Document

Exhibit 99.1

COASTAL FINANCIAL CORPORATION ANNOUNCES FOURTH QUARTER 2024 RESULTS

Company Release: January 28, 2025

Everett, WA – Coastal Financial Corporation (Nasdaq: CCB) (the “Company”, "Coastal", "we", "our", or "us"), the holding company for Coastal Community Bank (the “Bank”), through which it operates a community-focused bank with an industry leading banking as a service ("BaaS") segment, today reported unaudited financial results for the quarter ended December 31, 2024, including net income of $13.4 million, or $0.94 per diluted common share, compared to $13.5 million, or $0.97 per diluted common share, for the three months ended September 30, 2024 and $45.2 million, or $3.26 per diluted common share, for the year ended December 31, 2024, compared to $44.6 million, or $3.27 per diluted common share for the year ended December 31, 2023.

Management Discussion of the Quarter and Full-year Results

“2024 was highlighted by the completion of our $98.0 million capital raise during the fourth quarter, which we will utilize to support growth of the Bank including in our CCBX segment,” said CEO Eric Sprink. “We saw high quality net loan growth of $67.7 million despite selling $845.5 million in loans during the fourth quarter, and our CCBX program fee income continued to increase which was up 56.9% for full-year 2024 relative to the prior year. We continue to invest heavily in CCBX to support future growth, and we are pleased to have three letters of intent ("LOI") signed going into 2025 with an active pipeline.”

Key Points for Fourth Quarter and Our Go-Forward Strategy

•Completed Capital Raise Allows CCBX Growth to Continue. During the fourth quarter of 2024, we completed a $98.0 million common equity raise, which was priced at $71.00/share. Proceeds will be used for general corporate purposes and to support growth of the Bank including in our CCBX segment. As of December 31, 2024 we had three signed LOIs and continue to have an active pipeline for 2025. The growth in common-equity tier 1 and total risk-based capital to 12.04% and 14.67%, respectively, includes the benefit of the capital raise.

•Strong Annual Growth in CCBX Program Fees. Total BaaS program fee income was $25.6 million for the year ended December 31, 2024, an increase of $9.3 million, or 56.9%, from the year ended December 31, 2023, and is representative of growth in partner transaction activity and expanded product offerings within our CCBX operating segment. Trends in CCBX noninterest income were also positive during the quarter, with total program fees of $8.2 million for the three months ended December 31, 2024, an increase of $1.8 million, or 27.6%, from the three months ended September 30, 2024.

•Investments for Growth Continues. Total non-interest expense of $64.2 million was down $1.4 million, or 2.1%, as compared to $65.6 million in the third quarter of 2024, mainly driven by lower BaaS loan expense, partially offset by higher salaries and employee benefits, point of sale expense, and legal and professional expenses. As we increase the number of new CCBX partners and programs launching in 2025, we expect that expenses will tend to be front-loaded with a focus on compliance and operational risk before any new program reaches significant revenues.

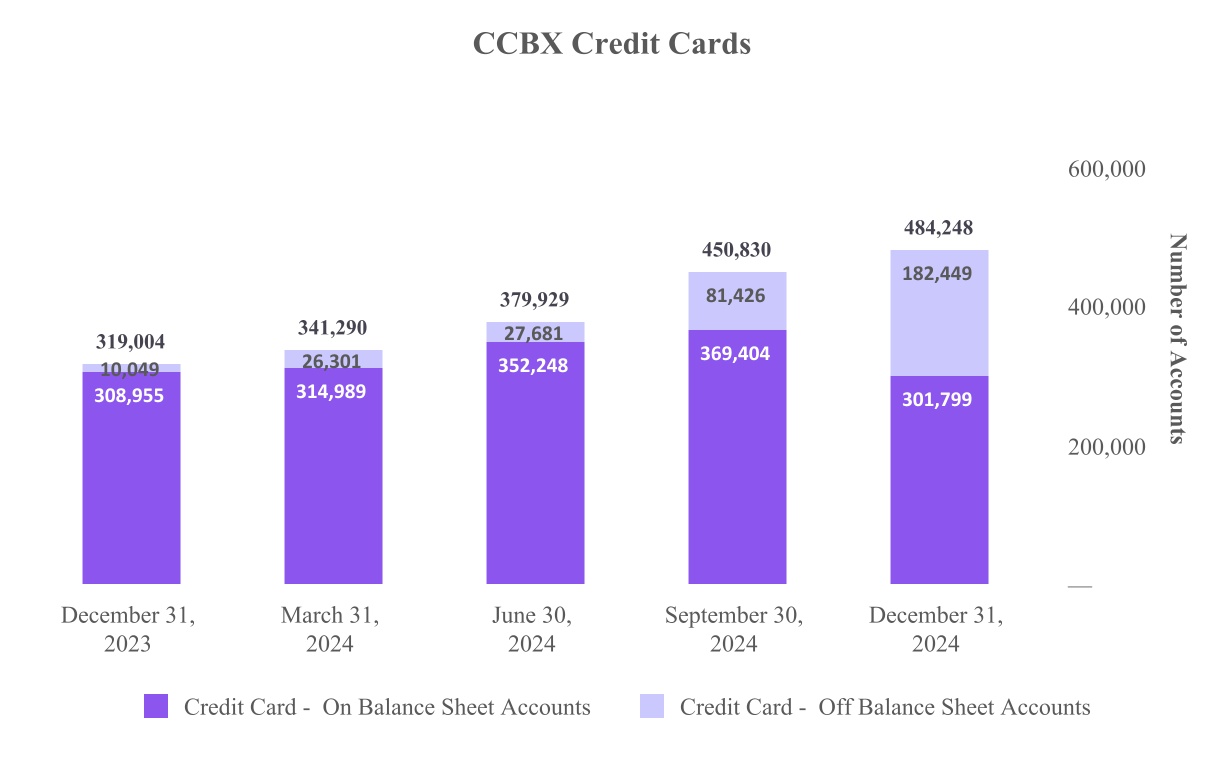

•Off Balance Sheet Activity Update. During the fourth quarter of 2024, we sold $845.5 million of loans, the majority of which were credit card receivables, and swept $273.2 million of deposits off balance-sheet. We are able to retain a portion of the fee income on these sold credit card loans. As of December 31, 2024 there were 182,449 credit cards with fee earning potential, an increase of 101,023 compared to the quarter ended September 30, 2024 and an increase of 172,400 from December 31, 2023.

•Continued Monitoring of CCBX Risk. We remain fully indemnified against fraud and 98.7% indemnified against credit risk with our CCBX partners as of year-end of 2024.

