|

BOSTON OMAHA CORPORATION

|

||

|

(Exact name of registrant as specified in its Charter)

|

||

|

|

||

|

Delaware

|

001-38113

|

27-0788438

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

|

|

||

|

|

||

|

1601 Dodge Street, Suite 3300

Omaha, Nebraska 68102

(Address and telephone number of principal executive offices, including zip code)

|

||

|

(857) 256-0079

(Registrant's telephone number, including area code)

|

||

|

Not Applicable

(Former name or address, if changed since last report)

|

||

|

Title of Class

|

Trading Symbol

|

Name of Exchange on Which Registered

|

|

Class A common stock,

$0.001 par value per share

|

BOC

|

The New York Stock Exchange

|

|

ITEM 2.02

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

|

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

|

(d)

|

Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

|

|

Exhibit

Number

|

Exhibit Title |

| 99.1 | Press release dated November 13, 2025 titled “Boston Omaha Corporation Announces Third Quarter 2025 Financial Results.” |

| 99.2 | Presentation dated November 13, 2025 titled "Boston Omaha Q3 2025 Financial Results" |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

BOSTON OMAHA CORPORATION

(Registrant)

|

|||

|

By:

|

/s/ Joshua P. Weisenburger

|

||

|

Joshua P. Weisenburger,

|

|||

|

|

|||

Exhibit 99.1

BOSTON OMAHA CORPORATION ANNOUNCES THIRD QUARTER 2025 FINANCIAL RESULTS

| Omaha, Nebraska (Business Wire) | November 13, 2025 |

Boston Omaha Corporation (NYSE: BOC) (the “Company”, “we”, or “our”) announced its financial results for the third quarter ended September 30, 2025, in connection with filing its Quarterly Report on Form 10-Q with the Securities and Exchange Commission.

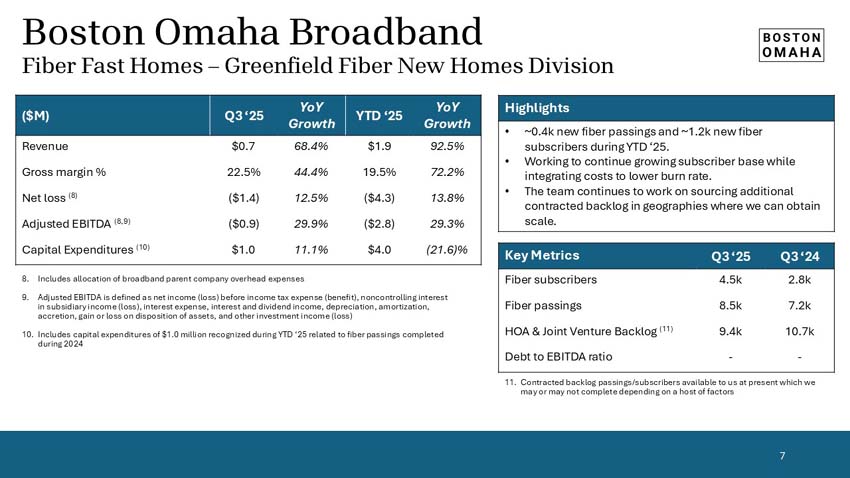

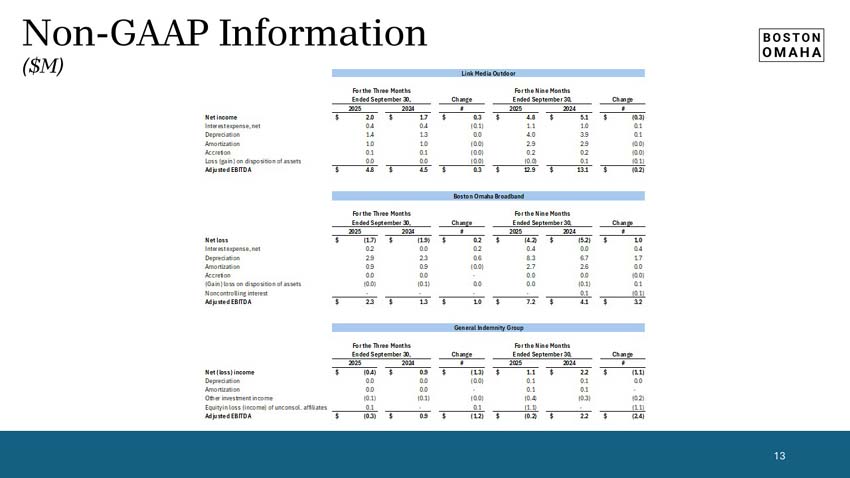

We show summary financial data below for the third quarter of 2025 and 2024. Our Quarterly Report on Form 10-Q can be found at www.bostonomaha.com. A supplemental presentation providing additional financial information for the third quarter of 2025 can be found on our investor relations website at https://investor.bostonomaha.com. We believe that it is important for shareholders to read the supplemental presentation as, in management’s opinion, it provides additional information on business metrics we use in gauging the performance of each of our three principal business units and investments.

