UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2025

or

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-38010

CLIPPER REALTY INC.

(Exact name of Registrant as specified in its charter)

|

Maryland |

47-4579660 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

4611 12th Avenue, Suite 1L

Brooklyn, New York 11219

(Address of principal executive offices) (Zip Code)

(718) 438-2804

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

|

Common Stock, par value $0.01 per share |

CLPR |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 7, 2025, there were 16,146,546 shares of the Registrant’s Common Stock outstanding.

TABLE OF CONTENTS

|

Page |

||

|

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS |

2 |

|

|

PART I – FINANCIAL INFORMATION |

||

|

ITEM 1. |

CONDENSED FINANCIAL STATEMENTS |

|

|

CONSOLIDATED BALANCE SHEETS AS OF JUNE 30, 2025 (UNAUDITED) AND DECEMBER 31, 2024 |

3 |

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024 (UNAUDITED) |

4 |

|

|

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2025 AND 2024 (UNAUDITED) |

5 |

|

|

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE SIX MONTHS ENDED JUNE 30, 2025 AND 2024 (UNAUDITED) |

6 |

|

|

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED) |

7 |

|

|

ITEM 2. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

26 |

|

ITEM 3. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

36 |

|

ITEM 4. |

CONTROLS AND PROCEDURES |

36 |

|

PART II – OTHER INFORMATION |

||

|

ITEM 1. |

LEGAL PROCEEDINGS |

36 |

|

ITEM 1A. |

RISK FACTORS |

37 |

|

ITEM 2. |

UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS |

39 |

|

ITEM 3. |

DEFAULTS UPON SENIOR SECURITIES |

39 |

|

ITEM 4. |

MINE SAFETY DISCLOSURES |

39 |

|

ITEM 5. |

OTHER INFORMATION |

39 |

|

ITEM 6. |

EXHIBITS |

39 |

|

SIGNATURES |

40 | |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

All statements other than statements of historical fact included in this Quarterly Report on Form 10-Q for Clipper Realty Inc. (the “Company”), including, without limitation, statements under “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” regarding the Company’s financial position, business strategy and the plans, objectives, expectations, or assumptions of management for future operations, are forward-looking statements. When used in this Quarterly Report on Form 10-Q, words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “believe,” “expect,” “intend,” “continue,” “potential,” “plan,” “goal” or other words that convey the uncertainty of future events or outcomes are intended to identify forward-looking statements, which are generally not historical in nature. These statements involve risks and uncertainties that could cause actual results to differ materially from those described in such statements. These risks, contingencies and uncertainties include, but are not limited to, the following:

|

● |

our dependency on two commercial leases with certain agencies of the City of New York, as a single government tenant in our office buildings, could cause a material adverse effect on us, including our financial condition, results of operations and cash flow, with one lease terminating effective August 23, 2025 and the other lease expiring on December 27, 2025; |

|

● |

the impact of the recent increase in inflation in the United States which could increase the cost of acquiring, replacing and operating our properties; |

|

● |

market and economic conditions affecting occupancy levels, rental rates, the overall market value of our properties, our access to capital and the cost of capital and our ability to refinance indebtedness; |

|

● |

economic or regulatory developments in New York City; |

|

● |

changes in rent stabilization regulations or claims by tenants in rent-stabilized units that their rents exceed specified maximum amounts under current regulations; |

|

● |

our ability to control operating costs to the degree anticipated; |

|

● |

the risk of damage to our properties, including from severe weather, natural disasters, climate change, and terrorist attacks; |

|

● |

risks related to financing, cost overruns, and fluctuations in occupancy rates and rents resulting from development or redevelopment activities and the risk that we may not be able to pursue or complete development or redevelopment activities or that such development or redevelopment activities may not be profitable; |

|

● |

concessions or significant capital expenditures that may be required to attract and retain tenants; |

|

● |

the relative illiquidity of real estate investments; |

|

● |

competition affecting our ability to engage in investment and development opportunities or attract or retain tenants; |

|

● |

unknown or contingent liabilities in properties acquired in formative and future transactions; |

|

● |

the possible effects of departure of key personnel in our management team on our investment opportunities and relationships with lenders and prospective business partners; |

|

● |

conflicts of interest faced by members of management relating to the acquisition of assets and the development of properties, which may not be resolved in our favor; |

|

● |

a transfer of a controlling interest in any of our properties that may obligate us to pay transfer tax based on the fair market value of the real property transferred; |

|

● |

the need to establish litigation reserves, costs to defend litigation and unfavorable litigation settlements or judgments; and |

|

● |

other risks and risk factors or uncertainties identified from time to time in our filings with the SEC. |

These forward-looking statements speak only as of the date of this report, and the Company undertakes no obligation to revise or update these statements to reflect subsequent events or circumstances.

PART I – FINANCIAL INFORMATION

ITEM 1. CONDENSED FINANCIAL STATEMENTS

Clipper Realty Inc.

Consolidated Balance Sheets

(In thousands, except for share and per share data)

|

June 30, |

December 31, |

|||||||

|

(unaudited) |

||||||||

|

ASSETS |

||||||||

|

Investment in real estate |

||||||||

|

Land and improvements |

$ | 508,311 | $ | 571,988 | ||||

|

Building and improvements |

720,622 | 736,420 | ||||||

|

Tenant improvements |

3,386 | 3,366 | ||||||

|

Furniture, fixtures and equipment |

13,514 | 13,897 | ||||||

|

Real estate under development |

162,281 | 146,249 | ||||||

|

Total investment in real estate |

1,408,114 | 1,471,920 | ||||||

|

Accumulated depreciation |

(250,650 |

) |

(243,392 |

) |

||||

|

Investment in real estate, net |

1,157,464 | 1,228,528 | ||||||

|

Cash and cash equivalents |

32,029 | 19,896 | ||||||

|

Restricted cash |

28,809 | 18,156 | ||||||

|

Tenant and other receivables, net of allowance for doubtful accounts of $321 and $258, respectively |

7,843 | 6,365 | ||||||

|

Deferred rent |

2,049 | 2,108 | ||||||

|

Deferred costs and intangible assets, net |

5,465 | 5,676 | ||||||

|

Prepaid expenses and other assets |

7,664 | 6,236 | ||||||

|

TOTAL ASSETS |

$ | 1,241,323 | $ | 1,286,965 | ||||

|

LIABILITIES AND EQUITY (DEFICIT) |

||||||||

|

Liabilities: |

||||||||

|

Notes payable, net of unamortized loan costs of $9,152 and $9,019, respectively |

$ | 1,268,171 | $ | 1,266,340 | ||||

|

Accounts payable and accrued liabilities |

15,436 | 18,731 | ||||||

|

Security deposits |

9,095 | 9,067 | ||||||

|

Other liabilities |

6,317 | 7,057 | ||||||

|

TOTAL LIABILITIES |

1,299,019 | 1,301,195 | ||||||

|

Equity (Deficit): |

||||||||

|

Preferred stock, $0.01 par value; 100,000 shares authorized (including 140 shares of 12.5% Series A cumulative non-voting preferred stock), zero shares issued and outstanding |

— | — | ||||||

|

Common stock, $0.01 par value; 500,000,000 shares authorized, 16,146,546 and 16,146,546 shares issued and outstanding, at June 30, 2025, and December 31, 2024, respectively |

160 | 160 | ||||||

|

Additional paid-in-capital |

90,342 | 89,938 | ||||||

|

Accumulated deficit |

(112,438 |

) |

(95,507 |

) |

||||

|

Total stockholders’ equity |

(21,936 | ) | (5,409 | ) | ||||

|

Non-controlling interests |

(35,760 | ) | (8,821 | ) | ||||

|

TOTAL EQUITY (DEFICIT) |

(57,696 | ) | (14,230 | ) | ||||

|

TOTAL LIABILITIES AND EQUITY (DEFICIT) |

$ | 1,241,323 | $ | 1,286,965 | ||||

See accompanying notes to these consolidated financial statements.

