

For the year ended December 31, 2023

Dated March 8, 2024

TABLE OF CONTENTS

This Annual Information Form and the documents incorporated by reference herein contain forward-looking statements that are based on the beliefs of management and reflect our current expectations as contemplated under the safe harbor provisions of Section 21E of the United States Securities Exchange Act of 1934, as amended. When used in this Annual Information Form, the words “estimate”, “project”, “believe”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may”, “could”, “should”, “will”, the negatives of these words or other variations thereof and comparable terminology are intended to identify forward-looking statements. Such statements include, but are not limited to, statements with respect to our objectives, goals, liquidity, sources and uses of capital, outlook, strategy, order backlog, order book of expected deliveries, future product roadmap costs and selling prices, future product sales, future production capacities and volumes, the markets for our products, expenses / costs, contributions and cash requirements to and from joint venture operations and research and development activities, as well as statements with respect to our beliefs, plans, objectives, expectations, anticipations, estimates and intentions. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict. In particular, these forward-looking statements are based on certain factors and assumptions relating to our expectations with respect to new and existing customer and partner relationships, the generation of new sales, producing, delivering, and selling the expected product and service volumes at the expected prices and controlling our costs. They are also based on a variety of general factors and assumptions including, but not limited to, our expectations regarding technology and product development efforts, manufacturing capacity and cost, product and service pricing, market demand, and the availability and prices of raw materials, labour, and supplies. These assumptions have been derived from information available to the Company including information obtained by the Company from third parties. These assumptions may prove to be incorrect in whole or in part. In addition, actual results may differ materially from those expressed, implied, or forecasted in such forward-looking statements. Factors that could cause our actual results or outcomes to differ materially from the results expressed, implied or forecasted in such forward-looking statements include, but are not limited to: challenges or delays in our technology and product development activities; changes in the availability or price of raw materials, labour, supplies and shipping; costs of integration, and the integration failing to achieve the expected benefits of the transaction; our ability to attract and retain business partners, suppliers, employees and customers; our ability to extract value from joint venture operations; global economic trends and geopolitical risks (such as conflicts in Ukraine and the Middle East), including changes in the rates of investment, inflation or economic growth in our key markets, or an escalation of trade tensions such as those between the U.S. and China; investment in hydrogen fueling infrastructure and competitive pricing of hydrogen fuel; the relative strength of the value proposition that we offer our customers with our products or services; changes in competitive technologies, including internal combustion engine, battery and fuel cell technologies;

challenges or delays in our technology and product development activities; changes in our customers’ requirements, the competitive environment and/or related market conditions; product safety, liability or warranty issues; warranty claims, product performance guarantees, or indemnification claims; changes in product or service pricing or cost; market developments or customer actions that may affect levels of demand and/or the financial performance of the major industries, regions and customers we serve, such as secular, cyclical and competitive pressures in the bus, truck, rail, marine and stationary sectors; the rate of mass adoption of our products or related ecosystem, including the availability of cost-effective hydrogen; cybersecurity threats; our ability to protect our intellectual property; climate risk; changing government or environmental regulations, including subsidies or incentives associated with the adoption of clean energy products, including hydrogen and fuel cells; currency fluctuations, including the magnitude of the rate of change of the Canadian dollar versus the U.S. dollar; our access to funding and our ability to provide the capital required for product development, operations and marketing efforts, working capital requirements, and joint venture capital contributions; changes in U.S. tax laws and tax status related to “passive foreign investment company” designation; the severity, magnitude and duration of the on-going COVID-19 pandemic, including impacts of the pandemic and of businesses’ and governments’ responses to the pandemic on our operations, personnel and joint venture operations, and on commercial activity and demand across our and our customers’, partners’ and joint venture businesses, and on global supply chains; potential merger and acquisition activities, including risks related to integration, loss of key personnel and disruptions to operations; and the general assumption that none of the risks noted in the “Risk Factors” section of this Annual Information Form will materialize.

The forward-looking statements contained in this Annual Information Form speak only as of the date of this Annual Information Form. Except as required by applicable legislation, Ballard does not undertake any obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this Annual Information Form, including the occurrence of unanticipated events.

In this Annual Information Form, references to “Corporation”, “Company”, “Ballard”, “we”, “us” and “our” refer to Ballard Power Systems Inc. and, as applicable, its subsidiaries. All dollar amounts are in United States dollars unless otherwise indicated. Canadian dollars are indicated by the symbol “C$”, and euros by the symbol “€”.

Except where otherwise indicated, all information presented is as of December 31, 2023.

CORPORATE STRUCTURE

Name, Address and Incorporation

Ballard was incorporated on November 12, 2008 under the Canada Business Corporations Act (Canada), under the name “7076991 Canada Inc.” Ballard changed its name to “Ballard Power Systems Inc.” on December 31, 2008. On August 24, 2016, Ballard continued into British Columbia under the Business Corporations Act (British Columbia). Ballard’s head office is located at 9000 Glenlyon Parkway, Burnaby, British Columbia, Canada V5J 5J8, and its registered office is located at Suite 1700, 666 Burrard Street, Vancouver, British Columbia, Canada V6C 2X8.

Previously, Ballard Power Systems Inc. was a British Columbia company incorporated on May 30, 1989. The original predecessor to Ballard was founded in 1979 under the name Ballard Research Inc. to conduct research and development on high-energy lithium batteries. In the course of investigating environmentally clean energy systems with commercial potential, we began to develop fuel cells and have been developing fuel cell products since 1983.

Our Vision, Mission and Values

Our vision is to deliver fuel cell power for a sustainable planet. Our mission is to use our fuel cell expertise to deliver valuable and innovative solutions to our customers globally, create rewarding opportunities for our team, provide extraordinary value to our shareholders and power the hydrogen society.

Our values represent our core beliefs and underpin how we carry on our business. In addition to our value pillars of safety and innovation, we have five key cultural values:

•Listen and Deliver – We listen to our customers, understand their business and deliver innovative and valuable solutions for lasting partnerships;

•Quality Always – We deliver quality in everything we do;

•Inspire Excellence – We live with integrity, passion, urgency, agility and humility;

•Row Together – We achieve success through respect, trust and collaboration; and

•Own It – We step up, take ownership for our results and trust others to do the same.

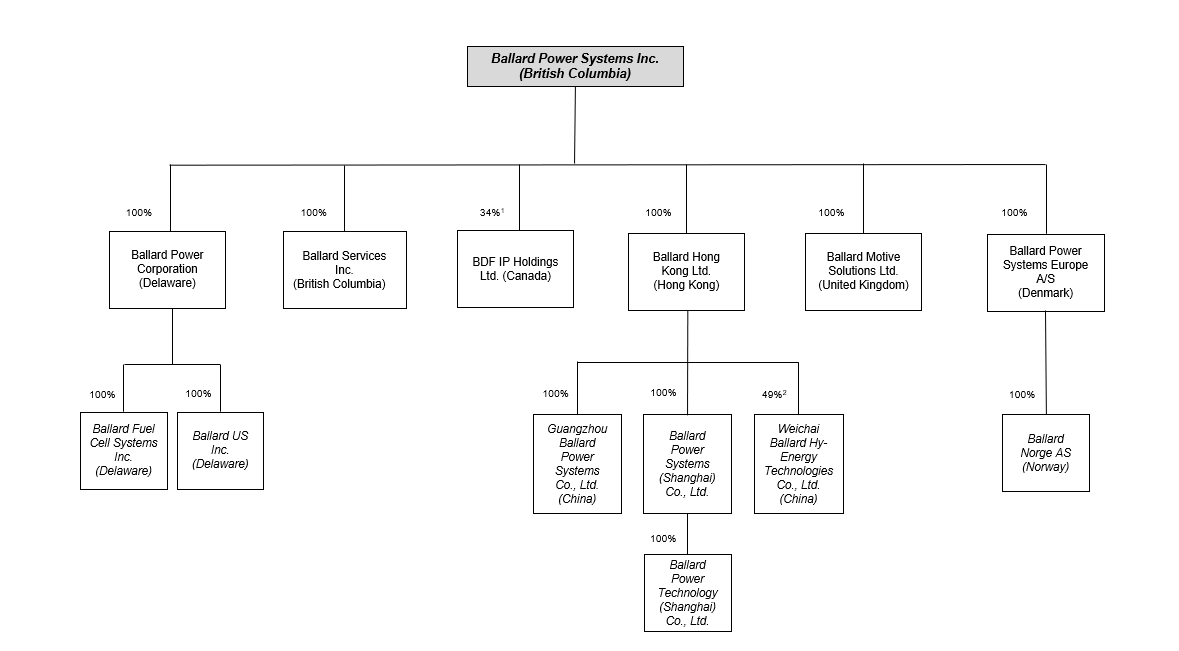

Intercorporate Relationships

We have eleven subsidiaries and affiliates: (i) Ballard Power Corporation, a Delaware corporation that is a holding company; (ii) Ballard Fuel Cell Systems, Inc., a Delaware corporation that does certain development and manufacturing work, and provides certain services to customers; (iii) Ballard US Inc.

