|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

MBCN

|

NASDAQ Capital Market

|

|

(d)

|

Exhibits.

|

|

99.1

|

||

|

99.2

|

|

104

|

Cover Page Interactive File (embedded within the Inline XBRL document)

|

|

MIDDLEFIELD BANC CORP.

|

||

|

Date: October 22, 2025

|

/s/ Ronald L. Zimmerly, Jr

|

|

|

President and Chief Executive Officer

|

||

Exhibit 99.1

|

|

Farmers National Banc Corp. and Middlefield Banc Corp.

Announce Definitive Merger Agreement

|

- |

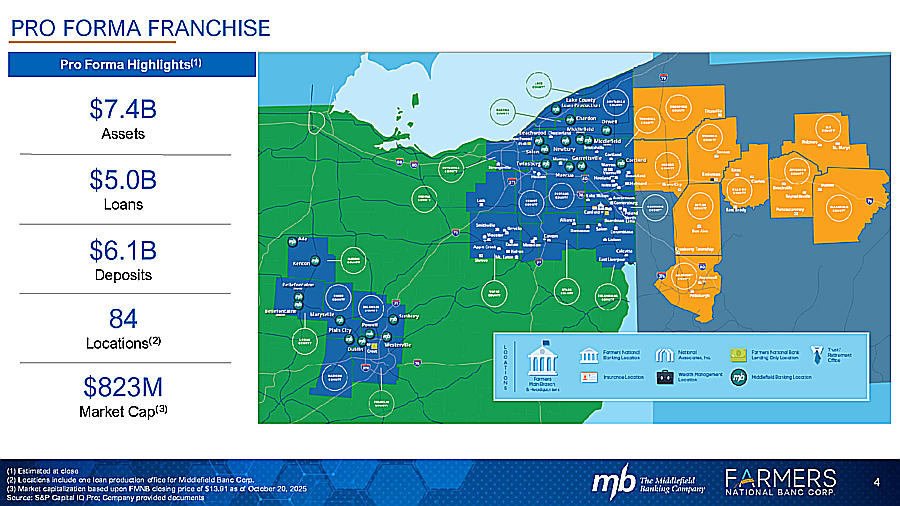

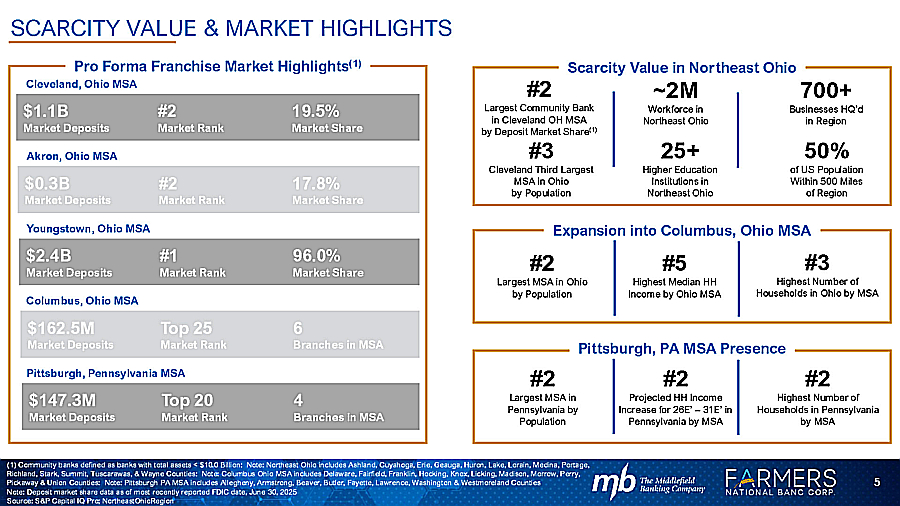

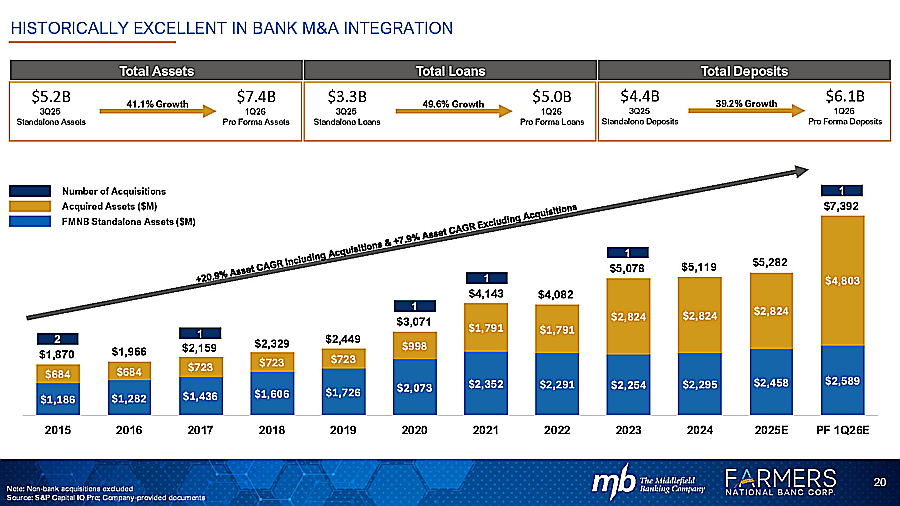

