UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark one)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2025

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934‐‐

For the transition period from ________________ to __________________

Commission File Number: 001-36291

DIAMEDICA THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

|

British Columbia, Canada (State or other jurisdiction of incorporation or organization) |

Not Applicable (I.R.S. Employer Identification No.) |

|

301 Carlson Parkway, Suite 210 Minneapolis, Minnesota 55305 (Address of principal executive offices) (Zip Code) |

|

(763) 496-5454

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

|

Voting common shares, no par value per share |

DMAC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). YES ☒ NO ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

Smaller reporting company ☒ Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of November 10, 2025, there were 52,077,439 voting common shares of the registrant outstanding.

DiaMedica Therapeutics Inc.

FORM 10-Q

September 30, 2025

TABLE OF CONTENTS

| Description | Page | |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 |

|

|

PART I. |

FINANCIAL INFORMATION | |

|

|

||

|

Item 1. |

Financial Statements |

2 |

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

14 |

|

Item 3. |

Quantitative and Qualitative Disclosures about Market Risk |

20 |

|

Item 4. |

Controls and Procedures |

20 |

|

PART II. |

OTHER INFORMATION | |

|

Item 1. |

Legal Proceedings |

21 |

|

Item 1A. |

Risk Factors |

21 |

|

Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

22 |

|

Item 3. |

Defaults Upon Senior Securities |

22 |

|

Item 4. |

Mine Safety Disclosures |

22 |

|

Item 5. |

Other Information |

22 |

|

Item 6. |

Exhibits |

23 |

|

SIGNATURE PAGE |

24 |

|

This quarterly report on Form 10-Q contains certain forward-looking statements that are within the meaning of Section 27A of the United States Securities Act of 1933, as amended, and Section 21E of the United States Securities Exchange Act of 1934, as amended, and are subject to the safe harbor created by those sections. For more information, see “Cautionary Note Regarding Forward-Looking Statements.”

As used in this report, references to “DiaMedica,” the “Company,” “we,” “our” or “us,” unless the context otherwise requires, refer to DiaMedica Therapeutics Inc. and its subsidiaries, all of which are consolidated in DiaMedica’s condensed consolidated financial statements. References in this report to “common shares” mean our voting common shares, no par value per share.

We own various unregistered trademarks and service marks, including our corporate logo. Solely for convenience, the trademarks and trade names in this report are referred to without the ® and ™ symbols, but such references should not be construed as any indicator that the owner of such trademarks and trade names will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this report that are not descriptions of historical facts are forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 that are based on management’s current expectations and are subject to risks and uncertainties that could negatively affect our business, operating results, financial condition, prospects and share price. We have attempted to identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” “would,” the negative of these terms or other comparable terminology and the use of future dates.

The forward-looking statements in this report are subject to risks and uncertainties and include, among other things:

|

● |

our plans to develop, obtain an investigational new drug (IND) application for the clinical study of DM199 for PE and ultimately to obtain regulatory approval for and commercialize our DM199 product candidate for the treatment of preeclampsia (PE) and acute ischemic stroke (AIS); |

|

● |

our ability to conduct successful clinical testing of our DM199 product candidate for PE and AIS and meet certain anticipated or target milestones and dates thereof with respect to our clinical studies; |

|

● |

the ability of our physician collaborators to successfully complete the current Phase 2, proof-of-concept clinical trial of DM199 for the treatment of PE, our reliance on these physician collaborators to conduct the study, and our expectations related to the timing of Part 1a of this study and the ability of these physician collaborators to identify a suitable dose for use in Part 1b of this study; |

|

● |

our ability to meet anticipated site activations, enrollment and interim analysis timing with respect to our Phase 2/3 ReMEDy2 clinical trial of DM199 for the treatment of AIS, especially in the light of slower than expected site activations and enrollment which we believe are due, in part, to hospital and medical facility staffing shortages; inclusion/exclusion criteria in the study protocol; concerns managing logistics and protocol compliance for participants discharged from the hospital to an intermediate care facility; concerns regarding the prior clinically significant hypotension events and circumstances surrounding the clinical hold which was lifted in June 2023; use of artificial intelligence and telemedicine which have enabled smaller hospitals to retain AIS patients not eligible for mechanical thrombectomy instead of sending these patients to the larger stroke centers which are more likely to be sites in our trial; and competition for research staff and trial subjects due to other pending stroke and neurological clinical trials; |

|

● |

the success of the actions we are taking to mitigate the impact of the factors adversely affecting our ReMEDy2 trial site activations and enrollment rate, including significantly expanding our internal clinical team and bringing in-house certain trial activities, such as study site identification, qualification and activation, clinical site monitoring and overall program management; globally expanding the trial; and making additional changes to the study protocol; and risks associated with these mitigation actions; |

|

● |

uncertainties relating to regulatory applications and related filing and approval timelines, especially in light of recent changes in funding and staffing levels for the U.S. Food and Drug Administration (FDA) and other government agencies; |

|

● |

the possible occurrence of future adverse events associated with or unfavorable results from the Phase 2 investigator-sponsored PE trial or our ReMEDy2 trial and their potential to adversely effect current or future trials; |

|

● |

the adaptive design of our ReMEDy2 trial, which is intended to enroll approximately 300 patients at up to 100 sites globally, and the possibility that the final sample size, which will be determined based upon the results of an interim analysis of 200 participants, may be up to 728 patients, according to a pre-determined statistical plan, other possible changes in the trial, including as a result of input from the FDA, and the results of the interim analysis as determined by our independent data safety monitoring board; |

|

● |

our expectations regarding the perceived benefits of our DM199 product candidate over existing treatment options for PE and AIS; |

|

● |

our ability to partner with and generate revenue from biopharmaceutical or pharmaceutical partners to develop, obtain regulatory approval for, and commercialize our DM199 product candidate for PE and AIS; |

|

● |

the potential size of the markets for our DM199 product candidate for PE and AIS and our or any future partner’s ability to serve those markets, the rate and degree of market acceptance of and ability to obtain coverage and adequate reimbursement for, our DM199 product candidate for PE and AIS both in the United States and internationally; |

|

● |

the success, cost and timing of our clinical trials, as well as our reliance on our key executives, clinical personnel, advisors and third parties in connection with our trials; |

|

● |

our or any future partner’s ability to commercialize, market and manufacture DM199; |

|

● |

expectations regarding U.S. federal, state and foreign regulatory requirements and developments affecting our pending and future clinical trials and regulatory approvals of our DM199 product candidate for PE and AIS and future commercialization and manufacturing of such products if required regulatory approvals are obtained; |

|

● |

our expectations regarding our ability to obtain and maintain intellectual property protection for our DM199 product candidate; |

|

● |

expectations regarding competition and our ability to obtain data exclusivity for our DM199 product candidate for PE and AIS; and |

|

● |

our estimates regarding expenses, market opportunity for our product candidates, future revenue, and capital requirements; our anticipated use of the net proceeds from our prior private placements; how long our current cash resources will last; and our need for and ability to obtain additional financing to fund our operations, including funding necessary to complete our current clinical trials and obtain regulatory approvals for our DM199 product candidate for PE and/or AIS. |

These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described under “Part I. Item 1A. Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2024 and those described above and elsewhere in this report, including under “Part II. Item 1A. Risk Factors.” Moreover, we operate in a very competitive and rapidly-changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Forward-looking statements should not be relied upon as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Except as required by law, including the securities laws of the United States, we do not intend to update any forward-looking statements to conform these statements to actual results or to changes in our expectations.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

