0001452477false2023FYhttp://fasb.org/us-gaap/2023#AccountingStandardsUpdate201613Member66.67202020202000014524772023-01-012023-12-3100014524772023-06-30iso4217:USD00014524772024-02-15xbrli:shares00014524772023-12-3100014524772022-12-31iso4217:USDxbrli:shares00014524772022-01-012022-12-310001452477us-gaap:CommonStockMember2021-12-310001452477us-gaap:AdditionalPaidInCapitalMember2021-12-310001452477us-gaap:RetainedEarningsMember2021-12-310001452477us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-12-3100014524772021-12-310001452477us-gaap:CommonStockMember2022-01-012022-12-310001452477us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001452477us-gaap:RetainedEarningsMember2022-01-012022-12-310001452477us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-01-012022-12-310001452477us-gaap:CommonStockMember2022-12-310001452477us-gaap:AdditionalPaidInCapitalMember2022-12-310001452477us-gaap:RetainedEarningsMember2022-12-310001452477us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-12-310001452477us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001452477srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001452477us-gaap:CommonStockMember2023-01-012023-12-310001452477us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001452477us-gaap:RetainedEarningsMember2023-01-012023-12-310001452477us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-01-012023-12-310001452477us-gaap:CommonStockMember2023-12-310001452477us-gaap:AdditionalPaidInCapitalMember2023-12-310001452477us-gaap:RetainedEarningsMember2023-12-310001452477us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-12-31xbrli:pure0001452477srt:CumulativeEffectPeriodOfAdoptionAdjustmentMembersevn:LoansHeldForInvestmentNetIncludingUnfundedLoanCommitmentsMember2023-01-010001452477sevn:LoansHeldForInvestmentNetMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-01-010001452477sevn:UnfundedLoanCommitmentsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2023-01-010001452477srt:MinimumMember2023-12-310001452477srt:MaximumMember2023-12-310001452477us-gaap:LandMember2023-12-310001452477us-gaap:BuildingImprovementsMember2023-12-310001452477sevn:TenantImprovementsMember2023-12-31sevn:loan0001452477srt:MultifamilyMember2023-01-012023-12-310001452477srt:MultifamilyMember2023-12-310001452477srt:MultifamilyMember2022-01-012022-12-310001452477srt:MultifamilyMember2022-12-310001452477srt:OfficeBuildingMember2023-01-012023-12-310001452477srt:OfficeBuildingMember2023-12-310001452477srt:OfficeBuildingMember2022-01-012022-12-310001452477srt:OfficeBuildingMember2022-12-310001452477srt:IndustrialPropertyMember2023-01-012023-12-310001452477srt:IndustrialPropertyMember2023-12-310001452477srt:IndustrialPropertyMember2022-01-012022-12-310001452477srt:IndustrialPropertyMember2022-12-310001452477srt:RetailSiteMember2023-01-012023-12-310001452477srt:RetailSiteMember2023-12-310001452477srt:RetailSiteMember2022-01-012022-12-310001452477srt:RetailSiteMember2022-12-310001452477srt:HotelMember2023-01-012023-12-310001452477srt:HotelMember2023-12-310001452477srt:HotelMember2022-01-012022-12-310001452477srt:HotelMember2022-12-310001452477sevn:SouthMember2023-01-012023-12-310001452477sevn:SouthMember2023-12-310001452477sevn:SouthMember2022-01-012022-12-310001452477sevn:SouthMember2022-12-310001452477sevn:WestMember2023-01-012023-12-310001452477sevn:WestMember2023-12-310001452477sevn:WestMember2022-01-012022-12-310001452477sevn:WestMember2022-12-310001452477sevn:MidwestMember2023-01-012023-12-310001452477sevn:MidwestMember2023-12-310001452477sevn:MidwestMember2022-01-012022-12-310001452477sevn:MidwestMember2022-12-310001452477sevn:EastMember2023-01-012023-12-310001452477sevn:EastMember2023-12-310001452477sevn:EastMember2022-01-012022-12-310001452477sevn:EastMember2022-12-310001452477sevn:RiskLevelOneMember2023-01-012023-12-310001452477sevn:RiskLevelOneMember2023-12-310001452477sevn:RiskLevelTwoMember2023-01-012023-12-310001452477sevn:RiskLevelTwoMember2023-12-310001452477sevn:RiskLevelThreeMember2023-01-012023-12-310001452477sevn:RiskLevelThreeMember2023-12-310001452477sevn:RiskLevelFourMember2023-01-012023-12-310001452477sevn:RiskLevelFourMember2023-12-310001452477sevn:RiskLevelFiveMember2023-01-012023-12-310001452477sevn:RiskLevelFiveMember2023-12-310001452477sevn:RiskLevelOneMember2022-01-012022-12-310001452477sevn:RiskLevelOneMember2022-12-310001452477sevn:RiskLevelTwoMember2022-01-012022-12-310001452477sevn:RiskLevelTwoMember2022-12-310001452477sevn:RiskLevelThreeMember2022-01-012022-12-310001452477sevn:RiskLevelThreeMember2022-12-310001452477sevn:RiskLevelFourMember2022-01-012022-12-310001452477sevn:RiskLevelFourMember2022-12-310001452477sevn:RiskLevelFiveMember2022-01-012022-12-310001452477sevn:RiskLevelFiveMember2022-12-310001452477sevn:LoansHeldForInvestmentNetMember2022-12-310001452477sevn:UnfundedLoanCommitmentsMember2022-12-310001452477sevn:LoansHeldForInvestmentNetIncludingUnfundedLoanCommitmentsMember2022-12-310001452477sevn:LoansHeldForInvestmentNetMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001452477sevn:UnfundedLoanCommitmentsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310001452477srt:CumulativeEffectPeriodOfAdoptionAdjustmentMembersevn:LoansHeldForInvestmentNetIncludingUnfundedLoanCommitmentsMember2022-12-310001452477sevn:LoansHeldForInvestmentNetMember2023-01-012023-12-310001452477sevn:UnfundedLoanCommitmentsMember2023-01-012023-12-310001452477sevn:LoansHeldForInvestmentNetIncludingUnfundedLoanCommitmentsMember2023-01-012023-12-310001452477sevn:LoansHeldForInvestmentNetMember2023-12-310001452477sevn:UnfundedLoanCommitmentsMember2023-12-310001452477sevn:LoansHeldForInvestmentNetIncludingUnfundedLoanCommitmentsMember2023-12-310001452477stpr:MOsrt:OfficeBuildingMember2023-06-012023-06-300001452477stpr:OHsrt:OfficeBuildingMember2023-08-012023-08-310001452477sevn:OfficePropertyYardleyPAMember2023-06-300001452477sevn:OfficePropertyYardleyPAMember2023-06-012023-06-300001452477sevn:OfficePropertyYardleyPAMember2023-01-012023-06-300001452477sevn:LoansHeldForInvestmentNetMember2023-07-012023-09-300001452477sevn:MortgagesAndRelatedAssetsMembersevn:UBSMember2023-08-310001452477sevn:MortgagesAndRelatedAssetsMembersevn:UBSMember2021-02-180001452477sevn:MasterRepurchaseAgreementsMembersevn:CitibankMember2023-12-310001452477sevn:MortgagesAndRelatedAssetsMembersevn:CitibankMember2023-12-310001452477sevn:MortgagesAndRelatedAssetsMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersevn:CitibankMember2023-01-012023-12-310001452477sevn:MortgagesAndRelatedAssetsMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersevn:CitibankMember2023-01-012023-12-310001452477sevn:MortgagesAndRelatedAssetsMembersevn:LondonInterbankOfferedRateMembersevn:CitibankMember2023-01-012023-12-310001452477sevn:MasterRepurchaseAgreementsMembersevn:BMOMember2023-12-310001452477sevn:MortgagesAndRelatedAssetsMembersevn:BMOMember2023-12-310001452477sevn:WellsFargoMembersevn:AssetSpecificFinancingMember2023-12-310001452477sevn:WellsFargoMembersevn:MortgagesAndRelatedAssetsMembersrt:MinimumMember2023-12-310001452477sevn:WellsFargoMembersevn:MortgagesAndRelatedAssetsMembersrt:MaximumMember2023-12-310001452477sevn:WellsFargoMembersevn:MortgagesAndRelatedAssetsMember2023-12-310001452477sevn:MasterRepurchaseAgreementsMembersevn:CitibankMember2023-01-012023-12-310001452477sevn:UBSMembersevn:MasterRepurchaseAgreementsMember2023-12-310001452477sevn:UBSMembersevn:MasterRepurchaseAgreementsMember2023-01-012023-12-310001452477sevn:MasterRepurchaseAgreementsMembersevn:BMOMember2023-01-012023-12-310001452477sevn:WellsFargoMembersevn:AssetSpecificFinancingMember2023-01-012023-12-310001452477sevn:MortgagesAndRelatedAssetsMember2023-12-310001452477sevn:MortgagesAndRelatedAssetsMember2023-01-012023-12-310001452477sevn:MasterRepurchaseAgreementsMembersevn:CitibankMember2022-12-310001452477sevn:MasterRepurchaseAgreementsMembersevn:CitibankMember2022-01-012022-12-310001452477sevn:UBSMembersevn:MasterRepurchaseAgreementsMember2022-12-310001452477sevn:UBSMembersevn:MasterRepurchaseAgreementsMember2022-01-012022-12-310001452477sevn:MasterRepurchaseAgreementsMembersevn:BMOMember2022-12-310001452477sevn:MasterRepurchaseAgreementsMembersevn:BMOMember2022-01-012022-12-310001452477sevn:WellsFargoMembersevn:AssetSpecificFinancingMember2022-12-310001452477sevn:WellsFargoMembersevn:AssetSpecificFinancingMember2022-01-012022-12-310001452477sevn:MortgagesAndRelatedAssetsMember2022-12-310001452477sevn:MortgagesAndRelatedAssetsMember2022-01-012022-12-310001452477sevn:MortgagesAndRelatedAssetsMembersrt:MinimumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-12-310001452477sevn:MortgagesAndRelatedAssetsMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-12-310001452477us-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001452477us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001452477us-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001452477us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001452477us-gaap:RestrictedStockMembersevn:OfficersAndCertainOtherEmployeesCompensationArrangementMember2023-01-012023-12-310001452477us-gaap:RestrictedStockMembersevn:OfficersAndCertainOtherEmployeesCompensationArrangementMember2022-01-012022-12-310001452477us-gaap:RestrictedStockMembersevn:TrusteeCompensationArrangementsMember2023-01-012023-12-310001452477us-gaap:RestrictedStockMembersevn:TrusteeCompensationArrangementsMember2022-01-012022-12-310001452477us-gaap:RestrictedStockMembersevn:A2021EquityCompensationPlanMember2023-12-31sevn:installment0001452477us-gaap:RestrictedStockMembersevn:A2021EquityCompensationPlanMember2022-12-310001452477us-gaap:RestrictedStockMembersevn:A2021EquityCompensationPlanMember2021-12-310001452477us-gaap:RestrictedStockMembersevn:A2021EquityCompensationPlanMember2023-01-012023-12-310001452477us-gaap:RestrictedStockMembersevn:A2021EquityCompensationPlanMember2022-01-012022-12-310001452477us-gaap:SubsequentEventMember2024-01-112024-01-11sevn:employee00014524772021-01-050001452477us-gaap:PrincipalOwnerMembersevn:SharedServiceCostsMember2023-01-012023-12-310001452477sevn:TremontRealtyAdvisorsLLCMembersevn:DianePortnoyMembersevn:ManagementServicesMember2022-05-110001452477sevn:TremontRealtyAdvisorsLLCMembersevn:DianePortnoyMembersevn:ManagementServicesMember2022-05-112022-05-110001452477sevn:ManagementServicesMembersevn:TremontRealtyAdvisorsLLCMember2023-12-310001452477srt:AffiliatedEntityMembersevn:DianePortnoyMembersevn:ManagementServicesMember2023-12-310001452477srt:AffiliatedEntityMembersrt:ChiefFinancialOfficerMember2023-01-012023-01-010001452477sevn:TheRMRGroupIncMembersevn:PropertyManagementServicesMember2023-07-012023-07-310001452477sevn:TheRMRGroupIncMembersevn:ConstructionSupervisionServicesMember2023-07-012023-07-310001452477sevn:TheRMRGroupIncMember2023-07-012023-07-310001452477sevn:RMRGroupMember2023-01-012023-12-310001452477us-gaap:RelatedPartyMembersevn:OfficersAndEmployeesMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-01-012023-12-310001452477us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RelatedPartyMembersevn:OfficersAndEmployeesMember2023-01-012023-12-310001452477us-gaap:ShareBasedCompensationAwardTrancheThreeMemberus-gaap:RelatedPartyMembersevn:OfficersAndEmployeesMember2023-01-012023-12-310001452477sevn:ShareBasedPaymentArrangementTrancheFourMemberus-gaap:RelatedPartyMembersevn:OfficersAndEmployeesMember2023-01-012023-12-310001452477sevn:ShareBasedPaymentArrangementTrancheFiveMemberus-gaap:RelatedPartyMembersevn:OfficersAndEmployeesMember2023-01-012023-12-310001452477us-gaap:UnfundedLoanCommitmentMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyOlmstedFallsOHMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MultifamilyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyOlmstedFallsOHMembersrt:MultifamilyMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:OfficeDallasTXMembersrt:OfficeBuildingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:OfficeDallasTXMembersrt:OfficeBuildingMember2023-12-310001452477sevn:IndustrialPassaicNJMemberus-gaap:FirstMortgageMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:IndustrialPropertyMember2023-01-012023-12-310001452477sevn:IndustrialPassaicNJMemberus-gaap:FirstMortgageMembersrt:IndustrialPropertyMember2023-12-310001452477us-gaap:FirstMortgageMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:RetailSiteMembersevn:RetailBrandywineMDMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersrt:RetailSiteMembersevn:RetailBrandywineMDMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyAuburnALMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MultifamilyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyAuburnALMembersrt:MultifamilyMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyStarkvilleMSMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MultifamilyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyStarkvilleMSMembersrt:MultifamilyMember2023-12-310001452477sevn:MultifamilyFarmingtonHillsMIMemberus-gaap:FirstMortgageMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MultifamilyMember2023-01-012023-12-310001452477sevn:MultifamilyFarmingtonHillsMIMemberus-gaap:FirstMortgageMembersrt:MultifamilyMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:OfficeDownersGroveIL1Membersrt:OfficeBuildingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:OfficeDownersGroveIL1Membersrt:OfficeBuildingMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:HotelAnaheimCAMembersrt:HotelMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:HotelAnaheimCAMembersrt:HotelMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyLasVegasNVMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MultifamilyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyLasVegasNVMembersrt:MultifamilyMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialFountainInnSCMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:IndustrialPropertyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialFountainInnSCMembersrt:IndustrialPropertyMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:OfficePlanoTXMembersrt:OfficeBuildingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:OfficePlanoTXMembersrt:OfficeBuildingMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialFayettevilleGAMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:IndustrialPropertyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialFayettevilleGAMembersrt:IndustrialPropertyMember2023-12-310001452477us-gaap:FirstMortgageMembersrt:OfficeBuildingMembersevn:OfficeCarlsbadCAMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersrt:OfficeBuildingMembersevn:OfficeCarlsbadCAMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialFontanaCAMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:IndustrialPropertyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialFontanaCAMembersrt:IndustrialPropertyMember2023-12-310001452477sevn:OfficeDownersGroveIL2Memberus-gaap:FirstMortgageMembersrt:OfficeBuildingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477sevn:OfficeDownersGroveIL2Memberus-gaap:FirstMortgageMembersrt:OfficeBuildingMember2023-12-310001452477us-gaap:FirstMortgageMembersrt:OfficeBuildingMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersevn:OfficeBellevueWAMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersrt:OfficeBuildingMembersevn:OfficeBellevueWAMember2023-12-310001452477sevn:MultifamilyPortlandOR1Memberus-gaap:FirstMortgageMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MultifamilyMember2023-01-012023-12-310001452477sevn:MultifamilyPortlandOR1Memberus-gaap:FirstMortgageMembersrt:MultifamilyMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:HotelScottsdaleAZMembersrt:HotelMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:HotelScottsdaleAZMembersrt:HotelMember2023-12-310001452477sevn:RetailDelrayBeachFLMemberus-gaap:FirstMortgageMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:RetailSiteMember2023-01-012023-12-310001452477sevn:RetailDelrayBeachFLMemberus-gaap:FirstMortgageMembersrt:RetailSiteMember2023-12-310001452477us-gaap:FirstMortgageMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:RetailSiteMembersevn:RetailSandySpringsGAMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersrt:RetailSiteMembersevn:RetailSandySpringsGAMember2023-12-310001452477us-gaap:FirstMortgageMembersrt:OfficeBuildingMembersevn:OfficeWestminsterCOMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersrt:OfficeBuildingMembersevn:OfficeWestminsterCOMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyPortlandOR2Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:MultifamilyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:MultifamilyPortlandOR2Membersrt:MultifamilyMember2023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialAllentownPAMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:IndustrialPropertyMember2023-01-012023-12-310001452477us-gaap:FirstMortgageMembersevn:IndustrialAllentownPAMembersrt:IndustrialPropertyMember2023-12-310001452477us-gaap:FirstMortgageMember2023-12-310001452477us-gaap:AccountingStandardsUpdate201613Member2022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-34383

