QUARTERLY SUPPLEMENTAL INFORMATION FOURTH QUARTER 2024 Exhibit 99.2

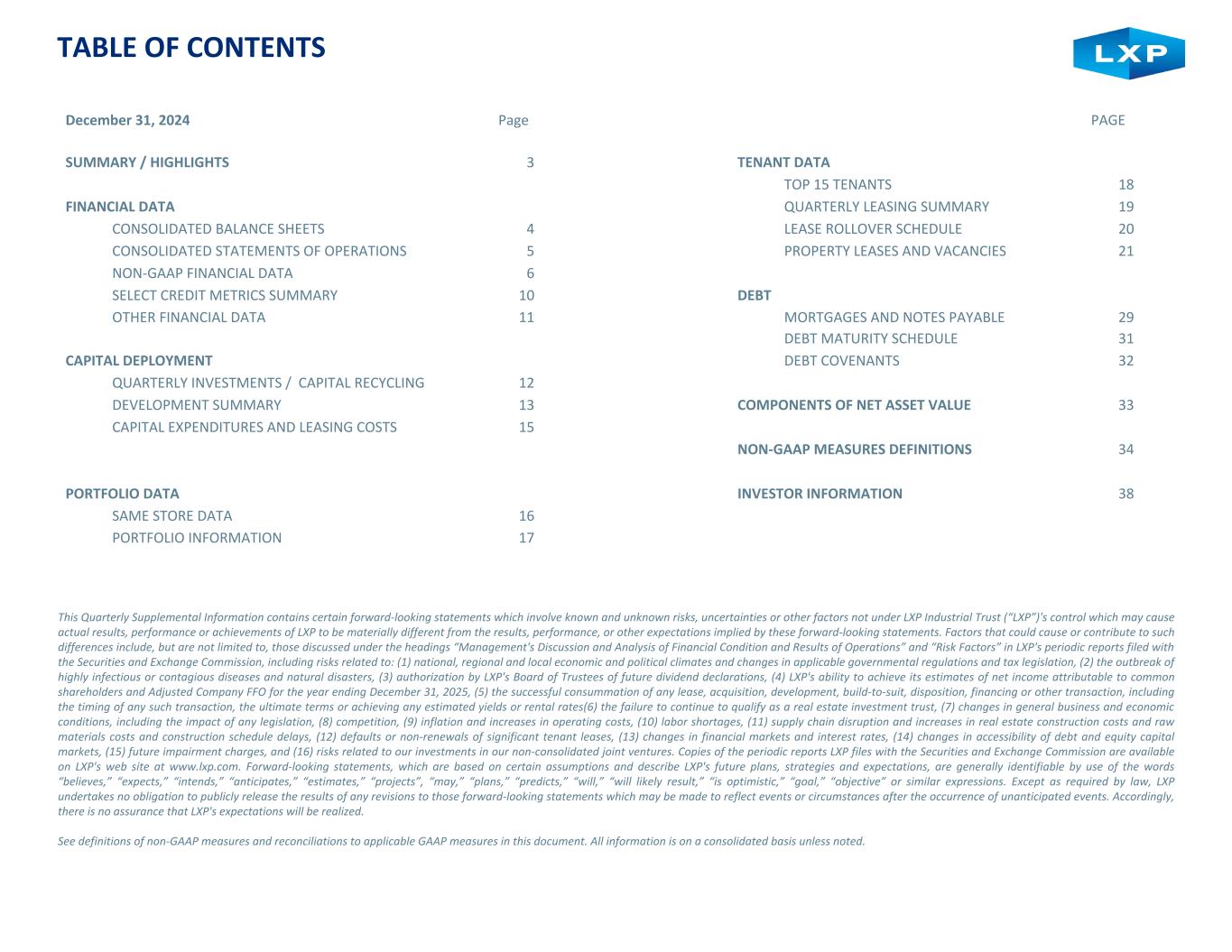

TABLE OF CONTENTS December 31, 2024 Page PAGE SUMMARY / HIGHLIGHTS 3 TENANT DATA TOP 15 TENANTS 18 FINANCIAL DATA QUARTERLY LEASING SUMMARY 19 CONSOLIDATED BALANCE SHEETS 4 LEASE ROLLOVER SCHEDULE 20 CONSOLIDATED STATEMENTS OF OPERATIONS 5 PROPERTY LEASES AND VACANCIES 21 NON-GAAP FINANCIAL DATA 6 SELECT CREDIT METRICS SUMMARY 10 DEBT OTHER FINANCIAL DATA 11 MORTGAGES AND NOTES PAYABLE 29 DEBT MATURITY SCHEDULE 31 CAPITAL DEPLOYMENT DEBT COVENANTS 32 QUARTERLY INVESTMENTS / CAPITAL RECYCLING 12 DEVELOPMENT SUMMARY 13 COMPONENTS OF NET ASSET VALUE 33 CAPITAL EXPENDITURES AND LEASING COSTS 15 NON-GAAP MEASURES DEFINITIONS 34 PORTFOLIO DATA INVESTOR INFORMATION 38 SAME STORE DATA 16 PORTFOLIO INFORMATION 17 This Quarterly Supplemental Information contains certain forward-looking statements which involve known and unknown risks, uncertainties or other factors not under LXP Industrial Trust (“LXP”)'s control which may cause actual results, performance or achievements of LXP to be materially different from the results, performance, or other expectations implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed under the headings “Management's Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in LXP's periodic reports filed with the Securities and Exchange Commission, including risks related to: (1) national, regional and local economic and political climates and changes in applicable governmental regulations and tax legislation, (2) the outbreak of highly infectious or contagious diseases and natural disasters, (3) authorization by LXP's Board of Trustees of future dividend declarations, (4) LXP's ability to achieve its estimates of net income attributable to common shareholders and Adjusted Company FFO for the year ending December 31, 2025, (5) the successful consummation of any lease, acquisition, development, build-to-suit, disposition, financing or other transaction, including the timing of any such transaction, the ultimate terms or achieving any estimated yields or rental rates(6) the failure to continue to qualify as a real estate investment trust, (7) changes in general business and economic conditions, including the impact of any legislation, (8) competition, (9) inflation and increases in operating costs, (10) labor shortages, (11) supply chain disruption and increases in real estate construction costs and raw materials costs and construction schedule delays, (12) defaults or non-renewals of significant tenant leases, (13) changes in financial markets and interest rates, (14) changes in accessibility of debt and equity capital markets, (15) future impairment charges, and (16) risks related to our investments in our non-consolidated joint ventures. Copies of the periodic reports LXP files with the Securities and Exchange Commission are available on LXP's web site at www.lxp.com. Forward-looking statements, which are based on certain assumptions and describe LXP's future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,” “projects”, “may,” “plans,” “predicts,” “will,” “will likely result,” “is optimistic,” “goal,” “objective” or similar expressions. Except as required by law, LXP undertakes no obligation to publicly release the results of any revisions to those forward-looking statements which may be made to reflect events or circumstances after the occurrence of unanticipated events. Accordingly, there is no assurance that LXP's expectations will be realized. See definitions of non-GAAP measures and reconciliations to applicable GAAP measures in this document. All information is on a consolidated basis unless noted.

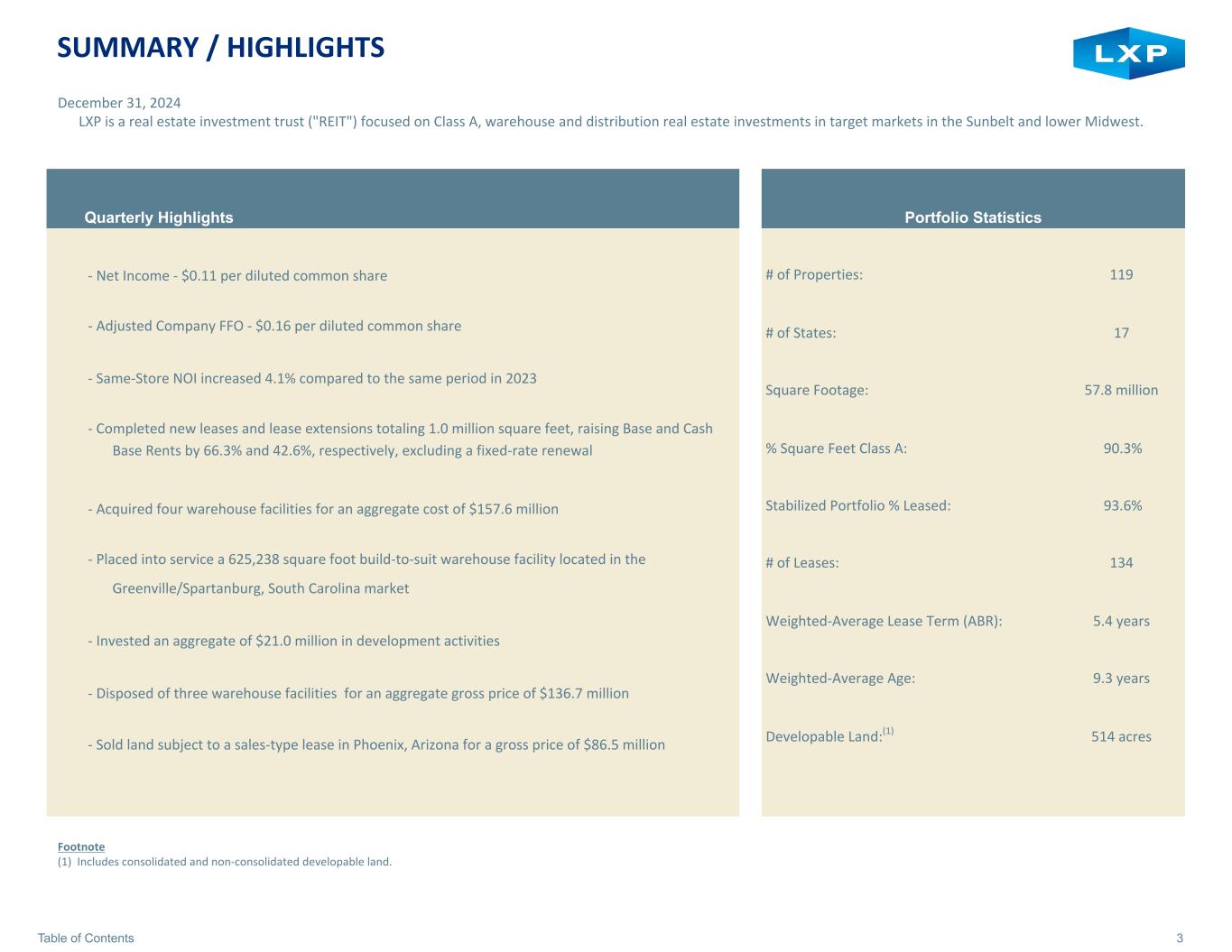

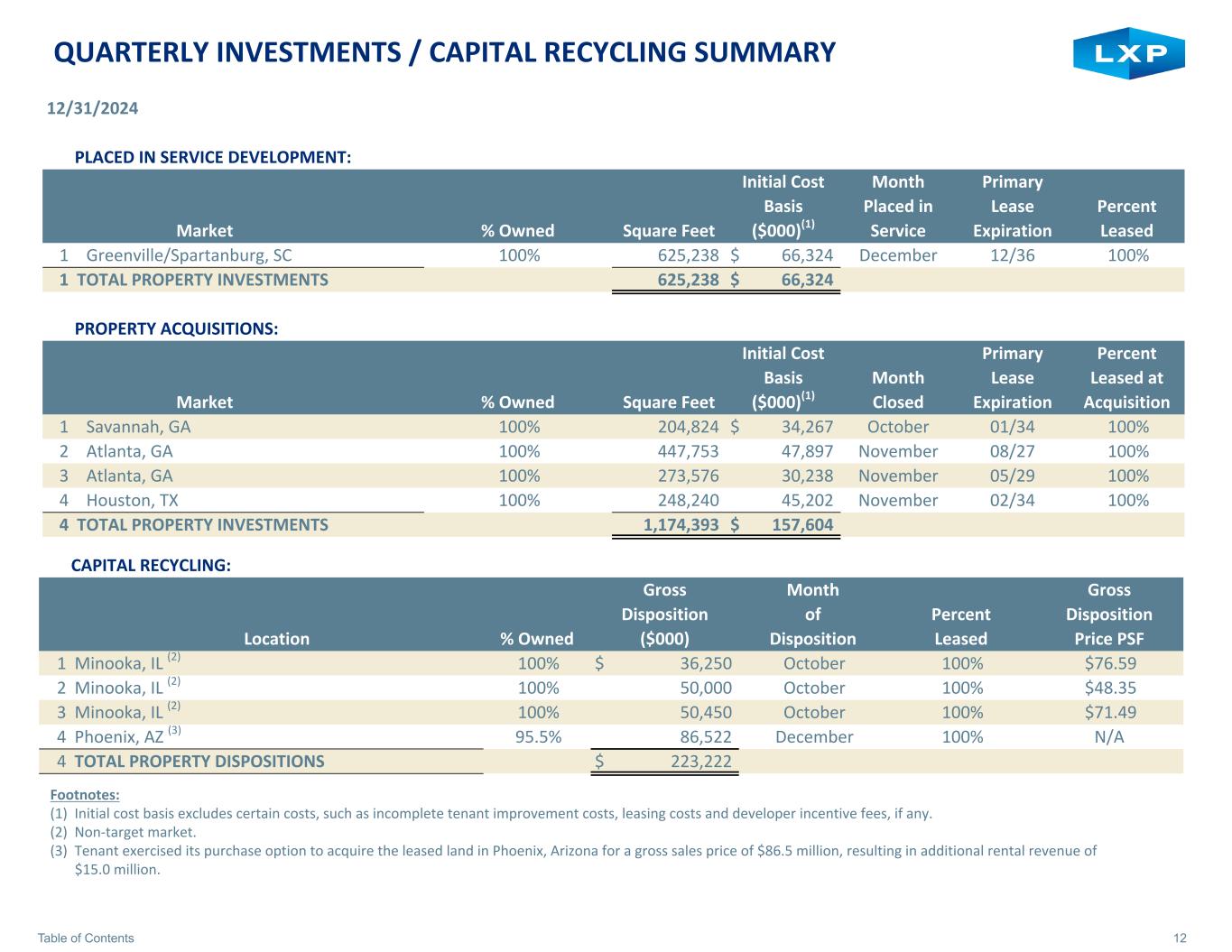

3Table of Contents SUMMARY / HIGHLIGHTS December 31, 2024 LXP is a real estate investment trust ("REIT") focused on Class A, warehouse and distribution real estate investments in target markets in the Sunbelt and lower Midwest. Quarterly Highlights - Net Income - $0.11 per diluted common share - Adjusted Company FFO - $0.16 per diluted common share - Same-Store NOI increased 4.1% compared to the same period in 2023 - Completed new leases and lease extensions totaling 1.0 million square feet, raising Base and Cash Base Rents by 66.3% and 42.6%, respectively, excluding a fixed-rate renewal - Acquired four warehouse facilities for an aggregate cost of $157.6 million - Placed into service a 625,238 square foot build-to-suit warehouse facility located in the Greenville/Spartanburg, South Carolina market - Invested an aggregate of $21.0 million in development activities - Disposed of three warehouse facilities for an aggregate gross price of $136.7 million - Sold land subject to a sales-type lease in Phoenix, Arizona for a gross price of $86.5 million Portfolio Statistics # of Properties: 119 # of States: 17 Square Footage: 57.8 million % Square Feet Class A: 90.3% Stabilized Portfolio % Leased: 93.6% # of Leases: 134 Weighted-Average Lease Term (ABR): 5.4 years Weighted-Average Age: 9.3 years Developable Land:(1) 514 acres Footnote (1) Includes consolidated and non-consolidated developable land.

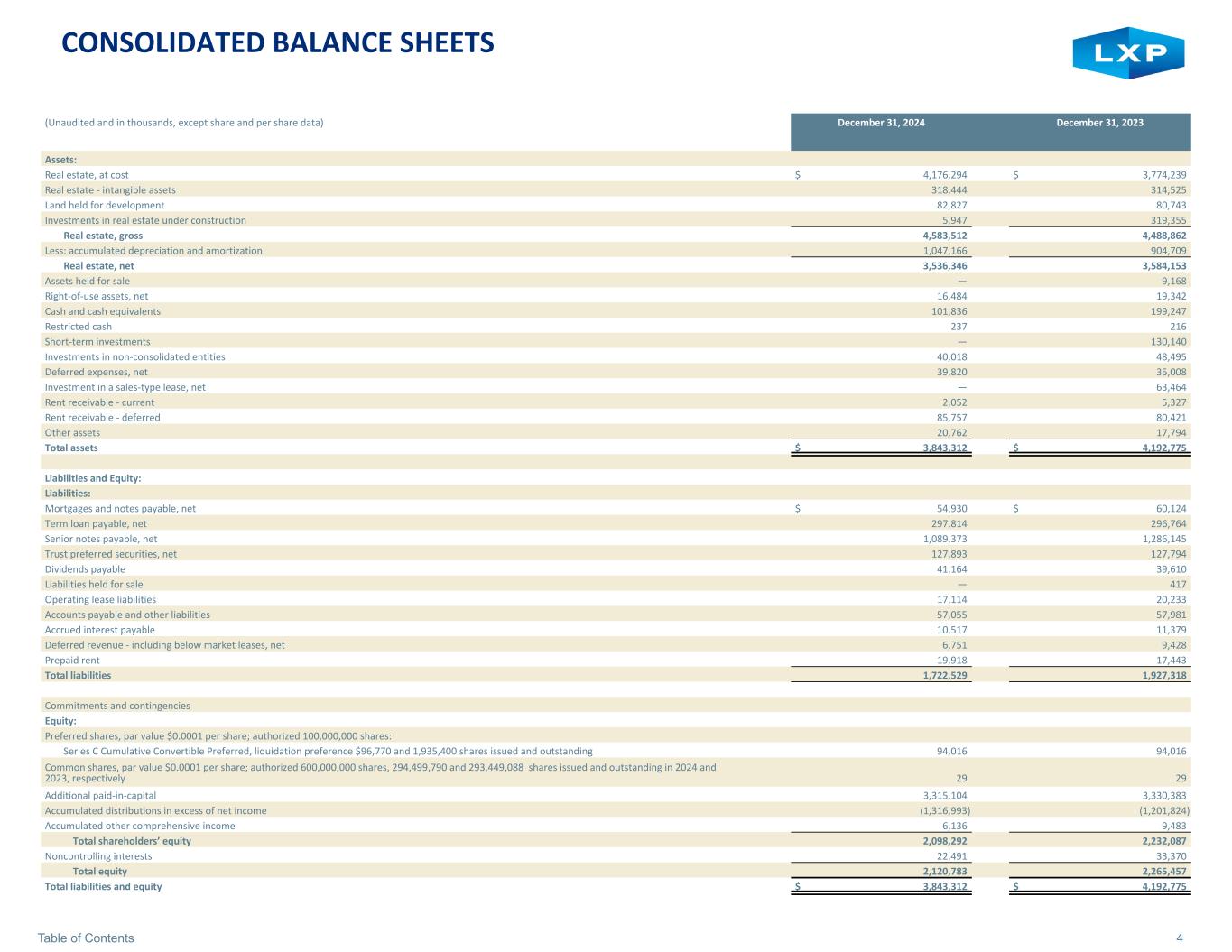

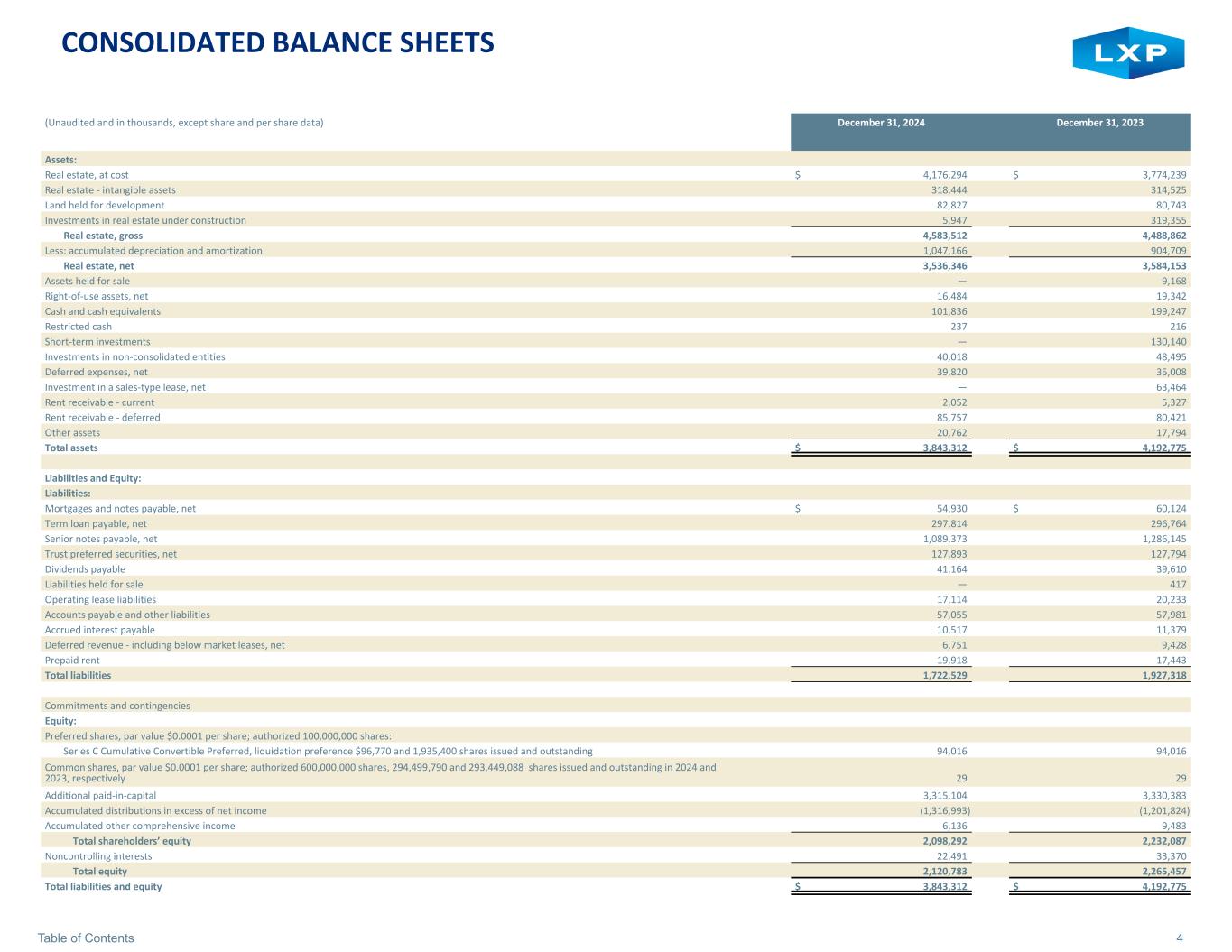

4Table of Contents CONSOLIDATED BALANCE SHEETS (Unaudited and in thousands, except share and per share data) December 31, 2024 December 31, 2023 Assets: Real estate, at cost $ 4,176,294 $ 3,774,239 Real estate - intangible assets 318,444 314,525 Land held for development 82,827 80,743 Investments in real estate under construction 5,947 319,355 Real estate, gross 4,583,512 4,488,862 Less: accumulated depreciation and amortization 1,047,166 904,709 Real estate, net 3,536,346 3,584,153 Assets held for sale — 9,168 Right-of-use assets, net 16,484 19,342 Cash and cash equivalents 101,836 199,247 Restricted cash 237 216 Short-term investments — 130,140 Investments in non-consolidated entities 40,018 48,495 Deferred expenses, net 39,820 35,008 Investment in a sales-type lease, net — 63,464 Rent receivable - current 2,052 5,327 Rent receivable - deferred 85,757 80,421 Other assets 20,762 17,794 Total assets $ 3,843,312 $ 4,192,775 Liabilities and Equity: Liabilities: Mortgages and notes payable, net $ 54,930 $ 60,124 Term loan payable, net 297,814 296,764 Senior notes payable, net 1,089,373 1,286,145 Trust preferred securities, net 127,893 127,794 Dividends payable 41,164 39,610 Liabilities held for sale — 417 Operating lease liabilities 17,114 20,233 Accounts payable and other liabilities 57,055 57,981 Accrued interest payable 10,517 11,379 Deferred revenue - including below market leases, net 6,751 9,428 Prepaid rent 19,918 17,443 Total liabilities 1,722,529 1,927,318 Commitments and contingencies Equity: Preferred shares, par value $0.0001 per share; authorized 100,000,000 shares: Series C Cumulative Convertible Preferred, liquidation preference $96,770 and 1,935,400 shares issued and outstanding 94,016 94,016 Common shares, par value $0.0001 per share; authorized 600,000,000 shares, 294,499,790 and 293,449,088 shares issued and outstanding in 2024 and 2023, respectively 29 29 Additional paid-in-capital 3,315,104 3,330,383 Accumulated distributions in excess of net income (1,316,993) (1,201,824) Accumulated other comprehensive income 6,136 9,483 Total shareholders’ equity 2,098,292 2,232,087 Noncontrolling interests 22,491 33,370 Total equity 2,120,783 2,265,457 Total liabilities and equity $ 3,843,312 $ 4,192,775

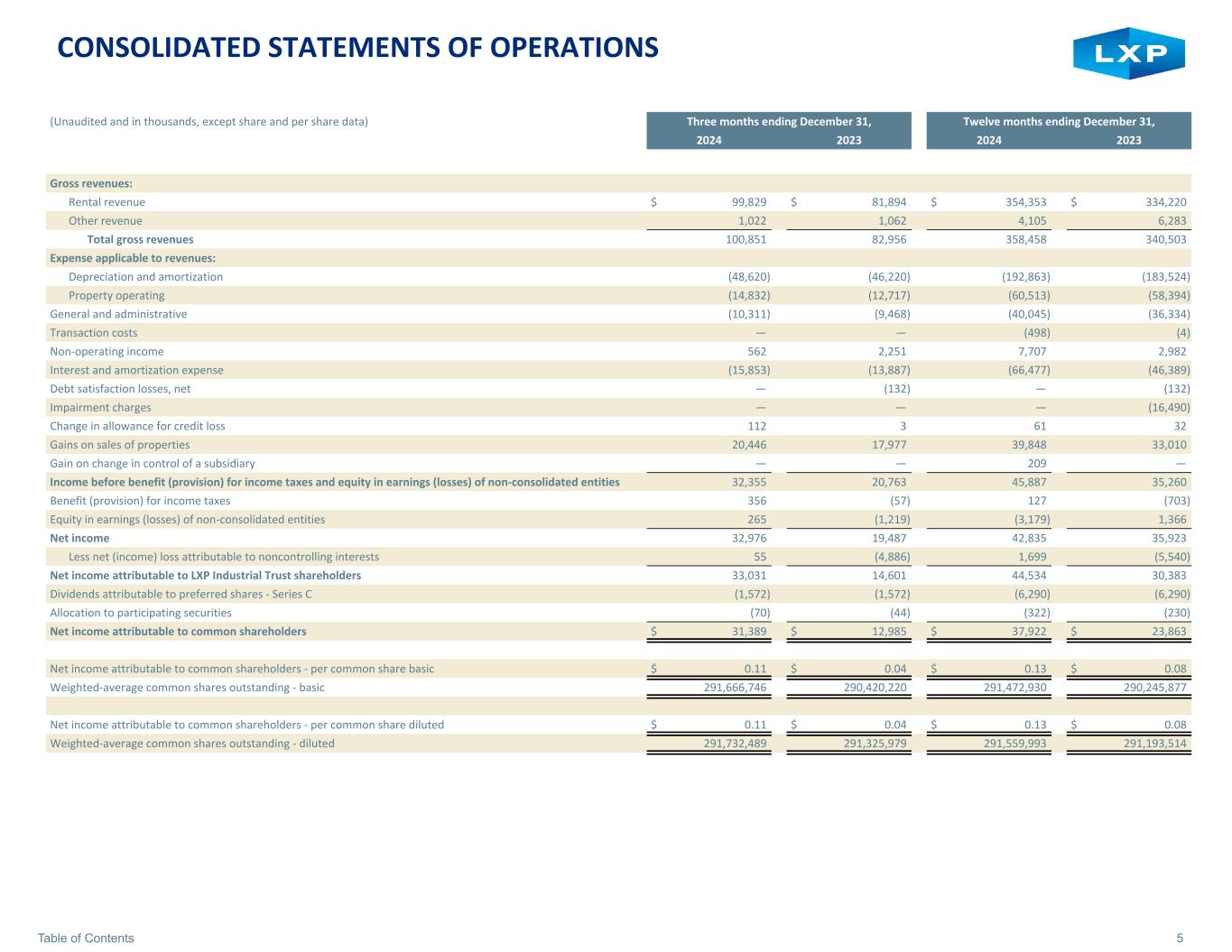

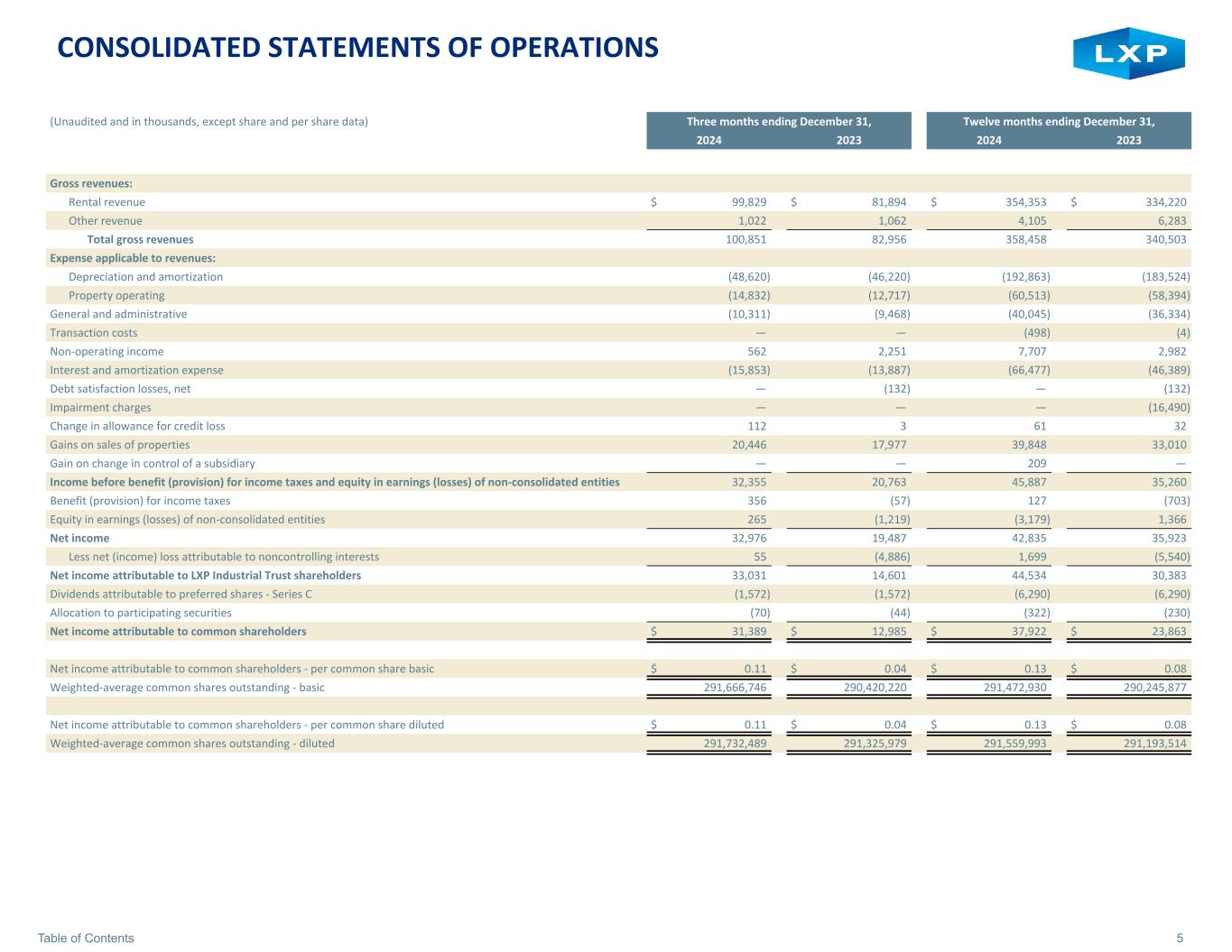

5Table of Contents CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited and in thousands, except share and per share data) Three months ending December 31, Twelve months ending December 31, 2024 2023 2024 2023 Gross revenues: Rental revenue $ 99,829 $ 81,894 $ 354,353 $ 334,220 Other revenue 1,022 1,062 4,105 6,283 Total gross revenues 100,851 82,956 358,458 340,503 Expense applicable to revenues: Depreciation and amortization (48,620) (46,220) (192,863) (183,524) Property operating (14,832) (12,717) (60,513) (58,394) General and administrative (10,311) (9,468) (40,045) (36,334) Transaction costs — — (498) (4) Non-operating income 562 2,251 7,707 2,982 Interest and amortization expense (15,853) (13,887) (66,477) (46,389) Debt satisfaction losses, net — (132) — (132) Impairment charges — — — (16,490) Change in allowance for credit loss 112 3 61 32 Gains on sales of properties 20,446 17,977 39,848 33,010 Gain on change in control of a subsidiary — — 209 — Income before benefit (provision) for income taxes and equity in earnings (losses) of non-consolidated entities 32,355 20,763 45,887 35,260 Benefit (provision) for income taxes 356 (57) 127 (703) Equity in earnings (losses) of non-consolidated entities 265 (1,219) (3,179) 1,366 Net income 32,976 19,487 42,835 35,923 Less net (income) loss attributable to noncontrolling interests 55 (4,886) 1,699 (5,540) Net income attributable to LXP Industrial Trust shareholders 33,031 14,601 44,534 30,383 Dividends attributable to preferred shares - Series C (1,572) (1,572) (6,290) (6,290) Allocation to participating securities (70) (44) (322) (230) Net income attributable to common shareholders $ 31,389 $ 12,985 $ 37,922 $ 23,863 Net income attributable to common shareholders - per common share basic $ 0.11 $ 0.04 $ 0.13 $ 0.08 Weighted-average common shares outstanding - basic 291,666,746 290,420,220 291,472,930 290,245,877 Net income attributable to common shareholders - per common share diluted $ 0.11 $ 0.04 $ 0.13 $ 0.08 Weighted-average common shares outstanding - diluted 291,732,489 291,325,979 291,559,993 291,193,514