DiaMedica Therapeutics Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

|

September 30, 2025 |

December 31, 2024 |

|||||||

|

(unaudited) |

||||||||

|

ASSETS |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 3,326 | $ | 3,025 | ||||

|

Marketable securities |

51,992 | 41,122 | ||||||

|

Prepaid expenses and other assets |

445 | 227 | ||||||

|

Amounts receivable |

260 | 236 | ||||||

|

Deposits |

200 | — | ||||||

|

Total current assets |

56,223 | 44,610 | ||||||

|

Non-current assets: |

||||||||

|

Deferred offering costs |

456 | — | ||||||

|

Operating lease right-of-use asset, net |

218 | 279 | ||||||

|

Property and equipment, net |

150 | 148 | ||||||

|

Deposits |

— | 1,308 | ||||||

|

Total non-current assets |

824 | 1,735 | ||||||

|

Total assets |

$ | 57,047 | $ | 46,345 | ||||

|

LIABILITIES AND EQUITY |

||||||||

|

Current liabilities: |

||||||||

|

Accounts payable |

$ | 1,920 | $ | 940 | ||||

|

Accrued liabilities |

3,239 | 4,347 | ||||||

|

Operating lease obligation |

99 | 90 | ||||||

|

Finance lease obligation |

10 | 13 | ||||||

|

Total current liabilities |

5,268 | 5,390 | ||||||

|

Non-current liabilities: |

||||||||

|

Operating lease obligation |

150 | 225 | ||||||

|

Finance lease obligation |

7 | 12 | ||||||

|

Total non-current liabilities |

157 | 237 | ||||||

|

Shareholders’ equity: |

||||||||

|

Common shares, no par value; unlimited authorized; 52,077,439 and 42,818,660 shares issued and outstanding, as of September 30, 2025 and December 31, 2024, respectively |

— | — | ||||||

|

Paid-in capital |

215,600 | 180,697 | ||||||

|

Accumulated other comprehensive income |

50 | 23 | ||||||

|

Accumulated deficit |

(164,028 | ) | (140,002 | ) | ||||

|

Total shareholders’ equity |

51,622 | 40,718 | ||||||

|

Total liabilities and shareholders’ equity |

$ | 57,047 | $ | 46,345 | ||||

See accompanying notes to the condensed consolidated financial statements.

DiaMedica Therapeutics Inc.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(In thousands, except share and per share amounts)

(Unaudited)

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

Operating expenses: |

||||||||||||||||

|

Research and development |

$ | 6,437 | $ | 4,983 | $ | 17,915 | $ | 12,587 | ||||||||

|

General and administrative |

2,596 | 1,900 | 7,269 | 5,675 | ||||||||||||

|

OPERATING LOSS |

(9,033 | ) | (6,883 | ) | (25,184 | ) | (18,262 | ) | ||||||||

|

Other income, net |

419 | 616 | 1,176 | 1,739 | ||||||||||||

|

Loss before income tax expense |

(8,614 | ) | (6,267 | ) | (24,008 | ) | (16,523 | ) | ||||||||

|

Income tax expense |

(6 | ) | (7 | ) | (18 | ) | (21 | ) | ||||||||

|

Net loss |

(8,620 | ) | (6,274 | ) | (24,026 | ) | (16,544 | ) | ||||||||

|

Other comprehensive loss |

||||||||||||||||

|

Unrealized gain on marketable securities |

64 | 132 | 27 | 75 | ||||||||||||

|

Net loss and comprehensive loss |

$ | (8,556 | ) | $ | (6,142 | ) | $ | (23,999 | ) | $ | (16,469 | ) | ||||

|

Basic and diluted net loss per share |

$ | (0.17 | ) | $ | (0.15 | ) | $ | (0.53 | ) | $ | (0.42 | ) | ||||

|

Weighted average shares outstanding – basic and diluted |

49,630,119 | 42,751,577 | 45,168,749 | 39,604,179 | ||||||||||||

See accompanying notes to the condensed consolidated financial statements.

DiaMedica Therapeutics Inc.

Condensed Consolidated Statements of Shareholders’ Equity

For the Three Months Ended September 30, 2025 and 2024

(In thousands, except share amounts)

(Unaudited)

|

Common Shares |

Paid-In Capital |

Accumulated Other Comprehensive Income (Loss) |

Accumulated Deficit |

Total Shareholders’ Equity |

||||||||||||||||

|

Balances at December 31, 2024 |

42,818,660 | $ | 180,697 | $ | 23 | $ | (140,002 | ) | $ | 40,718 | ||||||||||

|

Issuance of common shares upon the vesting and settlement of restricted stock units |

3,805 | — | — | — | — | |||||||||||||||

|

Issuance of common shares upon the exercise of stock options |

37,000 | 94 | — | — | 94 | |||||||||||||||

|

Share-based compensation expense |

— | 867 | — | — | 867 | |||||||||||||||

|

Unrealized loss on marketable securities |

— | — | (18 | ) | — | (18 | ) | |||||||||||||

|

Net loss |

— | — | — | (7,707 | ) | (7,707 | ) | |||||||||||||

|

Balances at March 31, 2025 |

42,859,465 | $ | 181,658 | $ | 5 | $ | (147,709 | ) | $ | 33,954 | ||||||||||

|

Issuance of common shares in settlement of deferred stock units |

142,345 | — | — | — | — | |||||||||||||||

|

Issuance of common shares upon the vesting and settlement of restricted stock units |

3,803 | — | — | — | — | |||||||||||||||

|

Issuance of common shares upon the exercise of stock options |

66,875 | 163 | — | — | 163 | |||||||||||||||

|

Share-based compensation expense |

— | 771 | — | — | 771 | |||||||||||||||

|

Unrealized loss on marketable securities |

— | — | (19 | ) | — | (19 | ) | |||||||||||||

|

Net loss |

— | — | — | (7,699 | ) | (7,699 | ) | |||||||||||||

|

Balances at June 30, 2025 |

43,072,488 | $ | 182,592 | $ | (14 | ) | $ | (155,408 | ) | $ | 27,170 | |||||||||

|

Issuance of common shares under Private Placement net of offering costs of $0.1 million |

8,606,425 | 29,977 | — | — | 29,977 | |||||||||||||||

|

Sale of common shares, net of offering costs |

223,472 | 1,550 | — | — | 1,550 | |||||||||||||||

|

Issuance of common shares upon the exercise of stock options |

171,250 | 465 | — | — | 465 | |||||||||||||||

|

Issuance of common shares upon the vesting and settlement of restricted stock units |

3,804 | — | — | — | — | |||||||||||||||

|

Share-based compensation expense |

— | 1,016 | — | — | 1,016 | |||||||||||||||

|

Unrealized gain on marketable securities |

64 | 64 | ||||||||||||||||||

|

Net loss |

— | — | — | (8,620 | ) | (8,620 | ) | |||||||||||||

|

Balances at September 30, 2025 |

52,077,439 | $ | 215,600 | $ | 50 | $ | (164,028 | ) | $ | 51,622 | ||||||||||

|

Common Shares |

Paid-In Capital |

Accumulated Other Comprehensive Income (Loss) |

Accumulated Deficit |

Total Shareholders’ Equity |

||||||||||||||||

|

Balances at December 31, 2023 |

37,958,000 | $ | 166,609 | $ | 6 | $ | (115,558 | ) | $ | 51,057 | ||||||||||

|

Issuance of common shares upon the vesting and settlement of restricted stock units |

5,916 | — | — | — | — | |||||||||||||||

|

Share-based compensation expense |

— | 488 | — | — | 488 | |||||||||||||||

|

Unrealized loss on marketable securities |

— | — | (45 | ) | — | (45 | ) | |||||||||||||

|

Net loss |

— | — | — | (5,151 | ) | (5,151 | ) | |||||||||||||

|

Balances at March 31, 2024 |

37,963,916 | $ | 167,097 | $ | (39 | ) | $ | (120,709 | ) | $ | 46,349 | |||||||||

|

Issuance of common shares under Private Placement net of offering costs of $0.1 million |

