UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

|

For the fiscal year ended September 27, 2025 |

or

|

☐ |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

|

|

For the transition period from _____ to _____ |

Commission File No. 000-14616

J&J SNACK FOODS CORP.

(Exact name of registrant as specified in its charter)

| New Jersey | 22-1935537 |

| (State or other jurisdiction of | (I.R.S. Employer Identification No.) |

| incorporation or organization) | |

| 350 Fellowship Road, | 08054 |

| Mt. Laurel, New Jersey | (Zip code) |

| (Address of principal executive offices) |

(856) 665-9533

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

|

Common Stock, no par value |

JJSF |

The Nasdaq Global Select Market |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

March 28, 2025 was the last business day of the registrant’s most recently completed second fiscal quarter. The aggregate market value of the registrant’s common stock held by non-affiliates was $1,968,027,965 based on the last sale price on March 28, 2025 of $130.14 per share.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Class |

Outstanding as of November 21, 2025 |

|

Common Stock, no par value |

19,343,158 shares |

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its Annual Meeting of Shareholders scheduled for February 12, 2026 are incorporated by reference into Part III of this report.

J & J SNACK FOODS CORP.

2025 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

| Page | ||

|

PART I |

||

|

Note About Forward-Looking Statements |

1 |

|

|

Item 1 |

Business |

1 |

|

Item 1A |

Risk Factors |

8 |

|

Item 1B |

Unresolved Staff Comments |

14 |

|

Item 1C |

Cybersecurity |

14 |

|

Item 2 |

Properties |

15 |

|

Item 3 |

Legal Proceedings |

15 |

|

Item 4 |

Mine Safety Disclosures |

15 |

|

PART II |

||

|

Item 5 |

Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities |

16 |

|

Item 6 |

[Reserved] |

17 |

|

Item 7 |

Management’s Discussion And Analysis Of Financial Condition And Results Of Operations |

17 |

|

Item 7A |

Quantitative And Qualitative Disclosures About Market Risk |

30 |

|

Item 8 |

Financial Statements And Supplementary Data |

30 |

|

Item 9 |

Changes In And Disagreements With Accountants On Accounting And Financial Disclosure |

30 |

|

Item 9A |

Controls and Procedures |

30 |

|

Item 9B |

Other Information |

32 |

|

Item 9C |

Disclosure Regarding Foreign Jurisdictions That Prevent Inspections |

32 |

|

PART III |

||

|

Item 10 |

Directors, Executive Officers and Corporate Governance |

32 |

|

Item 11 |

Executive Compensation |

33 |

|

Item 12 |

Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters |

33 |

|

Item 13 |

Certain Relationships And Related Transactions, and Director Independence |

33 |

|

Item 14 |

Principal Accountant Fees and Service |

33 |

|

PART IV |

||

|

Item 15 |

Exhibits, Financial Statement Schedules |

33 |

|

Item 16 |

Form 10-K Summary |

33 |

Note About Forward-Looking Statements

This annual report on Form 10-K contains forward-looking statements. Statements that are not historic or current facts are “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements discuss goals, intentions, and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to us, based on our current beliefs as well as assumptions made by us and information currently available to us. Forward-looking statements generally will be accompanied by words such as "anticipate," "if," "may," "believe," "plan,", "goals," "estimate," "expect," "project," "continue," "forecast," "intend," "may," "could," "should," "will," and other similar expressions. Statements addressing our future operating performance and statements addressing events and developments that we expect or anticipate will occur are also considered as forward-looking statements. This includes, without limitation, our statements and expectations regarding any current or future recovery in our industry (or the industries of our customers), the success of new product innovations, the impact of tariffs and other government regulations, and the future impact of our expense reduction and supply chain efficiency projects, including facility optimization projects and investments in additional production capacity and logistics and warehousing operations. Such forward-looking statements are inherently uncertain, and readers must recognize that actual results may differ materially from the expectations of management. We intend that such forward-looking statements be subject to the safe harbor provisions of the Securities Act and the Exchange Act. Important factors that could cause actual results to differ materially from the forward-looking statements include, without limitation: the risks described in Item 1A and in Item 7A of this annual report on Form 10-K.

We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties, and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation to subsequently revise, update, add or to otherwise correct, any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events. Furthermore, all subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this report. The discussion and analysis of our financial condition and results of operations included in Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations should be read in conjunction with our consolidated financial statements and related notes included in Item 8 of this Form 10-K.

PART I

Item 1. Business

General

J & J Snack Foods Corp. (the “Company” or “J & J”) manufactures snack foods and distributes frozen beverages which it markets nationally to the foodservice and retail supermarket industries. The Company’s principal snack food products are soft pretzels marketed primarily under the brand names SUPERPRETZEL, BRAUHAUS, FEDERAL PRETZEL, and BAVARIAN BAKERY, frozen novelties marketed primarily under the DIPPIN’ DOTS, LUIGI’S, WHOLE FRUIT, ICEE, DOGSTERS, PHILLY SWIRL and MINUTE MAID* brand names, churros marketed primarily under the ¡HOLA! brand name, and bakery products sold primarily under the READI-BAKE, COUNTRY HOME, MARY B’S, DADDY RAY’S and HILL & VALLEY brand names as well as for private label and contract packing. We believe we are the largest manufacturer of soft pretzels in the United States. Other snack food products include funnel cake sold under THE FUNNEL CAKE FACTORY brand and handheld products sold under smaller brands. The Company’s principal frozen beverage products are the ICEE brand frozen carbonated beverage and the SLUSH PUPPIE brand frozen non-carbonated beverage.

The Company’s Food Service and Frozen Beverages sales are made primarily to foodservice customers including snack bar and food stand locations in leading chain, department, discount, warehouse club and convenience stores; malls and shopping centers; fast food and casual dining restaurants; stadiums and sports arenas; leisure and theme parks; movie theatres; independent retailers; and schools, colleges, and other institutions. The Company’s retail supermarket customers are primarily supermarket chains.

* Minute Maid is a registered trademark of the Coca-Cola Company

The Company was incorporated in 1971 under the laws of the State of New Jersey.

The Company operates in three business segments: Food Service, Retail Supermarkets and Frozen Beverages. These segments are described below.

The Chief Operating Decision Maker for Food Service, Retail Supermarkets and Frozen Beverages reviews detailed operating income statements and sales reports in order to assess performance and allocate resources to each individual segment. Sales and operating income are key variables monitored by the Chief Operating Decision Maker and management when determining each segment’s and the Company’s financial condition and operating performance. In addition, the Chief Operating Decision Maker reviews and evaluates capital spending of each segment on a quarterly basis to monitor cash flow and asset needs of each segment (see Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Item 8 – Financial Statements and Supplementary Data for financial information about segments).

Food Service

The primary products sold by the Food Service segment are soft pretzels, frozen novelties, churros, handheld products, and baked goods. Our customers in the Food Service segment include snack bars and food stands in chain, department, and discount stores; malls and shopping centers; fast food and casual dining restaurants; stadiums and sports arenas; leisure and theme parks; convenience stores; movie theatres; warehouse club stores; schools, colleges and other institutions. Within the food service industry, our products are purchased by the consumer primarily for consumption at the point-of-sale or for take-away.