Fourth Quarter 2024 Financial Highlights

The tables below outline some of our key operating metrics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| (Dollars in thousands, except share and per share data; unaudited) |

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

| Income Statement Data: |

|

|

|

|

|

|

|

|

|

| Interest and dividend income |

$ |

96,587 |

|

|

$ |

105,079 |

|

|

$ |

97,487 |

|

|

$ |

90,472 |

|

|

$ |

88,243 |

|

| Interest expense |

30,071 |

|

|

32,892 |

|

|

31,250 |

|

|

29,536 |

|

|

28,586 |

|

| Net interest income |

66,516 |

|

|

72,187 |

|

|

66,237 |

|

|

60,936 |

|

|

59,657 |

|

| Provision for credit losses |

61,867 |

|

|

70,257 |

|

|

62,325 |

|

|

83,158 |

|

|

60,789 |

|

|

Net interest (expense)/ income after

provision for credit losses

|

4,649 |

|

|

1,930 |

|

|

3,912 |

|

|

(22,222) |

|

|

(1,132) |

|

| Noninterest income |

76,756 |

|

|

80,068 |

|

|

69,918 |

|

|

86,955 |

|

|

64,694 |

|

| Noninterest expense |

64,206 |

|

|

65,616 |

|

|

58,809 |

|

|

56,018 |

|

|

51,703 |

|

| Provision for income tax |

3,832 |

|

|

2,926 |

|

|

3,425 |

|

|

1,915 |

|

|

2,847 |

|

| Net income |

13,367 |

|

|

13,456 |

|

|

11,596 |

|

|

6,800 |

|

|

9,012 |

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Three Month Period |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

| Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

452,513 |

|

|

$ |

484,026 |

|

|

$ |

487,245 |

|

|

$ |

515,128 |

|

|

$ |

483,128 |

|

| Investment securities |

47,321 |

|

|

48,620 |

|

|

49,213 |

|

|

50,090 |

|

|

150,364 |

|

| Loans held for sale |

20,600 |

|

|

7,565 |

|

|

— |

|

|

797 |

|

|

— |

|

| Loans receivable |

3,486,565 |

|

|

3,418,832 |

|

|

3,326,460 |

|

|

3,199,554 |

|

|

3,026,092 |

|

| Allowance for credit losses |

(176,994) |

|

|

(170,263) |

|

|

(147,914) |

|

|

(139,258) |

|

|

(116,958) |

|

| Total assets |

4,121,208 |

|

|

4,065,821 |

|

|

3,961,546 |

|

|

3,865,258 |

|

|

3,753,366 |

|

| Interest bearing deposits |

3,057,808 |

|

|

3,047,861 |

|

|

2,949,643 |

|

|

2,888,867 |

|

|

2,735,161 |

|

| Noninterest bearing deposits |

527,524 |

|

|

579,427 |

|

|

593,789 |

|

|

574,112 |

|

|

625,202 |

|

Core deposits (1) |

3,123,434 |

|

|

3,190,869 |

|

|

3,528,339 |

|

|

3,447,864 |

|

|

3,342,004 |

|

| Total deposits |

3,585,332 |

|

|

3,627,288 |

|

|

3,543,432 |

|

|

3,462,979 |

|

|

3,360,363 |

|

| Total borrowings |

47,884 |

|

|

47,847 |

|

|

47,810 |

|

|

47,771 |

|

|

47,734 |

|

| Total shareholders’ equity |

438,704 |

|

|

331,930 |

|

|

316,693 |

|

|

303,709 |

|

|

294,978 |

|

|

|

|

|

|

|

|

|

|

|

Share and Per Share Data (2): |

|

|

|

|

|

|

|

|

|

| Earnings per share – basic |

$ |

0.97 |

|

|

$ |

1.00 |

|

|

$ |

0.86 |

|

|

$ |

0.51 |

|

|

$ |

0.68 |

|

| Earnings per share – diluted |

$ |

0.94 |

|

|

$ |

0.97 |

|

|

$ |

0.84 |

|

|

$ |

0.50 |

|

|

$ |

0.66 |

|

| Dividends per share |

— |

|

— |

|

— |

|

— |

|

— |

Book value per share (3) |

$ |

29.37 |

|

|

$ |

24.51 |

|

|

$ |

23.54 |

|

|

$ |

22.65 |

|

|

$ |

22.17 |

|

Tangible book value per share (4) |

$ |

29.37 |

|

|

$ |

24.51 |

|

|

$ |

23.54 |

|

|

$ |

22.65 |

|

|

$ |

22.17 |

|

| Weighted avg outstanding shares – basic |

13,828,605 |

|

13,447,066 |

|

13,412,667 |

|

13,340,997 |

|

13,286,828 |

| Weighted avg outstanding shares – diluted |

14,268,229 |

|

13,822,270 |

|

13,736,508 |

|

13,676,917 |

|

13,676,513 |

| Shares outstanding at end of period |

14,935,298 |

|

13,543,282 |

|

13,453,805 |

|

13,407,320 |

|

13,304,339 |

| Stock options outstanding at end of period |

186,354 |

|

198,370 |

|

286,119 |

|

309,069 |

|

354,969 |

See footnotes that follow the tables below

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of and for the Three Month Period |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

| Credit Quality Data: |

|

|

|

|

|

|

|

|

|

Nonperforming assets (5) to total assets |

1.52 |

% |

|

1.63 |

% |

|

1.34 |

% |

|

1.42 |

% |

|

1.43 |

% |

Nonperforming assets (5) to loans receivable and OREO |

1.80 |

% |

|

1.94 |

% |

|

1.60 |

% |

|

1.71 |

% |

|

1.78 |

% |

Nonperforming loans (5) to total loans receivable |

1.80 |

% |

|

1.94 |

% |

|

1.60 |

% |

|

1.71 |

% |

|

1.78 |

% |

| Allowance for credit losses to nonperforming loans |

282.5 |

% |

|

256.5 |

% |

|

278.1 |

% |

|

253.8 |

% |

|

217.2 |

% |

| Allowance for credit losses to total loans receivable |

5.08 |

% |

|

4.98 |

% |

|

4.45 |

% |

|

4.35 |

% |

|

3.86 |

% |

|

|

|

|

|

|

|

|

|

|

| Gross charge-offs |

$ |

61,585 |

|

|

$ |

53,305 |

|

|

$ |

55,207 |

|

|

$ |

58,994 |

|

|

$ |

47,652 |

|

| Gross recoveries |

$ |

5,646 |

|

|

$ |

4,069 |

|

|

$ |

1,973 |

|

|

$ |

1,776 |

|

|

$ |

2,781 |

|

Net charge-offs to average loans (6) |

6.51 |

% |

|

5.65 |

% |

|

6.57 |

% |

|

7.34 |

% |

|

5.92 |

% |

|

|

|

|

|

|

|

|

|

|

| Capital Ratios: |

|

|

|

|

|

|

|

|

|

| Company |

|

|

|

|

|

|

|

|

|

| Tier 1 leverage capital |

10.78 |

% |

|

8.40 |

% |

|

8.31 |

% |

|

8.24 |

% |

|

8.10 |

% |

| Common equity Tier 1 risk-based capital |

12.04 |

% |

|

9.24 |

% |

|

9.03 |

% |

|

8.98 |

% |

|

9.10 |

% |

| Tier 1 risk-based capital |

12.14 |

% |

|

9.34 |

% |

|

9.13 |

% |

|

9.08 |

% |

|

9.20 |

% |

| Total risk-based capital |

14.67 |

% |

|

11.89 |

% |

|

11.70 |

% |

|

11.70 |

% |

|

11.87 |

% |

| Bank |

|

|

|

|

|

|

|

|

|

| Tier 1 leverage capital |

10.64 |

% |

|

9.29 |

% |

|

9.24 |

% |

|

9.19 |

% |

|

9.06 |

% |

| Common equity Tier 1 risk-based capital |

11.99 |

% |

|

10.34 |

% |

|

10.15 |

% |

|

10.14 |

% |

|

10.30 |

% |

| Tier 1 risk-based capital |

11.99 |

% |

|

10.34 |

% |

|

10.15 |

% |

|

10.14 |

% |

|

10.30 |

% |

| Total risk-based capital |

13.28 |

% |

|

11.63 |

% |

|

11.44 |

% |

|

11.43 |

% |

|

11.58 |

% |

(1)Core deposits are defined as all deposits excluding brokered and time deposits.