4,720,000 | 11,747 | — | — | 11,747 | |||||||||||||||

|

Issuance of common shares upon the vesting and settlement of restricted stock units |

5,916 | — | — | — | — | |||||||||||||||

|

Issuance of common shares upon the exercise of common stock options |

2,750 | 7 | — | — | 7 | |||||||||||||||

|

Share-based compensation expense |

— | 443 | — | — | 443 | |||||||||||||||

|

Unrealized loss on marketable securities |

— | — | (12 | ) | — | (12 | ) | |||||||||||||

|

Net loss |

— | — | — | (5,119 | ) | (5,119 | ) | |||||||||||||

|

Balances at June 30, 2024 |

42,692,582 | $ | 179,294 | $ | (51 | ) | $ | (125,828 | ) | $ | 53,415 | |||||||||

|

Issuance of common shares upon the vesting of and settlement of restricted stock units |

5,915 | — | — | — | — | |||||||||||||||

|

Issuance of common shares upon the exercise of stock options |

68,000 | 126 | — | — | 126 | |||||||||||||||

|

Share-based compensation expense |

— | 565 | — | — | 565 | |||||||||||||||

|

Unrealized gain on marketable securities |

— | — | 132 | — | 132 | |||||||||||||||

|

Net loss |

— | — | — | (6,274 | ) | (6,274 | ) | |||||||||||||

|

Balances at September 30, 2024 |

42,766,497 | $ | 179,985 | $ | 81 | $ | (132,102 | ) | $ | 47,964 | ||||||||||

See accompanying notes to the condensed consolidated financial statements.

DiaMedica Therapeutics Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

Nine Months Ended September 30, |

||||||||

|

2025 |

2024 |

|||||||

|

Cash flows from operating activities: |

||||||||

|

Net loss |

$ | (24,026 |

) |

$ | (16,544 |

) |

||

|

Adjustments to reconcile net loss to net cash used in operating activities: |

||||||||

|

Share-based compensation |

2,654 | 1,496 | ||||||

|

Amortization of discounts on marketable securities |

(690 | ) | (1,013 | ) | ||||

|

Non-cash lease expense |

61 | 56 | ||||||

|

Depreciation |

32 | 28 | ||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Amounts receivable |

(24 | ) | 79 | |||||

|

Prepaid expenses and other assets |

(218 | ) | 131 | |||||

|

Deposits |

1,108 | (1,308 | ) | |||||

|

Accounts payable |

980 | 245 | ||||||

|

Accrued liabilities and operating lease liabilities |

(1,174 | ) | 1,188 | |||||

|

Net cash used in operating activities |

(21,297 | ) | (15,642 | ) | ||||

|

Cash flows from investing activities: |

||||||||

|

Purchase of marketable securities |

(51,224 |

) |

(39,623 |

) |

||||

|

Maturities and sales of marketable securities |

41,071 | 43,000 | ||||||

|

Purchases of property and equipment |

(34 |

) |

(18 |

) |

||||

|

Net cash provided by (used in) investing activities |

(10,187 | ) | 3,359 | |||||

|

Cash flows from financing activities: |

||||||||

|

Proceeds from the sale of common shares, net of offering costs |

31,527 | 11,747 | ||||||

|

Proceed from the exercise of common stock options |

722 | 133 | ||||||

|

Deferred offering costs |

(456 | ) | — | |||||

|

Principal payments on finance lease obligation |

(8 |

) |

(6 |

) |

||||

|

Net cash provided by financing activities |

31,785 | 11,874 | ||||||

|

Net increase (decrease) in cash and cash equivalents |

301 | (409 | ) | |||||

|

Cash and cash equivalents at beginning of period |

3,025 | 4,543 | ||||||

|

Cash and cash equivalents at end of period |

$ | 3,326 | $ | 4,134 | ||||

|

Supplemental disclosure of non-cash transactions: |

||||||||

|

Cash paid for income taxes |

$ | 18 | $ | 20 | ||||

|

Assets acquired under financing lease |

$ | — | $ | 30 | ||||

See accompanying notes to the condensed consolidated financial statements.

DiaMedica Therapeutics Inc.

Notes to the Condensed Consolidated Financial Statements

(Unaudited)

1. Business

DiaMedica Therapeutics Inc. and its wholly owned subsidiaries, DiaMedica USA Inc. and DiaMedica Australia Pty Ltd. (collectively, we, us, our, DiaMedica and the Company), is a clinical stage biopharmaceutical company focused on developing novel treatments for preeclampsia (PE), fetal growth restriction (FGR) and acute ischemic stroke (AIS). DiaMedica’s lead product candidate, DM199, is the first pharmaceutically active recombinant (synthetic) form of the human tissue kallikrein-1 (KLK1) protein, an established therapeutic modality in Asia for the treatment of preeclampsia, acute ischemic stroke and other vascular diseases. Our common shares are publicly traded on The Nasdaq Capital Market under the symbol “DMAC.”

2. Risks and Uncertainties

DiaMedica operates in a highly regulated and competitive environment. The development, manufacturing and marketing of pharmaceutical products require approval from, and are subject to ongoing oversight by, the United States Food and Drug Administration (FDA) in the United States, the European Medicines Agency (EMA) in the European Union, and comparable agencies in other countries. We are in the clinical stage of development of our lead product candidate, DM199, for the treatment of PE and AIS. We have not completed the development of any product candidate and do not generate any revenues from the commercial sale of any product candidate. Our lead product candidate, DM199, requires significant additional clinical testing and investment prior to seeking marketing approval and is not expected to be commercially available for at least three to four years, if at all.

With respect to our PE clinical program, a Phase 2 open-label, single center, single-arm, safety and pharmacodynamic, proof-of-concept, investigator-sponsored study of DM199 for the treatment of PE is currently being conducted at the Tygerberg Hospital in Cape Town, South Africa. This Phase 2 study consists of three studies in PE (Part 1a, dose-escalation; Part 1b, dose-expansion; and Part 2, expectant management) and a fourth study in fetal growth restriction (FGR, Part 3, expectant management). Part 1a topline study results are intended to identify a suitable dose for Parts 1b, 2, and 3. Up to 90 women with PE and potentially an additional 30 subjects with fetal growth restriction may be evaluated. The first subject in Part 1a was enrolled in the fourth quarter of 2024 and interim results from Part 1a of the study were released in July 2025. The interim results (N=28 subjects) demonstrated that DM199 appears safe and well-tolerated with clinically-relevant pharmacodynamic activity with no evidence of placental transfer. Additionally, subjects exhibited rapid, statistically significant reductions in blood pressure with duration of effect that was sustained up to 24 hours post-infusion compared to pre-treatment baseline. Preparations are underway to initiate Part 1b where up to 30 subjects with PE and expected delivery within 72 hours will be treated with a dose regimen identified from Part 1a.

With respect to our AIS clinical program, we are currently conducting a Phase 2/3, adaptive design, randomized, double-blind, placebo-controlled trial of DM199 for the treatment of AIS, (the ReMEDy2 trial). Our ReMEDy2 trial is intended to enroll approximately 300 participants at up to 100 sites globally. The adaptive design component includes an interim analysis by our independent data safety monitoring board to be conducted after the first 200 participants have completed the trial. Based on the results of the interim analysis, the study may then be stopped for futility or the final sample size will be determined, ranging between 300 and 728 patients, according to a pre-determined statistical plan. We have experienced and continue to experience slower than expected site activations and enrollment in our ReMEDy2 trial. We believe these conditions may be due to hospital and medical facility staffing shortages; inclusion/exclusion criteria in the study protocol; concerns managing logistics and protocol compliance for participants discharged from the hospital to an intermediate care facility; concerns regarding the prior clinically significant hypotension events and circumstances surrounding the previous clinical hold; use of artificial intelligence and telemedicine which have enabled smaller hospitals to retain AIS patients not eligible for mechanical thrombectomy instead of sending these patients to the larger stroke centers which are more likely to be sites in our trial; and competition for research staff and trial subjects due to other pending stroke and neurological trials. We continue to reach out to current and potential study sites to understand the specific issues at each study site. In an effort to mitigate the impact of these factors, we have significantly expanded our internal clinical team and have brought in-house certain trial activities, including site identification, qualification and activation, clinical site monitoring, and overall program management. We are currently conducting our ReMEDy2 trial in the United States and in the countries of Canada and Georgia. We are in the process of preparing regulatory filings and identifying and engaging study sites in an additional seven European countries and, on August 28, 2025, received approval for the conduct of this study in the United Kingdom. We continue to work closely with our contract research organizations and other advisors to develop procedures to support both U.S. and global study sites and potential participants as needed. We intend to continue to monitor the results of these efforts and, if necessary, implement additional actions to enhance site activations and enrollment in our ReMEDy2 trial; however, no assurances can be provided as to the success of these actions and if or when these issues will resolve. Failure to resolve these issues may result in further delays in our ReMEDy2 trial and increase the difficulty in forecasting enrollment. We currently estimate that the interim analysis will be completed in the second half of 2026.

Our future success is dependent upon the success of our development efforts, our ability to demonstrate clinical progress for our DM199 product candidate in the United States or other markets, our ability, or the ability of any future partner, to obtain required governmental approvals of our product candidate, our ability to license or market and sell our DM199 product candidate, and our ability to obtain additional financing to fund these efforts.

As of September 30, 2025, we have incurred losses of $164.0 million since our inception in 2000. For the nine months ended September 30, 2025, we incurred a net loss of $24.0 million and negative cash flows from operating activities of $21.3 million. We expect to continue to incur substantial operating losses until such time as any future product sales, licensing fees, milestone payments and/or royalty payments generate revenue sufficient to fund our continuing operations. For the foreseeable future, we expect to incur significant operating losses as we continue the development and clinical study of, and to seek regulatory approval for, our DM199 product candidate. As of September 30, 2025, we had combined cash, cash equivalents and marketable securities of $55.3 million, working capital of $51.0 million and shareholders’ equity of $51.6 million.

Our principal source of cash has been net proceeds from the issuance of equity securities. Although we have previously been successful in obtaining financing through equity securities offerings, there is no assurance that we will be able to do so in the future. This is particularly true if our clinical data are not positive or if economic and market conditions deteriorate.

We expect that we will need substantial additional capital to further our research and development activities and complete the required clinical studies, regulatory activities and manufacturing development for our product candidate, DM199, or any future product candidates, to a point where they may be licensed or commercially sold. We expect our current cash, cash equivalents and marketable securities to be sufficient to continue the Phase 2 PE trial, the ReMEDy2 trial and otherwise fund our planned operations for at least the next 12 months from the date of issuance of these condensed consolidated financial statements. The amount and timing of our future funding requirements will depend on many factors, including timing and results of our ongoing development efforts, including our current ReMEDy2 trial and the rate of site activation and participant enrollment in the study; the Phase 2 PE trial; the potential expansion of our current development programs; the effects of ongoing site staffing shortages; and other factors on our clinical trials and our operating expenses. We may require significant additional funds earlier than we currently expect and there is no assurance that we will not need or seek additional funding prior to such time, especially if market conditions for raising capital are favorable.

3. Summary of Significant Accounting Policies

Interim financial statements

We have prepared the accompanying condensed consolidated financial statements in accordance with accounting principles generally accepted in the United States (US GAAP) for interim financial information and with the instructions to Form 10-Q and Regulation S-X of the Securities and Exchange Commission (SEC). Accordingly, the condensed consolidated financial statements do not include all of the information and footnotes required by US GAAP for complete financial statements. These condensed consolidated financial statements reflect all adjustments consisting of normal recurring accruals which, in the opinion of management, are necessary to present fairly our condensed consolidated financial position, condensed consolidated results of operations, condensed consolidated statement of shareholders’ equity and condensed consolidated cash flows for the periods and as of the dates presented. Our fiscal year ends on December 31. The condensed consolidated balance sheet as of December 31, 2024 was derived from our audited consolidated financial statements. These condensed consolidated financial statements should be read in conjunction with our annual consolidated financial statements and the notes thereto. The nature of our business is such that the results of any interim period may not be indicative of the results to be expected for the entire year. Certain prior year amounts have been reclassified to conform to the current year presentation.

Segments

We operate in a single segment focusing on researching and developing potentially transformative treatments for severe ischemic diseases. Consistent with our operational structure, our chief operating decision maker manages and allocates resources for the Company at a consolidated level. Therefore, the results of our operations are reported on a consolidated basis for purposes of segment reporting. Substantially all assets are held in the United States.

Cash and cash equivalents

The Company considers all bank deposits, including money market funds and other investments, purchased with an original maturity to the Company of three months or less, to be cash and cash equivalents. The carrying amount of our cash equivalents approximates fair value due to the short maturity of the investments.

Marketable securities

Our marketable securities may consist of obligations of the United States government and its agencies, bank certificates of deposit and investment grade corporate obligations, which are classified as available-for-sale. Marketable securities which mature within 12 months from their purchase date are included in current assets. Securities are generally valued based on market prices for similar assets using third party certified pricing sources and are carried at fair value. The amortized cost of marketable securities is adjusted for amortization of premiums or accretion of discounts to maturity. Such amortization or accretion is included in interest income. Realized gains and losses, if any, are calculated on the specific identification method. Interest income is included in other income in the condensed consolidated statements of operations.

We conduct periodic reviews to identify and evaluate each available-for-sale debt security that is in an unrealized loss position in order to determine whether an other-than-temporary impairment exists. An unrealized loss exists when the current fair value of an individual security is less than its amortized cost basis. Declines in fair value considered to be temporary and caused by noncredit-related factors of the issuer, are recorded in accumulated other comprehensive income or loss, which is a separate component of shareholders’ equity. Declines in fair value that are other than temporary or caused by credit-related factors of the issuer, are recorded within earnings as an impairment loss. There were no other-than-temporary unrealized losses as of September 30, 2025.

Fair value measurements

Under the authoritative guidance for fair value measurements, fair value is defined as the exit price, or the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The authoritative guidance also establishes a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. Observable inputs are inputs market participants would use in valuing the asset or liability developed based on market data obtained from sources independent of the Company. Unobservable inputs are inputs that reflect the Company’s assumptions about the factors market participants would use in valuing the asset or liability developed based upon the best information available in the circumstances. The categorization of financial assets and financial liabilities within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

The hierarchy is broken down into three levels defined as follows:

Level 1 Inputs — quoted prices in active markets for identical assets and liabilities;

Level 2 Inputs — observable inputs other than quoted prices in active markets for identical assets and liabilities; and

Level 3 Inputs — unobservable inputs.

As of September 30, 2025, the Company believes that the carrying amounts of its other financial instruments, including amounts receivable, accounts payable and accrued liabilities, approximate their fair value due to the short-term maturities of these instruments. See Note 4, titled “Marketable Securities” for additional information.

Deferred offering costs

Deferred offering costs represent legal, accounting and other direct costs related to the Company’s efforts to raise capital through a public sale of the Company’s common shares under the 2025 Sales Agreement, see Note 10. Costs related to the public sale of the Company’s common shares are deferred until the completion of the applicable offering, at which time such costs are reclassified to additional paid-in-capital as a reduction of the proceeds. See Note 10 titled “Shareholders’ Equity” for additional information.