Retail Supermarkets

The primary products sold to the retail supermarket channel are soft pretzel products – including SUPERPRETZEL, frozen novelties including LUIGI’S Real Italian Ice, MINUTE MAID Juice Bars and Soft Frozen Lemonade, WHOLE FRUIT frozen fruit bars and sorbet, DOGSTERS ice cream style treats for dogs, PHILLY SWIRL cups and sticks, ICEE Squeeze-Up Tubes and handheld products. Within the retail supermarket channel, our frozen and prepackaged products are purchased by the consumer for consumption at home.

Frozen Beverages

We sell frozen beverages to the foodservice industry primarily under the names ICEE, SLUSH PUPPIE and PARROT ICE in the United States, Mexico, and Canada. We also provide repair and maintenance services to customers for customer-owned equipment.

Products

Soft Pretzels

The Company’s soft pretzels are sold under many brand names; some of which are: SUPERPRETZEL, SUPERPRETZEL BAVARIAN, NEW YORK PRETZEL, FEDERAL PRETZEL, AND BRAUHAUS; and, to a lesser extent, under private labels.

Soft pretzels are sold in the Food Service and Retail Supermarket segments. Soft pretzel sales amounted to 18% of the Company’s revenue in fiscal year 2025, 18% in fiscal year 2024, and 19% in fiscal year 2023.

Certain of the Company’s soft pretzels (whole grain) qualify under USDA regulations as the nutritional equivalent of grains for purposes of the USDA school nutrition program, thereby enabling a participating school to obtain partial reimbursement for the cost of the Company’s soft pretzels from the USDA.

The Company’s soft pretzels are manufactured according to a proprietary formula, ranging in size from one to twenty-four ounces in weight. A portion of the Company’s soft pretzels are shaped and formed by the Company’s twister machines. These soft pretzel tying machines are automated, high-speed machines for twisting dough into the traditional pretzel shape. Additionally, we make soft pretzels which are extruded or shaped by hand. Soft pretzels, after baking, are quick-frozen and packaged for delivery.

The Company’s principal marketing program in the Food Service segment includes supplying ovens, mobile merchandisers, display cases, warmers, and similar merchandising equipment to the retailer to prepare and promote the sale of soft pretzels. Some of this equipment is proprietary, including combination warmer and display cases that re-bake frozen soft pretzels while displaying them, thus eliminating the need for an oven. The Company retains ownership of the equipment placed in customer locations, and as a result, customers are not required to make an investment in equipment.

Frozen Novelties

The Company’s frozen novelties are marketed primarily under the DIPPIN’DOTS, LUIGI’S, WHOLE FRUIT, DOGSTERS, PHILLY SWIRL, ICEE and MINUTE MAID brand names. Frozen novelties are sold in the Food Service and Retail Supermarkets segments. Frozen novelties sales were 16% of the Company’s revenue in fiscal year 2025, 17% in fiscal year 2024, and 17% in fiscal year 2023.

The Company’s LUIGI’S and WHOLE FRUIT frozen juice cups for schools are produced in various flavors and contain one half of a cup of fruit equivalent made of 100% juice with no added sugar and in accordance with USDA guidelines.

The Company’s DIPPIN’ DOTS’ frozen novelty products are cryogenically frozen beads, created using liquid nitrogen at -320 degrees Fahrenheit. Product variations include ice cream (milk and cream based), flavored ice (water based) and frozen yogurt branded YODOTS. The product is served to consumers by the cup, or via individual serving packages.

The balance of the Company’s frozen novelties products are manufactured from water, sweeteners and fruit juice concentrates in various flavors and packaging including cups, tubes, and sticks. Several of the products contain ice cream and WHOLE FRUIT bars contains real fruit.

Churros

The Company’s churros are sold primarily under the ¡HOLA! brand name. Churros are sold to the Food Service and Retail Supermarkets segments. Churro sales were 6% of the Company’s sales in fiscal year 2025, 7% in fiscal year 2024, and 7% in fiscal year 2023. Churros are pastries in stick form which the Company produces in several sizes according to a proprietary formula. The churros are deep fried, frozen, and packaged. At food service point-of-sale they are reheated and topped with a cinnamon sugar mixture. The Company also sells chocolate-filled, fruit-filled, and crème-filled churros. The Company supplies churro merchandising equipment similar to that used for its soft pretzels.

Handheld Products

The Company's handheld products are sold primarily under private label names. Handheld products are sold to the Food Service and Retail Supermarket segments. Handheld product sales amounted to 7% of the Company’s sales in fiscal year 2025, 7% in fiscal year 2024, and 6% in fiscal year 2023.

Bakery Products

The Company’s bakery products are marketed under the MRS. GOODCOOKIE, READI-BAKE, COUNTRY HOME, MARY B’S, DADDY RAY’S and HILL & VALLEY brand names, and under private labels. Bakery products include primarily fig and fruit bars, cookies, breads, rolls, crumb, muffins, and donuts. Bakery products are sold to the Food Service segment. Bakery products sales amounted to 27% of the Company’s sales in fiscal year 2025, 26% in fiscal year 2024, and 26% in fiscal year 2023.

Frozen Beverages

The Company markets frozen beverages primarily under the names ICEE, SLUSH PUPPIE and PARROT ICE which are sold primarily in the United States, Mexico, and Canada. Frozen beverages are reported in the Frozen Beverages segment.

Frozen beverage sales amounted to 14% of the Company’s revenue in fiscal year 2025, 15% in fiscal year 2024, and 14% in fiscal year 2023.

Under the Company’s principal marketing program for frozen carbonated beverages, it installs frozen beverage dispensers for its ICEE brand at customer locations and thereafter services the machines, arranges to supply customers with ingredients required for production of the frozen beverages, and supports customer retail sales efforts with in-store promotions and point-of-sale materials. The Company sells frozen non-carbonated beverages under the SLUSH PUPPIE and PARROT ICE brands through a distributor network and through its own distribution network. The Company also provides repair and maintenance service to customers for customer-owned equipment and sells equipment in its Frozen Beverages segment. Revenue from equipment sales and repair and maintenance services totaled 9% of the Company’s sales in each of the fiscal years 2025, 2024, and 2023.

Each new frozen carbonated customer location requires a frozen beverage dispenser supplied by the Company or by the customer. Company-supplied frozen carbonated dispensers are purchased from outside vendors or rebuilt by the Company.

The Company provides managed service and/or products to approximately 132,000 Company-owned and customer-owned dispensers.

Other Products

Other products sold by the Company include funnel cakes sold under the FUNNEL CAKE FACTORY brand name and smaller amounts of various other food products. These products are sold in the Food Service and Frozen Beverages segments.

Customers

The Company sells its products to two principal channels: foodservice and retail supermarkets. The primary products sold to the foodservice channel are soft pretzels, frozen beverages, frozen novelties, churros, handheld products and baked goods. The primary products sold to the retail supermarket channel are soft pretzels, frozen novelties and handheld products.

We have several large customers that account for a significant portion of our sales. Our top ten customers accounted for 46%, 45% and 43% of our sales during fiscal years 2025, 2024, and 2023, respectively, with our largest customer accounting for 10% of our sales in fiscal 2025, 9% of our sales in fiscal 2024, and 9% of our sales in fiscal 2023. Five of the ten customers in 2025 are food distributors who sell our product to many end users. The loss of one or more of our large customers could adversely affect our results of operations. These customers typically do not enter long-term contracts and make purchase decisions based on a combination of price, product quality, consumer demand and customer service performance. If our sales to one or more of these customers are reduced, this reduction may adversely affect our business. If receivables from one or more of these customers become uncollectible, our operating income would be adversely impacted.

