UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of February 2026

Commission File No. 001-42797

BULLISH

Office 101, 103, 105 Suite 70202, Unit 7A-2B, 2nd Floor

Building A, Block 7, 60 Nexus Way, Camana Bay,

George Town, Grand Cayman, Cayman Islands, KY1-9005

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On February 5, 2026, Bullish issued a press release titled “Bullish Reports Fourth Quarter 2025 Results.” A copy of the press release and the earnings presentation are furnished as Exhibits 99.1 and 99.2, respectively, to this report on Form 6-K.

INDEX TO EXHIBITS

|

Exhibit No. |

Description |

|

99.1 |

|

|

99.2 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

BULLISH |

||

|

Date: February 5, 2026 |

By: |

/s/ Jose A. Torres |

|

Jose A. Torres |

||

|

Chief Accounting Officer |

||

Exhibit 99.1

Bullish Reports Fourth Quarter 2025 Results

|

● |

Q4’2025 Digital asset sales of $64.3 billion and Net income of $(563.6) million |

|

● |

Bullish posts record Adjusted revenue, Adjusted EBITDA, and Adjusted net income for Q4’2025 |

|

● |

Bullish beats guided range on Subscription, services, & other revenue and in-line with guided range on Adjusted operating expense in Q4’2025 |

|

● |

Q4’2025 Adjusted revenue of $92.5 million and Adjusted EBITDA of $44.5 million |

|

● |

Bullish options trading surpasses $9B in options trading volume and reaches open interest high of $4B (open interest data through January 31, 2026) |

Cayman Islands, February 5, 2025 – Bullish (NYSE: BLSH), an institutionally focused global digital asset platform that provides market infrastructure and information services, today announced financial results for the fourth quarter ended December 31, 2025.

Tom Farley, CEO: “I believe that we are at a turning point for digital assets. For all of crypto’s extreme volatility and cyclicality, the vision of faster, better, cheaper, permissionless capital is being unlocked in real-time to bring everything onchain. What I envision immediately ahead for this industry - and, particularly for Bullish, is why I came to the digital assets space.”

David Bonanno, CFO: "I’m proud of our financial results for the quarter and the Full Year 2025, achieving record adjusted revenue growth and demonstrating our strong and expanding operating leverage; we look forward to building on our momentum in 2026.”

Q4 2025 Financial Highlights

All amounts compared to Q4 2024

|

- |

Digital asset sales were $64.3 billion vs. $66.0 billion |

|

- |

Net income (loss) was $(563.6) million or $(3.73) per diluted share vs. $158.5 million or $1.37 per diluted share |

|

- |

Adjusted revenue (non-IFRS) was $92.5 million vs. $55.2 million |

|

- |

Adjusted transaction revenue (non-IFRS) was $37.9 million vs. $41.0 million |

|

- |

Adjusted net income (non-IFRS) was $28.9 million vs. $4.0 million |

|

- |

Adjusted EBITDA (non-IFRS) was $44.5 million vs. $15.8 million |

Full Year 2025 Financial Highlights

All amounts compared to Full Year 2024

|

- |

Digital asset sales were $244.8 billion vs. $250.2 billion |

|

- |

Net income (loss) was $(785.5) million vs. $79.6 million |

|

- |

Adjusted revenue (non-IFRS) was $288.5 million vs. $213.9 million |

|

- |

Adjusted transaction revenue (non-IFRS) was $130.7 million vs. $153.2 million |

|

- |

Adjusted net income (non-IFRS) was $38.8 million vs. $9.6 million |

|

- |

Adjusted EBITDA (non-IFRS) was $94.3 million vs. $52.1 million |

Q4 2025 Key Business Metrics

Business Highlights

|

- |

Options Launch and Rapid Adoption: Surpassed $9B in options trading volume and reached an open interest high of $4B, establishing Bullish as the #2 exchange for BTC options open interest (open interest data through January 31, 2026) |

|

- |

ETP Strength: Established position as the #1 Indexer by market share for all indexers of digital assets, winning 15 of 39 digital asset focused ETF listings globally in 4Q’ 2025 |

|

- |

Liquidity Services Growth: Continued momentum from established and emerging asset issuers with new institutional partnerships, driving another quarter of record SS&O revenue |

|

- |

U.S. Regulatory: Secured Transfer Agent Registration furthering the development of our tokenization stack |

2026 Guidance

To give investors insight into our business and expectations, management is providing the following guidance for the full year 2026:

|

- |

Subscription, services & other revenue (non-IFRS) of $220.0 million to $250.0 million |

|

- |

Adjusted operating expense (non-IFRS) of $210.0 million to $230.0 million |

|

- |

Finance expense of $52.0 million to $60.0 million |

Conference Call Webcast and Q&A Information

Bullish will host a call to discuss its results at 8:30 a.m. ET on February 5, 2026. The live webcast can be accessed at investors.bullish.com, along with supplemental slides. Following the call, a replay and transcript will be available at investors.bullish.com.

About Bullish

Bullish (NYSE: BLSH) is an institutionally focused global digital asset platform that provides regulated market infrastructure and information services. This includes Bullish Exchange – an institutionally focused digital assets spot and derivatives exchange, integrating a high-performance central limit order book matching engine with automated market making to provide deep and predictable liquidity. Bullish Europe is regulated under MiCAR as a crypto asset service provider offering spot trading and custody services for digital assets.