(formerly Ballard Unmanned Systems Inc.), a Delaware corporation that is a dormant holding company; (iv) Ballard Power Systems Europe A/S (formerly Dantherm Power A/S) (“Ballard Denmark”), a Danish corporation that provides certain sales, assembly, manufacturing, commissioning, research and development, engineering services and after-sales service; (v) Ballard Norge AS, a Norwegian company that provides certain sales and after-sales services; (vi) BDF IP Holdings Ltd., a Canadian corporation that holds certain intellectual property assets; (vii) Ballard Services Inc., a British Columbia company that provides certain engineering services; (viii) Ballard Hong Kong Limited, a holding company for certain assets in China; (ix) Guangzhou Ballard Power Systems Co., Ltd., a Chinese wholly foreign-owned entity, that provides certain sales, quality, supply chain and after-sales services; (x) Ballard Power Systems (China) Co. Ltd., a Chinese wholly foreign-owned entity that is a holding company; and (xi) Ballard Motive Solutions Ltd. (formerly Arcola Energy Ltd.) (“BMS”), a United Kingdom company which was restructured in the fourth quarter of 2023 and discontinued.

We have a non-controlling 49% interest in Weichai Ballard Hy-Energy Technologies Co., Ltd. (“Weichai-Ballard JV”), located in Weifang, Shandong Province, China, with Weichai Power Co., Ltd. (“Weichai”) holding a 51% interest. The Weichai-Ballard JV’s business is to manufacture Ballard’s FCgen®-LCS fuel cell bipolar plates, stacks and power modules for bus, commercial truck and forklift applications with certain exclusive rights in China.

The following chart shows these subsidiaries and affiliates, their respective jurisdictions of incorporation and our percentage of share ownership in each of them, all as of March 8, 2024:

Notes:

1. Ballard holds 100% of the non-voting, participating shares of BDF IP Holdings Ltd. and 34% of the voting, non-participating shares, along with each of Mercedes-Benz AG (33%) and Ford Motor Company (33%).

2. Ballard indirectly holds a 49% interest in Weichai Ballard Hy-Energy Technologies Co., Ltd. together with Weichai Power Co., Ltd. (51%).

Recent History

Over the past three years, we have continued to focus on building and commercializing our proton exchange membrane (“PEM”) fuel cell business for select mobility and stationary power applications. The following are key developments during that period:

15 MW order for stationary power products in Europe

On March 5, 2024, we announced an order for 15 megawatts (MW) of fuel cell systems from a UK-based company specializing in renewable off-grid power generation. We expect to deliver 150 FCmove®-HD+ 100 kW systems beginning in late 2024 and continuing through 2025.

The current order of 15 MW of fuel cell systems follows prior cumulative orders for roughly 5 MW of fuel cell systems from this customer. The purchase order is the first order under a new multi-year supply agreement.

The agreement also provides the customer an option to purchase up to an additional 296 systems by March 2026, which, if fully exercised, would bring the total number of systems ordered to 446.

Long-Term Supply Agreement with NFI Group Inc. (“NFI”) and purchase order for 100 fuel cell engines for bus deployments in North America

On January 3, 2024, we announced the signing of a new Long-Term Supply Agreement (“LTSA”) with NFI Group, a leading independent bus and coach manufacturer and a leader in electric mass mobility solutions in North America and Europe. The LTSA marks a new phase in the established partnership between Ballard and NFI, focused on deployment-level volumes of fuel cell powered buses across all of NFI’s major brands including New Flyer, Alexander Dennis, and MCI.

As part of the LTSA, NFI has placed its first purchase order under the LTSA for a minimum of 100 FCmove®-HD+ modules for planned delivery in 2024. The modules will primarily be produced in our Bend, Oregon facility with Buy America compliance, and will power New Flyer’s next generation Xcelsior CHARGE FC™ hydrogen fuel cell buses for deployment across the US and Canada, including California, Manitoba, Nevada, New York, Ohio, and Pennsylvania.

Guangdong Synergy Ballard Hydrogen Power Co., Ltd. (“Synergy Ballard JVCo”)

During 2017, Synergy Ballard JVCo commenced operations utilizing Ballard’s FCveloCity®-9SSL fuel cell stack technology in the city of Yunfu in China’s Guangdong Province. Ballard held a non-controlling 10% interest in the joint venture, Synergy Ballard JVCo, together with Guangdong Nation Synergy Hydrogen Power Technology Co., Ltd. (a member of the “Synergy Group”) who held a 90% interest. Ballard contributed $1.0 million for its 10% interest in Synergy Ballard JVCo. The fuel cell stacks manufactured by Synergy Ballard JVCo were expected to be used primarily in fuel cell engines assembled in China to provide propulsion power for zero-emission fuel cell electric buses and commercial vehicles in China.

Synergy Ballard JVCo had an exclusive license to manufacture and sell FCveloCity®-9SSL stacks in China until September 30, 2026.

On October 18, 2023, we completed an equity transfer agreement to sell our 10% interest (fair valued at nil) in Synergy Ballard JVCo to the Synergy Group for nominal consideration. As we no longer have significant influence over the operating activities of Synergy Ballard JVCo, the equity method of accounting for this investment was discontinued as of September 30, 2023. Ballard, Synergy Group and Synergy Ballard JVCo signed mutual releases and the exclusive license to Synergy Ballard JVCo was terminated.

LOI with Ford Trucks for fuel cell powered heavy-duty trucks & initial order

On August 3, 2023, we announced the signing of a letter of intent (“LOI”) with Ford Trucks to supply a fuel cell system as part of the development of a hydrogen fuel cell powered vehicle prototype. We also received an initial purchase order for 2 FCmove™-XD 120 kW fuel cell engines that were delivered by Ballard to Ford Trucks in the fourth quarter of 2023.

Ford Trucks, the global brand of Ford Otosan, plans to develop a FCEV F-MAX as part of the project. The 120 kW FCmove™-XD fuel cell engines will be integrated into Ford Trucks’ F-MAX 44-ton long-haul tractor truck. Ford Trucks plans to build and assemble the fuel cell-powered F-MAX in Turkey and aims to commence European Ten-T corridor demonstrations in 2025 as part of the European Union’s Horizon Europe ZEFES (Zero Emission Freight EcoSystem) project goals. As per the LOI, upon the successful completion of the development program and subject to certain other conditions, Ballard may be named as the preferred supplier for the serial production of the fuel cell-powered F-MAX.

Ballard Fuel Cells to Power CPKC Hydrogen Locomotive Program

On March 9, 2021, we announced that Canadian Pacific (“CP”), now Canadian Pacific Kansas City (“CPKC”) will employ Ballard fuel cell modules for CP’s pioneering Hydrogen Locomotive Program to develop North America’s first hydrogen-powered line-haul freight locomotive by retrofitting a formerly diesel-powered locomotive with Ballard’s 200 kW hydrogen fuel cell modules.

On January 19, 2022, we announced receipt of an order for six of an additional eight fuel cell modules to support CP’s expansion of the Hydrogen Locomotive Program. In total, Ballard will provide a total of 14 fuel cell modules, each module with a rated power output of 200 kW, to support this program.

On July 27, 2023, we announced an order for fuel cell engines from CPKC. These eighteen, 200 kW fuel cell engines were delivered in 2023 and will support the expansion of CPKC’s Hydrogen Locomotive Program.

On November 6, 2023, we announced an order for 2.4 MW of additional fuel cell engines from CPKC. These twelve, 200 kW fuel cell engines are planned for delivery in 2023 and will support the development of CPKC’s additional hydrogen-powered locomotives planned for regular switching and local freight service applications in Alberta.

Over the past two years, Ballard has supplied CPKC with 38 fuel cell engines for use in its hydrogen locomotives, with combined fuel cell power of 7.6 MW. The additional locomotives are expected to enter service in late 2024.