The Food Service and the Frozen Beverages segments sell primarily to foodservice channels. The Retail Supermarkets segment sells primarily to the retail supermarket channel.

The Company’s customers in the Food Service segment include snack bars and food stands in chain, department and mass merchandising stores, malls and shopping centers, fast food and casual dining restaurants, stadiums and sports arenas, leisure and theme parks, convenience stores, movie theatres, warehouse club stores, schools, colleges and other institutions, and independent retailers. Machines and machine parts are sold to other food and beverage companies. Within the food service industry, the Company’s products are purchased by the consumer primarily for consumption at the point-of-sale.

The Company sells its products to a large majority of supermarkets in the United States. Products sold to retail supermarket customers are primarily soft pretzel products, including SUPERPRETZEL, frozen novelties including LUIGI’S Real Italian Ice, MINUTE MAID Juice Bars and Soft Frozen Lemonade, WHOLE FRUIT frozen fruit bars, WHOLE FRUIT Sorbet, PHILLY SWIRL cups and sticks, MARY B’S biscuits and dumplings, DADDY RAY’S fig and fruit bars, HILL & VALLEY baked goods, and ICEE Squeeze-Up Tubes. Within the retail supermarket industry, the Company’s frozen and prepackaged products are purchased by the consumer for consumption at home.

Marketing and Distribution

The Company supports its portfolio of brands with national and regional marketing programs. For the Food Service and Frozen Beverages segments’ customers, these marketing programs include providing ovens, mobile merchandisers, display cases, freezers, kiosks, warmers, frozen beverage dispensers and other merchandising equipment for the individual customer requirements and point-of-sale materials as well as participating in trade shows and in-store demonstrations. The Company’s ongoing advertising and promotional campaigns for its Retail Supermarket segment’s products include consumer advertising campaigns across traditional and digital channels, and print/digital media with value added shopper offers and promotions.

The Company develops and introduces new products on a routine basis. The Company evaluates the success of new product introductions on the basis of sales and profit levels.

The Company’s products are sold through a network of food brokers, independent sales distributors, and the Company’s own direct sales force. For its snack food products, the Company maintains warehouse and distribution facilities in Pennsauken, Bellmawr, Bridgeport, and Woolwich, New Jersey; Vernon (Los Angeles), California; Brooklyn, New York; Scranton and Hatfield, Pennsylvania; Carrollton (Dallas) and Terrell, Texas; Moscow Mills (St. Louis), Missouri; Tampa, Florida; Weston, Oregon; Rock Island, Illinois; Glendale, Arizona; and Paducah, Kentucky. Frozen beverages and machine parts are distributed from 172 Company managed warehouse and distribution facilities located in 45 states, Mexico, and Canada, which allow the Company to directly service its customers in the surrounding areas. The Company’s products are shipped in frozen form from the Company’s manufacturing and warehouse facilities on a fleet of Company operated tractor-trailers, trucks, and vans, as well as by independent carriers.

Seasonality

The Company’s sales are seasonal because frozen beverage sales and frozen novelties sales are generally higher during warmer months.

Trademarks and Patents

The Company has a significant trademark portfolio, the most important of which are SUPERPRETZEL, TEXAS TWIST, NEW YORK PRETZEL, BAVARIAN BAKERY, SOFTSTIX, and BRAUHAUS for its pretzel products; DIPPIN’ DOTS, SHAPE-UPS, WHOLE FRUIT, PHILLY SWIRL, and LUIGI’S for its frozen novelties; ¡HOLA!, and CALIFORNIA CHURROS for its churros; ICEE, ARCTIC BLAST, SLUSH PUPPIE, and PARROT ICE for its frozen beverages; FUNNEL CAKE FACTORY for its funnel cake products; and MRS. GOODCOOKIE, READI-BAKE, COUNTRY HOME, CAMDEN CREEK, MARY B’S, DADDY RAY’S, and HILL & VALLEY for its bakery products.

The Company markets frozen beverages under the trademark ICEE in all the United States and in Mexico and Canada.

The trademarks, when renewed and continuously used, have an indefinite term and are considered important to the Company as a means of identifying its products. The Company considers its trademarks important to the success of its business.

The Company has numerous patents related to the manufacturing and marketing of its products.

Suppliers

The Company’s manufactured products are produced from raw materials which are readily available from numerous sources. With the exception of the Company’s churro production equipment, funnel cake production equipment and soft pretzel twisting equipment, all of which are made for the Company by independent third parties, and certain specialized packaging equipment, the Company’s manufacturing equipment is readily available from various sources. Syrup for frozen beverages is purchased primarily from The Coca-Cola Company, Keurig Dr. Pepper, Inc., the Pepsi Cola Company, and Jogue, Inc. Cups. Straws and lids are readily available from various suppliers. Parts for frozen beverage dispensing machines are purchased from several sources.

Competition

Snack food and bakery products markets are highly competitive. The Company’s principal products compete against similar and different food products manufactured and sold by numerous other companies, some of which are substantially larger and have greater resources than the Company. As the soft pretzel, frozen novelties, bakery products and related markets evolve, additional competitors and new competing products may enter the markets. Competitive factors in these markets include product quality, innovation, customer service, taste, price, identity and brand name awareness, method of distribution and sales promotions.

The Company believes it is one of the only national distributors of soft pretzels. However, there are numerous regional and local manufacturers of food service and retail supermarket soft pretzels as well as several chains of retail pretzel stores.

In Frozen Beverages, the Company competes directly with other frozen beverage companies. There are many other regional frozen beverage competitors throughout the country and one large retail chain which uses its own frozen beverage brand.

The Company competes with large soft drink manufacturers for counter and floor space for its frozen beverage dispensing machines at retail locations and with products which are more widely known than the ICEE, SLUSH PUPPIE and PARROT ICE frozen beverages.

The Company competes with several other companies in the frozen novelties and bakery products markets.

Risks Associated with Foreign Operations

Foreign operations can involve greater risk than doing business in the United States. Foreign economies differ favorably or unfavorably from the United States’ economy in such respects as the level of inflation and debt, which may result in fluctuations in the value of the country’s currency and real property. Sales from our foreign operations were $69.6 million, $73.4 million and $70.2 million in fiscal years 2025, 2024, and 2023, respectively. At September 27, 2025, the total assets in our foreign operations were $79.1 million or 5.7% of total assets. At September 28, 2024, the total assets in our foreign operations were $67.6 million or 5.0% of total assets.

Government Regulation and Food Safety

Our business operations are subject to regulation by various federal, state and local government entities and agencies. As a producer of food products for human consumption, our operations are subject to stringent production, packaging, quality, labeling and distribution standards, including regulations promulgated under the Federal Food, Drug and Cosmetic Act and the Food Safety Modernization Act. We are also subject to various federal, state, and local environmental protection laws. Based upon available information, the cost of compliance with these laws and regulations did not have a material effect upon the level of capital expenditures, earnings, or competitive position in fiscal 2025 and is not expected to have a material impact in fiscal 2026.

