00009101082023FYFALSEhttp://fasb.org/us-gaap/2023#LeaseIncomehttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssets00009101082023-01-012023-12-310000910108us-gaap:CommonStockMember2023-01-012023-12-310000910108us-gaap:SeriesCPreferredStockMember2023-01-012023-12-3100009101082023-06-30iso4217:USD00009101082024-02-13xbrli:shares00009101082023-12-3100009101082022-12-31iso4217:USDxbrli:shares00009101082022-01-012022-12-3100009101082021-01-012021-12-310000910108us-gaap:PreferredStockMember2022-12-310000910108us-gaap:CommonStockMember2022-12-310000910108us-gaap:AdditionalPaidInCapitalMember2022-12-310000910108us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-12-310000910108us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000910108us-gaap:NoncontrollingInterestMember2022-12-310000910108us-gaap:NoncontrollingInterestMember2023-01-012023-12-310000910108us-gaap:CommonStockMember2023-01-012023-12-310000910108us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000910108us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-01-012023-12-310000910108us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310000910108us-gaap:PreferredStockMember2023-12-310000910108us-gaap:CommonStockMember2023-12-310000910108us-gaap:AdditionalPaidInCapitalMember2023-12-310000910108us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2023-12-310000910108us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000910108us-gaap:NoncontrollingInterestMember2023-12-3100009101082021-12-310000910108us-gaap:PreferredStockMember2021-12-310000910108us-gaap:CommonStockMember2021-12-310000910108us-gaap:AdditionalPaidInCapitalMember2021-12-310000910108us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-12-310000910108us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000910108us-gaap:NoncontrollingInterestMember2021-12-310000910108us-gaap:NoncontrollingInterestMember2022-01-012022-12-310000910108us-gaap:CommonStockMember2022-01-012022-12-310000910108us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000910108us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2022-01-012022-12-310000910108us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-3100009101082020-12-310000910108us-gaap:PreferredStockMember2020-12-310000910108us-gaap:CommonStockMember2020-12-310000910108us-gaap:AdditionalPaidInCapitalMember2020-12-310000910108us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-12-310000910108us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000910108us-gaap:NoncontrollingInterestMember2020-12-310000910108us-gaap:NoncontrollingInterestMember2021-01-012021-12-310000910108us-gaap:CommonStockMember2021-01-012021-12-310000910108us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000910108us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2021-01-012021-12-310000910108us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-31lxp:propertylxp:statelxp:jointVenture0000910108lxp:OnGoingDevelopmentProjectsMember2023-12-310000910108lxp:LandJointVenturesMember2023-12-310000910108lxp:JointVenturesWithDevelopersMembersrt:MinimumMember2023-12-31xbrli:pure0000910108lxp:JointVenturesWithDevelopersMembersrt:MaximumMember2023-12-310000910108lxp:LepercqCorporateIncomeFundLPMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-12-310000910108lxp:LepercqCorporateIncomeFundLPMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310000910108us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310000910108us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310000910108us-gaap:BuildingAndBuildingImprovementsMember2023-12-31lxp:segment0000910108us-gaap:StockCompensationPlanMember2023-01-012023-12-310000910108us-gaap:StockCompensationPlanMember2022-01-012022-12-310000910108us-gaap:StockCompensationPlanMember2021-01-012021-12-310000910108us-gaap:SeriesCPreferredStockMember2023-01-012023-12-310000910108us-gaap:SeriesCPreferredStockMember2022-01-012022-12-310000910108us-gaap:SeriesCPreferredStockMember2021-01-012021-12-310000910108us-gaap:LeasesAcquiredInPlaceMember2023-12-310000910108us-gaap:LeasesAcquiredInPlaceMember2022-12-310000910108us-gaap:CustomerRelationshipsMember2023-12-310000910108us-gaap:CustomerRelationshipsMember2022-12-310000910108us-gaap:AboveMarketLeasesMember2023-12-310000910108us-gaap:AboveMarketLeasesMember2022-12-310000910108lxp:PhoenixAZIndustrialPropertyExpiringAugust2033Membersrt:IndustrialPropertyMemberlxp:PhoenixArizonaMember2023-01-012023-12-310000910108lxp:PhoenixAZIndustrialPropertyExpiringAugust2033Membersrt:IndustrialPropertyMemberlxp:PhoenixArizonaMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:DallasTexasMemberlxp:DallasTXIndustrialPropertyMember2023-01-012023-12-310000910108srt:IndustrialPropertyMemberlxp:DallasTexasMemberlxp:DallasTXIndustrialPropertyMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:ColumbusOhioMemberlxp:ColumbusOhioIndustrialPropertyExpiringOctober2033Member2023-01-012023-12-310000910108srt:IndustrialPropertyMemberlxp:ColumbusOhioMemberlxp:ColumbusOhioIndustrialPropertyExpiringOctober2033Member2023-12-310000910108lxp:GreenvilleSpartanburgSouthCarolinaMemberlxp:GreenvilleSpartanburgSCIndustrialPropertyExpiringFeburary2029Membersrt:IndustrialPropertyMember2023-01-012023-12-310000910108lxp:GreenvilleSpartanburgSouthCarolinaMemberlxp:GreenvilleSpartanburgSCIndustrialPropertyExpiringFeburary2029Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:CentralFloridaMemberlxp:CentralFloridaIndustrialPropertyExpiringJanuary2029Membersrt:IndustrialPropertyMember2023-01-012023-12-310000910108lxp:CentralFloridaMemberlxp:CentralFloridaIndustrialPropertyExpiringJanuary2029Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:CincinnatiDaytonOHIndustrialPropertyMembersrt:IndustrialPropertyMemberlxp:CincinnatiDaytonOHMember2022-01-012022-12-310000910108lxp:CincinnatiDaytonOHIndustrialPropertyMembersrt:IndustrialPropertyMemberlxp:CincinnatiDaytonOHMember2022-12-310000910108lxp:CincinnatiDaytonOHIndustrialPropertyExpiringApril2032Membersrt:IndustrialPropertyMemberlxp:CincinnatiDaytonOHMember2022-01-012022-12-310000910108lxp:CincinnatiDaytonOHIndustrialPropertyExpiringApril2032Membersrt:IndustrialPropertyMemberlxp:CincinnatiDaytonOHMember2022-12-310000910108srt:IndustrialPropertyMemberlxp:PhoenixArizonaMemberlxp:PhoenixAZIndustrialPropertyExpiringMay2037Member2022-01-012022-12-310000910108srt:IndustrialPropertyMemberlxp:PhoenixArizonaMemberlxp:PhoenixAZIndustrialPropertyExpiringMay2037Member2022-12-310000910108lxp:GreenvilleSpartanburgSouthCarolinaMemberlxp:GreenvilleSCIndustrialPropertyExpiringApril2035Membersrt:IndustrialPropertyMember2022-01-012022-12-310000910108lxp:GreenvilleSpartanburgSouthCarolinaMemberlxp:GreenvilleSCIndustrialPropertyExpiringApril2035Membersrt:IndustrialPropertyMember2022-12-310000910108us-gaap:LeasesAcquiredInPlaceMember2022-01-012022-12-310000910108srt:IndustrialPropertyMemberlxp:HebronOHMember2022-01-012022-12-310000910108lxp:CincinnatiDaytonOHIndustrialPropertyMembersrt:IndustrialPropertyMemberlxp:CincinnatiDaytonOHMember2023-01-012023-12-310000910108lxp:FairburnJVMember2023-01-012023-12-310000910108lxp:FairburnJVMember2023-12-310000910108lxp:Cotton303Memberlxp:RealEstateInvestmentPropertyLeasedMemberlxp:PhoenixArizonaMember2023-01-012023-12-310000910108lxp:Cotton303Memberlxp:PhoenixArizonaMember2023-12-31lxp:buildingutr:sqft0000910108lxp:RealEstateInvestmentPropertyLeasedMember2023-12-310000910108lxp:CentralFloridaMemberlxp:RealEstateInvestmentPropertiesAvailableForLeaseMemberlxp:OcalaMember2023-01-012023-12-310000910108lxp:CentralFloridaMemberlxp:RealEstateInvestmentPropertiesAvailableForLeaseMemberlxp:OcalaMember2023-12-310000910108lxp:RealEstateInvestmentPropertiesAvailableForLeaseMemberlxp:IndianapolisIndianaMemberlxp:MtComfortMember2023-01-012023-12-310000910108lxp:RealEstateInvestmentPropertiesAvailableForLeaseMemberlxp:IndianapolisIndianaMemberlxp:MtComfortMember2023-12-310000910108lxp:SmithFarmsMemberlxp:GreenvilleSpartanburgSouthCarolinaMemberlxp:RealEstateInvestmentPropertiesAvailableForLeaseMember2023-01-012023-12-310000910108lxp:SmithFarmsMemberlxp:GreenvilleSpartanburgSouthCarolinaMemberlxp:RealEstateInvestmentPropertiesAvailableForLeaseMember2023-12-310000910108lxp:CentralFloridaMemberlxp:SouthShoreMemberlxp:RealEstateInvestmentPropertiesAvailableForLeaseMember2023-01-012023-12-310000910108lxp:CentralFloridaMemberlxp:SouthShoreMemberlxp:RealEstateInvestmentPropertiesAvailableForLeaseMember2023-12-310000910108lxp:RealEstateInvestmentPropertiesAvailableForLeaseMemberlxp:ColumbusOhioMemberlxp:ETNABuildingDMember2023-01-012023-12-310000910108lxp:RealEstateInvestmentPropertiesAvailableForLeaseMemberlxp:ColumbusOhioMemberlxp:ETNABuildingDMember2023-12-310000910108lxp:RealEstateInvestmentPropertiesAvailableForLeaseMember2023-12-310000910108lxp:CentralFloridaMemberlxp:SouthShoreMemberlxp:RealEstateInvestmentPropertyLeasedMember2023-12-31utr:acre0000910108lxp:RealEstateInvestmentPropertyLeasedMemberlxp:ColumbusOhioMemberlxp:ETNABuildingDMember2023-12-310000910108lxp:ReemsOliveMemberlxp:PhoenixArizonaMember2023-01-012023-12-310000910108lxp:ReemsOliveMemberlxp:PhoenixArizonaMember2023-12-310000910108lxp:MtComfortPhaseIIMemberlxp:IndianapolisIndianaMember2023-01-012023-12-310000910108lxp:MtComfortPhaseIIMemberlxp:IndianapolisIndianaMember2023-12-310000910108lxp:FairburnJVMemberlxp:AtlantaGAMember2023-01-012023-12-310000910108lxp:FairburnJVMemberlxp:AtlantaGAMember2023-12-310000910108lxp:ReemsOliveMemberlxp:PhoenixArizonaMember2023-10-012023-12-310000910108us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-01-012023-12-310000910108us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-01-012022-12-310000910108us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310000910108lxp:MFGColdJVMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-31lxp:asset0000910108lxp:PropertiesDisposedByLCIFMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310000910108lxp:PropertiesDisposedByLCIFMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-12-310000910108us-gaap:NotesReceivableMember2021-12-310000910108us-gaap:FairValueMeasurementsRecurringMember2023-12-310000910108us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000910108us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000910108us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310000910108us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000910108us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000910108us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000910108us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000910108us-gaap:MeasurementInputDiscountRateMember2023-12-31lxp:year0000910108lxp:ResidualCapitalizationRateMember2023-12-310000910108us-gaap:FairValueMeasurementsRecurringMember2022-12-310000910108us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000910108us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000910108us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310000910108us-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000910108us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000910108us-gaap:FairValueInputsLevel3Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000910108us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000910108lxp:MFGColdJVMember2023-12-310000910108lxp:MFGColdJVMember2022-12-310000910108lxp:MFGColdJVMember2023-01-012023-12-310000910108lxp:MFGColdJVMember2022-01-012022-12-310000910108lxp:MFGColdJVMember2021-01-012021-12-310000910108lxp:NNNOfficeJointVentureMember2023-12-310000910108lxp:NNNOfficeJointVentureMember2022-12-310000910108lxp:NNNOfficeJointVentureMember2023-01-012023-12-310000910108lxp:NNNOfficeJointVentureMember2022-01-012022-12-310000910108lxp:NNNOfficeJointVentureMember2021-01-012021-12-310000910108lxp:EtnaPark70Member2023-12-310000910108lxp:EtnaPark70Member2022-12-310000910108lxp:EtnaPark70Member2023-01-012023-12-310000910108lxp:EtnaPark70Member2022-01-012022-12-310000910108lxp:EtnaPark70Member2021-01-012021-12-310000910108lxp:EtnaPark70EastLLCMember2023-12-310000910108lxp:EtnaPark70EastLLCMember2022-12-310000910108lxp:EtnaPark70EastLLCMember2023-01-012023-12-310000910108lxp:EtnaPark70EastLLCMember2022-01-012022-12-310000910108lxp:EtnaPark70EastLLCMember2021-01-012021-12-310000910108lxp:BSHLesseeLPMember2023-12-310000910108lxp:BSHLesseeLPMember2022-12-310000910108lxp:BSHLesseeLPMember2023-01-012023-12-310000910108lxp:BSHLesseeLPMember2022-01-012022-12-310000910108lxp:BSHLesseeLPMember2021-01-012021-12-310000910108lxp:NNNOfficeJointVenturePropertiesMemberlxp:NNNOfficeJointVentureMember2023-01-012023-12-31lxp:officeAsset0000910108lxp:NNNOfficeJointVenturePropertiesMemberlxp:NNNOfficeJointVentureMember2022-01-012022-12-310000910108lxp:BSHLesseeLPMemberlxp:BSHLesseeJointVenturePropertiesMember2023-01-012023-01-310000910108us-gaap:InvestmentAdviceMemberlxp:LexingtonRealityAdvisorsIncMember2023-01-012023-12-310000910108us-gaap:InvestmentAdviceMemberlxp:LexingtonRealityAdvisorsIncMember2022-01-012022-12-310000910108us-gaap:InvestmentAdviceMemberlxp:LexingtonRealityAdvisorsIncMember2021-01-012021-12-310000910108lxp:COVID19PandemicMember2022-01-012022-12-310000910108lxp:COVID19PandemicMember2021-01-012021-12-310000910108lxp:COVID19PandemicMember2023-01-012023-12-310000910108lxp:PhoenixArizonaMember2023-12-31iso4217:USDutr:sqft0000910108us-gaap:FairValueInputsLevel3Memberlxp:PhoenixArizonaMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000910108lxp:PhoenixArizonaMember2023-01-012023-12-31lxp:tenant0000910108lxp:UnspecifiedMember2022-12-310000910108lxp:UnspecifiedMember2022-01-012022-12-310000910108srt:MaximumMember2023-12-310000910108us-gaap:OperatingExpenseMember2023-01-012023-12-310000910108us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310000910108us-gaap:OperatingExpenseMember2022-01-012022-12-310000910108us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310000910108us-gaap:OperatingExpenseMember2021-01-012021-12-310000910108us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-12-310000910108lxp:MortgagesAndNotesPayableMember2023-12-310000910108lxp:MortgagesAndNotesPayableMember2022-12-310000910108srt:MinimumMemberlxp:MortgagesAndNotesPayableMember2023-12-310000910108srt:MinimumMemberlxp:MortgagesAndNotesPayableMember2022-12-310000910108srt:MaximumMemberlxp:MortgagesAndNotesPayableMember2023-12-310000910108srt:MaximumMemberlxp:MortgagesAndNotesPayableMember2022-12-310000910108lxp:UnsecuredTermLoanMemberlxp:UnsecuredRevolvingCreditFacilityExpiringFebruary2023Member2023-12-310000910108us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMemberlxp:UnsecuredRevolvingCreditFacilityExpiringFebruary2023Member2023-01-012023-12-310000910108lxp:UnsecuredTermLoanExpiringJanuary2025Memberlxp:UnsecuredTermLoanMember2023-12-310000910108us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlxp:UnsecuredTermLoanExpiringJanuary2025Memberlxp:UnsecuredTermLoanMember2023-01-012023-12-310000910108us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlxp:RevolvingCreditFacilityExpiresInJuly2026Memberus-gaap:RevolvingCreditFacilityMember2022-07-012022-07-310000910108us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlxp:RevolvingCreditFacilityExpiresInJuly2026Memberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMember2023-01-012023-12-310000910108us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlxp:RevolvingCreditFacilityExpiresInJuly2026Memberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2023-01-012023-12-310000910108us-gaap:RevolvingCreditFacilityMemberlxp:UnsecuredRevolvingCreditFacilityExpiringFebruary2023Member2023-12-310000910108lxp:UnsecuredTermLoanExpiringJanuary2027Memberus-gaap:InterestRateSwapMemberlxp:UnsecuredTermLoanMember2023-12-310000910108lxp:UnsecuredTermLoanMember2023-12-310000910108lxp:UnsecuredTermLoanMember2022-12-310000910108lxp:MortgagesNotesPayableCreditFacilityBorrowingsandTermLoansMember2023-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2028Member2023-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2028Member2022-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2031Member2023-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2031Member2022-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2030Member2023-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2030Member2022-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2024Member2023-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2024Member2022-12-310000910108us-gaap:SeniorNotesMember2023-12-310000910108us-gaap:SeniorNotesMember2022-12-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2028Member2023-11-300000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2031Member2021-08-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2023Member2021-08-012021-08-310000910108us-gaap:SeniorNotesMemberlxp:SeniorNotesDue2023Member2021-08-310000910108lxp:SixPointEightZeroFourPercentTrustPreferredSecuritiesMember2007-12-310000910108us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberlxp:SixPointEightZeroFourPercentTrustPreferredSecuritiesMember2007-01-012007-12-310000910108lxp:SixPointEightZeroFourPercentTrustPreferredSecuritiesMember2023-12-310000910108lxp:SixPointEightZeroFourPercentTrustPreferredSecuritiesMember2022-12-310000910108lxp:SeniorNotesConvertibleNotesandTrustPreferredSecuritiesMember2023-12-310000910108us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2022-07-31lxp:instrument0000910108us-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-12-31lxp:financial_instrument0000910108us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-12-310000910108us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2022-12-310000910108us-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2023-01-012023-12-310000910108us-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2022-01-012022-12-310000910108us-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateCapMember2023-01-012023-12-310000910108us-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateCapMember2022-01-012022-12-310000910108us-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-01-012023-12-310000910108us-gaap:InterestExpenseMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-01-012022-12-310000910108us-gaap:ForwardContractsMember2023-01-012023-12-310000910108lxp:AtMarketMember2022-12-310000910108lxp:AtMarketMember2023-12-310000910108lxp:UnderwrittenOfferingMember2022-01-012022-12-310000910108lxp:UnderwrittenOfferingMember2022-12-310000910108lxp:UnderwrittenOfferingMemberus-gaap:ForwardContractsMember2023-12-3100009101082022-08-310000910108us-gaap:CommonStockMember2022-01-012022-12-310000910108us-gaap:SeriesCPreferredStockMember2023-12-310000910108us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310000910108us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