Seven Hills Realty Trust

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

| Maryland |

20-4649929 |

| (State of Organization) |

(IRS Employer Identification No.) |

Two Newton Place, 255 Washington Street, Suite 300, Newton, MA 02458-1634

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, Including Area Code 617-332-9530

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common stock, $0.001 par value per share |

|

SEVN |

|

The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ý No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ý The aggregate market value of the voting common shares of beneficial interest, $0.001 par value, or common shares, of the registrant held by non-affiliates was approximately $129.4 million based on the $10.26 closing price per common share on The Nasdaq Stock Market LLC on June 30, 2023. For purposes of this calculation, an aggregate of 2,132,938 common shares held directly by, or by affiliates of, the trustees and the executive officers of the registrant have been included in the number of common shares held by affiliates.

Number of the registrant's common shares of beneficial interest, $0.001 par value per share, outstanding as of February 15, 2024: 14,810,739.

References in this Annual Report on Form 10-K to the “Company”, “SEVN”, “we”, “us”, the “Trust” or “our” mean Seven Hills Realty Trust and its consolidated subsidiaries unless otherwise expressly stated or the context indicates otherwise.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K is incorporated by reference to our definitive Proxy Statement for the 2024 Annual Meeting of Shareholders to be filed with the Securities and Exchange Commission within 120 days after the fiscal year ended December 31, 2023.

Warning Concerning Forward-Looking Statements

This Annual Report on Form 10-K contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. These statements include words such as “believe”, “could”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “would”, “should”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: the disposition of our real estate owned; economic, market and industry conditions; demand for commercial real estate, or CRE, debt and opportunities that may exist for alternative lenders like us; the diversity of our loan investment portfolio; our future lending activity and opportunities; the ability of our borrowers to achieve their business plans; our leverage levels and possible future financings; our liquidity needs and sources; and the amount and timing of future distributions.

Forward-looking statements reflect our current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause our actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in any forward-looking statements. Some of the risks, uncertainties and other factors that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following:

•Our borrowers’ ability to successfully execute their business plans, including our borrowers' ability to manage and stabilize properties;

•Whether the diversity and other characteristics of our loan portfolio will benefit us to the extent we expect;

•Our ability to carry out our business strategy and take advantage of opportunities for our business that we believe exist;

•The impact of inflation, geopolitical instability, interest rates and economic recession or downturn on the CRE industry generally and specific CRE sectors applicable to our investments and lending markets, us and our borrowers;

•Fluctuations in interest rates and credit spreads may reduce the returns we may receive on our investments and increase our borrowing costs;

•Fluctuations in market demand for CRE debt and the volume of transactions and available opportunities in the CRE debt market, including the middle market;

•Dislocations and volatility in the capital markets;

•Our ability to utilize our existing available repurchase and credit facilities to obtain additional capital to enable us to attain our target leverage, to make additional investments and to increase our potential returns, and the cost of that capital;

•Our ability to pay distributions to our shareholders and sustain or increase the amount of such distributions;

•Our ability to successfully execute, achieve and benefit from our operating and investment targets, investment and financing strategies and leverage policies;

•The amount and timing of cash flows we receive from our investments;

•The ability of our manager, Tremont Realty Capital LLC, or Tremont, to make suitable investments for us, to monitor, service and administer our existing investments and to otherwise implement our investment strategy and successfully manage us;

•Our ability to maintain and improve a favorable net interest spread between the interest we earn on our investments and the interest we pay on our borrowings;

•The extent to which we earn and receive origination, extension, exit, prepayment or other fees we may earn from our investments;

•Yields that may be available to us from mortgages on middle market and transitional CRE;

•The duration and other terms of our loan agreements with borrowers and our ability to match our loan investments with our repurchase lending arrangements;

•The credit qualities of our borrowers;

•The ability and willingness of our borrowers to repay our investments in a timely manner or at all;

•The extent to which our borrowers' sponsors provide support to our borrowers or us regarding our loans;

•Our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended, or the 1940 Act;

•Events giving rise to increases in our credit loss reserves;

•Our ability to diversify our investment portfolio based on industry and market conditions;

•The ability of our manager to arrange for the successful management of real estate owned and our ability to sell those properties at prices that allow us to recover amounts we invested;

•Our ability to successfully compete;

•Market trends in our industry or with respect to interest rates, real estate values, the debt securities markets or the economy generally;

•Reduced demand for office or retail space;

•Regulatory requirements and the effect they may have on us or our competitors;

•Competition within the CRE lending industry;

•Changes in the availability, sourcing and structuring of CRE lending;

•Defaults by our borrowers;

•Compliance with, and changes to, federal, state or local laws or regulations, accounting rules, tax laws or similar matters;

•Limitations imposed on our business and our ability to satisfy complex rules in order for us to maintain our qualification for taxation as a real estate investment trust, or REIT, for U.S. federal income tax purposes;

•Actual and potential conflicts of interest with our related parties, including our Managing Trustees, Tremont, the RMR Group LLC, or RMR, and others affiliated with them;

•Acts of God, earthquakes, hurricanes, outbreaks or continuation of pandemics, or other public health safety events or conditions, supply chain disruptions, climate change and other man-made or natural disasters or war, terrorism, social unrest or civil disturbances; and

•Other matters.