4. Marketable Securities

The available-for-sale marketable securities are primarily comprised of investments in commercial paper, corporate bonds and government securities and consist of the following, measured at fair value on a recurring basis (in thousands):

|

Fair Value Measurements Using Inputs Considered as of: |

||||||||||||||||||||||||||||||||

|

September 30, 2025 |

December 31, 2024 |

|||||||||||||||||||||||||||||||

|

Total |

Level 1 |

Level 2 |

Level 3 |

Total |

Level 1 |

Level 2 |

Level 3 |

|||||||||||||||||||||||||

|

Government securities |

$ | 44,522 | $ | — | $ | 44,522 | $ | — | $ | 12,831 | $ | — | $ | 12,831 | $ | — | ||||||||||||||||

|

Commercial paper and corporate bonds |

7,470 | — | 7,470 | — | 28,291 | — | 28,291 | — | ||||||||||||||||||||||||

|

Total |

$ | 51,992 | $ | — | $ | 51,992 | $ | — | $ | 41,122 | $ | — | $ | 41,122 | $ | — | ||||||||||||||||

Maturities of individual securities are less than 12 months and the amortized cost of all securities approximated fair value as of September 30, 2025 and December 31, 2024. Accrued interest receivable on marketable securities is included in amounts receivable and was $228,000 and $235,000 as of September 30, 2025 and December 31, 2024, respectively.

There were no transfers of assets between Level 1 and Level 2 of the fair value measurement hierarchy during the nine months ended September 30, 2025.

5. Deposits

DiaMedica periodically advances funds to vendors engaged to support the performance of our clinical trials and related supporting activities. The funds advanced are held, interest free, for varying periods of time and may be recovered by the Company through partial reductions of ongoing invoices, application against final study/project invoices or refunded upon completion of services to be provided. Deposits are classified as current or non-current based upon their expected recovery time.

6. Amounts Receivable

Amounts receivable consisted primarily of accrued interest receivable on marketable securities of $228,000 and $235,000 as of September 30, 2025 and December 31, 2024, respectively.

7. Property and Equipment

Property and equipment, net, consisted of the following (in thousands):

|

September 30, 2025 |

December 31, 2024 |

|||||||

|

Computer equipment |

145 | 118 | ||||||

|

Furniture and equipment |

128 | 128 | ||||||

|

Leasehold improvements |

16 | 16 | ||||||

| 289 | 262 | |||||||

|

Less accumulated depreciation |

(139 | ) | (114 | ) | ||||

|

Property and equipment, net |

$ | 150 | $ | 148 | ||||

8. Accrued Liabilities

Accrued liabilities consisted of the following (in thousands):

|

September 30, 2025 |

December 31, 2024 |

|||||||

|

Clinical trial costs |

$ | 1,615 | $ | 2,277 | ||||

|

Compensation |

920 | 1,060 | ||||||

|

Research and development services |

600 | 888 | ||||||

|

Professional services fees |

97 | 112 | ||||||

|

Other |

7 | 10 | ||||||

|

Total accrued liabilities |

$ | 3,239 | $ | 4,347 | ||||

9. Operating Lease

Office lease

Our operating lease costs were $78,000 for each of the nine-month periods ended September 30, 2025 and 2024. Our variable lease costs were $67,000 and $64,000 for the nine months ended September 30, 2025 and 2024, respectively. Variable lease costs consist primarily of common area maintenance costs, insurance and taxes which are paid based upon actual costs incurred by the lessor.

Maturities of our operating lease obligation are as follows as of September 30, 2025 (in thousands):

|

2025 |

$ | 29 | ||

|

2026 |

116 | |||

|

2027 |

119 | |||

|

2028 |

10 | |||

|

Total lease payments |

274 | |||

|

Less interest portion |

(25 | ) | ||

|

Present value of operating lease obligation |

249 | |||

|

Less current portion of operating lease |

(99 | ) | ||

|

Operating lease obligation, non-current |

$ | 150 |

10. Shareholders’ Equity

Authorized capital shares

DiaMedica has authorized share capital of an unlimited number of voting common shares, and the shares do not have a stated par value. Common shareholders are entitled to receive dividends as declared by the Company, if any, and are entitled to one vote per share at the Company’s annual general meeting and any extraordinary or special general meeting.

On August 12, 2025, we entered into a Sales Agreement (the 2025 Sales Agreement) with TD Securities (USA) LLC (TD Cowen) under which the Company may, from time to time, sell common shares having an aggregate offering price of up to $100 million, through an “at-the-market” offering program (ATM Offering). TD Cowen will receive a commission from the Company of 2.5% of the aggregate gross proceeds of any common shares sold under the 2025 Sales Agreement. Any shares offered and sold in the ATM Offering are to be issued pursuant to the Company’s shelf registration statement on Form S-3 and the 424(b)(2) prospectus supplement dated August 22, 2025.

Equity issued during the nine months ended September 30, 2025

On July 21, 2025, we entered into securities purchase agreements with accredited investors, pursuant to which we agreed to issue and sell an aggregate 8,606,425 common shares at a purchase price of $3.50 per share in a private placement. As a result of the offering, which closed on July 23, 2025, we received gross proceeds of $30.1 million, which resulted in net proceeds to us of approximately $30.0 million, after deducting the offering expenses.

In connection with the July 2025 private placement, we entered into a registration rights agreement (2025 Registration Rights Agreement) with the investors pursuant to which we agreed to file with the SEC a registration statement registering the resale of the shares sold in the July 2025 private placement (2025 Resale Registration Statement). The 2025 Resale Registration Statement was filed with the SEC on August 1, 2025 and declared effective by the SEC on August 8, 2025. Under the terms of the 2025 Registration Rights Agreement, we agreed to keep the 2025 Resale Registration Statement effective at all times until the shares are no longer considered “Registrable Securities” under the 2025 Registration Rights Agreement and if we fail to keep the 2025 Resale Registration Statement effective, subject to certain permitted exceptions, we will be required to pay liquidated damages to the investors in an amount of up to 10% of the invested capital, excluding interest. We also agreed, among other things, to indemnify the selling holders under the 2025 Resale Registration Statement from certain liabilities and to pay all fees and expenses incident to our performance of or compliance with the 2025 Registration Rights Agreement.

During the nine months ended September 30, 2025, 11,412 common shares were issued upon the vesting and settlement of restricted stock units, 142,345 shares were issued upon the settlement of deferred share units, 275,125 common shares were issued upon the exercise of stock options for gross proceeds of $722,000 and 223,472 common shares were issued and sold under the ATM Offering for gross proceeds of $1.6 million.

Equity issued during the nine months ended September 30, 2024

On June 25, 2024, we entered into securities purchase agreements with accredited investors, pursuant to which we agreed to issue and sell an aggregate 4,720,000 common shares at a purchase price of $2.50 per share in a private placement. As a result of the offering, which closed on June 28, 2024, we received gross proceeds of $11.8 million, which resulted in net proceeds to us of approximately $11.7 million, after deducting the offering expenses.

In connection with the June 2024 private placement, we entered into a registration rights agreement (2024 Registration Rights Agreement) with the investors pursuant to which we agreed to file with the SEC a registration statement registering the resale of the shares sold in the June 2024 private placement (2024 Resale Registration Statement). The 2024 Resale Registration Statement was filed with the SEC on July 10, 2024 and declared effective by the SEC on July 18, 2024. Under the terms of the 2024 Registration Rights Agreement, we agreed to keep the 2024 Resale Registration Statement effective at all times until the shares are no longer considered “Registrable Securities” under the 2024 Registration Rights Agreement and if we fail to keep the 2024 Resale Registration Statement effective, subject to certain permitted exceptions, we will be required to pay liquidated damages to the investors in an amount of up to 10% of the invested capital, excluding interest. We also agreed, among other things, to indemnify the selling holders under the 2024 Resale Registration Statement from certain liabilities and to pay all fees and expenses incident to our performance of or compliance with the 2024 Registration Rights Agreement.