310000910108us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberlxp:LCIFPartnershipMember2023-01-012023-12-310000910108lxp:NonVestedSharesMember2021-12-310000910108lxp:NonVestedSharesMember2022-01-012022-12-310000910108lxp:NonVestedSharesMember2022-12-310000910108lxp:NonVestedSharesMember2023-01-012023-12-310000910108lxp:NonVestedSharesMember2023-12-310000910108lxp:IndexPerformanceSharesMember2023-01-012023-12-310000910108lxp:IndexPerformanceSharesMember2022-01-012022-12-310000910108lxp:PeerPerformanceSharesMember2023-01-012023-12-310000910108lxp:PeerPerformanceSharesMember2022-01-012022-12-310000910108lxp:NonVestedCommonSharesMember2023-01-012023-12-310000910108lxp:NonVestedCommonSharesMember2022-01-012022-12-310000910108us-gaap:PerformanceSharesMember2023-01-012023-12-310000910108us-gaap:PerformanceSharesMember2020-01-012020-12-310000910108us-gaap:PerformanceSharesMember2022-01-012022-12-310000910108us-gaap:PerformanceSharesMember2019-01-012019-12-310000910108lxp:NonManagementAwardGrantMember2023-01-012023-12-310000910108lxp:NonManagementAwardGrantMember2022-01-012022-12-310000910108lxp:NonManagementAwardGrantMember2021-01-012021-12-310000910108lxp:SharesSubjectToTimeMember2023-12-310000910108lxp:SharesSubjectToPerformanceMember2023-12-310000910108us-gaap:StateAndLocalJurisdictionMember2023-01-012023-12-310000910108us-gaap:StateAndLocalJurisdictionMember2022-01-012022-12-310000910108us-gaap:StateAndLocalJurisdictionMember2021-01-012021-12-310000910108us-gaap:CommonStockMember2021-01-012021-12-310000910108us-gaap:CommonStockMemberlxp:OrdinaryIncomeMember2023-01-012023-12-310000910108us-gaap:CommonStockMemberlxp:OrdinaryIncomeMember2022-01-012022-12-310000910108us-gaap:CommonStockMemberlxp:OrdinaryIncomeMember2021-01-012021-12-310000910108us-gaap:CommonStockMemberlxp:FifteenPercentRateQualifyingDividendMember2023-01-012023-12-310000910108us-gaap:CommonStockMemberlxp:FifteenPercentRateQualifyingDividendMember2022-01-012022-12-310000910108us-gaap:CommonStockMemberlxp:FifteenPercentRateQualifyingDividendMember2021-01-012021-12-310000910108us-gaap:CommonStockMemberlxp:FifteenPercentRateGainMember2023-01-012023-12-310000910108us-gaap:CommonStockMemberlxp:FifteenPercentRateGainMember2022-01-012022-12-310000910108us-gaap:CommonStockMemberlxp:FifteenPercentRateGainMember2021-01-012021-12-310000910108us-gaap:CommonStockMemberlxp:ReturnOfCapitalMember2023-01-012023-12-310000910108us-gaap:CommonStockMemberlxp:ReturnOfCapitalMember2022-01-012022-12-310000910108us-gaap:CommonStockMemberlxp:ReturnOfCapitalMember2021-01-012021-12-310000910108us-gaap:SeriesCPreferredStockMember2022-01-012022-12-310000910108us-gaap:SeriesCPreferredStockMember2021-01-012021-12-310000910108lxp:OrdinaryIncomeMemberus-gaap:SeriesCPreferredStockMember2023-01-012023-12-310000910108lxp:OrdinaryIncomeMemberus-gaap:SeriesCPreferredStockMember2022-01-012022-12-310000910108lxp:OrdinaryIncomeMemberus-gaap:SeriesCPreferredStockMember2021-01-012021-12-310000910108lxp:FifteenPercentRateQualifyingDividendMemberus-gaap:SeriesCPreferredStockMember2023-01-012023-12-310000910108lxp:FifteenPercentRateQualifyingDividendMemberus-gaap:SeriesCPreferredStockMember2022-01-012022-12-310000910108lxp:FifteenPercentRateQualifyingDividendMemberus-gaap:SeriesCPreferredStockMember2021-01-012021-12-310000910108lxp:FifteenPercentRateGainMemberus-gaap:SeriesCPreferredStockMember2023-01-012023-12-310000910108lxp:FifteenPercentRateGainMemberus-gaap:SeriesCPreferredStockMember2022-01-012022-12-310000910108lxp:FifteenPercentRateGainMemberus-gaap:SeriesCPreferredStockMember2021-01-012021-12-310000910108lxp:ReturnOfCapitalMemberus-gaap:SeriesCPreferredStockMember2023-01-012023-12-310000910108lxp:ReturnOfCapitalMemberus-gaap:SeriesCPreferredStockMember2022-01-012022-12-310000910108lxp:ReturnOfCapitalMemberus-gaap:SeriesCPreferredStockMember2021-01-012021-12-310000910108us-gaap:ConsolidatedPropertiesMember2023-12-310000910108lxp:PaloAltoCaliforniaMemberlxp:PaloAltoOfficePropertyMember2023-01-012023-12-310000910108lxp:PropertiesDisposedByLCIFMemberlxp:LCIFMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2021-01-012021-12-310000910108lxp:LCIFMemberlxp:NonRecourseMortgageMember2021-01-012021-12-310000910108lxp:MFGColdJVMember2021-12-310000910108lxp:MFGColdJVMemberlxp:NonRecourseMortgageMember2021-01-012021-12-310000910108lxp:RROcala44LLCMember2021-01-012021-12-310000910108lxp:TheCubesAtEtnaEastMemberus-gaap:SubsequentEventMemberlxp:ColumbusOhioMember2024-01-012024-02-150000910108srt:IndustrialPropertyMemberlxp:ChandlerAZIndustrialPropertyAcquiredNov20Memberlxp:ChandlerArizonaMember2023-12-310000910108lxp:GoodyearArizonaMembersrt:IndustrialPropertyMemberlxp:GoodyearAZIndustrialPropertyAcquiredNov18Member2023-12-310000910108lxp:GoodyearArizonaMembersrt:IndustrialPropertyMemberlxp:GoodyearAZIndustrialPropertyAcquiredNov19Member2023-12-310000910108lxp:GoodyearArizonaMembersrt:IndustrialPropertyMemberlxp:GoodyearAZIndustrialPropertyAcquiredJan20Member2023-12-310000910108lxp:GoodyearAZIndustrialPropertyAcquiredNov21Memberlxp:GoodyearArizonaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:GoodyearArizonaMembersrt:IndustrialPropertyMemberlxp:GoodyearAZIndustrialPropertyAcquiredDec23Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:PhoenixAZIndustrialPropertyAcquiredDec21Memberlxp:PhoenixArizonaMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:PhoenixAZIndustrialPropertyAcquiredApr22Memberlxp:PhoenixArizonaMember2023-12-310000910108lxp:TollesonArizonaMembersrt:IndustrialPropertyMemberlxp:TollesonAZIndustrialPropertyAcquiredOct19Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:LakelandFLIndustrialPropertyAcquiredJan21Memberlxp:LakelandFloridaMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:OcalaFloridaMemberlxp:OcalaFLIndustrialPropertyAcquiredJun20Member2023-12-310000910108lxp:OrlandoFLIndustrialPropertyAcquiredDec06Membersrt:IndustrialPropertyMemberlxp:OrlandoFloridaMember2023-12-310000910108lxp:PlantCityFloridaMembersrt:IndustrialPropertyMemberlxp:PlantCityFLIndustrialPropertyAcquiredDec21Member2023-12-310000910108lxp:TampaFloridaMemberlxp:TampaFLIndustrialPropertyAcquiredJul88Membersrt:IndustrialPropertyMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:AdairsvilleGAIndustrialPropertyAcquiredDec21Memberlxp:AdairsvilleGeorgiaMember2023-12-310000910108lxp:AustellGeorgiaMemberlxp:AustellGAIndustrialPropertyAcquiredJun19Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:CartersvilleGAIndustrialPropertyAcquiredDec21Property2Membersrt:IndustrialPropertyMemberlxp:CartersvilleGeorgiaMember2023-12-310000910108lxp:CartersvilleGAIndustrialPropertyAcquiredDec21Membersrt:IndustrialPropertyMemberlxp:CartersvilleGeorgiaMember2023-12-310000910108lxp:FairburnGAIndustrialPropertyAcquiredNov21Memberlxp:FairburnGeorgiaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:McDonoughGeorgiaMemberlxp:McDonoughGAIndustrialPropertyAcquiredAug17Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:McDonoughGAIndustrialPropertyAcquiredFeb19Memberlxp:McDonoughGeorgiaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:PoolerGAIndustrialPropertyAcquiredApr20Membersrt:IndustrialPropertyMemberlxp:PoolerGeorgiaMember2023-12-310000910108lxp:RinconGAIndustrialPropertyAcquiredSep20Membersrt:IndustrialPropertyMemberlxp:RinconGeorgiaMember2023-12-310000910108lxp:SavannahGAIndustrialPropertyAcquiredJun20Membersrt:IndustrialPropertyMemberlxp:SavannahGAMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:SavannahGAIndustrialPropertyAcquiredJun20Property2Memberlxp:SavannahGAMember2023-12-310000910108lxp:UnionCityGAIndustrialPropertyAcquiredJun19Membersrt:IndustrialPropertyMemberlxp:UnionCityGAMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:EdwardsvilleIllinoisMemberlxp:EdwardsvilleILIndustrialPropertyAcquiredDec16Member2023-12-310000910108lxp:EdwardsvilleILIndustrialPropertyAcquiredJun18Membersrt:IndustrialPropertyMemberlxp:EdwardsvilleIllinoisMember2023-12-310000910108lxp:MinookaIllinoisMembersrt:IndustrialPropertyMemberlxp:MinookaILIndustrialPropertyAcquiredJan20Member2023-12-310000910108lxp:MinookaIllinoisMemberlxp:MinookaILIndustrialPropertyAcquiredDec19Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:MinookaIllinoisMemberlxp:MinookaILIndustrialPropertyAcquiredJan20Property2Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:RantoulILIndustrialPropertyAcquiredJan14Membersrt:IndustrialPropertyMemberlxp:RantoulIllinoisMember2023-12-310000910108lxp:RockfordILIndustrialPropertyAcquiredDec06Membersrt:IndustrialPropertyMemberlxp:RockfordIllinoisMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:RockfordIllinoisMemberlxp:RockfordILIndustrialPropertyAcquiredDec06Property2Member2023-12-310000910108lxp:LafayetteIndianaMembersrt:IndustrialPropertyMemberlxp:LafayetteINIndustrialPropertyAcquiredOct17Member2023-12-310000910108lxp:LebanonIndianaMemberlxp:LebanonINIndustrialPropertyAcquiredFeb17Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:WhitelandINIndustrialPropertyAcquiredOct21Membersrt:IndustrialPropertyMemberlxp:WhitelandIndianaMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:WhitelandIndianaMemberlxp:WhitelandINIndustrialPropertyAcquiredOct21Property2Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:WhitelandINIndustrialPropertyAcquiredOct21Property3Memberlxp:WhitelandIndianaMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:WhitestownIndianaMemberlxp:WhitestownINIndustrialPropertyAcquiredJan21Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:WhitestownIndianaMemberlxp:WhitestownINIndustrialPropertyAcquiredJan19Member2023-12-310000910108lxp:WhitestownINIndustrialPropertyAcquiredJan21Property2Membersrt:IndustrialPropertyMemberlxp:WhitestownIndianaMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:WhitestownIndianaMemberlxp:WhitestownINIndustrialPropertyAcquiredDec21Member2023-12-310000910108lxp:NewCenturyKSIndustrialPropertyAcquiredFeb17Membersrt:IndustrialPropertyMemberlxp:NewCenturyKansasMember2023-12-310000910108lxp:WaltonKYIndustrialPropertyAcquiredFeb22Membersrt:IndustrialPropertyMemberlxp:WaltonKYMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:WaltonKYMemberlxp:WaltonKYIndustrialPropertyAcquiredFeb22Property2Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:MinneapolisMinnesotaMemberlxp:MinneapolisMNIndustrialPropertyAcquiredSep12Member2023-12-310000910108lxp:ByhaliaMSIndustrialPropertyAcquiredMay11Memberlxp:ByhaliaMississippiMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:ByhaliaMississippiMembersrt:IndustrialPropertyMemberlxp:ByhaliaMSIndustrialPropertyAcquiredSep17Member2023-12-310000910108lxp:CantonMSIndustrialPropertyAcquiredMar15Memberlxp:CantonMississippiMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:OliveBranchMississippiMemberlxp:OliveBranchMSIndustrialPropertyAcquiredApr18Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:OliveBranchMississippiMembersrt:IndustrialPropertyMemberlxp:OliveBranchMSIndustrialPropertyAcquiredApr18Property2Member2023-12-310000910108lxp:OliveBranchMississippiMembersrt:IndustrialPropertyMemberlxp:OliveBranchMSIndustrialPropertyAcquiredMay19Member2023-12-310000910108lxp:OliveBranchMississippiMembersrt:IndustrialPropertyMemberlxp:OliveBranchMSIndustrialPropertyAcquiredMay19Property2Member2023-12-310000910108lxp:ShelbyNCIndustrialPropertyAcquiredJune11Memberlxp:ShelbyNorthCarolinaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:StatesvilleNCIndustrialPropertyAcquiredDec06Membersrt:IndustrialPropertyMemberlxp:StatesvilleNorthCarolinaMember2023-12-310000910108lxp:ErwinNewYorkMembersrt:IndustrialPropertyMemberlxp:ErwinNYIndustrialPropertyAcquiredSep12Member2023-12-310000910108lxp:LongIslandCityNewYorkMemberlxp:LongIslandCityNYIndustrialPropertyAcquiredMar13Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:ChillicotheOHIndustrialPropertyAcquiredOct11Membersrt:IndustrialPropertyMemberlxp:ChillicotheOhioMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:ColumbusOhioMemberlxp:ColumbusOHIndustrialPropertyAcquiredAug21Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:EtnaOHIndustrialPropertyAcquiredDec23Memberlxp:EtnaOHMember2023-12-310000910108lxp:GlenwillowOHIndustrialPropertyAcquiredDec06Membersrt:IndustrialPropertyMemberlxp:GlenwillowOhioMember2023-12-310000910108lxp:HebronOhioMemberlxp:HebronOHIndustrialPropertyAcquiredDec97Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:HebronOHIndustrialPropertyAcquiredDec01Memberlxp:HebronOhioMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:LockbourneOHIndustrialPropertyAcquiredMar21Membersrt:IndustrialPropertyMemberlxp:LockbourneOhioMember2023-12-310000910108lxp:MonroeOHIndustrialPropertyAcquiredDec21Membersrt:IndustrialPropertyMemberlxp:MonroeOhioMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:MonroeOhioMemberlxp:MonroeOHIndustrialPropertyAcquiredSep19Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:MonroeOhioMemberlxp:MonroeOHIndustrialPropertyAcquiredSep19Property2Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:MonroeOhioMemberlxp:MonroeOHIndustrialPropertyAcquiredSep19Property3Member2023-12-310000910108lxp:StreetsboroOHIndustrialPropertyAcquiredJun07Membersrt:IndustrialPropertyMemberlxp:StreetsboroOhioMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:BristolPAIndustrialPropertyAcquiredMar98Memberlxp:BristolPennsylvaniaMember2023-12-310000910108lxp:DuncanSCIndustrialPropertyAcquiredJul21Memberlxp:DuncanSouthCarolinaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:DuncanSouthCarolinaMembersrt:IndustrialPropertyMemberlxp:DuncanSCIndustrialPropertyAcquiredJul21Property2Member2023-12-310000910108lxp:DuncanSCIndustrialPropertyAcquiredJul21Property3Memberlxp:DuncanSouthCarolinaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:DuncanSouthCarolinaMemberlxp:DuncanSCIndustrialPropertyAcquiredJul21Property4Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:DuncanSouthCarolinaMemberlxp:DuncanSCIndustrialPropertyAcquiredOct19Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:DuncanSouthCarolinaMembersrt:IndustrialPropertyMemberlxp:DuncanSCIndustrialPropertyAcquiredOct19Property2Member2023-12-310000910108lxp:DuncanSouthCarolinaMemberlxp:DuncanSCIndustrialPropertyAcquiredApr19Membersrt:IndustrialPropertyMember2023-12-310000910108lxp:GreerSouthCarolinaMembersrt:IndustrialPropertyMemberlxp:GreerSCIndustrialPropertyAcquiredJun21Member2023-12-310000910108lxp:GreerSouthCarolinaMembersrt:IndustrialPropertyMemberlxp:GreerSCIndustrialPropertyAcquiredDec19Member2023-12-310000910108lxp:GreerSCIndustrialPropertyAcquiredJun21Property2Memberlxp:GreerSouthCarolinaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:GreerSCIndustrialPropertyAcquiredDec22Memberlxp:GreerSouthCarolinaMembersrt:IndustrialPropertyMember2023-12-310000910108lxp:GreerSouthCarolinaMembersrt:IndustrialPropertyMemberlxp:GreerSCIndustrialPropertyAcquiredDec23Member2023-12-310000910108lxp:SpartanburgSouthCarolinaMembersrt:IndustrialPropertyMemberlxp:SpartanburgSCIndustrialPropertyAcquiredAug18Member2023-12-310000910108lxp:SpartanburgSouthCarolinaMembersrt:IndustrialPropertyMemberlxp:SpartanburgSCIndustrialPropertyAcquiredDec20Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:AntiochTNIndustrialPropertyAcquiredMay07Memberlxp:AntiochTennesseeMember2023-12-310000910108lxp:ClevelandTennesseeMemberlxp:ClevelandTNIndustrialPropertyAcquiredMay17Membersrt:IndustrialPropertyMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:JacksonTennesseeMemberlxp:JacksonTNIndustrialPropertyAcquiredSep17Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:LewisburgTNIndustrialPropertyAcquiredMay14Memberlxp:LewisburgTennesseeMember2023-12-310000910108lxp:MillingtonTNIndustrialPropertyAcquiredApr05Membersrt:IndustrialPropertyMemberlxp:MillingtonTennesseeMember2023-12-310000910108lxp:SmyrnaTNIndustrialPropertyAcquiredSep17Memberlxp:SmyrnaTennesseeMembersrt:IndustrialPropertyMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:CarrolltonTexasMemberlxp:CarrolltonTXIndustrialPropertyAcquiredSep18Member2023-12-310000910108lxp:DallasTXIndustrialPropertyAcquiredApr19Membersrt:IndustrialPropertyMemberlxp:DallasTexasMember2023-12-310000910108lxp:DeerParkTexasMembersrt:IndustrialPropertyMemberlxp:DeerParkTXIndustrialPropertyAcquiredMay2023Member2023-12-310000910108lxp:GrandPrairieTexasMembersrt:IndustrialPropertyMemberlxp:GrandPrairieTXIndustrialPropertyAcquiredJun17Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:HoustonTXIndustrialPropertyAcquiredMar13Memberlxp:HoustonTexasMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:HutchinsTexasMemberlxp:HutchinsTXIndustrialPropertyAcquiredMay20Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:LancasterTexasMemberlxp:LancasterTXIndustrialPropertyAcquiredDec20Member2023-12-310000910108lxp:MissouriCityTexasMembersrt:IndustrialPropertyMemberlxp:MissouriCityTXIndustrialPropertyAcquiredApr12Member2023-12-310000910108lxp:NorthlakeTexasMembersrt:IndustrialPropertyMemberlxp:NorthlakeTXIndustrialPropertyAcquiredFeb20Member2023-12-310000910108lxp:NorthlakeTexasMembersrt:IndustrialPropertyMemberlxp:NorthlakeTXIndustrialPropertyAcquiredDec20Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:PasadenaTexasMemberlxp:PasadenaTXIndustrialPropertyAcquiredMay21Member2023-12-310000910108lxp:PasadenaTXIndustrialPropertyAcquiredJun20Membersrt:IndustrialPropertyMemberlxp:PasadenaTexasMember2023-12-310000910108lxp:PasadenaTXIndustrialPropertyAcquiredMay21Property2Membersrt:IndustrialPropertyMemberlxp:PasadenaTexasMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:PasadenaTXIndustrialPropertyAcquiredAug18Memberlxp:PasadenaTexasMember2023-12-310000910108lxp:SanAntonioTXIndustrialPropertyAcquiredJun17Membersrt:IndustrialPropertyMemberlxp:SanAntonioTexasMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:ChesterVirginiaMemberlxp:ChesterVAIndustrialPropertyAcquiredDec18Member2023-12-310000910108lxp:WinchesterVAIndustrialPropertyAcquiredDec17Membersrt:IndustrialPropertyMemberlxp:WinchesterVirginiaMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:WinchesterVirginiaMemberlxp:WinchesterVAIndustrialPropertyAcquiredSept20Member2023-12-310000910108srt:IndustrialPropertyMemberlxp:WinchesterVirginiaMemberlxp:WinchesterVAIndustrialPropertyAcquiredJun07Member2023-12-310000910108lxp:RuskinFloridaMembersrt:IndustrialPropertyMemberlxp:RuskinFLIndustrialPropertyAcquiredDec23NotStabalizedMember2023-12-310000910108srt:IndustrialPropertyMemberlxp:LancasterTXIndustrialPropertyAcquiredJul2023NonStabilizedMemberlxp:LancasterTexasMember2023-12-310000910108srt:OtherPropertyMemberlxp:BaltimoreMarylandMember2023-12-310000910108us-gaap:ConstructionInProgressMember2023-12-310000910108us-gaap:LandMember2023-12-3100009101082023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________ to ________________