The merger will create the region’s premier community banking franchise with over $7 billion total assets |

|

- |

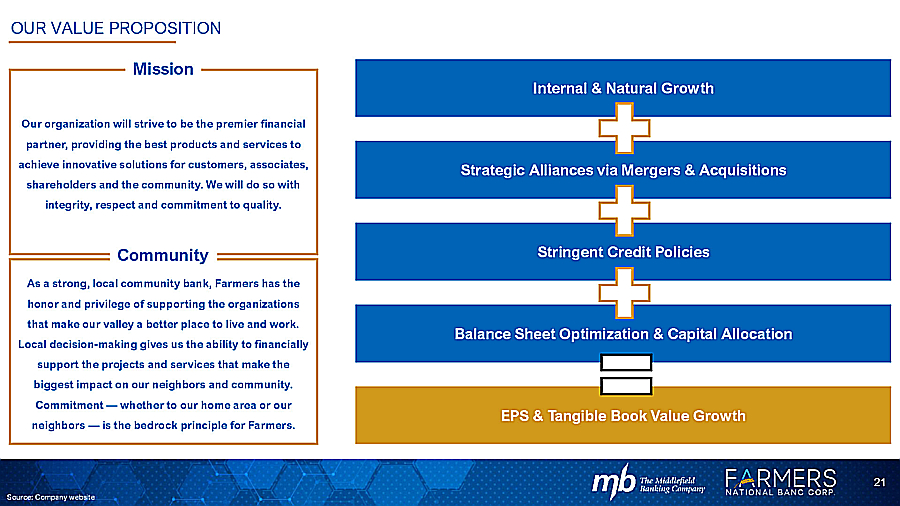

Unlocks meaningful growth opportunities and improves competitive positioning as a top Midwest community bank franchise |

|

- |

83 branches serving Northeast and Central Ohio and Western Pennsylvania |

|

- |

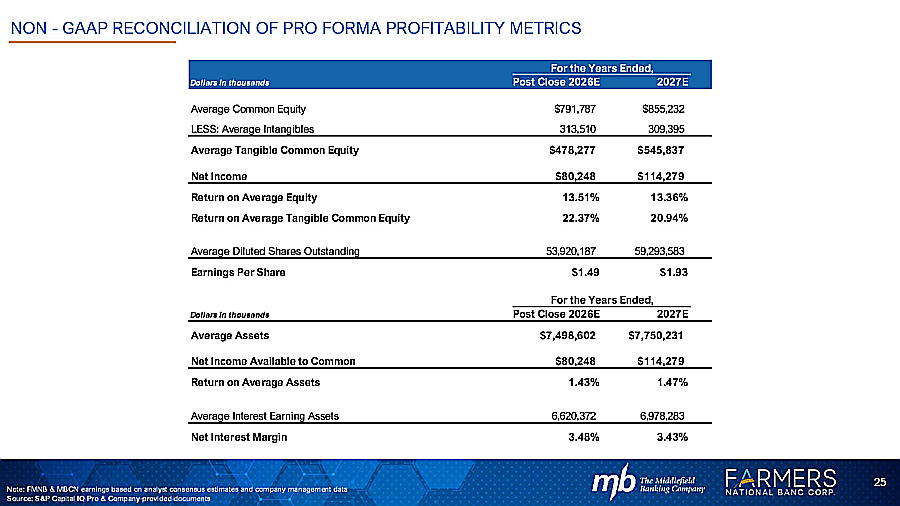

Enhances profitability profile through increased operating leverage |

|

- |

Accretive to pro forma TCE/TA |

|

- |

Transaction expected to close by the end of the first quarter of 2026 after shareholder and regulatory approvals |