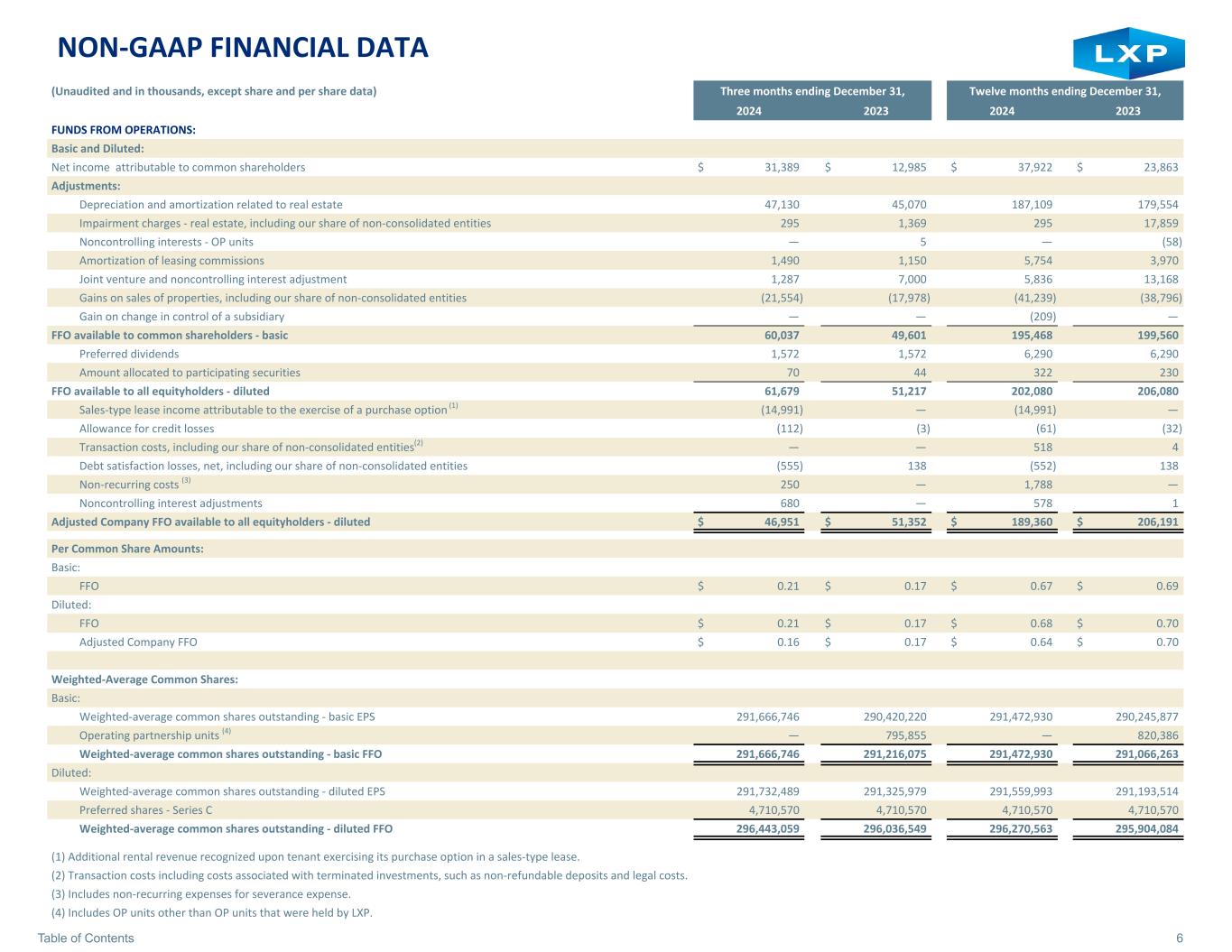

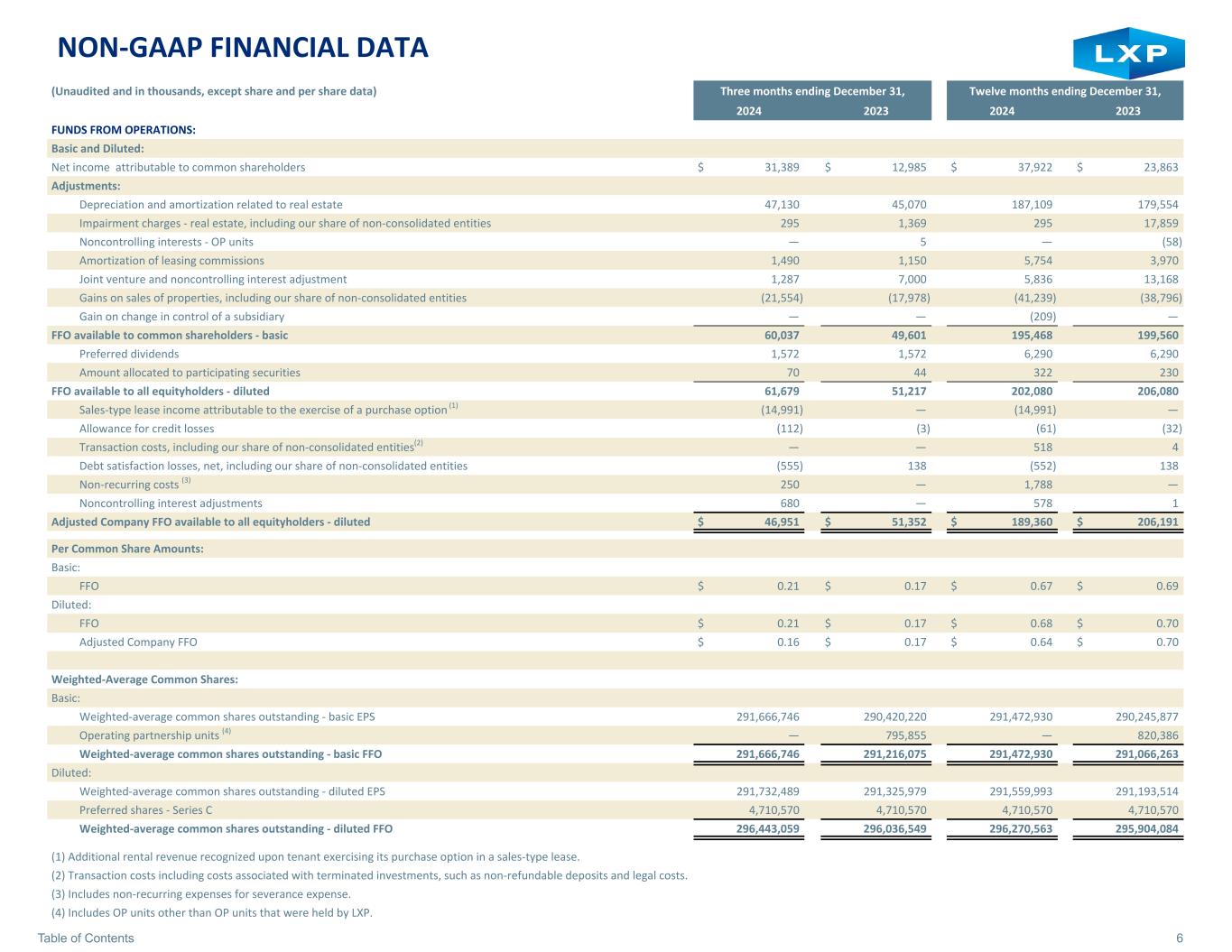

6Table of Contents NON-GAAP FINANCIAL DATA (Unaudited and in thousands, except share and per share data) Three months ending December 31, Twelve months ending December 31, 2024 2023 2024 2023 FUNDS FROM OPERATIONS: Basic and Diluted: Net income attributable to common shareholders $ 31,389 $ 12,985 $ 37,922 $ 23,863 Adjustments: Depreciation and amortization related to real estate 47,130 45,070 187,109 179,554 Impairment charges - real estate, including our share of non-consolidated entities 295 1,369 295 17,859 Noncontrolling interests - OP units — 5 — (58) Amortization of leasing commissions 1,490 1,150 5,754 3,970 Joint venture and noncontrolling interest adjustment 1,287 7,000 5,836 13,168 Gains on sales of properties, including our share of non-consolidated entities (21,554) (17,978) (41,239) (38,796) Gain on change in control of a subsidiary — — (209) — FFO available to common shareholders - basic 60,037 49,601 195,468 199,560 Preferred dividends 1,572 1,572 6,290 6,290 Amount allocated to participating securities 70 44 322 230 FFO available to all equityholders - diluted 61,679 51,217 202,080 206,080 Sales-type lease income attributable to the exercise of a purchase option (1) (14,991) — (14,991) — Allowance for credit losses (112) (3) (61) (32) Transaction costs, including our share of non-consolidated entities(2) — — 518 4 Debt satisfaction losses, net, including our share of non-consolidated entities (555) 138 (552) 138 Non-recurring costs (3) 250 — 1,788 — Noncontrolling interest adjustments 680 — 578 1 Adjusted Company FFO available to all equityholders - diluted $ 46,951 $ 51,352 $ 189,360 $ 206,191 Per Common Share Amounts: Basic: FFO $ 0.21 $ 0.17 $ 0.67 $ 0.69 Diluted: FFO $ 0.21 $ 0.17 $ 0.68 $ 0.70 Adjusted Company FFO $ 0.16 $ 0.17 $ 0.64 $ 0.70 Weighted-Average Common Shares: Basic: Weighted-average common shares outstanding - basic EPS 291,666,746 290,420,220 291,472,930 290,245,877 Operating partnership units (4) — 795,855 — 820,386 Weighted-average common shares outstanding - basic FFO 291,666,746 291,216,075 291,472,930 291,066,263 Diluted: Weighted-average common shares outstanding - diluted EPS 291,732,489 291,325,979 291,559,993 291,193,514 Preferred shares - Series C 4,710,570 4,710,570 4,710,570 4,710,570 Weighted-average common shares outstanding - diluted FFO 296,443,059 296,036,549 296,270,563 295,904,084 (1) Additional rental revenue recognized upon tenant exercising its purchase option in a sales-type lease. (2) Transaction costs including costs associated with terminated investments, such as non-refundable deposits and legal costs. (3) Includes non-recurring expenses for severance expense. (4) Includes OP units other than OP units that were held by LXP.

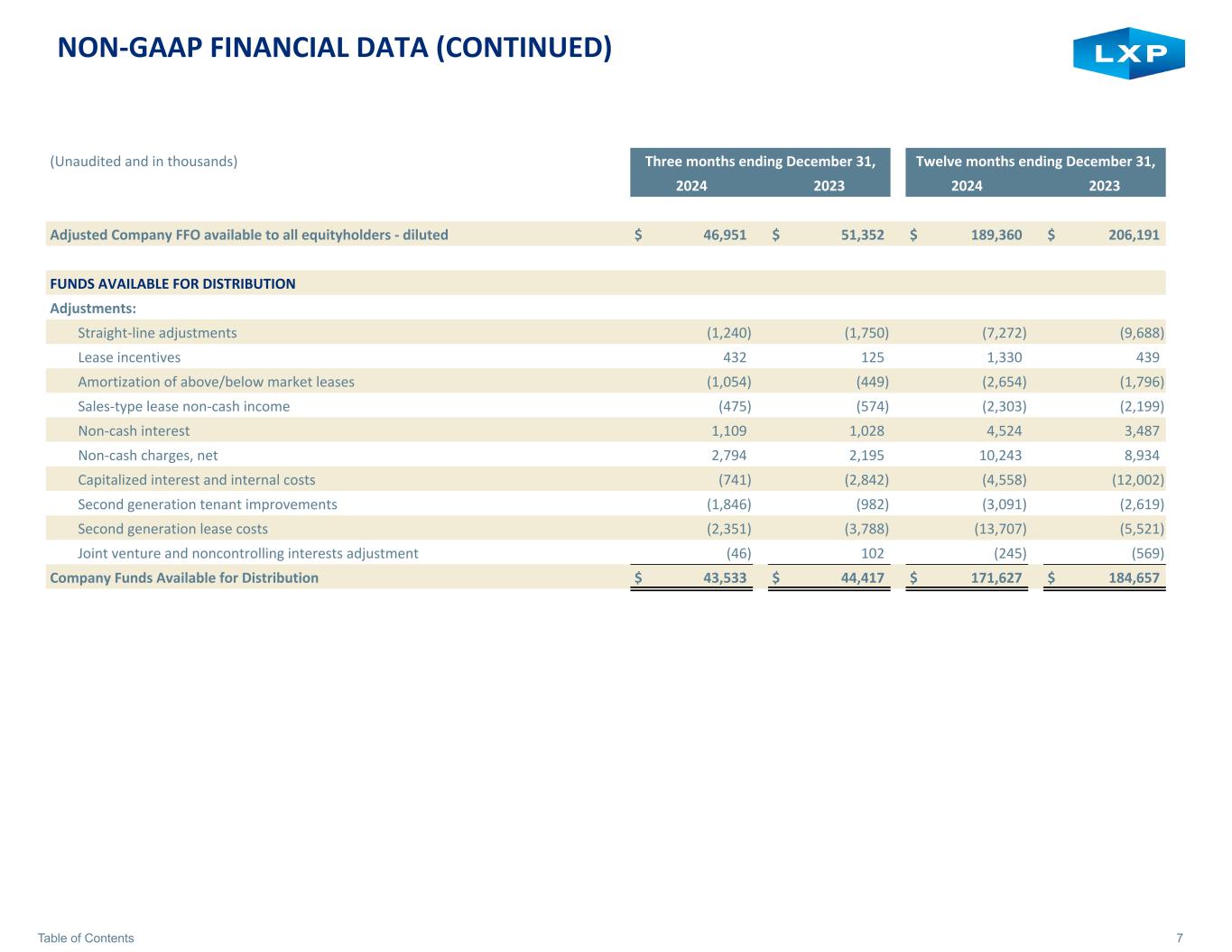

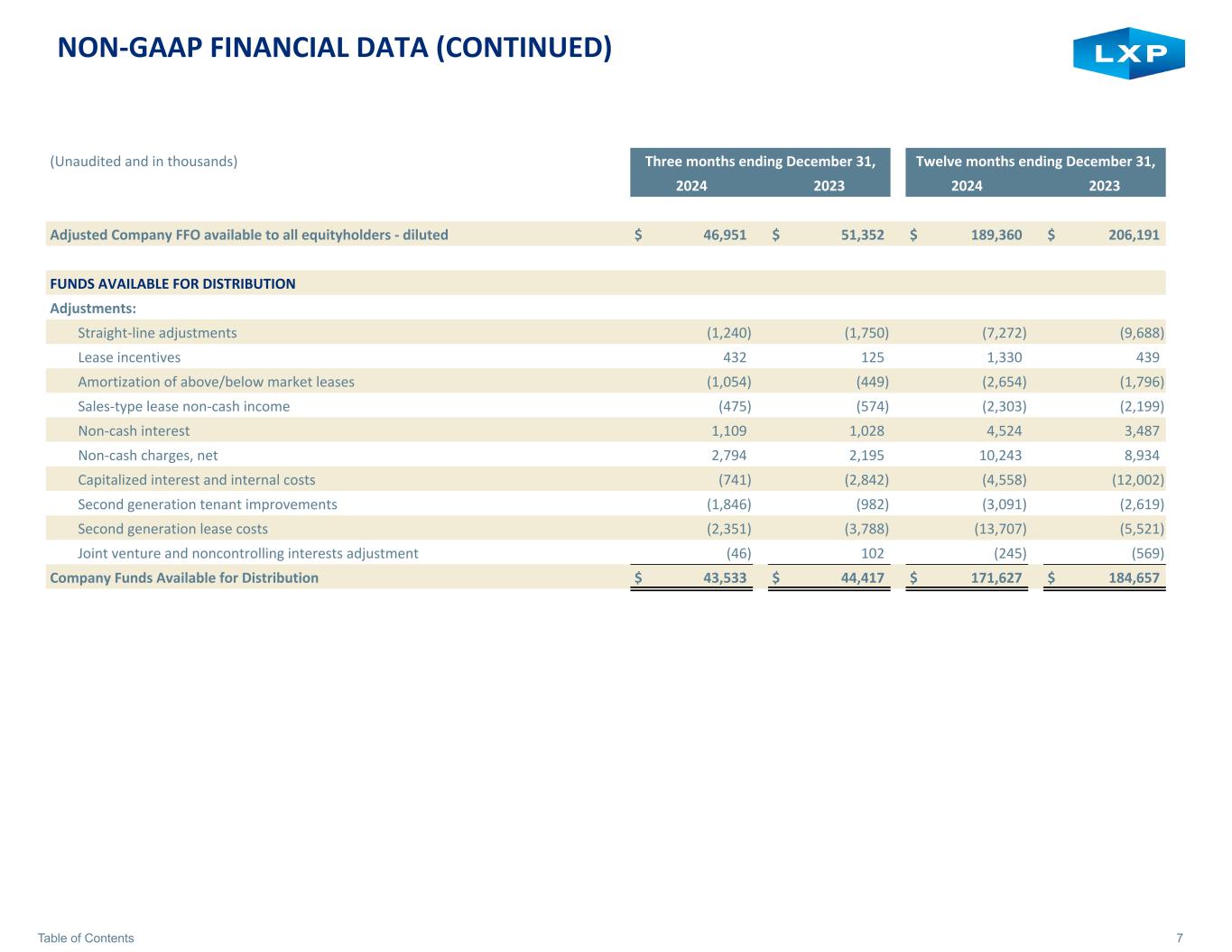

7Table of Contents NON-GAAP FINANCIAL DATA (CONTINUED) (Unaudited and in thousands) Three months ending December 31, Twelve months ending December 31, 2024 2023 2024 2023 Adjusted Company FFO available to all equityholders - diluted $ 46,951 $ 51,352 $ 189,360 $ 206,191 FUNDS AVAILABLE FOR DISTRIBUTION Adjustments: Straight-line adjustments (1,240) (1,750) (7,272) (9,688) Lease incentives 432 125 1,330 439 Amortization of above/below market leases (1,054) (449) (2,654) (1,796) Sales-type lease non-cash income (475) (574) (2,303) (2,199) Non-cash interest 1,109 1,028 4,524 3,487 Non-cash charges, net 2,794 2,195 10,243 8,934 Capitalized interest and internal costs (741) (2,842) (4,558) (12,002) Second generation tenant improvements (1,846) (982) (3,091) (2,619) Second generation lease costs (2,351) (3,788) (13,707) (5,521) Joint venture and noncontrolling interests adjustment (46) 102 (245) (569) Company Funds Available for Distribution $ 43,533 $ 44,417 $ 171,627 $ 184,657

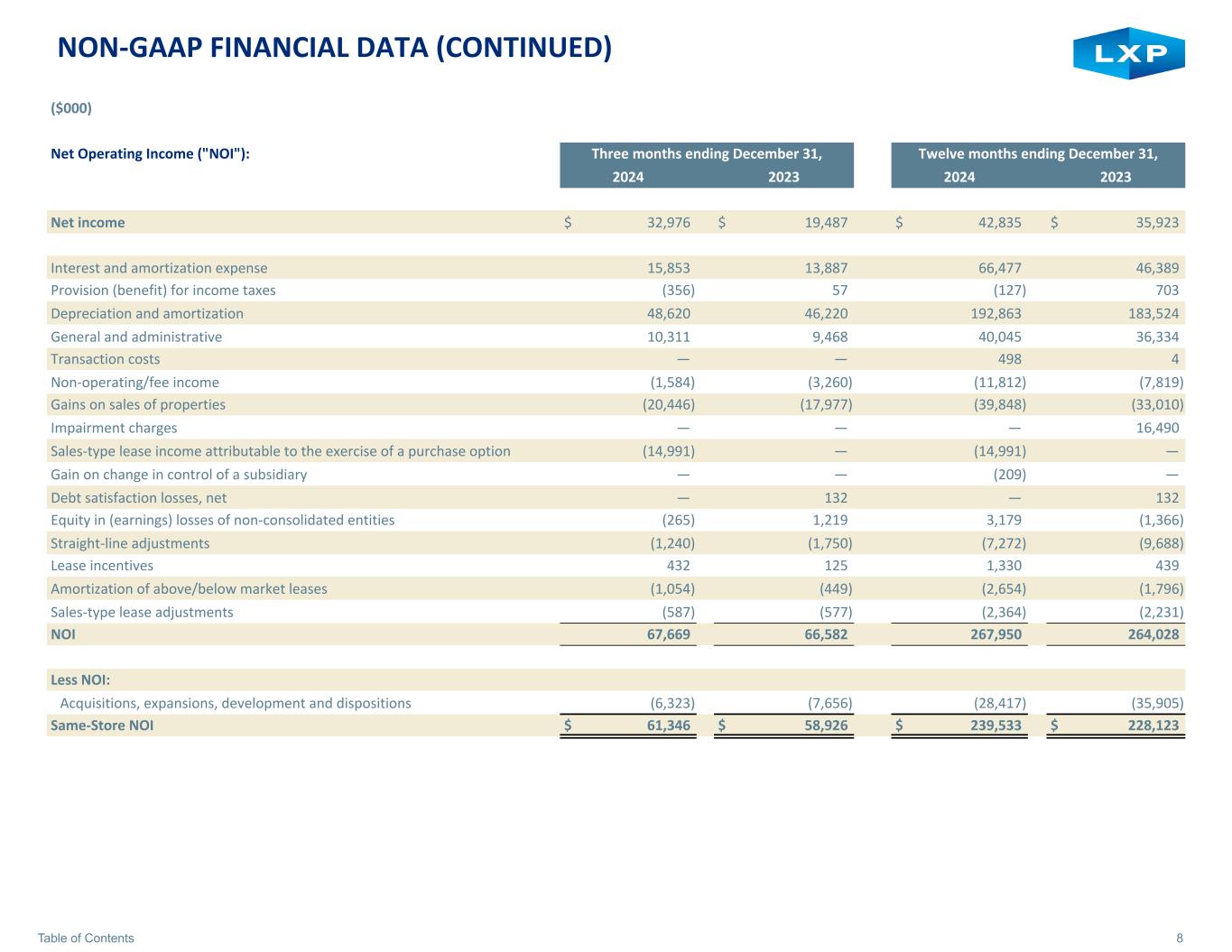

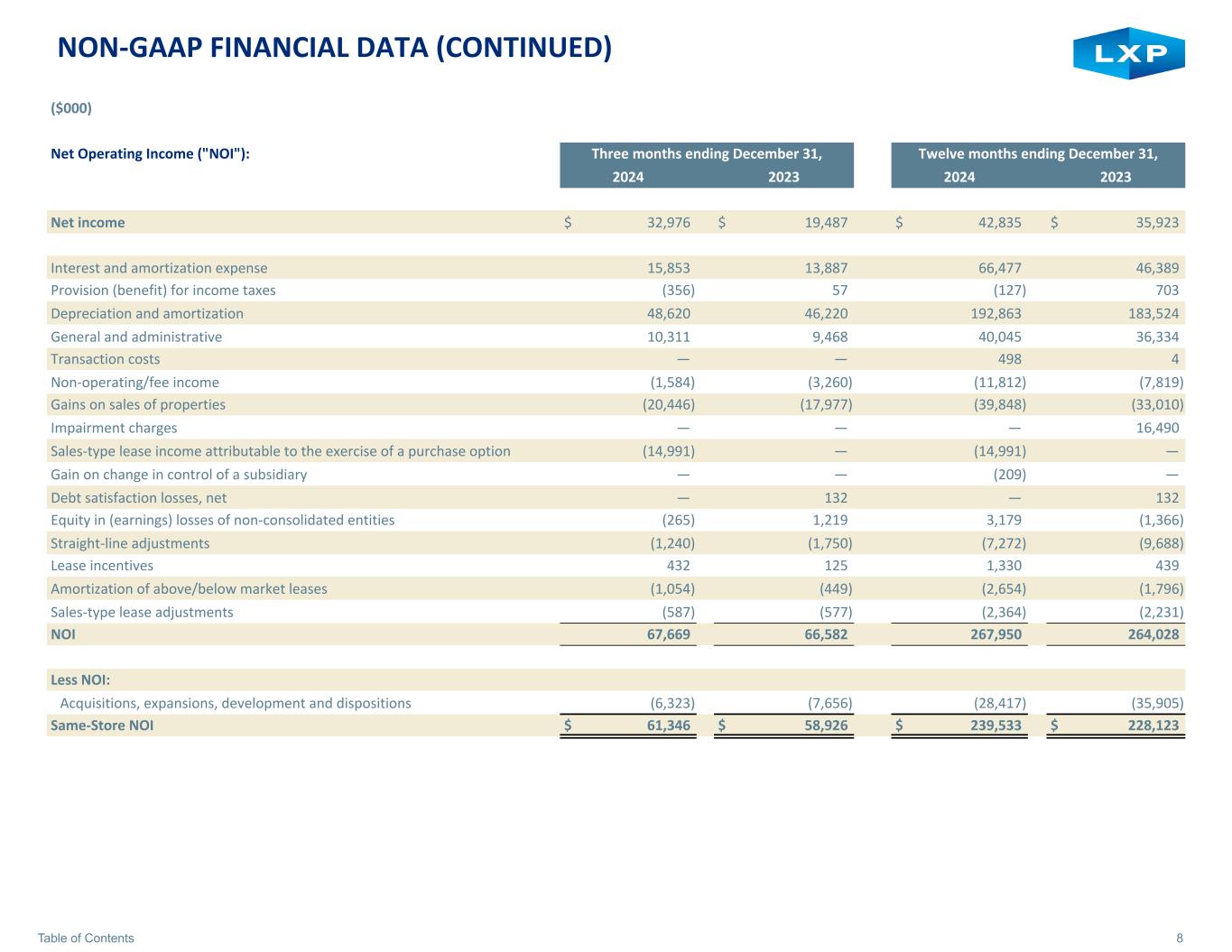

8Table of Contents NON-GAAP FINANCIAL DATA (CONTINUED) ($000) Net Operating Income ("NOI"): Three months ending December 31, Twelve months ending December 31, 2024 2023 2024 2023 Net income $ 32,976 $ 19,487 $ 42,835 $ 35,923 Interest and amortization expense 15,853 13,887 66,477 46,389 Provision (benefit) for income taxes (356) 57 (127) 703 Depreciation and amortization 48,620 46,220 192,863 183,524 General and administrative 10,311 9,468 40,045 36,334 Transaction costs — — 498 4 Non-operating/fee income (1,584) (3,260) (11,812) (7,819) Gains on sales of properties (20,446) (17,977) (39,848) (33,010) Impairment charges — — — 16,490 Sales-type lease income attributable to the exercise of a purchase option (14,991) — (14,991) — Gain on change in control of a subsidiary — — (209) — Debt satisfaction losses, net — 132 — 132 Equity in (earnings) losses of non-consolidated entities (265) 1,219 3,179 (1,366) Straight-line adjustments (1,240) (1,750) (7,272) (9,688) Lease incentives 432 125 1,330 439 Amortization of above/below market leases (1,054) (449) (2,654) (1,796) Sales-type lease adjustments (587) (577) (2,364) (2,231) NOI 67,669 66,582 267,950 264,028 Less NOI: Acquisitions, expansions, development and dispositions (6,323) (7,656) (28,417) (35,905) Same-Store NOI $ 61,346 $ 58,926 $ 239,533 $ 228,123

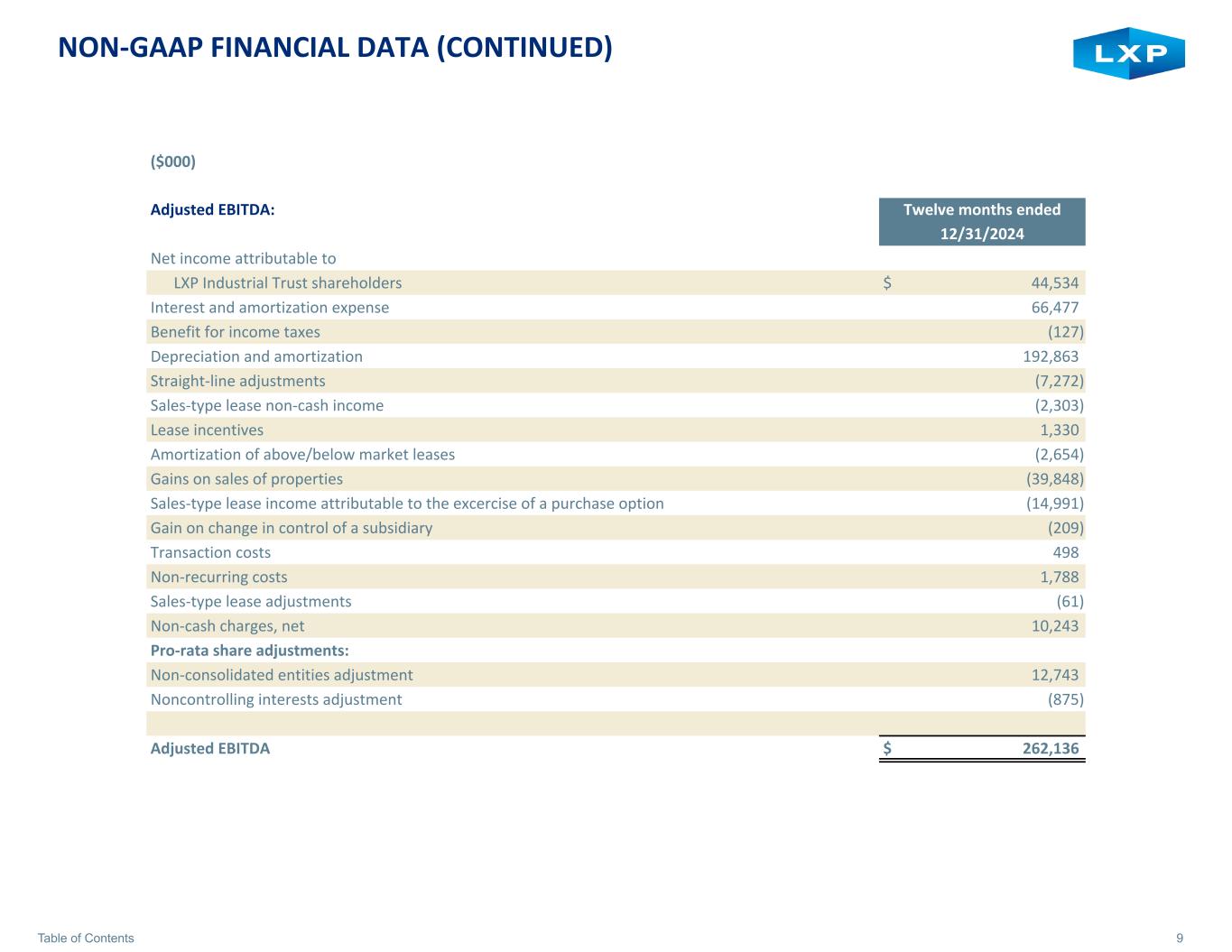

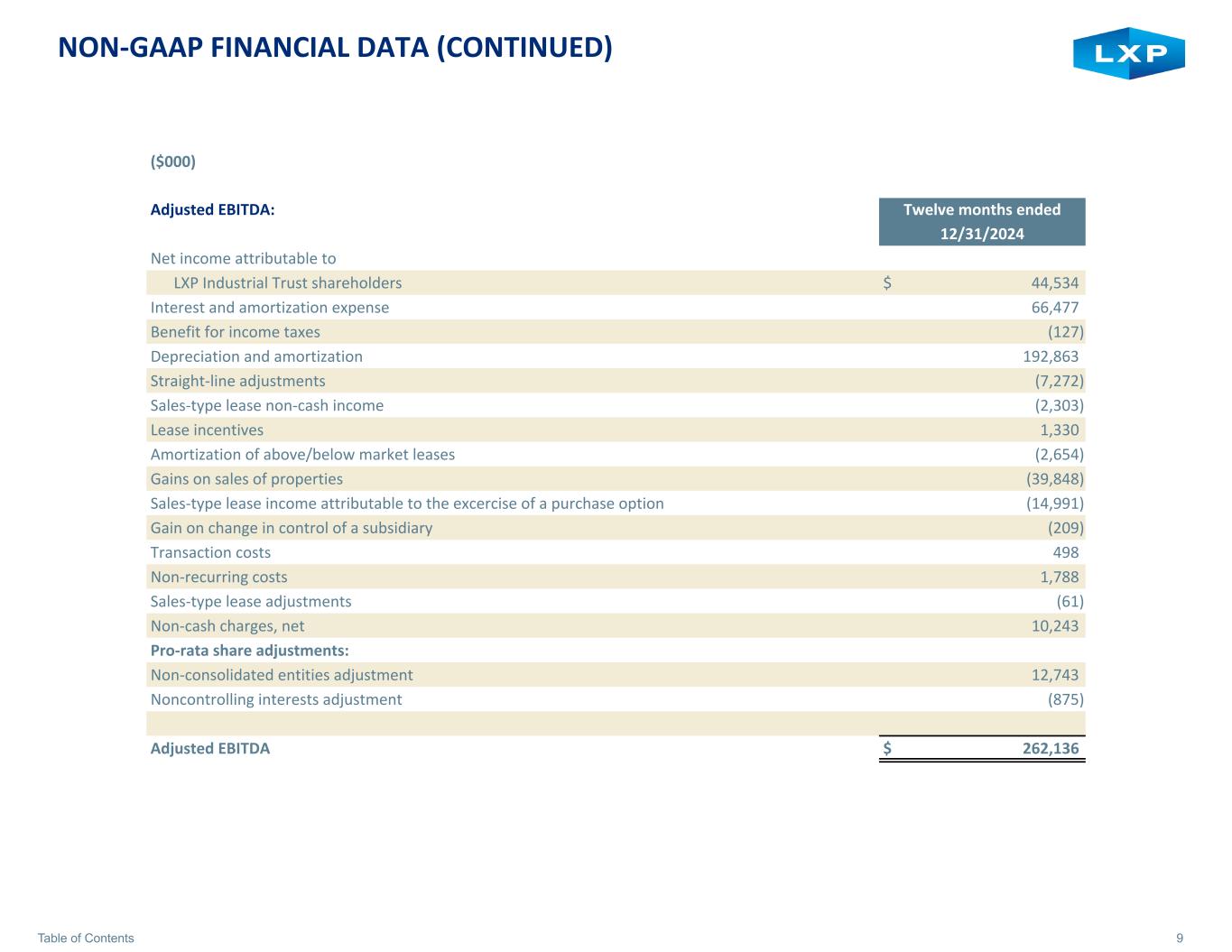

9Table of Contents NON-GAAP FINANCIAL DATA (CONTINUED) ($000) Adjusted EBITDA: Twelve months ended 12/31/2024 Net income attributable to LXP Industrial Trust shareholders $ 44,534 Interest and amortization expense 66,477 Benefit for income taxes (127) Depreciation and amortization 192,863 Straight-line adjustments (7,272) Sales-type lease non-cash income (2,303) Lease incentives 1,330 Amortization of above/below market leases (2,654) Gains on sales of properties (39,848) Sales-type lease income attributable to the excercise of a purchase option (14,991) Gain on change in control of a subsidiary (209) Transaction costs 498 Non-recurring costs 1,788 Sales-type lease adjustments (61) Non-cash charges, net 10,243 Pro-rata share adjustments: Non-consolidated entities adjustment 12,743 Noncontrolling interests adjustment (875) Adjusted EBITDA $ 262,136

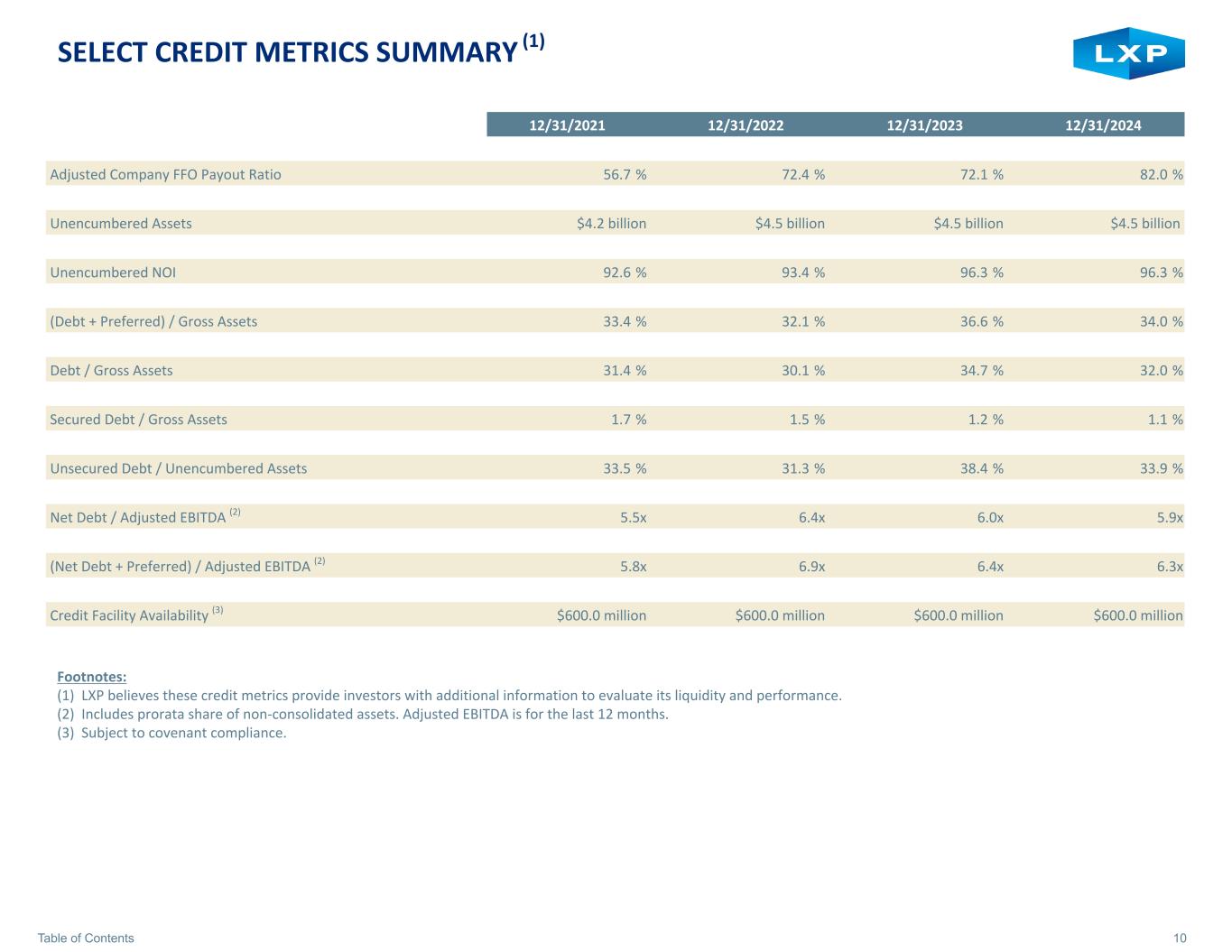

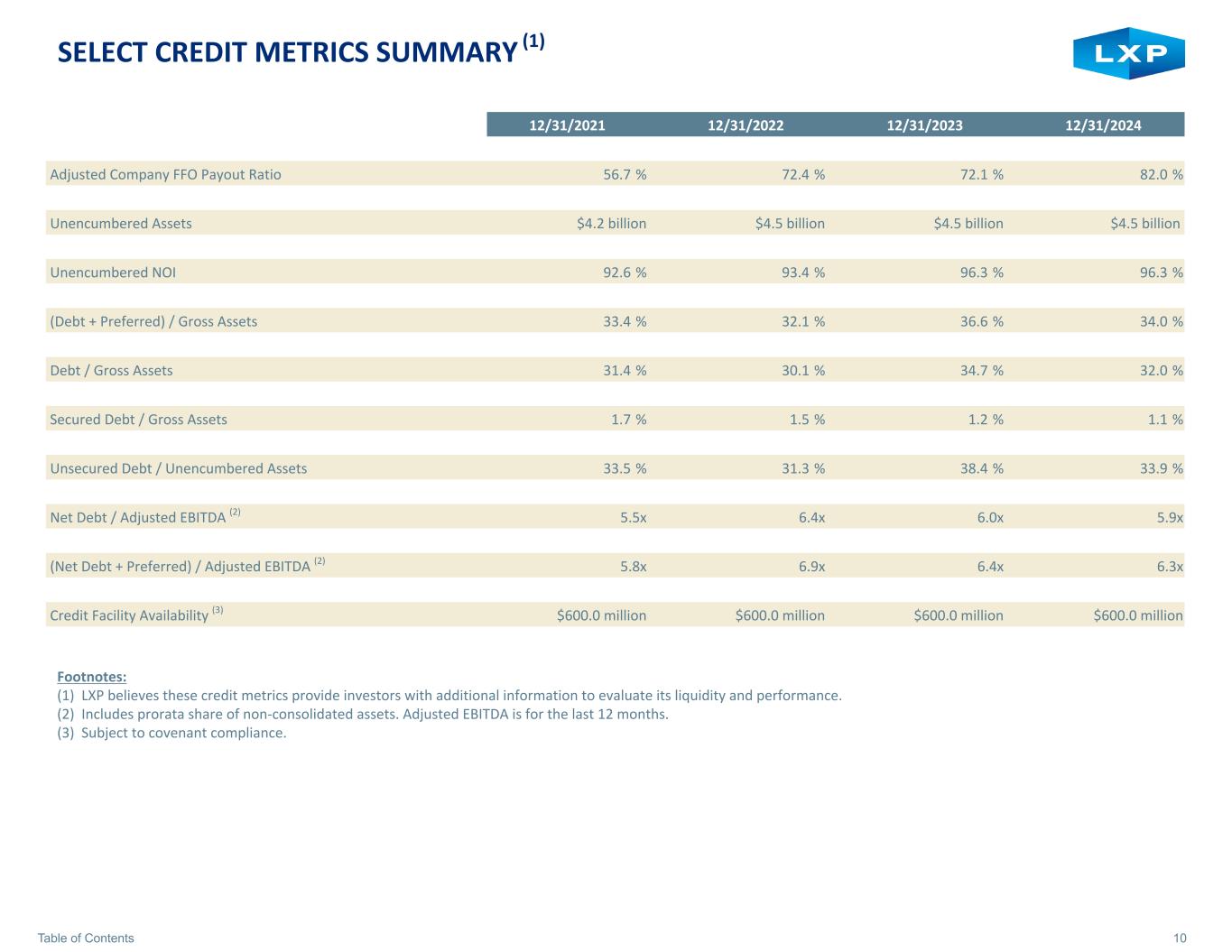

10Table of Contents SELECT CREDIT METRICS SUMMARY (1) 12/31/2021 12/31/2022 12/31/2023 12/31/2024 Adjusted Company FFO Payout Ratio 56.7 % 72.4 % 72.1 % 82.0 % Unencumbered Assets $4.2 billion $4.5 billion $4.5 billion $4.5 billion Unencumbered NOI 92.6 % 93.4 % 96.3 % 96.3 % (Debt + Preferred) / Gross Assets 33.4 % 32.1 % 36.6 % 34.0 % Debt / Gross Assets 31.4 % 30.1 % 34.7 % 32.0 % Secured Debt / Gross Assets 1.7 % 1.5 % 1.2 % 1.1 % Unsecured Debt / Unencumbered Assets 33.5 % 31.3 % 38.4 % 33.9 % Net Debt / Adjusted EBITDA (2) 5.5x 6.4x 6.0x 5.9x (Net Debt + Preferred) / Adjusted EBITDA (2) 5.8x 6.9x 6.4x 6.3x Credit Facility Availability (3) $600.0 million $600.0 million $600.0 million $600.0 million Footnotes: (1) LXP believes these credit metrics provide investors with additional information to evaluate its liquidity and performance. (2) Includes prorata share of non-consolidated assets. Adjusted EBITDA is for the last 12 months. (3) Subject to covenant compliance.