Clipper Realty Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

|

Three Months Ended |

Six Months Ended |

|||||||||||||||

|

2025 |

2024 |

2025 |

2024 |

|||||||||||||

|

REVENUE |

||||||||||||||||

|

Residential rental income |

$ | 29,054 | $ | 27,748 | $ | 58,244 | $ | 53,854 | ||||||||

|

Commercial rental income |

9,982 | 9,598 | 20,190 | 19,252 | ||||||||||||

|

TOTAL REVENUES |

39,036 | 37,346 | 78,434 | 73,106 | ||||||||||||

|

OPERATING EXPENSES |

||||||||||||||||

|

Property operating expenses |

9,561 | 8,996 | 19,672 | 17,618 | ||||||||||||

|

Real estate taxes and insurance |

7,518 | 7,438 | 15,145 | 14,574 | ||||||||||||

|

General and administrative |

3,819 | 3,459 | 7,644 | 7,010 | ||||||||||||

|

Transaction pursuit costs |

(10 | ) | - | (10 | ) | - | ||||||||||

|

Depreciation and amortization |

7,314 | 7,455 | 14,950 | 14,834 | ||||||||||||

| Loss on impairment of long-lived assets | - | - | 33,780 | - | ||||||||||||

|

TOTAL OPERATING EXPENSES |

28,202 | 27,348 | 91,181 | 54,036 | ||||||||||||

|

Litigation settlement and other |

(26 | ) | - | (26 | ) | - | ||||||||||

|

INCOME (LOSS) FROM OPERATIONS |

10,808 | 9,998 | (12,773 | ) | 19,070 | |||||||||||

| Loss on disposal of long-lived assets | (685 | ) | - | (685 | ) | - | ||||||||||

|

Interest expense, net |

(11,479 | ) | (11,741 | ) | (23,001 | ) | (23,480 | ) | ||||||||

|

Net loss |

(1,356 | ) | (1,743 | ) | (36,459 | ) | (4,410 | ) | ||||||||

|

Net loss attributable to non-controlling interests |

840 | 1,083 | 22,596 | 2,737 | ||||||||||||

|

Net loss attributable to common stockholders |

$ | (516 | ) | $ | (660 | ) | $ | (13,863 | ) | $ | (1,673 | ) | ||||

|

Basic and diluted net loss per share |

$ | (0.07 |

) |

$ | (0.06 |

) |

$ | (0.93 | ) | $ | (0.15 | ) | ||||

See accompanying notes to these consolidated financial statements.

Clipper Realty Inc.

Consolidated Statements of Changes in Equity

(In thousands, except for share data)

(Unaudited)

|

Number of |

Common |

Additional |

Accumulated |

Total |

Non- |

Total |

||||||||||||||||||||||

|

Balance December 31, 2024 |

16,146,546 | $ | 160 | $ | 89,938 | $ | (95,507 |

) |

$ | (5,409 | ) | $ | (8,821 | ) | $ | (14,230 | ) | |||||||||||

|

Amortization of LTIP grants |

— | — | — | — | — | 1,143 | 1,143 | |||||||||||||||||||||

|

Dividends and distributions |

— | — | — | (1,534 |

) |

(1,534 |

) |

(3,080 |

) |

(4,614 |

) |

|||||||||||||||||

|

Net loss |

— | — | — | (13,347 |

) |

(13,347 |

) |

(21,756 |

) |

(35,103 |

) |

|||||||||||||||||

|

Reallocation of noncontrolling interests |

— | — | 214 | — | 214 | (214 | ) | — | ||||||||||||||||||||

|

Balance March 31, 2025 |

16,146,546 | $ | 160 | $ | 90,152 | $ | (110,388 |

) |

$ | (20,076 | ) | $ | (32,728 | ) | $ | (52,804 | ) | |||||||||||

|

Amortization of LTIP grants |

— | — | — | — | — | 1,078 | 1,078 | |||||||||||||||||||||

|

Conversion of LTIP units |

— | — | — | — | — | — | — | |||||||||||||||||||||

|

Dividends and distributions |

— | — | — | (1,534 | ) | (1,534 | ) | (3,080 | ) | (4,614 | ) | |||||||||||||||||

|

Net loss |

— | — | — | (516 | ) | (516 | ) | (840 | ) | (1,356 | ) | |||||||||||||||||

|

Reallocation of noncontrolling interests |

— | — | 190 | — | 190 | (190 | ) | — | ||||||||||||||||||||

|

Balance June 30, 2025 |

16,146,546 | $ | 160 | $ | 90,342 | $ | (112,438 | ) | $ | (21,936 | ) | $ | (35,760 | ) | $ | (57,696 | ) | |||||||||||

|

Number of |

Common |

Additional |

Accumulated |

Total |

Non- |

Total |

||||||||||||||||||||||

|

Balance December 31, 2023 |

16,063,228 | $ | 160 | $ | 89,483 | $ | (86,899 | ) | $ | 2,744 | $ | 4,491 | $ | 7,235 | ||||||||||||||

|

Amortization of LTIP grants |

— | — | — | — | — | 561 | 561 | |||||||||||||||||||||

|

Dividends and distributions |

— | — | — | (1,526 | ) | (1,526 | ) | (2,870 | ) | (4,396 | ) | |||||||||||||||||

|

Net loss |

— | — | — | (1,011 | ) | (1,011 | ) | (1,655 | ) | (2,666 | ) | |||||||||||||||||

|

Reallocation of noncontrolling interests |

— | — | 72 | — | 72 | (72 | ) | — | ||||||||||||||||||||

|

Balance March 31, 2024 |

16,063,228 | $ | 160 | $ | 89,555 | $ | (89,436 | ) | $ | 279 | $ | 455 | $ | 734 | ||||||||||||||

|

Amortization of LTIP grants |

— | — | — | — | — | 713 | 713 | |||||||||||||||||||||

|

Conversion of LTIP units |

14,062 | — | — | — | — | — | — | |||||||||||||||||||||

|

Dividends of LTIP grants |

— | — | — | (1,527 | ) | (1,527 | ) | (2,869 | ) | (4,396 | ) | |||||||||||||||||

|

Net loss |

— | — | — | (660 | ) | (660 | ) | (1,083 | ) | (1,743 | ) | |||||||||||||||||

|

Reallocation of noncontrolling interests |

— | — | 130 | — | 130 | (130 | ) | — | ||||||||||||||||||||

|

Balance June 30, 2024 |

16,077,290 | $ | 160 | $ | 89,685 | $ | (91,623 | ) | $ | (1,778 | ) | $ | (2,914 | ) | $ | (4,692 | ) | |||||||||||

See accompanying notes to these consolidated financial statements.

Clipper Realty Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

|

Six Months Ended June 30, |

||||||||

|

2025 |

2024 |

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES |

||||||||

|

Net loss |

$ | (36,459 | ) | $ | (4,410 | ) | ||

|

Adjustments to reconcile net loss to net cash provided by operating activities: |

||||||||

|

Depreciation |

14,900 | 14,781 | ||||||

|

Amortization of deferred financing costs |

914 | 1,061 | ||||||

|

Amortization of deferred costs and intangible assets |

291 | 294 | ||||||

|

Loss on impairment of long-lived asset |

33,780 | - | ||||||

| Loss on disposal of long-lived asset | 685 | - | ||||||

|

Deferred rent |

59 | 87 | ||||||

|

Stock-based compensation |

2,221 | 1,274 | ||||||

|

Bad debt (recovery) expense |

50 | 16 | ||||||

|

Changes in operating assets and liabilities: |

||||||||

|

Tenant and other receivables |

(1,524 | ) | (671 | ) | ||||

|

Prepaid expenses, other assets and deferred costs |

(1,411 | ) | 4,511 | |||||

|

Accounts payable and accrued liabilities |

2,251 | (1,777 | ) | |||||

|

Security deposits |

24 | 345 | ||||||

|

Other liabilities |

(737 | ) | (467 | ) | ||||

|

Net cash provided by operating activities |

15,044 | 15,044 | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES |

||||||||

|

Additions to land, buildings, and improvements |

(25,425 | ) | (42,051 | ) | ||||

|

Proceeds from sale of real estate, net |

43,489 | - | ||||||

|

Purchase of interest rate caps |

(97 | ) | - | |||||

|

Net cash provided (used) in investing activities |

17,967 | (42,051 | ) | |||||

|

CASH FLOWS FROM FINANCING ACTIVITIES |

||||||||

| Payments of mortgage notes | (163,224 | ) | (985 | ) | ||||

|

Proceeds from mortgage notes |

165,188 | 37,303 | ||||||

|

Dividends and distributions |

(9,228 | ) | (8,792 | ) | ||||

|

Loan issuance and extinguishment costs |

(2,961 | ) | - | |||||

|

Net cash provided (used) by financing activities |

(10,225 | ) | 27,526 | |||||

|

Net increase in cash and cash equivalents and restricted cash |

22,786 | 519 | ||||||

|

Cash and cash equivalents and restricted cash - beginning of period |

38,052 | 36,225 | ||||||

|

Cash and cash equivalents and restricted cash - end of period |

$ | 60,838 | $ | 36,744 | ||||

|

Cash and cash equivalents and restricted cash – beginning of period: |

||||||||

|

Cash and cash equivalents |

$ | 19,896 | $ | 22,163 | ||||

|

Restricted cash |

18,156 | 14,062 | ||||||

|

Total cash and cash equivalents and restricted cash – beginning of period |

$ | 38,052 | $ | 36,225 | ||||

|

Cash and cash equivalents and restricted cash – end of period: |

||||||||

|

Cash and cash equivalents |

$ | 32,029 | $ | 20,254 | ||||

|

Restricted cash |

28,809 | 16,490 | ||||||

|

Total cash and cash equivalents and restricted cash – end of period |

$ | 60,838 | $ | 36,744 | ||||

|

Supplemental cash flow information: |

||||||||

|

Cash paid for interest, net of capitalized interest of $5,902 and $4,760 in 2025 and 2024, respectively |