(2)Share and per share amounts are based on total actual or average common shares outstanding, as applicable.

(3)We calculate book value per share as total shareholders’ equity at the end of the relevant period divided by the outstanding number of our common shares at the end of each period.

(4)Tangible book value per share is a non-GAAP financial measure. We calculate tangible book value per share as total shareholders’ equity at the end of the relevant period, less goodwill and other intangible assets, divided by the outstanding number of our common shares at the end of each period. The most directly comparable GAAP financial measure is book value per share. We had no goodwill or other intangible assets as of any of the dates indicated. As a result, tangible book value per share is the same as book value per share as of each of the dates indicated.

(5)Nonperforming assets and nonperforming loans include loans 90+ days past due and accruing interest.

(6)Annualized calculations.

Key Performance Ratios

Return on average assets ("ROA") was 1.30% for the quarter ended December 31, 2024 compared to 1.34% and 0.97% for the quarters ended September 30, 2024 and December 31, 2023, respectively. ROA for the quarter ended December 31, 2024, decreased 0.04% and increased 0.33% compared to September 30, 2024 and December 31, 2023, respectively. Noninterest expenses were lower for the quarter ended December 31, 2024 compared to the quarter ended September 30, 2024 largely due to a decrease in BaaS loan expense, which is directly related to the amount of interest earned on CCBX loans, and higher than the quarter ended December 31, 2023 largely due to an increase in salaries and employee benefits, data processing and software licenses, legal and professional expenses and point of sale expenses, all of which are related to the growth of Company and investments in technology and risk management.

Yield on earning assets and yield on loans receivable decreased 1.14% and 0.99%, respectively, for the quarter ended December 31, 2024 compared to the quarter ended September 30, 2024. This decrease is due to a combination of factors. We continue to refine our credit approach with partners, widening the scope of loans that we are moving to nonaccrual, which decreased loan interest income in the quarter ended December 31, 2024 as compared to prior quarters. Average loans receivable as of December 31, 2024 decreased $45.4 million compared to September 30, 2024 as we continue to sell CCBX loans as part of our on-going strategy to manage the loan portfolio and credit quality.

New loans are being booked with enhanced credit standards, which typically results in a lower interest rate than some of the higher risk loans that have paid off or we have chosen to sell.

The following table shows the Company’s key performance ratios for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Twelve Months Ended |

| (unaudited) |

|

December 31,

2024 |

|

September 30,

2024 |

|

June 30,

2024 |

|

March 31,

2024 |

|

December 31,

2023 |

|

December 31,

2024 |

|

December 31,

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (1) |

|

1.30 |

% |

|

1.34 |

% |

|

1.21 |

% |

|

0.73 |

% |

|

0.97 |

% |

|

1.15 |

% |

|

1.28 |

% |

Return on average equity (1) |

|

14.90 |

% |

|

16.67 |

% |

|

15.22 |

% |

|

9.21 |

% |

|

12.35 |

% |

|

14.11 |

% |

|

16.41 |

% |

Yield on earnings assets (1) |

|

9.65 |

% |

|

10.79 |

% |

|

10.49 |

% |

|

10.07 |

% |

|

9.77 |

% |

|

10.25 |

% |

|

9.82 |

% |

Yield on loans receivable (1) |

|

10.44 |

% |

|

11.43 |

% |

|

11.23 |

% |

|

10.85 |

% |

|

10.71 |

% |

|

10.99 |

% |

|

10.60 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of funds (1) |

|

3.24 |

% |

|

3.62 |

% |

|

3.60 |

% |

|

3.52 |

% |

|

3.39 |

% |

|

3.49 |

% |

|

2.91 |

% |

Cost of deposits (1) |

|

3.21 |

% |

|

3.59 |

% |

|

3.58 |

% |

|

3.49 |

% |

|

3.36 |

% |

|

3.46 |

% |

|

2.87 |

% |

Net interest margin (1) |

|

6.65 |

% |

|

7.41 |

% |

|

7.13 |

% |

|

6.78 |

% |

|

6.61 |

% |

|

6.99 |

% |

|

7.10 |

% |

Noninterest expense to average assets (1) |

|

6.23 |

% |

|

6.54 |

% |

|

6.14 |

% |

|

6.04 |

% |

|

5.56 |

% |

|

6.24 |

% |

|

5.90 |

% |

Noninterest income to average assets (1) |

|

7.45 |

% |

|

7.98 |

% |

|

7.30 |

% |

|

9.38 |

% |

|

6.95 |

% |

|

8.00 |

% |

|

5.97 |

% |

| Efficiency ratio |

|

44.81 |

% |

|

43.10 |

% |

|

43.19 |

% |

|

37.88 |

% |

|

41.58 |

% |

|

42.21 |

% |

|

45.92 |

% |

Loans receivable to deposits (2) |

|

97.82 |

% |

|

94.46 |

% |

|

93.88 |

% |

|

92.42 |

% |

|

90.05 |

% |

|

97.8 |

% |

|

90.1 |

% |

(1)Annualized calculations shown for quarterly periods presented.

(2)Includes loans held for sale.

Management Outlook; CEO Eric Sprink

“As we look forward to 2025, our strategy involves selectively expanding our current base of CCBX partners while continuing to invest in and enhance our technology and risk management infrastructure. This will enable us to support the next phase of growth within CCBX more efficiently. Additionally, we are focused on growing noninterest income through increased transaction activity and new product offerings with our established partners. We plan to continue selling credit card loans while retaining a portion of the fee income for our role in processing transactions, which offers an additional source of noninterest income without adding on-balance-sheet risk. We believe that by increasing noninterest income, we can mitigate the uncertainties associated with fluctuating interest rates and provide a more stable income stream in the future.” said CEO Eric Sprink.

Coastal Financial Corporation Overview

The Company has one main subsidiary, the Bank which consists of three segments: CCBX, the community bank and treasury & administration. The CCBX segment includes all of our BaaS activities, the community bank segment includes all community banking activities, and the treasury & administration segment includes treasury management, overall administration and all other aspects of the Company.

CCBX Performance Update

Our CCBX segment continues to evolve, and we have 24 relationships, at varying stages, including three signed letters of intent as of December 31, 2024. We continue to refine the criteria for CCBX partnerships, exploring relationships with larger more established partners, with experienced management teams, existing customer bases and strong financial positions and will continue to exit relationships where it makes sense for us to do so.

As we explore relationships with new partners we plan to continue expanding product offerings with our existing CCBX partners. As we become more proficient in the BaaS space we aim to cultivate new relationships that align with our long-term goals. We believe that a strategy of adding new partnerships and launching new products with existing partners positions us to reach a wide and established customer base with a modest increase in regulatory risk given that we have already vetted existing partners and have an operational history. Increases in partner activity/transaction counts is positively impacting noninterest income and we expect that trend to continue as products launched earlier in the year gain traction. We plan to continue selling loans as part of our strategy to balance partner and lending limits, and manage the loan portfolio and credit quality.

We retain a portion of the fee income for our role in processing transactions on sold credit card balances, and plan to continue this strategy to provide an on-going and passive revenue stream with no on balance sheet risk.