CANFIELD, Ohio and MIDDLEFIELD, Ohio – October 22, 2025 -- Farmers National Banc Corp. (“Farmers”) (NASDAQ: FMNB), the holding company for The Farmers National Bank of Canfield (“Farmers National Bank”), and Middlefield Banc Corp. (“Middlefield”) (NASDAQ: MBCN), the holding company for The Middlefield Banking Company (“Middlefield Bank”), jointly announced today the signing of a definitive merger agreement (the “Agreement”) pursuant to which Middlefield will merge with and into Farmers in an all-stock transaction. The Agreement was unanimously approved by the boards of directors of both companies.

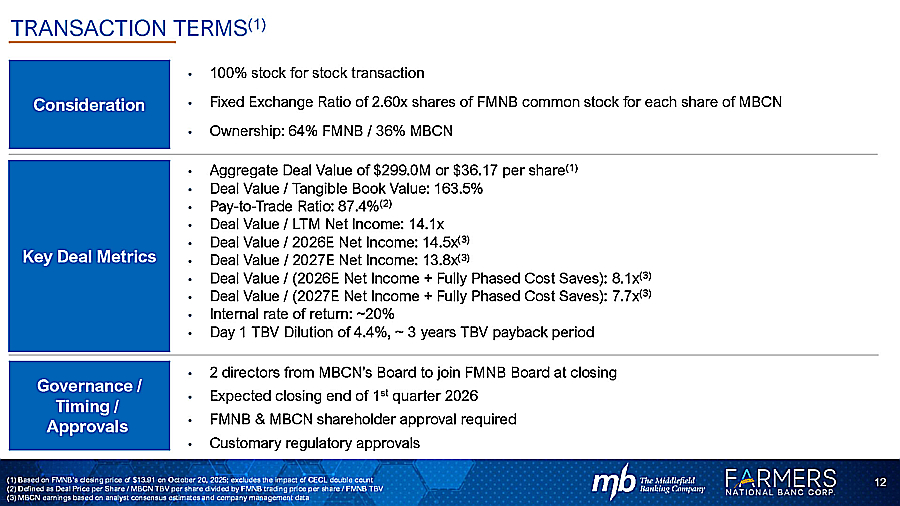

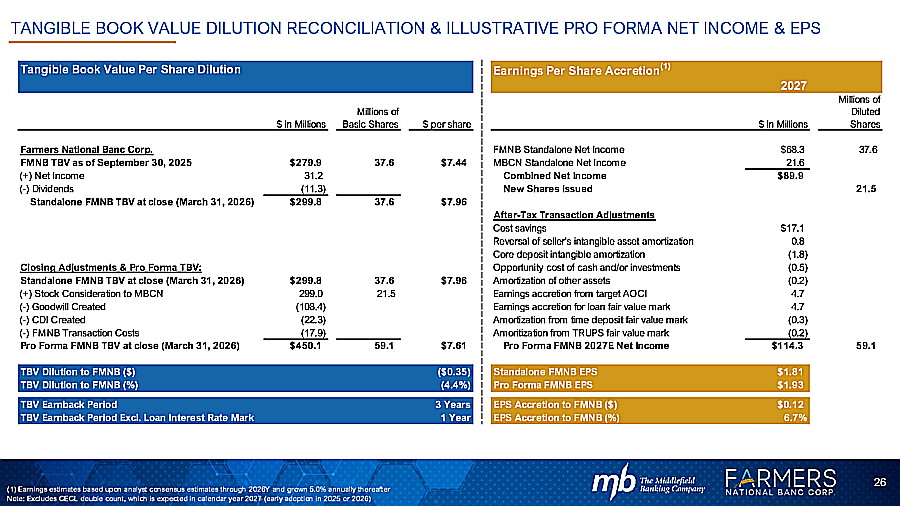

Pursuant to the Agreement, each share of Middlefield common stock outstanding immediately prior to completion of the merger will be converted into the right to receive 2.6 shares of Farmers common stock. Based on Farmers’ closing share price of $13.91 on October 20, 2025, the proposed transaction is valued at approximately $299.0 million, or $36.17 per Middlefield share. The merger is expected to qualify as a tax-free reorganization. The transaction is subject to receipt of Middlefield and Farmers shareholder approvals and customary regulatory approvals. The transaction is expected to close by the end of the first quarter of 2026.