During the nine months ended September 30, 2024, 17,747 common shares were issued upon the vesting and settlement of restricted stock units and 70,750 common shares were issued upon the exercise of common stock options for gross proceeds of $133,000.

Common shares reserved for future issuance are as follows:

|

September 30, 2025 |

||||

|

Common shares issuable upon exercise of employee and non-employee stock options |

7,321,854 | |||

|

Common shares issuable upon settlement of deferred stock units |

174,515 | |||

|

Common shares issuable upon vesting and settlement of restricted stock units |

3,803 | |||

|

Common shares available for grant under the Amended and Restated 2019 Omnibus Incentive Plan |

976,252 | |||

|

Common shares available for grant under the 2021 Employment Inducement Incentive Plan |

600,625 | |||

|

Total |

9,077,049 | |||

11. Net Loss Per Share

We compute net loss per share by dividing our net loss (the numerator) by the weighted-average number of common shares outstanding (the denominator) during the period. Shares issued during the period and shares reacquired during the period, if any, are weighted for the portion of the period that they were outstanding. The computation of diluted earnings per share, or EPS, is similar to the computation of basic EPS except that the denominator is increased to include the number of additional common shares that would have been outstanding if the dilutive potential common shares had been issued. Our diluted EPS is the same as basic EPS due to common equivalent shares being excluded from the calculation, as their effect is anti-dilutive.

The following table summarizes our calculation of net loss per common share for the periods presented (in thousands, except share and per share data):

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

Net loss |

$ | (8,620 |

) |

$ | (6,274 |

) |

$ | (24,026 | ) | $ | (16,544 | ) | ||||

|

Weighted average shares outstanding—basic and diluted |

49,630,119 | 42,751,577 | 45,168,749 | 39,604,179 | ||||||||||||

|

Basic and diluted net loss per share |

$ | (0.17 |

) |

$ | (0.15 |

) |

$ | (0.53 | ) | $ | (0.42 | ) | ||||

The following outstanding potential common shares were not included in the diluted net loss per share calculations as their effects were not dilutive:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

Common shares issuable upon exercise of employee and non-employee stock options |

7,321,854 | 4,632,438 | 7,321,854 | 4,632,438 | ||||||||||||

|

Common shares issuable upon settlement of deferred stock units |

174,515 | 284,886 | 174,515 | 284,886 | ||||||||||||

|

Common shares issuable upon vesting and settlement of restricted stock units |

3,803 | 5,913 | 3,803 | 5,913 | ||||||||||||

12. Share-Based Compensation

Amended and Restated 2019 Omnibus Incentive Plan (2019 Plan)

The 2019 Plan permits the Board, or a committee or subcommittee thereof, to grant to the Company’s eligible employees, non-employee directors and certain consultants non-statutory and incentive stock options, stock appreciation rights, restricted stock awards, restricted stock units (RSUs), deferred stock units (DSUs), performance awards, non-employee director awards and other share-based awards. We grant options to purchase common shares under the 2019 Plan at no less than the fair market value of the underlying common shares as of the date of grant. Options granted to employees and non-employee directors have a maximum term of ten years and generally vest over one to four years. Options granted to non-employees have a maximum term of five years and generally vest over one year. Subject to adjustment as provided in the 2019 Plan, the maximum number of the Company’s common shares authorized for issuance under the 2019 Plan is 7,000,000 shares. As of September 30, 2025, options to purchase an aggregate of 5,707,444 common shares were outstanding; 164,770 common shares were reserved for issuance upon settlement of DSUs; 3,803 shares were reserved for issuance upon the vesting and settlement of RSUs; and 976,252 shares remained available for issuance.

2021 Employment Inducement Incentive Plan (2021 Inducement Plan)

The 2021 Inducement Plan permits the Board, or a committee or subcommittee thereof, to grant of non-statutory options, stock appreciation rights, restricted stock awards, restricted stock units, performance awards and other share-based awards, to new employees who satisfy the standards for inducement grants under Nasdaq Listing Rule 5635(c)(4) or 5635(c)(3), as applicable. The Inducement Plan has a term of 10 years. The share reserve under the Inducement Plan may be increased at the discretion of and approval by the Board and on July 31, 2025, the Board increased the number of common shares reserved for issuance under the plan to 2,000,000. As of September 30, 2025, options to purchase an aggregate of 1,240,000 common shares were outstanding under the Inducement Plan and 600,625 shares remained available for issuance.

Prior Stock Option Plan

The Company ceased granting awards under its Amended and Restated Stock Option Plan in conjunction with shareholder approval of the 2019 Plan. Awards outstanding under the prior plan remain outstanding in accordance with and pursuant to the terms thereof. Options granted under the prior plan have terms similar to those used under the 2019 Plan. As of September 30, 2025, options to purchase an aggregate of 374,410 common shares were outstanding.

Prior Deferred Stock Unit Plan

The Company ceased granting awards under its Deferred Share Unit Plan in conjunction with shareholder approval of the 2019 Plan. Awards outstanding under that plan remain outstanding in accordance with and pursuant to the terms thereof. As of September 30, 2025, there were 9,745 common shares reserved for issuance upon settlement of outstanding deferred share units.

Share-based compensation expense for each of the periods presented is as follows (in thousands):

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

General and administrative |

$ | 646 | $ | 418 | $ | 1,862 | $ | 1,047 | ||||||||

|

Research and development |

370 | 147 | 792 | 449 | ||||||||||||

|

Total share-based compensation |

$ | 1,016 | $ | 565 | $ | 2,654 | $ | 1,496 | ||||||||

We recognize share-based compensation for options awards based on the fair value of each award as estimated using the Black-Scholes option valuation model. Ultimately, the actual expense recognized over the vesting period will only be for those options that actually vest.

A summary of option activity is as follows (in thousands except share and per share amounts):

|

Shares Underlying Options |

Weighted Average Exercise Price Per Share |

Aggregate Intrinsic Value |

||||||||||

|

Balances at December 31, 2024 |

4,692,438 | $ | 3.33 | $ | 10,243 | |||||||

|

Granted |

3,358,416 | 4.79 | ||||||||||

|

Forfeitures |

(408,875 | ) | 3.67 | |||||||||

|

Exercised |

(275,125 | ) | 2.63 | |||||||||

|

Expired |

(45,000 | ) | 8.03 | |||||||||

|

Balances at September 30, 2025 |

7,321,854 | $ | 3.99 | $ | 21,221 | |||||||

Information about stock options outstanding, vested and expected to vest as of September 30, 2025, is as follows:

|

Outstanding, Vested and Expected to Vest |

Options Vested and Exercisable |

|||||||||||||||||||||

|

Per Share Exercise Price |

Shares |

Weighted Average Remaining Contractual Life (Years) |

Weighted Average Exercise Price |

Options Exercisable |

Weighted Average Remaining Contractual Life (Years) |

|||||||||||||||||

|

$1.00 |

- | $1.99 | 191,443 | 7.5 |

$ |

1.59 | 117,974 | 7.5 | ||||||||||||||

|

$2.00 |

- | $2.99 | 2,420,895 | 7.0 | 2.73 | 1,453,679 | 6.7 | |||||||||||||||

|

$3.00 |

- | $3.99 | 311,893 | 5.0 | 3.54 | 241,270 | 3.9 | |||||||||||||||

|

$4.00 |

- | $4.99 | 3,167,069 | 8.1 | 4.30 | 726,031 | 4.2 | |||||||||||||||

|

$5.00 |

- | $10.00 | 1,230,554 | 8.3 | 6.15 | 374,519 | 5.0 | |||||||||||||||

| 7,321,854 | 7.6 |

$ |

3.99 | 2,913,473 | 5.6 | |||||||||||||||||

13. Segment Information

An operating segment is identified as a component of an enterprise that engages in business activities about which separate discrete financial information and operating results is regularly reviewed by the chief operating decision-maker (CODM) in making decisions regarding resource allocation and assessing performance. DiaMedica's CODM is the Chief Executive Officer. The Company operates in a single operating segment focused on the development of its drug product candidate, DM199, for the treatment of severe ischemic disease. The CODM manages and allocates resources to the operations of the Company on a total company basis. Further, the CODM reviews and utilizes functional expenses (i.e., research, development and general and administrative) at the consolidated level to manage the Company's operations. Other segment items included in consolidated net loss are revenues, share-based compensation, interest income, other expense, net, and income tax expense, which are reflected in the condensed consolidated statements of operations and comprehensive loss. The measure of segment assets is reported on the condensed consolidated balance sheet as total consolidated assets.

The following table presents financial information, including significant segment expenses, which are regularly provided to the CODM and included within segment and consolidated net loss:

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

Operating expenses, excluding share-based compensation |

||||||||||||||||

|

Research and development |

$ | 6,066 | $ | 4,835 | $ | 17,122 | $ | 12,137 | ||||||||

|

General and administrative |

1,951 | 1,483 | 5,408 | 4,629 | ||||||||||||

|

Total operating expenses, excluding share-based compensation |

8,017 | 6,318 | 22,530 | 16,766 | ||||||||||||

|

Share-based compensation |

||||||||||||||||

|

Research and development |

370 | 147 | 792 | 449 | ||||||||||||

|

General and administrative |

646 | 418 | 1,862 | 1,047 | ||||||||||||

|

Total share-based compensation |

1,016 | 565 | 2,654 | 1,496 | ||||||||||||

|

Operating loss |

(9,033 | ) | (6,883 | ) | (25,184 | ) | (18,262 | ) | ||||||||

|

Interest income |

440 | 618 | 1,197 | 1,758 | ||||||||||||

|

Other income (expense), net |

(21 | ) | (2 | ) | (21 | ) | (19 | ) | ||||||||

|

Income tax expense |

(6 | ) | (7 | ) | (18 | ) | (21 | ) | ||||||||

|

Segment and consolidated net loss |

$ | (8,620 | ) | $ | (6,274 | ) | $ | (24,026 | ) | $ | (16,544 | ) | ||||

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations is based upon accounting principles generally accepted in the United States of America and discusses the financial condition and results of operations for DiaMedica Therapeutics Inc. and our subsidiaries for the three- and nine-month periods ended September 30, 2025 and 2024.

This discussion should be read in conjunction with our condensed consolidated financial statements and related notes included elsewhere in this report and our audited financial statements and related notes included in our annual report on Form 10-K for the year ended December 31, 2024. The following discussion contains forward-looking statements that involve numerous risks and uncertainties. Our actual results could differ materially from the forward-looking statements as a result of these risks and uncertainties. See “Cautionary Note Regarding Forward-Looking Statements” for additional cautionary information.

Business Overview

We are a clinical stage biopharmaceutical company committed to improving the lives of people suffering from preeclampsia (PE) and acute ischemic stroke (AIS). Our lead candidate DM199 (rinvecalinase alfa) is the first pharmaceutically active recombinant (synthetic) form of the human tissue kallikrein-1 (KLK1) protein (serine protease enzyme) to be clinically studied in patients. KLK1 is an established therapeutic modality in Asia, with human urinary KLK1 for the treatment of AIS and porcine KLK1 for the treatment of cardio renal disease, including hypertension. Our current focus is on the treatment of PE and AIS. We plan to advance DM199 through required clinical trials to create shareholder value by establishing its clinical and commercial potential as a therapy for PE and AIS. We have also produced a potential novel treatment for severe acute pancreatitis, DM300, which is currently in the early preclinical stage of development.

DM199 is a recombinant form of KLK1 (rhKLK1), which is a synthetic version of the naturally occurring protease enzyme kallikrein-1, and the first and only rhKLK1 undergoing global clinical development studies in both PE and AIS. DM199 has been granted Fast Track designation from the FDA for the treatment of AIS. Naturally occurring KLK1 (extracted from human urine or porcine pancreas) has been an approved therapeutic agent in Asia for decades in the treatment of AIS and hypertension associated with cardiorenal disease. DM199 is produced using recombinant DNA technology without the need for extracted human or animal tissue sources and thereby eliminates risk of pathogen transmission.

KLK1 is a serine protease enzyme that plays an important role in the regulation of diverse physiological processes via a molecular mechanism that may enhance microcirculatory blood flow and tissue perfusion by increasing production of nitric oxide (NO), prostacyclin (PGI2) and endothelium-derived hyperpolarizing factor (EDHF). In preeclampsia, DM199 is intended to lower blood pressure, enhance endothelial health and improve perfusion to maternal organs and the placenta, potentially disease modifying outcomes improving both maternal and perinatal outcomes. In the case of AIS, DM199 is intended to enhance blood flow and boost neuronal survival in the ischemic penumbra by dilating arterioles surrounding the site of the vascular occlusion and inhibiting apoptosis (neuronal cell death) while also facilitating neuronal remodeling through the promotion of angiogenesis.

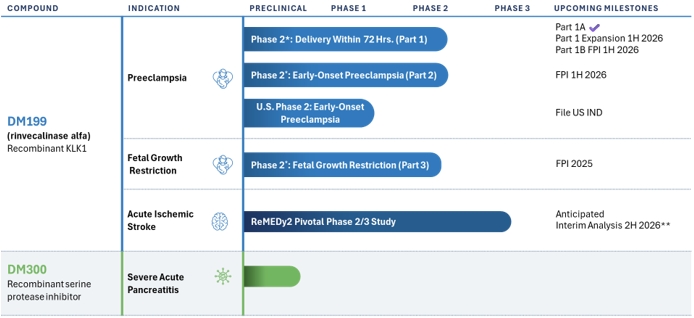

Our product development pipeline is as follows:

* Investigator sponsored trial

We are developing DM199 to address two major critical unmet needs. In PE, there are currently no approved agents in any global market to safely lower maternal blood pressure and/or reduce the risk of fetal growth restriction. Historically, the major issue with potential PE treatments has been that traditional vasodilators commonly used to reduce essential hypertension (e.g., beta-blockers, angiotensin converting enzyme inhibitors (ACEi)) can readily cross the placental barrier and enter into the fetal circulation and cause harm to the developing fetus. We believe that DM199 is uniquely suited to treat PE since its molecular size, approximately 26 kilodaltons (KD), is typically too large to cross the placental barrier, as was demonstrated in the interim result noted below, and therefore may reduce blood pressure and enhance microcirculatory perfusion to the maternal organs and placenta without entering fetal circulation, a potentially significant safety advantage. Additionally, we believe DM199 has the potential to not only address hypertension of PE, but also to confer disease modifying outcomes for both maternal and perinatal outcomes, including fetal growth restriction. In AIS, up to 80% of AIS patients are not eligible for treatment with currently approved clot-busting (thrombolytic) drugs or catheter-based clot removal procedures (mechanical thrombectomy). DM199 is intended to enhance collateral blood flow and boost neuronal survival in the ischemic penumbra by inhibiting neuronal cell death (apoptosis) and promoting neuronal remodeling and neoangiogenesis, and accordingly, offer a potential treatment option for AIS patients who otherwise have no therapeutic options.