Our Food Safety & Quality (FSQA) personnel within our Compliance Department have broad, diverse academic and experience credentials and oversee all aspects of product safety & quality assurance across the Company. Our facilities are Global Food Safety Initiative (GFSI) certified and are audited annually by third-party certification bodies. Our “Food Safety & Quality Plans” are validated and verified to ensure product safety and quality. We have implemented Corporate Standards which are aligned with GFSI and Regulatory standards and routinely conduct audits to ensure compliance. We provide bi-weekly support calls and mentorship programs for FSQA and Plant Leadership and annual Food Safety Summit Meetings to develop and strengthen our facility teams. As part of the onboarding process, and throughout their careers, employees are engaged in food safety discussions and trainings to provide safe, high-quality products to customers and consumers.

Human Capital Management

Employees and Labor Relations

The Company has approximately 4,600 full and part-time employees and approximately 600 workers employed by staffing agencies as of September 27, 2025. About 1,400 production and distribution employees throughout the Company are covered by collective bargaining agreements. The Company considers its culture and employee relations to be positive.

Employee Safety

We maintain a safety culture grounded on the premise of eliminating workplace incidents, risks and hazards. We have a team of dedicated Employee Health & Safety professionals within our Compliance Department who oversee all aspects of employee safety across the company. We keep our employees safe by ensuring all employees receive ongoing support and training. We have developed and implemented processes to identify and eliminate safety incidents by reducing their frequency and severity. We also closely review and monitor our safety performance. According to data from the U.S Bureau of Labor Statistics, the Company’s Total Recordable Incident Rate (“TRIR”) and Days Away, Restricted or Transferred (“DART”) incident rates were lower than food manufacturing averages. Our goal is to reduce Occupational Safety and Health Administration (“OSHA”) recordable incidents year-over-year.

Professional Development

We deploy a variety of training programs throughout the organization and go to great lengths to make learning and knowledge available to our employees. Programs such as tuition reimbursement, mentorships, internships, and internal trainings are some of the ways in which we invest in our people and their knowledge. We know that these investments are not only beneficial for our employees, but they are also important for the future success of our business. We continue to see increases in internal promotions across all levels of the organization.

Diversity and Inclusion

We believe that having an inclusive and diverse culture strengthens our ability to recruit and develop talent and allows our employees to thrive and succeed. Diversity of input and perspectives is an essential part of our strategic plan to build a winning team and culture. We believe that one key to success is attracting and retaining a diverse workforce that reflects our consumers of today and tomorrow, and we strive to do so. We also strive to foster an inclusive and diverse workplace culture where colleagues feel a sense of belonging and are included in discussions and valued for their contributions.

Compensation

We believe in equal pay for equal work and that compensation should match talent, experience and skill set of a person.

Available Information

The Company’s internet address is www.jjsnack.com. On the investor relations section of its website, the Company provides free access to its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports, as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the Securities and Exchange Commission (“SEC”). The information on the website listed above is not and should not be considered part of this annual report on Form 10-K and is not incorporated by reference in this document.

Item 1A. Risk Factors

Our business is subject to numerous risks and uncertainties. You should carefully consider the risks described below, together with all the other information included in this report, in considering our business and prospects. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us or that we currently deem insignificant or immaterial may also materially and adversely affect our business, financial condition, results of operations or prospects. The following is a discussion of known potentially significant risks which could result in harm to our business, financial condition, or results of operations.

General Economic Risk

The willingness of our customers and consumers to purchase our products may depend in part on economic conditions. Worsening economic conditions or future challenges to economic growth could have a negative impact on consumer demand, which could adversely affect our business. Deterioration of national and global economic conditions could cause consumers to forego certain purchases during economic downturns that could result in decreased demand for our business. The economic uncertainty may limit our ability to increase or maintain prices and reduce sales of higher margin products. In addition, changes in tax or interest rates, current or future governmental policies or regulations, which include the imposition of tariffs, efforts to combat inflation, financial and credit market disruptions or other reasons, could negatively impact us.

Risks of Shortages or Increased Cost of Raw Materials and Packaging

We are exposed to market risks arising from adverse changes in commodity prices, affecting the cost of our raw materials and energy. The raw materials and energy which we use for the production and distribution of our products are largely commodities that are subject to price volatility and fluctuations in availability caused by changes in global supply and demand, weather conditions, agricultural uncertainty, or governmental policies and regulations, which can include the imposition of tariffs. We purchase these materials and energy mainly in the open market. Our procurement practices are intended to reduce the risk of future price increases, but also may potentially limit the ability to benefit from possible price decreases. If commodity price changes result in increases in raw materials and energy costs, we may not be able to increase our prices to offset these increased costs without suffering reduced revenue and operating income. These increased costs, if not offset, may have a significant impact on our profits.

U.S. trade policies, including the imposition of tariffs, and potential related actions by other countries are outside of our control and may affect our results of operations. Recently, the United States announced tariffs on imports from a broad range of countries which we anticipate will cause inflationary pressures, possible retaliatory tariffs and higher costs on certain of our raw materials and packaging imported from the affected countries. If maintained, the announced U.S. tariffs, as well as related measures that could be taken by other countries, could affect our results of operations.

Risks Relating to Pandemics, Epidemics, or Other Disease Outbreaks

Pandemics, epidemics, or other disease outbreaks could significantly change consumption patterns for our products. These changes could force us to rapidly adapt to those new patterns, and, if we do not, our business could be materially and adversely affected. Additionally, pandemics, epidemics or other disease outbreaks may depress or otherwise impact demand for our products because quarantines may inhibit consumption. Restrictions on public gatherings or interactions may also limit the opportunity for our customers and consumers to purchase our products, especially in certain of our sales channels, such as food service. Any economic downturn caused by any pandemic, epidemic, or other disease outbreak may also cause substantial changes in consumer behavior and our supply chain operations, some of which may materially affect our operations and results of operations.

General Risks of the Food Industry

We are subject to the risks of adverse changes in general economic conditions; evolving consumer preferences and nutritional and health-related concerns; changes in food distribution channels; federal, state and local food processing controls or other mandates; changes in federal, state, local and international laws and regulations, or in the application of such laws and regulations; consumer product labeling and liability claims; risks of product tampering and contamination; and negative publicity surrounding actual or perceived product safety deficiencies. The increased buying power of large supermarket chains, other retail outlets and wholesale food vendors could result in greater resistance to price increases and could alter customer inventory levels and access to shelf space.

Federal or state actions targeting specific food ingredients (including bans or phase-outs of certain dyes, preservatives or processing aids) – or actions that incentivize removal of those ingredients – could require us to reformulate existing products, incur higher ingredient or manufacturing costs, reduce shelf life, or change product functionality and taste. These changes could result in lost sales, customer dissatisfaction, increased recall risk or material expenses. Further, new rules requiring front-of-pack nutrition labels, warnings, or expanded ingredient disclosures may require redesign of packaging, increase unit costs, and influence consumer purchase decisions. These requirements may restrict certain claims we make and could lead to product delisting or store exclusion in some channels.

Our business, results of operations, and financial condition could be materially and adversely affected by changes in consumer behavior arising from the increased use of prescription weight-loss therapies, including GLP-1 and related drugs. These therapies can suppress appetite and change food preferences and consumption patterns, which could reduce demand for food categories we sell. This reduction in demand could adversely affect our results of operations and growth prospects.