Commission File Number 1-12386

LXP INDUSTRIAL TRUST

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

| Maryland |

13-3717318 |

(State or other jurisdiction of

incorporation of organization) |

(I.R.S. Employer

Identification No.) |

One Penn Plaza, Suite 4015, New York, NY 10119-4015

(Address of principal executive offices) (zip code)

(212) 692-7200

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Shares of beneficial interest, par value $0.0001 per share, classified as Common Stock |

LXP |

New York Stock Exchange |

6.50% Series C Cumulative Convertible Preferred Stock, par value $0.0001 per share |

LXPPRC |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. Yes ☐ No ☒

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). Yes ☐ No ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the shares of beneficial interest, par value $0.0001 per share, classified as common stock (“common shares”) of LXP Industrial Trust held by non-affiliates as of June 30, 2023, which was the last business day of the registrant's most recently completed second fiscal quarter, was $2,797,660,954 based on the closing price of the common shares on the New York Stock Exchange as of that date, which was $9.75 per share.

Number of common shares outstanding as of February 13, 2024 was 294,289,569.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information contained in the Definitive Proxy Statement for LXP Industrial Trust's Annual Meeting of Shareholders, or an amendment on Form 10-K/A, is incorporated by reference in this Annual Report on Form 10-K in response to Part III, Items 10, 11, 12, 13 and 14, which will be filed with the Securities and Exchange Commission not later than 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

Description |

|

Page |

|

|

|

|

|

PART I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

Defined Terms

Unless stated otherwise or the context otherwise requires, the “Company,” the “Trust,” “LXP,” “we,” “our,” and “us” refer collectively to LXP Industrial Trust and its consolidated subsidiaries. All of the Company's interests in properties are held, and all property operating activities are conducted, through special purpose entities, which we refer to as property owner subsidiaries or lender subsidiaries and are separate and distinct legal entities, but in some instances are consolidated for financial statement purposes and/or disregarded for income tax purposes.

When we use the term “REIT,” we mean real estate investment trust. All references to 2023, 2022 and 2021 refer to our fiscal years ended December 31, 2023, December 31, 2022 and December 31, 2021, respectively.

When we use the term “GAAP,” we mean United States generally accepted accounting principles in effect from time to time.

When we use the term “common shares,” we mean our shares of beneficial interest par value $0.0001, classified as common stock. When we use the term “Series C Preferred Shares,” we mean our beneficial interest classified as 6.50% Series C Convertible Preferred Stock.

When we use the term “base rent,” we mean GAAP rental revenue and ancillary income, but excluding billed tenant reimbursements and lease termination income.

When we use the term “Annualized Cash Base Rent,” (“ABR”) we mean the period end cash base rent multiplied by 12. For leases with free rent periods or that were signed prior to the end of the year but have not commenced, the first cash base rent payment is multiplied by 12.

When we use “Stabilized Portfolio,” we mean all real estate properties other than acquired or developed properties that have not achieved 90% occupancy within one-year of acquisition or cessation of major construction activities. Non-stabilized, substantially completed development projects are classified within investments in real estate under construction.