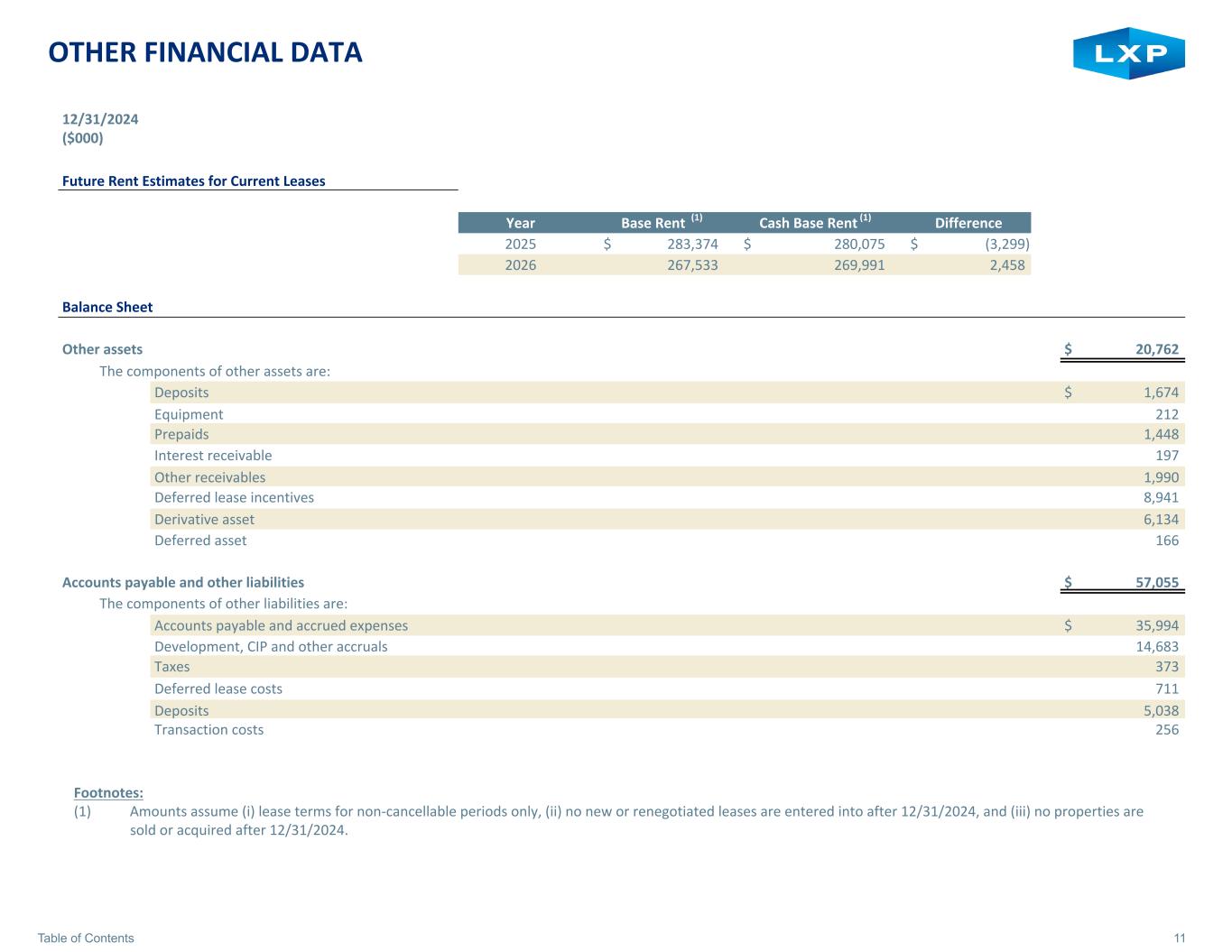

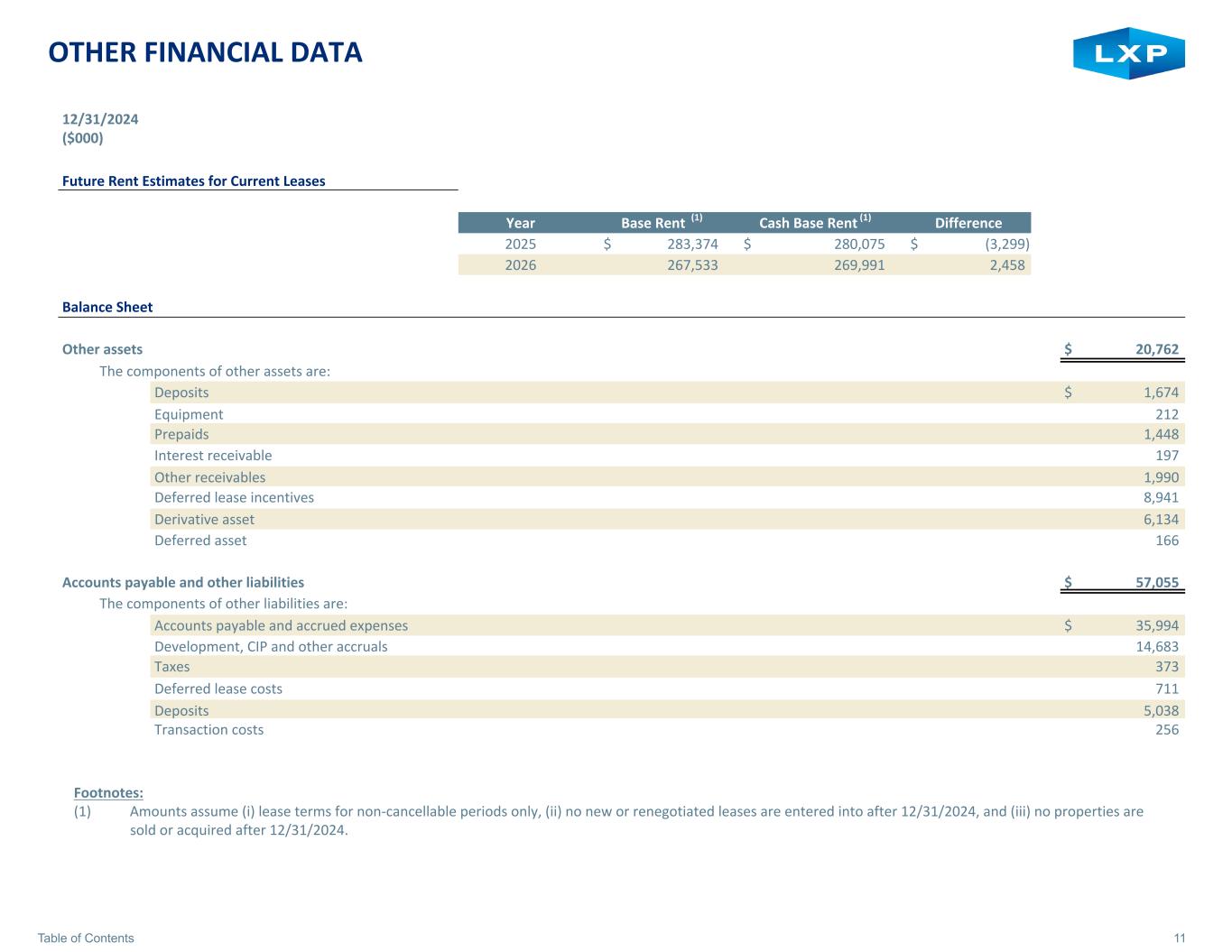

11Table of Contents OTHER FINANCIAL DATA 12/31/2024 ($000) Future Rent Estimates for Current Leases Year Base Rent (1) Cash Base Rent (1) Difference 2025 $ 283,374 $ 280,075 $ (3,299) 2026 267,533 269,991 2,458 Balance Sheet Other assets $ 20,762 The components of other assets are: Deposits $ 1,674 Equipment 212 Prepaids 1,448 Interest receivable 197 Other receivables 1,990 Deferred lease incentives 8,941 Derivative asset 6,134 Deferred asset 166 Accounts payable and other liabilities $ 57,055 The components of other liabilities are: Accounts payable and accrued expenses $ 35,994 Development, CIP and other accruals 14,683 Taxes 373 Deferred lease costs 711 Deposits 5,038 Transaction costs 256 Footnotes: (1) Amounts assume (i) lease terms for non-cancellable periods only, (ii) no new or renegotiated leases are entered into after 12/31/2024, and (iii) no properties are sold or acquired after 12/31/2024.

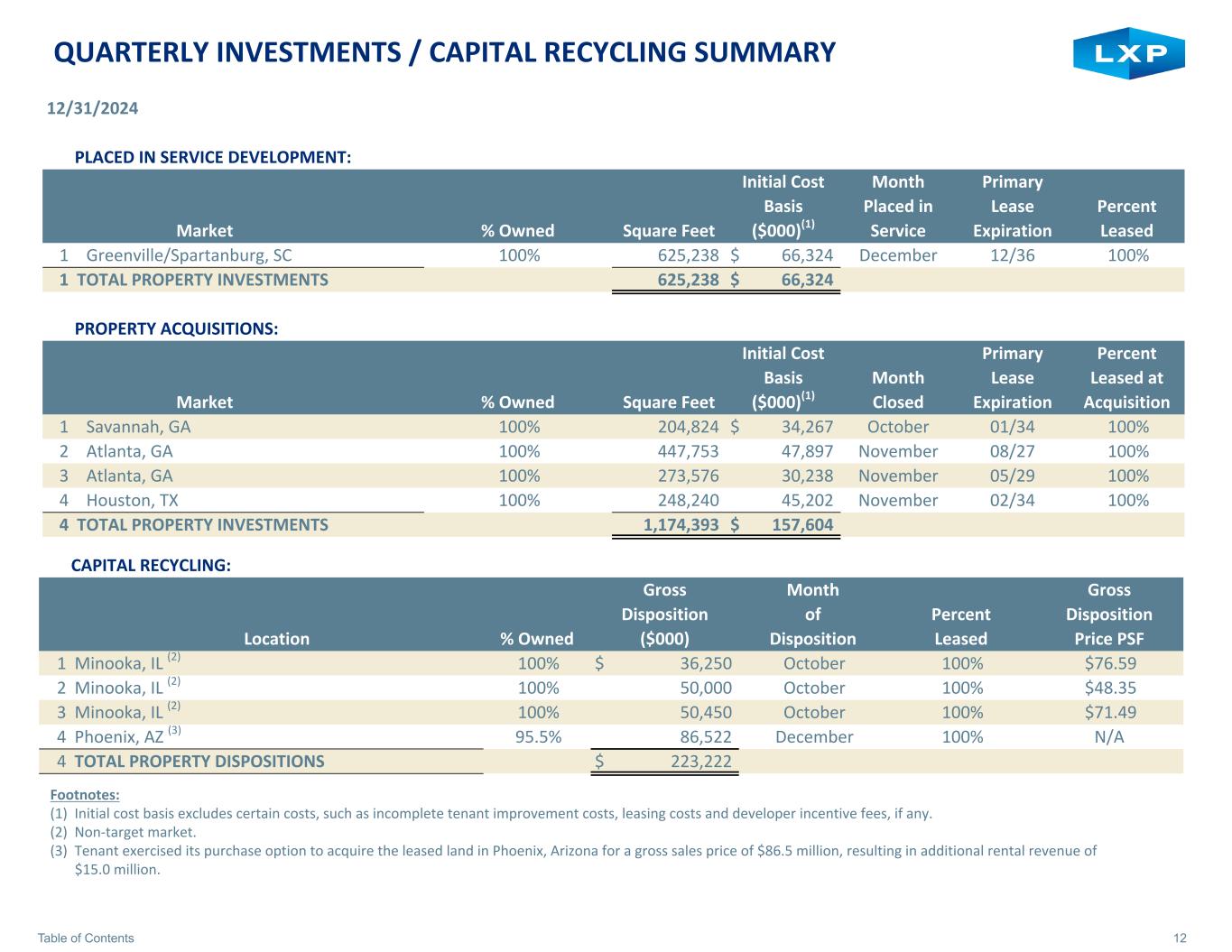

12Table of Contents QUARTERLY INVESTMENTS / CAPITAL RECYCLING SUMMARY 12/31/2024 PLACED IN SERVICE DEVELOPMENT: Initial Cost Month Primary Basis Placed in Lease Percent Market % Owned Square Feet ($000)(1) Service Expiration Leased 1 Greenville/Spartanburg, SC 100% 625,238 $ 66,324 December 12/36 100% 1 TOTAL PROPERTY INVESTMENTS 625,238 $ 66,324 PROPERTY ACQUISITIONS: Initial Cost Primary Percent Basis Month Lease Leased at Market % Owned Square Feet ($000)(1) Closed Expiration Acquisition 1 Savannah, GA 100% 204,824 $ 34,267 October 01/34 100% 2 Atlanta, GA 100% 447,753 47,897 November 08/27 100% 3 Atlanta, GA 100% 273,576 30,238 November 05/29 100% 4 Houston, TX 100% 248,240 45,202 November 02/34 100% 4 TOTAL PROPERTY INVESTMENTS 1,174,393 $ 157,604 Footnotes: (1) Initial cost basis excludes certain costs, such as incomplete tenant improvement costs, leasing costs and developer incentive fees, if any. (2) Non-target market. (3) Tenant exercised its purchase option to acquire the leased land in Phoenix, Arizona for a gross sales price of $86.5 million, resulting in additional rental revenue of $15.0 million. CAPITAL RECYCLING: Gross Month Gross Disposition of Percent Disposition Location % Owned ($000) Disposition Leased Price PSF 1 Minooka, IL (2) 100% $ 36,250 October 100% $76.59 2 Minooka, IL (2) 100% 50,000 October 100% $48.35 3 Minooka, IL (2) 100% 50,450 October 100% $71.49 4 Phoenix, AZ (3) 95.5% 86,522 December 100% N/A 4 TOTAL PROPERTY DISPOSITIONS $ 223,222

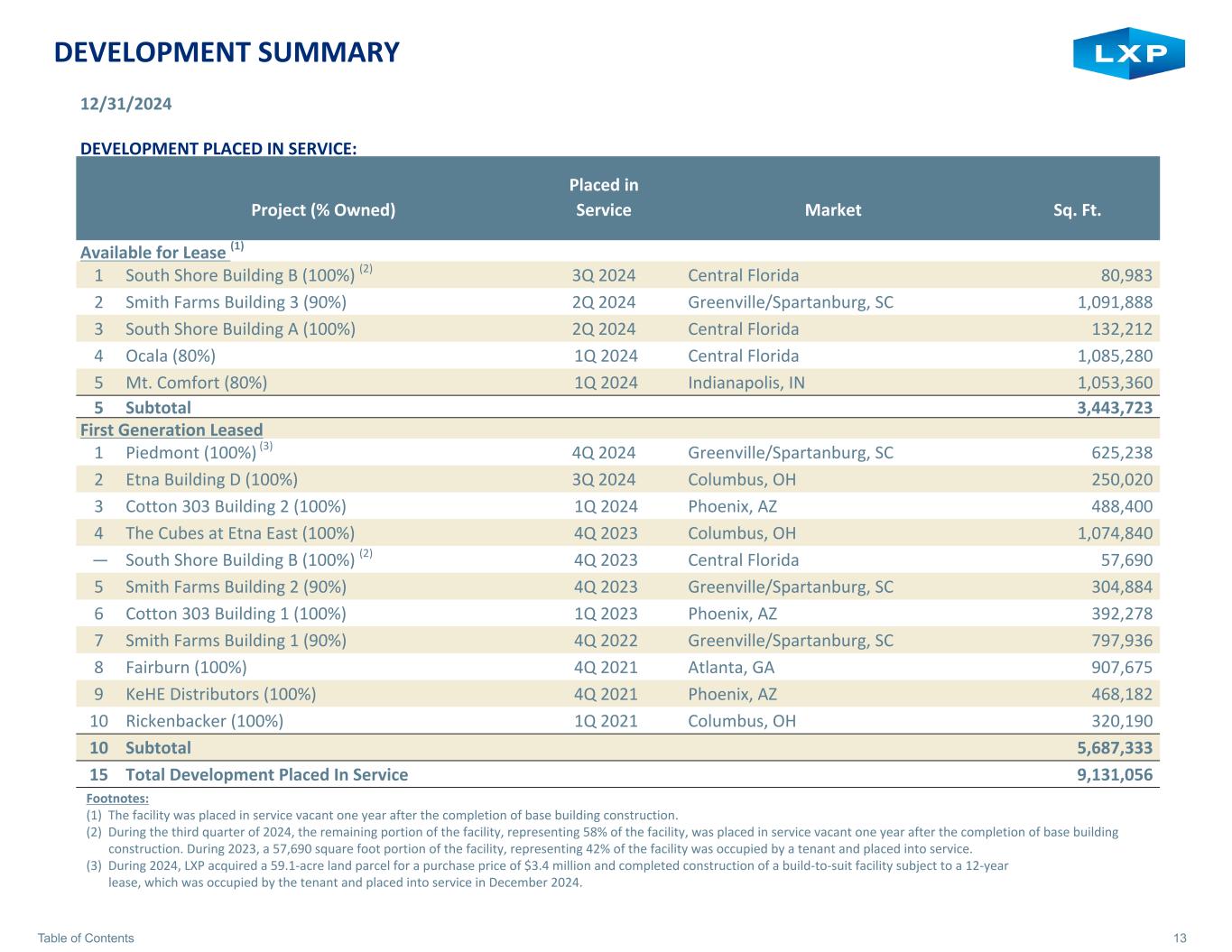

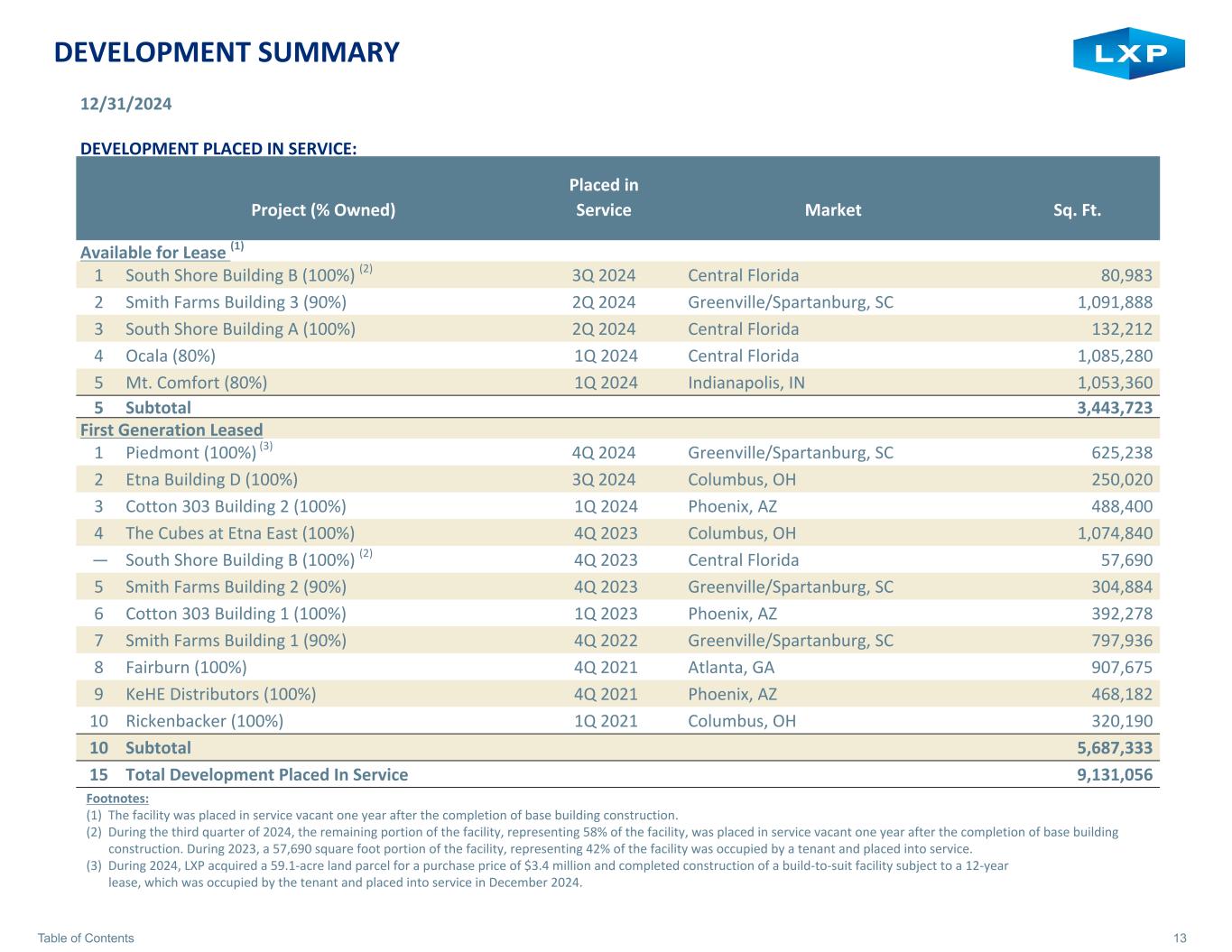

13Table of Contents DEVELOPMENT SUMMARY 12/31/2024 DEVELOPMENT PLACED IN SERVICE: Placed in Project (% Owned) Service Market Sq. Ft. Available for Lease (1) 1 South Shore Building B (100%) (2) 3Q 2024 Central Florida 80,983 2 Smith Farms Building 3 (90%) 2Q 2024 Greenville/Spartanburg, SC 1,091,888 3 South Shore Building A (100%) 2Q 2024 Central Florida 132,212 4 Ocala (80%) 1Q 2024 Central Florida 1,085,280 5 Mt. Comfort (80%) 1Q 2024 Indianapolis, IN 1,053,360 5 Subtotal 3,443,723 First Generation Leased 1 Piedmont (100%) (3) 4Q 2024 Greenville/Spartanburg, SC 625,238 2 Etna Building D (100%) 3Q 2024 Columbus, OH 250,020 3 Cotton 303 Building 2 (100%) 1Q 2024 Phoenix, AZ 488,400 4 The Cubes at Etna East (100%) 4Q 2023 Columbus, OH 1,074,840 — South Shore Building B (100%) (2) 4Q 2023 Central Florida 57,690 5 Smith Farms Building 2 (90%) 4Q 2023 Greenville/Spartanburg, SC 304,884 6 Cotton 303 Building 1 (100%) 1Q 2023 Phoenix, AZ 392,278 7 Smith Farms Building 1 (90%) 4Q 2022 Greenville/Spartanburg, SC 797,936 8 Fairburn (100%) 4Q 2021 Atlanta, GA 907,675 9 KeHE Distributors (100%) 4Q 2021 Phoenix, AZ 468,182 10 Rickenbacker (100%) 1Q 2021 Columbus, OH 320,190 10 Subtotal 5,687,333 15 Total Development Placed In Service 9,131,056 Footnotes: (1) The facility was placed in service vacant one year after the completion of base building construction. (2) During the third quarter of 2024, the remaining portion of the facility, representing 58% of the facility, was placed in service vacant one year after the completion of base building construction. During 2023, a 57,690 square foot portion of the facility, representing 42% of the facility was occupied by a tenant and placed into service. (3) During 2024, LXP acquired a 59.1-acre land parcel for a purchase price of $3.4 million and completed construction of a build-to-suit facility subject to a 12-year lease, which was occupied by the tenant and placed into service in December 2024.

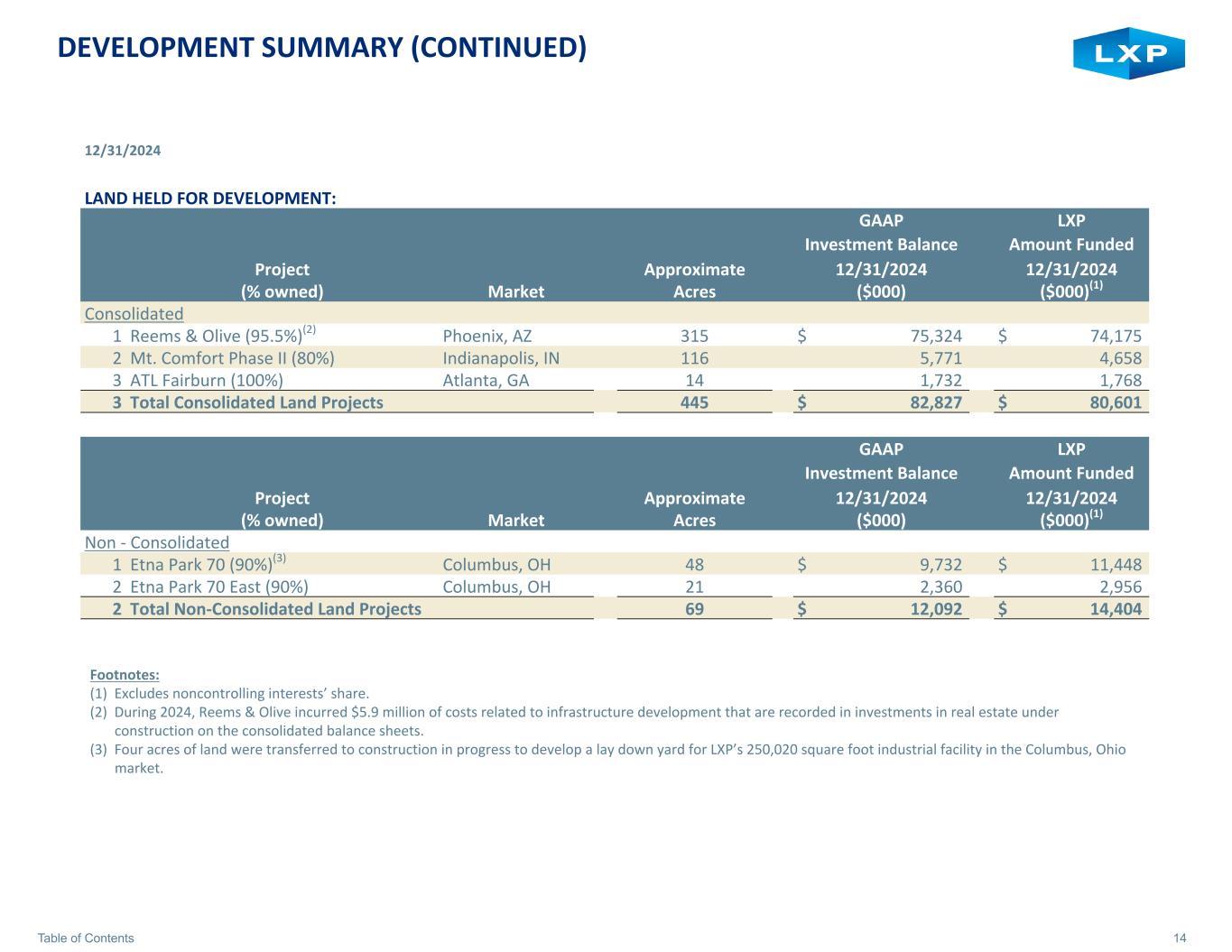

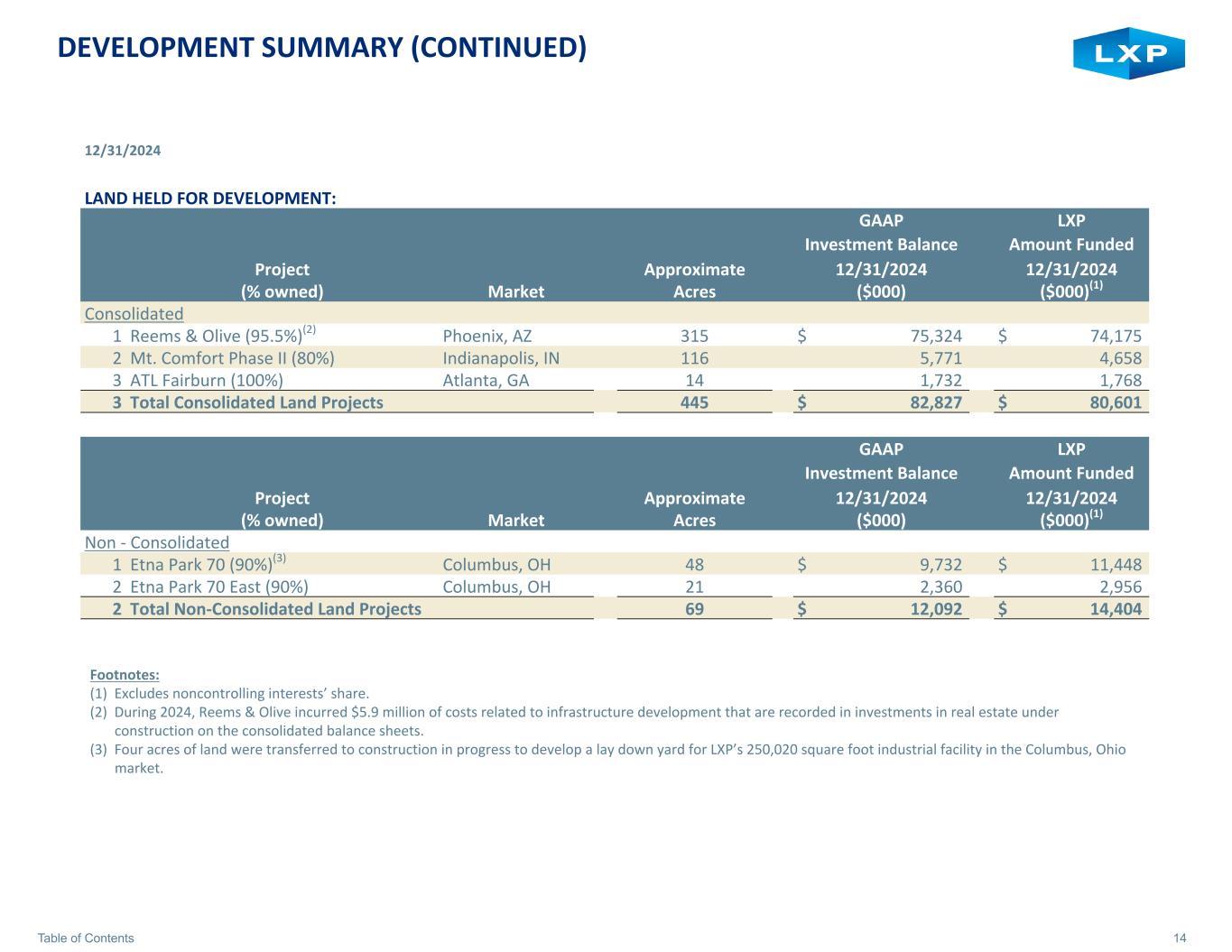

14Table of Contents DEVELOPMENT SUMMARY (CONTINUED) 12/31/2024 LAND HELD FOR DEVELOPMENT: GAAP LXP Investment Balance Amount Funded Project Approximate 12/31/2024 12/31/2024 (% owned) Market Acres ($000) ($000)(1) Consolidated 1 Reems & Olive (95.5%)(2) Phoenix, AZ 315 $ 75,324 $ 74,175 2 Mt. Comfort Phase II (80%) Indianapolis, IN 116 5,771 4,658 3 ATL Fairburn (100%) Atlanta, GA 14 1,732 1,768 3 Total Consolidated Land Projects 445 $ 82,827 $ 80,601 GAAP LXP Investment Balance Amount Funded Project Approximate 12/31/2024 12/31/2024 (% owned) Market Acres ($000) ($000)(1) Non - Consolidated 1 Etna Park 70 (90%)(3) Columbus, OH 48 $ 9,732 $ 11,448 2 Etna Park 70 East (90%) Columbus, OH 21 2,360 2,956 2 Total Non-Consolidated Land Projects 69 $ 12,092 $ 14,404 Footnotes: (1) Excludes noncontrolling interests’ share. (2) During 2024, Reems & Olive incurred $5.9 million of costs related to infrastructure development that are recorded in investments in real estate under construction on the consolidated balance sheets. (3) Four acres of land were transferred to construction in progress to develop a lay down yard for LXP’s 250,020 square foot industrial facility in the Columbus, Ohio market.

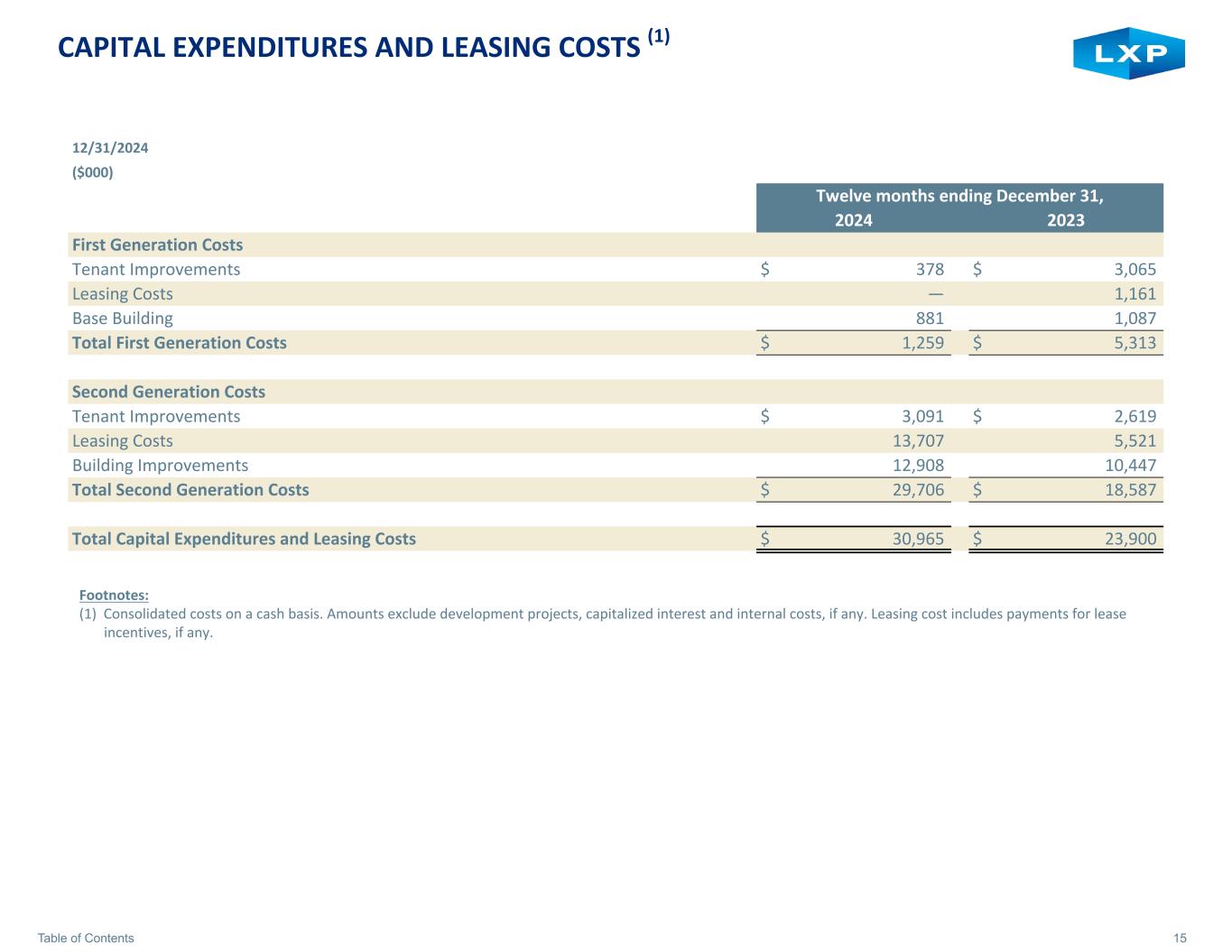

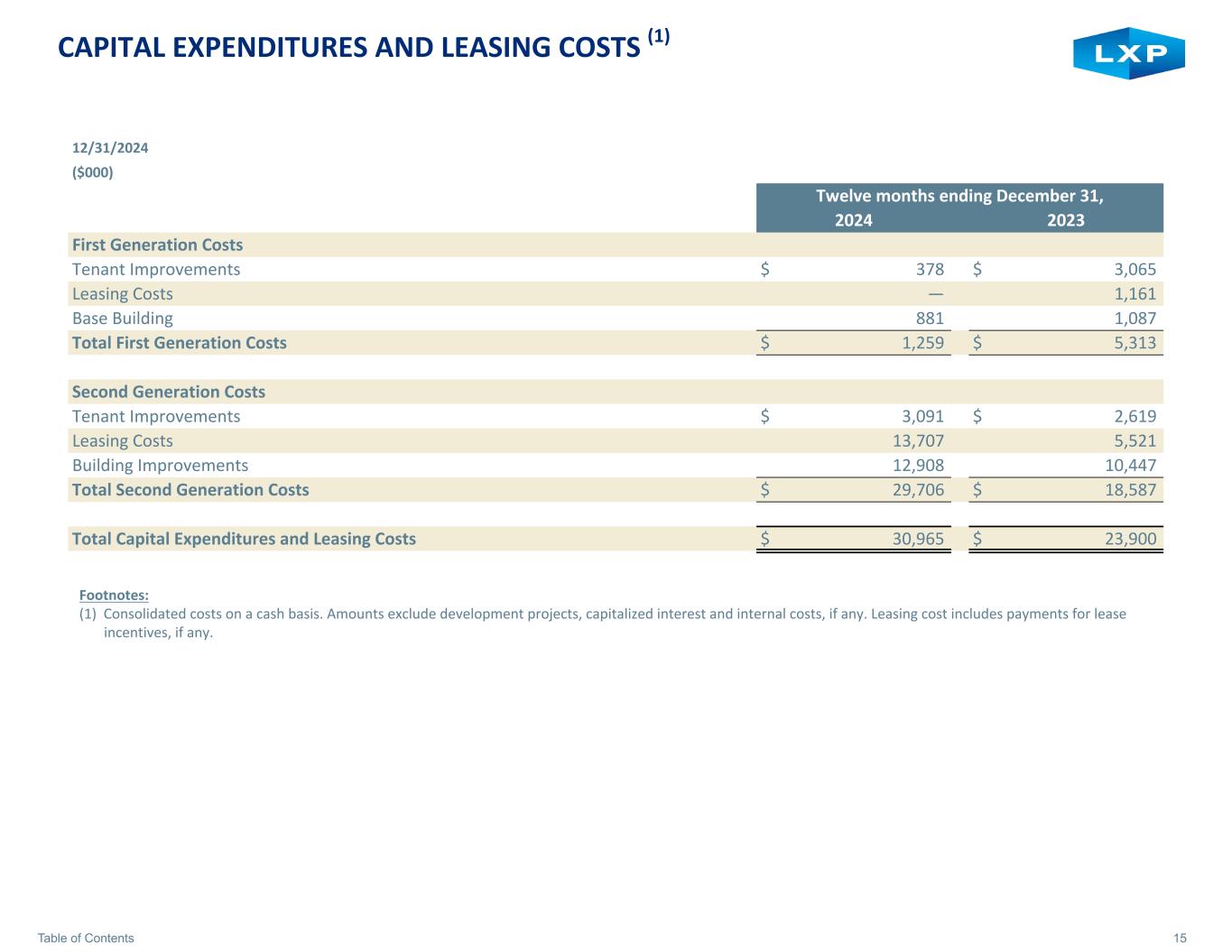

15Table of Contents CAPITAL EXPENDITURES AND LEASING COSTS (1) 12/31/2024 ($000) Twelve months ending December 31, 2024 2023 First Generation Costs Tenant Improvements $ 378 $ 3,065 Leasing Costs — 1,161 Base Building 881 1,087 Total First Generation Costs $ 1,259 $ 5,313 Second Generation Costs Tenant Improvements $ 3,091 $ 2,619 Leasing Costs 13,707 5,521 Building Improvements 12,908 10,447 Total Second Generation Costs $ 29,706 $ 18,587 Total Capital Expenditures and Leasing Costs $ 30,965 $ 23,900 Footnotes: (1) Consolidated costs on a cash basis. Amounts exclude development projects, capitalized interest and internal costs, if any. Leasing cost includes payments for lease incentives, if any.