Bullish is the parent company of CoinDesk, a leading provider of digital asset media and information services. CoinDesk's offerings include: CoinDesk Indices – a collection of tradable proprietary and single-asset benchmarks and indices that track the performance of digital assets for global institutions in the digital assets and traditional finance industries; CoinDesk Data – a broad suite of digital asset market data and analytics, providing real-time insights into prices, trends and market dynamics; and CoinDesk Insights – a digital asset media and events provider and operator of coindesk.com, a digital media platform that covers news and insights about digital assets, the underlying markets, policy and blockchain technology. For more information, please visit bullish.com and follow LinkedIn and X.

Use of Websites to Distribute Material Company Information

We use the Bullish Investor Relations website (investors.bullish.com) and our X account (x.com/bullish) to publicize information relevant to investors, including information that may be deemed material, in addition to filings we make with the U.S. Securities and Exchange Commission (SEC) and press releases. We encourage investors to regularly review the information posted on our website and X account in addition to our SEC filings and press releases to be informed of the latest developments.

Contacts

Media: media@bullish.com

Investor Relations: investors@bullish.com

Source: Bullish

Non-IFRS financial measures and key performance indicators

This communication includes certain financial measures that are not recognized by the International Financial Reporting Standards (“IFRS”). These non-IFRS financial measures are “adjusted transaction revenue,” “subscription, services and other revenue,” “adjusted revenue,” “adjusted net income / (loss)” and “adjusted EBITDA,” “gross liquid assets” and “net liquid assets”, and “adjusted operating expense.” These non-IFRS financial measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under IFRS. We believe these non-IFRS financial measures provide useful information to management and investors regarding certain financial and business trends. These non-IFRS financial measures are subject to inherent limitations as they reflect the exercise of judgments about which items of expense and income are excluded or included in determining these non-IFRS financial measures. Refer to the section “Reconciliation of Non-IFRS Measures” for further details and a reconciliation of the non-IFRS financial measures presented to their most directly comparable IFRS financial measures.

This communication also provides our forward-looking “adjusted transaction revenue,” “subscription, services & other revenue,” “adjusted revenue,” “adjusted operating expense,” “adjusted EBITDA,” and “adjusted net income” guidance for the upcoming fiscal quarter. Information reconciling upcoming fiscal quarter “adjusted transaction revenue,” “subscription, services & other revenue,” “adjusted revenue,” “adjusted operating expense,” “adjusted EBITDA,” and “adjusted net income” to their most directly comparable IFRS financial measures is unavailable to us without unreasonable effort due to the high variability, complexity and lack of visibility in making accurate forecasts and projections to certain reconciling items. These items cannot be reasonably and accurately predicated without the investment of undue time, costs and other resources, and accordingly, no reconciliation of the forward-looking non-IFRS financial measures is included. These reconciling items could be material to our actual results for the period.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Sentences containing words such as “believe,” “intend,” “plan,” “may,” “expect,” “should,” “could,” “anticipate,” “estimate,” “predict,” “project,” or their negatives, or other similar expressions of a future or forward-looking nature generally should be considered forward-looking statements. Such statements include, without limitation, statements relating to our expected financial or operating performance, including for the upcoming fiscal quarter; our business strategy and potential market opportunities; current and prospective products, services or acquisitions; trends in, demand for, and growth and market size of, the digital assets industry; the breadth and timing of onchain adoption; expectations regarding relationships with clients and third-party business partners and overall business momentum; our plans and expectations related to tokenization; competition in our industry; the regulatory and legal environment, including regulatory proceedings or approvals; and general economic and business conditions. Such forward-looking statements are based upon estimates and assumptions that, while considered reasonable by us, are inherently uncertain and are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that may cause results to differ from those expressed in our forward-looking statements include, but are not limited to intense competition in our industry, including from unregulated and less-regulated entities and platforms; our ability to execute our business strategy and grow our business and operations, including in new geographic locations; our ability to develop, launch and improve our products and services and their adoption; our ability to attract and retain customers; the evolving rules and regulations applicable to digital assets and our products and services; our ability to obtain and maintain regulatory approvals and stay in compliance with laws and regulations, and the costs of doing so; evolution and adoption of digital assets; interest rate fluctuations and digital asset price volatility; changes in, or unexpected, costs to operate our business; cybersecurity risks, including with respect to digital assets custody; disruptions to information and technology systems, blockchain networks and third-party services on which we rely; changes in general market, political or economic conditions; and other risks and uncertainties set forth in the section entitled “Risk Factors” in our final prospectus dated August 12, 2025 filed with the Securities and Exchange Commission (“SEC”), as well as potential risks and uncertainties disclosed in our other filings with the SEC. We may not actually achieve the performance, plans, or expectations disclosed in our forward-looking statements. Nothing in this communication should be regarded as a representation by any person that the forward-looking statements set forth therein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. We do not undertake any duty to update forward-looking statements.