At the close of the transaction, Farmers intends to appoint two Middlefield directors to Farmers’ Board of Directors. For additional information about the proposed merger, please see the Investor Presentation – Merger, filed as Exhibit 99.4 to Farmers’ Form 8-K filed on October 22, 2025.

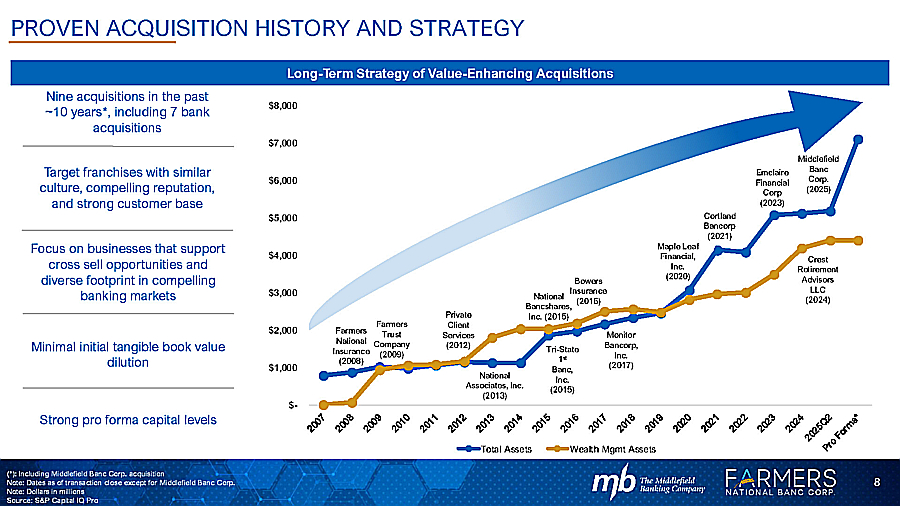

Kevin J. Helmick, President and CEO of Farmers, stated, “We are excited to announce the merger with Middlefield. This is our seventh bank acquisition in the last 10 years and reflects our proven track record of executing and integrating strategic M&A. The merger brings together two high-performing community banks with complementary markets, shared values, and a common vision for growth. We know Middlefield and its markets well, and this partnership not only deepens our presence in Northeast Ohio but meaningfully expands our footprint across Central and Western Ohio markets. This includes the Columbus region, where we are making strategic investments to expand in Ohio’s largest and fastest-growing market. Together, we will create a larger, more diversified institution with enhanced scale, deeper relationships, and a stronger foundation to drive long-term shareholder value.”

Ronald L. Zimmerly, Jr., President and Chief Executive Officer of Middlefield, commented, “Joining Farmers represents an exciting next chapter for Middlefield and the communities we serve. Our customers will benefit from a broader suite of financial products and advanced digital capabilities, while continuing to receive the same personalized service and local decision-making that define our culture. This merger enhances our ability to grow and support our stakeholders and deliver meaningful value for our shareholders.”

Upon consummation of the transaction, Middlefield Bank will be merged with and into Farmers National Bank and Middlefield Bank’s branches will become branches of Farmers National Bank. Upon closing, Farmers estimates it will have approximately $7.4 billion in assets and 83 branch locations throughout Ohio and western Pennsylvania.