These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in our periodic filings. The information contained elsewhere in this Annual Report on Form 10-K or in our other filings with the Securities and Exchange Commission, or SEC, including under the caption “Risk Factors” herein or therein, or incorporated herein or therein, identifies other important factors that could cause differences from our forward-looking statements. Our filings with the SEC are available on the SEC’s website at www.sec.gov.

You should not place undue reliance upon our forward-looking statements.

Except as required by law, we do not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.

Statement Concerning Limited Liability

The Declaration of Trust of Seven Hills Realty Trust, a copy of which, together with any amendments or supplements thereto, is duly filed with the State Department of Assessments and Taxation of Maryland, provide that the name Seven Hills Realty Trust refers to the trustees collectively as trustees, but not individually or personally. No trustee, officer, shareholder, employee or agent of Seven Hills Realty Trust shall be held to any personal liability, jointly or severally, for any obligation of, or claim against, Seven Hills Realty Trust. All persons or entities dealing with Seven Hills Realty Trust, in any way, shall look only to the assets of Seven Hills Realty Trust for the payment of any sum or the performance of any obligation.

SEVEN HILLS REALTY TRUST

2023 FORM 10-K ANNUAL REPORT

Table of Contents

PART I

Item 1. Business

Our Company. Seven Hills Realty Trust is a Maryland REIT that focuses primarily on originating and investing in floating rate first mortgage loans in the $15.0 million to $75.0 million range, secured by middle market and transitional CRE properties that have values of up to $100.0 million. We define transitional CRE as commercial properties subject to redevelopment or repositioning activities that are expected to increase the value of the properties.

As of December 31, 2023, we had a portfolio of 24 floating rate first mortgage loans with aggregate loan commitments of $670.3 million with a weighted average maximum maturity of 3.0 years, weighted average coupon rate of 9.19% and 9.64% all in yield.

We operate our business in a manner consistent with our qualification for taxation as a REIT under the Internal Revenue Code of 1986, or the IRC. As such, we generally are not subject to U.S. federal income tax, provided that we meet certain distribution and other requirements. We also operate our business in a manner that permits us to maintain our exemption from registration under the 1940 Act.

Our principal executive offices are located at Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458-1634, and our telephone number is 617-332-9530.

Our Investment and Leverage Strategies. Our primary investment strategy is to balance capital preservation with generating attractive, risk adjusted returns by creating customized loan structures tailored to borrowers’ specific business plans for the underlying collateral properties. To this end, the loans that we target for origination and investment generally have the following characteristics:

•first mortgage loans with principal balances ranging from $15.0 million to $75.0 million;

•stabilized loan to value ratios, or LTVs, of 75% or less;

•terms of five years or less;

•floating interest rates based on the Secured Overnight Financing Rate, or SOFR, plus a margin that is competitive in the market;

•non-recourse to sponsors (subject to customary non-recourse carve-out guarantees); and

•secured by middle market and transitional CRE across the United States that are equity owned by well capitalized sponsors with experience investing in the relevant property type.

We invest in floating rate first mortgage loans that provide bridge financing on transitional CRE properties. These investments typically are secured by properties undergoing redevelopment or repositioning activities that are expected to increase the value of the properties. We fund these loans over time as the borrowers’ business plans for the properties are carried out. Our loans secured by transitional CRE are typically bridge loans that are refinanced with the proceeds from other CRE mortgage loans or property sales. We expect to receive origination fees for bridge loans we make and we may also receive exit fees, extension fees, modification or similar fees in connection with some of our bridge loans.

Bridge loans may lead to future investment opportunities for us, including making mortgage loans to repay our transitional loans, otherwise known as “takeout mortgage loans.” We may also originate or acquire subordinated and mezzanine loans, which are loans secured by junior mortgages on the underlying collateral property or loans secured by a pledge of the ownership interests of either the entity owning the property or a pledge of the ownership interests in the entity that owns the interest in the entity owning the property.

Our strategy to invest in floating rate first mortgage loans generally will result in an increase to our net income in periods of rising interest rates and a decrease to our net income in periods of declining interest rates. Decreases to our net income during periods of declining interest rates may be mitigated by active interest rate floors that are higher than the applicable benchmark index. As of December 31, 2023, 96.3% of our loan portfolio by principal outstanding had interest rate floors in place with a weighted average floor of 1.36%.

We generally seek to match the terms of our financing, including benchmark indices and duration, to the loans we originate and pledge as collateral. As of December 31, 2023, all amounts outstanding under our financing agreements pay interest at floating rates that are not subject to floors. We currently expect that our leverage, on a debt to equity basis, will generally be below a ratio of 3:1. As of December 31, 2023, our debt to equity ratio was 1.7:1.

We employ direct leverage, and we may employ structural leverage, on our first mortgage loan investments. Our direct leverage is from repurchase facilities and other secured financing facilities for which we may pledge our first mortgage loans as collateral. If we employ structural leverage, we expect it will involve the sale of senior interests in first mortgage loans, such as A-Notes, to third parties and our retention of B-Notes and other subordinated interests in the loans.

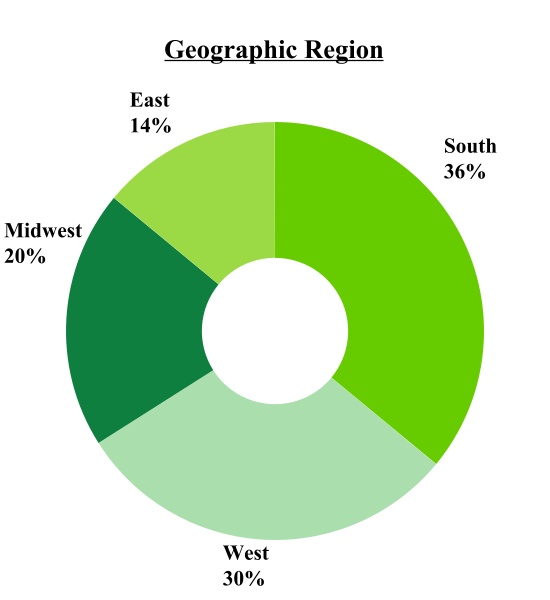

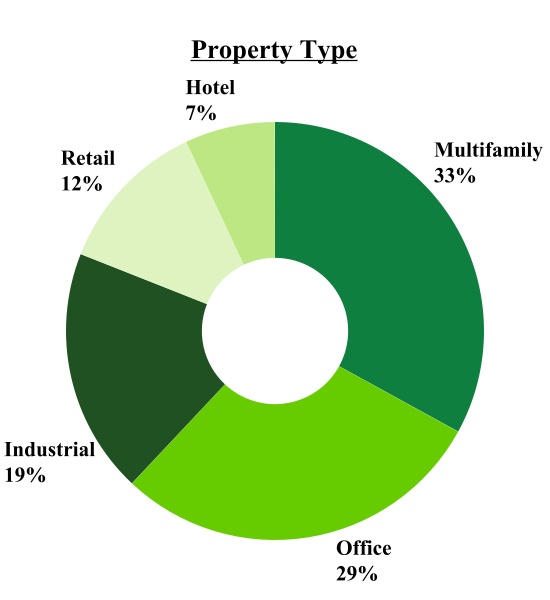

As of December 31, 2023, we had a portfolio of 24 loans held for investment with a total commitment of $670.3 million, of which $40.4 million remained unfunded. The charts below detail the geographic region and property type of the properties securing the loans in our portfolio by amortized cost as of December 31, 2023:

For further information regarding our loans held for investment, see Part II, Item 7, "Management’s Discussion and Analysis of Financial Condition and Results of Operations" and Note 3 to our Consolidated Financial Statements included in Part IV, Item 15 of this Annual Report on Form 10-K.