Definitions of Certain Metrics

|

● |

Adjusted transaction revenue is a non-IFRS financial measure intended to capture the fees and trading spreads earned from customers trading on our Exchange. We define adjusted transactional revenue as (i) the portion of “Digital asset sales”, as reported in accordance with IFRS, attributable to digital asset sales on our Exchange, less (ii) the “Cost of digital assets derecognized” excluding such costs from sales on venues other than the Exchange, plus (iii) the change in fair value of digital asset inventories, arising from purchase of digital assets on our Exchange (included within reported “Change in fair value of digital assets held, net”), plus (iv) transaction income (included within reported “Other revenues”), plus (v) net spread related income and change in fair value of perpetual futures on the Exchange. |

|

|

|

||

|

We exclude digital asset sales, and the related cost of digital assets derecognized, from trading activity on venues other than our Exchange. We also exclude subscription and services revenue (included within reported other revenues). In each case, this approach is intended to ensure that our adjusted transaction revenue metric reflects the core performance of our trading operations and provides a clearer understanding of our business activities on our Exchange. |

||

|

|

||

|

While we include change in fair value of digital asset inventories, specifically the bid-offer spread earned from the purchase of digital assets on our Exchange, as part of our adjusted transaction revenue, we do not include other reported changes in fair value, such as subsequent remeasurements and mark-to-market adjustments. This is because these remeasurements, including impairment losses of digital assets held under intangible assets, are not considered part of our ongoing business operations and do not align with our intention to avoid taking directional trading positions. |

|

● |

Adjusted revenue is a non-IFRS financial measure intended to reflect the revenues generated by our trading and information services and also from our investing activities. We define adjusted revenue as adjusted transaction revenue, plus (i) subscription and services revenue, which is included in reported other revenues and includes interest and revenues from CoinDesk and CCData, plus (ii) for periods prior to 2024 only, change in fair value of investment in financial assets, plus (iii) the net income from DeFi protocols excluding the fair value change of underlying digital assets, that is reported under OCI. |

|

|

|

||

|

Specifically, adjusted revenue includes the fees and trading spreads earned from customers trading on our Exchange, excludes gains or losses from the remeasurement of our digital assets and includes other fees such as interest and revenue from CoinDesk and CCData businesses that we acquired in November 2023 and October 2024, respectively. |

|

● |

Adjusted EBITDA is calculated as income/(loss) after tax adjusted to exclude: |

|

○ |

digital asset sales and the cost of digital assets derecognized on other venues, as these transactions do not directly reflect the core activities of liquidity provision and client facilitation on our Exchange. Excluding these is intended to ensure that our Adjusted EBITDA remains focused on the fundamental operations that drive our business; |

|

○ |

gains or losses from the remeasurement of our digital assets, as these assets are held to facilitate client trading rather than for proprietary trading purposes. Such remeasurement reflects mark-to-market (MTM) adjustments including the impairment losses of digital assets held under intangible assets that are not part of our ongoing business operations and do not align with our intention to avoid taking directional trading positions. The primary focus of our business model is to provide liquidity and facilitate client transactions on our Exchange, with the key performance metric being the bid-offer spread earned from digital asset spot transactions. Including MTM adjustments would introduce volatility that is not reflective of our core operational performance and could mislead stakeholders about the true drivers of our business; |

|

○ |

certain non-cash charges such as share-based compensation expenses and depreciation and amortization because the amount of such expenses in any specific period may not directly correlate to the underlying performance of our business operations; |

|

○ |

provision for or benefit from income tax and finance expenses; |

|

○ |

change in fair value of derivatives and financial liability at FVTPL; |

|

○ |

the change in fair value of investments in financial assets related to digital asset funds. These investments are not central to our core operations, as they do not directly contribute to our primary business activities of liquidity provision and client facilitation. The fair value changes are primarily driven by the mark-to-market (MTM) adjustments of the underlying digital assets within the funds. Including these fair value changes would introduce volatility of digital assets that does not accurately represent the operational metrics that are indicative of our business performance. Our core operating performance focuses on providing liquidity and facilitating client transactions, and we aim to avoid taking directional trading positions; |

|

○ |

certain acquisition-related and integration costs associated with business combinations, various restructuring and other costs, and goodwill impairment charges, all of which are not normal operating expenses. These adjustments aid in the comparability of our results across periods. Acquisition related costs include amounts paid to redeem acquirees’ unvested share-based compensation awards, legal, accounting, valuation, and due diligence costs. Integration costs include advisory and other professional services or consulting fees necessary to integrate acquired businesses. Restructuring and other costs that are not reflective of our core business operating expenses may include severance costs, contingent losses, impairment charges, and certain litigation and regulatory charges; and |

|

○ |

the net income from DeFi protocols, excluding the fair value change of underlying digital assets, which is a component of the “Revaluation of digital assets held as investments” under OCI. Deploying our digital assets in these protocols are a strategic component of our business model, providing additional yield and enhancing our liquidity management capabilities. Including this net income in Adjusted EBITDA reflects the performance of our investment activities and supports our focus on core operations. |

|

● |

Adjusted net income/(loss) is calculated as income/(loss) after tax adjusted by the same adjustment items taken into account for determining adjusted EBITDA, with further adjustment to add back finance expense and depreciation and amortization, and reduced by tax effect of the adjustments. |

|

● |

Adjusted operating expense is calculated by taking total operating expenses (which includes Administrative expenses and Other expenses) and excluding items we do not consider representative of our core, ongoing operating performance. These excluded items are Stock-based compensation expense, Depreciation and amortization expense, and certain non-recurring expenses. |

|

|

|

||

|

We believe Adjusted operating expense is a useful supplemental measure for investors, as it provides a clearer view of our operational efficiency by removing non-cash expenses (depreciation, amortization, and stock-based compensation) and other items not indicative of ongoing business trends. Management uses this measure to assess business performance and to plan for future periods. |

|

● |

Subscription, services & other revenue is a non-IFRS financial measure intended to provide a comprehensive view of our diverse revenue streams beyond core transaction fees and spreads. This measure includes revenue from lending and liquidity services, such as interest earned from third-party lending arrangements like credit line facilities and margin loans, interest on our own cash and stablecoins, fees from liquidity services and promotional income, and revenues from CoinDesk services such as sponsorships, event admissions, and index data licensing fees. It also incorporates the net income from DeFi protocols (excluding any fair value changes of the underlying digital assets). This non-IFRS measure is calculated by taking "Subscription and services revenue" (as reported within the "Other revenues") and adding "Net income from DeFi protocols, excluding the fair value change of underlying digital assets" (as reported within “Revaluation of digital assets held as investments”). By consolidating these various income sources, we believe this measure offers a more distinct view of the growth and performance of our service-oriented business lines, separate from our core transaction-based revenues. |

|

● |

Trading volume represents the notional value of trades, i.e., the product of the quantity of assets transacted and the trade price at the time the spot transaction was executed. The quantity represents the total U.S. dollar equivalent value of matched trades transacted between a buyer and seller through our platform during the period of measurement. |

|

● |

Average daily volume represents the total Trading volume for the applicable period divided by the number of trading days in such period. |

|

● |

Average trading spread represents total commissions earned from transactions on the Bullish Exchange for the period, expressed in basis points (bps) of the trading volume for the period. Management reviews this metric, which reflects the cost of trading on the Bullish Exchange, changes in fair value of perpetual futures, and rebates, for insight into the average revenue generated per unit of trading volume on our platform. |

|

|

|

||

|

● |

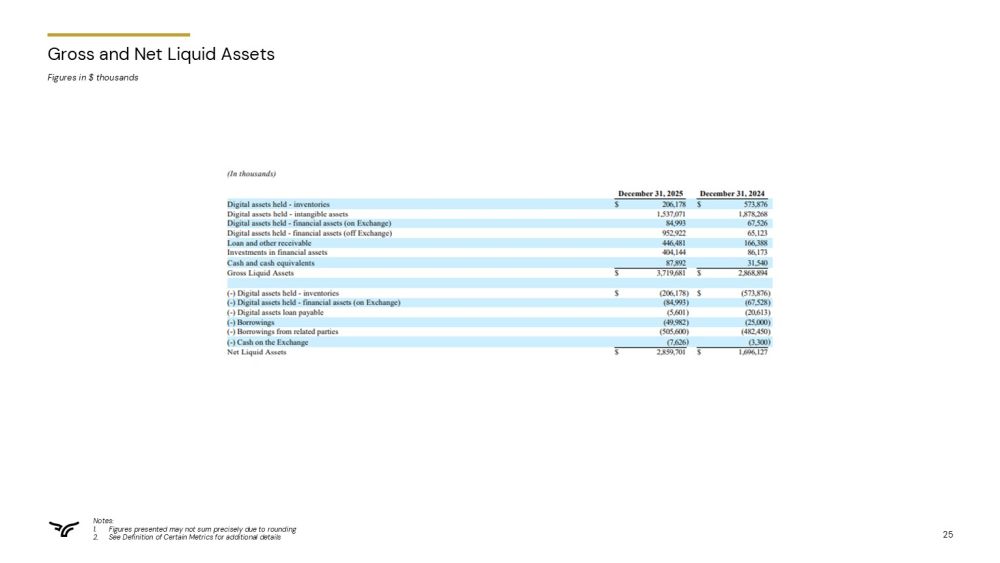

Gross liquid assets is defined as the sum of (i) Digital assets held — inventories, (ii) Digital assets held — intangible assets, (iii) Digital assets held — financial assets, (iv) Loans and other receivables — digital assets, (v) Investments in financial assets, and (vi) Cash and cash equivalents. |

|

|

|

||

|

● |

Net liquid assets is defined as Gross liquid assets, reduced by (i) Digital assets held — inventories, (ii) the portion of Digital assets held — financial assets on our Exchange, (iii) the portion of Cash and cash equivalents on our Exchange, (iv) Borrowings, (v) Borrowings from related parties, and (iv) Digital assets loan payable. |

BULLISH

CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME/(LOSS) (UNAUDITED)

FOR THE THREE AND TWELVE MONTHS ENDED DECEMBER 31, 2025 AND 2024

(In thousands, except per share data)

|

Three months ended December 31, |

Twelve months ended December 31, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

Digital assets sales |

$ | 64,345,078 | $ | 66,026,131 | $ | 244,811,387 | $ | 250,201,282 | ||||||||

|

Cost of digital assets derecognized |

(64,323,568 | ) | (66,001,337 | ) | (244,733,087 | ) | (250,104,770 | ) | ||||||||

|

Other revenues |

56,195 | 14,473 | 158,941 | 61,967 | ||||||||||||

|

Change in fair value of digital assets held, net |

(485,175 | ) | 186,029 | (674,968 | ) | 207,043 | ||||||||||

|

Net spread related income and change in fair value of perpetual futures on the Exchange |

(886 | ) | (3,228 | ) | (7,179 | ) | (17,139 | ) | ||||||||

|

Change in fair value of investment in financial assets |

(105,555 | ) | 27,369 | (36,034 | ) | 29,453 | ||||||||||

|

Administrative expenses |

(46,276 | ) | (37,082 | ) | (182,188 | ) | (153,119 | ) | ||||||||

|

Other expenses |

(14,392 | ) | (12,635 | ) | (60,425 | ) | (46,079 | ) | ||||||||

|

Finance expense |

(14,932 | ) | (10,659 | ) | (52,369 | ) | (38,529 | ) | ||||||||

|

Change in fair value of derivatives |

17,521 | (12,867 | ) | 9,609 | (12,190 | ) | ||||||||||

|

Change in fair value of financial liability at FVTPL |

6,900 | (13,950 | ) | (20,100 | ) | (43,350 | ) | |||||||||

|

Income/(loss) before income tax |

$ | (565,090 | ) | $ | 162,244 | $ | (786,413 | ) | $ | 84,569 | ||||||

|

Income tax benefit/(expense) |

1,523 | (3,782 | ) | 944 | (5,005 | ) | ||||||||||

|

Net income/(loss) |

$ | (563,567 | ) | $ | 158,462 | $ | (785,469 | ) | $ | 79,564 | ||||||

|

Attributable to: |

||||||||||||||||

|

Owners of the Group |

(546,598 | ) | 157,033 | (764,681 | ) | 78,527 | ||||||||||

|

Non-controlling interests |

(16,969 | ) | 1,429 | (20,788 | ) | 1,037 | ||||||||||

|

Net income/(loss) |

$ | (563,567 | ) | $ | 158,462 | $ | (785,469 | ) | $ | 79,564 | ||||||

|

Other comprehensive income/(loss) |

||||||||||||||||

|

Items that will not be subsequently reclassified to profit or loss: |

||||||||||||||||

|

Revaluation of digital assets held as investments |

(123,816 | ) | 575,424 | 409,644 | 1,020,339 | |||||||||||

|

Fair value gain/(loss) on financial liabilities designated as at FVTPL attributable to changes in credit risk |

1,350 | (11,450 | ) | (3,050 | ) | (16,350 | ) | |||||||||

| $ | (122,466 | ) | $ | 563,974 | $ | 406,594 | $ | 1,003,989 | ||||||||

|

Items that may be reclassified subsequently to profit or loss: |

||||||||||||||||

|

Foreign exchange differences on translation of foreign operations |

41 | (712 | ) | 1,676 | (712 | ) | ||||||||||

|

Total comprehensive income/(loss) |

$ | (685,992 | ) | $ | 721,724 | $ | (377,199 | ) | $ | 1,082,841 | ||||||

|

Attributable to: |

||||||||||||||||

|

Owners of the Group |

(695,383 | ) | 714,757 | (436,588 | ) | 1,072,710 | ||||||||||

|

Non-controlling interests |

9,391 | 6,967 | 59,389 | 10,131 | ||||||||||||

|

Total comprehensive income/(loss) |

$ | (685,992 | ) | $ | 721,724 | $ | (377,199 | ) | $ | 1,082,841 | ||||||

|

Weighted average number of ordinary shares for the purposes of basic and diluted earnings/(loss) per share |

||||||||||||||||

|

Basic |

150,924 | 113,153 | 127,723 | 112,664 | ||||||||||||

|

Diluted |

150,924 | 115,889 | 127,723 | 115,400 | ||||||||||||

|

Earnings/(Loss) per share |

||||||||||||||||

|

Basic |

$ | (3.73 | ) | $ | 1.40 | $ | (6.15 | ) | $ | 0.70 | ||||||

|

Diluted |

$ | (3.73 | ) | $ | 1.37 | $ | (6.15 | ) | $ | 0.68 | ||||||

BULLISH

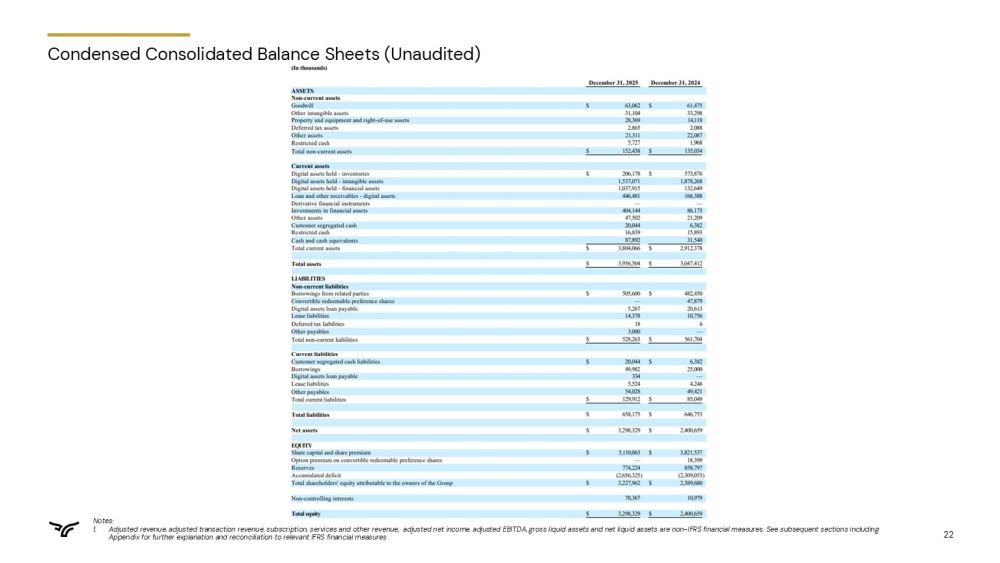

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

AS OF DECEMBER 31, 2025 AND DECEMBER 31, 2024

(In thousands)

|

December 31, 2025 |

December 31, 2024 |

|||||||

|

ASSETS |

||||||||

|

Non-current assets |

||||||||

|

Goodwill |

$ | 63,062 | $ | 61,475 | ||||

|

Other intangible assets |

31,104 | 33,298 | ||||||

|

Property and equipment and right-of-use assets |

28,369 | 14,118 | ||||||

|

Deferred tax assets |

2,865 | 2,088 | ||||||

|

Other assets |

21,311 | 22,087 | ||||||

|

Restricted cash |

5,727 | 1,968 | ||||||

|

Total non-current assets |

$ | 152,438 | $ | 135,034 | ||||

|

Current assets |

||||||||

|

Digital assets held - inventories |

$ | 206,178 | $ | 573,876 | ||||

|

Digital assets held - intangible assets |

1,537,071 | 1,878,268 | ||||||

|

Digital assets held - financial assets |

1,037,915 | 132,649 | ||||||

|

Loan and other receivables - digital assets |

446,481 | 166,388 | ||||||

|

Derivative financial instruments |

— | — | ||||||

|

Investments in financial assets |

404,144 | 86,173 | ||||||

|

Other assets |

47,502 | 21,209 | ||||||

|

Customer segregated cash |

20,044 | 6,382 | ||||||

|

Restricted cash |

16,839 | 15,893 | ||||||

|

Cash and cash equivalents |

87,892 | 31,540 | ||||||

|

Total current assets |

$ | 3,804,066 | $ | 2,912,378 | ||||

|

Total assets |

$ | 3,956,504 | $ | 3,047,412 | ||||

|

LIABILITIES |

||||||||

|

Non-current liabilities |

||||||||

|

Borrowings from related parties |

$ | 505,600 | $ | 482,450 | ||||

|

Convertible redeemable preference shares |

— | 47,879 | ||||||

|

Digital assets loan payable |

5,267 | 20,613 | ||||||

|

Lease liabilities |

14,378 | 10,756 | ||||||

|

Deferred tax liabilities |

18 | 6 | ||||||

|

Other payables |

3,000 | — | ||||||

|

Total non-current liabilities |

$ | 528,263 | $ | 561,704 | ||||

|

Current liabilities |

||||||||

|

Customer segregated cash liabilities |

$ | 20,044 | $ | 6,382 | ||||

|

Borrowings |

49,982 | 25,000 | ||||||

|

Digital assets loan payable |

334 | — | ||||||

|

Lease liabilities |

5,524 | 4,246 | ||||||

|

Other payables |

54,028 | 49,421 | ||||||

|

Total current liabilities |

$ | 129,912 | $ | 85,049 | ||||

|

Total liabilities |

$ | 658,175 | $ | 646,753 | ||||

|

Net assets |

$ | 3,298,329 | $ | 2,400,659 | ||||

|

EQUITY |

||||||||

|

Share capital and share premium |

$ | 5,110,063 | $ | 3,821,537 | ||||

|

Option premium on convertible redeemable preference shares |

— | 18,399 | ||||||

|

Reserves |

774,224 | 858,797 | ||||||

|

Accumulated deficit |

(2,656,325 | ) | (2,309,053 | ) | ||||

|

Total shareholders' equity attributable to the owners of the Group |

$ | 3,227,962 | $ | 2,389,680 | ||||

|

Non-controlling interests |

70,367 | 10,979 | ||||||

|

Total equity |

$ | 3,298,329 | $ | 2,400,659 | ||||

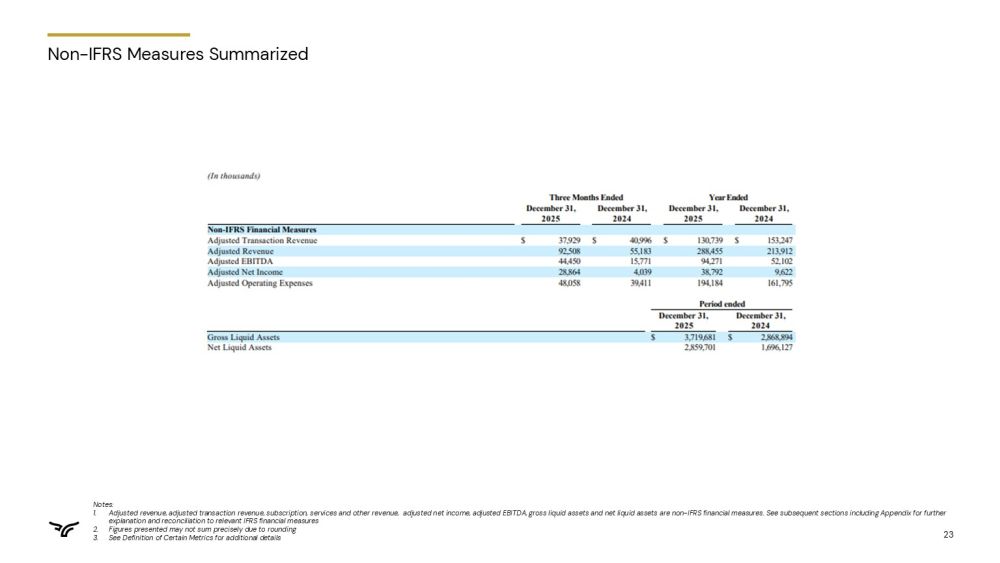

Non-IFRS Measures Summarized

(In thousands)

|

Three Months Ended |

Year Ended |

|||||||||||||||

|

December 31, |

December 31, |

December 31, |

December 31, |

|||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

Non-IFRS Financial Measures |

||||||||||||||||

|

Adjusted Transaction Revenue |

$ | 37,929 | $ | 40,996 | $ | 130,739 | $ | 153,247 | ||||||||

|

Adjusted Revenue |

92,508 | 55,183 | 288,455 | 213,912 | ||||||||||||

|

Adjusted EBITDA |

44,450 | 15,771 | 94,271 | 52,102 | ||||||||||||

|

Adjusted Net Income |

28,864 | 4,039 | 38,792 | 9,622 | ||||||||||||

|

Adjusted Operating Expenses |

48,058 | 39,411 | 194,184 | 161,795 | ||||||||||||

|

Period ended |

||||||||

|

December 31, |

December 31, |

|||||||

|

2025 |

2024 |

|||||||

|

Gross Liquid Assets |

$ | 3,719,681 | $ | 2,868,894 | ||||

|

Net Liquid Assets |

2,859,701 | 1,696,127 | ||||||

Reconciliation of Non-IFRS Measures

(In thousands)

|

Three Months Ended |

Year Ended |

|||||||||||||||

|

December 31, |

December 31, |

December 31, |

December 31, |

|||||||||||||

|

Adjusted Transaction Revenue and Adjusted Revenue |

2025 |

2024 |

2025 |

2024 |

||||||||||||

|

Digital assets sales |

$ | 64,345,078 | $ | 66,026,131 | $ | 244,811,387 | $ | 250,201,282 | ||||||||

|

Digital asset sales on venues other than Exchange |

(36,583 | ) | (2,124 | ) | (396,424 | ) | (21,821 | ) | ||||||||

|

Digital asset sales - on our Exchange |

$ | 64,308,495 | $ | 66,024,007 | $ | 244,414,963 | $ | 250,179,461 | ||||||||

|

Cost of digital assets derecognized - on our Exchange |

(64,286,992 | ) | (65,999,234 | ) | (244,336,500 | ) | (250,082,963 | ) | ||||||||

|

Change in fair value of digital assets inventories, arising from purchase of digital assets on our Exchange |

15,670 | 18,662 | 56,031 | 71,685 | ||||||||||||

|

Transaction income |

1,642 | 789 | 3,424 | 2,203 | ||||||||||||

|

Net spread related income and change in fair value of perpetual futures |

(886 | ) | (3,228 | ) | (7,179 | ) | (17,139 | ) | ||||||||

|

Adjusted Transaction Revenue |

$ | 37,929 | $ | 40,996 | $ | 130,739 | $ | 153,247 | ||||||||

|

Subscriptions and services revenue |

54,554 | 13,684 | 155,517 | 59,764 | ||||||||||||

|

Change in fair value of investment in financial assets |

— | — | — | 168 | ||||||||||||

|

Revaluation of digital assets held as investments |

25 | 503 | 2,199 | 733 | ||||||||||||

|

Adjusted Revenue |

$ | 92,508 | $ | 55,183 | $ | 288,455 | $ | 213,912 | ||||||||

|

Adjusted EBITDA and Adjusted Net Income |

||||||||||||||||

|

Income/(loss) |

$ | (563,567 | ) | $ | 158,462 | $ | (785,469 | ) | $ | 79,564 | ||||||

|

Adjusted to exclude the following: |

||||||||||||||||

|

Digital asset sales on other venues |

(36,583 | ) | (2,124 | ) | (396,424 | ) | (21,821 | ) | ||||||||

|

Cost of digital assets derecognized on other venues |

36,576 | 2,103 | 396,586 | 21,807 | ||||||||||||

|

Loss/(Gain) from changes in fair value of digital assets inventories net payable to customers |

120,241 | (131,742 | ) | 208,577 | (130,732 | ) | ||||||||||

|

Income tax expense |

(1,523 | ) | 3,782 | (944 | ) | 5,005 | ||||||||||

|

Finance expenses |

14,932 | 10,659 | 52,369 | 38,529 | ||||||||||||

|

Employee share-based payment expenses |

4,047 | 4,699 | 15,567 | 22,587 | ||||||||||||

|

Other share-based payment expenses |

628 | — | 628 | — | ||||||||||||

|

Change in fair value of loan and other receivables - digital assets |

64,268 | (48,510 | ) | 24,994 | (43,676 | ) | ||||||||||

|

Change in fair value of digital assets loan payable |

(2,873 | ) | 14,339 | (15 | ) | 14,449 | ||||||||||

|

Change in fair value of derivatives |

(17,521 | ) | 12,867 | (9,609 | ) | 12,191 | ||||||||||

|

Change in fair value of financial liability at FVTPL |

(6,900 | ) | 13,950 | 20,100 | 43,350 | |||||||||||

|

Change in fair value of investments in financial assets |

105,555 | (27,369 | ) | 36,034 | (29,286 | ) | ||||||||||

|

Impairment losses of digital assets held - intangible assets |

319,209 | (1,454 | ) | 497,443 | 24,601 | |||||||||||

|

Impairment of right-of-use assets |

— | — | — | 956 | ||||||||||||

|

Non-recurring expenses |

7,360 | 4,629 | 29,172 | 10,019 | ||||||||||||

|

Depreciation and amortization |

576 | 977 | 3,063 | 3,826 | ||||||||||||

|

Adjusted to include the following: |

||||||||||||||||

|

Revaluation of digital assets held as investments |

25 | 503 | 2,199 | 733 | ||||||||||||

|

Adjusted EBITDA |

$ | 44,450 | $ | 15,771 | $ | 94,271 | $ | 52,102 | ||||||||

|

Finance expenses |

(14,932 | ) | (10,659 | ) | (52,369 | ) | (38,529 | ) | ||||||||

|

Depreciation and amortization |

(576 | ) | (977 | ) | (3,063 | ) | (3,826 | ) | ||||||||

|

Tax effect of adjusted net income before taxes |

(78 | ) | (96 | ) | (47 | ) | (125 | ) | ||||||||

|

Adjusted Net Income |

$ | 28,864 | $ | 4,039 | $ | 38,792 | $ | 9,622 | ||||||||

Note - Figures presented may not sum precisely due to rounding.

Gross and Net Liquid Assets

(In thousands)

|

December 31, 2025 |

December 31, 2024 |

|||||||

|

Digital assets held - inventories |

$ | 206,178 | $ | 573,876 | ||||

|

Digital assets held - intangible assets |

1,537,071 | 1,878,268 | ||||||

|

Digital assets held - financial assets (on Exchange) |

84,993 | 67,526 | ||||||

|

Digital assets held - financial assets (off Exchange) |

952,922 | 65,123 | ||||||

|

Loan and other receivable |

446,481 | 166,388 | ||||||

|

Investments in financial assets |

404,144 | 86,173 | ||||||

|

Cash and cash equivalents |

87,892 | 31,540 | ||||||

|

Gross Liquid Assets |

$ | 3,719,681 | $ | 2,868,894 | ||||

|

(-) Digital assets held - inventories |

$ | (206,178 | ) | $ | (573,876 | ) | ||

|

(-) Digital assets held - financial assets (on Exchange) |

(84,993 | ) | (67,528 | ) | ||||

|

(-) Digital assets loan payable |

(5,601 | ) | (20,613 | ) | ||||

|

(-) Borrowings |

(49,982 | ) | (25,000 | ) | ||||

|

(-) Borrowings from related parties |

(505,600 | ) | (482,450 | ) | ||||

|

(-) Cash on the Exchange |

(7,626 | ) | (3,300 | ) | ||||

|

Net Liquid Assets |

$ | 2,859,701 | $ | 1,696,127 | ||||

Note - Figures presented may not sum precisely due to rounding.

Reconciliation of Adjusted Operating Expense

(In thousands)

|

Three Months Ended |

Year Ended |

|||||||||||||||

|

December 31, |

December 31, |

December 31, |

December 31, |

|||||||||||||

|

IFRS Core Operating Expense to Adjusted Operating Expense |

2025 |

2024 |

2025 |

2024 |

||||||||||||

|

IFRS Core Operating Expense |

$ | 60,669 | $ | 49,717 | $ | 242,614 | $ | 199,199 | ||||||||

|

Adjusted for |

||||||||||||||||

|

Employee share-based compensation expense |

4,047 | 4,699 | 15,567 | 22,587 | ||||||||||||

|

Other share-based compensation expense |

628 | — | 628 | — | ||||||||||||

|

Non-recurring expenses - legal and professional fees |

6,386 | 4,322 | 25,292 | 7,245 | ||||||||||||

|

Non-recurring expenses - compensation and benefits |

974 | 308 | 3,880 | 3,746 | ||||||||||||

|

Depreciation and amortization expense |

576 | 977 | 3,063 | 3,826 | ||||||||||||

|

Adjusted Operating Expense |

$ | 48,058 | $ | 39,411 | $ | 194,184 | $ | 161,795 | ||||||||

Note - Figures presented may not sum precisely due to rounding.

Exhibit 99.2