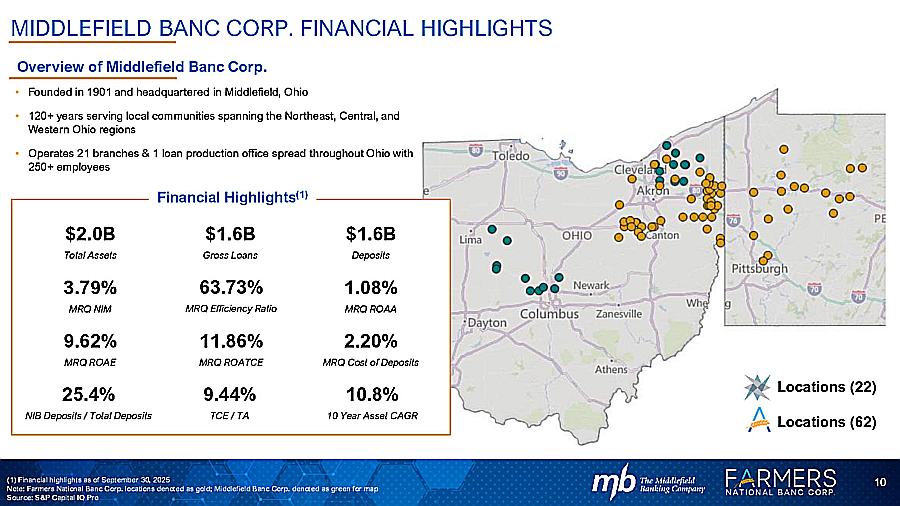

As of September 30, 2025, Middlefield had total assets of approximately $2.0 billion, which included total loans of $1.6 billion, deposits of $1.6 billion and stockholders’ equity of $224.1 million.

Janney Montgomery Scott LLC. is serving as financial advisor to Farmers and Vorys, Sater, Seymour and Pease LLP is serving as legal counsel to Farmers on the transaction. Raymond James & Associates, Inc. is serving as financial advisor to Middlefield and Nelson Mullins Riley & Scarborough LLP is serving as legal counsel to Middlefield on the transaction.

CONFERENCE CALL INFORMATION

Farmers will host a conference call on October 22, 2025, at 9:00 a.m. ET, to discuss the acquisition of Middlefield Banc Corp. Participants can join the call by dialing 1-877-407-0752 or 1-201-389-0912. The conference call will also be broadcast simultaneously via webcast on a listen-only basis and can be found here: https://viavid.webcasts.com/starthere.jsp?ei=1738011&tp_key=9334633d73.

A link to the press release, presentation, and webcast will be available at ir.farmersbankgroup.com.

A replay of the conference call can be accessed through November 5, 2025, by dialing 1-844-512-2921 or 1-412-317-6671 and Access ID: 13756434.

ABOUT FARMERS NATIONAL BANC CORP.

Founded in 1887, Farmers National Banc Corp. is a diversified financial services company headquartered in Canfield, Ohio, with $5.2 billion in banking assets. Farmers National Banc Corp.’s wholly-owned subsidiaries are comprised of The Farmers National Bank of Canfield, a full-service national bank engaged in commercial and retail banking with 62 banking locations in Mahoning, Trumbull, Columbiana, Portage, Stark, Wayne, Medina, Geauga and Cuyahoga Counties in Ohio and Beaver, Butler, Allegheny, Jefferson, Clarion, Venango, Clearfield, Mercer, Elk and Crawford Counties in Pennsylvania, and Farmers Trust Company, which operates trust offices and offers services in the same geographic markets. Total wealth management assets under care at September 30, 2025 are $4.6 billion. Farmers National Insurance, LLC, a wholly-owned subsidiary of The Farmers National Bank of Canfield, offers a variety of insurance products.

About Middlefield Banc Corp.

Middlefield Banc Corp., headquartered in Middlefield, Ohio, is the bank holding company of The Middlefield Banking Company, with total assets of $1.98 billion at September 30, 2025. The Bank operates 21 full-service banking centers and an LPL Financial® brokerage office serving Ada, Beachwood, Bellefontaine, Chardon, Cortland, Dublin, Garrettsville, Kenton, Mantua, Marysville, Middlefield, Newbury, Orwell, Plain City, Powell, Solon, Sunbury, Twinsburg, and Westerville. The Bank also operates a Loan Production Office in Mentor, Ohio.

Additional information is available at www.middlefieldbank.bank

FORWARD LOOKING STATEMENTS

We make statements in this news release and our related investor conference call, and we may from time to time make other statements, that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about Farmers’ and Middlefield’s financial condition, results of operations, asset quality trends and profitability. Forward-looking statements are not historical facts but instead represent only management’s current expectations and forecasts regarding future events, many of which, by their nature, are inherently uncertain and outside of Farmers’ and Middlefield’s control. Forward-looking statements are preceded by terms such as “expects,” “believes,” “anticipates,” “intends” and similar expressions, as well as any statements related to future expectations of performance or conditional verbs, such as “will,” “would,” “should,” “could” or “may.”