The terms “FFO,” “Adjusted Company FFO,” and “NOI” are defined in “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Annual Report.

Cautionary Statements Concerning Forward-Looking Statements

This Annual Report, together with other statements and information publicly disseminated by us, contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and include this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “believes,” “expects,” “intends,” “anticipates,” “estimates,” “projects,” “may,” “plans,” “predicts,” “will,” “will likely result” or similar expressions. Readers should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could materially affect actual results, performances or achievements. In particular, among the factors that could cause actual results, performances or achievements to differ materially from current expectations, strategies or plans include, among others, those risks discussed below under “Risk Factors” in Part I, Item 1A of this Annual Report and under “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Annual Report. Except as required by law, we undertake no obligation to publicly release the results of any revisions to these forward-looking statements which may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Accordingly, there is no assurance that our expectations will be realized.

PART I.

Item 1. Business

General

We are a Maryland real estate investment trust, qualified as a REIT for federal income tax purposes, focused on investing in single-tenant warehouse/distribution real estate investments. A majority of our properties are subject to net or similar leases, where the tenant bears all or substantially all of the costs, including cost increases, for real estate taxes, utilities, insurance and ordinary repairs. However, certain leases provide that the landlord is responsible for certain operating expenses.

As of December 31, 2023, we had equity ownership interests in approximately 115 consolidated real estate properties, located in 18 states and containing an aggregate of approximately 54.6 million square feet of space, approximately 99.8% of which was leased.

History and Current Corporate Structure

We became a Maryland REIT in December 1997. Prior to that, our predecessor was organized in the state of Delaware in October 1993 upon the rollup of two partnerships focused on investments in diversified net-leased assets. Primarily all of our business is conducted through wholly-owned subsidiaries, but historically we conducted a portion of our business through an operating partnership subsidiary, Lepercq Corporate Income Fund L.P., which we refer to as LCIF.

On December 31, 2023, we merged LCIF with and into us, with us as the surviving entity. As a result of the merger 0.7 million LCIF partnership units not already owned by us were converted on a 1 for 1.126 basis into 0.8 million of our common shares for a total value of $7.8 million.

Since December 31, 2015 through December 31, 2023, we transitioned our portfolio from approximately 16% warehouse/distribution assets to approximately 99.7% warehouse/distribution assets. As of December 31, 2023, our portfolio consisted of 112 warehouse/distribution facilities and three other properties.

Strategy

General. Our business strategy is focused on growing our portfolio with attractive warehouse/distribution properties in target markets while maintaining a strong, flexible balance sheet to allow us to act on opportunities as they arise. We acquire and develop warehouse/distribution properties in markets with strong income and growth characteristics that we believe provide an optimal balance of income and capital appreciation.

We provide capital to merchant builders by providing construction financing and/or a takeout for build-to-suit projects and speculative development properties. We believe our development strategy has the potential to provide us with higher returns than we could obtain by acquiring fully-leased buildings. We also believe our strategy mitigates against certain development risks and overhead costs because we partner with merchant builders, who are generally responsible for typical cost overruns. However, we are constantly exploring ways to be more efficient and earn higher returns.

We believe our current strategy mitigates against unexpected costs and the cyclicality of many asset classes and investment strategies and provides shareholders with a secure dividend. We believe our strategy is more conservative than most industrial REITs. We believe our strategy provides defensive attributes for investors in the industrial sector and better growth potential for investors compared to the net lease sector.

Target Markets. We focus our investment strategy on growing markets where we believe there are advantages to building a geographic concentration.

We target markets that we believe have strong growth prospects for us to build a concentration of assets. Strong growth prospects are generally determined by:

•Expanding transportation and logistics networks;

•Distances to major population centers;

•Population growth;

•Physical and regulatory constraints;

•Labor cost and availability;

•Utility costs;

•Land cost and availability; and

•Re-tenanting opportunities and costs.

We focus our investments in the Sunbelt and Midwest. Our current target markets consist of the following:

We expect to grow in these markets by executing on our development pipeline, including through build-to-suits, and opportunistically acquiring facilities in these markets.

We currently expect to opportunistically dispose of properties outside of our target markets as opportunities and the need for liquidity arise.

Building Type. We target general purpose warehouse/distribution facilities that are versatile, easily leased to alternative users and have other attractive features, including some or all of the following features:

•Clear heights generally ranging from 28 feet for smaller buildings to 40 feet for larger buildings;

•Wide column spacing and speed bays;

•Efficient loading dock ratios;

•Deep truck courts;

•Cross docking for larger facilities; and

•Ample trailer and employee parking.

The average age of our warehouse/distribution properties as of December 31, 2023, was approximately 9.5 years.

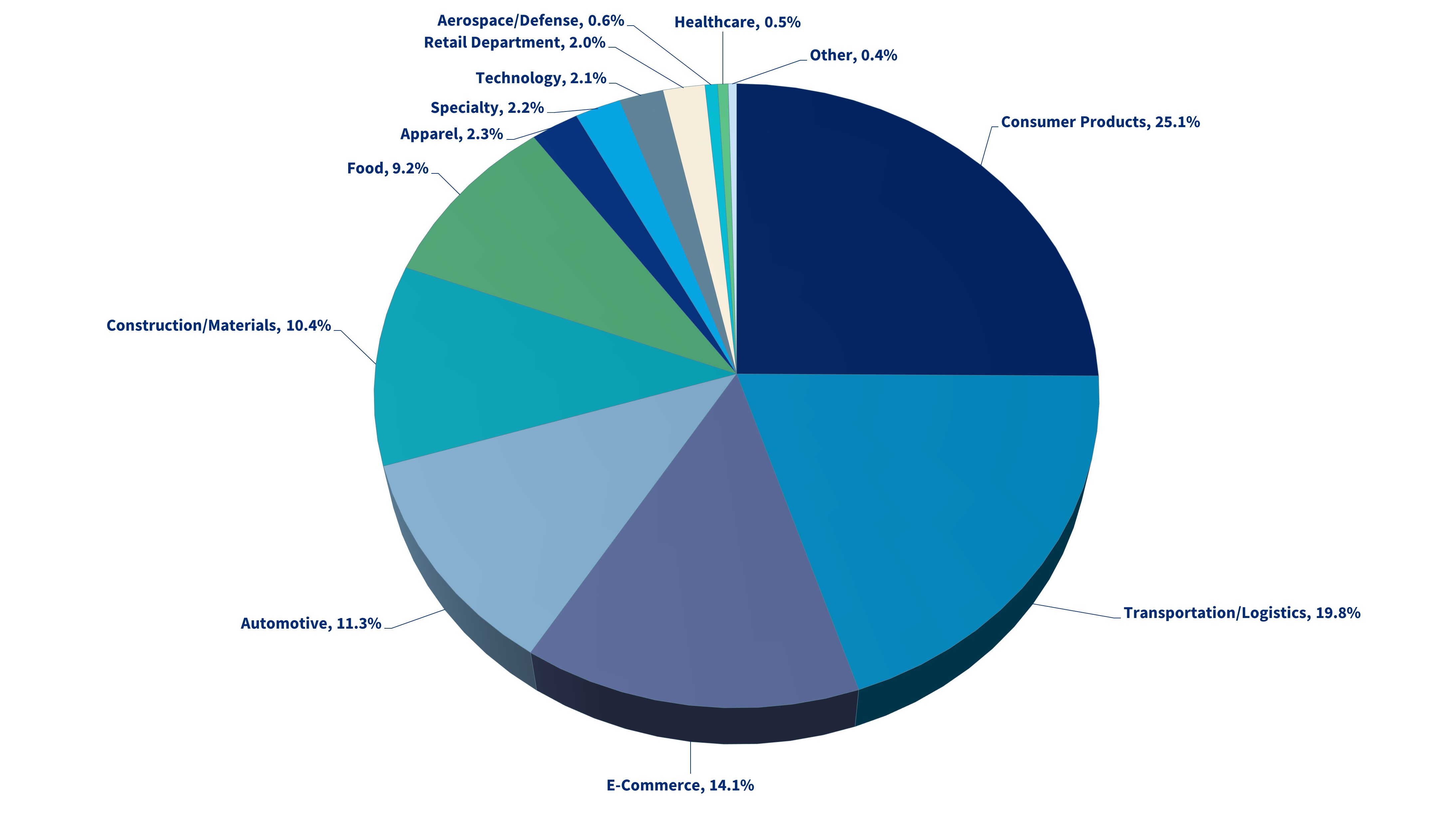

Tenants. We believe we have a diversified tenant base and are not dependent upon any one tenant. While we invest primarily in single-tenant facilities, we believe our tenant credit strength mitigates somewhat against binary risk in occupancy. As of December 31, 2023, our largest tenant represented 6.9% of our ABR and 49.9% of our ABR was from tenants with investment grade credit ratings (either tenant, guarantor or parent/ultimate parent). See “Item 2—Properties—Tenant Diversification.”