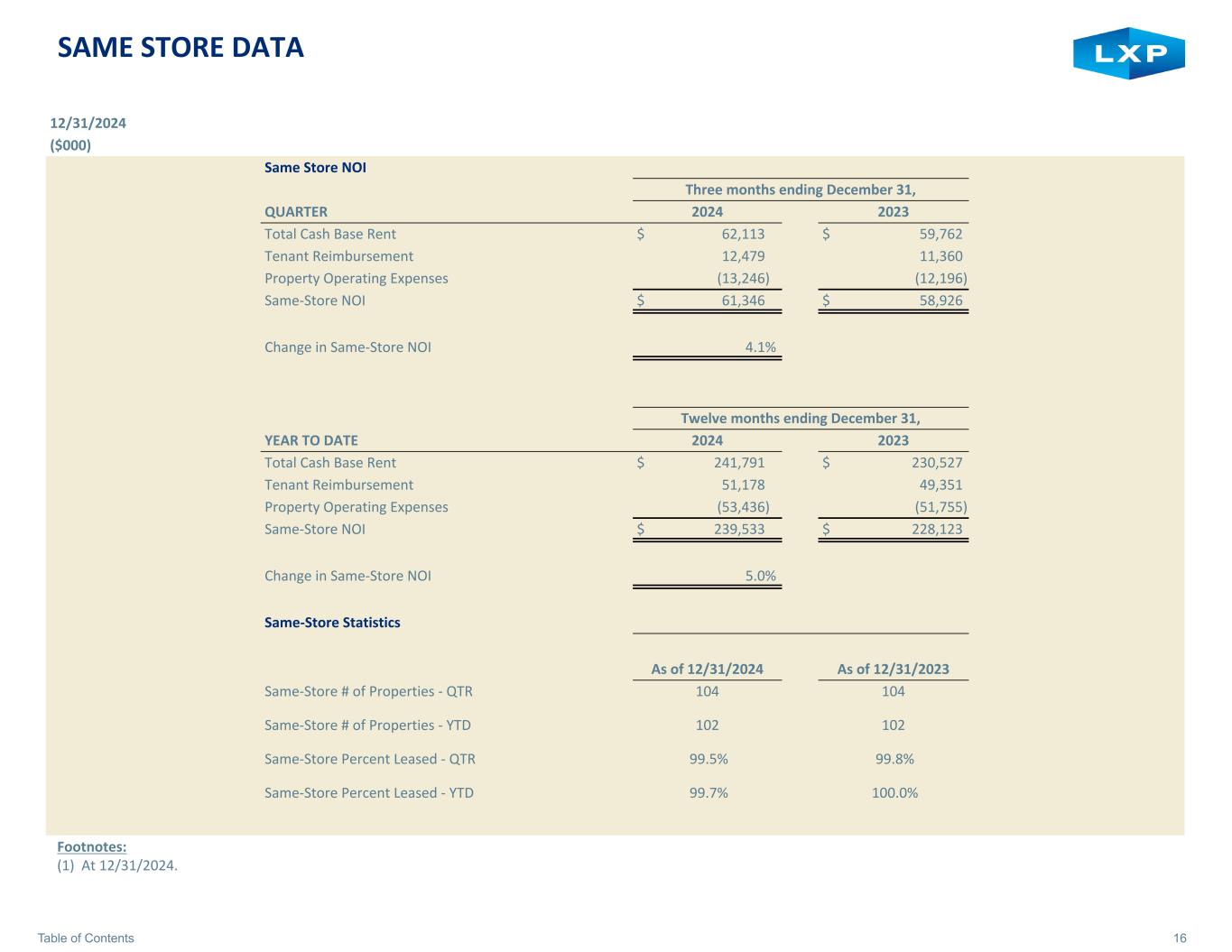

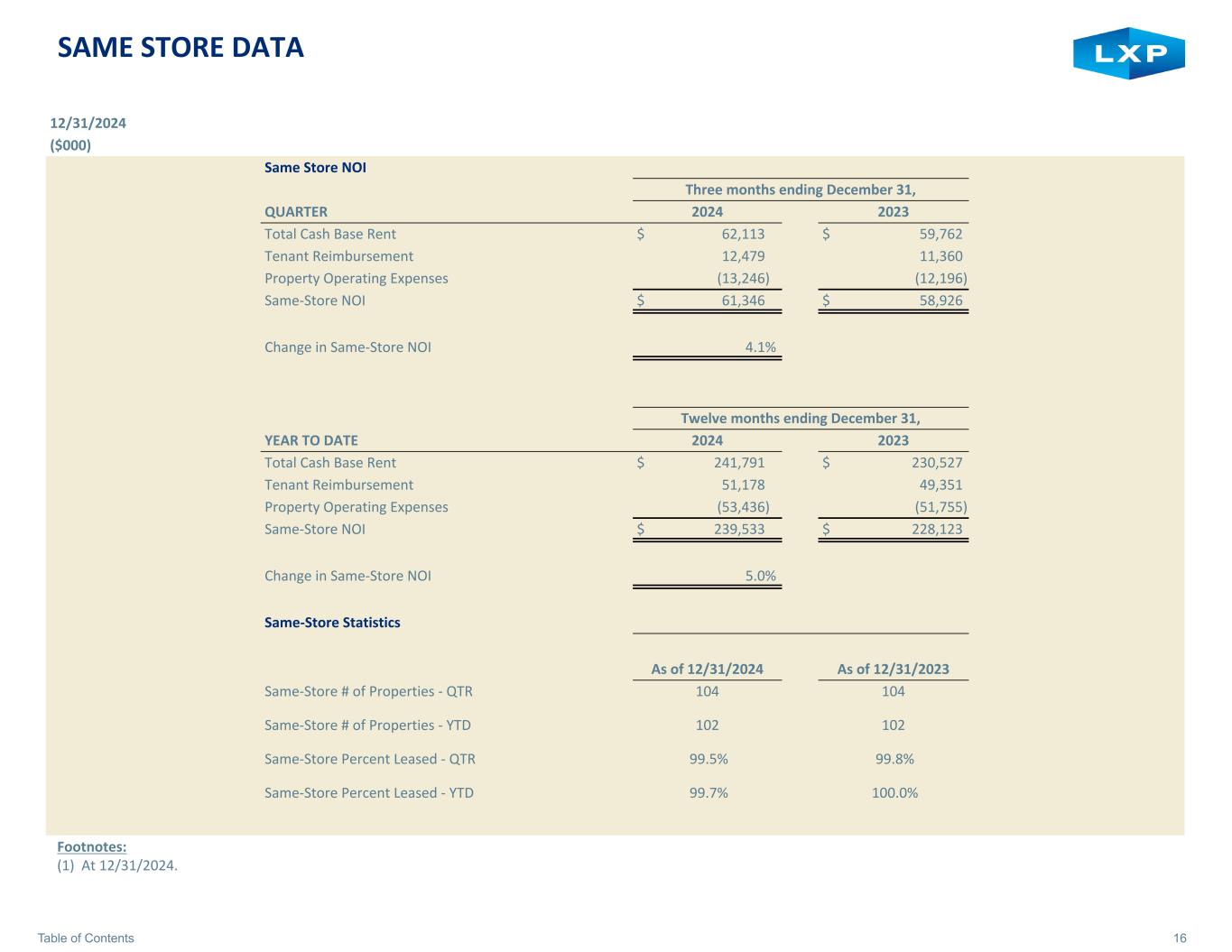

16Table of Contents SAME STORE DATA 12/31/2024 ($000) Same Store NOI Three months ending December 31, QUARTER 2024 2023 Total Cash Base Rent $ 62,113 $ 59,762 Tenant Reimbursement 12,479 11,360 Property Operating Expenses (13,246) (12,196) Same-Store NOI $ 61,346 $ 58,926 Change in Same-Store NOI 4.1% Twelve months ending December 31, YEAR TO DATE 2024 2023 Total Cash Base Rent $ 241,791 $ 230,527 Tenant Reimbursement 51,178 49,351 Property Operating Expenses (53,436) (51,755) Same-Store NOI $ 239,533 $ 228,123 Change in Same-Store NOI 5.0% Same-Store Statistics As of 12/31/2024 As of 12/31/2023 Same-Store # of Properties - QTR 104 104 Same-Store # of Properties - YTD 102 102 Same-Store Percent Leased - QTR 99.5% 99.8% Same-Store Percent Leased - YTD 99.7% 100.0% Footnotes: (1) At 12/31/2024.

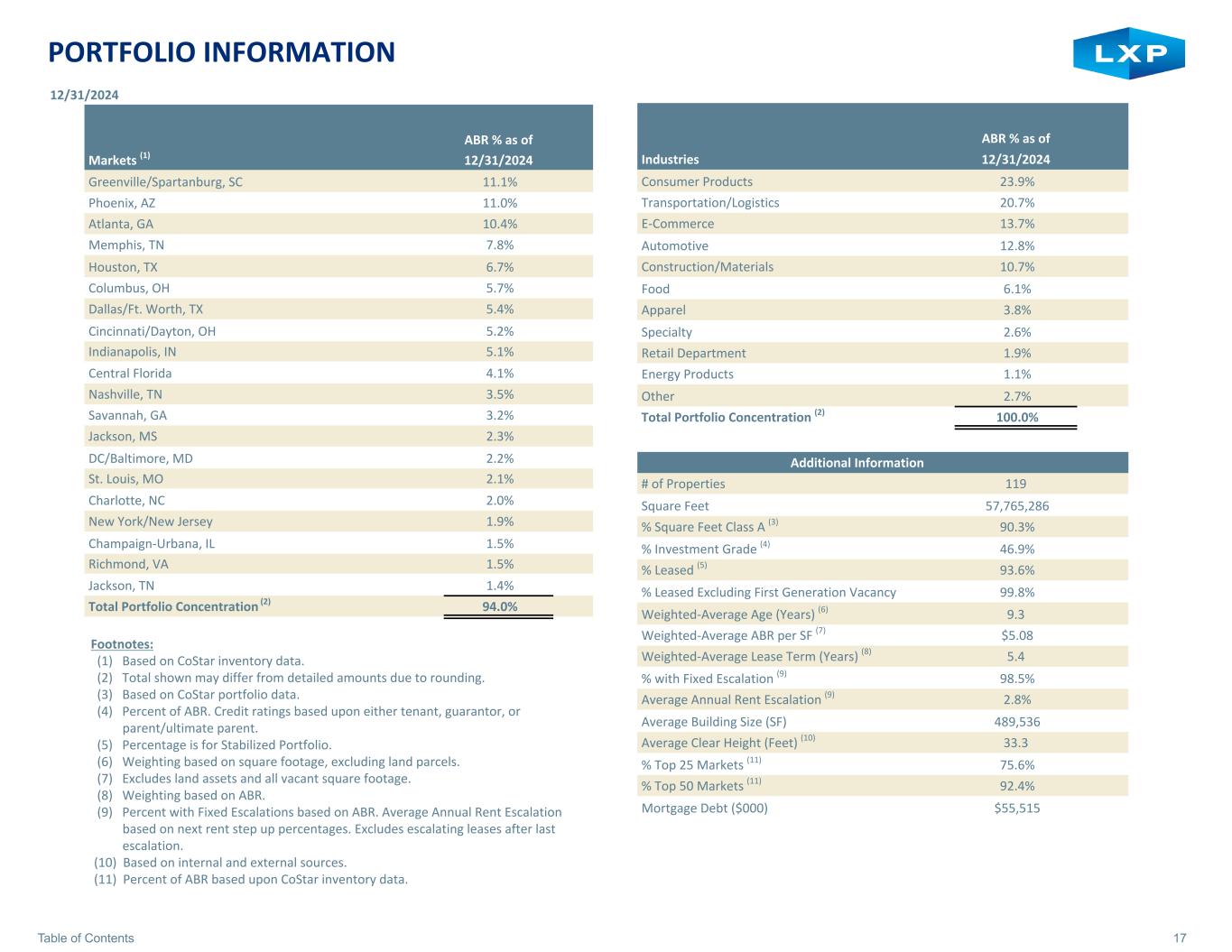

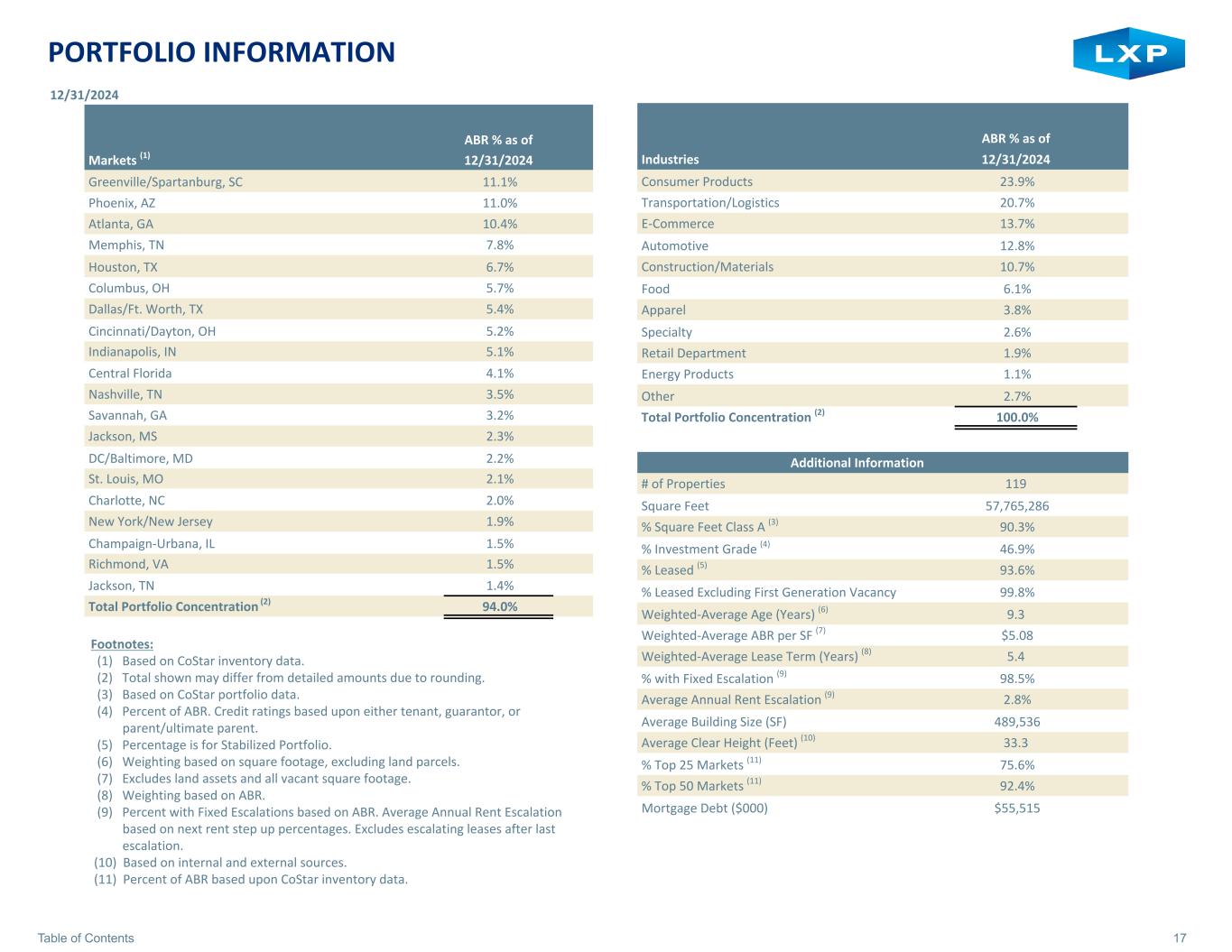

17Table of Contents PORTFOLIO INFORMATION 12/31/2024 ABR % as of Markets (1) 12/31/2024 Greenville/Spartanburg, SC 11.1% Phoenix, AZ 11.0% Atlanta, GA 10.4% Memphis, TN 7.8% Houston, TX 6.7% Columbus, OH 5.7% Dallas/Ft. Worth, TX 5.4% Cincinnati/Dayton, OH 5.2% Indianapolis, IN 5.1% Central Florida 4.1% Nashville, TN 3.5% Savannah, GA 3.2% Jackson, MS 2.3% DC/Baltimore, MD 2.2% St. Louis, MO 2.1% Charlotte, NC 2.0% New York/New Jersey 1.9% Champaign-Urbana, IL 1.5% Richmond, VA 1.5% Jackson, TN 1.4% Total Portfolio Concentration (2) 94.0% ABR % as of Industries 12/31/2024 Consumer Products 23.9% Transportation/Logistics 20.7% E-Commerce 13.7% Automotive 12.8% Construction/Materials 10.7% Food 6.1% Apparel 3.8% Specialty 2.6% Retail Department 1.9% Energy Products 1.1% Other 2.7% Total Portfolio Concentration (2) 100.0% Additional Information # of Properties 119 Square Feet 57,765,286 % Square Feet Class A (3) 90.3% % Investment Grade (4) 46.9% % Leased (5) 93.6% % Leased Excluding First Generation Vacancy 99.8% Weighted-Average Age (Years) (6) 9.3 Weighted-Average ABR per SF (7) $5.08 Weighted-Average Lease Term (Years) (8) 5.4 % with Fixed Escalation (9) 98.5% Average Annual Rent Escalation (9) 2.8% Average Building Size (SF) 489,536 Average Clear Height (Feet) (10) 33.3 % Top 25 Markets (11) 75.6% % Top 50 Markets (11) 92.4% Mortgage Debt ($000) $55,515 Footnotes: (1) Based on CoStar inventory data. (2) Total shown may differ from detailed amounts due to rounding. (3) Based on CoStar portfolio data. (4) Percent of ABR. Credit ratings based upon either tenant, guarantor, or parent/ultimate parent. (5) Percentage is for Stabilized Portfolio. (6) Weighting based on square footage, excluding land parcels. (7) Excludes land assets and all vacant square footage. (8) Weighting based on ABR. (9) Percent with Fixed Escalations based on ABR. Average Annual Rent Escalation based on next rent step up percentages. Excludes escalating leases after last escalation. (10) Based on internal and external sources. (11) Percent of ABR based upon CoStar inventory data.

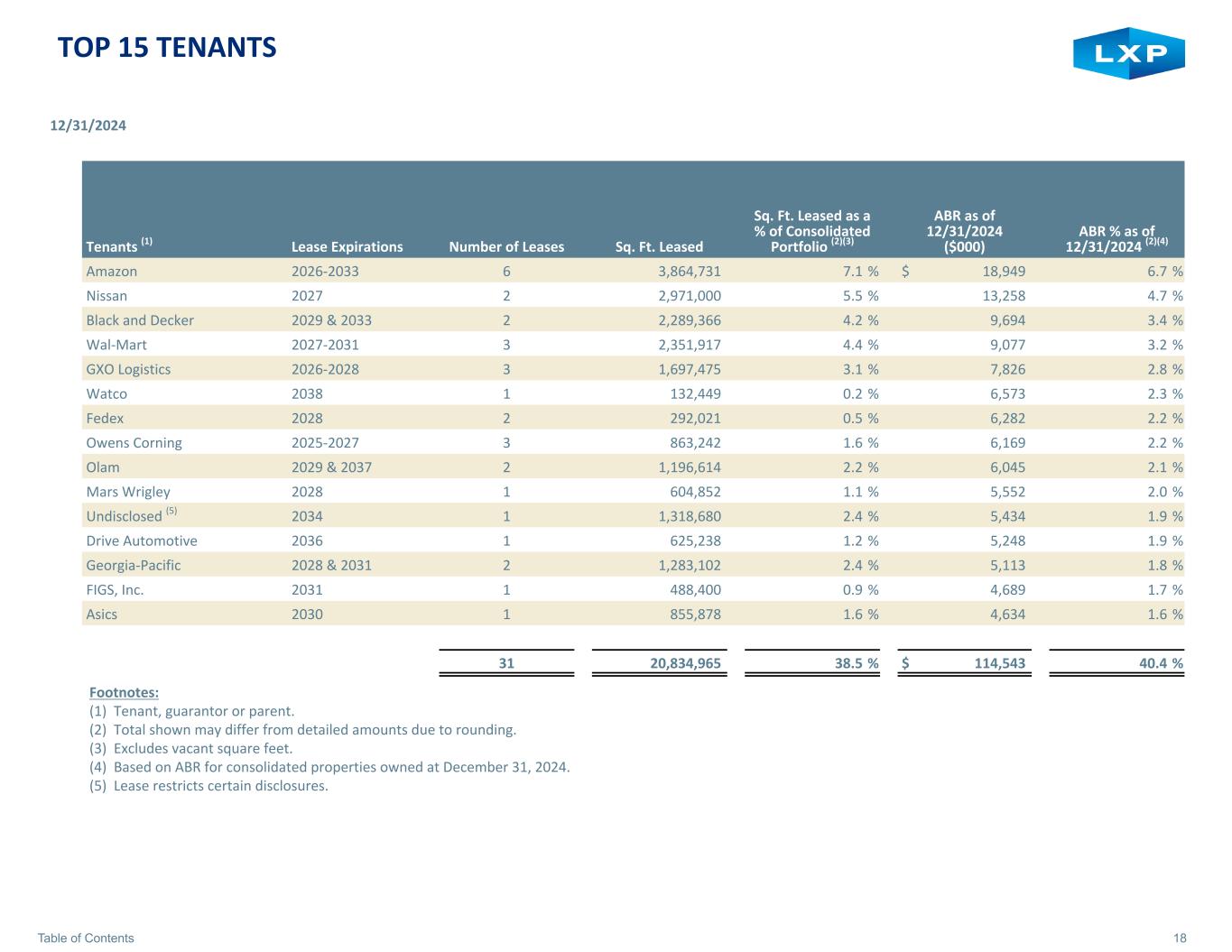

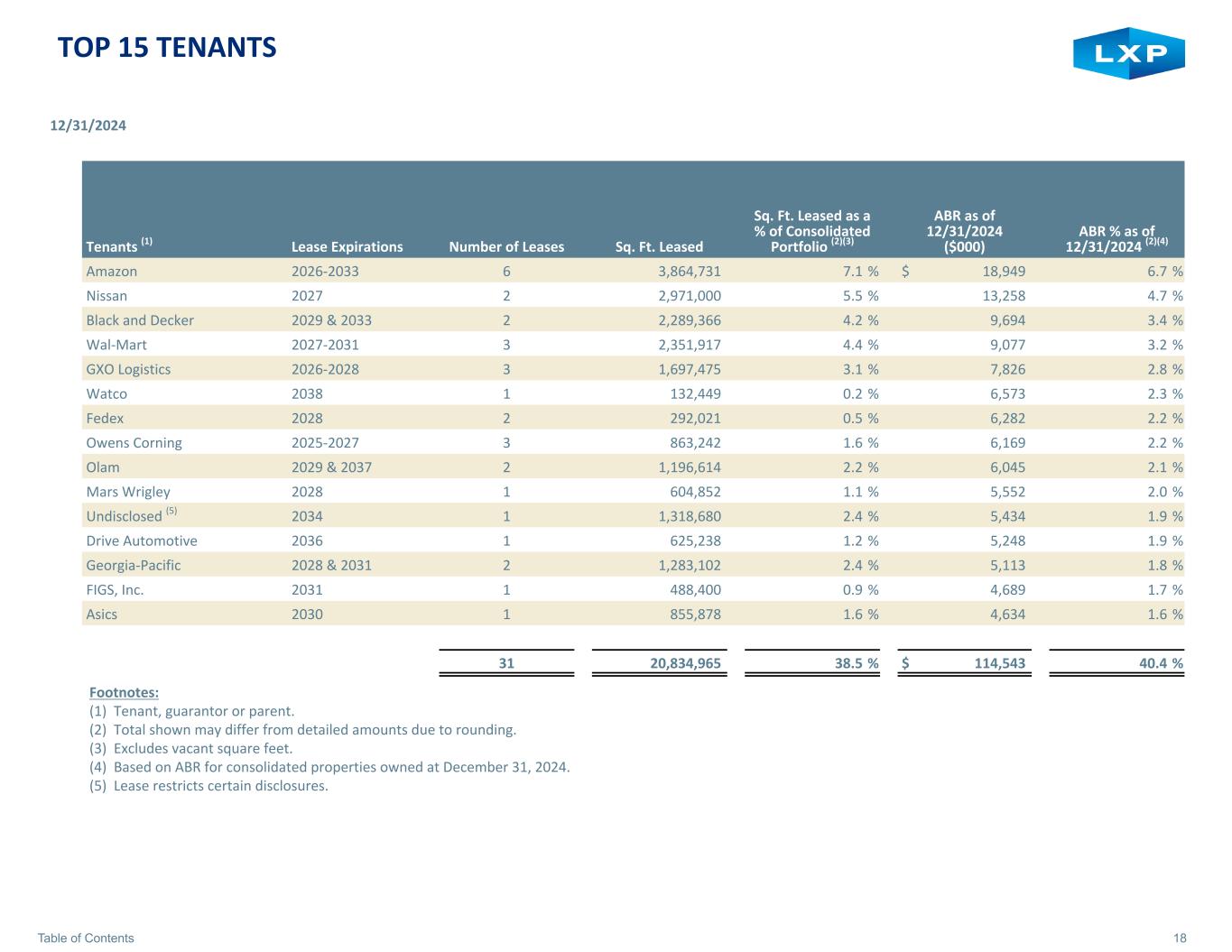

18Table of Contents TOP 15 TENANTS 12/31/2024 Tenants (1) Lease Expirations Number of Leases Sq. Ft. Leased Sq. Ft. Leased as a % of Consolidated Portfolio (2)(3) ABR as of 12/31/2024 ($000) ABR % as of 12/31/2024 (2)(4) Amazon 2026-2033 6 3,864,731 7.1 % $ 18,949 6.7 % Nissan 2027 2 2,971,000 5.5 % 13,258 4.7 % Black and Decker 2029 & 2033 2 2,289,366 4.2 % 9,694 3.4 % Wal-Mart 2027-2031 3 2,351,917 4.4 % 9,077 3.2 % GXO Logistics 2026-2028 3 1,697,475 3.1 % 7,826 2.8 % Watco 2038 1 132,449 0.2 % 6,573 2.3 % Fedex 2028 2 292,021 0.5 % 6,282 2.2 % Owens Corning 2025-2027 3 863,242 1.6 % 6,169 2.2 % Olam 2029 & 2037 2 1,196,614 2.2 % 6,045 2.1 % Mars Wrigley 2028 1 604,852 1.1 % 5,552 2.0 % Undisclosed (5) 2034 1 1,318,680 2.4 % 5,434 1.9 % Drive Automotive 2036 1 625,238 1.2 % 5,248 1.9 % Georgia-Pacific 2028 & 2031 2 1,283,102 2.4 % 5,113 1.8 % FIGS, Inc. 2031 1 488,400 0.9 % 4,689 1.7 % Asics 2030 1 855,878 1.6 % 4,634 1.6 % 31 20,834,965 38.5 % $ 114,543 40.4 % Footnotes: (1) Tenant, guarantor or parent. (2) Total shown may differ from detailed amounts due to rounding. (3) Excludes vacant square feet. (4) Based on ABR for consolidated properties owned at December 31, 2024. (5) Lease restricts certain disclosures.

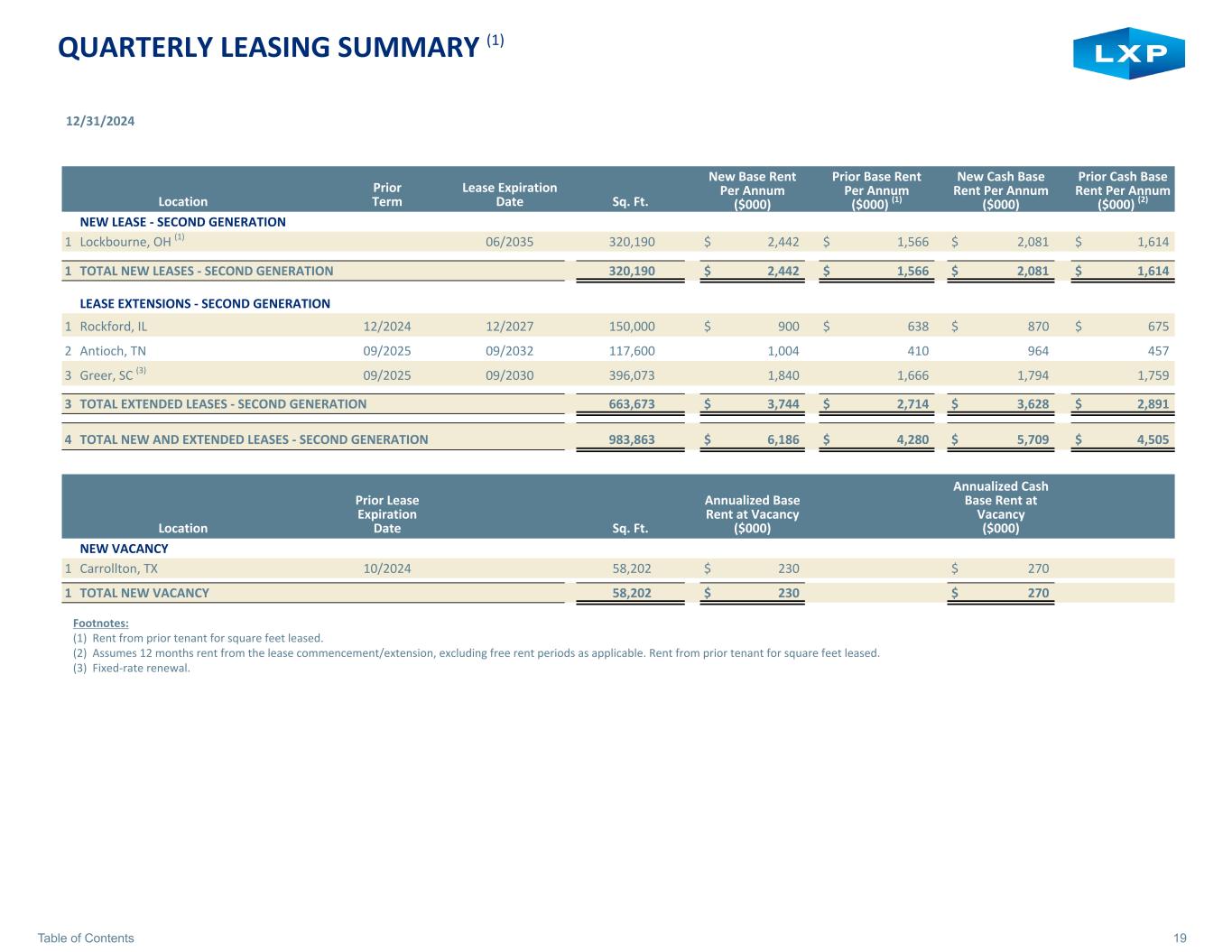

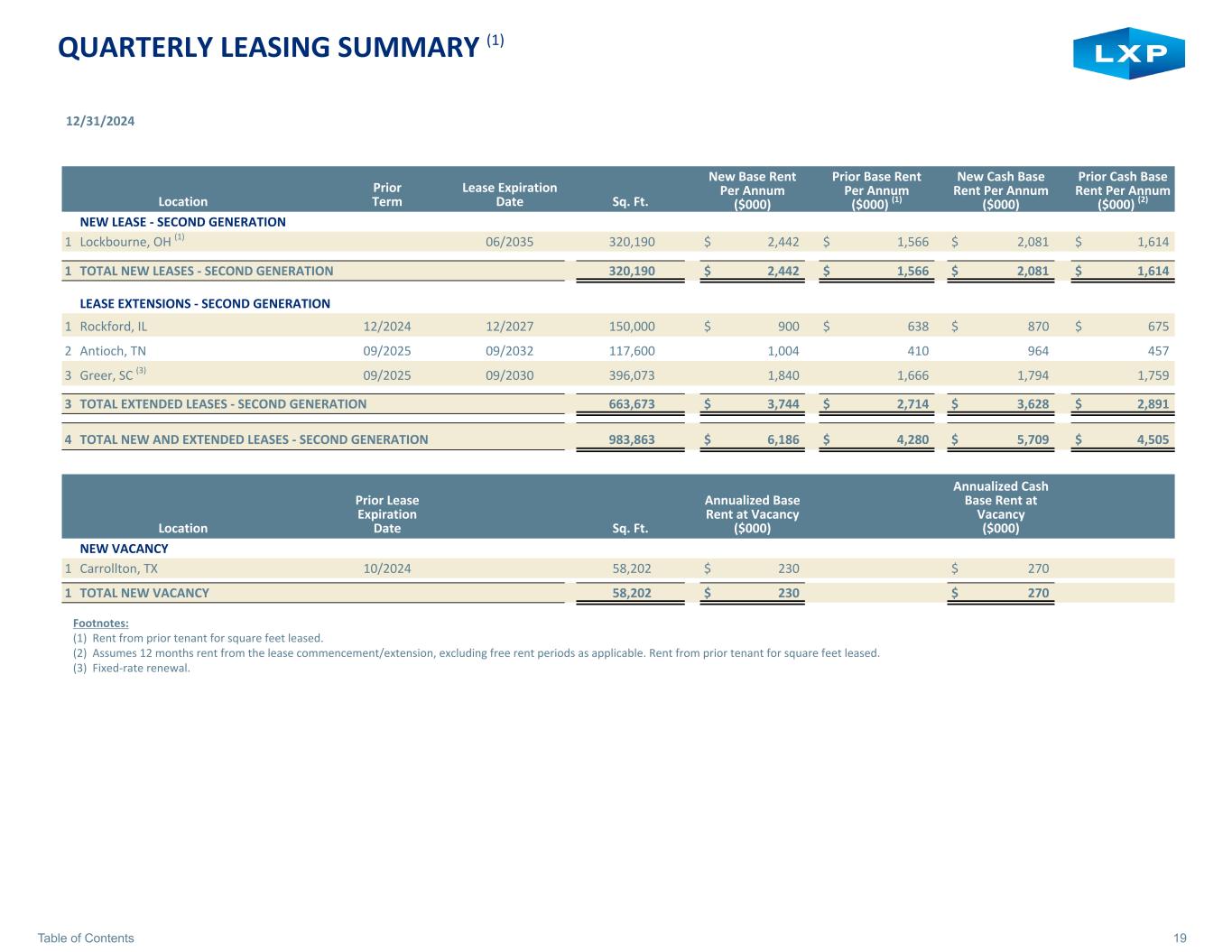

19Table of Contents QUARTERLY LEASING SUMMARY (1) 12/31/2024 Location Prior Term Lease Expiration Date Sq. Ft. New Base Rent Per Annum ($000) Prior Base Rent Per Annum ($000) (1) New Cash Base Rent Per Annum ($000) Prior Cash Base Rent Per Annum ($000) (2) NEW LEASE - SECOND GENERATION 1 Lockbourne, OH (1) 06/2035 320,190 $ 2,442 $ 1,566 $ 2,081 $ 1,614 1 TOTAL NEW LEASES - SECOND GENERATION 320,190 $ 2,442 $ 1,566 $ 2,081 $ 1,614 LEASE EXTENSIONS - SECOND GENERATION 1 Rockford, IL 12/2024 12/2027 150,000 $ 900 $ 638 $ 870 $ 675 2 Antioch, TN 09/2025 09/2032 117,600 1,004 410 964 457 3 Greer, SC (3) 09/2025 09/2030 396,073 1,840 1,666 1,794 1,759 3 TOTAL EXTENDED LEASES - SECOND GENERATION 663,673 $ 3,744 $ 2,714 $ 3,628 $ 2,891 4 TOTAL NEW AND EXTENDED LEASES - SECOND GENERATION 983,863 $ 6,186 $ 4,280 $ 5,709 $ 4,505 Location Prior Lease Expiration Date Sq. Ft. Annualized Base Rent at Vacancy ($000) Annualized Cash Base Rent at Vacancy ($000) NEW VACANCY 1 Carrollton, TX 10/2024 58,202 $ 230 $ 270 1 TOTAL NEW VACANCY 58,202 $ 230 $ 270 Footnotes: (1) Rent from prior tenant for square feet leased. (2) Assumes 12 months rent from the lease commencement/extension, excluding free rent periods as applicable. Rent from prior tenant for square feet leased. (3) Fixed-rate renewal.