We believe that our investment and leverage strategies are appropriate for the current market environment. However, we may change our investment and leverage strategies from time to time to capitalize on investment opportunities at different times in the economic and CRE investment cycle. We believe that the flexibility of our investment and leverage strategies and the experience and resources of Tremont and its affiliates will allow us to take advantage of changing market conditions to preserve capital and generate attractive risk adjusted returns on our investments. Our investment and leverage strategies may be changed, amended, supplemented or waived at any time by our Board of Trustees without shareholder approval.

Our Financing Policies. To maintain our qualification for taxation as a REIT under the IRC, we must distribute at least 90% of our annual REIT taxable income (excluding capital gains) and satisfy a number of organizational and operational requirements. Accordingly, we generally will not be able to retain sufficient cash from operations to fund our loan originations or investments. Instead, we expect to fund our loan originations or investments by utilizing our existing debt facilities or other future financing arrangements, issuing debt or equity securities or using retained cash from operations that may exceed any distributions we make.

We will decide when and whether to issue equity or new debt depending upon market conditions and other factors. Because our ability to raise capital depends, in large part, upon market conditions, we cannot be sure that we will be able to raise sufficient capital to fund our growth strategies. We expect to repay our debts through repayments from our borrowers on loans held for investment.

We funded our loan originations to date using cash on hand and advancements under our debt facilities. For further information regarding our debt agreements, see Note 5 to our Consolidated Financial Statements included in Part IV, Item 15 of this Annual Report on Form 10-K.

For further information regarding our financing sources and activities, see Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources” in this Annual Report on Form 10-K.

Our Board of Trustees may change our financing policies at any time without a vote of, or notice to, our shareholders.

Competition. The financial services industry and CRE markets are highly competitive. We compete with a variety of banks, insurance companies, other financial institutions, specialty finance companies and public and private funds, including mortgage REITs, that Tremont, RMR or their subsidiaries currently, or may in the future, sponsor, advise or manage. Some of our competitors may have a lower cost of funds and greater financial and other resources than we have. Many of our competitors are not subject to the operating constraints associated with maintaining REIT status, SEC reporting compliance or maintaining an exemption from registration as an investment company under the 1940 Act.

For additional information about competition and other risks associated with our business, see Item 1A, “Risk Factors—We operate in a highly competitive market for investment opportunities and competition may limit our ability to originate or acquire our target investments on attractive terms or at all and could also affect the pricing of any investment opportunities” in this Annual Report on Form 10-K.

Our Manager, Tremont Realty Capital LLC. Tremont manages our day to day operations, subject to the oversight and direction of our Board of Trustees. Tremont is an investment adviser registered with the SEC, that is owned by RMR, the majority owned operating subsidiary of The RMR Group Inc., or RMR Inc., a holding company listed on The Nasdaq Stock Market LLC, or Nasdaq.

RMR is an alternative asset management company that is focused on CRE and related businesses. RMR or its subsidiaries also act as a manager to other publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. Most of the CRE assets under management by RMR are middle market properties owned by four publicly traded equity REITs that are managed by RMR.

As of December 31, 2023, RMR Inc. had over $41 billion of real estate assets under management and the combined RMR managed companies had more than $5 billion of annual revenues, over 2,000 properties and over 20,000 employees. In addition, RMR, on behalf of its managed companies, manages significant capital expenditure budgets for building improvements and property redevelopment.

We believe that Tremont’s relationship with RMR provides us with a depth of market knowledge that may allow us to identify high quality investment opportunities and to evaluate them more thoroughly than many of our competitors, including other commercial mortgage REITs. We also believe that RMR’s broad platform provides us with access to its extensive network of real estate owners, operators, intermediaries, sponsors, financial institutions and other real estate related professionals and businesses with which RMR has historical relationships. We also believe that Tremont provides us with significant experience and expertise in investing in middle market and transitional CRE.

As of February 15, 2024, the executive officers of RMR are: Adam D. Portnoy, president and chief executive officer; Christopher J. Bilotto, executive vice president; Jennifer B. Clark, executive vice president, general counsel and secretary; Matthew P. Jordan, executive vice president, chief financial officer and treasurer; and John G. Murray, executive vice president. Messrs. Portnoy and Jordan are our Managing Trustees. Our President and Chief Investment Officer, Thomas J. Lorenzini, and our Chief Financial Officer and Treasurer, Fernando Diaz, are officers and employees of Tremont and/or RMR.

For further information about these and other such relationships and related person transactions, see Item 1A, "Risk Factors—Risks Relating to Our Relationships with Tremont and RMR" and Notes 8 and 9 to our Consolidated Financial Statements included in Part IV, Item 15 of this Annual Report on Form 10-K.

Sustainability, Environmental and Climate Change Matters. We are managed by Tremont, a subsidiary of RMR. As such, many of the environmental, social and governance, or ESG, initiatives employed by RMR apply to us. RMR periodically publishes its Sustainability Report, which summarizes the ESG initiatives employed by RMR and its clients, including us. RMR’s Sustainability Report may be accessed on the RMR Inc. website at www.rmrgroup.com/corporate-sustainability/default.aspx. The information on or accessible through RMR Inc.’s website is not incorporated by reference into this Annual Report on Form 10-K and should not be considered part of this report.

We are committed to responsibly managing risk and preserving capital. We consider the ESG characteristics of potential borrowers and collateral properties when evaluating investment opportunities, performing due diligence procedures and making capital allocation decisions. In addition to incorporating ESG diligence practices in our investment process, where available, we also share key ESG initiatives with Tremont and RMR, including corporate sustainability and environmental improvements at our office locations and diversity, equality and inclusion programs.

Investments in Human Capital. We have no employees. All services that would otherwise be provided to us by employees are provided or arranged by Tremont. As of December 31, 2023, RMR had over 1,100 employees, including Tremont’s employees, located at its headquarters and more than 35 offices throughout the United States.

Corporate Citizenship. We seek to be a responsible corporate citizen and to strengthen the communities in which we operate. Tremont regularly encourages its employees to engage in a variety of charitable and community programs, including participating in a company-wide service day and charitable gift giving matching program.

Diversity & Inclusion. We value a diversity of backgrounds, experience and perspectives. As of December 31, 2023, our Board was comprised of six Trustees, of which four were independent and one, or approximately 17%, was female. RMR is an equal opportunity employer, with all qualified applicants receiving consideration for employment without regard to race, color, religion, sex, sexual orientation, gender identity, national origin, disability or protected veteran status.

Government Regulation. Our operations are subject, in certain instances, to supervision and regulation by state and federal governmental authorities, and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, among other things: (a) regulate credit granting activities; (b) establish maximum interest rates, finance charges and other charges; (c) require disclosures to customers; (d) govern secured transactions; (e) set collection, foreclosure, repossession and claims handling procedures and other trade practices; (f) govern privacy of customer information; and (g) regulate anti-terror and anti-money laundering activities.

In our judgment, existing statutes and regulations have not had a material adverse effect on our business. While we expect that additional new regulations in these areas will be adopted and existing regulations may change in the future, it is not possible at this time to forecast the exact nature of any future legislation, regulations, judicial decisions, orders or interpretations, nor their impact upon our future business, financial condition or our results of operations or prospects.

Internet Website. Our internet website address is www.sevnreit.com. Copies of our governance guidelines, our code of business conduct and ethics, or our Code of Conduct, and the charters of our audit, compensation and nominating and governance committees are posted on our website and also may be obtained free of charge by writing to our Secretary, Seven Hills Realty Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458-1634. We also have a policy outlining procedures for handling concerns or complaints about accounting, internal accounting controls or auditing matters and a governance hotline accessible on our website that shareholders can use to report concerns or complaints about accounting, internal accounting controls or auditing matters or violations or possible violations of our Code of Conduct. We make available, free of charge, through the “Investors” section of our website, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, as soon as reasonably practicable after these forms are filed with, or furnished to, the SEC. Any material we file with or furnish to the SEC is also maintained on the SEC website, www.sec.gov. Security holders may send communications to our Board of Trustees or individual Trustees by writing to the party for whom the communication is intended at c/o Secretary, Seven Hills Realty Trust, Two Newton Place, 255 Washington Street, Suite 300, Newton, Massachusetts 02458-1634 or by email at secretary@sevnreit.com. Our website address and the website address of one or more unrelated third parties are included several times in this Annual Report on Form 10-K as textual references only and the information in any such website is not incorporated by reference into this Annual Report on Form 10-K or other documents we file with, or furnish to, the SEC. We intend to use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Those disclosures will be included on our website in the “Investors” section. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts.

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS

The following summary of material United States federal income tax considerations is based on existing law and is limited to investors who own our shares as investment assets rather than as inventory or as property used in a trade or business. The summary does not discuss all of the particular tax considerations that might be relevant to you if you are subject to special rules under U.S. federal income tax law, for example if you are:

•a bank, insurance company or other financial institution;

•a regulated investment company or REIT;

•a subchapter S corporation;

•a broker, dealer or trader in securities or foreign currencies;

•a person who marks-to-market our shares for U.S. federal income tax purposes;

•a U.S. shareholder (as defined below) that has a functional currency other than the U.S. dollar;

•a person who acquires or owns our shares in connection with employment or other performance of services;

•a person subject to alternative minimum tax;

•a person who acquires or owns our shares as part of a straddle, hedging transaction, constructive sale transaction, constructive ownership transaction or conversion transaction, or as part of a “synthetic security” or other integrated financial transaction;

•a person who owns 10% or more (by vote or value, directly or constructively under the IRC) of any class of our shares;

•a U.S. expatriate;

•a non-U.S. shareholder (as defined below) whose investment in our shares is effectively connected with the conduct of a trade or business in the United States;

•a nonresident alien individual present in the United States for 183 days or more during an applicable taxable year;

•a “qualified shareholder” (as defined in Section 897(k)(3)(A) of the IRC);

•a “qualified foreign pension fund” (as defined in Section 897(l)(2) of the IRC) or any entity wholly owned by one or more qualified foreign pension funds;

•a non-U.S. shareholder that is a passive foreign investment company or controlled foreign corporation;

•a person subject to special tax accounting rules as a result of their use of applicable financial statements (within the meaning of Section 451(b)(3) of the IRC); or

•except as specifically described in the following summary, a trust, estate, tax-exempt entity or foreign person.

The sections of the IRC that govern the federal income tax qualification and treatment of a REIT and its shareholders are complex. This presentation is a summary of applicable IRC provisions, related rules and regulations, and administrative and judicial interpretations, all of which are subject to change, possibly with retroactive effect. Future legislative, judicial or administrative actions or decisions could also affect the accuracy of statements made in this summary. We have not received a ruling from the U.S. Internal Revenue Service, or the IRS, with respect to any matter described in this summary, and we cannot be sure that the IRS or a court will agree with all of the statements made in this summary. The IRS could, for example, take a different position from that described in this summary with respect to our acquisitions, operations, valuations, restructurings or other matters, which, if a court agreed, could result in significant tax liabilities for applicable parties. In addition, this summary is not exhaustive of all possible tax considerations and does not discuss any estate, gift, state, local or foreign tax considerations. For all these reasons, we urge you and any holder of or prospective acquiror of our shares to consult with a tax advisor about the federal income tax and other tax consequences of the acquisition, ownership and disposition of our shares. Our intentions and beliefs described in this summary are based upon our understanding of applicable laws and regulations that are in effect as of the date of this Annual Report on Form 10-K. If new laws or regulations are enacted which impact us directly or indirectly, we may change our intentions or beliefs.

Your federal income tax consequences generally will differ depending on whether or not you are a “U.S. shareholder.” For purposes of this summary, a “U.S. shareholder” is a beneficial owner of our shares that is:

•an individual who is a citizen or resident of the United States, including an alien individual who is a lawful permanent resident of the United States or meets the substantial presence residency test under the federal income tax laws;

•an entity treated as a corporation for federal income tax purposes that is created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

•an estate the income of which is subject to federal income taxation regardless of its source; or

•a trust if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial decisions of the trust, or, to the extent provided in Treasury regulations, a trust in existence on August 20, 1996 that has elected to be treated as a domestic trust;

whose status as a U.S. shareholder is not overridden by an applicable tax treaty. Conversely, a “non-U.S. shareholder” is a beneficial owner of our shares that is not an entity (or other arrangement) treated as a partnership for federal income tax purposes and is not a U.S. shareholder.

If any entity (or other arrangement) treated as a partnership for federal income tax purposes holds our shares, the tax treatment of a partner in the partnership generally will depend upon the tax status of the partner and the activities of the partnership. Any entity (or other arrangement) treated as a partnership for federal income tax purposes that is a holder of our shares and the partners in such a partnership (as determined for federal income tax purposes) are urged to consult their own tax advisors about the federal income tax consequences and other tax consequences of the acquisition, ownership and disposition of our shares.

Taxation as a REIT

We have elected to be taxed as a REIT under Sections 856 through 860 of the IRC, commencing with our 2020 taxable year. Our REIT election, assuming continuing compliance with the then applicable qualification tests, has continued and will continue in effect for subsequent taxable years. Although we cannot be sure, we believe that from and after our 2020 taxable year we have been organized and have operated, and will continue to be organized and to operate, in a manner that qualified us and will continue to qualify us to be taxed as a REIT under the IRC.

As a REIT, we generally are not subject to federal income tax on our net income distributed as dividends to our shareholders. Distributions to our shareholders generally are included in our shareholders’ income as dividends to the extent of our available current or accumulated earnings and profits. Our dividends are not generally entitled to the preferential tax rates on qualified dividend income, but a portion of our dividends may be treated as capital gain dividends or as qualified dividend income, all as explained below. In addition, for taxable years beginning before 2026 and pursuant to the deduction-without-outlay mechanism of Section 199A of the IRC, our noncorporate U.S. shareholders that meet specified holding period requirements are generally eligible for lower effective tax rates on our dividends that are not treated as capital gain dividends or as qualified dividend income. No portion of any of our dividends is eligible for the dividends received deduction for corporate shareholders. Distributions in excess of our current or accumulated earnings and profits generally are treated for federal income tax purposes as returns of capital to the extent of a recipient shareholder’s basis in our shares, and will reduce this basis. Our current or accumulated earnings and profits are generally allocated first to distributions made on our preferred shares, of which there are none outstanding at this time, and thereafter to distributions made on our common shares. For all these purposes, our distributions include cash distributions, any in kind distributions of property that we might make, and deemed or constructive distributions resulting from capital market activities (such as some redemptions), as described below.

Our tax counsel, Sullivan & Worcester LLP, is of the opinion that we have been organized and have qualified for taxation as a REIT under the IRC for our 2020 through 2023 taxable years, and that our current and anticipated investments and plan of operation will enable us to continue to meet the requirements for qualification and taxation as a REIT under the IRC. Our tax counsel’s opinions are conditioned upon the assumption that our leases, declaration of trust and all other legal documents to which we have been or are a party have been and will be complied with by all parties to those documents, upon the accuracy and completeness of the factual matters described in this Annual Report on Form 10-K and upon representations made by us to our tax counsel as to certain factual matters relating to our organization and operations and our expected manner of operation. If this assumption or a description or representation is inaccurate or incomplete, our tax counsel’s opinions may be adversely affected and may not be relied upon. The opinions of our tax counsel are based upon the law as it exists today, but the law may change in the future, possibly with retroactive effect.

Given the highly complex nature of the rules governing REITs, the ongoing importance of factual determinations, and the possibility of future changes in our circumstances, neither Sullivan & Worcester LLP nor we can be sure that we will qualify as or be taxed as a REIT for any particular year. Any opinion of Sullivan & Worcester LLP as to our qualification or taxation as a REIT will be expressed as of the date issued. Our tax counsel will have no obligation to advise us or our shareholders of any subsequent change in the matters stated, represented or assumed, or of any subsequent change in the applicable law. Also, the opinions of our tax counsel are not binding on either the IRS or a court, and either could take a position different from that expressed by our tax counsel.

Our continued qualification and taxation as a REIT will depend upon our compliance with various qualification tests imposed under the IRC and summarized below. While we believe that we have satisfied and will satisfy these tests, our tax counsel does not review compliance with these tests on a continuing basis. If we fail to qualify for taxation as a REIT in any year, then we will be subject to federal income taxation as if we were a corporation taxed under subchapter C of the IRC, or a C corporation, and our shareholders will be taxed like shareholders of a regular C corporation, meaning that federal income tax generally will be applied at both the corporate and shareholder levels. In this event, we could be subject to significant tax liabilities, and the amount of cash available for distribution to our shareholders could be reduced or eliminated.

If we continue to qualify for taxation as a REIT and meet the tests described below, then we generally will not pay federal income tax on amounts that we distribute to our shareholders. However, even if we continue to qualify for taxation as a REIT, we may still be subject to federal tax in the following circumstances, as described below:

•We will be taxed at regular corporate income tax rates on any undistributed “real estate investment trust taxable income,” determined by including our undistributed ordinary income and net capital gains, if any. We may elect to retain and pay income tax on our net capital gain. In addition, if we so elect by making a timely designation to our shareholders, a shareholder would be taxed on its proportionate share of our undistributed capital gain and would generally be expected to receive a credit or refund for its proportionate share of the tax we paid.

•If we have net income from “prohibited transactions”—that is, dispositions at a gain of inventory or property held primarily for sale to customers in the ordinary course of a trade or business other than dispositions of foreclosure property and other than dispositions excepted by statutory safe harbors—we will be subject to tax on this income at a 100% rate.

•If we elect to treat property that we acquire in connection with a foreclosure of a mortgage loan or certain property that we dispose of as “foreclosure property,” as described in Section 856(e) of the IRC, we may thereby avoid both (a) the 100% tax on gain from a resale of that property (if the sale would otherwise constitute a prohibited transaction) and (b) the inclusion of any income from such property not qualifying for purposes of the REIT gross income tests discussed below, but in exchange for these benefits we will be subject to tax on the foreclosure property income at the highest regular corporate income tax rate.

•If we fail to satisfy the 75% gross income test or the 95% gross income test discussed below, due to reasonable cause and not due to willful neglect, but nonetheless maintain our qualification for taxation as a REIT because of specified cure provisions, we will be subject to tax at a 100% rate on the greater of the amount by which we fail the 75% gross income test or the 95% gross income test, with adjustments, multiplied by a fraction intended to reflect our profitability for the taxable year.

•If we fail to satisfy any of the REIT asset tests described below (other than a de minimis failure of the 5% or 10% asset tests) due to reasonable cause and not due to willful neglect, but nonetheless maintain our qualification for taxation as a REIT because of specified cure provisions, we will be subject to a tax equal to the greater of $50,000 or the highest regular corporate income tax rate multiplied by the net income generated by the nonqualifying assets that caused us to fail the test.

•If we fail to satisfy any provision of the IRC that would result in our failure to qualify for taxation as a REIT (other than violations of the REIT gross income tests or violations of the REIT asset tests described below) due to reasonable cause and not due to willful neglect, we may retain our qualification for taxation as a REIT but will be subject to a penalty of $50,000 for each failure.

•If we fail to distribute for any calendar year at least the sum of 85% of our REIT ordinary income for that year, 95% of our REIT capital gain net income for that year and any undistributed taxable income from prior periods, we will be subject to a 4% nondeductible excise tax on the excess of the required distribution over the amounts actually distributed.

•If we acquire a REIT asset where our adjusted tax basis in the asset is determined by reference to the adjusted tax basis of the asset in the hands of a C corporation, under specified circumstances we may be subject to federal income taxation on all or part of the built-in gain (calculated as of the date the property ceased being owned by the C corporation) on such asset. We generally do not expect to sell assets if doing so would result in the imposition of a material built-in gains tax liability; but if and when we do sell assets that may have associated built-in gains tax exposure, then we expect to make appropriate provision for the associated tax liabilities on our financial statements.

•Our subsidiaries that are C corporations, including our “taxable REIT subsidiaries”, as defined in Section 856(l) of the IRC, or TRSs, generally will be required to pay federal corporate income tax on their earnings, and a 100% tax may be imposed on any transaction between us and one of our TRSs that does not reflect arm’s length terms.

•We acquired Tremont Mortgage Trust, or TRMT, by merger in 2021, or the Merger. If it is determined that TRMT failed to satisfy one or more of the REIT tests described below before its merger into us, the IRS might allow us, as TRMT’s successor, the same opportunity for relief as though we were the remediating REIT. In such case, TRMT would be deemed to have retained its qualification for taxation as a REIT and the relevant penalties or sanctions for remediation would fall upon us in a manner comparable to the above.

If we fail to qualify for taxation as a REIT in any year, then we will be subject to federal income tax in the same manner as a regular C corporation. Further, as a regular C corporation, distributions to our shareholders will not be deductible by us, nor will distributions be required under the IRC. Also, to the extent of our current and accumulated earnings and profits, all distributions to our shareholders will generally be taxable as ordinary dividends potentially eligible for the preferential tax rates discussed below under the heading “—Taxation of Taxable U.S. Shareholders” and, subject to limitations in the IRC, will be potentially eligible for the dividends received deduction for corporate shareholders. Finally, we will generally be disqualified from taxation as a REIT for the four taxable years following the taxable year in which the termination of our REIT status is effective. Our failure to qualify for taxation as a REIT for even one year could result in us reducing or eliminating distributions to our shareholders, or in us incurring substantial indebtedness or liquidating substantial investments in order to pay the resulting corporate-level income taxes. Relief provisions under the IRC may allow us to continue to qualify for taxation as a REIT even if we fail to comply with various REIT requirements, all as discussed in more detail below. However, it is impossible to state whether in any particular circumstance we would be entitled to the benefit of these relief provisions.