Order from First Mode for 30 additional hydrogen fuels for diesel-free mining trucks

On March 1, 2023, we announced a purchase order to supply First Mode with 30 hydrogen fuel cell modules – totaling 3 MW – to power several hybrid hydrogen and battery ultra-class mining haul trucks. This is the equivalent of approximately 4,000 horsepower.

The 30 Ballard hydrogen fuel cell modules are to be integrated into clean energy powerplants built in Seattle, Washington and installed into ultra-class haul trucks to be operated at First Mode’s Proving Grounds in Centralia, Washington. These trucks are estimated to save 2,600 tons of diesel fuel each year.

Order from CrossWind for stationary power project

On January 23, 2023, we announced an order for a fuel cell system from CrossWind, a joint venture between Shell and Eneco. The Ballard fuel cell system will be integrated in the Hollandse Kust Noord offshore wind project. The Hollandse Kust Noord offshore wind project, located off the coast of the Netherlands, will have a capacity of 759 MW to generate at least 3.3 TWh per year. Ballard will supply a containerized fuel cell power solution with a peak power capacity of 1 MW, with delivery expected in 2024.

Update on global manufacturing strategy

On September 30, 2022, we announced our strategy ‘local for local’ where we summarized our plan to deepen our global manufacturing footprint in Europe, the United States, and China to support expected global market demand growth through 2030. As part of this strategy, we entered into an investment agreement with the Government of Anting in Shanghai’s Jiading District to establish our new China headquarters, membrane electrode assembly (“MEA”) manufacturing facility, and a research and development (“R&D”) center, at a site strategically located at the Jiading Hydrogen Port, located in one of China’s leading automotive industry clusters, with the plan to invest approximately $130 million over the next three years.

However, as a result of the increasingly constructive hydrogen policy landscape and increased market activity in the U.S. and Europe; and given the continued hydrogen and fuel cell policy uncertainties and market delays in China, as well as geopolitical risks, we decided to suspend our MEA localization plan in China while we continue with a comparative analysis on manufacturing capacity expansion options and possible sequencing prioritization in the U.S. and/or European markets. We expect to conclude this review in 2024.

Ballard signs contract with Stadler to supply fuel cell engines to power first hydrogen train in United States

On September 26, 2022, we announced an order from Stadler Rail AG (“Stadler”), a leading manufacturer of rolling stock, for the supply of six 100 kW FCmoveTM-HD+ fuel cell engines to power the first hydrogen train in the United States.

The contract to provide the hydrogen-powered train was awarded to Stadler by San Bernardino County Transportation Authority (SBCTA), with the option of additional trains in the future. The train is expected to be in service in San Bernardino, California in 2024 and is expected to seat over 100 passengers.

Ballard to power India’s first hydrogen trains

On September 6, 2022, we announced a fuel cell module order from Medha Servo Drives (“Medha”), a leading rail system integrator, who has been contracted by Indian Railways to develop India’s first hydrogen powered trains. The two retrofitted diesel-electric commuter trains will integrate 8 units of 100 kW FCmoveTM-HD+, Ballard’s latest fuel cell technology, which offers improved efficiency and power density than previous module generations. The contract to provide the hydrogen-powered trains was awarded to Medha as a first step in Indian Railways’ path to achieve their net zero ambitions. The fuel cell modules were shipped in 2023, with trains scheduled to go into service in 2024, with potential for additional retrofits following the initial deployment.

Ballard partners with Wisdom Motor Company

On May 9, 2022, we announced a strategic collaboration with Wisdom (Fujian) Motor Company Limited (“Wisdom”), Templewater Group (“Templewater”), and Bravo Transport Services Limited (“Bravo”) to accelerate the adoption of commercial fuel cell electric vehicles (“FCEVs”) in Hong Kong.

Templewater, an alternative asset management firm and parent company of Bravo, Hong Kong island’s largest transit operator, together with Ballard, co-invested in a Series A funding for Wisdom, a technology company that designs and manufactures zero emission commercial vehicles. The Series A funds (including Ballard’s $10.0 million equity ownership contribution in the second quarter of 2022) will support Wisdom’s organizational growth, R&D, and manufacturing platforms, including the expansion and development of its hydrogen zero emission fuel cell truck, bus, and specialty vehicle offerings for international markets.

Wisdom’s hydrogen vehicle product lines are expected to exclusively deploy Ballard’s world leading PEM fuel cell technology, with modules supplied by the Weichai-Ballard JV in China. On August 8, 2022, Ballard entered into a joint development agreement with Wisdom to advance the integration and optimization of its fuel cell electric powertrain designs and control strategies.

Ballard granted Type Approval by DNV for the FCwaveTM marine fuel cell module

On April 6, 2022, we announced the receipt of Europe’s industry first Type Approval by DNV, one of the world’s leading classification and certification bodies, for our marine fuel cell module FCwaveTM. The Type Approval marks an important step in commercializing Ballard’s fuel cell technology for marine applications and is key to including fuel cells as part of zero- emission solutions for the marine industry.

The FCwaveTM module is a flexible solution that can support the energy needs of various vessel types as well as onshore power. The scalable 200 kW power module offers a plug-and-play replacement for conventional diesel engines. The Type Approval certification confirms the design meets certain safety, functional, design and documentation requirements necessary for global marine commercialization.

Project with Adani for Hydrogen Fuel Cells in India

On February 22, 2022, we announced the signing of a non-binding Memorandum of Understanding (“MOU”) with the Adani Group (“Adani Group”) to evaluate a joint investment case for the commercialization of fuel cells in various mobility and industrial applications in India.

On January 17, 2023, we announced the signing of an agreement to launch a pilot project to develop a hydrogen fuel cell electric truck (“FCET”) for mining logistics and transportation with Adani Enterprises Limited (“AEL”), part of the diversified Adani portfolio of companies, and Ashok Leyland.

This collaboration marks Asia’s first planned hydrogen powered mining truck. The demonstration project will be led by AEL, a company focused on both mining operations and developing green hydrogen projects for sourcing, transporting, and building out hydrogen refueling infrastructure. Ballard, an industry leading PEM fuel cell engine manufacturer, will supply the FCmoveTM fuel cell engine for the hydrogen truck and Ashok Leyland, one of the largest manufacturers of buses in the world, will provide the vehicle platform and technical support. The FCET launched in India in 2023.

Ballard fuel cells installed onboard the world’s first liquid hydrogen-powered ferry

On February 2, 2022, we announced the delivery of two, 200 kilowatt (kW) FCwaveTM modules to Norled A/S, one of Norway’s largest ferry and express boat operators. The fuel cell modules power the world’s first liquid hydrogen-powered ferry, the MF Hydra.

Orders for 31 fuel cell engines to a leading global construction, electric power & off-road equipment manufacturer

On January 13, 2022, we announced orders for 31 modules, totaling 3 MW of hydrogen fuel cell power, to a leading global construction, electric power, and off-road equipment manufacturer for testing and deployment in a variety of end-use applications. The modules were delivered, and have been undergoing various testing programs.

Acquisition of Arcola

On November 11, 2021, we announced the acquisition of Arcola Energy Ltd. (“Arcola”) (now BMS), a UK-based systems engineering company, specializing in hydrogen fuel cell powertrain and vehicle systems integration.

Ballard acquired Arcola for total consideration of up to US$40 million, including 337,353 Ballard shares (with an approximate valuation of US$6 million at acquisition) that vest over two years, and up to US$34 million in upfront and earn-out cash consideration based on the achievement of certain performance conditions over a two-year period.

During the fourth quarter of 2022, we completed a post-acquisition restructuring of the operations at BMS and recognized impairment charges on intangible assets of approximately $13 million and restructuring related operating expenses of approximately $5 million which included contract exit and modification costs, grant adjustment charges, personnel change costs, and legal and advisory costs, net of expected recoveries. Pursuant to this restructuring of operations, it was agreed to reduce the earn-out consideration by approximately $10 million which resulted in a corresponding recovery on settlement of contingent consideration payable.

During the fourth quarter of 2023, we completed a restructuring of operations at BMS and operations have been effectively closed and discontinued.

Infrastructure Funds

In 2021, we invested in two hydrogen infrastructure and growth equity funds whereby we acquired a 12% interest in the HyCap Fund I SCSP (“HyCap”), a special limited partnership registered in Luxembourg; and a 1% interest in the Clean H2 Infra Fund (“Clean H2”), a special limited partnership registered in France.