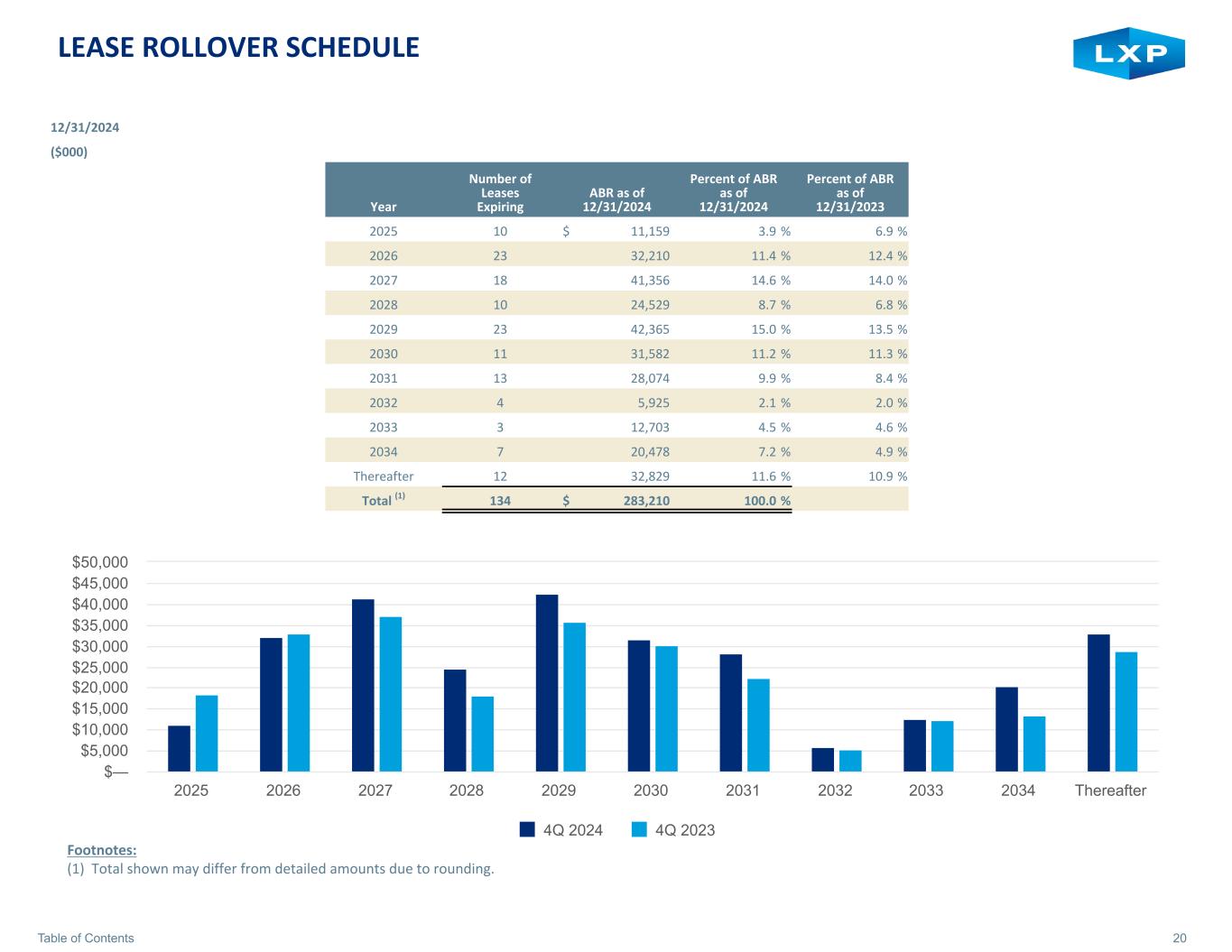

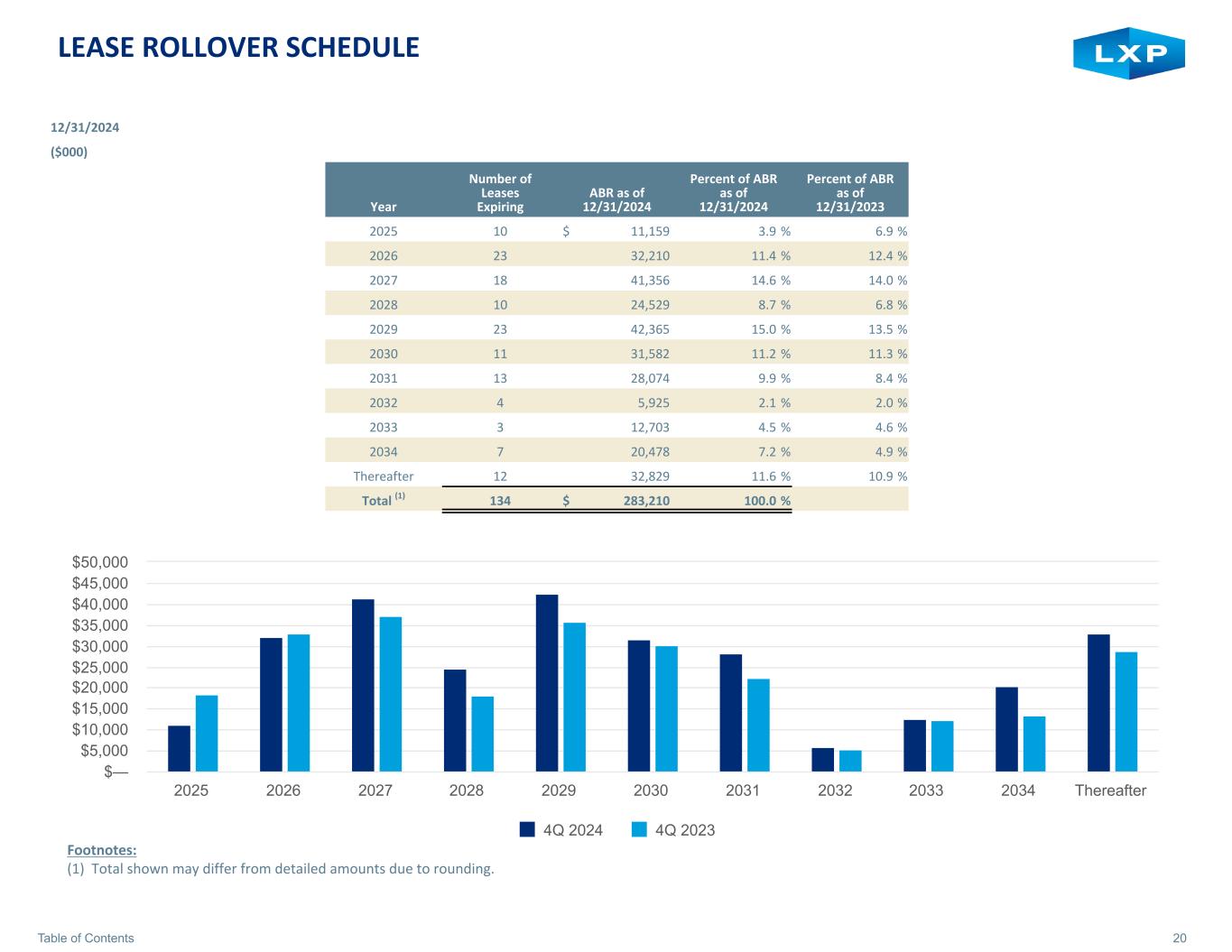

20Table of Contents LEASE ROLLOVER SCHEDULE 12/31/2024 ($000) Year Number of Leases Expiring ABR as of 12/31/2024 Percent of ABR as of 12/31/2024 Percent of ABR as of 12/31/2023 2025 10 $ 11,159 3.9 % 6.9 % 2026 23 32,210 11.4 % 12.4 % 2027 18 41,356 14.6 % 14.0 % 2028 10 24,529 8.7 % 6.8 % 2029 23 42,365 15.0 % 13.5 % 2030 11 31,582 11.2 % 11.3 % 2031 13 28,074 9.9 % 8.4 % 2032 4 5,925 2.1 % 2.0 % 2033 3 12,703 4.5 % 4.6 % 2034 7 20,478 7.2 % 4.9 % Thereafter 12 32,829 11.6 % 10.9 % Total (1) 134 $ 283,210 100.0 % Footnotes: (1) Total shown may differ from detailed amounts due to rounding. 4Q 2024 4Q 2023 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Thereafter $— $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 $40,000 $45,000 $50,000

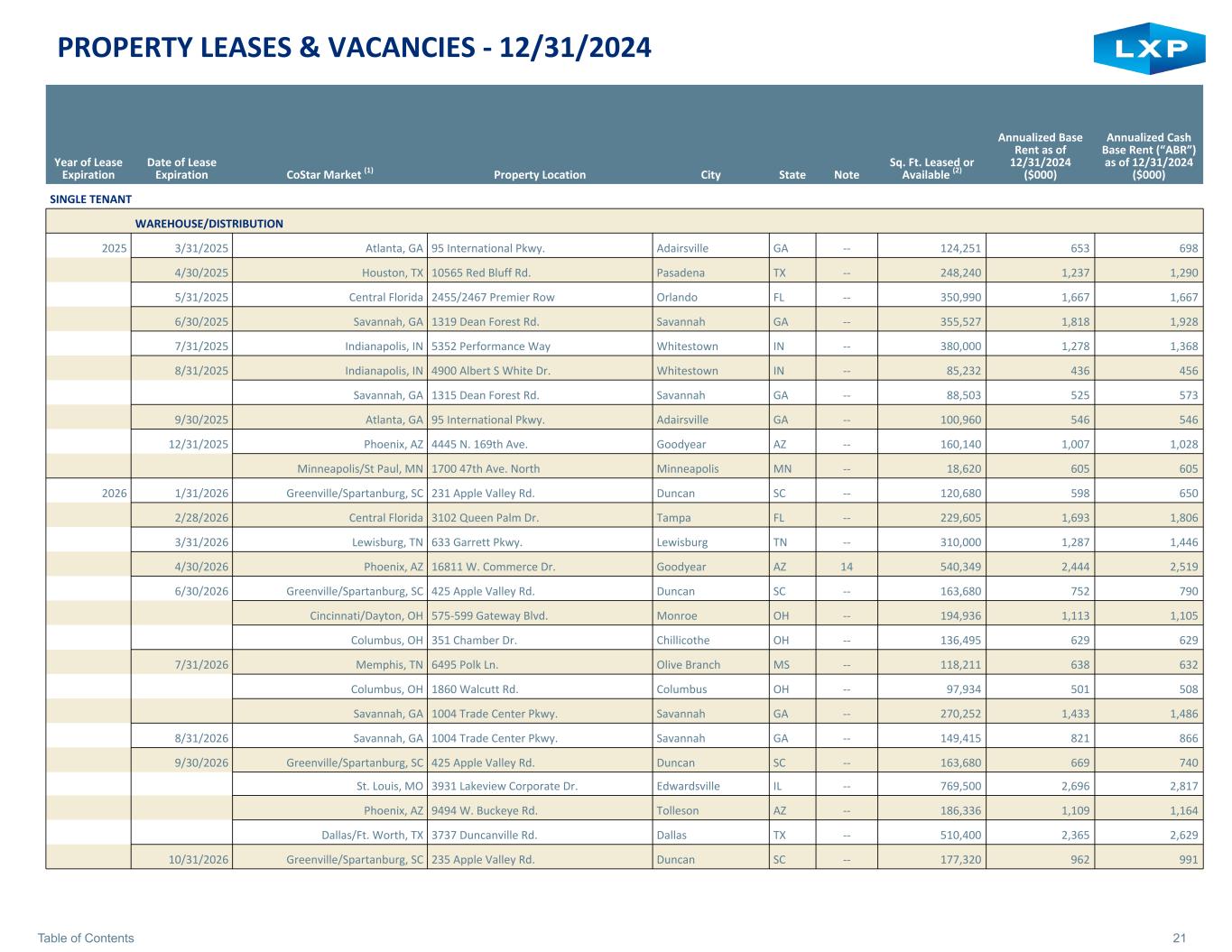

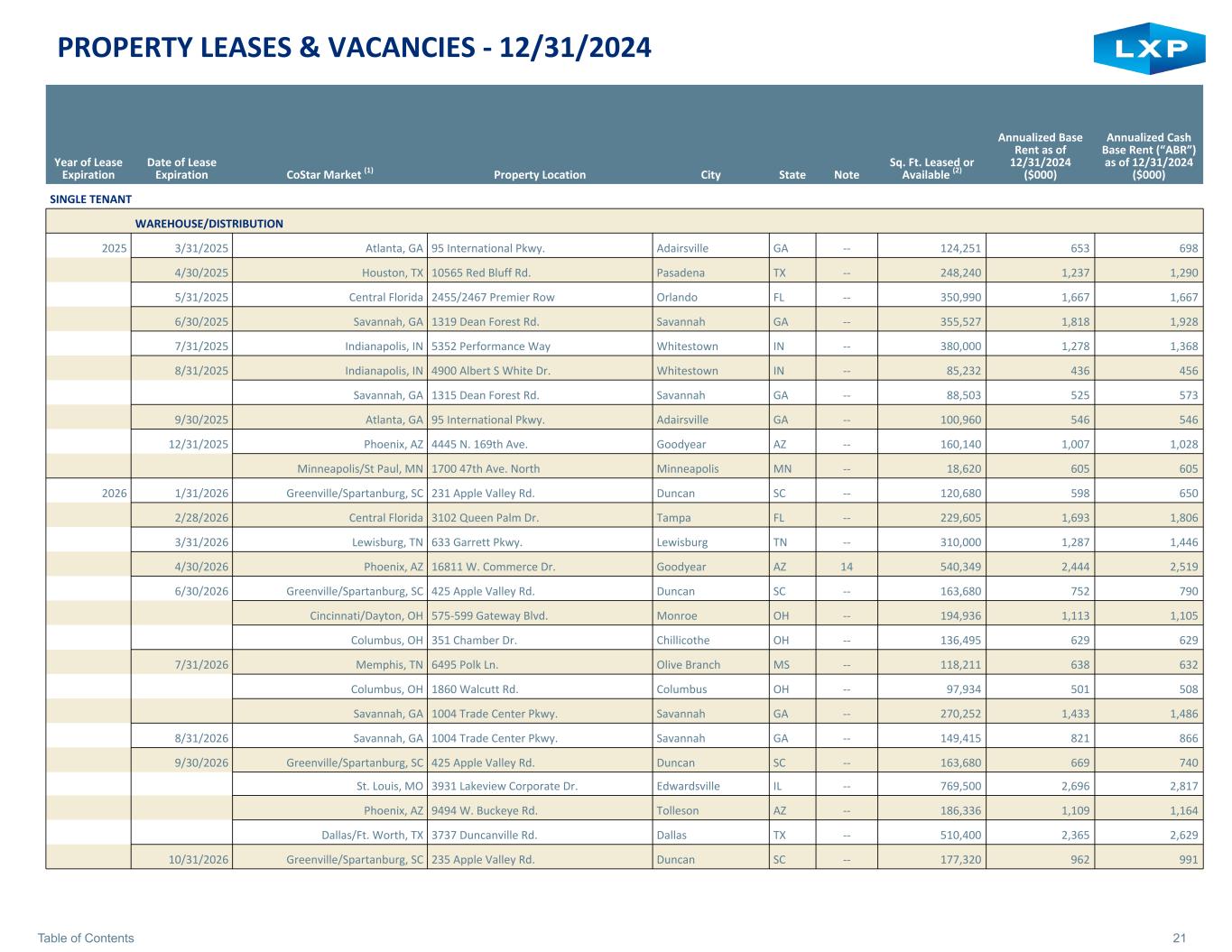

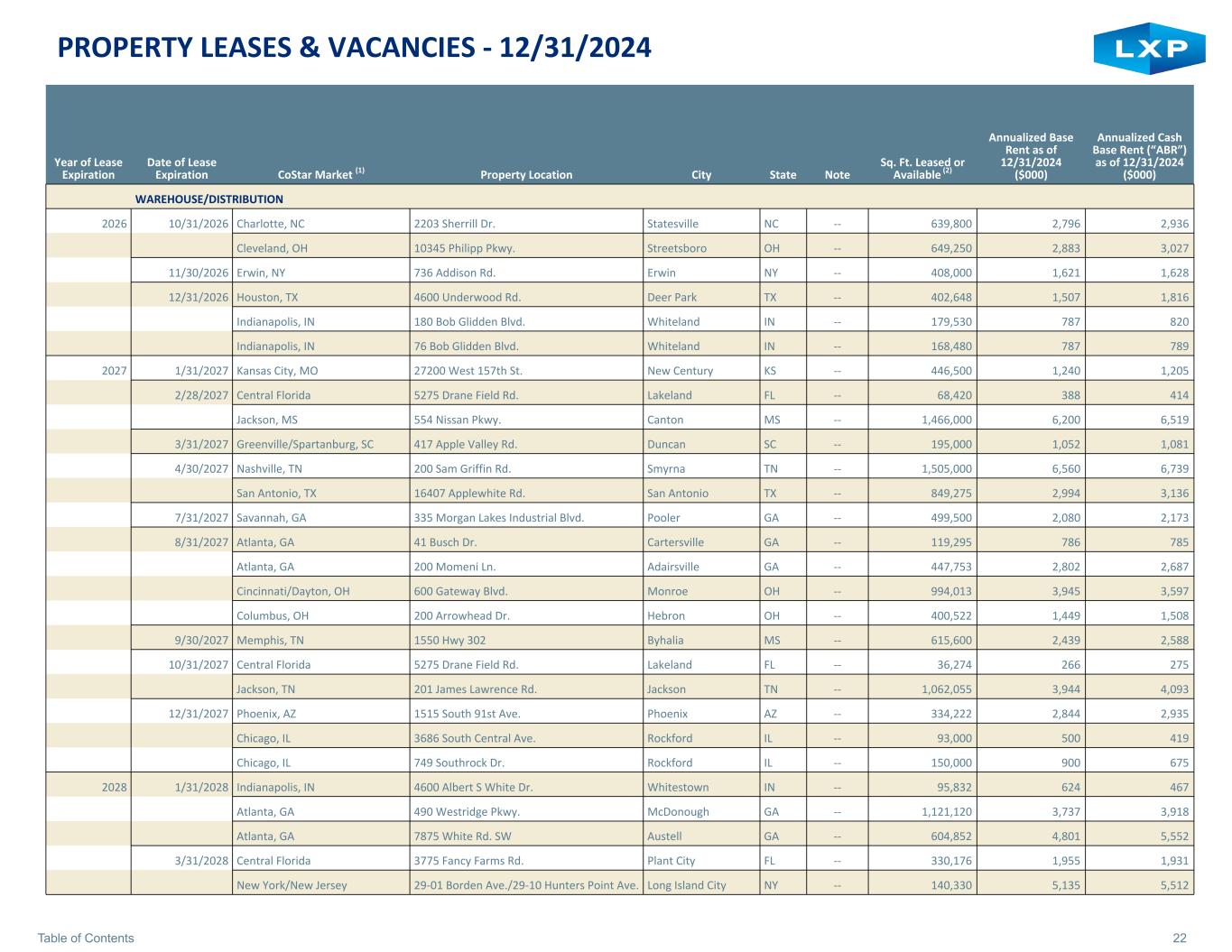

21Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) SINGLE TENANT WAREHOUSE/DISTRIBUTION 2025 3/31/2025 Atlanta, GA 95 International Pkwy. Adairsville GA -- 124,251 653 698 4/30/2025 Houston, TX 10565 Red Bluff Rd. Pasadena TX -- 248,240 1,237 1,290 5/31/2025 Central Florida 2455/2467 Premier Row Orlando FL -- 350,990 1,667 1,667 6/30/2025 Savannah, GA 1319 Dean Forest Rd. Savannah GA -- 355,527 1,818 1,928 7/31/2025 Indianapolis, IN 5352 Performance Way Whitestown IN -- 380,000 1,278 1,368 8/31/2025 Indianapolis, IN 4900 Albert S White Dr. Whitestown IN -- 85,232 436 456 Savannah, GA 1315 Dean Forest Rd. Savannah GA -- 88,503 525 573 9/30/2025 Atlanta, GA 95 International Pkwy. Adairsville GA -- 100,960 546 546 12/31/2025 Phoenix, AZ 4445 N. 169th Ave. Goodyear AZ -- 160,140 1,007 1,028 Minneapolis/St Paul, MN 1700 47th Ave. North Minneapolis MN -- 18,620 605 605 2026 1/31/2026 Greenville/Spartanburg, SC 231 Apple Valley Rd. Duncan SC -- 120,680 598 650 2/28/2026 Central Florida 3102 Queen Palm Dr. Tampa FL -- 229,605 1,693 1,806 3/31/2026 Lewisburg, TN 633 Garrett Pkwy. Lewisburg TN -- 310,000 1,287 1,446 4/30/2026 Phoenix, AZ 16811 W. Commerce Dr. Goodyear AZ 14 540,349 2,444 2,519 6/30/2026 Greenville/Spartanburg, SC 425 Apple Valley Rd. Duncan SC -- 163,680 752 790 Cincinnati/Dayton, OH 575-599 Gateway Blvd. Monroe OH -- 194,936 1,113 1,105 Columbus, OH 351 Chamber Dr. Chillicothe OH -- 136,495 629 629 7/31/2026 Memphis, TN 6495 Polk Ln. Olive Branch MS -- 118,211 638 632 Columbus, OH 1860 Walcutt Rd. Columbus OH -- 97,934 501 508 Savannah, GA 1004 Trade Center Pkwy. Savannah GA -- 270,252 1,433 1,486 8/31/2026 Savannah, GA 1004 Trade Center Pkwy. Savannah GA -- 149,415 821 866 9/30/2026 Greenville/Spartanburg, SC 425 Apple Valley Rd. Duncan SC -- 163,680 669 740 St. Louis, MO 3931 Lakeview Corporate Dr. Edwardsville IL -- 769,500 2,696 2,817 Phoenix, AZ 9494 W. Buckeye Rd. Tolleson AZ -- 186,336 1,109 1,164 Dallas/Ft. Worth, TX 3737 Duncanville Rd. Dallas TX -- 510,400 2,365 2,629 10/31/2026 Greenville/Spartanburg, SC 235 Apple Valley Rd. Duncan SC -- 177,320 962 991

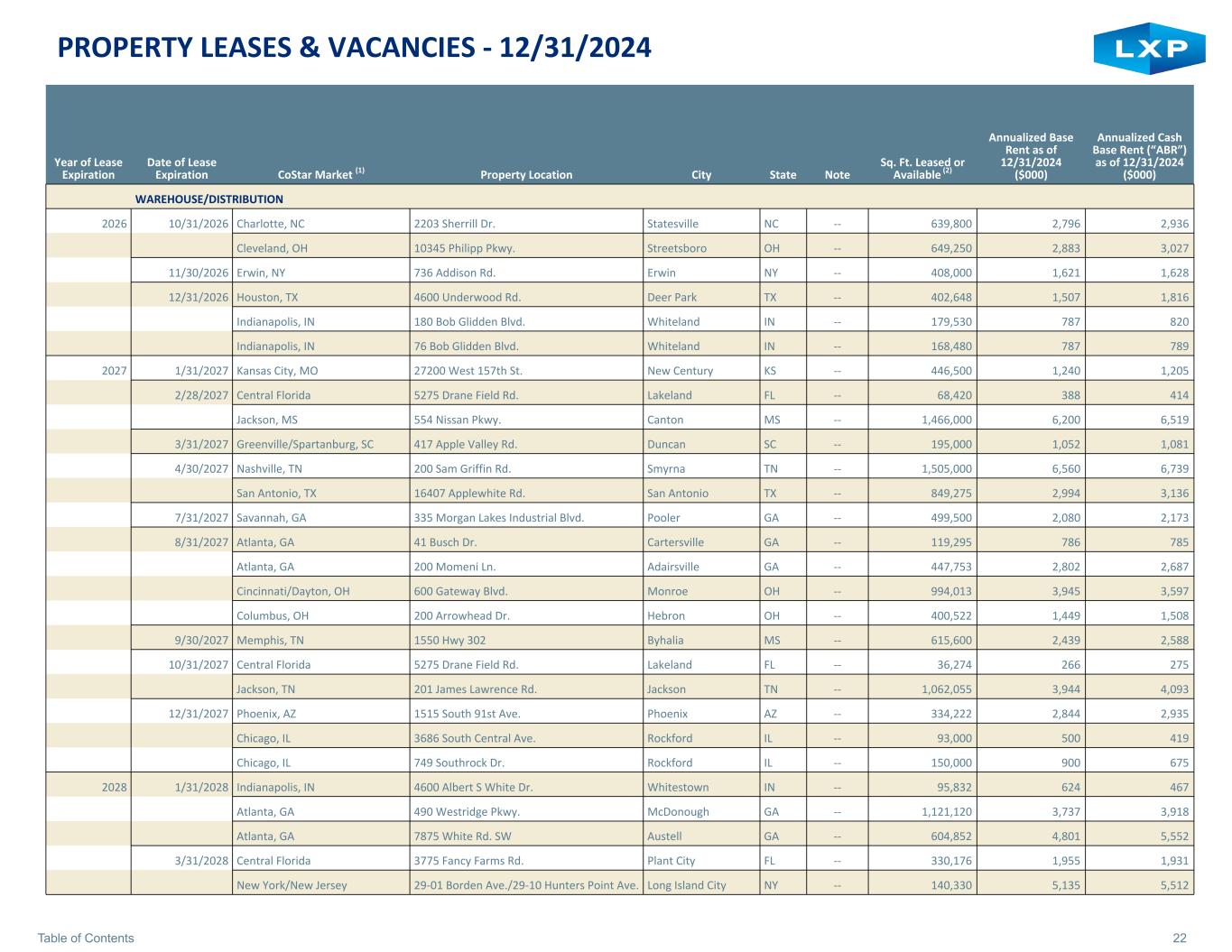

22Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) WAREHOUSE/DISTRIBUTION 2026 10/31/2026 Charlotte, NC 2203 Sherrill Dr. Statesville NC -- 639,800 2,796 2,936 Cleveland, OH 10345 Philipp Pkwy. Streetsboro OH -- 649,250 2,883 3,027 11/30/2026 Erwin, NY 736 Addison Rd. Erwin NY -- 408,000 1,621 1,628 12/31/2026 Houston, TX 4600 Underwood Rd. Deer Park TX -- 402,648 1,507 1,816 Indianapolis, IN 180 Bob Glidden Blvd. Whiteland IN -- 179,530 787 820 Indianapolis, IN 76 Bob Glidden Blvd. Whiteland IN -- 168,480 787 789 2027 1/31/2027 Kansas City, MO 27200 West 157th St. New Century KS -- 446,500 1,240 1,205 2/28/2027 Central Florida 5275 Drane Field Rd. Lakeland FL -- 68,420 388 414 Jackson, MS 554 Nissan Pkwy. Canton MS -- 1,466,000 6,200 6,519 3/31/2027 Greenville/Spartanburg, SC 417 Apple Valley Rd. Duncan SC -- 195,000 1,052 1,081 4/30/2027 Nashville, TN 200 Sam Griffin Rd. Smyrna TN -- 1,505,000 6,560 6,739 San Antonio, TX 16407 Applewhite Rd. San Antonio TX -- 849,275 2,994 3,136 7/31/2027 Savannah, GA 335 Morgan Lakes Industrial Blvd. Pooler GA -- 499,500 2,080 2,173 8/31/2027 Atlanta, GA 41 Busch Dr. Cartersville GA -- 119,295 786 785 Atlanta, GA 200 Momeni Ln. Adairsville GA -- 447,753 2,802 2,687 Cincinnati/Dayton, OH 600 Gateway Blvd. Monroe OH -- 994,013 3,945 3,597 Columbus, OH 200 Arrowhead Dr. Hebron OH -- 400,522 1,449 1,508 9/30/2027 Memphis, TN 1550 Hwy 302 Byhalia MS -- 615,600 2,439 2,588 10/31/2027 Central Florida 5275 Drane Field Rd. Lakeland FL -- 36,274 266 275 Jackson, TN 201 James Lawrence Rd. Jackson TN -- 1,062,055 3,944 4,093 12/31/2027 Phoenix, AZ 1515 South 91st Ave. Phoenix AZ -- 334,222 2,844 2,935 Chicago, IL 3686 South Central Ave. Rockford IL -- 93,000 500 419 Chicago, IL 749 Southrock Dr. Rockford IL -- 150,000 900 675 2028 1/31/2028 Indianapolis, IN 4600 Albert S White Dr. Whitestown IN -- 95,832 624 467 Atlanta, GA 490 Westridge Pkwy. McDonough GA -- 1,121,120 3,737 3,918 Atlanta, GA 7875 White Rd. SW Austell GA -- 604,852 4,801 5,552 3/31/2028 Central Florida 3775 Fancy Farms Rd. Plant City FL -- 330,176 1,955 1,931 New York/New Jersey 29-01 Borden Ave./29-10 Hunters Point Ave. Long Island City NY -- 140,330 5,135 5,512

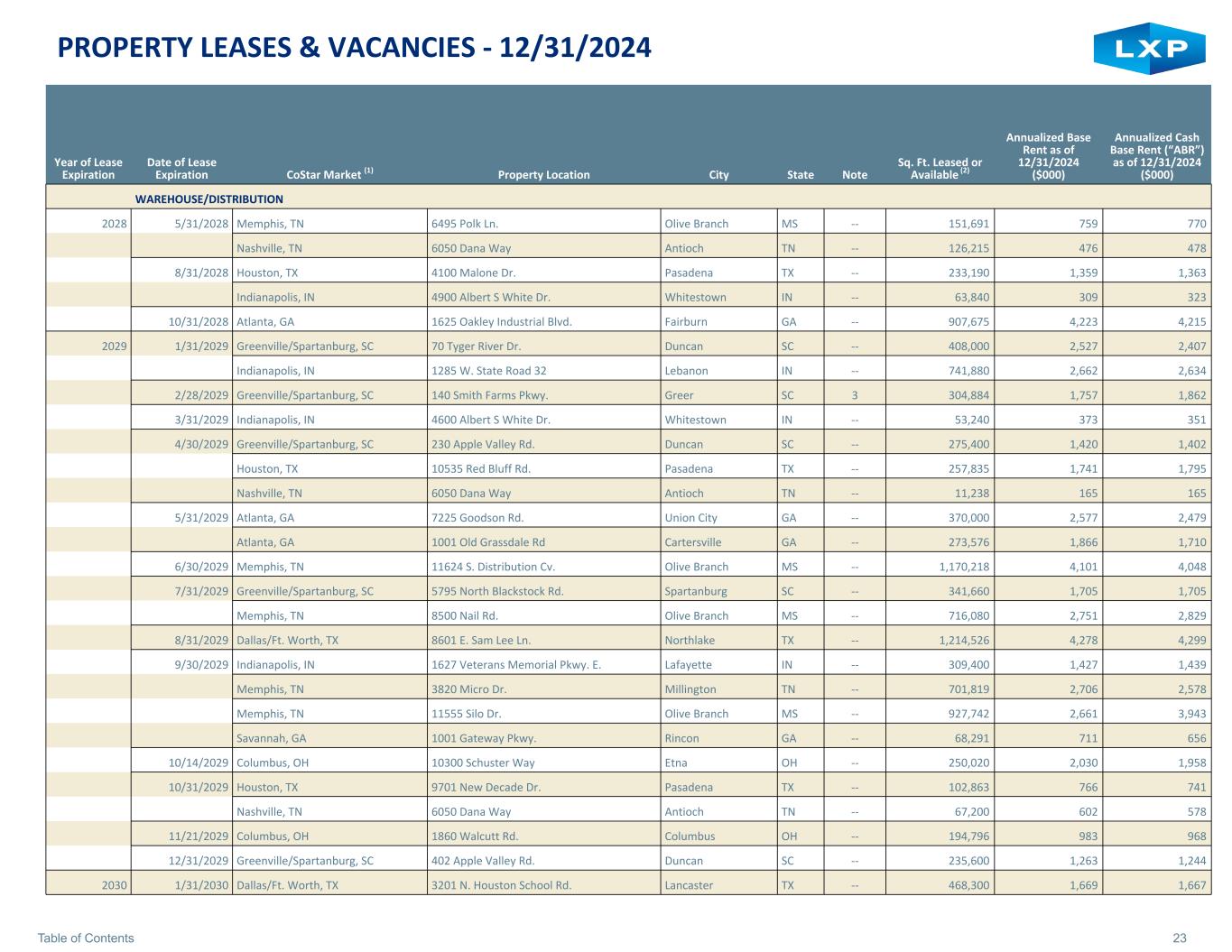

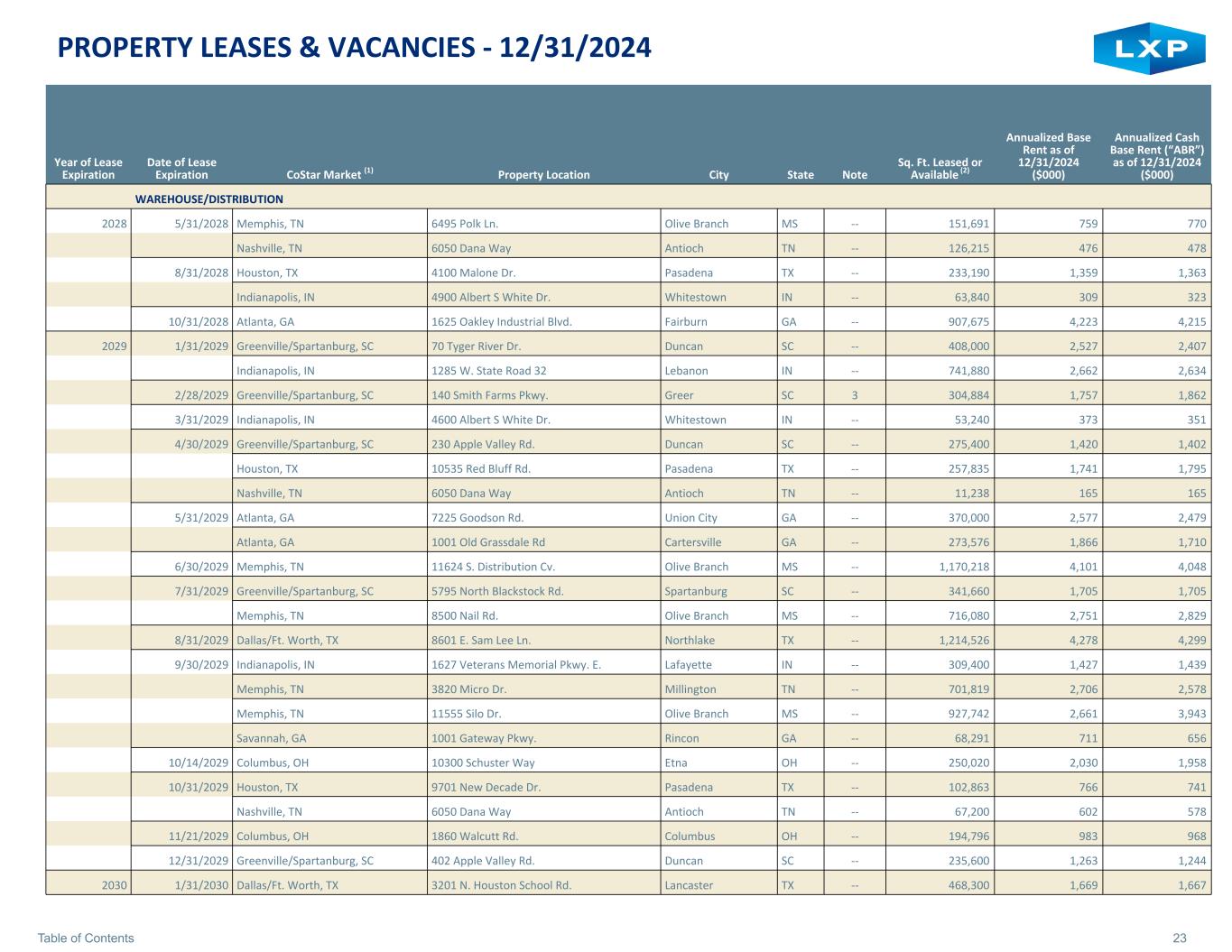

23Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) WAREHOUSE/DISTRIBUTION 2028 5/31/2028 Memphis, TN 6495 Polk Ln. Olive Branch MS -- 151,691 759 770 Nashville, TN 6050 Dana Way Antioch TN -- 126,215 476 478 8/31/2028 Houston, TX 4100 Malone Dr. Pasadena TX -- 233,190 1,359 1,363 Indianapolis, IN 4900 Albert S White Dr. Whitestown IN -- 63,840 309 323 10/31/2028 Atlanta, GA 1625 Oakley Industrial Blvd. Fairburn GA -- 907,675 4,223 4,215 2029 1/31/2029 Greenville/Spartanburg, SC 70 Tyger River Dr. Duncan SC -- 408,000 2,527 2,407 Indianapolis, IN 1285 W. State Road 32 Lebanon IN -- 741,880 2,662 2,634 2/28/2029 Greenville/Spartanburg, SC 140 Smith Farms Pkwy. Greer SC 3 304,884 1,757 1,862 3/31/2029 Indianapolis, IN 4600 Albert S White Dr. Whitestown IN -- 53,240 373 351 4/30/2029 Greenville/Spartanburg, SC 230 Apple Valley Rd. Duncan SC -- 275,400 1,420 1,402 Houston, TX 10535 Red Bluff Rd. Pasadena TX -- 257,835 1,741 1,795 Nashville, TN 6050 Dana Way Antioch TN -- 11,238 165 165 5/31/2029 Atlanta, GA 7225 Goodson Rd. Union City GA -- 370,000 2,577 2,479 Atlanta, GA 1001 Old Grassdale Rd Cartersville GA -- 273,576 1,866 1,710 6/30/2029 Memphis, TN 11624 S. Distribution Cv. Olive Branch MS -- 1,170,218 4,101 4,048 7/31/2029 Greenville/Spartanburg, SC 5795 North Blackstock Rd. Spartanburg SC -- 341,660 1,705 1,705 Memphis, TN 8500 Nail Rd. Olive Branch MS -- 716,080 2,751 2,829 8/31/2029 Dallas/Ft. Worth, TX 8601 E. Sam Lee Ln. Northlake TX -- 1,214,526 4,278 4,299 9/30/2029 Indianapolis, IN 1627 Veterans Memorial Pkwy. E. Lafayette IN -- 309,400 1,427 1,439 Memphis, TN 3820 Micro Dr. Millington TN -- 701,819 2,706 2,578 Memphis, TN 11555 Silo Dr. Olive Branch MS -- 927,742 2,661 3,943 Savannah, GA 1001 Gateway Pkwy. Rincon GA -- 68,291 711 656 10/14/2029 Columbus, OH 10300 Schuster Way Etna OH -- 250,020 2,030 1,958 10/31/2029 Houston, TX 9701 New Decade Dr. Pasadena TX -- 102,863 766 741 Nashville, TN 6050 Dana Way Antioch TN -- 67,200 602 578 11/21/2029 Columbus, OH 1860 Walcutt Rd. Columbus OH -- 194,796 983 968 12/31/2029 Greenville/Spartanburg, SC 402 Apple Valley Rd. Duncan SC -- 235,600 1,263 1,244 2030 1/31/2030 Dallas/Ft. Worth, TX 3201 N. Houston School Rd. Lancaster TX -- 468,300 1,669 1,667