Risks of Shortages or Increased Costs of Labor

Our businesses operate in highly competitive markets. The labor market in the United States is very competitive. We depend on the skills, working relationships, and continued services of employees, including our experienced management team. We must hire, train, and develop effective employees. We compete with other companies both within and outside of our industry for talented employees, and we may lose key personnel or fail to attract, train, and retain other talented personnel. In addition, our ability to achieve our operating goals depends on our ability to identify, hire, train, and retain qualified individuals. Any such loss or failure could adversely affect our product sales, financial condition, and operating results. Additionally, a shortage in the labor pool and other general inflationary pressures or changes, and applicable laws and regulations could increase labor costs, which could have a material adverse effect on our consolidated operating results or financial condition.

In addition, some of our associates are covered by collective bargaining agreements, and other associates may seek to be covered by collective bargaining agreements. Strikes or work stoppages or other business interruptions could occur if we are unable to renew these agreements on satisfactory terms or enter into new agreements on satisfactory terms or if we are unable to otherwise manage changes in, or that affect, our workforce, which could impair manufacturing or distribution of our products or result in a loss of sales, which could adversely impact our business, financial condition, or results of operations. The terms and conditions of existing, renegotiated, or new collective bargaining agreements could also increase our costs or otherwise affect our ability to fully implement future operational changes to enhance our efficiency or adapt to changing business needs or strategy.

Environmental Risks

The disposal of solid and liquid waste material and the discharge of airborne pollutants resulting from the preparation and processing of foods is subject to various federal, state, and local laws and regulations relating to the protection of the environment. Such laws and regulations have a substantial effect on the food processing industry as a whole, requiring substantially all firms in the industry to incur material expenditures for modification of existing processing facilities and for construction of upgraded or new waste treatment facilities.

We cannot predict what environmental legislation or regulations will be enacted in the future, how existing or future laws or regulations will be administered or interpreted or what environmental conditions may be found to exist. Enactment of more stringent laws or regulations or more strict interpretation of existing laws and regulations may require additional expenditure by us, some of which could have a negative impact on our operations and financial condition. Additionally, the failure by any one or more of our suppliers to comply with applicable federal, state, and local laws and regulations relating to the protection of the environment, or allegations of non-compliance, may disrupt their operations and could result in accompanying disruptions to our operations.

Risks Resulting from Customer Concentration

We have several large customers that account for a significant portion of our sales. Our top ten customers accounted for 46% of our sales during fiscal year 2025, 45% of our sales during fiscal year 2024 and 43% of our sales during fiscal year 2023, with our largest customer accounting for 10% of our sales in 2025, 9% of our sales in 2024, and 9% of our sales in 2023.

Five of the ten customers are food distributors who sell our product to many end users. The loss of one or more of our large customers could adversely affect our results of operations. These customers typically do not enter into long-term contracts and make purchase decisions based on a combination of price, product quality, consumer demand and customer service performance. If our sales to one or more of these customers are reduced, this reduction may adversely affect our business. If receivables from one or more of these customers become uncollectible, our operating income would be adversely impacted.

Risks Relating to Competition

Our businesses operate in highly competitive markets. We compete against national and regional manufacturers and distributors on the basis of price, quality, product variety, brand recognition and loyalty, and effective distribution. Many of our major competitors in the market are larger and have greater financial and marketing resources than we do. Increased competition from our competitors could lead to downward pressure on prices and/or a decline in our market share, either of which could adversely affect our results. See “Competition” in Item 1 for more information about our competitors.

Risks Relating to Manufacturing and Distribution

Our ability to purchase, manufacture and distribute products is critical to our success. Because we source certain products from single manufacturing sites, it is possible that we could experience a production disruption that results in a reduction or elimination of the availability of some of our products. If we are not able to obtain alternate production capability in a timely manner, or on favorable terms, it could have a negative impact on our business, results of operations, financial condition, and cash flows, including the potential for long-term loss of product placement with various customers. We are also subject to risks of other business disruptions associated with our dependence on production facilities and distribution systems. Natural disasters, terrorist activity, cyberattacks or other unforeseen events could interrupt production or distribution and have a material adverse effect on our business, results of operations, financial condition, and cash flows, including the potential for long-term loss of product placement with our customers. For example, on August 19, 2024, we experienced a fire at our Holly Ridge plant in North Carolina. The building was damaged as a result of the fire, and plant operations were interrupted.

Risks Relating to the Availability and Costs of Transportation

Our ability to obtain adequate and reasonably priced methods of transportation to distribute our products, including refrigerated trailers for many of our products, is a key factor to our success. Delays in transportation, including weather-related delays, and carrier capacity limitations, could have a material adverse effect on our business and results of operations. Further, higher fuel costs and increased line haul costs due to industry capacity constraints, customer delivery requirements and a more restrictive regulatory environment could also negatively impact our financial results. We pay fuel surcharges that fluctuate with the price of diesel fuel to third-party transporters of our products, and such surcharges can be substantial. Any sudden or dramatic increases in the price of diesel fuel would serve to increase our fuel surcharges and our cost of goods sold. These higher costs could have a material adverse effect on our business, results of operations, financial condition, and cash flows.

Risks Relating to Manufacturing Capacity Constraints

Our current manufacturing resources may be inadequate to meet significantly increased demand for some of our products. Our ability to increase our manufacturing capacity depends on many factors, including the costs and availability of equipment, the equipment delivery and construction lead-times, installation, qualification, regulatory permitting, and regulatory requirements. A lack of sufficient manufacturing capacity to meet demand could cause our customer service levels to decrease, which may negatively affect customer demand for our products and customer relations generally, which in turn could have a material adverse effect on our business, results of operations, financial condition, and cash flows. In addition, operating facilities at or near capacity may also increase production and distribution costs and negatively affect relations with our employees or contractors, which could result in disruptions in our operations.

Risks Relating to Acquisition Integration

From time to time, the Company undertakes acquisitions or divestitures. The success of any acquisition or divestiture depends on the Company’s ability to identify opportunities that help the Company meet its strategic objectives, consummate a transaction on favorable contractual terms, and achieve expected returns and other financial benefits.

Acquisitions, require us to efficiently integrate the acquired business or businesses, which involves a significant degree of difficulty, including the following:

|

● |

integrating the operations and business cultures of the acquired businesses; |

|

|

● |

the possibility of faulty assumptions underlying our expectations regarding the prospects of the acquired businesses; |

|

|

● |

attracting and retaining the necessary personnel associated with the acquisitions; |

|

|

● |

creating uniform standards, controls, procedures, policies, and information systems and controlling the costs associated with such matters; and |

|

|

● |

expectations about the performance of acquired trademarks and brands and the fair value of such trademarks and brands. |

Divestitures have operational risks that may include impairment charges. Divestitures also present unique financial and operational risks, including diverting management attention from the existing core business, separating personnel and financial data and other systems, and adversely affecting existing business relationships with suppliers and customers.

In situations where acquisitions and divestitures are not successfully implemented or completed, or the expected benefits of such acquisitions or divestitures are not otherwise realized, the Company’s business or financial results could be negatively impacted.