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||||||||

|

September 30, |

September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

Billboard Rentals, Net |

$ | 11,788,400 | $ | 11,503,915 | $ | 33,992,908 | $ | 33,638,043 | ||||||||

|

Broadband Services |

10,150,921 | 9,664,074 | 30,704,514 | 29,135,486 | ||||||||||||

|

Premiums Earned |

5,636,732 | 5,425,052 | 16,765,865 | 14,165,167 | ||||||||||||

|

Insurance Commissions |

629,982 | 520,657 | 1,657,467 | 1,550,400 | ||||||||||||

|

Investment and Other Income |

528,320 | 587,238 | 1,547,765 | 1,852,354 | ||||||||||||

|

Total Revenues |

28,734,355 | 27,700,936 | 84,668,519 | 80,341,450 | ||||||||||||

|

Depreciation and Amortization Expense |

6,275,246 | 5,673,662 | 18,323,329 | 16,467,929 | ||||||||||||

|

Net Loss from Operations |

(1,052,152 | ) | (740,022 | ) | (2,670,045 | ) | (7,194,918 | ) | ||||||||

|

Net Other Expense |

(4,113,722 | ) | (1,065,883 | ) | (10,423,439 | ) | (834,439 | ) | ||||||||

|

Net Loss Attributable to Common Stockholders |

$ | (2,587,905 | ) | $ | (1,595,136 | ) | $ | (5,577,273 | ) | $ | (6,638,436 | ) | ||||

|

Basic and Diluted Net Loss per Share |

$ | (0.08 | ) | $ | (0.05 | ) | $ | (0.18 | ) | $ | (0.21 | ) | ||||

|

September 30, |

December 31, |

|||||||

|

2025 |

2024 |

|||||||

|

Total Unrestricted Cash and Investments (1) |

$ | 56,203,902 | $ | 41,659,941 | ||||

|

Total Assets |

721,354,111 | 728,345,729 | ||||||

|

Total Liabilities |

173,429,102 | 165,626,276 | ||||||

|

Total Boston Omaha Stockholders' Equity |

528,378,789 | 532,819,509 | ||||||

|

Noncontrolling Interests (2) |

19,546,220 | 29,899,944 | ||||||

|

Total Equity |

$ | 547,925,009 | $ | 562,719,453 | ||||

|

1. |

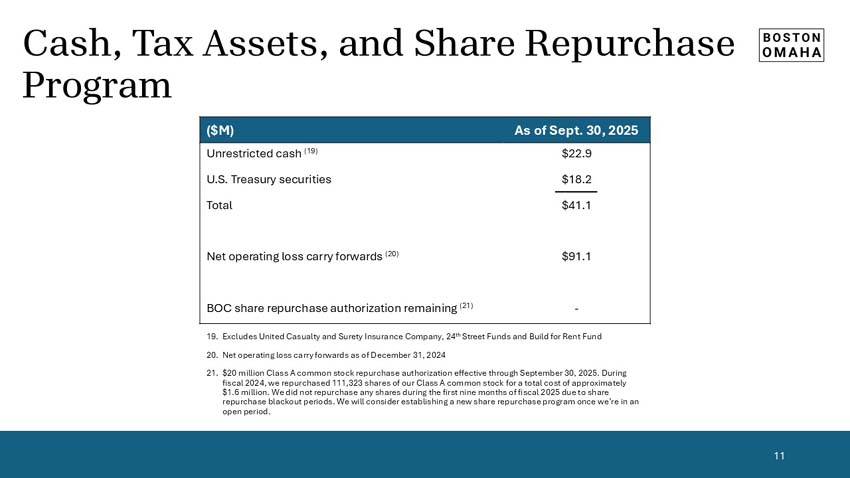

Investments consist of U.S. Treasury securities classified as trading securities and marketable equity securities, of which $997,447 is held by our insurance entities at September 30, 2025. Marketable equity securities excludes Sky Harbour Group Corporation (“Sky Harbour”) Class A common stock as we account for our 15.4% stake (as measured at September 30, 2025) under the equity method. |

|

2. |

Noncontrolling interests are primarily related to third party capital raised within our Build for Rent Fund as well as within our 24th Street commercial real estate funds. |