Institutional Fund Management. We also provide advisory services and co-invest with high-quality institutional investors in non-consolidated entities. One of these institutional joint ventures, NNN Office JV L.P. (“Office JV”), in which we have a 20% interest, was formed in 2018 upon our disposition of a portfolio of office assets and has seven office properties and a land parcel remaining. Another one of these institutional joint ventures, NNN MFG Cold JV L.P. (“MFG Cold JV”) in which we have a 20% interest, was formed in 2021 upon our disposition of a portfolio of 22 special purpose industrial properties outside of our core warehouse/distribution strategy.

MFG Cold JV has additional equity commitments of $250 million, of which our proportionate share is $50 million, for the acquisition of special purpose industrial properties outside of our core warehouse/distribution focus. We believe investing in special purpose industrial properties in a joint venture structure allows us to mitigate the risk of investing in these types of industrial assets while earning certain fees related to the operation and growth of the joint venture. MFG Cold JV has not made any acquisitions since its original formation transaction.

Our institutional joint ventures use non-recourse mortgage loans to finance their investments.

Insurance

We maintain comprehensive property, liability and pollution insurance policies with limits and deductibles that we believe are appropriate for our portfolio. Our property insurance policy includes business interruption, windstorm coverage and terrorism coverage, subject to certain exclusions. The premiums for our property, liability and pollution insurance are generally reimbursed by our tenants. We also maintain Directors and Officers, Crime, Fiduciary Liability, Employment Practices Liability, Cyber and Miscellaneous Professional Liability insurance.

Regulation

We are subject to various laws, ordinances and regulations, including:

REIT. We elected to be taxed as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended, which we refer to as the Code, commencing with our taxable year ended December 31, 1993. We intend to continue to qualify as a REIT. If we qualify for taxation as a REIT, we generally will not be subject to federal corporate income taxes on our net taxable income that is currently distributed to our common shareholders. We conduct certain taxable activities through our taxable REIT subsidiary, Lexington Realty Advisors, Inc.

Americans with Disabilities Act. Our properties must comply with the Americans with Disabilities Act of 1990, as amended, or the Americans with Disabilities Act, to the extent that such properties are “public accommodations” as defined under the Americans with Disabilities Act. Although we believe that our properties in the aggregate substantially comply with current requirements of the Americans with Disabilities Act, and we have not received any notice for correction, we have not conducted a comprehensive audit or investigation of all of our properties to determine whether we are in compliance.

Environmental Matters. Under various federal, state and local environmental laws, statutes, ordinances, rules and regulations, an owner of real property may be liable for the costs of removal or remediation of certain hazardous or toxic substances at, on, in or under such property as well as certain other potential costs relating to hazardous or toxic substances.

As of December 31, 2023, we are not aware of any environmental conditions or material costs of complying with environmental or other government regulations that would have a material adverse effect on our overall business, financial condition, or results of operations. However, it is possible that we are not aware of, or may become subject to, potential environmental liabilities or material costs of complying with government regulations that could be material. See “Risks Related to Our Business” in Item 1A. “Risk Factors” for further information regarding our risks related to government regulations.

Competition

There are numerous developers, real estate companies, financial institutions, such as banks and insurance companies, and other investors with greater financial or other resources that compete with us in seeking properties for acquisition and tenants who will lease space in these properties.

Operating Segments

We manage our operations on an aggregated, single segment basis for purposes of assessing performance and making operating decisions, and accordingly, have only one reporting and operating segment. While we have target markets, we do not allocate capital by market or operate properties in specific markets independent of our overall portfolio.

Human Capital

While our investment focus is on physical assets, human capital is critical to our success. We believe investing in our team will result in value creation for our shareholders. We strive to maintain a supportive work atmosphere that values community and promotes professional and personal growth, work autonomy and health and wellness.

We rely on our employees and the employees of our contractors and vendors to operate our business and implement our strategy.

Employees. As of December 31, 2023, we had 64 full-time employees. None of our employees are covered by a collective bargaining agreement. Each of our employees work in one or more of the following departments: Investments, Asset Management, Accounting, Tax, Corporate, Legal and Information Technology.

On at least an annual basis, our Chief Executive Officer submits a management succession plan that provides for the ordinary course and emergency succession for our Chief Executive Officer and other key members of management, which is reviewed by the Nominating and ESG Committee of our Board of Trustees and, ultimately, our Board of Trustees.

Attraction & Retention of Talent. We compete for talent by providing competitive compensation and benefits and by working to maintain a culture that is supportive and collaborative and that provides opportunities for both personal and professional growth. Some of our benefit highlights are:

•The compensation for employees above a certain level generally includes long-term equity awards, giving them ownership in us in an effort to retain their services.

•Medical insurance with a portion of the premiums paid by us. The minimum employee portion of premium to participate in one of the medical insurance plans for a single employee making less than $100,000 in base salary per year is $1 per month.

•Dental and vision benefits at no cost to all of our employees.

•A minimum of 14 paid time off, or PTO, days for first year employees, which increases to 19 PTO days in the third and fourth year of employment and 24 PTO days in the fifth year of employment.

•A 401(k) plan where all employees can defer a portion of their compensation and receive matching and profit sharing contributions from the Company.

•Flexible working arrangements where employees are able to work from home on specified days per workweek.

•Professional development policy providing full reimbursement for career-relevant trainings and classes and professional organizations and other resources.

•Employee stock purchase plan where all employees can defer a portion of their salary to purchase Company stock at a discount.

•Semi-annual performance reviews and an online platform to provide real-time feedback.

•Anniversary bonuses for employees who have reached certain tenure amounts.

Due to the small size of our employee base, our turnover is generally low. In 2023, three employees voluntarily or involuntarily separated service from us and we hired one employee for a net change of two employees.

Demographics. We believe there are many benefits to diversity in our employee base. Of our 64 full-time employees at December 31, 2023, 57.8% were female and 46.9% were non-white. Of our eight executive employees at December 31, 2023, 25.0% were female and 12.5% were non-white.

We maintain a diversity, equity and inclusion policy that acknowledges our commitment to cultivating a culture of diversity, equity and inclusion and related initiatives and provides a process for employees to report violations of the policy.

Training and Development. In addition to our professional development policy, we maintain a variety of training programs for our employees, including annual trainings for sustainability, accounting, cybersecurity, human rights, harassment (for managers and non-managers) and anti-corruption/bribery. During 2023, none of our employees violated our anti-corruption/bribery policies and we did not pay any fines for violating anti-corruption/bribery laws or regulations.

Employee Engagement. We regularly engage our employees through the following methods:

•During 2023, we conducted a mid-year performance review for our non-executive employees and a year-end performance review for all of our employees. The year-end performance review consisted of a 180-degree review where non-executive employees reviewed their immediate supervisor. We believe this 180-degree review provides an objective measurement of our employees' performance. The performance of each of our executive-titled employees is reviewed by our Chief Executive Officer, which is presented to, and discussed by, the Compensation Committee of our Board of Trustees.

•During 2023, we engaged our employees with several surveys, including an employee satisfaction survey. The participation rate for the employee satisfaction survey was 88% and we achieved an 86% overall satisfaction rate.

Human Rights. We believe respect for human rights is essential. We maintain an enterprise level human rights policy that acknowledges our efforts to promote human rights in accordance with the UN Guiding Principles on Business and Human Rights and the UN Universal Declaration of Human Rights. We respect freedom of association in our employment practices.

Vendors and Contractors. We outsource the following material functions:

•Information Technology. We engaged a third-party provider of virtual desktop and digital workspaces for managed IT services and a national accounting firm through its digital product line, for virtual chief technology officer services, including as our chief information security officer, or CISO.

•Internal Audit. We engaged a “big-four” accounting firm to assist with our internal audit function.

•Property Management. We primarily engage CBRE, Cushman & Wakefield and Jones Lang LaSalle for the management of our properties where we have operating responsibilities. We also use the management affiliates of the developer/sellers of properties we acquire and develop for the management of such properties if we have operating responsibilities and we believe it is important for such management affiliates to continue to manage the property.

•ESG. We engaged RE Tech Advisors to assist us with our environmental, social and governance, or ESG, initiatives. The 2022 energy, GHG emissions, water and waste data in our corporate responsibility report was independently verified by Lucideon CICS, a private limited company providing in verification and certification services.

We maintain a supplier code of conduct for our vendors and contractors.

Corporate Responsibility

Due to the properties in our portfolio primarily being subject to net leases where tenants are responsible for maintaining the buildings and are in control of their energy usage and environmental sustainability practices, our ability to implement ESG+R initiatives throughout our portfolio may be limited.

We understand the importance of aligning with our stakeholders on environmental, social, governance, and resilience, or ESG+R, matters. Our goal is to continue building a sustainable ESG+R platform that enhances both our company and shareholder value. We are committed to implementing sustainability measures across our organization, from the way in which we assess investment decisions to the business practices we promote at both the corporate and property levels. We believe our publicly disclosed ESG+R objectives will continue to evolve as our platform grows and contribute to our ongoing long-term success on behalf of our stakeholders, including our shareholders, employees, tenants, suppliers, creditors, and local communities.

We find that communicating and engaging with our stakeholders to learn their needs enhances our knowledge and enables us to take actions that we believe may increase the value of our assets. We understand that each stakeholder has a specific point-of-view and unique needs. We seek to continuously identify avenues to engage with our stakeholders to better understand those needs, and we maintain a stakeholder engagement policy. During 2023, we held various meetings with our shareholders and tenants. We held townhall meetings with our employees, we completed questionnaires from shareholders and industry groups, and we engaged our tenants and employees with satisfaction surveys and newsletters.

The Nominating and ESG Committee of our Board of Trustees oversees our ESG+R strategy and initiatives.

Environmental, Sustainability and Climate Change

Developing strategies that reduce our environmental impact and operational costs is a critical component of our ESG+R program. When feasible, we implement base building upgrades and provide tenants with improvement allowance funds to complete sustainability efforts.

Actions:

•Track and monitor all landlord-paid utilities, and track tenant utility data wherever possible.

•Strategically implement green building certifications to highlight sustainability initiatives and pursue ENERGY STAR certification for eligible properties annually.

•Annually review and evaluate opportunities to improve efficiency, reduce operating costs, and reduce our properties' environmental footprint.

• Evaluate opportunities to increase renewable energy usage across the portfolio.

Performance:

•Benchmarked landlord paid energy, water, waste, and recycling across the portfolio and working to expand tenant-paid utility data coverage.

•Completed a Greenhouse Gas (GHG) Inventory of our 2022 Scope 1, 2, and 3 GHG Emissions.

•Obtained green building certifications for eight properties and submitted ENERGY STAR applications for six properties in our portfolio during 2023.

•Circulated and maintained sustainability-focused resources for tenants and property managers, including a Tenant Fit-Out Guide and an Industrial Tenant Sustainability Guide.

•Evaluated sustainability and efficiency initiatives across the portfolio in an effort to reduce energy consumption and drive down greenhouse gas emissions.

•Included ESG+R in metrics for executive cash incentive awards.

Social

We believe that actively engaging with stakeholders is critical to our business and ESG+R efforts, providing valuable insight to inform strategy, attract and retain top talent, and strengthen tenant relationships.

Actions:

•Routinely engage with our tenants to understand leasing and operational needs at our assets and provide tools and resources to promote sustainable tenant operations.

•Collaborate with tenants and property managers on health and well-being focused initiatives.

•Assess our tenant and employee satisfaction and feedback through annual surveys.

•Circulate ESG+R focused newsletter to tenants and maintain a tenant portal with ESG+R resources.

•Provide our employees with periodic trainings, industry updates and access to tools and resources related to ESG+R.

•Provide our employees with health and well-being resources focused on physical, emotional and financial health.

•Track and highlight the diversity and inclusion metrics of our employees, board and executive management team.

•Support and engage with local communities through philanthropic and volunteer events, focusing on food insecurity and diversity, equity and inclusion initiatives.

•Incorporate sustainability clauses into tenant leases, allowing collaboration on our ESG+R initiatives.

Performance:

•Conducted a tenant feedback survey through Kingsley Associates and achieved a satisfaction score in excess of the Kingsley Associates average.

•Engaged with our employees through regular surveys, including an employee satisfaction survey.

•Organized employee volunteer opportunities at non-profit organizations on Company time and held clothing and food drives.

•Maintained a paid-time-off policy for employees to volunteer in their local communities.

•Organized step and other health-related challenges for our employees.

•Invited our employees to donate to non-profit organizations within the local communities of our office locations.

•Provided an employee assistance program with 24/7 unlimited access to referrals and resources for all work-life needs, including access to face-to-face and telephonic counseling sessions, legal and financial referrals and consultations.

•Awarded as a 2023 Best Company to Work for in New York.

•Maintained a women's mentorship program, where female employees are paired with female mentors for career related advice and support.

•Named 2023 Green Lease Leader with Gold recognition by the Institution for Market Transformation and the U.S. Department of Energy’s Better Buildings Alliance.

Governance

Transparency to our stakeholders is essential. We pride ourselves on providing our stakeholders with regular reports and detailed disclosures on our operational and financial health and ESG+R efforts.

Actions:

•Strive to implement best governance practices, mindful of the concerns of our shareholders.

•Increase our ESG+R transparency and disclosure by providing regular ESG updates to shareholders and other stakeholders and aligning with appropriate reporting frameworks and industry groups, including GRESB, SASB, GRI and TCFD.

•Monitor compliance with applicable benchmarking and disclosure legislation, including utility data reporting, audit and retro-commissioning requirements, and greenhouse gas emission laws.

•Ensure employees operate in accordance with the highest ethical standards and maintain the policies outlined in our Code of Business Conduct and Ethics.

Performance:

•Updated and disclosed our Code of Business Conduct and Ethics, which includes a whistleblower policy, and provided annual training.

•Performed enterprise risk assessments and management succession planning.

•Participated in the GRESB Real Estate Assessment:

◦Placed 3rd in the U.S. Industrial Distribution/Warehouse listed peer group;

◦Achieved a Real Estate Benchmark score of 74, a five-point increase compared to 2022; and,

◦Received Public Disclosure Score of 96 (A), above the comparison group and global average, and placed first in the U.S. Industrial Peer Group.

•Published our 2022 Corporate Responsibility Report, aligned with GRI, SASB, SDGs and TCFD.

•Maintained a Stakeholder Engagement Policy to disclose our process when working with our key stakeholders, including investors, property management teams, and tenants.

•Continued to support the UN Women's Empowerment Principles and the CEO Action for Diversity & Inclusion.

•Conducted annual ESG+R training for asset managers, lease administrators and property managers.

Resilience

We believe that our resilience to climate change-related physical and transition risks is critical to our long-term success.

Actions:

•Align our resilience program with the TCFD framework.

•Evaluate physical and transition climate-related risks as part of our acquisition due diligence process.

•Utilize climate analytics metrics to (1) identify physical risk exposure across the portfolio, (2) identify high risk assets and (3) implement mitigation measures and emergency preparedness plans.

•Assess transition risks and opportunities arising from the shift to a low-carbon economy, including market, reputation, policy, legal, and technology.

Performance:

•Engaged a third-party consultant to conduct ESG+R assessments on all new acquisitions.

•Continued to be a supporter of the TCFD reporting framework.

•Engaged a climate analytics firm to evaluate physical risk due to climate change across our portfolio.

Corporate Information

Principal Executive Offices. Our principal executive offices are located at One Penn Plaza, Suite 4015, New York, New York 10119-4015; our telephone number is (212) 692-7200.

Web Site. Our Internet address is www.lxp.com. We make available, free of charge, on or through the Investors section of our web site or by contacting our Investor Relations Department, our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the Securities and Exchange Commission, or SEC. Also posted on our web site, and available in print upon request of any shareholder to our Investor Relations Department, are our declaration of trust and by-laws, charters for the Audit and Cyber Risk Committee, Compensation Committee and Nominating and ESG Committee of our Board of Trustees, our Corporate Governance Guidelines, and our Code of Business Conduct and Ethics governing our trustees, officers and employees (which contains our whistleblower procedures). Within the time period required by the SEC and the NYSE, we will post on our web site any amendment to the Code of Business Conduct and Ethics and any waiver applicable to any of our trustees or executive officers or other people performing similar functions, and that relate to any matter enumerated in Item 406(b) of Regulation S-K. In addition, our web site includes information concerning purchases and sales of our equity securities by our executive officers and trustees as well as disclosure relating to certain non-GAAP financial measures (as defined in the SEC's Regulation G) that we may make public orally, telephonically, by webcast, by broadcast or by similar means from time to time. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding LXP at http://www.sec.gov. Information contained on our web site or the web site of any other person is not incorporated by reference into this Annual Report or any of our other filings with or documents furnished to the SEC.

Our Investor Relations Department can be contacted at LXP Industrial Trust, One Penn Plaza, Suite 4015, New York, New York 10119-4015, Attn: Investor Relations, by telephone: (212) 692-7200, or by e-mail: ir@lxp.com.

NYSE CEO Certification. Our Chief Executive Officer made an unqualified certification to the NYSE with respect to our compliance with the NYSE corporate governance listing standards in 2023.

Item 1A. Risk Factors

In addition to the other information in our Annual Report on Form 10-K, you should consider the risks described below that we believe may be material to investors in evaluating the Company. This section contains forward-looking statements, and in considering these statements, you should refer to the qualifications and limitations on our forward-looking statements that are described on page four above.

Risks Related to Our Business

We are subject to risks related to defaults under, or termination or expiration of, our leases.