$ | 23,927 | $ | 21,232 | ||||

|

Non-cash interest capitalized to real estate under development |

1,913 | 1,132 | ||||||

|

Additions to investment in real estate included in accounts payable and accrued liabilities |

2,621 | 10,070 | ||||||

See accompanying notes to these consolidated financial statements.

Clipper Realty Inc.

Notes to Condensed Consolidated Financial Statements

(In thousands, except for share and per share data and as noted)

(Unaudited)

INTRODUCTION TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The unaudited condensed consolidated financial statements of Clipper Realty Inc. and subsidiaries (the “Company” or “we”) and subsidiaries have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States ("GAAP") have been condensed or omitted pursuant to such rules and regulations. We believe that the disclosures are adequate to make the information presented not misleading when read in conjunction with the financial statements and the notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 14, 2025. Note that any references to square footage and unit count are outside the scope of our Independent registered public accounting firm’s review.

The financial information presented reflects all adjustments (consisting of normal recurring adjustments) which are, in our opinion, necessary for a fair presentation of the results of operations, cash flows and financial position for the interim periods presented. These results are not necessarily indicative of a full year’s results of operations.

1. Organization

As of June 30, 2025, the properties owned by the Company consisted of the following (collectively, the “Properties”):

|

• |

Tribeca House in Manhattan, comprising two buildings, one with 21 stories and one with 12 stories, containing residential and retail space with an aggregate of approximately 483,000 square feet of residential rental Gross Leasable Area (“GLA”) and 77,000 square feet of retail rental and parking GLA; |

|

• |

Flatbush Gardens in Brooklyn, a 59-building residential housing complex with 2,494 rentable units and approximately 1,749,000 square feet of residential rental GLA; |

|

• |

141 Livingston Street in Brooklyn, a 15-story office building with approximately 216,000 square feet of GLA; |

|

• |

250 Livingston Street in Brooklyn, a 12-story office and residential building with approximately 370,000 square feet of GLA (fully remeasured); |

|

• |

Aspen in Manhattan, a 7-story building containing residential and retail space with approximately 166,000 square feet of residential rental GLA and approximately 21,000 square feet of retail rental GLA; |

|

• |

Clover House in Brooklyn, a 11-story residential building with approximately 102,000 square feet of residential rental GLA; |

|

• |

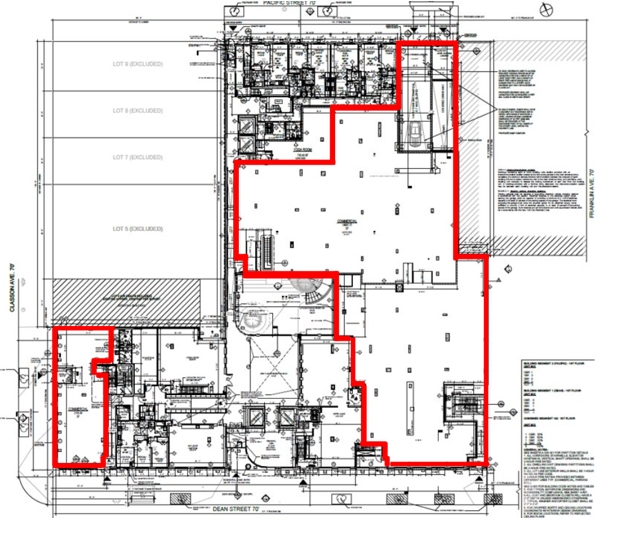

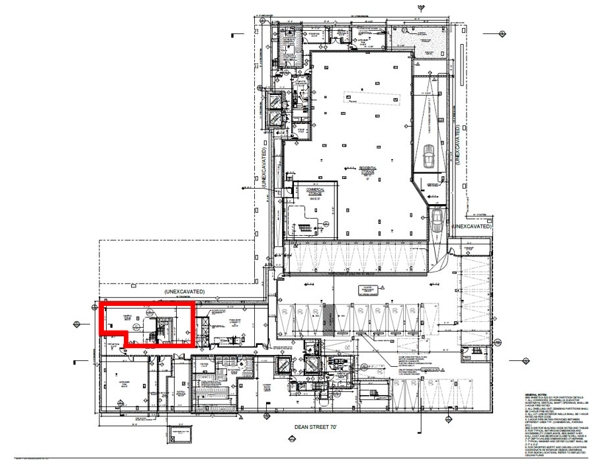

1010 Pacific Street in Brooklyn, 9-story residential building with approximately 119,000 square feet of residential rental GLA; and |

|

• |

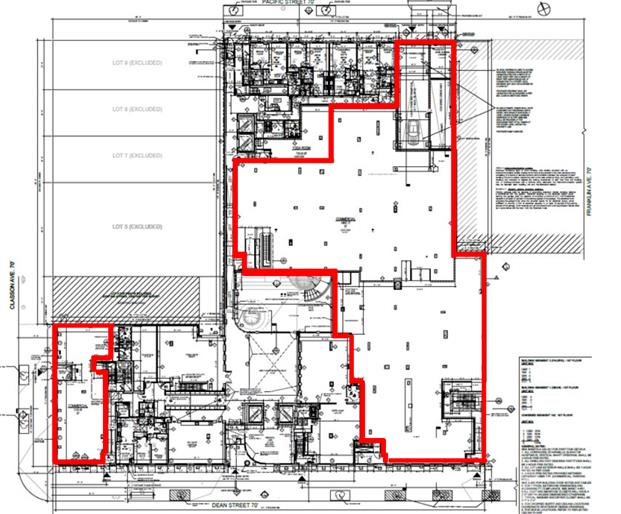

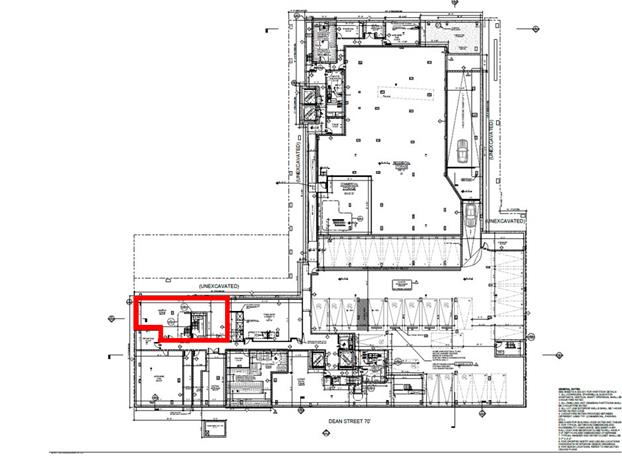

the Dean Street property in Brooklyn, which the Company plans to redevelop as a 9-story residential building with approximately 160,000 square feet of residential rental GLA and approximately 9,000 square feet of retail rental GLA. |

On May 30, 2025 the Company completed the sale of 10 West 65th Street in Manhattan, a 6-story residential building with approximately 76,000 square feet of residential rental GLA.for gross proceeds of $45,500. The Company incurred $1,900 in closing costs and paid $800 in accrued interest at closing. At closing, the Company repaid in full its $31,200 mortgage note (the “Mortgage”) with Flagstar Bank (“Flagstar”) (see note 4 below). The Company recorded a loss on the disposal of long-lived assets of $685 in the three and six months ended June 30, 2025 after previously recording a loss on impairment of long-lived assets of $33,780 in the three months ended March 31, 2025 (see note 10 below).