The following table illustrates the activity and evolution in CCBX relationships for the periods presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

| (unaudited) |

December 31, 2024 |

September 30,

2024 |

December 31, 2023 |

| Active |

19 |

19 |

19 |

| Friends and family / testing |

1 |

1 |

1 |

| Implementation / onboarding |

1 |

1 |

1 |

| Signed letters of intent |

3 |

1 |

0 |

| Wind down - active but preparing to exit relationship |

0 |

0 |

0 |

| Total CCBX relationships |

24 |

22 |

21 |

CCBX loans increased $82.3 million, or 5.4%, to $1.60 billion despite selling $845.5 million loans during the three months ended December 31, 2024. In accordance with the program agreement for one partner, effective April 1, 2024, the portion of the CCBX portfolio that we are responsible for losses on decreased from 10% to 5%. At December 31, 2024 the portion of this portfolio for which we are responsible represented $20.6 million in loans.

The following table details the CCBX loan portfolio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CCBX |

|

As of |

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| (dollars in thousands; unaudited) |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

| Commercial and industrial loans: |

|

|

|

|

|

|

|

|

|

|

|

|

| Capital call lines |

|

$ |

109,017 |

|

|

6.8 |

% |

|

$ |

103,924 |

|

|

6.8 |

% |

|

$ |

87,494 |

|

|

7.3 |

% |

All other commercial & industrial loans |

|

33,961 |

|

|

2.1 |

|

|

36,494 |

|

|

2.4 |

|

|

54,298 |

|

|

4.5 |

|

| Real estate loans: |

|

|

|

|

|

|

|

|

|

|

|

|

| Residential real estate loans |

|

267,707 |

|

|

16.7 |

|

|

265,402 |

|

|

17.5 |

|

|

238,035 |

|

|

19.9 |

|

| Consumer and other loans: |

|

|

|

|

|

|

|

|

|

|

|

|

| Credit cards |

|

528,554 |

|

|

33.0 |

|

|

633,691 |

|

|

41.6 |

|

|

505,837 |

|

|

42.3 |

|

| Other consumer and other loans |

|

664,780 |

|

|

41.4 |

|

|

482,228 |

|

|

31.7 |

|

|

310,574 |

|

|

26.0 |

|

| Gross CCBX loans receivable |

|

1,604,019 |

|

|

100.0 |

% |

|

1,521,739 |

|

|

100.0 |

% |

|

1,196,238 |

|

|

100.0 |

% |

| Net deferred origination (fees) costs |

|

(442) |

|

|

|

|

(447) |

|

|

|

|

(300) |

|

|

|

| Loans receivable |

|

$ |

1,603,577 |

|

|

|

|

$ |

1,521,292 |

|

|

|

|

$ |

1,195,938 |

|

|

|

Loan Yield - CCBX (1)(2) |

|

15.28 |

% |

|

|

|

17.35 |

% |

|

|

|

17.36 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)CCBX yield does not include the impact of BaaS loan expense. BaaS loan expense represents the amount paid or payable to partners for credit enhancements and originating & servicing CCBX loans. See reconciliation of the non-GAAP measures at the end of this earnings release for the impact of BaaS loan expense on CCBX loan yield.

(2)Loan yield is annualized for the three months ended for each period presented and includes loans held for sale and nonaccrual loans.

The increase in CCBX loans in the quarter ended December 31, 2024, includes an increase of $77.4 million or 6.9%, in consumer and other loans, an increase of $5.1 million, or 4.9%, in capital call lines as a result of normal balance fluctuations and business activities, and an increase of $2.3 million, or 0.9%, in residential real estate loans. We continue to monitor and manage the CCBX loan portfolio, and sold $845.5 million in CCBX loans during the quarter ended December 31, 2024 compared to sales of $423.7 million in the quarter ended September 30, 2024. We continue to reposition ourselves by managing CCBX credit and concentration levels in an effort to optimize our loan portfolio and generate off balance sheet fee income.

CCBX loan yield decreased 2.06% for the quarter ended December 31, 2024 compared to the quarter ended September 30, 2024 as a result of our widening the scope of loans that we are moving to nonaccrual, which decreased loan interest income in the quarter ended December 31, 2024. Also contributing to the decrease are lower interest rates on new CCBX loans, which are replacing higher risk and higher rate loans that have paid off or were sold as part of our strategy to manage the loan portfolio and credit quality.

The recent decrease in the Fed funds interest rate further contributed to the change.

The following chart show the growth in credit card accounts that we are able to generate fee income from. This includes accounts with balances, which are included in our loan totals, and accounts that have been sold and have no corresponding balance in our loan totals, but that we are still able to generate fee income on.

The following table details the CCBX deposit portfolio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| CCBX |

|

As of |

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| (dollars in thousands; unaudited) |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

| Demand, noninterest bearing |

|

$ |

55,686 |

|

|

2.7 |

% |

|

$ |

60,655 |

|

|

2.9 |

% |

|

$ |

63,630 |

|

|

3.4 |

% |

Interest bearing demand and

money market |

|

1,958,459 |

|

|

94.9 |

|

|

1,991,858 |

|

|

94.6 |

|

|

1,794,168 |

|

|

96.3 |

|

| Savings |

|

5,710 |

|

|

0.3 |

|

|

5,204 |

|

|

0.3 |

|

|

4,964 |

|

|

0.3 |

|

| Total core deposits |

|

2,019,855 |

|

|

97.9 |

|

|

2,057,717 |

|

|

97.8 |

|

|

1,862,762 |

|

|

100.0 |

|

| Other deposits |

|

44,233 |

|

|

2.1 |

|

|

47,046 |

|

|

2.2 |

|

|

— |

|

|

— |

|

| Total CCBX deposits |

|

$ |

2,064,088 |

|

|

100.0 |

% |

|

$ |

2,104,763 |

|

|

100.0 |

% |

|

$ |

1,862,762 |

|

|

100.0 |

% |

Cost of deposits (1) |

|

4.19 |

% |

|

|

|

4.82 |

% |

|

|

|

4.90 |

% |

|

|

(1)Cost of deposits is annualized for the three months ended for each period presented.

CCBX deposits decreased $40.7 million, or 1.9%, in the three months ended December 31, 2024 to $2.06 billion as a result of normal balance fluctuations. This excludes the $273.2 million in CCBX deposits that were transferred off balance sheet for increased Federal Deposit Insurance Corporation ("FDIC") insurance coverage and sweep purposes, compared to $214.5 million for the quarter ended September 30, 2024. Amounts in excess of FDIC insurance coverage are transferred, using a third party facilitator/vendor sweep product, to participating financial institutions.

Community Bank Performance Update

In the quarter ended December 31, 2024, the community bank saw net loans decrease $14.6 million, or 0.8%, to $1.88 billion.

The following table details the Community Bank loan portfolio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Community Bank |

|

As of |

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| (dollars in thousands; unaudited) |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Commercial and industrial loans |

|

$ |

150,395 |

|

|

8.0 |

% |

|

$ |

152,161 |

|

|

8.0 |

% |

|

$ |

149,502 |

|

|

8.2 |

% |

| Real estate loans: |

|

|

|

|

|

|

|

|

|

|

|

|

| Construction, land and land development loans |

|

148,198 |

|

|

7.8 |

|

|

163,051 |

|

|

8.6 |

|

|

157,100 |

|

|

8.5 |

|

| Residential real estate loans |

|

202,064 |

|

|

10.7 |

|

|

212,467 |

|

|

11.2 |

|

|

225,391 |

|

|

12.3 |

|

| Commercial real estate loans |

|

1,374,801 |

|

|

72.8 |

|

|

1,362,452 |

|

|

71.5 |

|

|

1,303,533 |

|

|

70.9 |

|

| Consumer and other loans: |

|

|

|

|

|

|

|

|

|

|

|

|

| Other consumer and other loans |

|

13,542 |

|

|

0.7 |

|

|

14,173 |

|

|

0.7 |

|

|

1,628 |

|

|

0.1 |

|

| Gross Community Bank loans receivable |

|

1,889,000 |

|

|

100.0 |

% |

|

1,904,304 |

|

|

100.0 |

% |

|

1,837,154 |

|

|

100.0 |

% |

| Net deferred origination fees |

|

(6,012) |

|

|

|

|

(6,764) |

|

|

|

|

(7,000) |

|

|

|

| Loans receivable |

|

$ |

1,882,988 |

|

|

|

|

$ |

1,897,540 |

|

|

|

|

$ |

1,830,154 |

|

|

|

Loan Yield(1) |

|

6.53 |

% |

|

|

|

6.64 |

% |

|

|

|

6.32 |

% |

|

|

(1)Loan yield is annualized for the three months ended for each period presented and includes loans held for sale and nonaccrual loans.

Community bank loans decreased $14.9 million in construction, land and land development loans, decreased $1.8 million in commercial and industrial loans and decreased $631,000 in consumer and other loans, and were partially offset by an increase in commercial real estate loans of $12.3 million during the quarter ended December 31, 2024.

The following table details the community bank deposit portfolio:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Community Bank |

|

As of |

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| (dollars in thousands; unaudited) |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

|

Balance |

|

% to Total |

| Demand, noninterest bearing |

|

$ |

471,838 |

|

|

31.0 |

% |

|

$ |

518,772 |

|

|

34.1 |

% |

|

$ |

561,572 |

|

|

37.5 |

% |

Interest bearing demand and

money market |

|

570,625 |

|

|

37.5 |

|

|

552,108 |

|

|

36.3 |

|

|

846,072 |

|

|

56.5 |

|

| Savings |

|

61,116 |

|

|

4.0 |

|

|

62,272 |

|

|

4.1 |

|

|

71,598 |

|

|

4.8 |

|

| Total core deposits |

|

1,103,579 |

|

|

72.5 |

|

|

1,133,152 |

|

|

74.5 |

|

|

1,479,242 |

|

|

98.8 |

|

| Other deposits |

|

400,118 |

|

|

26.3 |

|

|

373,681 |

|

|

24.5 |

|

|

1 |

|

|

0.0 |

|

| Time deposits less than $100,000 |

|

5,920 |

|

|

0.4 |

|

|

6,305 |

|

|

0.4 |

|

|

8,109 |

|

|

0.5 |

|

| Time deposits $100,000 and over |

|

11,627 |

|

|

0.8 |

|

|

9,387 |

|

|

0.6 |

|

|

10,249 |

|

|

0.7 |

|

| Total Community Bank deposits |

|

$ |

1,521,244 |

|

|

100.0 |

% |

|

$ |

1,522,525 |

|

|

100.0 |

% |

|

$ |

1,497,601 |

|

|

100.0 |

% |

Cost of deposits(1) |

|

1.86 |

% |

|

|

|

1.92 |

% |

|

|

|

1.57 |

% |

|

|

(1)Cost of deposits is annualized for the three months ended for each period presented.

Community bank deposits decreased $1.3 million, or 0.1%, during the three months ended December 31, 2024 to $1.52 billion as result of normal balance fluctuations. The community bank segment includes noninterest bearing deposits of $471.8 million, or 31.0%, of total community bank deposits, resulting in a cost of deposits of 1.86%, which compared to 1.92% for the quarter ended September 30, 2024, largely due to the decreases in the Fed funds rate late in the third quarter and during the fourth quarter of 2024. The cost of community bank deposits are projected to decline further as the Fed funds rate had a decrease of 0.25%, which occurred in December 2024 and the full quarterly effect of that decrease will not be recognized until the first quarter of 2025.

Net Interest Income and Margin Discussion

Net interest income was $66.5 million for the quarter ended December 31, 2024, a decrease of $5.7 million, or 7.9%, from $72.2 million for the quarter ended September 30, 2024, and an increase of $6.9 million, or 11.5%, from $59.7 million for the quarter ended December 31, 2023. The decrease in net interest income compared to September 30, 2024, was a result of a decrease in average loans receivable as a result of selling $845.5 million in CCBX loans during the quarter ended December 31, 2024, the recent decrease in the Fed funds interest rate, and continued enhancements to our partner credit practices that resulted in a reduction of interest income on loans. The increase in net interest income compared to December 31, 2023 was largely related to increased yield on loans resulting from higher interest rates and growth in higher yielding loans, partially offset by an increase in cost of funds relating to higher interest rates and growth in interest bearing deposits.

Net interest margin was 6.65% for the three months ended December 31, 2024, compared to 7.41% for the three months ended September 30, 2024, largely due to lower loan yield. Net interest margin, net of BaaS loan expense, (A reconciliation of the non-GAAP measures are set forth in the Non-GAAP Financial Measures section of this earnings release.) was 4.16% for the three months ended December 31, 2024, compared to 4.06% for the three months ended September 30, 2024. Net interest margin was 6.61% for the three months ended December 31, 2023. The increase in net interest margin for the three months ended December 31, 2024 compared to the three months ended December 31, 2023 was largely due to an increase in loan yield, partially offset by higher interest rates on interest bearing deposits. Interest and fees on loans receivable decreased $9.9 million, or 9.9%, to $89.7 million for the three months ended December 31, 2024, compared to $99.6 million for the three months ended September 30, 2024, as a result of loan sales and a decrease in the Fed funds interest rate. Additionally, as we continue to refine our credit approach with partners, we are widening the scope of loans that we are moving to nonaccrual which decreased interest income in the quarter ended December 31, 2024 and lowered loan yield and net interest margin; however this also decreased BaaS loan expense (which is in noninterest expense) resulting in no impact to net income. Interest and fees on loans receivable increased $8.6 million, or 10.5%, compared to $81.2 million for the three months ended December 31, 2023, due to an increase in outstanding balances and higher interest rates. Net interest margin, net of Baas loan expense (A reconciliation of the non-GAAP measures are set forth in the Non-GAAP Financial Measures section of this earnings release.) increased 0.10% for the three months ended December 31, 2024, compared to the three months ended September 30, 2024 and increased 0.25% compared the three months ended December 31, 2023.

The following tables illustrate how net interest margin and loan yield is affected by BaaS loan expense:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