New Jersey Law and Provisions of Our Amended and Restated Certificate of Incorporation and Bylaws May Inhibit a Change In Control

The New Jersey Shareholders' Protection Act, N.J.S.A. 14A:10A-1, et seq., may delay, deter or prevent a change in control by prohibiting the Company from engaging in a business combination transaction with an interested shareholder for a period of five years after the person becomes an interested stockholder, even if a majority of our shareholders believe a change in control would be in the best interests of the Company and its shareholders. In addition, our Amended and Restated Certificate of Incorporation and Bylaws contain provisions that may delay, deter or prevent a future acquisition of J & J Snack Foods Corp. not approved by our Board of Directors. This could occur even if our shareholders are offered an attractive value for their shares or if a substantial number or even a majority of our shareholders believe the takeover is in their best interest. These provisions are intended to encourage any person interested in acquiring us to negotiate with and obtain the approval of our Board of Directors in connection with the transaction. Provisions of our Amended and Restated Certificate of Incorporation and Bylaws that could delay, deter or prevent a future acquisition include the following:

|

● |

a classified Board of Directors; |

|

|

● |

the requirement that our shareholders may only remove Directors for cause; |

|

|

● |

limitations on share holdings and voting of certain persons who exceed the “Voting Threshold” specified in the Amended and Restated Certificate of Incorporation; |

|

|

● |

special Director voting rights are granted to certain “Experienced Directors” only in the event of a “hostile change of Board control,” as such terms are defined in the Amended and Restated Certificate of Incorporation; |

|

|

● |

the ability of the Board of Directors to consider the interests of various constituencies, including our employees, customers, suppliers, creditors and the local communities in which we operate; |

|

|

● |

shareholders do not generally have the right to call special meetings or to act by written consent; |

|

|

● |

our Bylaws contain advance notice procedures for nominations of Directors or submission of shareholder proposals at an annual meeting; and |

|

|

● |

our Bylaws contain a forum selection clause providing that certain litigation against the Company can only be brought in New Jersey state or federal courts. |

Risk Related to Increases in our Health Insurance Costs

The costs of employee health care insurance have been increasing in recent years due to rising health care costs, legislative changes, and general economic conditions. Because of the breadth and complexity of health care regulations as well as other health care reform legislation considered by Congress and state legislatures, we cannot predict with certainty the future effect of these laws on us. A continued increase in health care costs or additional costs incurred as a result of new or existing health care reform laws or changes in enforcement policies could have a negative impact on our financial position and results of operations.

Risk Related to Product Changes

There are risks in the marketplace related to trade and consumer acceptance of product improvements, packaging initiatives and new product introductions. We cannot be sure if our new products, product improvements, or packaging initiatives will be accepted by customers.

Risks Associated with Foreign Operations

Foreign economies may differ favorably or unfavorably from the United States’ economy in such respects as the level of inflation and debt, which may result in fluctuations in the value of the country’s currency. Further, there may be less government regulation in various countries, and we may face difficulty in enforcing our legal rights outside the United States. Additionally, in some foreign countries, there is the possibility of expropriation or confiscatory taxation limitations on the removal of property or other assets, political or social instability or diplomatic developments which could affect the operations and assets of U.S. companies doing business in that country. Any such difficulties noted above could affect our business. Sales of our foreign operations were $69.6 million, $73.4 million, and $70.2 million in fiscal years 2025, 2024, and 2023, respectively. At September 27, 2025, the total assets of our foreign operations were approximately $79.1 million or 5.7% of total assets. At September 28, 2024, the total assets of our foreign operations were $67.6 million or 5.0% of total assets.

Risks Associated with our Information Technology Systems

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems to effectively manage our business data, communications, supply chain, manufacturing, order entry and fulfillment, and other business processes. The failure of our information technology systems (including those provided to us by third parties) to perform as we anticipate could disrupt our business and could result in production, billing, collecting, and ordering errors, processing inefficiencies, and the loss of sales and customers, causing our business and results of operations to suffer.

Our information technology systems may be vulnerable to damage or interruption from circumstances beyond our control, including fire, natural disasters, systems failures, security breaches or intrusions (including those against our third-party providers and theft of customer, consumer, or other confidential data), and viruses. Although we continue to monitor our information technology networks, if we are unable to prevent physical and electronic break-ins, cyber-attacks, and other information security breaches, we may suffer material financial and reputational damage, be subject to litigation or incur significant remediation costs or penalties.

Risks Associated with Real or Perceived Safety Issues Regarding our Food Products

We sell food products for human consumption, which involves risks such as product contamination or spoilage, product tampering, other adulteration of food products, mislabeling, and misbranding. We can be impacted by both real and unfounded claims regarding the safety of our operations, or concerns regarding mislabeled, adulterated, contaminated, or spoiled food products. Any of these circumstances could necessitate a voluntary or mandatory recall, a need to change a product’s labeling or other consumer safety concerns. A pervasive product recall may result in significant loss due to the costs of a recall, related legal claims, including claims arising from bodily injury or illness caused by our products, the destruction of product inventory, or lost sales due to product unavailability or negative publicity. A highly publicized product recall, whether involving us or any related products made by third parties, also could result in a loss of customers or an unfavorable change in consumer sentiment regarding our products or any category in which we operate. In addition, an allegation of noncompliance with federal or state food laws and regulations could force us to cease production, stop selling our products or create significant adverse publicity that could harm our credibility and decrease market demand for our products. Any of these events could have a material adverse effect on our business, results of operations, financial condition, and cash flows.

Risks Associated with our Intellectual Property Rights

We consider our intellectual property rights, particularly our trademarks, to be a significant and valuable aspect of our business. We protect our intellectual property rights through a combination of trademark, patent, copyright and trade secret protection, contractual agreements, and policing of third-party misuses of our intellectual property in traditional retail and digital environments. Our failure to obtain or adequately protect our intellectual property or any change in law that lessens or removes the current legal protections of our intellectual property may diminish our competitiveness and adversely affect our business and financial results.

Competing intellectual property claims that impact our brands or products may arise unexpectedly. Any litigation or disputes regarding intellectual property may be costly and time consuming and may divert the attention of our management and key personnel from our business operations. We may also be subject to significant damages or injunctions against development, launch and sale of certain products. Any of these occurrences may harm our business and financial results.

Risks Associated with the Favorable Perception of our Brands

We have a number of iconic brands with significant value. Maintaining and continually enhancing the value of these brands is critical to the success of our business. Brand value is primarily based on consumer perceptions. Success in promoting and enhancing brand value depends in large part on our ability to provide high-quality products. Brand value could diminish significantly due to a number of factors, including consumer perception that we have acted in an irresponsible manner, adverse publicity about our products, packaging, ingredients, our environmental, social, human capital or governance practices, our failure to maintain the quality of our products, the failure of our products to deliver consistently positive consumer experiences, or the products becoming unavailable to consumers. The growing use of social and digital media by consumers increases the speed and extent that information and opinions can be shared. Negative posts or comments about us, our brands, products, or packaging on social or digital media could seriously damage our brands and reputation. In addition, we might fail to appropriately target our marketing efforts, anticipate consumer preferences, or invest sufficiently in maintaining our brand image. If we do not maintain the favorable perception of our brands, our financial results could be adversely impacted.

Risk Associated with Generating Anticipated Cost Savings and/or Operating Efficiencies Associated with our Strategic Initiatives

Our future success and earnings growth depend in part on our ability to achieve the appropriate cost structure and operate efficiently in the highly competitive food industry, particularly in an environment of volatile cost inputs. We continuously pursue initiatives to reduce costs and increase effectiveness. We also regularly pursue cost productivity initiatives in procurement, manufacturing, and logistics. Any failure or delay in implementing our initiatives in accordance with our plans could adversely affect our ability to meet our long-term growth and profitability expectations and could adversely affect our business. If we do not continue to effectively manage costs and achieve additional efficiencies, our competitiveness and profitability could decrease.