The operations of Clipper Realty Inc. and its consolidated subsidiaries are carried on primarily through Clipper Realty L.P., the Company’s operating partnership subsidiary (the "Operating Partnership”). The Company has elected to be taxed as a Real Estate Investment Trust ("REIT”) under Sections 856 through 860 of the Internal Revenue Code (the "Code”). The Company is the sole general partner of the Operating Partnership and the Operating Partnership is the sole managing member of the limited liability companies (the "LLCs”) that comprised the predecessor of the Company (the "Predecessor”).

At June 30, 2025 and 2024, the Company’s interest, through the Operating Partnership, in the LLCs that own the properties generally entitles it to 38.0% and 37.9%, respectively, of the aggregate cash distributions from, and the profits and losses of, the LLCs.

The Company determined that the Operating Partnership and the LLCs are variable interest entities (“VIEs”) and that the Company was the primary beneficiary. The assets and liabilities of these VIEs represented substantially all of the Company’s assets and liabilities.

2. Significant Accounting Policies

Segments

At June 30, 2025 and December 31, 2024, the Company had two reportable operating segments, Residential Rental Properties and Commercial Rental Properties. Our Chief Operating Decision Maker (“CODM”), represented by our Co-Chairman and Chief Executive Officer, reviews the results in which the revenue and Income from Operations is divided between the commercial and residential performance.

Basis of Consolidation

The accompanying consolidated financial statements of the Company are prepared in accordance with GAAP. The effect of all intercompany balances has been eliminated. The consolidated financial statements include the accounts of all entities in which the Company has a controlling interest. The ownership interests of other investors in these entities are recorded as non-controlling interests.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of commitments and contingencies at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could materially differ from these estimates.

Investment in Real Estate

Real estate assets held for investment are carried at historical cost and consist of land, buildings and improvements, furniture, fixtures and equipment. Expenditures for ordinary repair and maintenance costs are charged to expense as incurred. Expenditures for improvements, renovations, and replacements of real estate assets are capitalized and depreciated over their estimated useful lives if the expenditures qualify as betterment or the life of the related asset will be substantially extended beyond the original life expectancy.

In accordance with ASU 2018-01, "Business Combinations – Clarifying the Definition of a Business,” the Company evaluates each acquisition of real estate or in-substance real estate to determine if the integrated set of assets and activities acquired meets the definition of a business and needs to be accounted for as a business combination. If either of the following criteria is met, the integrated set of assets and activities acquired would not qualify as a business:

|

• |

Substantially all of the fair value of the gross assets acquired is concentrated in either a single identifiable asset or a group of similar identifiable assets; or |

|

• |

The integrated set of assets and activities is lacking, at a minimum, an input and a substantive process that together significantly contribute to the ability to create outputs (i.e., revenue generated before and after the transaction). |

An acquired process is considered substantive if:

|

• |

The process includes an organized workforce (or includes an acquired contract that provides access to an organized workforce) that is skilled, knowledgeable and experienced in performing the process: |

|

• |

The process cannot be replaced without significant cost, effort or delay; or |

|

• |

The process is considered unique or scarce. |

Generally, the Company expects that acquisitions of real estate or in-substance real estate will not meet the revised definition of a business because substantially all of the fair value is concentrated in a single identifiable asset or group of similar identifiable assets (i.e., land, buildings and related intangible assets) or because the acquisition does not include a substantive process in the form of an acquired workforce or an acquired contract that cannot be replaced without significant cost, effort or delay.

Upon acquisition of real estate, the Company assesses the fair values of acquired tangible and intangible assets including land, buildings, tenant improvements, above-market and below-market leases, in-place leases and any other identified intangible assets and assumed liabilities. The Company allocates the purchase price to the assets acquired and liabilities assumed based on their fair values. In estimating fair value of tangible and intangible assets acquired, the Company assesses and considers fair value based on estimated cash flow projections that utilize appropriate discount and capitalization rates, estimates of replacement costs, net of depreciation, and available market information. The fair value of the tangible assets of an acquired property considers the value of the property as if it were vacant.

The Company records acquired above-market and below-market lease values initially based on the present value, using a discount rate which reflects the risks associated with the leases acquired based on the difference between (i) the contractual amounts to be paid pursuant to each in-place lease and (ii) management’s estimate of fair market lease rates for each corresponding in-place lease, measured over a period equal to the remaining term of the lease for above-market leases and the initial term plus the term of any below-market fixed renewal options for the below-market leases. Other intangible assets acquired include amounts for in-place lease values and tenant relationship values (if any) that are based on management’s evaluation of the specific characteristics of each tenant’s lease and the Company’s overall relationship with the respective tenant. Factors to be considered by management in its analysis of in-place lease values include an estimate of carrying costs to execute similar leases. In estimating carrying costs, management includes real estate taxes, insurance and other operating expenses and estimates of lost rentals at market rates during the expected lease-up periods, depending on local market conditions. In estimating costs to execute similar leases, management considers leasing commissions, legal and other related expenses.

The Company reviews long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. A property’s value is impaired if management’s estimate of the aggregate future cash flows (undiscounted and without interest charges) to be generated by the property is less than the carrying value of the property. To the extent impairment has occurred, a write-down is recorded and measured by the amount of the difference between the carrying value of the asset and the fair value of the asset. In the event that the Company obtains proceeds through an insurance policy due to impairment, the proceeds are offset against the write-down in calculating gain/loss on disposal of assets. Management of the Company does not believe that any of its properties within the portfolio, other than the impairment of 10 West 65th Street described in note 10, are impaired as of June 30, 2025.

For long-lived assets to be disposed of, impairment losses are recognized when the fair value of the assets less estimated cost to sell is less than the carrying value of the assets. Properties classified as real estate held-for-sale generally represent properties that are actively marketed or contracted for sale with closing expected to occur within the next twelve months. Real estate held-for-sale is carried at the lower of cost, net of accumulated depreciation, or fair value less cost to sell, determined on an asset-by-asset basis. Expenditures for ordinary repair and maintenance costs on held-for-sale properties are charged to expense as incurred. Expenditures for improvements, renovations and replacements related to held-for-sale properties are capitalized at cost. Depreciation is not recorded on real estate held-for-sale.

If a tenant vacates its space prior to the contractual termination of the lease and no rental payments are being made on the lease, any unamortized balances of the related intangibles are written off. The tenant improvements and origination costs are amortized to expense over the remaining life of the lease (or charged against earnings if the lease is terminated prior to its contractual expiration date).

Depreciation is computed using the straight-line method over the estimated useful lives of the assets as follows:

|

Building and improvements (in years) |

10 | - | 44 | ||

|

Tenant improvements |

Shorter of useful life or lease term |

||||

|

Furniture, fixtures and equipment (in years) |

3 | - | 15 | ||

The capitalized above-market lease values are amortized as a reduction to base rental revenue over the remaining terms of the respective leases, and the capitalized below-market lease values are amortized as an increase to base rental revenue over the remaining initial terms plus the terms of any below-market fixed rate renewal options of the respective leases. The value of in-place leases is amortized to expense over the remaining initial terms of the respective leases.

Cash and Cash Equivalents

Cash and cash equivalents are defined as cash on hand and in banks, plus all short-term investments with a maturity of three months or less when purchased. The Company maintains some of its cash in bank deposit accounts, which, at times, may exceed the federally insured limit. No losses have been experienced related to such accounts.

Restricted Cash

Restricted cash generally consists of escrows for future real estate taxes and insurance expenditures, repairs, capital improvements, loan reserves and security deposits.

Tenant and Other Receivables and Allowance for Doubtful Accounts

Tenant and other receivables are comprised of amounts due for monthly rents and other charges less allowance for doubtful accounts. In accordance with Accounting Standards Codification ("ASC”) 842 "Leases,” the Company performed a detailed review of amounts due from tenants to determine if accounts receivable balances and future lease payments were probable of collection, wrote off receivables not probable of collection and recorded a general reserve against revenues for receivables probable of collection for which a loss can be reasonably estimated. If management determines that the tenant receivable is not probable of collection it is written off against revenues. In addition, the Company records a general reserve under ASC 450.

Deferred Costs

Deferred lease costs consist of fees incurred to initiate and renew operating leases. Lease costs are being amortized using the straight-line method over the terms of the respective leases.

Deferred financing costs represent commitment fees, legal and other third-party costs associated with obtaining financing. These costs are amortized over the term of the financing and are recorded in interest expense in the consolidated statements of operations. Unamortized deferred financing costs are expensed when the associated debt is refinanced or repaid before maturity. Costs incurred in seeking financing transactions which do not close are expensed in the period the financing transaction is terminated.

Comprehensive Income (Loss)

Comprehensive income (loss) is comprised of net income (loss) adjusted for changes in unrealized gains and losses, reported in equity, for financial instruments required to be reported at fair value under GAAP. For the three and six months ended June 30, 2025 and 2024, the Company did not own any material financial instruments for which the change in value was not reported in net income (loss); accordingly, its comprehensive income (loss) was its net income (loss) as presented in the consolidated statements of operations.

Revenue Recognition

As mentioned above under Tenant and Other Receivables and Allowance for Doubtful Accounts the Company records lease income under ASC 842,"Leases” which replaces the guidance under ASC 840. ASC 842 applies to the Company principally as lessor; as a lessee, the Company’s leases are immaterial. The Company has determined that all its leases as lessor are operating leases. The Company has elected to not bifurcate lease and non-lease components under a practical expedient provision. With respect to collectability, the Company has written off all receivables not probable of collection and related deferred rent and has recorded income for those tenants on a cash basis. When the probability assessment has changed for these receivables, the Company has recognized lease income to the extent of the difference between the lease income that would have been recognized if collectability had always been assessed as probable and the lease income recognized to date. For remaining receivables probable of collection, the Company has recorded a general reserve under ASC 450.

For the three months ended June 30, 2025 and 2024, the Company charged revenue in the amount of $985 and $933, respectively, for residential receivables not deemed probable of collection and recognized revenue of $23 and $113, respectively, for a reassessment of collectability of residential receivables previously not deemed probable of collection.

For the six months ended June 30, 2025 and 2024, the Company charged revenue in the amount of $1,892 and $1,719, respectively, for residential receivables not deemed probable of collection and recognized revenue of $91 and $229, respectively, for a reassessment of collectability of residential receivables previously not deemed probable of collection.

In accordance with the provisions of ASC 842, rental revenue for commercial leases is recognized on a straight-line basis over the terms of the respective leases. Deferred rents receivable represents the amount by which straight-line rental revenue exceeds rents currently billed in accordance with lease agreements. Rental income attributable to residential leases and parking is recognized as earned, which is not materially different from the straight-line basis. Leases entered by residents for apartment units are generally for one-year terms, renewable upon consent of both parties on an annual or monthly basis.

Reimbursements for operating expenses due from tenants pursuant to their lease agreements are recognized as revenue in the period the applicable expenses are incurred. These costs generally include real estate taxes, utilities, insurance, common area maintenance costs and other recoverable costs and are recorded as part of commercial rental income in the condensed consolidated statements of operations.

Stock-based Compensation

The Company accounts for stock-based compensation pursuant to Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, “Compensation — Stock Compensation.” As such, all equity-based awards are reflected as compensation expense in the Company’s consolidated statements of operations over their vesting period based on the fair value at the date of grant. In the event of a forfeiture, the previously recognized expense would be reversed.

As of June 30, 2025, and December 31, 2024, there were 6,242,095 and 5,700,534 long-term incentive plan (“LTIP”) units outstanding, respectively, with a weighted average grant date fair value of $6.85 and $7.07 per unit, respectively. As of June 30, 2025, and December 31, 2024, there was $17,724 and $19,945, respectively, of total unrecognized compensation cost related to unvested share-based compensation arrangements granted under share incentive plans. As of June 30, 2025, the weighted-average period over which the unrecognized compensation expense will be recorded is approximately three and a half years.

During the six months ended June 30, 2025, the Company granted employees and non-employee directors 345,561 and 196,000 LTIP units, respectively, with a weighted-average grant date value of $4.54 per unit. The grants vesting period ranges from up to one year for those granted to the non-employee directors and from one to 2.5 years to those granted to employees as 2024 bonus and long-term incentive compensation.

During the six months ended June 30, 2024, the Company granted employees and non-employee directors 320,172 and 181,602 LTIP units, respectively, with a weighted-average grant date value of $4.90 per unit. The grants vesting period ranges from up to one year for those granted to the non-employee directors and from 1 to 2.5 years to those granted to employees as 2023 bonus and long-term incentive compensation.

At the 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of the Company held on June 18, 2025, the stockholders of the Company approved the 2025 Omnibus Incentive Compensation Plan (the “Omnibus Plan”) and the 2025 Non-Employee Director Plan (the “Non-Employee Director Plan”). The Omnibus Plan replaced the 2015 Omnibus Incentive Plan, and the Company ceased granting any new awards under the 2015 Omnibus Incentive Plan. A total of 7,800,000 shares of common stock are reserved for issuance under the 2025 Omnibus Incentive Plan. The Non-Employee Director Plan replaced the 2015 Non-Employee Director Plan, and the Company ceased granting any new awards under the 2015 Non-Employee Director Plan. A total of 3,000,000 shares of common stock are reserved for issuance under the Non-Employee Director Plan.

Transaction Pursuit Costs

Transaction pursuit costs primarily reflect costs incurred for abandoned acquisition, disposition or other transaction pursuits.

Income Taxes

The Company elected to be taxed and to operate in a manner that will allow it to qualify as a REIT under the Code. To qualify as a REIT, the Company is required to distribute dividends equal to at least 90% of the REIT taxable income (computed without regard to the dividends paid deduction and net capital gains) to its stockholders, and meet the various other requirements imposed by the Code relating to matters such as operating results, asset holdings, distribution levels and diversity of stock ownership. Provided the Company qualifies for taxation as a REIT, it is generally not subject to U.S. federal corporate-level income tax on the earnings distributed currently to its stockholders. If the Company fails to qualify as a REIT in any taxable year, the Company will be subject to U.S. federal and state income tax on its taxable income at regular corporate tax rates and any applicable alternative minimum tax. In addition, the Company may not be able to re-elect as a REIT for the four subsequent taxable years. The entities comprising the Predecessor are limited liability companies and are treated as pass-through entities for income tax purposes. Accordingly, no provision has been made for federal, state or local income or franchise taxes in the accompanying consolidated financial statements.

In accordance with FASB ASC Topic 740, the Company believes that it has appropriate support for the income tax positions taken and, as such, does not have any uncertain tax positions that, if successfully challenged, could result in a material impact on its financial position or results of operations. The prior three years’ income tax returns are subject to review by the Internal Revenue Service.

Fair Value Measurements

Refer to Note 7, “Fair Value of Financial Instruments”.

Derivative Financial Instruments

FASB derivative and hedging guidance establishes accounting and reporting standards for derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging activities. As required by FASB guidance, the Company records all derivatives on the consolidated balance sheets at fair value. The accounting for changes in the fair value of derivatives depends on the intended use of the derivative and the resulting designation.

Derivatives used to hedge the exposure to changes in the fair value of an asset, liability, or firm commitment attributable to a particular risk, such as interest rate risk, are considered fair value hedges. Derivatives used to hedge the exposure to variability in expected future cash flows, or other types of forecast transactions, are considered cash flow hedges. For derivatives designated as fair value hedges, changes in the fair value of the derivative and the hedged item related to the hedged risk are recognized in earnings. For derivatives designated as cash flow hedges, the effective portion of changes in the fair value of the derivative is initially reported in other comprehensive income (loss) (outside of earnings) and subsequently reclassified to earnings when the hedged transaction affects earnings, and the ineffective portion of changes in the fair value of the derivative is recognized directly in earnings. The Company assesses the effectiveness of each hedging relationship by comparing the changes in the fair value or cash flows of the derivative hedging instrument with the changes in the fair value or cash flows of the designated hedged item or transaction. For derivatives not designated as hedges, changes in fair value would be recognized in earnings. As of June 30, 2025 and December 31, 2024, the Company has no derivatives for which it applies hedge accounting.

Loss Per Share

Basic and diluted net loss per share is computed by dividing net loss attributable to common stockholders by the weighted average common shares outstanding. As of June 30, 2025 and 2024, the Company had unvested LTIP units which provide for non-forfeitable rights to dividend-equivalent payments. Accordingly, these unvested LTIP units are considered participating securities and are included in the computation of basic and diluted net loss per share pursuant to the two-class method. The Company did not have dilutive securities as of June 30, 2025 or 2024

The effect of the conversion of the 26,317 Class B LLC units outstanding is not reflected in the computation of basic and diluted net loss per share, as the effect would be anti-dilutive. The net loss allocable to such units is reflected as non-controlling interests in the accompanying consolidated financial statements.

The following table sets forth the computation of basic and diluted net loss per share for the periods indicated (unaudited):

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|||||||||||||||

|

(in thousands, except per share amounts) |

2025 |

2024 |

2025 |

2024 |

||||||||||||

|

Numerator |

||||||||||||||||

|

Net loss attributable to common stockholders |

$ | (516 |

) |

$ | (660 |

) |

$ | (13,863 | ) | $ | (1,673 | ) | ||||

|

Less: income attributable to participating securities |

(580 |

) |

(369 |

) |

(1,160 | ) | (738 | ) | ||||||||

|

Subtotal |

$ | (1,096 |

) |

$ | (1,029 |

) |

$ | (15,023 | ) | $ | (2,411 | ) | ||||

|

Denominator |

||||||||||||||||

|

Weighted-average common shares outstanding |

16,147 | 16,077 | 16,147 | 16,077 | ||||||||||||

|

Basic and diluted net loss per share attributable to common stockholders |

$ | (0.07 |

) |

$ | (0.06 |

) |

$ | (0.93 | ) | $ | (0.15 | ) | ||||

Recently Issued Pronouncements

In 2023, the FASB issued ASU No. 2023-07, Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires a public entity to disclose significant segment expenses and other segment items on an annual and interim basis and to provide in interim periods all disclosures about a reportable segment’s profit or loss and assets that are currently required annually. Public entities with a single reportable segment are required to provide the new disclosures and all the disclosures required under ASC 280. The guidance is applied retrospectively to all periods presented in the financial statements, unless it is impracticable. The Company adopted ASU 2023-07 in the year ended December 31, 2024 and the adoption did not have a material impact on the Company’s consolidated financial statements. See Note 9 – Segment Reporting.

Recent Accounting Pronouncements

In November 2024, the FASB issued ASU No. 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40), which requires a public business entity to provide disaggregated disclosures, in the notes to the financial statements, of certain categories of expenses that are included in expense line items on the face of the income statement. The guidance is effective for the Company in its 2027 annual reporting. The guidance is applied prospectively and may be applied retrospectively. The Company is evaluating the impact of ASU 2024-03.

3. Deferred Costs and Intangible Assets

Deferred costs and intangible assets consist of the following:

|

June 30, |

December 31, |

|||||||

|

(unaudited) |

||||||||

|

Deferred costs |

$ | 348 | $ | 348 | ||||

|

Lease origination costs |

1,690 | 1,610 | ||||||

|

In-place leases |

428 | 428 | ||||||

|

Real estate tax abatements |

9,142 | 9,142 | ||||||

|

Total deferred costs and intangible assets |

11,608 | 11,529 | ||||||

|

Less accumulated amortization |

(6,143 |

) |

(5,852 |

) |

||||

|

Total deferred costs and intangible assets, net |

$ | 5,465 | $ | 5,676 | ||||

Amortization of deferred costs, lease origination costs and in-place lease intangible assets was $25 and $27 for the three months ended June 30, 2025 and 2024, respectively, and $51 and $53 for the six months ended June 30, 2025 and 2024, respectively; Amortization of real estate tax abatements of $120 and $120 for the three months ended June 30, 2025 and 2024, respectively, and $241 and $241 for the six months ended June 30, 2025 and 2024, is included in real estate taxes and insurance in the consolidated statements of operations.

Deferred costs and intangible assets as of June 30, 2025, amortize in future years as follows:

|

2025 (Remainder) |

$ | 300 | ||

|

2026 |

595 | |||

|

2027 |

583 | |||

|

2028 |

566 | |||

|

2029 |

531 | |||

|

Thereafter |

2,890 | |||

|

Total |

$ | 5,465 |

4. Notes Payable

The mortgages, loans and mezzanine notes payable collateralized by the properties, or the Company’s interest in the entities that own the properties and assignment of leases, are as follows:

|

Property |

Maturity |

Interest Rate |

June 30, |

December 31, |

|||||||||

|

Flatbush Gardens, Brooklyn, NY(a) |

6/1/2032 |

3.125 | % | $ | 329,000 | $ | 329,000 | ||||||

|

250 Livingston Street, Brooklyn, NY(b) |

6/6/2029 |

3.63 | % | 125,000 | 125,000 | ||||||||

|

141 Livingston Street, Brooklyn, NY(c) |

3/6/2031 |

3.21 | % | 100,000 | 100,000 | ||||||||

|

Tribeca House, Manhattan, NY(d) |

3/6/2028 |

4.506 | % | 360,000 | 360,000 | ||||||||

|

Aspen, Manhattan, NY(e) |

7/1/2028 |

3.68 | % | 58,573 | 59,403 | ||||||||

|

Clover House, Brooklyn, NY(f) |

12/1/2029 |

3.53 | % | 82,000 | 82,000 | ||||||||

|

10 West 65th Street, Manhattan, NY(g) |

11/1/2027 |

SOFR + 2.50 | % | - | 31,437 | ||||||||

|

1010 Pacific Street, Brooklyn, NY(h) |

9/15/2025 |

5.55 | % | 60,000 | 60,000 | ||||||||

|

1010 Pacific Street, Brooklyn, NY(h) |

9/15/2025 |

6.37 | % | 20,000 | 20,000 | ||||||||

|

953 Dean Street, Brooklyn, NY(i) |

5/9/2027 |

SOFR + 2.65 | % | 115,000 | - | ||||||||

|

953 Dean Street, Brooklyn, NY(i) |

5/9/2027 |

SOFR + 2.65 | % | 27,750 | - | ||||||||

|

953 Dean Street, Brooklyn, NY(i) |

8/10/2026 |

SOFR + 4.0 | % | - | 98,849 | ||||||||

|

953 Dean Street, Brooklyn, NY(i) |

8/10/2026 |

SOFR + 10.0 | % | - | 9,670 | ||||||||

|

Total debt |

$ | 1,277,323 | $ | 1,275,359 | |||||||||

|

Unamortized debt issuance costs |

(9,152 | ) | (9,019 | ) | |||||||||

|

Total debt, net of unamortized debt issuance costs |

$ | 1,268,171 | $ | 1,266,340 | |||||||||

(a) The $329,000 mortgage note agreement with New York Community Bank (“NYCB”), entered into on May 8, 2020, matures on June 1, 2032, and bears interest at 3.125% through May 2027 and thereafter at the prime rate plus 2.75%, subject to an option to fix the rate. The note requires interest-only payments through May 2027, and monthly principal and interest payments thereafter based on a 30-year amortization schedule. The Company has the option to prepay all (but not less than all) of the unpaid balance of the note prior to the maturity date, subject to certain prepayment premiums, as defined.

(b) The $125,000 mortgage note agreement with Citi Real Estate Funding Inc., entered into on May 31, 2019, matures on June 6, 2029, bears interest at 3.63% and requires interest-only payments for the entire term. The Company has the option to prepay all (but not less than all) of the unpaid balance of the note within three months of maturity, without a prepayment premium.

As of February 23, 2024, The City of New York, a municipal corporation acting through the Department of Citywide Administrative Services ("NYC”), notified us of its intention to terminate its lease at 250 Livingston Street effective August 23, 2025. The lease generally provides for rent payments in the amount of $15,400 per annum. We may be unable to replace NYC as a tenant or unable to replace it with other commercial tenants at comparable rent rates, may incur substantial costs to improve the vacated space or may have to offer significant inducements to fill the space, all of which may have an adverse effect on our financial condition, results of operations and cash flow. In connection with the termination of the 250 Livingston Street lease, pursuant to the terms of the loan agreement related to $125,000 building mortgage, we have established a cash management account for the benefit of the lender, into which we will be obligated to deposit all revenue generated by the building at 250 Livingston Street. All amounts remaining in such cash management account after the lender’s allocations set forth in the loan agreement will be disbursed to us once the tenant cure conditions are satisfied under the loan agreement. If we are unable to replace the NYC lease at comparable rents, we may not be able to cure the conditions listed in the loan agreement. If the excess cash is not released to us, it could impact our available cash to fund corporate operations and pay dividends and distributions to our stockholders.

On January 2, 2025, the Company was notified that the loan servicing of the loan related to the 250 Livingston Street property was transferred, at our request, to LNR Partners (“LNR”) to serve as special servicer in order for us to engage in negotiations on a modification of our loan. All remaining servicing has remained with Midland. On January 6, 2025, the Company and LNR signed a Pre-Negotiation Letter Agreement to discuss our request for a reduction in the loan. These negotiations continue and there can be no guarantee that they will conclude with an agreement. On October 10, 2024, the Company guaranteed an agreement between the Company's subsidiary, 250 Livingston Owner LLC, and IronHound Management Company LLC, whose principal is the Company's director Roberto Verrone, to provide consulting services regarding the loan related to the 250 Livingston Street property. The initial fee paid upon the agreement is $125 and the agreement also includes restructuring and other fees payable upon certain loan modifications. The arrangement was approved by an independent committee of the Company’s board of directors.

On March 18, 2025, we were notified by legal counsel to the servicer that, due to the failure of our subsidiary, 250 Livingston Owner LLC, to cause all revenue generated by the 250 Livingston Street property to be deposited into the cash management account as required by the loan agreement related to the $125,000 building mortgage loan, an event of default occurred under the $125 million building mortgage loan. The notice provided that if the 250 Livingston Owner LLC fails to cure the event of default, the lender may, among other things, accelerate the $125,000 building mortgage loan and demand all amounts owing to the lender to be immediately payable, institute proceedings for the foreclosure of all liens securing the loan and sell the 250 Livingston Street Property, or file a lawsuit against the 250 Livingston owner LLC or the guarantors. As of May 12, 2025, the Company has complied with the lenders requirement to have the deposits made by all tenants deposited directly into the cash management account. On May 8, 2025, the Company transferred $6,300 to the cash management account prior to the activation of the cash management account. On May 15, 2025, legal counsel for the lender notified us that they alleged that we were in default on the $125,000 mortgage loan due to its allegation that Clipper Realty Inc. (the “Guarantor”) did not maintain a net worth of not less than $100,000 as of December 31, 2024, as required under the loan agreement. The Company replied to the lender disputing such calculation and alleging that the lender did not calculate net worth in a reasonable manner. The Company provided the lender with its own calculation of net worth that shows a net worth in excess of the required amount. On May 28, 2025, the lender replied concurring with the Company and notifying that they agree that we are compliant with the $100 million requirement. On July 28, 2025, we were notified by legal counsel for the lender that they alleged that we were once again in default for failure to remit all revenue derived from 250 Livingston into the cash management account. The Company responded by disputing the allegations in the July 28, 2025, letter and noting that all rents from the tenants had been deposited into the cash management account.

(c) Our subsidiary, 141 Livingston Owner LLC (the “141 Borrower”) and Citi Real Estate Funding Inc. entered into the loan agreement related to a $100,000 loan on February 18, 2021. The loan is evidenced by promissory mortgage notes and secured by the 141 Livingston Street property. The Company and our Operating Partnership subsidiary serve as limited guarantors of certain obligations under the loan, including those related to the reserve monthly deposit discussed below.

The $100,000 loan matures on March 6, 2031, bears interest at 3.21% and requires interest-only payments for the entire term. The company has the option to prepay all (but not less than all) of the unpaid balance of the note within three months of maturity, without a prepayment premium.

The 141 Livingston Street lease expires on December 27, 2025. Should the lease not be extended for a minimum of five years, in accordance with terms of the mortgage note, the company will be required to either fund a reserve account in the amount of $ 10,000 payable in equal monthly payments over the 18 months after lease expiration or deliver to the lender a letter of credit in the amount of $10,000.

On October 28, 2024, the Company received notice that as of October 7, 2024 the servicing of the mortgage note was transferred to a special servicer (“Special Servicer”) due to, Company’s alleged failure to make certain required payments under the loan agreement, including, but not limited to, reserve monthly deposit starting on July 7, 2024. The Special Servicer has demanded that the company pay $2,222 of reserve payments into a reserve account immediately (for July-October 2024) and continued monthly payments of $555 for an additional 14 months, $1,166 of default interest and late charges through October 7, 2024, and an additional $10 per diem interest for each day thereafter.

On November 11, 2024, the Special Servicer notified the 141 Borrower that, due to its alleged event of default under the Loan Agreement, as a result of the failure to make the payments described above, the mortgage notes have been accelerated, and all amounts under the loan agreement were due and payable. Such amounts include, but are not limited to, $100,000 principal amount of the mortgage notes, approximately $5,000 of default yield maintenance premium, $10,000 aggregate reserve deposit, and the above-described penalty default interest and penalties.

The Company believes that (i) the Company has made timely payments under the loan agreement, (ii) the servicer and the Special Servicer have misinterpreted the terms of the loan agreement requiring monthly reserve payments beginning on July 7, 2024, (iii) the Company has no current obligation to make such reserve payments under the loan agreement and (iv) The Company should not be obligated to pay the default interest and late charges.

On December 18, 2024, the Company received notice from the Special Servicer that due to its allegation that Clipper Realty Inc. (the “Guarantor”) did not maintain a net worth of not less than $100,000 as of December 31, 2022 and 2023, respectively, as required under the loan agreement, the Company is in default on the loan. The Company replied to the Special Servicer disputing such calculation and alleging that the Special Servicer did not calculate net worth in a reasonable manner. The Company provided the Special Servicer with its own calculation of net worth that shows a net worth in excess of the required amount.

On January 21, 2025, the Company received notice from the Special Servicer alleging that certain elements of our insurance on the building at 141 Livingston Street are not in compliance with the loan agreement requirements, including, but not limited to, due to a deductible in excess of what is permitted under the terms of the loan agreement and the use of an insurance carrier with a rating agency rating below that which is permitted under the terms of the loan agreement.

On March 12, 2025, we received a letter from counsel to the successor to the Special Servicer reaffirming the occurrence of alleged events of default under the loan agreement described above and demanding the establishment of a restricted account, a cash management account and a debt service account. In addition, the letter demanded that tenants of 141 Livingston Street be sent notices directing them to make lease payments to the cash management account.

We believe that we are not required to establish the foregoing accounts or send such notices to the tenants. However, if we are required to establish such accounts and deliver such notices, it could impact our available cash to fund corporate operations and pay dividends and distributions to our stockholders.

On March 20, 2025, Wells Fargo Bank, National Association, as trustee for the benefit of the registered holders of certain pass-through certificates issued by trusts that are the holders of the promissory mortgage notes secured by the 141 Livingston Street property, referred to as “Plaintiff,” filed a lawsuit against 141 Borrower, as well as us and our Operating Partnership subsidiary, as guarantors, in the Supreme Court of the State of New York. Plaintiff demands, among other things, that (i) the 141 Livingston Street property be sold and the Plaintiff be paid the amounts due under the loan agreement, with interest thereon to the time of such payment, together with, among other items, the expenses of the sale, Plaintiff’s attorneys’ fees; (ii) Plaintiff be paid all rents and revenues of the 141 Livingston Street property as they become due and payable; (iii) a receiver be appointed to manage the 141 Livingston Street property, with power among other things to demand and recover payment from anyone who has received a distribution from 141 Borrower after any event of default; (iv) Plaintiff have such other and further relief as may be just and equitable; (v) guarantors pay to Plaintiff the amount of any losses or damages suffered or incurred by Plaintiff as the court may determine to be just and equitable and amounts owed under the guaranty. We believe that the claims set forth in this complaint are without merit and intend to vigorously defend against this lawsuit.

On April 7, 2025 the Company filed an Affirmation in opposition to the motion of the plaintiff for their appointment of a receiver and in support of defendants cross motion to dismiss the action and cancel notice of pendency with the Supreme Court of the state of New York County of Kings. A hearing on the motions was scheduled to be had on April 8, 2025 and was adjourned until May 6, 2025. The Plaintiff submitted additional filings on April 29, 2025 and the Company submitted its replies on May 6, 2025. On May 13, 2025, the Court denied (i) the Plaintiff’s motion to appoint a receiver to manage the 141 Livingston Street property, “as Plaintiff’s likelihood of ultimately prevailing on its claims herein appears remote” and (ii) the Company’s cross motion to dismiss the lawsuit, “as Plaintiff’s contentions do raise a question of fact”.

In April 2025, the Company and the City of New York agreed to the terms of a five-year extension of the current lease, with an option for the City of New York to terminate the lease after two years with a prior six-month notice. The City of New York has sent the lease to the Company to sign. On April 22, 2025, the Company sent the lease to the loan special servicer for approval in accordance with the terms of the loan agreement. On May 21, 2025 the special servicer approved the lease subject to certain conditions. The Company rejected the conditions that amongst other changes required us to change the terms of the cancellation provisions in the lease and make amendments to the loan documents to be in the line with the lenders allegations in the above lawsuit. There can be no assurance that the lease will be approved or finalized.

On June 11, 2025, the lender filed an appeal of the denial of the receiver. On June 23, 2025, the Lender filed an amended complaint seeking a declaratory judgment that its conditions for its consent to the lease were reasonable. On July 2, 2025, the lender filed a renewed motion for a temporary receiver. On July 11, 2025, the Company filed an answer with counter claims, seeking among other things declaratory relief that the lenders conditions are unreasonable for the proposed lease renewal. On July 18, the Company filed opposition to the renewed receiver motion. On July 30, 2025, the judge heard arguments on the renewed motion for a temporary receiver. The motion is currently pending. On July 31, the lender filed motion to dismiss counter claims. Currently the Company has until September 3, 2025, to respond and a hearing is currently scheduled for September 10, 2025.

The Company believes that the claims set forth in the Plaintiff’s complaint are without merit and intends to continue to vigorously defend against this lawsuit.

(d) The $360,000 loan with Deutsche Bank, entered into on February 21, 2018, matures on March 6, 2028, bears interest at 4.506% and requires interest-only payments for the entire term. The Company has the option to prepay all (but not less than all) of the unpaid balance of the loan prior to the maturity date, subject to a prepayment premium if it occurs prior to December 6, 2027.

(e) The $70,000 mortgage note agreement with Capital One Multifamily Finance LLC matures on July 1, 2028, and bears interest at 3.68%. The note required interest-only payments through July 2017, and monthly principal and interest payments of $321 thereafter based on a 30-year amortization schedule. The Company has the option to prepay the note prior to the maturity date, subject to a prepayment premium.

(f ) The $82,000 mortgage note agreement with MetLife Investment Management, entered into on November 8, 2019, matures on December 1, 2029, bears interest at 3.53% and requires interest-only payments for the entire term. The Company has the option, commencing on January 1, 2024, to prepay the note prior to the maturity date, subject to a prepayment premium if it occurs prior to September 2, 2029.

(g) On May 30, 2025, in connection with the Sale of the 10 West 65 street property, the Company repaid in full the $31.200 million 2017 acquisition mortgage note (the “Mortgage”) to Flagstar Bank (“Flagstar”). In addition to the Mortgage repayment, the Company paid $0.8 million in accrued interest through the payoff date. Upon repayment of the Mortgage, Flagstar released $1.1 million in previously deposited property tax escrow and other debt reserves to the Company. The Company did not incur any penalties related to the prepayment of the Mortgage.

(h) On August 10, 2021, the Company entered into a group of loans with AIG Asset Management (U.S.), LLC, succeeding a property acquisition loan, providing for maximum borrowings of $52,500 to develop the property. The notes had a 36-month term, bore interest at 30 day LIBOR plus 3.60% (with a floor of 4.1%). The notes were scheduled to mature on September 1, 2024 and could have been extended until September 1, 2026. The Company could have prepaid the unpaid balance of the note within five months of maturity without penalty.

On February 9, 2023, the Company refinanced this construction loan with a mortgage loan with Valley National Bank which provided for maximum borrowings of $80,000. The loan provided initial funding of $60,000 and a further $20,000 subject to achievement of certain financial targets. The loan has a term of five years and an initial annual interest rate of 5.7% subject to reduction by up to 25 basis points upon achievement of certain financial targets (during the quarter ended June 30, 2023, the Company achieved the applicable financial target, and the interest rate was reduced to 5.55%). The interest rate on subsequent fundings will be fixed at the time of any funding. The loan requires interest-only payments for the first two years and principal and interest thereafter based on a 30-year amortization schedule. The Company has the option to prepay in full, or in part, the unpaid balance of the note prior to the maturity date. Prior to the second anniversary of the date of the note prepayment is subject to certain prepayment premiums, as defined. After the second anniversary of the date of the note the prepayment is not subject to a prepayment premium.

On September 15, 2023, the Company borrowed an additional $20,000 from Valley National Bank. The additional borrowing has a term of twenty-four months and an annual interest rate of 6.37%. The loan is interest only subject to the maintenance of certain financial targets after the first 16 months of the term. In conjunction with the additional borrowing, the Company and the bank agreed to amend the expiration date of the initial $60,000 to expire at the same time as the additional borrowing. No change was made to the interest rate on the initial borrowing.

(i) On December 22, 2021, the Company entered into a $30,000 mortgage note agreement with Bank Leumi, N.A. related to the Dean Street acquisition. The notes original maturity was December 22, 2022 and was subsequently extended to September 22, 2023. The note required interest-only payments and bears interest at the prime rate (with a floor of 3.25%) plus 1.60%. In April 2022, the Company borrowed an additional $6,985 under the mortgage note in connection with the acquisition of additional parcels of land in February and April 2022.

On August 10, 2023, the Company refinanced its $37,000 mortgage on its Dean Street development with a senior construction loan (“Senior Loan”) with Valley National Bank that permits borrowings up to $115,000 and a mezzanine loan (the “Mezzanine Loan”) with BADF 953 Dean Street Lender LLC that permits borrowings up to $8,000.

The Senior Loan allows maximum borrowings of $115,000 for a 30-month term, has two 6-month extension options, and bears interest at 1-Month Term SOFR plus 4.00%, with an all-in floor of 5.50%. The Senior Loan consists of a land loan, funded at closing to refinance the existing loan totaling $36,985, a construction loan of up to $62,400 and a project loan of up to $15,600. The Company has provided a 30% payment guarantee of outstanding borrowings among other standard indemnities.

The Mezzanine Loan allows maximum borrowings of $8,000 for a 30-month term, have two 6-month extension options, and bears interest at 1-Month Term SOFR plus 10%, with an all-in floor of 13%. Interest shall accrue on the principal, is compounded monthly and is due at the end of the term of the loan. At closing, $4,500 was funded to cover closing costs incurred on the construction loans and the remaining $3,500 was drawn for ongoing construction costs.

On May 2, 2025, the Company entered into the Multifamily Loan and Security Agreement (the “Loan Agreement”), dated as of May 2, 2025 and the Mezzanine Multifamily Loan and Security Agreement (the “Mezzanine Loan Agreement” and together with the Loan Agreement, the “New Loan Agreements”) with MF1 Capital, a company not affiliated with the Company dated as of May 2, 2025.

The Loan Agreement provides for $115,000 and the Mezzanine Loan Agreement provides for the $26,750 loan to Dean Member (collectively, the “Loans”). The Loans have an initial May 9, 2027 maturity date, with three one-year extensions available upon meeting the applicable extension conditions, and bear interest at 2.65% rate, plus 1-Month CME Term SOFR (with a floor of 2.25%)(6.96% at June 30, 2025). The Company can borrow up to an additional $18,250 under the Mezzanine Loan Agreement based on meeting various performance targets over the term of the loan. Under the Loan Agreement, the Company deposited with MF1 Capital (i) $4,250 for a shortfall reserve account to pay interest and operating expenses during the initial lease up period of the Dean Street Property, and (ii) $1,550 for completion reserve deposits towards the completion of the construction of the building.

Subsequent to the loan closing the Company drew an additional $1,000 from the Mezzanine Loan.

The New Loan Agreements also contain customary representations, covenants, events of default and certain limited guarantees.

In addition, the Company purchased an interest rate cap with US Bank that caps the SOFR portion of the interest rate on the Loans at 6%.

Concurrently with entering into the New Loan Agreements, the Company repaid the $115,000 Senior Loan and the $8,000 Mezzanine Loan, plus $2,900 in accrued interest. The Company incurred no fees or costs as a result of the termination of the Prior Loan Agreements, and the Company incurred approximately $3,104 in closing costs for the New Loan Agreements.

During the three- and six-month periods ended June 30, 2025 the Company incurred $3,561 and $6,025, respectively, and during the three- and six-month periods June 30, 2024 the Company incurred $1,975 and $3,643, respectively, in interest and is included in the balance of the Notes Payable in the Consolidated Balance Sheet.

On April 30, 2025 the Company entered into a $10,000 corporate line of credit with Valley National Bank. The line of credit bears interest of Prime + 4.0%. On May 1, 2025, the Company drew $5,000 from the line of credit. On May 2, 2025 the Company repaid the balance with proceeds from the Loans.