|

As of and for the Three Months Ended |

As of and for the Twelve Months Ended |

| (dollars in thousands; unaudited) |

|

December 31

2024 |

|

September 30

2024 |

|

December 31

2023 |

December 31

2024 |

|

December 31

2023 |

| Net interest margin, net of BaaS loan expense: |

|

|

|

|

|

|

|

Net interest margin (1) |

|

6.65 |

% |

|

7.41 |

% |

|

6.61 |

% |

6.99 |

% |

|

7.10 |

% |

| Earning assets |

|

3,980,078 |

|

3,875,911 |

|

3,581,772 |

3,802,275 |

|

3,364,406 |

| Net interest income (GAAP) |

|

66,516 |

|

72,187 |

|

59,657 |

265,876 |

|

238,727 |

| Less: BaaS loan expense |

|

|

(24,859) |

|

|

|

(32,612) |

|

|

|

(24,310) |

|

(111,384) |

|

|

(86,900) |

Net interest income, net of BaaS loan expense(2) |

|

$ |

41,657 |

|

$ |

39,575 |

|

$ |

35,347 |

$ |

154,492 |

|

$ |

151,827 |

Net interest margin, net of BaaS loan expense (1)(2) |

|

4.16 |

% |

|

4.06 |

% |

|

3.92 |

% |

4.06 |

% |

|

4.51 |

% |

| Loan income net of BaaS loan expense divided by average loans: |

|

|

|

|

|

Loan yield (GAAP)(1) |

|

10.44 |

% |

|

11.43 |

% |

|

10.71 |

% |

10.99 |

% |

|

10.60 |

% |

| Total average loans receivable |

|

$ |

3,419,476 |

|

$ |

3,464,871 |

|

$ |

3,007,289 |

$ |

3,320,582 |

|

$ |

2,936,908 |

| Interest and earned fee income on loans (GAAP) |

|

89,714 |

|

99,590 |

|

81,159 |

364,869 |

|

311,441 |

| BaaS loan expense |

|

|

(24,859) |

|

|

(32,612) |

|

(24,310) |

|

(111,384) |

|

|

(86,900) |

Net loan income(2) |

|

$ |

64,855 |

|

$ |

66,978 |

|

$ |

56,849 |

$ |

253,485 |

|

$ |

224,541 |

Loan income, net of BaaS loan expense, divided by average loans (1)(2) |

|

7.55 |

% |

|

7.69 |

% |

|

7.50 |

% |

7.63 |

% |

|

7.65 |

% |

(1) Annualized calculations shown for periods presented.

(2) A reconciliation of the non-GAAP measures are set forth at the end of this earnings release.

Average investment securities decreased $820,000 to $48.2 million compared to the three months ended September 30, 2024 and decreased $101.5 million compared to the three months ended December 31, 2023 as a result of principal paydowns and maturing securities.

Cost of funds was 3.24% for the quarter ended December 31, 2024, a decrease of 38 basis points from the quarter ended September 30, 2024 and a decrease of 16 basis points from the quarter ended December 31, 2023. Cost of deposits for the quarter ended December 31, 2024 was 3.21%, compared to 3.59% for the quarter ended September 30, 2024, and 3.36% for the quarter ended December 31, 2023. The decreased cost of funds and deposits compared to September 30, 2024 and December 31, 2023 was largely due to the recent reductions in the Fed funds rate.

The following table summarizes the average yield on loans receivable and cost of deposits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

Yield on

Loans (2)

|

|

Cost of

Deposits (2)

|

|

Yield on

Loans (2)

|

|

Cost of

Deposits (2)

|

|

Yield on

Loans (2)

|

|

Cost of

Deposits (2)

|

| Community Bank |

6.53% |

|

1.86% |

|

6.64% |

|

1.92% |

|

6.32% |

|

1.57% |

CCBX (1) |

15.28% |

|

4.19% |

|

17.35% |

|

4.82% |

|

17.36% |

|

4.90% |

| Consolidated |

10.44% |

|

3.21% |

|

11.43% |

|

3.59% |

|

10.71% |

|

3.36% |

(1)Annualized calculations for periods shown for credit and fraud enhancements and originating & servicing CCBX loans. To determine Net BaaS loan income earned from CCBX loan relationships, the Company takes BaaS loan interest income and deducts BaaS loan expense to arrive at Net BaaS loan income which can be compared to interest income on the Company’s community bank loans. See reconciliation of the non-GAAP measures at the end of this earnings release for the impact of BaaS loan expense on CCBX loan yield.

(2)Annualized calculations for periods shown.

The following table illustrates how BaaS loan interest income is affected by BaaS loan expense resulting in net BaaS loan income and the associated yield:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended |

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| (dollars in thousands, unaudited) |

|

Income / Expense |

|

Income / expense divided by average CCBX loans (2) |

|

Income / Expense |

|

Income / expense divided by average CCBX loans(2) |

|

Income / Expense |

|

Income / expense divided by average CCBX loans (2) |

| BaaS loan interest income |

|

$ |

58,671 |

|

|

15.28 |

% |

|

$ |

67,692 |

|

|

17.35 |

% |

|

$ |

52,327 |

|

|

17.36 |

% |

| Less: BaaS loan expense |

|

24,859 |

|

|

6.48 |

% |

|

32,612 |

|

|

8.36 |

% |

|

24,310 |

|

|

8.06 |

% |

Net BaaS loan income (1) |

|

$ |

33,812 |

|

|

8.81 |

% |

|

$ |

35,080 |

|

|

8.99 |

% |

|

$ |

28,017 |

|

|

9.30 |

% |

Average BaaS Loans(3) |

|

$ |

1,527,178 |

|

|

|

|

$ |

1,552,443 |

|

|

|

|

$ |

1,196,137 |

|

|

|

(1) A reconciliation of the non-GAAP measures are set forth at the end of this earnings release.

(2) Annualized calculations shown for quarterly periods presented.

(3) Includes loans held for sale.

Noninterest Income Discussion

Noninterest income was $76.8 million for the three months ended December 31, 2024, a decrease of $3.3 million from $80.1 million for the three months ended September 30, 2024, and an increase of $12.1 million from $64.7 million for the three months ended December 31, 2023. The decrease in noninterest income for the quarter ended December 31, 2024 as compared to the quarter ended September 30, 2024 was primarily due to a decrease of $3.3 million in total BaaS income. The $3.3 million decrease in total BaaS income included an $8.0 million decrease in BaaS credit enhancements related to the provision for credit losses, partially offset by a a $3.0 million increase in BaaS fraud enhancements and an increase of $1.8 million in BaaS program income. The $1.8 million increase in BaaS program income is largely due to higher reimbursement of expenses as well as an increase in transaction fees and interchange fees, our primary BaaS source for recurring fee income, as well as higher reimbursement of expenses (see “Appendix B” for more information on the accounting for BaaS allowance for credit losses and credit and fraud enhancements).

The $12.1 million increase in noninterest income over the quarter ended December 31, 2023 was primarily due to a $7.9 million increase in BaaS credit and fraud enhancements and an increase of $3.8 million in BaaS program income.

Noninterest Expense Discussion

Total noninterest expense decreased $1.4 million to $64.2 million for the three months ended December 31, 2024, compared to $65.6 million for the three months ended September 30, 2024, and increased $12.5 million from $51.7 million for the three months ended December 31, 2023. The decrease in noninterest expense for the quarter ended December 31, 2024, as compared to the quarter ended September 30, 2024, was primarily due to a $4.8 million decrease in BaaS expense from a $7.8 million decrease in BaaS loan expense, partially offset by a $3.0 million increase in BaaS fraud expense. BaaS loan expense represents the amount paid or payable to partners for credit enhancements, fraud enhancements, and originating & servicing CCBX loans. BaaS fraud expense represents non-credit fraud losses on partner’s customer loan and deposit accounts. A portion of this expense is realized during the quarter in which the loss occurs, and a portion is estimated based on historical or other information from our partners. Other variances that partially offset the net decrease in noninterest expense include an increase of $1.4 million in point of sale expenses as a result of increased partner transaction activity, an increase of $893,000 in salaries and employee benefits and an increase of $1.0 million in legal and professional fees as part of our continued investments in technology and risk management.

The increase in noninterest expenses for the quarter ended December 31, 2024 compared to the quarter ended December 31, 2023 was largely due to an increase of $4.8 million in BaaS partner expense primarily from a $4.3 million increase in BaaS fraud expense, a $549,000 increase in BaaS loan expense, a $2.0 million increase in legal and professional expenses, a $1.8 million increase in point of sale expenses, a $1.5 million increase in salary and employee benefits, and a $1.2 million increase in data processing and software licenses due to enhancements in technology.

Certain noninterest expenses are reimbursed by our CCBX partners. In accordance with GAAP we recognize all expenses in noninterest expense and all reimbursement of expenses from our CCBX partner in noninterest income. The following table reflects the portion of noninterest expenses that are reimbursed by partners to assist the understanding of how the increases in noninterest expense are related to expenses incurred for and reimbursed by CCBX partners:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

December 31, |

|

September 30, |

|

December 31, |

| (dollars in thousands; unaudited) |

|

2024 |

|

2024 |

|

2023 |

| Total noninterest expense (GAAP) |

|

$ |

64,206 |

|

|

$ |

65,616 |

|

|

$ |

51,703 |

|

| Less: BaaS loan expense |

|

24,859 |

|

|

32,612 |

|

|

24,310 |

|

| Less: BaaS fraud expense |

|

5,043 |

|

|

2,084 |

|

|

779 |

|

| Less: Reimbursement of expenses (Baas) |

|

3,468 |

|

|

1,843 |

|

|

1,076 |

|

|

Noninterest expense, net of Baas loan expense, BaaS fraud expense

and reimbursement of expenses (BaaS) (1)

|

|

$ |

30,836 |

|

|

$ |

29,077 |

|

|

$ |

25,538 |

|

(1) A reconciliation of the non-GAAP measures are set forth at the end of this earnings release.

Provision for Income Taxes

The provision for income taxes was $3.8 million for the three months ended December 31, 2024, $2.9 million for the three months ended September 30, 2024 and $2.8 million for the fourth quarter of 2023. The income tax provision was higher for the three months ended December 31, 2024 compared to the quarter ended September 30, 2024 as a result of the deductibility of certain equity awards which reduced tax expense during the quarter ended September 30, 2024 compared to the quarter ended December 31, 2024 despite net income being higher fairly even, and higher than the quarter ended December 31, 2023, primarily due to higher net income compared to that quarter, partially offset by the deductibility of certain equity awards.

The Company is subject to various state taxes that are assessed as CCBX activities and employees expand into other states, which has increased the overall tax rate used in calculating the provision for income taxes in the current and future periods. The Company uses a federal statutory tax rate of 21.0% as a basis for calculating provision for federal income taxes and 2.63% for calculating the provision for state income taxes.

Financial Condition Overview

Total assets increased $55.4 million, or 1.4%, to $4.12 billion at December 31, 2024 compared to $4.07 billion at September 30, 2024. The increase is primarily due to stronger loan growth, partially offset by lower cash balances. Total loans receivable increased $67.7 million to $3.49 billion at December 31, 2024, from $3.42 billion at September 30, 2024.

As of December 31, 2024, the Company had the capacity to borrow up to a total of $642.1 million from the Federal Reserve Bank discount window and Federal Home Loan Bank, and an additional $50.0 million from a correspondent bank. There were no borrowings outstanding on these lines as of December 31, 2024.

The Company completed a $98.0 million capital raise during the quarter ended December 31, 2024. After contributing $50.0 million to the Bank, the Company had a cash balance of $47.7 million as of December 31, 2024, which is retained for general operating purposes, including debt repayment, and for funding $480,000 in commitments to bank technology investment funds.

Uninsured deposits were $543.0 million as of December 31, 2024, compared to $542.2 million as of September 30, 2024.

Total shareholders’ equity as of December 31, 2024 increased $106.8 million since September 30, 2024. The increase in shareholders’ equity was primarily due to an increase of $93.4 million in common stock outstanding as a result of the aforementioned capital raise and, to a lessor extent, equity awards exercised during the three months ended December 31, 2024 combined with $13.4 million in net earnings.

The Company and the Bank remained well capitalized at December 31, 2024, as summarized in the following table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

Coastal Community Bank |

|

Coastal Financial Corporation |

|

Minimum Well Capitalized Ratios under Prompt Corrective Action (1) |

| Tier 1 Leverage Capital (to average assets) |

|

10.64 |

% |

|

10.78 |

% |

|

5.00 |

% |

|

|

|

|

|

|

|

| Common Equity Tier 1 Capital (to risk-weighted assets) |

|

11.99 |

% |

|

12.04 |

% |

|

6.50 |

% |

| Tier 1 Capital (to risk-weighted assets) |

|

11.99 |

% |

|

12.14 |

% |

|

8.00 |

% |

| Total Capital (to risk-weighted assets) |

|

13.28 |

% |

|

14.67 |

% |

|

10.00 |

% |

(1) Presents the minimum capital ratios for an insured depository institution, such as the Bank, to be considered well capitalized under the Prompt Corrective Action framework. The minimum requirements for the Company to be considered well capitalized under Regulation Y include to maintain, on a consolidated basis, a total risk-based capital ratio of 10.0 percent or greater and a tier 1 risk-based capital ratio of 6.0 percent or greater.

Asset Quality

The total allowance for credit losses was $177.0 million and 5.08% of loans receivable at December 31, 2024 compared to $170.3 million and 4.98% at September 30, 2024 and $117.0 million and 3.86% at December 31, 2023. The allowance for credit loss allocated to the CCBX portfolio was $158.1 million and 9.86% of CCBX loans receivable at December 31, 2024, with $18.9 million of allowance for credit loss allocated to the community bank or 1.00% of total community bank loans receivable.

The following table details the allocation of the allowance for credit loss as of the period indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of December 31, 2024 |

|

As of September 30, 2024 |

|

As of December 31, 2023 |

| (dollars in thousands; unaudited) |

|

Community Bank |

|

CCBX |

|

Total |

|

Community Bank |

|

CCBX |

|

Total |

|

Community Bank |

|

CCBX |

|

Total |

| Loans receivable |

|

$ |

1,882,988 |

|

|

$ |

1,603,577 |

|

|

$ |

3,486,565 |

|

|

$ |

1,897,540 |

|

|

$ |

1,521,292 |

|

|

$ |

3,418,832 |

|

|

$ |

1,830,154 |

|

|

$ |

1,195,938 |

|

|

$ |

3,026,092 |

|

Allowance for

credit losses |

|

(18,924) |

|

|

(158,070) |

|

|

(176,994) |

|

|

(20,132) |

|

|

(150,131) |

|

|

(170,263) |

|

|

(21,595) |

|

|

(95,363) |

|

|

(116,958) |

|

Allowance for

credit losses to

total loans

receivable |

|

1.00 |

% |

|

9.86 |

% |

|

5.08 |

% |

|

1.06 |

% |

|

9.87 |

% |

|

4.98 |

% |

|

1.18 |

% |

|

7.97 |

% |

|

3.86 |

% |

Net charge-offs totaled $55.9 million for the quarter ended December 31, 2024, compared to $49.2 million for the quarter ended September 30, 2024 and $44.9 million for the quarter ended December 31, 2023. Net charge-offs as a percent of average loans increased to 6.51% for the quarter ended December 31, 2024 compared to 5.65% for the quarter ended September 30, 2024. CCBX partner agreements provide for a credit enhancement that covers the net-charge-offs on CCBX loans and negative deposit accounts by indemnifying or reimbursing incurred losses, except in accordance with the program agreement for one partner where the Company was responsible for credit losses on approximately 5% of a $324.6 million loan portfolio. At December 31, 2024, our portion of this portfolio represented $20.6 million in loans. Net charge-offs for this $20.6 million in loans were $1.1 million for the three months ended December 31, 2024, compared to $1.1 million for the three months ended September 30, 2024 and $1.5 million for the three months ended December 31, 2023.