Preeclampsia Program and Phase 2 Investigator-Sponsored Study

Our clinical development program in PE currently centers around an investigator-sponsored safety, tolerability and pharmacodynamic, proof-of-concept Phase 2 study in PE patients. This Phase 2 study consists of three studies in PE (Part 1a, dose-escalation; Part 1b, dose-expansion; and Part 2, expectant management) and a fourth study in fetal growth restriction (FGR, Part 3, expectant management). Part 1a topline study results are intended to identify a suitable dose for Parts 1b, 2, and 3. Up to 90 women with PE and potentially an additional 30 subjects with fetal growth restriction may be evaluated. The first subject in Part 1a was enrolled in the fourth quarter of 2024 and interim results from Part 1a of the study were released in July 2025. The interim results (N=28 subjects) demonstrate that DM199 appears safe and well-tolerated with clinically-relevant pharmacodynamic activity with no evidence of placental transfer. Additionally, subjects exhibited rapid, statistically significant reductions in blood pressure with duration of effect that was sustained up to 24 hours post-infusion compared to pre-treatment baseline, a durable effect extending up to 24 hours post-infusion. Preparations are underway to initiate Part 1b where up to 30 subjects with PE and expected delivery within 72 hours will be treated with a dose regimen identified from Part 1a.

Based in part upon these interim results, we believe DM199 has the potential to lower blood pressure, enhance endothelial health and improve perfusion to maternal organs and the placenta. We have completed studies on fertility, embryofetal development and pre- and post-natal development in animal models, which support the potential safety of DM199 in pregnant humans. Given the complexities inherent in conducting clinical studies involving pregnant women, a very vulnerable patient group, DiaMedica requested a pre-IND meeting with the FDA to obtain feedback prior to submitting an IND application for PE. The FDA granted DiaMedica an in-person meeting, which has been recently held and we plan to provide an update regarding the meeting once the final meeting minutes are received.

AIS Program and Phase 2/3 ReMEDy2 Trial

Our clinical program in AIS centers on our ReMEDy2 clinical trial of DM199 for the treatment of AIS. Our ReMEDy2 clinical trial is a Phase 2/3, adaptive design, randomized, double-blind, placebo-controlled trial intended to enroll approximately 300 participants at up to 100 sites globally. The adaptive design component includes an interim analysis by our independent data safety monitoring board to be conducted after the first 200 participants have completed the trial. Based on the results of the interim analysis, the study may be stopped for futility or the final sample size will be determined, ranging between 300 and 728 patients, according to a pre-determined statistical plan. As previously disclosed, we have experienced and continue to experience slower than expected site activations and enrollment in our ReMEDy2 trial. We believe these conditions may be due to hospital and medical facility staffing shortages; inclusion/exclusion criteria in the study protocol; concerns managing logistics and protocol compliance for participants discharged from the hospital to an intermediate care facility; concerns regarding the prior clinically significant hypotension events and circumstances surrounding the previous clinical hold; use of artificial intelligence and telemedicine which have enabled smaller hospitals to retain AIS patients not eligible for mechanical thrombectomy instead of sending these patients to the larger stroke centers which are more likely to be sites in our trial; and competition for research staff and trial subjects due to other pending stroke and neurological trials. We continue to reach out to current and potential study sites to understand the specific issues at each study site. In an effort to mitigate the impact of these factors, we have significantly expanded our internal clinical team and have brought in-house certain trial activities, including site identification, qualification and activation, clinical site monitoring and overall program management. We are currently conducting the trial in the United States and in the countries of Canada and Georgia. We are in the process of preparing regulatory filings and identifying and engaging study sites in an additional seven European countries and have submitted for approval of this study in the United Kingdom. We continue to work closely with our contract research organizations and other advisors to develop procedures to support both U.S. and global study sites and potential participants as needed. We intend to continue to monitor the results of these efforts and, if necessary, implement additional actions to enhance site activations and enrollment in our ReMEDy2 trial; however, no assurances can be provided as to the success of these actions and if or when these issues will resolve. Failure to resolve these issues may result in further delays in our ReMEDy2 trial and increase the difficulty in forecasting enrollment. We currently estimate that the interim analysis will be completed in the second half of 2026.

Financial Overview

We have not generated any revenues from product sales. Since our inception, we have financed our operations primarily from sales of equity securities, interest income on funds available for investment, and government grants. We have incurred a net loss in each year since our inception. Our net losses were $24.0 million and $16.5 million for the nine months ended September 30, 2025 and 2024, respectively. As of September 30, 2025, we had an accumulated deficit of $164.0 million. Substantially all of our operating losses resulted from expenses incurred in connection with our research and development (R&D) activities and general and administrative (G&A) support costs associated with our operations.

We expect to continue to incur significant expenses and operating losses for at least the next few years. We anticipate that our quarterly expenses will increase moderately relative to recent prior quarterly periods as we continue to advance our DM199 clinical development program into PE and we continue our ReMEDy2 trial, including additional site activations in the U.S. and globally and enrollment of participants in the trial. Our efforts to expand our team to provide support for our clinical and administrative operations will likely also contribute to such increases.

While we expect the level of future negative operating quarterly cash flows to generally increase moderately relative to recent prior quarterly periods as we expand our DM199 clinical development program into PE and we continue our ReMEDy2 trial, including our global expansion, we expect our current cash resources will be sufficient to allow us to continue our ReMEDy2 trial, support the Phase 2 PE trial, and otherwise fund our planned operations for at least the next 12 months from the date of issuance of the condensed consolidated financial statements included in this report. However, the amount and timing of our future funding requirements will depend on many factors, including timing and results of our ongoing development efforts, including the current Phase 2 PE trial, our current ReMEDy2 trial and in particular the rate of site activation and participant enrollment in the study, the potential further expansion of our current development programs and other factors. We may require or otherwise seek significant additional funds earlier than we currently need or expect. We may elect to raise additional funds even before we need them if market conditions for raising additional capital are favorable.

Components of Our Results of Operations

Research and Development Expenses

R&D expenses consist primarily of fees paid to external service providers such as contract research organizations; clinical support services; clinical development including clinical site costs; outside nursing services; and laboratory testing. R&D costs also include non-clinical testing; fees paid to our contract manufacturing and development organizations and outside laboratories for development of DM199 and related manufacturing processes; costs for production runs of DM199; consulting resources with specialized expertise related to the execution of our development plan for DM199; and personnel costs, including salaries, benefits, non-cash share-based compensation expense; and other personnel costs. Over the past approximately 10 years, our R&D efforts have been primarily focused on developing DM199. At this time, due to the risks inherent in the clinical development process and the clinical stage of our product development programs, we are unable to estimate with any certainty the costs we will incur in completing the development of DM199 through marketing approval. The process of conducting clinical studies necessary to obtain regulatory approval and manufacturing scale-up to support expanded development and potential future commercialization is costly and time consuming. Any failure by us or delay in completing clinical studies, manufacturing scale-up, or in obtaining regulatory approvals could lead to increased R&D expenses and, in turn, have a material adverse effect on our results of operations.

General and Administrative Expenses

G&A expenses consist primarily of salaries and benefits, including non-cash share-based compensation related to our executive, finance, business development and support functions. G&A expenses also include insurance, including directors’ and officers’ liability coverage, rent and utilities, travel expenses, patent costs, and professional fees, including for auditing, tax and legal services.

Other Income, Net

Other income, net consists primarily of interest income earned on marketable securities.

Results of Operations

Comparison of the Three and Nine Month Periods Ended September 30, 2025 and 2024

The following table summarizes our unaudited results of operations for the three and nine month periods ended September 30, 2025 and 2024 (in thousands):

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |