|

THE LGL GROUP, INC.

|

||

|

(Exact Name of Registrant as Specified in Charter)

|

||

|

Delaware

|

001-00106

|

38-1799862

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

2525 Shader Road, Orlando, FL

|

32804

|

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

(Former Name or Former Address, If Changed Since Last Report)

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

Common Stock, par value $0.01

|

LGL

|

NYSE American

|

||

|

Warrants to Purchase Common Stock, par value $0.01

|

LGL WS

|

NYSE American

|

|

Item 2.02.

|

Results of Operations and Financial Condition |

|

Item 7.01.

|

Regulation FD Disclosure

|

|

Item 8.01.

|

Other Events

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

(d)

|

Exhibits

|

|

Exhibit No.

|

Description

|

|

99.1

|

|

| 99.2 | The LGL Group, Inc. Investor Presentation. |

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

THE LGL GROUP, INC.

|

|||

| (Registrant) | |||

| Date: September 22, 2025 |

By:

|

/s/ Patrick Huvane

|

|

|

Name:

|

Patrick Huvane

|

||

|

Title:

|

Executive Vice President - Business Development

|

||

Exhibit 99.1

THE LGL GROUP, INC. ANNOUNCES COMMENCEMENT OF SHARE REPURCHASE

ORLANDO, FL. – September 18, 2025 – The LGL Group, Inc. (NYSE American: LGL) ("LGL," "LGL Group," or the "Company") announced today that its Board of Directors authorized the commencement of the repurchase of $500,000 to $700,000 of shares of LGL Group common stock under its existing share repurchase plan at such times, amounts and prices management deems appropriate. The repurchase will be made subject to availability and relative to book value and is not expected to exceed 100,000 shares within its existing authority. This repurchase is expected to begin this quarter.

Additionally, LGL Group's warrants are exercisable today through November 17, 2025 and contain the following terms:

|

• |

Five (5) warrants to purchase one (1) share of common stock; |

|

• |

Common stock can be purchased at a strike price of $4.75 per share; |

|

• |

Oversubscription privilege available to warrant holders beginning October 16, 2025 that allows warrant holders to subscribe for additional shares of common stock that remain unsubscribed as a result of any unexercised Warrants; and |

|

• |

No fractional shares will be issued. |

Further information concerning how to exercise LGL Group Warrants can be found on the Warrant FAQ page of the Company's website at www.lglgroup.com/WarrantFAQ.

To date, approximately 45,000 shares have been issued from the exercise of the warrants.

LGL Group to Present Today at Sidoti Small Cap Conference

LGL Group will present at the Sidoti Small Cap Virtual Conference on Thursday, September 18, 2025. The presentation will begin at 11:30 a.m. ET and can be accessed live here: https://sidoti.zoom.us/webinar/register/WN_t0HZAS1XStOfyp5mpRF-VQ.

To register for the presentation, visit www.sidoti.com/events. Registration is free and you don't need to be a Sidoti client.

Update to Purchase of 1 Million Newly Issued Shares of Morgan Group Holding Co. (OTC Pink: MGHL)

The purchase remains pending final multi-party agreements, certain approvals and final diligence. We continue to believe this transaction will be completed in 2025. LGL Group entered into an amended and restated subscription agreement to purchase, via a private placement, 1,000,000 newly issued shares of Morgan Group Holding Co. ("MGHL") common stock for $2.00 per share in April 2025. This transaction has received approval from MGHL’s directors, and shareholders and once completed MGHL will have approximately 1.6 million shares outstanding and is expected to close in the third quarter.

MGHL, through its wholly owned subsidiary, G.research, LLC ("G.R"), provides brokerage, underwriting, and institutional research services. G.R is a broker-dealer registered under the Securities Exchange Act of 1934, as amended, and is a member of the Financial Industry Regulatory Authority ("FINRA"). G.R has over $5.0 billion of private client assets held in over 1,000 accounts. G.R also sponsors a series of industry-focused investment conferences featuring leading public and private companies in sectors with a high degree of investor interest. The conferences cover important sectors, including automotive and aerospace and defense. MGHL will continue to trade as an independently listed company with its own set of shareholders.

Once closed, Herve Francois will join MGHL as Chairman and Chief Executive Officer and Chris Nossokoff will join as Chief Financial Officer. G.R. will continue to be led by Vincent Amabile as President and Joseph Fernandez as Financial Operations Principal and Controller and continue to manage and build the strength of the platform.

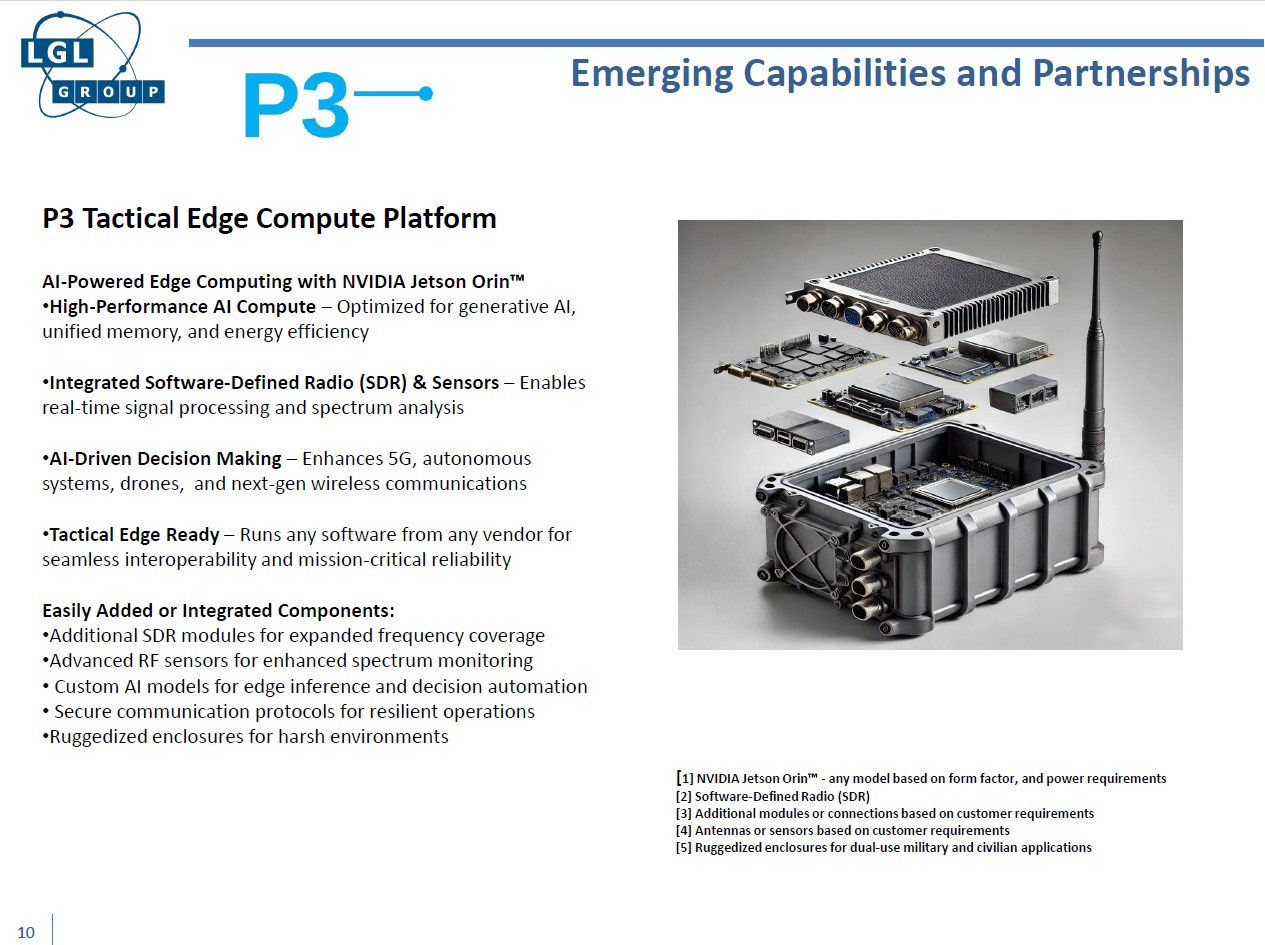

New Initiatives Continue

Further expanding adjacent capabilities with the Company’s PTF division, P3 Logistic Solutions LLC ("P3") is developing new opportunities with AI-driven tactical edge device prototypes. P3 is preparing to field test on farms, adapting technology originally engineered for U.S. Department of Defense use cases to meet the challenges of modern agriculture. These ruggedized edge systems deliver real-time, autonomous decision-making without relying on centralized networks — ensuring uninterrupted operation in remote and demanding conditions.

The trials will apply the technology to precision crop monitoring, smart irrigation control, and autonomous asset tracking, bringing smart analytics and resilience to the field. Testing will measure gains in efficiency, resource optimization, and operational performance across diverse farming environments, laying the foundation for scalable deployment.

We do not expect to recognize any material benefits from our new initiatives in 2025 but expect to develop value in the medium term.

Q2 2025 Results as Previously Reported

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||||||||||

|

2025 |

2024 |

% Change |

2025 |

2024 |

% Change |

|||||||||||||||||||

|

U.S. GAAP Financial Measures |

||||||||||||||||||||||||

|

Revenues |

$ | 924 | $ | 1,068 | -13.5 | % | $ | 1,842 | $ | 1,956 | -5.8 | % | ||||||||||||

|

Gross margin |

57.0 | % | 59.7 | % | -4.5 | % | 54.7 | % | 54.7 | % | 0.0 | % | ||||||||||||

|

Net (loss) income |

$ | (51 | ) | $ | 137 | -137.2 | % | $ | (57 | ) | $ | 158 | -136.1 | % | ||||||||||

|

Net (loss) income per diluted share |

$ | (0.01 | ) | $ | 0.02 | -138.1 | % | $ | (0.01 | ) | $ | 0.03 | -137.4 | % | ||||||||||

Consolidated Results from Operations

Second quarter 2025 net (loss) income available to LGL Group common stockholders was ($51,000), or ($0.01) per diluted share, compared with $137,000, or $0.02 per diluted share, in the second quarter of 2024. The decrease was primarily due to:

|

• |

lower Net sales due to lower product shipments during Q2 2025 and lower backlog as of March 31, 2025; and |

|

• |

lower Net investment income on investments in U.S. Treasury money market funds due to lower yields. |

Gross Margin

Gross margin decreased to 57.0% for the three months ended June 30, 2025 compared to 59.7% for the three months ended June 30, 2024. The decrease was primarily due to sales of lower margin products.

Fiscal year to date 2025 net (loss) income available to LGL group common stockholders was ($57,000), or ($0.01) per diluted share, compared with $158,000, or $0.03 per diluted share, in 2024. The decrease was primarily due to lower Net investment income on investments in U.S. Treasury money market funds due to lower yields partially offset by higher Net sales driven by higher product shipments.

Gross Margin

Gross margin was flat at 54.7% for the six months ended June 30, 2025 and 2024 reflecting the consistent nature of the fixed costs.

Backlog

As of June 30, 2025, our order backlog was $527,000, an increase of $191,000 from $336,000 as of December 31, 2024 and an decrease of $210,000 from $737,000 as of June 30, 2024. The backlog of unfilled orders includes amounts based on signed contracts, which we have determined are firm orders likely to be fulfilled primarily in the next 12 months but most of the backlog will ship in the next 90 days.

Liquidity

Our working capital metrics were as follows:

|

(in thousands) |

June 30, 2025 |

December 31, 2024 |

||||||

|

Current assets |

$ | 42,515 | $ | 42,642 | ||||

|

Less: Current liabilities |

881 | 904 | ||||||

|

Working capital |

$ | 41,634 | $ | 41,738 | ||||

As of June 30, 2025, LGL Group had investments (classified within Cash and cash equivalents and Marketable securities) with a fair value of $41.8 million, of which $25.2 million was held within the Merchant Investment business.

About The LGL Group, Inc.

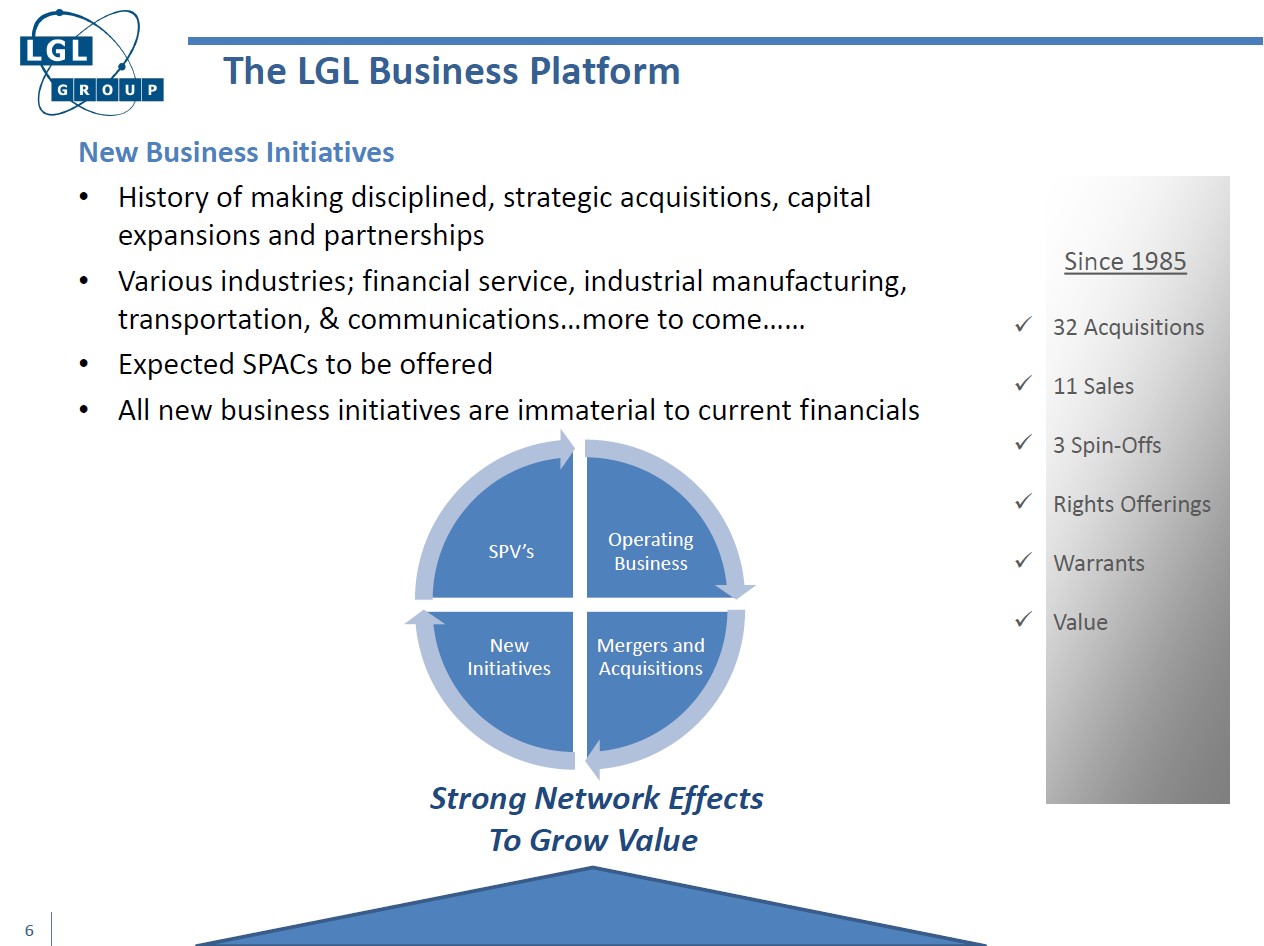

The LGL Group, Inc. ("LGL," "LGL Group," or the "Company") is a holding company engaged in services, merchant investment and manufacturing business activities. Precise Time and Frequency, LLC ("PTF") is a globally positioned producer of industrial Electronic Instruments and commercial products and services. Founded in 2002, PTF operates from our design and manufacturing facility in Wakefield, Massachusetts. Lynch Capital International LLC is focused on the development of value through investments.

LGL Group was incorporated in 1928 under the laws of the State of Indiana, and in 2007, the Company was reincorporated under the laws of the State of Delaware as The LGL Group, Inc. We maintain our executive offices at 2525 Shader Road, Orlando, Florida 32804. Our telephone number is (407) 298-2000. Our Internet address is www.lglgroup.com. LGL Group common stock and warrants are traded on the NYSE American ("NYSE") under the symbols "LGL" and "LGL WS", respectively.

LGL Group's business strategy is primarily focused on growth through expanding new and existing operations across diversified industries. The Company's engineering and design origins date back to the early 1900s. In 1917, Lynch Glass Machinery Company ("Lynch Glass"), the predecessor of LGL Group, was formed and emerged in the late 1920s as a successful manufacturer of glass-forming machinery. Lynch Glass was then renamed Lynch Corporation ("Lynch") and was incorporated in 1928 under the laws of the State of Indiana. In 1946, Lynch was listed on the "New York Curb Exchange," the predecessor to the NYSE American. The Company has a had a long history of owning and operating various business in the precision engineering, manufacturing, and services sectors.

Cautionary Note Concerning Forward-Looking Statements

This press release may contain forward-looking statements made in reliance upon the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, and can be identified by the use of words such as "may," "will," "expect," "project," "estimate," "anticipate," "plan," "believe," "potential," "should," "continue" or the negative versions of those words or other comparable words. These forward-looking statements are not guarantees of future actions or performance. These forward-looking statements are based on information currently available to us and our current plans or expectations and are subject to a number of uncertainties and risks that could significantly affect current plans, anticipated actions and our future financial condition and results. Certain of these risks and uncertainties are described in greater detail in our filings with the Securities and Exchange Commission. We are under no obligation to (and expressly disclaim any such obligation to) update or alter our forward-looking statements, whether as a result of new information, future events or otherwise.

###

Contact:

The LGL Group, Inc.

(407) 298-2000

info@lglgroup.com

The LGL Group, Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

|

(in thousands, except share data) |

2025 |

2024 |

2025 |

2024 |

||||||||||||

|

Revenues: |

||||||||||||||||

|

Net sales |

$ | 491 | $ | 531 | $ | 989 | $ | 923 | ||||||||

|

Net investment income |

428 | 538 | 845 | 1,037 | ||||||||||||

|

Net gains (losses) |

5 | (1 | ) | 8 | (4 | ) | ||||||||||

|

Total revenues |

924 | 1,068 | 1,842 | 1,956 | ||||||||||||

|

Expenses: |

||||||||||||||||

|

Manufacturing cost of sales |

211 | 214 | 448 | 418 | ||||||||||||

|

Engineering, selling and administrative |

744 | 617 | 1,384 | 1,222 | ||||||||||||

|

Total expenses |

955 | 831 | 1,832 | 1,640 | ||||||||||||

|

(Loss) income from operations before income taxes |

(31 | ) | 237 | 10 | 316 | |||||||||||

|

Income tax expense |

14 | 76 | 42 | 112 | ||||||||||||

|

Net (loss) income |

(45 | ) | 161 | (32 | ) | 204 | ||||||||||

|

Less: Net income attributable to non-controlling interests |

6 | 24 | 25 | 46 | ||||||||||||

|

Net (loss) income attributable to LGL Group common stockholders |

$ | (51 | ) | $ | 137 | $ | (57 | ) | $ | 158 | ||||||

|

(Loss) income per common share attributable to LGL Group common stockholders: |

||||||||||||||||

|

Basic |

$ | (0.01 | ) | $ | 0.03 | $ | (0.01 | ) | $ | 0.03 | ||||||

|

Diluted |

$ | (0.01 | ) | $ | 0.02 | $ | (0.01 | ) | $ | 0.03 | ||||||

|

Weighted average shares outstanding: |

||||||||||||||||

|

Basic |

5,352,937 | 5,352,937 | 5,352,937 | 5,352,937 | ||||||||||||

|

Diluted |

5,352,937 | 5,482,543 | 5,352,937 | 5,548,869 | ||||||||||||

The LGL Group, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

|

(in thousands) |

June 30, 2025 |

December 31, 2024 |

||||||

|

Assets: |

||||||||

|

Current assets: |

||||||||

|

Cash and cash equivalents |

$ | 41,735 | $ | 41,585 | ||||

|

Marketable securities |

26 | 17 | ||||||

|

Accounts receivable, net of reserves of $52 and $52, respectively |

263 | 493 | ||||||

|

Inventories, net |

254 | 267 | ||||||

|

Prepaid expenses and other current assets |

237 | 280 | ||||||

|

Total current assets |

42,515 | 42,642 | ||||||

|

Right-of-use lease assets |

276 | 308 | ||||||

|

Intangible assets, net |

25 | 36 | ||||||

|

Deferred income tax assets |

214 | 159 | ||||||

|

Total assets |

$ | 43,030 | $ | 43,145 | ||||

|

Liabilities: |

||||||||

|

Total current liabilities |

881 | 904 | ||||||

|

Non-current liabilities |

1,017 | 1,001 | ||||||

|

Total liabilities |

1,898 | 1,905 | ||||||

|

Stockholders' equity: |

||||||||

|

Total LGL Group stockholders' equity |

39,097 | 39,230 | ||||||

|

Non-controlling interests |

2,035 | 2,010 | ||||||

|

Total stockholders' equity |

41,132 | 41,240 | ||||||

|

Total liabilities and stockholders' equity |

$ | 43,030 | $ | 43,145 | ||||

The LGL Group, Inc.

Segment Results

(Unaudited)

|

Three Months Ended June 30, |

||||||||||||||||

|

(in thousands) |

2025 |

2024 |

$ Change |

% Change |

||||||||||||

|

Revenues: |

||||||||||||||||

|

Electronic Instruments |

$ | 491 | $ | 531 | $ | (40 | ) | -7.5 | % | |||||||

|

Merchant Investment |

262 | 315 | (53 | ) | -16.8 | % | ||||||||||

|

Corporate |

171 | 222 | (51 | ) | -23.0 | % | ||||||||||

|

Total revenues |

924 | 1,068 | (144 | ) | -13.5 | % | ||||||||||

|

Expenses: |

||||||||||||||||

|

Electronic Instruments |

423 | 457 | (34 | ) | -7.4 | % | ||||||||||

|

Merchant Investment |

114 | 78 | 36 | 46.2 | % | |||||||||||

|

Corporate |

418 | 296 | 122 | 41.2 | % | |||||||||||

|

Total expenses |

955 | 831 | 124 | 14.9 | % | |||||||||||

|

Income (loss) from operations before income taxes |

||||||||||||||||

|

Electronic Instruments |

68 | 74 | (6 | ) | -8.1 | % | ||||||||||

|

Merchant Investment |

148 | 237 | (89 | ) | -37.6 | % | ||||||||||

|

Corporate |

(247 | ) | (74 | ) | (173 | ) | 233.8 | % | ||||||||

|

Income (loss) from operations before income taxes |

(31 | ) | 237 | (268 | ) | -113.1 | % | |||||||||

|

Income tax expense (benefit) |

14 | 76 | (62 | ) | -81.6 | % | ||||||||||

|

Net income (loss) |

(45 | ) | 161 | (206 | ) | -128.0 | % | |||||||||

|

Less: Net income attributable to non-controlling interests |

6 | 24 | (18 | ) | -75.0 | % | ||||||||||

|

Net income (loss) attributable to LGL Group common stockholders |

$ | (51 | ) | $ | 137 | $ | (188 | ) | -137.2 | % | ||||||

The LGL Group, Inc.

Segment Results

(Unaudited)

|

Six Months Ended June 30, |

||||||||||||||||

|

(in thousands) |

2025 |

2024 |

$ Change |

% Change |

||||||||||||

|

Revenues: |

||||||||||||||||

|

Electronic Instruments |

$ | 989 | $ | 923 | $ | 66 | 7.2 | % | ||||||||

|

Merchant Investment |

509 | 604 | (95 | ) | -15.7 | % | ||||||||||

|

Corporate |

344 | 429 | (85 | ) | -19.8 | % | ||||||||||

|

Total revenues |

1,842 | 1,956 | (114 | ) | -5.8 | % | ||||||||||

|

Expenses: |

||||||||||||||||

|

Electronic Instruments |

902 | 847 | 55 | 6.5 | % | |||||||||||

|

Merchant Investment |

208 | 127 | 81 | 63.8 | % | |||||||||||

|

Corporate |

722 | 666 | 56 | 8.4 | % | |||||||||||

|

Total expenses |

1,832 | 1,640 | 192 | 11.7 | % | |||||||||||

|

Income (loss) from operations before income taxes |

||||||||||||||||

|

Electronic Instruments |

87 | 76 | 11 | 14.5 | % | |||||||||||

|

Merchant Investment |

301 | 477 | (176 | ) | -36.9 | % | ||||||||||

|

Corporate |

(378 | ) | (237 | ) | (141 | ) | 59.5 | % | ||||||||

|

Income from operations before income taxes |

10 | 316 | (306 | ) | -96.8 | % | ||||||||||

|

Income tax expense |

42 | 112 | (70 | ) | -62.5 | % | ||||||||||

|

Net income |

(32 | ) | 204 | (236 | ) | -115.7 | % | |||||||||

|

Less: Net income attributable to non-controlling interests |

25 | 46 | (21 | ) | -45.7 | % | ||||||||||

|

Net income attributable to LGL Group common stockholders |

$ | (57 | ) | $ | 158 | $ | (215 | ) | -136.1 | % | ||||||

Exhibit 99.2