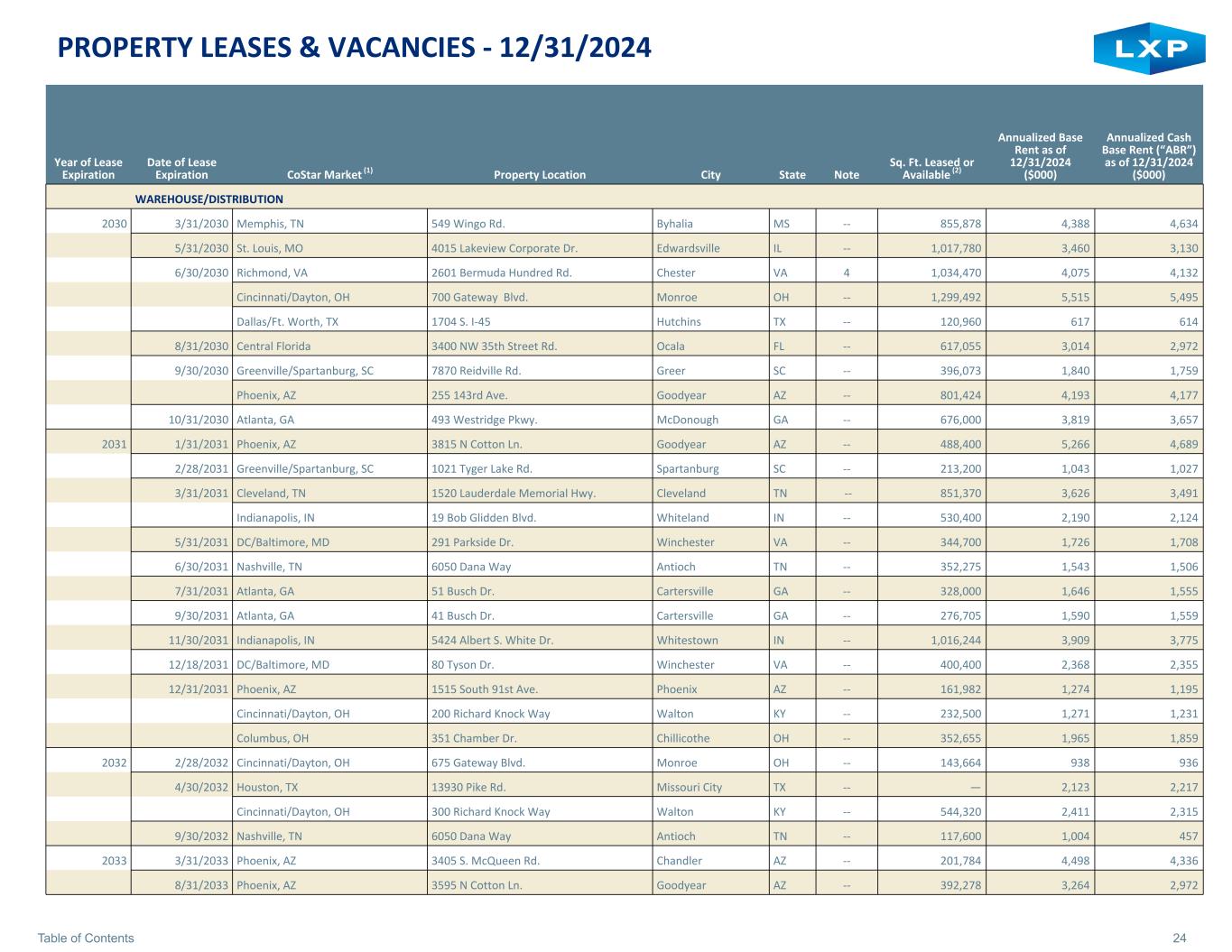

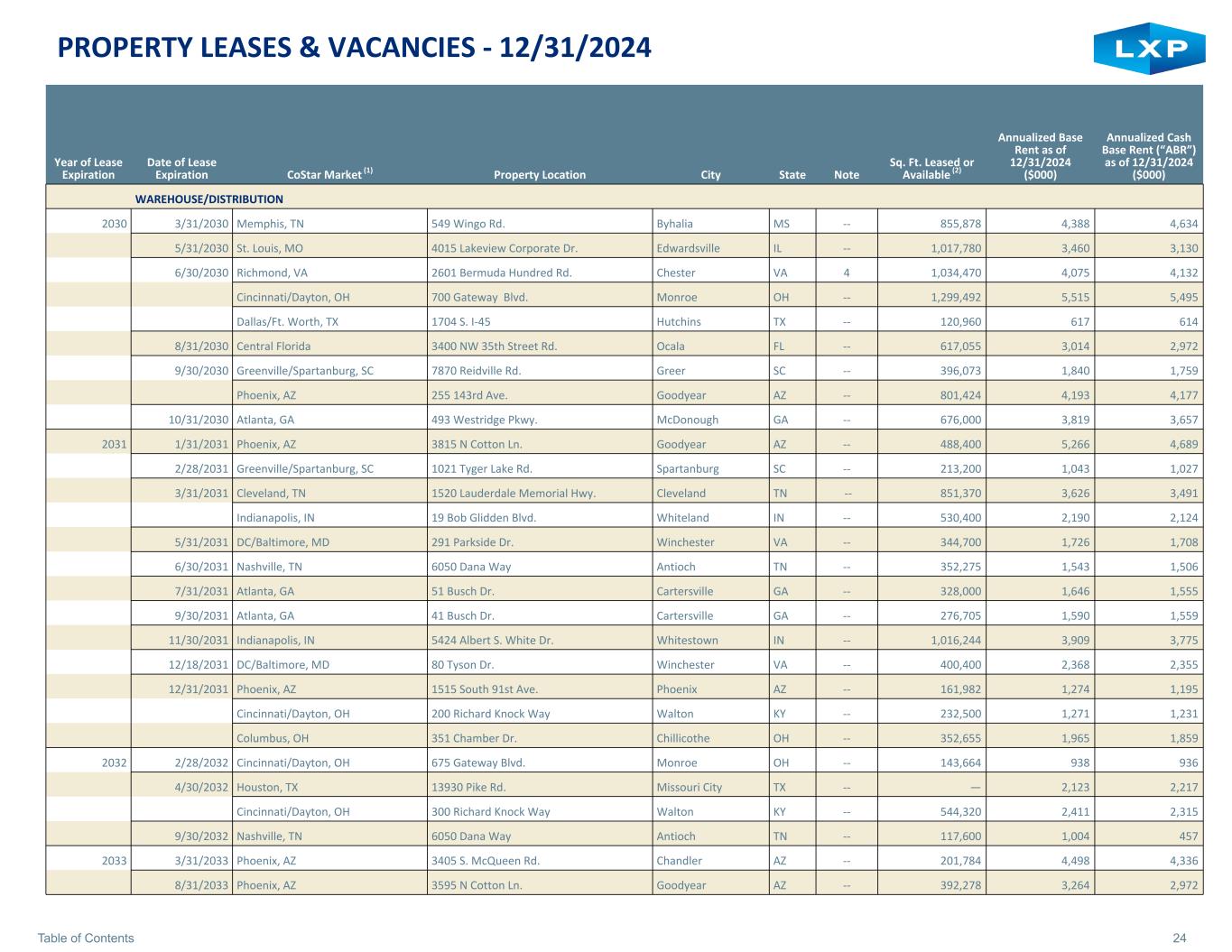

24Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) WAREHOUSE/DISTRIBUTION 2030 3/31/2030 Memphis, TN 549 Wingo Rd. Byhalia MS -- 855,878 4,388 4,634 5/31/2030 St. Louis, MO 4015 Lakeview Corporate Dr. Edwardsville IL -- 1,017,780 3,460 3,130 6/30/2030 Richmond, VA 2601 Bermuda Hundred Rd. Chester VA 4 1,034,470 4,075 4,132 Cincinnati/Dayton, OH 700 Gateway Blvd. Monroe OH -- 1,299,492 5,515 5,495 Dallas/Ft. Worth, TX 1704 S. I-45 Hutchins TX -- 120,960 617 614 8/31/2030 Central Florida 3400 NW 35th Street Rd. Ocala FL -- 617,055 3,014 2,972 9/30/2030 Greenville/Spartanburg, SC 7870 Reidville Rd. Greer SC -- 396,073 1,840 1,759 Phoenix, AZ 255 143rd Ave. Goodyear AZ -- 801,424 4,193 4,177 10/31/2030 Atlanta, GA 493 Westridge Pkwy. McDonough GA -- 676,000 3,819 3,657 2031 1/31/2031 Phoenix, AZ 3815 N Cotton Ln. Goodyear AZ -- 488,400 5,266 4,689 2/28/2031 Greenville/Spartanburg, SC 1021 Tyger Lake Rd. Spartanburg SC -- 213,200 1,043 1,027 3/31/2031 Cleveland, TN 1520 Lauderdale Memorial Hwy. Cleveland TN -- 851,370 3,626 3,491 Indianapolis, IN 19 Bob Glidden Blvd. Whiteland IN -- 530,400 2,190 2,124 5/31/2031 DC/Baltimore, MD 291 Parkside Dr. Winchester VA -- 344,700 1,726 1,708 6/30/2031 Nashville, TN 6050 Dana Way Antioch TN -- 352,275 1,543 1,506 7/31/2031 Atlanta, GA 51 Busch Dr. Cartersville GA -- 328,000 1,646 1,555 9/30/2031 Atlanta, GA 41 Busch Dr. Cartersville GA -- 276,705 1,590 1,559 11/30/2031 Indianapolis, IN 5424 Albert S. White Dr. Whitestown IN -- 1,016,244 3,909 3,775 12/18/2031 DC/Baltimore, MD 80 Tyson Dr. Winchester VA -- 400,400 2,368 2,355 12/31/2031 Phoenix, AZ 1515 South 91st Ave. Phoenix AZ -- 161,982 1,274 1,195 Cincinnati/Dayton, OH 200 Richard Knock Way Walton KY -- 232,500 1,271 1,231 Columbus, OH 351 Chamber Dr. Chillicothe OH -- 352,655 1,965 1,859 2032 2/28/2032 Cincinnati/Dayton, OH 675 Gateway Blvd. Monroe OH -- 143,664 938 936 4/30/2032 Houston, TX 13930 Pike Rd. Missouri City TX -- — 2,123 2,217 Cincinnati/Dayton, OH 300 Richard Knock Way Walton KY -- 544,320 2,411 2,315 9/30/2032 Nashville, TN 6050 Dana Way Antioch TN -- 117,600 1,004 457 2033 3/31/2033 Phoenix, AZ 3405 S. McQueen Rd. Chandler AZ -- 201,784 4,498 4,336 8/31/2033 Phoenix, AZ 3595 N Cotton Ln. Goodyear AZ -- 392,278 3,264 2,972

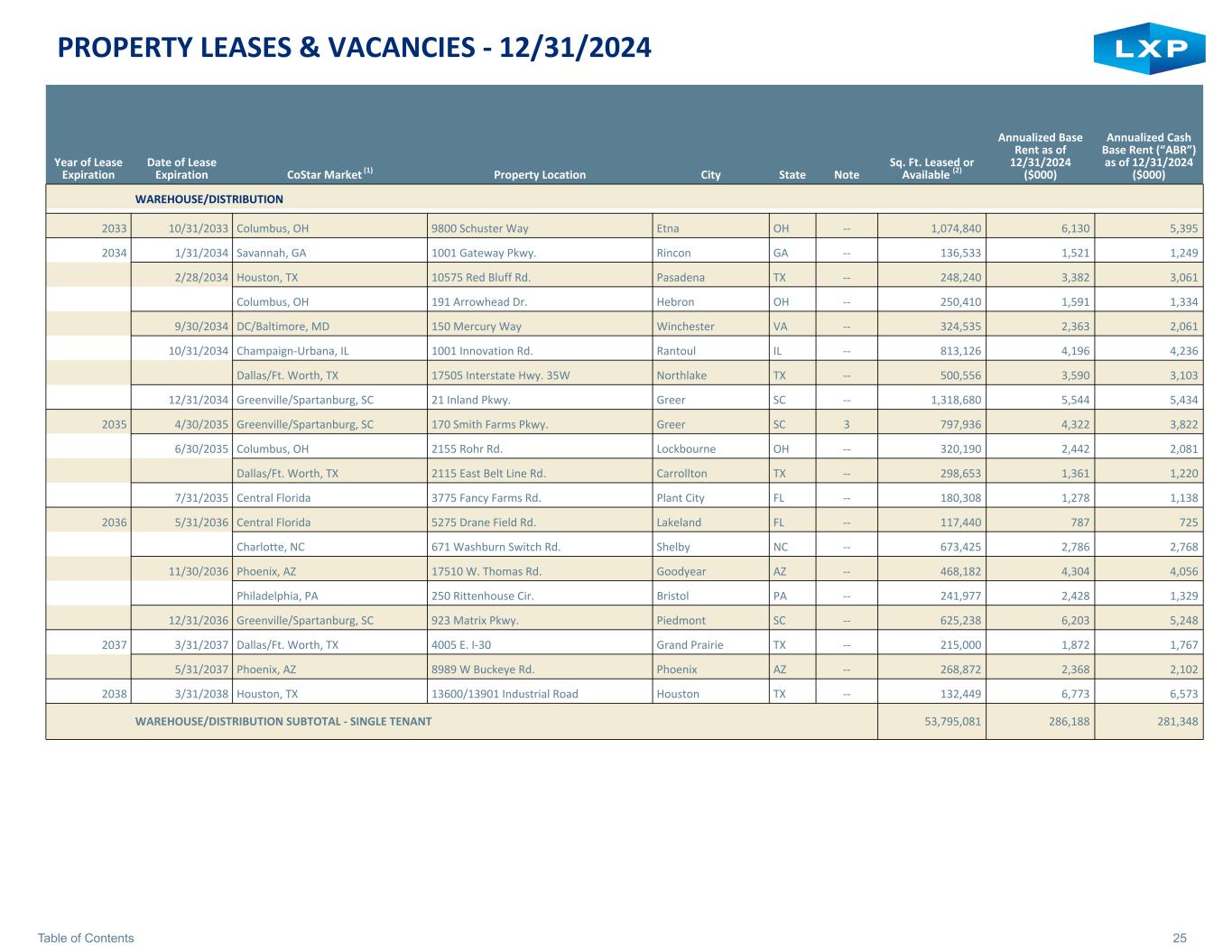

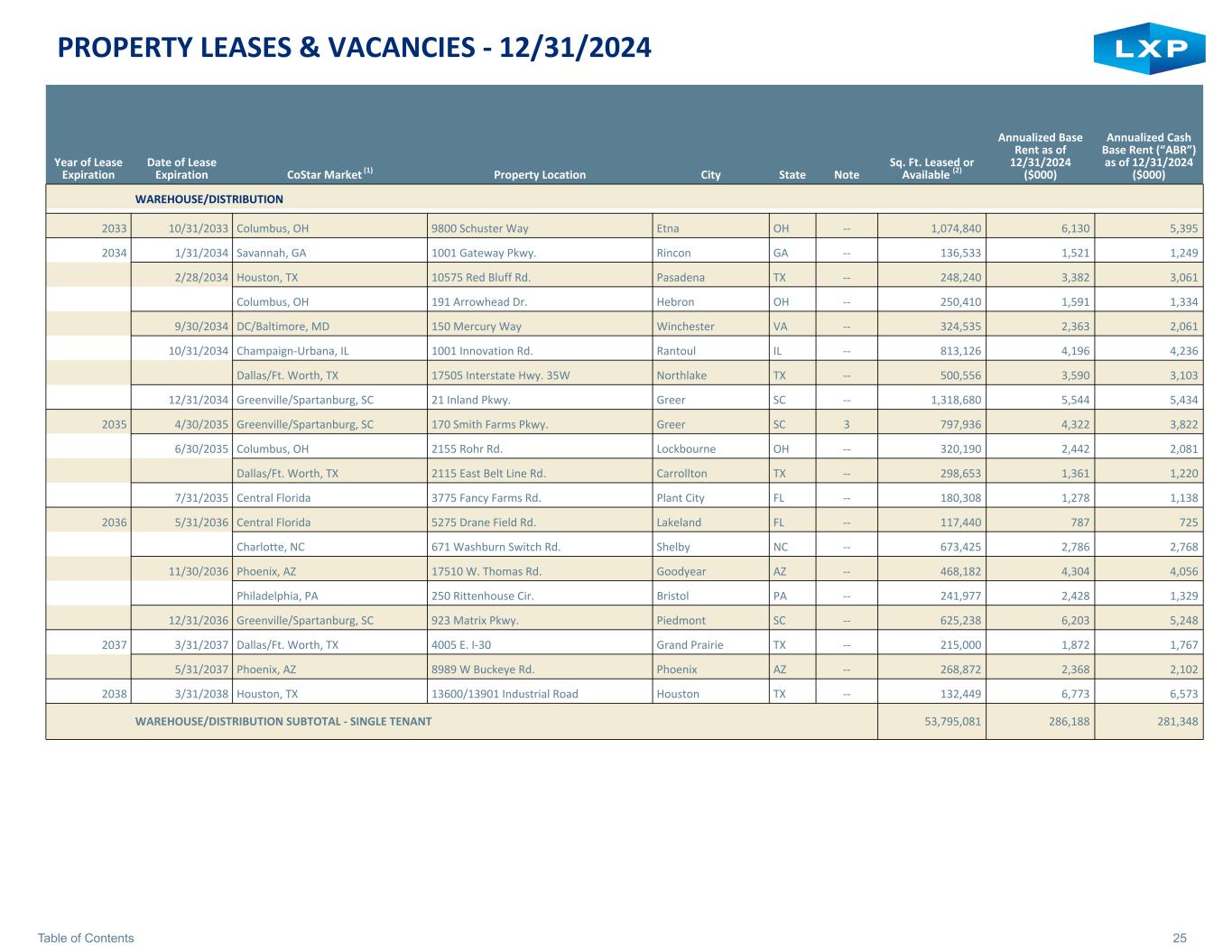

25Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) WAREHOUSE/DISTRIBUTION 2033 10/31/2033 Columbus, OH 9800 Schuster Way Etna OH -- 1,074,840 6,130 5,395 2034 1/31/2034 Savannah, GA 1001 Gateway Pkwy. Rincon GA -- 136,533 1,521 1,249 2/28/2034 Houston, TX 10575 Red Bluff Rd. Pasadena TX -- 248,240 3,382 3,061 Columbus, OH 191 Arrowhead Dr. Hebron OH -- 250,410 1,591 1,334 9/30/2034 DC/Baltimore, MD 150 Mercury Way Winchester VA -- 324,535 2,363 2,061 10/31/2034 Champaign-Urbana, IL 1001 Innovation Rd. Rantoul IL -- 813,126 4,196 4,236 Dallas/Ft. Worth, TX 17505 Interstate Hwy. 35W Northlake TX -- 500,556 3,590 3,103 12/31/2034 Greenville/Spartanburg, SC 21 Inland Pkwy. Greer SC -- 1,318,680 5,544 5,434 2035 4/30/2035 Greenville/Spartanburg, SC 170 Smith Farms Pkwy. Greer SC 3 797,936 4,322 3,822 6/30/2035 Columbus, OH 2155 Rohr Rd. Lockbourne OH -- 320,190 2,442 2,081 Dallas/Ft. Worth, TX 2115 East Belt Line Rd. Carrollton TX -- 298,653 1,361 1,220 7/31/2035 Central Florida 3775 Fancy Farms Rd. Plant City FL -- 180,308 1,278 1,138 2036 5/31/2036 Central Florida 5275 Drane Field Rd. Lakeland FL -- 117,440 787 725 Charlotte, NC 671 Washburn Switch Rd. Shelby NC -- 673,425 2,786 2,768 11/30/2036 Phoenix, AZ 17510 W. Thomas Rd. Goodyear AZ -- 468,182 4,304 4,056 Philadelphia, PA 250 Rittenhouse Cir. Bristol PA -- 241,977 2,428 1,329 12/31/2036 Greenville/Spartanburg, SC 923 Matrix Pkwy. Piedmont SC -- 625,238 6,203 5,248 2037 3/31/2037 Dallas/Ft. Worth, TX 4005 E. I-30 Grand Prairie TX -- 215,000 1,872 1,767 5/31/2037 Phoenix, AZ 8989 W Buckeye Rd. Phoenix AZ -- 268,872 2,368 2,102 2038 3/31/2038 Houston, TX 13600/13901 Industrial Road Houston TX -- 132,449 6,773 6,573 WAREHOUSE/DISTRIBUTION SUBTOTAL - SINGLE TENANT 53,795,081 286,188 281,348

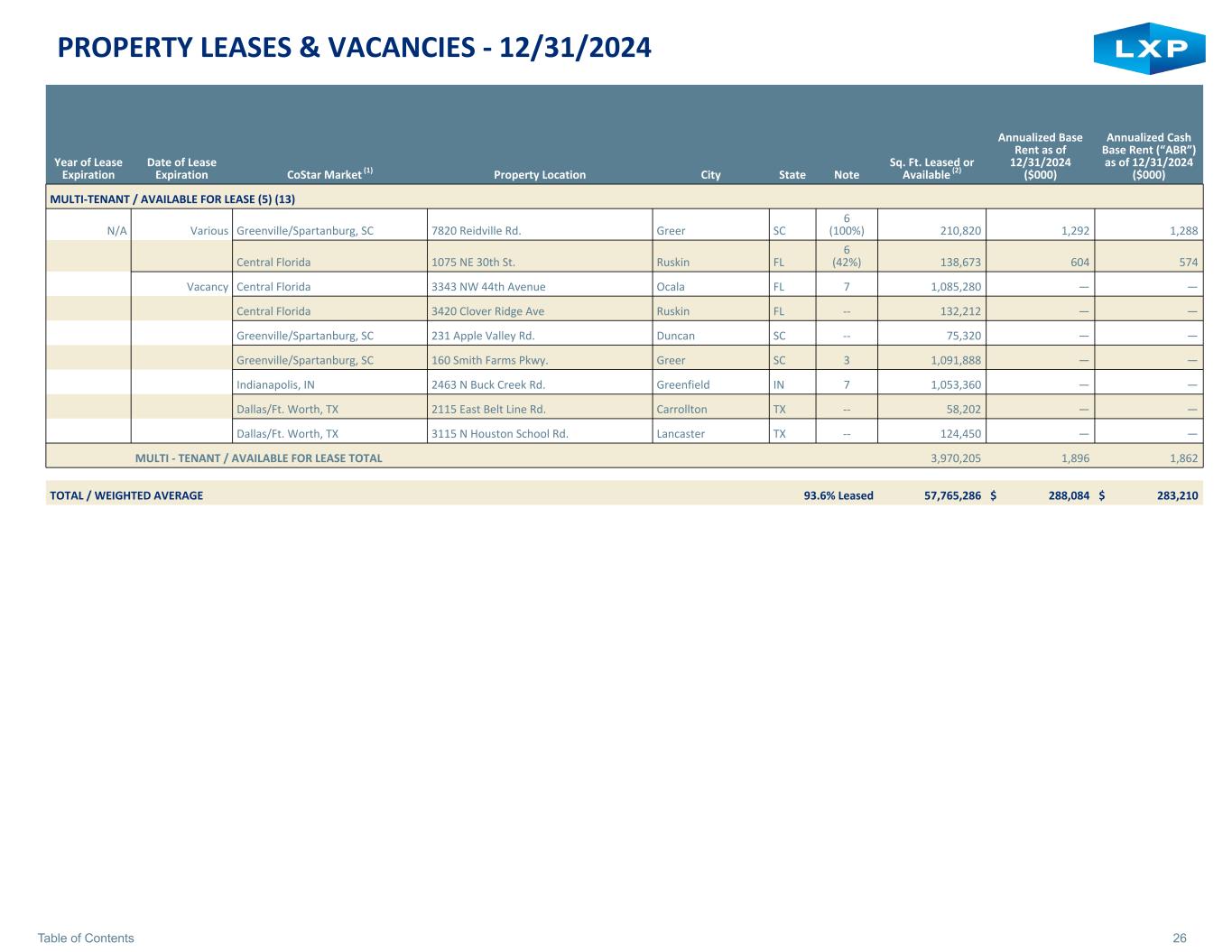

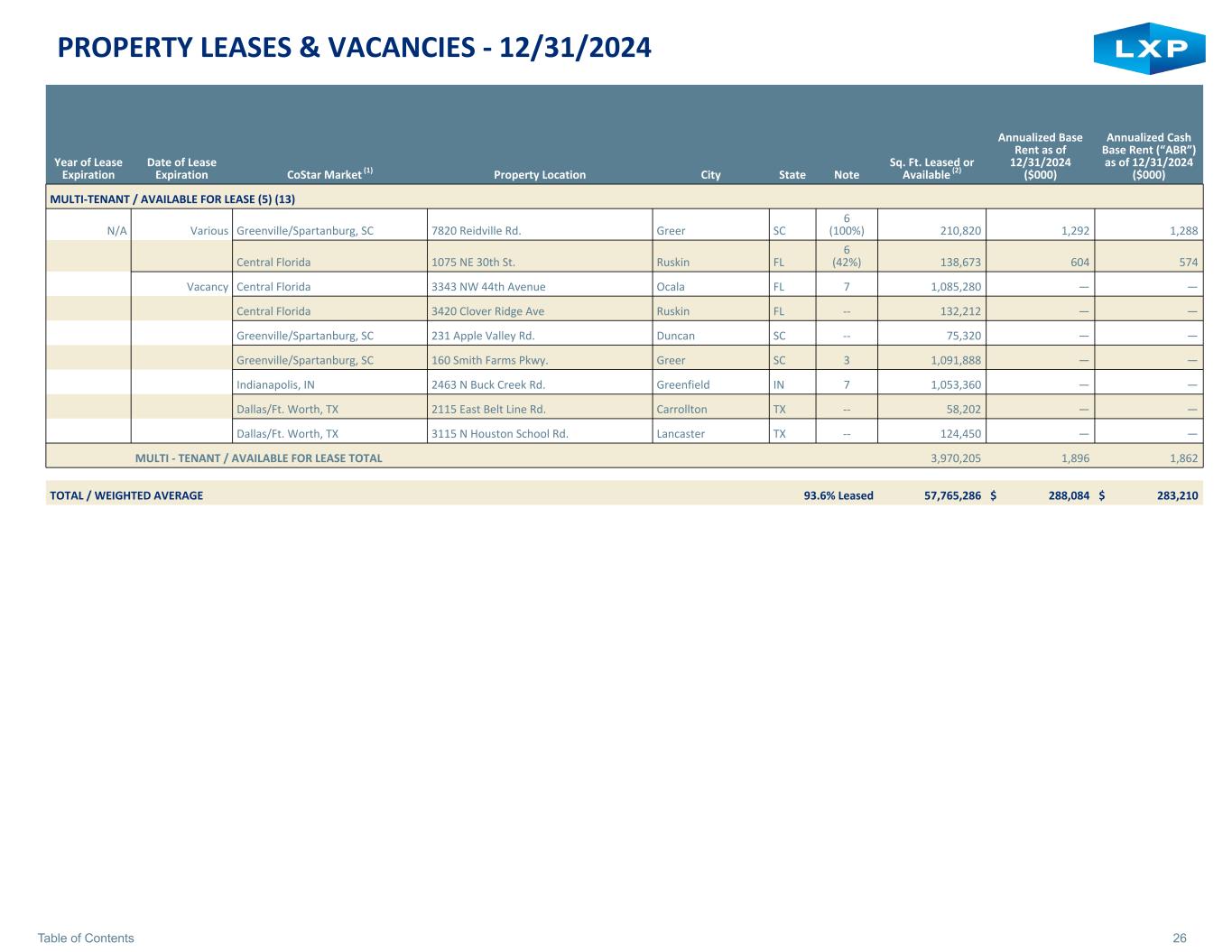

26Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) MULTI-TENANT / AVAILABLE FOR LEASE (5) (13) N/A Various Greenville/Spartanburg, SC 7820 Reidville Rd. Greer SC 6 (100%) 210,820 1,292 1,288 Central Florida 1075 NE 30th St. Ruskin FL 6 (42%) 138,673 604 574 Vacancy Central Florida 3343 NW 44th Avenue Ocala FL 7 1,085,280 — — Central Florida 3420 Clover Ridge Ave Ruskin FL -- 132,212 — — Greenville/Spartanburg, SC 231 Apple Valley Rd. Duncan SC -- 75,320 — — Greenville/Spartanburg, SC 160 Smith Farms Pkwy. Greer SC 3 1,091,888 — — Indianapolis, IN 2463 N Buck Creek Rd. Greenfield IN 7 1,053,360 — — Dallas/Ft. Worth, TX 2115 East Belt Line Rd. Carrollton TX -- 58,202 — — Dallas/Ft. Worth, TX 3115 N Houston School Rd. Lancaster TX -- 124,450 — — MULTI - TENANT / AVAILABLE FOR LEASE TOTAL 3,970,205 1,896 1,862 TOTAL / WEIGHTED AVERAGE 93.6% Leased 57,765,286 $ 288,084 $ 283,210

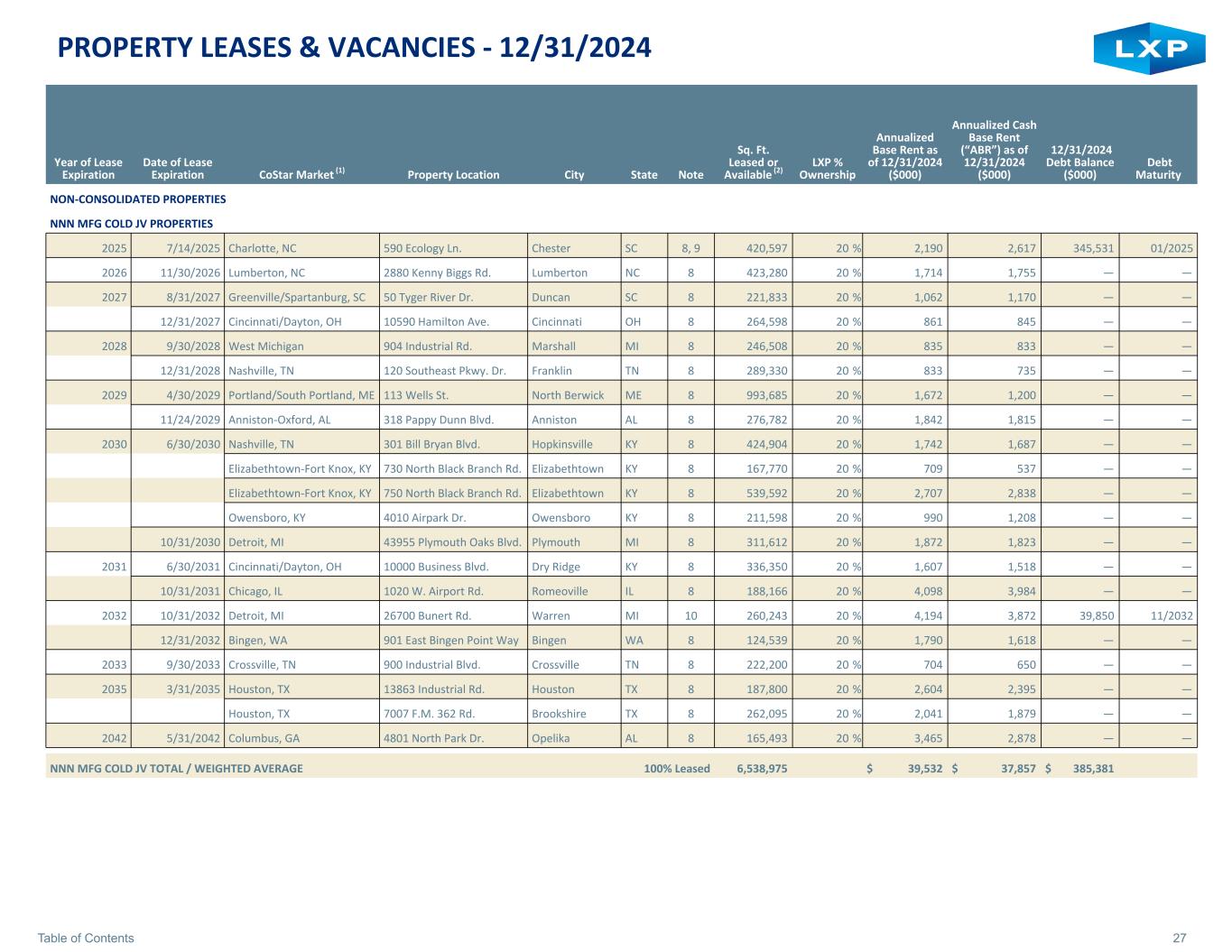

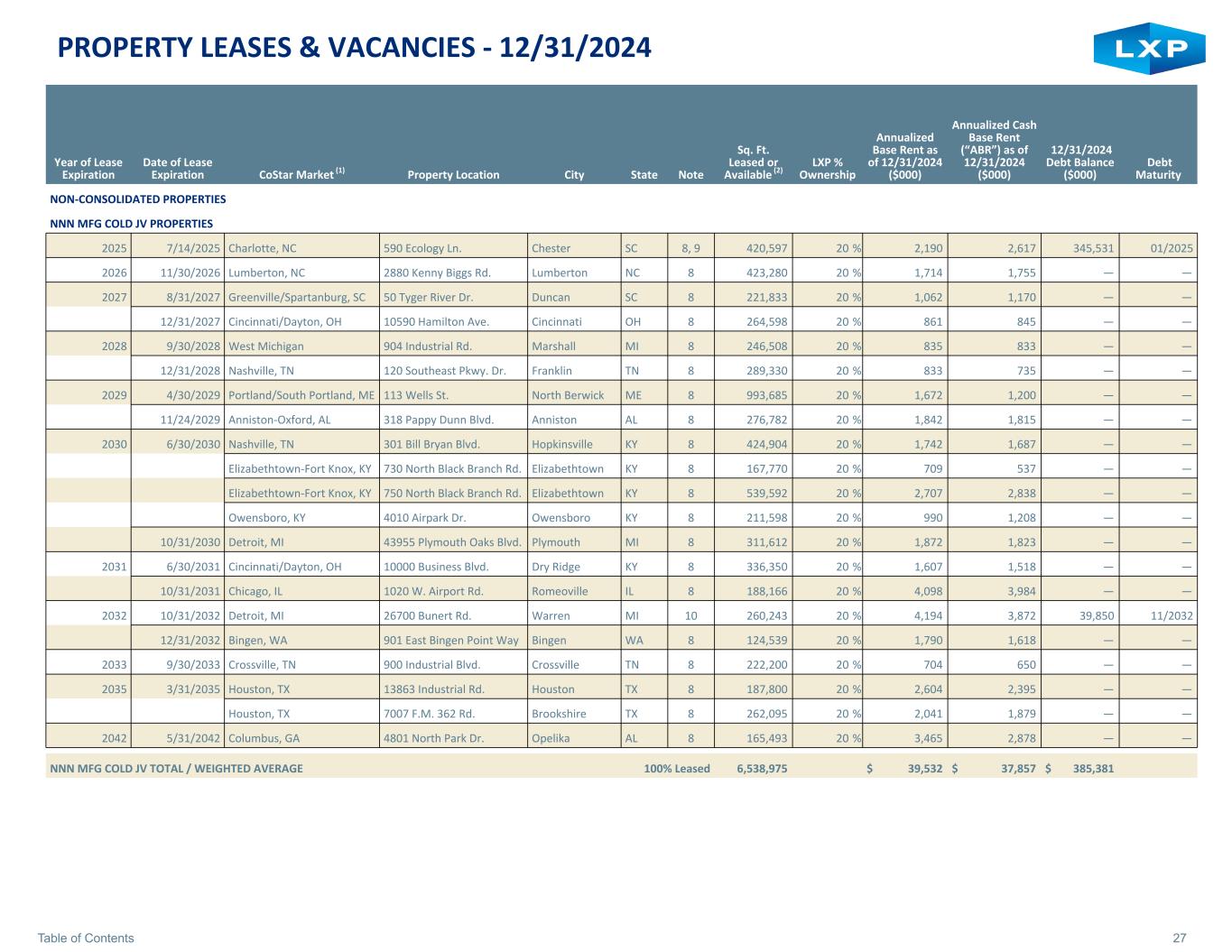

27Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) LXP % Ownership Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) 12/31/2024 Debt Balance ($000) Debt Maturity NON-CONSOLIDATED PROPERTIES NNN MFG COLD JV PROPERTIES 2025 7/14/2025 Charlotte, NC 590 Ecology Ln. Chester SC 8, 9 420,597 20 % 2,190 2,617 345,531 01/2025 2026 11/30/2026 Lumberton, NC 2880 Kenny Biggs Rd. Lumberton NC 8 423,280 20 % 1,714 1,755 — — 2027 8/31/2027 Greenville/Spartanburg, SC 50 Tyger River Dr. Duncan SC 8 221,833 20 % 1,062 1,170 — — 12/31/2027 Cincinnati/Dayton, OH 10590 Hamilton Ave. Cincinnati OH 8 264,598 20 % 861 845 — — 2028 9/30/2028 West Michigan 904 Industrial Rd. Marshall MI 8 246,508 20 % 835 833 — — 12/31/2028 Nashville, TN 120 Southeast Pkwy. Dr. Franklin TN 8 289,330 20 % 833 735 — — 2029 4/30/2029 Portland/South Portland, ME 113 Wells St. North Berwick ME 8 993,685 20 % 1,672 1,200 — — 11/24/2029 Anniston-Oxford, AL 318 Pappy Dunn Blvd. Anniston AL 8 276,782 20 % 1,842 1,815 — — 2030 6/30/2030 Nashville, TN 301 Bill Bryan Blvd. Hopkinsville KY 8 424,904 20 % 1,742 1,687 — — Elizabethtown-Fort Knox, KY 730 North Black Branch Rd. Elizabethtown KY 8 167,770 20 % 709 537 — — Elizabethtown-Fort Knox, KY 750 North Black Branch Rd. Elizabethtown KY 8 539,592 20 % 2,707 2,838 — — Owensboro, KY 4010 Airpark Dr. Owensboro KY 8 211,598 20 % 990 1,208 — — 10/31/2030 Detroit, MI 43955 Plymouth Oaks Blvd. Plymouth MI 8 311,612 20 % 1,872 1,823 — — 2031 6/30/2031 Cincinnati/Dayton, OH 10000 Business Blvd. Dry Ridge KY 8 336,350 20 % 1,607 1,518 — — 10/31/2031 Chicago, IL 1020 W. Airport Rd. Romeoville IL 8 188,166 20 % 4,098 3,984 — — 2032 10/31/2032 Detroit, MI 26700 Bunert Rd. Warren MI 10 260,243 20 % 4,194 3,872 39,850 11/2032 12/31/2032 Bingen, WA 901 East Bingen Point Way Bingen WA 8 124,539 20 % 1,790 1,618 — — 2033 9/30/2033 Crossville, TN 900 Industrial Blvd. Crossville TN 8 222,200 20 % 704 650 — — 2035 3/31/2035 Houston, TX 13863 Industrial Rd. Houston TX 8 187,800 20 % 2,604 2,395 — — Houston, TX 7007 F.M. 362 Rd. Brookshire TX 8 262,095 20 % 2,041 1,879 — — 2042 5/31/2042 Columbus, GA 4801 North Park Dr. Opelika AL 8 165,493 20 % 3,465 2,878 — — NNN MFG COLD JV TOTAL / WEIGHTED AVERAGE 100% Leased 6,538,975 $ 39,532 $ 37,857 $ 385,381