Seasonality and Quarterly Fluctuations

Our sales are affected by the seasonal demand for our products. Demand is greater during the summer months primarily as a result of the warm weather demand for our ICEE and frozen novelties products. Because of seasonal fluctuations, there can be no assurance that the results of any particular quarter will be indicative of results for the full year or for future years.

Item 1B. Unresolved Staff Comments

We have no unresolved SEC staff comments to report.

Item 1C. Cybersecurity

Cybersecurity Risk Management and Strategy

Our enterprise risk management process includes an evaluation of cybersecurity risk together with other company risks. The Company has established a cybersecurity risk management program (the “program”) designed to assess, identify, and manage material cybersecurity risks. Our program is designed based on industry best practices and is aligned with the core components of frameworks established by the National Institute of Standards and Technology (NIST), Center for Internet Security (CIS) and International Organization for Standardization (ISO).

An annual risk assessment is performed to identify internal and external cybersecurity threats and vulnerabilities, assess the likelihood and potential impact of such threats and vulnerabilities, and prioritize the risks from such threats and vulnerabilities. The results of the risk assessment, along with professional judgment, are used to develop and implement cybersecurity risk mitigation strategies and controls.

Our program includes:

|

● |

A cybersecurity incident response plan that outlines a structured approach to investigating, containing, documenting, and mitigating cybersecurity incidents, including reporting findings and keeping senior management, the Audit Committee, and other key stakeholders informed and involved as appropriate; |

|

● |

Annual external penetration testing to identify vulnerabilities, assess perimeter security, improve incident response, and strengthen security policies and procedures; |

|

● |

Regular phishing, social engineering, and cybersecurity awareness training for employees with access to the Company’s information technology environment; |

|

● |

Annual tabletop exercises to test incident response plans, improve communication and coordination between relevant employees, and identify gaps to inform needed adjustments to plans; |

|

● |

Ongoing risk assessments of third-party service providers designed to ensure they meet the Company’s standards for reliability, security, compliance, and performance. |

Third-party service providers are used in various capacities as part of our cybersecurity risk management program, including performing risk mitigation controls and providing cloud-based cybersecurity services and platforms. For example, third-party service providers are used to conduct our external penetration testing, as well as assist the Company in detecting, responding, and mitigating cybersecurity incidents. The Company uses a variety of processes to oversee and identify material risks from cybersecurity threats associated with the use of third-party service providers. Third-party service providers are required to complete a detailed questionnaire, which is used to identify and assess material cybersecurity risks. In addition, the Company performs an annual review of independent attestation reports of the third-party service providers’ control environments designed to ensure that the controls meet Company security requirements and that any identified issues in the independent attestation reports do not present material cybersecurity risks to the Company.

To date, we have not identified any cybersecurity threats or incidents which have materially affected, or are reasonably likely to materially affect, the Company, including its business strategy, results of operations or financial condition; however, there is no guarantee that we will not be the subject of future successful cybersecurity threats or incidents that may materially and adversely affect the Company, including its business strategy, financial condition, results of operations or prospects. Additional information on cybersecurity-related risks is discussed under the heading “Risks Associated with our Information Technology Systems” under Item 1A, which should be read in conjunction with Item 1C.

Cybersecurity Governance

Our Board of Directors has delegated oversight responsibilities for enterprise risk, including cybersecurity risk, to the Audit Committee. The Chief Information Officer (“CIO”) and Chief Information Security Officer (“CISO”) provide periodic updates to the Audit Committee regarding the Company's cybersecurity risk management program. The Company has a cybersecurity incident response plan that includes a process to evaluate cybersecurity incidents for materiality. The escalation protocol includes reporting potentially material cybersecurity incidents to senior members of management for further evaluation. Any cybersecurity incident determined to have a material impact on the Company is timely reported to the Audit Committee.

The CISO has primary responsibility for the development, operation, and maintenance of our cybersecurity risk management program. Our CISO has 25 years of experience in information technology and cybersecurity generally, which has been gained from a combination of education, including relevant degrees, and prior work experience.

Item 2. Properties

|

Location |

Reporting Segment |

Facility Type |

Products Manufactured |

Owned Square Footage |

Leased Square Footage |

Total Square Footage |

|||||||||

|

Pennsauken, NJ |

Food Service/Retail Supermarket |

Manufacturing |

Soft Pretzels, Churros, Bakery Products |

70,000 | - | 70,000 | |||||||||

|

Pennsauken, NJ |

Food Service/Retail Supermarket |

Warehousing/Distribution |

N/A | 171,000 | - | 171,000 | |||||||||

|

Mt. Laurel, NJ |

Food Service/Retail Supermarket/Frozen Beverages |

Office |

N/A | - | 30,000 | 30,000 | |||||||||

|

Bellmawr, NJ |

Food Service/Retail Supermarket |

Manufacturing |

Soft Pretzels, Bakery Products |

150,000 | - | 150,000 | |||||||||

|

Vernon, CA |

Food Service |

Manufacturing |

Soft Pretzels, Churros, Bakery Products |

- | 107,000 | 107,000 | |||||||||

|

Vernon, CA |

Food Service |

Warehousing/Distribution |

N/A | - | 30,000 | 30,000 | |||||||||

|

Vernon, CA |

Food Service |

Office/Warehousing |

N/A | - | 80,000 | 80,000 | |||||||||

|

Brooklyn, NY |

Food Service |

Manufacturing |

Soft Pretzels |

- | 20,000 | 20,000 | |||||||||

|

Colton, CA |

Food Service |

Manufacturing |

Churros, Bakery Products |

- | 45,000 | 45,000 | |||||||||

|

Atlanta, GA |

Food Service/Retail Supermarket |

Manufacturing |

Bakery Products |

- | 85,000 | 85,000 | |||||||||

|

Rock Island, IL |

Food Service |

Manufacturing |

Bakery Products |

- | 129,000 | 129,000 | |||||||||

|

Scranton, PA |

Food Service/Retail Supermarket |

Manufacturing |

Frozen Novelties |

46,000 | - | 46,000 | |||||||||

|

Scranton, PA |

Food Service/Retail Supermarket |

Warehousing |

N/A | 42,000 | - | 42,000 | |||||||||

|

Hatfield, PA |

Food Service |

Manufacturing |

Soft Pretzels |

- | 30,000 | 30,000 | |||||||||

|

Carrollton, TX |

Food Service |

Manufacturing |

Soft Pretzels |

- | 48,000 | 48,000 | |||||||||

|

Carrollton, TX |

Food Service |

Warehousing |

N/A | - | 7,000 | 7,000 | |||||||||

|

Bridgeport, NJ |

Food Service |

Manufacturing |

Bakery Products |

- | 133,000 | 133,000 | |||||||||

|

Moscow Mills, MO |

Food Service |

Manufacturing |

Bakery Products |

165,000 | - | 165,000 | |||||||||

|

Holly Ridge, NC |

Food Service/Retail Supermarket |

Manufacturing |

Handheld Products |

84,000 | - | 84,000 | |||||||||

|

Weston, OR |

Food Service/Retail Supermarket |

Manufacturing |

Handheld Products |

- | 70,000 | 70,000 | |||||||||

|

Weston, OR |

Food Service/Retail Supermarket |

Warehousing |

N/A | - | 11,000 | 11,000 | |||||||||

|

Little Rock, AR |

Food Service |

Office |

N/A | - | 3,000 | 3,000 | |||||||||

|

Paducah, KY |

Food Service |

Manufacturing |

Frozen Novelties |

130,000 | - | 183,000 | |||||||||

|

Paducah, KY |

Food Service |

Office |

N/A | - | 59,000 | 59,000 | |||||||||

|

Lancaster, CA |

Food Service |

Warehousing |

N/A | - | 23,000 | 23,000 | |||||||||

|

Tampa, FL |

Retail Supermarket |

Manufacturing |

Frozen Novelties |

- | 67,000 | 67,000 | |||||||||

|

LaVergne, TN |

Frozen Beverages |

Office |

N/A | - | 84,000 | 84,000 | |||||||||

|

Terrell, TX |

Food Service/Retail Supermarket |

Warehousing |

N/A | - | 117,000 | 117,000 | |||||||||

|

Woolwich, NJ |

Food Service/Retail Supermarket |

Warehousing |

N/A | - | 201,000 | 201,000 | |||||||||

|

Glendale, AZ |

Food Service/Retail Supermarket |

Warehousing |

N/A | - | 87,000 | 87,000 | |||||||||

| 858,000 | 1,466,000 | 2,324,000 | |||||||||||||

The Company also leases approximately 170 smaller warehouse and distribution facilities in 45 states, Mexico, Canada, Australia, and China.

Item 3. Legal Proceedings

The Company has no material pending legal proceedings, other than ordinary routine litigation incidental to the business, to which the Company or any of its subsidiaries is a party or of which any of their property is subject.

Item 4. Mine Safety Disclosures

Not Applicable

PART II

Item 5. Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities

We have, issued and outstanding, one class of capital stock, Common Stock. Holders of Common Stock are generally entitled to one vote per share on matters submitted to shareholders for approval. As of September 27, 2025, we had approximately 66 stockholders of record of our common stock.

Market Information

The Company’s common stock is traded on the NASDAQ Global Select Market under the symbol “JJSF.”

Issuer Purchases of Equity Securities

The following tables sets forth repurchases of our common stock during the fourth quarter of 2025:

|

Total number of shares |

Approximate dollar value |

|||||||||||||||

|

Total number |

Average |

purchased as part of |

of shares that may yet |

|||||||||||||

|

of shares |

price paid |

publicly announced |

be purchased under |

|||||||||||||

|

Period |

purchased (1) |

per share |

plans or programs (2) |

plans or programs (2) |

||||||||||||

|

(in thousands) |

||||||||||||||||

|

June 29, 2025 to July 26, 2025 |

- | - | - | $ | 45,000 | |||||||||||

|

July 27, 2025 to August 23, 2025 |

27,715 | $ | 108.24 | 27,715 | 42,000 | |||||||||||

|

August 24, 2025 to September 27, 2025 |

- | - | - | 42,000 | ||||||||||||

|

Three months ended September 27, 2025 |

27,715 | 108.24 | 27,715 | 42,000 | ||||||||||||

|

(1) |

There were 27,715 shares repurchased as part of our publicly announced share repurchase program during the quarter ended September 27, 2025. |

|

(2) |

On February 3, 2025, the Company announced that the Board of Directors authorized a share repurchase program (the 2025 Share Repurchase Program) pursuant to which the Company could repurchase up to $50.0 million of the Company’s common stock, exclusive of any fees, commissions, and other expenses related to such repurchases. As of September 27, 2025, there remains $42.0 million of share repurchase availability under the 2025 Share Repurchase Program. |

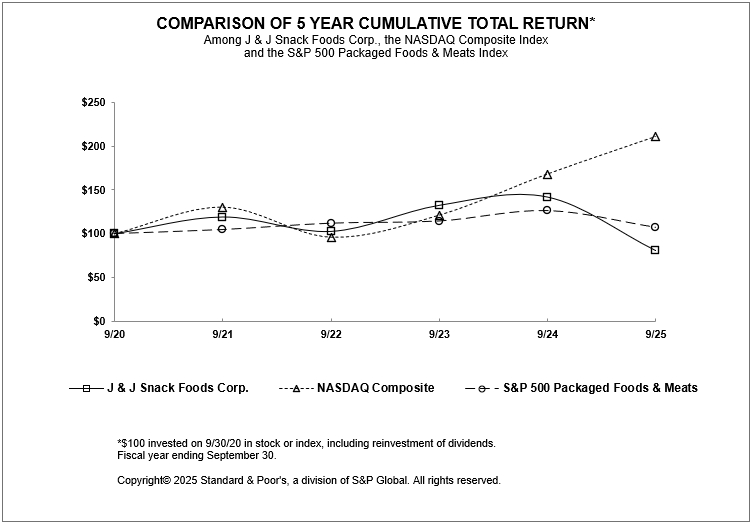

Performance Graph

The following graph shows a five-year comparison of cumulative total returns for our stock, the Nasdaq Composite Index and our peer group, the Standard & Poor’s (“S&P”) Packaged Foods & Meats Index.

Item 6. [ RESERVED ]

Item 7. Management’s Discussion And Analysis Of Financial Condition And Results Of Operations

Objective

This Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide a reader of our financial statements with a narrative from the perspective of our management regarding our financial condition and results of operations, liquidity and certain other factors that may affect our future results. The following discussion should be read in conjunction with the consolidated financial statements and accompanying notes included in Item 8 of this Form 10-K. Refer to the Company’s Annual Report on Form 10-K for the fiscal year ended September 28, 2024 for additional information related to the discussion and analysis of our financial condition and results of operations for the fiscal year ended September 28, 2024 compared to the fiscal year ended September 30, 2023.

Business Overview

The Company manufactures snack foods and distributes frozen beverages which it markets nationally to the foodservice and retail supermarket industries. The Company’s principal snack food products are soft pretzels, frozen novelties, churros and bakery products. We are the largest manufacturer of soft pretzels in the United States. Other snack food products include funnel cake and handheld products. The Company’s principal frozen beverage products are the ICEE brand frozen carbonated beverage and the SLUSH PUPPIE brand frozen non-carbonated beverage.

The Company’s Food Service and Frozen Beverages sales are made primarily to foodservice customers including snack bar and food stand locations in leading chain, department, discount, warehouse club and convenience stores; malls and shopping centers; fast food and casual dining restaurants; stadiums and sports arenas; leisure and theme parks; movie theatres; independent retailers; and schools, colleges and other institutions. The Company’s retail supermarket customers are primarily supermarket chains.

Business Trends and Strategy

Our results are impacted by macroeconomic and demographic trends and changes in consumer behavior. The U.S. economy has experienced economic volatility and uncertainty in recent years, which has had, and we expect might continue to have, an impact on consumer behavior. Consumer spending may continue to be impacted by levels of discretionary income and the impact of that on the consumer’s decision making around their purchases. In addition, inflation continues to impact our business, and fluctuating raw material input costs may continue to impact the costs of our products.

In fiscal year 2025, we encountered significant headwinds associated with certain cost inputs, most notably, rising cocoa costs. Record high cocoa costs were fueled by supply deficits, led by significant production declines among the largest producers. Despite an anticipated supply recovery, cocoa market prices continued to remain volatile, and touched record highs in fiscal 2025. These rising costs pressured margins, primarily during the first half of our fiscal year, as they outweighed pricing actions up to that point in time.