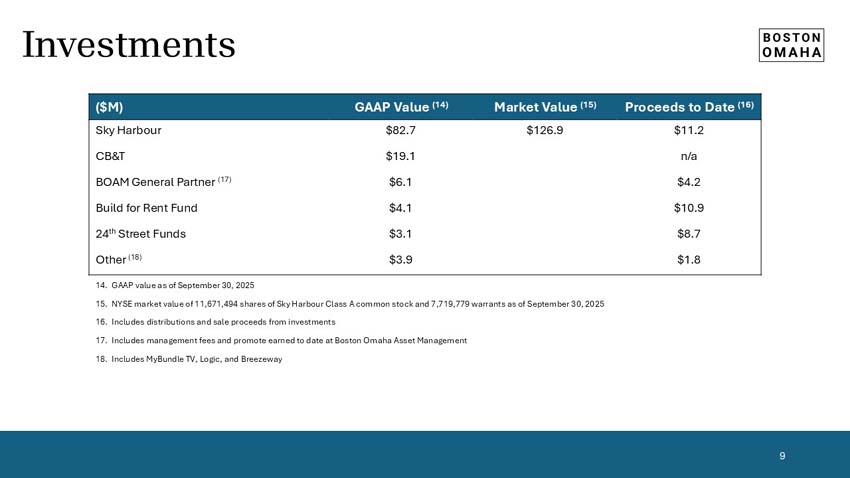

During the third quarter of fiscal 2025, “Net Other Expense” included an unrealized loss of $1.5 million on the Sky Harbour warrants held by Boston Omaha, losses of $2.0 million within BOAM primarily related to the changes in the fair value of the underlying assets within the 24th Street Funds, $0.6 million in losses from unconsolidated affiliates mainly related to our equity method position in Sky Harbour, and $0.7 million in interest expense. These items were partially offset by interest and dividend income of $0.3 million.

Our investment in Sky Harbour Class A common stock and warrants was valued at $82.7 million on our condensed consolidated balance sheet as of September 30, 2025. If our investment in Sky Harbour Class A common stock was accounted for at fair value based on its quoted market price (currently valued using equity method accounting), then our total investment in Sky Harbour Class A common stock and warrants would be valued at $126.9 million as of September 30, 2025.

Cash inflow from operations for the nine months ended September 30, 2025 was $12.1 million, compared to a cash inflow of $12.1 million for the nine months ended September 30, 2024.

Our book value per share was $16.80 at September 30, 2025, compared to $16.99 at December 31, 2024.

As of September 30, 2025, we had 30,872,876 shares of Class A common stock and 580,558 shares of Class B common stock outstanding.

As of November 12, 2025, we had 30,872,876 shares of Class A common stock and 580,558 shares of Class B common stock outstanding.

About Boston Omaha Corporation

Boston Omaha Corporation is a public holding company with four majority owned businesses engaged in outdoor advertising, broadband telecommunications services, surety insurance, and asset management.

Forward-Looking Statements

Any statements in this press release about the Company’s future expectations, plans and prospects, including statements about our financing strategy, future operations, future financial position and results, market growth, total revenue, as well as other statements containing the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” and similar expressions, constitute forward-looking statements within the meaning of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. The Company may not actually achieve the plans, intentions or expectations disclosed in the Company’s forward-looking statements, and you should not place undue reliance on the Company’s forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking statements the Company makes as a result of a variety of risks and uncertainties, including risks related to the Company’s estimates regarding the potential market opportunity for the Company’s current and future products and services, the competitive nature of the industries in which we conduct our business, general business and economic conditions, our ability to acquire suitable businesses, our ability to successfully integrate acquired businesses, the effect of a loss of, or financial distress of, any reinsurance company which reinsures the Company’s insurance operations, the risks associated with our investments in both publicly traded securities and privately held businesses, our history of losses and ability to maintain profitability in the future, the Company’s expectations regarding the Company’s sales, expenses, gross margins and other results of operations, and the other risks and uncertainties described in the “Risk Factors” sections of the Company’s public filings with the Securities and Exchange Commission (the “SEC”) on Form 10-K for the year ended December 31, 2024, as well as other risks and uncertainties which may be described in any subsequent quarterly report on Form 10-Q filed by the Company, and the other reports the Company files with the SEC. Copies of our SEC filings are available on our website at www.bostonomaha.com. In addition, the forward-looking statements included in this press release represent the Company’s views as of the date hereof. The Company anticipates that general economic conditions and subsequent events and developments may cause the Company’s views to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date hereof.

Our investor relations website, https://investor.bostonomaha.com, serves as a comprehensive resource for investors. We strongly encourage its use for easy access to information about the Company. We promptly make available on this website, free of charge, the reports that we file or furnish with the SEC, corporate governance information, and select press releases, which may contain material information about us, and you may subscribe to be notified of new information posted to this site.

Contacts:

Boston Omaha Corporation

Josh Weisenburger, 402-210-2633

contact@bostonomaha.com

Exhibit 99.2