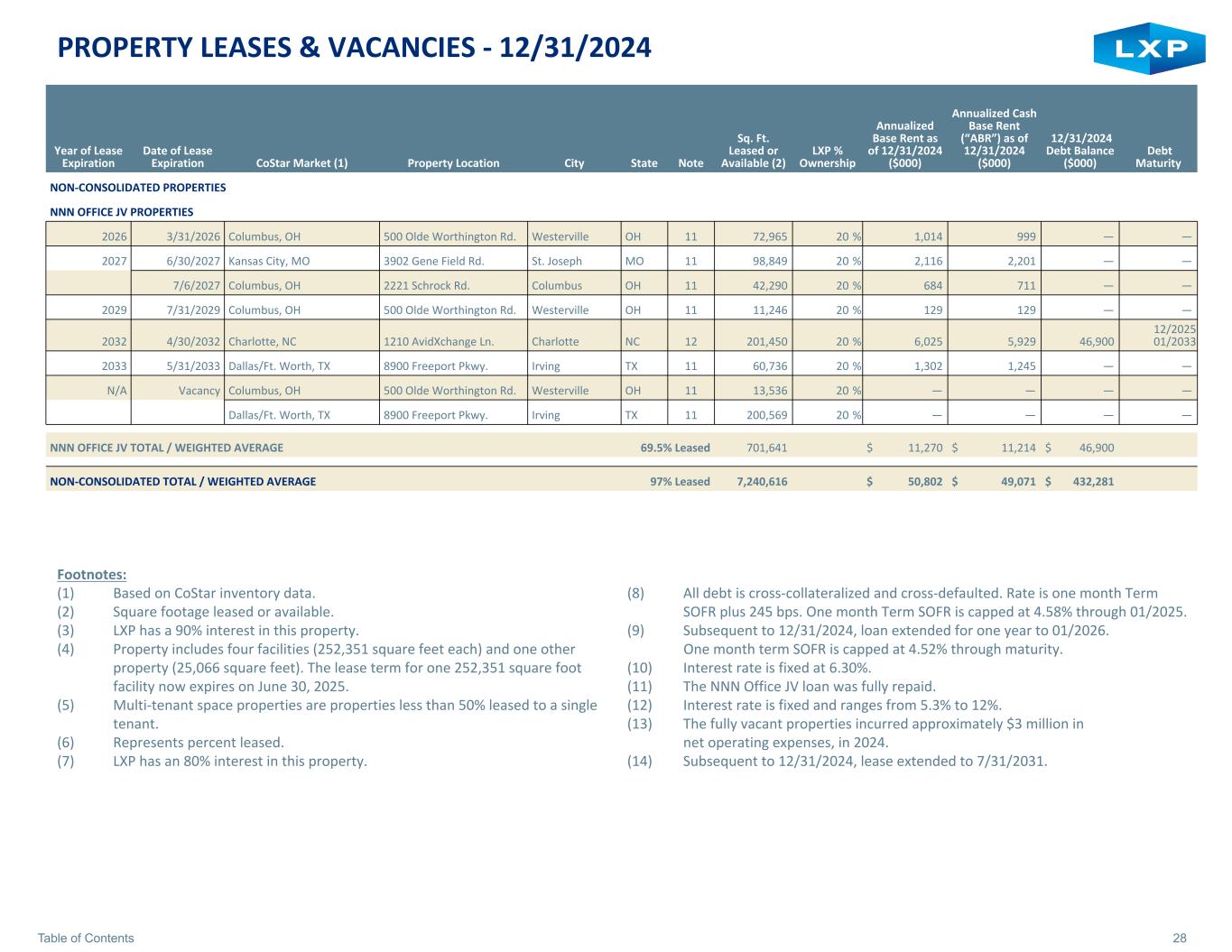

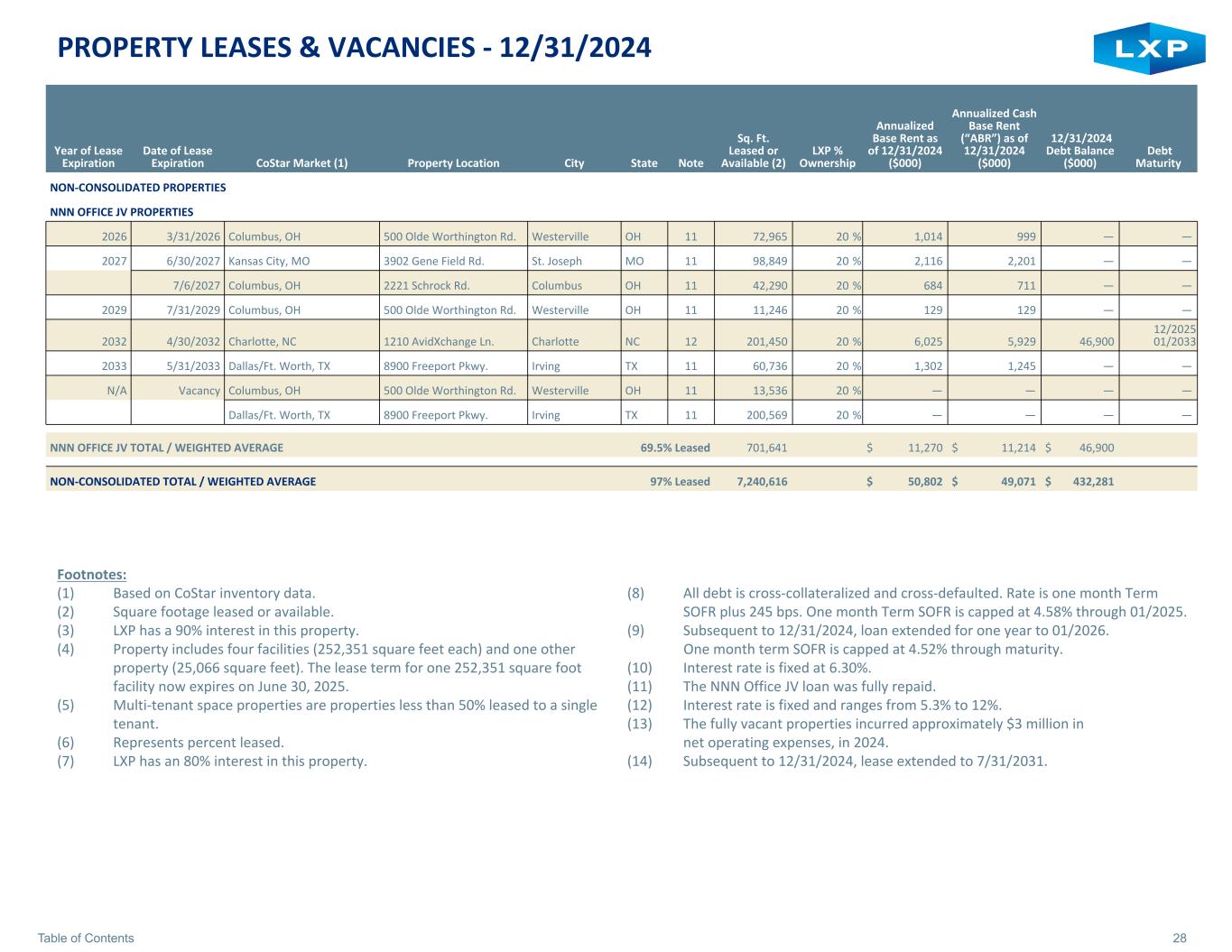

28Table of Contents PROPERTY LEASES & VACANCIES - 12/31/2024 Year of Lease Expiration Date of Lease Expiration CoStar Market (1) Property Location City State Note Sq. Ft. Leased or Available (2) LXP % Ownership Annualized Base Rent as of 12/31/2024 ($000) Annualized Cash Base Rent (“ABR”) as of 12/31/2024 ($000) 12/31/2024 Debt Balance ($000) Debt Maturity NON-CONSOLIDATED PROPERTIES NNN OFFICE JV PROPERTIES 2026 3/31/2026 Columbus, OH 500 Olde Worthington Rd. Westerville OH 11 72,965 20 % 1,014 999 — — 2027 6/30/2027 Kansas City, MO 3902 Gene Field Rd. St. Joseph MO 11 98,849 20 % 2,116 2,201 — — 7/6/2027 Columbus, OH 2221 Schrock Rd. Columbus OH 11 42,290 20 % 684 711 — — 2029 7/31/2029 Columbus, OH 500 Olde Worthington Rd. Westerville OH 11 11,246 20 % 129 129 — — 2032 4/30/2032 Charlotte, NC 1210 AvidXchange Ln. Charlotte NC 12 201,450 20 % 6,025 5,929 46,900 12/2025 01/2033 2033 5/31/2033 Dallas/Ft. Worth, TX 8900 Freeport Pkwy. Irving TX 11 60,736 20 % 1,302 1,245 — — N/A Vacancy Columbus, OH 500 Olde Worthington Rd. Westerville OH 11 13,536 20 % — — — — Dallas/Ft. Worth, TX 8900 Freeport Pkwy. Irving TX 11 200,569 20 % — — — — NNN OFFICE JV TOTAL / WEIGHTED AVERAGE 69.5% Leased 701,641 $ 11,270 $ 11,214 $ 46,900 NON-CONSOLIDATED TOTAL / WEIGHTED AVERAGE 97% Leased 7,240,616 $ 50,802 $ 49,071 $ 432,281 Footnotes: (1) Based on CoStar inventory data. (2) Square footage leased or available. (3) LXP has a 90% interest in this property. (4) Property includes four facilities (252,351 square feet each) and one other property (25,066 square feet). The lease term for one 252,351 square foot facility now expires on June 30, 2025. (5) Multi-tenant space properties are properties less than 50% leased to a single tenant. (6) Represents percent leased. (7) LXP has an 80% interest in this property. (8) All debt is cross-collateralized and cross-defaulted. Rate is one month Term SOFR plus 245 bps. One month Term SOFR is capped at 4.58% through 01/2025. (9) Subsequent to 12/31/2024, loan extended for one year to 01/2026. One month term SOFR is capped at 4.52% through maturity. (10) Interest rate is fixed at 6.30%. (11) The NNN Office JV loan was fully repaid. (12) Interest rate is fixed and ranges from 5.3% to 12%. (13) The fully vacant properties incurred approximately $3 million in net operating expenses, in 2024. (14) Subsequent to 12/31/2024, lease extended to 7/31/2031.

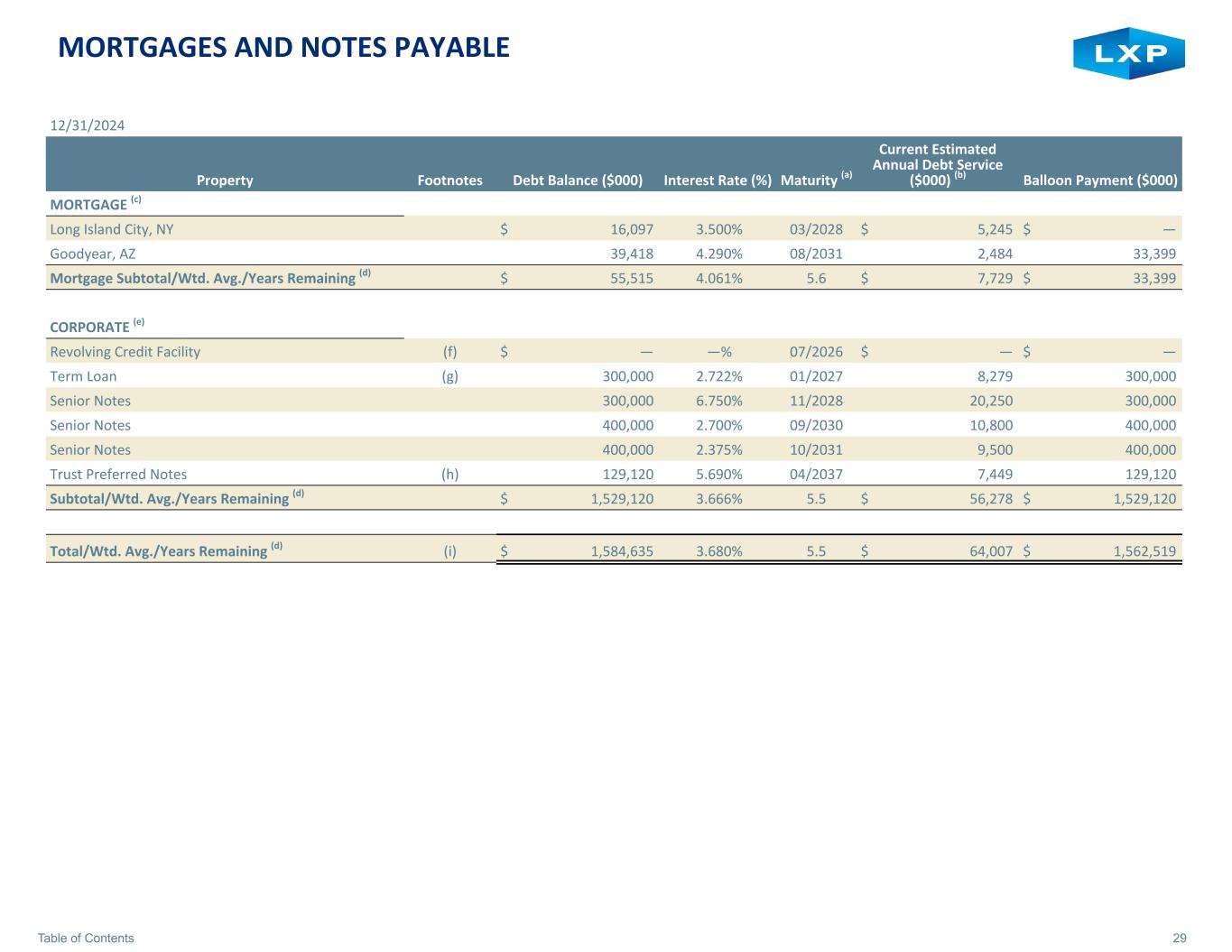

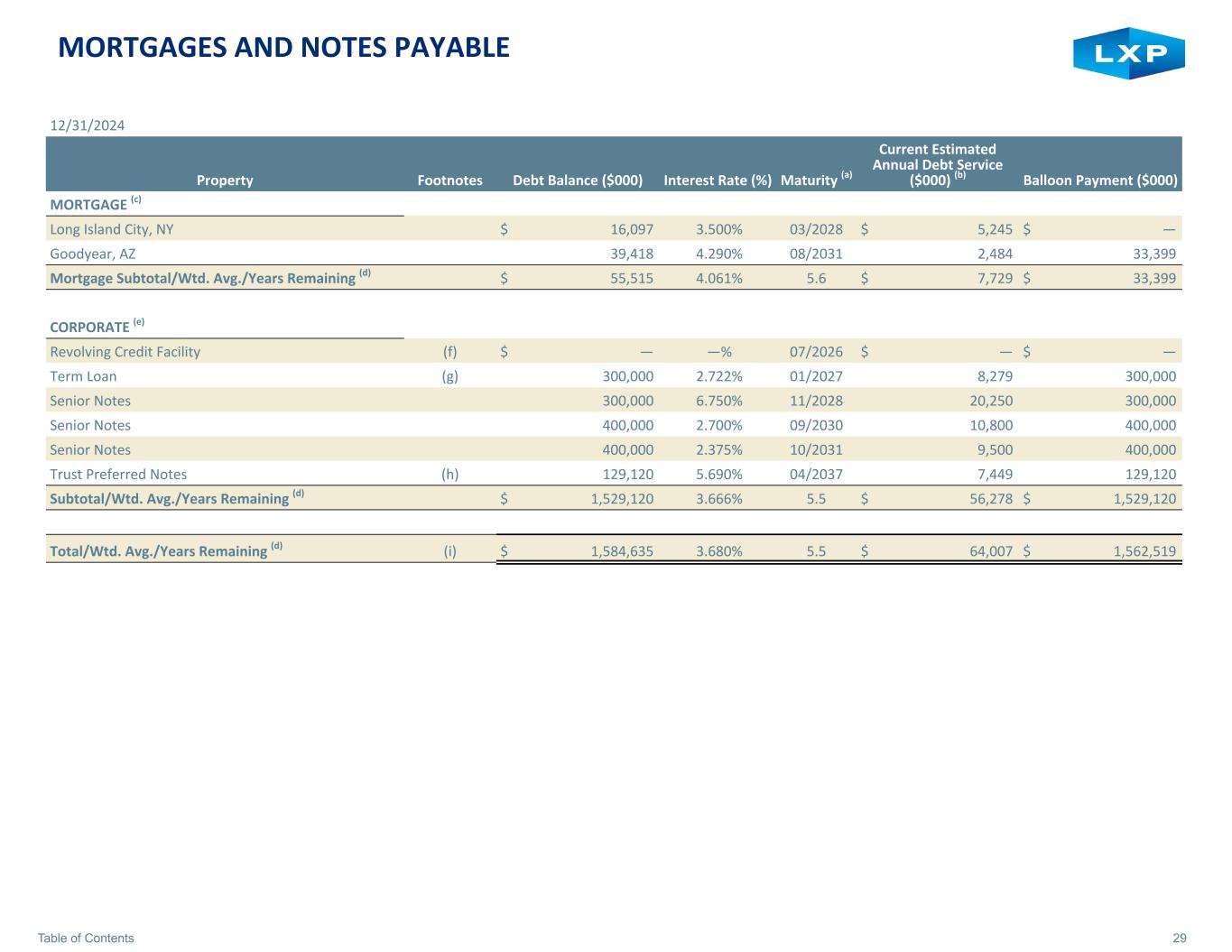

29Table of Contents MORTGAGES AND NOTES PAYABLE 12/31/2024 Property Footnotes Debt Balance ($000) Interest Rate (%) Maturity (a) Current Estimated Annual Debt Service ($000) (b) Balloon Payment ($000) MORTGAGE (c) Long Island City, NY $ 16,097 3.500% 03/2028 $ 5,245 $ — Goodyear, AZ 39,418 4.290% 08/2031 2,484 33,399 Mortgage Subtotal/Wtd. Avg./Years Remaining (d) $ 55,515 4.061% 5.6 $ 7,729 $ 33,399 CORPORATE (e) Revolving Credit Facility (f) $ — —% 07/2026 $ — $ — Term Loan (g) 300,000 2.722% 01/2027 8,279 300,000 Senior Notes 300,000 6.750% 11/2028 20,250 300,000 Senior Notes 400,000 2.700% 09/2030 10,800 400,000 Senior Notes 400,000 2.375% 10/2031 9,500 400,000 Trust Preferred Notes (h) 129,120 5.690% 04/2037 7,449 129,120 Subtotal/Wtd. Avg./Years Remaining (d) $ 1,529,120 3.666% 5.5 $ 56,278 $ 1,529,120 Total/Wtd. Avg./Years Remaining (d) (i) $ 1,584,635 3.680% 5.5 $ 64,007 $ 1,562,519

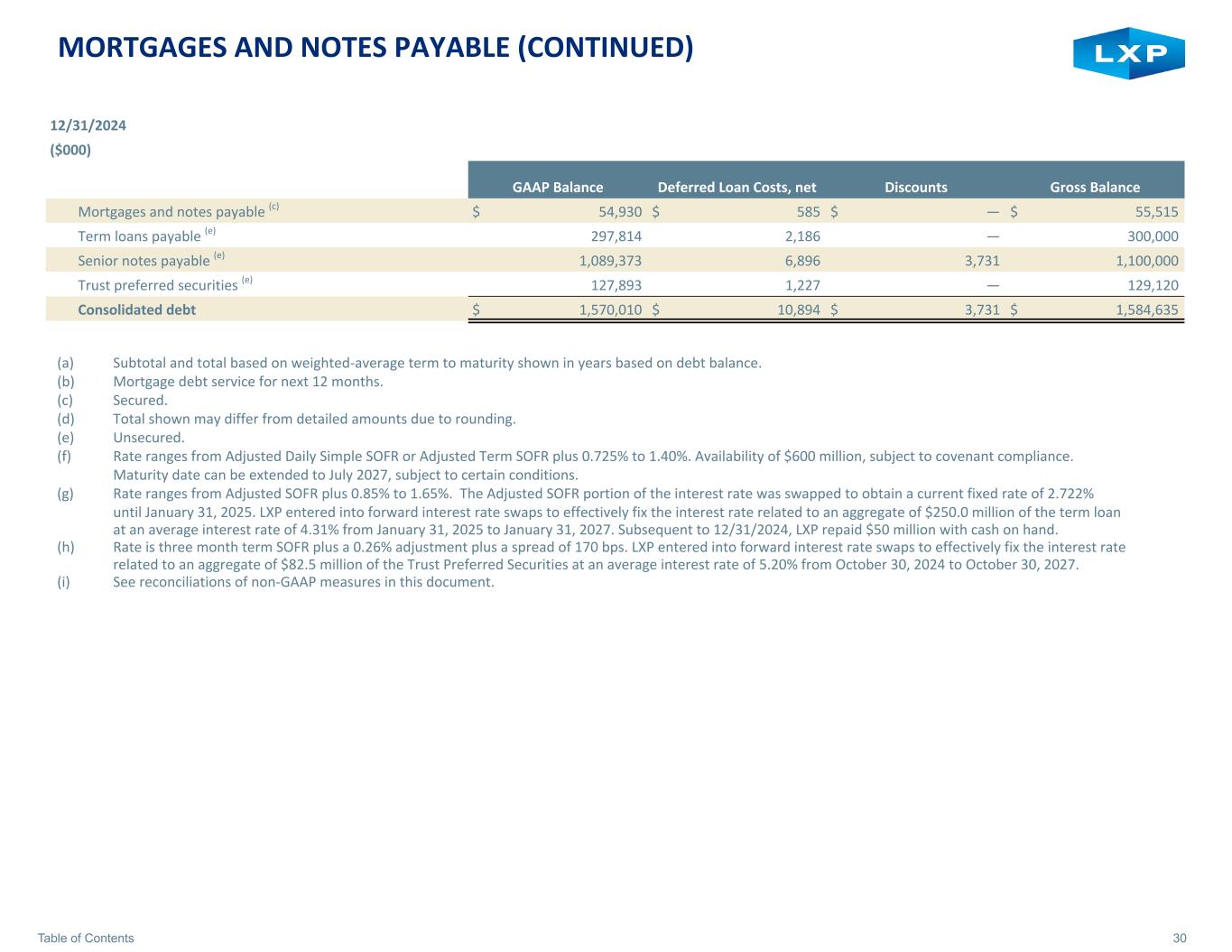

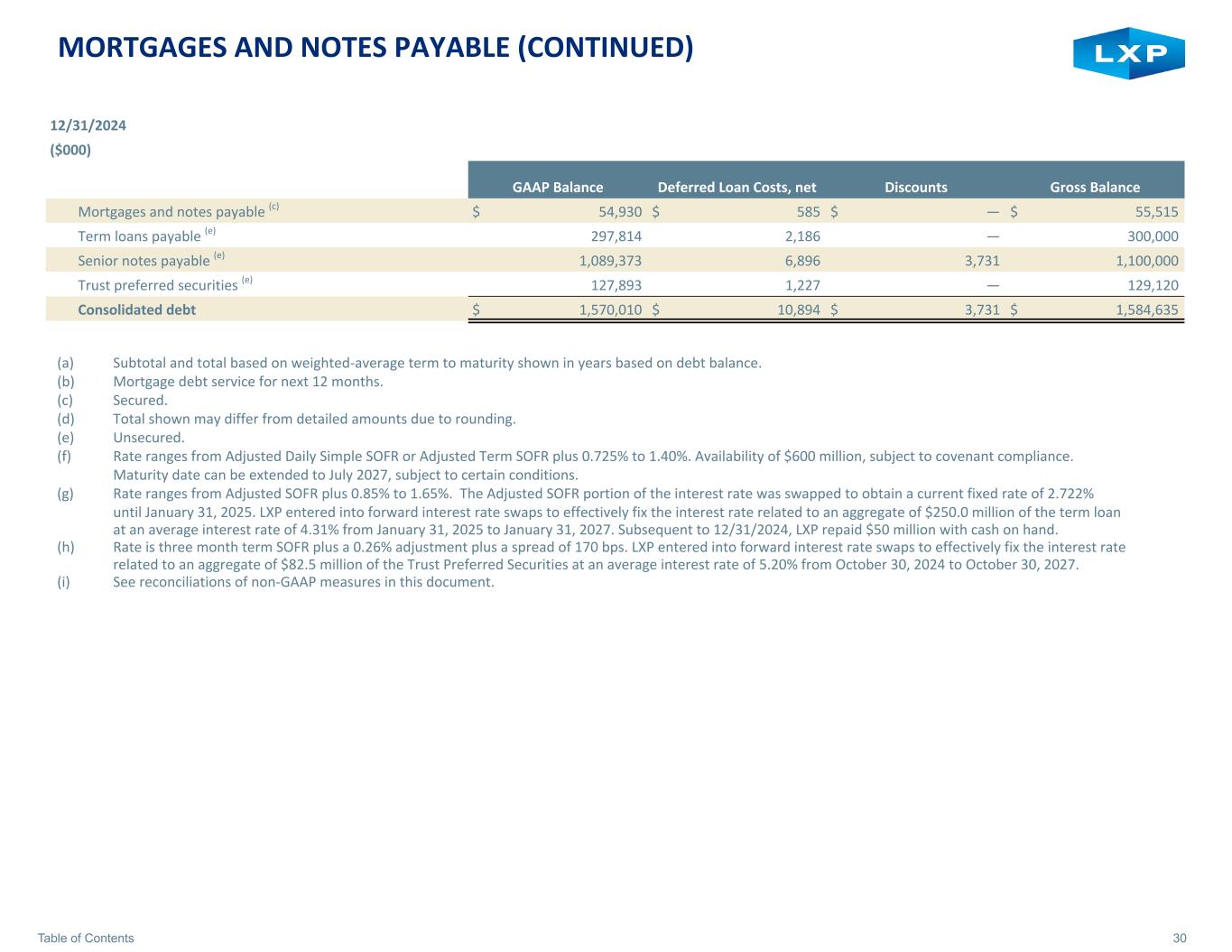

30Table of Contents MORTGAGES AND NOTES PAYABLE (CONTINUED) 12/31/2024 ($000) GAAP Balance Deferred Loan Costs, net Discounts Gross Balance Mortgages and notes payable (c) $ 54,930 $ 585 $ — $ 55,515 Term loans payable (e) 297,814 2,186 — 300,000 Senior notes payable (e) 1,089,373 6,896 3,731 1,100,000 Trust preferred securities (e) 127,893 1,227 — 129,120 Consolidated debt $ 1,570,010 $ 10,894 $ 3,731 $ 1,584,635 (a) Subtotal and total based on weighted-average term to maturity shown in years based on debt balance. (b) Mortgage debt service for next 12 months. (c) Secured. (d) Total shown may differ from detailed amounts due to rounding. (e) Unsecured. (f) Rate ranges from Adjusted Daily Simple SOFR or Adjusted Term SOFR plus 0.725% to 1.40%. Availability of $600 million, subject to covenant compliance. Maturity date can be extended to July 2027, subject to certain conditions. (g) Rate ranges from Adjusted SOFR plus 0.85% to 1.65%. The Adjusted SOFR portion of the interest rate was swapped to obtain a current fixed rate of 2.722% until January 31, 2025. LXP entered into forward interest rate swaps to effectively fix the interest rate related to an aggregate of $250.0 million of the term loan at an average interest rate of 4.31% from January 31, 2025 to January 31, 2027. Subsequent to 12/31/2024, LXP repaid $50 million with cash on hand. (h) Rate is three month term SOFR plus a 0.26% adjustment plus a spread of 170 bps. LXP entered into forward interest rate swaps to effectively fix the interest rate related to an aggregate of $82.5 million of the Trust Preferred Securities at an average interest rate of 5.20% from October 30, 2024 to October 30, 2027. (i) See reconciliations of non-GAAP measures in this document.

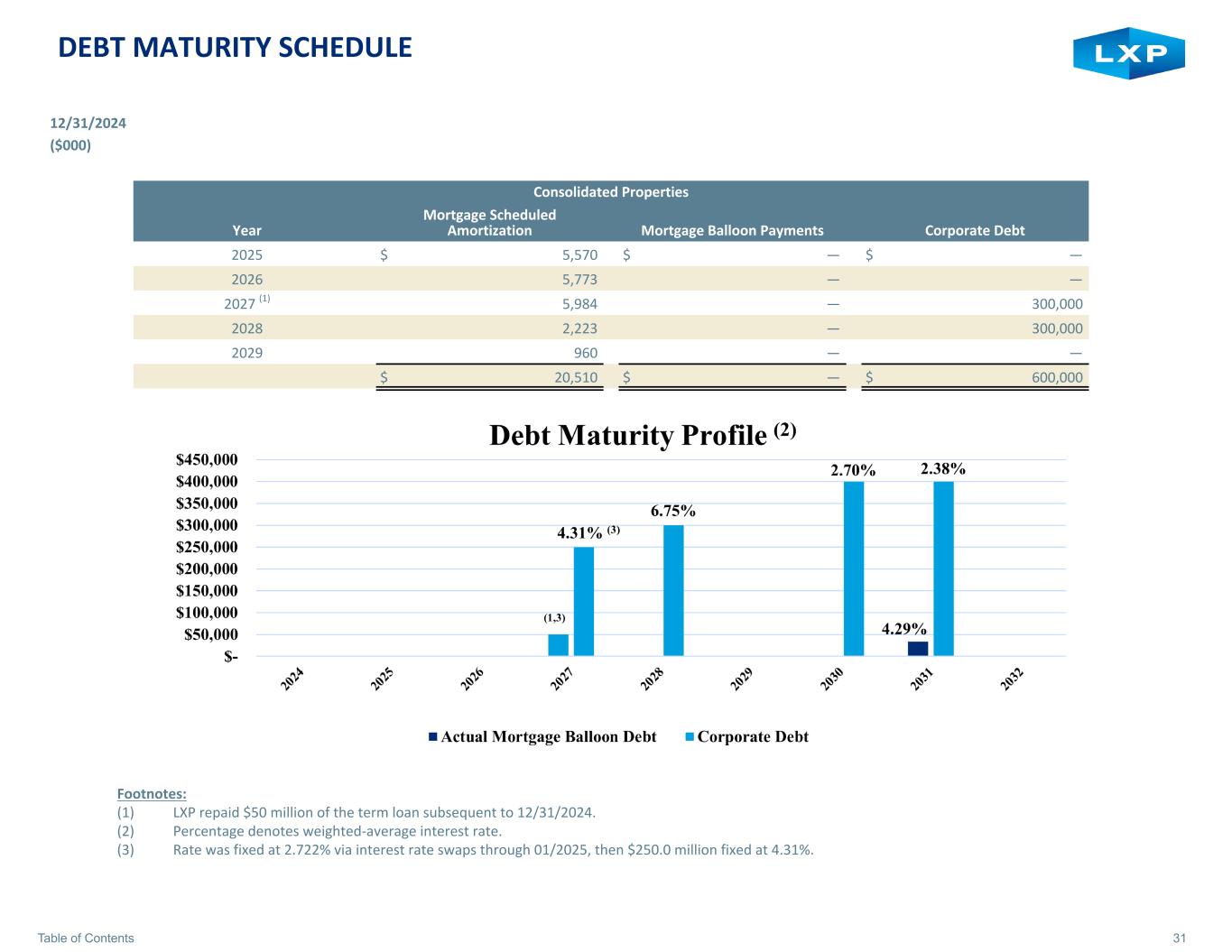

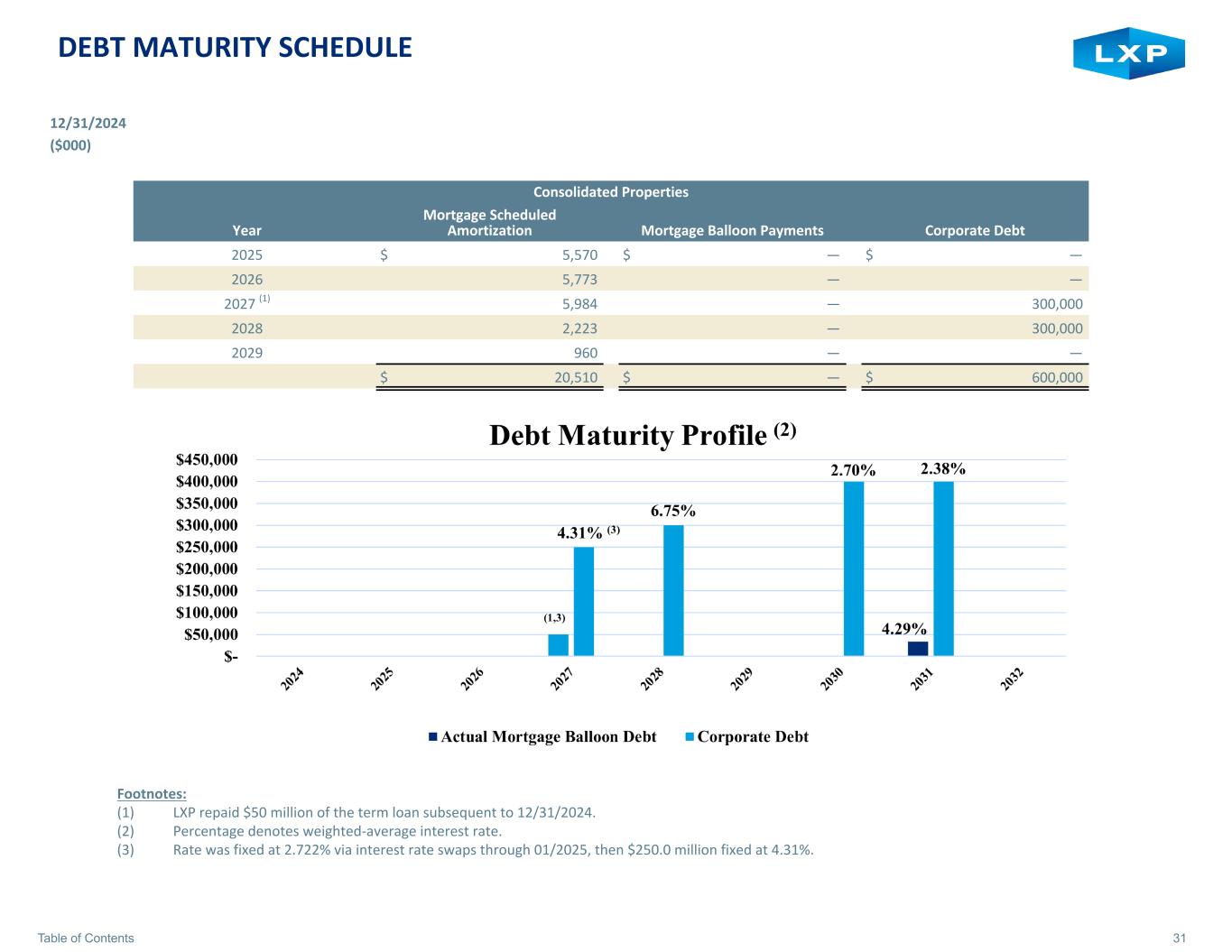

31Table of Contents DEBT MATURITY SCHEDULE 12/31/2024 ($000) Consolidated Properties Year Mortgage Scheduled Amortization Mortgage Balloon Payments Corporate Debt 2025 $ 5,570 $ — $ — 2026 5,773 — — 2027 (1) 5,984 — 300,000 2028 2,223 — 300,000 2029 960 — — $ 20,510 $ — $ 600,000 Footnotes: (1) LXP repaid $50 million of the term loan subsequent to 12/31/2024. (2) Percentage denotes weighted-average interest rate. (3) Rate was fixed at 2.722% via interest rate swaps through 01/2025, then $250.0 million fixed at 4.31%.

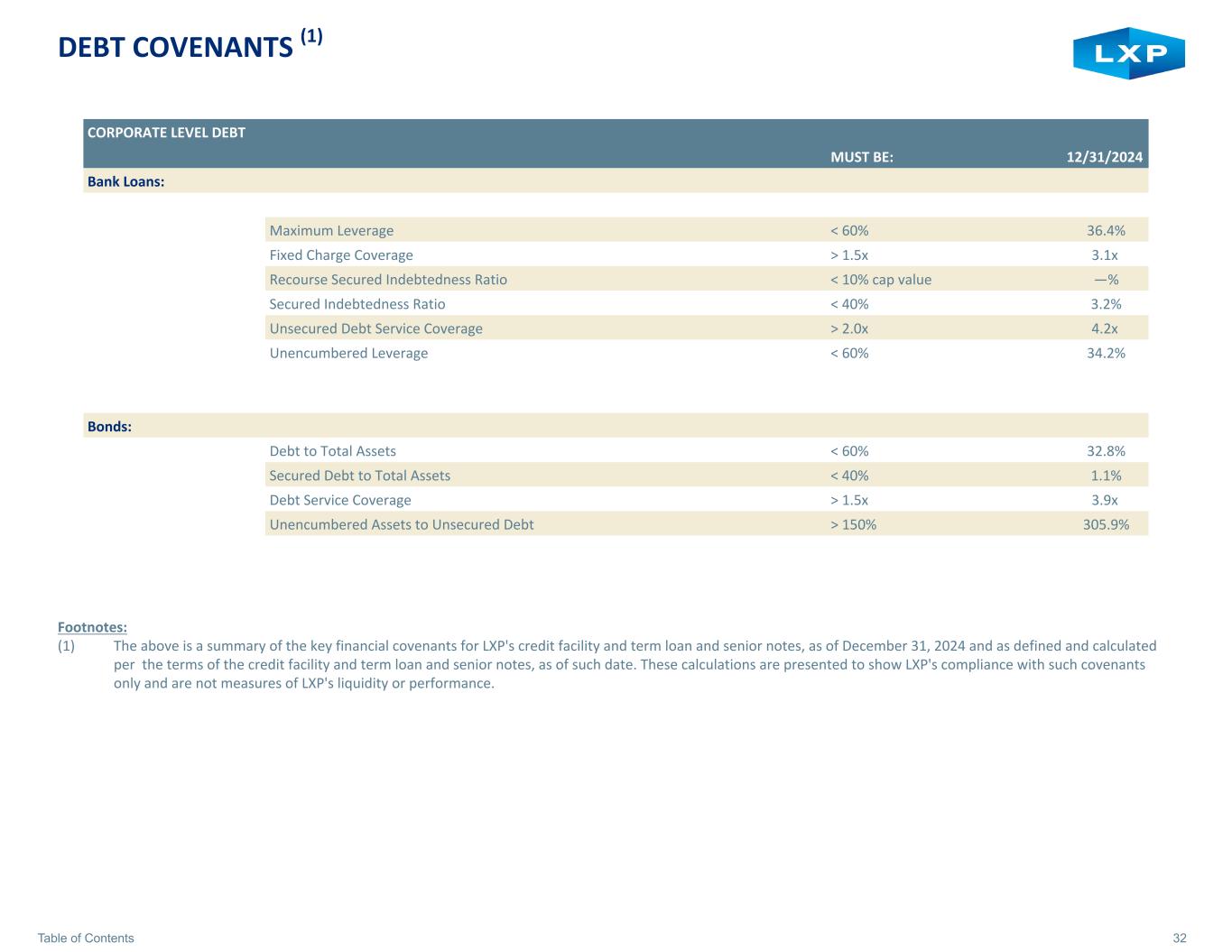

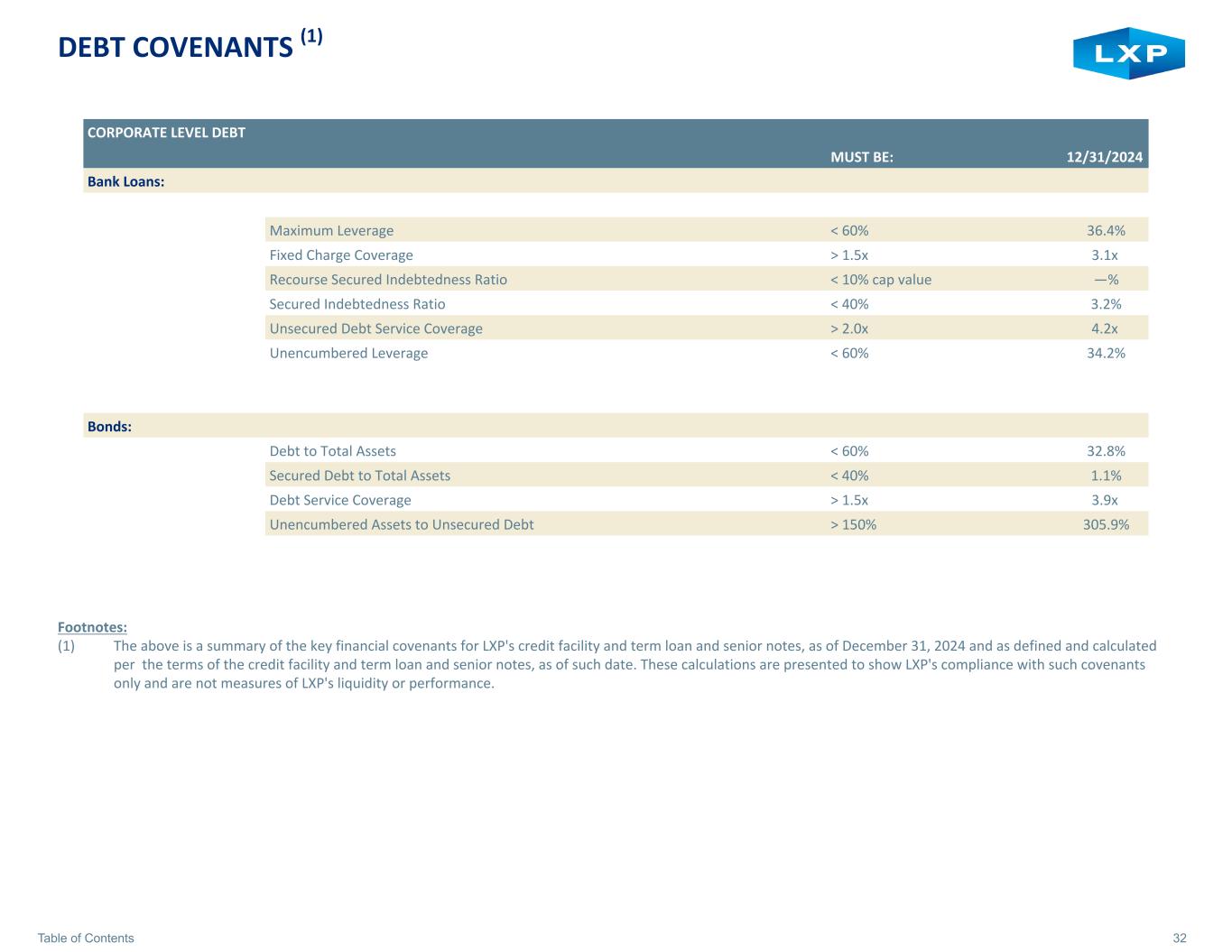

32Table of Contents DEBT COVENANTS (1) CORPORATE LEVEL DEBT MUST BE: 12/31/2024 Bank Loans: Maximum Leverage < 60% 36.4% Fixed Charge Coverage > 1.5x 3.1x Recourse Secured Indebtedness Ratio < 10% cap value —% Secured Indebtedness Ratio < 40% 3.2% Unsecured Debt Service Coverage > 2.0x 4.2x Unencumbered Leverage < 60% 34.2% Bonds: Debt to Total Assets < 60% 32.8% Secured Debt to Total Assets < 40% 1.1% Debt Service Coverage > 1.5x 3.9x Unencumbered Assets to Unsecured Debt > 150% 305.9% Footnotes: (1) The above is a summary of the key financial covenants for LXP's credit facility and term loan and senior notes, as of December 31, 2024 and as defined and calculated per the terms of the credit facility and term loan and senior notes, as of such date. These calculations are presented to show LXP's compliance with such covenants only and are not measures of LXP's liquidity or performance.

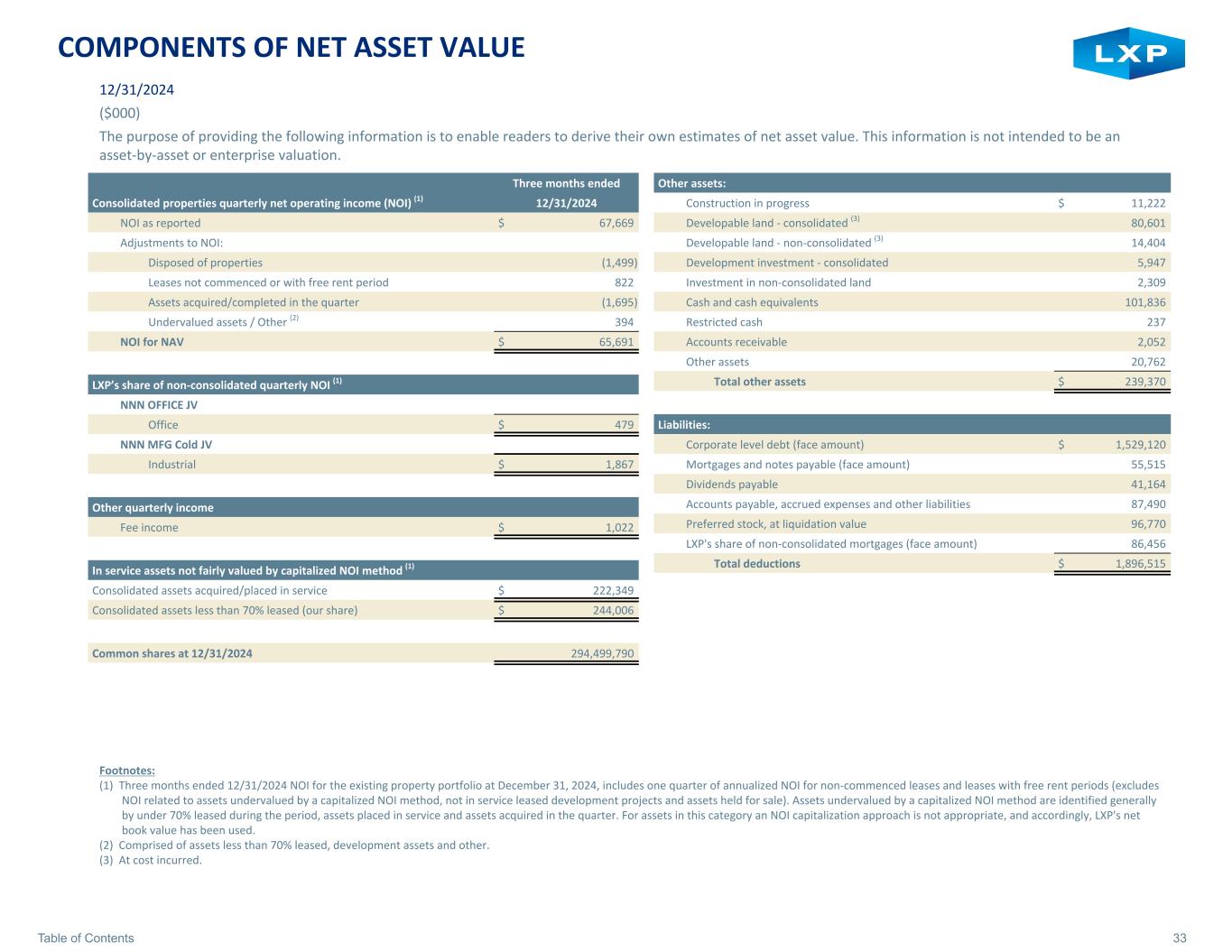

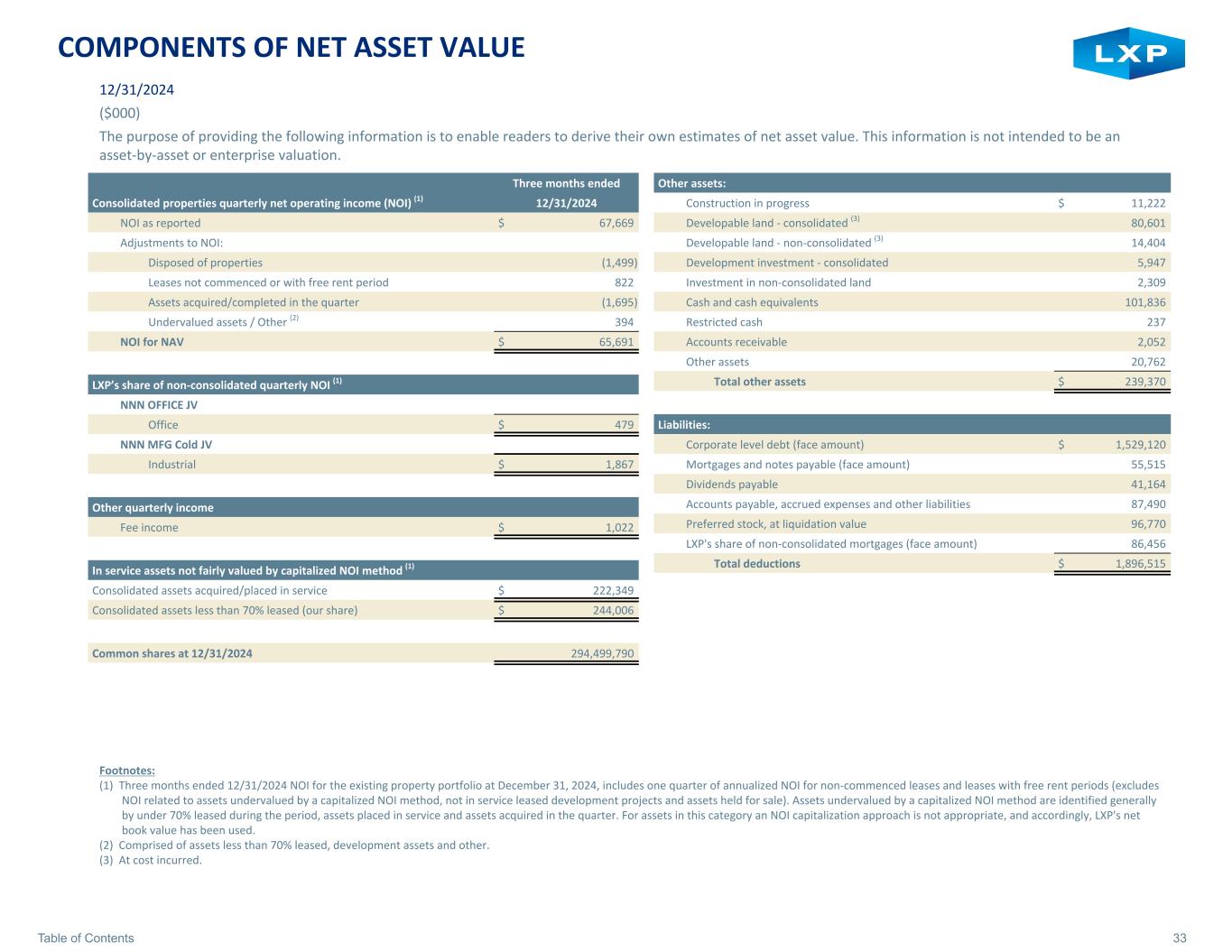

33Table of Contents COMPONENTS OF NET ASSET VALUE Footnotes: (1) Three months ended 12/31/2024 NOI for the existing property portfolio at December 31, 2024, includes one quarter of annualized NOI for non-commenced leases and leases with free rent periods (excludes NOI related to assets undervalued by a capitalized NOI method, not in service leased development projects and assets held for sale). Assets undervalued by a capitalized NOI method are identified generally by under 70% leased during the period, assets placed in service and assets acquired in the quarter. For assets in this category an NOI capitalization approach is not appropriate, and accordingly, LXP's net book value has been used. (2) Comprised of assets less than 70% leased, development assets and other. (3) At cost incurred. 12/31/2024 ($000) The purpose of providing the following information is to enable readers to derive their own estimates of net asset value. This information is not intended to be an asset-by-asset or enterprise valuation. Three months ended Consolidated properties quarterly net operating income (NOI) (1) 12/31/2024 NOI as reported $ 67,669 Adjustments to NOI: Disposed of properties (1,499) Leases not commenced or with free rent period 822 Assets acquired/completed in the quarter (1,695) Undervalued assets / Other (2) 394 NOI for NAV $ 65,691 LXP’s share of non-consolidated quarterly NOI (1) NNN OFFICE JV Office $ 479 NNN MFG Cold JV Industrial $ 1,867 Other quarterly income Fee income $ 1,022 In service assets not fairly valued by capitalized NOI method (1) Consolidated assets acquired/placed in service $ 222,349 Consolidated assets less than 70% leased (our share) $ 244,006 Common shares at 12/31/2024 294,499,790 Other assets: Construction in progress $ 11,222 Developable land - consolidated (3) 80,601 Developable land - non-consolidated (3) 14,404 Development investment - consolidated 5,947 Investment in non-consolidated land 2,309 Cash and cash equivalents 101,836 Restricted cash 237 Accounts receivable 2,052 Other assets 20,762 Total other assets $ 239,370 Liabilities: Corporate level debt (face amount) $ 1,529,120 Mortgages and notes payable (face amount) 55,515 Dividends payable 41,164 Accounts payable, accrued expenses and other liabilities 87,490 Preferred stock, at liquidation value 96,770 LXP's share of non-consolidated mortgages (face amount) 86,456 Total deductions $ 1,896,515

34Table of Contents NON-GAAP MEASURES DEFINITIONS LXP has used non-GAAP financial measures as defined by the Securities and Exchange Commission Regulation G in this Quarterly Supplemental Information and in other public disclosures. LXP believes that the measures defined below are helpful to investors in measuring our performance or that of an individual investment. Since these measures exclude certain items which are included in their respective most comparable Generally Accepted Accounting Principles (“GAAP”) measures, reliance on the measures has limitations; management compensates for these limitations by using the measures simply as supplemental measures that are weighed in balance with other GAAP measures. These measures are not necessarily indications of our cash flow available to fund operations. Additionally, they should not be used as an alternative to the respective most comparable GAAP measures when evaluating LXP's financial performance or cash flow from operating, investing, or financing activities or liquidity. Definitions: Adjusted EBITDA: Adjusted EBITDA represents EBITDA (earnings before interest expense, taxes, depreciation and amortization) modified to include other adjustments to GAAP net income for gains on sales of properties or changes in control, non-cash and purchase option impact of sales-type leases, impairment charges, debt satisfaction gains (losses), net, non-cash charges, net, straight-line adjustments, change in credit loss revenue, non-recurring charges and adjustments for pro-rata share of non-wholly owned entities. LXP’s calculation of Adjusted EBITDA may not be comparable to similarly titled measures used by other companies. LXP believes that net income is the most directly comparable GAAP measure to Adjusted EBITDA. Annualized Cash Base Rent ("ABR"): Annualized Cash Base Rent is calculated by multiplying the current monthly Cash Base Rent by 12. For leases in free rent periods or that were signed in the month prior to the end of the quarter or have not commenced, the next full Cash Base Rent payment is multiplied by 12. Excludes not in service leased development projects. LXP believes ABR provides a meaningful indication of an investment's ability to fund cash needs. Annualized Base Rent: Annualized Base rent is calculated by multiplying the current monthly Base Rent by 12. For leases signed in the month prior to the end of the quarter or have not commenced, the next Base Rent is multiplied by 12. LXP believes Annualized Base Rent provides a meaningful measure to the net lease structure of the portfolio. Base Rent: Base Rent is calculated by making adjustments to GAAP rental revenue to exclude billed tenant reimbursements and lease termination income and to include ancillary income. Base Rent excludes reserves/write-offs of deferred rent receivable, as applicable. LXP believes Base Rent provides a meaningful measure due to the net lease structure of leases in the portfolio. Cash Base Rent: Cash Base Rent is calculated by making adjustments to GAAP rental revenue to remove the impact of GAAP required adjustments to rental income such as adjustments for straight-line rents related to free rent periods and contractual rent increases. Cash Base Rent excludes billed tenant reimbursements, non- cash sales-type lease income and lease termination income, and includes ancillary income. LXP believes Cash Base Rent provides a meaningful indication of an investments ability to fund cash needs.

35Table of Contents NON-GAAP MEASURES DEFINITIONS Company Funds Available for Distribution (“FAD”): FAD is calculated by making adjustments to Adjusted Company FFO (see below) for (1) straight-line adjustments, (2) lease incentive amortization, (3) amortization of above/below market leases, (4) lease termination payments, net, (5) non-cash income related to sales-type leases, (6) non-cash interest, (7) non-cash charges, net, (8) capitalized interest and internal costs, (9) cash paid for second generation tenant improvements, and (10) cash paid for second generation lease costs. Although FAD may not be comparable to that of other real estate investment trusts (“REITs”), LXP believes it provides a meaningful indication of its ability to fund its quarterly distributions. FAD is a non-GAAP financial measure and should not be viewed as an alternative measurement of operating performance to net income, as an alternative to net cash flows from operating activities or as a measure of liquidity. First Generation Costs: Represents cash spend for tenant improvements, leasing costs and expenditures contemplated at acquisition for recently acquired properties with vacancy. Because all companies do not calculate First Generation Costs the same way, LXP's presentation may not be comparable to similarly titled measures of other. Funds from Operations (“FFO”) and Adjusted Company FFO: LXP believes that Funds from Operations, or FFO, which is a non-GAAP measure, is a widely recognized and appropriate measure of the performance of an equity real estate investment trust (“REIT”). LXP believes FFO is frequently used by securities analysts, investors and other interested parties in the evaluation of REITs, many of which present FFO when reporting their results. FFO is intended to exclude GAAP historical cost depreciation and amortization of real estate and related assets, which assumes that the value of real estate diminishes ratably over time. Historically, however, real estate values have risen or fallen with market conditions. As a result, FFO provides a performance measure that, when compared year over year, reflects the impact to operations from trends in occupancy rates, rental rates, operating costs, development activities, interest costs and other matters without the inclusion of depreciation and amortization, providing perspective that may not necessarily be apparent from net income. The National Association of Real Estate Investment Trusts, or Nareit, defines FFO as “net income (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains and losses from the sales of certain real estate assets, gains and losses from change in control and impairment write- downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in value of depreciable real estate held by the entity. The reconciling items include amounts to adjust earnings from consolidated partially-owned entities and equity in earnings of unconsolidated affiliates to FFO.” FFO does not represent cash generated from operating activities in accordance with GAAP and is not indicative of cash available to fund cash needs. LXP presents FFO available to common shareholders - basic and also presents FFO available to all equityholders - diluted on a company-wide basis as if all securities that are convertible, at the holder's option, into LXP's common shares, are converted at the beginning of the period. LXP also presents Adjusted Company FFO available to all equityholders - diluted which adjusts FFO available to all equityholders - diluted for certain items which we believe are not indicative of the operating results of LXP's real estate portfolio and not comparable from period to period. LXP believes this is an appropriate presentation as it is frequently requested by security analysts, investors and other interested parties. Since others do not calculate these measures in a similar fashion, these measures may not be comparable to similarly titled measures as reported by others. These measures should not be considered as an alternative to net income as an indicator of LXP’s operating performance or as an alternative to cash flow as a measure of liquidity.

36Table of Contents NON-GAAP MEASURES DEFINITIONS Net Operating Income (NOI): NOI is a measure of operating performance used to evaluate the individual performance of an investment. This measure is not presented or intended to be viewed as a liquidity or performance measure that presents a numerical measure of LXP's historical or future financial performance, financial position or cash flows. LXP defines NOI as operating revenues (rental income (less GAAP rent adjustments, non-cash income and purchase option income related to sales-type leases, and lease termination income, net) and other property income) less property operating expenses. Other REITs may use different methodologies for calculating NOI, and accordingly, LXP's NOI may not be comparable to that of other companies. Because NOI excludes general and administrative expenses, interest expense, depreciation and amortization, acquisition-related expenses, other nonproperty income and losses, and gains and losses from property dispositions, it provides a performance measure that, when compared year over year, reflects the revenues and expenses directly associated with owning and operating commercial real estate and the impact to operations from trends in occupancy rates, rental rates, and operating costs, providing a perspective on operations not immediately apparent from net income. LXP believes that net income is the most directly comparable GAAP measure to NOI. Same-Store NOI: Same-Store NOI represents the NOI for consolidated properties that were owned, stabilized and included in our portfolio for the entirety of the two comparable reporting periods. As Same-Store NOI excludes the change in NOI from acquired, expanded and disposed of properties, it highlights operating trends such as occupancy levels, rental rates and operating costs on properties. Other REITs may use different methodologies for calculating Same-Store NOI, and accordingly, LXP's Same-Store NOI may not be comparable to other REITs. Management believes that Same-Store NOI is a useful supplemental measure of LXP's operating performance. However, Same-Store NOI should not be viewed as an alternative measure of LXP's financial performance since it does not reflect the operations of LXP's entire portfolio, nor does it reflect the impact of general and administrative expenses, acquisition-related expenses, interest expense, depreciation and amortization costs, other nonproperty income and losses, the level of capital expenditures and leasing costs necessary to maintain the operating performance of LXP's properties, or trends in development and construction activities which are significant economic costs and activities that could materially impact LXP's results from operations. LXP believes that net income is the most directly comparable GAAP measure to Same-Store NOI. Second Generation Costs: Represents cash spend for tenant improvements and leasing costs to maintain revenues at existing properties and are a component of the FAD calculation. LXP believes that second generation building improvements represent an investment in existing stabilized properties. Stabilized Portfolio: All real estate properties other than non-stabilized properties, LXP considers stabilization to occur upon the earlier of 90% occupancy of the property or one year from cessation of major construction activities. Non-stabilized, substantially completed development projects are classified within investments in real estate under construction. If some portions of a development project are substantially complete and ready for use and other portions have not yet reached that stage, LXP ceases capitalizing costs on the completed portion of the project but continue to capitalize costs for the incomplete portion. When a portion of the development project is substantially complete and ready for its intended use, the classification changes from investments in real estate under construction to operating, the project is placed in service and depreciation commences.

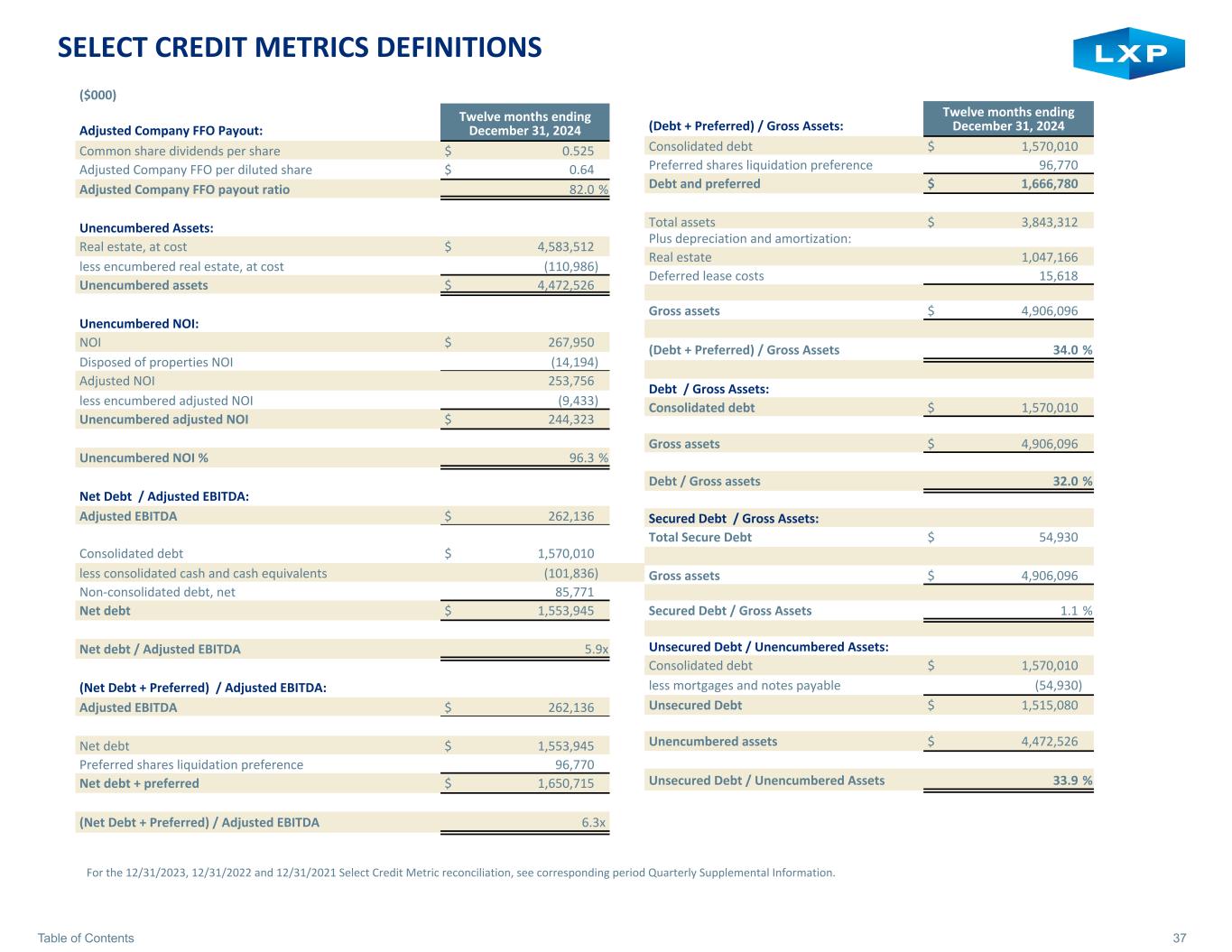

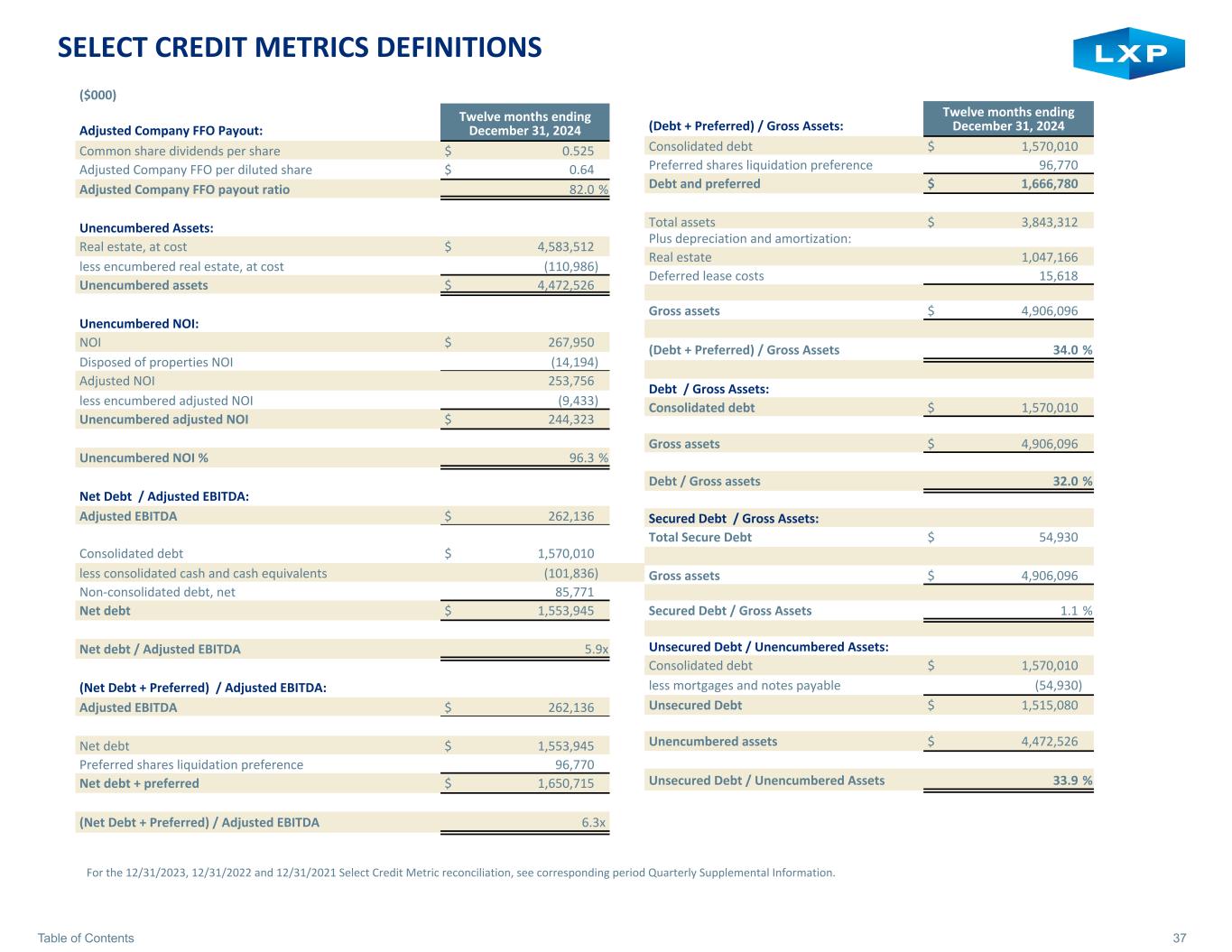

37Table of Contents SELECT CREDIT METRICS DEFINITIONS ($000) Adjusted Company FFO Payout: Twelve months ending December 31, 2024 Common share dividends per share $ 0.525 Adjusted Company FFO per diluted share $ 0.64 Adjusted Company FFO payout ratio 82.0 % Unencumbered Assets: Real estate, at cost $ 4,583,512 less encumbered real estate, at cost (110,986) Unencumbered assets $ 4,472,526 Unencumbered NOI: NOI $ 267,950 Disposed of properties NOI (14,194) Adjusted NOI 253,756 less encumbered adjusted NOI (9,433) Unencumbered adjusted NOI $ 244,323 Unencumbered NOI % 96.3 % Net Debt / Adjusted EBITDA: Adjusted EBITDA $ 262,136 Consolidated debt $ 1,570,010 less consolidated cash and cash equivalents (101,836) Non-consolidated debt, net 85,771 Net debt $ 1,553,945 Net debt / Adjusted EBITDA 5.9x (Net Debt + Preferred) / Adjusted EBITDA: Adjusted EBITDA $ 262,136 Net debt $ 1,553,945 Preferred shares liquidation preference 96,770 Net debt + preferred $ 1,650,715 (Net Debt + Preferred) / Adjusted EBITDA 6.3x For the 12/31/2023, 12/31/2022 and 12/31/2021 Select Credit Metric reconciliation, see corresponding period Quarterly Supplemental Information. (Debt + Preferred) / Gross Assets: Twelve months ending December 31, 2024 Consolidated debt $ 1,570,010 Preferred shares liquidation preference 96,770 Debt and preferred $ 1,666,780 Total assets $ 3,843,312 Plus depreciation and amortization: Real estate 1,047,166 Deferred lease costs 15,618 Gross assets $ 4,906,096 (Debt + Preferred) / Gross Assets 34.0 % Debt / Gross Assets: Consolidated debt $ 1,570,010 Gross assets $ 4,906,096 Debt / Gross assets 32.0 % Secured Debt / Gross Assets: Total Secure Debt $ 54,930 Gross assets $ 4,906,096 Secured Debt / Gross Assets 1.1 % Unsecured Debt / Unencumbered Assets: Consolidated debt $ 1,570,010 less mortgages and notes payable (54,930) Unsecured Debt $ 1,515,080 Unencumbered assets $ 4,472,526 Unsecured Debt / Unencumbered Assets 33.9 %

38Table of Contents INVESTOR INFORMATION Transfer Agent Computershare Overnight Correspondence: PO Box 43006 150 Royall Street, Suite 101 Providence, RI 02940 Canton, MA 02021 (800) 850-3948 www-us.computershare.com/investor Investor Relations Heather Gentry Executive Vice President, Investor Relations Telephone (direct) (212) 692-7219 E-mail hgentry@lxp.com Research Coverage BNP Paribas Evercore Partners Nate Crossett (646) 342-1588 Steve Sakwa (212) 446-9462 Monir Koummal (646) 342-1554 Jim Kammert (312) 705-4233 Green Street Advisors Jefferies & Company, Inc. Vince Tibone (949) 640-8780 Jon Petersen (212) 284-1705 JMP Securities J.P. Morgan Chase Mitch Germain (212) 906-3537 Anthony Paolone (212) 622-6682 KeyBanc Capital Markets Inc. Todd Thomas (917) 368-2286

LXP INDUSTRIAL TRUST ■ 515 N. FLAGLER DRIVE ■ SUITE 408 ■ WEST PALM BEACH, FL 33401 ■ WWW.LXP.COM