Forward-looking statements are not a guarantee of future performance and actual future results could differ materially from those contained in forward-looking information. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of Farmers’ and Middlefield’s control. Numerous uncertainties, risks, and changes could cause or contribute to Farmers’ or Middlefield’s actual results, performance, and achievements to be materially different from those expressed or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, the possibility that the closing of the proposed transaction is delayed or does not occur at all because required regulatory approvals, shareholder approval or other conditions to the transaction are not obtained or satisfied on a timely basis or at all; the possibility that the anticipated benefits of the transaction are not realized when expected or at all; Farmers’ and Middlefield’s failure to integrate Middlefield and Middlefield Bank with Farmers and Farmers National Bank in accordance with expectations; deviations from performance expectations related to Middlefield and Middlefield Bank ; diversion of management’s attention on the proposed transaction; significant changes in economic conditions in markets where Farmers and Middlefield conduct business which could materially impact credit quality trends; significant changes in U.S. economic conditions including those resulting from continued high rates of inflation, tightening monetary policy of the Board of Governors of the Federal Reserve, and effects of U.S. and foreign country tariff policies; general business conditions in the banking industry; the regulatory environment; general fluctuations in interest rates; demand for loans in the market areas where Farmers and Middlefield conduct business; rapidly changing technology and evolving banking industry standards; competitive factors, including increased competition with regional and national financial institutions; and new service and product offerings by competitors and price pressures; and other factors disclosed periodically in Farmers’ and Middlefield’s filings with the Securities and Exchange Commission (the “SEC”).

Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this release or made elsewhere from time to time by Farmers, Middlefield or on Farmers’ or Middlefield’s behalf, respectively. Forward-looking statements speak only as of the date made, and neither Farmers nor Middlefield assumes any duty and does not undertake to update forward-looking statements.

Farmers and Middlefield provide further detail regarding these risks and uncertainties in their respective latest Annual Reports on Form 10-K, including in the risk factors section of their respective latest Annual Reports on Form 10-K, as well as in subsequent SEC filings, available on the SEC’s website at www.sec.gov.

OTHER INFORMATION

In connection with the proposed merger, Farmers will file with the SEC a Registration Statement on Form S-4 that will include a joint proxy statement and a prospectus of Farmers, as well as other relevant documents concerning the proposed transaction.

SHAREHOLDERS OF FARMERS AND MIDDLEFIELD AND OTHER INVESTORS ARE URGED TO CAREFULLY READ THE PROXY STATEMENT AND PROSPECTUS TO BE INCLUDED IN THE REGISTRATION STATEMENT ON FORM S-4, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FARMERS, MIDDLEFIELD, THE PROPOSED MERGER, THE PERSONS SOLICITING PROXIES WITH RESPECT TO THE PROPOSED MERGER, AND THEIR INTERESTS IN THE PROPOSED MERGER AND RELATED MATTERS.

The respective directors and executive officers of Farmers and Middlefield and other persons may be deemed to be participants in the solicitation of proxies from Farmers and Middlefield shareholders with respect to the proposed merger. Information regarding the directors of Farmers is available in its proxy statement filed with the SEC on March 18, 2025 in connection with its 2025 Annual Meeting of Shareholders and information regarding the executive officers of Farmers is available in its Form 10-K filed with the SEC on March 6, 2025. Information regarding the directors of Middlefield is available in its proxy statement filed with the SEC on April 4, 2025 in connection with its 2025 Annual Meeting of Shareholders and information regarding the directors and executive officers of Middlefield is available in its Form 10-K filed with the SEC on March 13, 2025. Other information regarding the participants in the solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and prospectus to be included in the Registration Statement on Form S-4 and other relevant materials to be filed with the SEC when they become available.

Investors and security holders will be able to obtain free copies of the registration statement (when available) and other documents filed with the SEC by Farmers through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Farmers will be available free of charge on Farmers’ website at https://www.farmersbankgroup.com or may be obtained from Farmers by written request to Farmers National Banc Corp., 20 South Broad Street, Canfield, Ohio 44406, Attention: Investor Relations. Copies of the documents filed or to be filed with the SEC by Middlefield may be obtained without charge from Middlefield by written request to Middlefield Banc Corp., 15985 East High Street, Middlefield, Ohio, 44062, Attention: Julie E. Shaw, Secretary.

Exhibit 99.2