The following table details net charge-offs for the community bank and CCBX for the period indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

| (dollars in thousands; unaudited) |

|

Community Bank |

|

CCBX |

|

Total |

|

Community Bank |

|

CCBX |

|

Total |

|

Community Bank |

|

CCBX |

|

Total |

| Gross charge-offs |

|

$ |

139 |

|

|

$ |

61,446 |

|

|

$ |

61,585 |

|

|

$ |

398 |

|

|

$ |

52,907 |

|

|

$ |

53,305 |

|

|

$ |

2 |

|

|

$ |

47,650 |

|

|

$ |

47,652 |

|

| Gross recoveries |

|

(3) |

|

|

(5,643) |

|

|

(5,646) |

|

|

(3) |

|

|

(4,066) |

|

|

(4,069) |

|

|

(4) |

|

|

(2,777) |

|

|

(2,781) |

|

| Net charge-offs |

|

$ |

136 |

|

|

$ |

55,803 |

|

|

$ |

55,939 |

|

|

$ |

395 |

|

|

$ |

48,841 |

|

|

$ |

49,236 |

|

|

$ |

(2) |

|

|

$ |

44,873 |

|

|

$ |

44,871 |

|

|

Net charge-offs to

average loans (1)

|

|

0.03 |

% |

|

14.54 |

% |

|

6.51 |

% |

|

0.08 |

% |

|

12.52 |

% |

|

5.65 |

% |

|

0.00 |

% |

|

14.88 |

% |

|

5.92 |

% |

(1) Annualized calculations shown for periods presented.

During the quarter ended December 31, 2024, a $63.7 million provision for credit losses was recorded for CCBX partner loans, compared to the $72.1 million provision for credit losses was recorded for CCBX partner loans for the quarter ended September 30, 2024, the provision was based on management's analysis, bringing the CCBX allowance for credit losses to $158.1 million at December 31, 2024 compared to $150.1 million at September 30, 2024. The increase in the allowance is due to the addition of new loans, partially offset by loan sales. CCBX loans have a higher level of expected losses than our community bank loans, which is reflected in the factors for the allowance for credit losses. Agreements with our CCBX partners provide for a credit enhancement which protects the Bank by indemnifying or reimbursing incurred losses.

In accordance with accounting guidance, we estimate and record a provision for expected losses for these CCBX loans and reclassified negative deposit accounts. When the provision for CCBX credit losses and provision for unfunded commitments is recorded, a credit enhancement asset is also recorded on the balance sheet through noninterest income (BaaS credit enhancements). Expected losses are recorded in the allowance for credit losses. The credit enhancement asset is relieved when credit enhancement recoveries are received from the CCBX partner. If our partner is unable to fulfill their contracted obligations then the Bank could be exposed to additional credit losses. Management regularly evaluates and manages this counterparty risk.

The factors used in management’s analysis for community bank credit losses indicated that a provision recapture of $1.1 million and was needed for the quarter ended December 31, 2024 compared to a provision recapture of $519,000 and provision of $277,000 for the quarters ended September 30, 2024 and December 31, 2023, respectively. The recapture in the current period was due to the decrease in the community bank loan portfolio combined with an improvement in the forward look, which is driven by the future projected unemployment and GDP curves, which flattened since last quarter, lessening the impact of this factor.

The following table details the provision expense/(recapture) for the community bank and CCBX for the period indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| (dollars in thousands; unaudited) |

|

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

| Community bank |

|

$ |

(1,071) |

|

|

$ |

(519) |

|

|

$ |

277 |

|

| CCBX |

|

63,741 |

|

|

72,104 |

|

|

60,467 |

|

| Total provision expense |

|

$ |

62,670 |

|

|

$ |

71,585 |

|

|

$ |

60,744 |

|

A recapture for unfunded commitments of $803,000 was recorded for the quarter ended December 31, 2024 as a result of a decrease in the overall available balance combined with an improvement in the reserve rates.

At December 31, 2024, our nonperforming assets were $62.7 million, or 1.52%, of total assets, compared to $66.4 million, or 1.63%, of total assets, at September 30, 2024, and $53.8 million, or 1.43%, of total assets, at December 31, 2023. These ratios are impacted by nonperforming CCBX loans that are covered by CCBX partner credit enhancements. As of December 31, 2024, $60.8 million of the $62.6 million in nonperforming CCBX loans were covered by CCBX partner credit enhancements described above.

Nonperforming assets decreased $3.7 million during the quarter ended December 31, 2024, compared to the quarter ended September 30, 2024. This change is due to a decrease in CCBX and community bank nonaccrual loans. Community bank nonperforming loans decreased $1.0 million from September 30, 2024 to $100,000 as of December 31, 2024, and CCBX nonperforming loans decreased $2.7 million to $62.6 million from September 30, 2024. The decrease in CCBX nonperforming loans is due to an decrease of $570,000 in nonaccrual loans from September 30, 2024 to $19.5 million.

Some CCBX partners have a collection practice that places certain loans on nonaccrual status to improve collectability. $17.2 million of these loans are less than 90 days past due as of December 31, 2024. Additionally, there was a $2.2 million decrease in CCBX loans that are past due 90 days or more and still accruing interest. As a result of the type of loans (primarily consumer loans) originated through our CCBX partners we anticipate that balances 90 days past due or more and still accruing will generally increase as those loan portfolios grow. Installment/closed-end and revolving/open-end consumer loans originated through CCBX lending partners will continue to accrue interest until 120 and 180 days past due, respectively and are reported as substandard, 90 days or more days past due and still accruing. There were no repossessed assets or other real estate owned at December 31, 2024. Our nonperforming loans to loans receivable ratio was 1.80% at December 31, 2024, compared to 1.94% at September 30, 2024, and 1.78% at December 31, 2023.

For the quarter ended December 31, 2024, there were $136,000 community bank net charge-offs and $55.8 million in net charge-offs were recorded on CCBX loans. These CCBX loans have a higher level of expected losses than our community bank loans, which is reflected in the factors for the allowance for credit losses.

The following table details the Company’s nonperforming assets for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated |

As of |

| (dollars in thousands; unaudited) |

December 31,

2024 |

|

September 30,

2024 |

|

December 31,

2023 |

| Nonaccrual loans: |

|

|

|

|

|

| Commercial and industrial loans |

$ |

334 |

|

|

$ |

531 |

|

|

$ |

— |

|

| Real estate loans: |

|

|

|

|

|

|

|

|

|

|

|

| Residential real estate |

— |

|

|

44 |

|

|

170 |

|

| Commercial real estate |

— |

|

|

831 |

|

|

7,145 |

|

| Consumer and other loans: |

|

|

|

|

|

| Credit cards |

10,262 |

|

|

7,987 |

|

|

— |

|

| Other consumer and other loans |

8,967 |

|

|

11,713 |

|

|

— |

|

| Total nonaccrual loans |

19,563 |

|

|

21,106 |

|

|

7,315 |

|

| Accruing loans past due 90 days or more: |

|

|

|

|

|

Commercial & industrial loans |

1,006 |

|

|

1,566 |

|

|

2,086 |

|

| Real estate loans: |

|

|

|

|

|

| Residential real estate loans |

2,608 |

|

|

3,025 |

|

|

1,115 |

|

| Consumer and other loans: |

|

|

|

|

|

| Credit cards |

34,490 |

|

|

34,562 |

|

|

34,835 |

|

| Other consumer and other loans |

4,989 |

|

|

6,111 |

|

|

8,488 |

|

| Total accruing loans past due 90 days or more |

43,093 |

|

|

45,264 |

|

|

46,524 |

|