HyCap is a newly created hydrogen infrastructure and growth equity fund. HyCap is to invest in a combination of hydrogen infrastructure projects and investments in companies along the hydrogen value chain. We have committed to investing £25.0 million (including £11 million invested as of December 31, 2023) into HyCap.

Clean H2 is another newly created hydrogen infrastructure and growth equity fund. Clean H2 is to invest in a combination of hydrogen infrastructure projects and investments in companies along the hydrogen value chain. We have committed to investing €30.0 million (including €4.7 million invested as of December 31, 2023) into Clean H2.

During the first quarter of 2024, we invested in a decarbonization and climate technology and growth equity fund by acquiring a 2% interest in Templewater Decarbonization I, L.P., a limited partnership registered in Cayman Islands, for an initial investment of $0.5 million on a total commitment of $1.0 million.

Ballard and Forsee Power SA (“Forsee Power”) enter Long-Term Strategic Partnership to Develop & Commercialize Integrated Fuel Cell and Battery Solutions for Heavy-Duty Hydrogen Mobility

On October 18, 2021, we announced the signing of an MOU for a strategic partnership with Forsee Power to develop fully integrated fuel cell and battery solutions, optimized for performance, cost and installation for heavy-duty hydrogen mobility applications.

As part of the strategic relationship, in October 2021, Ballard participated as a cornerstone lead investor in Forsee Power’s initial public offering on Euronext in Paris, France. We made a contribution of €37.7 million (approximately $43.8 million), resulting in an ownership interest of 9.77% in Forsee Power at that time. In connection with our investment, Ballard has the right to appoint a nominee to the Forsee Power board of directors. Ballard appointed a nominee effective as of the closing of the initial public offering.

The MOU was superseded by a Collaboration Agreement between the parties, dated December 14, 2022, pursuant to which the parties agreed to jointly approach new and existing customers with an integrated fuel cell and battery solution. Both companies have started to promote integrated solutions to a number of customers.

Ballard and Quantron AG Announce a Strategic Partnership for the Development of Hydrogen Fuel Cell Electric Trucks

On September 7, 2021, we announced a strategic partnership with Quantron AG (“Quantron”) expected to accelerate deployment and market adoption of fuel cell technologies. Initial collaboration will focus on the integration of Ballard’s FCmove™ family of heavy-duty fuel cell power modules into Quantron’s electric drivetrain and vehicles.

On September 19, 2022, we announced a minority equity investment in Quantron. As part of Quantron’s financing round of up to €50 million, Ballard’s investment proceeds (€5 million was contributed in the fourth quarter of 2022), are to be used by Quantron to develop their truck fuel cell vehicle platforms, under the terms of a Joint Development Agreement. Ballard is to be the exclusive fuel cell supplier to Quantron for these platforms.

In connection with our investment, Ballard has the right to appoint a nominee to the Quantron AG board of directors.

In 2023, Ballard made an additional investment in Quantron of €3 million after the satisfaction of certain investment conditions.

As part of the strategic partnership, Quantron committed to purchase 140 FCmove™ modules totaling approximately 17 MW, with an option to purchase an additional 50 units. Subsequent to the initial order, Quantron committed to purchase an additional 72 FCmove™ modules totaling approximately 3 MW. All of the ordered 212 fuel cell modules were expected to be delivered in 2023 and 2024. While a small number of modules were delivered in 2023, further deliveries have been postponed due to financing and related vehicle program delays at Quantron.

The zero-emission fuel cell electric vehicle platforms developed by Quantron are to integrate Ballard fuel cell products for various truck applications in Europe.

Ballard and Linamar Form Strategic Alliance to Develop Fuel Cell Solutions for Light-Duty Vehicles

On May 3, 2021, we announced the formation of a strategic alliance with Linamar Corporation (“Linamar”) for the co-development and sale of fuel cell powertrains and components for class 1 and 2 vehicles, weighing up to 5 tons, initially in North America and Europe.

On May 9, 2022, Ballard announced with Linamar the unveiling of its concept hydrogen fuel cell powered class 2 truck chassis with FCmove™ product. The technology demonstration platform was showcased at the ACT Expo displayed in a RAM 2500 truck chassis.

Ballard and Linamar are currently working on development of a new fuel cell commercial vehicle platform to be announced in 2024.

Orders for Fuel Cell Modules to Power Buses

On November 4, 2021, we announced orders for a total of 40 FCmoveTM-HD (70kW) modules for planned deployment in hydrogen fuel cell electric buses (“FCEBs”) across Europe in 2022. As of March 2023, the announced FCmoveTM-HD sales have been deployed in FCEBs across Europe.

On June 22, 2021, we announced a follow-on purchase order from New Flyer for 20 fuel cell modules to power 20 New Flyer Xcelsior® model FCEBs, planned for deployment with Alameda-Contra Costa Transit District (AC Transit) in Oakland, California.

On March 9, 2021, we announced follow-on purchase orders from Wrightbus for a total of 50 fuel cell modules to power FCEBs planned for deployment in a number of UK cities.

Ballard Receives Orders to Power Siemens Mireo Plus H Passenger Trains and signs LOI for up to an additional 200 modules over the next six years

On July 15, 2021, we announced a purchase order for two of our 200 kW fuel cell modules from Siemens Mobility GmbH to power a 2-car Mireo Plus H passenger train through a trial operation in Bavaria, Germany.

On September 22, 2022, we announced an order for 14 x 200 kW fuel cell modules from Siemens Mobility GmbH, to power a fleet of seven Mireo Plus H passenger trains. Delivery of The 14 fuel cell modules were delivered 2023 with the fleet planned to be in service in Berlin-Brandenburg region in late 2024.

In addition to the initial order of 14 fuel cell modules, Siemens Mobility also signed a letter of intent with Ballard for the supply of 200 fuel cell modules totaling 40 MW over the next six years, including a firm commitment on 100 of the fuel cell modules totaling 20 MW. The modules will be used for Siemen’s Mireo Plus H trains.

February 2021 Bought Deal Offering of Common Shares

On February 23, 2021, we announced the closing of a bought deal offering of 14,870,000 common shares of Ballard at a price of $37.00 per common share for gross proceeds of $550,190,000.

Ballard and AUDI Sign Agreements Regarding Use of the High-Power Density Fuel Cell Stack for Vehicle Propulsion

As part of the planned completion of the AUDI program, on October 29, 2020, we announced that we had signed definitive agreements – in the form of an amendment to the existing Technology Development Agreement and a Patent License Agreement – with AUDI AG (“AUDI”) expanding Ballard’s right to use the FCgen®-HPS product, a high-performance, zero-emission, PEM fuel cell stack in all applications, including commercial trucks and passenger cars. The amendments allowed AUDI to reduce the size of the remaining Technology Solutions program to the lower end of the range previously disclosed, and in return Ballard acquired expanded rights to use the FCgen®-HPS product, subject to certain royalty obligations. The FCgen®-HPS fuel cell stack provides propulsion for a range of Light-, Medium- and Heavy-Duty vehicles with a high volumetric power density of 4.3 kilowatts per liter (4.3 kW/L).

Ballard and MAHLE to Collaborate on Fuel Cell Propulsion Systems for Heavy- and Medium-Duty Trucks

On September 28, 2020, we announced an agreement to collaborate with MAHLE International GmbH (“MAHLE”), a leading international development partner and Tier 1 supplier to the commercial vehicle and automotive industry, on the development of zero-emission fuel cell systems to provide primary propulsion power in various classes of commercial trucks. The definitive agreement defining the collaboration was entered in October 2020.

During the initial development phase, Ballard has prime responsibility for fuel cell system design, while MAHLE’s scope of responsibility includes some of the balance-of-plant components, thermal management and power electronics development and testing.

Solaris Bus & Coach S.A. Orders

On April 27, 2020, we announced a purchase order from Solaris Bus & Coach S.A. (“Solaris”), a leading European bus and trolleybus manufacturer headquartered in Bolechowo, Poland, for 20 of Ballard’s new 70 kW heavy-duty FCmove™-HD fuel cell modules. These modules will power 20 Solaris Urbino 12 hydrogen buses planned for deployment The Netherlands, under the Joint Initiative For Hydrogen Vehicles Across Europe (“JIVE 2”) funding program. The buses will be operated by Connexxion, which provides transport services for South Holland province.

On March 12, 2020, we announced a purchase order from Solaris for 25 70 kW heavy-duty FCmove™-HD fuel cell modules. These 25 modules will power 15 Solaris Urbino 12 hydrogen buses planned for deployment in Cologne, Germany and 10 Urbino 12 hydrogen buses planned for deployment in Wuppertal, Germany, all under the JIVE 2 funding program.

On November 17, 2022, we announced another purchase order from Solaris for a further 25 70 kW heavy-duty FCmove™-HD fuel cell modules. These modules will be installed in Solaris’ Urbino 12 hydrogen buses for deployment to Polish public transport operator MPK Poznań and were delivered in the second half of 2023. The buses are to be partially funded by the National Fund for Environmental Protection and Water Management’s Green Public Transport program. MPK Poznań requires 30% of its fleet to be zero-emission by 2028. These 25 hydrogen fuel cell buses will increase its zero-emission fleet from 18% to 25%.

On October 10, 2023, we announced multiple purchase orders totaling 177 hydrogen fuel cell engines from Solaris. Ballard started deliveries of these fuel cells in 2023 and we expect t the remainder to ship in 2024 and 2025. The orders include the supply of fuel cell engines to support the largest announced deployment of a fleet of fuel cell city buses in Europe, with 127 Solaris fuel cell buses to be deployed in Bologna, Italy. Ballard also received orders for a further 50 modules to power Solaris fuel cell buses in Germany and Italy.

On November 6, 2023 we announced multiple purchase orders totaling 62 hydrogen fuel cells engines from Solaris. The hydrogen fuel cell engines will power buses in Germany and Poland. The number of engines ordered by Solaris year-to-date is now 365, representing substantial growth over the close to 200 fuel cell city buses that Solaris has deployed with customers in Europe to date.

Ballard and HDF Energy Sign Development Agreement for Multi-Megawatt Fuel Cell Systems

On December 9, 2019, we signed a Product Development Agreement with Hydrogène de France (“HDF Energy”) for the development and integration of a multi-megawatt (“MW”) scale PEM fuel cell system into HDF Energy’s Renewstable® power plant designed for stationary power applications.

HDF Energy’s Renewstable® power plant is a multi-MW baseload system enabling large-scale storage of intermittent renewable wind or solar energy in the form of hydrogen – through the process of electrolysis – as well as electricity generation using that hydrogen feedstock together with a fuel cell system.

Subject to certain conditions, the collaboration contemplates a future technology transfer of Ballard’s new MW-scale containerized PEM fuel cell system to HDF Energy with an exclusive royalty-bearing, non-transferable, multi-year global license for the manufacture and sale of MW-scale fuel cell systems for Renewstable® power plant systems. The collaboration also contemplates Ballard supplying FCgen®-LCS fuel cell stacks for these systems based on an exclusive long-term supply agreement.

The initial HDF Energy project is an installation planned in French Guiana, an overseas region of France located off the northern Atlantic coast of South America, under the Centrale Electricité de l’Ouest Guyanais (“CEOG”) project. The project includes the supply of 2 x 1.55 MW fuel cell systems built by Ballard in 2023. Systems will be installed and commissioned on site in 2024.

Strategic Collaboration with Weichai

On November 13, 2018, we closed a strategic collaboration transaction with Weichai. The strategic collaboration included an equity investment by Weichai in Ballard, formation of a joint venture company and a development program.

Weichai and Ballard established the Weichai-Ballard JV on November 26, 2018 in Shandong Province to support China’s fuel cell electric vehicle market. Ballard holds a 49% ownership position and Weichai holds a 51% ownership position. Weichai holds three of five Weichai-Ballard JV board seats and Ballard holds two, with Ballard having certain minority shareholder protections.

The Weichai-Ballard JV develops and manufactures fuel cell modules and components including Ballard’s LCS bipolar plates, fuel cell stacks and FCgen®-LCS-based power modules for bus, commercial truck, and forklift applications with exclusive rights (subject to certain conditions) in China and is to pay Ballard a total of $90 million under a Research and Development Agreement to develop and transfer technology to Weichai-Ballard JV in order to enable these manufacturing activities. Ballard retains an exclusive right to the developed technologies outside China, subject to certain restrictions on sublicensing outside China. The Weichai-Ballard JV will also purchase MEAs for FCgen®-LCS fuel cell stacks exclusively from Ballard under a long-term supply agreement.

The Weichai-Ballard JV operation, located in Weifang, Shandong Province, China, has commenced production activities of LCS bipolar plates, LCS fuel cell stacks and LCS-based modules to power bus and truck FCEVs for the China market. After recent production automation projects, the Weichai-Ballard JV is expected to have annual production capacity of 40,000 fuel cell stacks which equates to approximately 20,000 engines.

OUR BUSINESS

At Ballard, our vision is to deliver fuel cell power for a sustainable planet. We are recognized as a world leader in PEM fuel cell and power system development and commercialization.

Our principal business is the design, development, manufacture, sale and service of PEM fuel cell products for a variety of applications, focusing on our market verticals of bus, truck, rail, marine, stationary power, and emerging markets, as well as offering engineering services, product and systems integration services, and related technology transfer for a variety of PEM fuel cell applications.

A fuel cell is an environmentally clean electrochemical device that combines hydrogen fuel with oxygen (from the air) to produce electricity. The hydrogen fuel can be obtained from natural gas, kerosene, methanol or other hydrocarbon fuels, or from water through electrolysis. Ballard’s PEM fuel cell products feature high fuel efficiency, low operating temperature, low noise and vibration, compact size, quick response to changes in electrical demand and modular design. Embedded in each Ballard PEM fuel cell product lies a stack of unit cells designed with Ballard’s proprietary technology, which include membrane electrode assemblies, catalysts, plates, and other key components, and which draw on intellectual property from our patent portfolio together with our extensive experience and know-how, in key areas of PEM fuel cell stack design, operation, production processes and system integration.

Strategy

We strive to build value for our shareholders by developing, manufacturing, selling, and servicing zero-emission, industry-leading PEM fuel cell technology products and services to meet the needs of our customers in target markets. More specifically, our business plan is to leverage our core competencies of PEM fuel cell stack technology and engine development and manufacturing, our investments in advanced manufacturing and production capacity, and our product portfolio by marketing our products and services across select large and attractive addressable market applications and select geographic regions.

We typically select our target market applications based on use cases where the comparative user value proposition for PEM fuel cells powered by hydrogen are strongest – such as where operators value low emission vehicles that require high utilization, long driving range, heavy payload, fast refueling, and similar user experiences to legacy diesel vehicles – and where the barriers to entry for hydrogen refueling infrastructure are lowest – such as use cases where fuel cell vehicles typically return to a depot or hydrogen hub for centralized refueling and don’t require a distributed hydrogen refueling network. Our current target markets include certain medium- and heavy-duty mobility applications for bus, truck, rail, and marine, along with certain off-road mobility and stationary power applications.

We select our target geographic markets based on a variety of factors, including addressable market sizes of the target market applications in the geographic markets, historic deployments and expected market adoption rates for hydrogen and fuel cells, supportive government policies, existing and potential partner, customer, and end user relationships, and competitive dynamics. Our current target markets are the geographic regions of Europe, North America, and China.

While we recognize addressing multiple market applications and geographic markets in parallel increases our near-term cost structure and investments, we believe offering the same core PEM fuel cell technologies and substantially similar derivative PEM fuel cell products across multiple mobility and power market applications and select geographic regions will significantly expand and strengthen our long-term business prospects by increasing volume scaling in our operations, enabling lower product and production costs for the benefit of all markets, improving our competitive positioning and market share, enabling richly diversified revenue streams and profit pools, and improving our return on investment in our technology and product development programs and our investments in manufacturing.

Our strategy is built on four key themes:

1.Double down in the fuel cell stack & module: invest in leading PEM fuel cell technology and products to provide leading value to our customers and end users on a total cost of ownership basis;

2.Accelerate market development: deepen and create new partnerships to accelerate hydrogen and fuel cell market adoption and grow volumes for product sales;

3.Win in key regions: prioritize investments in North America and Europe, and monitor China before materially deepening our investment in China; and

4.Here for Life: deliver a compelling environmental, social and governance (“ESG”) proposition for our stakeholders.

In 2020 and 2021, we materially strengthened our financial position through equity financings, thereby providing additional flexibility to fund our growth strategy. Following these financings, given strong indicators of long-term market adoption of hydrogen and zero-emission mobility, given growing customer interest in our fuel cell products, given a growing opportunity set, and given an increasingly competitive environment, we strategically decided to significantly increase and accelerate our investments ahead of the adoption curve. As a result, over the past three years, we increased and accelerated our investments in technology and product innovation, product cost reduction, production capacity expansion and localization, strategic pricing for select customer demonstration programs, and customer experience. Our increased investments include: next generation products and technology, including our proprietary membrane electrode assemblies (“MEAs”), bipolar plates, stacks, and modules; advanced manufacturing processes, technologies, equipment, and production capacity expansion activities primarily in Canada, Europe and the United States; and technology and product cost reduction.

Given challenging and dynamic macroeconomic and geopolitical conditions, given continued delays in hydrogen and fuel cell market adoption, and given changes in investor sentiment towards pre-profitability clean energy companies with long-duration investment horizons, we sharpened our focus in 2023 to protect our balance sheet. While we continue to invest against our long-term strategy, we rationalized our product portfolio, reduced the number of active product development programs, dropped new corporate development investments, and discontinued certain legacy products and non-core activities, including Ballard Motive Solutions in the U.K. We also discontinued our proposed $130 million investment for the localization of a new MEA production facility in China.

Revenues from Market Segments

We report our results in the single operating segment of Fuel Cell Products and Services. Our Fuel Cell Products and Services segments consist of the sale and service of PEM fuel cell products and the delivery of Technology Solutions, including engineering services for our target markets of bus, truck, rail, marine, stationary power, and emerging markets.

During the fourth quarter of 2023, we completed a restructuring of operations at BMS and operations have been effectively closed. As such, the historic operating results (including revenue and operating expenses) of the BMS business for both 2023 and 2022 have been removed from continuing operating results and are instead presented separately in the statement of comprehensive income (loss) as loss from discontinued operations.

The following chart shows the percentage of total revenues which arises from sales to investees and sales of products and services to other customers, for the years 2023 and 2022:

|

|

|

|

|

|

|

|

|

|

2023 |

2022 |

| Revenues from Fuel Cell Products and Services |

|

|

Percentage of total revenues |

100% |

100% |

Portion representing sales to investees (1) |

8.0% |

10.0% |

Portion representing sales to customers other than investees |

92.0% |

90.0% |

Notes:

1. In this table, “investees” means Weichai Ballard Hy-Energy Technologies Co., Ltd., a joint venture formed in China, of which we hold a 49% equity interest.

Our Markets, Products and Services

Product & Service Overview

Ballard’s product offering provides for a cost effective and flexible set of fuel cell power solutions. Ballard provides products in four distinct product classes and two separate categories of services:

1.MEAs: We provide our proprietary MEAs to the Weichai-Ballard JV that use the MEAs to produce our proprietary FCgen®-LCS fuel cell stacks, respectively.

2.Fuel cell stacks: We provide our proprietary FCgen® and FCveloCity® fuel cell stacks to OEM customers and system integrators that use the stacks to produce fuel cell systems for power solutions. As the fuel cell stack provider, we are the power inside the system.

3.Fuel cell modules: We design and build, including specifying and procuring balance of plant components, self-contained FCmoveTM motive modules using our fuel cell stacks that are plug-and-play into commercial vehicle powertrains. We also design and build self-contained FCwave™ modules designed for marine applications and FCrail™ for rail applications. As a fuel cell module provider, we make it easier for OEMs and system integrators to create fuel cell powertrains.

4.Fuel cell systems: We also build complete fuel cell systems, FCgen®-H2PM and CleargenTM products, for stationary power markets that are designed to solve certain power needs of our customers, including back-up for critical infrastructure and MW distributed power generation.

5.Technology Solutions: We offer engineering services to our customers for specialized integration of our products or, specific to partnerships, custom fuel cell product development.

6.After Sales Services: We offer our customers after sales services including in and out of warranty support, service contracts, spare part management, fleet monitoring and training.

The following table lists the key fuel cell and non-fuel cell products we currently produce, offer for sale, have under development or are testing:

|

|

|

|

|

|

|

|

|

| Fuel Cell Product Family: |

| Product Name |

Application |

Status |

FCgen®-LCS MEA |

Fuel cell stacks for buses, commercial vehicles, light rail, and material handling |

Sales to licensee (Weichai-Ballard JV) |

FCgen®-HPS stacks |

Light-duty and heavy-duty commercial vehicles and passenger car |

Sales to OEMs and system integrators |

FCgen®-LCS stacks |

Buses, commercial vehicles, light rail, and material handling |

Sales to OEMs and system integrators |

FCveloCity®-9SSL stacks |

Buses, commercial vehicles, light rail, and material handling |

Sales to OEMs and system integrators |

FCgen®-1020ACS stacks |

Material handling and backup power |

Sales to OEMs and system integrators |

| FCmove™ modules |

Buses, commercial vehicles, and light rail (legacy product range) |

Sales to OEMs and system integrators |

| FCwave™ modules |

Marine, rail (freight locomotives) and stationary |

Sales to OEMs and system integrators |

| FCrail™ |

Passenger rail application |

Sales to OEMs and system integrators |

| FCgen®-1020ACS |

Backup power |

Sales to OEMs and system integrators |

FCgen®-H2PM |

Backup power systems |

Sales to customers |

ClearGen® |

Distributed generation systems |

Sales to customers and Integrators |

Fuel Cell Products and Services

Our primary business is the sale of Power Products, consisting of fuel cell modules and fuel cell stacks offered to customers in our target market verticals of bus, truck, rail, marine, stationary power, and emerging markets.

Fuel cell electric vehicles and power generation systems in these applications rely on centralized fueling depots that simplify the hydrogen infrastructure requirements and are typically government-subsidized, thus enabling the purchase of pre-commercial fleets.

In addition to our fuel product, we also provide engineering services to customers in our target markets under our Technology Solutions offering. Our engineering services help customers solve difficult technical and business challenges in the commercialization of their PEM fuel cell products or address new business opportunities and markets. We offer customized, bundled technology solutions, including specialized PEM fuel cell engineering services, access to our intellectual property portfolio and know-how, as well as specialized integration support for our products in various applications across all of our market verticals.

We design and manufacture fuel cell modules and stack products capable of delivering 50 kW to 200 kW of power. These modules and stacks can be combined to provide power output in excess of 1 MW for certain applications. We supply the fuel cell modules to a combination of vehicle OEMs and system integrators to deliver to end users. The demand for zero-emission vehicles is driven in many jurisdictions by the requirement to reduce greenhouse gases and other harmful emissions.

In 2019, we launched our eighth-generation high-performance fuel cell module, the FCmove™-HD. The FCmove™ family of products is designed to power medium- and heavy-duty commercial vehicles such as buses and trucks. The FCmove™-HD 70kW version is being delivered to customers in China and Europe and has been integrated into vehicles. The FCmove™-HD+ 100kW version was launched in 2021 and we are starting delivery of the first modules to customers for integration into their new vehicle platforms in 2022. We presented at the IAA Show in September 2022 the concept unit for FCmoveTM-XD (120/240kW) product which was developed for heavy duty trucks (>19t and class 6-8) and became commercially available in 2023.

In 2020, we introduced the FCwaveTM, a fuel cell module designed for certain marine applications. The FCwaveTM fuel cell module is a 200 kW modular unit that can be scaled in series up to the multi-megawatt (MW) power level. The FCwaveTM product provides primary propulsion power for marine vessels – such as passenger and car ferries, river push boats, and fishing boats – as well as stationary electrical power to support hotel and auxiliary loads on cruise ships and other vessels while docked at port (also known as ‘cold ironing’). In 2021, we also started to sell FCwave™ products for stationary and rail applications. In 2022, our FCwaveTM fuel cell module was granted the industry-first Type Approval by DNV, one of the world’s leading marine classification and certification bodies.

Our Technology Solutions efforts support expanding our key market verticals. In 2023, we completed the development of the 200kW FCrailTM fuel cell engine to power Siemens’ Mireo light rail train pursuant to the Development Agreement entered into with Siemens in 2017.

Related to the bus and truck verticals we continued the execution of the Research and Development Agreement to develop and transfer technology to the Weichai-Ballard JV to enable manufacturing of Ballard’s FCgen®-LCS fuel cell stack and FCgen®-LCS-based power modules for bus, commercial truck and forklift applications with exclusive rights in China. We also completed several large scale stationary installations in the 1-1.5 MW range for various customers and have several more planned for 2024.

Market Verticals

Bus

We supply Power Products and Technology Solutions to bus manufacturers primarily in Europe and North America. The bus market is the most mature of our markets as measured by the length of time Ballard has been active in the market and by the number of products sold to customers in the market. Hydrogen fuel cell buses offer long range, the ability to complete demanding routes, and short refueling times for bus operators. Target applications for our bus vertical include transit buses and intercity coach buses.

Truck

We supply Power Products and Technology Solutions to truck manufacturers and truck integrators in Europe and North America. Our Power Products and Technology Solutions revenues from Weichai-Ballard JV are also recorded in this vertical. The hydrogen fuel cell truck market is at a nascent phase typified by demonstration projects to prove the capabilities of the technology in the real world. For truck applications, hydrogen fuel cell power offers long range, high payloads, short refueling times, and high fuel efficiency. Target applications for our truck vertical include heavy-duty long haul trucks, rubbish collection vehicles or garbage trucks, and medium-duty trucks or delivery vans.

Rail

We supply Power Products and Technology Solutions to train OEMs and railway operators in Europe and North America. Our technology offers a compelling value proposition to railway operators seeking to eliminate carbon emissions on railway lines that lack overhead catenary power infrastructure, as hydrogen fuel cells eliminate the need to build the overhead infrastructure by utilizing refueling depots that mirror current practice for diesel locomotives. Target applications for our rail vertical include passenger rail and freight locomotive applications.

Marine

We supply Power Products and Technology Solutions to ship operators and shipyards in Europe and North America. Fuel cell power provides marine vessel operators with ships that have long range and short refueling times.

Target applications in our marine vertical include river transport, barges, short sea container ships, and ferries.

Stationary Power

We supply Power Products and Technology Solutions to OEMs and system integrators of power generation products. Our products allow users to generate zero emission power in remote locations that lack access to electrical grid infrastructure or generate back-up power for up to several days. Given the expected growth in electricity demand and the difficulties of expanding the electrical distribution network, we see an opportunity for fuel cell products to support demand for incremental power generation. Target applications include EV charging, TV and film production sites, grid balancing, and data centers.

Emerging Markets

Our Emerging Markets vertical encompasses two distinct markets: Materials Handling and Off-Highway. We supply Power Products and Technology Solutions to customers in both market verticals.

The material handling market includes industrial vehicles such as forklifts, automated guided vehicles and ground support equipment. Our initial focus is on battery-powered Class 1 counterbalance lift trucks, Class 2 reach trucks and Class 3 pallet forklifts. Ballard is currently supplying fuel cell stacks to a limited number of system integrators in North America and Europe.

The off-highway market includes industrial vehicles such as ultra-class mining haul trucks, excavators, construction equipment and farming equipment. Fuel cell products enable customers to operate their vehicles with high up-times, and are able to meet high power demands in heavy-duty applications.

Competition

Diesel-powered buses and commercial trucks currently dominate the market today. Compressed natural gas and diesel electric hybrid powertrains are lower-emission alternatives to diesel engines but are in limited service today. Electric trolley buses provide a zero-emission alternative; however, their purchase price is high and the overhead catenary power infrastructure is expensive to maintain and is considered aesthetically undesirable in many urban centres. The recent developments in battery-powered powertrain vehicles have created a zero-emission alternative to fuel cell buses in the form of battery electric buses and commercial trucks, as well as electrified trains and battery-powered marine vessels. These battery-powered heavy-duty vehicles will continue to offer a competitive zero emission mobility solution for zero-emission mobility applications.

We believe that fuel cell electric vehicles are the best zero-emission alternative for medium-duty and heavy-duty applications in certain use cases in bus, truck, train, marine and off-highway. In comparison to battery electric vehicles, we believe fuel cell electric vehicles in medium-duty and heavy-duty applications: are able to operate over a longer range and on more demanding routes; offer higher energy density to maximize payload; and are capable of refueling quickly, ensuring the vehicle is on the road generating revenue for the fleet operator.

We also believe that in certain cases hydrogen refueling infrastructure has certain scaling cost and logistics advantages compared to battery recharging for large fleets.

Companies developing fuel cell systems for heavy-duty applications include Beijing Sinohytec Co. Ltd., cellcentric GmbH & Co. KG (a joint venture of Daimler Truck AG and the Volvo Group), Cummins Inc., EKPO Fuel Cell Technologies GmbH (a joint venture of ElringKlinger and Plastic Omnium), Hyzon Fuel Cell Technologies Pte. Ltd., Sino-Synergy Hydrogen Energy Technology (Jiaxing) Co., Ltd., Hyundai Motor Company, Nikola Motor Company, Plug Power, Inc., Powercell Sweden AB, Robert Bosch GmbH, Shanghai Re-Fire Technology Co., Ltd., Symbio SAS (a joint venture of Michelin, Forvia and Stellantis), and Toyota Motor Corporation.

We are also seeing the emergence of product offerings for hydrogen internal combustion engines developed by companies like Cummins Inc. and J C Bamford Excavators Ltd. Numerous engine and vehicle manufacturers are interested in development programs. This technology is seen as a potential bridge between legacy internal combustion engines and hydrogen fuel cell mobility. Through modification of existing diesel engines, it allows the use of hydrogen as a fuel leading to CO2 emission reduction. However, the technology is not expected to meet zero emission requirements (such as NOx emissions) and is expected to have significantly lower efficiency compared to fuel cells .

The stationary power generation market is currently dominated by diesel generators and batteries. Advanced battery technology continues to make modest progress in the backup power generation market. However, advanced battery technologies still require lengthy recharging and, in many cases, cannot meet desired run times without requiring substantial space. We believe that PEM fuel cell products are superior to batteries in some applications, because of their ability to provide extended run time without frequent or lengthy recharging, as well as their ability to offer lower life cycle costs, given that batteries require periodic replacement.

For certain applications and markets we believe fuel cell power generators offer a value proposition against diesel generators with lower operating cost, extended run time, low emission and noise, and less risk of theft.

Hydrogen fueled gas turbines are also being developed and could be an alternative to diesel generators. Compared with fuel cell systems, however, H-ICEs and gas turbines produce nitrous oxide emissions and are considered to be less power efficient.

Companies developing PEM fuel cell systems for stationary power generation applications include CHEM, Plug Power, Inc., SFC Energy, Powercell, and Nedstack. We seek to gain competitive advantage through fuel cell designs that provide zero emissions, superior performance, reliability, durability and cost.

We believe that we are well positioned to compete with our competitors based on our talented workforce, intellectual property portfolio, technology, number of product offerings, manufacturing capabilities, vertical integration, customers, partners, brand, financial strength, and extensive operating hours in real world heavy-duty operations.

Impact of Regulations and Public Policy

In the course of carrying on our business we believe we have become aware of government regulation and public policies that may be supportive of our business, the fuel cell industry in general or zero-emission vehicles. The statements below in this section are based on our understanding of the regulations and public policies in place in the particular jurisdiction as of the date of this Annual Information Form that we believe to be correct. While we believe the statements below in this section to be correct, regulation and public policy may change without notice and our understanding of regulations and public policies may be incorrect.

Approximately 75 countries have announced targets to achieve net-zero emissions strategies for 2050 or pledged to be carbon neutral by 2050. As of June 7, 2023, 35 countries representing approximately 90% of global GDP have specific hydrogen strategies according to the industry association “Hydrogen Europe”. The main drivers of such policies include GHG emission reduction goals, energy security, the integration of renewables, as well as the opportunity for economic growth and green recovery plans. Interest and investment in hydrogen is increasing globally, as governments across the globe continue to adopt national hydrogen strategies. The Hydrogen Council reported in 2023 that over 1,400 large-scale hydrogen project proposals worth $570 billion have been announced.

On November 15, 2021, President Biden signed into law the Infrastructure Investment and Jobs Act. The bill allocates over $62 billion to the Department of Energy to advance clean energy technologies, including: (1) $8 billion to support the development of at least four clean hydrogen hubs across the United States in order to further development with respect to the production, processing, delivery, storage, and end-use of clean hydrogen; and (2) $1 billion to support the demonstration, commercialization, and deployment of electrolyzer systems, in order to decrease the cost of clean hydrogen production. On October 13, 2023, the Department of Energy announced that seven Hydrogen Hubs across the United Status have been awarded $7 billion in funding to support the development of clean hydrogen production, delivery, and end-use.

In 2023, nearly $1.7 billion was allocated through the Federal Transit Administration’s (the “FTA”) Low and No Emission Grants and the Bus and Bus Facilities Grants; this funding supported investment in 150 transit fleets and facilities throughout the United States with more than 1,700 vehicles being zero-emission.

The Inflation Reduction Act was signed into law by President Biden in August 2022, and represents a $369 billion investment in the modernization of the American energy system. Among other things, the broad bill includes a hydrogen production tax credit (up to $3/kg of hydrogen produced at a given facility, based on the carbon intensity of production ). It is intended to make technologies, like green hydrogen and carbon capture, profitable in large scale improving business case for hydrogen mobility and deployment of fuel cell applications.

The California Air and Resource Board (“CARB”) Low Carbon Transportation and Air Quality Improvement Program programs provide mobile source incentives to reduce GHG emissions, criteria pollutants, and air toxics through the development of advanced technology and clean transportation in California. The ICT Regulation was adopted in December 2018 and requires all public transit agencies to gradually transition to a 100 percent zero‑emission bus (“ZEB”) fleet. Beginning in 2029, all new transit bus purchases by California transit agencies must be ZEBs, with a goal for full transition by 2040. In 2020, the CARB unanimously adopted the world’s first zero-emission commercial truck requirement, the Advanced Clean Trucks rule. Beginning in 2024, truck manufacturers must increase their zero-emission truck sales to between 30-50 percent by 2030 and 40-75 percent by 2035 depending on the class of truck. The CARB requirements are expected to be key drivers of the growing demand in California for fuel cell trucks and buses. In 2023, the CARB passed the In-Use Locomotive Regulation to reduce emissions from locomotives operating in the state. Under the rules, switch, industrial and passenger locomotives built in 2030 or after will be required to operate in zero-emissions configurations while in California, and in 2023 for freight line haul.

Significant funding is invested in hydrogen production, distribution and use, throughout the EU. In 2020, multiple countries in Europe announced ambitious hydrogen strategies supported by significant funding (for example, €9 billion in Germany and €7 billion in France). In 2023, the European Commission launched a €800 million auction for hydrogen production subsidies in November 2023. The Netherlands, Germany, Denmark and the UK also launched support schemes for hydrogen (and derivatives) production.

The European Commission’s “Fit for 55 package”, announced in July 2021, includes 19 legislative proposals to help the European Union reach its climate goals of reducing GHG emissions by 55% by 2030 and achieving carbon-neutrality by 2050. As of December 31, 2023, 14 pieces of legislation tabled under this package have been adopted, several of which could support growth of the European Union’s hydrogen economy. For instance, the Alternative Fuels Infrastructure Regulation (EU 2023/1804) mandates the deployment of hydrogen refueling stations at least every 200 km along the main EU highways (“TEN-T network”) for compressed hydrogen by 2030. The revised Renewable Energy Directive (2023/2413) that came into force on November 20, 2023, mandates fuel suppliers to supply enough hydrogen and derivatives (Renewable Fuels of Non-Biological Origin “RFNBOs”) to cover at least 1% of the energy used in transport by 2030.

The revised CO2 emission standards for heavy-duty vehicles presented by the European Commission on February 14, 2023, are also expected to drive adoption of zero-emission trucks, buses and coaches by setting emission reduction targets for all major OEMs. As of end 2023, the European Institutions have reached a preliminary agreement to mandate CO2 emission reduction of 45% by 2030, 65% by 2035 and 90% by 2040 for trucks above 7.5 tons. All city buses are also expected to be zero-emission by 2035. In November 2021, the European Commission launched the Clean Hydrogen Partnership, taking over the activities of the existing Fuel Cell and Hydrogen Joint Undertaking. The Partnership will support hydrogen technologies R&D with €1 billion of funding for the period 2021-2027, complemented by at least an equivalent amount of private investment (from the private members of the partnership).

Other relevant EU legislative initiatives for the hydrogen and fuel cell sector include the, the new Fuel EU Maritime, the revised EU emission trading scheme, the Energy Efficiency Directive, the revision of the EU gas directive and EU gas regulation, the revised Weights and Dimensions directive and the Net Zero Industry Act.

In December 2020, Canada announced its Hydrogen Strategy setting an ambitious framework to cement hydrogen as a key part of Canada’s path to net-zero carbon emissions by 2050 and make Canada a global leader in hydrogen technologies. In 2021, Natural Resources Canada set up a framework for the execution of Canadian Hydrogen Strategy including development of hydrogen hubs and have released first call for proposal for production at scale of green hydrogen to be used for fuel for zero emission vehicles. In August 2021, the Canadian government announced the creation of the Zero Emission Transit Fund, which will allocate $2.75 billion to ZEBs over five years with a goal of deploying 5,000 ZEBs. In 2022 and 2023 the Canadian Government has been working on the implementation of the hydrogen strategy with focus on a number of hydrogen hubs.

The Clean Hydrogen Investment Tax Credit (ITC), first announced in the 2022 Fall Economic Statement and described in Budget 2023, will provide a 15 to 40 per cent refundable tax credit for investments in projects that produce all, or substantially all, hydrogen through their production process. Projects with less than 0.75kg of carbon dioxide-equivalent (CO2e) per kilogram of hydrogen produced will receive the full 40% rate.

In September 2020, the Government of China announced a new 4-year policy framework replacing existing subsidy programs with awards. While previous policies in China to support zero-emission vehicle makers (sometimes referred to as new-energy vehicles) had offered subsidies on sales, the new policy framework will require local governments and companies to build a more mature supply chain and business model for the new-energy vehicle industry. The Government of China is expected to provide financial incentives to demonstration regions that meet requirements based on:

•Completeness of industry base with leading enterprises;

•Competitive hydrogen energy supply and economics;

•Prior fleet demonstration of FCEV applications; and

•Guaranteed local policy to support FCEV industry.

In 2021, the Government of China announced the first demonstration city clusters in Beijing, Shanghai and Guangdong. In early 2022, the Government of China announced Henan and Hebei as the second demonstration city clusters.

In March 2022, the National Development and Reform Commission (NDRC) and National Energy Administration (NEA) jointly released the country’s first mid to long-term plan for implementing and developing hydrogen usage in China, stretching until 2035. According to the plan, the projected volume for renewable-based hydrogen is aimed to reach within the range 100,000-200,000 tons annually by 2025.

Workforce

As of December 31, 2023, we had 1,173 employees in Canada, the United States, the European Union, the United Kingdom and China, representing such diverse disciplines as electrochemistry, polymer chemistry, chemical, mechanical, electronic and electrical engineering, manufacturing, quality, supply chain management, advanced manufacturing, marketing, sales, service, business development, legal, finance, accounting, people & culture, information technology and business management. Our employees are not represented by any labour union. Each employee must agree to confidentiality provisions as part of the terms of his or her employment, and certain employees have also executed non-competition agreements with Ballard.

Sustainability and ESG

Strategy and Oversight

Our strategic theme of Here for Life™ connotes our purpose to decarbonize mobility and accelerate the impact of a low carbon energy transition. Our strategy continues to be based on our fundamental commitment to managing our risks, capitalizing on opportunities, and conducting our operations in an environmentally and socially responsible manner. By focusing on sustainable ESG practices and transparency, Ballard strives to ensure that we, our customers, partners and suppliers continue to maximize our positive impact on the world around us.

The Sustainability and Governance Committee (“S&G Committee”) of the Board has the responsibility of overseeing our environmental, social and governance performance. This includes overseeing policies and practices relating to ESG. The S&G Committee is composed of independent directors and reports regularly to the Board. The SGC Committee mandate can be found on Ballard’s website (www.ballard.com/investors/governance).

Recent Developments

In late 2021, we completed our first three-year ESG strategy and conducted our first stakeholder-informed materiality assessment. This assessment helped us understand and prioritize the ESG topics most impactful to our business and to our stakeholders. These topics remained unchanged for 2023 and our top seven include: (1) energy transition impact, (2) climate and greenhouse gas emissions, (3) employee attraction, engagement, and retention, (4) health and safety, (5) diversity, equity, and inclusion, (6) ethics and anti-corruption, and (7) corporate governance.

In March 2023, we signed as participants to the United Nations Global Compact, a voluntary leadership platform for the development, implementation, and disclosure of responsible business practices. We are planning to submit our first Communications on Progress (CoP) report in 2024.

During 2023, we continued to pursue our “Mission Carbon Zero” initiative; a multi-year approach to reduce our environmental impact and achieve carbon neutrality by 2030. Through this initiative we continued to execute against our Carbon Neutral Plan (“CNP”), a roadmap which contains six primary goals focused on the material initiatives that will support a reduced carbon footprint and accelerate the avoidance of emissions as our business grows. More information on our CNP activities can be found in our annual ESG report.