We do not intend to acquire or otherwise own assets or to conduct financing or other activities if doing so would produce “excess inclusion” or similar income for us or our shareholders, except that we may own assets or conduct activities through a TRS such that no excess inclusion or similar income results for us and our shareholders. However, if we own assets or conduct activities contrary to this expectation—e.g., if we were to (a) acquire or otherwise own a residual interest in a real estate mortgage investment conduit, or a REMIC, or (b) sponsor a non-REMIC collateralized mortgage pool to issue multiple class debt instruments related to the underlying mortgage loans, in each case other than through a TRS—then a portion of our income will be treated as excess inclusion income and a portion of the dividends that we pay to our shareholders will also be considered to be excess inclusion income. Generally, a shareholder’s dividend income from a REIT corresponding to the shareholder’s share of the REIT’s excess inclusion or similar income: (a) cannot be offset by any net operating losses otherwise available to the shareholder; (b) is subject to tax as “unrelated business taxable income” as defined by Section 512 of the IRC, or UBTI, in the hands of most types of shareholders that are otherwise generally exempt from federal income tax; and (c) results in the application of federal income tax withholding at the maximum statutory rate of 30% (and any otherwise available rate reductions under income tax treaties do not apply) with respect to non-U.S. shareholders. IRS guidance indicates that if we were to generate excess inclusion or similar income, then that income would be allocated among our shareholders in proportion to our dividends paid. Even so, the manner in which this income would be allocated to dividends attributable to a taxable year that are not paid until a subsequent taxable year (or to dividends attributable to a portion of a taxable year when no assets or operations were held or conducted that produced excess inclusion or similar income), as well as the manner of reporting these special tax items to shareholders, is not clear under current law, and there can be no assurance that the IRS will not challenge our method of making any such determinations. If the IRS were to disagree with any such determinations made or with the method used by us, the amount of any excess inclusion or similar income required to be taken into account by one or more of our shareholders could be significantly increased.

In addition, if we own a residual interest in a REMIC, we will be taxed at the highest corporate income tax rate on the percentage of our excess inclusion income that corresponds to the percentage of our shares of beneficial interest that are held in record name by “disqualified organizations.” Although the law is unsettled, the IRS asserts that similar rules apply to a REIT that generates income similar to excess inclusion income as a result of owning specified non-REMIC collateralized mortgage pools. If we become subject to tax on excess inclusion or similar income as a consequence of one or more “disqualified organizations” owning our shares, we are entitled under our declaration of trust (but not required) to reduce the amount of distributions that we pay to those shareholders whose ownership gives rise to the tax liability. If we do not specifically allocate this tax burden to the applicable shareholders, then as a practical matter it will be borne by us and all of our shareholders. Disqualified organizations include: (a) the United States; (b) any state or political subdivision of the United States; (c) any foreign government; (d) any international organization; (e) any agency or instrumentality of any of the foregoing; (f) any other tax-exempt organization, other than a farmer’s cooperative described in Section 521 of the IRC, that is exempt both from income taxation and from taxation under the UBTI provisions of the IRC; and (g) any rural electrical or telephone cooperative. To the extent that our shares owned by disqualified organizations are held in street name by a broker-dealer or other nominee, the IRS asserts that the broker-dealer or nominee is liable for a tax at the highest corporate income tax rate on the portion of our excess inclusion or similar income allocable to the shares held on behalf of the disqualified organizations. A regulated investment company or other pass-through entity owning our shares would, according to the IRS, also be subject to tax at the highest corporate income tax rate on any excess inclusion or similar income from us that is allocated to their record name owners that are disqualified organizations.

In sum, although we do not intend to own assets or conduct activities if doing so would produce “excess inclusion” or similar income for us or our shareholders, tax-exempt investors, foreign investors, taxpayers with net operating losses, regulated investment companies, pass-through entities and broker-dealers and other nominees should carefully consider the tax consequences described above and are urged to consult their tax advisors in connection with their decision to invest in or hold our shares.

REIT Qualification Requirements

General Requirements. Section 856(a) of the IRC defines a REIT as a corporation, trust or association:

(1)that is managed by one or more trustees or directors;

(2)the beneficial ownership of which is evidenced by transferable shares or by transferable certificates of beneficial interest;

(3)that would be taxable, but for Sections 856 through 859 of the IRC, as a domestic C corporation;

(4)that is not a financial institution or an insurance company subject to special provisions of the IRC;

(5)the beneficial ownership of which is held by 100 or more persons;

(6)that is not “closely held,” meaning that during the last half of each taxable year, not more than 50% in value of the outstanding shares are owned, directly or indirectly, by five or fewer “individuals” (as defined in the IRC to include specified tax-exempt entities);

(7)that does not have (and has not succeeded to) the post-December 7, 2015 tax-free spin-off history proscribed by Section 856(c)(8) of the IRC; and

(8)that meets other tests regarding the nature of its income and assets and the amount of its distributions, all as described below.

Section 856(b) of the IRC provides that conditions (1) through (4) must be met during the entire taxable year and that condition (5) must be met during at least 335 days of a taxable year of 12 months, or during a proportionate part of a taxable year of less than 12 months. Although we cannot be sure, we believe that we have met conditions (1) through (8) during each of the requisite periods ending on or before the close of our most recently completed taxable year, and that we will continue to meet these conditions in our current and future taxable years.

To help comply with condition (6), our declaration of trust restricts transfers of our shares that would otherwise result in concentrated ownership positions. These restrictions, however, do not ensure that we have previously satisfied, and may not ensure that we will in all cases be able to continue to satisfy, the share ownership requirements described in condition (6). If we comply with applicable Treasury regulations to ascertain the ownership of our outstanding shares and do not know, or by exercising reasonable diligence would not have known, that we failed condition (6), then we will be treated as having met condition (6). Accordingly, we have complied and will continue to comply with these regulations, including by requesting annually from holders of significant percentages of our shares information regarding the ownership of our shares. Under our declaration of trust, our shareholders are required to respond to these requests for information. A shareholder that fails or refuses to comply with the request is required by Treasury regulations to submit a statement with its federal income tax return disclosing its actual ownership of our shares and other information.

For purposes of condition (6), an “individual” generally includes a natural person, a supplemental unemployment compensation benefit plan, a private foundation, or a portion of a trust permanently set aside or used exclusively for charitable purposes, but does not include a qualified pension plan or profit-sharing trust. As a result, REIT shares owned by an entity that is not an “individual” are considered to be owned by the direct and indirect owners of the entity that are individuals (as so defined), rather than to be owned by the entity itself. Similarly, REIT shares held by a qualified pension plan or profit-sharing trust are treated as held directly by the individual beneficiaries in proportion to their actuarial interests in such plan or trust. Consequently, five or fewer such trusts could own more than 50% of the interests in an entity without jeopardizing that entity’s qualification for taxation as a REIT.

The IRC provides that we will not automatically fail to qualify for taxation as a REIT if we do not meet conditions (1) through (7), provided we can establish that such failure was due to reasonable cause and not due to willful neglect. Each such excused failure will result in the imposition of a $50,000 penalty instead of REIT disqualification. This relief provision may apply to a failure of the applicable conditions even if the failure first occurred in a year prior to the taxable year in which the failure was discovered.

Our Wholly Owned Subsidiaries and Our Investments Through Partnerships. Except in respect of a TRS as discussed below, Section 856(i) of the IRC provides that any corporation, 100% of whose stock is held by a REIT and its disregarded subsidiaries, is a qualified REIT subsidiary and shall not be treated as a separate corporation for U.S. federal income tax purposes. The assets, liabilities and items of income, deduction and credit of a qualified REIT subsidiary are treated as the REIT’s. We believe that each of our direct and indirect wholly owned subsidiaries, other than the TRSs discussed below (and entities whose equity is owned in whole or in part by such TRSs), will be either a qualified REIT subsidiary within the meaning of Section 856(i)(2) of the IRC or a noncorporate entity that for federal income tax purposes is not treated as separate from its owner under Treasury regulations issued under Section 7701 of the IRC, each such entity referred to as a QRS. Thus, in applying all of the REIT qualification requirements described in this summary, all assets, liabilities and items of income, deduction and credit of our QRSs are treated as ours, and our investment in the stock and other securities of such QRSs will be disregarded.